Travel, Tourism & Hospitality

Travel and tourism in Europe - statistics & facts

What are the most popular travel destinations in europe, travel planning and behavior of european tourists, key insights.

Detailed statistics

Travel and tourism's total contribution to GDP in Europe 2019-2022

Travel and tourism's total contribution to employment in Europe 2019-2022

Number of international tourist arrivals worldwide 2005-2023, by region

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

European countries with the highest number of inbound tourist arrivals 2019-2022

Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

Related topics

Travel and tourism in europe.

- Inbound tourism in Europe

- Chinese tourism in Europe

- Backpacking in Europe

- Business travel in Europe

- Cruise industry in Europe

City tourism in Europe

- Tourism in London

- Tourism in Paris

- Tourism in Rome

- Tourism in Amsterdam

- Tourism in Barcelona

Recommended statistics

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Travel and tourism's total contribution to GDP in Europe 2019-2022

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2022, by type

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2022, by tourist type

- Basic Statistic Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

- Basic Statistic Travel and tourism's total contribution to employment in Europe 2019-2022

- Premium Statistic Leading European countries in the Travel & Tourism Development Index 2021

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

International tourist arrivals worldwide 2019-2022, by subregion

Number of international tourist arrivals worldwide from 2019 to 2022, by subregion (in millions)

Travel and tourism's total contribution to GDP in Europe 2019-2022

Total contribution of travel and tourism to GDP in Europe in 2019 and 2022 (in billion U.S. dollars)

Distribution of travel and tourism expenditure in Europe 2019-2022, by type

Distribution of travel and tourism spending in Europe in 2019 and 2022, by type

Distribution of travel and tourism expenditure in Europe 2019-2022, by tourist type

Distribution of travel and tourism spending in Europe in 2019 and 2022, by type of tourist

Share of travel and tourism's total contribution to GDP in European Union member countries (EU-27) and the United Kingdom (UK) in 2019 and 2022

Travel and tourism's total contribution to employment in Europe 2019-2022

Total contribution of travel and tourism to employment in Europe in 2019 and 2022 (in million jobs)

Leading European countries in the Travel & Tourism Development Index 2021

Leading European countries in the Travel & Tourism Development Index (TTDI) in 2021

Inbound tourism

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Premium Statistic International tourist arrivals in Europe 2010-2022, by region

- Premium Statistic European countries with the highest number of inbound tourist arrivals 2019-2022

- Basic Statistic Monthly number of inbound tourist arrivals in Europe 2019-2023

- Basic Statistic Monthly change in tourist arrivals in Europe 2020-2023, by region

- Premium Statistic Inbound tourism visitor growth in Europe 2020-2025, by region

- Premium Statistic International tourist arrival growth in European countries 2019-2023

- Basic Statistic International tourism spending in Europe 2019-2022

- Premium Statistic European countries with the highest inbound tourism receipts 2019-2022

International tourist arrivals in Europe 2006-2023

Number of international tourist arrivals in Europe from 2006 to 2023 (in millions)

International tourist arrivals in Europe 2010-2022, by region

Number of international tourist arrivals in Europe from 2017 to 2022, by region (in millions)

Countries with the highest number of international tourist arrivals in Europe from 2019 to 2022 (in millions)

Monthly number of inbound tourist arrivals in Europe 2019-2023

Number of monthly international tourist arrivals in Europe from 2019 to 2023 (in millions)

Monthly change in tourist arrivals in Europe 2020-2023, by region

Change in monthly international tourist arrivals in Europe from January 2020 to July 2023, by region

Inbound tourism visitor growth in Europe 2020-2025, by region

Inbound tourism visitor growth in Europe from 2020 to 2022, with a forecast until 2025, by region

International tourist arrival growth in European countries 2019-2023

Percentage change in international tourist arrivals in Europe from 2019 to 2023, by country

International tourism spending in Europe 2019-2022

International tourism expenditure in Europe in 2019 and 2022 (in billion U.S. dollars)

European countries with the highest inbound tourism receipts 2019-2022

Countries with the highest international tourism receipts in Europe from 2019 to 2022 (in billion U.S. dollars)

Domestic tourism

- Premium Statistic Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

- Basic Statistic Number of domestic arrivals in tourist accommodation in the EU 2011-2022

- Basic Statistic Domestic tourism spending in Europe 2019-2022

- Basic Statistic Domestic tourism spending in EU-27 countries and the UK 2019-2022

- Premium Statistic Share of Europeans planning to take a domestic summer trip 2023, by country

Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

Number of domestic tourist trips in European Union member countries (EU-27) and the United Kingdom from 2018 to 2021 (in 1,000s)

Number of domestic arrivals in tourist accommodation in the EU 2011-2022

Number of domestic arrivals in tourist accommodation establishments in the European Union (EU-27) from 2011 to 2022 (in millions)

Domestic tourism spending in Europe 2019-2022

Domestic tourism expenditure in Europe in 2019 and 2022 (in billion U.S. dollars)

Domestic tourism spending in EU-27 countries and the UK 2019-2022

Domestic tourism expenditure in European Union member countries (EU-27) and the United Kingdom in 2019 and 2022, by country (in billion U.S. dollars)

Share of Europeans planning to take a domestic summer trip 2023, by country

Share of adults who planned to take a domestic summer holiday trip in selected countries in Europe as of April 2023

Outbound tourism

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound visitor growth in Europe 2020-2025, by region

- Premium Statistic Number of outbound trips from EU-27 countries and the UK 2018-2021

- Premium Statistic European countries with the highest outbound tourism expenditure 2019-2022

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound visitor growth in Europe 2020-2025, by region

Outbound visitor growth in Europe from 2020 to 2022, with a forecast until 2025, by region

Number of outbound trips from EU-27 countries and the UK 2018-2021

Number of outbound trips from European Union member countries (EU-27) and the United Kingdom from 2018 to 2021 (in 1,000s)

European countries with the highest outbound tourism expenditure 2019-2022

Countries with the highest outbound tourism expenditure in Europe from 2019 to 2022 (in billion U.S. dollars)

European travelers

- Premium Statistic Travel intentions of Europeans in the next six months 2023, by destination

- Premium Statistic Share of Europeans planning to travel domestically or in Europe 2023

- Premium Statistic Europeans planning domestic or European trips in the next six months 2023, by age

- Premium Statistic Europeans planning leisure domestic or European trips 2023, by trip type

- Premium Statistic European travelers' favorite destinations for their next European trip 2023

Travel intentions of Europeans in the next six months 2023, by destination

Share of European travelers planning a trip in the next six months as of September 2023, by destination

Share of Europeans planning to travel domestically or in Europe 2023

Share of European travelers planning to take an overnight trip domestically or in Europe in the next six months as of March, May, and September 2023

Europeans planning domestic or European trips in the next six months 2023, by age

Share of European travelers planning to take an overnight trip domestically or in Europe in the next six months as of September 2023, by age group

Europeans planning leisure domestic or European trips 2023, by trip type

Share of Europeans planning to take a leisure overnight trip domestically or in Europe in the next six months as of September 2023, by type of trip

European travelers' favorite destinations for their next European trip 2023

Preferred European countries for the next trip among European travelers as of September 2023

Accommodation

- Basic Statistic Number of tourist accommodation establishments in the EU 2012-2022

- Basic Statistic Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

- Premium Statistic Hotel market revenue in Europe 2017-2028

- Premium Statistic Hotel market revenue in Europe 2017-2028, by region

- Premium Statistic Share of hotel market sales in Europe 2017-2028, by channel

Number of tourist accommodation establishments in the EU 2012-2022

Number of tourist accommodation establishments in the European Union (EU-27) from 2012 to 2022

Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

Number of overnight stays in tourist accommodation establishments in the European Union (EU-27) from 2011 to 2022 (in millions)

Hotel market revenue in Europe 2017-2028

Revenue of the hotel market in Europe from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Hotel market revenue in Europe 2017-2028, by region

Revenue of the hotel market in Europe from 2017 to 2023, with a forecast until 2028, by region (in billion U.S. dollars)

Share of hotel market sales in Europe 2017-2028, by channel

Sales distribution of the hotel market in Europe from 2017 to 2023, with a forecast until 2028, by channel

Travel companies

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Premium Statistic Market capitalization of leading travel and leisure companies in Europe 2024

- Premium Statistic Leading airlines in Europe based on passenger numbers 2022

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Market capitalization of leading travel and leisure companies in Europe 2024

Market capitalization of leading travel and leisure companies in Europe as of March 2024 (in billion U.S. dollars)

Leading airlines in Europe based on passenger numbers 2022

Leading airlines in Europe in 2022, based on passenger traffic (in millions)

- Premium Statistic Travel and tourism revenue in Europe 2018-2028, by segment

- Premium Statistic Number of users of package holidays in Europe 2019-2028

- Premium Statistic Number of users of hotels in Europe 2019-2028

- Premium Statistic Number of users of vacation rentals in Europe 2019-2028

- Premium Statistic Revenue of travel and tourism market in selected countries worldwide 2023

Travel and tourism revenue in Europe 2018-2028, by segment

Revenue of the travel and tourism market in Europe from 2018 to 2028, by segment (in billion U.S. dollars)

Number of users of package holidays in Europe 2019-2028

Number of users of package holidays in Europe from 2019 to 2028 (in millions)

Number of users of hotels in Europe 2019-2028

Number of users of hotels in Europe from 2019 to 2028 (in millions)

Number of users of vacation rentals in Europe 2019-2028

Number of users of vacation rentals in Europe from 2019 to 2028 (in millions)

Revenue of travel and tourism market in selected countries worldwide 2023

Travel and tourism market revenue in selected countries worldwide in 2023 (in billion U.S. dollars)

EU tourism: an almost full recovery to pre-pandemic levels

The upgraded EU Tourism Dashboard offers insights on the impact and state-of-play of this industry and supports the transition to greener, more digital tourism.

Fresh statistics on EU tourism suggest that in 2022, tourism demand was already at nearly 96% the level in 2019. This shows an almost full recovery on average for the EU , with countries like Belgium, Denmark, France, Ireland, and Netherlands even surpassing pre-pandemic levels.

However, recovery in Eastern European tourism destinations has been more sluggish, possibly also due to the war in Ukraine. Data also shows that international tourism demand is picking up more slowly than domestic tourism, staying in 2022 at 91% the level of 2019.

These new figures result from an update of the EU Tourism Dashboard , an interactive tool providing statistics and indicators relevant for tourism policies . These include, amongst others, the environmental and socio-economic impact in a given area, the level of digitalisation and the main tourism typology.

The recent upgrade has brought updated figures and novel indicators on the adoption of environmental labels and schemes by tourist accommodations, nature-based tourism opportunities and the economic impact of tourism.

A greener and digitalised tourism in the EU

According to the new data, on the digitalisation front, internet infrastructure continues to improve, covering tourism destinations with ever increasing internet speeds: in 2019, only 10% of the tourism capacity had internet speed above 100 Mb/s. This has improved to 42% and 63% in 2021 and 2023, respectively.

On the green front, nearly 850 tourist accommodation establishments had the EU Ecolabel in 2022 or were registered to the EU Eco-Management and Audit Scheme (EMAS) . The EU tourism dashboard also identifies that other 4750 tourist accommodations in the EU countries, Switzerland, Iceland and Norway that have other reliable environmental labels and schemes.

However, the number is still a tiny fraction of the nearly 650,000 tourist accommodation establishments in these countries.

Better data to design policies for a more sustainable tourism

The new data collected and provided in the upgraded dashboard will further help decision makers to identify vulnerabilities and opportunities, and to design effective strategies to make the EU tourism ecosystem more sustainable and resilient to possible shocks, for example encouraging further the adoption of reliable environmental labels and schemes by tourist accommodation establishments.

The EU Tourism Dashboard is a valuable source of knowledge for policy makers in EU countries and regions to better understand how tourism is progressing towards the green and digital transition, and to assess local socio-economic resilience. It can also contribute to the work of statistics experts in EU countries, of researchers, as well as of public and private operators who promote local and regional tourism.

Indicators on the dashboard are organised under three main policy pillars: green, digital and socioeconomic. The dashboard also includes descriptors of tourism demand and supply such as occupancy rates, average duration of stays, presence of UNESCO sites and many more.

Launched in October 2022, the EU Tourism Dashboard was developed by the JRC and the European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs , following a request by EU Member States in 2021 to design a tool for monitoring the twin transition and resilience of the tourism ecosystem – one of the most heavily affected by the travel and health restrictions put in place during the COVID-19 pandemic. The dashboard is developed in cooperation with Eurostat and in coordination with the EU Member States.

The initiative contributes to the Transition Pathway for Tourism published in February 2022, which was created in collaboration with public and private EU tourism stakeholders to identify 27 areas of actions for the green and digital transition and for improving the resilience of EU tourism. Improving statistics and measurements for tourism regarding its economic, environmental and social impacts was recognised among key topics for action.

- Territorial intelligence

High-value datasets – tourism in the EU

Discover statistics to analyse tourism flows

This is part of a series of articles showcasing examples of high-value datasets from their different thematic categories. High-value datasets are defined by EU law based on their potential to provide essential benefits to society, the environment and the economy. This series aims to help readers find reliable and accurate information from official sources relating to the availability of various high-value datasets, and to present this information through data visualisation. You can check out the article providing an overview of high-value datasets .

Only datasets specifically defined by law can be considered high-value datasets and, as such, the data presented in this series of articles does not necessarily fall under that definition. Instead, the data has been chosen to be thematically adjacent to high-value datasets and to showcase what can be done with information made available by official EU bodies and EU Member States. The official list of high-value datasets adopted on 12 December 2022 can be found in the legal documents that define these datasets and their characteristics.

Using high-value datasets to analyse tourism

Representing nearly 10 % of the EU’s GDP and accounting for 23 million jobs in 2019 , tourism is an essential part of the EU’s economy. The EU’s tourism ecosystem involves various sectors such as food and beverage services, online information and services, travel agents and tour operators, accommodation suppliers and transportation.

Furthermore, the EU’s industrial strategy aims to accelerate the green and digital transitions and increase tourism resilience. In February 2022, the European Commission proposed a transition pathway for the tourism industry, including 27 areas of measures for the green and digital transitions and improving tourism resilience. Based on the Commission’s transition pathway, the Council of the European Union has adopted the European agenda for tourism 2030 , which includes a multiannual work plan with actions for Member States, the Commission and tourism stakeholders.

In this context, data on tourism can provide essential insights and as such, tourism statistics have been included in the list of high-value datasets. The ‘Statistics’ category of high-value datasets includes several datasets about tourism flows in Europe, as laid out by section 2 of Annex I to Regulation (EU) No 692/2011 of the European Parliament and of the Council.

Tourism-related high-value datasets contain information about yearly tourism flows and include indicators such as the number of nights spent at tourist establishments, including specifically by EU residents, participation in tourism for personal purposes, tourism trips and expenditures. The indicators may also offer several breakdowns, including the countries of origin and destination, duration of the trip, means of transport and accommodation. In some cases, geographical information is also accessible, with data available up to the NUTS 2 (region), NUTS 3 (province) or coastal/non-coastal area levels.

Tourism data from Eurostat

The EU’s official statistical office, Eurostat , offers a large number of datasets to study tourism, along with a detailed page in the ‘Statistics Explained’ section that shows major trends. One way to look at tourism is to analyse where people tend to come from and where they go. Eurostat data can be used to determine the countries in which people travel the most and others where tourism is less frequent.

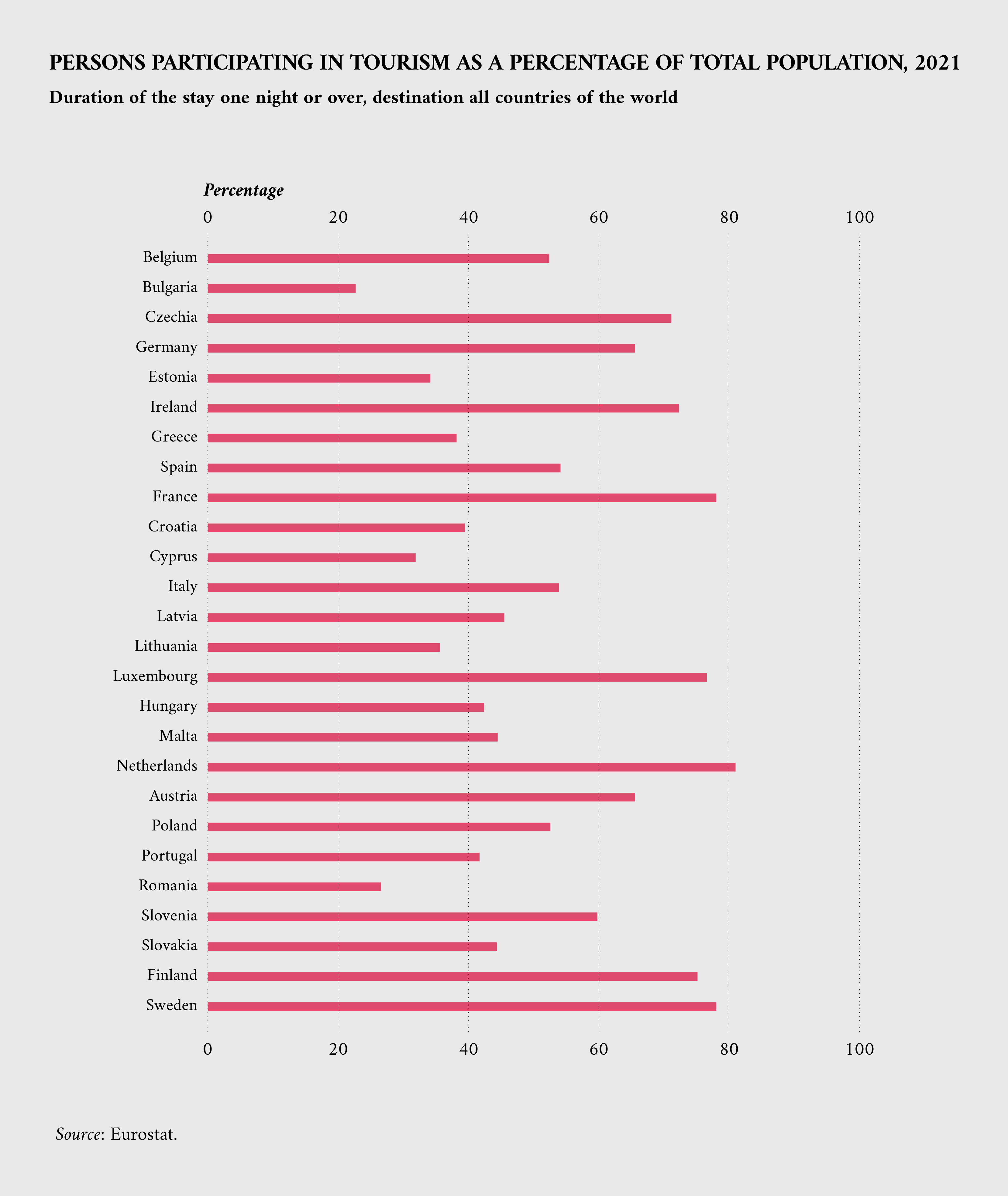

The following visualisation shows the share of people out of the total population participating in tourism, from Member States to other world destinations. This data shows that the countries with the highest values are the Netherlands, France, Luxembourg, Finland and Sweden.

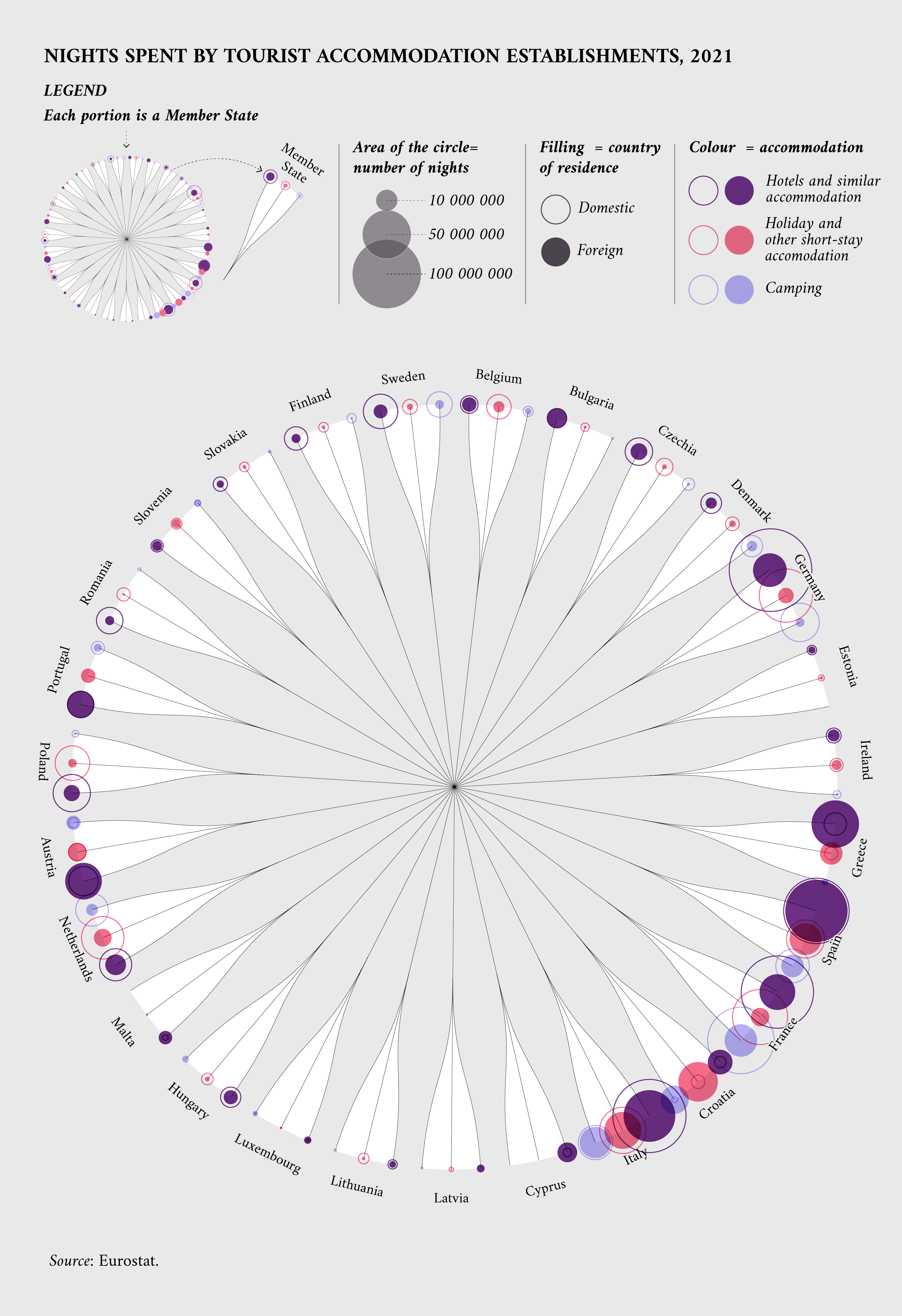

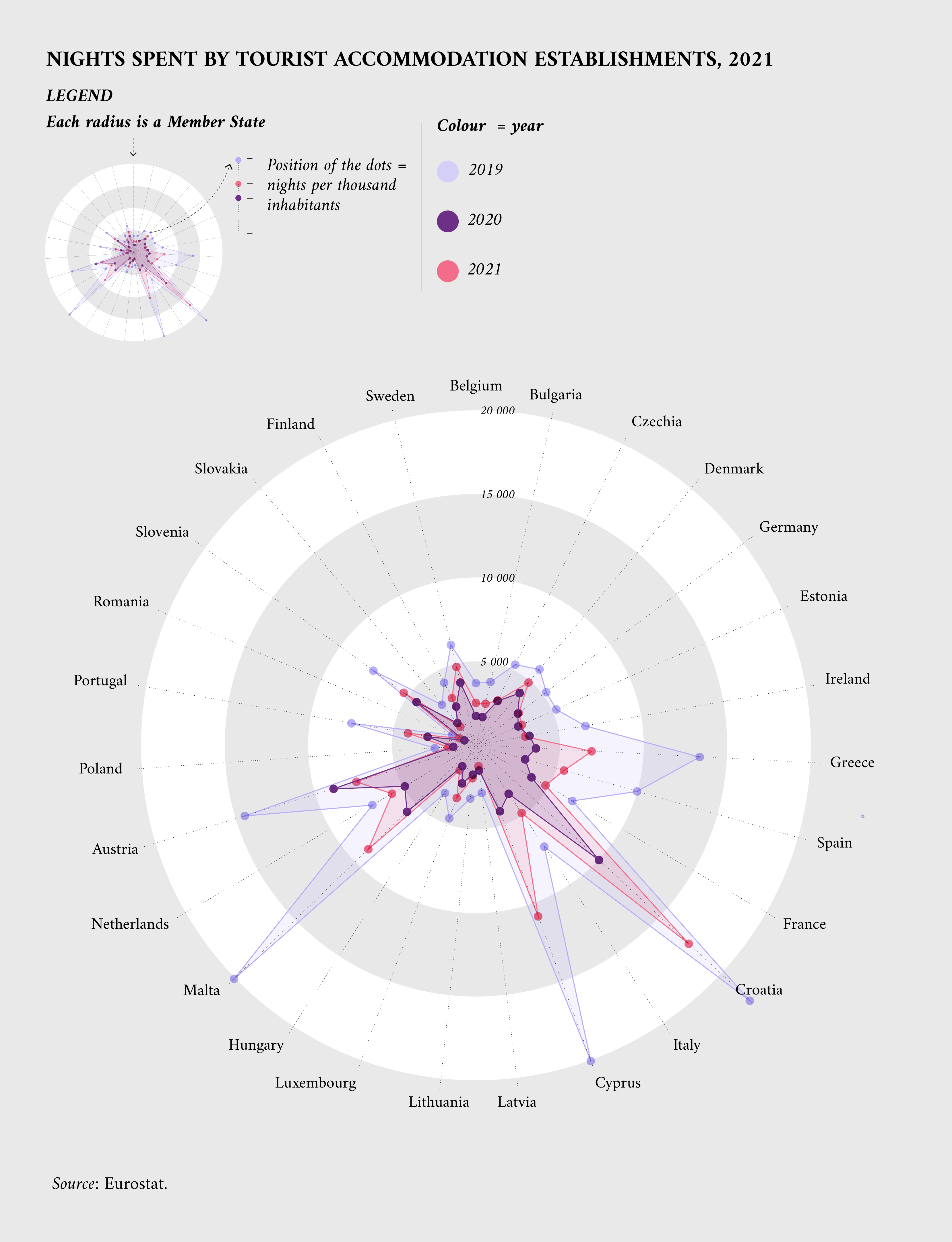

Eurostat also offers datasets that show the preferred destinations for tourists from inside and outside the EU. A good indicator to measure this phenomenon is the total number of nights spent in tourist accommodation establishments, which is available for all guests or only for international guests .

To better understand tourists’ preferences, data can be disaggregated to show the type of accommodation they chose – a hotel, a camping site or other short-term accommodation – and whether the tourists were domestic or came from abroad.

By adjusting for population, the indicator called ‘Tourism intensity’ represents the number of nights spent by domestic or international guests in tourist accommodation. Looking at this indicator, smaller countries like Croatia, Malta, Cyprus, Austria and Greece stand out as major tourism destinations.

Tourism data on data.europa.eu

As previously mentioned, high-value datasets include several indicators through which it is possible to analyse tourism from different perspectives. Information of similar scope has been provided by Member States on the data.europa.eu portal, where it can be freely reused by everyone.

One of these indicators is tourism expenditure, for which the portal provides several datasets . Examples include a study from the EU’s Joint Research Centre that estimated the average economic value generated for each night spent or a dataset showing expenditures and earnings by and from travellers to and from Ireland.

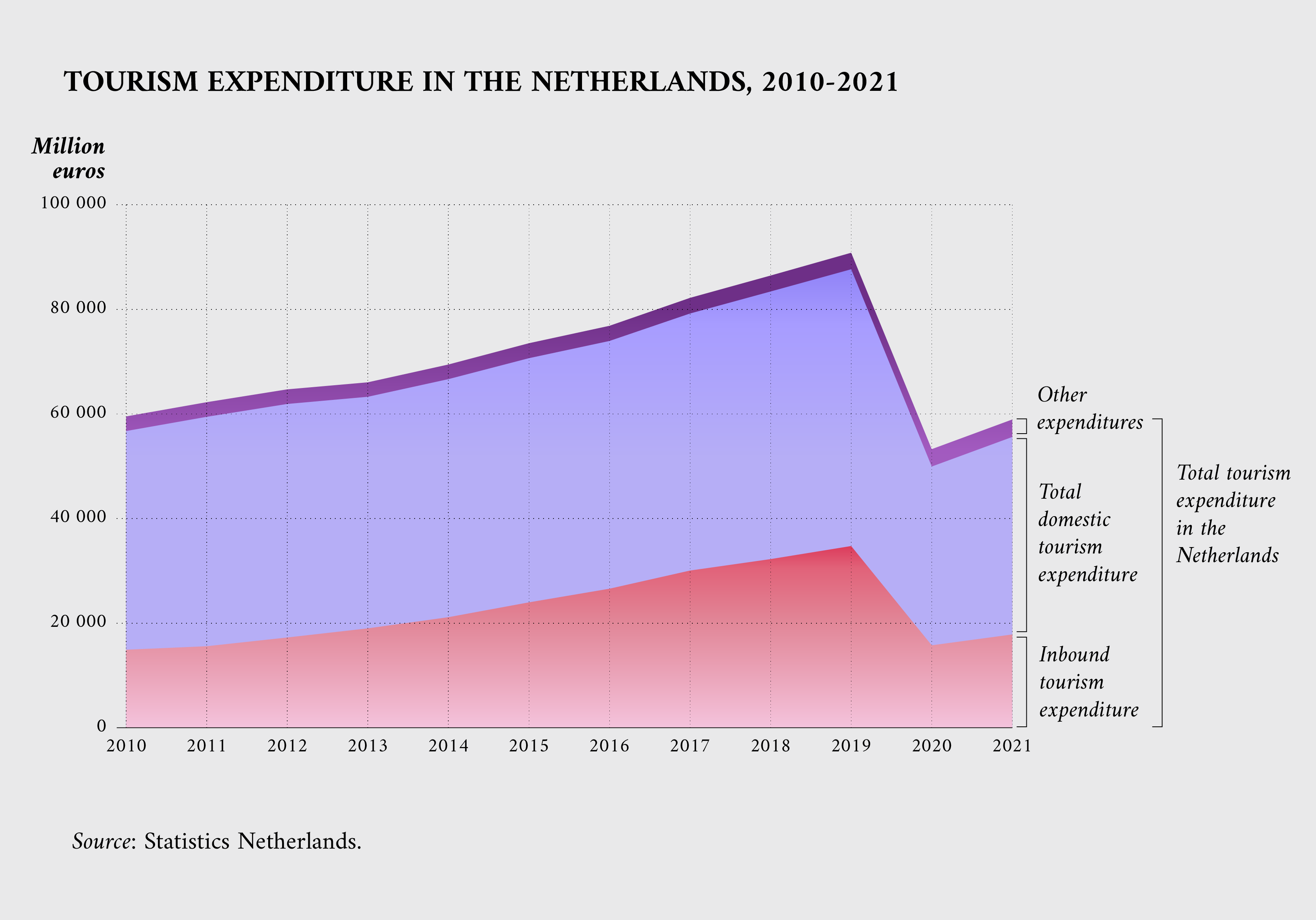

Another interesting dataset was uploaded by the data portal of the Dutch government. The Eurostat data revealed that Dutch people are among the most active in tourist activities and this dataset offers many insights about their travel habits over time.

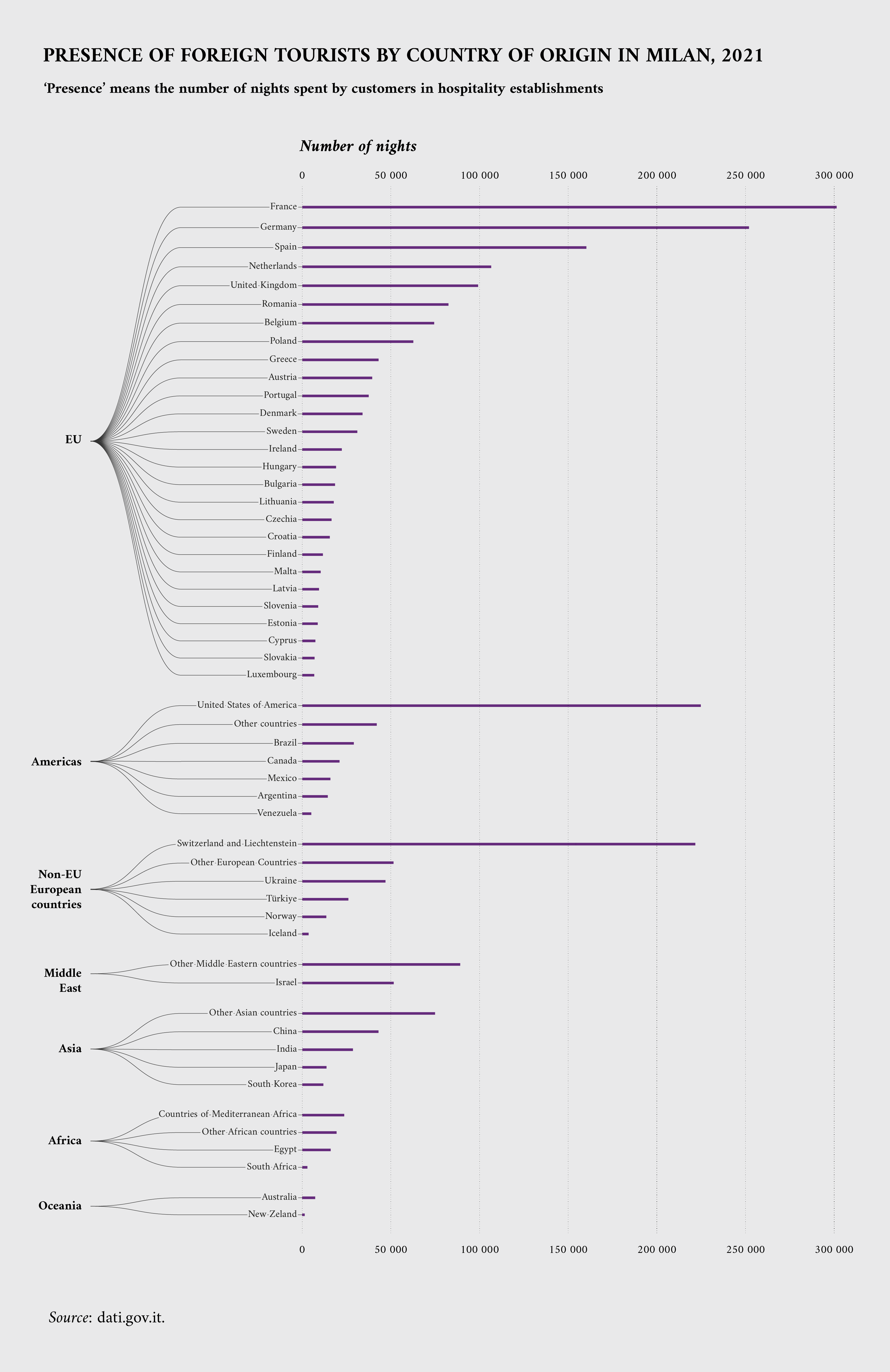

Datasets on data.europa.eu also cover other aspects related to tourism, such as means of transport , accommodation and booking modalities . Examples include a Joint Research Centre study that estimated the percentage of travel by train and the number of foreign tourists staying in Milan by area of origin and type of accommodation.

Data for tourism in Milan accounts for the number of nights spent in the city and shows a significant presence of tourists from other Member States – especially France and Germany. The third-largest influx of tourists come from the United States, while other important groups of people travelled to Milan from Switzerland, Liechtenstein and from several Middle Eastern countries.

Other than Eurostat and the Member States, data about tourism is also produced by the European Environmental Agency , which focuses on the environmental impact of tourism. Sociological data is made available by Eurobarometer , with public opinion surveys on a range of EU-related topics across its Member States regularly conducted by the Commission and other EU institutions since 1973. Some of those surveys asked European residents about their attitude towards tourism and the results can be downloaded from the data.europa.eu portal.

Download the data visualisations presented in this story and the data behind them.

Article by Davide Mancino

Data visualisations by Federica Fragapane

International tourism, number of arrivals - European Union

Selected Countries and Economies

European union.

- Privacy Notice

- Access to Information

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here.

DATES project

European Tourism Data Space

DATES is a EU project that aims to explore approaches and options for the deployment of a secure and trusted tourism data space , ensuring transparent control of data access, use and re-use. The project focuses on the development of governance and business models , while providing a shared roadmap that will ensure the coordination of the tourism ecosystem stakeholders and the connection between data ecosystems at EU level and interconnected data spaces in other sectors.

The project promotes the vision of a prosperous tourism data space and recommend clear strategies on how to inspire and motivate all key tourism stakeholders to collaboratively build a powerful interconnected tourism data space. Besides providing leadership and practical advice about how every stakeholder in the tourism value chain can contribute and utilise data streams, the added benefits of a European Tourism Data Space will be highlighted from each stakeholder’s perspective. In more general terms, DATES supports the digital transformation of the sector, fostering competitiveness, resilience, and sustainability as key success factors to maintain Europe’s leading role.

Suscribe to Dates Newsletter

Check your inbox or spam folder to confirm your subscription.

What we do?

Identification.

We identify high-priority data sets and define rules for their usage

Development

We develop a blueprint of the technological and non-technological elements that will define a tourism data space

We create an integrated and comprehensive tourism data ecosystem managed by a common governance

Sustainability

We incorporate resilience and sustainability as transversal pillars of the tourism data space

Need and added value of a European Tourism Data Space

As a transversal industry, tourism is an integral and important part of the European economy, directly linked with other sectors such as mobility, logistics, health, agriculture, culture, media, automotive, food and beverage, etc. The interdependencies of tourism with other industries could be well observed during the COVID19 pandemic, when many of the sectors mentioned above were directly affected by travel restrictions and lockdowns for tourism businesses. As a consequence, there is a great need for efficient data exchange in all directions, as different applications need to access and combine data to provide added values for users and decision makers across all sectors.

The consortium of the DATES project counts with 13 European partners from the whole tourism data space value chain: TIC applied to tourism and mobility, academia, travel tech – tourism players, tourism public authorities at national and regional level, having the capacity to engage also the civil society.

DATES is a EU funded project coordinated by AnySolution, S.L.

For information and inquieries please contact [email protected]

Strengthen: transition to sustainable, responsible and smart tourism

24. Notes that sustainable tourism should take account of current and future economic, social and environmental impacts, addressing the needs of visitors, the industry, the environment and local communities (15) ; recalls that the tourism and travel industry creates an ecological footprint worldwide; highlights the need to devise sustainable and flexible solutions for multimodal transport and to develop policies for preserving natural heritage and biodiversity, respecting the sociocultural authenticity of host communities, ensuring sustainability and delivering socio-economic benefits to all stakeholders;

25. Calls on the Commission to swiftly develop a roadmap for sustainable tourism that includes innovative measures to reduce the climate and environmental footprint of the sector by developing more sustainable forms of tourism, diversifying the offer, boosting new initiatives for cooperation and developing new digital services;

26. Calls on the Member States to devise sustainable tourism action plans at national and regional level in consultation with stakeholders and civil society and in line with a future European roadmap for sustainable tourism, and to make full use of the Next Generation EU funds to finance the tourism transition action plans;

27. Highlights that the COVID-19 pandemic has led to a shift in the nature of travellers’ demands towards safe, clean and more sustainable tourism; underlines that local craft activities, agrotourism, rural tourism and ecotourism are an integral part of sustainable tourism, with an emphasis on discovering nature and the countryside in Europe via routes suitable for walking, cycling or horseback riding with shared access;

28. Calls on the Commission to bring the European Tourism Indicators System (ETIS) into operation, to equip it with a permanent governance structure and to introduce it in tourism destinations, with static indicators and real-time data for their management and evaluation, in partnership with regions; stresses that the aim of the ETIS scoreboard is to monitor the economic, social and environmental impact of tourism;

29. Calls on the Commission to examine the barriers to obtaining the Ecolabel and to expand its scope to other tourism services, as a complement to the EU Eco-Management and Audit Scheme (EMAS) for tourism, and to establish mechanisms to support those certification schemes and to promote tourism operators that have obtained those schemes;

30. Calls on the Member States, national tourism bodies and the industry to bolster their coordination of the criteria for and application of existing quality labels in the Union, and to encourage the Commission to pursue its coordination role and to support local initiatives;

31. Commends the Commission for setting up the Tourism Sustainability Group and calls on the group to resume its work and to revise the 2012 European Charter for Sustainable and Responsible Tourism as a means to encourage participation and the adoption of good practices at national, regional and local levels; believes that the group can serve as a reference for a European network of stakeholders in the area of sustainable tourism, present new tools and initiatives to assess the economic, social and ecological impact of tourism-related activities, involve travellers and enable both travellers and tourism companies to understand their environmental footprint;

32. Stresses the importance of the UNWTO Statistical Framework for Measuring the Sustainability of Tourism, which aims to integrate statistics on the economic, environmental and social dimensions of sustainable tourism;

33. Recalls that the lack of accurate quantitative and qualitative metric data on the effects of tourism on sustainability impedes the decision-making of public and private actors; asks Eurostat to establish a frame of reference for the collection of data relating to sustainability, overtourism, undertourism and criteria on working conditions and calls for Regulation (EU) No 692/2011 (16) to be updated; stresses the vast potential of big data and up-to-date data, namely in terms of origin and type of bookings, length of stays, average spending broken down by category, and occupancy rate, for understanding the evolution of tourism flows and changes in demand, and for adapting the offer and implementing adequate policies accordingly;

34. Welcomes the European Data Strategy and the Commission’s proposal for a Data Governance Act; calls on the Commission to incorporate tourism in the governance framework for common data spaces and to better regulate the activity of online booking platforms and online travel intermediaries, enabling tourism businesses to fully commit to innovation and digitalisation, as the latter are crucial for modernising the entire sector and for developing new services and a broader, high-quality offer; calls on the Commission, furthermore, to promote data pooling for tourism and regional incubators and accelerators for tourism enterprises, harnessing research and innovation to help the many SMEs in the sector collect, process and utilise the data they produce and enable them to fully benefit from the data economy and implement sustainable solutions;

35. Notes that an increasing number of purchases of tourism products and services are taking place online; recognises the enhanced role of collaborative economy platforms as intermediaries and their merits in terms of innovation and sustainability; welcomes the Commission’s proposals for a Digital Services Act and a Digital Markets Act and stresses the need to ensure a level playing field between online and offline businesses to avoid market distortions and preserve healthy competition, with particular regard to the distinction between peers and professional service providers; highlights, in this changing environment, the impact of online reviews and ratings on tourism experiences;

36. Considers it equally important to ensure cooperation between knowledge and innovation communities in the food and culture sectors; believes that promoting market awareness, better qualifications, increased management efficiency, real-life partnerships and targeted networking opportunities, as well as developing innovative measures for the future, are key success factors for agrotourism; also believes that improved cooperation and coordination between stakeholders, greater involvement of local authorities in tourism and market research and professional communication and marketing strategies are necessary in order to boost the social, economic and environmental performance of agrotourism;

37. Calls on the Commission to respect the right of local authorities to regulate against the harmful impacts of overtourism;

38. Notes that tourism is closely linked to mobility and that Member States must, with financial support from the EU, increase investment in the transition to cleaner fuels, in low and zero-emission vehicles, whenever possible, in more accessible modes of transport, including for disabled people and people with reduced mobility for all modes, and in support for mobility as a service and platforms that guarantee the interoperability and intermodality of ticketing systems to offer transnational and intermodal door-to-door tickets;

39. Believes that tourism mobility should prioritise the use of the most sustainable means of transport, which create a smaller carbon footprint; recalls the necessity for all Member States to have modern, safe and sustainable transport infrastructure in order to facilitate travel across the EU and to make the outermost regions, peripheral and remote areas and islands more accessible for intra-European and international tourism and strengthen territorial cohesion; points out that particular attention should be paid to missing connections across borders, to their completion and to compliance with the TEN-T 2030 and 2050 deadlines;

40. Highlights that the European Year of Rail could present an opportunity to create public awareness of sustainable tourism and the new cross-border routes that European citizens can discover thanks to rail connections; calls on the Commission, therefore, to improve the European railway network; applauds the Union’s DiscoverEU initiative, which gives mostly young people the opportunity to discover Europe through learning and cultural experiences and the promotion of local cultural heritage;

41. Underlines the importance of culture and cultural heritage in European tourism; calls on the Member States, therefore, to allocate sufficient funding to culture and cultural heritage sites, without forgetting their intrinsic value as a part of our cultural heritage that needs to be protected, not least from climate change and overtourism;

42. Stresses the need to study the resilience of cultural heritage and notes the liaison between sustainable tourism and cultural heritage; believes that cultural tourism can act as a catalyst for strengthening the mutual understanding of people in the EU by allowing them to discover European cultural heritage in all its diversity; highlights the need to take into account the lessons learnt from the European Year of Cultural Heritage; recalls that many initiatives have been taken at EU, national and local level to improve sustainable tourism by integrating cultural heritage into environmental, architectural and planning policies; considers the need to protect industrial heritage of regions in transition to enable new economic and professional opportunities in those areas; reiterates the need to raise awareness of heritage protection among all actors, including of the risk of illicit traffic in cultural goods; points out that any reflection on sustainable tourism must also take a another look at works and cultural goods that have been looted, stolen or illegally obtained during wars; encourages the promotion of excellence in sustainable cultural tourism; calls on the Member States to take measures to foster collaboration between experts in cultural tourism and to promote cooperation and exchange of best practices in the sector;

43. Considers that the Cultural Routes programme launched by the Council of Europe will help to highlight Europe’s diverse history and promote cultural heritage; notes the importance of connecting tourist attractions; believes that the programme has a high potential for small businesses, intercultural dialogue and transnational cooperation, and it must evolve by increasingly advocating for sustainability in tourism, including protection for cultural heritage;

44. Calls on the Commission to explore possible synergies with EuroVelo and its 17 corridors, notably by increasing financial support, in order to promote cycling tourism in Europe; calls on the Commission to encourage the reconversion of disused railway lines, including by supporting bike-train projects, and to actively support bike-train intermodality; proposes the promotion of cycling packages aimed at tourists combined with other sustainable offers; believes that cross-border routes for outdoor activities including rural, mountain or nautical tourism, promoted through specific networks supported by EU funding, can play a key role in connecting different Member State regions and diverting tourism flows in an efficient manner, while providing opportunities to boost tourism in less developed regions;

45. Urges the Commission to propose a new European inclusive tourism scheme following the model of the Calypso initiative, enabling vulnerable social groups to use national tourist vouchers in associated establishments in other Member States which also offer a social tourism programme to their citizens; notes that many Member States are implementing such programmes with very good results and believes that it would be very positive to make these schemes interoperable at EU level;

46. Calls on the Commission to present the results of the Smart Tourism Destinations pilot project and outline how it intends to implement the scheme, linking innovation with the protection of UNESCO and nature sites and traditional local specialities and centres of culture;

47. Calls on the Member States and the Commission to make the European Capital of Smart Tourism a permanent project with broader and fairer criteria, thereby benefiting the local economy and local supply chains; calls for greater commitment towards a gradual increase in sustainable mobility opportunities throughout Europe;

48. Commends the Commission for the Access City Award and calls for the implementation of similar initiatives at national and regional levels;

49. Commends the Commission for its work on the 14 actions which make up the Strategy for Coastal and Maritime Tourism, and invites it to present the results, which can be used to channel financing to infrastructure (ports and marinas), logistical and operational support, waste prevention and the use of renewable energy; stresses the need to respect the maritime ecosystem, promote dialogue between Member States, regional and local authorities, stakeholders and civil society, and foster the sustainable development of coastal and maritime tourism; calls on the Commission, in agreement with the Member States, to take measures to support the cruise industry, which continues to be severely damaged by the COVID-19 pandemic, and to facilitate its operational restart, while respecting social and environmental standards;

50. Calls on the Commission to develop initiatives for nautical and coastal tourism with regard to the recognition of skipper qualifications, VAT rules on boats, marinas and anchorages, to tackle seasonality and promote cross-border routes, such as a network of routes for nautical tourism, and to make public the state of play of the pilot project: charter of good practices for sustainable cruise tourism;

51. Encourages the Commission to include local actors that work in rural and coastal areas in income diversification initiatives through the creation of tourism products, services or experiences, in the design of new initiatives and the search for synergies between existing ones; encourages efforts to involve producers from the primary sector (agriculture, livestock and fisheries) in these initiatives and to explore whether these initiatives could be used as a means of marketing their products and disseminating their cultural or gastronomic traditions;

52. Underlines the potential employment opportunities in rural areas for legally resident third-country nationals, thereby promoting their social and economic inclusion;

53. Highlights the positive contribution of rural tourism in safeguarding small-scale and diverse farming, tackling social inequalities and creating employment opportunities for women, with the proportion of women in the sector in the EU being around 50 %, thereby contributing to generational renewal and reversing depopulation;

54. Stresses the need to include health tourism, in particular spa and wellness tourism, as a separate industry with high competitive and innovative potential in future measures to develop tourism in Europe, in view of demographic changes and increasing public health awareness;

Rethink: planning the future of the tourism industry

55. Stresses the need to support the tourism industry in implementing the principles of the circular economy, by for instance boosting the supply of climate-neutral products, using clean energy, reducing the use of harmful chemicals and single-use plastics, improving the energy efficiency of buildings by incentivising the renovation of the tourism building stock, implementing rainwater and domestic wastewater recycling processes, facilitating recycling and preventing waste;

56. Urges the Commission to present an analysis in the first semester of 2021 on the requests received from each Member State for State aid schemes for the tourism industry and on EU financing used to tackle the effects of COVID-19, including the applicability of the SURE programme; calls on the Commission to consolidate and extend SURE until the end of 2022 in view of the socioeconomic difficulties the Member States are facing;

57. Calls on the Commission and the Member States to address the situation of workers in the tourism sector affected by the COVID-19 crisis and to consider the possibility of establishing a European framework, within the action plan for the European Pillar of Social Rights, across the industry’s entire value chain, in close cooperation with social partners and businesses, through a constructive dialogue on the working conditions in the sector, which is characterised by seasonality and part-time and atypical forms of employment; emphasises that access to social protections must be guaranteed;

58. Calls on the Commission, together with the European Investment Bank, to establish sufficient dedicated support for the decarbonisation of the tourism sector, for digitalisation and for innovative projects, and the conditions of access for micro enterprises and SMEs to InvestEU, so that new skills can be acquired and more quality jobs created; stresses the need for better coordination between the EU and the local level in order to solve the issue of access to finance; highlights that new technologies, such as artificial intelligence, robotics and virtual and augmented reality, can have a significant impact on the tourism industry; notes that their uptake requires adequate funding for tourism establishments, in particular micro enterprises and SMEs;

59. Calls on the Commission to propose new programmes to support innovation in the tourism sector through design thinking;

60. Calls on the Commission, together with the Member States, to support the best practices currently employed by national, regional and local authorities, the transition to seamless intermodality in transport, and the development of through-ticketing for rail travel; recalls the importance of modern, seamless TEN-T networks and high-speed cross-border services across Europe for unlocking the potential of international collective sustainable transport to make tourism more sustainable throughout every season of the year; recalls, in this respect, the need to strengthen urban nodes and public transport, which are an important part of tourists’ experiences and citizens’ everyday lives in tourist destinations;

61. Calls on the Commission to introduce the e-visa, along with the travel visa and other measures that allow visitors to enter the Union lawfully;

62. Believes that the promotion of the European tourism brand in third countries must focus on the diversification of the tourism product to attract a wider range of tourists and increase market share, while promoting key destinations which offer an alternative to areas of mass tourism; highlights the attractiveness of pan-European touristic products and services such as transnational itineraries;

63. Points out the major contribution of sport to European tourism and highlights the opportunities arising from sporting events and activities, while not forgetting the importance of improving the sustainability of major events; underlines the importance of Europe’s gastronomy, gastronomic routes and hotel, restaurant and catering (Horeca) sector for the tourism industry; underlines the importance of health and spa tourism and calls on the Commission to promote tourist initiatives that may help to reduce health costs through preventive measures and lower pharmaceutical consumption; believes that the promotion of the European tourism brand must focus on the diversification of the EU’s offering in cultural and natural heritage, food and health, in cooperation with destinations and tour operators;

64. Urges the Commission to submit a proposal on geographical indications for non-agricultural products, not least in the light of the outcome of the 2014 public consultation, which showed that this recognition, in the form of the immediate identification of a product with a territory, would boost the tourism industry;

65. Calls on the Commission to promote artistic and traditional craft professions, which exemplify the excellence of products made in Europe as an expression of the identity and traditions of European territories, including in the context of the tourism industry, through official recognition as part of European cultural heritage;

66. Calls on the Commission to evaluate and, if necessary, to review the Package Travel Directive (17) and to unblock the negotiations in the Council on the revision of Regulation (EC) No 261/2004 on air passenger rights (18) to take account of the effects of the recent crisis, prevent future legal uncertainty and ensure the protection of consumer rights; asks the Commission to analyse the possibility of strengthening the insolvency protection provisions by adding a prevention approach to support companies and SMEs at an earlier stage and in order to protect workers in the event of systemic shocks and/or insolvency;

67. Calls on the Commission to establish a European travel guarantee scheme, based on the experience of the COVID-19 crisis and similar schemes in the Member States, in order to secure financial liquidity for companies and guarantee refunds for travellers as well as repatriation costs, together with fair compensation for any damages incurred in the event of bankruptcy;

68. Calls on the Commission to establish a single platform for the creation of digital innovation literacy programmes for the senior executives of micro enterprises and SMEs, giving them the skills they need to optimise their wealth-creating potential; believes that regular training and the reskilling of the existing workforce in the tourism sector is of the utmost importance, with a specific focus on digital skills and innovative technologies; calls on the Commission to develop an EU roadmap to upskill workers in the sector, including an EU financing scheme to this end;

69. Notes that skills and qualifications are not always harmonised between countries and there is a lack of mutual recognition; calls on the Commission, therefore, to evaluate options for harmonising the rules and legislation in this regard;

70. Urges the Commission to work together with associations in the sector and to use best practices to issue recommendations and provide financial support for the organisation of trade tourism events, fairs, congresses and tourism related to artistic and entertainment events, such as concerts and festivals;

71. Requests that the Commission publish and share with stakeholders and the Member States good practices for the professional tour guide profession in order to address the problems affecting this sector; considers that professional tour guides play a vital role in promoting cultural heritage in synergy with the local territory, its traditions and its specificities; believes, therefore, that this profession should enjoy adequate protection in the labour market in order to ensure high-quality services while preserving open and fair competition; calls on the Commission to analyse the lack of mutual recognition in the sector in order to ascertain where the Union can make the requisite improvements;

72. Underlines the importance of accessibility of travel and tourism services for all, including for children, elderly people and disabled people, regardless of their economic situation or potential vulnerabilities; calls on the Commission to work to facilitate the possible wider implementation and recognition of the European disability card scheme; highlights that accessible tourism for all can only be achieved with the right combination of legal standards implemented by the Member States, innovation and technological developments, personnel training, awareness-raising, adequate promotion and communication, throughout the supply chain of the tourism offer; stresses, in this regard, the importance of European networks where public and private stakeholders can cooperate and exchange best practices; further calls on the Commission and the Member States to actively drive the ongoing development of the International Organisation for Standardisation standard on accessible tourism services and to ensure its swift and correct implementation once adopted, while also ensuring that service providers respect the relevant accessibility standards already in place or in the process of implementation and provide information on the accessibility of their services;

73. Calls on the Commission to propose a standardised method for collating interactive feedback on the accessibility of destinations by enterprises and tourists and to promote its use to the tourism sector as a whole;

74. Calls on the Commission to consider the special characteristics and additional constraints of the outermost regions when formulating and assessing the impact of tourism legislation, in accordance with Article 349 of the TFEU, as those regions rely heavily on tourism for their economic, social and cultural development; warns, in this context, of the need to ensure proper funding to safeguard the accessibility of the outermost regions; calls on the Commission, furthermore, to take into consideration the climate and digital transition in the outermost regions;

75. Call on the Commission to pay particular attention to mountainous regions, islands and insular regions and rural areas and underlines the importance of well-structured institutional cooperation with all interested regional actors, as well as the Committee of the Regions;

76. Encourages the Commission and the Member States to ensure mobility in territories suffering from double and triple insularity, given the abrupt decline in supply; highlights the possibility of establishing safe travel corridors to and from the outermost regions and islands to help alleviate the permanent constraints they face;

77. Stresses that EU rural development measures contribute to strengthening the EU agrofood sector, environmental sustainability and the well-being of rural areas;

78. Instructs its President to forward this resolution to the Council and the Commission.

UN Tourism | Bringing the world closer

The first global dashboard for tourism insights.

- UN Tourism Tourism Dashboard

- Language Services

- Publications

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism Data Dashboard

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms, guest and nights)

Two special modules present data on the impact of COVID 19 on tourism as well as a Policy Tracker on Measures to Support Tourism

The UN Tourism/IATA Destination Tracker

Un tourism tourism recovery tracker.

UN Tourism Tourism Data Dashboard

- International tourist arrivals and receipts and export revenues

- International tourism expenditure and departures

- Seasonality

- Tourism Flows

- Accommodation

- Tourism GDP and Employment

- Domestic Tourism

International Tourism and COVID-19

- The pandemic generated a loss of 2.6 billion international arrivals in 2020, 2021 and 2022 combined

- Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels.

- The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period.

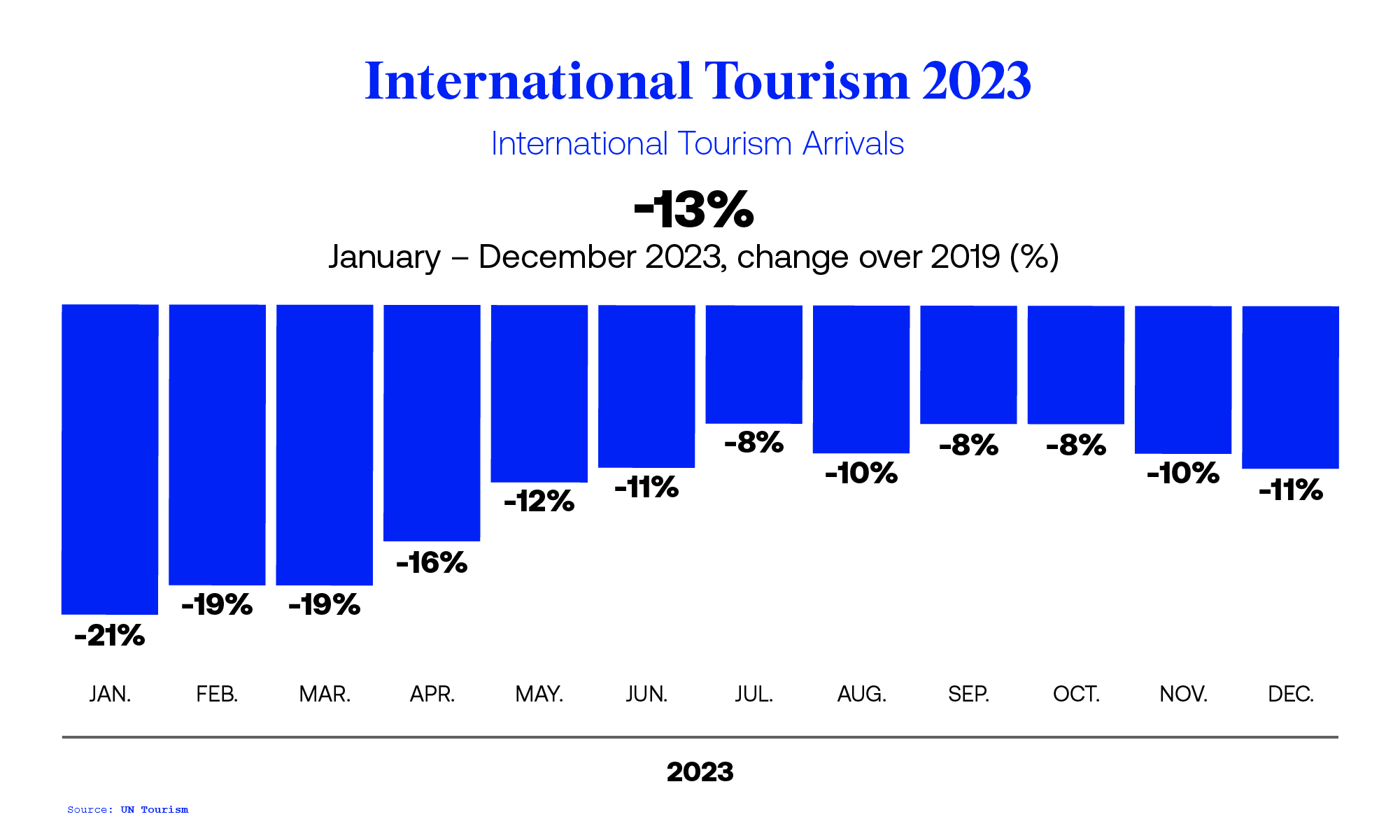

- International tourist arrivals reached 88% of pre-pandemic levels in January-December 2023

Data Space for tourism

- Digital Europe Programme

- Digital technology

- Digital transformation

- EU financing

Description

The objective is to develop a trusted and secure common European data space for tourism, which will provide the ecosystem with access to information, with an impact on productivity, greening and sustainability, innovative business models and upskilling. It will give the possibility of aligning offers to tourists’ expectations, adapting service proposals to new tourist groups, predicting a high influx of tourists, and thus allow planning of resources more efficiently, and creating new business opportunities.

The data space for tourism will be closely connected to other sectoral data spaces, such as the data space for cultural heritage. The work will build on the outcome of the two preparatory actions selected in the previous WP.

Expected outcome:

- Infrastructure for the Tourism Data Space.

- Connections between relevant local and national data ecosystems and initiatives at EU level.

- Establish connections with other sectoral data spaces.

- Guidance/training documents to involve stakeholders in sharing data.

- Exploitation of available data for better interconnection, exchange of information and reuse.

- Once the data space is operational, regular updates on usage data and troubleshooting.

Share this page

Iona vs. Manhattan

SportsCenter

MAC Women's Golf Championship

2024 ACC Men's Golf Championship

Nevada vs. Utah Tech

Renegades vs. Chargers

Mon, 4/22 - espn fc, the paul finebaum show, ahora o nunca, pardon the interruption, #15 oklahoma state vs. kansas state, texas football orange-white spring game presented by texas one fund, latest clips, aaron boone irate after being tossed for something he claims he didn't say, kiper wonders if jets will target a qb in draft after trading zach wilson, stephen a. not confident the lakers can compete with the nuggets, dan orlovsky: broncos trade is a good opportunity for zach wilson, schefter to mcafee: vikings, giants are trying to move up in draft, why stephen a. is expecting the knicks to go up 2-0, jwill to mcafee: there's a jordan-esque feeling to anthony edwards, scottie scheffler taps in to seal tbc heritage win, stephen a. wonders if dak is committed to cowboys long-term, why stephen a. was impressed by the clippers in g1 win over mavs, why p.k. subban likes the rangers' stanley cup chances, ryan smith tells mcafee how he was able to bring an nhl team to utah, schefter tells mcafee why michael penix jr. could go in the 1st round, hahn, jwill get heated over theory that lakers should have ducked nuggets, is jayden daniels a lock to commanders with the no. 2 pick, thunder outlast pelicans in gritty game 1 win, steve levy to mcafee: jets are the sleeper team that could win the stanley cup, dame cooks the pacers for 35 in game 1 win for bucks, shohei ohtani mashes a historic, no-doubt hr, adam lowry's second goal of the game barely crosses the red line, bellingham plays hero for real madrid in thrilling el clasico, tatum's triple-double leads celtics to game 1 win over heat, man united win penalty shootout vs. coventry to reach fa cup final, fernando tatis jr. wows with a spectacular leaping catch, rockies fan interferes with jacob stallings' potential walk-off hr, chris kreider nets breakaway goal to seal rangers' game 1 win, jasmine koo's unbelievable shot bounces off floating sign, rempe and panarin score 33 seconds apart to put rangers ahead 2-0, tempers flare between heat, celtics after jayson tatum's hard fall.

IMAGES

VIDEO

COMMENTS

Tourism participation: 62 % of EU residents made at least one personal trip in 2022. It is estimated that 62 % of the EU population aged 15 or over took part in tourism for personal purposes in 2022, in other words they made at least one tourism trip for personal purposes during the year (such as holidays, leisure, visiting friends and relatives).

Eurostat also publishes a separate series on short-stay accommodation offered via online collaborative economy platforms; data on tourism trips made by EU residents, including information on destination, duration, accommodation, transport, expenditure, etc. and data on participation in tourism. Additionally, other business or social statistics ...

Directly accessible data for 170 industries from 150+ countries and over 1 Mio. facts. ... Domestic tourism spending in EU-27 countries and the UK 2019-2022.

The Commission launches today the EU Tourism Dashboard, a new tool to help policy makers at country and regional level to steer policies and strategies in the tourism ecosystem.The aim of this tool is to improve access to statistics and policy-relevant indicators for tourism, supporting destinations and public authorities in tracking their progress in the green and digital transition.

A greener and digitalised tourism in the EU. According to the new data, on the digitalisation front, internet infrastructure continues to improve, covering tourism destinations with ever increasing internet speeds: in 2019, only 10% of the tourism capacity had internet speed above 100 Mb/s. This has improved to 42% and 63% in 2021 and 2023 ...

The official list of high-value datasets adopted on 12 December 2022 can be found in the legal documents that define these datasets and their characteristics. Using high-value datasets to analyse tourism. Representing nearly 10 % of the EU's GDP and accounting for 23 million jobs in 2019, tourism is an essential part of the EU's economy.

International tourism, number of arrivals - European Union World Tourism Organization, Yearbook of Tourism Statistics, Compendium of Tourism Statistics and data files. License : CC BY-4.0

Tourism is a major economic activity in the European Union, accounting for 10% of its GDP, with wide-ranging impact on economic growth, employment and social development. It can be a powerful tool in fighting economic decline and unemployment. EU policy aims to maintain Europe's standing as a leading destination, while maximising the industry ...

UN Tourism systematically collects tourism statistics from countries and territories around the world in an extensive database that provides the most comprehensive repository of statistical information available on the tourism sector. This database consists mainly of more than 145 tourism indicators that are updated regularly. You can explore the data available through the UNWTO database below:

This article delves deeply into the burgeoning field of Tourism Data Spaces (TDS) in Europe, focusing on how technologies like Big Data and IoT are redefining the tourism sector. This technological shift is steering traditional tourist destinations towards smarter, more sustainable models. The study utilizes a multifaceted approach, combining documentary and bibliographical analysis with ...

DATES is a EU project that aims to explore approaches and options for the deployment of a secure and trusted tourism data space, ensuring transparent control of data access, use and re-use.The project focuses on the development of governance and business models, while providing a shared roadmap that will ensure the coordination of the tourism ecosystem stakeholders and the connection between ...

The European Agency for Tourism should be responsible for, inter alia: - providing the EU and its Member States with a factual overview and data for policymakers, enabling them to devise informed strategies based on collected and analysed tourism data, including on the possible social, economic and environmental impact of these;

International Tourism and COVID-19. Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels. The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period. Go to Dashboard.

Data sources. Tourism statistics are collected via monthly and quarterly surveys. This depends on the topic and the country running the survey. The data on online platforms is based on data sharing agreements with 4 major international platforms offering short-stay accommodation. These are Airbnb, Booking.com, Tripadvisor, and Expedia Group.

use of tourism data within the EU. Regarding the frequency of selected initiativ es by country (Figure 2), it is important to note that more tourism data-sharing in itiatives have been found in ...

The data space for tourism will be closely connected to other sectoral data spaces, such as the data space for cultural heritage. The work will build on the outcome of the two preparatory actions selected in the previous WP. Expected outcome: Infrastructure for the Tourism Data Space. Connections between relevant local and national data ...

Military spending in Central and Western Europe is now higher than the last year of the Cold War, a new report has found. According to new data released by the Stockholm International Peace ...

Over the past year, tourism was among the sectors most affected by the COVID-19 pandemic, due to the travel restrictions as well as other precautionary measures taken in response. The number of nights spent at EU tourist accommodation establishments dropped by 61% between April 2020 and March 2021 (1.1 billion), compared with the 12 months prior to the pandemic (April 2019 to March 2020: 2.8 ...

Stream the NCAA Women's Lacrosse Game Iona vs. Manhattan live from ESPN+ on Watch ESPN. Live stream on Saturday, April 20, 2024.