- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AAA Travel Insurance Review 2024: Is it Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does AAA travel insurance cover?

Aaa single-trip plans, aaa annual plans, which aaa travel insurance plan is best for me, can you buy aaa travel insurance online, what isn’t covered by aaa travel insurance, aaa travel insurance, recapped.

- You don't need to be an AAA member.

- Annual or single-trip policies are available.

- Can add on a Rental Car Damage protector plan.

- Cheapest option doesn't include medical coverage.

- CFAR upgrade is only available for higher-cost plans.

Before going on a trip, it's important to give travel insurance some serious thought as it can protect you if anything goes wrong on your vacation. One provider to consider is AAA Travel Insurance.

The company’s policies are administered by Allianz Global Assistance, an insurer that serves 40 million customers in the U.S. and operates in 35 countries. You do not have to be a AAA member to purchase AAA travel insurance.

AAA offers annual or single-trip policies for domestic and international travel. The policies vary by state and travel destination, so the plans available in your home area may differ from the examples shown below. Use AAA's Get A Quote tool to see your specific pricing.

» Learn more: The majority of Americans plan to travel in 2022

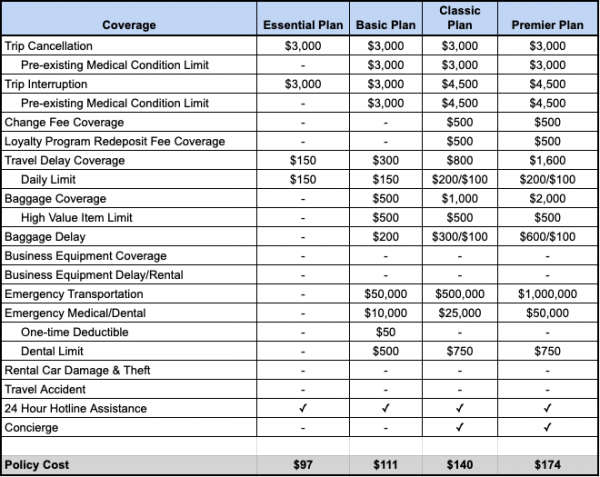

AAA’s single-trip plans are designed for travelers who are leaving their homes, visiting another destination, domestic or international, and returning. To get an idea of which plans are available, we input a sample itinerary of a $3,000, two-week trip to Spain by a 45-year-old from Indiana. For this itinerary, AAA offered four single-trip plans.

* Higher limit requires receipts to be submitted.

AAA single-trip plans cost

The Essential Plan ($97) is ideal for those who just want the basics of trip cancellation and trip interruption insurance and don't need the other protections. This is a good fit for domestic travelers who already have health coverage in the U.S. and don't plan on bringing business equipment.

The Basic Plan ($111) includes all the features of the Essential Plan, along with medical coverage and some increased protections for baggage and travel delays.

The Classic ($140) and Premier Plans ($174) are nearly identical, but the latter provides double emergency medical coverage, emergency transportation, trip delay and baggage delay limits.

The Classic Plan offers a "cancel for any reason" optional upgrade for $71, which would bring the total to $211.

There is also a Rental Car Damage protector plan for $135, which provides $1,000 of trip interruption and baggage loss coverage and $40,000 of rental car damage and theft benefits. This plan will cover your costs if the rental car is stolen or damaged. In addition, you’ll be reimbursed for the unused portion of your trip and if your bags are lost or damaged. This plan offers an alternative to purchasing coverage at the rental counter.

» Learn More: Cancel For Any Reason (CFAR) travel insurance explained

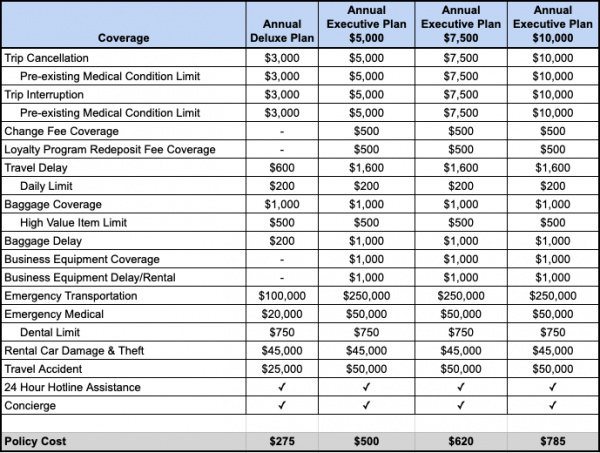

The annual policies provide 365 days of domestic and international coverage and are best suited for those who travel often. To see which plans are available, we input a $15,000 annual travel budget for coverage starting in July 2020 for a 30-year-old from New Hampshire. For this itinerary, AAA is offering four policies, with the three higher-end plans geared toward business travelers.

AAA annual plans cost

The Annual Deluxe Plan ($275) is designed for those who aren’t too concerned with pre-trip cancellation benefits or business equipment protections and are more interested in medical coverage while abroad. If you already have some travel insurance through a credit card, this plan may be sufficient.

The next three Annual Executive Plans ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other protections under the Executive Plans are identical. All three plans include business equipment coverage as well as business equipment rental and delay protections. If you’re traveling for work, these plans may be your best bet.

Although all four of these are annual plans, no individual trip can exceed 45 days. For trips longer than 45 days, Allianz offers an AllTrips Premier plan , which provides coverage for up to 90 days per trip.

» Learn more: What to know before buying travel insurance

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re traveling.

If you have a premium travel card that already provides you with a sufficient level of trip cancellation coverage, you may only need to get a standalone emergency medical policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits. Terms apply. Only the Annual Executive Plan ($10,000) has a comparable level of trip cancellation coverage.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like one of the single or annual trip plans, depending on your travel goals.

If you’re a long-term traveler and expect to take many trips, the annual plans will be the most suitable. However, with coverage for each trip capped at 45 days, you’ll want to look at other options if you will be away from home for longer.

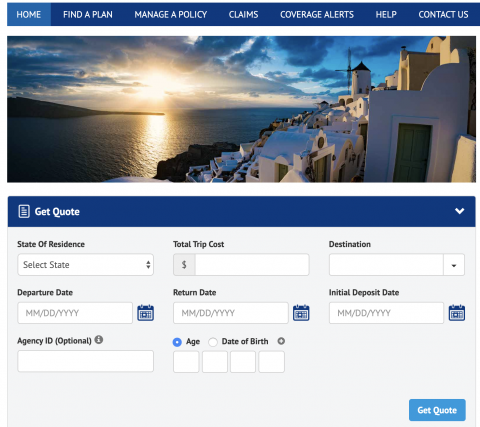

Yes, you can buy AAA Travel Insurance onlince. Head over to Agentmaxonline.com , input your trip details and choose “Get Quote” to see a list of available plans.

Trip insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

» Learn more: Will travel insurance cover winter weather woes?

Yes. However, plan choices depend on your state of residence and trip duration. We performed various searches for sample trips and found policies for single trips and annual trips. Single-trip plans are great for travelers who are traveling from their home to a different destination (domestic or international) and then returning. Coverage ends when the traveler returns home. Annual trip plans are designed for those who want to take several trips during a specific period of time, regardless of how many times they return home during the covered period.

The cost of a travel insurance policy depends on many factors , including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit AAA’s travel insurance site and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if travel insurance is worth it .

The cost of a travel insurance policy

depends on many factors

, including the trip length, your state of residence and how much coverage you’d like. Our sample search for a $3,000 two-week trip to Spain showed policies ranging from $97 to $211, representing 3% to 7% of the total trip cost.

Yes, AAA’s travel insurance policies offer coverage for international travel. To check the type of plans available for your intended destination, visit

AAA’s travel insurance site

and enter your trip details.

Travel insurance offers a safety net so that if something goes wrong while you’re on vacation, you’re not alone. Whether it's a cancelled flight, lost luggage or emergency medical care, travel insurance coverage will come in handy. Although it's never fun to think about unexpected emergencies that can derail your trip, consider how much risk you’re willing to take before deciding to not purchase a policy. That will help you decide if

travel insurance is worth it

AAA was found to be one of the best travel insurance companies according to NerdWallet's most recent analysis.

Before shopping for a policy, check to see what coverage you may already have. Some premium credit cards provide travel insurance. If you hold one of these credit cards and the coverage limits are adequate, you may only need a standalone emergency medical insurance policy . However, if your credit card doesn’t cover you sufficiently, a comprehensive travel insurance plan might be the right choice. AAA offers a few plans to pick from, but the choices boil down to annual or single-trip insurance plans.

No matter what type of traveler you are, AAA offers various trip insurance options to choose from. Rates and options vary by state, so be sure to input your information into the online tool.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AAA RV Insurance Review | Money

W hen it comes to hitting the road and exploring the great outdoors in the comfort of a recreational vehicle (RV), having the right insurance coverage is a must. RVs are valuable investments that require protection from unforeseen events.

One RV insurance provider is The American Automobile Association, usually called “Triple-A” (AAA). The company is most well-known for its roadside assistance services and travel discounts, but AAA also offers insurance products to its club members.

In this AAA RV insurance review, we’ll look at the company’s offerings, pricing, financial stability, accessibility and customer satisfaction to help you choose the best RV insurance for your needs.

AAA RV insurance pros and cons

Extensive coverage options, offers emergency roadside assistance, membership includes additional benefits, only available to aaa members, coverage varies by region, pros explained.

Similar to car insurance, AAA RV Insurance offers comprehensive coverage that includes protection for your RV against accidents, collisions, theft and vandalism, as well as liability coverage in case of bodily injury or property damage to others. In addition to these basic coverages, as a AAA member, you get roadside assistance.

Although coverage varies by state, there are two options you can add to your RV insurance policy for an extra fee: personal property protection for items kept in your RV and travel expenses coverage if you need to stay somewhere else while your RV is repaired.

One of the standout features of AAA is its emergency roadside assistance, a feature that not all insurance companies offer. Whether your RV has a flat tire, mechanical breakdown or empty fuel tank, AAA RV roadside assistance can help, giving you peace of mind during your travels. All AAA memberships include roadside assistance for you and the car you are in. Extending coverage to your RV may be included on some plans in certain states but must be added for an extra cost in other areas.

AAA could be a good option for RV owners due to its many travel-related perks. In order to purchase the company’s RV insurance, you must purchase a AAA membership, but it comes with extra benefits that may make it worth it. You can access discounts at hundreds of places, including hotels, restaurants, movie theaters and attractions. In addition, AAA memberships include travel agent services, savings on rental cars, identity theft monitoring, DMV services at local branches and more.

Cons explained

AAA RV insurance is only available to AAA members. While this is an extra yearly cost, you get all of the features of a AAA membership. You can purchase a membership through your local club to access the insurance products and other benefits.

AAA’s RV insurance protection options and prices vary significantly based on your region. For example, in some states, you can extend your roadside coverage to include your RV for an extra cost but it may be included in other states. You can contact your local AAA branch to see what coverage is available in your area.

AAA RV insurance offerings

AAA RV insurance covers a variety of vehicles, from travel trailers to campers. Before you can purchase AAA RV insurance, you’ll need to get a club membership. AAA offers three different membership tiers at varying prices. The levels are called Classic, Plus and Premier.

The Classic level typically doesn’t offer RV roadside assistance. At the Plus and Premier tiers, some AAA clubs include RV coverage at no additional cost, while others charge an extra fee to add it. In addition to roadside coverage, you can choose to purchase an RV insurance policy. We’ll explore the membership tiers below, followed by the RV insurance options.

AAA Plus membership

Purchasing a AAA Plus membership may offer you the following types of benefits, but you’ll need to check with your local AAA club to confirm what is offered in your region.

- Towing services

- Locksmith service reimbursements

- Emergency fuel delivery

- Battery jumpstart and replacement service

- TripTik travel planner

- Identity theft monitoring

- AAA maps and travel discounts

- Car repair discounts

- Lost baggage and trip interruption coverage when traveling

- Hotel, movie tickets and restaurant discounts

- DMV, passport photos and notary services at local AAA branches

- RV and motorcycle service coverage

AAA Premier membership

With the AAA Premier plan, you’ll have the benefits included in a AAA Plus membership and more. AAA Premier generally expands your Plus-level coverage to include more miles for towing and higher reimbursement levels. It may also add extra features like the following:

- Emergency car rental

- Home lockout service reimbursement

- Pet injury coverage

- Refund for windshield repair

- Emergency medical transportation

- Travel accident insurance

AAA RV insurance

Once you’ve enrolled in a Plus or Premier membership, AAA insurance policies are available for you to purchase. Aside from RV insurance, AAA offers auto, home, pet business and life insurance.

AAA typically offers the following RV insurance coverage types:

- Comprehensive

- Uninsured motorist

- Medical payments

Additional RV insurance options

If you’re using your RV as your primary residence, add-ons for full-timers may include the following options.

- Personal property coverage : Protects your belongings in case of theft or damage

- Travel expenses : Provides coverage for accommodations if your RV needs repairs

AAA RV insurance pricing

AAA RV insurance costs can vary based on several factors, including the type of coverage you choose, the make and model of your RV, your driving history and your location. You may also qualify for insurance discounts. Getting a personalized quote from your local AAA club is advisable to determine the exact pricing for your RV insurance.

In addition to your insurance premiums, a yearly AAA club membership costs anywhere from around $40 to $186 or more per year, depending on the coverage level you choose and the prices set in your region. Some clubs include RV coverage in the Plus or Premier level, while others charge more to add RV roadside assistance coverage. For example, in Ohio, you’ll pay an extra $37 per year to add RV roadside coverage to your AAA Plus or Premier membership. In California, a AAA Premier membership includes RV roadside coverage at no additional cost. There may also be a one-time membership enrollment fee of $10 to $15 or more when you purchase a new membership.

AAA RV insurance financial stability

Established in 1902, AAA has a long-standing history. Each AAA club functions as an independent and not-for-profit organization. Furthermore, each club is governed by its own board of directors. To be a part of AAA, every club commits to offering specific standard services, but the exact membership dues and services provided differ from one club to another.

Each AAA club partners with different affiliated insurance providers. CSAA Insurance Group offers insurance products to AAA members in 23 states and Washington, D.C. The company, founded over 100 years ago, is rated A+ (Superior) by AM Best, an independent insurance rating agency. The Auto Club Enterprises Insurance Group provides insurance to members in 21 states and is also rated A+ (Superior) by AM Best.

AAA RV insurance accessibility

AAA encompasses 32 independent clubs with more than 1,000 local branches. Visiting the organization’s website and entering your zip code will redirect you to the AAA website specific to your region. You’ll find membership information and prices specific to your local area there. You can browse your club’s site for details about RV insurance availability and find contact details and branch locations.

Availability

AAA has clubs and branches across all 50 U.S. states, Washington, D.C., Puerto Rico and Canada. However, its services and products will vary between states and provinces. Before considering AAA RV insurance, check with your local AAA club to confirm whether it’s offered in your area.

Contact information and user experience

Enter your zip code on AAA’s main website to find the locations of your nearest branches. Every club has its own website with contact information, including phone numbers and online contact forms. There are also physical AAA branch locations you can visit.

You can reach AAA emergency roadside assistance at the following number: 800-AAA-HELP (800-222-4357).

The AAA mobile app allows users to request roadside assistance, manage insurance policies, check nearby gas prices, access the TripTik travel planner and more.

AAA RV insurance customer satisfaction

Customer satisfaction is an important factor to consider when evaluating any insurance provider. We looked at the J.D. Power 2022 U.S. Auto Insurance Study to see how various AAA clubs rank for overall customer satisfaction. While some clubs ranked above the average, others fell short.

For example, the Auto Club of Southern California ranks second in California with 844 points out of a 1,000-point scale. In the North Central region, which includes Illinois, Indiana, Michigan, Ohio and Wisconsin, AAA ranks slightly below the local average of 838 points with 810 out of 1,000 points.

AAA insurance has mixed ratings across customer review platforms, but your experience can vary significantly based on your location. Each AAA club has its own Better Business Bureau (BBB) page, and the ratings and reviews were similar across the clubs we evaluated on the site. For example, AAA Northeast and AAA Nebraska are both BBB-accredited with A+ ratings, and the AAA Ohio Auto Club is BBB-accredited with a B rating.

AAA RV insurance FAQs

Is aaa rv insurance worth it, what does aaa rv insurance cover, how much is aaa rv coverage.

The availability and price of adding RV coverage to your AAA membership varies by state. You may have the option to extend emergency roadside assistance, towing service and other benefits to your RV. Membership also allows you to purchase AAA RV insurance for liability, collision, comprehensive and personal coverage options, depending on your location.

The cost of AAA RV insurance varies depending on the type of policy, your state of residence, the make and model of your RV, your driving record and more. To get an accurate quote, you can contact your local AAA club.

How we evaluated AAA RV insurance

To conduct this review of AAA RV insurance, we evaluated the following things:

- Coverage offerings : We examined the levels of AAA RV membership as well as the available RV insurance offerings.

- Pricing : We assessed the affordability and value of AAA RV membership cost and coverage.

- Financial stability : We researched AAA’s financial strength and longevity to determine its ability to fulfill policyholder claims.

- Accessibility : We evaluated AAA’s availability, contact options and user experience to assess its accessibility and customer support.

- Customer satisfaction : We considered customer feedback and reviews to gauge overall satisfaction levels with AAA RV insurance.

Summary of Money’s AAA RV insurance review

Considering AAA for RV insurance may be worthwhile for RV owners due to its extensive coverage, added benefits like hotel discounts and reliable emergency roadside service. With different membership levels and coverage options, RV owners can tailor their insurance and AAA membership plans to suit their needs. While the availability of AAA services and products varies depending on location, it has a strong reputation and financial stability.

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

You are using an outdated browser. Please upgrade your browser .

- Russian News and Stories

The Moscow metro now has a full 4G coverage

- On 19 Oct 2018

The Tele2 mobile network company became the first to build an infrastructure for 100% stations of the Moscow's metro. The high-quality 4G internet is now available on all 259 stations of the Moscow's metro, Moscow Central Circle (MCC) and monorail.

The operator has secured a 100% 4G indoor-coverage internet an all stations of the metropolitan metro, including the passageways, pavilions, and stairways. The investments into the project have exceeded 800 million rubles.

The Moscow underground is a specific infrastructure object, which has its own particularities. All works on designing, installation, and adjustment of the hardware should have been conducted exceptionally during night hours when the metro is closed for entry. A sufficient number of stations have a status of cultural heritage, thus, the network development has required additional approvement from the Department of Cultural Heritage of Moscow.

The network coverage within the metro system opens new horizons for the analysis of the "big data". Tele2 Network has analyzed the users' activity during the summer months and has indicated the busiest metro lines, which were: Tagansko-Krasnopresnenskaya, Zamoskvoretskaya and Kaluga-Riga lines. During the summer months, on the stations of Tagansko-Krasnopresnenskaya lines the subscribers have downloaded 125 TByte of internet-traffic, have made over 2 million calls with the total duration of 27 thousand hours, which equals to 3 years.

Our travel brands include

Express to Russia

Join us on Facebook

We invite you to become a fan of our company on Facebook and read Russian news and travel stories. To become a fan, click here .

Join our own Russian Travel, Culture and Literature Club on Facebook. The club was created to be a place for everyone with an interest in Russia to get to know each other and share experiences, stories, pictures and advice. To join our club, please follow this link .

We use cookies to improve your experience on our Website, and to facilitate providing you with services available through our Website. To opt out of non-essential cookies, please click here . By continuing to use our Website, you accept our use of cookies, the terms of our Privacy Policy and Terms of Service . I agree

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Why were so many metro stations in Moscow renamed?

Okhotny Ryad station in Soviet times and today.

The Moscow metro system has 275 stations, and 28 of them have been renamed at some point or other—and several times in some cases. Most of these are the oldest stations, which opened in 1935.

The politics of place names

The first station to change its name was Ulitsa Kominterna (Comintern Street). The Comintern was an international communist organization that ceased to exist in 1943, and after the war Moscow authorities decided to call the street named after it something else. In 1946, the station was renamed Kalininskaya. Then for several days in 1990, the station was called Vozdvizhenka, before eventually settling on Aleksandrovsky Sad, which is what it is called today.

The banner on the entraince reads: "Kalininskaya station." Now it's Alexandrovsky Sad.

Until 1957, Kropotkinskaya station was called Dvorets Sovetov ( Palace of Soviets ). There were plans to build a monumental Stalinist high-rise on the site of the nearby Cathedral of Christ the Saviour , which had been demolished. However, the project never got off the ground, and after Stalin's death the station was named after Kropotkinskaya Street, which passes above it.

Dvorets Sovetov station, 1935. Letters on the entrance: "Metro after Kaganovich."

Of course, politics was the main reason for changing station names. Initially, the Moscow Metro itself was named after Lazar Kaganovich, Joseph Stalin’s right-hand man. Kaganovich supervised the construction of the first metro line and was in charge of drawing up a master plan for reconstructing Moscow as the "capital of the proletariat."

In 1955, under Nikita Khrushchev's rule and during the denunciation of Stalin's personality cult, the Moscow Metro was named in honor of Vladimir Lenin.

Kropotkinskaya station, our days. Letters on the entrance: "Metropolitan after Lenin."

New Metro stations that have been opened since the collapse of the Soviet Union simply say "Moscow Metro," although the metro's affiliation with Vladimir Lenin has never officially been dropped.

Zyablikovo station. On the entrance, there are no more signs that the metro is named after Lenin.

Stations that bore the names of Stalin's associates were also renamed under Khrushchev. Additionally, some stations were named after a neighborhood or street and if these underwent name changes, the stations themselves had to be renamed as well.

Until 1961 the Moscow Metro had a Stalinskaya station that was adorned by a five-meter statue of the supreme leader. It is now called Semyonovskaya station.

Left: Stalinskaya station. Right: Now it's Semyonovskaya.

The biggest wholesale renaming of stations took place in 1990, when Moscow’s government decided to get rid of Soviet names. Overnight, 11 metro stations named after revolutionaries were given new names. Shcherbakovskaya became Alekseyevskaya, Gorkovskaya became Tverskaya, Ploshchad Nogina became Kitay-Gorod and Kirovskaya turned into Chistye Prudy. This seriously confused passengers, to put it mildly, and some older Muscovites still call Lubyanka station Dzerzhinskaya for old times' sake.

At the same time, certain stations have held onto their Soviet names. Marksistskaya and Kropotkinskaya, for instance, although there were plans to rename them too at one point.

"I still sometimes mix up Teatralnaya and Tverskaya stations,” one Moscow resident recalls .

“Both have been renamed and both start with a ‘T.’ Vykhino still grates on the ear and, when in 1991 on the last day of my final year at school, we went to Kitay-Gorod to go on the river cruise boats, my classmates couldn’t believe that a station with that name existed."

The city government submitted a station name change for public discussion for the first time in 2015. The station in question was Voykovskaya, whose name derives from the revolutionary figure Pyotr Voykov. In the end, city residents voted against the name change, evidently not out of any affection for Voykov personally, but mainly because that was the name they were used to.

What stations changed their name most frequently?

Some stations have changed names three times. Apart from the above-mentioned Aleksandrovsky Sad (Ulitsa Kominterna->Kalininskaya->Vozdvizhenka->Aleksandrovsky Sad), a similar fate befell Partizanskaya station in the east of Moscow. Opened in 1944, it initially bore the ridiculously long name Izmaylovsky PKiO im. Stalina (Izmaylovsky Park of Culture and Rest Named After Stalin). In 1947, the station was renamed and simplified for convenience to Izmaylovskaya. Then in 1963 it was renamed yet again—this time to Izmaylovsky Park, having "donated" its previous name to the next station on the line. And in 2005 it was rechristened Partizanskaya to mark the 60th anniversary of victory in World War II.

Partizanskaya metro station, nowadays.

Another interesting story involves Alekseyevskaya metro station. This name was originally proposed for the station, which opened in 1958, since a village with this name had been located here. It was then decided to call the station Shcherbakovskaya in honor of Aleksandr Shcherbakov, a politician who had been an associate of Stalin. Nikita Khrushchev had strained relations with Shcherbakov, however, and when he got word of it literally a few days before the station opening the builders had to hastily change all the signs. It ended up with the concise and politically correct name of Mir (Peace).

The name Shcherbakovskaya was restored in 1966 after Khrushchev's fall from power. It then became Alekseyevskaya in 1990.

Alekseyevskaya metro station.

But the station that holds the record for the most name changes is Okhotny Ryad, which opened in 1935 on the site of a cluster of market shops. When the metro system was renamed in honor of Lenin in 1955, this station was renamed after Kaganovich by way of compensation. The name lasted just two years though because in 1957 Kaganovich fell out of favor with Khrushchev, and the previous name was returned. But in 1961 it was rechristened yet again, this time in honor of Prospekt Marksa, which had just been built nearby.

Okhotny Ryad station in 1954 and Prospekt Marksa in 1986.

In 1990, two historical street names—Teatralny Proyezd and Mokhovaya Street—were revived to replace Prospekt Marksa, and the station once again became Okhotny Ryad.

Okhotny Ryad in 2020.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- 7 things that the USSR unexpectedly put on WHEELS

- Why did the USSR build subway stations inside residential buildings? (PHOTOS)

- How Russian trains deal with winter

This website uses cookies. Click here to find out more.

Na Ulitse Yalagina 13B Apartments

Property Policies

Frequently asked questions, how much does it cost to stay at na ulitse yalagina 13b apartments, what are the check-in and check-out times at na ulitse yalagina 13b apartments, does na ulitse yalagina 13b apartments provide airport transfer services, what amenities and services does na ulitse yalagina 13b apartments have, does na ulitse yalagina 13b apartments have a swimming pool, does na ulitse yalagina 13b apartments have fitness amenities, does na ulitse yalagina 13b apartments provide wi-fi, does na ulitse yalagina 13b apartments have non-smoking rooms, does na ulitse yalagina 13b apartments have a restaurant, is parking available at na ulitse yalagina 13b apartments, popular hotels, popular attractions, explore more.

IMAGES

VIDEO

COMMENTS

AAA Plus and Premier Members enjoy: Worldwide Trip Interruption coverage on 50+ mile trips. Worldwide Lost Baggage coverage. 24/7 Helpline for Travel emergencies. Emergency Medical Transportation up to $25,000 per trip (premier only) View Full Terms and Conditions.

As a AAA Member, you may request reimbursement for reasonable, unanticipated costs for your hotel, meals, and substitute transportation, up to $500 for Classic Members, up to $1,000 for Plus Members and Premier Members are reimbursed up to $1,500. If you're on a planned leisure trip that included at least one overnight stay and you're involved ...

Trip interruption coverage is usually included within comprehensive travel insurance plans. Using the same $5,000, two-week trip to Argentina, a search of policies on travel insurance broker ...

You'll get the best and most comprehensive coverage if you purchase travel insurance within the first 14 days of making a trip deposit. (That clock starts ticking once you put a down payment on any part of the vacation.) The biggest benefits include: Trip Cancellation: The earlier you buy travel insurance, the sooner you are protected—even ...

Trip interruption and lost baggage reimbursements are available to AAA Plus and AAA Premier Members only. Within the U.S. and Canada, call toll-free: 866-456-3106. Outside the U.S., call collect: 804-673-3390. Although AAA holds its Service Providers to high standards of service, AAA cannot control the manner in which independent Service ...

Check out our full AAA travel insurance review. ... ($500-$785) are tiered based on the amount of trip cancellation and interruption coverage provided ($5,000, $7,500 or $10,000). All the other ...

AAA Premier offers the highest level of coverage and more personalized service that extend beyond traditional AAA Membership offerings. We're confident you'll like it at the top. Download a complete version of the Member Benefits Guide (PDF). To ensure easy access to AAA Premier services and benefits, you can call 1-888-222-9688.

Trip Interruption Expense Reimbursement, and more, making AAA Plus coverage ideal for those who spend more time behind the wheel. A seven (7) day Emergency Roadside Service waiting period applies to ALL Plus Membership upgrades. Premier Membership AAA Premier Membership offers a distinctively different

Trip interruption insurance typically reimburses between 100% and 150% of the insured trip cost. Dollar caps for trip interruption insurance are generally between $6,000 and $9,000. Many travel ...

In the North Central region, which includes Illinois, Indiana, Michigan, Ohio and Wisconsin, AAA ranks slightly below the local average of 838 points with 810 out of 1,000 points. AAA insurance ...

The Moscow metro now has a full 4G coverage The high-quality 4G internet is now available on all 259 stations of the Moscow's metro, Moscow Central Circle (MCC) and monorail. The operator has secured a 100% 4G indoor-coverage internet an all stations of the metropolitan metro, including the passageways, pavilions, and stairways.

何游天下. The Red Square is located in the center of Moscow, Russia, is a famous square in Russia. It is also the venue for major events in Moscow and is one of the famous landmarks in Moscow. There is also Vasili Ascension Cathedral nearby. . St. Basil's Cathedral. เด็กน้อยในมอสโก. Very beautiful, give full marks.

The Moscow metro system has 275 stations, and 28 of them have been renamed at some point or other—and several times in some cases. Most of these are the oldest stations, which opened in 1935.

LocationIf you want to feel like you're at home no matter where you are, choose this — apartment «Na Ulitse Yalagina 13A Apartments» is located in Elektrostal. This apartment is located in 3 km from the city center. You can take a walk and explore the neighbourhood area of the apartment — ZIL Culture Center, Saint Basil's Cathedral and ...