The Best Travel Insurance for Canada: IEC Working Holiday

The International Experience Canada (IEC) Working Holiday program offers young people the chance to live and work in Canada for up to two years. It is an amazing opportunity but there is a couple of rules to abide by when taking part in the IEC.

One of these is the program requirement to have comprehensive health insurance while in Canada.

This article will help you find the best travel insurance for Canada. I moved to Canada on the IEC program and I’ve helped thousands of people do the same since then.

Last updated November 2023 . This post includes some affiliate links – if you make a purchase via one of these, we may receive a small percentage of the sale.

The importance of travel insurance for Canada

As mentioned, it is a mandatory part of the IEC program to have health insurance for the length of your stay in Canada.

If you go to Canada without appropriate IEC travel insurance, you may receive a shortened work permit and/or be refused one altogether.

Those who do receive a shortened work permit are unable to extend or adjust the work permit later. This happens to more people than you would think!

As per the IEC rules , your health insurance for Canada must cover:

- medical care,

- hospitalization, and

- repatriation (returning you to your country in the event of severe illness, injury or death).

Be sure to buy the best travel insurance for Canada.

Taking part in the IEC program is a once-in-a-lifetime opportunity for most people – don’t waste this opportunity.

Thinking beyond the IEC requirement for insurance, you should also be aware that medical care in Canada can be very expensive.

Emergency room visits for relatively simple injuries can easily run up a bill of thousands of dollars.

Saving money on buying travel insurance for Canada can turn out to be an expensive mistake.

Options for IEC travel insurance

Read on for my research into the best IEC travel insurance for Canada.

Please research each company to ensure that the coverage is right for you. The specifics of the coverage can change at any time. Read the policy wording to make sure that you are covered.

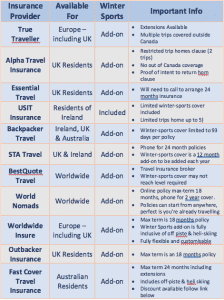

UK and EU citizens – True Traveller

I used True Traveller insurance for my working holiday in Canada.

Travel insurance policies with True Traveller are available up to 24 months in length. Policies can be started if you are already travelling.

Unlimited visits home are also allowed, with the insurance cover being suspended when in your home country. Winter sports coverage is available and there are no minimum residency requirements.

92 activities are covered as standard with True Traveller, including horse riding and bungee jumping. If you need coverage for more activities (such as rock climbing), an additional activity pack can be selected.

An alternative to True Traveller for UK citizens is Go Walkabout . Working Holiday cover is available for 2 years with 3 years available soon. Unlimited visits home are allowed with ski coverage available for an additional premium (Activity Pack 4).

Australian citizens – Fast Cover and HeyMondo

With Fast Cover , an initial IEC 12-month policy can be purchased and then extended for another 12 months on the departure date.

Optional winter sports coverage is available for an additional fee. Fast Cover policies cannot be started when already abroad.

HeyMondo offers single trip policies up to 12 months in length. Coverage for Covid-19 is included as standard as well as up to $10 million for emergency medical and dental expenses.

To have coverage for a full 24 month IEC working holiday, simply purchase 2 x one-year policies before leaving for Canada. For the second policy, you’ll need to tick the ‘already travelling’ box for it to be valid.

There is a 5% discount available for HeyMondo if you use the below link when purchasing. Note that HeyMondo does not offer winter sports coverage.

Alternatively, look at BestQuote (note lower medical coverage), Cover More (phone call required to buy a 2 year policy) or World Nomads.

New Zealand citizens – HeyMondo

HeyMondo includes coverage for Covid and up to $10 million of medical expenses. There is, however, no ski cover available.

For 23 months of coverage with HeyMondo, you’ll need to purchase a 12 month policy and then another 11 month policy. Make sure to tick the ‘already travelling’ box when purchasing the second policy.

Alternatively, look at BestQuote (note lower medical coverage) or World Nomads.

For citizens of 100+ countries – BestQuote

BestQuote are travel insurance specialists, partnered with some of the largest and most reputable insurance providers in Canada. Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims.

There are various medical coverage amounts available (most starting at $100,000), and adjustable excess levels as well. Please note that this medical coverage is lower than the other insurance providers mentioned on this page.

Buying the best IEC Travel Insurance

There is not one perfect working holiday travel insurance policy for Canada. Everyone has different requirements and circumstances.

The best working holiday travel insurance for Canada is the one that suits your own needs.

Before purchasing travel insurance for Canada, you may want to check factors such as:

- The type of activities that are covered. Climbing, kayaking and even hiking may have an additional premium

- Whether it is possible to return home for a short time and still have valid insurance coverage on return . Some policies become invalidated as soon as you reach home

- Residency requirements to purchase. Some IEC travel insurance policies require a minimum time spent resident in your home country before purchase

- Whether the policy can be started abroad if you are already travelling elsewhere. Most insurers are limited to only covering those who haven’t left home yet

- Winter sports coverage options. Even if you do not plan to work a ski season or live in a mountainous area, things can change

- The excess (deductible) on the policy. This is the amount you have to pay when making a claim

Finding Travel Insurance for Canada

Canada’s IEC program offers some of the longest working holiday options available in the world.

For this reason, one of the biggest problems with buying the best IEC travel insurance is finding a company that offers two-year travel insurance for Canada.

It can be such a rare occurrence that some working holiday companies advise their clients that there is no such thing. This is absolutely not true.

Another thing to remember is that the cheapest travel insurance for Canada may not be the best travel insurance for you. Be sure to look at the coverage limits and whether the policy is suitable for your travel plans.

Working Holiday Travel Insurance for Canada: The Small Print

Always read the policy wording to decide which IEC travel insurance provider and policy is right for you. As noted above, the best travel insurance for Canada isn’t necessarily perfect for everyone.

All details of IEC travel insurance providers mentioned above are correct at the time of writing but are subject to change.

The above companies also offer standard travel insurance for short-term holidays as well as working holiday insurance for Canada.

Found this post helpful? Subscribe to our IEC newsletter ! Working holiday advice and updates delivered straight to your inbox, with a FREE printable IEC packing list

Check out these other posts about working holidays in Canada

IEC Working Holiday Canada Extension Guide

IEC Working Holiday Canada: Arrival Checklist

Working Holiday Visa 2024 Canada IEC: Ultimate Application Guide

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Sunday 14th of May 2023

Hey Gemma, we are NZ residents coming to Canada on an IEC, coming through the US first. We have insurance confirmed for the first 12-months of our travel. Ideally we want to book the second year of our insurance, however, our current insurance company won't do that - they will only extend near the end of our current policy.. Do you know any options for us that would provide insurance for that second year (i.e., provide a policy so far in advance). Alternatively, do you know if it is doable/easy to get our visas extended/updated once we are able to confirm a further 12-months of travel insurance? Hope this makes sense!! Thank you :)

Sunday 21st of May 2023

Hi Annelise,

For your first question, I would look at World Nomads or BestQuote (the latter mentioned in this article). For your second question, you MUST have 23 months of insurance on entry into Canada to receive your full 23 month work permit. There is no way to extend your work permit if you did not have the appropriate insurance on arrival in Canada OR apply again. So make sure you have the full 23 months before you arrive in Canada!

Tuesday 5th of November 2019

Hi Gemma! Currently helping my British fiance figure out flights since he has been accepted for IEC. A little anxious that he will not receive his full 24 month permit if we buy return flights (since return flights only go aprox. 10 months ahead). Should we just splurge and buy the stupidley expensive one way ticket, or can we purchase a round trip ticket and just not use the return ticket? Do the border agents even ask for a return ticket or do they just expect that we won't have one since its an open 24 month work permit? Do you think he would just be able to tell the border agent, if asked, that he does have a return flight 3 days after his arrival flight but plans to cancel it because it's cheaper, then proceed to show the agent proof of funds for a return flight?

Monday 11th of November 2019

The good news is that you don't need a return ticket at all, just proof to be able to purchase one if needed. And for that, a credit card can be shown. Hope that helps!

Thursday 16th of May 2019

Hi Gemma, the question I have, do you have to pay the one year insurance all upfront or is it possible to pay monthly? My travel insurance offered it and I am wondering now if this would be accepted.

Saturday 18th of May 2019

Hi Jessica,

It needs to be upfront, not monthly. A monthly policy can be cancelled at any time so hence is not proof of insurance for the entire length of your trip.

Wednesday 14th of June 2017

Hi Gemma I am going to Canada from New Zealand and looking for travel insurance options...and a bit lost. The link for 'Down Under Insurance' under New Zealand doesn't seem to work, even when I searched it on Google. Would you please be able to recommend a travel insurance company / companies for someone going from New Zealand for the full 23 month period? Thank you :)

Thursday 15th of June 2017

The link to Down Under insurance goes directly to the booking page. As mentioned in the description on my page, you will need to call them to purchase the 23/24 month IEC policy. Alternatively, you could also book 2 x 1 year policies with World Nomads who are also linked on this page.

Saturday 14th of January 2017

Hi Gemma, I have been granted an IEC visa, I want it to be valid for the two years but I don't want to necessary stay there for two years. The idea is I go for 3/4 months say, before returning home. However, I would like to keep my options open and be able to return to Canada in the two year period. I also don't want to be paying for insurance for the full two years if I am not there. I assume It's possible to enter and leave Canada as many times as I like during the two year period?

I applied on my U.K. Passport but I have been living in Australia as a resident, and have become an Australian citizen since being granted my IEC Visa so will be travelling from oz(my Australian address and residency was on my IEC application). So another option I am looking at is if it's possible to reapply on an Australian passport now I can obtain one, even thought I have been granted the IEC on my uk passport. The reason being is I have to enter Canada by end of June 2017, however I am still in two minds financially as paying off debts and it would be more suitable for me to leave at a later date(I was granted my IEC a lot quicker then anticipated). I will be 31 in November 17 so would have to apply by then with Australian passport.

Otherwise 3rd option is to go on a holiday before end of June to validate and get the two years granted and then return later(rather then quitting my job and going for 3/4 months as per option one), but again that will go back to my intial question on insurance options to get a visa for two years to come and go as I please, and also if it's possible to enter and re-enter during the two years.

Thanks for any input or advice. Sorry it's long winded but wanted to include all the facts. You run a great site and I have been finding your ebook on whv in Canada most helpful. :-)

Tuesday 17th of January 2017

Wow, a lot of questions! OK, let's see if I don't miss anything. You can enter and re-enter Canada with the IEC subject to normal entry requirements (i.e. it is not technically a visa and as such does not guarantee entry). The usual problem with entering and leaving is with insurance. Most insurance policies do not allow you to return to your home country for 10 or more days. Some do not even allow you to return at all without invalidating the policy. To receive the full 2 year work permit on arrival it is necessary to have 2 years insurance - if you do not, then you risk being given a work permit to the length of your insurance (or no permit at all if you don't have any insurance).

Australian insurance by the way (as in, coverage for Australians) is VERY expensive, much more expensive than insurance for UK residents/citizens. Be aware though that you may not be eligible for many UK insurance policies as you have not been resident there for a while.

It seems like you have two options -

Go to Canada before your POE expires, activate your work permit with two years insurance. If you need to go home directly afterwards, that is OK, provided your insurance provider allows it (as mentioned, not many do and only for a short time). True Traveller allows you to return home for an indefinite time period without invalidating your policy is True Traveller. With your living situation, they are also one of the few UK insurers that you may be eligible to get a policy with.

Second option is to apply for the Australian quota. I would do this before September as the pools closed in early autumn last year. You must receive an invite before your 31st birthday to be eligible.

IEC Travel Insurance

If you’re going to be travelling to Canada through International Experience Canada (IEC) then one of the requirements to be allowed to enter Canada is that you have IEC travel insurance (IEC health insurance).

But what exactly does the IEC travel insurance need to cover and how can you make sure to get the best deal?

We’ll cover everything you need to know in this article.

International Experience Canada

Iec travel insurance, iec travel insurance requirements, when do i need to purchase iec travel insurance, best iec travel insurance, what to look for in iec travel insurance, iec travel insurance cost, working in quebec.

If you’re figuring out what to do about IEC travel insurance, I’m sure you’re already familiar with what the International Experience Canada program is.

But just to confirm the context around the insurance:

IEC is what Canada calls its working holiday visas program for people aged between 18 and 35.

There are three different types of visa covered by IEC and which ones you can apply for depends on your country of citizenship.

The most common visa is the working holiday visa which is an open work permit. The working holiday visa lets you come to Canada without a job offer and work for almost any employer in Canada.

There are various requirements for each type of visa but, regardless of which visa you get, the IEC insurance requirements are the same.

If you get an IEC visa then one of the requirements you need to meet to be allowed to actually enter Canada on that visa is having IEC travel insurance, or IEC health insurance.

The IEC travel insurance that is required for entry into Canada on an IEC visa is insurance that covers you for medical matters, it’s not travel insurance that covers things like lost baggage.

So a more accurate term for the insurance you need is probably IEC health insurance.

There are a number of requirements that your IEC health insurance needs to cover, otherwise you might be denied entry to Canada.

In terms of the policy coverage, the IEC heath insurance must cover:

- Medical care

- Hospitalization

- Repatriation which includes getting you to a medical facility, and returning you or your remains to your home country

The insurance policy must be for the full duration of the time you plan to spend in Canada. So if you want to stay in Canada for the full two years (or three years for some countries), the policy will need to cover two (or three) years.

If the policy is shorter than two years, when you arrive in Canada the border agent will only give you a permit for the duration of the policy – so your work permit will expire on the day your health insurance does.

Keep in mind you won’t be able to extend your work permit at a later date. So if you want to have the option of staying in Canada for the full length that your visa allows, you need to already have insurance that covers that full time period when you land in Canada.

This is where it’s a good idea to buy insurance that allows you to do partial refunds. So if you leave Canada before you’ve used the whole duration of the policy you can get a refund for the unused duration.

Many of the Canadian insurers offered on the price comparison website we recommend offer partial refunds on time that’s not been used.

One last point on getting insurance to cover your full length of stay – if you can’t get one insurance policy that covers the full time, it’s acceptable to get two consecutive policies instead.

It’s important to note that having IEC travel insurance is not required to apply to IEC or to be approved for the visa. But it is required before you arrive in Canada.

So when you arrive in Canada the border agent will check your insurance and if everything isn’t in order you might be denied entry to Canada.

As with most insurance, there isn’t one insurer I can recommend that is always going to be the best or the cheapest.

What’s best for you will depend on your circumstances and what you want from a policy.

That’s why I recommend the best way of finding your insurance is to use a price comparison website .

The site I use for travel insurance when my family is visiting Canada is BestQuote .

It compares across a whole host of insurers and provides you with various options.

The results page also nicely displays the key components of each policy so you can quickly see which options look good for you.

You can then go ahead and purchase the policy through the BestQuite website.

You can check them out here .

When you’re comparing quotes, some of the key things to look out for are:

Coverage amount . What is the maximum amount the policy will pay out if you need to claim on it? Keep in mind the headline maximum figure will be further broken down into maximum amounts for individual things.

Coverage . What elements does the policy actually cover? Obviously you’ll want to make sure it covers the minimum requirements for IEC travel insurance as outlined above. But also make sure it covers anything else you think you might need and the coverage amount per item is sufficient. A big one here (with this being Canada!) is to consider if you want winter sports coverage.

The deductible . This is how much you’ll need to pay out your own pocket before the insurer will cover the rest. This can range from zero up to thousands, so pick which is right for you. Basically the higher the deductible the lower the insurance premium.

If you’re wanting some ballpark figures of what IEC health insurance might cost I’ve outlined a few ranges below.

I’ve given the costs for a 27 year old, but the insurance cost doesn’t really vary significantly for anyone in the visa age range.

Here’s what some typical IEC travel insurance policies will cost:

- $1,200. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $0 deductible. No pre-existing medical conditions and no winter sports.

- $2,700. Same criteria as above but with a stable pre-existing medical condition.

- $1,025. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible . No pre-existing medical conditions and no winter sports.

- $1,450. 2-year IEC travel insurance policy for a 27 year old, with $100,000 coverage and $250 deductible. No pre-existing medical conditions and winter sports included .

You can use a price comparison website to quickly get an idea of the cost of IEC health insurance for your circumstances.

Some countries have agreements with the province of Quebec that makes you eligible for health coverage. In which case you wouldn’t need IEC travel insurance that covers the medical care component of the requirements.

But the agreement doesn’t cover the repatriation part of the IEC travel insurance requirements so you’ll still need to buy separate insurance for that part. You can find out more if your country has agreements with Quebec here .

* All of the products and services I recommend on Canada for Newbies are independently selected based upon what I’ve personally found to be useful. I f you buy insurance through BestQuote using one of the links in this article, I might earn a small affiliate commission. Rest assured it won’t cost you anything and I would never recommend something I don’t believe in or use myself.

So that’s my overview of IEC health insurance. I hope you’ve found it useful.

Please feel free to drop me a comment on anything below.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Signup for new content and exclusive extras in your inbox.

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

Medical & Repatriation

All of our policies exceed the International Experience Canada (IEC) requirements. Our Premier policy covers you for up to £10m for hospitalisation, medical and repatriation expenses ; up to £5m for our standard policy; and up to £2m for our budget policy. All our policies also include emergency dental treatment to relieve pain and suffering (limited to £350).

Winter Sports

We have 4 different options for our winter sports add-on. You can include cover for 14, 28 or 56 days of consecutive or non-consecutive winter sports activities, or you can include cover for the entire duration of your policy with our Unlimited add-on.

Free Home Visits

If you feel homesick at any time, so long as your policy duration is more than 4 months, you can pop home to see family and friends at any time, however many times you choose. Covers stops as soon as you arrive home and starts again as soon as you depart.

Early Return Refund

Decide Canada’s not for you and want to return earlier than your full period of insurance? Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

Easy to Re-new or Extend

Big Cat allows you to re-new or extend your travel insurance whether you are at home or abroad. It doesn't matter if you are already travelling you can buy or re-new your policy from anywhere in the world via online access to our system.

No Return Ticket Required

Unlike most other Insurers we don't require you purchase a return airline ticket. Our IEC policy allows stays for up to 2 years, so presenting IEC insurance for 2 years at the Canadian border on entry means that you can receive the maximum 2 year visa. Show up with just 6 months insurance and you'll only get a visa for 6 months!

Up to £10m Medical Cover

No return ticket required, 24 hour emergency helpline, claim while still travelling, iec travel insurance.

For British citizens aged between 18 and 30 years you can travel to Canada for a working holiday under the IEC visa programme. This will allow you to find temporary paid employment to help pay for your trip (up to 24 months). That means, for example, you could work in a ski resort in Banff, a restaurant in Quebec, or gain work experience at a business in Toronto.

Key Features of the Big Cat IEC Travel Insurance :

- Emergency Medical and Repatriation Expenses up to £10 million.

- Emergency Dental Cover up to £350.

- Cover duration of up to 2 years.

- Baggage Cover.

- Gadgets & Valuables Cover up to £1000.

- Free Home visits.

- Policy Extensions whilst still travelling.

- 156+ Sports and Activities.

- You can claim whilst Travelling.

- Winter Sports Cover.

- Loss of Passports & Visas replacement costs.

- Early Return Refund scheme, conditions apply, please see FAQ page.

Frequently Asked Questions:

If you get sick while travelling or you're seriously injured you are covered for emergency medical treatment including:

- Hospitalisation

- Ambulance costs

- Surgery and follow up treatment

- Visits to the Doctor

- Repatriation

- Prescribed Medicine

- Emergency dental treatment to relieve pain and suffering (limited to £350)

24hrs Medical Emergency Assistance.

Decide Canada’s not for you, and want to return earlier than your full period of insurance?

Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

How does the EARLY RETURN REFUND work?

Let’s say you buy a 24-month policy to cover your time in Canada. But after nine months, you decide that Canada’s not for you, and you want to return home. You may have invested a substantial amount for your 24 months Big Cat policy, most of which you’ll now no longer need. Unlike most insurers, Big Cat is happy to offer you a partial refund on the redundant portion of your insurance as a fair’s fair consolation. Please note that travel insurance premiums are not calculated on a pro-rata basis, as such, no refund is calculated in this manner either.

How does Big Cat calculate the amount of EARLY RETURN REFUND?

We take the length of time of the original policy and subtract the actual amount of time you have used, and payout the difference, deducting a £50 Cancellation Charge.

Are there other conditions that apply to my EARLY RETURN REFUND?

- Only applicable to 24 month IEC policies.

- We are not able to offer refunds to cover the first 6 months of the policy.

- No refund can be given on a policy where a claim has been made or is likely to be made prior to the cancellation of your Big Cat policy.

- You must be back in your home country and notify us by email of your wish to cancel the policy within 14 days of your arrival, please also provide us with proof of your return to the UK (flight ticket / e-ticket / boarding pass).

- All refund calculations are based on the base premium paid only. Add-ons are non-refundable.

Can you give an example of how much I could receive back in my EARLY RETURN REFUND?

Say you took out a 24-month budget IEC policy costing £525.24, then you wish to cancel the policy after 9 months. Our 9-month budget IEC policy costs £312.55. So we deduct £312.55 from £525.24 = £212.99

Then we apply the £50 Cancellation Charge, refunding you a total of £162.99.

Temporary return to home country (Single trip policies only) Where cover has been purchased for a total duration of 4 months or more, and you want to return to your home country during the period of insurance for any reason that is not directly or indirectly caused by arising or resulting from, or in connection with a claim under this insurance all cover under this policy will be suspended from the time that you clear customs in your home country and restarts after the baggage check in at the international departure point for the return flights, international train or ferry to the overseas destination. Any illness, disease, injuries, accidents which existed, showed symptoms or were diagnosed in the previous trip(s) during this period of insurance will not be covered in the restarted period of insurance.

To add any of our Activity Packs, just follow the Quote form - to stage 3 - there you will find all of the optional extras.

You do not need to call the medical screening helpline in respect of the following automatically covered pre-existing medical conditions, as they are automatically covered at no additional premium provided you do not also have a pre-existing medical condition. If you have a pre-existing medical condition in addition to any of the following automatically covered pre-existing medical conditions all conditions will be excluded from cover, unless disclosed to the medical screening helpline and additional cover agreed in writing.

A cne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication),

B lindness or partial sightedness,

C arpal tunnel syndrome, Cataracts, Chicken pox – if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis – provided there is no on-going treatment,

D eafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting – if completely resolved,

E czema, Enlarged prostate – benign only, Essential tremor,

G laucoma, Gout,

H aemorrhoids, Hay fever,

L igament or tendon injury – provided you are not currently being treated,

M acular degeneration, Menopause, Migraine – provided there are no on-going investigations,

N asal polyps,

R SI, Sinusitis – provided there is no on-going treatment,

S kin or wound infections that have completely resolved with no current treatment,

U nder active Thyroid (Hypothyroidism), Urticaria,

V aricose veins in the legs.

To declare any pre-existing medical conditions,

please visit our online medical screening

If you would rather undergo your medical screening by telephone,

please get in touch with us on 01702 427237 and any of our agents will be happy to assist you.

This is a secure and confidential service which allows you to declare any pre-existing medical conditions you may have,

as defined by your Big Cat policy wording.

For more information about the (IEC) International Experience Canada insurance requirements, visit the Canadian Immigration & Citizenship .

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

By Lisa Jackson

Best travel insurance in Canada

Day Of Victory Studio / Shutterstock

You’ve packed your bags, mapped your itinerary, and set your “out of office” message – it’s vacation time! But what about travel insurance?

According to a 2019 study by the Travel Health Insurance Association of Canada, 13% of Canadians aren’t sure if they have travel insurance before they go on vacation. Of those who have bought insurance, 17% don’t know what their policy covers.

As a professional travel writer, I find this rather alarming. Canadian health insurance is not valid outside Canada, and your provincial or territorial health plan may not cover all the costs even if you’re travelling domestically. If you suffer an accident or get sick abroad, unexpected medical bills can bankrupt you. It’s why the Canadian government advises all travellers to buy travel insurance , and I never leave the country without it. Whether you’re taking a two-week trip or a gap year abroad, every one needs the best travel insurance in Canada, regardless of age, health status, destination, or length of vacation.

Best for thrill seekers: World Nomads

Designed for adrenaline lovers with wanderlust, World Nomads insures a long list of adventure sports, activities and volunteer/work experiences, as well as sporting equipment delay/loss/theft. You also get access to a 24/7 hotline that provides information that adventure travellers may need: weather reports and travel advisories, assistance locating the nearest trail, and finding a gear shop.

The standard policy covers emergency medical expenses up to $5 million, emergency dental, trip cancellation/interruption/delay, baggage delays/theft/damage, and more. The downside: you must be under 66 years of age to qualify.

Best for families: CAA Travel Insurance

A long-trusted Canadian institution, CAA travel Insurance offers flexible travel plans to suit every type of traveller and vacation, but their policies are particularly great for families. Their stand-alone emergency medical policy of up to $5 million in health coverage is extremely comprehensive, even including medical repatriation, emergency dental, and reimbursements for pet care and kenneling.

The Vacation Package Plan provides full cancellation/interruption insurance – ideal for prepaid, all-inclusive vacation packages – as well as family transportation and escort of children during emergencies. Anyone can buy CAA travel insurance, but members get a 10% discount.

CAA’s emergency medical plans also now include coverage for COVID-19-related illnesses for vaccinated customers. Coverage is up to $2.5 million if partially vaccinated and up to $5 million if fully vaccinated.

Best for seniors and retirees: Blue Cross

Blue Cross has been around for more than 70 years, and 1 in 4 Canadians utilize its travel insurance. Blue Cross’s emergency medical covers up to $5 million. It has special “snowbird” travel insurance packages designed for Canadians who head to warmer climates each year, making Blue Cross ideal for retirees.

Part of the package is the recently launched Serenity Service. This free perk provides a range of benefits if your flight is delayed, including access to an airport lounge or even a hotel room (depending on the length of the delay). Pre-existing conditions are generally not covered.

Best for budget travellers: Travel CUTS Bon Voyage Insurance

Starting at only $1.36 a day, Travel CUTS Bon Voyage Insurance offers very affordable travel insurance packages, and it’s personally been my “go-to” travel policy for years. Yes, it’s geared toward students (e.g., you can swap your travel dates at no charge due to an exam schedule conflict), but anyone between 15 and 50 years of age can purchase a policy.

The standard package includes hospital and medical up to $1 million, dental care, air ambulance evacuation, flight accident, accidental death or dismemberment, and trip interruption/cancellation insurance. Adventure and extreme sports are also covered.

Best for Canadians with pre-existing medical conditions: Manulife CoverMe

Manulife CoverMe offers highly comprehensive Canadian travel insurance packages for those travelling as a family, a visitor to Canada, or a student. You also get access to the TravelAid mobile app, which provides directions to the nearest medical facility and local emergency telephone numbers.

However, the stand-out feature is arguably TravelEase – a special policy designed to cover fully disclosed medical conditions. For travellers with pre-existing conditions, it insures a bunch of expenses for health services and transportation. It provides up to $10 million in emergency medical benefits – a unicorn in the travel insurance world.

Best for emergency medical assistance: Medipac Travel Insurance

Medipac is one of the only travel insurance companies out there that is staffed by their own team of trained medical professionals, via their Medipac Assistance hotline. Medipac’s medical professionals are your first point of contact in an emergency medical situation. This service is also helpful for dealing with foreign medical systems and helping to prevent unnecessary expenses when dealing with a large deductible.

Medipac offers several competitive features for their travel insurance plans, including no age limits, a claim-free discount, and a 90-day stability period for most pre-existing conditions. If your pre-existing medical condition isn’t covered by a standard Medipac insurance plan, Medipac also offers personalized, underwritten insurance policies to help you meet your needs.

Medipac is offering a 5% Vaccine Discount to clients who have received a minimum of one dose of a COVID-19 vaccine, as well as the new MedipacMAX option. This COVID insurance option provides maximum coverage of up to $5 million USD for COVID-19, in addition to its other benefits.

Best for frequent travellers: Allianz Travel Insurance

Touted as a world leader in the Canadian travel insurance and assistance industry, Allianz Travel Insurance is a major provider of travel insurance, corporate assistance, and concierge services. It seeks to help its customers find solutions to various travel-related problems. Allianz Travel has partnered with many reputable companies, including travel agencies, airlines, resorts, websites, event ticket brokers, corporations, universities and credit card companies.

Allianz Travel Insurance is a great choice for anyone looking for travel insurance. Its single-trip plans are perfect for those leaving home and visiting another destination (or destinations) before going back home. Its parent company, Allianz Global Assistance, has five plans to choose from, all offering different levels of protection and coverage.

Allianz Travel Insurance’s annual/multi-trip plans are perfect for both personal and professional travelers who take multiple trips in a year. It offers four distinct options to choose from.

Will my provincial insurance be valid overseas?

No! If you get sick or injured overseas, the Canadian government will not cough up a dime to cover your medical costs. Here are the sobering facts:

- Canadian public health insurance is not valid outside of Canada.

- Foreign hospitals can be extremely expensive and may demand payment before treating you.

- The Canadian government will not pay a Canadian’s medical bills for an illness or accident suffered abroad. You’re on the hook for footing the bill!

Will my provincial insurance work in another province/territory?

Flash your valid provincial health card in another part of Canada, and you’ll likely be covered for some of the same services insured by your home provincial plan. This is because the provinces and territories (except Quebec) signed an agreement whereby the host province foots the bill for any medically necessary health care services and gets reimbursed by the home province later.

However, that doesn’t mean you’re completely out of the woods. Depending on your destination, a slew of other services may not be covered, such as an ambulance, hospital transfer, prescription drugs, transportation back to your home province, and procedures not currently approved by your home plan.

Plus, since Quebec wasn’t a signatory to the interprovincial billing agreement, you’ll likely be charged for any medical bills incurred there. For this reason, it’s recommended that you buy extra travel insurance (or verify your credit card’s travel insurance coverage ) to cover any uninsured health care services that may crop up during your trip.

What does the best travel insurance in Canada cover?

Every travel insurance policy is different and what’s covered depends on how much you’re willing to pay for coverage. Typical medical services that you can expect to be covered include:

- Emergency hospital and medical costs

- Ambulance and air ambulance costs

- Outpatient services

- Physician and laboratory costs

- Prescription drugs

- Direct payment to the hospitals and doctors caring for you

- Assistance with bringing a family member to your bedside

- Air ambulance or commercial repatriation home

- Return of your vehicle if you are ill and have to come home

Additional benefits may include:

- Trip cancellation for non-refundable monetary losses

- Trip interruption

- Baggage loss, rental car damage, out-of-pocket expenses

- Accidental death and dismemberment

How much coverage do I need?

Securing a policy with a minimum of $1M maximum payable is a safe bet. But don’t just look at the numbers when choosing a policy – read the fine print. Every insurer has a list of situations in which coverage is not provided, otherwise known as “exclusions.” Check whether your provider includes coverage or has provisions for the following:

- Pre-existing medical conditions: According to the International Association for Medical Assistance to Travelers, a pre-existing condition is “something that happened (or started to happen) before you were insured.” Some policies may cover claims relating to pre-existing conditions that are “stable and controlled,” but read the definitions carefully. If you don’t declare a condition, the entire policy could be invalidated!

- Medical evacuation: Ensure the policy covers medical evacuation to the nearest hospital and/or to Canada and the costs of a medical escort to accompany you to your final destination.

- Repatriation in case of death: On the grim side, ensure that your plan covers the preparation and return of your remains to Canada.

- Adventurous Activities: If you plan on engaging in “high-risk” activities on your trip, you may need to shell out extra dough for a more comprehensive plan. Many policies don’t cover “risky” activities, such as skiing or snowboarding “out of bounds,” skydiving, scuba diving, white-water rafting, mountaineering, or participation in any rodeo activity. To cover your bases, ask questions and get specifics before purchasing a policy.

You may have to pay more to have these things included, but a few extra bucks may be worth it for peace of mind.

Should I buy “a la carte” travel insurance or get a travel credit card with free insurance?

A credit card with travel insurance is always a good thing to carry in your wallet. The best travel credit cards in Canada usually cover everything from emergency medical costs to trip cancellation/interruption to flight delay to rental car insurance, which could save you a wad of cash.

The Scotiabank Gold American Express ® Card has saved my butt a few times, and I’ve filed several travel-related claims through my card. I cancelled my trip to Portugal a few years ago due to a death in the family, and I got a full refund on my hotel deposit and flights for myself, my husband, and my baby. It totally justified the $120 annual fee.

That being said, don’t rely on your credit card to take care of all your travel insurance needs. It usually includes a basic policy, meaning it offers low (or no!) travel medical insurance as part of the package. Like any travel insurance company policy, you’ve really got to read the fine print and understand the conditions of your policy to avoid sticky situations.

For instance, the Scotiabank Gold American Express ® Card requires a cardholder to have charged at least 75% of trip expenses to make a trip cancellation/interruption insurance claim. So if you book an all-inclusive vacation for $5,000 and then cancel due to illness, at least $3,750 must have been charged onto your AMEX to qualify for a claim. If you didn’t do that, you’re out of luck.

Can I still purchase insurance if i’ve already started my vacation?

The short answer: most insurance providers won’t cover you after your departure date. However, a handful of insurers (such as World Nomads) will allow you to purchase a policy while already overseas. Just know that it can come with sky-high costs and/or conditions: World Nomads has a 48-hour waiting period before coverage kicks in. The bottom line? It’s always best to buy travel insurance before leaving the country.

Can I get travel insurance for part of a trip?

Some plans offer insurance coverage options that will allow you to customize your coverage, but you’ll have to research to find one that works for your unique circumstances. Alternatively, you could take out an insurance policy for each destination and/or segment of your trip.

For instance, you could get a World Nomads policy for the two weeks you’re scuba diving in Australia, followed by a basic Travel CUTS Bon Voyage insurance to cover a month-long trip to Europe. However, when you buy Canadian travel insurance, you must select a trip start and end date – meaning you must know the exact dates for travelling to those places.

Should I carry a printout of my policy with me at all times?

I recommend carrying the travel insurance card in your wallet and locking it up in the hotel safe with other important travel documents like my passport. But don’t rely totally on paper: Wallets get lost or stolen, luggage can be delayed or M.I.A., and papers are easy to misplace when you’re on the road. My advice is to send a copy of the policy to your email and save it on your iCloud or another storage system that can be accessed anywhere, anytime.

Recommended reads

- What’s the Added Value of a Credit Card with Travel Insurance?

- The Best Travel Rewards Programs in Canada

- Aeroplan vs. AIR MILES vs. Avion

About our author

Lisa Jackson is a freelance personal finance and travel journalist, editor, and blogger who contributes to various online and print media outlets in Canada and abroad, including The Globe & Mail, Toronto Star, Islands Magazine, Fodors, BRIDES, Huffington Post Canada, CAA Magazine, The Food Network, West Jet Magazine, NUVO Magazine, and many others. When she's not writing from her home office, she's busy globe-trotting to new destinations in search of her next story.

Latest Articles

Planning a summer trip to Quebec's Îles-de-la-Madeleine? You'll have to pay up.

Globe wins seven newspaper awards; CP recognized for CSIS investigation

Orca's escape from B.C. lagoon will be talked about for 'generations,' say nations

A list of NNA winners and finalists; Globe and Mail nabs seven

Cap on plastic production may be too complicated for global treaty: Guilbeault

Warren Buffett bet $1M and won!

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

IEC Travel Insurance – The Best 2 Year Visa Cover From Europe

By: Author Sunset Travellers

Posted on Last updated: January 27, 2022

Categories Canada , Travel , Travel Advice

If you are looking for the best IEC visa travel insurance from Europe, you are in the right place.

We spent two years on a working holiday visa in Canada from Europe.

We know how difficult it might be to find the best IEC visa cover that suits your needs.

With all the changes happening around the world, it is essential to have the best possible insurance cover that doesn’t cost a fortune either.

After lengthy visa processes, paying all the fees, booking flights and most likely shipping some belongings , there’s so much you can invest in travel insurance.

We’ve been there, so we completely understand you.

We travelled to many places around the world, but all the IEC visa requirements got us very stressed.

Well, then, let’s get to the point.

As the Canadian government website states, the insurance for an International Experience Canada visa must cover:

- medical care;

- hospitalization; and

- repatriation.

For International Experience Canada, you must have health insurance for the entire time in Canada.

They also recommend buying the insurance only after receiving your port of entry (POE) letter.

Remember that you may be refused entry if you don’t have insurance!

If your insurance policy is valid for less time than your expected stay in Canada, you may receive a work permit that expires at the same time as your insurance.

Therefore make sure to buy the best IEC travel insurance for Canada.

Taking part in the IEC program can be by far one of the most amazing experiences you’ll have, so don’t waste this opportunity.

Thinking beyond the IEC travel insurance requirements, you should also be aware that medical care in Canada can be costly.

Emergency room visits for relatively simple injuries can quickly add up to thousands of dollars.

Saving money on buying IEC travel insurance for Canada can turn out to be an expensive mistake.

We found TrueTraveller to be the best IEC travel insurance for Canada from Europe with all of the above in mind.

Suppose you are looking for two years IEC visa travel insurance for Canada from Ireland, the United Kingdom, Germany, Poland or any other EU country. In that case, True Traveller has the right cover for you.

If you’re going to Canada on an IEC Visa , you’ll need travel insurance that satisfies the requirements of the Canadian Immigrations authorities, and which you can extend as well if you need to.

True Traveller insurance has many benefits over some other policies, including:

- medical and repatriation cover;

- cover available for up to 2 years;

- you can claim whilst you’re still in Canada; no need to wait to return home

- you can extend your policy without returning home first;

- free home visits allowed;

- 92 activities covered as standard;

- 40 optional activities in the Adventure Pack.

Steve and I used TrueTraveller for our two year IEC travel insurance and always recommend them to others.

Coming from Ireland and Poland to Canada was very stressful for us. We were therefore glad to have a proper cover when crossing the border.

Having the 2-year travel insurance for Canada really made our experience stress-free.

We also enjoyed all the activities like snowboarding, knowing we are insured with True Traveller.

Arriving in Canada with no travel insurance can invalidate your IEC Visa.

Local Provincial Insurance is no substitute for international travel insurance. This type of insurance is usually only available to permanent residents of Canada. It also doesn’t include medical repatriation.

We found True Traveller the best and cheapest IEC insurance for Canada from Europe.

Hit this link to get a free quote with TrueTraveller.

As always, please double-check up to date visa requirements on the Canadian government website .

Thanks for reading,

Steve and Sabina

Notify me of follow-up comments by email.

Notify me of new posts by email.

Travel insurance

On this page.

Instruction: Change of selection promptly shifts the focus to a matching heading further down, on the same page.

Our travel insurance products

As one of the top insurance companies in Canada, Manulife offers a wide range of coverage options to best suit your travel protection needs. Whether you are snowbirds, seniors, students, or visitors to Canada, we’ve got you covered.

Travelling Canadians

Help provide Canadian residents with out-of-province or country coverage for unexpected travel expenses such as emergency medical and more.

Visitors to Canada

Get affordable coverage for medical expenses while visiting Canada. Meets the requirements for super visa.

Get help with medical expenses when studying away from home – either in Canada or abroad.

Travel insurance explained

Whether it’s to the beach, the city, or somewhere in between, travel gives us unforgettable escapes in beautiful places. But what happens when a trip doesn’t go as planned? A medical emergency or accident can have financial consequences that last far longer than your trip. That’s where travel insurance comes in. This short video explains:

- What’s included in travel insurance? What are the different types (travel medical insurance, trip cancellation and interruption insurance, visitors to Canada insurance and student travel insurance)?

- How insurance can reimburse you for unexpected expenses while you’re abroad or in another province or territory, from hospitalization, to transportation, and more!

Download a transcript (PDF)

It’s easy! To get the plan best suited to your needs, you can get a quote and apply online or by calling 1-877-268-3763. Have your travel dates, contact information, health information, and credit card or bank information on hand.

Having insurance while travelling is strongly recommended. Based on a survey conducted by the Conference Board of Canada, 82% of Canadians traveled with travel coverage in 2022. This speaks volumes and shows that most Canadians think having protection for unplanned emergencies while travelling is a necessity.

Travel coverage can protect you not only from emergency medical costs, but also from flight delays/cancellations, baggage loss/damage, travel accidents, and unforeseen events. Depending on your policy, you could get reimbursed for incurred costs if a covered event caused you to cancel or rebook your trip.

Ready to buy?

You can get a quote and purchase Manulife travel insurance online through Manulife CoverMe.

Need assistance?

Want to talk through your options.

Have questions and want to speak to a licensed insurance advisor? We can help with that!

Submit a travel claim

Visit our dedicated travel portal to start a claim. First-time on the site? Simply register, activate your account, and sign in

- Choosing an IEC Travel Insurance Policy

Essential Requirements

Choosing the right insurer, questions to ask, 24 month travel insurance providers.

Don’t forget to check out our Youtube channel or WSC Ski-Tok for those wanting more visually appealing content!

Use our free instant-call back or Whatsapp widgets to get in touch. Check out our FAQ’s. for answers to all your questions.

But if you have any unanswered concerns we are always on hand to help via our free instant call-back , mail & Whatsapp widgets.

IEC Travel Insurance Options

Choosing a 2 year IEC Travel Insurance Policy

The IEC working holiday visa for Canada is 24 months for most countries, which means you need a 2 year IEC travel insurance policy. In this article, we’ll tell you what to look out for, the essential requirements of travel insurance, questions to ask, and at the very end, we list and link to the companies which offer 24-month travel insurance policies.

- The policy must cover the entire length of your stay. The immigration officer who issues your work permit on arrival will only issue a visa for the length of your travel insurance policy. So, if you’re trying to save money and only opt for a 1-year policy, be aware that you will only be issued a 1-year work permit, and it can’t be extended once it’s issued.

- Your IEC travel insurance policy must cover medical care, hospitalization and repatriation to your home country.

- Comprehensive winter sports cover is essential for all Winter Sports Company clients. We recommend taking a high level of winter sports cover, especially if you expect to ski or snowboard in the back-country or snow park.

- You are looking for a ‘long-stay’ or a ‘single trip’ policy. A multi-trip policy is standard travel insurance for holidays but usually, it only insures you for trips 30 days or less and is not suitable for IEC travel insurance.

- The added extras – consider everything! This insurance may save you tens of thousands of dollars in the long run.

Insurance companies all have different terms and conditions – before you commit to a policy, read the fine print. For example, some policies may include a clause of proof of intent to return to your home country at the end of your visa. If you can’t prove this, any claims you make may be rejected.

Trips home and further travelling – some companies have a condition written into their policies that you can only travel outside of Canada once or twice (this includes trips home). If you are planning further travel or may extend your stay after your visa expires, look for an IEC travel insurance policy with ‘extensions possible’.

Pre-existing medical conditions will need to be declared and checked to see if they are covered in your policy. If you need medical attention during travel, paying more for insurance to cover pre-existing conditions will be worthwhile.

Don’t forget, Travel Insurance companies are smart – and they will investigate. This can include checking your travel records and medical records to refuse pay-outs if you break the terms of your insurance.

What is the level of cover before I travel?

It is a good idea to opt for a policy with cancellation cover from the date you purchase insurance until the day you travel – most policies will include this as standard.

How are claims handled?

Some insurance companies require you to pay for things upfront and then claim reimbursement. Others deal with claims directly – be clear on this policy. It will cause you less stress if you have an unexpected trip to the hospital and you know what proof you need to make a claim.

Where can I view my documents?

You need a printed proof of insurance for IEC to enter the country. Most insurance companies offer digital proof of insurance – so save it to your computer.

Does the policy have financial failure protection?

This means you can claim if a company that is providing you with part of your trip goes into liquidation.

Is there a free-phone claims line, and what is the number for calling outside the country?

Put this number in your phone – then you have quick access to it in emergencies.

Am I covered for trips outside of Canada?

If you think you’ll take impromptu trips south of the border to the USA, or holidays further afield, make sure your insurance covers these.

What is your policy on trips home?

Some insurers do not allow trips home, others only allow a couple, and some allow unlimited trips back and forth. Be wise and realistic; returning to your home country may seem unlikely. However, you don’t want to void your insurance if you need to make a trip home for a family emergency.

Are luggage and personal items covered?

This includes ski and snowboard equipment – if you’ve got a lot of expensive stuff, find out if it’s covered and how much for.

Can I make changes to my policy?

Do you think you might extend your trip or want to add an extra level of cover at a later date? If so, check if this is possible – some insurance policies are iron clad after the initial cooling off period.

What is your policy on pre-existing medical conditions?

If you need cover for existing conditions, ask as many questions as possible about it, and get something in writing before you commit to the policy.

Is there an excess waiver, and how much is it?

Insurance companies usually offer an excess waiver which means if you need to claim, you don’t have to pay anything towards your claim.

Is this the best price you can do?

This is always worth an ask! Travel insurance can be expensive, but never be afraid to phone up. Ask if there is an active discount code or if you can have a discount for booking insurance well in advance.

True Traveller BigCat Travel insurance Fast Cover Travel Insurance

For short term travel and winter sports cover, check out our insurance page .

Canada , IEC , Insurance , Internships , Visa , Work Permit

Privacy Overview

- Trustpilot Reviews

- Instructor Courses

- Internships

- Career Break

- Progression

- Instructor courses

- All Mountain Experience

- Ski Patrol | Snowboard Patrol

- The Wintersports Knowledge Base

- Snow Ready Fitness Program

- Sun Peaks – Canada

- Panorama- B.C Canada

- Hidden Valley-Canada

- Verbier- Switzerland

- Queenstown – New Zealand

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis dapibus rutrum vulputate. Mauris sed eros nec est vehicula mattis ac vitae ligula. Maecenas vitae tristique sapien, vitae pellentesque lectus.

Get a free one hour consultation

Canada Travel Insurance

Travel insurance for canada: a guide for us travelers .

From exploring Banff National Park's breathtaking landscapes to experiencing Toronto's vibrant culture or the historic sites of Quebec City, Canada offers a wide range of popular locations and activities. However, before you dive into your adventure, there's a crucial detail to address: securing your travel insurance.

Discover all the ins and outs of travel insurance for Canada in this guide. We've got you covered with details on costs, requirements, essential coverage, COVID-19 restrictions, and some handy tips for your trip.

What should your Travel insurance cover for a trip to Canada?

How does travel insurance work for canada, do i need travel insurance for canada , how much does travel insurance cost for canada .

- Travel Insurance Requirements for Canada

Are there any COVID-19 restrictions for US Visitors?

Are there any required travel vaccinations for canada , traveling with pre-existing medical conditions , our suggested axa travel protection plan .

At a minimum, your travel insurance to Canada should cover trip cancellation, trip interruption and emergency medical expenses. Regarding international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Canada.

Let’s say you’re exploring Ottawa's stunning architecture or skiing down Banff's slopes with AXA Travel Protection. If you were to fall ill or face an unexpected travel hiccup, AXA Travel Protection steps in to help support you. Whether assisting in medical transportation or finding the best alternative for a trip delay, AXA Travel Protection ensures you’re supported in your time of need.

How AXA Travel Protection Can Benefit Visitors to Canada

Here’s the entire list of benefits travelers can have access to with an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Americans aren't required to purchase domestic or international travel insurance to visit Canada. But it’s still highly recommended to have a travel insurance plan before embarking on your next trip.

Why? There are several reasons:

- Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in Canada, travel insurance offers the means to receive prompt and quality medical care.

- Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

- Flight Delays: Travel disruptions like flight delays can happen. If you miss a connecting flight or incur additional expenses due to delays, travel insurance can help cover the costs.

In general, travel insurance to Canada costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.