- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

5 Things to Know About the Expedia Credit Cards

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

» These cards are no longer available

In 2022, Citi stopped issuing the Expedia® Rewards Card from Citi and the Expedia® Rewards Voyager Card from Citi , so this page is out of date. On Oct. 23, 2022, holders of the Expedia® Rewards Card from Citi were to be moved to the Citi Rewards+® Card , while those who had an Expedia® Rewards Voyager Card from Citi were to be switched to the Citi Premier® Card .

In a crowded world of discount travel sites, Expedia is a longtime fan favorite. Whether you’re looking to fuel your wanderlust or find a basic hotel for a work trip, you can likely score a good deal.

And if you’re a loyal and frequent user of the site, an Expedia credit card can help you juice up your rewards earnings.

There are two possibilities:

The Expedia® Rewards Card from Citi .

The Expedia® Rewards Voyager Card from Citi .

The Voyager version of the card could be a good fit despite its annual fee, thanks to its decent bonus, solid ongoing rewards and annual travel credit.

But point values are underwhelming, and especially for casual Expedia fans, there are better and more rewarding travel credit cards to choose from.

Here are five things to know about Expedia credit cards.

» MORE: NerdWallet's best credit cards for online travel-booking websites

1. You can choose no annual fee or richer incentives

There’s a basic $0 -annual-fee version of the card, but if you’re willing to pay an annual fee you’ll ramp up your rewards and perks.

The Expedia® Rewards Card from Citi may appeal to frugal, infrequent travelers who are opposed to annual fees. But all things considered, the Expedia® Rewards Voyager Card from Citi is the better deal.

If you make full use of the $100 annual air travel fee credit, you can more than make up for the annual fee, and that's before taking into account the sign-up bonus, ongoing rewards and potential anniversary points.

To get either Expedia credit card, you must first become a member of the Expedia Rewards loyalty program. Through that program, even without an Expedia credit card, you earn 2 points for every $1 spent on things like hotels, cars and cruises, and 1 point for every $5 on flights. Any points you earn with an Expedia credit card would be on top of those baseline rates.

» MORE: Why it can be worth paying an annual fee

2. Point values aren't great ...

If you’re using your Expedia points to book travel, they’ll be worth 0.7 cent apiece, which is well below the industry standard of at least a penny per point.

In comparison, the Chase Sapphire Preferred® Card — which has a similar annual fee — earns points that are worth 1.25 cents each when you redeem them for travel through the Chase Ultimate Rewards® portal.

It’s also important to know that not all Expedia bookings will qualify for bonus rewards on your Expedia credit card. The following bookings don’t count as eligible Expedia bookings:

Expedia Rate hotels booked through Expedia but not prepaid.

Properties booked through the "vacation rental" tab.

Car reservations not booked as part of a travel package.

Cruise bookings.

Expedia highlights certain hotels, called VIP Access hotels, that are vetted for high customer service and quality standards (and you can filter your Expedia search to show only these options). There are only about 8,000 of them, but if you book a VIP property through your Expedia account, you'll earn extra points and perks like food and drink extras, free breakfast or parking credits.

» MORE: How much are hotel points and airline miles worth?

3. ... But you can triple-dip your rewards earnings

When you hold either the Expedia® Rewards Card from Citi or the Expedia® Rewards Voyager Card from Citi it's possible to earn points three different ways when you book:

Expedia Rewards points: Independent of the credit cards, being a member of Expedia's loyalty program means you'll earn 2 points for every $1 spent on hotels, cars, packages, things to do, and cruises, and 1 point for every $5 spent on flights.

Credit card bonus points: As noted above, you can earn up to 4 points per $1 spent on the Expedia® Rewards Voyager Card from Citi or up to 3 points per $1 spent on the Expedia® Rewards Card from Citi .

Airline miles: You can also collect miles on your favorite airline program when you book with Expedia.

Plus, you can receive double the points when you use the Expedia app to book your trip. The points you'll earn from the card won't double, but the base Expedia Rewards loyalty points earned do. That means if you book a $500 hotel stay through the Expedia app, you'll earn 2,000 Expedia Rewards points.

» MORE: Best hotel credit cards right now

4. You’ll get automatic status

Who doesn’t like the red-carpet treatment when they stay at hotels? The Expedia® Rewards Card from Citi and the Expedia® Rewards Voyager Card from Citi come with varying levels of elite status:

Silver membership: You’ll get this status automatically with the Expedia® Rewards Card from Citi . As a Silver member, you can enjoy perks like free breakfast and spa credits at VIP Access hotels, and you can earn 10% more Expedia points when you book. Usually you have to stay seven nights or spend $5,000 a year on Expedia bookings to earn Silver membership.

Gold membership: If you have the Expedia® Rewards Voyager Card from Citi , you’ll get automatic Expedia Gold membership. It entitles you to free room upgrades at VIP Access hotels when available (in addition to free breakfast and spa credits), plus you’ll earn 30% more Expedia points on bookings. To earn this status without the credit card, you’d have to stay 15 hotel nights or spend $10,000 in a year on Expedia bookings.

5. You won't want to carry a balance

Travel credit cards aren’t known for having low APRs, and the Expedia credit cards are no exception. The ongoing interest rate on both the Expedia® Rewards Card from Citi and the Expedia® Rewards Voyager Card from Citi can be quite high.

The ongoing APR is 14.99%-22.99% Variable APR for the Expedia® Rewards Card from Citi .

The ongoing APR is 13.99%-21.99% Variable APR for the Expedia® Rewards Voyager Card from Citi .

» MORE: What's a good APR for a credit card?

Information related to the Expedia® Rewards Card from Citi and the Expedia® Rewards Voyager Card from Citi has been collected by NerdWallet and has not been reviewed or provided by the issuer of these cards.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

/static-assets/statics-12532/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Expedia rewards voyager card review.

/authors/kevin_payne_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Editor's note:

Expedia is one of the world’s most popular full-service travel websites, with millions of people booking travel through the site each month. It offered two co-branded cards, one of which was the Expedia Rewards Voyager Card, which allowed you to earn valuable travel rewards and elevated Expedia status.

Who got the Expedia Rewards Voyager Card?

Expedia rewards voyager card benefits and perks, drawbacks to the expedia rewards voyager card, earning and redeeming expedia rewards, expedia rewards voyager card faqs, other cards to consider.

The Expedia Rewards Voyager Card was geared toward individuals who regularly booked travel through Expedia.com. Through Expedia, you could book flights, hotels, rental cars, cruises, and vacation packages, which gave you plenty of opportunities to earn rewards for future travel.

If you didn't plan on booking travel through Expedia very often, the Expedia Rewards Voyage Card was probably not the right card for you, as most of its redemptions were exclusively within the world of Expedia. If you’re a frequent traveler, there are better credit cards, such as the Chase Sapphire Preferred ® Card , that offer more flexibility for earning and using rewards points.

- Gold status : Cardholders got automatic Expedia Gold Status when they had the card. Gold status gave you extra perks like complimentary breakfasts and spa credits. You could also get room upgrades at VIP Access hotels, hotel price matching, member discounts, and elevated rewards rates when booking a hotel.

- Entertainment access : As a Citi credit card, the Expedia Rewards Voyager gave you access to Citi Entertainment. Through the program, you could get exclusive access to purchase tickets for once-in-a-lifetime events, concerts, and experiences.

- Limited redemptions: Cardholders had several redemption options, but redemptions were available only through Expedia.

- Points could expire: Expedia Rewards expired if you didn't earn or use them for 18 months.

Best ways to earn

The quickest way for frequent travelers to earn Expedia points with the Expedia Rewards Voyager was by spending enough to earn the card’s welcome bonus.

As an Expedia-branded credit card, it made sense that it offered a higher rewards rate for Expedia purchases.

Not all Expedia purchases qualified for bonus rewards on the Voyager card. Several travel bookings didn't count as eligible purchases.

The Expedia Rewards Voyager came with automatic Expedia Rewards Gold status, which allowed you to earn an additional discount on eligible Expedia bookings.

Maximizing your redemptions

Expedia Rewards points were redeemable in several ways, but most of them were available only through Expedia. Your options included:

- Rental cars

- Vacation packages

A good perk was that this card allowed you to use reward points to partially pay for travel. The exception to this rule was for Expedia flights. You could redeem points for Expedia flights only when you paid for the full fare, including taxes and fees, with points.

You could also put your Expedia Rewards points to good use by donating them to St Jude’s Children's Research Center.

Was the Expedia Rewards Voyager Card worth it?

The Expedia Rewards Voyager Card was a solid choice if you regularly booked travel through Expedia. Most of its points-earning potential and redemptions were through the travel site, so it wasn't an ideal card if you didn't use Expedia.

What benefits did you get with Expedia Rewards Gold status?

Expedia Rewards Gold status came with several benefits, including hotel discounts and price matching, complimentary breakfast and spa credits at VIP Access hotels, extra bonus points on Expedia bookings, and free room upgrades at VIP Access hotels.

As you compare credit cards , consider each card’s drawbacks and benefits to find the card that’s best for your wallet.

If you want a more flexible travel rewards credit card, the Chase Sapphire Preferred ® Card might be a better option. This credit card offers a substantial welcome bonus and flexible travel redemptions through one of the most popular rewards programs around, Chase Ultimate Rewards. Through Chase Ultimate Rewards , you can redeem points for flights, hotels, rental cars, cruises, and more. Plus, your points are worth 25% more when redeemed for travel through the Ultimate Rewards program. Points are also redeemable for statement credits.

The Chase Sapphire Preferred also has a $95 annual fee, but it’s loaded with travel and other perks to provide more than enough value to justify the fee.

To see other travel card options, check out our recommendations for the best travel credit cards .

Author Details

/authors/kevin_payne_updated.png)

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Want to learn how to make an extra $200?

Get proven ways to earn extra cash from your phone, computer, & more with Extra.

You will receive emails from FinanceBuzz.com. Unsubscribe at any time. Privacy Policy

- Vetted side hustles

- Exclusive offers to save money daily

- Expert tips to help manage and escape debt

Hurry, check your email!

The Extra newsletter by FinanceBuzz helps you build your net worth.

Don't see the email? Let us know.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Rewards credit cards

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Expedia®+ Card from Citi

*The information about the Expedia®+ Card from Citi has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Rewards rate

3 Expedia+ bonus points per $1 spent on eligible Expedia purchases including flights, hotels, activities and travel packages* 1 Expedia+ bonus point per $1 spent on other purchases*

Intro offer

Earn 15,000 Expedia+ bonus points after spending $1,000 in purchases within 3 months of account opening.

Regular APR

Citi is an advertising partner

Editor’s note: some of the offers on this page are no longer available.

The Expedia+ Card from Citi is the junior version of the Expedia+ Voyager Card. It offers the same complex redemption options, but at a lower earnings rate.

Let’s start with the good: This card has no annual fee and can accelerate your Expedia+ points earnings.

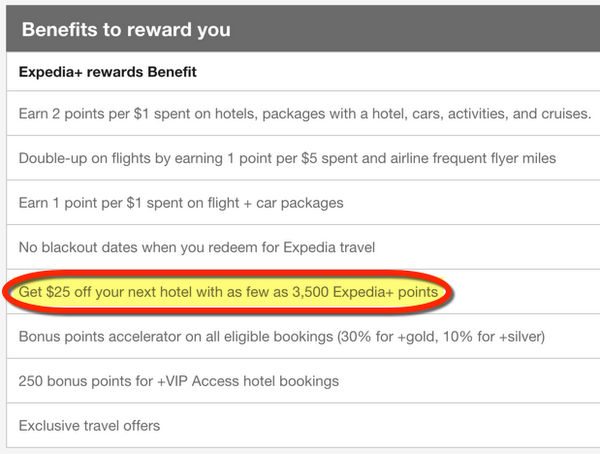

You’ll earn 3 Expedia+ bonus points on every Expedia booking made using the card and 1 Expedia+ bonus point on all other spending. Since the card grants you automatic Expedia+ silver status, you’ll also get a 10% bonus on base Expedia+ points.

But — and here’s the tricky part — the value of Expedia+ points depends on how you use them. The best value comes from using the points towards a VIP Access hotel stay, where 3,500 Expedia+ points are worth a $50 credit toward the hotel. Expedia says your points are worth twice as much when booking a +VIP Access Hotel, and you’ll get 250 bonus points for booking a hotel with this designation.

If you prefer a hotel that’s not labeled +VIP Access, those 3,500 points are worth a $25 credit toward that hotel.

The lowest value use of Expedia+ points would be to book a flight, where it takes 8,000 Expedia+ points to receive up to $50 worth of credit toward a flight. You also have to have enough points to redeem for the entire cost of the flight; you can’t use a combination of points and cash.

If you’re using your earnings toward hotels or flight and hotel packages, you’ll have to redeem your points for a coupon first and then book your travel and apply the coupon to your trip. So, if you have a $500 coupon, and the cost of your hotel stay is $491, you lose the remaining $9 of value. And, the coupons can only be used on one room per booking. This means if you’re a family who needs two rooms, you can only pay for one room with your earnings.

Still, this card is a sub-par choice compared to the Expedia+ Voyager Card. In addition to a lower rewards rate, the Expedia+ Card also dings you 3% on every foreign transaction. This is a charge no decent travel rewards card should carry. For those who are up for the challenge of maximizing Expedia+ rewards, our advice is to pay the $95 annual fee for the Voyager version and get a bigger sign-up, better rewards and no foreign exchange fees.

This card comes with a 15,000 point sign-up bonus after you spend $1,000 within the first three months of opening the account. This could be worth as much $200 towards a +VIP Access hotel or as little as $75 on airfare booked through Expedia.

Who should get this card

Anyone who uses Expedia to book their travel and typically travels domestically can benefit from the Expedia+ bonus rewards of using this card.

If you book most of your travel through Expedia, this card offers some of the best rewards

To get the maximum value out of your Expedia+ points can be cumbersome and requires thorough understanding of a complex redemption program.

You can only redeem rewards for flights or hotels booked through the Expedia site.

If you don’t use or earn points within 18 months, they’ll expire.

You can only redeem your points for a vacation package up to $300.

There’s a foreign transaction fee of 3% for purchases made overseas.

Fees and APR

- Pay no annual fee.

- This card has a variable APR of 14.99% – 22.99% on purchases and balance transfers.

- You’ll be charged a 3% foreign transaction fee for purchases made outside the U.S.

Extras, perks and using points

To redeem your points, log into your Expedia account and select which type of redemption you’d like.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One SavorOne Cash Rewards Credit Card Review

Chase Freedom Unlimited® Review

Citi Custom Cash® Card Review

Discover it® Cash Back Review

Bank of America® Customized Cash Rewards credit card Review

Citi Double Cash® Card Review

Upgrade Cash Rewards Elite Visa® Review

Discover it® Chrome Review

Bank of America® Unlimited Cash Rewards credit card Review

Capital One Quicksilver Cash Rewards Credit Card Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

This offer is no longer available.

Sorry! This credit card offer is currently unavailable. It may return in the future, so check back soon. In the meantime, explore other great offers from our top credit cards.

Expedia®+ Voyager Card from Citi

Credit Recommended (740-850)

We'll Be Right Back!

- Things to do

Explore > Company > Deals > Expedia Travel Week: Hotel Discounts, Rewards Benefits, and More

Expedia Travel Week: Hotel Discounts, Rewards Benefits, and More

Mark your calendars because Expedia’s first-ever Expedia Travel Week sale is right around the corner. Running from June 8-12, our biggest savings event of the year will be available on the Expedia Mobile app and Expedia.com, offering travelers up to 60% off savings on select hotels and activities.

The Expedia Travel Week Sale will feature savings on more than 30,000 hotels worldwide, 800+ activities, offers from cruise lines and more, to help vacation-deprived travelers plan their next well-deserved trip.

Not ready to travel just yet? Fear not. Offers will be open to bookings as far out as January 2022, and most include flexible cancellation policies, making it the perfect time to lock in travel plans to look forward to for the rest of the year.

Here are all the different ways to save:

EXPEDIA TRAVEL WEEK DEALS

Beginning Tuesday, June 8, Expedia will launch five days of deals to some of the most dream-worthy destinations, with hotel and activities up to 60% off. Whether it’s a relaxing summer trip to explore the surf-ready shores of Oahu or an international bucket list vacation to roam the vineyards of Tuscany, there’s something for every kind of traveler.

Plus, find exclusive cruise offers such as complimentary onboard credits, upgrades and discounts from AMA Waterways, Carnival and Norwegian for select sailings through 2023 (offers vary by cruise line).

CURATED DAILY GETAWAYS

In celebration of Expedia Travel Week, Expedia tapped travel and lifestyle trendsetters to create Daily Getaways, custom itineraries for travelers to discover and plan that much-deserved vacation or bucket list trip. Each day of the sale, a new Daily Getaway itinerary will be featured and will include a limited-time 20%-off coupon to be used on the select hotel and activity.

Preview them now and set a reminder when your favorite Daily Getaway goes on sale:

- TUESDAY, JUNE 8: Where to stay and what to do in Los Angeles and Tulum from @Weylie

- WEDNESDAY, JUNE 9: Discovering hidden gems in Las Vegas and Oahu with @FlyWithGarrett

- THURSDAY, JUNE 10: Learn @OneikaTraveller ’s tricks to enjoying the city life in Nashville and New York City

- FRIDAY, JUNE 11: The perfect couples’ getaways in Miami and Brooklyn with @HannahAyl

- SATURDAY, JUNE 12: Sunshine and family fun from coast to coast with @Raffinee in San Diego and Orlando

EXPEDIA REWARDS PERKS

The savings don’t end there. For Rewards Members looking to maximize their points game, Expedia Travel Week will be one of the largest promotions to date:

- 5X APP OFFER During Expedia Travel Week Rewards Members can shop through the mobile app and receive 5X points on any transaction, that’s up to 10 points for every $1.00 spent. Members can stack this offer to get even more rewards by shopping VIP Access properties and receive 7X points, up to 14 points for every $1.00 spent.

- EXPEDIA REWARDS CARD The Expedia Rewards Card from Citi and the Expedia Rewards Voyager Card from Citi are both offering a limited time Welcome Bonus, of 20,000 and 50,000 bonus points respectively after qualifying purchases. The offer is available to new cardholders through July 30, 2021.

TIPS AND TRICKS FOR GETTING THE MOST OUT OF EXPEDIA TRAVEL WEEK

- DOWNLOAD THE APP: In addition to unlocking 5x the Rewards points during Expedia Travel Week, Expedia’s award-winning mobile app also makes it easier to plan and keep track of travel plans.

- BOOKMARK IT: Do a little pre-shopping and save hotels to your favorites list, then set a reminder for when the sale kicks off and your favorite Daily Getaway goes live.

- BOOK FLEXIBLE RATES: Many of the deals featured will have flexible cancellation policies. While many destinations are open, choosing refundable rates allows travelers to snag a great deal without worrying about plans needing to change. Filter search results for “free cancellation” or “reserve now, pay later” and select a refundable room type.

- UNLOCK DEEPER SAVINGS BY BUNDLING: Just by booking multiple items at the same time, such as adding a car rental, activity, or hotel to a flight purchase, travelers could save up to hundreds of dollars on their trip.

- KEEP TABS ON THE LATEST TRAVEL RESTRICTIONS: With restrictions changing by the day, it can be tricky to stay up to date on the latest COVID-related guidelines. Use the Expedia Travel Advisor, which lets travelers search by their origin and destination to see what travel advisories or COVID-19 restrictions are in place.

Happy shopping and safe travels!

More Articles With Company

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Review of the Expedia Voyager Card With $100 Statement Credit

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

When you sign-up for the Citi Expedia+ Voyager card, you’ll earn 20,000 Expedia points after spending $2,000 on purchases in the 1st 3 months of account opening.

And you’ll get a $100 statement credit for an eligible Expedia purchase of $100+ in the 1st 3 months, too.

Let’s take a look at the new offer. I’ll help you decide if it’s right for you!

About the Citi Expedia+ Voyager Card

Link: The Expedia®+ Voyager Credit Card from Citi

I’ve written about the Citi Expedia+ cards . And showed you how the Expedia+ program works. With the Citi Expedia+ Voyager MasterCard , you’ll earn:

- $100 statement credit after your 1st eligible Expedia purchase of $100+ within 3 months of account opening

- 20,000 Expedia points after you spend $2,000 on purchases in the 1st 3 months of account opening

- $100 annual statement credit for airline incidental fees on qualified airlines, like checked bags and in-flight Wi-Fi, or for Global Entry or TSA PreCheck application fees

- 4 Expedia points per $1 you spend on Expedia purchases

- 2 Expedia points per $1 you spend on dining and entertainment

- 1 Expedia point per $1 you spend on everything else

- Free +gold elite status (upgrades and perks at +VIP Access hotels, points earning bonuses)

- 5,000 point anniversary bonus if you spend over $10,000 in a cardmembership year on purchases

- No foreign transaction fees

- $95 annual fee, NOT waived for the 1st year

If you use the $100 travel credit each year, it more than off-sets the $95 annual fee. So this could be a very good deal for folks who use Expedia often, already have lots of Citi cards with better sign-up bonuses, or don’t want to fuss with airline mile cards.

The Expedia Rewards program has lots of complex rules for earning and redeeming your points. But I figured out how much Expedia points are worth . 20,000 Expedia points is enough for:

- ~$120 worth of flights (20,000 points x ~0.6 cents per point)

- ~$125 worth of Expedia hotel nights @ 3,500 points per $25 coupon (5 coupons)

- ~$250 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (5 coupons)

So the value of the sign-up bonus depends on how you want to use your points.

This might appeal to folks who don’t have elite status at chain hotels but want the extra perks! Or if you prefer boutique, independent, or all-inclusive hotels that can’t be booked with points.

20,000 Expedia points is also good for ~$120 toward flights.

But when you consider the $100 Expedia statement credit, the total sign-up bonus is worth:

- ~$220 worth of flights (20,000 points x ~0.6 cents per point plus $100 statement credit)

- ~$225 worth of Expedia hotel nights @ 3,500 points per $25 coupon (5 coupons plus $100 statement credit)

- ~$350 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (5 coupons plus $100 statement credit)

Is It Worth It?

I’ll be skipping this offer because there are lots of better deals when you sign-up for a new credit card. And other sign-up bonuses are worth much more than the $350 you can save at the select hotels included in the Expedia +VIP Access program.

I don’t like being restricted to a small selection of hotels. And other cards are worth much more toward flights.

For example, you’ll earn 50,000 Chase Ultimate Rewards points when you sign-up for the Chase Sapphire Preferred card and spend $4,000 on purchases within the 1st 3 months of opening your account.

This is the best sign-up bonus I’ve seen for this card . And Chase Ultimate Rewards points are flexible , which makes them more valuable. And it’s also my favorite points program overall!

Chase Ultimate Rewards points are worth 1.25 cents each when you book flights through the Chase Travel Portal . So you’ll get at least $625 worth of travel with the 50,000 points you’ll earn with the Chase Sapphire Preferred . And, you won’t have to worry about blackout dates or finding award seats!

You can also transfer the points at a 1:1 ratio to travel partners like British Airways, Hyatt, or United Airlines for award flights or hotel stays. And get potentially thousands of dollars worth of flights or hotels.

Or, you can sign-up for the Barclaycard Arrival Plus World Elite Mastercard to book flights or hotels on Expedia. You’d earn 2.1 cents per $1 you spend (2 miles per $1 + 5% rebate when redeemed for travel). And you’ll earn 40,000 Barclaycard Arrival miles which are worth ~$420 in flights or hotel nights. And again, you won’t have to worry about choosing certain hotels.

And if you want to earn airline miles, there are lots of cards to choose from , too.

For example, you can earn 50,000 American Airlines miles after making $3,000 in purchases within the 1st 3 months of opening a new Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard® . That’s enough for 2 round-trip coach award flights to anywhere in the continental US. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

It has the same annual fee as the Citi Expedia+ Voyager card, and you can bet the flights will be worth more than $220 (which is how much the total sign-up bonus on the Citi Expedia+ Voyager card is worth). Here are more ways to use your American Airlines miles .

And there are cards with a similar sign-up bonus which have no annual fee and a lower minimum spending requirement. For example, the TD Cash Visa currently has a $200 sign-up bonus after you spend $1,500 on purchases in the 1st 90 days of opening your account.

Plus, it earns 2% cash back on dining (1% on everything else) and you can use the cash however you want – for flights, hotels, or spending money!

OK, We Get It! So Who Should Get This Card?

As you can see, you’ll usually do better by selecting another card because their sign-up bonuses are worth much more. In some cases, hundred of dollars more!

But you should consider the Citi Expedia+ Voyager card if:

- You spend a lot of money on Expedia

- You already have all the other Citi credit cards you need

- It’s easy for you to earn Expedia points because you book a lot of hotels for other people

- You like overly complex rewards programs 😉

Some folks might like this card for the double-dip opportunities with paid airline tickets (because you’ll earn airline miles and 4X Expedia points). Or if you tend to book independent or boutique hotels that don’t have award programs.

Keep in mind you must wait ~8 days between Citi personal card applications, and can NOT get more than 2 personal cards each 65 days.

And if you’ve already received this sign-up bonus, you must wait ~18 months after you’ve last had the card to earn the bonus again. If you signed-up with a lower offer, call Citi and ask if they will match you to the current offer.

Remember, personal Citi credit cards are eligible for Citi Price Rewind , which is a great way to save money on big-ticket items!

Bottom Line

Now you can earn 20,000 Expedia points and a $100 statement credit on a $100+ Expedia purchase when you sign-up for the Citi Expedia+ Voyager and spend $2,000 on purchases in the 1st 3 months of account opening. The Expedia points combined with the $100 statement credit you’ll earn are worth:

- $350 at Expedia +VIP Access hotels

- $225 toward other hotels on Expedia

- $220 toward flights booked through Expedia

Expedia points aren’t usually worth as much as other airline and hotel points. And flexible points programs like Chase Ultimate Rewards points give you access to both flights and hotels, plus rental cars, cruises, and more when you book through the Chase Ultimate Rewards travel portal .

The sign-up bonus on the Citi Expedia+ Voyager isn’t a lot when you look at other credit card offers . For example, the sign-up bonus on the Chase Sapphire Preferred card is worth at least $625 in the Chase Travel Portal .

And the sign-up bonus on the Barclaycard Arrival Plus card is worth at least $420 toward travel. And there are no blackout dates or hotel restrictions to worry about!

The Citi Expedia+ Voyager card is best for folks who spend a lot of money on Expedia, or have run out of Citi cards to apply for. Otherwise, I recommend selecting another card to earn a better sign-up bonus!

Do you collect Expedia points? Does this new offer appeal to you?

More Topics

Credit Cards,

Points and Miles

Join the Discussion!

Comments are closed.

You May Also Like

This Capital One credit card is a great option for anyone looking to build credit

June 23, 2021 0

Establish credit history and boost your credit score with the no annual fee Capital One Platinum

June 21, 2021 0

Our Favorite Partner Cards

Popular posts.

COMMENTS

Earn Expedia Rewards bonus points with the Expedia ® Rewards Voyager Card from Citi. Earn Expedia Rewards bonus points after $ in purchases within months of account opening. 2 Expedia Rewards bonus points offer is not available if you have had an Expedia Rewards or Expedia Rewards Voyager account opened or closed in the past 24 months.

This Citi Expedia card offers 25,000 bonus points when you spend $2,000 within the first three months of opening your account. The Expedia Rewards site explains that 140 points are equal to $1 ...

Get the Expedia® Rewards Voyager Card from Citi card today. Earn 25,000 Expedia Rewards bonus points after $2,000 in purchases within 3 months of account opening.

Flights earn Expedia Rewards at a lower rate than other types of purchases: you'll earn 1 point per $5 spent. On a cheap $100 flight, you'd earn only 20 rewards points. On a $1,000 ticket, you ...

Get the Expedia®+ Voyager Card from Citi card today. Earn 25,000 Expedia+ bonus points after $2,000 in purchases within 3 months of account opening* ... Rewards rate. 1 Point per Dollar.

In 2022, Citi stopped issuing the Expedia® Rewards Card from Citi and the Expedia® Rewards Voyager Card from Citi, so this page is out of date.On Oct. 23, 2022, holders of the Expedia® Rewards ...

The quickest way for frequent travelers to earn Expedia points with the Expedia Rewards Voyager was by spending enough to earn the card's welcome bonus. As an Expedia-branded credit card, it made sense that it offered a higher rewards rate for Expedia purchases. Not all Expedia purchases qualified for bonus rewards on the Voyager card.

The Expedia Rewards card from Citi is a credit card offered in partnership with Expedia.com that earns rewards in the Expedia Rewards program. The card earns 3 points per dollar on travel booked ...

The Expedia+ Card from Citi charges no annual fee, but it can't compete with its sibling card, the Expedia+ Voyager Card from Citi, which offers better rewards and travel perks.

When you click on the "Apply Now" button, you can review the credit card terms and conditions on the issuer's web site. Find out all about the Expedia®+ Voyager Card from Citi - we'll provide you with the latest information and tell you everything you need to know to find your perfect card. Learn more about this card, read our expert reviews ...

The Expedia+ Voyager credit card from Citi offers frequent travelers the chance to earn points toward their next vacation. As a cardholder you'll earn 4 Expedia+ bonus points per $1 spent on eligible Expedia purchases, including flights, hotels and travel packages. You'll then earn 2 Expedia+ bonus points per $1 spent on dining out and ...

NEW YORK, September 17, 2014 - Expedia and Citi are introducing a new travel cobranded credit card program designed for travelers to earn Expedia+ rewards bonus points faster and redeem for travel rewards on Expedia.com.The program includes two new chip-enabled credit cards, the Expedia+ Card and the Expedia+ Voyager Card from Citi which can be used at millions of locations around the world ...

Both of these cards can be used at the millions of locations around the world that accept MasterCard. Both cards come with a rich range of features and member benefits. Perks with the Expedia+ Voyager Card from Citi include immediate Expedia+ gold status, automatic upgrades at more than 1,400 +VIP Access hotels, and amenities at select +VIP ...

Both of the Expedia® credit cards — the Expedia®+ Card from Citi and the Expedia®+ Voyager Card from Citi — offer rewards for Expedia® users with points to use on site bookings. But the Expedia®+ Voyager Card from Citi delivers a better overall rewards system, even if you only book one trip per year. Editorial Note: Intuit Credit Karma ...

When you sign up for the Expedia ® + Voyager Card, you will receive 25,000 Expedia+ bonus points after spending $2,000 within the first 3 months. This is redeemable for $350 off a stay at any +VIP Access ™ hotel. When you use your Expedia ® + Voyager Card for eligible Expedia.com purchases, you will receive 4x points per dollar spent.

EXPEDIA REWARDS CARD The Expedia Rewards Card from Citi and the Expedia Rewards Voyager Card from Citi are both offering a limited time Welcome Bonus, of 20,000 and 50,000 bonus points respectively after qualifying purchases. The offer is available to new cardholders through July 30, 2021.

Citi Expedia+ Voyager Credit Card Review (Discontinued) physixfan 2012-06-09 2022-08-05 1 Comment. Citibank. Citibank, No Foreign Transaction Fee.

Now you can earn 20,000 Expedia points and a $100 statement credit on a $100+ Expedia purchase when you sign-up for the Citi Expedia+ Voyager and spend $2,000 on purchases in the 1st 3 months of account opening. The Expedia points combined with the $100 statement credit you'll earn are worth: $350 at Expedia +VIP Access hotels.

Update 9/17/22: Expedia Voyager (annual fee) will be converted to Citi Premier card. Original Post: Citi has discontinued the Citi Expedia cards and existing no annual fee cardholders are being converted to the Citi Rewards+ (unclear what will happen to annual fee cardholders). The conversion will happen on October 23, 2022.

Contact. This product is rating not yet determined by SuperMoney users with a score of 0, equating to 3 on a 5 point rating scale. Recommendation score measures the loyalty between a provider and a consumer. It's at +100 if everybody recommends the provider, and at -100 when no one recommends. Is Expedia® Rewards Voyager Credit Card right for ...

Your Expedia credit card is being converted to a Citi Premier Card! If you have a Citi PremierPass® / Expedia® Card - Elite Level or an Expedia® Rewards Voyager Card from Citi, on October 23, 2022, your card will be converting to a Citi Premier Card account. Citi will no longer issue Expedia credit cards; however, we remain committed to ...

Your Expedia credit card is being converted to a Citi Rewards+ Card! If you have a Citi PremierPass® / Expedia® Card or an Expedia® Rewards Card Card from Citi, on October 23, 2022, your card will be converting to a Citi Rewards+ Card account. Citi will no longer issue Expedia credit cards; however, we remain committed to providing you with ...

Chase Sapphire and Ink Business Preferred® Credit Card cardholders also can transfer their Ultimate Rewards at a 1:1 ratio to Chase's airline and hotel partners, including Southwest Rapid ...