Access a world of possibilities with Citigold benefits.

No ATM or Foreign Exchange Fees 2,3

Travel across the globe with the freedom of using any ATM, while enjoying waived ATM foreign exchange fees and unlimited refunds on ATM fees charged by other banks.

Citigold Lounges & Client Centers

Whether you’re in your home city or traveling abroad, you have exclusive access to lounges in Citi properties in cities around the world. Take a break to relax and recharge...

Home Connect Customer Service 5

Home Connect service provides toll-free access to your local Citigold service center from select foreign countries.

The Citigold Concierge Service 1

The complimentary Citigold Concierge service helps clients book reservations, tickets and vacations.

World Wallet Currency Exchange 4

If you need foreign currency, you have access to the next business day delivery of foreign currencies to your home, office or nearest branch. Plus, you get waived foreign exchange fees...

Emergency Cash 6

Citi is by your side when you travel with cash for eligible emergencies (up to $10,000 per day from the available funds in your Citigold Account).

Call Toll Free: 1-888-248-4465 | For TTY: We accept 711 or other Relay Service.

Ready to Get Started?

Open a new Citigold checking account to earn up to $2,500 with required activities.

Open a Checking Account Online

Call: 1-833-382-0004 EXT 1087 | For TTY: We accept 711 or other Relay Service.

Contact Us today to learn more about Citigold and we will call you back shortly.

Citi is here to help you meet your financial goals.

Sign On to schedule an appointment with your Citigold dedicated team.

If you would like to start another Citigold relationship, Open an Account Online .

Call the Dedicated Service Line: 1-833-382-0004 EXT 1087 | For TTY: We accept 711 or other Relay Service.

This website requires JavaScript to be viewable. Please revisit the website with a JavaScript-enabled web browser.

Whether you’re in your home city or traveling abroad, you have exclusive access to lounges in Citi properties in cities around the world. Take a break to relax and recharge, attend unique invitation-only events, and meet with Citi financial professionals in a private setting.

Find a Citigold Lounge

If you need foreign currency, you have access to the next business day delivery of foreign currencies to your home, office or nearest branch. Plus, you get waived foreign exchange fees and waived delivery fees as a Citigold client. Currency conversions are done at competitive currency exchange rates. Your order will be debited from your Citibank checking, savings or money market account.

Call: 1-800-756-7050 (option 2) by 3pm CST 24 hr. Exchange Rate Hotline: 1-800-756-7050 (option 1) Toll-free International: 1-210-677-0065 Speech and Hearing Impaired Customers: dial 711

Unused Foreign Bank Note Exchange If you return from traveling with unused foreign bank notes, you can exchange them for U.S. dollars at any Citibank branch .

- Disclosures

The Best Travel Credit and Debit Cards with No Foreign Transaction Fees (Updated 2022)

No matter where you go or how long you travel, using a credit or debit card with no foreign transaction fees is one of the easiest ways to save money while travelling, period.

Currency exchange booths at airports and banks can be convenient, but a lot of your money goes towards exchange fees (e.g. $10 per exchange) and hidden commissions padded into poor exchange rates (especially the booths advertising “no commissions”). With a bit of research and planning, you can save hundreds , if not thousands of dollars in fees over the long-term!

Credit and debit cards with no foreign transaction fees are the cheapest, easiest ways to get money and make payments overseas. Credit cards are accepted worldwide, and ATMs are internationally networked through the Visa/Plus and Mastercard/Cirrus networks. You enter your PIN and withdraw your cash just like you would at home, while the exchange rates are automatically handled by the banks.

However, some credit and debit cards are better than others! For the majority of cards, banks still try to add commissions and fees to each payment or ATM withdrawal made abroad. Even if you don't travel a lot, these fees add up quickly.

We've rounded up the best credit and debit cards around the world that minimize or eliminate these fees, putting more money back into your adventure funds!

NOTE: These are cards to be used overseas to avoid foreign transaction fees. For the best all around travel points cards, check out the travel rewards cards section of CardRatings , as well as our free guide “ How to Get Free Flights with Travel Credit Cards and Points “!

The best travel credit cards with no foreign transaction fees

Credit cards have various features that can make or break your travel savings. Ideally, these are the features to look for in a credit card:

- Foreign transaction fee of 0%

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

- Extra perks, like free car or travel insurance

The best travel debit cards with no foreign transaction fees

These are the ideal features to look for in a debit card:

- Foreign transaction rate of 0%

- International ATM withdrawal fee of $0

- Refund of third-party ATM withdrawal fees (This is rare, but it exists!)

- Competitive points or cash-back rewards program (at least 1% of the purchase price)

Many banks around the world have come together to establish the Global ATM Alliance . If your card belongs to a bank in the alliance, you can make withdrawals from banks at other alliance member ATMs around the world without paying additional fees . Here's our roundup of the best debit cards for travel.

Essential tips for using debit and credit cards while travelling

1. pay using a credit card whenever possible..

Foreign ATMs can still inflate their exchange rates and charge withdrawal fees, but a direct credit card payment only involves the credit card you signed up with in your home country. And with a good points or cashback program, this beats any other method of foreign payment.

Bottom line? Always pay with a credit card, but NEVER withdraw cash from an ATM with one. Credit cards charge interest on cash advances from the moment you withdraw it at the ATM.

2. Never take the option of paying in your own currency

Card terminals at shops and hotels will often detect that your card is from another country and offer to bill you in your home currency. Never choose this option – always pay in the foreign currency! The exchange rate offered will be inflated by the card terminal, so if you’re using one of the credit cards recommended above, you will receive a much better exchange rate.

3. Inform your debit and credit card providers of your travels

Credit and debit cards are frequently being monitored by security departments for suspicious activity. If you're from the U.S. and you make an ATM withdrawal in Thailand when they don’t know you’re overseas, this could appear suspicious to your bank, and your card might be locked the next time you withdraw. Give your bank or credit card provider a call and let them know when and where you’ll be travelling. Take it from us – you do not want to be stuck without cash and a useless card!

4. Obtain at least one debit and credit card on each of the Visa/Plus and MasterCard/Cirrus networks.

Even if you follow the advice in tip #3, it’s possible your card could get locked anyway. On top of that, it’s easy to find yourself in a situation where an ATM accepts only one network and not the other. For example, when we travelled in Japan, the only ATMs we could find that would even accept international cards were at 7-Eleven, and they only worked with cards on the Visa/Plus network. I speak from experience – there’s nothing more stressful than needing more cash and not being able to withdraw it, so be prepared and bring multiple cards on multiple networks .

5. Consider a credit card with included insurance

The jury is still out on whether it's safe to rely on car and travel insurance that is sometimes provided by credit cards, and unfortunately, the only way to know for sure is to file a claim after the accident has happened. If you're concerned about insurance, its best to be safe and purchase it from the car rental company, but if not, you might as well pay with a credit card that offers car insurance and hope for the best if you do end up in an accident. We generally try to use American Express cards when thinking about insurance, as they are managing the insurance on the cards worldwide, whereas Visa/Mastercard insurance is often handled by the card's issuing bank, and may not be as straightforward to redeem.

6. Keep backup cards in your hotel room

If you lose all your credit and debit cards while overseas, you're going to be in quite the pickle. Always keep at least one extra card back at your accommodation in case your main card or entire wallet is lost or stolen while you're out.

7. Bring $100 USD as backup cash

When all else fails, U.S. dollars are the closest thing to a global currency that we have today. It's the most commonly accepted currency, not only at exchange booths, but even at shops and restaurants in other countries. If there are no ATMs in sight or your cards have been stolen, an emergency backup of U.S. dollars will get you out an emergency situation.

Do you have another card recommendation? Know something we don't? Write it in the comments below!

Psssst : for more guides like this, Like Us on Facebook and follow us on Twitter !

Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions expressed here are author's alone. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Nice! This is really helpful thanks!

Great tips for travelers!

- Pingback: How to Travel Safely in a Foreign Country

- Pingback: The Get-Your-Sh*t-Together List AKA Prepping for Your Backpacking Adventure | petrinatravels

- Pingback: How to Book the Cheapest Flight Possible to Anywhere - Thrifty Nomads

What are the best U.S. debit and credit cards to use overseas?

Just got off a long phone call with HSBC Canada. They are unable to tell me what their card issuer exchange rate surcharge. I had just come back from Mexico and used my HSBC ATM card on a HSBC ATM machine and I calculated the fee to be about 2.1% based on that days interbank rate. Shouldn’t this fee be in the disclosure statements? There was a class action lawsuit I believe many years ago because the credit card companies failed to state their foreign exchange surcharge. From what I’m reading on the Global ATM website is that Visa is involved with the foreign exchange when using an ATM and it states they add a 2.5% foreign exchange fee. You didn’t show this in your nice graphics above. Is it berried in the base exchange rate?

We use Visa Avion, which is good in all categories but I believe they do charge a slight foreign transaction fee. But we have claimed through their default insurance, both car, health, and travel. All minor things, but ya, no issues. The card is not free however, and unless you spend a lot each month or travel frequently it’s not worth it. For us, the points for the business transactions transfer to personal, so it really adds up! (Currently we have more than enough to fly the entire family pretty much anywhere. ) When abroad we usually only use the card for car rental or nicer hotels and of course flights or trains and such (to access insurance benefits one must book the flight etc on that card…) But read the fine print, confirm with the agent. For example, usually to get car insurance you have to wave the rental companies insurance. (This saved us a ton in Africa!) The rental agencies will even phone and confirm if they don’t know the card. These cards were set up for frequent business travelers originally. But read the fine print too, I know our card covers 30 days from home, but you can add insurance to the card for longer trips too. It’s all through RBC, and like any blood sucking corporation there are advantages for the savvy but their ultimate goal is to get you to pay twice for the same thing. Read the fine print, phone your card agent, etc… But we honestly have found the Avion worth it for us because of the company points.

This info is super helpful! For Canadians, what about the Marriott Rewards® Premier Visa® Card? I’ve been looking into credit and debit cards for an upcoming trip to Southeast Asia, and came across this card today. From what I can tell, it seems pretty good (no foreign currency transaction charges and has perks). Anyone have any experience or thoughts on this card? Thanks!

so where do you find that tangerine thrive chequing account info? I have an account with tangerine and I can find no info on this animal on their website

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Disclosures Many of the listings that appear on this website are from companies which we receive compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The site does not review or include all companies or all available products. Thrifty Nomads has partnered with CardRatings for our coverage of credit card products. Thrifty Nomads and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IMPORTANT NOTICE

Credit cards" data-destinationurl="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" data-ctaposition="header:meganav" data-aria-label="Click here to view all Credit cards" href="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" rel="" innerhtml="Credit cards">Credit cards

Features & Benefits

Citi rewards program, citi rewards program > citi rewards" data-destinationurl="https://www1.citibank.com.au/rewardsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to view the citi rewards program" href="https://www1.citibank.com.au/rewardsintcid=meganav-cc" rel="" innerhtml="citi rewards">citi rewards, citi rewards program >pay with points" data-destinationurl="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn more about pay with points" target="_self" href="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" rel="" innerhtml="pay with points">pay with points, instalment plans" data-destinationurl="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn about citi instalment plans" target="_self" href="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" rel="" innerhtml="instalment plans">instalment plans, account information, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to setting up repayments" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" rel="" innerhtml="setting up repayments">setting up repayments, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" data-ctaposition="header:meganav" data-aria-label="click here to view the useful forms and links page" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to use our credit card calculators" target="_self" href="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" rel="" innerhtml="calculators & tools">calculators & tools, loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view our personal loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" rel="" innerhtml="loans">loans, loans > citi ready credit" data-destinationurl="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi ready credit page" target="_self" href="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" rel="" innerhtml=" citi ready credit"> citi ready credit, loans > personal loan plus" data-destinationurl="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi personal loan plus page" target="_self" href="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" rel="" innerhtml=" personal loan plus"> personal loan plus, loans > help me choose" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the help me choose page" target="_self" href="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" rel="" innerhtml="help me choose">help me choose, loans > compare loans" data-destinationurl="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the compare loans page" target="_self" href="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" rel="" innerhtml="compare loans">compare loans, view all loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" data-ctaposition="header:meganav" data-aria-label="click here to view all loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" rel="" innerhtml=" view all loans > "> view all loans >, account information > how to use your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to use your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" rel="" innerhtml="how to use your account">how to use your account, account information > how to manage your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to manage your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" rel="" innerhtml="how to manage your account">how to manage your account, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to make repayments to your personal loan account" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" rel="" innerhtml="setting up repayments">setting up repayments, account information > fees & charges" data-destinationurl="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view personal loans fees & charges" target="_self" href="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" rel="" innerhtml="fees & charges">fees & charges, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view useful forms and links" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the calculators & tools" target="_self" href="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" rel="" innerhtml="calculators & tools">calculators & tools, help with credit cards" data-destinationurl="" href="unsafe:javascript:void(0);" rel="" innerhtml=" help with credit cards"> help with credit cards, help with credit cards > check application status" data-destinationurl="https://www.citibank.com.au/global_docs/check_app_status.htm" data-ctaposition="header:meganav" data-aria-label="click here to check the status of your application" target="_self" href="https://www.citibank.com.au/global_docs/check_app_status.htm" rel="" innerhtml="check application status">check application status.

Account management

Account management > update contact details" data-destinationurl="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to update your contact details" target="_self" href="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" rel="" innerhtml="update contact details">update contact details, account management > travelling overseas" data-destinationurl="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to view the travelling overseas page" target="_self" href="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" rel="" innerhtml="travelling overseas">travelling overseas, account management > reset user id or password" data-destinationurl="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to reset your user id or password" target="_self" href="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" rel="" innerhtml="reset user id or password">reset user id or password, account management > document upload" data-destinationurl="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to upload your forms and documents" target="_self" href="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" rel="" innerhtml="document upload">document upload, account management > download citi mobile app" data-destinationurl="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the citi mobile® app" target="_self" href="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" rel="" innerhtml="download citi mobile ®️ app">download citi mobile ®️ app, account management > deposit & home loan accounts" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" href="https://www1.citibank.com.au/nabintcid=meganav-hs" rel="" innerhtml="deposit & home loan accounts">deposit & home loan accounts, support > support services" data-destinationurl="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our support services" target="_self" href="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" rel="" innerhtml="support services">support services, support > financial hardship" data-destinationurl="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about financial hardship" target="_self" href="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" rel="" innerhtml="financial hardship">financial hardship, support > disaster & crisis support" data-destinationurl="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our disaster and crisis support" target="_self" href="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" rel="" innerhtml="disaster & crisis support">disaster & crisis support, support > scams" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about scam prevention and reporting scams" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" rel="" innerhtml="scams">scams, support > dispute transactions" data-destinationurl="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn how to dispute a transaction" target="_self" href="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" rel="" innerhtml="dispute transactions">dispute transactions, support > banking code of practice" data-destinationurl="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the banking code of practice" target="_self" href="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" rel="" innerhtml="banking code of practice">banking code of practice, support > data sharing consent (open banking)" data-destinationurl="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our data sharing consents and open banking" target="_self" href="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" rel="" innerhtml=" ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking)"> ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking), the move to nab" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-au" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" target="_self" href="https://www1.citibank.com.au/nabintcid=meganav-au" rel="" innerhtml="the move to nab">the move to nab, sign into nab >" data-destinationurl="https://ib.nab.com.au/login" data-ctaposition="header:meganav" data-aria-label="click here to sign in to nab" target="_blank" href="https://ib.nab.com.au/login" rel="" innerhtml=" sign into nab > "> sign into nab >, report lost or stolen card" data-destinationurl="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a lost or stolen card" target="_self" href="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" rel="" innerhtml="report lost or stolen card">report lost or stolen card, report a scam" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a scam" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" rel="" innerhtml="report a scam">report a scam.

- Help and Support

Travelling Overseas

Please make sure you update your mobile number in Citi Online when travelling overseas, so we can reach you if we detect any irregular transactions on your account.

Before you Travel

Ensure you have done the following before you travel.

Ensure we have your overseas mobile number

There are inherent risks to using your card overseas such as card theft and skimming. To protect your account security, we will temporarily suspend your account if we suspect your card has been compromised and we can’t contact you. Your account will remain blocked until we can get in touch. To minimise any inconvenience, it's important that we have the mobile number you will be using while overseas.

You can update your mobile number by signing on to Citi Online, click Services > My Profile > Personal Information > View/Update Details > Update Information.

There are inherent risks to using your card overseas such as card theft and skimming. To protect your account security, we will temporarily suspend your account if we suspect your card has been compromised and we can’t contact you. Your account will remain blocked until we can get in touch. To minimise any inconvenience, it's important that we have the mobile number you will be using while overseas.

You can update your mobile number by signing on to Citi Online, click Services > My Profile > Personal Information > View/Update Details > Update Information.

Download the Citi Mobile ® App

Download the Citi Mobile ® App

Download the Citi Mobile ® App and register for a mobile One-Time PIN (OTP). This allows you to generate an offline OTP to access your accounts, anywhere in the world. This feature is free to use internationally as no network coverage or internet connection is required to generate an offline OTP.

Please note that the offline mobile OTP function will not work if the time on your device is reset manually. If you would like to update the time on your device, please update the time zone or allow the network to select automatically.

Learn more  >

Download the Citi Mobile ® App and register for a mobile One-Time PIN (OTP). This allows you to generate an offline OTP to access your accounts, anywhere in the world. This feature is free to use internationally as no network coverage or internet connection is required to generate an offline OTP.

Learn more >

Set up your Citi Mobile ® Token to receive One-Time Pin (OTP) overseas

Set up your Citi Mobile ® Token to receive One-Time Pin (OTP) overseas

There are two ways you can receive an OTP while overseas.

1. Generate an OTP via the Citi Mobile ® App

You can get an OTP sent via the Citi Mobile ® App without internet connection or network coverage.

To receive an OTP via the Citi Mobile ® App you will need to activate the Citi Mobile® Token and set up your 4-digit passcode.

- Log in to the Citi Mobile ® App

- Tap the ‘Profile and Settings’ icon on the top left of the screen

- Go to ‘Security & app’ in ‘Settings’

- Select ‘Manage Citi Mobile ® Token

- Tap ‘Create Unlock Code’

- Create your 4-digit Unlock Code. Re-enter it to confirm

- You will be able to receive the OTP via the Citi Mobile ® App

2. Receive an OTP via SMS

To receive an OTP to your mobile phone you will need to activate global roaming before travelling. The SMS OTP has been optimised for international delivery and is still delivered instantly.

Learn more >

1. Generate an OTP via the Citi Mobile ® App

You can get an OTP sent via the Citi Mobile ® App without internet connection or network coverage.

To receive an OTP via the Citi Mobile ® App you will need to activate the Citi Mobile® Token and set up your 4-digit passcode.

- Log in to the Citi Mobile ® App

- Tap the ‘Profile and Settings’ icon on the top left of the screen

- Go to ‘Security & app’ in ‘Settings’

- Select ‘Manage Citi Mobile ® Token

- Tap ‘Create Unlock Code’

- You will be able to receive the OTP via the Citi Mobile ® App

2. Receive an OTP via SMS

Learn more >

Check your card expiry date

Check your card expiry date

If your card is due to expire or it will expire while you are overseas and you have not received your new card, please contact us and our Customer Service Officers can assist.

Memorise your PIN

Memorise your PIN

Just like in Australia, many overseas countries will require a PIN when using your card to make purchases. Change your PIN to one you will remember.

You can change your PIN through the Citi Mobile ® App or on Citi Online.

You can change your PIN through the Citi Mobile ® App or on Citi Online.

Lost or stolen cards

To protect your account, take action immediately if your card is lost or stolen.

Credit Cards: If your card is lost or stolen you can check recent transactions, report the card as lost or stolen and block it using our digital channels. Learn more >

Alternatively, you can call us on 13 24 84 or +61 2 8225 0615 if you’re calling from overseas and we can assist you with reviewing recent transactions, blocking and replacing your card.

Debit Cards: Call us on 13 24 84 or +61 2 8225 0615 if you are calling from overseas and we can assist you with reviewing recent transactions, blocking and replacing your Debit Card.

Credit Cards: If your card is lost or stolen you can check recent transactions, report the card as lost or stolen and block it using our digital channels. Learn more >

Alternatively, you can call us on 13 24 84 or +61 2 8225 0615 if you’re calling from overseas and we can assist you with reviewing recent transactions, blocking and replacing your card.

Debit Cards: Call us on 13 24 84 or +61 2 8225 0615 if you are calling from overseas and we can assist you with reviewing recent transactions, blocking and replacing your Debit Card.

Travel Tips

Set up Easi-Pay

Set up Easi-Pay which will ensure your minimum repayments or full closing balance are made by the due date each month. You can keep this service when you come back too. Click here to set up Easi-Pay today .

Set up Mobile Wallet

Be prepared with an easy and convenient payment alternative in the event your cards are lost or stolen overseas. Turn your mobile phone into a mobile wallet and experience a faster, more convenient way to pay. Learn more >

Visit smarttraveller.com.au

This Government website has handy travel tips, advice and all the latest travel advisory warnings.

Be prepared with an easy and convenient payment alternative in the event your cards are lost or stolen overseas. Turn your mobile phone into a mobile wallet and experience a faster, more convenient way to pay. Learn more >

Keep your card safe

Keep an eye on your card at all times, we encourage you to always pay at the terminal when paying bills in restaurants and other places. Ensure that the merchant only swipes your card through one machine and if you suspect fraudulent behaviour call us straight away on 13 24 84 if in Australia or +61 2 8225 0615 when overseas.

Don't make a record of your PIN number and we encourage you not to use your birth date or any other personal details that could be easily determined.

Don't leave your card in unsecured locations such as in unaccompanied luggage.

MULTI-CURRENCY FEATURE

- Manage Your Account

- Multi-currency Feature

Travel light with Citibank Debit Mastercard ®

With the new Citibank Debit Mastercard ®

Access multiple foreign currencies with Citibank Debit Mastercard, for payments and withdrawals at Citibank ATMs overseas at no additional conversion fee. You will also enjoy attractive exchange rates for your foreign currency conversions on Citi Online Foreign Exchange (eFX).

To start enjoying this feature through your Citibank Debit Mastercard, simply apply for the Global Foreign Currency Account.

The foreign currencies are:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Sterling Pound (GBP)

- Swiss Franc (CHF)

- US Dollar (USD)

- UAE Dirham (AED)

- South African Rand (ZAR)

- Swedish Krona (SEK)

- Norwegian Krone (NOK)

- Danish Krone (DKK)

- HOW DOES IT WORK

- HOW TO APPLY

- IMPORTANT INFORMATION

Get ready for your dream holiday. Every two weeks from 6 November to 31 December 2017, stand a chance to win a pair of business class tickets to 1 of 9 holiday destinations . On top of that, you get to choose the destination that's perfect for you. All you have to do is start spending on your Citibank Debit Mastercard today.

We are also pleased to extend our S$100 cash back * promotion so you can continue to spend locally and overseas with your Citibank Debit Mastercard till 31 December 2017.

The 9 destinations are:

Christchurch

New york city, zürich, how you can win.

At the end of each two-week period, the three highest spenders will win a pair of business class tickets to their destination of choice.

Spend using your Citibank Debit Mastercard.

Win, choose your destination and start packing!

The Destinations

From 18 to 31 December 2017, simply spend with your Citibank Debit Mastercard and if you are our top 3 spenders, you can win a pair of business class tickets* to either London, Paris or Zurich.

- 6 Nov - 19 Nov

- 20 Nov - 3 Dec

- 4 Dec - 17 Dec

- 18 Dec - 31 Dec

(Promo extended)

Earn up to S$100 cash back when you spend, both locally and abroad! The offer has been extended till 31 December 2017. T&Cs Apply.

Here's how it works:

Earn S$50 cash back when you spend at least S$500.

Earn an additional S$50 cash back if at least S$200 of your spending is in any of the 9 eligible foreign currencies.

Don't have a Citibank Debit Mastercard?

* Click here for the full promotion Terms and Conditions.

Purchase foreign currencies at your preferred rates

Save the hassle of searching for the best exchange rates with real-time alerts, or have currencies auto-purchased when markets hit your preferred rates with Citi eFX. Enjoy the convenience of purchasing currencies on-the-go.

FIND OUT MORE >

Safe and convenient

Avoid carrying bulky cash whenever you travel with this safe and convenient way of paying through your Citibank Debit Mastercard. Choose to also pay in the preferred foreign currency when you shop online globally.

Access cash anytime overseas

Enjoy cash withdrawals overseas at no foreign exchange conversion fee and administrative charge, at Citibank ATMs.

Track your account on the go

Stay updated with your latest transactions wherever you are, with Citibank Online and Citi Mobile ® App.

Exclusive Citibank Debit Mastercard Privileges

Gain access to exclusive social events and a host of lifestyle privileges tailored for you and your family.

Open a local and foreign currency account

If you do not have a Citibank Savings or Current account, please visit any branch.

- For existing Citibank Savings and Current Account customers

*Tip: Set your target exchange rates on Citi eFX and be notified via SMS or email alerts when the rates are met.

Transfer from your SGD account to your Foreign Currency account

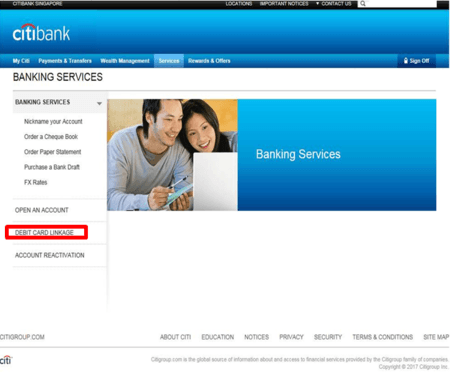

- Select your choice of currency (eg. USD) from your Foreign Currency Account and link to your Citibank Debit Mastercard via Citibank Online .

- For overseas travel and online purchases, ensure that your card is activated for overseas usage.

- Simply log in to Citibank Online or Citi Mobile ® App to transfer funds from your SGD account to your foreign currency account.

Link your preferred currency to your Citibank Debit Mastercard

- Select your choice of currency (e.g. USD) from your Foreign Currency Account and link to your Citibank Debit Mastercard via Citibank Online or Citi Mobile ® App

- You are now ready to make purchases or withdrawals in your chosen currency, at no additional conversion fee.

Re-link your Citibank Debit Mastercard to a different currency

- Login to Citibank Online to link your Citibank Debit Mastercard to a different currency (eg. SGD) after your overseas transaction or travels.

Sign up for the Global Foreign Currency Account now to access your preferred foreign currency via Citibank Debit Mastercard.

Global Foreign Currency Account

Gain access to multiple foreign currency types and carry out transactions on different currency types from a single platform.

Already have a Global Foreign Currency Account?

- Apply for the Citibank Debit Mastercard to enjoy its benefits and privileges.

- For existing account and cardholders, simply link your Citibank Debit Mastercard to the Foreign Currency Account via Citibank Online or Citi Mobile ® App.

The Multi-currency feature on your Citibank Debit Mastercard is also available with:

- US$ Savings Account

- US$ Checking Account

The multi-currency feature allows you to make purchases overseas at point-of-sale or online using your Debit Card without incurring additional foreign currency conversion fees and admin fees.

For example, if you are travelling to Hong Kong and have a HKD Foreign Currency Account with us, you can set your Debit Card Linkage to your HKD Foreign Currency Account so that any HKD transactions will be debited directly from your HKD Foreign Currency Account at no additional conversion fees.

The multiple foreign currencies are Swiss Franc, Australian Dollar, Canadian Dollar, Euro, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Sterling Pound, US Dollar, UAE Dirham, South African Rand, Swedish Krona, Norwegian Krone and Danish Krone.

You need to select the foreign currency account you wish to debit as your primary account via Citibank Online or Citi Mobile ® App. Once the selection of your desired foreign currency account is completed, your subsequent overseas/online transactions and any ATM cash withdrawals will be conducted and debited from your account in your selected foreign currency by default.

In some online shopping sites, merchants may in their own discretion and without giving prior notice authorize an online transaction before shipment. In such cases, the transaction will be subjected to a currency conversion fee and admin fee if your Debit Card is linked to a different currency account from the transaction currency.

Please ensure that the amount of your online transaction has been set aside in your Foreign Currency Account before changing your Debit Card Linkage.

You can easily keep track of all your transactions performed on Citibank Online or Citi Mobile ® App.

You may do so via Citibank Online or Citi Mobile ® App. Remember to change your Debit Card Linkage immediately to a different currency (i.e. SGD) after your overseas transactions or travels.

You may incur foreign currency conversion fees for transactions performed in SGD if you do not revert your primary account to your preferred SGD account after use or travel.

Your transaction will be declined.

Your daily transaction limit is set at S$2,000 or equivalent in foreign currency at the prevailing exchange rate on the day the spending in foreign currency is made.

No, this feature is only applicable for point-of-sale, e-commerce and withdrawal transactions.

Important information pertaining to the use of your Citibank Debit Mastercard

In addition to ATM withdrawal functions, your Debit Card also allows you to sign for local and overseas purchases, perform contactless payment via Mastercard Contactless (including through the use of digital wallets like Citi Pay and Samsung Pay) and card-not-present transactions (such as mail and phone orders) (collectively, "Debit Card Transactions") which shall be paid for by directly deducting the transaction amount from your primary bank account. If your Debit Card is tagged to a Foreign Currency Account as your primary bank account or if you make cash withdrawals from your Foreign Currency Account, where the Debit Card Transaction and/or cash withdrawal is in a different currency from the Foreign Currency Account, please note that the Debit Card Transaction/ cash withdrawal will be subject to an administrative fee of up to 2.5% on the converted amount, or such other rate as determined and notified to you.

Your Debit Card therefore carries the risk of unauthorized signature-based, contactless payment or card-not-present transactions. Please note that the default daily limit for these types of Debit Card Transactions is S$2,000 unless revised by you. For replacement card: if you had previously revised your old Debit Card's daily limit, your new Debit Card daily limit remains the same as your existing daily limit of your old card or the available balance in your primary bank account, whichever is lower. For clarity, this limit is shared between the Debit Card Transactions that you are permitted to effect using your Debit Card. You may choose to increase or decrease this limit upon activation.

In addition, because the magnetic stripe of your Debit Card contains sensitive payment card data, double swiping the magnetic stripe of your Debit Card on Point-of-Sale readers or Electronic Cash Registers may expose it to skimming and/or cloning and hence theft of your sensitive payment card data. To protect your information from being skimmed and/or cloned, it is recommended that the magnetic stripe of your Citibank Debit Card is not swiped on Point-of-Sale readers or Electronic Cash Registers.

Debit cards are similar to ATM cards. You can use your debit card with your personal identification number (PIN) to withdraw cash from ATMs. You can use it to purchase goods and services. For purchases made on debit cards, the purchase amount is immediately deducted from your bank account. You can spend only the amount in your account. Make sure your card is safe at all times.

Your debit card carries the Mastercard branding which allows you to perform signature-based Point-Of-Sale (POS) transactions. While this may seem similar to credit cards, do note that when you use credit cards, you are paying on credit. But when you use a debit card, the purchase amount or withdrawal is deducted immediately and directly from your account.

Although the Mastercard that you have received is a chip card it also has the magnetic stripe for overseas use. While chip technology can reduce the risks of cloning, the magnetic stripe portion of the debit card can still be cloned. As debit cards allow customers to sign off on the receipt, there is also a risk of forgery.

Some merchants allow you to make transactions below a certain value without the need to sign off on the transaction receipt. Do ask the merchant for a receipt of the transaction to ensure the correct amount is deducted. If the wrong payment amount is deducted, please contact Citibank immediately.

Your debit card details (such as name, account number, expiry date etc.) may be captured by fraudsters either through skimming or via intercepted online transactions. Fraudsters will then be able to use such information to clone a card or perform fraudulent card-not-present transactions (such as online or mail-order-telephone-order (MOTO) transactions).

However, for online purchases with merchants whose websites are enabled with the 3D Secure Technology, you will be asked to enter a One-Time Password before you can complete the transaction. This helps to protect you against online fraud and is a secure way to authenticate that you are making the purchase as the rightful owner of the debit card being used. Inform Citibank immediately if you have received a One-Time Password (OTP) but you did not make the transaction.

If you lose your debit card, inform Citibank immediately. If your card is stolen, make a police report and inform Citibank immediately.

Once you report the loss, your maximum liability for unauthorised charges prior to reporting the loss to Citibank will be capped at $100. This cap applies provided you have not acted fraudulently, or were not grossly negligent, or did not fail to inform Citibank as soon as reasonably practicable after you became aware that the card was lost or stolen.

- Never leave your debit card or documents containing its details lying around.

- Sign the back of your debit card with permanent ink as soon as you receive it.

- Safeguard your card details. Do not disclose your personal identification number (PIN) for cash withdrawals to anyone. Memorise your PIN and destroy the PIN mailer.

- Only shop at reputable and legitimate merchants (including online stores). Do not perform online transactions using shared devices such as computers in cybercafes.

- When you make small value transactions without the need to sign off on the receipt, ask the merchant for a receipt of the transaction to ensure the correct amount is deducted.

- Check regularly that your cards are with you.

- Call Citibank immediately if your card or card information is lost or stolen. Note the time and date when you do so.

For a comparison of ATM, Debit and Credit Cards, we urge you to visit MoneySense by clicking here .

Disclaimer: Disclaimer:

Your Citibank Debit Card comes with a daily point of sales limit that is set at S$2,000. This limit is shared between signature-based, contactless payments (e.g. Mastercard Contactless and payments made using digital wallets) and card not present transactions (including mail and phone orders). You may choose to increase/decrease this limit upon activation of your Citibank Debit Card. Notwithstanding the limit that you set, the limit on your Citibank Debit Card will remain subject to your available bank balance.

Where we allow your Citibank Debit Mastercard to be tagged to a Foreign Currency Account and used for any and/or all foreign currency fund in the Foreign Currency Account, foreign currency transactions and Cash Withdrawals will be directly authorized from the respective Foreign Currency Account in the foreign currency directly provided that that there are sufficient funds in the relevant foreign currency. In the event that you perform a Cash Withdrawal and/or Card Transactions in a different currency from the Foreign Currency Account tagged to your Citibank Debit Mastercard , the transaction will be subject to an administrative fee of up to 2.5% on the converted amount, or such other rate as determined by us and notified to you.

Where your Citibank Debit Card has Mastercard Card Transaction functionality enabled, you acknowledge and accept that the Citibank Debit Card carries risk of unauthorized signature-based, contactless payments (e.g. Mastercard Contactless and other payments made using digital wallets) or card not present transactions.

Double Swiping is a term used to describe the act of a second swipe of a payment card at a Point-of-Sale terminal after the first swipe to obtain initial authorization from the bank. The second swipe effectively exposes your Citibank Debit Card's magnetic stripe full track data to compromise. You acknowledge and accept that double swiping the magnetic stripe of your Citibank Debit Card on Point-of-Sale readers or Electronic Cash Registers increases the risk of skimming and/or cloning and hence the theft of your sensitive payment card data.

Any customers using Citibank eFX acknowledge and accept that all transactions they make are made solely upon their judgment and at their discretion and own risk. Nothing in Citibank's brochures, investment reports and/or any of Citibank's material supplied to the customer, nor any customer investment profiling conducted for the customer, shall be construed as Citibank's investment advice as regards the relative attractiveness of one investment option over another. Investors investing in investment and/or treasury products denominated in non-local currency should be aware of the risks of exchange rate fluctuations that may cause a loss of principal when foreign currency is converted back to the investors' home currency. Foreign currency trading is subject to rate fluctuations, which may provide both opportunities and risks. Customers who have any questions about their legal or tax positions as a result of opening an account with Citibank or effecting any transaction on an account with Citibank should engage an independent legal or tax adviser as they consider appropriate.

Exchange controls may apply from time to time to certain foreign currencies. Our Treasury Services Managers and Relationship Managers may assist customers with information on any exchange controls that are relevant to the currencies in which they invest. Placing contingent orders, such as "stop loss" or "stop limit" orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders.

Citibank's full disclaimers, terms and conditions apply to individual products and banking services. This communication does not constitute the distribution of any information or the making of any offer of solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such document or to make any offer or solicitation.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. For more information, please visit www.sdic.org.sg .

TRAVELLING OVERSEAS

- Global Banking

- Travelling overseas

'There's always something so exciting about arriving in a new city.

We enjoy exclusive discounts at restaurants, hotels, car rental companies and shopping malls with Citi World Privileges'.

Your passport to global banking.

The world is a big place full of exciting adventures. At Citibank, we want to help you enjoy every minute of your travels. Take advantage of Citibank's global presence by tapping into our international branch and ATM network, and international support services.

Before you leave home

For your convenience, you no longer need to contact Citibank to advise us of your travel plans. In the event any of your transactions are detected as irregular activity, we will endeavour to contact you as soon as possible via text or voice call using the mobile number we have on file to discuss the situation.

There are inherent risks to using your card overseas such as card theft and skimming, to protect your account security, we will temporarily suspend your account if you are not contactable and your account will remain blocked until we have contacted you. To minimise any inconvenience, it is important that you ensure we have your correct mobile number that you will be using whilst overseas. You can update your mobile number by logging onto Citibank Online, click Services > My Profile > Personal Information > View / Update details.

Click here to learn more about the top five things to do before going overseas.

Lost or stolen cards

If your card is lost or stolen, please contact us as soon as possible, at any time, via our international customer service number +61 2 8225 0615. One of our Customer Service Officers will review your recent transactions, block your account to stop any fraudulent activity and organise to issue you with a new card.

Emergency cash

If you ever misplace your wallet or get caught in a bind while travelling, you may be able to access your money at a Citibank branch. Please note that withdrawal limits and transaction fees vary based on the country you are visiting and that Citibank locations may not be in all countries visited.

Citibank World Privileges

- Spa & Health

Tourist information

Citibank has teamed up with Lonely Planet to give you an insider's view on some of the world's most intriguing hotels, museums, retail shops, spas, historic sites and more. You can access:

- Customised City Guides for some of the most exciting cities in the world. Guides include travel tips like local customs, etiquette and hot spots.

- Points of interest across 50 of the world's most dynamic cities.

Citigold advantage

If you have or open a Citigold account, you may also enjoy additional benefits when travelling. An example is access to International SOS, the world's leading provider of medical assistance. If you ever need medical help whilst abroad, ISOS provides your guaranteed peace of mind. Benefits do vary by country, please contact your local Citibank location for more information.

Protecting your card

Citibank takes the security of your account seriously and we constantly monitor for any unusual activity on your account.

In the event your card is not working or if you encounter any other card usage issues , you can contact us at citibank.com.au/contactus .

Using Citi Mobile overseas

The Citi Mobile app allows you to generate an offline One-Time PIN for use when banking on Citibank Online, anywhere in the world.

This feature is free to use internationally as no network coverage or internet connection is required to generate an offline One-Time PIN. Learn more at citibank.com.au/otp .

Mastercard Traveller Rewards

Receive exclusive offers and cashback on travel or shopping purchases when paying with your Citi Debit Mastercard at participating overseas retailers 1 .

Important information:

1. Offers are not provided or administered by Citigroup Pty Ltd. For full terms and conditions please visit www.mastercard.com/travelerrewards

- 13 24 84

- Email Us

- Visit a Branch

- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

CITI TRAVEL with Booking.com

Coming soon, introducing citi travel sm : your first stop to your next destination.

The Citi Travel site will give eligible Citi ThankYou ® cardmembers an expansive, all-in-one view of seemingly endless booking options. With exciting offers and the flexibility to book when and how you want, the way to go is now way easier. For more ways to redeem, your points visit thankyou.com.

Access to over 1.4 million hotel and resort options

Competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Citi Credit Card Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Do Citi cards have travel insurance?

Car rental insurance, costco anywhere visa® card by citi travel insurance benefits, citi® / aadvantage® executive world elite mastercard® travel insurance coverage, does citibank offer travel insurance.

Citi credit cards provide a host of benefits, including some generous points and miles earning opportunities (depending on the card you have).

But, when it comes to travel insurance, let’s just say it’s not necessarily Citi cards' strong suit.

Still, there are Citibank travel insurance benefits you should know about to ensure you use the right card when paying for your next trip. Here are the primary benefits associated with Citi card travel insurance.

Only two Citi cards have travel insurance, and each one has a different set of benefits: The Costco Anywhere Visa® Card by Citi and the Citi® / AAdvantage® Executive World Elite Mastercard® .

on Citibank's application

Both cards provide rental car insurance.

The Costco Anywhere Visa® Card by Citi also offers roadside assistance, worldwide travel accident insurance and a 24/7 concierge for travel and emergency assistance. The Citi® / AAdvantage® Executive World Elite Mastercard® , on the other hand, offers baggage protection, trip cancellation/interruption insurance and trip delay protections.

» Learn more: Best Citi credit cards right now

If you use either of the two Citi credit cards listed above to pay for a car rental, Citi travel insurance will protect any damages to a rental car up to $50,000.

This amount will cover the cost of repairs or the cash value of the car, whichever is lower. It applies anywhere you rent a car — there are no geographic limitations — as long as the rental period is no longer than 31 days. Citibank travel insurance covers accidental damage, theft, vandalism or a natural disaster, and any necessary towing costs.

Citi's rental car insurance is secondary when renting a car within the U.S., but if you're renting outside of the country, it switches to primary coverage.

With secondary insurance, you need to rely on any other insurance coverage you have before Citi’s car rental insurance kicks in. Primary insurance, alternatively, will be the first line of coverage you have.

Coverage wouldn't apply if you rent the car to someone else or operate a rental car as a rideshare vehicle. It also only covers the car, not any personal injuries that might result from an accident.

There are several types of vehicles that are excluded from coverage. These include:

Trucks, pickup trucks, trailers, full-size vans on a truck chassis or recreational vehicles like campers and off-road vehicles.

Motorcycles or motorized bikes.

Commercial vehicles or cargo vans.

Any vehicle with fewer than four wheels.

Antique vehicles older than 20 years or that have not been made in the past decade.

Limousines.

Sport-utility trucks or open, flat-bed trucks.

Any vehicle that retails for over $50,000.

» Learn more: Rental car insurance explained

Roadside assistance

When driving in the U.S., roadside assistance is available for Costco Anywhere Visa® Card by Citi cardholders by calling 866-918-4670.

Roadside assistance is valuable in the event of an accident, loss of fuel or other vehicle malfunction. Keep in mind that you would still have to pay for the assistance (like a tow truck, for example), but this benefit makes it easy to reach someone with one phone call.

Citi card provides access to similar assistance as a membership program like AAA . The difference is that AAA’s annual fee covers roadside assistance fees while Citi's coverage doesn't; it solely provides access to someone who can help you for a reduced rate.

Several credit cards provide some type of roadside assistance and are worth considering before paying the annual fee for AAA.

Worldwide travel accident insurance

The Costco Anywhere Visa® Card by Citi includes accident insurance, which covers the cardholder or family members if they are injured or killed when traveling on a common carrier (any vehicle that is licensed to carry passengers like a bus, plane, cruise ship or train).

You will need to have used the Citi card to cover the entire cost of the travel on that common carrier for the benefit to apply. The maximum coverage is $250,000.

» Learn more: How does travel insurance work?

Travel and emergency assistance

The Costco Anywhere Visa® Card by Citi card provides access to a 24/7 concierge to help you with a disruption to your trip. This can include medical assistance, referrals to a doctor or legal help. It can also help if you need to adjust travel plans.

Just remember, you’ll be responsible for paying for any services used, but the call is toll-free.

Baggage protection

Only available for the Citi® / AAdvantage® Executive World Elite Mastercard® , this luggage protection provides coverage if your checked bag is stolen, lost or damaged.

The insurance covers as much as $3,000 per person ($2,000 for New York residents), but only kicks in if you use the card or American AAdvantage miles to pay for the trip.

» Learn more: The guide to baggage insurance

Trip cancellation and interruption insurance

If a covered traveler has a medical emergency or dies, the Citi® / AAdvantage® Executive World Elite Mastercard® coverage can provide reimbursement for up to $5,000 in eligible nonrefundable expenses.

You would need to use the card or American AAdvantage miles to pay for the trip.

Trip delay protection

Another benefit that’s reserved only for the Citi® / AAdvantage® Executive World Elite Mastercard® is trip delay protection . This coverage kicks in if your trip is delayed by at least six hours, and offers reimbursement for expenses incurred during the delay, up to $500 per trip.

This would include reasonable purchases like hotel stays, rental cars and meals.

» Learn more: The best travel credit cards right now

Citibank travel insurance is available, but limited. It is only offered on two cards and isn't as comprehensive as other credit cards with travel insurance .

Both cards include rental car coverage, but beyond this, each has its own set of benefits. Depending on which one you hold, it may include coverage like trip delay protection or roadside assistance.

People hold Citi cards for many reasons, including the ability to earn transferable Citi ThankYou Points . But, the travel insurance benefits are somewhat limited. If you have a Citi card, review the travel insurance perks before you take off to understand your coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

What are virtual cards and when should you use them?

Let's be real. Sometimes, suspicious online websites have the best deals or the items we need. When you feel hesitant about entering your card information, you could use a virtual card -- not to be confused with a digital wallet .

Also: Is Temu legit? Everything to know before you place your first order

In observation of Financial Literacy Month, Google shared ways users can protect their payment information when using Google Pay. Unsurprisingly, given their ability to protect your card information easily and efficiently, virtual cards made the list.

So, what are virtual cards?

A virtual card is a unique credit card number you can enter on a site to complete a transaction. The technology masks your actual card information, keeping it hidden from businesses and protecting you against fraud.

Some virtual cards expire after every transaction, so if anyone accesses your card information, that number would be useless to them. Other virtual cards, like Google Pay , have a longer duration.

Also: The best budgeting apps: Find the Mint alternative that's right for you

If someone steals your virtual card's payment information, you can cancel just that virtual card instead of your entire credit card. Once you cancel the virtual account, the thief no longer has access to your credit card, which you can continue using.

Creating a virtual card is free and easy, and there are multiple ways to do so, regardless of the type of phone, browser, or card you use.

How can you create a virtual card?

Google pay .

One way to create a virtual card is by using Google Pay. When you check out from Chrome desktop or mobile, if you have an eligible American Express, Capital One, or Citi card, you have the option to save your card as a virtual card.

Then, every time you autofill your card information using Google Play, your virtual card information will be inputted automatically. If you don't use Google Pay, don't worry -- there are other options.

Your credit card

Many major credit card companies offer virtual cards within their platform to users free of charge, including American Express, Capital One, Mastercard, or Citi. For example, as a Citibank credit card holder, I can go into the app and generate a virtual card number simply by tapping the quick action.

I often use this feature when I try to place an online order, am nowhere near my wallet, need to enter my credit card information, and have no desire to get up. While this isn't the intended use case, it's still a big plus.

Also: Proton VPN review (2024): A very solid VPN with robust leak protection

CNET has a comprehensive list of the best credit cards with virtual card numbers. You can cross-reference this list to see if your card is included. You can also see credit cards with the feature that you might want to consider in the future.

Third-party payment sites

Many popular third-party payment sites offer virtual cards, including Wise, Stripe, and PayPal. These cards function a little differently: you can choose what funds get added and create separation between your personal account and your virtual card.

For example, with the PayPal Debit Card, you can spend your PayPal balance online and in stores. You can load money onto that card from an eligible bank account or debit card. This approach gives you control over how much money someone can access if the payment information is stolen and makes it easier to cancel the account if needed.

The best AirTag wallets you can buy: Expert recommended

How to freeze your credit (and why you might want to), the best travel vpns: expert tested.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit