- Skip to main content

Additional menu

Learn How To Manage Money

ICICI Bank Sapphiro Coral Forex Travel Cards Review

By Shiba Behera Latest Updated November 14, 2023

Share this post:

This ICICI Bank Sapphiro Forex Travel Card will make your travel easy and slowly upsurge the non-refundable income that gives you the result for the travel industry for escalating from the last few years. Due to this, holidays and business travelling as gradually increase, that too for the international journey.

Due to which the ICICI Bank introduced a forex travel card, which will work as a prepaid credit card. It can be burdened with a lot of different foreign curries. This way, this ICICI Bank Sapphiro Forex Travel Card will become a great use for international transactions to process with secure, safe, and conveniently makes payments at the establishments.

This kind of card is provided by the ICICI Bank with the collaboration with MasterCard and VISA, due to which the cardholders get an additional benefit, features, and network coverage at various platforms.

This is how this ICICI Bank Sapphiro Forex Travel Card is unique in its way.

The ‘Gemstone Collection’ of the ICICI Bank is an ICICI Bank Coral Forex Travel Card. This Coral Travel Card is available in MasterCard as well as Visa alternatives. With that, you can have the privileges on the card’s movie, shopping, and travel expenditure. With these privileges, the cardholder also gets access to a complimentary lounge.

Lets review the article in detail.

Key Highlights

In this article

ICICI Bank Sapphiro Forex Travel Card

- With this ICICI Bank Sapphiro Forex Travel Card, you need to pay Rs.6,500.

- The annual fee of Rs. 3,500 can be waived if your expenditure goes above Rs.6 lakhs in the preceding year.

- This ICICI Bank Sapphiro Forex Travel Card is best appropriate for Travel and Shopping.

- You are needed to require a minimum income of Rs.80,000 for one month for salaried people and for self-employed for Rs. 83,333 for one month.

- With this ICICI Bank Sapphiro Forex Travel Card, you get welcome vouchers for travel and shopping for Rs. 9,000 or more on the joining fee during payment.

ICICI Bank Coral Forex Travel Card

- With this ICICI Bank, Coral Forex Travel Card has Rs. 500 as an annual fee.

- You also get a BookMyShow 2 movie tickets complimentary basis for each month with ICICI Bank Coral Forex Travel Card.

- On achieving the milestone expenditure, you can access the bonus PAYBACK points.

- With this ICICI Bank Coral Forex Travel Card, you can have the ‘Buy One Get One benefit at the INOX cinemas.

- You can save 15% on your dining bills at some of the selected restaurants.

- In a quarter, you can get 1 railway lounge and an airport lounge on a complimentary basis.

- You can get to earn 2 PAYBACK points on each Rs. 100 of expenditure on the ICICI Bank Coral Forex Travel Card.

- You get to enjoy a waiver of 1% on fuel surcharge at HPCL Petrol Pumps.

Who Should Opt for Travel Cards?

Icici bank sapphiro forex travel card features and benefits, i. joining benefits.

- With the help of One Assist, you can protect your wallet and cards with the Complete Cards protection.

- You get access to the international lounge as you have a Dragon Pass membership of USD 99, and along with that, you can enjoy 2 complimentary lounge visits.

- You also get a voucher for Rs.500 on central shopping.

- For Rs.1,000, you get to enjoy the facilities of the Uber discount voucher.

ii. Exclusive Privileges

- For Rs.5,00,000, you get a lost card liability coverage.

- You also get a cashback of 5% of hotels and airlines expenditure through online channels, for Rs.3,000 each month.

- On cross-currency transactions, you get no mark-up fee.

iii. Vouchers For Shopping And Travel

For some users, the fees of this ICICI Bank Sapphiro Coral Forex Travel Card may feel high, which is Rs.3,500 of card charges and annual fee.

Moreover, this ICICI Bank Sapphiro Coral Forex Travel Card provides you with a voucher of Rs.9,000 or above as a welcome gift which will level up the yearly fees of your card which you paid. This will show you a reasonable fee for the ICICI Bank Sapphiro Coral Forex Travel Card.

You will get the vouchers from the below-mentioned brands: –

You will able to access these vouchers within 45 days of your payment is complete for joining fees. But if you want to know more about this offer, then click here.

iv. For Up To 6 PAYBACK Reward Points On Each Rs.100 Of Expenditure

This ICICI Bank Sapphiro Coral Forex Travel Card provides you with a perfect number of international and domestic expenditure rewards. This way, you get to redeem your PAYBACK reward points through many different options, including travel and movie vouchers to mobile, lifestyle products, appliances, and many more.

Below are the points mentioned in a series: –

v. Complimentary Airport Lounge Access

The ICICI Bank Sapphiro Coral Forex Travel Card offers you 4 complimentary access to the airport lounge on each quarter by a minimum of expenditure of Rs.5,000 or more in one calendar quarter on the card if you have to access the facility in the next coming quarter calendar. Moreover, there is a valid number of complimentary visits; each subsequent visit will be charged according to the appropriate rates of every lounge servicer.

If you want to see the list of the accessible lounges, then you can give a call on 1800 102 6263 or 022-42006396, and even you can click here to have a full list of lounges.

vi. DreamFolks Membership Programme

This privilege is said to be the best benefit that any card provides. Because, as a member of DreamFolks, you can chill at 450 and above comfortable and luxurious airport lounge access from around the world for 115 countries. Also, there is no need of knowing the class or the airline you flew, and even there is no need to know that you are a member of an airline or regular flyer club.

You can just access the benefits: –

- You get to have some good offers on shopping, restaurants, to limos through the DreamFolks application.

- On the DreamFolks Programme for USD 99 for the yearly membership fee is entirely complimentary. You just need to pay for the lounge visit, that too those visits are above the complimentary access.

- Outside India, you get to visit 2 airport lounges on a complimentary basis. At some selected airports, you get to have 2 spa sessions but only in India for each year, that also on a complimentary basis if you have DreamWorks membership.

- To know which airport lounges you get access to, then click here .

- To know that which spa places you get to visit, then click here .

vii. Complimentary Rounds Of Golf

If you are the ICICI Bank Sapphiro Coral Forex Travel Cardholder, then you get to have a complimentary round of golf for each Rs.50,000 on retail expenditure on the preceding month in the calendar, for up to a maximum of 4 months in one month.

- You get to explore some accessible tee time slots at free time, and that will make your chosen bookings and that will able to track your bookings online.

- To manuscript, your game, check teetimes.golftripz.com , which will help you make a Golftripz account using the email ID registered with ICICI Bank Credit Cards.

- After the 10 days or in the next month, you will see a complimentary golf round visible in the Golftripz account.

- These offers are valid for 2 months only.

- If you want to know the updated list of the courses related to golf, then click here .

viii. Entertainment Through BookMyShow

Buy a ticket through BookMyShow 2 times each month; then, if you buy one ticket, along with that, you can get up to Rs.500 off on your second ticket.

ix. Other Benefits

- You can get a minimum of 15% off on all the partnered restaurants on your dining bills.

- You get 1% off for fuel surcharge waived at any fuel outlets for fuel transactions.

- You get an insurance cover for an air accident of Rs.3 crore.

- For Rs.50,000 on lost card liability which included a loss for 2 days former to reporting for the same and 7 days post-reporting. And you want to know more then, click here .

- You get to have 24*7 concierge services at a premium to take care of your all wants and needs related to travel bookings that deliver movie tickets at your home. If you need service, then call on this number 1800 26 70731.

ICICI Bank Coral Forex Travel Card Features And Benefits

- BookMyShow Vouchers for worth Rs.500.

- With this ICICI Bank Coral Forex Travel Card, you get a Lost Card or Counter Card Liability coverage worth Rs.5,00,000.

- Uber Vouchers for Rs.1,000, but only a minimum load of USD 1,000.

- You can also protect your card, but you won’t get any discount on mentioned mark-up fee.

This ICICI Bank Coral Forex Travel Card is very normal, and with that, you do not get any discount on the markup fee. That makes it that you will be stimulated with 3.5% pus additional GST. Therefore, you can neglect this card and opt for any premium card, just like the Regalia card.

ii. Movie Benefit

With this ICICI Bank Coral Forex Travel Card, you can benefit from the ‘Buy One Get One Free’ privilege on all the tickets of movies booked on INOX cinemas and BookMyShow.

You can get a maximum of 2 tickets for free worth Rs.250 for each to access this privilege. But this offer is served on first come first and due to which it is not guaranteed that you will get this offer with surety.

iii. Reward Points

The rewards with ICICI Bank Coral Forex Travel Card are associated with the PAYBACK for all the expenditures you have with this card. You can earn these rewards as per the below details: –

- You can earn 1 PAYBACK point on each Rs.100 of expenditure on your payments of insurance and the utility bill.

- You can earn 2 PAYBACK points on each Rs.100 of expenditure across all the expenditures but not fuel.

iv. Dining Benefit

You get to access 15% of the minimum discount at the dining restaurants to 2,500 and above partnered restaurants in the main 12 cities under the ICICI Bank Culinary Treats Program.

v. Milestone Benefit

For expending Rs.2 Lakhs in one year, you get to have a bonus of 2,000 PAYBACK points and extra PAYBACK points of 1,000 on achieving other Rs.1 lakh of expenditure. With that, you also get to earn a maximum 10,000 of PAYBACK points in one year.

vi. Lifestyle Benefits

With all these above offers, you also get to access some discounts on spas, luxurious hotels, salons, lifestyle stores, wine junctions, and many more for using this ICICI Bank Coral Forex Travel Card. Also, note that you can benefit from the network partner, which is MasterCard and Visa.

vii. Annual Fee Waiver

For this ICICI Bank Coral Forex Travel Card, you can waive the annual fee on your expenditure for Rs.1.5 lakhs or even more in the preceding year.

viii. Fuel Surcharge Waiver

With your ICICI Bank Coral Forex Travel Card, you can save a lot of money on fuel, as you can get a 1% of waive on fuel surcharge at all the HPCL petrol pumps from all around the nation for Rs.4,000 on the transactions.

Eligibility and Documents Required

Along with a full application form, you will also be obligated to give in to legal individuality proof, address, and income.

ICICI Bank Sapphiro Forex Travel Card and ICICI Bank Coral Forex Travel Card has very modest and candid credentials.

- Last 3 months salary statement.

- Proof of employment/proof of business details and proof of salary.

- Form 16, the income Tax Returns Statement, a PAN Card.

- Electricity bill, Proof of address – Ration card, etc. can be submitted

- 1 passport size photograph and signature bearing national identity cards.

How To Apply For The Card?

If you want to apply for ICICI Bank Sapphiro Forex Travel Card and ICICI Bank Coral Forex Travel Card, you can follow these below mentioned stages: –

- You need to check through the official website, and you will be asked to fill out some basic details.

- After that, you will be directed to a new page to know your eligibility for this ICICI Bank Sapphiro Forex Travel Card and ICICI Bank Coral Forex Travel Card.

- Then, you will have to sieve the list and choose the ICICI Bank Sapphiro Forex Travel Card or ICICI Bank Coral Forex Travel Card from the list of the cards of ICICI Bank.

- Then select ‘Check Eligibility’ for the ICICI Bank Sapphiro Forex Travel Card and ICICI Bank Coral Forex Travel Card and fill out all the extra questions.

- And then, your final eligibility will be checked by filling out all the information in the form and submit.

- After that, a manager from the ICICI Bank will call you to know the date and time for the meeting for the documentation and collecting them.

- Lastly, the ICICI Bank will study your application and all the documents. After verifying everything, the ICICI Bank will send you your ICICI Bank Sapphiro Forex Travel Card or ICICI Bank Coral Forex Travel Card to your mentioned address in the next 20 working days.

For this, ICICI Bank Sapphiro Forex Travel Card or ICICI Bank Coral Forex Travel Card can also apply for it by visiting the ICICI Bank branch, any branch nearby you, or you can also SMS “SAPPHIRO” to 5676766. Then the ICICI Bank executive will call you back.

1. Can I momentarily slab my ICICI Bank Sapphiro, Coral Travel Card?

2. what is the least sum that i can preload my icici bank sapphiro coral forex travel card with, 3. can i use the card to manage money other than the one burdened on the card, 4. can i preserve the balance on my icici bank sapphiro coral forex travel card after arriving in india, 5. i have lost my icici bank sapphiro coral forex travel card overseas. what would i do, 6. what is the one assist package for icici bank sapphiro forex travel card, 7. how much can i suppose through except through icici bank sapphiro coral forex travel credit card, 8. which option of icici bank sapphiro coral forex travel card must i smear for, 9. how many periods will it take for the transfer of converted items, 10. how can i exchange payback points, 11. can i brand consumption online utilizing my icici bank sapphiro coral forex travel card, 12. can we take out money from icici bank coral forex travel card, 13. is icici bank coral forex travel card for free, 14. what are icici bank coral forex travel card offers, 15. can i allocate money from icici bank coral forex travel card to the bank account, 16. how can i stimulate my icici bank coral forex travelcard, 17. will i grow a fuel surcharge waiver at indian oil petrol pump, similar cards, icici bank sapphiro coral travel card.

It seems like ICICI Bank does not leave any stones when the cards are business cards. After looking at the changes happening around, I feel very thrilled enough by seeing the ICICI cards, freshly.

In just a period of ~6 months, ICICI Bank has created some enormous developments on most things connected to plastic cards. Moral for them, virtuous for us.

But, then too, you would have a question, “Still, why Forex Cards?”

Not everyone is friendly with using credit cards. Due to this, many people like to use Forex Card in the country. For those people, ICICI Bank has introduced this ICICI Bank Sapphiro Forex Travel Card and ICICI Bank Coral Forex Travel Card, which encounters the premium traveller’s expectations, till the 5X or 10X forex freight, which provides along with the HDFC Regalia Forex Card, which is said as the best one.

Related Posts:

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Share Market News

- e-ATM Order

- FindYourMojo

- Relax For Tax

- Budget 2024

- Live Webinar

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

- Travel Card Loan

- Credit Card

- Two Wheeler

- More Business Loan SME LOAN FOREX & REMITTANCE TRAVEL CARDS

- Introduction

- REGISTERING YOUR TRAVEL CARD

- Features and Benefits

- MANAGING TRAVEL CARD FUNCTIONS

Get smart, convenient and reloadable foreign-currency with the smartest travel card.

ICICI Travel Cards offer you:

Join the growing number of smart global travellers with ICICI Travel Cards. With the convenience of the card and the security of a check, your ICICI Travel Card will allow you to travel abroad without the worries of carrying foreign currency in cash.

Say goodbye to forex procuring hassles with your Smart ICICI Travel Card.

Browse through our wide range of travel card variants to choose the one that fits you best. All ICICI Travel Cards are accepted globally across international stores and online shopping sites.

About International Travel Card

Travelling abroad for business or leisure? Can’t decide how much money to carry? Now you can say goodbye to all the forex-procuring hassles with ICICI Travel Card. Carry forex smartly, safely and conveniently on your travel card and access a world of rewards and benefits. The prepaid Travel Card is your perfect alternative to carrying foreign currency; it is the ideal travel companion for all your international trips.

Choose from a wide range of Travel Card Variants by browsing through our website. Our travel cards are globally accepted across international retail stores and online shopping websites.

Travel Card Functions and Facilities Accessible on the Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- E-Com Activation: My Profile My Setup e-com Activation

- View/download your transaction history: My Accounts Statement View

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet

How to Register a Travel Card?

Register your Travel Card on the Self Care Portal in 3 easy steps

Enter your Travel Card number and your 4-digit ATM PIN

Define your user id, login password and transaction password, set your security questions, input their respective answers and submit to create user id, manage travel card through imobile/ internet banking.

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Features of Travel Card

EXCLUSIVE FEATURES

- Safe and convenient mode of carrying forex

- Globally accepted mode of payment

- Available in 15 foreign currencies

- Facility to check balance on travel card at ATMs worldwide

- Facility to recharge the travel card on-the-go via mobile or net banking

- Doubles as ATM-cum-debit card

Benefits of Forex Card

- Load up to 15 currencies on the same card

- No additional charges levied on PoS swipes

- Better exchange rates than buying forex currency in cash

- Reward points on every swipe

- Exclusive discounts at select retail stores and restaurants worldwide

- High daily withdrawal limit of USD 2000 or its equivalent amount

Managing Travel Card Functions via Internet Banking and Imobile

View the balance amount in your travel card, view last 10 transactions, reload your travel card instantly, update e-mail id & domestic & international mobile number, block or unblock your travel card, online refund of your travel card, pin generation of your travel card.

Travel Card FAQs

What is the use of forex prepaid card.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

How do forex cards work?

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

What is ICICI Bank Forex Prepaid Card?

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

What is the benefit of Forex Prepaid/Travel Card?

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

What is a multi-currency card?

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Can you transfer money from a Forex Prepaid/Travel Card to a bank account?

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

How can I apply for a Forex Prepaid/Travel Card?

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

How do you put money in a Forex Prepaid/Travel Card?

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

How can I activate my Forex/Travel Card?

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

I am unable to withdraw funds from ATM using my Forex Prepaid/Travel Card, what should I do?

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check the balance in the card, for confirmation on whether you can withdraw the amount. If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges). If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

What is the limit for cash withdrawal from ATM in my Forex Prepaid/Travel Card?

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

Subscribe Now! Get features like

- Latest News

- Entertainment

- Real Estate

- SRH vs RCB Live Score

- Crick-it: Catch The Game

- Lok Sabha Election 2024

- Election Schedule 2024

- IPL 2024 Schedule

- IPL Points Table

- IPL Purple Cap

- IPL Orange Cap

- AP Board Results 2024

- The Interview

- Web Stories

- Virat Kohli

- Mumbai News

- Bengaluru News

- Daily Digest

New ICICI Bank Credit Card rules: Airport lounge access benefits, reward points for these 21 credit cards

Icici bank credit card rules: icici bank will implement changes to airport lounge access benefits for these credit cards from april 1..

ICICI Bank will implement changes to airport lounge access benefits across several of its credit cards from April 1. As per ICICI Bank website, “Starting Apr 01, 2024, you can enjoy One complimentary airport lounge access by spending Rs. 35,000 in the preceding calendar quarter. Spends made in the preceding calendar quarter will unlock access for the subsequent calendar quarter."

Read more: Bank holidays in April 2024: Banks closed for 14 days across states. Check state-wise list here

It added, "To be eligible for complimentary lounge access in Apr-May-Jun, 2024 quarter, you need to spend a minimum of Rs.35,000 in the January-February-March 2024 quarter and similarly for following quarters.”

Read more: New tax rules come into effect from April 1: Here's all you need to know on basic exemption limit and rebate

Icici bank: airport lounge access benefits.

- If you spend Rs. 35,000 in the quarter before, you can get one free pass to an airport lounge from April 1, 2024.

- In order to get free lounge access in April-May-June quarter, you have to spend at least Rs. 35,000 in the January-February-March 2024 quarter.

These cards will be able to avail complimentary domestic airport lounge access:

Read more: credit card rules to nps: 5 money-related changes that will come into effect in april 2024.

ICICI Bank Coral Credit Card, ICICI Bank NRI Secured Coral Visa Credit Card, ICICI Bank Coral American Express Credit Card, ICICI Bank Secured Coral Credit Card, ICICI Bank Coral Contactless Credit Card, ICICI BANK HPCL SUPER SAVER RuPay Credit Card, ICICI Bank LEADTHENEW Coral Credit Card, ICICI Bank Coral Rupay Credit Card, ICICI Bank MasterCard Coral Credit Card, ICICI Bank Expressions Credit Card, MINE Credit Card By ICICI Bank Visa Card, MINE Credit card By ICICI Bank Mastercard, ICICI Bank HPCL SUPER SAVER Visa Credit Card, ICICI Bank HPCL SUPER SAVER Master Credit Card, MakeMyTrip ICICI Bank Platinum Credit Card, ICICI Bank Manchester United Platinum Credit Card, Chennai Super Kings ICICI Bank Credit Card, Accelero ICICI Bank Credit Card, ICICI Bank Parakram Credit Card, ICICI Bank Business Blue Advantage Card and ICICI Bank MakeMy Trip Mastercard Business Platinum Credit Card.

Follow the latest breaking news and developments from India and around the world with Hindustan Times' newsdesk. From politics and policies to the economy and the environment, from local issues to national events and global affairs, we've got you covered. ...view detail

Join Hindustan Times

Create free account and unlock exciting features like.

- Terms of use

- Privacy policy

- Weather Today

- HT Newsletters

- Subscription

- Print Ad Rates

- Code of Ethics

- DC vs SRH Live Score

- India vs England

- T20 World Cup 2024 Schedule

- IPL Live Score

- IPL 2024 Auctions

- T20 World Cup 2024

- Cricket Teams

- Cricket Players

- ICC Rankings

- Cricket Schedule

- Other Cities

- Income Tax Calculator

- Budget 2024

- Petrol Prices

- Diesel Prices

- Silver Rate

- Relationships

- Art and Culture

- Taylor Swift: A Primer

- Telugu Cinema

- Tamil Cinema

- Board Exams

- Exam Results

- Competitive Exams

- BBA Colleges

- Engineering Colleges

- Medical Colleges

- BCA Colleges

- Medical Exams

- Engineering Exams

- Horoscope 2024

- Festive Calendar 2024

- Compatibility Calculator

- The Economist Articles

- Explainer Video

- On The Record

- Vikram Chandra Daily Wrap

- PBKS vs DC Live Score

- KKR vs SRH Live Score

- EPL 2023-24

- ISL 2023-24

- Asian Games 2023

- Public Health

- Economic Policy

- International Affairs

- Climate Change

- Gender Equality

- future tech

- Daily Sudoku

- Daily Crossword

- Daily Word Jumble

- HT Friday Finance

- Explore Hindustan Times

- Privacy Policy

- Terms of Use

- Subscription - Terms of Use

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

15+ Best Forex Cards in India 2024

Using your regular credit card while you’re on an international trip might not be the wisest of decisions, as international transactions, which are usually in a foreign currency, attract an additional forex markup fee, which, for most credit cards, is around 3.5% of the transaction amount. For this reason, banks offer forex cards, which are tailored to the needs of customers who make frequent international transactions. With the best forex card, a person can get the most out of their foreign transactions.

Forex credit cards are basically prepaid cards. Unlike credit cards, you need to load a balance on these cards before you can make any purchases. Almost all the best forex cards in India support multiple currencies—you can load the card using any of the supported currencies. Spending in the currency loaded on the card does not attract any foreign currency mark-up fee. Therefore, it’s a good idea to carry a Forex card on an international trip loaded with the home currency of the country you are visiting.

Niyo Global Card by Equitas Bank

Bookmyforex yes bank forex card, axis bank multi-currency forex card, hdfc bank regalia forexplus card, hdfc bank multicurrency platinum forexplus chip card, axis bank club vistara forex card, icici bank student forex prepaid card, axis bank world traveller forex card, state bank multi-currency foreign travel card, indusind bank multi-currency travel card, icici bank sapphiro forex prepaid card, goibibo icici bank forex prepaid card, icici bank coral prepaid forex card, idfc first multi-currency forex card, yes bank multicurrency travel card, list of top forex cards in india.

Here, we have shortlisted some of the best Forex cards offered by the various banks in the country. Many of these cards, just like credit cards, also offer add-on benefits like complimentary lounge access, insurance plans, discount vouchers, etc. You can go through their detailed features and advantages in this article and then choose one that seems to suit you the best:

Add to Compare

Joining Fee

Renewal fee, best suited for, reward type.

Reward Points

Welcome Benefits

Card Details +

Niyo Solutions launched the Niyo Global card in partnership with Equitas Small Finance Bank. It is a premium, high-interest digital savings account that offers up to 7% interest on savings and zero forex markup charges on international transactions worldwide.

The Niyo Global card provides convenient and affordable ways to handle international payments in more than 130 currencies. It offers domestic and international lounge access at all Indian airports, and its user-friendly app has features like Global ATM Locator, real-time currency conversion, and more.

- Cash Withdrawal Charges – 3 free withdrawals per month, and Rs. 21 plus taxes from the 4th withdrawal onwards for Domestic ATMs.

- Rs. 110 plus taxes for International ATMs.

- Currencies Supported – More than 130 currencies supported

- Cross-Currency Usage Fee – Nil

- Additional Benefits – High 7% interest rate on your savings, complimentary lounge access, and user-friendly mobile application.

- No TCS Up to Rs. 7 Lakhs -TCS is exempted from international spends up to Rs. 7 Lakhs per year. However, 20% TCS is applicable beyond the Rs. 7 Lakhs threshold.

The BookMyForex YES Bank Prepaid Card is a recently launched co-branded foreign travel card. The card aims to provide its customers with hassle-free international travel experiences. It also supports multiple currencies, making it even more convenient to travel to different countries without any worries about finding a currency conversion center there. Along with all these features, the card also offers several great deals and discounts across different categories.

The multi-currency Forex Card by Axis Bank is a prepaid international travel card. The card supports 16 widely used currencies, including the United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, and Japanese Yen. As with all foreign exchange credit cards, transactions in the currency loaded on the card do not attract any markup fee; however, transactions in a currency other than the one loaded on the card attract a cross-currency markup fee of 3.5% of the transaction amount.

The Axis Bank Multi-Currency Forex Card comes with an initial issuance fee of Rs. 300 (plus GST), which is waived for Burgundy and Priority account holders. Although the card does not have any reward structure, you do get many value-added benefits like discounts on international roaming packs by VI, a lower currency conversion rate for Southeast Asian currencies, and 247×7 travel assistance by TripAssist. You may want to refer to this article for more information on Axis Bank Multi-Currency Forex Card.

The Regalia ForexPlus Card is a sub-premium prepaid foreign exchange credit card by HDFC Bank. Although the card comes with zero annual fee, an initial fee of Rs. 1,000 is payable at the time of card issuance.

Regalia ForexPlus Card can be loaded in US Dollars. The best part about the Regalia ForexPlus Card is that not only do you not get charged any mark-up fee on transactions in USD, but there is no cross-currency usage fee applicable on transactions done in any other currency. You may refer to this article for more information on the HDFC Regalia ForexPlus Card.

Just like the MakeMyTrip HDFC ForexPlus Card, the Multicurrency Platinum card can also be loaded in 22 different foreign currencies- Australian Dollar, Dirhams, Canadian Dollar, Euro, Hongkong Dollar, Japanese Yen, Singapore Dollar, Sterling Pound, Swiss Franc, Swedish Krona, Thailand Baht, South African Rand, Oman Riyal, New Zealand Dollar, Danish Krone, Norwegian Krone, Saudi Riyal, Korean Won, Bahrain Dinar, Qatari Riyal, Kuwait Dinar and US Dollar. No markup fee is charged on transactions made in the currency loaded on the card; a cross-currency usage fee of 2% of the transaction amount is applicable on transactions made in a currency other than the one loaded on the card.

Multicurrency Platinum ForexPlus Chip Card comes with an initial issuance fee (joining fee) of Rs. 500 (plus GST), which is waived off on the first-time loading of a minimum of USD 1,000. Although the card does not earn you any reward points/cashback, you do get plenty of add-on benefits like Amazon vouchers, emergency assistance, global concierge service, etc. with the card. Check out this article for more info on HDFC Multicurrency Platinum ForexPlus Chip Card.

Axis Bank Club Vistara Forex Card is a co-branded prepaid forex card by Axis Bank in collaboration with Air Vistara. Axis Bank Club Vistara Forex Card can also be loaded in 16 different currencies, including United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, Japanese Yen, Singapore Dollar, Swedish Krona/Kronor, UAE Dirham, Saudi Royal, Thai Baht, New Zealand Dollar, Hong Kong Dollar, South African Rand and Danish Krone.

Since it is an Air Vistara co-branded Forex card, you earn Club Vistara Points (CV Points) as rewards on Axis Bank Club Vistara Forex Card. You earn 3 CV Points for every USD 5 spent with the card. Apart from CV Points, you also get a complimentary Club Vistara base membership. Other add-on benefits that you get with the Club Vistara Forex Card include cashback on international roaming packs and 24×7 emergency assistance during international travel.

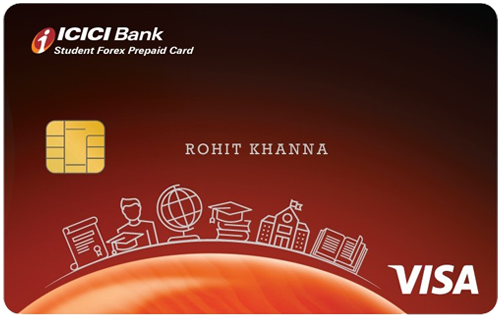

The ICICI Bank Student Forex Credit Card is a great option for those who are planning to go to a foreign country for higher studies. It comes with an issuance fee of Rs. 499 and a renewal fee of Rs. 199 plus taxes. This Student Forex Card allows you to make international transactions without any hassle and with much lower charges compared to credit & debit cards. The cardholders get introductory privileges worth Rs. 5,000, and several other benefits, such as complimentary insurance coverage and zero liability protection, are there.

Axis Bank World Traveller Forex Card is another prepaid travel card by Axis Bank in collaboration with Germany-based Lufthansa Airlines. Like the other two Axis Bank forex cards, the World Traveller Forex Card can also be loaded in 16 different foreign currencies including United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, Japanese Yen, Singapore Dollar, Swedish Krona/Kronor, UAE Dirham, Saudi Royal, Thai Baht, New Zealand Dollar, Hong Kong Dollar, South African Rand and Danish Krone.

Like most other forex cards, no forex markup fee applies to transactions made in the currency loaded on the card. However, a cross-currency usage fee of 3.5% of the transaction amount applies to transactions made in a currency other than the one loaded on the card.

State Bank Multi-Currency Foreign Travel Card is a prepaid forex card issued by the State Bank of India. The card does not have an annual membership fee; however, an initial issuance fee of Rs. 100 (plus GST) is charged at the time of issuance. The issuance fee of the SBI Multi-Currency Foreign Travel Card is the lowest amongst all forex cards presently offered in India.

State Bank Multi-Currency Foreign Travel Card can be loaded in seven different currencies- USD, Euro, Pound, Singapore Dollar, Canadian Dollar, UAE Dirham, and Australian Dollar. No mark-up fee is charged on transactions made using the currency loaded on the card. However, a cross-currency usage fee of 3% of the transaction amount is applicable on transactions made in a currency other than the one loaded on the card. See this article for more details on the State Bank Multi-Currency Foreign Travel Card.

As the name suggests, IndusInd Multi-Currency Travel Card is a prepaid forex card issued by IndusInd Bank. The card does not have an annual membership fee, but an initial fee of Rs. 300 is payable at the time of issuance.

The card supports 14 international currencies- US Dollar, Australian Dollar, Canadian Dollar, Euro, Great Britain Pound, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Singapore Dollar, South African Rand, Swiss Franc, Thailand Baht, Saudi Riyal, and UAE Dirham. No forex markup fee is charged on transactions made in the currency loaded on the card; a cross-currency usage fee of 3% of the transaction amount is, however, applicable on transactions made in a currency other than the one loaded on the card. Check out this article to learn more about IndusInd Bank Multi-Currency Travel Card.

Sapphiro Forex Prepaid Card is a premium prepaid Forex card by ICICI Bank. The card comes with a hefty joining (issuance) fee of Rs. 2,999 (plus GST), and being a premium forex card, offers plenty of add-on privileges like shopping vouchers, Uber vouchers, complimentary international lounge access with Dragon Pass, discounts on international roaming packs and many other benefits. There is no annual membership fee applicable to the ICICI Sapphiro Forex Prepaid Card.

One differentiating feature of the Sapphiro Forex Prepaid Card is that, like the HDFC Regalia Forex Card, the ICICI Sapphiro Forex Prepaid Card does not charge a cross-currency usage fee. This means that you can transact in any currency without being charged an extra fee.

Goibibo ICICI Forex Prepaid Card, as is obvious from the name, is a co-branded forex card by ICICI Bank launched in collaboration with the travel portal Goibibo. The card comes with an initial issuance fee of Rs. 499 (plus GST), while no annual fee is applicable to the card.

Since it is a Goibibo co-branded card, you get many Goibibo exclusive benefits with the card, like a goCash+ gift voucher worth Rs. 500 and Goibibo vouchers worth Rs. 15,000 with the card as a welcome gift. Apart from these Goibibo exclusive benefits, you also get cab vouchers worth Rs. 1,000 on loading a minimum of USD 1,000 on the card, discounted rates on dining at Indian restaurants across Kuala Lumpur, Dubai, London, Singapore, Hong Kong, and Bangkok, and a comprehensive insurance plan with covers against air accident, checked-in baggage, loss of passport/ticket, etc.

Coral Prepaid Forex Card is another prepaid Forex card by ICICI Bank. The card has an initial joining fee of Rs. 499 (plus GST). However, an annual fee of Rs. 299 (plus GST) applies from the second year onwards.

Although the ICICI Coral Prepaid Forex Card does not have a reward structure (like Reward Points or cashback), it offers plenty of value-added benefits, like BookMyShow and Uber vouchers, a comprehensive insurance plan, complete card protection by OneAssist, etc. You may refer to this article for more information on the Card.

International Spends

The IDFC FIRST Multi-Currency Forex Card stands out with its enticing zero issuance charges, making it appealing right from the start. Moreover, it offers the convenience of a replacement card in case of loss, ensuring peace of mind for travelers. What’s more, there are no charges for loading or reloading foreign currencies, making it a cost-effective choice for managing finances abroad. Whether working or on vacation, this Forex card will be useful for everyone going abroad.

The Yes Bank Multi-Currency card is one of the most beneficial cards in India as it is cost-effective and highly secure to use. You can get in touch with the online customer care department to help manage your card from anywhere around the world. Compared to most other cards, this one offers higher security and lower costs. The card supports over 10 currencies, and you get instant real-time SMS alerts whenever you transact with the card. You can analyze and check the previous 10 transaction details and can even temporarily lock the Yes Bank Multi-Currency card.

What are The Types of Forex Cards?

Forex cards are generally of two types. These have been classified on the basis of the number of currencies that they support. The following are the two major types of forex cards:

- Single Currency Forex Cards: Single Currency Forex Cards, as suggested by their names, support a single currency, and these cards are suitable for individuals who often travel to a particular country for some time. These cards can only be loaded in the one currency that they support.

- Multi-Currency Forex Cards: Multi-currency Forex Cards support multiple currencies and can be used in different countries without any additional charges. Nowadays, most card issuers offer multicurrency forex cards so that cardholders can travel all across the world with a single forex card.

Forex Cards – Features and Benefits

Like the general credit cards, some of the forex cards are also issued by the major card issuers in the country. These cards come with various features and benefits across different categories. Some of the common advantages of the forex credit cards are as follows:

- Rewards Rate: Some of the forex credit cards, such as the Axis Bank World Traveller Forex Card & Axis Bank Club Vistara Forex Card, also reward their customers in all their spends. As these cards are most suitable for international travelers, they offer travel-based rewards such as air miles, CV points, etc.

- Support Multiple Currencies: Almost all forex credit cards support not just one or two but multiple currencies, and hence, one can make transactions in different currencies and different countries without any hassle.

- Lounge Access: Some premium Forex credit cards also offer complimentary airport lounge access. These cards let you use the airport lounge facility without paying a usage fee.

- Other Features: Some cards also provide cardholders with complimentary insurance covers and zero liability protection against lost/stolen cards.

How to Use a Forex Card?

Unlike Credit Cards, a Forex card doesn’t come with a credit limit, but you need to load it on your own. Forex Cards are of best use when you are traveling to a different country, as these cards allow you to make transactions in foreign currencies. Load your card as per your requirements and as per the currency of the country you are traveling to.

After that, you can use your card, just like a debit or a credit card. You can withdraw cash in a foreign currency using your Forex card, which you can also use for online/in-store transactions anywhere.

How to Apply for a Forex Card?

Getting a Forex card is as simple as getting a general debit card. The only difference is that you might have to submit a few additional documents like your Passport, Visa, and other travel documents. So, just check the eligibility and document requirements on the respective bank’s official website or by contacting their customer care.

You can visit the branch with all the necessary documents and ask the bank officials if there is an offline procedure to apply for the card. If there is one, you can apply for the card by filling out the physical application form and completing all other formalities. You can also apply online for the card of your choice as follows:

- Visit the respective bank’s official website.

- Find an option to apply for a Forex card.

- Choose the card of your choice.

- Proceed further to apply for it and fill in all the required details in the digital application form.

Bottom Line

While credit cards are an extremely useful financial tool, using them while on foreign trips can cost you a lot. Almost all credit cards charge a mark-up fee of around 3.5% of the transaction amount (it may be less in the case of some premium and super-premium credit cards) on transactions made in a foreign currency. Therefore, it is always a good idea to carry a Forex card on foreign trips and use the same for foreign currency transactions.

As you can see above, the SBI Multi-Currency Foreign Travel Card has the lowest issuance fee of just Rs. 100 amongst all forex cards, and premium forex cards like HDFC Regalia ForexPlus Card and ICICI Sapphiro Forex Card can be used to make payments in any currency without any cross-currency usage fee. Then, there are also co-branded Forex cards like Axis Bank Club Vistara Forex Card, Goibibo ICICI Forex Card, MakeMyTrip HDFC ForexPlus Card, etc. You must find the right Forex card that best suits your needs. For example, for someone who does not travel very frequently, a simple and less expensive forex card like the SBI Multi-Currency Foreign Travel Card might be a good pick; on the other hand, if you fly frequently via a particular airline, say Air Vistara, an Air Vistara co-branded forex card like Axis Bank Club Vistara Forex Card will suit you the best.

You missed one of the most selling forex card. It’s Thomas Cooks Forex card. Same card is selling by many exchange houses and banks

I am planning to go to Europe for a year. Currently, I have a Diners Premium credit card from HDFC bank only. Can you suggest the best forex/debit or credit card that can help me save on exchange rates/taxes and can be widely used in Europe without any security issues? I have heard that Diners card acceptance is not good enough in Europe.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Add cards to start comparing

- Credit Cards

- Investments

- Terms and Conditions

- Privacy Policy

21 Best Forex Cards in India (2024)

- January 2, 2024

- 39 min read

![icici multi currency travel card lounge access 11 Best Forex Cards in India 2020 [Review]](https://moneymint.com/wp-content/uploads/2019/09/11-Best-Forex-Cards-in-India-2019-Review-Comparison-930x576.png)

Forex cards have revolutionized the way people carry foreign currency while traveling abroad. With the convenience of using them like a debit or credit card, forex cards are gaining immense popularity among travelers in India. If you are planning to travel abroad, you might be wondering which forex card to choose. In this article, we have compiled a list of the best forex cards in India to help you make an informed decision.

What is a Forex Card?

Also known as a prepaid card, prepaid travel money card, or Travel credit card, A Forex card is a ‘ready to use card’ instead of a regional currency. It is available in a fixed amount but offers the facility to top up the card as per your requirement.

You can load it with any currency and use it like your debit or credit. One of the significant advantages of this card is that it helps you pay when you travel abroad and saves you from the inconvenience of currency exchange. And just like a credit or debit card, it can also be used to withdraw cash from an ATM. Forex card helps to keep your money safe when you are traveling abroad.

Different Type Of Forex Cards In India:

There are two types of Forex cards in India. They are:

- Multi-currency Forex cards : A card that can be loaded with 23 different currencies and can be used throughout the world. When you are traveling from one country to another, it helps you change to the currency of the country you are going to visit from the currency you are currently using.

- Single currency forex cards: There is a high cross-currency charge on this card whenever you use a different currency and also comes with limited use.

There are few other kinds of forex cards also introduced like the Student Forex cards for students traveling abroad and the Contactless Forex Cards that help you pay for your purchase at retail outlets in a safe way. One should choose among these the best forex card as per his use.

List of 21 Best Forex Cards India

Forex cards are one of the best options for spending your money wisely when you travel abroad. These cards are safe and serve as a less expensive replacement for your cash. Even if the forex market rates keep increasing or decreasing, the rate of the funds you have loaded in your forex card remains the same. Let us begin our list.

1. Axis Bank World Traveller Forex Card

This card is offered by Axis Bank in association with Miles and More; this is one of the best forex cards that aim at Indian travelers who undertake frequent international trips. The card comes with free Miles and More membership. You can earn award miles for loading and each time you spend using the Travellers Forex Card.

The currencies which the card supports are:

- Saudi riyal

- New Zealand dollar

- Hong Kong dollar

- Australian Dollar

- Canadian Dollar

- Swiss Franc

- Japanese Yen

- Indian Rupee

- Singapore dollar

- Pound Sterling

- Swedish kronor

- Danish Krone

- South African Rand

- The transactions become fast and secure when we are able to pay with MasterCard’s contactless technology.

- The card uses the technology of chip and PIN, which is far more secure than legacy cards that use magnetic strips.

- With the locked-in exchange rate feature users can save up to 4% on exchange rates besides avoiding extra fees per transaction.

- Earn five award miles for every $5 spent on the card.

- Trip Assist provides you emergency assistance.

- Miles and More programs allow you to earn miles.

- Welcome bonus of 1,000 air miles and 2,000 miles as a bonus reward on loading more than $4,000.

- The remaining cash on the card can be used to do retail transactions in India through the INR wallet.

Axis Bank World Traveller Forex Card charges and fees

The fees and charges for this forex card are mentioned below:

You can redeem your miles both online and offline with miles and more and its partners. Some of the partners are Taj Hotels, resorts, and palaces, PVR Cinemas, India times shopping, etc.

2. Multi-currency Forex cards by Axis Bank

Students traveling abroad for their studies or vacation or college trip or any other reason try to save money on each transaction they make, such as airfare, travel insurance, college fees, cash withdrawal, etc.

Axis Bank Multi-currency forex card is among the best forex cards for students and one of the best forex cards India that allows you to hold 16 different foreign currencies in a single card.

The 16 currencies are as follows:

- British Pound

- Swedish Kronor

- Singapore Dollar

- New Zealand Dollar

- Saudi Riyal

Moreover, this card is of two types:

I. Contactless Forex Card: This card features Visa’s payWave technology. According to Visa’s payWave technology, you can just wave the card a secured card reader to make the payment. It is more secure because you don’t even need to hand over your card to someone to swipe it, you yourself can wave it over the card reader, and the payment is made.

II. Image Forex Card: This Axis Bank Multi-Currency Forex card gives you the option to personalize by allowing you to add an image of your choice on the card.

To apply for this card, you don’t need to be an existing customer of Axis Bank. The validity of this card is 5 years. You can reload and use it in as many trips as wanted in this time period. And the first 3 ATM transactions are complementary.

This card comes with TripAssist by Axis Bank – emergency assistance which allows you to:

- Block the card.

- Lost passport assistance.

- Get emergency cash.

- With locked-in exchange rate feature, the cash in the card remains unaffected from fluctuating currency rates.

- You can withdraw cash at any Mastercard/VISA ATMs across the world.

- Minimum 15% discount at various restaurants.

- Earn 2 reward points for every USD 5 or equivalent amount spent in any currency.

Special offer valid only for students:

- ATM transaction fee is waived off

- Issuance and reload fee is waived

- 1% cashback on ECOM/POS transactions

- Complimentary TripAssist service

Axis Bank Multi-Currency Forex Card Fees & Charges

The fees and charges for this forex card in India are mentioned below:

3. Axis Bank Diners card

The Axis Bank diners card only allows you to load USD. There are several other benefits associated with the card for travelers going to the US. The card gifts you 2 points every time you spend USD 5 at any shops/merchant outlets.

- Along with the TripAssist features of the Axis Bank, they also have chip and PIN technology which works far better than old cards which used a magnetic strip.

- Can Pay without lag directly at any Diners powered merchant outlets.

- Coverage of medical treatment and ATM robbery. (Maximum amount Rs 60,000)

- Insurance coverage in case of theft/lost.

- Users can encash the balance, transfer it to a resident foreign currency domestic account.

Axis Bank Diners Card Fees & Charges

The fees and other charges for this forex card are mentioned below:

4. HDFC Bank Multicurrency ForexPlus Card

HDFC ForexPlus Cards is among one of the best forex cards India, it is easy, safe as well as a cashless way of carrying foreign currency on your trip abroad. You can use this card to make payments for shopping, lodging, dining, etc.

This card allows you to avail currencies of 22 different countries, which are:

- Omani Riyal

- Qatari Riyal

- Hong Kong Dollar

- Norwegian Krone

- Bahraini Dinar

- Kuwaiti Dinar

- Its payWave NFC technology helps you make a payment without providing information about the card that means contactless.

- A backup card facility is available if your primary card is stolen or lost.

- It comes with an embedded chip and PIN-based transactions.

- Emergency Cash Delivery Assistance: if you lose your card or there is a card failure HDFC bank provides Emergency Cash delivery service all over the world.

- There is an extra assistant service for lost passport and lost luggage.

- Free complimentary international SIM that offers talk time worth ₹200.

- Customers also get insurance protection valued ₹5 lakh which protects the card against any misuse.

HDFC Bank Multicurrency ForexPlus Card Fees & Charges

The fees and other charges for this forex card in India are mentioned below:

5. HDFC Bank ISIC Student ForexPlus Card

As the name suggests, this card is introduced for students and works as a student identity card. It comes with lots of benefits like you can get discounts in around 130 countries like books, travel, etc.

The card allows the following 3 currencies:

- Sterling Pounds

- Can avail of special discounts and exclusive benefits.

- Protection from skimming and fraud, the card comes with an EMV chip.

- Card is accepted as student identity card across the country.

- An added benefit of insurance cover of up to Rs 5 lakhs along with accidental death coverage.

- Baggage loss charges are Rs. 50,000.

- Passport reconstruction cover, maximum of Rs 20,000.

- Customers will get free, complimentary international SIM with talk time worth Rs.200.

- It can be purchased 60 days in advance from the date of travel.

Also Read: Best Banks For A Personal Loan In India

HDFC ISIC Student ForexPlus Card Fees & Charges:

Cross-reference: How prepaid forex cards differ from debit or credit cards

6. HDFC Regalia ForexPlus Card

This card comes loaded with USD currency. There are no-cost currency charges. You can pay for payments across other currencies as well. Also, the cross-currency charge for this card is zero.

- Contactless payment method.

- HDFC provides assistant worldwide if the Card is lost or is failing.

- Emergency cash delivery within 6-7 hours if card is lost.

- Complimentary service by Partner hotels.

- Earn reward points for every $1 spent.

- Free access to lounges in the international airport.

- Insurance coverage from Rs. 50000 to 5 lakhs.

- In case of cash withdrawals managed at ATMs associated to All Point Network, the ATM ownership charges get waived.

HDFC Regalia Forex Plus Card Fees & Charges

*Rs. 1000 is the card issuance fee.

7. Thomas Cook Borderless Prepaid Card

Another best forex card in India, this card comes with a validity of 5 years, and another best thing about this card is that you get a backup card free of cost. You can use this backup card if you lose your card’s primary forex card or it gets stolen.

This card allows you to avail currencies of 9 different countries through one single card, which are:

- Swiss Francs

- Australian Dollars

- British Pounds

- Canadian Dollars

- Singapore Dollars

- Arab Emirates Dirham

- Card protection based on a Chip and PIN.

- Backup card without any charges.

- Not linked to your bank account.

- Dedicated customer support and emergency service.

- No cash withdrawal charges at ATMs are deducted.

- Backup Card available at Zero Cost.

- No surcharge at ATM’s across All Point network.

- Insurance cover up to USD 10,000.

- Free replacement of lost or stolen card.

Thomas Cook Borderless Prepaid Card Fees & Charges

8. Thomas Cook One Currency Card

This card can be stuffed with USD and used throughout the world. Issued on the MasterCard network, this card is valid for up to 5 years.

- Like in a modern debit or credit card, to make the transactions safe and convenient, this forex card comes with Chip and PIN technology.

- Zero cross conversion charge.

- Chip and Pin protected.

- Free replacement of lost or stolen cards.

- USD 10,000 cover-up under any complimentary insurance.

Thomas Cook One Currency Card Fees & Charges

9. IndusInd Bank Multi-Currency Forex card

This Forex card is for the once who frequently travel abroad. About 8 currencies can be loaded on this card. It is not necessary that you must be an existing IndusInd Bank customer to opt for this forex card. You also get dining, and safe transaction offers with this card.

There are different currencies that can be loaded are as follows:

- United States Dollar

- Great Britain Pound

- South African Rand & Thai Baht

- The card is highly secured as it comes with an embedded chip.

- Easy online transactions.

- Allows withdrawals from all VISA ATMs.

- It comes with a paired card key option, which is a backup card in case you lose the primary card.

- Cardholders can easily encash the remaining balance once they come back to India.

- Card replacement is available in case of loss or damage of card.

- It offers you 2 free ATM withdrawals per currency every month.

- The refund process is very convenient.

- Get instant alerts for transactions.

- It provides you with instant transaction alerts. This helps avoid fraud.

- Extra back up card is provided along with the primary card.

IndusInd Bank Multi-Currency Forex Card Fees &Other Charges

10. ICICI Bank Multi-Currency Platinum Travel Card

This travel/forex card is a prepaid foreign currency card that will make your foreign trip enjoyable without constant worrying of cash problems. You can load this card with multiple foreign currencies in India and use it abroad to withdraw cash in the local currency.

The ICICI Bank MultiCurrency Platinum Travel Card also comes with features such as travel insurance, emergency assistance, advanced account management features.

The currencies that can be loaded are as follows:

- Swedish Krona

- Saudi Arabian Riyal

- Liability insurance cover of up to Rs 2 lakhs on lost cards.

- In case of loss of card/the card being misplaced will get help 24*7.

- Duty Free shopping at Indian airports.

- Superior security through 3D Secure and CHIP & PIN technology.

- Discounts on shopping, dining, and stay.

- Up to Rs 10 lakhs of cover on personal air accident cover.

- Convenient refund process.

- Instant account update in real-time.

- It can be easily reloaded online.

- Wallet to wallet transfer.

ICICI Bank Single Currency Forex Card fees and charges:

Cross-reference: How Does a Forex Card Work?

11. Trip Money Global Cash Card

One of MakemyTrip’s best forex cards India is the SBM bank-issued TripMoney Global Cash Card. It provides financial support to overseas travelers and reduces the cost of currency exchange. People who want to handle their cash and cards online are the target market for the Tripmoney Global cash card. The fact that the card, unlike others, does not need a credit history has been a godsend to those who enjoy traveling abroad. The Tripmoney Global Cash Card is used worldwide. You may make purchases at every POS and ATM in any currency of your choice. You may quickly load money in INR and utilize it in any foreign currency with no forex markup or currency conversion fees, giving you freedom. This card can be used in 150-plus countries in a completely hassle-free manner.

This card lets you avail of the following currencies:

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- United States Dollar (USD)

- Great Britain Pound (GBP)

- Singapore Dollar (SGD)

- United Arab Emirates Dirham (AED)

- Saudi Riyal (SAR)

- Thai Baht (THB)

- New Zealand Dollar (NZD)

- Hong Kong Dollar (HKD)

- Swiss France (CHF)

- Japanese Yen (JPY)

- Swedish Krone (SEK)

- South African Rand (ZAR)

- Regular audits take place to ensure the safety of the transactions.

- The forex card is secured by data encryption to ensure the safety of the digital data.

- The data of the cards and the customers are secured.

- Global Cash Card from Tripmoney is free for life.

- There are no additional expenses associated with this prepaid card, such as joining, yearly, or renewal fees.

- The card will be delivered within 7 days minimum.

- Borrow money in INR and use it in whatever you choose.

- The entire procedure is computerized.

- It provides easy app-based card management.

- Free subscription to MakeMyTrip (MMT) Black.

- A coupon is good for savings of up to INR 70,000 at MakeMyTrip.

- Customers save 2% to 4% when there is no foreign exchange markup on their purchases.

- When compared to the exchange rates at airport currency counters, you may save up to 10%.

Trip Money Global Cash Card Fees and Charges

12. YES Bank Multi-Currency Travel Card

It is considered one of the most beneficial foreign exchange cards of India, being cost-efficient and secure. The online customer care portal helps in easy management of cards from all over the world at any point of time. It has high security and low total cost compared to others.

The currencies that are supported by this card are:

- USD (United States Dollar)

- SGD (Singapore Dollar)

- GBP (British Pound)

- AED (UAE Dirhams)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

- JPY (Japanese Yen)

- HKD (Hong Kong Dollar)

- CHF (Swiss Franc)

- Chip based Card for higher security

- Instant SMS Alerts in real time

- Insurance coverage on Card

- Temporary Card Lock Feature

- Safer and Secured mode of carrying foreign currency

- You can see and analyze the details of any previous transaction made. You can also check your last 10 transactions.

- It is easy to manage this Card by connecting to the customer support portal accessible online.

YES Bank Multi-Currency Travel Card Fees & Charges:

13. BookMyForex Travel Card

BookMyForex has launched its very own Visa-powered forex card in association with YesBank for making foreign payments simpler. Travelling students and working professionals like its service and find it beneficial. There are no costly fees for using ATMs to withdraw money or scanning balance at retail locations. BookMyForex has resulted in saving Rs. 19.25 crores by selling 1,25,000+ forex cards and this is what differentiates it from its competitors.

This card supports the following currencies:

- British pound

- Stringent PIN protection method that ensures security of the customer’s account and money.

- You can get notifications for all your transactions through automatic fraud prevention mechanism.

- Free Insurance Cover for theft or other unwanted incidents.

- The Card can support 15 different currencies of several countries at the same time.

- It is more convenient than other cards, since you can exchange currency for free.

- Bookmyforex waives off all charges commonly associated with forex cards, such as issuance, reloading, etc.

BookMyForex Travel Card Fees & Charges:

14. Niyo Global Card

According to a survey by a trustworthy travel agency, the Niyo Global Card is a popular and beneficial currency card. In association with DCB Bank, this card was launched. It eases use of the card through their mobile application, and you can lock the card if unused for a long time.

- United Arab Emirates Dirham

- Swiss France

- Manage digital savings account by locking or adding limits on various transactions.

- Insurance cover of up to ₹5 Lakh

- Real-time updates for your transactions

- Besides the TripAssist capabilities given by DCB Bank, it functions on chip and PIN technology, that is more effective than older cards using magnetic strips.

- ATM ownership charges are waived for withdrawals made from machines connected to the All Point Network.

Niyo Global Card Fees & Charges:

15. Wise Borderless Card

Wise Borderless Cards are one of the best student forex cards. They allow transactions at minimum cost across countries and easy payments, both big and small, in respective local currencies. It is online-based, and you can transfer money throughout the world in 60+ currencies. If you are a student of the United States, Europe, Australia, or the United Kingdom, you can avail of a Wise multi-currency account, a single card that lets users carry 45+ currencies and make withdrawals of up to USD 350/INR 25,976 for free per month.

- AUD (Australia)

- CAD (Canada)

- EUR (European banks)

- GBP from any bank account in the UK, or by SWIFT

- NZD (New Zealand)

- MYR (Malaysia – only available for personal accounts)

- SGD (Singapore)

- USD (United States of America), or by SWIFT from certain countries

- RON (Romania – only available if you’re a resident in the EEA, Switzerland, the US, Canada, Australia, or Japan)

- HUF (Hungary)

- TRY (Turkey)

- Freeze and unfreeze card in one go.

- Generate new digital cards for safety and security.

- Get notifications for every transaction.

- This card has low uniform fees for exchange rates.

- It doesn’t require many formalities to send money to their home country.

- You can save up to 85% for international transactions.

Wise Borderless Card Fees & Charges:

Cross-reference: Forex card: Who is eligible, what paperwork is necessary, and what fees are associated with it

16. ICICI Bank Student Forex Card

ICICI Bank Student Forex Prepaid Card is made exclusively for students who want to study in foreign countries. One great feature is that you can reload it at any Forex branch of ICICI, their online platform Forex@Click, or through their iMobile app.

- Provision of lost card/counterfeit card liability coverage of up to Rs. 5 lakhs.

- Card protection plus insurance worth Rs. 1,600.

- International Student Identity Card (ISIC) membership at just Rs. 590.

- 40% discount on excess baggage.

- 20% discount on courier service by DHL.

ICICI Bank Student Forex Card Fees & Charges:

17. MakeMyTrip HDFC Bank ForexPlus Card

This is one of the best forex cards for students and workers abroad. MakeMyTrip HDFC ForexPlus Card is a co-branded prepaid forex card. The card has initial issuance fee of Rs. 500 (plus GST), but there is no annual membership fee for the card. Transactions from the card can be completed easily and do not incur any forex mark-up fee, however, a cross-currency usage charge of 2% of the transaction amount is charged for a currency other than the one loaded on the card.

- Hongkong Dollar

- Sterling Pound

- Thailand Baht

- Bahrain Dinar

- Kuwait Dinar

- Secured Transactions with Chip & PIN at POS feature

- Protection against Foreign Exchange rate fluctuation

- Facility to change ATM PIN according to your convenience

- Backup Card facility (available only on request)

- Complimentary MMT Black membership

- Ola voucher worth Rs. 500 for a minimum of USD 1,000 (or equivalent)

- Issuance fee waiver with a valid MMT flight/hotel/holiday booking ID, or on the first loading of a minimum of USD 1,000 (or equivalent)

- 2 complimentary lounge access at international airports across India.

MakeMyTrip HDFC Bank ForexPlus Card Fees & Charges:

18. Axis Bank Club Vistara Forex Card

Axis Bank Club Vistara Forex Card is a co-branded prepaid card, launched by the association of Axis Bank and Air Vistara. Though not a credit card, you can earn rewards as Club Vistara Points (CV Points) on all transactions through the card. No annual fee is charged for the card membership, but there is an initial fee of Rs. 500 (plus GST) during card issuance. Also, no minimum income criteria is required for its eligibility.

- USD (United States Dollars)

- GBP (Great Britian Pounds)

- SGD (Singapore Dollars)

- AUD (Australian Dollars)

- CAD (Canadian Dollars)

- SEK (Swedish Krona)

- THB (Thai Baht)

- AED (UAE Dirham)

- SAR (Saudi Riyal)

- HKD (Hongkong Dollars)

- NZD (New Zealand Dollars)

- DKK (Danish Kroner)

- ZAR (South African Rand)

- Ultra-short range of less than 4 cm

- Unique built in secret key to generate a unique code for every contactless transaction

- Every transaction is securely authorised.

- The power and global reach of the VisaNet system to help prevent fraudulent transactions.

- 500 Club Vistara Points (CV Points) as a welcome gift on loading the card for the first time.

- Cashback of up to Rs. 1,000 on international roaming packs by VI.

- No forex mark-up fee on transactions made in the currency loaded on the card.

- A cash withdrawal fee of USD 2.25 (or equivalent) is charged every time you withdraw cash from an ATM.

- A cash advance fee of 0.5% of the transaction amount (maximum fee of USD 75) is also applicable on cash withdrawals using the card.

Axis Bank Club Vistara Forex Card Fees & Charges:

19. Goibibo ICICI Bank Forex Prepaid Card

Goibibo ICICI Bank Forex Prepaid Card is a co-branded forex card launched by ICICI Bank and Goibibo jointly. Like all other prepaid cards, you need to first load the card with cash before you can use it for transactions. Although there is no reward structure, few other benefits can be availed of, like discounts on forex rates, dining, cab vouchers, etc.

- Complimentary comprehensive insurance plan with the card.

- goCash+ Gift Voucher worth Rs. 500. goCash+ is a 100% redeemable currency on Goibibo.

- Goibibo vouchers worth Rs. 1,000.

- Cab voucher worth up to Rs. 1,000 on loading USD 1,000 on the card.

- Discount of Rs. 0.40 on forex rate on loading USD 1,000 on the card.

- Discount of 15% on dining at 100+ Indian restaurants in 6 countries- Kuala Lumpur, Dubai, London, Singapore, Hong Kong and Bangkok when you make the payment with your Goibibo ICICI Forex Prepaid Card.

- Complimentary cards protection worth Rs. 1,600 from OneAssist wallet assistance.

- Discount of Rs. 500 on shopping at Croma outlets (including airport outlets and online).

Goibibo ICICI Bank Forex Prepaid Card Fees & Charges:

20. ICICI Bank Sapphiro Forex Prepaid Card

ICICI Bank Sapphiro Prepaid Forex Card is a premium forex card with a high issuance (joining) fee of Rs. 2,999 (Rs. 999/annum chargeable second year onwards), and benefits like complimentary international lounge access, discounts on hotel/flight bookings, etc. ICICI Sapphiro Prepaid Forex Card does not have any reward structure as it is not a credit card. No income-based criteria is required for eligibility for Sapphiro Prepaid Forex Card. You can apply for the card either online or through ICICI Bank’s forex branches where you can submit your application offline.

- Central shopping voucher worth Rs. 500.

- Uber discount vouchers worth Rs. 1,000.

- 2 complimentary international lounge access at airports worldwide with Dragon Pass membership.

- 5% discount on hotel and flight bookings with a monthly max cap of Rs. 3,000 on the cashback.

- Discounts on international roaming packs.

- No mark-up fee on cross-currency usage.

- A free replacement card is provided in the welcome kit.

- The card can be used for shopping at duty-free stores at international airports across India.

ICICI Bank Sapphiro Forex Prepaid Card Fees & Charges:

Cross-reference: Forex cards are a cheaper, value-loaded option for international travel

21. ICICI Bank Coral Prepaid Forex Card

The ICICI Bank Coral Prepaid Forex Card is one of the best forex cards India, and it is available only for transactions involving foreign currencies. It is a prepaid card, thus before using it for foreign exchange transactions, you must fill the card with one of the supported foreign currencies. It’s important to note that the card cannot be used at any Indian online or offline retailers; however, it may be used at any international online or offline retailers that accept Visa credit or debit cards that are registered outside of India. The card is also accepted in duty-free shops in all of India’s international airports. Although the card doesn’t have a reward system (reward points or cash back), you still get a lot of extra advantages like cinema tickets, insurance covers, taxi vouchers, etc.

- Complimentary Complete card security with OneAssist.

- With the new 3D Secure authentication available on the Card, you can protect your online transactions.

- Card a 24-hour GCAS service for a fee to owners. Customers can use this service, subject to relevant fees, in the event of an emergency, a lost or stolen card, or to obtain certain types of information when traveling abroad.

- A joining bonus of Rs. 500 for each BookMyShow and Uber voucher.

- Comprehensive insurance coverage includes insurance payouts for check-in luggage delays, card loss, and aviation accident coverage.

- The card can be used to make purchases at duty-free shops at all Indian airports.

- The welcome kit includes a free replacement card. The backup card can be triggered if the primary card is lost.

- During overseas travel, concierge services and emergency cash delivery are available.

- Exciting discounts available just like various best forex cards India on international travel, eating, and shopping.

Insurance benefits