Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

"People want to travel": 4 sector leaders say that tourism will change and grow

The global travel and tourism industry's post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. Image: Unsplash/Anete Lūsiņa

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Anthony Capuano

Shinya katanozaka, gilda perez-alvarado, stephen kaufer.

Listen to the article

- In 2020 alone, the travel and tourism industry lost $4.5 trillion in GDP and 62 million jobs - the road to recovery remains long.

- The World Economic Forum’s latest Travel & Tourism Development Index gives expert insights on how the sector will recover and grow.

- We asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

The global travel and tourism sector’s post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. The difference in international tourist arrivals in January 2021 and a similar period in January 2022 was as much as the growth in all of 2021. However, with $4.5 trillion in GDP and 62 million jobs lost in 2020 alone, the road to recovery remains long.

A few factors will greatly determine how the sector performs. These include travel restrictions, vaccination rates and health security, changing market dynamics and consumer preferences, and the ability of businesses and destinations to adapt. At the same time, the sector will need to prepare for future shocks.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The World Economic Forum's latest Travel & Tourism Development Index highlights many of these aspects, including the opportunity and need to rebuild the travel and tourism sector for the better by making it more inclusive, sustainable, and resilient. This will unleash its potential to drive future economic and social progress.

Within this context, we asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

Have you read?

Are you a 'bleisure' traveller, what is a ‘vaccine passport’ and will you need one the next time you travel, a travel boom is looming. but is the industry ready, how to follow davos 2022, “the way we live and work has changed because of the pandemic and the way we travel has changed as well”.

Tony Capuano, CEO, Marriott International

Despite the challenges created by the COVID-19 pandemic, the future looks bright for travel and tourism. Across the globe, people are already getting back on the road. Demand for travel is incredibly resilient and as vaccination rates have risen and restrictions eased, travel has rebounded quickly, often led by leisure.

The way many of us live and work has changed because of the pandemic and the way we travel has changed as well. New categories of travel have emerged. The rise of “bleisure” travel is one example – combining elements of business and leisure travel into a single trip. Newly flexible work arrangements, including the opportunity for many knowledge workers to work remotely, have created opportunities for extended travel, not limited by a Monday to Friday “9 to 5” workweek in the office.

To capitalize on this renewed and growing demand for new travel experiences, industry must join governments and policymakers to ensure that the right conditions are in place to welcome travellers as they prepare to get back on the road again, particularly those who cross international borders. Thus far, much of the recovery has been led by domestic and leisure travel. The incremental recovery of business and international travel, however, will be significant for the broader industry and the millions who make their livelihoods through travel and tourism.

Looking ahead to future challenges to the sector, be they public health conditions, international crises, or climate impacts, global coordination will be the essential component in tackling difficult circumstances head-on. International agreement on common – or at least compatible – standards and decision-making frameworks around global travel is key. Leveraging existing organizations and processes to achieve consensus as challenges emerge will help reduce risk and improve collaboration while keeping borders open.

“The travel and tourism sector will not be able to survive unless it adapts to the virtual market and sustainability conscience travellers”

Shinya Katanozaka, Representative Director, Chairman, ANA Holdings Inc.

At a time when people’s movements are still being restricted by the pandemic, there is a strong, renewed sense that people want to travel and that they want to go places for business and leisure.

In that respect, the biggest change has been in the very concept of “travel.”

A prime example is the rapid expansion of the market for “virtual travel.” This trend has been accelerated not only by advances in digital technologies, but also by the protracted pandemic. The travel and tourism sector will not be able to survive unless it adapts to this new market.

However, this is not as simple as a shift from “real” to “virtual.” Virtual experiences will flow back into a rediscovery of the value of real experiences. And beyond that, to a hunger for real experiences with clearer and more diverse purposes. The hope is that this meeting of virtual and actual will bring balance and synergy the industry.

The pandemic has also seen the emergence of the “sustainability-conscious” traveller, which means that the aviation industry and others are now facing the challenge of adding decarbonization to their value proposition. This trend will force a re-examination of what travel itself should look like and how sustainable practices can be incorporated and communicated. Addressing this challenge will also require stronger collaboration across the entire industry. We believe that this will play an important role in the industry’s revitalization as it recovers from the pandemic.

How is the World Economic Forum promoting sustainable and inclusive mobility systems?

The World Economic Forum’s Platform for Shaping the Future of Mobility works across four industries: aerospace and drones; automotive and new mobility; aviation travel and tourism; and supply chain and transport. It aims to ensure that the future of mobility is safe, clean, and inclusive.

- Through the Clean Skies for Tomorrow Coalition , more than 100 companies are working together to power global aviation with 10% sustainable aviation fuel by 2030.

- In collaboration with UNICEF, the Forum developed a charter with leading shipping, airlines and logistics to support COVAX in delivering more than 1 billion COVID-19 vaccines to vulnerable communities worldwide.

- The Road Freight Zero Project and P4G-Getting to Zero Coalition have led to outcomes demonstrating the rationale, costs and opportunities for accelerating the transition to zero emission freight.

- The Medicine from the Sky initiative is using drones to deliver vaccines and medicine to remote areas in India, completing over 300 successful trials.

- The Forum’s Target True Zero initiative is working to accelerate the deployment and scaling of zero emission aviation, leveraging electric and hydrogen flight technologies.

- In collaboration with the City of Los Angeles, Federal Aviation Administration, and NASA, the Forum developed the Principles of the Urban Sky to help adopt Urban Air Mobility in cities worldwide.

- The Forum led the development of the Space Sustainability Rating to incentivize and promote a more safe and sustainable approach to space mission management and debris mitigation in orbit.

- The Circular Cars Initiative is informing the automotive circularity policy agenda, following the endorsement from European Commission and Zero Emission Vehicle Transition Council countries, and is now invited to support China’s policy roadmap.

- The Moving India network is working with policymakers to advance electric vehicle manufacturing policies, ignite adoption of zero emission road freight vehicles, and finance the transition.

- The Urban Mobility Scorecards initiative – led by the Forum’s Global New Mobility Coalition – is bringing together mobility operators and cities to benchmark the transition to sustainable urban mobility systems.

Contact us for more information on how to get involved.

“The tourism industry must advocate for better protection of small businesses”

Gilda Perez-Alvarado, Global CEO, JLL Hotels & Hospitality

In the next few years, I think sustainability practices will become more prevalent as travellers become both more aware and interested in what countries, destinations and regions are doing in the sustainability space. Both core environmental pieces, such as water and air, and a general approach to sustainability are going to be important.

Additionally, I think conservation becomes more important in terms of how destinations and countries explain what they are doing, as the importance of climate change and natural resources are going to be critical and become top of mind for travellers.

The second part to this is we may see more interest in outdoor events going forward because it creates that sort of natural social distancing, if you will, or that natural safety piece. Doing outdoor activities such as outdoor dining, hiking and festivals may be a more appealing alternative to overcrowded events and spaces.

A lot of lessons were learned over the last few years, but one of the biggest ones was the importance of small business. As an industry, we must protect small business better. We need to have programmes outlined that successfully help small businesses get through challenging times.

Unfortunately, during the pandemic, many small businesses shut down and may never return. Small businesses are important to the travel and tourism sector because they bring uniqueness to destinations. People don’t travel to visit the same places they could visit at home; they prefer unique experiences that are only offered by specific businesses. If you were to remove all the small businesses from a destination, it would be a very different experience.

“Data shows that the majority of travellers want to explore destinations in a more immersive and experiential way”

Steve Kaufer, Co-Founder & CEO, Tripadvisor

We’re on the verge of a travel renaissance. The pandemic might have interrupted the global travel experience, but people are slowly coming out of the bubble. Businesses need to acknowledge the continued desire to feel safe when travelling. A Tripadvisor survey revealed that three-quarters (76%) of travellers will still make destination choices based on low COVID-19 infection rates.

As such, efforts to showcase how businesses care for travellers - be it by deep cleaning their properties or making items like hand sanitizer readily available - need to be ingrained within tourism operations moving forward.

But travel will also evolve in other ways, and as an industry, we need to be prepared to think digitally, and reimagine our use of physical space.

Hotels will become dynamic meeting places for teams to bond in our new hybrid work style. Lodgings near major corporate headquarters will benefit from an influx of bookings from employees convening for longer periods. They will also make way for the “bleisure” traveller who mixes business trips with leisure. Hotels in unique locales will become feasible workspaces. Employers should prepare for their workers to tag on a few extra days to get some rest and relaxation after on-location company gatherings.

Beyond the pandemic, travellers will also want to explore the world differently, see new places and do new things. Our data reveals that the majority want to explore destinations in a more immersive and experiential way, and to feel more connected to the history and culture. While seeing the top of the Empire State building has been a typical excursion for tourists in New York city, visitors will become more drawn to intimate activities like taking a cooking class in Brooklyn with a family of pizza makers who go back generations. This will undoubtedly be a significant area of growth in the travel and tourism industry.

Governments would be smart to plan as well, and to consider an international playbook that helps prepare us for the next public health crisis, inclusive of universal vaccine passports and policies that get us through borders faster.

Understanding these key trends - the ongoing need to feel safe and the growing desire to travel differently - and planning for the next crisis will be essential for governments, destinations, and tourism businesses to succeed in the efforts to keep the world travelling.

An official website of the United States government

- Special Topics

Travel and Tourism

Travel and tourism satellite account for 2018-2022.

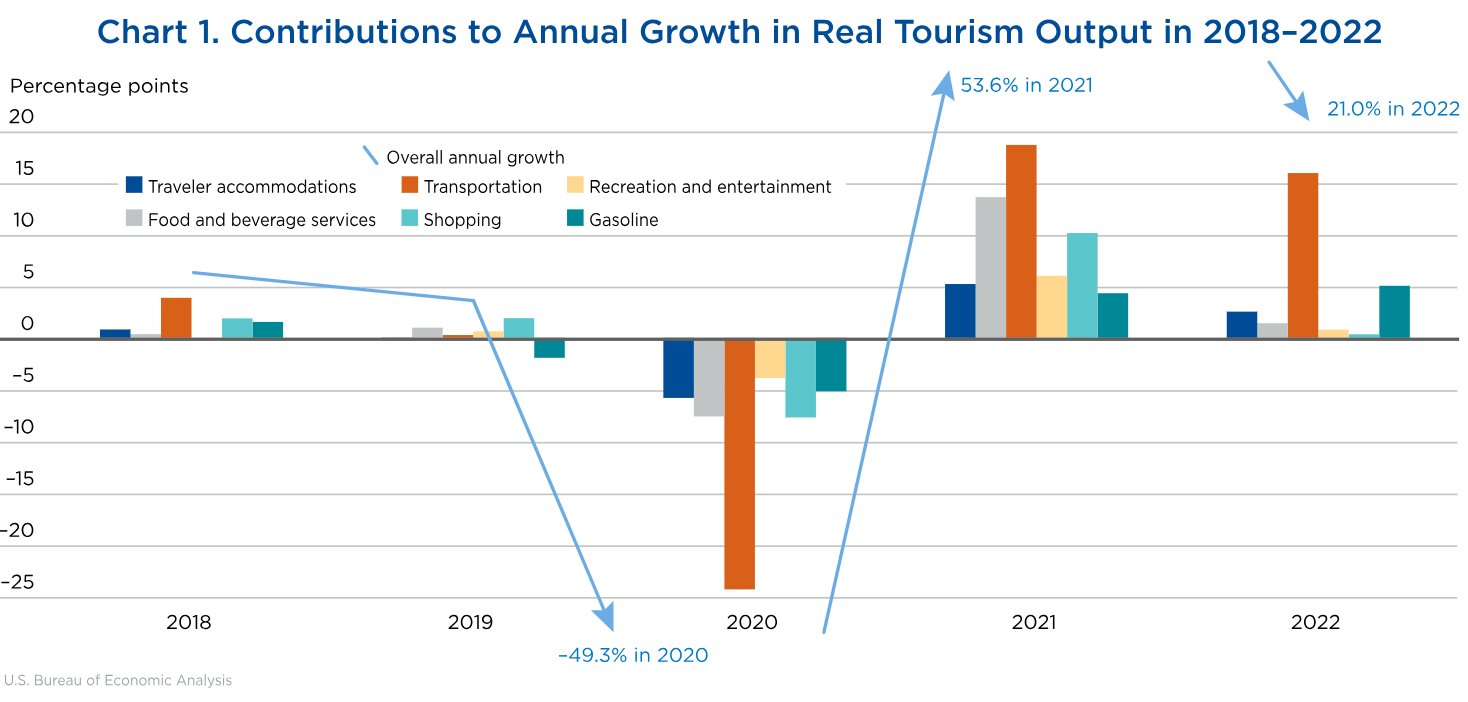

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

Tourism’s Importance for Growth Highlighted in World Economic Outlook Report

- All Regions

- 10 Nov 2023

Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector’s rapid recovery will have on certain economies worldwide.

According to the World Economic Outlook (WEO) Report , the global economy will grow an estimated 3.0% in 2023 and 2.9% in 2024. While this is higher than previous forecasts, it is nevertheless below the 3.5% rate of growth recorded in 2022, pointing to the continued impacts of the pandemic and Russia's invasion of Ukraine, and from the cost-of-living crisis.

Tourism key sector for growth

The WEO report analyses economic growth in every global region, connecting performance with key sectors, including tourism. Notably, those economies with "large travel and tourism sectors" show strong economic resilience and robust levels of economic activity. More specifically, countries where tourism represents a high percentage of GDP have recorded faster recovery from the impacts of the pandemic in comparison to economies where tourism is not a significant sector.

As the report Foreword notes: "Strong demand for services has supported service-oriented economies—including important tourism destinations such as France and Spain".

Looking Ahead

The latest outlook from the IMF comes on the back of UNWTO's most recent analysis of the prospects for tourism, at the global and regional levels. Pending the release of the November 2023 World Tourism Barometer , international tourism is on track to reach 80% to 95% of pre-pandemic levels in 2023. Prospects for September-December 2023 point to continued recovery, driven by the still pent-up demand and increased air connectivity particularly in Asia and the Pacific where recovery is still subdued.

Related links

- Download the News Release on PDF

- UNWTO World Tourism Barometer

- IMF World Economic Outlook

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., international tourism swiftly overcoming pandemic downturn, tourism on track for full recovery as new data shows st....

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

COVID-19 has affected every sector across the globe, and the hotel industry is among the hardest hit. Our research suggests that recovery to pre-COVID-19 levels could take until 2023—or later. Investors are providing similar views of hotel companies’ prospects, as seen in the underperformance of US lodging real estate investment trusts (REITs). Like so many industries, hospitality will also see both subtle and substantial shifts in the post-pandemic era. Some are already apparent today.

In this article, we will examine a set of recovery scenarios for US hotels, including differing return and recovery timelines for hotels ranging from luxury to economy segment. On the consumer side, we will look at what guests say will make them feel safe when traveling, including contactless check-ins and check-outs, and an added emphasis on hygiene. And we will review the factors affecting the initial return of travel in the domestic business and leisure segments.

Today: High vacancy

COVID-19 is a challenge to both our lives and livelihoods. The crisis is unprecedented and moving quickly, yet still deeply uncertain.

To put parameters around that uncertainty, our colleagues created nine potential scenarios for recovery of national economies , based on the extent to which the pandemic spread is controlled, as well as the effectiveness of economic policies intended to counter the effects of quarantine (Exhibit 1).

Our recent survey of 2,000 global business executives found that scenarios A3 and A1 are seen as most likely. Each scenario has distinct implications. A3 projects GDP recovery as early as 2021. The more conservative A1 projects a delay in GDP recovery until 2023.

On the hotel front, we analyzed the long-term historical relationship between industry performance and economic data. There is variation across chain scales (from luxury to economy), but we found the strongest relationship between changes in revenue per available room (RevPAR) and the unemployment rate. Based on this relationship, we used the unemployment rate projections from our colleagues to set a baseline for hotel performance. We then adjusted the baseline to account for additional impacts of COVID-19, factoring in the likely length of shelter-in-place restrictions, changes in company travel policies, consumer sentiment and willingness to travel, and structural changes to demand, such as videoconferences instead of in-person events.

In scenario A3, the virus’s spread is contained, and the economy recovers slowly, revenue per available hotel room (RevPAR) falls by 53 percent in 2020, and returns to very near pre-crisis levels in 2022 (Exhibit 2).

In A3, travel restrictions are lifted for most domestic travel in June 2020 and some international travel in July 2020. In this scenario, it will take six months after restrictions are lifted before buying behavior is based on economic, rather than health-related factors driven by effective, at-scale treatment and/or availability of vaccinations. A3 also assumes limited structural, long-term impact on demand from visiting family and relatives (VFR) and leisure travelers, though transient business travel and groups are reduced by 5 to 10 percent.

A1 is more dire: this scenario presents a sustained, systemic shock for hotels. Recovery to something like 2019’s level does not occur until beyond 2023. RevPAR falls by 60 percent in 2020, and only recovers slightly in 2021.

Economy class is faring better than others

Many US hotels are closed, especially luxury hotels. Occupancy rates show what’s happening. In early May, occupancy was less than 15 percent for luxury hotels and around 40 percent for economy.

Looking ahead, we expect economy hotels to have the fastest return to pre-pandemic levels, and luxury and upper upscale hotels to have the slowest (Exhibit 3). That’s in part because economy hotels are better able to tap segments of demand that remain relatively healthy despite travel restrictions, including truck drivers and extended-stay guests.

Operating economics are also significant: economy hotels can stay open at lower occupancy rates than other chain scales. In all hotels, revenue is a function of average daily rate, number of rooms, and occupancy—plus food and beverage where available. Costs are threefold: variable (with revenue); semi-fixed (may be eliminated if hotel suspends operations); and fixed. For owners considering suspending operations, variable and semi-fixed costs are factors, since fixed costs don’t change, no matter what.

Our analysis indicates that to cover variable and semi-fixed costs, luxury hotels conservatively need occupancy rates 1.5 times greater than economy hotels. Many economy hotels can further reduce their variable and semi-fixed costs, especially if they use family labor. Many luxury hotels, on the other hand, require more than 100 employees to operate.

Better demand and lower operating costs suggest that economy hotels will recover faster. That would be consistent with what we’ve seen in past crises. But there will likely be pockets of resilience and recovery across the market. We are already hearing stories about hotels that are sold out for Labor Day weekend. Similarly, there could be air pockets in otherwise solid chain scales. Hotels reliant on meetings, incentives, conferences, and events (MICE) revenue could face deep shortfalls. Owners will need to monitor bookings carefully, to distinguish between one-off blips in growth and a sustained recovery.

Investors are pessimistic

While publicly traded hotel companies have done much worse than the broader market—bottoming out at a 60 percent share price decrease, 25 percentage points below the S&P 500—lodging REITs, which make up a large portion of publicly traded hotel groups, have fared even worse. Mid-cap REIT share prices have fallen as much as 70 percent since January 1, and some small-cap funds have fared even worse. That’s driven by the structure of the REIT, a pass-through vehicle required to pay out 80 to 90 percent of its net income as shareholder dividends. Shareholders’ confidence in REITs has fallen, as many assume that with component properties hit hard, REITS will not be able to pay dividends, their primary value proposition.

Investors are distinguishing among REITs in a few ways, including debt structure and balance-sheet resilience, geography, and the chain scale of the lodging portfolio. Larger REITs are retaining shareholder confidence, for two reasons: most have more liquidity (cash, mainly) with which to cover fixed costs, and larger REITS tend to be less leveraged than smaller REITs.

The road to recovery: Making the hotel experience safe

When asked what it would take to get them to travel again, most US leisure travelers want additional health and safety measures, according to the McKinsey Consumer Leisure Travel Survey, which surveyed 3,498 travelers from five countries in April 2020 (Exhibit 4).

No one measure, however, satisfies those queried. Survey participants were asked to select all the answers that applied, and respondents said, essentially, “yes”—they do not distinguish among the safety measures, and think these all are more or less valuable.

As they ponder those results, many hotels are wondering what steps to take, in what order, to make their properties safe, and demonstrate that to reluctant customers. Some answers may be emerging from China, the first nation affected by the crisis, and the first one to start coming out of it. Leading Chinese hotels are deploying a range of health and hygiene measures that may be helpful as examples.

Would you like to learn more about our Travel, Logistics & Transport Infrastructure Practice ?

Some Chinese hotels are fine-tuning their booking tools to remind customers about the restrictions in place, and hotels follow up with guests about those before they arrive. Upon check-in, some hotels require guests to provide proof (via a QR code) that they have not been in contact with infected people. Some also measure guests’ body temperature several times: at check-in, anytime they enter and exit the hotel during their stay, as well as upon their checkout. For Western hotels to adopt the same standards would of course require changes in government policy and public-health approaches.

Chinese hotels have also instituted new cleaning processes. Some leading chains have also added touchless or contactless elements to the customer experience, including contactless checkouts via app or email, and robots to deliver food, beverages, and the like. Some operators are limiting food and beverage options to prepackaged meals, to be consumed inside guests’ rooms versus common restaurant or bar areas. Additional hotel amenities like gyms, spas, and laundry facilities may be closed. At the same time, many Chinese hotels have increasingly targeted their offerings toward the local population and those traveling within short distances—for example, by offering meal plans for locals, or weekend getaways for those who want to spend time outside the city or their apartments.

See “ The way back: What the world can learn from China’s travel restart after COVID-19 ” to read how hotels are testing and learning to see what’s effective all along the customer journey, from prebooking through checkout.

Implications for travel and hospitality

Travel will return. But the recovery will likely take longer than in other industries, and will vary across segments. Business and leisure travel will return at different paces, as will domestic and international travel. What’s certain is that the next normal will be marked by structural shifts, especially around customer expectations for hygiene and flexibility.

For business travelers, demand will likely come back unevenly. Essential travel will differ by industry. According to executives and chief human resources officers in North America, interviewed in April 2020 across an array of industries, every one of their companies is using technology as a substitute for nonessential travel. Most expect that certain types of travel—like internal meetings—will never fully return to pre-COVID-19 levels.

Companies say they plan to turn off their travel restrictions in phases, and are developing decision-making processes and more agile travel policies to account for safety before authorizing travel. Client-facing visits such as site visits and sales calls are likely to return first. Day trips and self-drive travel are likely to return earlier since physical-distancing measures, exposure, and risk will be more manageable. Conferences and industry events will likely be the last to return.

In leisure, we expect that travel to visit friends and relatives will return first, likely by car. Travel restrictions combined with economic uncertainty will likely translate into a higher share of domestic and close-to-home travel. Longer international leisure trips will be slow to return, and travelers will expect greater flexibility in cancelation and change fees. The recovery may include extremely short planning cycles driven by gradual lifts of the travel restrictions and very short booking windows as travelers monitor the situation.

Recent trends in China may offer a glimpse of the weeks ahead for US travelers. As domestic travel in China slowly returns , cautious travelers prefer to stay close to home, either driving or taking trains to regional destinations (Exhibit 5).

Hotels face the prospect of a long recovery. Over the coming months and years, properties’ circumstances will vary based on a number of factors, including chain scale, location, and demand profile. There is no one right response for everyone, but some guidelines apply universally. Hotels must care for their employees, staying engaged with them through the pandemic and keeping them safe when they return. They must manage customer expectations, recognize that these will continue to evolve, and prepare to act agilely to address health and safety concerns. And they must revise their commercial strategy for the restart, with an eye toward the next normal. In the long term, travel will return because of an important shift in consumption—an accelerated pivot from buying things to buying experiences.

We hope the ideas in this article stimulate your thinking and we look forward to hearing your thoughts.

Vik Krishnan is a partner in McKinsey’s San Francisco office, Ryan Mann is an associate partner in the Chicago office, Nathan Seitzman is a partner in the Dallas office, and Nina Wittkamp is an associate partner in the Munich office.

The authors wish to thank Peter Boehm, Andrew Curley, Ben Kohlmann, Melinda Peters, Ganesh Raj, Kyle Snyder, Peimin Suo, and Edison Yu for their contributions to this article.

This article was edited by Justine Jablonska, an editor in the New York office.

Explore a career with us

Related articles.

The way back: What the world can learn from China’s travel restart after COVID-19

Hitting the road again: How Chinese travelers are thinking about their first trip after COVID-19

Beyond contactless operations: Human-centered customer experience

The magazine of Glion Institute of Higher Education

- What is tourism and hospitality?

Tourism and hospitality are thriving industries encompassing many sectors, including hotels, restaurants, travel, events, and entertainment.

It’s an exciting and dynamic area, constantly evolving and adapting to changing customer demands and trends.

The tourism and hospitality industry offers a diverse range of career opportunities that cater to various interests, skills, and qualifications, with positions available from entry-level to executive management.

The booming tourism and hospitality industry also offers job security and career growth potential in many hospitality-related occupations.

What is tourism?

Tourism is traveling for leisure, pleasure, or business purposes and visiting various destinations, such as cities, countries, natural attractions, historical sites, and cultural events, to experience new cultures, activities, and environments.

Tourism can take many forms, including domestic, or traveling within your country, and international tourism, or visiting foreign countries.

It can also involve sightseeing, adventure tourism , eco-tourism, cultural tourism, and business tourism, and it’s a huge contributor to the global economy, generating jobs and income in many countries.

It involves many businesses, including airlines, hotels, restaurants, travel agencies, tour operators, and transportation companies.

What is hospitality?

Hospitality includes a range of businesses, such as hotels, restaurants, bars, resorts, cruise ships, theme parks, and other service-oriented businesses that provide accommodations, food, and beverages.

Hospitality is all about creating a welcoming and comfortable environment for guests and meeting their needs.

Quality hospitality means providing excellent customer service, anticipating guests’ needs, and ensuring comfort and satisfaction. The hospitality industry is essential to tourism as both industries often work closely together.

What is the difference between tourism and hospitality?

Hospitality and tourism are both related and separate industries. For instance, airline travel is considered as part of both the tourism and hospitality industries.

Hospitality is a component of the tourism industry, as it provides services and amenities to tourists. However, tourism is a broader industry encompassing various sectors, including transportation, accommodation, and attractions.

Transform your outlook for a successful career as a leader in hospitality management

This inspiring Bachelor’s in hospitality management gives you the knowledge, skills, and practical experience to take charge and run a business

Is tourism and hospitality a good career choice?

So, why work in hospitality and tourism? The tourism and hospitality industry is one of the fastest-growing industries in the world, providing a colossal number of job opportunities.

Between 2021 and 2031, employment in the hospitality and tourism industry is projected to expand faster than any other job sector, creating about 1.3 million new positions .

A tourism and hospitality career can be a highly rewarding choice for anyone who enjoys working with people, has a strong service-oriented mindset, and is looking for a dynamic and exciting career with growth potential.

Growth and job opportunities in tourism and hospitality

Tourism and hospitality offers significant growth and job opportunities worldwide. The industry’s increasing demand for personnel contributes to economic and employment growth, particularly in developing countries.

The industry employs millions globally, from entry-level to high-level management positions, including hotel managers, chefs, tour operators, travel agents, and executives.

It provides diverse opportunities with great career progression and skill development potential.

Career paths in tourism and hospitality

There are many career opportunities in tourism management and hospitality. With a degree in hospitality management, as well as relevant experience, you can pursue satisfying and fulfilling hospitality and tourism careers in these fields.

Hotel manager

Hotel managers oversee hotel operations. They manage staff, supervise customer service, and ensure the facility runs smoothly.

Tour manager

Tour managers organize and lead group tours. They work for tour companies, travel agencies, or independently. Tour managers coordinate a group’s transportation, accommodations, and activities, ensuring the trip runs to schedule.

Restaurant manager

Restaurant managers supervise the daily operations of a restaurant. They manage staff, ensure the kitchen runs smoothly, and monitor customer service.

Resort manager

Resort managers supervise and manage the operations of a resort. From managing staff to overseeing customer service, they ensure the entire operation delivers excellence.

Entertainment manager

Entertainment managers organize and oversee entertainment at venues like hotels or resorts. They book performers, oversee sound and lighting, and ensure guests have a great experience.

Event planner

Event planners organize and coordinate events, such as weddings, conferences, and trade shows. They work for event planning companies, hotels, or independently.

vent planners coordinate all aspects of the event, from the venue to catering and decor.

Travel consultant

Travel consultants help customers plan and book travel arrangements, such as flights, hotels, and rental cars. They work for travel agencies or independently. Travel consultants must know travel destinations and provide superb customer service.

What skills and qualifications are needed for a career in tourism and hospitality?

Tourism and hospitality are rewarding industries with growing job opportunities. Necessary qualifications include excellent skills in communication, customer service, leadership, problem-solving, and organization along with relevant education and training.

Essential skills for success in tourism and hospitality

A career in the tourism and hospitality industry requires a combination of soft and technical skills and relevant qualifications. Here are some of the essential key skills needed for a successful career.

- Communication skills : Effective communication is necessary for the tourism and hospitality industry in dealing with all kinds of people.

- Customer service : Providing excellent customer service is critical to the success of any tourism or hospitality business . This requires patience, empathy, and the ability to meet customers’ needs.

- Flexibility and adaptability : The industry is constantly changing, and employees must be able to adapt to new situations, be flexible with their work schedules, and handle unexpected events.

- Time management : Time management is crucial to ensure guest satisfaction and smooth operations.

- Cultural awareness : Understanding and respecting cultural differences is essential in the tourism and hospitality industry, as you’ll interact with people from different cultures.

- Teamwork : Working collaboratively with colleagues is essential, as employees must work together to ensure guests have a positive experience.

- Problem-solving : Inevitably, problems will arise, and employees must be able to identify, analyze, and resolve them efficiently.

- Technical skills : With the increasing use of technology, employees must possess the necessary technical skills to operate systems, such as booking software, point-of-sale systems, and social media platforms.

Revenue management : Revenue management skills are crucial in effectively managing pricing, inventory, and data analysis to maximize revenue and profitability

Master fundamental hospitality and tourism secrets for a high-flying career at a world-leading hospitality brand

With this Master’s degree, you’ll discover the skills to manage a world-class hospitality and tourism business.

Education and training opportunities in tourism and hospitality

Education and training are vital for a hospitality and tourism career. You can ensure you are prepared for a career in the industry with a Bachelor’s in hospitality management and Master’s in hospitality programs from Glion.

These programs provide a comprehensive understanding of the guest experience, including service delivery and business operations, while developing essential skills such as leadership, communication, and problem-solving. You’ll gain the knowledge and qualifications you need for a successful, dynamic, and rewarding hospitality and tourism career.

Preparing for a career in tourism and hospitality

To prepare for a career in tourism and hospitality management, you should focus on researching the industry and gaining relevant education and training, such as a hospitality degree . For instance, Glion’s programs emphasize guest experience and hospitality management, providing students with an outstanding education that launches them into leading industry roles.

It would help if you also worked on building your communication, customer service, and problem-solving skills while gaining practical experience through internships or part-time jobs in the industry. Meanwhile, attending industry events, job fairs, and conferences, staying up-to-date on industry trends, and networking to establish professional connections will also be extremely valuable.

Finding jobs in tourism and hospitality

To find jobs in tourism and hospitality, candidates can search online job boards, and company career pages, attend career fairs, network with industry professionals, and utilize the services of recruitment agencies. Hospitality and tourism graduates can also leverage valuable alumni networks and industry connections made during internships or industry projects.

Networking and building connections in the industry

Networking and building connections in the hospitality and tourism industry provide opportunities to learn about job openings, meet potential employers, and gain industry insights. It can also help you expand your knowledge and skills, build your personal brand, and establish yourself as a valuable industry professional.

You can start networking by attending industry events, joining professional organizations, connecting with professionals on social media, and through career services at Glion.

Tips for success in tourism and hospitality

Here are tips for career success in the tourism and hospitality industry.

- Gain relevant education and training : Pursue a hospitality or tourism management degree from Glion to gain fundamental knowledge and practical skills.

- Build your network : Attend industry events, connect with colleagues and professionals on LinkedIn, and join relevant associations to build your network and increase your exposure to potential job opportunities.

- Gain practical experience : Look for internships, part-time jobs, or volunteering opportunities to gain practical experience and develop relevant skills.

- Develop your soft skills : Work on essential interpersonal skills like communication, empathy, and problem-solving.

- Stay up-to-date with industry trends : Follow industry news and trends and proactively learn new skills and technologies relevant to tourism and hospitality.

- Be flexible and adaptable : The tourism and hospitality industry constantly evolves, so be open to change and to adapting to new situations and challenges.

- Strive for excellent guest service : Focus on delivering exceptional guest experiences as guest satisfaction is critical for success.

Tourism and hospitality offer many fantastic opportunities to create memorable guest experiences , work in diverse and multicultural environments, and develop transferable skills.

If you’re ready to embark on your career in tourism and hospitality, Glion has world-leading bachelor’s and master’s programs to set you up for success.

Photo credits Main image: Maskot/Maskot via Getty Images

LIVING WELL

HOSPITALITY UNCOVERED

BUSINESS OF LUXURY

LISTENING TO LEADERS

WELCOME TO GLION.

This site uses cookies. Some are used for statistical purposes and others are set up by third party services. By clicking ‘Accept all’, you accept the use of cookies

Privacy Overview

- Hospitality Industry

Sustainable Tourism: Why Should Hotels Lead in This Effort?

January 19, 2019 •

8 min reading

The tourism industry has one of the highest growth rates out of all industries in the world, accounting for 10.4% of global GDP and 319 million jobs (10% of total employment in 2018) 1 . . At the moment, there is no sign of a slump in this trend. In 2018, 1.4 billion international tourist arrivals were recorded (up 47% from the 2010s' 950.8 million) and the number is expected to rise to 1.8 billion in 2030. Hotels are only one of the many actors that play a big role in the industry as a whole 2 .

Hotels play a vital role in sustainable tourism

The demand for hotels is usually associated with the number of tourists that are seeking an overnight stay and the popularity of a destination 3 . Thus, when an area's tourist demand grows, demand for hotels rises, driving developers and hotel companies to rush into popular destinations. Hotels, tourism, and local communities intertwine in close symbiotic relationships due to their physical proximity of and inevitable collaboration 4 .

For this reason, sustainable tourism practices and ethical hotel development (that connects social, cultural and economic factors) are vital factors for both the long term preservation of culture and the social-economic stability of the host communities 5 . With this considered, hotels play a vital role in setting up viable operational practices as well as educating consumers on sustainable behaviors.

Consumers are increasingly seeking sustainable destinations

Not only is sustainability a growing social issue, but consumers are becoming more aware of sustainable practices in hotels as information becomes more transparent.

According to Booking.com’s 2019 Sustainable Travel Report , 70% of global travelers say they would be more likely to book an accommodation knowing it was eco-friendly, and 55% of global travelers report being more determined to make sustainable travel choices compared to last year.

The UN's Sustainable Development Goals: a Lever to lead in sustainable tourism

Sustainability is a multi-faceted term to indicate initiatives that preserve a particular resource. To address sustainability, one needs to address the four main pillars: human, social, economic and environment.

As sustainability must be a global and multi-stakeholder effort, the United Nations (UN) launched their Sustainable Development Goals (SDG) in 2015, as ‘the blueprint to achieve a better and more sustainable future for all’. The 17 goals aim to ‘address the global challenges we face, including those related to poverty, inequality, climate, environmental degradation, prosperity, and peace and justice’ 6 .

As the SDG act as a guideline for hotels to compartmentalize each of their major operational functions (ie. housekeeping, sales and marketing, client service), how can hotels adjust their current practices accordingly?

- Identify and commit – Identify areas of major department functions (ie. housekeeping, sales and marketing, client service) with regards to ways that may impact the SDGs.

- Alignment - Align SDG with a hotel's strategy and priorities to engage with stakeholders (ie. franchisee, employees, customers etc).

- Develop target and KPIs – Create new KPIs to address new areas in relation to identified SDG. Alternatively, hotels can add new factors to existing KPIs. These KPIs will be the key to monitor and communicate progress.

- Revisit corporate strategy – Assess how existing practices in different departments can be adjusted to follow the SDGs.

- Measure the quantitative data collected

- Assess data for possible improvements

- Report performance and compare with set target and KPI

- Communicate with brand and customers about this effort

What are the benefits?

- Drive growth – Business growth is tied to the achievement of the SDGs at a macro level. Businesses need a resilient, reliable, educated and healthy workforce from all departments to support their workforce 7 . In the hospitality industry, its workforce plays a vital role to contribute to the overall guest experience, therefore, it is important for businesses to take action at a local level to drive their growth in the long term.

- Address risk – Creating a stable market means there is less risk involved in the investment. Each SDG represents a risk area that holds challenge to the business and society 8 . In the asset-heavy world of the hospitality industry with long-term management contracts, building a stable environment is therefore both a win for the hotel investors and management company to operate in a low-risk environment and a win for the local community to benefit from this stable lifestyle.

- Attract investment - For the implementation of SDGs, both government and private sectors have flowed cash to projects through climate-focused multilateral public funds 9 . In the financial sector, innovative financial models have been introduced 10 . BNP Paribas , for example, arranges their bond as part of its own SDG initiative where the return on investment of the bonds is directly linked to the stock performance of companies included in the Solactive Sustainable Development Goals World Index of recognized leaders in their industries on socially and environmentally sustainable issues 11 .

- Refocus on company value – The hospitality industry is a people-focused business. From guests to employees to stakeholders and locals, the hospitality industry’s value is rooted in creating value for others and improving the world we live in. Since the SDGs require global effort from different sectors, contributing to the SDGs is a good leap towards re-assessing values for all stakeholders. The SDGs can help hotels define their aspirational purpose, inspire stakeholders at all levels and increase shareholder value in the long run.

- Heighten brand appeal – The demand for sustainable properties will continue to rise as consumers become more aware of sustainable issues. 70% of global travelers say they would be more likely to book an accommodation knowing it was eco-friendly, and over half of the global travelers reporting they are more determined to make sustainable travel choices in the coming year compared to last year 12 . By advertising a brand or a hotel property's sustainable practices and activities, these brands/properties can gain an upper hand on attracting more customers.

- Appeal to a wider audience – Hotels constantly introduce new brands to relate to different age groups and accommodate different lifestyles. Despite the rise in demand for sustainable accommodations, travelers still face barriers when making sustainable travel choices - 37% of respondents do not know how to make their travel more sustainable 13 . Focusing on sustainable factors can be a blue-ocean strategy.

- Your effort pays off – At the early stage, capital is needed to jump-start in sustainable transformation, but the return is gradual and will eventually build long-term return 13 . Therefore, companies should take a real and especially complex effort to achieve relative SDGs.

Best in class examples

Accor has been the leading hotel chain in its sustainable effort. Their “Planet 21” initiative was launched in 2011 and addresses 10 of the 17 SDGs 14 .

In response, both Marriott and Hilton launched their own sustainability projects aimed to address the SDGs in 2018 15, 16 . Marriott is the leader in providing transparency regarding each property’s efforts , and has pledged for the goal “that by 2020, each property will have a 'Serve 360’ section on their website with specific hotel impact metrics” 17 . Accor and Hilton also aim to provide property-wide transparent data at an indefinite time in the future 18, 19 .

Marriott , Accor , Hilton lead the best-in-class examples, nonetheless, there remains significant questions about the reporting and monitoring accuracy of their goals - an issue which should be addressed through the transparency and public availability of information from each property.

Challenges at hand

While big hotel chains have been fighting for the top spot on the podium of hitting all SDG, these companies have a big shoe to fill that impacts the company’s goal and the community around it. Therefore, it is important that the company’s CSR is created and also rolled out in a responsible manner.

Companies need to be strategic and careful when using the SDG as a tool to actualize benefit for the society in a sustainable manner instead of using it as a marketing tool for “greenwashing”, which will hurt the brand’s image in the long run.

One of the way to tackle the monitoring fairness, for example, is for hotels to consider hiring a third party verifier to ensure the consistency and these data are fraud-free – the next essential step is to assess the sincerity of hotels' devotion to the sustainability cause.

- https://ourworldindata.org/tourism

- https://www.globalwellnesssummit.com/wp-content/uploads/Industry-Research/Global/2011_UNWTO_Tourism_Towards_2030.pdf

- https://www.worldatlas.com/articles/what-are-the-negative-effects-of-tourism-on-the-environment.html

- https://s3-eu-west-1.amazonaws.com/s3-euw1-ap-pe-ws4-cws-documents.ri-prod/9781138784567/Ch%206_Timothy.pdf

- https://sustainabledevelopment.un.org/?menu=1300

- https://www.ey.com/en_gl/assurance/why-sustainable-development-goals-should-be-in-your-business-plan

- http://businesscommission.org/

- https://globalnews.booking.com/bookingcom-reveals-key-findings-from-its-2019-sustainable-travel-report/

- https://all.accor.com/gb/sustainable-development/index.shtml

- https://www.marriott.com/default.mi

- https://cr.hilton.com/

EHL Alumni 2018

Keep reading

How Airbnb and short-term rentals reshape rural and urban communities

May 02, 2024

What does a Hotel Manager do?

Luxury hotels and a ‘sense of place’: The challenge for hoteliers

May 01, 2024

This is a title

This is a text

- Bachelor Degree in Hospitality

- Pre-University Courses

- Master’s Degrees & MBA Programs

- Executive Education

- Online Courses

- Swiss Professional Diplomas

- Culinary Certificates & Courses

- Fees & Scholarships

- Bachelor in Hospitality Admissions

- EHL Campus Lausanne

- EHL Campus (Singapore)

- EHL Campus Passugg

- Host an Event at EHL

- Contact our program advisors

- Join our Open Days

- Meet EHL Representatives Worldwide

- Chat with our students

- Why Study Hospitality?

- Careers in Hospitality

- Awards & Rankings

- EHL Network of Excellence

- Career Development Resources

- EHL Hospitality Business School

- Route de Berne 301 1000 Lausanne 25 Switzerland

- Accreditations & Memberships

- Privacy Policy

- Legal Terms

© 2024 EHL Holding SA, Switzerland. All rights reserved.

IMAGES

VIDEO

COMMENTS

Globally, travel and tourism's direct contribution to gross domectic product (GDP) was approximately 7.7 trillion U.S. dollars in 2022. This was a, not insignificant, 7.6 percent share of the ...

Hospitality that benefits people and the planet. How will hotel companies improve the guest experience, create a happier workforce, and help fight climate change? Five of McKinsey's travel and hospitality experts—Margaux Constantin, Vik Krishnan, Matteo Pacca, Steve Saxon, and Caroline Tufft—envision the hotel industry of the 2030s.

As travel resumes and builds momentum, it's becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 "Tourism set to return to pre-pandemic levels ...

10 hospitality trends 2024 - Elevate experiences, embrace evolution. Workforce empowerment: Transforming challenges into opportunities. Artificial intelligence and technology: Choosing the best tech to revolutionize hospitality. Culinary experiences: Putting experiences, authenticity and the senses first.

The hospitality industry experienced a remarkable growth from $4,390.59 billion in 2022 to $4,699.57 billion in 2023, achieving a compound annual growth rate (CAGR) of 7.0%. This significant expansion is a testament to the industry's resilience and ability to bounce back from the challenges posed over recent years.

Hotels will continue to struggle with staffing shortages, reducing their ability to maximize revenue from potential travelers. Inflationary pressure means that though a nominal recovery may occur earlier, true adjusted recovery for the industry will take until 2025, according to STR and Tourism Economics . 9

Governments have generally played a limited role in the industry, with partial oversight and light-touch management. COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024.

The global travel and tourism sector's post-pandemic recovery is gaining pace as the world's pent-up desire for travel rekindles. The difference in international tourist arrivals in January 2021 and a similar period in January 2022 was as much as the growth in all of 2021. However, with $4.5 trillion in GDP and 62 million jobs lost in 2020 ...

The hospitality industry spans across service industry sectors such as restaurants, hotels and the broader tourism industry (e.g. cruise ships). As one of the largest job creators and economic contributors, it is important for both customers and workers to understand the ins and outs of this dynamic industry.

Travel and Tourism Satellite Account for 2018-2022 The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Sate

The overall growth in the travel and tourism industry stands at +5.8% Vs. Overall GDP +2.7%. According to the Hospitality Global Market Report 2023 the global hospitality marketgrew from $4,390.59 billion in 2022 to $4,699.57 billion in 2023 at a compound annual growth rate (CAGR) of 7.0%.

They will be more likely to survive and thrive. As an ex-strategy consultant and public speaker on digital and technology trends, and now running venture-backed, travel-tech startup Beyonk, here ...

10 Nov 2023. Tourism has again been identified as a key driver of economic recovery and growth in a new report by the International Monetary Fund (IMF). With UNWTO data pointing to a return to 95% of pre-pandemic tourist numbers by the end of the year in the best case scenario, the IMF report outlines the positive impact the sector's rapid ...

The outlook for the tourism sector remains highly uncertain. The coronavirus (COVID-19) pandemic continues to hit hard, with international tourism expected to decrease by around 80% in 2020. Domestic tourism is helping to soften the blow, at least partially, and governments have taken impressive immediate action to restore and re-activate the sector, while protecting jobs and businesses.

June 10, 2020 | Article. (PDF-362 KB) COVID-19 has affected every sector across the globe, and the hotel industry is among the hardest hit. Our research suggests that recovery to pre-COVID-19 levels could take until 2023—or later. Investors are providing similar views of hotel companies' prospects, as seen in the underperformance of US ...

The tourism and hospitality industry is one of the fastest-growing industries in the world, providing a colossal number of job opportunities. Between 2021 and 2031, employment in the hospitality and tourism industry is projected to expand faster than any other job sector, creating about 1.3 million new positions.

What are the benefits of tourism? And what are all the sectors within the tourism Industry? ...

Hotels are only one of the many actors that play a big role in the industry as a whole 2. Hotels play a vital role in sustainable tourism. The demand for hotels is usually associated with the number of tourists that are seeking an overnight stay and the popularity of a destination 3. Thus, when an area's tourist demand grows, demand for hotels ...

tourism, the act and process of spending time away from home in pursuit of recreation, relaxation, and pleasure, while making use of the commercial provision of services.As such, tourism is a product of modern social arrangements, beginning in western Europe in the 17th century, although it has antecedents in Classical antiquity.. Tourism is distinguished from exploration in that tourists ...