- Search Search Please fill out this field.

- Other Insurance Topics

- Insurance Company Reviews

Generali Global Assistance Travel Insurance Company Review

Extra protection to cover your travel related expenses

Company Overview

In a perfect world, we would never have to change plans or delay a trip or vacation. Since plans do change and you may need extra protection to cover your travel-related expenses, there is travel insurance. One company to consider for your travel insurance needs is Generali Global Assistance, formerly known as CSA Travel Protection Insurance Company, which has been providing protection for travelers since 1991. Even though the company rebranded in 2017 to Generali Global Assistance, there are travel insurance plans that still carry the CSA Travel Protection name.

The company’s U.S. operations are based out of San Diego, California. Generali Global Assistance is owned by Europ Assistance Group (EA), which is a worldwide organization providing emergency assistance services and has been in business since 1963.

Financial Stability

Generali Group has an A (Excellent) rating with A.M. Best Insurance rating organization , as well as a stable A- rating with Fitch and a stable Baa1 rating with Moody's.

Better Business Bureau Rating

The Better Business Bureau (BBB) file was originally opened as the CSA Travel Protection Insurance Company in 1994 and has been an accredited business since 2009. Since the brand change, the customer service rating of Generali Global Assistance has since maintained its “A+” rating with the BBB. There are a total of 197 customer reviews with 556 total customer complaints in three years, as of Sept. 2021. Of those complaints; there were 443 with products/services, 13 with advertising/sales issues, 71 with billing/collection issues, 24 with guarantee/warranty issues, and 5 were delivery issues. Also, of these complaints, 98 were resolved to the customer’s satisfaction. The company has a composite score rating of 1.03 out of 5 stars.

Available Plans

Travel insurance plans available through Generali Global Assistance are the Standard, Preferred , and Premium plans. You can review the information for each plan, receive a quote, and buy coverage right from the Generali Global Assistance Travel Insurance website. Preferred offers the added benefits of covering sports equipment and Premium is designed for expensive cruises tours. All three plans offer a combination of the following travel insurance benefits:

- Trip Cancellation

- Trip Interruption

- Travel Delay

- Baggage Delay

- Missed Connection

- Medical & Dental

- Emergency Assistance & Transportation

- Accidental Death & Dismemberment, Air Flight Accident

Optional Features and Services

You have the option of adding these optional features and services through your Generali Global Assistance travel insurance plan:

- 24-Hour Emergency Assistance Services

- Telemedicine

- No Out-Off-Pocket Medical

- Identity Theft Resolution Services

- Concierge Services

- Rental Care Damage

- Trip Cancellation for Any Reason

Exclusions to Coverage

Generali Global Assistance travel insurance plans are not available for travel to Cuba, Syria, North Korea, Sudan, The Crimea Peninsula in Ukraine, or Iran.

The company has strong financial strength and customer service ratings from the BBB. Generali Global Assistance Travel Insurance has a 10-day free look clause meaning that you can change your mind within 10 days and receive a refund as long as you have not yet left for your trip. There are three travel insurance plans with comprehensive coverage options, making it an easy process to find the right travel insurance plan and buy your policy online.

Generali Global Assistance provides its customers with a 24/7 emergency assistance hotline available from anywhere in the world. There are attractive optional service options including concierge, identity theft resolution, and telemedicine services.

Read your description of coverage carefully. If you have homeowners or renters insurance, those policies are considered primary and Generali Global Assistance will only pay what your primary insurance policy does not pay. Some complaints from policyholders have stated that the policy language is confusing as to what is and is not a valid reason for canceling your trip.

The Bottom Line

It is a good idea to check and see how much coverage you have through other insurance policies before purchasing additional travel insurance. If you feel you need additional coverage than what you already have, Generali Global Assistance Travel Insurance is a good option to consider. They have solid financial strength ratings and have an “A+” rating from the Better Business Bureau. Generali Global Assistance travel insurance plans are customizable according to your travel insurance needs as well as offering attractive optional features.

Contact Information

To learn more about the travel insurance plans available or to receive a quote and purchase your policy, you may visit the Generali Global Assistance Travel Insurance Company website or call toll-free 800-874-2442 in the United States. You can also submit questions and comments by email at [email protected] .

Generali Global Assistance. " CSA Travel Protection: 26 Years of Travel Insurance ."

Europ Assistance. " History ."

Generali Group. " Ratings ."

Better Business Bureau. " Generali Global Assistance Complaints ."

Better Business Bureau. " Generali Global Assistance ."

Generali Global Assistance. " Compare Travel Insurance Plans ."

Generali Global Assistance. " Free Look Period: Our Travel Insurance Refund Policy ."

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Generali Global Assistance Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Generali Global Assistance plans and costs

Which generali travel insurance plan is best for me, coronavirus considerations, how to choose a generali plan online, what isn’t covered with generali, generali insurance, recapped.

- Three plan options.

- Includes wide ranging COVID coverage.

- The premium plan includes pre-exisiting medical condition coverage.

- Rental car coverage only on highest cost plan.

- CFAR only covers 60% of travel costs (75% is found elsewhere).

- Baggage delay benefits don't kick in until 24 hours on the Standard plan.

More travelers than ever are considering travel insurance, but navigating the vast seas of insurance companies and coverage options can leave you feeling less than enthused about your next trip. But if you want to protect your investment, Generali Global Assistance is a notable provider. Here’s what to expect and the plans the company offers.

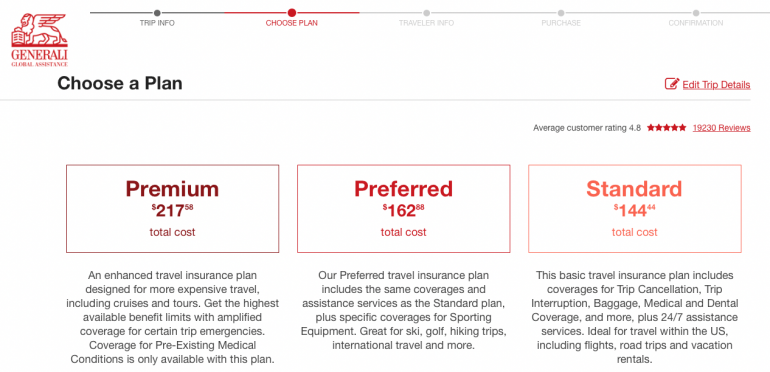

Generali offers three different plans (Standard, Preferred or Premium), depending on what type of trip you’re planning. Each offers a different level of coverage and benefits.

Generali plan cost

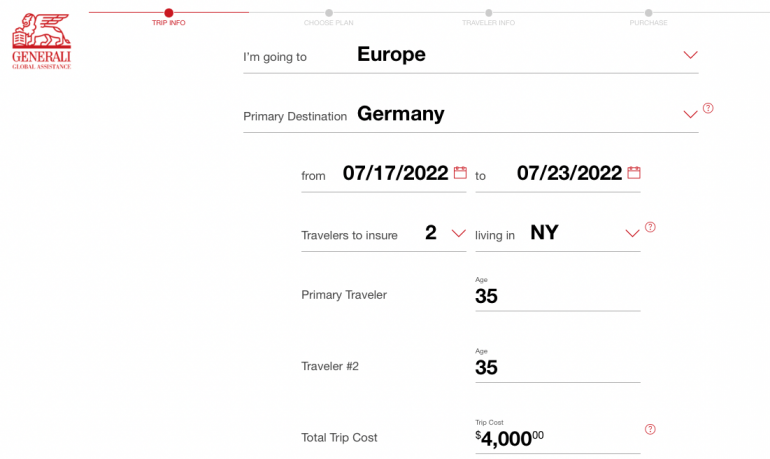

Here’s a closer look at what a standard coverage plan with Generali might cost. Let’s say you and your partner — two travelers in their thirties — are planning to take a roughly $4,000 trip from New York to Germany for one week.

For this itinerary, a Generali Standard plan would cost $144. Rental car coverage isn’t included, but you can add it to your plan for $63 for the week.

The Preferred level of coverage can be a good option for those traveling with expensive gear like golf clubs or skis. For the same sample itinerary, a Generali Preferred plan would cost $162, an $18 upgrade from Standard. Rental car coverage is also extra.

The Premium plan is designed for luxury travel or vacations with a high price tag. Notably, this plan includes rental car insurance for no extra fee. Also important to note that only the Premium plan offers coverage for pre-existing medical conditions . A Generali Premium plan for our sample itinerary would cost $217, a $55 upgrade from Standard.

» Learn more: How to cancel a flight with travel insurance

It’s important to choose the right coverage for you and your trip based on your needs and what each plan covers. So make sure to look at each carefully.

If you have pre-existing medical conditions, your best bet will be to stick with the Premium plan. It’s more expensive, but you’ll be covered no matter what medical issues arise on your trip.

The Standard plan is the only one with no coverage for accidental death and dismemberment during on-the-ground travel (air travel is covered, though).

If you’re traveling with sports equipment, you may want to opt for one of the top two tiers of coverage. Just make sure to accurately estimate how much your gear is worth to ensure you’re getting the coverage you need.

If your trip is worth more, you’re bringing more luggage, etc., consider more expensive coverage. That way, if something goes wrong, you, your possessions and plans are more fully protected.

Unlike some other travel insurance companies, Generali (formerly known as CSA Travel Protection or colloquially as CSA Travel Insurance) offers COVID-19 coverage with every plan. That means that if you, a family member or a travel companion test positive for COVID-19 before or during your trip, you’ll be covered for trip cancellation and interruption, travel delay, medical and dental, and emergency assistance and transportation.

You’ll also be covered if you have to extend your trip due to quarantining or isolation and can’t return home on schedule.

You do have to meet certain requirements to qualify — such as using an approved test and taking it while in front of an authorized supervisor.

When it comes time to get a quote and choose your travel insurance plan, you can do so on the Generali website. Type in trip details like destination, where you’re from, your age, the total cost of the trip and your travel dates. Quotes for all three tiers of plans will be presented.

Then, select add-ons like rental car insurance if you’re not opting for the Premium plan and start the checkout process.

Like many travel insurance policies, there are several incidents that aren’t covered by Generali travel insurance. Examples include injuries that result from mental disorders, pregnancy, injuries as a result of being under the influence of drugs or alcohol, or if you are flying an aircraft yourself.

Destination matters, too. As of publication, you can’t get coverage for travel to Belarus, the Crimea Peninsula, Cuba, Iran, North Korea, Russia, Syria or Ukraine. Also, you won’t be covered for anything that results from acts of war or civil disorder.

If you’re participating in extreme sports or activities like skydiving, mountain climbing or backcountry skiing, many benefits won’t be covered.

No matter what policy you choose, read the fine print before your buy, including everything that’s excluded from coverage. That will help ensure there are no surprises if your trip goes awry.

Generali provides three tiers of travel insurance for those who want to protect their nonrefundable trip expenses and/or who want to have a safety net in case their travels are disrupted or canceled.

Just like with any travel insurance policy, check to see if you’re already covered before you buy ( many travel credit cards offer travel insurance ), determine what kind of coverage you need and how much, and always read the details of what is and isn't included in coverage. That goes for policies available from Generali Travel Insurance as well as other providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Business Partners

Buy Travel Insurance for Your Trip

Help protect your vacation investment

You dream. You plan. You save. Even the best laid travel plans can be affected by trouble at home, medical emergencies, lost luggage, flight delays or severe weather. Customers buy travel insurance and assistance plans from Generali Global Assistance to help protect vacation investments from certain unforeseen events that could upset travel plans and cost you.

To buy travel insurance for your trip, cruise or vacation visit the Generali Travel Insurance booking website .

Get A Quote

Why Buy Travel Insurance?

Problems happen more often than you think. One in six U.S. adults reported having to cut a trip short or change travel plans. And of those affected, only 22% had travel insurance, according to a recent U.S. Travel Insurance Association survey. 1

Travel protection plans include coverages and services that can help you before, during and after your trip:

- Trip Cancellation coverage

- Trip Interruption coverage

- Travel Delay

- Baggage Loss and Delay

- Medical and Dental coverage

- Emergency Assistance and Transportation

- 24-Hour Emergency Assistance Services Hotline

- Concierge Services

- Identity Theft Resolution Services

Buy Travel Insurance with a Free Look Period

We proudly stand behind our products and services. That’s why we offer a 10-day free look period . If you aren’t completely satisfied with your travel protection plan, you can cancel your purchase within 10 days and receive a full refund, as long as you haven’t left for your trip or filed a claim.

Still not convinced? See ratings and reviews from verified Generali Global Assistance customers.

After what we endured on this trip, it is nice to deal with a service-oriented company! - Richard M. from Rochester, MN

Travel Protection Plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services and Generali Global Assistance & Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions. Benefits and services are described on a general basis; certain conditions and exclusions apply. Travel Retailers may not be licensed to sell insurance in all states, and are not authorized to answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance. This Plan provides insurance coverage for your trip that applies only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this Plan with your existing life, health, home and automobile policies. The purchase of this Plan is not required in order to purchase any other travel product or service offered to you by your travel retailers. Travel retailers receive payment from CSA related to the offer of travel insurance. If you have any questions about your current coverage, call your insurer, insurance agent or broker. This notice provides general information on CSA’s products and services only. The information contained herein is not part of an insurance policy and may not be used to modify any insurance policy that might be issued. In the event the actual policy forms are inconsistent with any information provided herein, the language of the policy forms shall govern.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

EDITOR'S PICK

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

CSA Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is CSA rated?

Overall rating: 3.4 / 5 (very good), csa plans & coverage, coverage - 3.5 / 5, emergency medical coverage details, baggage coverage details, csa financial strength, financial strength - 3 / 5, csa price & reputation, price & reputation - 3.5 / 5, csa customer assistance services, extra benefits - 3.5 / 5, travel assistance services.

- Return Travel Arrangements

- Lost Baggage Search

- Lost Passport/Document Assistance

- Emergency Cash

- Translation Services

- Legal Assistance Referral

- Roadside Assistance

Emergency Medical Assistance Services

- Physician Referral

- Emergency Medical Case Management

- Arrange Medical Payment Where Available

- Emergency Prescription Replacement

- Eyeglass Replacement Assistance

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

- Ground Transportation Recommendations

Our Comments Policy | How to Write an Effective Comment

113 Customer Comments & Reviews

- ← Previous

- Next →

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

Enter your ZIP Code!

Get a quote today., csa travel protection | travel insurance review.

CSA travel insurance is owned by Europe Assistance, an insurance company that specializes in providing emergency assistance services.

Launched in 1991, and headquartered in San Diego, California, CSA Travel Insurance has protected millions of travelers worldwide from common travel issues such as canceled trips and delays, as well as 24/7 assistance with emergencies such as hurricanes and medical evacuations by helicopter.

Whether you’re a single person traveling alone or a budget-conscious parent taking a family trip, CSA has options for you.

CSA Travel Protection

The CSA Custom Travel Protection Plan is designed to offer affordable trip cancellation insurance for travelers of all ages.

Coverage can be purchased per single trip and canceled within ten days of purchase if needed.

Their online cost calculator provides obligation-free travel insurance quotes .

CSA offers a variety of affordable coverage, and its range of service providers across the globe ensure that customers can travel with peace of mind, knowing that help is only a phone call away.

CSA received an A+rating from the Better Business Bureau (BBB), and its underwriter, Generali , has high marks from A.M. Best and Moody’s.

Benefits of CSA Travel Insurance

CSA offers two types of trip insurance for travelers of all ages which cover trip cancellation, delays, and interruptions.

Customers have a ten day, obligation-free period to cancel their travel insurance should they decide they no longer need it, and get full reimbursement as long as they have not yet left for their trip.

Customers may purchase any one of the CSA Travel Protection Plans online for their convenience.

Medical assistance, baggage cover, accidental death, and group cover are available options, and children are protected under their parents’ coverage.

Travelers can have peace of mind knowing that 24/7 customer support is available from over 108,000 service providers internationally.

There are no exclusions on the CSA Custom Travel Protection Luxe Plan, and both CSA trip insurance packages offer extras that include return travel arrangements, rebooking assistance, lost baggage search, and legal aid.

CSA’s travel insurance reviews have been favorable thanks to exclusive services such as ‘Consult a Doctor’, which links customers to medical professionals anywhere in the world in case an emergency strikes while traveling abroad.

What’s Covered With CSA Travel Insurance?

The most common claims covered are:

- Trip cancellation: If you’re forced to cancel your vacation for any of the reasons covered by CSA Trip Insurance, you may be reimbursed in full. For more flexibility regarding cancellations for any other reason, make sure you add it to your travel insurance package when making your first deposit.

- Trip interruption: Regardless of whether you fall sick with the flu or you’re forced to return to work due to unforeseen circumstances, the costs for a return flight or for unused accommodations could be covered by the trip insurance.

- Travel delays and missed connections: Severe weather can interrupt flights for longer than expected, even if you’ve allowed for delays in your travel schedule. A holdup during the first leg of a trip can result in missing the next flight, cruise, or tour departure. CSA trip insurance provides ample coverage for delays and missed connections.

- Baggage delay and loss: In the event that an airline loses your luggage, they won’t cover the lost items’ cash value, quite an annoyance when the luggage contains essential items such as clothes and much-needed toiletries. Likewise, the airline isn’t required to provide essential items if there is baggage delay. CSA’s Custom Travel Luxe Plan gives you $500 for replacing baggage whether it’s lost or delayed by the airline or for any other reason.

- Medical expenses: The Custom Luxe plan provides generous coverage for a wide range of medical expenses while you are traveling. This high-end plan also covers accidental death and dismemberment, including funeral expenses.

- Emergency assistance: The 24-hour travel hotline helps travelers transfer cash, find a doctor, rent a car in the event of an emergency, or make an emergency airline reservation. Concierge and emergency assistance services are also provided.

CSA Travel Insurance Plans

CSA Trip Insurance offers two different plans depending on your budget:

CSA Custom Travel Protection Luxe Plan

An ideal, comprehensive coverage plan for single travelers or groups, CSA’s Luxe Plan offers a range of high-end options such as full reimbursements for trip cancellations and comprehensive coverage in the event of trip interruptions, travel delays, or missed connections.

If baggage is lost or delayed, the plan may pay out up to $500 for items such as clothing and toiletries, even if your luggage is found later.

Coverage is also provided for medical emergencies, airline reservations, cash transfers, emergency car rentals, and for dependents through their parents.

CSA Custom Travel Insurance Plan

This budget-friendly policy offers several perks, although its reduced costs come with coverage limits.

Travelers enjoy coverage that includes concierge service and identity theft resolution as well as 24-hour emergency medical services.

In the event of lost or stolen luggage, CSA trip insurance covers its cash value.

Nonetheless, the CSA Custom Travel Protection Plan does not offer coverage for preexisting conditions.

Even with its limitations, customers still enjoy plan benefits such as reimbursement for trip cancellations and delays, lost baggage, and certain medical and dental emergencies (excluding preexisting conditions).

The following chart compares the covered reasons for the Custom Travel Protection Luxe Plan and the Custom Travel Protection Plan.

The following chart compares the limits between the Custom Travel Protection Luxe Plan and the Custom Travel Protection Plan.

Add-ons such as travel assistance services, return travel arrangements, and roadside assistance may also be purchased on the CSA Custom Travel Protection Luxe Plan.

Add-ons provide protection that goes above and beyond regular benefits.

On the other hand, the optional cover on the Custom Travel Protection Plan is limited to $9 per day for rental car damage.

How Much Does CSA Travel Insurance Cost?

Travel insurance costs are based on factors such as destination and departure lag, and usually range between four and eight percent of the total trip cost.

CSA does not have age limits for travelers, and dependents are covered through their parents on both the Custom Luxe and Custom Travel Protection Plans.

However, the coverage is only valid for single trips.

Online quotes are based on the total cost of the trip and are available in real-time on the CSA website, allowing travelers to immediately determine the amount of travel insurance they’ll need.

All refunds and claims must be made within ten days of purchasing the policy, either full reimbursements for trip cancellations or unused accommodations and return flight reimbursement for trip interruptions.

Claims can be started online through the CSA website or through fax, email, or regular mail.

CSA Travel Protection Company Ratings & Reviews

Despite receiving some negative reviews, CSA Travel Insurance has an A+ rating from the BBB.

CSA strives to resolve all customer queries and provides feedback to its customers. Negative reviews are usually related to terms and conditions stated in the fine print on insurance contracts.

In 2017, CSA Travel Protection won two Stevie ® Awards for Sales and Customer Services. CSA Travel Protection was voted one of the best trip insurance companies in 2018.

Financial Stability

CSA Travel Insurance policies are underwritten by Generali , an Italian insurance company founded in 1831.

As of 2010, Generali was the world’s second-largest insurer (based on revenue) making it a financially sound international company.

Financial strength is essential since the insurer must be able to pay its customers’ current and future claims.

CSA has earned Moody’s Long-term Corporate Obligation Rating of Baa2 implying moderate credit risk, which is acceptable in the travel industry.

CSA’s A.M. Best financial rating is a+.

CSA Travel Insurance Customer Assistance Services

Travelers can call any of the more than 108,000 service providers available internationally for assistance ranging from emergency cash transfers, identity theft resolution services, eyeglass, and medication replacement, to return travel arrangements.

Help is available over the phone 24/7 eliminating time zone difference and providing peace of mind for travelers requiring assistance at any time.

CSA lacks basic digital options, as it does not have a mobile application, and their online experience only offers an online cost calculator that lets customers determine the cost of insurance per trip.

Furthermore, apart from commenting on review pages, customers can expect some delays receiving responses to emails or for an operator to answer their call.

Customer assistance does include help with rebooking, lost baggage search, lost passport/document assistance, emergency cash, translation services, legal assistance, and roadside assistance.

Additional benefits include medical assistance services, physician referral, medical case management, arrangements for medical payments, emergency prescription replacement, and eyeglass replacement.

Concierge services provided by CSA include restaurant referrals and reservations, event referrals and bookings, and ground transportation.

CSA Travel Insurance Phone Number & Contact Information

- Homepage URL: https://shop.generalitravelinsurance.com/csa-travel-protection/

- Provider Phone: (877) 243-4135 – Toll-free in the United States, (240) 330-1529 – Collect from anywhere else in the world

- Headquarters Address: CSA Travel Protection, P.O. Box 939057, San Diego, CA 92193-9057

- Year Founded: 1991

Best Alternatives to CSA Travel Insurance

Not satisfied with what CSA has to offer? These companies provide great travel insurance alternatives:

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

This site requires that you have JavaScript enabled in order to provide you with the best user experience. Please see your device or browser settings to enable JavaScript or click here for instructions .

Coronavirus (COVID-19) Notice

We are experiencing a high volume of customer phone calls and emails. You may experience an extended wait. Coronavirus coverages vary by plan purchased. Please read our Coronavirus FAQ page for more information.

Vacation Rental Insurance

Safeguard your trip with csa travel protection.

- Why Should I Buy?

- What Could Happen?

- Coverage Overview

- Plan Details

- Vacation Rental Damage Protection

- Claims Information

- Claim Forms

- Emergency Information

- Travel Insurance Alerts

Get a Free Quote

Before You Go

Unable to travel because you're sick? Kids making up their snow days on the first day of family vacation? No problem! Trip Cancellation coverage keeps you from losing your vacation savings if you need to cancel for a covered reason. Want to plan additional activities before you get there? Our Concierge Services can help you make restaurant reservations, order flowers, arrange tee times and more at your request.

During Your Vacation

Even when everything goes right, vacations can be a stressful time: making flights, renting cars, traveling with young children, finding activities .... the last thing you need is something to go wrong. But if it does, CSA Vacation Rental Insurance can help you keep your cool. With coverage for Baggage Delay, Emergency Assistance and Transportation, Trip Interruption and more, you can focus on the more important things. Our designated assistance provider can even help with the smaller issues that can plague travelers, such as medical referral and replacement of medication or eyeglasses.

After You're Home

At CSA we strive to keep our claims process as hassle-free as possible. You will have a dedicated claims representative working with you from start to finish, making sure you receive the responsive, friendly service you need. As identity theft can be a bigger concern while traveling, Identity Theft Resolution Services are included and offer you six months of service after your scheduled departure date.

- Privacy Policy

Customer Service (866) 999-4018

Copyright © 2024 CSA Travel Protection ® , Company Code: 805-93, Approval Code: B030_14_12

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures

This site requires that you have JavaScript enabled in order to provide you with the best user experience. Please see your device or browser settings to enable JavaScript or click here for instructions .

- Agent Login

- Product Details

- Travel Resources

- Agent Resources

- What Could Happen?

- Why Choose CSA?

Testimonials

- Freestyle/Freestyle Luxe

- Packing List

- Frequently Asked Questions

- Claims Information

- Claim Forms

- Required Claim Documents

- Agent Toolbox

- Frequently Asked Questions

- CSA Affiliate Program

Get a Quick Quote!

"...While we may have been skeptical of travel insurance providers, our interaction with you as reassured us and we will definitely use CSA when we rebook our trip. Thank you again."

– Lee and Margo G. from Petaluma, CA

Read other stories!

Travel Insurance FAQs

Who do I call if I have an emergency while on my trip?

What can I insure?

What destination do I select online when visiting multiple countries?

What services are available to me before, during and after my trip?

What if I change my mind?

How do I file a claim?

What is a foreseeable event?

- Our Underwriter

- Assistance Provider

CSA - A Trusted and Respected Innovative Company

CSA Travel Protection proudly delivers quality travel insurance and emergency services to our business partners and customers. Founded in 1991 and based in San Diego, California, CSA combines customer-driven innovation and risk management to create strategic solutions for our customers and business partners. Benefits and pricing are built on common-sense needs from customers, travel professionals, and underwriter .

CSAis owned by Generali Global Assistance (GGA), formerly Europ Assistance in the U.S., based in Bethesda and a leader in the assistance industry since its founding in 1963. GGA is a division of the multinational Generali Group which in over 200 years has built a presence in more than 60 countries with 470 companies and nearly 80,000 employees.

Exceeding Expectations is Our Mission

CSA is dedicated to providing customized travel insurance, related products, and comprehensive administrator services to exceed the expectations of our business partners and the traveling public, through quality customer service, innovative systems, and analytical expertise. With over 20 years of experience, CSA has developed a reputation for standing behind its customers and offering products and services to meet their needs.

Home | Terms of Use | Contact Us | Site Map | About CSA | Help | Privacy Policy | CCPA

Orders & Information (800) 348-9505 | Copyright © 2024 CSA Travel Protection ® , Company Code: 805-93

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures .

If you have a producer or agent code, enter it in the box above and click Submit to proceed.

Note: If you do not enter a producer/agent code, or wish to proceed by clicking Cancel, be advised the plan and pricing you choose may differ from the CSA product offered by your travel agent .

sign up and keep track of your travel insurance events

Compare Travel Insurance and Assistance Plans

Insurance coverages.

Underwritten by Generali U.S. Branch

If you, a family member or a traveling companion are diagnosed with COVID-19 before or during your trip, and meet the requirements for coverage due to sickness , you can be covered for Trip Cancellation, Trip Interruption, Travel Delay, Medical & Dental, and Emergency Assistance & Transportation, in addition to our 24/7 Travel Support Services.

$500 Emergency Dental expense limit

$10,000 limit applies for companion hospitality expenses

Travel Services

Provided by Generali's designated provider

Optional Coverages

Not available to residents of Texas

Not available to residents of New York

Reimburses you up to 60% of the penalty amount when you cancel for any reason. Available as an optional upgrade to the Premium plan if purchased within 24 hours of initial deposit and other requirements are met. Please see a sample Description of Coverage or Policy for details.

Is CFAR right for me?

Travel protection plans on this website are only available to U.S. residents. Generali Global Assistance cannot provide travel protection for trips to Afghanistan, Belarus, Burkina Faso, Central African Republic, Cuba, Haiti, Iran, Iraq, Israel, Lebanon, Libya, Mali, Myanmar, North Korea, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, the Russian Federation, Crimea, and the Zaporizhzhia, Kherson, Donetsk and Luhansk People's regions.

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

This site requires that you have JavaScript enabled in order to provide you with the best user experience. Please see your device or browser settings to enable JavaScript or click here for instructions .

- Traveler Login

Buy Travel Insurance

Booking travel insurance?

Click here to be re-directed to our new website under a new company name, Generali Global Assistance . Generali offers the same CSA-quality plans and outstanding customer service that travelers have relied on for over 25 years.

Get A Quote

Already have a CSA plan? Click here

Already working with a Travel Agent? Click here

CSA Travel Protection does not sell plans for travel to Cuba, Syria, North Korea, Sudan, The Crimea Peninsula in Ukraine, or Iran.

Who do I call if I have an emergency while on my trip?

Copyright © 2020 CSA Travel Protection ® , Company Code: 805-93, Approval Code: A140_16_05 Travel insurance coverages are underwritten by: Generali U.S. Branch, New York,NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures

Life is unpredictable and vacations are worth protecting. Vacation rental insurance and Damage Protection from Generali Global Assistance help guard your vacation investment from certain unforeseen events and accidents that might otherwise cost you a bundle. One purchase covers everyone staying at your vacation rental!

The plan cost includes the travel insurance premium and assistance services fee.

Travel protection plans on this website are only available to U.S. residents. Generali Global Assistance cannot provide travel protection for trips to Afghanistan, Belarus, Burkina Faso, Central African Republic, Cuba, Haiti, Iran, Iraq, Israel, Lebanon, Libya, Mali, Myanmar, North Korea, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, the Russian Federation, Crimea, and the Zaporizhzhia, Kherson, Donetsk and Luhansk People's regions.

Vacation Rental Insurance Plans

Why buy vacation rental insurance.

Vacation Protection

- If you need to cancel or interrupt your trip, how much prepaid trip cost could you get back without vacation insurance? With it, you can be reimbursed for lost vacation rental costs, flights, rental cars, entertainment and more.

- Hurricanes and beach vacation rentals don’t mix. Be prepared if a hurricane becomes a trip-wrecker.

Damage Protection

While no one expects it on vacation, accidents happen. And no one wants to lose their security deposit.

The Travel Secure plan includes vacation rental damage protection that can cover you in the case of accidental damage to the rental and reimburse you if your damage deposit is withheld due to a covered loss.

Traveler Protection

- Whether it’s simple treatment for a fever, a visit to the emergency room, or the rare need for medical evacuation by air ambulance, we’re there for you 24/7/365. See our COVID-19 Travel Insurance Guide

- Travel assistance services, such as Roadside Assistance and ID Theft Resolution

- All guests staying at the vacation rental are covered.

Frequently Asked Questions

Yes. Everyone staying at the reservation is insured. Note that some coverages are subject to plan maximums.

You can qualify for coverage for pre-existing medical conditions as long as the plan is purchased prior to or within 24 hours of your final trip payment, you are medically able to travel at the time the plan is purchased, and all prepaid trip costs that are subject to cancellation penalties or restrictions have been insured.

Review Plan Documents for full details

The Travel Secure plan includes Damage Protection, which covers for unintentional damage to the vacation home during your stay. You can be reimbursed up to $1,000 if you are charged for covered losses or if your damage security deposit is withheld.

See More FAQs

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plan cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

IMAGES

VIDEO

COMMENTS

The plans combine the best of CSA Travel Protection, with some extras, like Sporting Equipment coverage. No hassle refund Buy with confidence, knowing you have at least 10 days from the time of purchase to review your travel insurance and cancel the plan for a full refund of the plan cost if it doesn't meet your needs (as long as you have not ...

4. Their Plans . With a Custom Plan and a Custom Luxe plan, their products offer strong coverage to suit the needs of most travelers. Any number of things can happen on a trip, and CSA Travel Protection covers most of it through these two plans. Medical expenses, travel delays, baggage losses, and even travel emergencies are covered under CSA ...

Travel insurance plans provided by Generali Global Assistance (Formerly CSA Travel Protection) are backed by their Customer Commitment to provide superior products and services, attentive customer care and personalized claims handling. With a Generali plan you can rest assured that they will uphold their reputation and stand by you in a ...

Generali Global Assistance, formerly known as CSA Travel Protection, pioneered the vacation rental travel insurance business in 1992 and we've been the industry leader for decades.We pride ourselves on providing the support that is crucial for happy and safe travel. We specialize in travel insurance and assistance services designed to help protect your vacation rental trip and travelers.

CSA Travel Protection, a leading provider of travel insurance, today announced that it is rebranding to Generali Global Assistance . This corporate initiative is part of a broader organizational program to rebrand several Europ Assistance business lines in the United States to Generali Global Assistance. Europ Assistance is part of the Generali ...

Since plans do change and you may need extra protection to cover your travel-related expenses, there is travel insurance. One company to consider for your travel insurance needs is Generali Global Assistance, formerly known as CSA Travel Protection Insurance Company, which has been providing protection for travelers since 1991.

Find what you need from CSA Travel Protection & Generali Global Assistance travel insurance: buy a plan, partner with us, start a claim, and more. ... NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures.

Unlike some other travel insurance companies, Generali (formerly known as CSA Travel Protection or colloquially as CSA Travel Insurance) offers COVID-19 coverage with every plan.

Travel Protection Plans are administered by Customized Services Administrators, Inc., CA Lic. No. 821931, located in San Diego, CA and doing business as CSA Travel Protection and Insurance Services and Generali Global Assistance & Insurance Services. Plans are available to residents of the U.S. but may not be available in all jurisdictions.

Overall Rating: 3.4 / 5 (Very good) CSA Travel Protection is one of the leading travel insurance providers in the industry, despite their average financial ratings. One of the features unique to their plans is their Consult a Doctor service, that puts customers in touch with medical professionals, no matter where they may be.

CSA Travel Protection. The CSA Custom Travel Protection Plan is designed to offer affordable trip cancellation insurance for travelers of all ages. Coverage can be purchased per single trip and canceled within ten days of purchase if needed. Their online cost calculator provides obligation-free travel insurance quotes.

This plan gives you $500 for replacing your baggage whether it's lost or delayed by the airlines or for another reason. Medical expenses - The Custom Luxe plan has generous coverage for medical expenses while you're traveling. It also covers accidental death and dismemberment, including funeral expenses. Emergency assistance - If you ...

But if it does, CSA Vacation Rental Insurance can help you keep your cool. With coverage for Baggage Delay, Emergency Assistance and Transportation, Trip Interruption and more, you can focus on the more important things. Our designated assistance provider can even help with the smaller issues that can plague travelers, such as medical referral ...

CSA Travel Protection proudly delivers quality travel insurance and emergency services to our business partners and customers. Founded in 1991 and based in San Diego, California, CSA combines customer-driven innovation and risk management to create strategic solutions for our customers and business partners. Benefits and pricing are built on ...

Great for ski, golf, hiking trips, international travel and more. This basic travel protection plan includes coverages for Trip Cancellation, Trip Interruption, Baggage, Medical and Dental Coverage, and more, plus 24/7 assistance services. Ideal for travel within the US, including flights, road trips and vacation rentals.

The budget-minded traveler will appreciate the CSA Travel Protection Custom plan. It is a family-friendly policy that includes typical travel insurance coverage with a few perks and comfortable limits. For example, it offers identity theft resolution and concierge service. Also, a traveler receives 24-hour emergency services from a trained doctor.

Get Group Travel Insurance from CSA Travel Protection for your group vacation. The CSA Group Plan provides comprehensive coverage that protects group travelers against unexpected events such as trip cancellation, trip interruption, emergency medical situations, and terrorism in departure and destination cities. It also provides Worldwide 24-Hour Emergency Assistance Services for rapid aid with ...

CSA Travel Protection is now selling consumer travel insurance plans as Generali Global Assistance. Learn more inside. CSA plan holders can still file claims and access 24/7 Emergency Assistance Services and support. ... CSA Travel Protection does not sell plans for travel to Cuba, Syria, North Korea, Sudan, The Crimea Peninsula in Ukraine, or ...

For globetrotting or large homes: An enhanced plan with maximum protection including coverage for accidental vacation rental damage. Get the highest available benefit limits, plus sporting equipment coverage. ... 2024 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: BC01 17 04 ...

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers: Trip cancellation coverage up to $100,000. Trip interruption coverage up to $150,000. Emergency ...