- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

How to save for retirement via superannuation, your entitlements and obligations, when you can withdraw your super.

What is super

If you're new to Australia's superannuation system for retirement saving, find out how it works and how to benefit.

Choosing a super fund

When choosing a super fund make sure you understand your options and set up an account that suits your situation.

Growing and keeping track of your super

Your entitlement to super as a worker, how to make extra voluntary contributions, and how to keep track of your super.

Withdrawing and using your super

When and how you can access your super and whether you need to pay tax on withdrawals.

Foreign super funds

How to access money in a foreign super fund (may be called a retirement fund, pension fund, retirement savings plan).

Temporary residents and superannuation

How to deal with superannuation if you are a temporary visa holder.

Superannuation and relationship breakdown

How your super is affected if your marriage or relationship breaks down.

I am looking for…

Travel allowance or LAFHA? And how is each taxed?

Thanks to Tax & Super Australia for the article.

Being asked by the boss to travel for work purposes can be demanding on staff — financially, physically and also emotionally. Out of this has developed more than one way to compensate employees; these being a travel allowance and the living away from home allowance (LAFHA).

When both were developed, the difference between the two were often decided by an ATO-initiated rule-of-thumb in that travel of less than 21 days was deemed to be the former, while more than 21 days was considered to have a more LAFHA flavour. The 21-day “threshold” however no longer applies.

For travel allowances, typically employees are:

- paid standard travel allowance for accommodation and food

- working at the one location

- visiting home on weekends

- staying in accommodation provided by the supplier (which may be available for use by other customers when the employee is not there).

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee.

However it has also been found that some employees may be on a travel allowance for six weeks or more.

It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA ) or the income tax rules (for travel allowances ). The tax treatment (and therefore the financial outcomes) of both can be different.

Deciding factors

The FBT framework would generally provide for a more concessional tax outcome where certain prescribed requirements for a LAFHA is met in comparison with the income tax effect of a travel allowance.

The reality is that you could have someone who is away from home but is still considered to be only travelling. Alternatively you could have someone that is away from home for two weeks only, but in those two weeks was actually living away from home.

When an employee is required to travel on business and overnight their food, drink and accommodation expenses become deductible expenses and are FBT free for the employer. The difference between LAFH rules and travelling on business is quite simply the employee on LAFH has to temporarily change their usual place of residence and therefore their food, drink and accommodation expenses become private and non-deductible. And that is why the employer needs the FBT concession for such employees. It is a question of fact as to whether or not the employee has temporarily changed their usual place of residence as opposed to travelling around on business.

So it is a test of substance whether someone is just travelling or is actually living away from home. It would have to be substantiated to be proven in fact as a LAFHA. Similarly, if away from home and treated as a travel allowance, the ATO will generally not challenge such treatment if substantiated as travel. Taxation ruling TR 2017/D6 deals with these factors.

Travel allowance or living away from home?

The following general principles may be of guidance:

- When a person is living away from home, there will be a change in job location and a temporary residence will be taken up near the new work location. Often, but not always, the employee’s spouse and family will accompany the employee to the new location.

- When a person is merely travelling, there will be no change in job location and there will be no establishment of a temporary residence – rather, the person will merely be accommodated while travelling. Usually the employee’s spouse and family will not accompany the employee.

- However the issue of whether the family accompanies the employee is not determinative. The critical factor seems to be where the job is located. If it is temporarily located away from the employee’s usual place of residence, the employee will usually be living away from his or her usual place of residence. Where the job location does not change, but the employee must travel to undertake duties, he or she will be regarded as travelling.

- While the length of period away from home is not determinative, the ATO will generally accept that shorter periods away will generally be deemed to be travelling. In addition, the Tax Commissioner has stated that employees attending short-term staff training courses will generally be treated as travelling in the course of their employment.

- There is no minimum or maximum period of absence to qualify as living away from home, although the application of the FBT rules may be less concessional if someone lives away from their usual place of residence for more than 12 months. The period that a person is living away from home will end when the person returns to his or her usual place of residence, or changes his or her usual place of residence to the new location.

Related resources

analyst report

Get Started

Your privacy is assured.

Travel allowances (and retaining the exception to substantiate)

A travel allowance is a payment made to employees to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight or longer in the course of their duties.

In most circumstances, when claiming other deductions, your clients will be expected to be able to substantiate the expense being claimed with documentary evidence, and produce that evidence should the ATO request it. However an exception to substantiate claims applies to travel allowance expenses if the ATO considers the total claimed to be “reasonable” and to be no more that the allowance provided.

“It is not unusual for the Commissioner to issue guidance on travel allowances”, say tax policy specialist Ken Mansell. “He releases an annual update on reasonable travel and meal allowance expenses.” (See below for a link to the latest update of reasonable expenses.)

There are three administrative concessions that relate to travel allowances — for employees there is the substantiation exception as mentioned above ( see TD2004/6 ), but for employers there is also a withholding exception and a payment summary exception.

Recently the ATO has been at pains to emphasise that the first of these travel allowance concessions does not extinguish the requirement for the employee to actually incur an expense. The taxpayer may not be required to substantiate it in a written form like other deductible work expenses, but the expense must still have actually been incurred to be able to claim a deduction.

Mansell reminds us that travel allowances are assessable income. “To claim a deduction for travel expenses the general rules in section 8-1 apply – that the expenditure must be incurred in gaining assessable income. Simply, there is no standard deduction that can be claimed by those who have a travel allowance.”

It will also pay to remember that if your client relies on the exception from substantiation, the ATO may still require that they show the basis for determining the amount claimed, that the expense was actually incurred, and that it was for specific travel costs and for work-related purposes.

And remember, the ATO seems to be at pains to emphasise that this tax time it is targeting work-related expense claims such as travel costs — a point specifically referred to time and again by Tax Commissioner Chris Jordan.

Use it (correctly) or lose it The ATO has announced that it is aware of an increasing disparity between travel allowances paid and deductions claimed for accommodation, meals, and incidentals. The ATO claims that this trend has led to an increase in the incidence of it checking these claims. These checks have highlighted deficiencies and difficulties for employees in showing the amount claimed was incurred, or was incurred in gaining or producing their assessable income.

There are other issues surrounding such allowances that Mansell says should be considered, such distinguishing between travelling and living-away-from-home, and the targeting of certain industries. “There are certain industries getting particular focus from the ATO, such as truck drivers or mining company employees,” he says.

“In fact, the ATO found that many of the employees of a large employer in regional Queensland were all making incorrect claims for travel deductions due to this misunderstanding,” he says. “The ATO wrote letters to each taxpayer employed at this organisation to notify them that they may have had incorrectly claimed these deductions and to amend their returns if this was the case. And many of these taxpayers had used tax agents to lodge their return.”

He says that many of the incorrect deduction claims by tax agents and their clients is a result of “pub talk” about how travel deductions can be claimed. “They may hear talk about how someone had to travel overnight for work, had their employer give them a reasonable travel allowance in lieu of salary based on the Commissioner’s published rate, spent none of the money while travelling as they stayed with Aunty Gladys for free, and either did not declare the travel allowance as income, or claimed a deduction for the entire amount of the allowance even though they did not spend it,” he says. “The Commissioner says this is just simply incorrect.”

The introduction of what has come to be known as “self-assessment” in the mid-1980s meant that while documentary evidence of claims was required, under the substantiation rules at the time this would not have to be attached to an income tax return as a matter of course, but would need to be supplied upon request.

In more modern times, and to reduce the cost of compliance in keeping detailed records, it was decided that certain exclusions from substantiation should be included in the rules — although the ATO has made it clear that should the disparity between allowances paid and deductions claimed continues, the current substantiation exception leeway in regard to travel expenses may be reviewed.

Tax commentators, including Ken Mansell, have indicated that this is a strong signal that the ATO seems to be moving away from the exception to substantiation precedent, especially in light of a huge increase in court cases dealing with this area of tax law over the past couple of years. In fact, in the modern digital transaction world, the case can be made that such exceptions to substantiation are increasingly unnecessary; a point already made by the ATO. This in turn underlines the necessity to make sure your clients get such claims right in the first place.

For now, your clients can claim a deduction for travel expenses incurred without meeting the substantiation rules provided:

- the claim for deduction does not exceed the amount of the travel allowance received

- the travel allowance does not exceed an amount that the ATO considers to be “reasonable” (more below).

What is “reasonable”? The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee ( here is TD2017/19 for the 2017-18 year ). These guidelines give a reasonable daily travel allowance amount and take the following factors into consideration:

- destination of travel (broken down into metropolitan cities, country centres within Australia and international countries)

- accommodation

- other incidentals

- employee annual salary (in ranges)

- specific rates for truck drivers.

Where the travel allowance received by the taxpayer exceeds the amount considered reasonable, the whole deduction will generally be subject to the substantiation rules, which require your client to keep and produce detailed records of the expenses involved.

Tax Store Accountants Bankstown.

Tax & Super Australia: Travel allowances (and retaining the exception to substantiate)

Our management credentials.

travel allowance and superannuation

Hi, I am sure the answer is simple but just wondering if superannuation (SG) is paid by employer to employees in disability sector who are paid cents per km for using their own vehicle to take clients out within the community. These employees may travel up to 500kms per week and as low as 10kms per week. It varies quite a bit.

- Report as inappropriate

Most helpful reply

Hiya @Supportbeyond 👋

See the answer to the same question in this post .

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

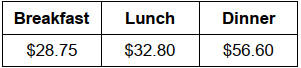

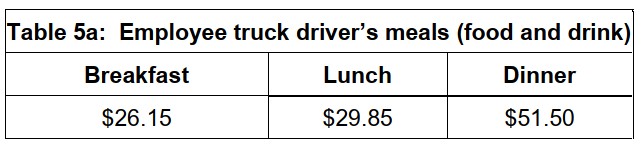

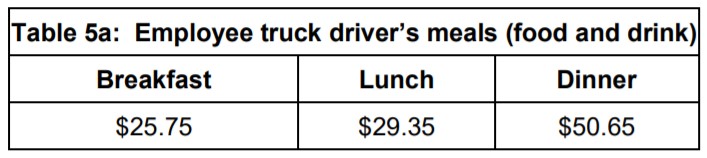

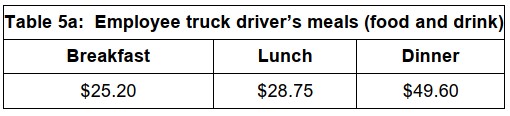

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

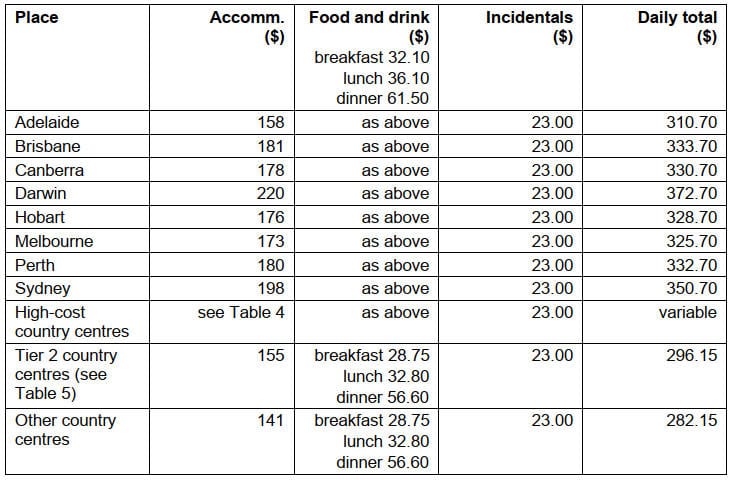

2023-24 Domestic Travel

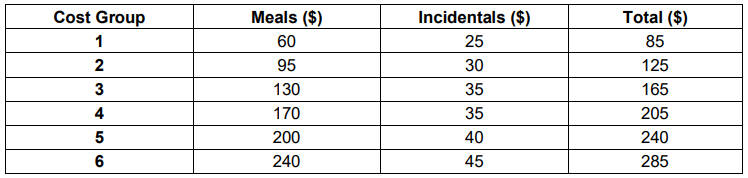

Table 1:Salary $138,790 or less

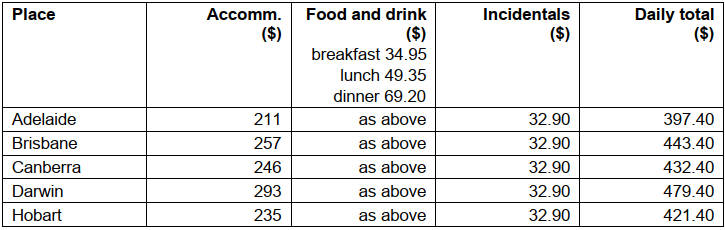

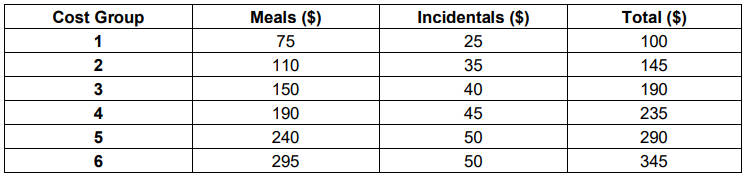

Table 2: Salary $138,791 to $247,020

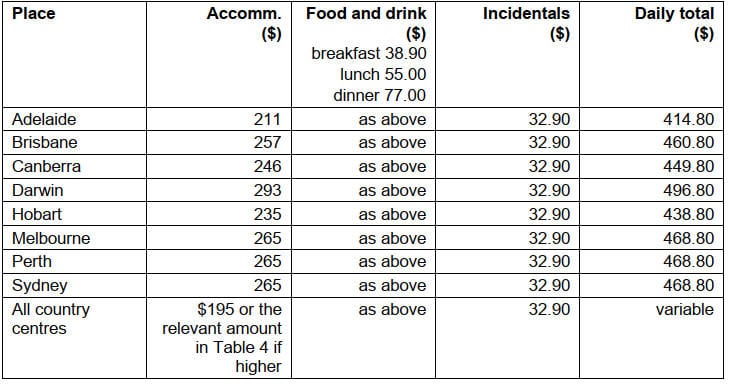

Table 3: Salary $247,021 or more

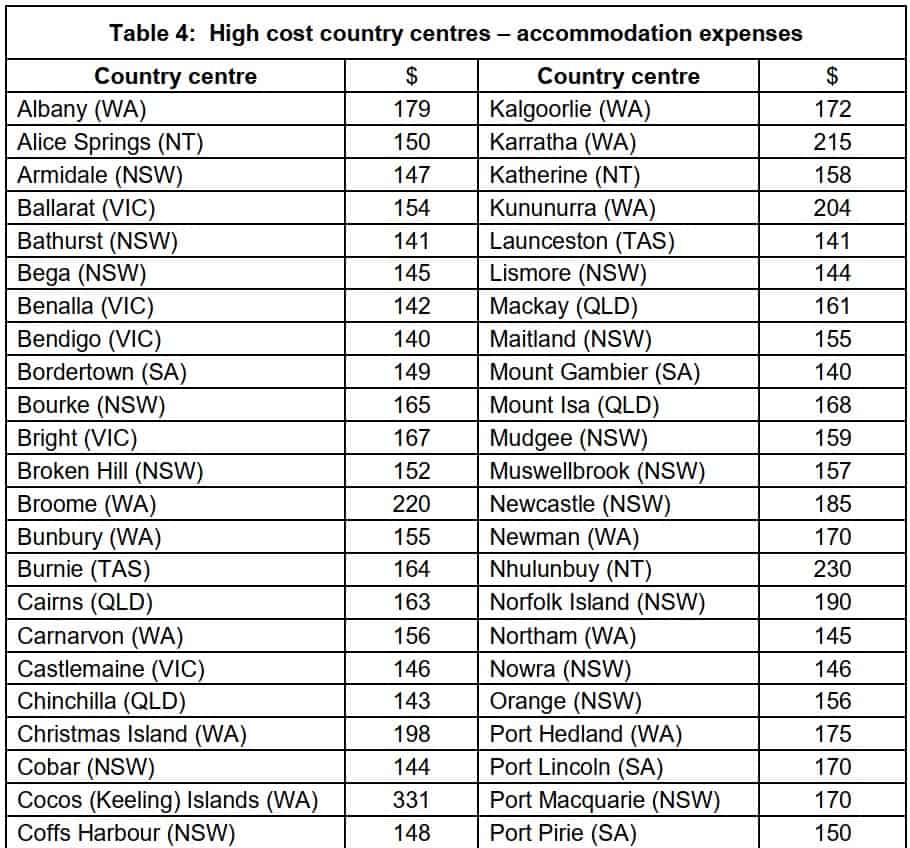

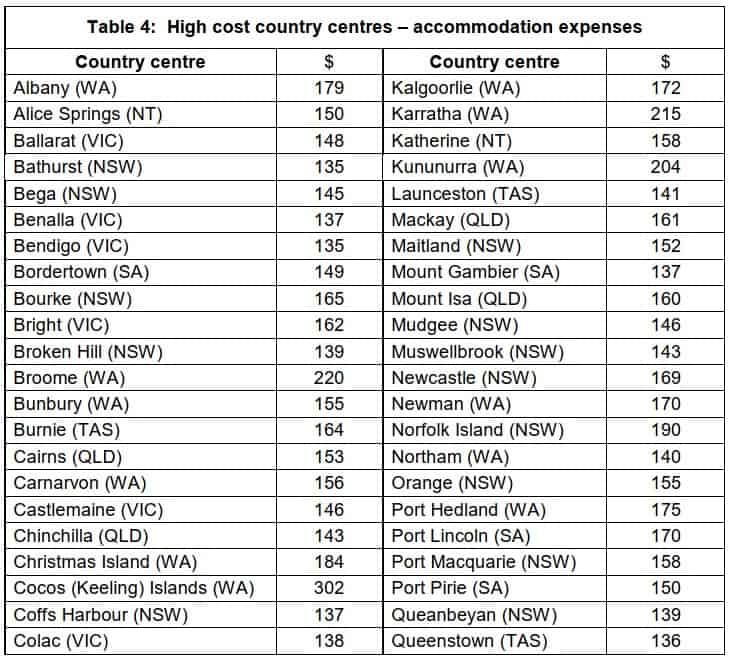

Table 4: High cost country centres accommodation expenses

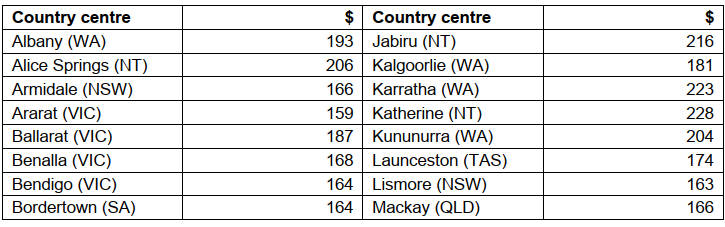

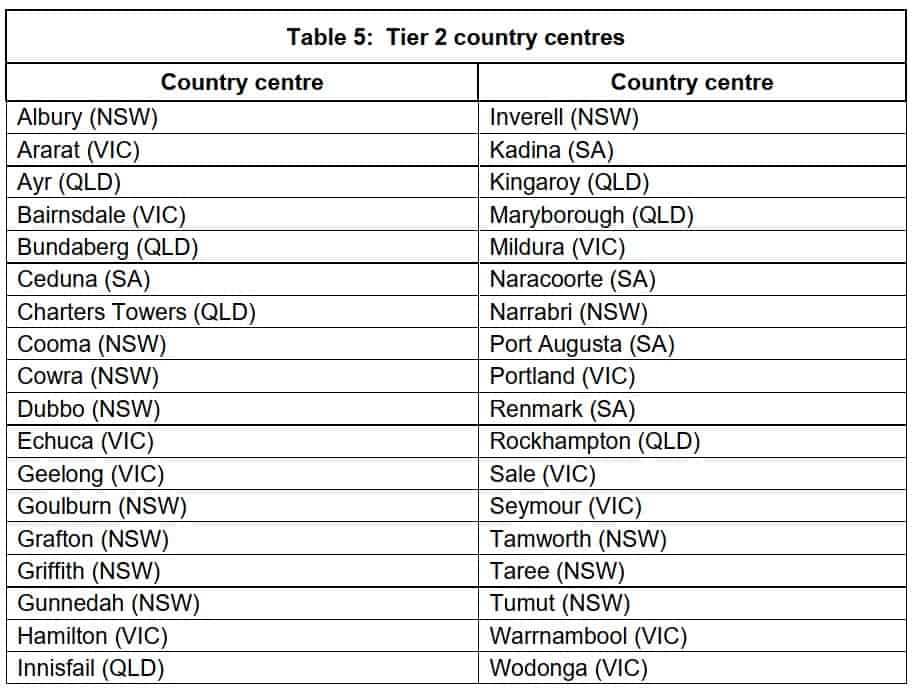

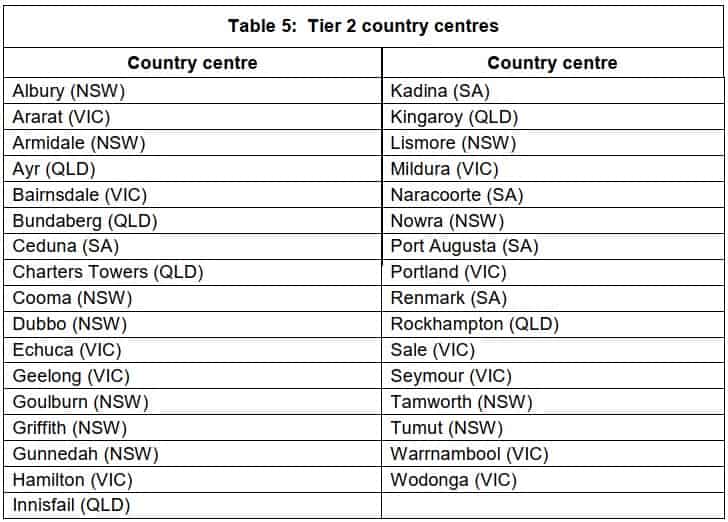

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

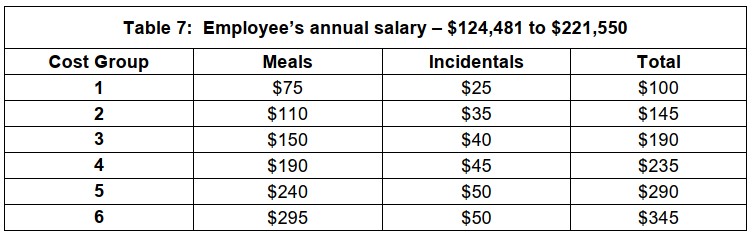

Table 7: Salary $138,791 to $247,020

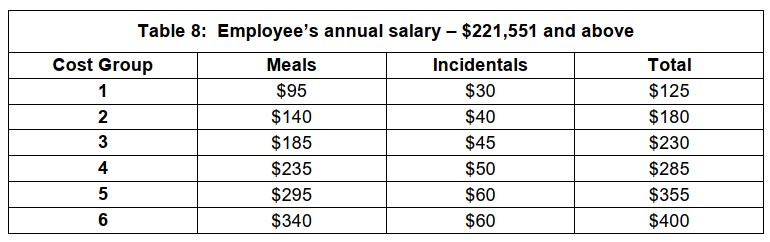

Table 8: Salary $247,021 or more

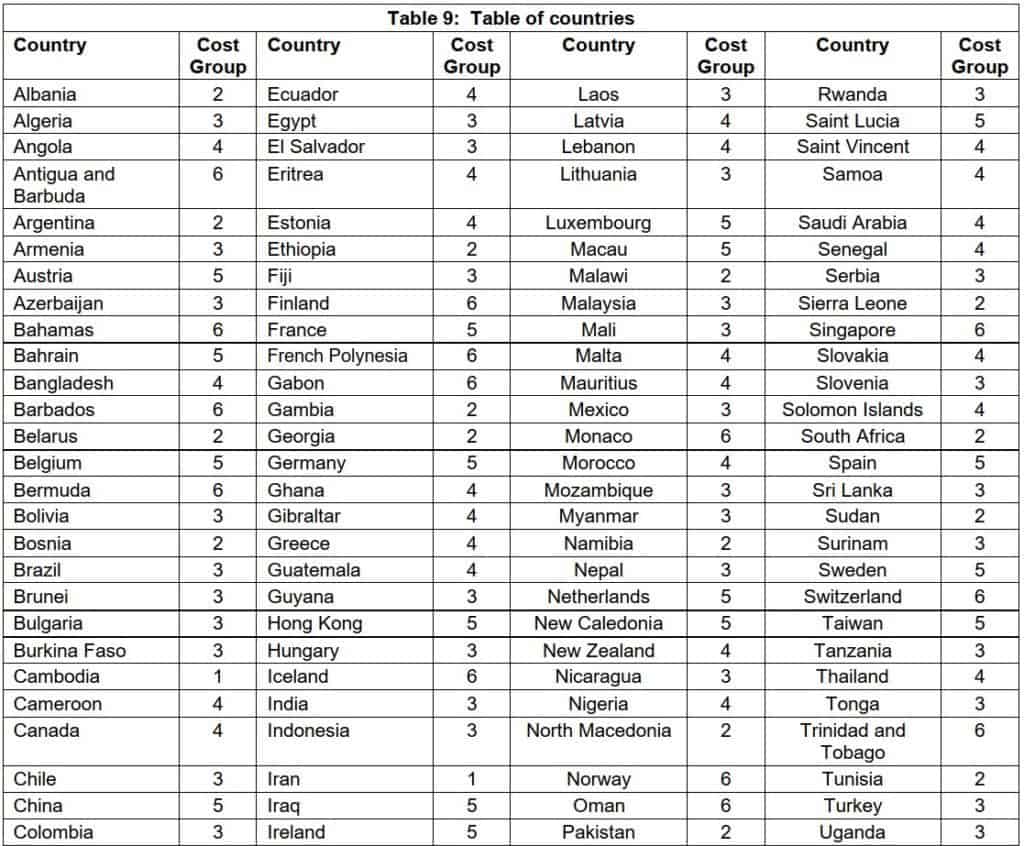

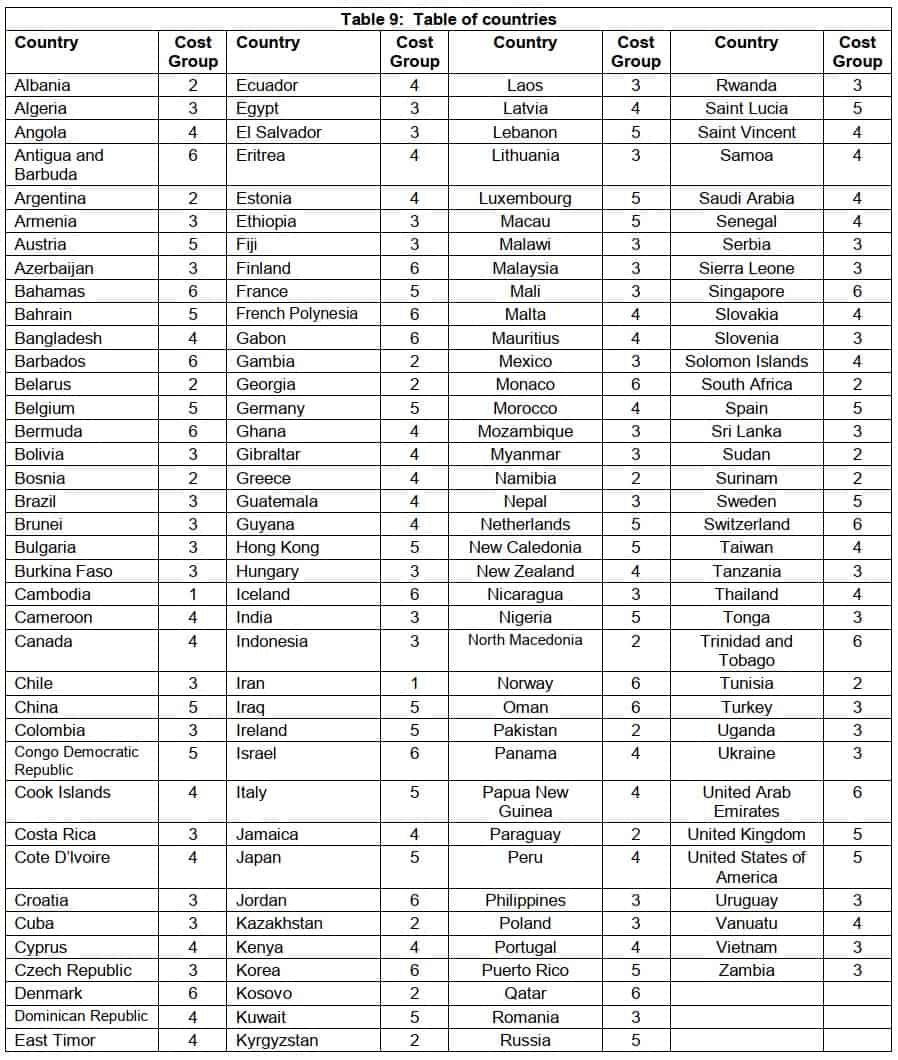

Table 9: Table of countries

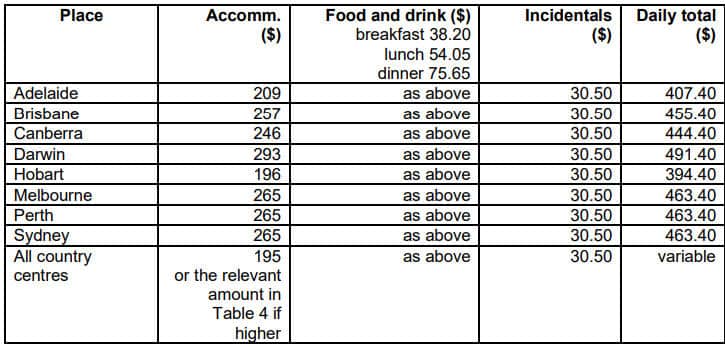

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

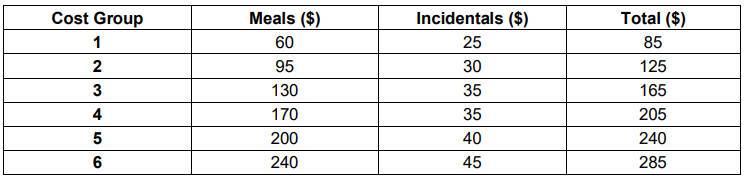

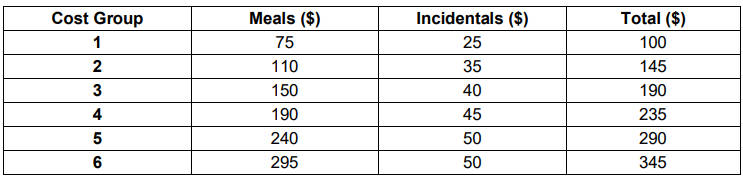

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

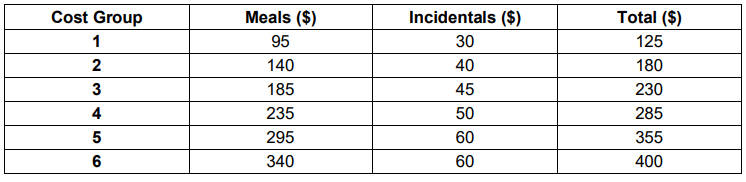

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

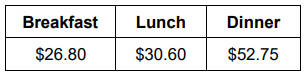

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

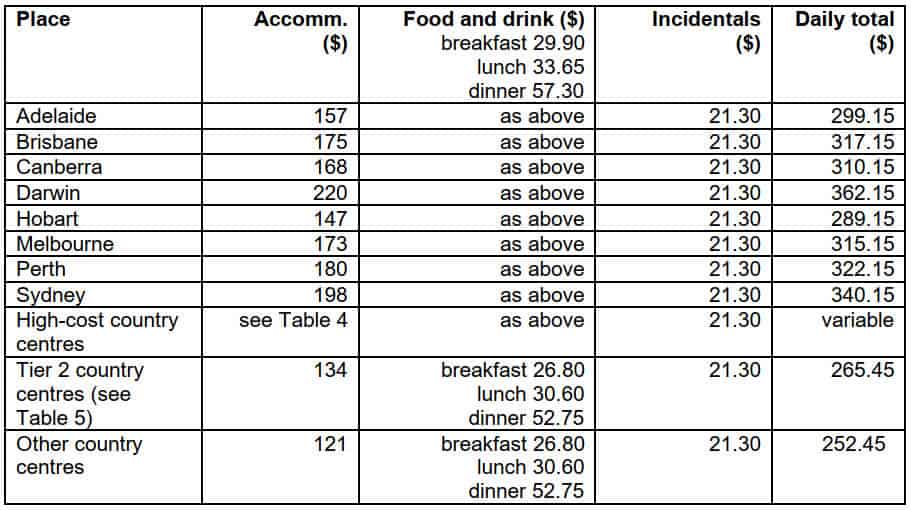

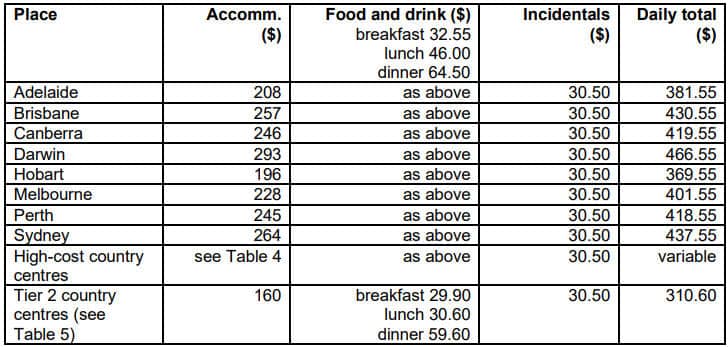

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

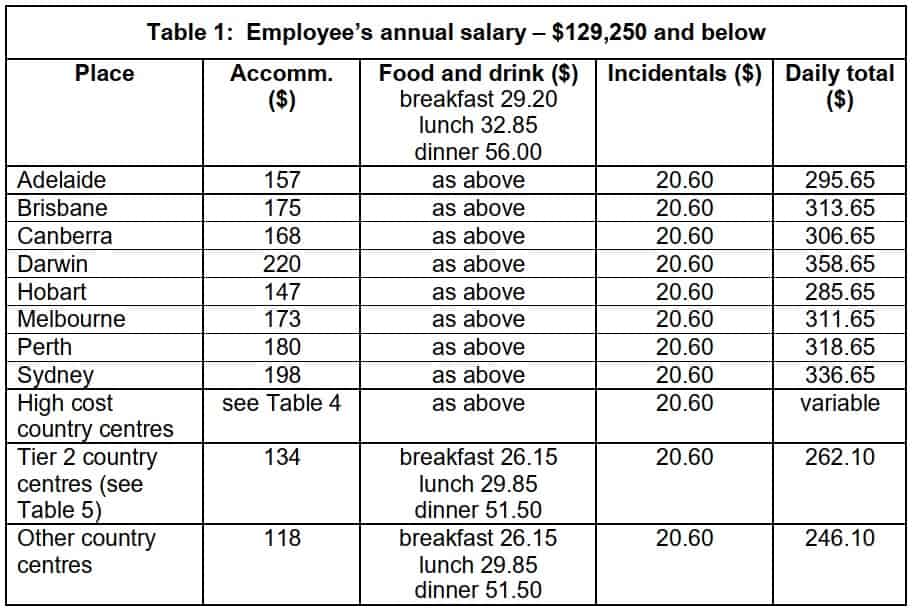

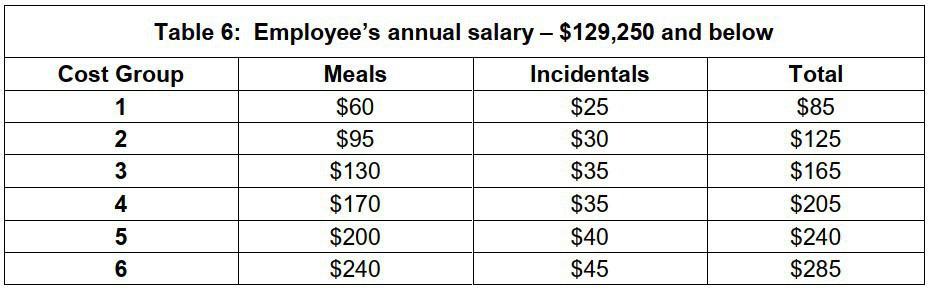

Table 1: Salary $129,250 and below

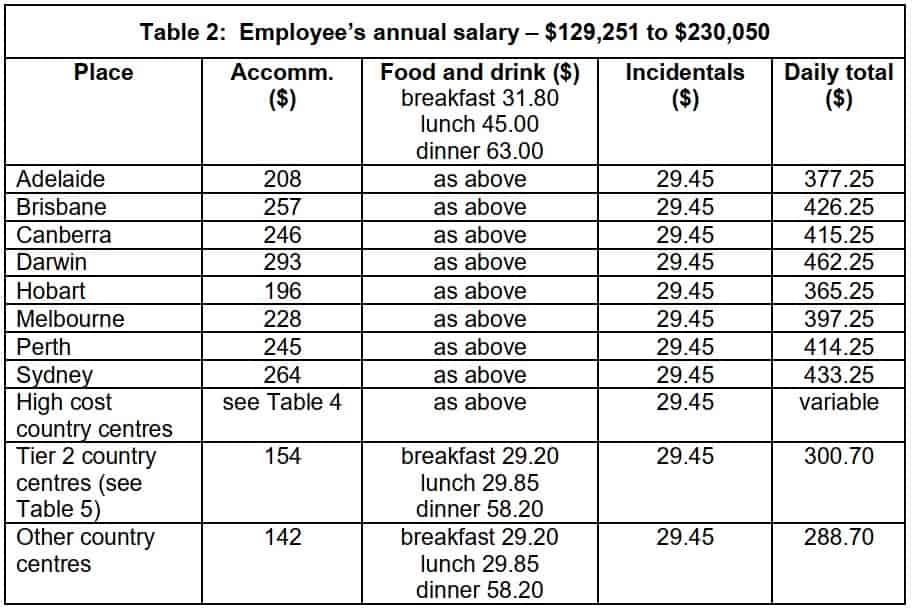

Table 2: Salary $129,251 to $230,050

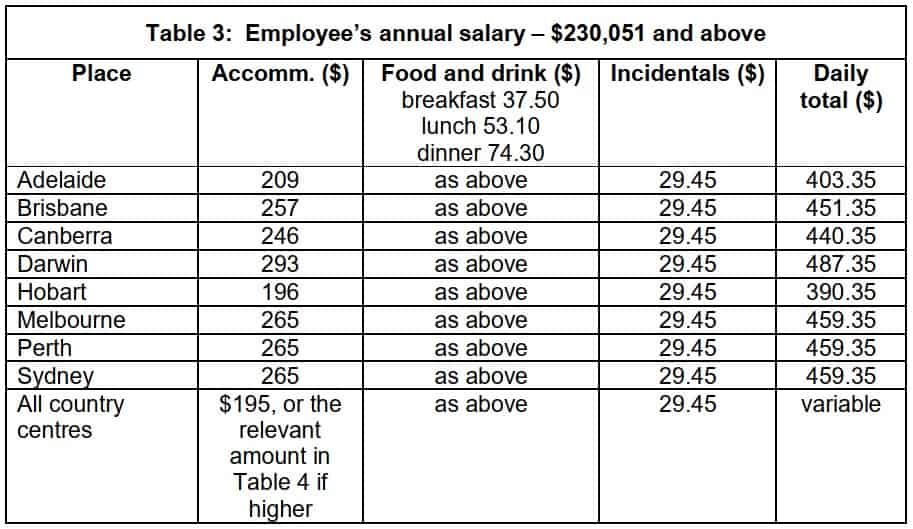

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

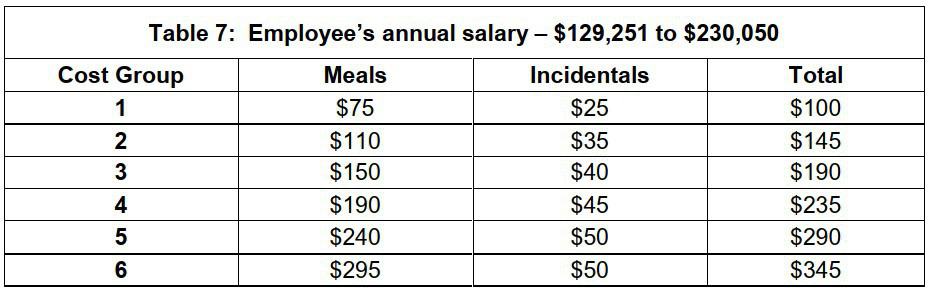

Table 7: Salary – $129,251 to $230,050

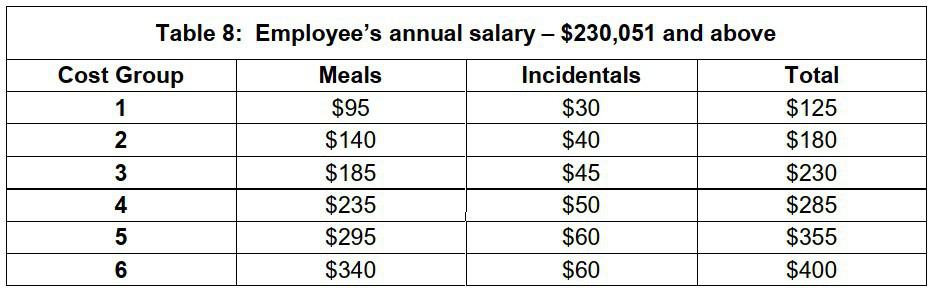

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

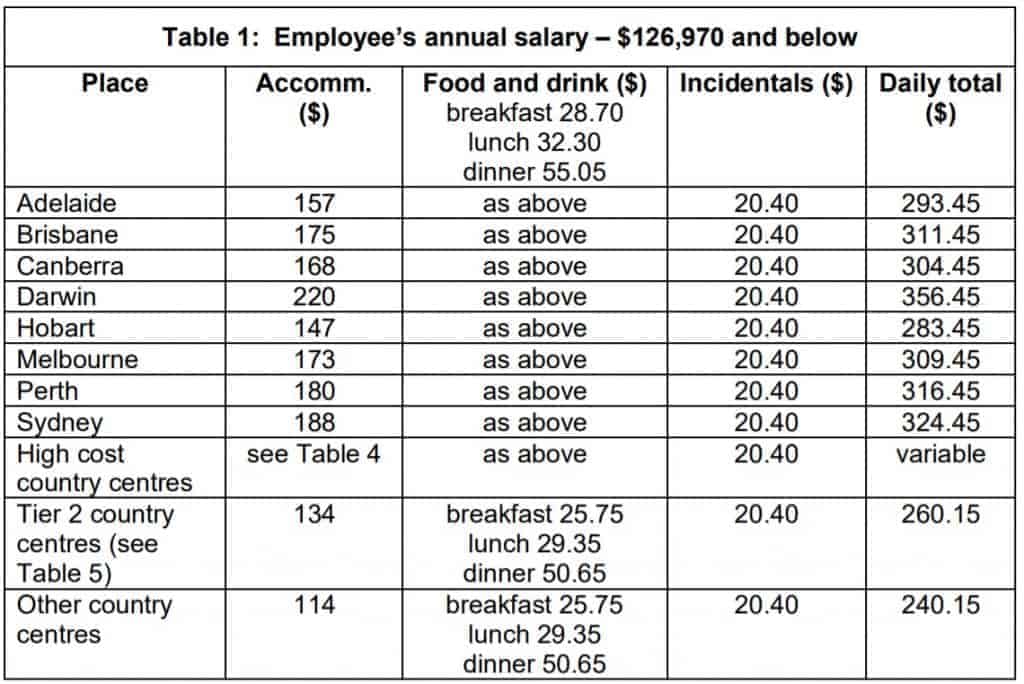

Table 1: Salary $126,970 and below

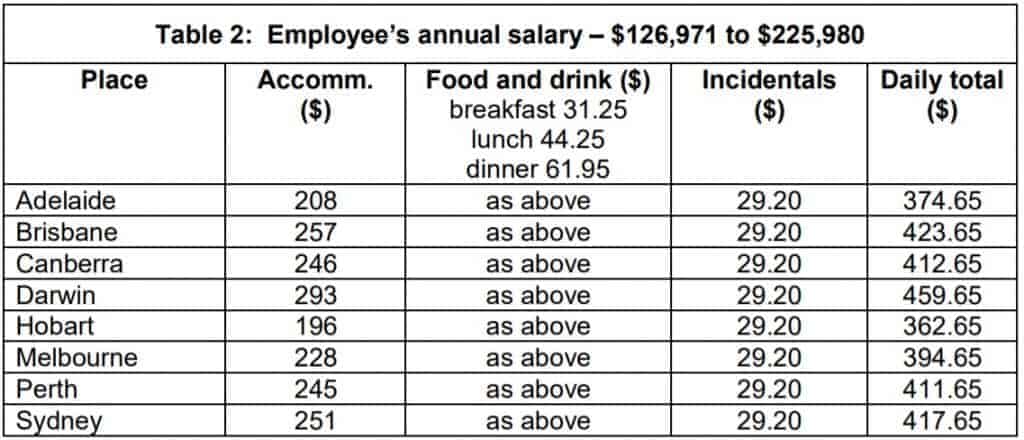

Table 2: Salary $126,971 to $225,980

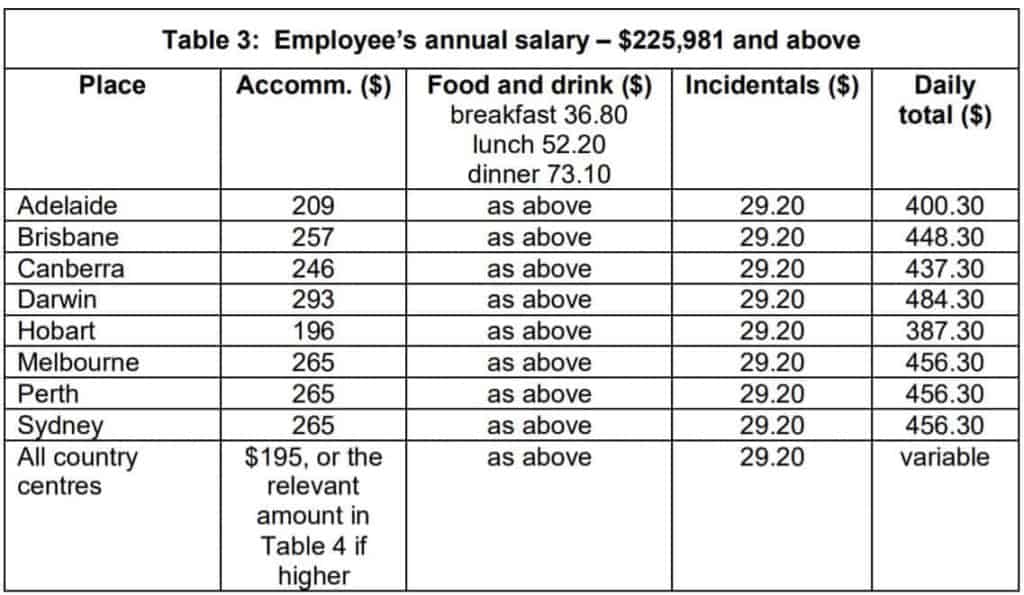

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

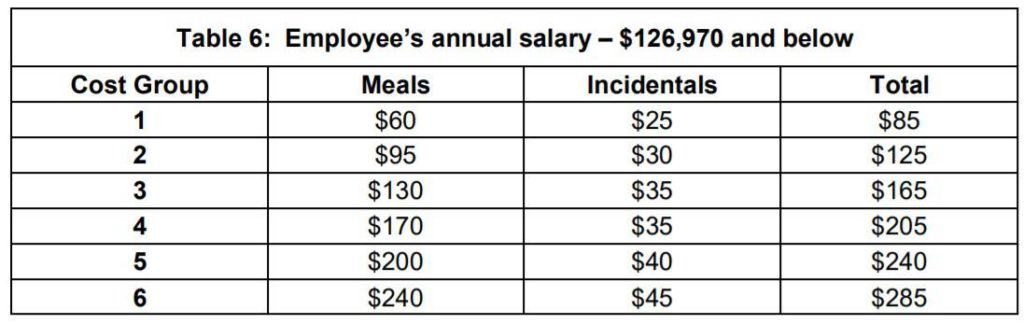

Table 6: Salary $126,970 and below

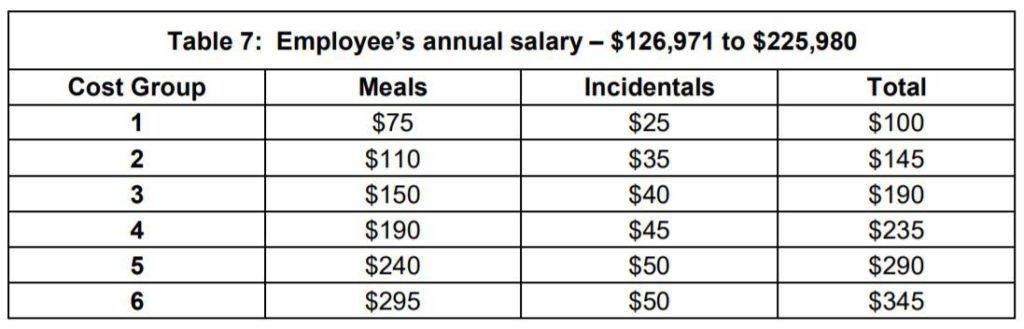

Table 7: Salary – $126,971 to $225,980

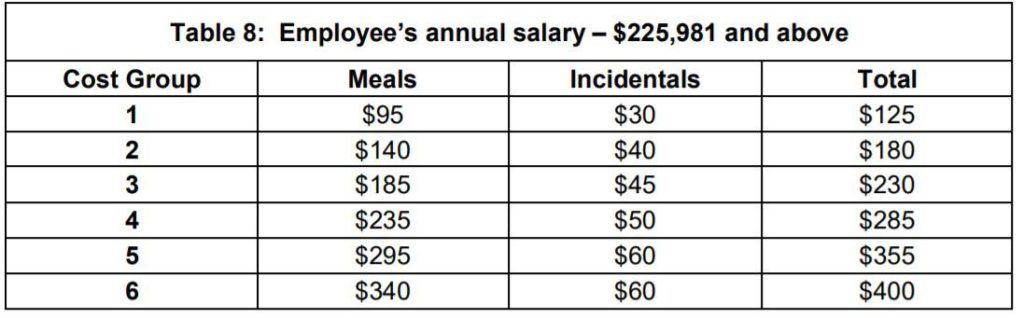

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

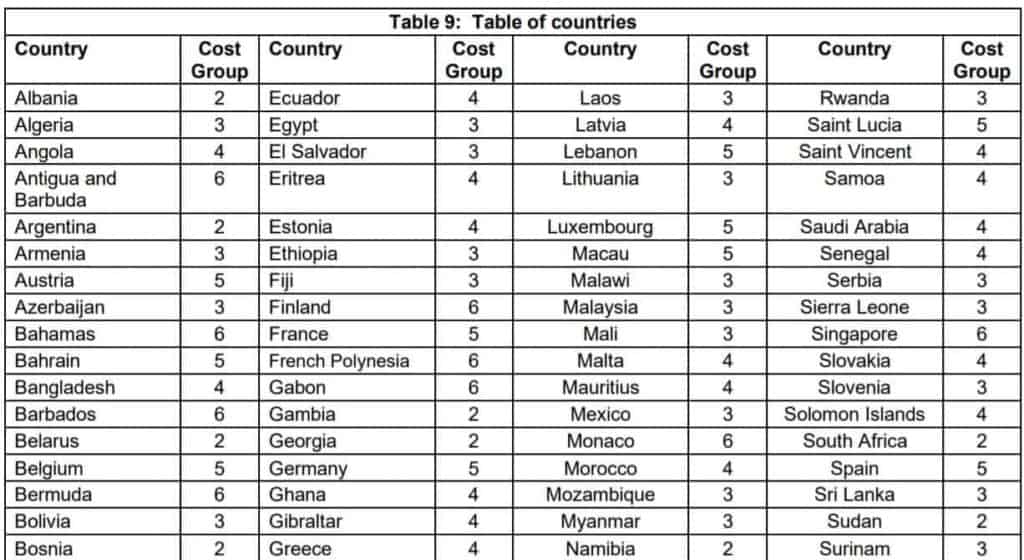

2020-21 Overseas Table 9: Table of countries

Allowances for 2019-20

The determination in sections:

Domestic Travel

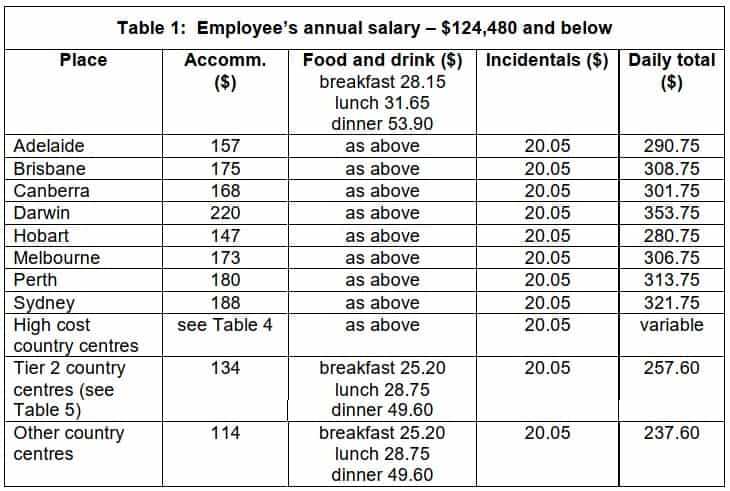

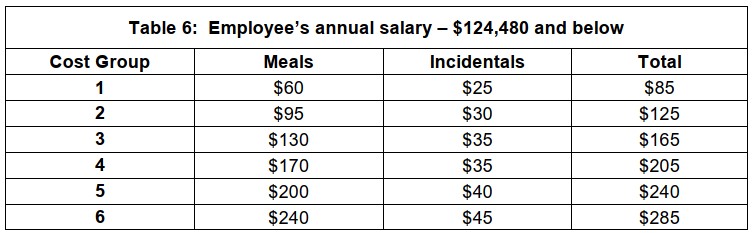

Table 1: Employee’s annual salary – $124,480 and below

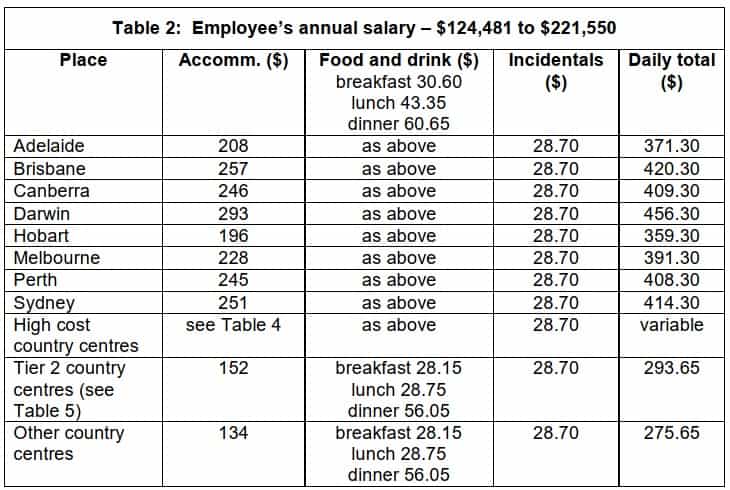

Table 2: Employee’s annual salary – $124,481 to $221,550

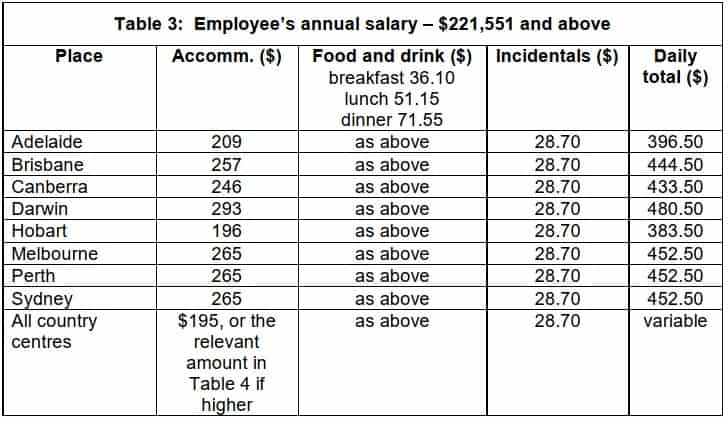

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

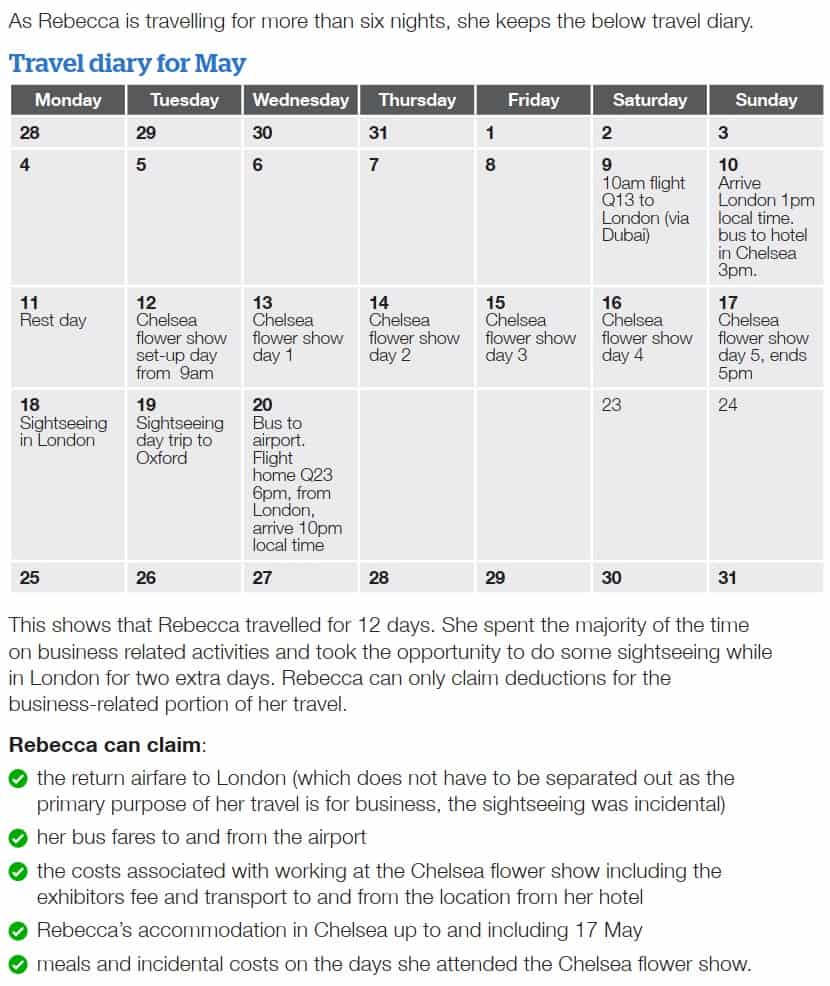

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

Sign in to MYOB

Don't have an account? Sign up

Login Register

Pay calculator tool

Find wages and penalty rates for employees.

Leave calculator tool

Work out annual and personal leave

Shift calculator

Rates for your shifts

Notice and redundancy calculator

- Accessibility

- Subscribe to email updates

- Visit Fair Work on YouTube

- Visit Fair Work on Twitter

- Visit Fair Work on Facebook

- Visit Fair Work on Instagram

- Visit Fair Work on LinkedIn

Automatic translation

Our automatic translation service can be used on most of our pages and is powered by Microsoft Translator.

Language help

For professionally translated information, select your language below.

Popular searches

- minimum wages

- annual leave

- long service leave

Tax and superannuation

Closing Loopholes: Fair Work Act changes

A new criminal offence for intentional underpayments by employers will be added to the Fair Work Act as part of the new ‘Closing Loopholes’ laws from no earlier than 1 January 2025.

We (the Fair Work Ombudsman) will investigate suspected criminal underpayment offences once the changes take effect.

Learn more at Closing Loopholes: Fair Work Act changes .

The Australian Taxation Office (ATO) gives advice and information about tax requirements and superannuation (super). The ATO is the primary enforcement agency for the compulsory super guarantee.

On this page:

Superannuation guarantee, superannuation under the national employment standards, extra terms about superannuation.

- When superannuation hasn't been paid

Tools and resources

Related information.

Our role (the Fair Work Ombudsman) is to give employers and employees information and advice on workplace rights and obligations. We can provide information on the entitlement to super in the National Employment Standards (NES) and extra terms about super in awards.

Find out how you can access advice and support on tax and super issues.

The ATO gives information and advice to employers and employees on tax.

If you want to understand your tax obligations as an employer or employee, find information on the ATO website:

- Employers: ATO – Tax and super when engaging an employee

- Employees: ATO – Working as an employee

You can also contact the ATO:

- online at ATO – Contact us , or

- over the phone on 13 28 61 .

If you’re an employer, we have templates to help you record tax or superannuation on employee records or pay slips. Access them at Pay slips and Record-keeping .

For more information on state and territory payroll tax, visit business.gov.au – Payroll tax .

Under the super guarantee, employers have to pay super contributions of 11% of an employee's ordinary time earnings when an employee is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

If eligible, the super guarantee applies to all types of employees, including:

- full-time employees

- part-time employees

- casual employees.

Temporary residents are also eligible for super.

Super has to be paid at least every 3 months and into the employee’s nominated account.

The ATO can give advice and assistance on super issues, including the super guarantee. Find out more at:

- ATO – Super for employers

- ATO – Super for employers – How much super to pay

- over the phone on 13 10 20 .

Super is an entitlement under the NES .

This means that most employees covered by the NES can take court action under the Fair Work Act to recover unpaid super, unless the ATO has already commenced proceedings in relation to that super.

The NES entitlement to super aligns with super laws, so if an employer complies with the super guarantee they will also meet their obligations under the NES.

The new NES entitlement doesn’t apply to some employees. Employees who are in the national workplace relations system because their state referred their powers to make workplace laws to the Commonwealth don’t have an entitlement to super under the NES. This broadly includes employees:

- sole traders

- partnerships

- other unincorporated entities

- non-trading corporations

- in Victoria employed in the public sector

- in Tasmania employed in local government.

These employees may still be entitled to super under the super guarantee and under super terms in an award or registered agreement.

Some awards, enterprise agreements and other registered agreements also have extra terms about super.

Find more information about super in your award by selecting from the list below.

Industry Embedded Filter Placeholder

When superannuation hasn’t been paid

Employees who think super hasn't been paid can make a complaint to the ATO.

Before doing this, you should:

- check if an award or registered agreement applies to your employment

- check if your award or agreement has extra terms about super (use the filter above or see our full list of awards )

- follow the steps on the ATO - Unpaid super from your employer page.

If there are extra super terms on top of the super guarantee in your award or agreement, you can contact us for further assistance.

Annual performance test – closed MySuper products

The Australian Prudential Regulation Authority (APRA) conducts an annual performance test for MySuper products. When a MySuper product fails the annual performance test for 2 consecutive years, it cannot accept new members until it passes a future performance test.

To learn more about which MySuper products are currently unable to accept new members go to FWC – Superannuation .

- Record-keeping

- Find my award

- Super – ATO website

- Pay slip template

- Find an enterprise agreement – Fair Work Commission

- National Employment Standards

- ATO website

- Super obligation employer’s checklist

- Super for temporary residents leaving Australia

Help for small business

- Find tools, resources and information you might need in our Small Business Showcase .

The Fair Work Ombudsman acknowledges the Traditional Custodians of Country throughout Australia and their continuing connection to land, waters, skies and communities. We pay our respects to them, their Cultures, and Elders past, present and future.

Thank you for your feedback. If you would like to tell us more about the information you’ve found today you can complete our feedback form .

Please note that comments aren't monitored for personal information or workplace complaints. If you have a question or concern about your job, entitlements or obligations, please Contact us .

Bookmark to My account

- Get priority support!

- Save results from our Pay, Shift, Leave and Notice and Redundancy Calculators

- Bookmark your favourite pages

- Ask us questions and save our replies

- View tailored information relevant to you.

Log in now to save this page to your account.

- Fair Work Online: www.fairwork.gov.au

- Fair Work Infoline: 13 13 94

Need language help?

Contacting the Translating and Interpreting Service (TIS) on 13 14 50

Hearing & speech assistance

Call through the National Relay Service (NRS):

- For TTY: 13 36 77 . Ask for the Fair Work Infoline 13 13 94

- Speak & Listen: 1300 555 727 . Ask for the Fair Work Infoline 13 13 94

The Fair Work Ombudsman is committed to providing you with advice that you can rely on. The information contained in this fact sheet is general in nature. If you are unsure about how it applies to your situation you can call our Infoline on 13 13 94 or speak with a union, industry association or a workplace relations professional.

Printed from fairwork.gov.au Content last updated: 2024-04-15 © Copyright Fair Work Ombudsman

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Europe » Moscow

EPIC MOSCOW Itinerary! (2024)

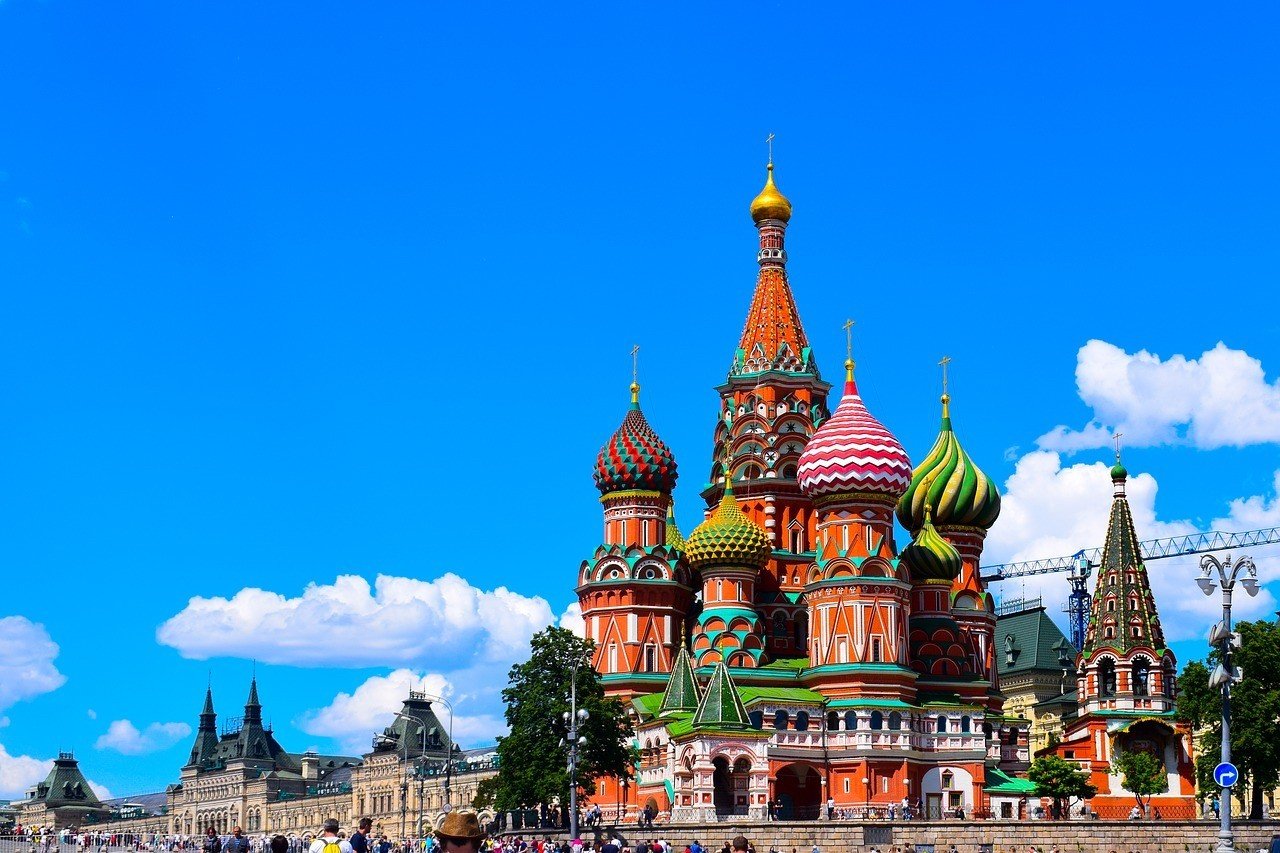

Moscow is the heart of Mother Russia. Just the mention of this city conjures images of colorful bulbous pointed domes, crisp temperatures, and a uniquely original spirit!

Moscow has an incredibly turbulent history, a seemingly resilient culture, and a unique enchantment that pulls countless tourists to the city each year! Although the warmer months make exploring Moscow’s attractions more favorable, there’s just something about a fresh snowfall that only enhances the appearance of the city’s iconic sites!

If you’re a first-time visitor to Moscow, or simply wanting to see as much of the city as possible, this Moscow itinerary will help you do just that!

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Best Time To Visit Moscow

Where to stay in moscow, moscow itinerary, day 1 itinerary in moscow, day 2 itinerary in moscow, day 3 and beyond, staying safe in moscow, day trips from moscow, faq on moscow itinerary.

Here is a quick look at the seasons so you can decide when to visit Moscow!

The summer months (June-August) are a great time to travel to Moscow to take advantage of the enjoyable mild temperatures. This is considered peak travel season. Bear in mind that hotel prices rise along with the temperatures!

If you’re planning a trip to Moscow during fall (September-November) try to plan for early fall. This way the temperatures will still be pleasant and winter won’t be threatening.

Russian winters (December-February) are not for the faint of heart as Napoleon learned to his peril. Some days the sun will be out for less than an hour, and snow is guaranteed. Although winters are exceptionally cold, this is when you’ll get a true glimpse of the Moscow experience!

The best time to visit Moscow is during spring (March-May). The temperatures will begin to creep up and the sun begins to shine for significant portions of the day. Hotel rates will also have yet to skyrocket into peak ranges!

With a Moscow City Pass , you can experience the best of Moscow at the CHEAPEST prices. Discounts, attractions, tickets, and even public transport are all standards in any good city pass – be sure invest now and save them $$$ when you arrive!

Moscow is a large city with many accommodation options to choose from. Staying in a location that fits with your travel plans will only enhance your Moscow itinerary. Here is a brief introduction to a few great areas of the city we recommend checking out!

The best place to stay in Moscow to be close to all the action is Kitay-Gorod. This charming neighborhood will put you within walking distance to Moscow’s famous Red Square, thus cutting down on travel time. This will allow you to see more of the city in a shorter amount of time!

It’s surrounded by restaurants, cafes, bars, and shops. If you’re a first-time visitor to Moscow, or just planning a quick weekend in Moscow, then this area is perfect for you!

Another great area to consider is the Zamoskvorechye district. This area of the city offers a blend of new and old Moscow. It has an artsy vibe and there are plenty of fun sites you can explore outside of the main touristy areas of Moscow.

Of course, as in all areas of Moscow, it’s close to public transportation that will quickly connect you with the rest of the city and make your Moscow itinerary super accessible!

Best Airbnb in Moscow – Exclusive Apartment in Old Moscow

Modern and cozy, this apartment is in the heart of Old Moscow. Bordering the Basmanny and Kitay-Gorod districts, this two-bedroom flat is walking distance to the Kremlin and Red Square. Safe, quiet, and comfortable, this is the best Airbnb in Moscow, no question!

Best Budget Hotel in Moscow – Izmailovo Alfa Hotel

The Izmailovo Alfa Hotel is a very highly rated accommodation that provides all the components necessary for a comfortable trip to Moscow. There is an on-site restaurant, bar, fitness center, and an airport shuttle service. The rooms are modern and spacious and are equipped with a TV, heating/air conditioning, minibar, and more!

Best Luxury Hotel in Moscow – Crowne Plaza Moscow World Trade Centre

If you’re touring Moscow in luxury, the Crowne Plaza Moscow World Trade Centre is the hotel for you! Elegantly furnished rooms are equipped with a minibar, flat-screen TV, in-room safes, as well as tea and coffee making facilities! Bathrooms come with bathrobes, slippers, and free toiletries. There is also an onsite restaurant, bar, and fitness center.

Best Hostel in Moscow – Godzillas Hostel

Godzillas Hostel is located in the center of Moscow, just a short walk from all the major tourist attractions and the metro station. Guests will enjoy all the usual hostel perks such as self-catering facilities, 24-hour reception, Free Wi-Fi, and security lockers. This is one of the best hostels in Moscow and its wonderful social atmosphere and will make your vacation in Moscow extra special!

Godzillas Hostel is one of our favourites in Moscow but they’re not taking guests right now. We’re not sure if they’re closed for good but we hope they’ll come back soon.

An important aspect of planning any trip is figuring out the transportation situation. You’re probably wondering how you’re going to get to all of your Moscow points of interest right? Luckily, this sprawling city has an excellent network of public transportation that will make traveling a breeze!

The underground metro system is the quickest and most efficient way to travel around Moscow. Most visitors rely exclusively on this super-efficient transportation system, which allows you to get to pretty much anywhere in the city! It’s also a great option if you’re planning a Moscow itinerary during the colder months, as you’ll be sheltered from the snow and freezing temperatures!

If you prefer above-ground transportation, buses, trams, and trolleybuses, run throughout the city and provide a rather comfortable alternative to the metro.

Moscow’s metro, buses, trams, and trolleybuses are all accessible with a ‘Troika’ card. This card can be topped up with any sum of money at a metro cash desk. The ticket is simple, convenient, and even refundable upon return to a cashier!

No matter which method you choose, you’ll never find yourself without an easy means of getting from point A to point B!

Red Square | Moscow Kremlin | Lenin’s Mausoleum | St. Basil’s Cathedral | GUM Department Store

Spend the first day of your itinerary taking your own self guided Moscow walking tour around the historic Red Square! This is Moscow’s compact city center and every stop on this list is within easy walking distance to the next! Get ready to see all of the top Moscow landmarks!

Day 1 / Stop 1 – The Red Square

- Why it’s awesome: The Red Square is the most recognizable area in Moscow, it has mesmerizing architecture and centuries worth of history attached to its name.

- Cost: Free to walk around, individual attractions in the square have separate fees.

- Food nearby: Check out Bar BQ Cafe for friendly service and good food in a great location! The atmosphere is upbeat and they’re open 24/7!

The Red Square is Moscow’s historic fortress and the center of the Russian government. The origins of the square date back to the late 15th century, when Ivan the Great decided to expand the Kremlin to reflect Moscow’s growing power and prestige!

During the 20th century, the square became famous as the site for demonstrations designed to showcase Soviet strength. Visiting the Red Square today, you’ll find it teeming with tourists, who come to witness its magical architecture up close!

The square is the picture postcard of Russian tourism, so make sure to bring your camera when you visit! No matter the season, or the time of day, it’s delightfully photogenic!

It’s also home to some of Russia’s most distinguishing and important landmarks, which we’ve made sure to include further down in this itinerary. It’s an important center of Russia’s cultural life and one of the top places to visit in Moscow!

In 1990, UNESCO designated Russia’s Red Square as a World Heritage site. Visiting this historic site is a true bucket-list event and essential addition to your itinerary for Moscow!

Day 1 / Stop 2 – The Moscow Kremlin

- Why it’s awesome: The Moscow Kremlin complex includes several palaces and cathedrals and is surrounded by the Kremlin wall. It also houses the principal museum of Russia (the Kremlin Armory).

- Cost: USD $15.00

- Food nearby: Bosco Cafe is a charming place to grat a casual bite to eat. They have excellent coffee and wonderful views of the Red Square and the Moscow Kremlin!

The iconic Moscow Kremlin , also known as the Kremlin museum complex, sits on Borovitsky Hill, rising above the Moscow River. It is a fortified complex in the center of the city, overlooking several iconic buildings in the Red Square!

It’s the best known of the Russian Kremlins – citadels or fortress’ protecting and dominating a city. During the early decades of the Soviet era, the Kremlin was a private enclave where the state’s governing elite lived and worked.

The Kremlin is outlined by an irregularly shaped triangular wall that encloses an area of 68 acres! The existing walls and towers were built from 1485 to 1495. Inside the Kremlin museum complex, there are five palaces, four cathedrals, and the enclosing Kremlin Wall with Kremlin towers.

The Armoury Chamber is a part of the Grand Kremlin Palace’s complex and is one of the oldest museums of Moscow, established in 1851. It showcases Russian history and displays many cherished relics. Definitely make sure to check out this museum while you’re here!

The churches inside the Moscow Kremlin are the Cathedral of the Dormition, Church of the Archangel, Church of the Annunciation, and the bell tower of Ivan Veliki (a church tower).

The five-domed Cathedral of the Dormition is considered the most famous. It was built from 1475–1479 by an Italian architect and has served as a wedding and coronation place for great princes, tsars, and emperors of Russia. Church services are given in the Kremlin’s numerous cathedrals on a regular basis.

The Grand Kremlin Palace was the former Tsar’s Moscow residence and today it serves as the official workplace of the President of the Russian Federation (Vladimir Putin seems to have bagged that title for life) .

Insider Tip: The Kremlin is closed every Thursday! Make sure to plan this stop on your Moscow itinerary for any other day of the week!

Day 1 / Stop 3 – Lenin’s Mausoleum

- Why it’s awesome: The mausoleum displays the preserved body of Soviet leader Vladimir Lenin .

- Cost: Free!

- Food nearby: Khinkal’naya is a charming Georgian restaurant with vaulted ceilings and exposed brick. It’s a popular place with locals and right next to the Red Square!

Lenin’s Mausoleum, also known as Lenin’s Tomb, is the modernist mausoleum for the revolutionary leader Vladimir Lenin. It’s located within the Red Square and serves as the resting place for the Soviet leader! His preserved body has been on public display since shortly after his death in 1924.

It’s located just a few steps away from the Kremlin Wall and is one of the most controversial yet popular Moscow attractions!

Admission is free for everyone, you’ll only need to pay if you need to check a bag. Before visitors are allowed to enter the mausoleum, they have to go through a metal detector first. No metal objects, liquids, or large bags are allowed in the mausoleum!

Expect a line to enter the building, and while you’re inside the building, you’ll be constantly moving in line with other visitors. This means you won’t be able to spend as long as you’d like viewing the mausoleum, but you’ll still be able to get a good look. Pictures and filming while inside the building are strictly prohibited, and security guards will stop you if they see you breaking this rule.

The mausoleum is only open on Tuesday, Wednesday, Thursday, and Saturday – unless it’s a public holiday or a day scheduled for maintenance. The hours it’s open for each day are limited, make sure to check online before you visit to make sure you can fit this into your Moscow itinerary for that day!

Insider Tip: The Lenin’s Museum is there for people to pay their respect; remember to keep silent and move along quickly, it’s not intended for people to congregate around. Also, men are not allowed to wear hats and everyone must take their hands out of their pockets when inside the building.

Day 1 / Stop 4 – St. Basil’s Cathedral

- Why it’s awesome: A dazzling designed cathedral that showcases Russia’s unique architecture. This cathedral is one of the most recognizable symbols of the country!

- Cost: USD $8.00

- Food nearby: Moskovskiy Chaynyy Klub is a cozy cafe serving food items and pipping hot tea; it’s the perfect place to go if you’re visiting Moscow during the winter months!

Located in the Red Square, the ornate 16th-century St. Basil’s Cathedral is probably the building you picture when you think of Moscow’s unique architecture. Its colorful onion-shaped domes tower over the Moscow skyline!

The cathedral was built from 1555-1561 by order of Tsar Ivan the Terrible. It was designed with an iconic onion dome facade and enchanting colors that captivate all who see it. Fun fact: If you’re wondering why Russian churches have onion domes, they are popularly believed to symbolize burning candles!

This iconic cathedral has become a symbol of Russia due to its distinguishing architecture and prominent position inside the Red Square. It’s one of the most beautiful, wonderful, and mesmerizing historical cathedrals in the world!

The interior of the church surprises most people when they visit. In contrast to the large exterior, the inside is not so much one large area, but rather a collection of smaller areas, with many corridors and small rooms. There are 9 small chapels and one mausoleum grouped around a central tower.

Visiting the inside is like walking through a maze, there are even small signs all around the cathedral tracing where to walk, and pointing you in the right direction! The walls are meticulously decorated and painted with intricate floral designs and religious themes.

The church rarely holds service and is instead a museum open for the public to visit.

Insider Tip: During the summer months the line to go inside the cathedral can get quite long! Make sure to arrive early or reserve your tickets online to guarantee quick access into the cathedral!

Day 1 / Stop 5 – GUM Department Store

- Why it’s awesome: This is Russia’s most famous shopping mall! It’s designed with elegant and opulent architecture and provides a real sense of nostalgia!

- Cost: Free to enter

- Food nearby: Stolovaya 57 is a cafeteria-style restaurant with a variety of inexpensive Russian cuisine menu items including soups, salads, meat dishes, and desserts. It’s also located inside the GUM department store, making it very easily accessible when you’re shopping!

The enormous GUM Department Store is located within the historic Red Square. It has a whimsical enchantment to it that sets it apart from your typical department store.

A massive domed glass ceiling lines the top of the building and fills the interior with natural sunlight. There are live plants and flowers placed throughout the mall that give the shopping complex a lively and cheerful feel! A playful fountain sits in the center, further adding to the malls inviting a sense of wonder and amusement!

The GUM department store opened on December 2, 1893. Today, it includes local and luxury stores, including Fendi, Louis Vuitton, Prada, and many more! There are numerous cafes, restaurants, and even a movie theater inside!

For a special treat, head into Gastronom 1. This 1950s-style shop sells gourmet food items, like wine, freshly-baked pastries, cheese, Russian chocolate, and of course, vodka! Also, be on the lookout for a bicycle pedaling ice cream truck with an employing selling ice cream!

The ambiance is simply amazing, a trip to this idyllic shopping mall is an absolute must on any Moscow itinerary!

Insider Tip: Make sure to carry some small change on you in case you need to use the restroom, you’ll need to pay 50 rubles – or about USD $0.80 to use the bathroom in GUM.

Wanna know how to pack like a pro? Well for a start you need the right gear….

These are packing cubes for the globetrotters and compression sacks for the real adventurers – these babies are a traveller’s best kept secret. They organise yo’ packing and minimise volume too so you can pack MORE.

Or, y’know… you can stick to just chucking it all in your backpack…

Novodevichy Convent | Gorky Park | State Tretyakov Gallery | All-Russian Exhibition Center | Bolshoi Theater

On your 2 day itinerary in Moscow, you’ll have a chance to use the city’s excellent public transportation service! You’ll explore a few more of Moscow’s historic highlight as well as some modern attractions. These sites are a little more spread out, but still very easily accessible thanks to the metro!

Day 2 / Stop 1 – Novodevichy Convent

- Why it’s awesome: The Novodevichy Convent is rich in imperial Russian history and contains some of Russia’s best examples of classical architecture!

- Cost: USD $5.00

- Food nearby: Culinary Shop Karavaevs Brothers is a cozy and simple place to have a quick bite, they also have vegetarian options!

The Novodevichy Convent is the best-known and most popular cloister of Moscow. The convent complex is contained within high walls, and there are many attractions this site is known for!

The six-pillared five-domed Smolensk Cathedral is the main attraction. It was built to resemble the Kremlin’s Assumption Cathedral and its facade boasts beautiful snowy white walls and a pristine golden onion dome as its centerpiece. It’s the oldest structure in the convent, built from 1524 -1525, and is situated in the center of the complex between the two entrance gates.

There are other churches inside the convent as well, all dating back from many centuries past. The convent is filled with an abundance of 16th and 17th-century religious artworks, including numerous large and extravagant frescos!

Just outside the convent’s grounds lies the Novodevichy Cemetery. Here, you can visit the graves of famous Russians, including esteemed authors, composers, and politicians. Probably the most intriguing gravestone belongs to Russian politician Nikita Khruschev!

The Novodevichy Convent is located near the Moscow River and offers a peaceful retreat from the busy city. In 2004, it was proclaimed a UNESCO World Heritage Site. The convent remains remarkably well-preserved and is an outstanding example of Moscow Baroque architecture!

Insider Tip: To enter the cathedrals inside the complex, women are advised to cover their heads and shoulders, while men should wear long pants.

Day 2 / Stop 2 – Gorky Central Park of Culture and Leisure

- Why it’s awesome: A large amusement area in the heart of the city offering many attractions!

- Cost: Free!

- Food nearby: Check out Mepkato, located inside Gorky Central Park for a casual meal in a cozy setting. There are indoor and outdoor seating options and the restaurant is child-friendly!

Gorky Central Park of Culture and Leisure is a large green space in the heart of Moscow. The park opened in 1928, and it stretches along the scenic embankment of the Moskva River. It covers an area of 300-acres and offers a lovely contrast from the compact city center.

You’ll find all sorts of wonderful attractions, from boat rides to bike rentals to tennis courts and ping-pong tables, and much more! there are an open-air cinema and festive events and concerts scheduled in the summer months. A wide selection of free fitness classes is also offered on a regular basis, including jogging, roller skating, and dancing!

Although many of the options you’ll find here are more suited for outdoor leisure during the summer, you’ll also a selection of winter attractions, including one of Europe’s largest ice rinks for ice-skating!

If you’re trying to decide what to do in Moscow with kids, the park also offers several venues designed specifically for kids. Check out the year-round Green School which offers hands-on classes in gardening and art! You can also feed the squirrels and birds at the Golitsinsky Ponds!

The park is very well maintained and kept clean and the entrance is free of charge, although most individual attractions cost money. There is also Wi-Fi available throughout the park.

With so many attractions, you could easily spend all day here! If you’re only planning a 2 day itinerary in Moscow, make sure to plan your time accordingly and map out all the areas you want to see beforehand!

Day 2 / Stop 3 – The State Tretyakov Gallery

- Why it’s awesome: The gallery’s collection consists entirely of Russian art made by Russian artists!

- Food nearby : Brothers Tretyakovs is located right across the street from the gallery. It’s a wonderfully atmospheric restaurant serving top quality food and drinks!

The State Tretyakov Gallery was founded in 1856 by influential merchant and collector Pavel Tretyakov. The gallery is a national treasury of Russian fine art and one of the most important museums in Russia!

It houses the world’s best collection of Russian art and contains more than 130, 000 paintings, sculptures, and graphics! These works have been created throughout the centuries by generations of Russia’s most talented artists!

The exhibits range from mysterious 12th-century images to politically charged canvases. The collection is rich and revealing and offers great insight into the history and attitudes of this long-suffering yet inspired people!

All pictures are also labeled in English. If you plan to take your time and see everything inside the museum it will take a good 3-4 hours, so make sure to plan your Moscow trip itinerary accordingly! This gallery is a must-see stop for art lovers, or anyone wanting to explore the local culture and history of Russia in a creative and insightful manner!

Insider Tip: When planning your 2 days in Moscow itinerary, keep in mind that most museums in Moscow are closed on Mondays, this includes The State Tretyakov Gallery!

Day 2 / Stop 4 – All-Russian Exhibition Center

- Why it’s awesome: This large exhibition center showcases the achievements of the Soviet Union in several different spheres.

- Food nearby: Varenichnaya No. 1 serves authentic and homestyle Russian cuisine in an intimate and casual setting.

The All-Russian Exhibition Center is a massive park that presents the glory of the Soviet era! It pays homage to the achievements of Soviet Russia with its many different sites found on the property.

The center was officially opened in 1939 to exhibit the achievements of the Soviet Union. It’s a huge complex of buildings and the largest exhibition center in Moscow. There are several exhibition halls dedicated to different achievements and every year there are more than one hundred and fifty specialized exhibitions!

The Peoples Friendship Fountain was constructed in 1954 and is a highlight of the park. The stunning gold fountain features 16 gilded statues of girls, each representing the former Soviet Union republics.

The Stone Flower Fountain was also built in 1954 and is worth checking out. The centerpiece of this large fountain is a flower carved from stones from the Ural Mountains! Along the side of the fountain are various bronze sculptures.

You will find many people zipping around on rollerblades and bicycles across the large area that the venue covers. It’s also home to amusement rides and carousels, making it the perfect place to stop with kids on your Moscow itinerary! Make sure to wear comfortable shoes and allow a few hours to explore all the areas that interest you!

Day 2 / Stop 5 – Bolshoi Theater

- Why it’s awesome: The Bolshoi Theater is a historic venue that hosts world-class ballet and opera performances!

- Cost: Prices vary largely between USD $2.00 – USD $228.00 based on seat location.

- Food nearby: Head to the Russian restaurant, Bolshoi for high-quality food and drinks and excellent service!

The Bolshoi Theater is among the oldest and most renowned ballet and opera companies in the world! It also boasts the world’s biggest ballet company, with more than 200 dancers!

The theater has been rebuilt and renovated several times during its long history. In 2011 it finished its most recent renovation after an extensive six-year restoration that started in 2005. The renovation included an improvement in acoustics and the restoration of the original Imperial decor.

The Bolshoi Theater has put on many of the world’s most famous ballet acts! Tchaikovsky’s ballet Swan Lake premiered at the theater in 1877 and other notable performances of the Bolshoi repertoire include Tchaikovsky’s The Sleeping Beauty and The Nutcracker!

Today, when you visit the theater, you can expect a magical performance from skilled singers, dancers, and musicians with the highest level of technique!

If you don’t have time to see a show, the theater also provides guided tours on select days of the week. Tours are given in both Russian and English and will provide visitors with a more intimate look at the different areas of the theater!

The stage of this iconic Russian theater has seen many outstanding performances. If you’re a fan of the performing arts, the Bolshoi Theater is one of the greatest and oldest ballet and opera companies in the world, making it a must-see attraction on your Moscow itinerary!

Godzillas Hostel

Godzillas Hostel is located in the center of Moscow, just a short walk from all the major tourist attractions and the metro station.

- Towels Included

Cosmonautics Museum | Alexander Garden | Ostankino Tower | Izmaylovo District | Soviet Arcade Museum

Now that we’ve covered what to do in Moscow in 2 days, if you’re able to spend more time in the city you’re going to need more attractions to fill your time. Here are a few more really cool things to do in Moscow we recommend!

Memorial Museum of Cosmonautics

- Hear the timeline of the ‘space race’ from the Russian perspective

- This museum is fun for both adults and children!

- Admission is USD $4.00

The Memorial Museum of Cosmonautics is a museum dedicated to space exploration! The museum explores the history of flight, astronomy, space exploration, space technology, and space in the arts. It houses a large assortment of Soviet and Russian space-related exhibits, and the museum’s collection holds approximately 85,000 different items!

The museum does an excellent job of telling the full story of the exciting space race between the USSR and the US! It highlights the brightest moments in Russian history and humanity and is very interesting and fun for all ages!

If you’re a fan of space or just curious about gaining insight into Russia’s fascinating history of space exploration, make sure to add this to your 3 day itinerary in Moscow!

The Alexander Garden

- A tranquil place to relax near the Red Square

- Green lawns dotted with sculptures and lovely water features

- The park is open every day and has no entrance fee

The Alexander Garden was one of the first urban public parks in Moscow! The garden premiered in 1821 and was built to celebrate Russia’s victory over Napoleon’s forces in 1812!

The park is beautiful and well maintained with paths to walk on and benches to rest on. The park contains three separate gardens: the upper garden, middle garden, and lower garden.

Located in the upper garden, towards the main entrance to the park is the Tomb of the Unknown Soldier with its eternal flame. This monument was created in 1967 and contains the body of a soldier who fell during the Great Patriotic War!

The park stretches along all the length of the western Kremlin wall for about half a mile. Due to its central location in the city, it’ll be easily accessible when you’re out exploring The Red Square.

It provides a bit of relief from the city’s high-energy city streets. Bring a picnic lunch, go for a walk, or just sit and people watch, this is one of the best Moscow sites to wind-down and relax!

Ostankino Television Tower

- Television and radio tower in Moscow

- Currently the tallest free-standing structure in Europe

- Make sure you bring your passport when you visit, you can’t go up without it!

For spectacular views of the city, make sure to add the Ostankino Television Tower to your itinerary for Moscow! This impressive free-standing structure provides stunning views of the city in every direction. The glass floor at the top also provides great alternative views of the city!

It takes just 58 seconds for visitors to reach the Tower’s observation deck by super fast elevator. The tower is open every day for long hours and is a great site in Moscow to check out! There is even a restaurant at the top where you can enjoy rotating views of the city while you dine on traditional Russian cuisine or European cuisine!

The tower is somewhat of an architectural surprise in a city that is not known for skyscrapers! To see the city from a new perspective, make sure to add this stop to your Moscow itinerary!

Izmaylovo District

- The most popular attractions in this district are the kremlin and the flea market

- Outside of the city center and easy to reach via metro

- Most popular during the summer and on weekends

Travel outside the city center and discover a unique area of the city! The Izmaylovo District is a popular destination for locals and tourists alike, and one of the coolest places to see in Moscow! The two main attractions we recommend checking out are the Kremlin and the flea market.

The Izmailovo Kremlin was established as a cultural center and molded after traditional Russian architecture. This colorful complex is home to several single-subject museums, including a Russian folk art museum and a vodka museum!

Next to the Kremlin is the Izmailovo open-air market, which dates back to the 17th century! The market is connected to the Izmailovo Kremlin by a wooden bridge. Pick up all your Russian souvenirs here, including traditional handicrafts, paintings, books, retro toys, and Soviet memorabilia!

You will find many hand-made and hand-painted options available at higher prices, as well as mass-produced souvenir options at lower prices!

Museum of Soviet Arcade Games

- Closed on Mondays

- Filled with old arcade games that visitors get to try out!

- The museum also includes a small cafe and burger shop

For something a little different, check out the Museum of Soviet Arcade Games! The museum features roughly 60 machines from the Soviet era, including video games, pinball machines, and collaborative hockey foosball! The machines inside the museum were produced in the USSR in the mid-1970s.

The best part is, most of the games are still playable! Purchase tickets and try the games out for yourself! The museum also has a neat little screening room that plays old Soviet cartoons and an area with Soviet magazines! This unique attraction is a fun addition to a 3 day itinerary in Moscow, and an attraction that all ages will enjoy!

Whether you’re spending one day in Moscow, or more, safety is an important thing to keep in mind when traveling to a big city! Overall, Moscow is a very safe place to visit. However, it is always recommended that tourists take certain precautions when traveling to a new destination!

The police in Moscow is extremely effective at making the city a safe place to visit and do their best to patrol all of the top Moscow, Russia tourist attractions. However, tourists can still be a target for pickpockets and scammers.

Moscow has a huge flow of tourists, therefore there is a risk for pickpocketing. Simple precautions will help eliminate your chances of being robbed. Stay vigilant, keep your items close to you at all times, and don’t flash your valuables!

If you’re planning a solo Moscow itinerary, you should have no need to worry, as the city is also considered safe for solo travelers, even women. Stay in the populated areas, try and not travel alone late at night, and never accept rides from strangers or taxis without a meter and correct signage.

The threat of natural disasters in Moscow is low, with the exception of severe winters when the temperature can dip below freezing! Bring a good, warm jacket if you visit in Winter.

However, please note that Russian views on homsexuality are far less accepting than those in Western Europe. Likewise, Non-Caucasian travellers may sadly encounter racism in Russia .

Don’t Forget Your Travel Insurance for Moscow

ALWAYS sort out your backpacker insurance before your trip. There’s plenty to choose from in that department, but a good place to start is Safety Wing .

They offer month-to-month payments, no lock-in contracts, and require absolutely no itineraries: that’s the exact kind of insurance long-term travellers and digital nomads need.

SafetyWing is cheap, easy, and admin-free: just sign up lickety-split so you can get back to it!

Click the button below to learn more about SafetyWing’s setup or read our insider review for the full tasty scoop.

Now that we’ve covered all the top things to see in Moscow, we thought we’d include some exciting day trips to other areas of the country!

Sergiev Posad (Golden Ring)

On this 7-hour guided tour, you’ll visit several scenic and historic areas of Russia. Start your day with hotel pick-up as you’re transferred by a comfortable car or minivan to Sergiev Posad. Admire the charming Russian countryside on your drive and enjoy a quick stop to visit the Russian village, Rudonezh!

You’ll see the majestic Saint Spring and the Church of Sergiev Radonezh. You’ll also visit the UNESCO World Heritage Site, Trinity Lavra of St. Sergius, one of the most famous Orthodox sites in Russia!

Lastly, you’ll swing by the local Matreshka market and enjoy a break in a nice Russian restaurant before returning to Moscow!

Day Trip to Vladimir and Suzdal

On this 13-hour trip, you’ll discover old Russia, with its picturesque landscapes and white-stoned beautiful churches! You’ll visit the main towns of the famous Golden Ring of Russia – the name for several cities and smaller towns north-east of Moscow.

Your first stop will be in the town of Vladimir, the ancient capital of all Russian principalities. The city dates back to the 11th century and is one of the oldest and the most important towns along the Ring! Next, you’ll visit Suzdal, a calm ancient Russian town north of Vladimir with only 13,000 inhabitants!

The old-style architecture and buildings of Suzdal are kept wonderfully intact. If you’re spending three days in Moscow, or more, this is a great option for exploring the charming areas outside the city!

Zvenigorod Day Trip and Russian Countryside

On this 9-hour private tour, you’ll explore the ancient town of Zvenigorod, one of the oldest towns in the Moscow region! As you leave Moscow you’ll enjoy the stunning scenery along the Moscow River, and make a few stops at old churches along the way to Zvenigorod.

Upon arrival, you’ll explore the medieval center, including the 14th-century Savvino-Storozhevsky Monastery. Next, you’ll take a break for lunch (own expense) where you’ll have the chance to try out the Russian cuisine! Next, you’ll visit the Museum of Russian Dessert and sip on tea at a Russian tea ceremony.

The final stop of the day is at the Ershovo Estate, a gorgeous place to walk around and enjoy nature!

Day Trip to St Petersburg by Train visiting Hermitage & Faberge

On this full-day tour, you’ll enjoy a a full round trip to St Petersburg where you’ll spend an exciting day exploring another popular Russian city! You’ll be picked up from your hotel in Moscow and be transferred to the train station where you’ll ride the high-speed train ‘Sapsan’ to St Petersburg.

Upon arrival, you’ll start the day by touring the Hermitage Museum and the Winter Palace. Next, you’ll visit the Faberge Museum, where you’ll explore the impressive collection of rare Faberge Eggs! In the afternoon, enjoy a sightseeing boat ride and a traditional 3-course Russian lunch.

If you’re spending 3 days in Moscow, or more, this is an excellent trip to take!

Trip to Kolomna – Authentic Cultural Experience from Moscow

On this 10-hour tour, you’ll escape the city and travel to the historic town of Kolomna! First, you’ll visit the 14th-century Kolomna Kremlin, home to the Assumption Cathedral and an abundance of museums!

Next, enjoy lunch at a local cafe (own expense) before embarking on a tour of the Marshmallow Museum – of course, a marshmallow tasting is provided! Your final stop is the Museum of Forging Settlements, where displays include armor and accessories for fishing and hunting.

Discover this beautiful Russian fairytale city on a private trip, where all of the planning is taken care of for you!

Stash your cash safely with this money belt. It will keep your valuables safely concealed, no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash, a passport photocopy or anything else you may wish to hide. Never get caught with your pants down again! (Unless you want to…)

Find out what people want to know when planning their Moscow itinerary.

How many days you need in Moscow?