Get the Scotiabank Passport ® Visa Infinite * Card

Are you a scotiabank customer with access to online banking.

Are you new to Canada in the past three years? Visit a branch to apply. Use our Branch Locator

Get the Scotiabank American Express ® Card

Are you new to Canada in the past three years? Visit a branch to apply. Use our Branch Locator

Get the Scotiabank Gold American Express ® Card

Get the scotiabank platinum american express ® card, get the scotiagold passport ® visa * card.

Trending Search is available and can be access through arrow keys

- Bank Your Way

New to Scotia OnLine? Activate Now

Travel & lifestyle credit cards

Get a card that rewards your lifestyle — whether that’s travelling the world, sporting the latest tech, or redeeming for your favourite gift cards., choose the credit card that’s right for you.

Scotiabank Passport ® Visa Infinite * Card

Earn up to $1,300+ in value in the first 12 months, including up to 40,000 bonus Scene+ points and first year annual fee waived. ‡

Earn 3 Scene+ points 1 on every $1 you spend at Sobeys, Safeway, IGA, Foodland & Participating Co-ops and more.

Annual fee: $150 Interest rates: 20.99% purchases / 22.99% cash advances

Scotiabank Gold American Express ® Card

Earn up to $650 * in value in the first 12 months, including up to 40,000 bonus Scene+ points . 1

Earn 6 Scene+ points 2 on every $1 CAD you spend in Canada at Sobeys, Safeway, FreshCo, Foodland and more.

Annual fee: $120

Interest rates: 20.99% purchases / 22.99% cash advances

Scotiabank American Express ® Card

Earn up to 7,500 bonus Scene+ points within your first 3 months (that’s up to $75 towards travel). 4

Earn 3 Scene+ points 1 on every $1 you spend at Sobeys, Safeway, FreshCo, Foodland and more.

Annual fee: $0 Interest rates: 19.99% purchases / 22.99% cash advances

Scotiabank Platinum American Express ® Card

Earn up to $2,100* in value in the first 14 months, including up to 60,000 4 bonus Scene+ points .

Earn 2X the Scene+ points 1 for every $1 you spend.

Annual fee: $399 Interest rates: 9.99% purchases / 9.99% cash advances

Plan today for a secure tomorrow

Scotia credit card protection.

New! Discover your credit card rewards

Enter your monthly spending details to compare Scotiabank's credit card benefits and calculate your rewards.

Manage your card

Do more with your card, helpful resources.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

Scotiabank Gold American Express Review 2024: Is It Worth It?

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

NerdWallet Rating

NerdWallet CA

Great for travellers who collect Scene+ points.

If you’re looking for an Amex that earns extra Scene+ points and you’ve always wanted a Priority Pass membership, this card may be worth considering. Learn more about our star rating methodology.

The Scotiabank Gold American Express is one of four Amex cards offered by Scotiabank. Cardholders earn Scene+ points on select grocery, restaurant, entertainment, transit and streaming purchases. However, points can’t be spent outside of the Scene+ platform.

Scotiabank Gold American Express® Card

- Annual Fee $120

- Interest Rates 20.99% / 22.99% 20.99% on purchases. 22.99% on cash advances.

- Rewards Rate 1x-6x Points Earn 6X Scene+ points for each $1 CAD charged to your account on all eligible purchases¹ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op. Earn 5X Scene+ points for every $1 CAD spent on eligible grocery stores, restaurants, fast food, and drinking establishments. Includes popular food delivery and food subscriptions. Earn 5X Scene+ points for every $1 CAD spent on eligible entertainment purchases. Includes movies, theatre, and ticket agencies. Earn 3X Scene+ points for every $1 CAD spent on eligible gas and daily transit. Includes rideshare, buses, taxis, subway, and more. Earn 1X Scene+ point for every $1 spent on every other purchase.

- Intro Offer Up to 40,000 Points To qualify for the 40,000 bonus Scene+ points offer: 1. Earn 20,000 bonus Scene+ points by making at least $1,000 in everyday eligible purchases in your first 3 months. 2. Plus, for a limited time, you are eligible to earn a 20,000 Scene+ point bonus when you spend at least $7,500 in everyday eligible purchases in your first year. Offer ends July 1, 2024.

- Earn up to $650* in value in the first 12 months, including up to 40,000 bonus Scene+ points. Offer ends July 1, 2024.

- You will not pay 2.5% foreign transaction fees on any foreign currency purchases, including online shopping and when travelling abroad. Only the exchange rate applies.

- Earn 5X Scene+ points for every $1 CAD spent on eligible grocery stores, restaurants, fast food, and drinking establishments. Includes popular food delivery and food subscriptions.

- Earn 5X Scene+ points for every $1 CAD spent on eligible entertainment purchases. Includes movies, theatre, and ticket agencies.

- Earn 3X Scene+ points for every $1 CAD spent on eligible gas and daily transit. Includes rideshare, buses, taxis, subway, and more.

- Earn 1X Scene+ point for every $1 spent on every other purchase.

- You’ll earn 6X Scene+ points for each $1 CAD charged to your account on all eligible purchases¹ at Sobeys, IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry and Co-Op.

- Discounted Priority Pass™ membership, which grants you access to over 1200 VIP lounges around the world.

- Score deals on shopping, dining, travel and more with Amex Offers®, and experience special events and discounts with American Express Invites®.

- Access to Amex Front Of The Line® presale and reserved tickets.

- To be eligible, $12,000 (individual) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- Terms and Conditions Apply. Click ‘Apply Now’ for complete details.

- Full review

- Customer ratings

- Eligibility

- How to apply

- Amex Gold vs Cobalt

- Rating methodology

Scotiabank Gold American Express full review

The Scotiabank Gold American Express is one of three Amex cards offered by the bank. You can earn Scene+ points on select grocery, restaurant, entertainment, transit and streaming purchases. However, you can’t earn cash back, and points can’t be spent outside of the Scene+ platform.

Benefits of the Scotiabank Gold Amex

- 24/7 concierge customer service.

- Discounted membership to Priority Pass, which grants access to more than 1,200 airport lounges worldwide.

- Extensive travel insurance perks, including hotel burglary, flight cancellation and lost luggage coverage.

- No foreign transaction fees , which means you just pay the exchange rate.

Drawbacks of the Scotiabank Gold Amex

- No cash-back rewards.

- Points can’t be used or transferred outside of the Scene+ platform.

Who should get the Scotiabank Gold American Express card?

The Scotiabank Gold American Express card is a great choice if you:

- Collect Scene+ points. Scene+ points can be used to purchase a range of products and services, such as movie tickets, flights, groceries and more.

- Don’t plan to carry a balance month-to-month. While not unusually high, the card’s 20.99% purchase APR is among the highest of Scotiabank’s credit cards. Therefore, this card may be a better fit if you’re confident you will pay off the balance in full each month.

Is the Scotiabank Gold American Express worth it?

Whether the Scotiabank Gold Amex makes sense for your wallet depends on how you want to earn rewards. If you’re looking for a card that offers Scene+ points, has Amex perks and a low income requirement, this card may be worth it. However, if you want a card that offers cash back rewards or low interest rates, you’ll need to look elsewhere.

Scotia Bank customer ratings

- Below average in customer satisfaction: Scotiabank ranks 7th out of 13 issuers in J.D. Power’s 2023 Canada Credit Card Satisfaction Study.

- Poor Trustpilot rating: 1.2 out of 5 possible stars based on more than 860 customer reviews, as of this writing.

- Low Better Business Bureau rating: 1.17 out of 5 possible stars based on more than 100 customer reviews, as of this writing. Scotiabank is not accredited by the BBB itself.

Scotiabank Gold American Express eligibility

Who qualifies for the scotiabank gold american express card.

To qualify for the Scotiabank Gold Amex, you must:

- Be a Canadian resident.

- Be at least the age of majority.

- Have no history of bankruptcy in the last seven years.

- Have a minimum annual gross income of $12,000.

Approximate credit score needed for approval

Canadian credit card issuers rarely disclose required credit scores , which makes it hard to know your chances of approval when comparing credit cards. What we do know is that higher scores have better chances of approval — that’s true no matter what type of credit you’re applying for. Want to learn more? Visit our “ What Credit Score Is Needed for a Credit Card? ” page.

Scotiabank Gold American Express rewards

Earn up to 40,000 bonus Scene+ points. Spend at least $1,000 in eligible purchases within the first three months of card ownership and receive 20,000 points. Earn an additional 20,000 points if you spend at least $7,500 in the first year (offer available for limited time and only to new cardholders).

You can earn Scene+ points on the following purchases.

- 6x points on purchases at Sobeys, Safeway, Foodland and participating co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Participating IGAs, Rachelle Béry, Les Marchés Tradition, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA.

- 5x points on eligible restaurants, food delivery and groceries.

- 5x points on eligible ticket purchases to movies and theatres.

- 3x points on gas and daily transit, including rideshare.

- 3x points on select streaming services.

- 1x points on everything else.

The value of Scotiabank Scene+ points may vary based on the redemption method you choose, but according to NerdWallet analysis, you can expect to get around 1 cent per point on travel, movies, dining, entertainment, banking, and retail, pharmacy and grocery shopping.

In the first year, you could potentially earn $680 in travel rewards, according to the Scotiabank website. The welcome bonus of 40,000 Scene+ points is equal to $400 in travel rewards. Plus, a year of everyday purchases can generate an average $247 in travel rewards, as well as $33 in foreign transaction fee savings, on average.

How to apply for the Scotiabank Gold Amex

You can apply for the Scotiabank Gold Amex via the company’s website. Follow the below steps to apply.

- Log in or sign up for a new account.

- Enter any personal details like name and email address.

- Create username and password, if you do not already have an account. .

- Verify your identity.

- Enter any employment or financial information requested.

- Review the card’s terms and conditions before you submit your application.

Scotiabank Gold Amex vs Amex Cobalt

If you’re not committed to Scotiabank’s Scene+ program, and you’re simply looking for an Amex that earns rewards, you might consider the American Express Cobalt. The card has a similar annual fee to the Scotiabank Gold Amex but earns Amex Membership Rewards points instead.

Reasons you might want a different card

You may want to consider a different card if you:

- Want to earn cash back or non-Scene+ points.

- Want a card with customizable spending categories.

» MORE: Best American Express credit cards

Scotiabank Gold American Express facts

Rating methodology.

NerdWallet Canada rates credit cards according to overall consumer value and their suitability for specific kinds of consumers. Factors in our evaluation methodology include annual and other fees, rewards rates, the earning structure (for example, flat-rate rewards versus bonus categories), redemption options, bonus offers for new cardholders, introductory and ongoing APRs, and other noteworthy features such as airline or hotel perks or the ability to transfer points.

Frequently asked questions about Scotiabank Gold American Express

You must have a minimum gross income of $12,000 to apply for the Scotiabank Gold American Express card.

Yes, for a discount. The Scotiabank Gold American Express card offers a discount on Priority Pass membership, which grants access to over 1,200 airport lounges worldwide.

About the Author

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

DIVE EVEN DEEPER

23 Best Credit Cards in Canada for April 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

Scotiabank’s Scene+ Rewards: How to Earn and Redeem Scene+ Points

Scotiabank Scene+ points can be earned on eligible purchases and redeemed for merchandise, travel, dining out and entertainment experiences.

25 Best Rewards Credit Cards in Canada for April 2024

Compare the best rewards credit cards in Canada across numerous rewards categories, including travel, cash back and more, to find the ideal card for your spending preferences.

- Book Travel

- Credit Cards

Canada’s 6 Best Scotiabank Credit Cards

Scotiabank, one of Canada’s Big 5 banks, has many credit cards aimed at travellers, socialites, and cash back collectors alike.

Here are our top choices for the best Scotiabank credit cards in Canada.

Best Scotiabank Credit Cards

Best overall scotiabank credit card.

- Earn 20,000 Scene+ points upon spending $1,000 in the first three months

- Earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 1x 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 1x 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120

The Scotiabank Gold American Express Card is one of the best credit cards in Canada. It earns 5 points per dollar spent on groceries, restaurants, and entertainment, the highest rates in those categories on any credit card. Also, you’ll earn 3 points per dollar spent on gas, transit, and select streaming services, among the best rates around.

Of course, high rewards rates are only as good as the rewards themselves, and in that respect Scotiabank delivers as well.

Scene+ points are extremely easy to use for statement credit. You can cover just about any travel expense at a fixed rate. With transparent value and unparalleled flexibility, just about anyone would benefit from having this card.

You’ll also get additional benefits like no foreign transaction fees, making this card quite handy for when you’re travelling out of the country or shopping online. And as an American Express card, you’ll have access to many exclusive events, discounts and rebates, and presale offers.

Finally, this card has no minimum income requirement. It’s a great choice if you’re a student or just starting out your career. Typically for a Visa or Mastercard with higher rewards, you’d need to meet a higher income threshold, but luckily Amex cards are available to anyone.

Best Premium Scotiabank Credit Card

- Earn 50,000 Scene+ points upon spending $3,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $10,000 in the first 14 months

- Plus, earn 2x Scene+ points on all purchases

- Priority Pass membership with 10 free lounge visits per year

- Annual fee: $399

The Scotiabank Platinum American Express Card is a step up from its Gold counterpart, although whether or not you’ll benefit depends on your spending habits.

The Scotiabank Platinum Amex earns a steady 2 points per dollar spent on all purchases, with no limit on the number of bonus points you can earn. This is less than the Scotiabank Gold Amex for the latter’s elevated lifestyle categories, but an unequalled base rate for general spending.

Regardless of rewards, the $399 annual fee is really justified by the card’s travel benefits. You’ll get a DragonPass membership with 10 free visits annually to their lounges, and out-of-province medical insurance for up to 31 days if you’re under 65, or up to 10 days for people of all ages.

For those perks alone, which aren’t found at such generous levels on most other cards, you might find it worth paying the annual fee.

Best Scotiabank Visa Credit Card

- Earn 30,000 Scene+ points upon spending $1,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $40,000 in the first year

- Earn 1x 2x Scene+ points on groceries, dining, entertainment, and transit

- Plus, earn 3x Scene+ points on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per year

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $150 (waived in the first year)

The Scotiabank Passport Visa Infinite Card is a good Visa alternative to the Scotiabank Gold Amex , for any stores that don’t take American Express.

Like its Amex counterpart, the card has no foreign transaction fees and earns Scene+ points which can be used for any travel purchase.

The Visa’s earn rates aren’t as high as the Amex, topping out at 2 points per dollar spent . Instead, the card makes up for it with stronger travel perks and better insurance coverage.

In particular, the Scotiabank Passport Visa Infinite comes with a complimentary DragonPass membership , and six passes for lounge visits each year. This is an awesome benefit for a card with an annual fee of just $150 – usually this perk is reserved for Visa Infinite Privilege cards, with higher fees and income requirements.

Best No Fee Scotiabank Credit Card

- Earn 2,500 Scene+ points upon spending $250 in the first three months†

- Earn an additional 5,000 Scene+ points upon spending $1,000 in the first three months†

- Also, earn 3x Scene+ points on Empire grocery stores such as Sobeys, IGA, Safeway, Foodland, and FreshCo

- Plus, earn 2x Scene+ points on dining, groceries, gas, transit, and streaming purchases

- Annual fee: $0

The Scotiabank American Express Card is a nice choice for an entry-level card. It earns Scene+ points at a flat rate of 1 point per dollar spent, equivalent to 1% back.

While you don’t get any category bonuses, you do get a higher rate on all other purchases, whereas most no-fee cards only award 0.5% back.

Also, as an American Express card, you’ll get access to Amex Offers, exclusive events, and ticket presale opportunities. You can indeed dabble in the Amex lifestyle without shelling out for a premium credit card!

Best Cash Back Scotiabank Credit Card

- Earn 1% 4% cash back on groceries and recurring bill payments

- Also, earn 1% 2% cash back on gas and transit

- Annual fee: $120 (waived for the first year)

The Scotiabank Momentum Visa Infinite Card is Scotiabank’s flagship cash back card, and it’s one of the top cash back cards on the market.

You’ll earn 4% cash back on the ever-popular groceries category, and also on recurring bills. The latter is particularly interesting, as the highest earn rate offered by any credit card for recurring payments. If you have high bills and your payees accept Visa cards, you can certainly get some momentum going as you rack up rewards.

Rounding out the bonus rates with 2% back on gas and transit, the Scotia Momentum will ensure you have most of your needs covered.

The card often has the industry standard welcome bonus among cash back cards: 10% cash back on your first $2,000 spent and the first-year annual fee waived.

With an incentive offer that holds its own and daily earn rates that exceed many competitors, the Scotiabank Momentum Visa Infinite is a stellar option if you’re looking for a cash back card.

Best Scotiabank Credit Card for Business Owners

- Earn 30,000 Scene+ points upon spending $5,000 in the first three months

- Earn 10,000 Scene+ points upon spending $60,000 in the first year

- Plus, earn 1.5x Scene+ points on all purchases

- Priority Pass membership with six free lounge visits per year

- Qualify on the basis of your business financials

- Annual fee: $199

The Scotiabank Passport Visa Infinite Business is one of the stronger business Visa cards on the market.

It mirrors many of the same perks as the personal Passport card , like no foreign transaction fees, a DragonPass membership with six annual free visits, and a good travel insurance package.

The card earns 1.5 Scene+ points on all purchases, a solid base earn rate and the best in Scotiabank’s business portfolio.

Given how flexible the points are, this card would be a good choice if your business expenses tend not to fall into the popular bonus categories, and if you can’t use American Express cards with your suppliers.

Scotiabank Credit Cards: What You Need to Know

When choosing a Scotiabank credit card, you should familiarize yourself with what benefits a Scotiabank credit card can offer, what features to look out for, and how Scotiabank credit cards can fit into an optimized credit card strategy.

Why get a Scotiabank credit card?

Scene+ points are one of the best fixed-value travel rewards programs in Canada because they’re so easy to redeem.

You can use them for statement credit against any travel expense at a flat rate of 1 cent per point – all you have to do is log in to the Scene+ website. Between unparalleled flexibility, a self-serve option, and predictable value, it makes for an awesome rewards program that is useful for anyone.

Also, Scotiabank’s rewards rates on premium credit cards are quite high, setting the standard for many spending categories. They also have very high annual spending limits for the category bonus rates. However, their entry-level cards with no annual fee don’t stand up to their competitors quite as well.

If you already bank with Scotiabank, getting one of their credit cards is a no-brainer. On most cards, you can get your annual fee rebated every year if you have a Scotiabank Ultimate chequing account . This is useful if you plan on keeping a premium card year after year for its benefits and higher everyday earning rates.

What should you look for in a Scotiabank credit card?

Scotiabank’s credit cards have two different types of rewards:

- Scene+ cards earn points that can be used for any travel expenses. Because they’re so flexible, you can essentially treat these points like cash back rewards if you’d like. There are cards that earn Scene+ points on both the Visa and American Express payment networks, so if the program interests you, card acceptance shouldn’t be a big issue.

- Momentum cards earn cash back, which is redeemable once a year on your November statement. These cards are all Visa cards, plus an oddball legacy Mastercard.

For each type of card, Scotiabank offers cards with a wide range of welcome bonuses, everyday rewards, annual fees, perks, and income requirements.

Any of these cards come with the standard benefits for their card tier:

- All Visa Infinite cards have access to Concierge services, the Luxury Hotel Collection, and the Dining Series & Wine Country program

- American Express cardholders are eligible for American Express Experiences, American Express Invites, and some Amex Offers such as Shop Small

In addition, Scotiabank provides a DragonPass membership on its personal and business Passport Visa Infinite cards.

Cardholders get six annual visits to participating airport lounges and restaurants each year. This perk is normally only seen on Visa Infinite Privilege cards, so it’s definitely worth considering one of these cards if you don’t qualify for a top-tier card from another issuer.

Notably, Scotiabank has no foreign transaction fees on many of their travel cards. This significantly sets them apart from other major Canadian credit card issuers – in fact, they’re the only one of the Big 5 banks to offer this benefit.

Also, as with all premium credit cards, keep an eye out for any Scotiabank cards that offer appealing insurance on travel and other purchases. In particular, some of Scotiabank’s cards have a price protection benefit, another rarity amongst credit cards, as well as mobile device insurance and protection against hotel burglary.

Scotiabank occasionally offers First Year Free promotions or elevated welcome bonuses for new signups. However, with high rates on everyday earning, it’s not always worth holding out for a better offer – these cards are good to have if you think you’ll benefit from them.

What’s the optimal strategy for Scotiabank credit cards?

When it comes to maximizing credit cards as a whole, Scotiabank credit cards typically play a secondary, but still significant role in a savvy individual’s wallet compared to the other Big 5 banks’ cards.

While Scene+ points are exceedingly easy to use, their potential upside is rather limited compared to other options on the market. Scene+ points are worth a flat 1 cent per point against travel purchases, but they can’t unlock greater value than that, unlike the points offered by many of Canada’s other Big 5 banks.

Therefore, in an optimized credit card strategy, you’d prioritize credit cards from other issuers (such as American Express or RBC ) to earn points in more powerful loyalty programs like Aeroplan , Avios , or Marriott Bonvoy . These points would allow you to book the bulk of your flights and hotels at an impressive value.

Then, you’d use Scene+ points to cover your non-flight travel expenses, such as car rentals or non-chain hotels.

In fact, since Scotiabank allows you to book travel directly on your credit card and then offset the charge using points retroactively (unlike other Big 5 banks, which require you to book through their internal portal), you’d be able to redeem Scene+ points towards a much wider range of travel expenses, like organized tours, train tickets, or Airbnbs.

Overall, it’s important to recognize that a Scotiabank credit card won’t get you the same spectacular flight rewards in premium cabins that you’d get from, say, American Express credit cards.

However, Scotiabank credit cards continue to play an important supporting role in the optimal credit card strategy for Canadians, thanks to their versatility in being redeemable towards a wide range of travel purchases.

Frequently Asked Questions

Below are some questions we frequently hear from readers about the best Scotiabank credit cards in Canada.

What’s the difference between Scotia Rewards and Scene+ Rewards?

Scotiabank bought the SCENE program, formerly centred around rewards for movie-goers, in 2021. They merged the two programs into Scene+.

Scotiabank’s credit cards have remained unchanged (aside from some cosmetic tweaks), with the same cards now earning Scene+ points instead of Scotia Rewards.

The new Scene+ program works much the same way as the old Scotia Rewards. You can make all of the same flexible travel redemptions as before. Additionally, they’ve introduced elevated offers for earning points with individual partner brands, which you can find and activate on the Scene+ website.

How are Scotiabank’s American Express cards different from other American Express cards?

American Express is both a payment network and a card issuer. These cards operate on the Amex payment network, but aren’t issued by Amex.

Although they come with many of the same benefits, they’re entirely independent from Amex as an issuer. Scotiabank is the one approving your application, you manage your card online with Scotiabank and pay bills to Scotiabank, and you’re subject to Scotiabank’s terms and conditions.

Which credit bureau does Scotiabank check?

All recent reports indicate that Scotiabank only checks TransUnion.

Can I do a product switch with Scotiabank?

Yes, but you won’t get a welcome bonus.

there is no BNS CC still offering price protection

Don’t fall for marketing gimmicks, Reality of the Scotiabank Amex Gold card is that when you want to make a foreign currency transaction, you have to call their customer service, answer personal questions before they let you speak to their security team to have a transaction approved even if it’s for $20. This is usually a 2-3 hour process due to clogged lines.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Credit cards

Comparison: RBC Avion Visa Infinite Card vs. Scotiabank Passport™ Visa Infinite* Card

Here are two Visa Infinite credit cards that earn different types of points.

- Scotiabank Passport™ Visa Infinite* Card

- RBC Avion Visa Infinite Card

Their names are very similar! These point-connected cards both give us a passport to low-cost travel, but their characteristics are different. Let’s see which one is the best!

We will base our analysis on the major differences between these credit cards regarding :

Welcome bonus

Earning points.

- Using points

Minimum income

- Travel Insurance

The welcome bonus offered by each of these credit cards varies according to promotions. However, there are some important differences between the two.

Scotiabank Passport™ Visa Infinite* Card offers up to 40,000 Scene+ points:

- 30,000 Scene+ points with total purchases of $1,000 or more in the first three months ( $300 value)

- 10,000 additional points with $40,000 in purchases during the first year with the card ($100 value)

What’s more, the annual fee is fully refunded in the first year (a $150 value).

When you sign up for the RBC Avion Visa Infinite Card , you’ll get up to $825 worth of :

- 35,000 Avion points on approval (no minimum purchase) ($525 value) ;

- 20,000 Avion points when you spend at least $5,000 in the first 6 months with your new card ($300 value).

Advantage: RBC Avion Visa Infinite Card

Once you’re approved for the card, the 35,000 Avion points deposit themselves into your account when the card is activated. It’s easy!

While the annual fee for the Scotiabank Passport™ Visa Infinite* Card (net value of $550) is a net zero, it’s even better with the RBC Avion Visa Infinite* Card (net value of $825 – $120 = $705 ).

The RBC Avion Visa Infinite Card and Scotiabank Passport™ Visa Infinite Card each offer different levels of point accumulation.

Earnings levels

With the Scotiabank Passport™ Visa Infinite* Card , you earn 3 Scene+ points per dollar (i.e. 3%) on purchases at:

- Rachelle Béry

- Les Marchés Tradition

- Voià by IGA / Safeway / Sobeys

- Sobeys and Safeway

- Foodland and Thrifty Foods

- FreshCo and Chalo! FreshCo

Then you earn :

- 2 Scene+ points / $1 purchase at restaurants, entertainment, grocery stores and travel (2%)

- 2 Scene+ points / $1 purchase in restaurants, entertainment, grocery stores and travel outside Canada (2%)

- 1 Scene+ point / $1 purchase remainder (1%)

The RBC Avion Visa Infinite Card has a earning of 1.25 Avion points / $1 purchase, for travel purchases charged to the card:

“Travel” expenses include the following:

- Tour operator, cruise line or travel agency;

- Car rental company.

This has a value of 1.25% .

After that, you earn 1 point per dollar for all other purchases. This is a 1% value.

Advantage: Scotiabank Passport™ Visa Infinite* Card

The Scotiabank Passport™ Visa Infinite* Card is the best of the two! It pays twice as much on everyday purchases and the biggest budget items, such as groceries, entertainment, travel and restaurants.

Redeeming points

The two cards are linked to different loyalty programs, and the ways of redeeming them are not the same.

Scene+ points and travel:

You can apply them to travel purchases in two ways, thanks to the fixed redemption rate where 10,000 points = $100 credit :

- Redeem points directly when booking travel with Scene+ Travel, administered by Expedia .

- Make your own travel arrangements and use your points to pay off the balance on the card

It also lets you apply your points to everyday purchases.

You can redeem 1,000 Scene+ points for a $10 discount at the IGA/Sobeys checkout.

Points can also be used to purchase gift cards on the Scotiabank/Scene+ website, from 1,000 to 1,400 points for a $10 discount.

Scene+ points can also be redeemed:

- 500 points for a $5 discount at selected restaurants (Harvey’s, Swiss Chalet, etc.);

- 100 points for $1 off movie tickets at Cineplex ;

- 500 points for $5 off food and beverages at Cineplex, Rec Room and chips at Playdium ;

- At least 3,000 points for an account credit of between $6.67 and $8 on any card charge.

With the RBC Avion Visa Infinite Card , you can apply your points to travel purchases.

The redemption rate is:

- 100 points = $1 towards purchases of your choice on the Avion Rewards website, including hotels, airline tickets, cruises, car rentals and more.

Avion Rewards acts like a travel agency when you buy an airline ticket. There are no blackout periods or reservations imposed, even in high season. Here is the fixed number of points required for a flight reservation:

So this equates to about 2 cents per point ($350 divided by 15,000 points) on average.

Or you can use your points for something else:

- 12,000 points for $100 (0.83 cent per point) on a contribution to an RRSP, TFSA, line of credit or mortgage;

- 12,000 to 14,000 points for a $100 gift card (0.71 to 0.83 cents per point) ;

- Make a donation (1 cent per point) ;

- 4,300 points = $25 (0.58 cent per point) you can apply an account credit to everyday purchases.

Scotiabank Passport™ Visa Infinite* Card wins this round. Scene+ points are more diversified and have a stable value of 1,000 points for $10 off, for both grocery needs or small pleasures when traveling.

What’s more, you can use them in any way you like, by booking any travel expense and then taking your Scene+ points to get reimbursed.

Earn Scene+ points all year round and buy yourself a huge grocery store for a real holiday feast. Or keep them to pay for a plane ticket or hotel.

But if you’re aiming for a plane ticket to a specific destination, the Avion Rewards fixed points chart and the RBC Avion Visa Infinite Card are the best way to go.

The Scotiabank Passport™ Visa Infinite* Card has an annual fee of $150. At the moment, there’s a promotion that refunds these costs for the first year.

And if you have a Scotiabank Ultimate Plan , you’ll get the annual fee waived . Learn more about this here .

The RBC Avion Visa Infinite Card has an annual fee of $120. It is rare to have an annual fee rebate promotion for this card.

The RBC Avion Visa Infinite Card has a lower annual fee.

But for a first year or if you have a special package, the Scotiabank Passport™ Visa Infinite* Card wins out because it has a fully reimbursed annual fee.

The Scotiabank Passport™ Visa Infinite* Card requires :

- $60,000 (individual income)

- or $100,000 (household income)

The RBC Avion Visa Infinite Card requires :

- 60,000 individual income ;

- or $100,000 household income.

Advantage: Tie

It’s all the same, because a Visa Infinite card requires the same conditions for all financial institutions.

Scotiabank Passport™ Visa Infinite* Card offers a range of insurance options. The certificate of insurance can be found here :

The RBC Avion Visa Infinite Card offers various types of insurance, and its certificate of insurance can be found here :

Some RBC Avion Visa Infinite Card insurance amounts are slightly higher than those of its competitor for certain coverages.

If this is important to you, the RBC Avion Visa Infinite Card is even better, as it’s the only one between the two to have mobile device insurance. This comes in handy if you have an unfortunate accident with your phone or tablet.

Please note that at least 75% or 100% of the cost of the trip or tickets must be charged to these two cards for certain insurances to apply. We strongly advise you to read each insurance brochure carefully, to find out which one is best for your situation.

The Benefits

The Scotiabank Passport™ Visa Infinite* Card offers a number of advantages:

- No conversion fees for purchases in foreign currencies;

- 2 points/$1 spent abroad at restaurants, for entertainment, groceries and travel ;

- 6 free accesses to VIP airport lounges per year;

- Earn double Scene+ points with your Scene+ membership card at their partners;

- Exclusive benefits for Visa Infinite cardholders .

In addition to the above benefits, the RBC Avion Visa Infinite Card offers other advantages:

- Savings of 3 cents per liter and 20% more Petro-Points and Avion points at Petro-Canada ;

- Link this card to get 50 Be Well points / $1 at Rexall ;

- Free 12-month subscription to Doordash DashPass ;

- Free deliveries with Doordash on orders of $15 or more when paid with this card;

- Tons of points offers and discounts at various retailers with RBC offers ;

- WestJet Rewards

- American Airlines

- British Airways

- Hudson’s Bay Reward Points

The Scotiabank Passport™ Visa Infinite* Card has a big head start on travel perks, as it allows you to lounge in airport VIP lounges with 6 free accesses and avoid the 2.5% conversion fee outside Canada.

The RBC Avion Visa Infinite Card , on the other hand, offers better benefits for everyday life. What’s more, the great flexibility of its points gives you the opportunity to transfer your Avion points to other programs, something its competitor can’t do.

Bottom Line

So? Which card wins this duel?

For those who want a simple, uncomplicated card, the RBC Avion Visa Infinite Card is for you!

It stands out for:

- Its best welcome offer with great value and easy to get ;

- The possibility of investing in an investment or reducing your mortgage with Avion points;

- Everyday savings at Petro-Canada, Rexall or Doordash ;

- Transfer points to other programs ;

- Its excellent mobile device and travel insurance.

Opposite it, the Scotiabank Passport™ Visa Infinite* Card will be perfect for people who travel a lot thanks to:

- Faster accumulation for groceries, restaurants, travel and entertainment;

- 6 free airport lounges a year;

- The elimination of the 2.5% foreign exchange conversion charge on purchases in foreign currencies;

- To the opportunity to have the annual card fee refunded in the first year with the current welcome offer, which is rare;

- To the possibilities of simply paying for groceries with your points at IGA, Sobeys, etc.

What’s more, these are 2 cards that we recommend in several of our rankings:

- The Best No FX Fees Credit cards

- The Best Travel Credit Cards

All posts by Caroline Tremblay

Suggested Reading

Help Centre

- Popular questions

- Credit cards

- Travel & insurance

Does my Scotiabank credit card have Trip Cancellation or Trip Interruption Insurance?

This is a list of Scotiabank credit cards that include trip cancellation insurance and/or trip interruption insurance benefits, as well as links to the current Certificates of Insurance with full details of these coverages:

Trip Cancellation and Trip Interruption

Scotiabank Passport Visa Infinite Card English PDF

Scotiabank American Express Gold Card English PDF

Scotiabank American Express Platinum Card English PDF

Scotiabank Momentum Visa Infinite Card English PDF

Scotiabank Passport Visa Infinite Business Card English PDF

Trip Interruption Only

- Scotiabank American Express Card English PDF

Related Articles

What expenses are eligible for trip cancellation or trip interruption insurance?

Where can I find Scotiabank travel and insurance information related to COVID-19?

How do I make a claim because my trip had to be cancelled or was interrupted because of COVID-19?

How do I find out if I can change or cancel my flight?

- Ways to Bank

Learn More | Register Now

AERO Platinum Mastercard®

If you want travel rewards that take you anywhere, anytime

View our current credit card promotions.

Your card comes with benefits.

With flights, hotels, car rentals, and other travel rewards, the Scotiabank AERO Rewards Programme truly gives you the freedom to travel your way.

Travel your way

Book any airline, anywhere in the world. No blackout dates. No seat restrictions.

Earn when you spend

Earn 1 ScotiaPoint for every $1USD spent on your card*. Learn more about AERO rewards.

Free additional cards

Order additional cards for family members and friends at no extra charge.

Earn bonus points

Earn a total of 3,000 bonus points on first purchase.

Earn more with ScotiaPoints.

Apply today and get a Welcome Bonus.

Get bonus* ScotiaPoints with a Scotiabank AERO Platinum Mastercard® .

PLUS, you get a spend bonus and low introductory rate.

Security in mind

Every transaction you make using a Scotiabank card with chip and your unique 4-digit Personal Identification Number (PIN) gives you an added layer of security. That means greater protection each and every time.

Find the card that's right for you

Compare cards with our Mastercard Benefits Comparison Chart

Review the Credit Card Cardholder Agreement

View the Credit Card Schedule of Rates & Fees

Get details on Welcome Offers for New Credit Cards

View the Credit Card Comparison Chart

Learn more about 3D Secure Credit Card Feature

Request Additional Cards

Ready to get started?

- Digital banking

Learn More | Register Now

Choose the credit card that's right for you

Select from our suite of travel, cash back that suits you lifestyle and enjoy rewards you will love. Don’t have rewards card, apply for one today.

Convert your bigger credit card purchases into bite size monthly installments

with Scotia SelectPayTM

Low Interest

No Annual Fee

Based on your selections

Chip technology is now available on scotiabank credit cards.

Not sure what Credit Card is right for you? Let us help.

View our Credit Card Comparison Chart and make your choice. View our Credit Card Terms & Conditions View our Credit Card Rates & Fees View our Credit Card Holder Agreement

Tools and Advice

- MasterCard Benefits Comparison Chart

- VISA Benefits Comparison Chart

- Additional Card Requests

- Smart Use of Credit

- Card Watch: 7 Ways to Combat Credit Card Fraud

- Will That Be Debit, Credit or Cash?

- Digital banking

Learn More | Register Now

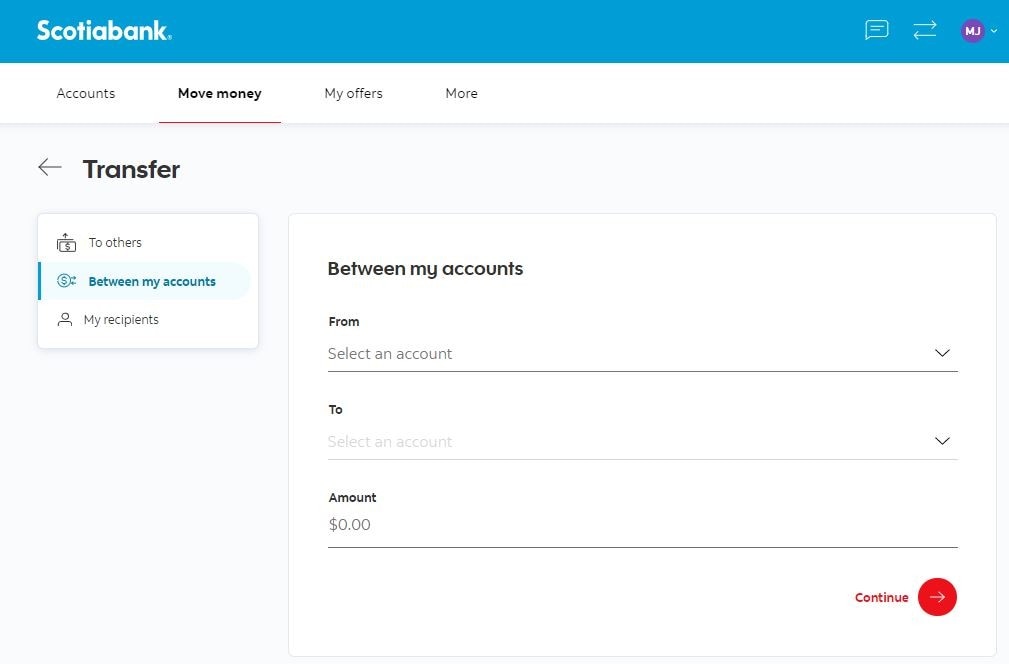

Scotia OnLine - How to transfer between accounts

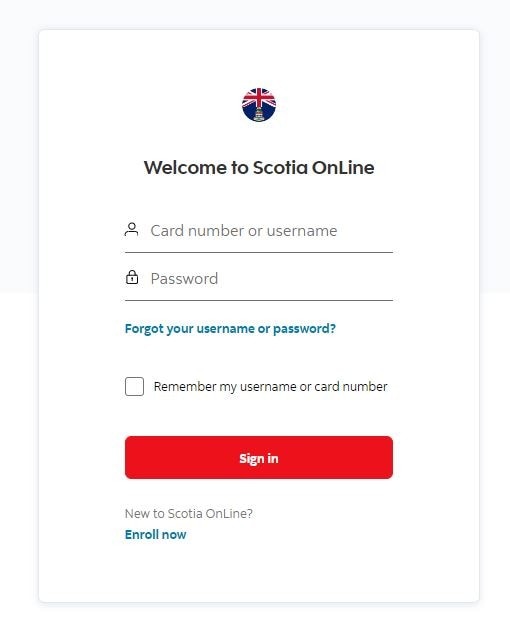

Step 1 - sign in to scotia online.

Log in to Scotia OnLine

- Sign into tc.scotiabank.com

- Click on the sign in drop down in the top right corner of the page

- Click Personal Banking

- Enter your card number or username, password and click the "sign in" button to continue

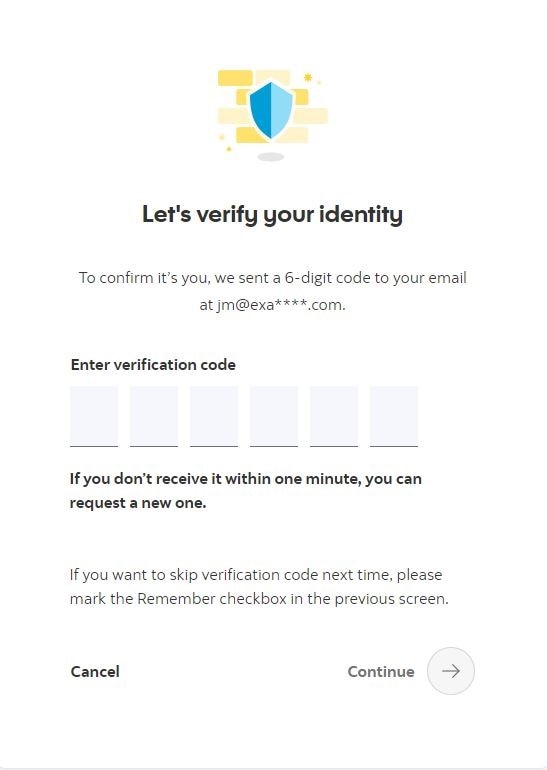

STEP 2 - Sign in verification

- Check you emails for your verification code

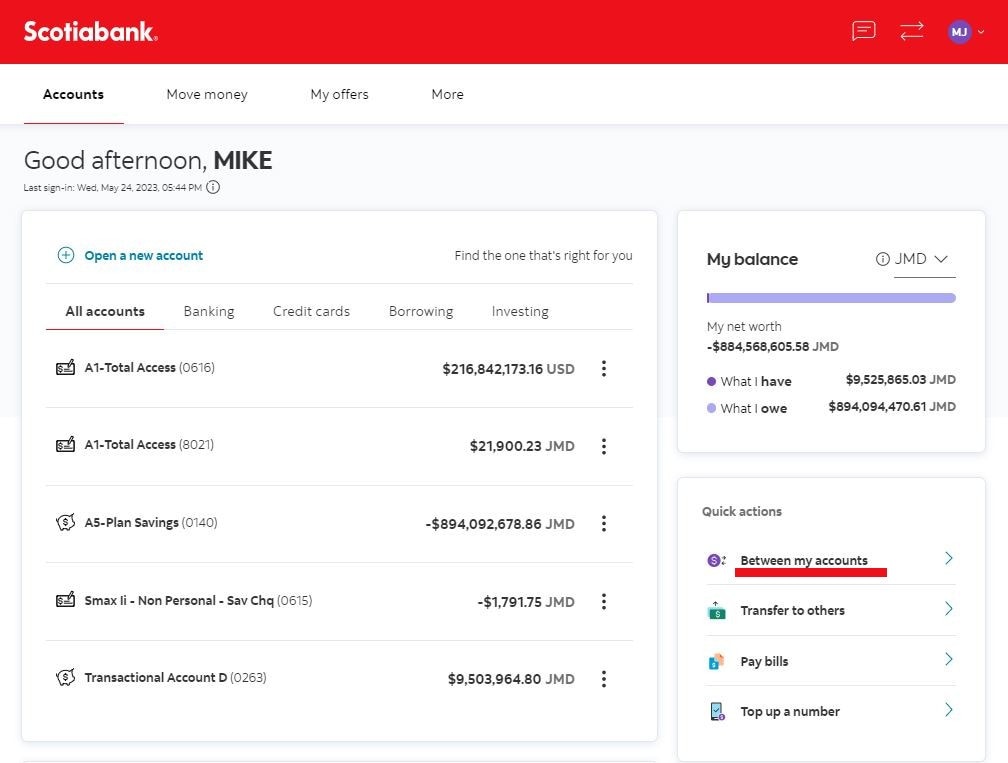

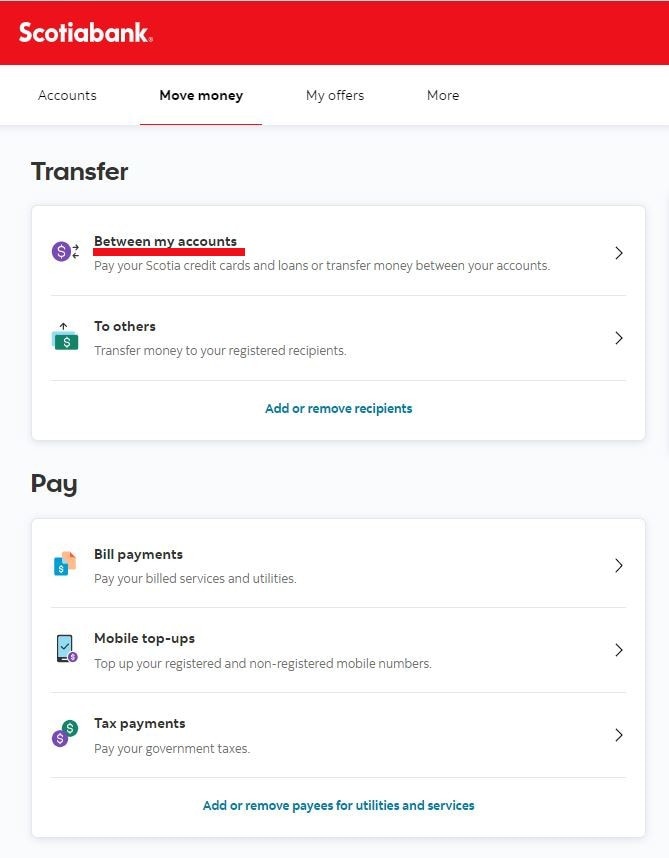

Step 3 - Select option

From the dashboard select " Between my accounts"

Select the Move Money link and click on“ Between my accounts ”.

Step 4 - Select option

- Enter the transfer details

- From - select account you are transferring from

- To - select accounts you are transferring to

- Press ' Continue ’

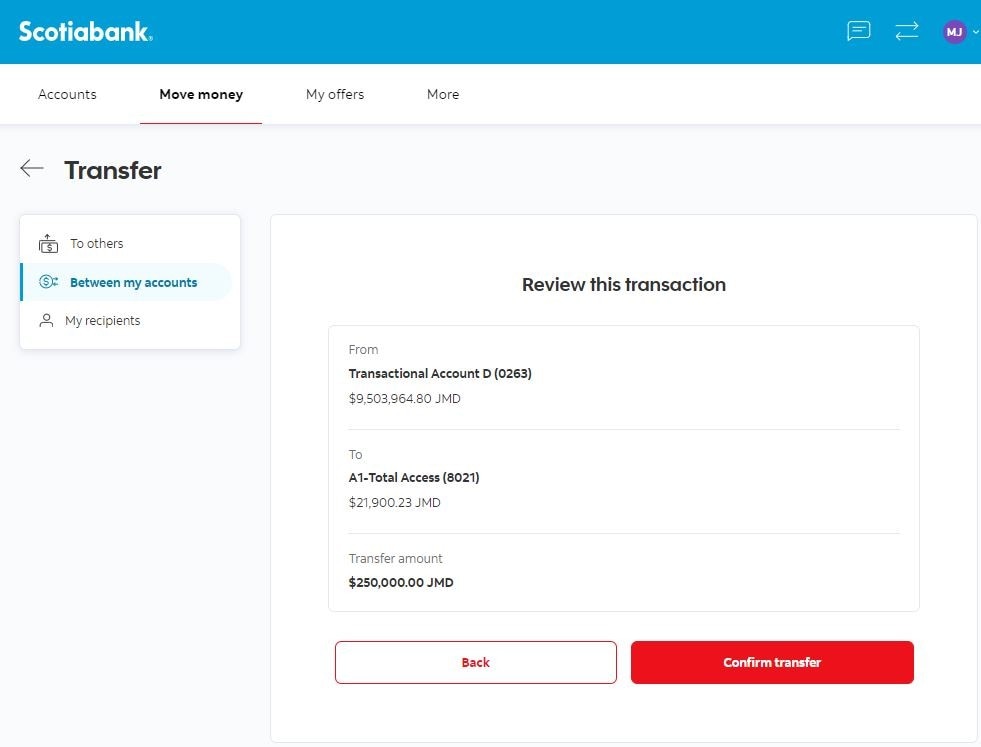

Step 5 - Review the payments

- Ensure the information is correct

- Press “ Confirm ”

Your transaction is complete

Step by step guides on how to the scotia self-service channels atm | scotia online | mobile app ..

IMAGES

VIDEO

COMMENTS

Compare and choose from various travel credit cards that offer Scene+ points, cash back, low interest, and more benefits. Find out how to apply, manage, and redeem your rewards with Scotiabank.

Earn 25,000 bonus Scene+ points by making at least $1,000 in everyday eligible purchases in your first 3 months. 2. Plus, as a Scotiabank Passport Visa Infinite cardholder, you are eligible to ...

Rewards Potential. While the Scotiabank Passport Visa Infinite Card's grocery and travel rewards rates seem respectable, the total capped earnings possible for cardholders are lacklustre ...

The Scotiabank Passport Visa Infinite is the Best No-Fx Fee Credit Card for 2024. 4. Complimentary Priority Pass membership that includes 6 free visits per year and is worth $379 per year. 5. Earn 10,000 extra points ( $100 value) when you spend at least $40,000 annually.

Scotia Momentum® Visa Infinite* Card. Open a new Scotia Momentum® Visa Infinite* credit card account by October 31, 2024 to qualify. 20.99% on purchases, 22.99% on cash advances. 10% intro offer ...

Launched in early 2018, the Scotiabank Passport Visa Infinite entered the fray as the only credit card from the country's big banks to completely waive its foreign transaction fees (and made headlines for doing so). But its appeal doesn't stop there. One of the best travel credit cards in Canada, the Scotiabank Passport Visa Infinite is packed with other perks frequent travellers care ...

The Scotiabank Passport Visa Infinite will earn you up to 3 Scene+ points per $1 spent on purchases and 30,000 welcome bonus Scene+ points, and offers 6 free airport lounge passes per year. Plus, you'll get 10,000 bonus points every year you spend $40,000. $150 $0. Annual fee. 1st year waived.

Both the Scotiabank Passport Visa Infinite and Scotiabank American Express Platinum cards give you access to airport lounges.The Scotiabank Passport Visa Infinite card gives primary cardholders a complimentary membership in the Visa Airport Companion Program, plus six complimentary lounge visits per year from the date of enrollment. This program is powered by DragonPass, and provides access to ...

Scotiabank Gold American Express® Card. Annual Fee. $120. Interest Rates. 20.99% / 22.99%. 20.99% on purchases. 22.99% on cash advances. Rewards Rate. 1x-6x Points. Earn 6X Scene+ points for each ...

The Scotiabank Passport® Visa Infinite* Card offers up to 40,000 Scene+ points as a signup offer. The bulk of the bonus, 30,000 Scene+ points, are awarded upon spending $1,000 in the first three months. 30,000 Scene+ points is worth up to $300 when redeemed for a statement credit against travel purchases. You can also earn an additional 10,000 ...

More benefits. Earn AAdvantage Miles. With every purchase made on your card; additional cards available for family members and friends at no extra charge. 3,000 AAdvantage bonus miles. with their first purchase on the card, plus welcome bonus of up to 4,000 miles*. Free, personalised Convenience Cheques that you can use just like your personal ...

To enter an airport lounge with a Passport Visa Infinite card, you first need to sign up for the Visa Airport Companion Program (powered by DragonPass). Once you sign up, a Membership ID linked to your card will be created under the DragonPass Membership Profile. To find out more about the Visa Airport Companion Program and other benefits ...

The Scotiabank Gold American Express Card is one of the best credit cards in Canada. It earns 5 points per dollar spent on groceries, restaurants, and entertainment, the highest rates in those categories on any credit card. Also, you'll earn 3 points per dollar spent on gas, transit, and select streaming services, among the best rates around.

The Scotiabank Passport™ Visa Infinite* Card has an annual fee of $150. At the moment, there's a promotion that refunds these costs for the first year. And if you have a Scotiabank Ultimate Plan, you'll get the annual fee waived. Learn more about this here. The RBC Avion Visa Infinite Card has an annual fee of $120.

This is a list of Scotiabank credit cards that include trip cancellation insurance and/or trip interruption insurance benefits, as well as links to the current Certificates of Insurance with full details of these coverages:Trip Cancellation and Trip InterruptionScotiabank Passport Visa Infinite Card English PDFScotiabank American Express Gold Card English PDFScotiabank American Express ...

The Platinum Card® American Express. Up to 5x Membership Rewards® Points with your purchases. Welcome bonus of up to 50,000 Membership Rewards® Points ($500 value) Redeem points for travel or convert them to a statement credit. Exceptional Travel & Lifestyle Benefits and Comprehensive Protection.

Contact Us. (246) 426-7000. More phone numbers. Details on your banking hours, digital banking, media notices and more. Learn more. A whole new world of convenience - banking transactions from your mobile phone! Learn more. Scotiabank AERO Platinum Mastercard® Credit Card.

The only credit card that allows you to earn MAGNA Rewards Points with every single purchase. Features: $3,948.50 annual fee. Up to US$25,000 Credit Life Protection. Up to US$100 per occurrence Purchase Protection. Earn double the reward whenever you use your Scotiabank MAGNA MasterCard along with your MAGNA Rewards card. More Details.

Using a travel rewards credit card has long been celebrated as an easy strategy to travel the world for less. Consumers can apply for rewards credit cards and earn points and miles on everyday ...

Here's another way travel credit cards offer more flexibility: I have more control when redeeming my credit card rewards. For example, I can book a flight or hotel room with an airline or hotel ...

Scotiabank / AAdvantage MasterCard; Scotiabank AERO Platinum MasterCard; The Platinum Card® American Express; Credit Card Installments. Select Pay; Tools & Advice. MasterCard Benefits Comparison Chart; Additional Card Requests; Card Watch: 7 Ways to Combat Credit Card Fraud; Will That Be Debit, Credit, or Cash? Smart Use of Credit; Credit ...