- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Beginning in the late 1980s, traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions such as American Express.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include American Express , Visa , and AAA . They often come with a 1% to 2% purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account. The redemption application online should take less than 15 minutes to complete.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from American Express, Visa, and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Many hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1322286458-04476bcc51ed474490a6de4473b43dc1.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients . Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. January 16th, 2024

- UK Passports Offer Better Travel Freedom Since Brexit The Henley Passport Index is an annual research project that evaluates the relative power of passports from 199 countries. It determines how many locations each passport allows its holders to access visa-free or with visa-on-arrival, creating a global ranking. June 5th, 2023

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. June 5th, 2023

- Cheapest European city breaks on the British government’s exemption list The study incorporated numerous factors across a variety of areas including: February 15th, 2023

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! February 19th, 2024

Contributors

April Summers

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

31 Published Articles 3097 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Are Traveler’s Checks?

Where to buy traveler’s checks, how to use traveler’s checks, what to do if traveler’s checks are stolen, 1. no access to credit or debit card, 2. limited access to atms, 3. access good exchange rates , 4. avoid common credit or debit fees, 5. as an added safety measure, 1. limited availability for use, 2. not all banks offer them, 3. potential for additional fees, 4. bulky paperwork, credit card, prepaid card, do your research, tell your bank you are traveling, don’t keep all of your money in 1 place, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

How To Buy and Use Traveler’s Checks

You can still buy and use traveler’s checks in the U.S. and other countries.

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

Best Ways To Use Traveler’s Checks

The following are situations when you might consider using traveler’s checks:

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Cons of Using Traveler’s Checks

Here are some reasons that might discourage you from using traveler’s checks:

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Other Alternatives

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Money Tips for Traveling Abroad

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![travellers cheque bca IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about traveler’s checks, plus modern alternatives

January 18, 2024 | 1 min video

Getting ready to travel? One thing to think about is how you’ll make purchases while you’re away. Traveler’s checks aren’t as common as they used to be. So you might want to consider modern alternatives that may offer the advantages of traveler’s checks and more.

Read on to learn more about the ins and outs of traveler’s checks. And find out about other options—for example, credit cards, prepaid cards and mobile wallets—that could help make the most of your trip.

Key takeaways

- Traveler’s checks are paper documents that can be exchanged for local currency or used to buy goods and services abroad.

- Traveler’s checks feature unique serial numbers, making them replaceable if they’re lost or stolen.

- Fees may apply when purchasing and exchanging traveler’s checks.

- There are modern alternatives to traveler’s checks that you may find more convenient.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is a traveler’s check?

A traveler’s check is a paper document you can use for making purchases when you’re traveling, typically in other countries. It can be used as cash or a regular check.

Traveler’s checks—you may also see them referred to as “cheques”—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

How do traveler’s checks work?

Traveler’s checks may be accepted at participating merchants like hotels, restaurants and stores. Just keep in mind that there could be fewer participating merchants than there used to be.

When you purchase your checks, you may notice that they have a space for two signatures:

- First signature: You might be asked to sign each of your traveler’s checks when you buy them. If not, you may want to sign them as soon as possible.

- Second signature: You’ll usually sign your traveler’s checks again when you’re making purchases.

This dual signature method is meant to provide extra security and ensure that only the purchaser is able to use them. The merchant can verify that the second signature matches the first.

How to cash in traveler’s checks

You can use traveler’s checks like cash to pay for goods and services at participating merchants. You’ll typically sign the check in front of the merchant at the time of the purchase.

While traveling, you may also be able to redeem your traveler’s checks for local currency at financial institutions or your hotel.

Potential fees associated with traveler’s checks

It’s possible that certain fees may apply to traveler’s checks. For example, you may need to pay a fee when you purchase them or when you exchange them for currency once you get to your destination. There might also be a fee for depositing unused checks into your bank account.

Where to get traveler’s checks

While traveler’s checks might be harder to find than they used to be, they’re still available. You may be able to purchase them at some banks, credit unions and travel-related service organizations.

Pros and cons of traveler’s checks

Take a look at some of the potential pros and cons of traveler’s checks:

When to use a traveler’s check

You might consider using traveler’s checks in certain situations, including:

- When you don’t have a credit or debit card. Some people may prefer to travel using modern payment options like credit and debit cards. But if you don’t have either, you may find traveler’s checks to be an acceptable alternative.

- When you can’t access an ATM. If you find yourself in a place that doesn’t have an ATM on every corner, you can instead use your checks at merchants that accept them.

- When you want to exchange them for local currency. When you get to where you’re going, you might want to have some local currency on hand. You may be able to exchange your traveler’s checks for currency at certain banks or other financial institutions.

Modern alternatives to traveler’s checks

There are a number of alternatives to traveler’s checks—options you may find faster, easier and more convenient. Here are a few to consider when you’re comparing your choices:

Credit cards

Carrying a credit card may be easier than carrying traveler’s checks. Plus, credit cards can be helpful for making large and online travel purchases like plane tickets and hotel reservations. That’s especially true with travel credit cards , which you could use to earn rewards on travel-related purchases.

Some credit cards may also come with benefits that could be useful while traveling. They might include things like protection from unauthorized charges and the ability to use a mobile app to track your purchases .

Keep in mind that foreign transaction fees may come into play when you use your credit card overseas. While this fee might vary between credit card companies, it could generally be in the range of 1%-3% of your purchase. You may also be charged a currency conversion fee. This fee is often part of a foreign transaction fee.

Some companies don’t charge foreign transaction fees. For example, none of Capital One’s U.S.-issued credit cards charge this fee. View important rates and disclosures .

If you’re traveling with your credit card, your credit card issuer may want to be alerted before you go. That’s because it might flag your purchases as fraudulent if it notices purchases made in an unfamiliar location. Thanks to the added security of its chip cards, Capital One doesn’t require this notification.

See if you’re pre-approved

Check for pre-approval offers with no risk to your credit score.

Debit cards

When you’re traveling, a debit card can be just as easy to carry around as a credit card. And like a credit card, it can help protect against fraud.

The big difference: A credit card lets you “borrow” money for purchases, while a debit card uses the money in your checking account to make purchases.

It may be helpful to carry a debit card when you’re visiting a country that generally favors cash transactions. In that case, you could use your debit card at an ATM to get cash once you’ve reached your destination. And that may be safer than bringing cash with you and exchanging it for local currency once you’ve arrived.

Keep in mind that you could be charged ATM fees when you use a debit card abroad. According to the Consumer Financial Protection Bureau (CFPB), some banks and credit unions don’t charge customers a fee for using their ATMs. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the operator of the ATM.

Also, be mindful that some banks may charge a foreign transaction fee when you make purchases abroad with a debit card. You may also be charged a currency conversion fee—often, this fee is folded into the foreign transaction fee.

Some banks, though, don’t charge foreign transaction fees. For example, Capital One doesn’t charge this fee for its 360 Checking account .

If you take a debit card on your travels, your bank may ask you to notify it beforehand. That’s because it could notice transactions made in an unfamiliar location and potentially freeze your account. Capital One doesn’t require this notification , thanks to the added security of your chip card.

Prepaid cards

Like credit cards and debit cards, prepaid cards may be easier to carry around than cash. They may also offer some protection against loss, theft or fraud once you register them.

But with a prepaid card, you don’t “borrow” money like you do with a credit card—or use money from your checking account, like with a debit card. Instead, you typically add money to a prepaid card before using it.

According to the CFPB, there are a few ways you can add funds to a prepaid card. For example, you can transfer money from your checking account or load funds at some retailers or financial institutions.

You might be charged one or more fees for using a prepaid card. The CFPB notes that if you get your prepaid card from a retailer, you should find a summary of fees on the card’s packaging. If you get your card from a different provider—online or over the phone, for example—the provider needs to share this information on paper or electronically.

Mobile wallet

You’ll probably have your phone with you when you’re traveling, right? Using a mobile wallet to make purchases is another modern alternative to traveler’s checks.

A mobile wallet is essentially a digital version of your real wallet. Depending on the wallet, you may be able to store things like credit cards, debit cards, prepaid cards, boarding passes, hotel reservations, event tickets and other types of personal data.

Mobile wallets can be convenient, allowing you to make quick and easy payments using your phone or other mobile device when you’re on the go. And they typically use advanced technology that prevents your actual account numbers from being stored in the wallet.

There are lots of mobile wallets to choose from. Researching your options could help you see which will work best while you’re traveling. Keep in mind, some merchants might not take mobile wallet payments.

Traveler’s checks in a nutshell

Traveler’s checks can be a helpful way to pay for things abroad, but there are also more modern options available today, like credit cards, debit cards, prepaid cards and mobile wallets. And with a travel credit card, you could earn rewards on your travel-related purchases.

Ready to upgrade the way you pay before your next trip? Compare Capital One travel credit cards today to find the best option for you, no matter where you’re headed.

Related Content

How do travel credit cards work.

article | February 8, 2024 | 7 min read

Should you notify your credit card company when traveling?

article | February 8, 2022 | 2 min read

Foreign transaction fees: What you need to know

article | August 10, 2023 | 8 min read

- How it Works

- Why choose us

- Snowbirds Real Estate

- Personal Expenses

- Importing Businesses

- Exporting Businesses

- Property Buyers

- International Students

Get started

What Are Traveller’s Cheques and How Do They Work?

You’ve probably heard of traveller’s cheques but may not have used them. A traveller’s cheque is among the many cashless methods of paying for services or goods. However, traveller’s cheques have been losing their popularity since the onset of credit and debit cards.

The good news is that traveller’s cheques are still functional and can save you from the stress and risk of carrying a huge chunk of money while travelling.

Here, we will answer the following questions:

- What are traveller’s cheques?

- How do they work?

- What are the benefits of traveller’s cheques?

- Can traveller’s cheques be a hassle?

- What are alternatives to traveller’s cheques?

Let’s get started.

Don't Waste Money With Banks. Get Exchange Rates Up to 2% Better With KnightsbridgeFX

What are Traveller’s Cheques?

A traveller’s cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination.

You can easily get traveller’s cheques in Canada from financial institutions like American Express or Visa. Also, some local banks offer traveller’s cheques, but most of them scrapped it a long time ago.

How Do Traveller’s Cheques Work?

Traveller’s cheques do not bounce since you pay upfront for a specific amount that you wish to spend. The cheque will have a fixed value and a unique serial number.

Once you receive your traveller’s cheque, you should be conversant with how to use it. So, you should follow the issuer’s instructions and sign the traveller’s cheque upon receipt.

When making purchases, countersign the cheque in the presence of the receiver; the recipient should compare the signatures and confirm that they match. Any change is returned in the local currency since the traveller’s cheque is accepted at the same exchange rate as a cash payment.

However, you must enquire from the recipient if they accept traveller’s cheques as a means of payment before making any purchases. While the traveller’s cheques still work, some institutions and persons refer to them as outdated and do not accept them. You can still make the purchases in such cases, but you need to deposit the traveller’s cheque and receive cash in the local currency. Also, do your research ahead of your trip. Ensure that you can easily access services via your traveller’s cheque before purchasing them.

Most importantly, keep the details of your traveller’s cheque safe. If you lose your traveller’s cheque, you need to provide proof of purchase and the unique serial number to get a refund. Also, contact your cheque issuer immediately after losing your traveller’s cheque.

The traveller’s cheques do not expire. Therefore, you can keep them safe and use them in the future. Alternatively, you can deposit them in your bank account once you get home.

Benefits of Traveller’s Cheques

Here are the various advantages of traveller’s cheques.

- Safety: Traveller’s cheques are safe and can allow you to carry a large amount of money while travelling.

- Refunds are possible: With traveller’s cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank once you get home.

- Does not expire: Your traveller’s cheque does not expire and can be kept and used again in the future.

- Branded Cheques: The American Express and Visa offer branded traveller’s cheques that come in various denominations and are readily acceptable globally.

- Good exchange rates: In some cases, traveller’s cheques can access a better conversion rate.

Can Traveller’s Cheques Be A Hassle?

Traveller’s cheques have several advantages, but today, you can experience many struggles while using them.

For starters, the cheques have become outdated. Therefore, most hotels, banks, and individuals will decline them.

As a result, you will likely be forced to hunt down banks and hotels that will accept the traveller’s cheques prior to travelling. If you travel without doing your research, you can be frustrated finding that the cheques are not accepted at your destination.

Also, most banks no longer offer traveller’s cheques. The few banks that offer the cheques might charge you traveller’s cheque fees for the service.

Other Payment Methods That You Might Consider

Purchasing a traveller’s cheque may save you from the stress of carrying a large amount of money that can get lost or stolen. However, it has several limitations.

So, while travelling, you may need to consider the following alternatives:

Debit Cards

The popularity of debit cards is increasing every day. The size of the card and its acceptability rate make it among the most convenient methods of payment. So, many foreign banks, hotels, and ATMs accept foreign debit cards.

Credit Cards

Like a debit card, a credit card is small and secure to travel to various places. Besides, credit cards like MasterCard, Visa, and American Express are accepted as a method of payment in most countries globally.

Although carrying a huge amount of money while travelling is risky, it’s ideal to have a certain amount of money in cash for emergency purposes. For that reason, ensure you bring with you a given amount in the form of cash.

Prepaid Card

Prepaid cards work like debit cards and credit cards since you load them with your bank account money. Therefore, you can use your prepaid card as a debit card on the ATMs and credit card when making purchases and in hotels.

Traveller’s cheques are a safer, cashless method to use when travelling.

However, with the growing popularity of debit cards and credit cards, traveller’s cheques are quickly losing their place in the payment method.

Also, they are unacceptable in most places, making them more unreliable when travelling to destinations that limit their use. So, alongside your traveller’s cheque, carry your debit card, credit card, and some little cash to enjoy your travels .

Stop overpaying with your bank on foreign exchange

We are built to beat bank exchange rates and save you money

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788. Like most financial institutions, we are required to validate the identity of all clients. We have strict measures in place to protect your privacy.

You're 0% there.

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788 .

130,000+ Satisfied customers

There is no obligation to transact and no hidden fees.

We guarantee to beat your bank's rate 100% of the time.

Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Month January February March April May June July August September October November December

Year 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Are you or any close relative a Politically Exposed Foreign Person?

(Head of State, Member of Senate, House of Commons, or Legistrature, etc)*

I confirm I am not transacting on behalf of a third party and I have read and I agree to the Terms and Conditions*

- Daily Update (2,667)

- Editorials (40)

- Finance Tips (23)

- Guides (285)

- Holiday Hours (1)

- In the News (34)

- International Money Transfer (10)

- Monthly Canadian Dollar Outlook/Forecast (108)

- Real Estate (11)

- Trading Tips (15)

- Travel Tips (34)

- Uncategorized (6)

Recent Posts

- Canadian Dollar Update – Canadian Dollar remains under pressure

- Canadian Dollar Update – Canadian Dollar gets hammered

- Canadian Dollar Update – Canadian Dollar facing dual risks

- Canadian Dollar Update – Canadian Dollar becalmed before BoC

- Canadian Dollar Update – Canadian Dollar Eclipsed

- FX Monthly Update | April 2024

- Canadian Dollar Update – Canadian Dollar on back burner

- Canadian Dollar Update – Canadian Dollar bounces off of support

- Canadian Dollar Update – Canadian Dollar is Steady

- Canadian Dollar Update – Canadian Dollar trickles higher

- Canadian Dollar Update – Canadian Dollar consolidating losses

- Canadian Dollar Update – Canadian Dollar plunges

- Canadian Dollar Update – Canadian Dollar rebounds sharply

- Canadian Dollar Update – Canadian Dollar looking ahead to CPI

- Canadian Dollar Update – Canadian Dollar trading negatively

Foreign/Currency Exchange Resources

- Currency converter Canada

- Currency Conversion

- Foreign Exchange

- $100 USD in CAD

- RBC currency converter

- RBC foreign exchange rate

- BMO exchange rate

- CIBC exchange rate

- BMO currency exchange

- Tire Bank Exchange Rate

- Scotiabank exchange rate

- HSBC exchange rate

- PayPal conversion rate

- Knightsbridge FX Reviews

- Canadian Dollar History

Useful Links

- Why Choose Us

- Get Started

- Send Money to US

- Currency Exchange Canada

- Currency Converter

- USD to CAD Exchange

Our Offices

Main office (Appointment only)

First Canadian Place

100 King Street West Suite 5700 Toronto, ON, M5X 1C7

(416) 479-0834 Toll-Free: 1-877-355-5239 Fax: 1-877-355-5239

Local offices

Toronto : (416) 479-0834 Montreal : (514) 613-0393 Calgary : (403) 800-3025 Ottawa : (613) 704-1798 Vancouver : (604) 229-1065 Victoria : (877) 355-5239 Winnipeg : (204) 318-1150 Halifax : (902) 800-2063

Get up to 5% better than the bank

Choose your currency pair and get rate alerts

All rights reserved. Knightsbridge Foreign Exchange

Currency Exchange Canada.

Bank of Credit and Commerce International 1972–1991

Travellers Cheques

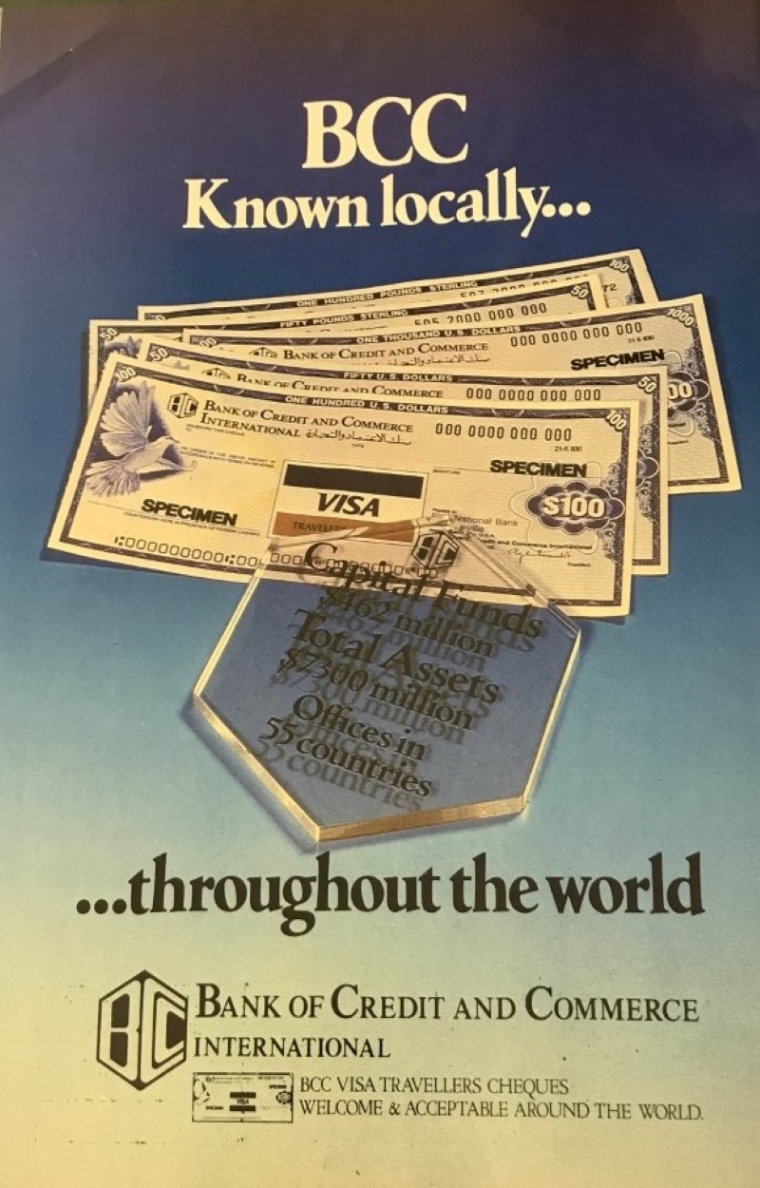

Bank of Credit Commerce International (BCCI) entered one of the largest and most exciting markets in the consumer banking world on 1 December 1981, with the token issue of BCCI's first travellers cheque bearing the logo of VISA International. This marked the bank's entrance to a sector which was then worth about $40 billion a year and growing.

Travellers Cheques are a form of "Guaranteed" bankers cheques sold to the public and payable on demand to the purchaser by most banks. The paying bank seeks reimbursement of the amount paid from the issuing bank.

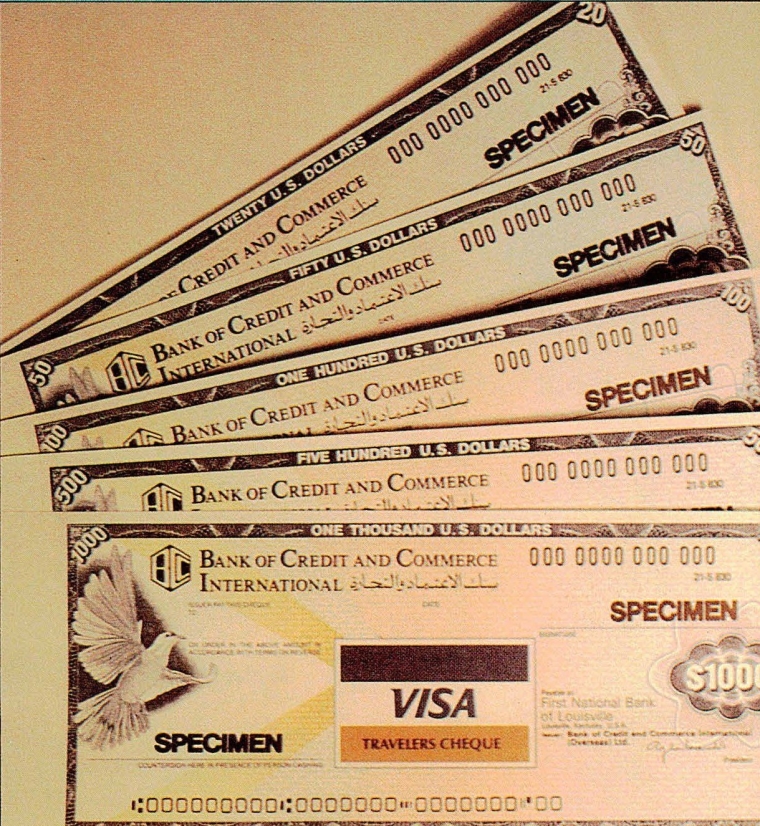

BCC Travellers Cheques were issued under the charter of Visa and ensured immediate acceptability around the world. The first travellers cheques issued by BCC were in US dollars in the denominations of 20, 50, 100, and 1000. This was followed by the issue of BCC Travellers cheques in Pound Sterling.

Popularity of travellers cheques

Travellers cheques are one of the oldest forms of instruments that have helped people take their money with them during their travels, whether on holiday or business. They are preprinted cheques in different currencies, for fixed amounts.

They could be held for any period of time and easily encashed at any location.

Unused Travellers Cheques could be kept for future travels but could be redeemed in cash or credited to a bank account at any time. This is because travellers cheques never expire and offere protection from theft and loss.

When a person purchases travellers cheques, they are required to sign each cheque (usually on the top left-hand corner). When these are used, the holders must countersign each one a second time in the presence of the person accepting/encashing them. This is so that the two signatures on each cheque can be compared and agreed before payment, and the identity of the holders verified.

Greatest financial benefit for banks issuing Travellers Cheques

The banks issuing their own travellers cheques earned fees at the time of issue, however, the greater benefit was the income earned from investing the sizeable funds accumulated for the bulk of unused travellers cheques that were still being held with the purchasers/holders.

The issuing banks earned interest for the period the cheques that were uncashed, while not paying any interest to the cheque holder, making them effectively interest-free deposits held by the banks to meet payments of unused travellers cheques.

There are cases where unused travellers cheques were retained for long periods, and some were only discovered after the death of holder.

With the forecast on growth of sales of travellers cheques, bankers were confident that this expansion would continue and may accelerate rather than falter with the growth of international travel. More banks than ever were issuing these cheques because they were seen as a strong source of rising profitability.

BCC issues travellers cheques

In the early years, BCC had arrangements with American Express, Thomas Cook and National Westminster Bank Limited to sell travellers cheques issued by them.

- American Express, Thomas Cook, National Westminster Bank

In 1981, BCC Travellers Cheques, in association with VISA International, entered the lucrative travellers cheques market.

On 1 May 1983, BCC introduced a new scheme providing free-accident cover for purchasers of its travellers cheques. This gave BCC a distinct advantage over its rival in the highly competitive and lucrative travellers cheques market dominated by Thomas Cook a British company that was forerunner of establishing tourism systems and a package holiday phenomenon, VISA International and American Express.

BCC Travellers Cheques – A New Periphery A New Thrust

BCC was constantly developing new services to meet the demands of its expanding customer base. The decision to launch of BCC’s own travellers cheques in 1981 enabled BCC to offer these worldwide to its customers and non-customers international travellers through sale points at its branches.

BCC travellers cheques were attractively designed and came in two sets, one in Arabic and the other in English.

BCC US dollar travellers cheques

The denominations BCC travellers cheques in US dollars were $20, $50, $100, $500. The Arabic sets also include cheques of $1,000.

The BCC travellers cheques were backed by VISA, which guaranteed universal acceptability of BCC cheques at all of their points around the world.

BCC travellers cheques were available in two forms: prepacked, which allowed for greater speed for the customer buying and cashing cheques, or loose, if the customer preferred to handle the cheques one at a time. There was a very quick and fool proof system for refunds in case the cheques were stolen or lost. This meant that BCC travellers cheques could be safer than cash: they were just as acceptable all around the world and the purchaser could get a refund if they were lost.

BCC pound sterling US travellers cheques

The introduction of BCC sterling travellers cheques had been brought forward from its original date because of the enthusiasm that greeted sales of dollar travellers cheques. As their sales were monitored in the branches, it was concluded at BCC that sterling travellers cheques would complement the dollar travellers cheques and not detract from their sales in any way.

The occasion on the signing of the first pound ceremony by the BCC President was a recognition of the success of the travellers cheque programme to date, and initiated a new stage in its development.

The sale of sterling travellers cheques was centred on the UK but they had a strong international dimension too. Sterling was the second largest currency for travellers cheques worldwide, after the US dollar. In 1982 it had about 16 per cent of the total market, a fact underlined by the popularity of sterling travellers cheques in many English-speaking countries. London, an international city for tourism and one of the world’s leading financial centre constantly attracted visitors and businessmen for whom it was convenient to have sterling travellers cheques. These were available in five denominations: £10, £20, £50, £100 and £500; all, like the dollar cheques, were backed by VISA.

VISA Alliance

BCC began its association with VISA International in 1977 when it helped launch BCC credit card. VISA was already a major issuer of travellers cheques.

In November 1979 VISA began its travellers cheque operation. In the few years after it entered the market VISA saw many travellers cheques programmes launched by different banks.

.jpg)

Mr K S Khrishnan, from the Systems and Operations Division at CSO, was in-charge of the launch of the BCC travellers cheques.

According to Mr Krishnan,

''There are two reasons why we have been able to move with such speed on this project; One is that we have had a lot of cooperation from Visa International. They are based in San Francisco, but we have been dealing with their London office.

The other reason for the success of this project lies in the nature of BCC. I have been working with BCC for four years and find it very different from anything I had known before. I used to work for one of the major banks in India, and I went along to BCC to find out about this new bank that had appeared in the community. They told me that although they do not attach great importance to job titles, this does not mean any lessening of individual responsibility. They also told me that any new ideas have the full support of management. I felt at home straight away. It is an exhilarating place to work. I spent my first year with BCC studying systems in many of the bank's different locations around the world. This has proved very helpful, and I have now been based in London for three years.

Within BCC there is freedom to operate. You feel you can produce something worthwhile. There is a lot of opportunity for growth and I grow with my bank. There is also a genuine concern for individuals and their families in this bank. The atmosphere is superb. Decisions can be taken very quickly. These are all reasons why we have been able to launch our travellers cheques within three months of starting the project.

I have talked to several of my colleagues; I have talked to several managers. We are determined to create a world record in the first year sales.”

- Letter from VISA to Mr K S Krishnan

A world first: BCC travellers cheques with free accident cover

On 1 May BCC was placed at a clear advantage over its rivals to market BCC travellers cheques in highly competitive and lucrative travellers cheques market.

BCC provided free accident cover with its trevellers cheques. A WORLD FIRST.

Anyone between the ages of 14 and 75 who purchased BCC travellers cheques was automatically insured for up to $275,000 against any accident that results in the loss of a limb or an eye, or in death.

The insurance was absolutely free. There was no extra charge to BCC customers, apart from the 1 % commission that was standard to all travellers cheques.

No other bank or financial institution at the time had the vision or the courage to attempt to redefine the travellers cheques market in the way BCC had done. BCC had not accepted the limitations that others might have taken for granted.

Any market for a product or a service is created by the laws of supply and demand. These are not static, but are constantly evolving. By introducing the new scheme linking travellers cheques with free accident cover, BCC displayed highly innovative marketing skills to increase sales its own travellers cheques.

BCC travellers cheques as a marketing tool

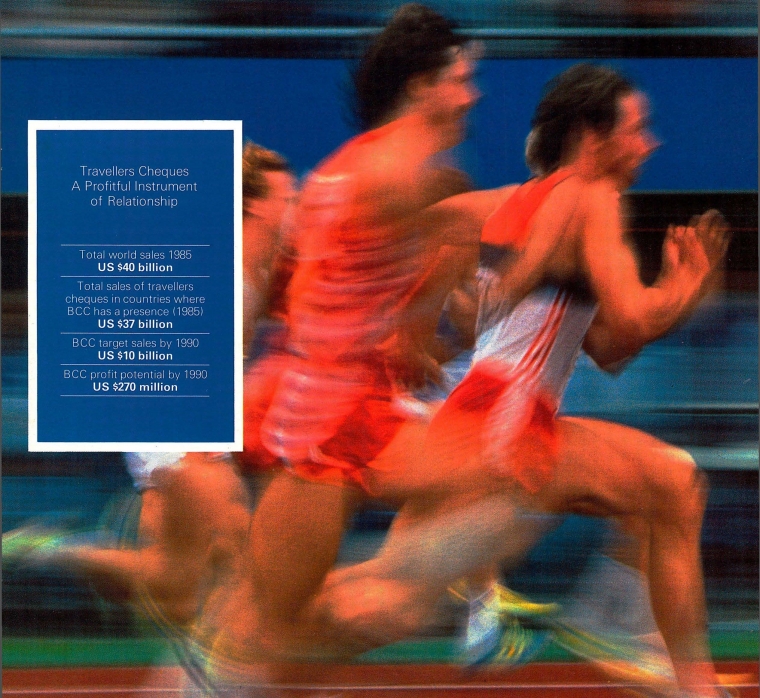

The market was worth $18 - 40bn in 1981 and even by more conservative forecasts was projected to grow at about 15 per cent each year. At this rate, travellers cheques worth almost $44bn would be issued in 1982 and just over $50bn in 1983. By 1984, the banking community expected expect sales of $58bn and $67bn.

In BCC travellers cheques were a major customer-orientated operation. Unlike Thomas Cook, VISA and American Express, BCC had the added benefit of marketing its cheques directly to BCC clients banking with its large network of branches worldwide.

BCC travellers cheques achieved high sales in the United Kingdom with its international links and also in the Third World (Asia, Middle East, Africa and South America) where its competitors' sales had not been impressive.

There was a great potential in Europe for travellers cheques.

The thousands of employees, the members of the BCC family, serving in BCC did their own marketing, directed by the Central Support Organisation in BCC’s headquarters in London.

The slogan in the BCC branches was " Sell travellers cheques through BCC and sell BCC through travellers cheques ".

BCC explored other avenues to increase sales of BCC travellers cheques

British airways.

The travellers cheques department of the BCC UK Regional Office established a special link-up with British Airways to sell BCC travellers cheques through the five major travel clubs run by them. The clubs relied on the strong connections that existed between the UK and the rest of the English speaking world.

The Australian Family Reunion Club was the first to be set up, in 1976, and now has some 60,000 members throughout the UK. The USA and Canadian Reunion Club, established the following year, also has 60,000 members, while the New Zealand Reunion Club had approximately 27,000. Two more clubs were established in 1981. Members could buy BCC travellers cheques on very favourable terms without payment of the normal 1 % commission.

BCC - official provider of travellers cheques to the 1986 Commonwealth Games

BCC was a major sponsor for the 13th Commonwealth Games held in Edinburgh, Scotland, between July 24 and August 2 1986. BCC signed an agreement with the authorities in March.

Around two thousand athletes competed for the coveted medals and nearly half a million visitors were reported to have visited the Games. In addition, the Games would have been seen around the world on television, with a potential audience of over 800 million people.

By becoming a major sponsor, BCC enjoyed prime advertising sites. Large wide banners displayed in the stadium promoted BCC's services. These would have been viewed by the athletes, large number of people visiting the Games and the worldwide television audience of millions.

For visitors to the Games BCC had a hospitality tent and a bureau de change prominently situated near the main entrance. These offered BCC marketing opportunities to publicise BCC services and generated sales of BCC travellers cheques.

BCC travellers cheques centres

Travellers cheques became an important product for BCC. They were easy to sell worldwide by its large network of branches and associated companies, and they were profitable and risk free. They frequently provided leads to other business and new clients for BCC.

As sales of BCC travellers gained a worthwhile share in various markets and BCC aspiring to be a market leader, Travellers Cheque Centres were established in Abu Dhabi (United Arab Emirates), Trinidad and Tobago, Kuwait, Muscat (Oman), Hong Kong (Far East), Indonesia and Canada. They acted as a focal point for the whole BCC travellers cheques operation in these areas.

At a specially convened conference on 19 January 1982, Mr Agha Hasan Abedi, President of BCC, called travellers cheques " a profitable instrument of relationship ". He urged delegates to grasp the reality behind travellers cheques and to understand their importance for the whole Group.

"Travellers cheques", Mr Abedi said, " add a new dimension to my personality. They are a means of making a profit and at the same time a means of fulfilling my aspirations. There is great happiness in selling the largest possible volume of travellers cheques."

BCC Travellers Division

The BCC travellers cheques division was formed in September 1981 in the Central Support Organisation (CSO) at BCC’s headquarters in London.

BCC Travellers Cheques a resounding success in the first year

.jpg)

Sales of BCC Travellers Cheques in 1983, the first year of its operation, created a world record, according to VISA International.

- Letter to BCC Central Profit Committee CSO London

As the sales volume increased, BCC travellers cheques operation became an important profitable activity.

The travellers cheques division in CSO London took care of inventory control, customer relations (i.e. supplying the branches with publicity material or special stationery that they might need) and refunds.

- Procedure for distribution of blank BCC travellers cheques

There was also an accounts department that looked after remittances from the branches and liaised with the investment department over the handling of the “float” representing funds held to cover payment of uncashed at any time in future.

Acknowledgement:

In-house Magazines

- Banking operations and other services

- St. Petersburg Tourism

- St. Petersburg Hotels

- St. Petersburg Bed and Breakfast

- St. Petersburg Vacation Rentals

- Flights to St. Petersburg

- St. Petersburg Restaurants

- Things to Do in St. Petersburg

- St. Petersburg Travel Forum

- St. Petersburg Photos

- St. Petersburg Map

- All St. Petersburg Hotels

- St. Petersburg Hotel Deals

- St. Petersburg

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Travellers cheques in Russia - St. Petersburg Forum

- Europe

- Russia

- Northwestern District

- St. Petersburg

Travellers cheques in Russia

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Northwestern District forums

- St. Petersburg forum

Today I am about to go to my bank to collect some travellers cheques for our up-coming trip through Russia. However I have just read an article on Trip Advisor which says, in part:

"...................If you plan to take American Express Travellers cheques to Russia, you should be aware that most banking instutions, including the local American Express agency, may refuse to accept them, or if they do, it could be at a 20% commission.

Travellers heading to Russia should re-think the use of American Express or any brand of Travellers Cheque............."

Somebody please tell me this isn't correct. We are taking our visa cards too.

Actually, the information IS correct.

I brought travelers' checks with me on my first trip to Russia in 2005, but I never did find a place where I could cash them in without getting royally hosed. Others will no doubt have more detailed information, but I have always done just fine with cash and an ATM card.

So, you used US dollars and your ATM card? We've been told it is a waste of time bringing Australian dollars with us. Maybe we should forget travelers cheques, get the money back from the bank (which they have already debited from our account) and buy US dollars with the money they give us back.

What do others think???

I usually withdraw Roubles from my American bank VISA card. The exchange rate and ATM fees are being taken care of by my bank. Because I have to pay a flat fee ($3) per each transaction, I usually take out the maximum amount (usually RUR7000 - RUR7500) at a time and watch carefully how to spend.

That's pretty much what I do, too: grab the maximum amount of rubles out of the ATM every so often. I also like to carry some cash because, well, you never know. One nice thing about staying in the Astoria/Angleterre is that you can change dollars for rubles right there in the hotel while they are registering your passport.

Before leaving - please inform the bank that has issued your card about the journey to Russia and possible payments and cash withdrawals, otherwise they may block operations due to an obscure destination (sounds non-patriotic - but so it is).

Actually Sberbank lists a 2 percent fee for cashing AMEX checks, which is nowhere like 20 but not so great either. You can bring some as a backup in case of problems with your card.

Thanks for the reminder veresch. We haven't done that yet but will do so. We've delayed our visit to our bank to sign the travellers cheques waiting for further info on this thread. Is Sberbank a bank that has branches everywhere? We land in Vladivostok so that is where we will first need to obtain money. Is there a Sberbank in Vladivostok?

I know we will have our Visa card with us but we are very cautious people and want to know that we have back up if our card doesn't work.

We can't delay this trip to the bank much longer so we'll go in there this afternoon. I think we will ask them to take back half of our travellers cheques and swap them for US cash. We haven't signed the cheques yet so we are hoping they won't charge us to cancel them. Banks here are not usually very accommodating so I reckon they will charge us to cancel the wretched things.

If someone could tell us if the is a Sberbank in Vladivostok we would be most grateful. We arrive early afternoon so we'll make a bee-line for the bank, if there is indeed one in the city.

> Is Sberbank a bank that has branches everywhere?

Yes, 19 050 branch offices.

> If someone could tell us if the is a Sberbank in Vladivostok

37 offices in Vladivostok.

Here is the link to Sberbank branches in Vladivostok. Sorry, it is in Russian, so please use a Google Language tool for translation or transliteration (for streets). Please remember that not all the branches might be able to accept travelers checks - most likely they will send you to a bigger or central branch. That happened to me in another city. Inconvenience to say the least.

http://vl.ru/dengi/info/companies_list/94/