Snapsolve any problem by taking a picture. Try it in the Numerade app?

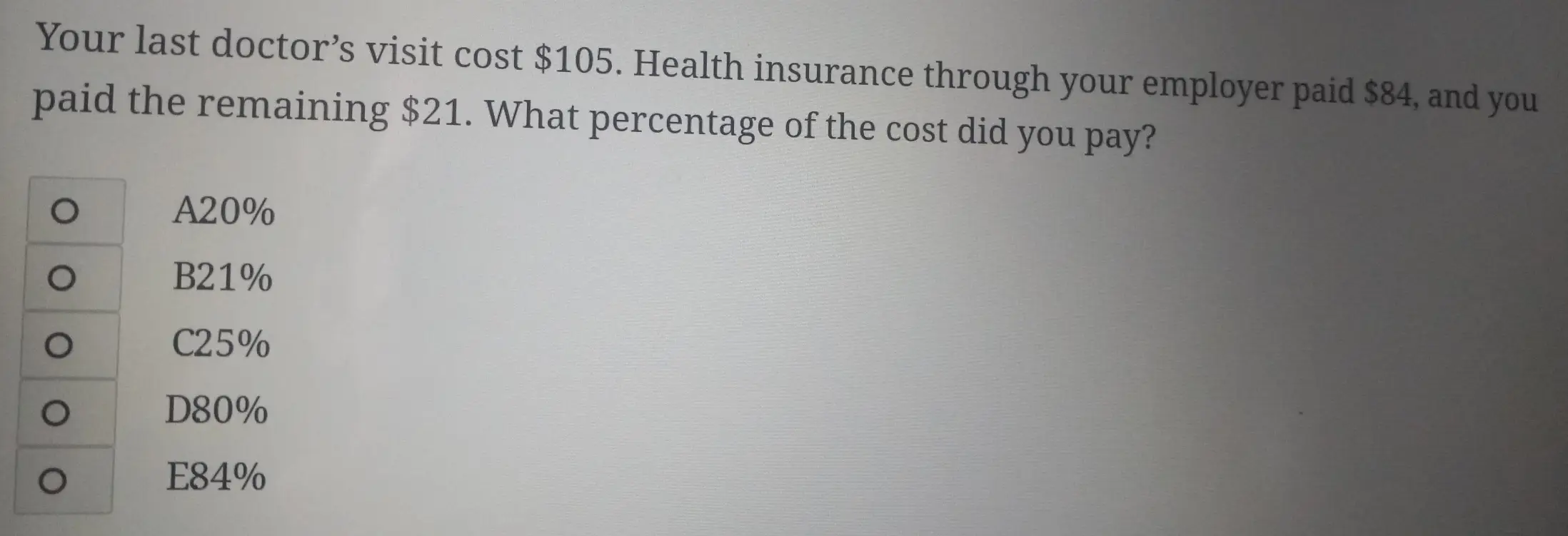

Your last doctor’s visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? A20% B21% C25% D80% E84%

How Much Does a Doctor Visit Cost With and Without Insurance?

Without insurance, medical care can get pricy fast. Where you live, what doctor you’re going to, and what tests you need will all figure into your doctor’s visit bill. In this article, we’ll break down those costs and give you some tips for saving money.

What Goes into the Cost of a Doctor’s Visit?

Geography is one of the biggest factors in the price of a doctor’s visit. Most medical facilities pass some of their overhead expenses onto their patients. If you live somewhere with a higher cost of living, like California or New York City, you’ll likely pay more for doctors’ visits. The practice has to pay more for utilities and rent, and those costs show up in your bill. For example, Mayo Clinic’s Patient Estimates tool quotes $846 for a 60-minute office visit in Jacksonville, Florida, but $605 for the same visit in Wisconsin.

Like the cost of living, supplies and equipment will also end up on your tab. Say you need a strep test, blood draw, or Pap smear. The supplies needed for the test plus the cost of the lab fees will all figure into the price.

Bills for the same exams and procedures can also vary depending on what kind of facility you’re going to. Smaller practices and public health centers are often a lot cheaper than university or private hospital systems. This is due in part to their buildings being smaller and their overhead fees being lower.

Price of Out-of-Pocket Doctors’ Visits

The cost of a doctor’s office visit also depends on what kind of doctor and the procedure you need to have done. For example, an in-office general wellness checkup will be cheaper than a specialist procedure. If you have an emergency, an urgent care center will be much more affordable than the emergency room.

Primary Care Physician — Physical Exam

Physicals usually include blood pressure readings, cholesterol measurements, and vaccines. Prostate exams for men and Pap smears and breast exams for women are also often included. Pediatric physicals focus on the growth milestones for your child’s age. Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools.

The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Primary Care Physician — Procedures

On top of the base cost for physical exams, you may have extra charges for any specific tests or procedures you need. According to the Cardiometabolic Health blog, the most common procedures in primary care medicine include bloodwork, electrocardiograms, and vaccines/injections.

Bloodwork is one of the biggest cost wild cards. Certain tests can run you from as little as $10 to as much as $10,000 . Large national labs like Labcorp offer pricing on their website, so you know what to expect going in. For example, Labcorp’s General Health Blood Test , which includes a metabolic panel, complete blood count (CBC), and urinalysis, costs $78.

Electrocardiograms or EKGs check your heart health and can find cardi ac issues. This quick procedure involves monitoring your heartbeat through electrodes placed on your skin. While it’s a painless and accurate way to detect heart conditions, the costs can add up without insurance. Expect to pay as little as $410 or as much as $1700 for this procedure, depending on local prices.

Vaccines are often required before sending your kids to school. The CDC publishes a vaccination price list annually to give you an idea of what to expect. For example, they quote $19-$132 for DTaP, $21 for Hepatitis A, and $13-$65 for Hepatitis B. The COVID-19 vaccine, however, is free of cost, regardless of insurance status.

Urgent Care Visit

If you have an emergency but are stable, urgent care is much cheaper than the emergency room. According to Scripps , most urgent care centers and walk-in clinics can at least treat dehydration, cuts or simple fractures, fever, flu, strep, and UTIs. Note that if you have chest pain, a serious injury, seizures, a stroke, or pregnancy complications, you should go straight to the ER .

For a base exam at an urgent care facility, expect to pay between $100-$150 . That price will go up depending on what else you need. For example, Advanced Urgent Care in Denver quotes $80 for an X-Ray, $50 for an EKG, $135 for stitches, and $5 for a urinalysis. In comparison, expect to pay $1,000-$1,300 for the same procedures in the emergency room.

How to Lower Your Out-of-Pocket Medical Costs

Healthcare expenses may seem overwhelming without insurance. Luckily, there are many resources available to help you cover the costs.

Free & Low-Cost Immunization and Wellness Clinics

For standard vaccines and checkups, look for local free or low-cost clinics. Check out The National Association of Free and Charitable Clinics’ search tool to find a location near you. Your city’s public health department should also offer free or low-cost vaccines and basic medical care services.

Certain large vaccine manufacturers also offer vaccine programs. For example, Merck’s patient assistance program offers 37 vaccines and medicines free to eligible patients. The program includes albuterol inhalers and vaccines for Hepatitis A, Hepatitis B, MMR, and HPV.

Cash Negotiations

Most health systems offer lower rates for patients paying cash. Some even have free programs for low-income families. For example, Heritage UPC in North Carolina has a yearly membership for low-cost preventative care. In Northern California, the Sutter Health medical system offers full coverage for patients earning 400% or less of the Federal Poverty Income Guideline .

As of January 1, 2021, all hospitals in the United States now have to follow the Hospital Price Transparency Rule . That means they have to list procedure prices clearly on their website. You can also call medical billing before your appointment to discuss cash pay options.

Federal Medical Payment Support

If all else fails, there are federal programs to help you cover the cost of medical bills.

Organizations like The United Way and United for Alice offer grants for ALICE (asset-limited, income-constrained, employed) patients. These are people living above the poverty level, making them ineligible for other government programs but below the basic cost-of-living threshold.

Medicaid is available for children, pregnant women, and adults under a certain income threshold. If your income is too high to qualify for Medicaid but you can’t afford private insurance for your children, you may be eligible for the Children’s Health Insurance Program (CHIP) to cover your children’s medical care.

Use Compare.com for the Best Doctors’ Visit Prices

Navigating bills for a doctor’s visit can feel overwhelming, but Compare.com is here to help. With our price comparison tool, you can search all clinic and doctors’ office prices in your area. Compare makes sure you’re prepared for the cost of your checkup long before you schedule your appointment.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

How to Estimate Health Care Costs Before You Get Care

02.08.2022 | 3 min read

- When your doctor refers you to a specialist or tells you to get a test, ask for the specific name of the procedure or service you’re going to have, including the medical billing code.

- Next, shop around. Call several health care providers and tell them the procedure you need and the insurance coverage you have. They can tell you if they’re an in-network provider, and they should be able to provide an estimate of what your out-of-pocket costs will be. Some hospitals and doctors list prices right on their websites.

- Finally, make a decision about your care based on the price and provider that best fit your needs.

You May Also Like

Subscribe to get updates in your inbox.

Consumers beware: Not all health plans cover doc visits before deductible is met

If you buy one of the less expensive insurance plans sold through the health law’s marketplaces, you may be in for a surprise. Some plans will not pay for a doctor visit before you meet your annual deductible, which could be thousands of dollars.

“This could be the next shoe to drop, as people don’t realize that if they’re buying a bronze plan, they may have to pay $5,000 out of pocket before it contributes a penny,” said Carl McDonald, senior analyst with Citi Investment Research, speaking at a Washington, D.C., conference last month.

Experts worry that some enrollees will be discouraged from seeing doctors if they have to pay the full charge, rather than simply a copayment.

Those who’ve bought their own insurance have always had to pay a set annual sum, called a deductible, before policies begin paying their claims. But first-time insurance buyers may not realize they’re on the hook for additional costs before benefits kick in, and may choose a plan based solely on the monthly premiums.

Bronze and silver plans — which have lower monthly costs but typically, higher deductibles — are the most likely to require consumers to spend that amount themselves before the insurer pays any claims.

There is no nationwide data on how many do that. But in seven major cities, half of bronze plans on average require policyholders meet the deductible before insurers help with the cost of a doctor visit, according to an analysis of data from online insurance broker eHealthinsurance.com for Kaiser Health News. Patients in those plans who haven’t yet met their annual deductible would have to pay the full cost of the visit, unless it was for a preventive service mandated by the law. A typical office visit can run $65 to $85, while more complex visits can cost more.

Silver plans, which generally have higher monthly premiums, are more generous, with more than three-quarters paying for doctor visits before the deductible is met. The analysis included most or all of the plans available through the health law marketplaces in Atlanta, Philadelphia, Dallas, Tampa-St. Petersburg, Miami, Chicago and Phoenix.

Meeting the deductible before most coverage kicks in is common in the individual market, but differs sharply from job-based health insurance. More than three-fourths of the insurance plans offered to Americans with coverage through their jobs pay a substantial chunk of the cost of doctor visits without the worker having to meet the annual deductible first, according to the annual survey of employers by the Kaiser Family Foundation. (KHN is an editorially independent program of the foundation.)

All plans must cover preventive services Under the law, Congress granted insurers leeway in how they design their plans, so long as bronze plans cover at least 60 percent of the costs of a typical policyholder, silver plans cover 70 percent, gold plans cover 80 percent and platinum plans cover 90 percent – with consumers on the hook for the remainder. Gold and platinum plans were not included in the eHealth/KHN analysis because they generally cover more services with less cost-sharing by consumers.

All new plans must cover some defined preventive services with no copayment by the consumer and without having to meet the deductible first. Those include some vaccinations, mammograms and other cancer screenings, contraception, including birth control pills, and periodic physicals. But prevention services do not include treatment for an illness, such as the flu. Charges could also apply if, during a preventive care visit, the patient is also treated for a medical condition or a minor injury.

In addition to doctor visits and preventive care, some plans may also offer limited coverage for some prescription drugs.

So policyholders get some coverage simply by paying their monthly premiums.

But “consumers need to look closely at plan design,” said Nancy Metcalf, senior program editor at Consumer Reports. “If you have someone without a lot of money and they have a $4,000 or $6,000 deductible before anything [beyond preventive services] is covered, I have concerns about access to care.”

Sixty-four percent of bronze plans offered in Dallas, for example, require policyholders to meet the full deductible before insurance coverage kicks in, according to the eHealth/KHN analysis, which included all insurers except one, Molina Healthcare. The average deductible in those plans was $5,400, according to the data provided to eHealth by insurers.

In Philadelphia, by contrast, 33 percent of bronze plans require policyholders to pay the deductible first, the smallest percentage among the cities studied. The average bronze deductible there was $5,689.

Among silver plans, the analysis showed that far more provide some coverage before the deductible is paid. Of 14 plans examined in Chicago, for example, only one required the deductible to be fully met before the consumer could see a primary care doctor for a small copayment. All but one insurer, Land of Lincoln Mutual, were included in that analysis.

In Florida, 90 percent of silver plans offered in Tampa and 89 percent in Miami allowed coverage for at least some doctor visits before the deductible was met. In Florida, however, the database did not include one major insurer, Florida Blue, which has more than 18 plans in the Miami market alone. Florida Blue did not respond to requests from KHN for information about which of its plans cover doctor visits before the deductible is met.

Don’t assume lowest premium plan is best Cigna spokesman Joe Mondy said that the insurer sought to offer consumers a range of choices. Some of Cigna’s plans, for example, allow in-network visits with primary care doctors before the deductible is met, typically for a $30 to $45 copayment, while others do not.

“We structured the plans with the recognition that a lot of the new customers have never had a primary care or family doctor,” Mondy said. Plans that allow primary care visits for a small copayment are expected to foster doctor-patient relationships, he said.

Under the law, there are special provisions for lower-income Americans who purchase a silver plan but not a bronze plan. People who earn less than 250 percent of the poverty level – about $28,700 for an individual – get extra help from the federal government in the form of lower copayments for doctor visits and smaller annual deductibles. For the lowest-income residents, that can mean plans with little or no deductible and copayments as small as $3 for primary care doctor visits.

“Be very careful before you take a bronze plan over a silver plan” if you are in the subsidy-eligible income range, said Linda Blumberg, a senior fellow at the Urban Institute. Those earning less than twice the federal poverty level, about $23,000 a year for an individual, get the most help, with subsidies ratcheting down sharply after that.

Consumer advocates say shoppers should consider a wide range of plans – and not assume that the plan with the lowest monthly premium is the best for them. Still, finding out about what services – other than preventive care – are covered before the deductible is met can take some digging.

Generally, any plan that can be linked with a “health savings account” — a way to put money aside tax-free to cover medical costs — will not cover much except preventive care before the deductible is met because of rules governing those accounts. For all other plans, consumers can check insurers’ websites for details or log onto healthcare.gov, the federal marketplace that covers residents of 36 states. A new feature added to healthcare.gov shows each policy’s monthly premium, annual deductible and the copayments required for doctor visits, drugs and emergency room care.

Plans that list a price for a doctor visit followed by the phrase “after the deductible is met” mean the consumer must pay the full deductible before getting doctor visits for a small copayment. Additional information can be found by clicking the “details” button and reading the summary of benefits. Consumers can also call insurers directly or look up the information under the policy name on an insurers’ website.

Ask any question and you be sure find your answer ? Ask Now

Your last doctor’s visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay?

Your last doctor’s visit cost $105. health insurance through your employer paid $84, and you paid the remaining $21. what percentage of the cost did you pay?

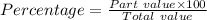

Step-by-step answer

20% percentage of the cost you pay .

Step-by-step explanation:

Your last doctor’s visit cost $105.

Health insurance through your employer paid $84, and you paid the remaining $21.

Part value = $21

Total value = $105

Put all the values in the formula

Percentage = 20%

Therefore the 20% percentage of the cost you pay .

Last Doctors visit cost $105.

Health insurance through employer paid $84 and you paid $21.

% of cost paid by you will be the amount paid by you divided by the total cost of the doctors visit multiplied by 100%.

That is $21/$105 x 100%

Therefore 20% of the cost of last doctors visit was paid by you .

The answer is in the image

Cost of 7 gallons=$24.50

Cost of 1 gallon=24.50/7=3.5

Cost of 15 gallons=15*3.5=52.5

Cost of 15 gallons will be $52.5

For 1 flavor there are 9 topping

Therefore, for 5 different flavors there will be 5*9 choices

No of choices= 5*9

The total nom of code that can be used is equal to 5+3 = 8

where y=Value of coin

x=Age in years

Value of coin after 19 years=2*19+15

Therefore, Value after 19 years=$53

where F=force

a=acceleration

=4300/3.3

=1303.03kg

The solution is given in the image below

tip=18%of $32

tip=(18/100)*32

Total payment=32+5.76=$37.76

Try asking the Studen AI a question.

It will provide an instant answer!

There are no comments.

Investigates

- Houston Life

- Newsletters

WEATHER ALERT

8 warnings, a watch and an advisory in effect for 21 regions in the area

‘it’s absolutely outrageous’: houston resident charged surprise $400 ‘facility fee’ after doctor visit, kprc 2 investigates ‘facility fees’ and what to look for on your medical bills.

Amy Davis , Investigative Reporter

Andrea Slaydon , Senior Investigative and Special Projects Producer

HOUSTON – Unexpected, unexplained fees are driving up the cost of doctor visits for families across Houston. We are talking hundreds of dollars in charges above your co-pay. They’re called “facility fees,” and patients are told days or weeks after their appointments they have to pay up.

“It’s absolutely outrageous,” said Mindy Easterbrook.

Outrageous new charges that Easterbrook has never been charged when she takes her two children with Type 1 diabetes to see their doctor.

“They see an amazing doctor there. We absolutely love her, but we’re getting charged facility fees now by Texas Children’s Hospital on top of our regular doctor fees that we’re being billed,” said Easterbrook.

One $290 item on her bill is labeled “observation/treatment room.” Another fee of $405 says it’s a “room, staff and supply charge.”

Texas Children’s Hospital told Easterbrook she will incur these fees at every visit with her children’s endocrinologist where her daughter and son check in every 3 months.

“For these facility fees, you don’t get a choice. You can’t opt-out. You don’t know what these fees are going for,” said Maribeth Guarino.

Guarino has studied facility fees as a healthcare advocate for the U.S. Public Interest Research Group Education Fund or “PIRG” for short.

She says facility fees are common at hospitals where patients are billed separately for doctors, specialists and room charges. But in recent years as hospital systems buy up doctor’s offices, they are adding these facility fees to regular doctor bills.

RELATED: What is a facility fee?

When did Hospitals in the Houston area start charging facility fees?

Texas Children’s Hospital told KPRC 2 it began adding the fees to its doctor’s offices that it considers “hospital-based clinics” on November 1, 2023.

“Right now, these outpatient departments that hospitals own are licensed under the same number as the hospital and so that’s how they kind of get away with “it’s a hospital location” even though the location might actually be 2-10 miles away from the actual campus of the hospital,” explains Guarino.

Other viewers have sent us their bills showing their own fees. One viewer’s bill shows a $200 facility fee. In their case Blue Cross Blue Shield paid $74 leaving the patient owing $126 above their co-pay.

While the chatter is largely from Texas Children’s patients locally, other hospitals here and across the country are charging the same type of fees.

Methodist, Memorial Hermann and MD Anderson all confirmed with KPRC 2 News that they also charge facility fees to patients visiting doctors outside of their traditional hospitals.

15 states have passed laws limiting the fees in some way but only Connecticut has banned facility fees for non-emergency, outpatient care.

Federal lawmakers are currently working on the ‘Lower Costs, More Transparency’ Act. If passed by both the House and Senate, it would end facility fees outside of traditional hospitals.

Until then patients like Hunter, Skye and their mom don’t have a choice.

“Our kids come first. We have to have them seen,” said Easterbook.

“Patients cannot be on the hook for these charges especially when they’re already struggling to pay and delaying care because they’re afraid of the cost,” said Guarino.

What can I do about facility fees on my medical bill?

So, what can you do about these facility fees? We know that many patients have had those facility fees waived as a one-time courtesy when they called the TCH billing department.

A Texas Children’s spokesperson also told me that telehealth visits and urgent care visits will not incur facility fees.

That federal bill is not before the U.S. Senate where it appears to have bipartisan support. You can reach out to your senator if you want them to ban these fees.

The Texas Hospital Association told KPRC 2 News the fees are necessary. They sent this document that explains that hospitals would have to reduce staff, cut services, and close outpatient clinics if these fees are banned.

KPRC 2 News reached out to several of the larger hospital systems in the Houston area to see if they charge facility fees. Find the full statements below.

Texas Children’s Hospital

Over 70 years ago, Texas Children’s was founded on the guiding principle that every child deserves the highest quality care regardless of their family’s ability to pay. Since then, navigating healthcare has become increasingly complex, but we remain resolute that cost should never stand in the way of our patients receiving the care they deserve. If any of our patients are struggling to either understand their bill or need financial assistance, we have a wonderful team dedicated to assisting them every step of the way. We are fully committed to meeting patient families where they are at and assisting them with any challenges or questions they have.

Why did TCH decide to add the facility fee so that they appear on a patient’s bill after what they believed were regular doctor office visits?

Texas Children’s follows the appropriate guidelines when billing health plans for the services rendered on behalf of a patient. It is important to understand that a patient’s out of pocket expense is determined by the assigned benefits within their individual health plan and not by Texas Children’s.

How can patients know when they will see this fee on their bill before they book an appointment?

Texas Children’s is fully committed to price transparency with our patients and offers a number of ways for them to receive a pre-visit estimate ahead of time.

*It is also important for patients to know that if patients schedule a TeleHealth visit or a visit at a Texas Children’s Pediatrics or Urgent Care location, the visit will not include a facility fee charge as that charge is only applicable in a hospital-based location.

Is there a way for patients who see the same doctor for routine visits (monthly visits, for example) can appeal so that they are not paying the facility fee with each appointment?

The facility fee is applicable to each individual visit in a hospital-based location until a patient meets their insurance deductible, after which the fee for each visit will transition to the co-insurance rate predetermined by the patient’s health insurance plan.

Billing FAQ from TCH

Houston Methodist

Houston Methodist does not charge facility fees at its physician-based clinics. There are a few hospital-based clinics where a facility fee is charged such as the transplant clinic, wound care clinic, radiation oncology clinic and the infusion clinic. Facility fees help hospitals offset the higher cost of providing specialty outpatient services to patients allowing us to provide a higher level of care that is safe and convenient for our community.

Billing FAQ from Houston Methodist

MD Anderson

MD Anderson facilities are hospital-based locations offering multidisciplinary hospital-level care in the outpatient setting, which requires specialized staffing and infrastructure. MD Anderson provides patients with one financial statement, which includes both physician and hospital charges, but these may be processed differently by a patient’s insurance. This information is shared with all new patients and is available online. Patients with questions can contact MD Anderson’s Patient Business Services for clarification.

Memorial Hermann

“Memorial Hermann has approximately 90 hospital outpatient departments across the system. These are not doctor’s offices. They are outpatient departments of the hospital that provide highly specialized services. In outpatient departments with a physician-led care team, the physicians are not employed by Memorial Hermann. In compliance with regulatory requirements, patients are provided notice that they are receiving care in an outpatient hospital department and the physician’s billed services will appear separately from the hospital payment. These hospital payments (also known as “facility fees”) cover all of the other essential aspects of care including nurses, lab technicians, technology and other functions – services for which the hospital would not otherwise be paid. Memorial Hermann does not bill facility fees from any of its primary care clinics.

Offering complex care in an outpatient setting means that care is more affordable and more convenient for patients to access, and these hospital payments enable us to effectively partner with physicians to provide that care. We also know that navigating health care costs is complex, so we offer patients access to resources like our good faith price estimate tool so they can make well-informed decisions about their care.”

Billing FAQ from Memorial Hermann

A weekly newsletter with content from KPRC 2's Amy Davis.

Copyright 2024 by KPRC Click2Houston - All rights reserved.

About the Authors

Passionate consumer advocate, mom of 3, addicted to coffee, hairspray and pastries.

Andrea Slaydon

Award-winning TV producer and content creator. My goal as a journalist is to help people. Faith and family motivate me. Running keeps me sane.

Recommended Videos

- Skip to main content

- Keyboard shortcuts for audio player

Morning Edition

- Latest Show

- About The Program

- Contact The Program

- Corrections

Listen to the featured story from this episode.

When he arranged to undergo top surgery, Cass Smith-Collins of Las Vegas selected a surgeon touted as an early developer of the procedure who does not contract with insurance. "I had one shot to get the chest that I should have been born with, and I wasn't going to chance it to someone who was not an expert at his craft," he says. Bridget Bennett for KFF Health News/Bridget Bennett for KFF Health News hide caption

Shots - Health News

Sign here financial agreements may leave doctors in the driver's seat.

Agreeing to an out-of-network doctor's financial policy, which protects their ability to get paid and may be littered with confusing jargon, can create a binding contract that leaves a patient owing.

Morning news brief

by Leila Fadel , Adriana Morga

Book News & Features

Ai is contentious among authors. so why are some feeding it their own writing.

by Chloe Veltman

Animation fans are mourning the loss of Larry the Barfly on 'The Simpsons'

An Atlanta police officer takes down tents on the campus of Emory University after a pro-Palestinian demonstration Thursday in Atlanta. Mike Stewart/AP hide caption

Campus protests over the Gaza war

As pro-palestinian protests spread, more university leaders weigh police involvement.

by Meg Anderson

Americans are sleeping less because they're also more stressed, poll shows

by A Martínez , Yuki Noguchi

Taylor Swift's new album, 'The Tortured Poets Department,' is setting records

Transgender rights advocates are celebrating a major legal victory.

by A Martínez , Selena Simmons-Duffin

by Katheryn Houghton , Emily Siner

Protesters at Columbia University are now occupying a campus building

by A Martínez , Brian Mann

Federal judges have enormous power over their courtrooms and their chambers, which can leave employees vulnerable to abuse, with few ways to report their concerns anonymously. Chelsea Beck for NPR hide caption

Investigations

Victims of harassment by federal judges often find the judiciary is above the law.

by Carrie Johnson

3 women are infected with HIV after undergoing a vampire facial at a N.M. spa

The irs considers its free direct file test program a success, the 2nd week of testimony is about to begin in trump's n.y. hush money trial.

by Leila Fadel , Andrea Bernstein

Middle East

Palestinians in rafah say they're in limbo as israel threatens an assault.

by Aya Batrawy

The 3-year search to identify a 17-second song clip has been solved

4 n.c. law enforcement officers were shot and killed trying to serve a warrant.

by A Martínez , Kenneth Lee

Ukraine presses military-age Ukrainian men living abroad to register for service

by A Martínez , Joanna Kakissis

Nearly 7 months into the Israel-Hamas war, how do things look for a cease-fire?

Navajo nation is concerned about health risks from trucks hauling uranium ore.

by Michel Marizco

Searching for a song you heard between stories? We've retired music buttons on these pages. Learn more here.

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Take action

- Report an antitrust violation

- File adjudicative documents

- Find banned debt collectors

- View competition guidance

- Competition Matters Blog

New HSR thresholds and filing fees for 2024

View all Competition Matters Blog posts

We work to advance government policies that protect consumers and promote competition.

View Policy

Search or browse the Legal Library

Find legal resources and guidance to understand your business responsibilities and comply with the law.

Browse legal resources

- Find policy statements

- Submit a public comment

Vision and Priorities

Memo from Chair Lina M. Khan to commission staff and commissioners regarding the vision and priorities for the FTC.

Technology Blog

Consumer facing applications: a quote book from the tech summit on ai.

View all Technology Blog posts

Advice and Guidance

Learn more about your rights as a consumer and how to spot and avoid scams. Find the resources you need to understand how consumer protection law impacts your business.

- Report fraud

- Report identity theft

- Register for Do Not Call

- Sign up for consumer alerts

- Get Business Blog updates

- Get your free credit report

- Find refund cases

- Order bulk publications

- Consumer Advice

- Shopping and Donating

- Credit, Loans, and Debt

- Jobs and Making Money

- Unwanted Calls, Emails, and Texts

- Identity Theft and Online Security

- Business Guidance

- Advertising and Marketing

- Credit and Finance

- Privacy and Security

- By Industry

- For Small Businesses

- Browse Business Guidance Resources

- Business Blog

Servicemembers: Your tool for financial readiness

Visit militaryconsumer.gov

Get consumer protection basics, plain and simple

Visit consumer.gov

Learn how the FTC protects free enterprise and consumers

Visit Competition Counts

Looking for competition guidance?

- Competition Guidance

News and Events

Latest news, ftc to host compliance webinar on rule banning noncompetes.

View News and Events

Upcoming Event

Older adults and fraud: what you need to know.

View more Events

Sign up for the latest news

Follow us on social media

--> --> --> --> -->

Playing it Safe: Explore the FTC's Top Video Game Cases

Learn about the FTC's notable video game cases and what our agency is doing to keep the public safe.

Latest Data Visualization

FTC Refunds to Consumers

Explore refund statistics including where refunds were sent and the dollar amounts refunded with this visualization.

About the FTC

Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and education.

Learn more about the FTC

Meet the Chair

Lina M. Khan was sworn in as Chair of the Federal Trade Commission on June 15, 2021.

Chair Lina M. Khan

Looking for legal documents or records? Search the Legal Library instead.

- Cases and Proceedings

- Premerger Notification Program

- Merger Review

- Anticompetitive Practices

- Competition and Consumer Protection Guidance Documents

- Warning Letters

- Consumer Sentinel Network

- Criminal Liaison Unit

- FTC Refund Programs

- Notices of Penalty Offenses

- Advocacy and Research

- Advisory Opinions

- Cooperation Agreements

- Federal Register Notices

- Public Comments

- Policy Statements

- International

- Office of Technology Blog

- Military Consumer

- Consumer.gov

- Bulk Publications

- Data and Visualizations

- Stay Connected

- Commissioners and Staff

- Bureaus and Offices

- Budget and Strategy

- Office of Inspector General

- Careers at the FTC

FTC Announces Rule Banning Noncompetes

- Competition

- Office of Policy Planning

- Bureau of Competition

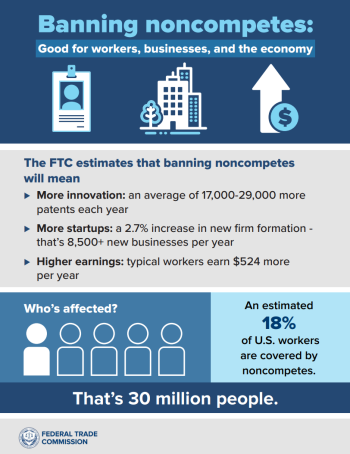

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives - who represent less than 0.75% of workers - can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.

Changes from the NPRM

Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.

Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance.

Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.

The Commission vote to approve the issuance of the final rule was 3-2 with Commissioners Melissa Holyoak and Andrew N. Ferguson voting no. Commissioners Rebecca Kelly Slaughter , Alvaro Bedoya , Melissa Holyoak and Andrew N. Ferguson each issued separate statements. Chair Lina M. Khan will issue a separate statement.

The final rule will become effective 120 days after publication in the Federal Register.

Once the rule is effective, market participants can report information about a suspected violation of the rule to the Bureau of Competition by emailing [email protected] .

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media , read consumer alerts and the business blog , and sign up to get the latest FTC news and alerts .

Press Release Reference

Contact information, media contacts.

Victoria Graham Office of Public Affairs

IMAGES

VIDEO

COMMENTS

See Answer. Question: Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? A. 20% B. 21% C. 25% D. 80%. Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21.

20% percentage of the cost you pay . Step-by-step explanation: Formula . As given . Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. Part value = $21. Total value = $105 . Put all the values in the formula . Percentage = 20% . Therefore the 20% percentage of the cost you pay .

Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? A. 20% B. 21% C. 25% D. 80% E. 84%. A. 20%. You report to your supervisor the average length of chain produced per operating hour each week. The equipment operates 5 days a week for 12 ...

Identify the total cost of the doctor's visit. The total cost of the doctor's visit is $105. Step 2/5 Identify the amount you paid. You paid $21 out of the total cost. Step 3/5 Calculate the percentage of the cost you paid. To find the percentage of the cost you paid, divide the amount you paid by the total cost of the visit.

A, 20%, because 21 divided by 105 times 100 is 20%. (please explain how you got your answer, thank you) Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21.

First, we need to find the total cost of the doctor visit. We know that the health insurance paid $84 and you paid $21. So, the total cost is: $84 + $21 = $105$ Now, we need to find the percentage of the cost that you paid. To do this, we can use the formula: Percentage = $\frac{Your\,Payment}{Total\,Cost} \times 100$ Step 2/2

Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? A. 20% B. 21% C. 25% D. 80% E. 84%. 165. Solution. Luke. Civil engineer · Tutor for 4 years. Answer. 100\% Explanation.

Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? A20% B21% C25% D80% E84% 145. Gauth. Excel in math with Plus benefits! Step-by-step explanations. 24/7 expert live tutors.

Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools. The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Understanding the cost of your doctor visit. In the fourth installment of this 4-part series on health care costs, we look at the different types of care to help you better understand what you'll need to pay. Understanding your health plan costs can help you choose the right coverage and budget for your health care spending.

Your doctor uses this code to bill the insurance company. It tells the insurance company what services you received. ... $105: $33: $25: $127: X-Ray Exam Of Spine - 1 View: 72020: $71: $69 - $77: $24: $18: $93: X-ray exam of the foot: ... And a 50-year-old woman may need a mammogram. As a result, your age affects the cost of your office visit ...

Last Doctors visit cost $105. Health insurance through employer paid $84 and you paid $21. % of cost paid by you will be the amount paid by you divided by the total cost of the doctors visit multiplied by 100%. That is $21/$105 x 100%. 0.2 x 100%. 20%. Therefore 20% of the cost of last doctors visit was paid by you .

Your last doctor visit cost $105 health insurance through your employer pay $84 and you pay the remaining $21 what percentage of the cost if you pay. star. 5/5. heart. 1. verified. Verified answer. Which tools would you use to make chart 1 look like chart 2 in excel. heart. 2. verified.

The tool allows you to estimate what the cost will be for a doctor's visit, test, surgery and other procedures before you step foot in the doctor's office. You'll find costs for more than 400 health care services, allowing you to compare costs by different facilities and doctors nationally. Doing your homework up front has the potential ...

Some of Cigna's plans, for example, allow in-network visits with primary care doctors before the deductible is met, typically for a $30 to $45 copayment, while others do not. "We structured ...

How Much a Doctor's Visit Is Without Insurance. Typically, the cost of a doctor's visit if you don't have insurance is anywhere from $150 to $600. However, there are a variety of factors ...

We have the right solution; Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? ☝️! At maryspreschool you can get the correct answer to any question on 💥: algebra trigonometry plane geometry solid geometry probability combinatorics calculus economics complex numbers.

20% percentage of the cost you pay . Step-by-step explanation: Formula . As given . Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. Part value = $21. Total value = $105 . Put all the values in the formula . Percentage = 20% . Therefore the 20% percentage of the cost you pay .

Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. Part value = $21 Total value = $105 Put all the values in the formula Percentage = 20% Therefore the 20% percentage of the cost you pay . heart outlined.

Your last doctor visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What's percentage of the cost did you pay? 20% is the percentage of the cost did you pay. Solution: Percentage = Part value * 100 / Total value = 21 * 100 / 105; = 2,100 / 105; = 20% .

Unexpected, unexplained fees are driving up the cost of doctor visits for families across Houston. We are talking hundreds of dollars in charges above your co-pay. ... Houston resident charged ...

Shots - Health News. Sign here? Financial agreements may leave doctors in the driver's seat. Tuesday, April 30, 2024. Listen to Full Show.

Your last doctors visit cost $105. Health insurance through your employer paid $84 and you paid the remaining $21. What percentage of the cost did you. black bean Burger $12.99 In addition to the limited menu. The Veggie Palace also increased its menu prices. It costs The Veggie Palace $2.85

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per ...

0.0% Complete Your last doctor's visit cost $105. Health insurance through your employer paid $84, and you paid the remaining $21. What percentage of the cost did you pay? 7 A. 20% B. 21% C. 25% D. 80% E. 84% A Report Content Errors Support o i NA Type here to search. loading. See answer. loading. plus. Add answer +5 pts. loading. Ask AI.