Korea Solved

Tax Refund In Korea: All You Need To Know

From the bustling streets of Seoul to the tranquil temples of Busan, shopping in Korea is an exhilarating experience.

And the cherry on top? Korea’s tourist tax refund system .

Let’s dive in and make sure those hard-earned won come back to you.

Similar Posts

Income Tax Brackets In Korea: Explained

Ever felt entangled in the enigma of Korea’s income tax brackets, with numbers dancing around like a vigorous drumbeat? Understanding Korea’s income tax system is crucial for expats looking to avoid an unwarranted financial tango! This article will act as your fiscal compass, navigating you through the intricate rhythms of tax brackets, ensuring your journey…

Church Tax In Korea: A Simple Guide

In the heart of Seoul’s bustling streets or the serene countryside of Jeju, understanding church tax in Korea can be as mystical as the morning mist over Namsan Tower. Whether you’re a local parishioner or an expat navigating new traditions, our guide demystifies the intricacies of church tax, blending cultural insight with practical advice. Let’s…

Tax Number In Korea: An Expats Guide

Venturing into the Land of the Morning Calm and puzzled about tax numbers? South Korea’s tax system might initially seem as intricate as a game of Baduk. This guide aims to simplify the process, helping you secure your Korean tax number with ease and clarity, paving the way for a smooth financial journey in Korea….

Radio Tax In Korea: A Simple Guide

South Korea’s dynamic media landscape includes a unique component: the Radio Tax. In ‘Radio Tax Korea’, we delve into this distinctive aspect of Korean fiscal policy, unraveling its implications for broadcasters and listeners alike. This guide offers a comprehensive understanding of how the tax works, its historical context, and its impact on the broadcasting industry…

Tax Declaration In Korea: Step By Step Guide

Welcome to the land of the morning calm, where the beauty of ancient palaces meets the buzz of modern life—and yes, the intricate web of tax declarations! Let’s unravel the knots and make sense of the tax nuances for you expats. In this guide, we’ll walk you through the labyrinth of tax declarations in Korea,…

Tax Return Software In Korea: A Simple Guide

Filing taxes in Korea doesn’t have to be a daunting task, even for those less familiar with the local language and tax system. Looking to resolve tax mysteries? Fret Not! We’ve got your back! With the right tax return software, you can navigate the complexities of Korean tax laws with ease and confidence. This guide…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

How to Get Your Tax Refund in Seoul: A Step-by-Step Guide for Tourists

Planning a trip to Seoul? This bustling city is not just famous for its K-pop culture, mouthwatering Korean BBQ, and historic palaces. It also offers a fantastic Tax Refund system for foreign tourists and overseas Koreans. In this blog post, we'll delve into the nitty-gritty of Seoul's Tax Refund system, so you can make the most of your travel experience!

Keywords : Seoul, Tax Refund, Travel, Tourism, VAT, Customs, Foreign Tourists, Overseas Koreans, Downtown Tax Refund, Immediate Tax Refund.

What is a Tax Refund in Seoul?

A Tax Refund in Seoul is a system where foreign tourists can get a refund on the domestic tax (such as VAT) from goods purchased at tax-free stores within three months of leaving Korea. This is a fantastic way to save money and enjoy a cost-effective travel experience in Seoul.

Who is Eligible for a Tax Refund?

- Foreign Tourists : If you've stayed in Korea for less than six months, you're eligible.

- Overseas Koreans : If you've stayed in Korea for less than three months and have lived overseas for over two years, you can also benefit from this system.

How to Get Your Tax Refund

- Purchase Goods : Buy items worth over 30,000 won at a tax-free shop in Seoul.

- Customs Export Approval : Show your purchased goods at the Customs Declaration counter to confirm your tax refund slip.

- Refund Slip Approval : Present your purchased goods and tax refund slips.

- Receive Your Refund : After confirmation, head to the tax refund service counter to get your refund.

Downtown Tax Refund

Before going through customs, you can get a domestic tax refund at a tax refund booth or kiosk. This is a convenient way to get your refund without waiting in long lines at the airport.

Immediate Tax Refund

- Purchase Limit : Your purchase should be under 500,000 won.

- Total Amount : The total amount of purchases should be under 2,500,000 won for the duration of one trip.

Mailbox Tax Refund

If you can't use a tax refund booth or kiosk, you can fill out a tax refund application, and it will be processed manually.

Understanding the Tax Refund system in Seoul can significantly enhance your travel experience. Whether you're a foreign tourist or an overseas Korean, make sure to take advantage of this opportunity to get some of your hard-earned money back.

So, the next time you're shopping in Seoul, keep these tax refund tips in mind to make your trip more economical and enjoyable!

- Accomodation

- Attractions

- Food & Drink

- K-Entertainment Tours

- Korean Culture

- Shopping Destinations

- Transportation

- Travel Essentials

- Travel Tips

- Travel News in Korea

- Gyeonggi-do

- North Gyeongsang (Gyeongsangbuk-do)

- North Jeolla (Jeollabuk-do)

- South Chungcheong (Chungcheongnam-do)

- South Gyeongsang (Gyeongsangnam-do)

- South Jeolla (Jeollanam-do)

Everything You Need to Know about Hotel Tax Refund in Korea

18,817 total views, 14 views today

As an international tourist in South Korea, you can claim a hotel tax refund if you stay in certified hotels within Korea for less than 30 days.

Who doesn’t love a little shopping frenzy in Korea? Or staying the night on a rooftop luxury hotel? Did you know you can actually claim tax refunds from the Korean government if you stay at certain hotels in Korea? First initiated in the year 2014, it only became popular in early 2020. It is unfortunate that most foreigners are unaware of this huge benefit, but in this blog, we will cover every detail so you can take advantage of your rights!

So how can you know if the hotel you’re staying at is eligible for a tax refund? What qualifications need to be met? Let’s find out together!

Table of Contents

General Tax Refund System in Korea

You must be a foreigner and on a short-term visa.

Hotel tax reimbursements are only available to foreigners without long-term visas to Korea, according to Korea’s general tax refund procedure. Tax refunds for hotels and accommodations are unavailable for those with visas that last more than 90 days and those employed or married in Korea. You can profit from tax return benefits if you enter the nation without a visa (on K-ETA ) or remain there for fewer than 90 days on a tourist visa.

Tax refunds can only be claimed from designated tax-refundable hotels

Tax refunds are not available for all hotels in Korea. To be qualified for this advantage, the hotels must submit an application to the government each season and be accepted as a “special hotel.”

Therefore, asking the hotel directly or clicking here to check the list is the quickest way to learn if the hotel you want to stay at is approved for the fourth quarter of 2022 (October to December). If the hotel you want to stay at is on the list, the next thing to do is to make sure that everyone who will be staying there complies with the requirements for a tax refund.

Payment must have been made directly to the hotel

You must make sure to complete payment straight to the hotel if you visit Korea as a tourist qualified for this advantage and select an authorized hotel that can be tax-refunded. If you reserve a hotel through a third-party website (such as Agoda , Booking.com, etc.) and make your payment there, you won’t be eligible for a tax refund.

You must make a reservation on the hotel’s official website to receive a tax refund. When making a reservation on a third-party website, you can request that the payment be handled on your behalf when you arrive. There is no method to produce formal receipts and tax return forms in the hotel’s name if the payment is made directly through a third-party platform and does not flow directly to the hotel itself.

You cannot receive a tax refund if you make a hotel reservation through a travel agency without paying in person. Please remember this.

As long as you haven’t paid the check-in charge through another platform and the hotel conforms with the tax return certification, you will receive a tax refund when paying on-site at the hotel, whether with cash or a card.

There is a limit on how long you can stay

You must stay between one and thirty nights if you want a tax refund. You won’t be given a tax refund if your stay is longer than 30 nights. Additionally, to be eligible for a refund, you must depart Korea within three months of checking out of the hotel.

At the end of your trip, after paying the hotel fee, you may be eligible for a tax refund of between 7% and 10% if you satisfy all four of the requirements above. Congratulations!

Hotel Tax Refund Process

1. check the tax refund eligibility and get a tax refund checklist.

Please be sure to thoroughly verify your hotel’s eligibility. In the final three months of the current year, but not in the first three months of the following, the hotel you reserved might be eligible for a tax refund. Please confirm with the hotel before making a reservation!

2. Receive a tax refund form after submitting the checklist

When you check out of the hotel, hand the staff the tax refund checklist, ask for the hotel tax refund form, and be ready to wait for your tax refund.

3. Collect your tax refund amount at the airport or a city kiosk

Within three months of checking out, you must locate a tax refund kiosk in the city or pick up your tax refund at the airport. Please be aware that while tax refunds at the airport can be obtained instantly in cash, you’ll need a credit card to use the machines in the city.

Related Posts

- How to Get a Tax Refund in South Korea

- Your Trip to Busan: Guide to Public Transportation

- Visiting Korea for Plastic Surgery: Tips for Planning the Trip

- Visit These 10+ Korean Restaurants for Extraordinary Valentine’s Day in Seoul

- Unlock Korean Hair Magic: Discover Seoul’s Top English-Speaking Salons

18,818 total views, 15 views today

Ga-ram is a travel blogger and photographer who is passionate about sharing her love of Korea with the world. She has been living in Seoul for the past 5 years, and she has explored every corner of the city. She loves to share her favorite spots with her readers, and she always has new recommendations for places to visit.

Explore Korea Like a Boss with InterparkTriple TRIPLE Korea

Temporary Suspension of VISIT BUSAN PASS Sales – Important Information for Travelers

Seoul Trip PASS App: Your Ultimate Travel Companion for Hassle-Free ID, Seamless Payments, and Instant Tax Refunds!

Best Korean to English Translation Apps for Your Korea Trip

Discover South Korea with the Best: Top 10 Tour Operators

A Complete Guide to Gimhae International Airport

Seollal - Lunar New Year's Day in South Korea

TESSAN Germany France Travel Power Adapter

Lonely Planet Korea 12

Korean Snack Box Variety Pack

OSULLOC Lovely Tea Gift Box Set

More from our network.

- Medical Tourism

FREE NEWSLETTER

Copyright © 2024 About Us| Terms of Use |Privacy Policy| Cookie Policy| Contact : [email protected]

Login to your account below

Fill the forms bellow to register

Retrieve your password

Please enter your username or email address to reset your password.

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

Tourists in South Korea can use app to pay for shopping, get tax refunds

Tourists in South Korea are now able to show their identification details, make payments and receive tax refunds through an app, as part of the Seoul government’s plan to attract more visitors to the country.

According to a report by Korea JoongAng Daily on Dec 10, the Seoul Metropolitan Government said the new functionalities on the Trip.Pass app allow tourists to explore the country without having to carry their passports and credit cards.

Visitors can pay for their purchases and rides on public transport after linking their debit card to the app.

Currently, visitors are allowed to make payment and receive tax refunds only at CU convenience stores and other designated shops.

By the first half of 2024, visitors will be able to make payment and receive tax refunds at GS25 convenience stores, Hyundai department stores and Shinsegae duty-free shops.

The app is expected to be beneficial for small merchants in Seoul, as shop owners will just have to scan QR codes to use the service without having to buy passport readers or payment terminals to accept overseas credit cards, said the report.

Android users are now able to access the updated app, while iPhone users will be able to use the new functions by late January 2024.

The service expansion is part of the government’s goal to attract 30 million international visitors by 2026.

In 2023, the Seoul Metropolitan Government launched taxi-hailing service Taba for foreign tourists, and implemented a real-time, interactive translation service at tourist information centres at Myeong-dong station in central Seoul.

By April 2024, the translation service will be introduced at five other subway stations in the city, including Seoul station and Itaewon station.

“The city government will ensure overseas visitors experience a safe and convenient Seoul by supporting start-ups with innovative ideas,” said Mr Kim Young-hwan, director-general of the city government’s Tourism and Sports Bureau.

“We will strive to attract 30 million tourists more quickly and create a convenient city for visitors travelling alone.”

Join ST's Telegram channel and get the latest breaking news delivered to you.

- South Korea

- Mobile apps

Read 3 articles and stand to win rewards

Spin the wheel now

- Entertainment

South Korea to double tax refund benefit for foreign tourists from January

SEOUL — South Korea will double the limit on tax refunds for foreign tourists from January 2024, its finance minister said on Nov 27.

The limit will be raised to the maximum one million won (S$1,000) worth of a local purchase and five million won in total, Finance Minister Choo Kyung-ho said.

Currently, on-the-spot tax refunds are provided for an individual purchase of up to 500,000 won at designated stores. The maximum cap for total payments is now set at 2.5 million won.

At airport departure halls, there are no restrictions on purchases eligible for tax refunds, the Yonhap news agency reported.

The change is aimed at boosting the tourism industry, the report added.

"Starting Jan 1, 2024, the maximum per-payment amount for tax refunds will be raised to one million won and the total to five million won," Choo said during a ministerial meeting.

"The move aims to promote foreign tourists' shopping here and to bolster the tourism industry," he added.

ALSO READ: Best day trips from Seoul: Where to go beyond the capital of South Korea

- Foreign Affairs

- Multicultural Community

- Environment & Animals

- Law & Crime

- Health & Science

- Cryptocurrency

- Thoughts of the Times

- Today in History

- Tribune Service

- Blondie & Garfield

- Letter to the Editor

- Travel & Food

- People & Events

- Around Town

- Fortune Telling

- Shows & Dramas

- Theater & Others

- Korean Storytellers

World Water Day 2024

Busan World Team Table Tennis Championships Finals

Super Bowl 2024

Welcoming Lunar New Year around world

Daily life in Afghanistan under Taliban rule

South Korea plans to offer bigger tax refunds to foreign tourists - finmin

- Medium Text

Sign up here.

Reporting by Jihoon Lee; Editing by Muralikumar Anantharaman

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Markets Chevron

Gulf bourses end mixed; Egypt extends decline

Stock markets in the Gulf put in a mixed performance on Sunday amid rising oil prices and receding hopes of rapid interest rate cuts by the U.S. Federal Reserve after a series of inflation readings.

Claiming a Tax Refund in Korea: A Must-Know for Savvy Travelers

This site uses affiliate links and we may earn a small commission when you use our links and make a purchase without incurring additional fee yourself. Many thanks for supporting this website. Please see our disclosure page for more details.

Do you know that foreigners travelling to Korea are eligible for tax-free shopping? Whether they are enjoying a shopping trip to Seoul or Busan , they are! But is claiming tax refunds in Korea really worth the hassle? Throughout our various trips to Korea we have learned that it definitely is. Even if you don’t make any expensive luxurious purchases, small purchases here and there can eventually accumulate into big money!

In this post, we will tell you all about the Korea tax refund for foreigners and walk you through the steps for getting a tax refund in Korea.

First time visiting South Korea? These travel resources will make your Korea trip a breeze: → eSIM: Knowroaming and Airalo both have affordable South Korea data plans. → VPN: Use ExpressVPN or NordVPN to protect your privacy and security while on the go. → Transportation: ★ How to get to Seoul from Incheon International Airport ★ How to take AREX from Seoul to Incheon International Airport → Flights: Visiting other Asian countries? Score flights deals on Expedia! → Hotels: Maximize your shopping time by staying in Hongdae and Myeongdong! Use Agoda to find the best hotel prices! → Need a durable suitcase? Try Rimowa , which builds exceptionally light luggages that last! → Shopping: Top 6 shopping districts in Seoul → Beaches: Top Busan Beaches You Need to Know About

How does tax refund work in Korea?

Foreign tourists can receive an exemption or refund of domestic sales tax (such as VAT) from purchased goods at tax free stores within 3 months of departure from Korea.

Korea’s Tax Free System can be divided into two categories: “Duty Free” and “Tax Refund.”

Duty free vs tax refunds in Korea

You might be quite familiar with the term “duty-free” before you visit Korea.

Duty-free means no tax is applied to the price of the item when you purchase from a duty-free shop. VAT, individual consumption tax, tobacco consumption tax and liquor tax are all exempted.

These duty-free stores are generally operated by large department store chains (e.g., Lotte, Shilla and Shinsegae) and are located within airports and downtown areas.

Buying duty-free items requires minimal effort on your part but the selection of items you can purchase is quite limited.

Tax refund , on the other hand, means you can get the Value Added Tax (VAT) and Individual Consumption Tax on certain items refunded at the airport before leaving Korea .

Getting a Korea tourist tax refund requires just a teeny bit more work than shopping duty-free, but don’t worry, we will tell you all about getting tax refunds in Korea in the sections below!

In fact, getting a tax refund has become increasingly easier for tourists. If you visited Seoul recently, you might have noticed that you can effortlessly receive an immediate tax refund up to a certain limit when shopping at certified tax free stores! More on this later.

How much is VAT in Korea?

Korean VAT (value added tax) is 10% on most goods and services. This is the tax merchants must collect from consumers and pay to the government.

Pro tip: Some small shops or street vendors might give you a 10% discount (deducting VAT) if you pay cash!

How much is tax refund in Korea?

The refund amount will be calculated based on the amount spent, VAT, and the service charge of the refund agency applicable to the purchase. Therefore, most of the VAT in Korea is 10%, but if the service charge of the refund agency is deducted from this, you will most likely receive a refund of about 4-7%.

Service charges may be calculated differently depending on the refund agency, the type of goods, or the amount spent on the goods.

Am I eligible for a tax refund in Korea?

You’re eligible to get a tax refund when your purchased goods are worth at least 30,000 won but under 5 million won in total . The items must have been bought within three months of your departure from Korea.

Non-Korean tourists must have stayed in Korea for less than 6 months to qualify.

Overseas Koreans must have stayed in Korea for less than 3 months and lived overseas for over 2 years.

Is it worth getting a tax refund in Korea?

Getting a tax refund in Korea couldn’t have been easier. Some stores even offer immediate tax refunds now so you don’t have to do extra work at the airport (details in the next section)!

If you plan to buy a lot and don’t mind carrying your passport with you as you shop, we encourage you to take the steps to get your tax refunds in Korea!

How do I get a tax refund in Korea?

Now, let us walk you through step by step for how to claim tax refund in Korea.

W hen shopping

STEP 1: Check whether the store is a VAT refund merchant. Tax-free stores have one of the following “Tax Free” logos:

STEP 2: When making payment at a tax-free store, request a tax refund. The cashier will ask you to present your passport for verification.

Once they verify that you are eligible for tax refunds, the receipt and a tax refund slip will be handed to you along with a tax-refund envelope .

Some stores issue immediate tax refunds, meaning they deduct the tax from the sale price on the spot so you pay the tax-free price. Alternatively, after paying the price with tax included, you can receive a tax refund at the tax refund service desk. This is usually the case in big department stores.

A note on immediate tax refund: Items must cost more than 30,000 won and less than 500,000 won, tax included, in one payment to be eligible for an immediate tax refund. The immediate tax refund is limited to a total purchase amount of less than 2,500,000 won during the entire trip in Korea. If you exceed that amount, you have no choice but to go to the airport to get your tax refund.

Tax refund preparations

STEP 3: Before heading to the airport, gather all the receipts and tax refund slips. Fill out the tax refund slips, which require you to print your full name, provide your passport number, nationality and address, and sign at the bottom. Remember, do not throw away any receipts.

Important note: tax refund items must be unopened and unused!

Tax refund process at the Incheon International Airport

Incheon International Airport is extremely busy! We recommend arriving at the airport at least 3 hours prior to your flight .

STEP 4: Check in at the airline counter, get your boarding pass, and inform the counter staff that you have tax refund items packed in your luggage (if you are checking bags).

The staff will tag your luggage and ask you to bring your luggage, along with the tax refund slips, to the Custom Declaration counter.

STEP 5: Take all your tax refund slips out of the envelope and hand them over to the custom officer. He or she will stamp every one of them and give them back to you.

Ensure you get the “All Goods Exported” customs confirmation stamp on all of them. The customs officer may sometimes ask to inspect the purchased items (we have never had them checked, but this is just between you and us) .

STEP 6: Proceed to the Oversized Baggage Check-In counter (right beside Custom Declaration) to check-in your luggage.

STEP 7: Head towards the tax refund counter or kiosk machine right next to Custom Declaration and scan your passport and tax refund slips. Usually there will be staff there to help you out. (we just handed the slips to them and they did all the work :P)

After the staff hands you back your receipts and tax refund slips, they will inform you at which gate you will have to complete your tax refund process.

STEP 8: Go through the immigration customs and proceed to the refund counter at the specific gate as directed by the staff.

Simply pass your receipts and tax refund slips to the staff and they will help you.

You also have the option to use the automated tax refund kiosks. By scanning your passport at the refund kiosk, the confirmed amount of tax refund will be issued to you in cash or credited back to your credit card (which can take 1-2 months to process)!

Now, you have all your money and are ready to go!

FAQ s on claiming tax refunds in Korea

Where are the locations for tax refunds at incheon international airport.

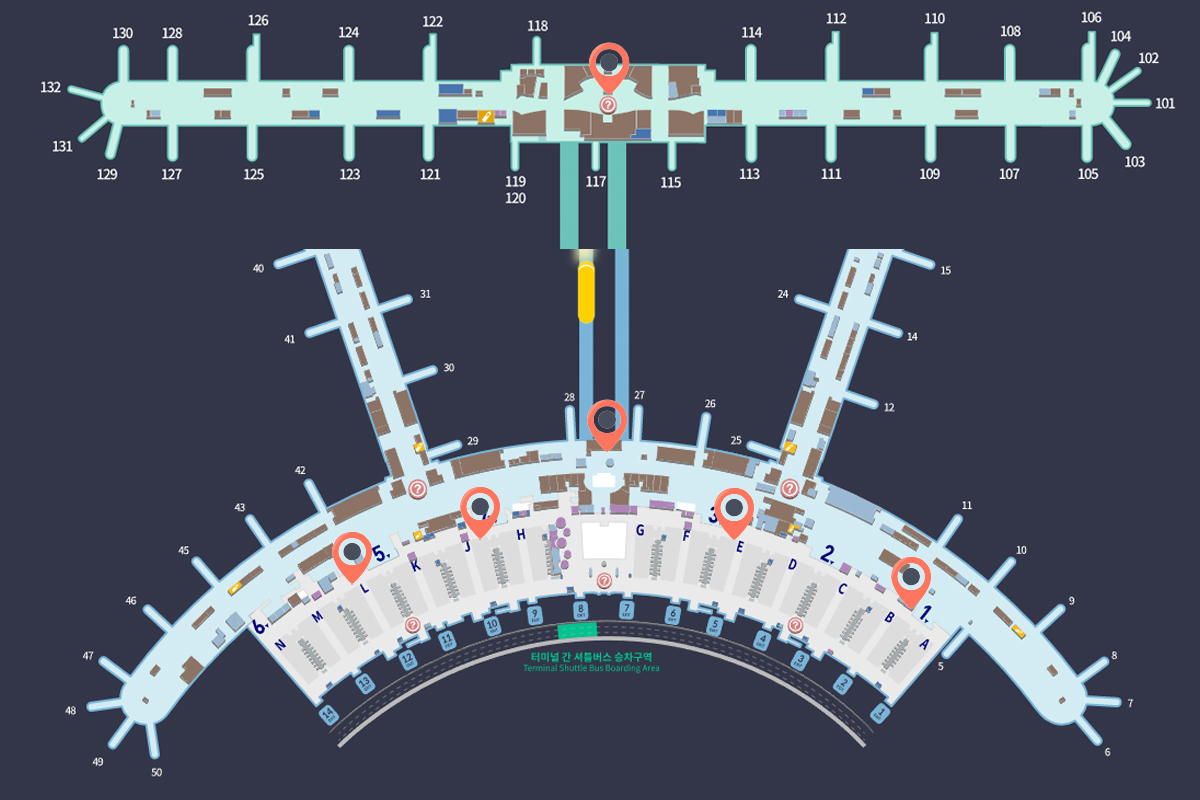

At Terminal 1:

Tax refund counters are located on the 3rd floor, near check-in counters B and E in the east general area, and near J and L in the west general area.

Tax refund kiosks are located after security, next to Gate 28 in the duty-free zone.

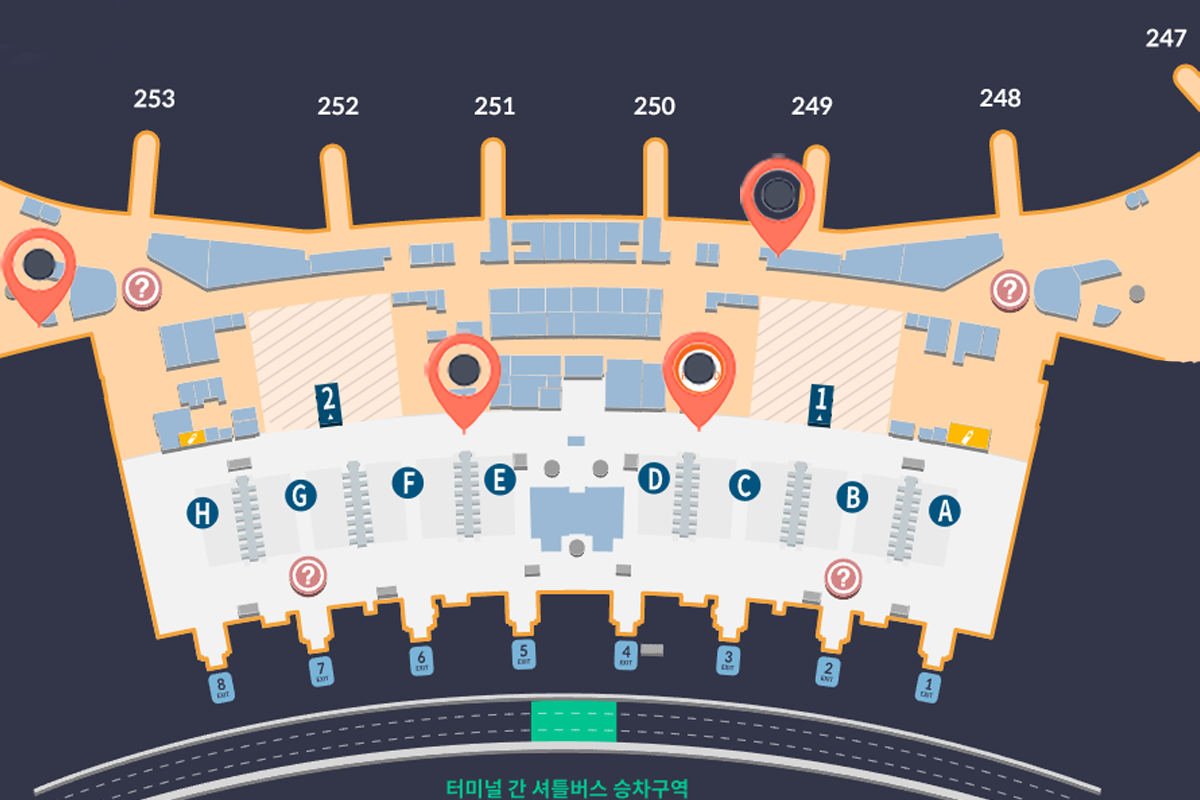

At Terminal 2:

Tax refund counters are located on the 3rd floor, next to check-in counters D and E, and near Gate 253 in the duty-free zone.

After security, you can collect refunds at automated tax refund kiosks near Gate 249.

★ Please check Incheon International Airport’s official website for details.

Can I claim a tax refund at international airports other than Incheon?

Yes, you can claim a tax refund in Korea at airports other than Incheon International Airport.

Gimpo, Gimhae, and Jeju International Airports all have tax refund counters.

Can I claim Korean tourist tax refunds outside airports?

There are tax refund booths in popular shopping areas like Myeongdong in Seoul . However, these booths can only provide refunds offered by their respective company.

For example, a Global Blue tax refund booth will only provide Global Blue refunds and you’ll need a tax refund form from Global Blue to claim it. Likewise, Global Tax Free refund counters only process refunds for purchased goods from Global Tax Free affiliate stores.

Only the booths inside the airports and ports can provide total refunds, regardless of company.

How can I get my tax refund?

You can receive your payment in cash – either in Korean won or in your own country’s currency. However, in non-Korean currency, the refund amount might be smaller due to conversion rate.

Aside from cash, you can also get refunded via credit cards or Alipay.

Need inspiration for your next couple's escape? Then, you're at the right place. Sign up to receive the latest travel inspiration and a FREE travel bucket list with 140 ideas for your next couple's getaway!

Awesome! We're almost done. Now check your inbox to get your copy of the Ultimate Travel Bucket List for Couples.

There was an error submitting your subscription. Please try again.

You May Also Like:

12 Best Countries to Visit in Asia: The Ultimate Honeymoon Hit List

24 Best Busan Cafes: Discovering the City’s Most Beloved Coffee Spots

Haeundae Blueline Park: How to Ride Busan’s Sky Capsule and Beach Train

11 comments leave a comment ».

Hi is there any rebate given to korean exporters on their exports to abroad ?

Thanks regards. S.M. Aamir [email protected]

Hi, S.M. Aamir, I am not quite sure on the regulations for exporters… you might need to check that with the Korean customs. Sorry I couldn’t help with your question.

Hello, Thanks a million for your great information. I am studying at KAIST ( Korean University ) and I bought a car and hoe appliances. I usually travel outside Korea every 5 or 6 months. sometime every two months where I go to Hong Kong.

Do you think I can get tax refund back for my car or home appliances ?

Hey, do you only get the refund money in KRW or can you choose dollars as welll?

I believe it is KRW only.

Can you kindly reply to my comment above if you didn’t see it? Thanks

Hi Enad, I am not the best person to answer this question as I have not bought car and home appliances myself in Korea. But it seems like you are Korean citizen and to my knowledge, tax refunds only are applicable to foreigners. Hope this help!

Hi Cat, is it a must to have the tax refund slips?

I’m confused by step 7: “Go through the immigration customs…”. Is this a tutorial about leaving Korea through Incheon to go abroad or coming back from abroad? Because if you leave Korea, there will only be a security check, but no mandatory immigration or customs queue. Secondly I wonder what you would do if you have items below a certain value which, according to one lady that assisted me at the airport, is not mandatory to get stamped?

the desk in the first step isnt needed anymore (nov. 17) helpers are directly sitting at those machines and give you guidancr to the refund counter after the sevurity check – very smoothly

Pingback: TripCheers Travel Guide : South Korea – Site Title

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Hi, we are Cat + Kev , an adventure-loving couple committed to help young couples find daring adventures, food encounters, and luxury escapes unique to a destination. Let us show you how to eat like a local, travel like a pro!

more about us » 認識我們

Looking For Something?

SIGN UP to get 100+ bucket list ideas for your next couple's getaway:

Do You Need To Rent A Car?

For Two, Please is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.

- Back to Top

- Work With Us

- Write For Us

- Privacy Policy

©2024 For Two, Please . All Rights Reserved. Design by Purr .

South Korea Plans to Offer Bigger Tax Refunds to Foreign Tourists - Finance Minister

FILE PHOTO: South Korean Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho takes part in a panel on the third day of the annual meeting of the International Monetary Fund and the World Bank, following last month's deadly earthquake, in Marrakech, Morocco, October 11, 2023. REUTERS/Susana Vera/File photo

SEOUL (Reuters) - South Korea is considering raising the maximum amount of tax refunds for foreign tourists on their domestic shopping, its finance minister said on Monday, to boost consumer spending amid growing tourist inflows.

The government plans to raise the tax refund limit from next year by a "huge amount", Finance Minister Choo Kyung-ho said, adding that the exact figure would be determined after more discussion with related agencies.

Currently, the maximum 500,000 won ($370) worth of a local purchase and 2.5 million won in total is applicable for tax refunds when foreign tourists leave the country.

The plan is aimed at benefiting South Korea's small businesses amid an improvement in foreign tourist inflows, Choo was quoted as saying in a media pool report.

($1 = 1,352.2100 won)

(Reporting by Jihoon Lee; Editing by Muralikumar Anantharaman)

Copyright 2023 Thomson Reuters .

Tags: South Korea

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

10 best growth stocks to buy for 2024.

Wayne Duggan April 26, 2024

7 High-Risk, High-Reward Stocks to Buy

Jeff Reeves April 26, 2024

5 Best Gold ETFs for 2024

Coryanne Hicks April 26, 2024

Green Hydrogen Stocks and ETFs

Matt Whittaker April 26, 2024

Best Tax-Free Muni Bond Funds

Tony Dong April 25, 2024

Bitcoin Runes 101: Bitcoin Meme Coins

Wayne Duggan April 25, 2024

7 Best High-Dividend ETFs to Buy Now

Glenn Fydenkevez April 25, 2024

What to Know About Sweep Accounts

Brian O'Connell April 24, 2024

Best Charles Schwab Mutual Funds

Tony Dong April 24, 2024

6 Best Airline Stocks to Buy

Coryanne Hicks April 24, 2024

7 Best Long-Term ETFs to Buy and Hold

Jeff Reeves April 24, 2024

7 Best Electric Vehicle ETFs to Buy

Tony Dong April 23, 2024

Best Beginner Investing Books

Julie Pinkerton April 23, 2024

Are There Any Tax-Free Investments?

Marguerita Cheng April 23, 2024

8 Best Defense Stocks to Buy Now

Wayne Duggan April 22, 2024

7 Best Energy ETFs to Buy Now

Tony Dong April 22, 2024

Small-Cap ETFs to Buy for Growth

Glenn Fydenkevez April 22, 2024

7 Best IPOs in 2024

Brian O'Connell April 22, 2024

Oil Stocks Tied to Crude Prices

Wayne Duggan April 19, 2024

7 Best Dividend ETFs to Buy Now

Jeff Reeves April 19, 2024

KoComfort comfortable life

A guide to getting your tax refund in korea: navigating the process with ease.

Navigating the tax system in a foreign country can be a daunting task, but understanding how to get a tax refund in Korea doesn't have to be a complicated affair. Whether you're an expatriate working in South Korea or a tourist who made eligible purchases during your stay, this guide will walk you through the process of obtaining a tax refund.

Understanding VAT (Value Added Tax) in Korea:

In South Korea, the Value Added Tax, or VAT, is levied on goods and services at a standard rate of 10%. Certain purchases made by foreign visitors are eligible for a tax refund, making it an attractive prospect for those looking to save a little extra money during their stay.

Eligibility Criteria:

Before diving into the process, it's crucial to ensure that you meet the eligibility criteria for a tax refund. Generally, the following conditions must be met:

You must be a non-resident foreigner or a foreign tourist and staying less than 6 months.

The purchased goods must be eligible for a tax refund.

The total purchase amount on a single receipt must be over KRW 30,000 (approximately USD 27).

Where to Shop:

To claim a tax refund, make sure to shop at stores that participate in the VAT refund program. These stores typically display a "Tax Free Shopping" or "Global Blue" sign, indicating that they are part of the tax refund scheme. Common places to find such stores include popular shopping districts, department stores, and duty-free shops.

The Process:

Ask for a Tax Refund Receipt: When making a purchase, inform the cashier that you would like a tax refund. They will provide you with a tax refund receipt along with your regular purchase receipt.

Fill Out the Necessary Forms: Complete the required forms, including your personal information and passport details. Make sure to fill out the forms accurately to avoid any issues during the refund process.

Customs Inspection: Before leaving Korea, you'll need to go through customs inspection. Present your purchased items, receipts, and passport to the customs officer for verification. They will stamp your refund documents if everything is in order.

Claim Your Refund: Once you've cleared customs, head to the designated tax refund counter at the airport or port. Provide the stamped documents, and the staff will process your refund. You can choose to receive your refund in cash or have it credited back to your credit card.

Tips for a Smooth Process:

Keep All Receipts: It's crucial to keep all original receipts for your purchases. These will be required during customs inspection and the refund process.

Start Early: Allow ample time for the customs and refund process, especially during peak travel seasons. Arriving at the airport early ensures a stress-free experience.

Understand the Exclusions: Not all purchases qualify for a tax refund. Services, certain foods, and items shipped directly to your home country may be excluded.

You can also redeem your tax refund at the Incheon airport from a kiosk as long as you provide the receipt and the passport. Tax receipt counter and kiosk are located at Incheon International Airport.

Tax refund counters

Terminal 1: 3F Duty Free Zone near Gate 28

Terminal 2: 3F Check-in counters D & E / 3F Duty Free Zone near Gate 253

Tax refund kiosk machines

Terminal 1: 3F Concourse near the central pharmacy / 3F Duty Free Zone near Gate 28

Terminal 2: 3F Duty Free Zone near Gates 250 & 253

Getting a tax refund in Korea is a straightforward process when armed with the right information. By shopping at participating stores, understanding the eligibility criteria, and following the outlined steps, you can make the most of your visit to South Korea and enjoy some extra savings. Remember, a little preparation goes a long way in ensuring a smooth and successful tax refund experience.

- Useful info

Recent Posts

We Offer Full Service Storage Room: The Perfect Solution for Your Storage Needs

How to Hire a Reliable Korean Driver for Your Day Trip or Business Trip in Korea: A Comprehensive Guide

Your Ultimate Guide to Finding Housing in Korea: Tips and Tricks

How to Get a Tax Refund in Korea

(updated 2024) check out the updated methods for receiving a tax refund in korea from the airport & in the city.

Last Updated: Jan 2024

If you are planning to shop in Korea (as you should!) you definitely want to take advantage of tax refund shopping! However, if it's your first time shopping in Korea, you may be a bit confused about what duty free and tax free shopping is, and how you should file a tax return. Don't worry, we have prepared an in-depth guide on how to shop tax-free and the best way to get a tax refund in Korea!

Need to exchange money for your upcoming trip? Use our Currency Exchange Service for easy exchange with the best rates right at the airport!

Easy Money Exchange at Incheon Airport (low exchange rates!) | Creatrip Currency Exchange Service

Korea's Tax Free System

There are three main ways to obtain a tax refund in South Korea; duty free, as a post-purchase refund, or as an on-site refund. A more in-depth explanation is provided in the list below.

1. Duty-Free (In-advance tax exemption): This is when you make a tax-free purchase at a designated duty free shop.

VAT, individual consumption tax, tobacco consumption tax and liquor tax are all exempted. The advance duty free shop is characterized by being able to purchase goods coming abroad at low prices. These stores are usually large department stores such as Shinsegae Department Store, Shilla Department Store, and Lotte Department Store.

They are usually located at the airport and downtown areas. Tourists can purchase goods at a low price with proof of a flight that leaves the country! For more info on department stores, click here .

- Duty-Free Purchase Limit: $800 USD *Liquor and perfumes can be purchased in addition and have a separate tax exemption range.

2. Immediate Tax Refund: This is when you make a purchase at a store that offers immediate tax deductions.

Tourists can easily and immediately get a tax-free refund within a certain limit when they shop at a certified tax free store.

3. Post-Purchase Tax Refund: This is when you pay full price at the time of purchase and later apply for a tax refund.

This is the most common tax refund system in South Korea, in which shoppers purchase products at the full price including tax and receive a refund of the tax paid before leaving the country. When making a purchase at a store and meeting the minimum purchase requirement, you will receive a tax refund receipt after presenting your passport.

Only VAT and individual consumption tax are exempted. (This does not include customs duties, tobacco consumption tax, and liquor tax.) In general, you can receive a tax refund by showing the receipt (refund slip) at the tax refund booth upon departure.

- Minimum Purchase Amount for Tax Refund: 15,000 KRW per item

Need to book beauty services at a Korean skincare clinic or hair salon? Check out the spots below to easily book appointments with special discounts!

Xenia Clinic | Foreigner-Friendly Skincare Treatment Clinic in Gangnam

JUNO Hair Myeongdong Street Branch

1. Duty Free

The tax imposed by the duty free shop is a duty on imports and does not apply to travelers. Therefore, you do not have to worry about products sold at major duty-free downtown department stores or airport duty free shops as the price does not include tax.

Q: What is the purchase limit at duty-free stores?

A: Foreign travelers can purchase up to $800 USD at the duty free shop. In addition to the applicable duty-free limit, alcohol and perfume can be purchased within a separate duty-free range.

Q: What is the purchase limit on alcohol, perfumes, and cigarettes?

A: If you have already met the $800 USD duty-free limit, you can still buy alcohol, perfume, and cigarettes. The limits for each are as follows:

- Alcohol: One bottle that is not over 1L and $400 USD

- Perfume: 60ml

- Cigarettes: 200 cigarettes

Q: What if I exceed the duty-free purchase limit?

A: If the total of goods purchased overseas or at duty-free shops (departure, arrival, duty free shops) exceeds $800 USD, the amount in excess of the duty-free limit of $800 USD will be taxed.

Q: Do I need to declare items that exceed the duty-free limit?

Yes. If you bring in items that exceed the duty-free limit, 30% of the standard duty will be reduced if you voluntarily declare it. However, if you are caught not declaring it, you will be penalized according to the Customs Act. (ex. 50% more than general tax, additional 60% penalty if caught twice or more within 2 years)

2. Immediate Tax Refund

There are stores in Korea that provide immediate tax refunds! If you see any of these logos at a shop, that means you can get an immediate tax refund.

Q: What is the purchase limit at tax-free stores?

A: You must purchase a minimum of 15,000 KRW in a single payment to be eligible for a tax refund. The maximum amount is 1,000,000 KRW. You are also only eligible if you've spent under 5,000,000 KRW during your entire trip.

Q: How can I get an immediate tax refund?

A: Before shopping, check whether the store is an official VAT refund merchant! (These include marts, shopping malls, department stores, etc.) After purchasing items within the limit, you can pay the duty-free price by presenting your passport to the cashier. Alternatively, after paying the price inclusive of tax, you can receive a tax refund at the information desk.

Q: What if I exceed the limited amount?

A: If you have paid more than 1,000,000 KRW or purchased more than 5,000,000 KRW after entering Korea, you must go to the airport to get your tax refund.

Q: Who is eligible for immediate tax refunds?

A: 1) Foreigners that spend less than 6 months in Korea. 2) Overseas Koreans that have been living abroad for more than 2 years or living in Korea for less than three months. 3) Those who do not pay Korean taxes.

Planning on visiting cities outside of Seoul, such as Busan or Jeonju? Get a package deal for KTX and AREX train tickets here!

KTX Package (15% discount) / Seoul ⇄ Busan/ Gangneung/ Jeonju/ Gyeongju/ Dongdaegu

3. How to Receive Tax Refunds at the Airport

1) Make sure you have all the requirements needed for a tax refund.

- If you've purchased items at a Tax-Free store, present your passport to the store staff, and request a tax refund form or tax refund slip.

- Be sure to keep the tax refund form, receipt, purchased items (unopened & unused) until departure from South Korea.

- Travelers who want to apply for a VAT refund at the departure airport are advised to arrive well in time in case the airport is crowded.

2) Head to the check-in area and check your luggage.

- If you wish to check in items as checked baggage, please inform the airline staff that there are items that are eligible for VAT refund in your checked baggage at check-in. You can attach a tag to your luggage for customs verification, then visit the customs declaration desk. There is a place to drop off your luggage at the customs check point.

3) If the total tax refund amount is under 75,000 KRW, you can use the self-service tax refund kiosk at the airport terminal.

- Select a language at the kiosk, scan your passport, and receive your refund slip.

- Check if the item needs to be checked by customs. If a customs check is not required, you can collect your refund in cash after going through security.

- The kiosks in general areas only scan receipts. Cash refunds can only be collected directly from duty-free kiosk machines or refund counters after going through security.

- In most cases, refunds are processed via the kiosk, but there are rare cases when you may be subject to customs inspection under certain conditions or random selection. If you are selected for inspection, present your passport, relevant items, receipt, and tax refund form at the customs declaration counter, and then receive a customs export confirmation stamp.

4) If the total tax refund amount is over 75,000 KRW, you'll need to head to the airport customs inspection area to get your refund.

- Items with a refund amount of 75,000 KRW or more and items that are carried by travelers with a Korean passport who have lived abroad for 2 years or more are subject to mandatory customs checks.

- Alternatively, you can receive a refund after customs inspection even if the receipt was previously scanned by a kiosk and found to be subject to customs inspection.

- Bring your passport, purchased items (unopened & unused), receipts, and VAT refund documents to the customs counter. After they are checked, you will get a stamp of export confirmation on the VAT refund documents.

- You can visit the VAT refund counter, submit the VAT refund document stamped with the customs confirmation stamp, and collect cash immediately on the spot. If you arrive outside the operating hours of the tax refund counter, please submit the relevant documents to the refund mailbox after receiving the customs confirmation stamp. After a period of time, the refund will be credited to your money order.

You'll need a SIM card and a transportation card to get around Korea easily; get the airport package to pick up both at once as soon as you land at the airport!

Airport Package | Pick-up your SIM card and transit card all at once at the airport!

4. Incheon Airport Tax Refund Locations

*Please keep in mind that the Incheon Airport Tax Refund locations are subject to change. Please check the official Incheon Airport site before you visit for confirmation.

Incheon Airport Terminal 1, 3F

L ocation: Near Gate 28 in the duty-free area, near B and E in the east general area, near J and L in the west general area, in the center of the 3rd floor concourse. A kiosk is located in the general area near the check-in area, and you can check whether the kiosk is subject to customs declaration by scanning the refund slip and passport.

If the item is over 75,000 KRW or is marked as subject to customs check in kiosk, go to the customs declaration counter opposite or right next to it. If you have luggage that needs to be declared for customs, you can check in the luggage here after checking customs.

Incheon Airport Terminal 2, 3F

Location: Near check-in D and E, near gates 250, 249, 253, in the duty free area. Kiosk is located in the general are near the check in area. check if the kiosk is subject to customs declaration. If the item is over 75,000 KRW or is marked as subject to customs check in, go to the customs declaration area opposite. You can check in your luggage there.

After your security check, you can collect cash in the lounge opposite Gate 249.

5. How to Get Tax Refunds in the City

City tax refunds mainly exist in major tourist areas and require a credit card for guarantee. If you paid in cash, you can get a cash refund on the spot, but the tax refund amount will be temporarily paid by the credit card. Don't worry, it is a tax refund guarantee, so it automatically, will get refunded once verified.

- After purchasing items at a tax-free store, you will receive a tax refund slip (it is the same thing as a refund document).

- Bring your passport, refund slip, and credit card to collect refunds at a manned tax refund office or unmanned tax refund kiosks in the city.

- Global Tax Free only refunds slips with a purchase amount between 15,000 KRW and 6,000,000 KRW can be refunded.

- The refund amount limit for Global Blue is 390,000 KRW in certain parts of the city.

- Proof of a tax refund must be presented at the airport. (When leaving the country, present the purchased items, tax refund documents, and passport to customs for confirmation.)

- A credit card is required as a guarantee for your tax refund.

- You must leave Korea within 3 weeks of receiving your tax refund. It is important to note that only items purchased from affiliated stores of each company can be refund at other tax refund windows other than airports or ports. (ex. After purchasing goods at a global tax free affiliate store, a refund is possible at the global tax free city refund counter)

- Again, the amount paid will be refunded only after verification is complete. Do not throw away the proof of tax refund because you will need to present it at the airport.

1) Where are the tax refund locations at other airports?

Gimpo Airport: Gates 1, 2, & 3, on the 2nd floor in front of Lotte Duty Free shop on the 2nd floor.

Gimhae Airport: Counter B26 on the 2nd floor

Jeju Airport: Gate 5 on the 3rd floor

2) Where are the refund locations in the city?

There are many tax-refund areas all over the city and even in the subway stations. If you shop at a tax-free department store, the best way to check is to see if there is a refund desk inside the department store.

3) How much in tax refunds can I get?

The refund amount will be calculated based on the amount spent, VAT, and the service charge of the refund agency applicable to the purchase. Therefore, most of the VAT in Korea is 10%, but if the service charge of the refund agency is deducted from this, you will be able to get a refund of about 4-7%.

Service charges may be calculated differently depending on the refund agency, goods, or the amount of foods, so it is recommended to check the exact refund amount at the refund window. Here are some examples listed below:

Global Tax Free

Global Blue

Easy Tax Refund

4) How can I get a refund?

If you receive payment in cash, you will be able to get a refund in your own country's currency as it is not only paid in just Korean currency. However in the case of non-Korean currency, the refund amount may be smaller in the process of being converted to another national currency.

Refund agencies process refunds not only in cash, but also in other various payment methods.

Global Blue: Alipay, Paypal, Mastercard, Unionpay, VISA, American Express, Bank Transfer, JCB

Global Tax Free: Cash, Cards issues outside Korea (VISA, Mastercard, JCB, Unionpay) Alipay, WeChat, QQ, etc.

Trendy Activities to Enjoy in Korea

We hope that this information was helpful for your tax refunds in Korea! Please leave a comment below or send us an email at [email protected] if you have any questions or concerns. Also make sure to follow us on Instagram , TikTok , Twitter , and Facebook to stay updated on all things Korea!

Travel DEPRECATED_ArrowIcon

Trends DEPRECATED_ArrowIcon

Language school deprecated_arrowicon.

South Korea plans to offer bigger tax refunds to foreign tourists

South Korea is considering raising the maximum amount of tax refunds for foreign tourists on their domestic shopping, its finance minister said on Monday, to boost consumer spending amid growing tourist inflows.

The government plans to raise the tax refund limit from next year by a “huge amount”, Finance Minister Choo Kyung-ho said, adding that the exact figure would be determined after more discussion with related agencies.

Currently, the maximum US$370 worth of a local purchase and $1845 in total is applicable for tax refunds when foreign tourists leave the country.

The plan is aimed at benefiting South Korea’s small businesses amid an improvement in foreign tourist inflows, Choo was quoted as saying in a media pool report.

- Reporting by Jihoon Lee; Editing by Muralikumar Anantharaman, of Reuters.

Recommended By IR

Retail appointments of the week

“Different journeys”: An inside look at Replay Jeans and Superdry

Be open to reinvention: Lessons from former global Nike VP, Mindy Grossman

What makes Uniqlo’s prototype store ‘inspiring, exciting and memorable’

South Korea emerges as key battleground for global luxury brands

This is for ir pro members only..

Log in below or subcribe.

By continuing, you agree to Octomedia Terms And Conditions and Privacy Policy .

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Biden-Harris Administration Announces Final Rule Requiring Automatic Refunds of Airline Tickets and Ancillary Service Fees

Rule makes it easy to get money back for cancelled or significantly changed flights, significantly delayed checked bags, and additional services not provided

WASHINGTON – The Biden-Harris Administration today announced that the U.S. Department of Transportation (DOT) has issued a final rule that requires airlines to promptly provide passengers with automatic cash refunds when owed. The new rule makes it easy for passengers to obtain refunds when airlines cancel or significantly change their flights, significantly delay their checked bags, or fail to provide the extra services they purchased.

“Passengers deserve to get their money back when an airline owes them - without headaches or haggling,” said U.S. Transportation Secretary Pete Buttigieg . “Our new rule sets a new standard to require airlines to promptly provide cash refunds to their passengers.”

The final rule creates certainty for consumers by defining the specific circumstances in which airlines must provide refunds. Prior to this rule, airlines were permitted to set their own standards for what kind of flight changes warranted a refund. As a result, refund policies differed from airline to airline, which made it difficult for passengers to know or assert their refund rights. DOT also received complaints of some airlines revising and applying less consumer-friendly refund policies during spikes in flight cancellations and changes.

Under the rule, passengers are entitled to a refund for:

- Canceled or significantly changed flights: Passengers will be entitled to a refund if their flight is canceled or significantly changed, and they do not accept alternative transportation or travel credits offered. For the first time, the rule defines “significant change.” Significant changes to a flight include departure or arrival times that are more than 3 hours domestically and 6 hours internationally; departures or arrivals from a different airport; increases in the number of connections; instances where passengers are downgraded to a lower class of service; or connections at different airports or flights on different planes that are less accessible or accommodating to a person with a disability.

- Significantly delayed baggage return: Passengers who file a mishandled baggage report will be entitled to a refund of their checked bag fee if it is not delivered within 12 hours of their domestic flight arriving at the gate, or 15-30 hours of their international flight arriving at the gate, depending on the length of the flight.

- Extra services not provided: Passengers will be entitled to a refund for the fee they paid for an extra service — such as Wi-Fi, seat selection, or inflight entertainment — if an airline fails to provide this service.

DOT’s final rule also makes it simple and straightforward for passengers to receive the money they are owed. Without this rule, consumers have to navigate a patchwork of cumbersome processes to request and receive a refund — searching through airline websites to figure out how make the request, filling out extra “digital paperwork,” or at times waiting for hours on the phone. In addition, passengers would receive a travel credit or voucher by default from some airlines instead of getting their money back, so they could not use their refund to rebook on another airline when their flight was changed or cancelled without navigating a cumbersome request process.

The final rule improves the passenger experience by requiring refunds to be:

- Automatic: Airlines must automatically issue refunds without passengers having to explicitly request them or jump through hoops.

- Prompt: Airlines and ticket agents must issue refunds within seven business days of refunds becoming due for credit card purchases and 20 calendar days for other payment methods.

- Cash or original form of payment: Airlines and ticket agents must provide refunds in cash or whatever original payment method the individual used to make the purchase, such as credit card or airline miles. Airlines may not substitute vouchers, travel credits, or other forms of compensation unless the passenger affirmatively chooses to accept alternative compensation.

- Full amount: Airlines and ticket agents must provide full refunds of the ticket purchase price, minus the value of any portion of transportation already used. The refunds must include all government-imposed taxes and fees and airline-imposed fees, regardless of whether the taxes or fees are refundable to airlines.

The final rule also requires airlines to provide prompt notifications to consumers affected by a cancelled or significantly changed flight of their right to a refund of the ticket and extra service fees, as well as any related policies.

In addition, in instances where consumers are restricted by a government or advised by a medical professional not to travel to, from, or within the United States due to a serious communicable disease, the final rule requires that airlines must provide travel credits or vouchers. Consumers may be required to provide documentary evidence to support their request. Travel vouchers or credits provided by airlines must be transferrable and valid for at least five years from the date of issuance.

The Department received a significant number of complaints against airlines and ticket agents for refusing to provide a refund or for delaying processing of refunds during and after the COVID-19 pandemic. At the height of the pandemic in 2020, refund complaints peaked at 87 percent of all air travel service complaints received by DOT. Refund problems continue to make up a substantial share of the complaints that DOT receives.

DOT’s Historic Record of Consumer Protection Under the Biden-Harris Administration

Under the Biden-Harris Administration and Secretary Buttigieg, DOT has advanced the largest expansion of airline passenger rights, issued the biggest fines against airlines for failing consumers, and returned more money to passengers in refunds and reimbursements than ever before in the Department’s history.

- Thanks to pressure from Secretary Buttigieg and DOT’s flightrights.gov dashboard, all 10 major U.S. airlines guarantee free rebooking and meals, and nine guarantee hotel accommodations when an airline issue causes a significant delay or cancellation. These are new commitments the airlines added to their customer service plans that DOT can legally ensure they adhere to and are displayed on flightrights.gov .

- Since President Biden took office, DOT has helped return more than $3 billion in refunds and reimbursements owed to airline passengers – including over $600 million to passengers affected by the Southwest Airlines holiday meltdown in 2022.

- Under Secretary Buttigieg, DOT has issued over $164 million in penalties against airlines for consumer protection violations. Between 1996 and 2020, DOT collectively issued less than $71 million in penalties against airlines for consumer protection violations.

- DOT recently launched a new partnership with a bipartisan group of state attorneys general to fast-track the review of consumer complaints, hold airlines accountable, and protect the rights of the traveling public.

- In 2023, the flight cancellation rate in the U.S. was a record low at under 1.2% — the lowest rate of flight cancellations in over 10 years despite a record amount of air travel.

- DOT is undertaking its first ever industry-wide review of airline privacy practices and its first review of airline loyalty programs.

In addition to finalizing the rules to require automatic refunds and protect against surprise fees, DOT is also pursuing rulemakings that would:

- Propose to ban family seating junk fees and guarantee that parents can sit with their children for no extra charge when they fly. Before President Biden and Secretary Buttigieg pressed airlines last year, no airline committed to guaranteeing fee-free family seating. Now, four airlines guarantee fee-free family seating, and the Department is working on its family seating junk fee ban proposal.

- Propose to make passenger compensation and amenities mandatory so that travelers are taken care of when airlines cause flight delays or cancellations.

- Expand the rights for passengers who use wheelchairs and ensure that they can travel safely and with dignity . The comment period on this proposed rule closes on May 13, 2024.

The final rule on refunds can be found at https://www.transportation.gov/airconsumer/latest-news and at regulations.gov , docket number DOT-OST-2022-0089. There are different implementation periods in this final rule ranging from six months for airlines to provide automatic refunds when owed to 12 months for airlines to provide transferable travel vouchers or credits when consumers are unable to travel for reasons related to a serious communicable disease.

Information about airline passenger rights, as well as DOT’s rules, guidance and orders, can be found at https://www.transportation.gov/airconsumer .

IMAGES

VIDEO

COMMENTS

Korean tax refunds are part of a government program that allows foreign tourists to get a refund on VAT (value added tax) when purchasing goods or services worth over 30,000 KRW (22 USD) but under 5 million KRW (4,700 USD).. You can get a tax refund at Incheon Airport, downtown, or immediately at participating stores. Medical services including cosmetic surgery or skin treatments, and some ...

This is a system where foreign tourists can receive a refund of domestic tax (such as VAT) from purchased goods at tax free stores within 3 months of departure from Korea. After receiving export confirmation from customs, tax refund can be immediately received at the Tax Refund Counter. (Domestic tax refund is eligible for purchases over 30,000 ...

Duty Free & Tax Refunds. Korea's Tax Free System can largely be divided into "Duty Free" and "Tax Refund." In duty free shops, no tax is applied to the price of the item, including Value Added Tax (VAT) and Individual Consumption Tax. ... 1330 Korea Travel Hotline: +82-2-1330 (Korean, English, Japanese, Chinese, Russian, Vietnamese ...

Hotel Tax Refund Policy for Foreigners. Hotel tax refund is applicable to international tourists who stay in certified hotels within Korea for less than 30 days. In order to receive the tax refund, eligible recipients should be scheduled to leave Korea within 3 months from their check-out date.

To bеnеfit from thе Korеan tax rеfund systеm, tourists must mееt thе following еligibility critеria:. Non-Rеsidеnt Status: You must bе a forеign tourist visiting South Korеa. South Korеan rеsidеnts or long-tеrm visitors do not qualify for thе tax rеfund. Minimum Purchasе Amount: Your purchasе must mееt a minimum amount, typically 30,000 Won, at a singlе storе on ...

A Tax Refund in Seoul is a system where foreign tourists can get a refund on the domestic tax (such as VAT) from goods purchased at tax-free stores within three months of leaving Korea. This is a fantastic way to save money and enjoy a cost-effective travel experience in Seoul.

Korea's Tax Free System. Tax Refund. Immediate Tax Refund. How to Get Tax Refund at the Airport in South Korea? 1) Tax refund preparations. 2) Registration and bag storage. 3) Use the self-refund machine to skip the queue at the airport terminal (if your refund amount is within 75,000 KRW) 4) Tax Refund after airport customs inspection in ...

Payment must have been made directly to the hotel. There is a limit on how long you can stay. Hotel Tax Refund Process. 1. Check the tax refund eligibility and get a tax refund checklist. 2. Receive a tax refund form after submitting the checklist. 3. Collect your tax refund amount at the airport or a city kiosk.

Effective April 1, 2020, items must cost more than 30,000 won and less than 500,000 won, tax included, in one payment to be eligible for an immediate tax refund. The immediate tax refund is limited to a total purchase amount of less than 2,000,000 won during the entire travel in Korea. * Eligible shoppers Must spend over 30,000 won and leave ...

Dec 11, 2023, 11:05 AM. Tourists in South Korea are now able to show their identification details, make payments and receive tax refunds through an app, as part of the Seoul government's plan to ...

SEOUL — South Korea will double the limit on tax refunds for foreign tourists from January 2024, its finance minister said on Nov 27. The limit will be raised to the maximum one million won (S ...

By Kang Aa-young, Jung Min-ho. Overseas tourists will be able to receive a 10 percent tax refund on accommodation fees in Korea this year. The Ministry of the Culture, Sports and Tourism said its ...

Korean tax refunds allow foreign tourists visiting Korea for less than 3 months to get a refund on VAT (value added tax) when purchasing goods or services worth over 30,000 KRW (22 USD) but under 5 million KRW (3,700 USD).

South Korea is considering raising the maximum amount of tax refunds for foreign tourists on their domestic shopping, its finance minister said on Monday, to boost consumer spending amid growing ...

Tax refund, on the other hand, means you can get the Value Added Tax (VAT) and Individual Consumption Tax on certain items refunded at the airport before leaving Korea.. Getting a Korea tourist tax refund requires just a teeny bit more work than shopping duty-free, but don't worry, we will tell you all about getting tax refunds in Korea in the sections below!

Currently, the maximum 500,000 won ($370) worth of a local purchase and 2.5 million won in total is applicable for tax refunds when foreign tourists leave the country.

Terminal 2: 3F Check-in counters D & E / 3F Duty Free Zone near Gate 253. Tax refund kiosk machines. Terminal 1: 3F Concourse near the central pharmacy / 3F Duty Free Zone near Gate 28. Terminal 2: 3F Duty Free Zone near Gates 250 & 253. Getting a tax refund in Korea is a straightforward process when armed with the right information. By ...

Korea's Tax Free System. There are three main ways to obtain a tax refund in South Korea; duty free, as a post-purchase refund, or as an on-site refund. A more in-depth explanation is provided in the list below. 1. Duty-Free (In-advance tax exemption): This is when you make a tax-free purchase at a designated duty free shop.

South Korea's Trip.PASS app offers document-free travel. Initially available at CU convenience stores and selected shops, the app's functionalities will expand. By mid-2024, tourists can make payments and receive tax refunds at Shinsegae duty-free shops, GS25 convenience stores, and Hyundai department stores.

South Korea will double the maximum limit of purchases eligible for an immediate tax refund by foreign tourists to US$3,831 next year to attract overseas visitors and bolster the tourism industry, the finance ministry said Monday. Currently, the country provides on-the-spot tax refunds for an individual purchase of up to $386.82 at designated ...

Currently, the maximum US$370 worth of a local purchase and $1845 in total is applicable for tax refunds when foreign tourists leave the country. The plan is aimed at benefiting South Korea's small businesses amid an improvement in foreign tourist inflows, Choo was quoted as saying in a media pool report.

Operating hours from 7 am to 10 pm. In case you arrive outside of the operating hours of the Refund Counter, you can still get your refund by using the automated kiosks which operate 24 hours. Terminal 1. Public accessible area Floor 3, near Customs Desks and near the central pharmacy. Duty-Free Zone Floor 4, near Gate 26.

Korea Express Road, running April 2 - May 12, was created with the idea of boarding a special express train to explore the full range of Korean content along the road. The pop-up exhibition has different themes for each of HiKR Ground's five floors: 2023-2024 VISIT KOREA YEAR, Fashion, Art, Travel & Lifestyle, and K-food & K-pop.

Media Contact. Press Office. US Department of Transportation 1200 New Jersey Ave, SE Washington, DC 20590 United States. Email: [email protected] Phone: 1 (202) 366-4570 If you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services.