Best United Airlines credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

As one of the largest airlines in the world, United Airlines is a popular choice among travelers worldwide. The airline offers flights to more than 300 destinations across six continents. United is also a founding member of the Star Alliance network, expanding the airline’s reach through alliance partner flights. Choosing the best United credit card for your travel needs can help you score nearly free travel and can make your flights more convenient too.

Chase offers six co-branded United credit cards—four United personal cards and two United Airlines business credit cards. There are also general travel rewards cards that earn points cardholders can transfer to United. Whether you’re a United loyalist or want the flexibility to fly them along with other airlines, there’s probably a card that’s right for you.

Overview of the best United Airlines credit cards in April 2024

- Best overall: United SM Explorer Card | Learn more

- Best for frequent flyers: United Quest℠ Card | Learn more

- Best for lounge access: United Club℠ Infinite Card | Learn more

- Best for no annual fee: United Gateway℠ Card | Learn more

- Best for general travel rewards: Chase Sapphire Preferred ® Card | Learn more

Best overall: United SM Explorer Card

The United SM Explorer Card offers a useful package of United benefits with a manageable annual fee that is waived in year one. In our assessment, the Explorer offers the best overall value of any of the personal United cards when you weigh the fee against the benefits cardholders enjoy.

United SM Explorer Card

Intro bonus.

Rewards Rates

- 2x 2x miles on dining (including eligible delivery services), hotel stays, and United® purchases (including tickets, inflight food, beverages and Wi-Fi, Economy Plus® and more)

- 1x 1x miles on all other purchases

- Free first checked bag benefit.

- Expanded award availability on United Saver flights.

- No foreign transaction fee.

- $0 introductory annual fee for the first year (then $95) annual fee

- Subject to Chase 5/24 rule.

- United perks: 25% back on in-flight purchases checked bag benefit, expanded Saver award ticket availability

- Travel perks: TSA/Global Entry credit, trip cancellation and interruption protection

- Foreign transaction fee: None

Why we like this card: The United Explorer Card is a mid-level card perfect for anyone who flies United Airlines at least a couple of times a year. It offers considerable airline perks to offset its annual fee, which is $0 introductory annual fee for the first year (then $95).

Cardholders and one travel companion receive their first checked bag free on eligible United flights. That’s potentially a savings of up to $140 per round-trip flight. This card also comes with two one-time United Club passes at account opening and each card anniversary—it’s rare to find lounge access on a card with a sub-$395 annual fee, so this benefit alone is worth more than the Explorer’s annual fee cost.

If you’d like to breeze through airport security more quickly, the United Explorer comes with a Global Entry, TSA PreCheck or NEXUS application fee credit up to $100. Other United-specific benefits include priority boarding, discounts on select in-flight and United Club purchases and complimentary Premier upgrades on eligible United award flights.

Check out our full review of the United Explorer Card .

Best for frequent flyers: United Quest℠ Card

The United Quest℠ Card offers expanded airline and travel benefits for individuals who frequently fly United throughout the year. The annual fee means this card won’t be for everyone, but for some travelers, the Quest will be the sweet spot between the Explorer and Club Infinite cards.

United Quest℠ Card

- 3x 3 miles per $1 spent on United® purchases credit

- 2x 2 miles per $1 spent on dining, select streaming services & all other travel

- 1x 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and priority boarding.

- $125 United® purchase credit and up to 10,000 miles in award flight credits each year (terms apply)

- Earn up to 6,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

- More miles can be earned elsewhere

- High annual fee for a card that doesn’t offer lounge access

- Subject to Chase 5/24 rule

- United perks: 25% back on in-flight purchases, checked bag benefit, expanded Saver award ticket availability, $125 flight credit

Why we like this card: If United is your preferred airline, the United Quest Card is worth a look. The $250 annual fee is a significant jump from entry-level and mid-tier United cards, but that doesn’t mean it’s not worth the added cost. In addition to a large bonus offer, the card earns an above-average rewards rate on United spending and solid rewards on other categories including other travel, transit, and dining.

The Quest also features expanded baggage benefits, with the first and second checked bags free for cardholders and a companion.

And, the United Quest provides a credit of up to $125 on eligible United purchases each card anniversary. You’ll also enjoy up to 10,000 miles in award flight credits annually on eligible United flights booked with miles. The benefit is available up to 5,000 miles twice a year.

The United Quest Card offers similar benefits to other United cards, such as priority boarding, award upgrades, and in-flight and United Club discounts. You’ll also receive a credit of up to $100 to cover an application fee for Global Entry, TSA PreCheck or NEXUS.

If you’re a regular United flyer, the Quest card offers enough first-year and ongoing value to more than offset its heftier annual fee.

Check out our full review of the United Quest card .

Best for United Club access: United Club℠ Infinite Card

The United Club℠ Infinite Card provides a bevy of United perks, including year-round access to United Club airport lounges worldwide. If you need extensive United benefits and you’re willing to pay for them, this card will be a faithful travel companion.

United Club℠ Infinite Card

- 4x 4 miles per $1 spent on United® purchases

- 2x 2 miles per $1 spent on all other travel and dining

- United Club lounge membership

- Valuable welcome bonus

- Path to earn elite airline status by card spend

- High annual fee

- Mostly useful if you want lounge access

- Additional perks: Primary rental car coverage, trip cancellation/interruption insurance, trip delay reimbursement, baggage delay insurance, lost luggage reimbursement

Why we like this card: The United Club Infinite Card is the airline’s premium co-branded credit card. It comes with all of the United-specific and general travel features you might expect, like free checked bags, priority boarding, discounts on in-flight and United Club purchases and a credit to reimburse Global Entry, TSA PreCheck or NEXUS. The card also features a huge welcome bonus offer and an impressive 4X miles per dollar bonus rate on United purchases.

As the card name suggests, the crown jewel benefit of the United Club Infinite Card is a United Club membership, valued at up to $650 annually. The airline operates more than 45 United Club locations. Plus, with qualifying flights, you may have access to additional United Polaris and partner lounges. While waiting for your flight, enjoy free food and snacks, high-speed internet access and other amenities.

The United Club Infinite Card offers additional benefits like Premier Access travel services (speeding you through check-in, security and more, where available), IHG One Rewards Platinum Elite status, and Avis President’s Club status (enrollment required).

It also includes a laundry list of travel and purchase protections to enhance the card’s value, including trip cancellation and interruption insurance, trip delay reimbursement, lost luggage reimbursement, baggage delay insurance, primary rental car insurance, purchase protection, extended warranty, and return protection, Plus, enjoy 24/7 access to Visa Infinite® Concierge Services for help with dinner reservations, travel planning and more.

The United Club Infinite has a $525 annual fee. Provided you utilize card benefits, including lounge visits each time you fly United, the Club Infinite Card is probably worth the high cost.

Check out our full review of the United Club Infinite Card .

Best for no annual fee: United Gateway℠ Card

The United Gateway℠ Card offers basic travel benefits with no annual fee for the occasional flyer. It can’t measure up to its big siblings in terms of perks, but for someone who isn’t sure they’d get enough value to justify paying $95 or more per year, this card is likely the best option.

United Gateway℠ Card

- 2x 2 miles per $1 spent on United® purchases, including tickets, Economy Plus, in-flight food, beverages and Wi-Fi, baggage service charges and other United purchases.

- 2x 2 miles per $1 spent on local transit and commuting, including rideshare services, taxicabs, train tickets, tolls, and mass transit.

- No annual fee or foreign transaction fee

- Reward bonus categories outside of United Airlines

- Robust travel protections for a no-annual-fee card

- No baggage or expanded award availability benefits like with other United cards

- United perks: 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

- Other perks: Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption insurance, Purchase Protection, Extended Warranty

Why we like this card: It’s hard to justify having an airline card if you’re not sure how often you’ll fly, especially on a specific airline. The United Gateway Card provides a solution, providing a way to earn airline miles without the investment of an annual fee.

The Gateway card offers minimal United benefits, unfortunately—25% back on United in-flight and Club premium drink purchases and access to United card events. It’s the lone United card without a free checked bag. Still, the card has decent value for travelers with benefits like secondary rental car insurance, trip cancellation/interruption insurance and no foreign transaction fees.

Like other select Chase cards, the United Gateway Card comes with a complimentary one-year DashPass through a DoorDash partnership (must activate by 12/31/24). And, while intro APR offers aren’t common with airline or travel cards, there’s one available with the Gateway. Cardholders receive a 0% Intro APR on Purchases for 12 months from account opening (after that, 21.99%–28.99% variable applies).

Check out our full review of the United Gateway Card .

Best for general travel rewards: Chase Sapphire Preferred ® Card

The Chase Sapphire Preferred ® Card offers flexibility and card benefits useful for any traveler regardless of your favorite airline. You won’t get airline-specific perks like a free checked bag, but the ability to use your points with multiple airlines and hotel chains might outweigh that consideration.

Chase Sapphire Preferred ® Card

- 5x 5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit)

- 3x 3x points on dining at restaurants, including takeout and eligible delivery services

- 2x 2x points on travel purchases not booked through Chase

- 1x 1x points on other purchases

- 5x 5x points on Lyft rides through March 31, 2025 (that's 3x points in addition to the 2x points you already earn on travel)

- Extensive list of transfer partners

- Extra value on travel redemptions

- No premium travel perks

- Has an annual fee

- Additional perks: $50 annual hotel credit, trip cancelation/interruption insurance, auto rental collision damage waiver, complimentary Doordash and Instacart+ membership along with quarterly Instacart+ credits

Why we like this card: Few rewards cards come as highly touted as the Chase Sapphire Preferred Card. As a general travel rewards card, it doesn’t come with United-specific benefits, like free checked bags or priority boarding. Its value lies in its flexibility.

You’ll earn 5X on eligible travel booked through Chase and 2X on travel booked directly. These rates make the Sapphire Preferred competitive with what you’d earn using a United co-branded card, and you get rewards that aren’t restricted to the United MileagePlus loyalty program.

The Chase Sapphire Preferred earns flexible rewards through the Chase Ultimate Rewards program. This versatile rewards program allows cardholders to redeem points in several ways. Points are worth 1 cent each if redeemed for cash back and 25% more when redeemed for travel bookings through Chase Travel℠, including available United flights.

Another way to use Chase Sapphire Preferred for United flights is to transfer your points to the card issuer’s 14 airline and hotel partner programs, including United MileagePlus. Chase points transfer to partners at a 1:1 rate, making it easy to calculate how many points you need to transfer for specific award United flights.

As a flexible travel rewards card, you’re not tied to a specific airline or even type of travel. As your travel habits and needs change, so can the way you use your points. Cardholders also have access to a host of travel and consumer protections for only a $95 annual fee.

Check out our full review of the Chase Sapphire Preferred Card .

How do United credit cards work?

United Airlines credit cards are co-branded cards available through a partnership between United Airlines and Chase. Currently, four personal and two business United cards are available. All six co-branded cards earn airline miles for use within United MileagePlus, the airline’s loyalty rewards program.

United cards earn bonus miles on United Airlines purchases and other spending categories. Bonus rates vary between cards, with the highest rates generally reserved for premium United cards.

United miles do not expire, which means you can use them as you earn them or save up for bigger redemptions. Generally, the best redemption value is booking award flights with United and partner airlines, but you can redeem miles in other ways with United, including seat and cabin upgrades, bag fees, TSA PreCheck fees, in-flight Wi-Fi and even a United Club membership.

Of course, you can redeem miles outside of the United umbrella to book hotels, rental cars and cruises, gift cards, merchandise and Apple products.

Most United credit cards come with at least one free checked bag, 25% back on select in-flight and United Club purchases and no foreign transaction fees.

Who should get a United Airlines credit card?

Because United Airlines cards are co-branded cards, they are best for individuals who either prefer to fly United or plan on flying with the airline at least a couple of times per year. All United cards come with at least some travel and consumer benefits and protections, but the real draw of United Airlines cards are airline-specific rewards and perks.

If you don’t fly on United often, a co-branded airline card with your preferred airline or a general travel rewards card may be a better fit.

How to choose the best credit card for United Airlines

The best United Airlines card will be the one that offers the best combination of benefits and perks to fit your travel needs at an annual fee you can afford. Chase offers a range of card types to fit various types of travelers, from entry-level cards to ones with luxury benefits.

Start by determining what you want to get out of a United card. Is your goal to earn the most rewards on your spending or access elite United benefits? If so, United’s mid- to top-tier cards would fit the bill. If your goal is to access basic airline benefits or earn enough rewards to book a few award flights each year, almost any of the United cards would work.

United Airlines card annual fees range from $0 to $525. Determine how much you’re willing to spend to have a United card and whether the card’s rewards and benefits justify the cost.

How to maximize your United credit card

Ideally, maximizing your United Airlines credit card starts with using it for your daily purchases, and especially on United tickets and other United purchases. Here are some other ways to get the most out of your United card:

- Earn the welcome bonus: Plan ahead when applying for a new card so you know you can spend enough to meet the requirements to earn the card’s welcome bonus offer. This is the quickest way to rack up points for award flights.

- Use the card’s perks: United cards feature a host of airline and travel perks. Ensure you’re using the card to its fullest potential by using its benefits each year you own the card. For example, if you know you’ll need to check a bag, pay for your flight with one of the United cards (such as the Explorer) with a free checked bag perk.

- Choose your redemptions wisely: Value is of course in the eye of the beholder. But certain redemptions, like award flights, offer the most value compared to say, using your miles to buy merchandise. United uses dynamic pricing for award flights, so the amount of miles needed to book a flight varies considerably. If you can be flexible about where you’re traveling and when, you can likely get outsized value by booking award travel.

Is a United card worth it?

United Cards are a great tool if you’re an occasional to frequent traveler on this popular air carrier. That said, credit cards are generally only worth having if you take advantage of the included benefits. Some United cards feature credits and discounts, which are factored in when setting annual fees. If you’re not claiming these benefits regularly, you may have a difficult time getting enough value from these United cards to offset the fee.

Frequently asked questions

Do united miles expire.

United MileagePlus miles never never expire. Depending on the redemption and the number of points needed, you can use them immediately or save them for a future trip.

Can you have more than one United Airlines credit card?

You can have more than one United credit card as long as you’re approved. Chase does not restrict cardholders from having more than one United card, but you are still subject to other Chase guidelines, like the unwritten 5/24 rule (you’ll be rejected when applying for a Chase credit card if you’ve opened five or more credit cards from any issuer in the past 24 months).

Having more than one United card could be beneficial, especially if you’re a small business owner who can pair a personal and business card together—but beware ending up with redundant benefits and bonus spending categories.

How many United miles do you need for a free award flight?

United Airlines switched from an award chart to dynamic pricing in 2019. Award pricing varies considerably based on availability. United Airlines miles are generally valued at around 1 cent per mile but can be worth more depending on the redemption.

Which credit card points transfer to United Airlines?

Chase Ultimate Rewards points and Bilt Rewards both transfer to United MileagePlus at a 1:1 ratio. You can also transfer Marriott Bonvoy points to United, but at a 3:1 ratio.

Do you get a free checked bag with a United credit card?

All United Airlines co-branded credit cards, except the United Gateway Card, come with at least one free checked bag on eligible United flights.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Advertisement

Supported by

Companies Linked to Russian Ransomware Hide in Plain Sight

Cybersecurity experts tracing money paid by American businesses to Russian ransomware gangs found it led to one of Moscow’s most prestigious addresses.

- Share full article

By Andrew E. Kramer

MOSCOW — When cybersleuths traced the millions of dollars American companies, hospitals and city governments have paid to online extortionists in ransom money, they made a telling discovery: At least some of it passed through one of the most prestigious business addresses in Moscow.

The Biden administration has also zeroed in on the building, Federation Tower East, the tallest skyscraper in the Russian capital. The United States has targeted several companies in the tower as it seeks to penalize Russian ransomware gangs, which encrypt their victims’ digital data and then demand payments to unscramble it.

Those payments are typically made in cryptocurrencies, virtual currencies like Bitcoin, which the gangs then need to convert to standard currencies, like dollars, euros and rubles.

That this high-rise in Moscow’s financial district has emerged as an apparent hub of such money laundering has convinced many security experts that the Russian authorities tolerate ransomware operators. The targets are almost exclusively outside Russia, they point out, and in at least one case documented in a U.S. sanctions announcement, the suspect was assisting a Russian espionage agency.

“It says a lot,” said Dmitry Smilyanets, a threat intelligence expert with the Massachusetts-based cybersecurity firm Recorded Future. “Russian law enforcement usually has an answer: ‘There is no case open in Russian jurisdiction. There are no victims. How do you expect us to prosecute these honorable people?’”

Recorded Future has counted about 50 cryptocurrency exchanges in Moscow City, a financial district in the capital, that in its assessment are engaged in illicit activity. Other exchanges in the district are not suspected of accepting cryptocurrencies linked to crime.

Cybercrime is just one of many issues fueling tensions between Russia and the United States, along with the Russian military buildup near Ukraine and a recent migrant crisis on the Belarus-Polish border.

The Treasury Department has estimated that Americans have paid $1.6 billion in ransoms since 2011. One Russian ransomware strain, Ryuk, made an estimated $162 million last year encrypting the computer systems of American hospitals during the pandemic and demanding fees to release the data, according to Chainalysis, a company tracking cryptocurrency transactions.

The hospital attacks cast a spotlight on the rapidly expanding criminal industry of ransomware, which is based primarily in Russia. Criminal syndicates have become more efficient, and brazen, in what has become a conveyor-belt-like process of hacking, encrypting and then negotiating for ransom in cryptocurrencies, which can be owned anonymously.

At a summit meeting in June, President Biden pressed President Vladimir V. Putin of Russia to crack down on ransomware after a Russian gang, DarkSide, attacked a major gasoline pipeline on the East Coast, Colonial Pipeline , disrupting supplies and creating lines at gas stations.

American officials point to people like Maksim Yakubets, a skinny 34-year-old with a pompadour haircut whom the United States has identified as a kingpin of a major cybercrime operation calling itself Evil Corp. Cybersecurity analysts have linked his group to a series of ransomware attacks, including one last year targeting the National Rifle Association. A U.S. sanctions announcement accused Mr. Yakubets of also assisting Russia’s Federal Security Service, the main successor to the K.G.B.

But after the State Department announced a $5 million bounty for information leading to his arrest, Mr. Yakubets seemed only to flaunt his impunity in Russia: He was photographed driving in Moscow in a Lamborghini partially painted fluorescent yellow.

The cluster of suspected cryptocurrency exchanges in Federation Tower East, first reported last month by Bloomberg News, further illustrates how the Russian ransomware industry hides in plain sight.

The 97-floor, glass-and-steel high-rise resting on a bend in the Moscow River stands within sight of several government ministries in the financial district, including the Russian Ministry of Digital Development, Signals and Mass Communications .

Two of the Biden administration’s most forceful actions to date targeting ransomware are linked to the tower. In September, the Treasury Department imposed sanctions on a cryptocurrency exchange called Suex, which has offices on the 31st floor. It accused the company of laundering $160 million in illicit funds.

In an interview at the time, a founder of Suex, Vasily Zhabykin, denied any illegal activity.

And last month, Russian news media outlets reported that Dutch police, using a U.S. extradition warrant, had detained the owner, Denis Dubnikov, of another firm called EggChange, with an office on the 22nd floor. In a statement issued by one of his companies, Mr. Dubnikov denied any wrongdoing.

Ransomware is attractive to criminals, cybersecurity experts say, because the attacks take place mostly anonymously and online, minimizing the chances of getting caught. It has mushroomed into a sprawling, highly compartmentalized industry in Russia known to cybersecurity researchers as “ransomware as a service.”

The organizational structure mimics franchises, like McDonald’s or Hertz, that lower barriers to entry, allowing less sophisticated hackers to use established business practices to get into the business. Several high-level gangs develop software and promote fearsome-sounding brands, such as DarkSide or Maze, to intimidate businesses and other organizations that are targets. Other groups that are only loosely related hack into computer systems using the brand and franchised software.

The industry’s growth has been abetted by the rise of cryptocurrencies. That has made old-school money mules, who sometimes had to smuggle cash across borders, practically obsolete.

Laundering the cryptocurrency through exchanges is the final step, and also the most vulnerable, because criminals must exit the anonymous online world to appear at a physical location, where they trade Bitcoin for cash or deposit it in a bank.

The exchange offices are “the end of the Bitcoin and ransomware rainbow,” said Gurvais Grigg, a former F.B.I. agent who is a researcher with Chainalysis, the cryptocurrency tracking company.

The computer codes in virtual currencies allow transactions to be tracked from one user to another, even if the owners’ identities are anonymous, until the cryptocurrency reaches an exchange. There, in theory, records should link the cryptocurrency with a real person or company.

“They are really one of the key points in the whole ransomware strain,” Mr. Grigg said of the exchange offices. Ransomware gangs, he said, “want to make money. And until you cash it out, and you get it through an exchange at a cash-out point, you cannot spend it.”

It is at this point, cybersecurity experts say, that criminals should be identified and apprehended. But the Russian government has allowed the exchanges to flourish, saying that it only investigates cybercrime if Russian laws are violated. Regulations are a gray area in Russia, as elsewhere, in the nascent industry of cryptocurrency trading.

Russian cryptocurrency traders say the United States is imposing an unfair burden of due diligence on their companies, given the quickly evolving nature of regulations.

“The people who are real criminals, who create ransomware, and the people working in Moscow City are completely different people,” Sergei Mendeleyev, a founder of one trader based in Federation Tower East, Garantex, said in an interview. The Russian crypto exchanges, he said, were blamed for crimes they are unaware of.

Mr. Mendeleyev, who no longer works at the company, said American cryptocurrency tracking services provide data to non-Russian exchanges to help them avoid illicit transactions but have refused to work with Russian traders — in part because they suspect the traders might use the information to tip off criminals. That complicates the Russian companies’ efforts to root out illegal activity.

He conceded that not all Russian exchanges tried very hard. Some based in Moscow’s financial district were little more than an office, a safe full of cash and a computer, he said.

At least 15 cryptocurrency exchanges are based in Federation Tower East, according to a list of businesses in the building compiled by Yandex, a Russian mapping service.

In addition to Suex and EggChange, the companies targeted by the Biden administration, cyberresearchers and an international cryptocurrency exchange company have flagged two other building tenants that they suspect of illegal activity involving Bitcoin.

The building manager, Aeon Corp., did not respond to inquiries about the exchanges in its offices.

Like the banks and insurance companies they share space with, those firms are likely to have chosen the site for its status and its stringent building security, said Mr. Smilyanets, the researcher at Recorded Future.

“The Moscow City skyscrapers are very fancy,” he said. “They can post on Instagram with these beautiful sights, beautiful skyscrapers. It boosts their legitimacy.”

An earlier version of a picture caption with this article misstated the year in which Colonial Pipeline was hacked. It was 2021, not 2020.

How we handle corrections

Andrew E. Kramer is a reporter based in the Moscow bureau. He was part of a team that won the 2017 Pulitzer Prize in International Reporting for a series on Russia’s covert projection of power. More about Andrew E. Kramer

Inside the World of Cryptocurrencies

Two years after the cryptocurrency market crashed, there are signs that crypto is booming again in the Philippines, long a center of crypto activity .

Pushed by a nonprofit with ties to the Trump administration, Arkansas became the first state to shield noisy cryptocurrency operators from unhappy neighbors. A furious backlash has some lawmakers considering a statewide ban .

Ben Armstrong, better known as BitBoy, was once the most popular cryptocurrency YouTuber in the world. Then his empire collapsed .

Federal judges are weighing whether digital currencies should be subject to the same rules as stocks and bonds. The outcome could shape crypto’s future in the United States .

New investment funds that hold Bitcoin have begun trading , and it might be tempting to invest in them. Should you ?

Since the FTX cryptocurrency exchange collapsed in 2023, a whole new market has emerged that hopes to profit from claims in the company’s bankruptcy .

United Airlines MileagePlus: Guide to earning and redeeming miles, elite status and more

Editor's Note

In 2023, United massively devalued the MileagePlus program by increasing award rates by up to 122% without advance notice. MileagePlus also uses dynamic pricing (as opposed to award charts), giving the airline total flexibility to adjust award prices.

However, the program can still be valuable to its members since United miles never expire , you can use PlusPoints and miles to confirm long-haul Polaris upgrades and MileagePlus now lets you pool miles .

This guide will provide you with all the necessary information on the program, including how to earn United miles and status and how to maximize your miles for award travel.

United MileagePlus overview

With over 100 million members, United MileagePlus is one of the largest loyalty programs in the world.

MileagePlus members can earn miles by flying United and its partners, as well as through non-flight activities like credit card spending, shopping and dining. You can redeem your miles for award travel on the airline as well as its Star Alliance partners.

MileagePlus members can also earn United elite status by meeting a certain threshold of Premier qualifying points. Elite status includes additional benefits, such as upgrades, preferred and Economy Plus seating , priority boarding, and free checked bags. Additionally, United offers various cobranded credit cards that can help members earn miles more quickly and enjoy additional perks.

Related: How to get maximum value from the United MileagePlus program

United Airlines partners

You can earn and redeem miles with various international airlines through United Airlines' membership in the Star Alliance, the world's largest airline alliance. United Premier members can often enjoy perks like lounge access and extra baggage allowance when traveling with these partners.

Here's a look at United's current Star Alliance partners.

- Aegean Airlines

- Air New Zealand

- All Nippon Airways

- Asiana Airlines

- Austrian Airlines

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- Ethiopian Airlines

- EVA Airways

- Juneyao Airlines (a connecting partner)

- LOT Polish Airlines

- Scandinavian Airlines

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- TAP Air Portugal

- Thai Airways

- Turkish Airlines

United also partners with several airlines outside of the Star Alliance:

- Air Dolomiti

- Azul Brazilian Airlines

- Boutique Air

- Discover Airlines

- Hawaiian Airlines

- Olympic Air

- Silver Airways

- Virgin Australia

Partners can have their own limitations regarding MileagePlus members — including applicable bonuses, eligible fare classes and excluded routes, so be sure to review United's airline partners page for full details of each one.

Related: The best websites to search for Star Alliance award availability

United Airlines Premier status

United Airlines has four levels of elite status : Premier Silver, Premier Gold, Premier Platinum and Premier 1K. There's also an exclusive Global Services tier, which you can only earn after completing 4 million flight miles or receiving a personal invitation.

To earn United Premier status, you must take at least four United or United Express flights and either earn PQPs or a combination of Premier qualifying flights and PQPs. You can earn PQFs and PQPs by flying United or its partners. You can also earn PQPs by spending on most of United's cobranded credit cards .

This is what it takes to qualify for United status in 2025:

United Premier members enjoy perks like bonus miles on paid tickets, free checked bags and complimentary waitlisted upgrades on most United-operated flights.

Higher-tier members receive perks like complimentary Economy Plus seating, PlusPoints (which can be used to confirm upgrades), Marriott Bonvoy Gold Elite status and Star Alliance Gold status , which comes with perks when flying on other Star Alliance carriers.

Related: United Premier status: What it is and how to earn it

How to earn United miles

You can refer to our guide on how to earn United miles for the complete picture, but here are some of the most popular ways to boost your MileagePlus balance.

Fly on United Airlines

When flying on United-marketed and -operated tickets, you earn MileagePlus miles based on your ticket's price minus taxes and your MileagePlus status rather than the distance you fly.

Here's how many miles you'll earn per dollar spent based on your level of status:

- General member : 5 miles

- Premier Silver : 7 miles

- Premier Gold : 8 miles

- Premier Platinum : 9 miles

- Premier 1K : 11 miles

For example, suppose you buy a one-way United ticket from San Francisco International Airport (SFO) to Los Angeles International Airport (LAX) with a base fare of $210 and $30 in taxes and fees. In that case, you'd earn 1,050 miles as a regular MileagePlus member but 2,310 miles if you're a top-tier Premier 1K member.

These earning rates also apply if you book United's basic economy fare class.

Fly on partner airlines

You can earn United MileagePlus miles when flying with United's partners, but it can be complicated. If you book a partner flight through United (indicated by a 016 ticket number), you'll earn miles based on your ticket fare and elite status.

But if you book on partner ticket stock, you'll earn miles based on the length of your flight and fare class. Generally, you can see your fare class when booking your flight or in your confirmation email. Mileage-earning rates vary by airline, so check your booking class and use United's partner airline list to determine your award miles. As expected, premium-cabin tickets earn more miles than economy tickets, and Premier members are eligible for bonus miles on select partners.

Related: Your ultimate guide to United Airlines partners

Get and use United Airlines credit cards

United's cobranded credit cards issued by Chase are among the most popular ways to earn MileagePlus miles. Here's a look at the sign-up bonuses and earning rates on some of our favorite United credit cards:

- United℠ Explorer Card : Earn 50,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open. The card earns 2 miles per dollar on United purchases, dining and direct hotel purchases, and 1 mile per dollar elsewhere.

- United Quest℠ Card : Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open. The card earns 3 miles per dollar on United purchases (immediately after earning your $125 annual United purchase credit); 2 miles per dollar on dining, travel and select streaming services; and 1 mile per dollar elsewhere.

- United℠ Business Card : Earn 75,000 bonus miles after you spend $5,000 on purchases in the first three months your account is open. The card earns 2 miles per dollar on United purchases, gas stations, dining (including eligible delivery services), office supply stores, local transit and commuting (including ride-hailing services, taxicabs, train tickets, tolls and mass transit), and 1 mile elsewhere. You'll also earn 5,000 bonus miles on each card anniversary when you have both the United Business Card and a personal United credit card.

- United Club℠ Infinite Card : Earn 80,000 bonus miles after you spend $5,000 on purchases in the first three months from account opening. The card earns 4 miles per dollar spent on purchases with United, and 2 miles per dollar spent on all other travel purchases, dining and eligible food delivery services. All other purchases earn 1 mile per dollar spent.

United credit cards with an annual fee allow you to earn 25 PQPs for every $500 you spend on the card, but limits apply. For example, the Explorer Card earns a maximum of 1,000 PQPs per calendar year.

Related: United's best-kept elite status secret: How to earn PQPs faster with partner flights

Transfer credit card points from Chase Ultimate Rewards

You can instantly transfer Chase Ultimate Rewards points to United at a 1:1 ratio, which can be an appealing way to instantly increase your MileagePlus balance.

TPG values Chase Ultimate Rewards points at 2.05 cents apiece, while United miles are worth 1.4 cents apiece. You can also redeem your Chase points for United flights in the Chase Ultimate Rewards travel portal. When you do this, you'll generally earn United miles since your ticket will be coded as a paid fare.

More ways to earn United miles

Like most airlines, United has an online shopping portal where you can earn miles for your online purchases.

You can also earn more miles with the MileagePlus X app by purchasing select merchant gift cards. Participating merchants include major brands like Walmart, Staples and Panera Bread. Primary United credit card holders also earn a 25% bonus on miles earned from these purchases.

Meanwhile, MileagePlus Dining awards up to 5 miles per dollar when you dine at participating restaurants and use a linked credit card.

Other ways to earn United miles include buying miles , transferring Marriott Bonvoy points and booking hotels, car rentals and cruises through the United travel portal.

Related: Flights, credit cards and more: How to earn miles with the United MileagePlus program

United MileagePlus pooling

In 2024, United announced the addition of miles pooling , which will allow MileagePlus members of all ages to share and redeem miles in one account.

Since there is no age restriction on members being able to sign up for a MileagePlus account, extra and unused miles from kids, for instance, can be used in a single account. Up to five members can be added to a pool, and there is no limit to the number of miles you can contribute to a pool.

However, you must be at least 18 years old to create a pool and become the "pool leader." You can also only operate in one pool at a time, so you cannot be a part of several pools.

Some stipulations exist; you can enter and exit a pool at your own discretion, but the airline will enforce a 90-day "cooling" period when you exit a pool, so you'll have to wait before joining another one.

When you're contributing miles to a pool, you have 24 hours to reverse a transaction. After 24 hours have passed, you cannot get the miles you contributed to a pool back.

United also stated that pooling miles will not affect a member's Premier status.

How to redeem United miles

United has retired its award charts and now uses dynamic award pricing. Still, there are ways to maximize the program .

To redeem United miles , go to united.com or the United app. United Airlines credit card holders and Premier members can access additional award space on United flights. If you hold a United credit card or Premier status, log in to your MileagePlus account before searching for award space.

United also has an option called Money + Miles, which offers a fixed rate of 1 cent per mile. This option is available on the final payment screen for eligible tickets. When possible, steer clear of this option since it's a suboptimal use of miles.

Best uses of United miles

You can refer to our guide on maximizing the MileagePlus program , but here are a few of our favorite uses of United miles.

You might find award options starting around 5,000 miles on high-frequency, short-haul flights. Although these flights almost always cost less than $100, these awards can be a great way to keep your travel plans flexible since United no longer charges redeposit fees when you cancel award flights.

For something a little more complex, the United Excursionist Perk is a great way to maximize your United miles when booking multicity trips. Basically, the first flight within a region different from your departure and destination regions is free in the same class as the preceding flight. For example, if you book a round-trip business-class flight from Newark Liberty International Airport (EWR) to London's Heathrow Airport (LHR) and back, you can also get a "free" business-class flight from London to another European airport, such as Brussels Airport (BRU).

This allows you to fly to London, then Brussels and then back to Newark for the same number of miles as a simple round-trip flight between Newark and London.

To book, use the "Multi-city" search feature on united.com. In our experience, many of United's phone agents aren't familiar with this lesser-known United sweet spot .

Besides the Excursionist Perk, you can maximize United miles by booking a transcontinental flight for 15,000 miles for economy class and 30,000 miles for business class when there's saver award space. You might also consider keeping a healthy "just in case" sum of miles in your MileagePlus account for last-minute situations.

Finally, you can consider using United miles to fly on top partner carriers — including products like ANA's "The Room" business class or EVA Air's business class , which offer high-end amenities but come in with high award rates.

Related: Feels like first class: Flying ANA The Room business class from LA-Tokyo

Other uses of United miles

You can use United miles for United Club memberships , inflight Wi-Fi purchases, TSA PreCheck fees , car rentals and hotel stays. You can also transfer United miles to Marriott Bonvoy . However, it's not recommended, as the value you'll get from these redemptions is almost always lower than the value of MileagePlus miles for flight redemptions.

The same can be said for redeeming your miles for gift cards through the MileagePlus X app, retail products, Broadway tickets, newspapers and magazines. These options generally provide less than 0.5 cents per mile.

Bottom line

If you're a frequent United Airlines traveler, sticking with the airline's loyalty program might make sense. By knowing the intricacies of the MileagePlus program, you can get lots of miles and redeem them for top value. And if you fly enough, you can enjoy all the elite status perks.

2018 Primetime Emmy & James Beard Award Winner

R&K Insider

Join our newsletter to get exclusives on where our correspondents travel, what they eat, where they stay. Free to sign up.

A History of Moscow in 13 Dishes

Featured city guides.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

United Airlines Premium Economy: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What to expect flying premium economy with United

How to book united premium plus, united premium plus vs. economy plus, 4 ways to get good value from united premium plus, final thoughts on united premium economy.

Are you looking for an upgraded experience when flying United Airlines but you're not ready to shell out for first class just yet? United premium economy service, which is called Premium Plus, may be the right fit. With larger seats in a semi-separate cabin, complimentary alcohol and two free checked bags, it’s available on select long-haul international flights and some transcontinental domestic routes.

Here’s what to expect with United Premium Plus and how to book it with MileagePlus miles .

What is premium economy on United and what does it offer? While your exact United Premium Plus economy experience may vary depending on your route (the class of service is currently available on select long-haul international, premium transcontinental and Hawaii routes), there are still a few things you can count on no matter what.

Bag allowance

The United Premium Plus baggage allowance is two free checked bags , plus reserved overhead bin space for your carry-on. Regular economy seats don’t offer any free checked bags on domestic flights and only one checked bag on select international flights.

You can also get a free checked bag (or two) if you hold certain United Airlines credit cards . More on that below.

Premier Access

Premium Plus passengers also get Premier Access, which offers dedicated airport check-in lines, exclusive security lanes at select airports, priority bag handling and priority boarding. Those flying in economy or Economy Plus do not get Premier Access benefits unless they have United elite status, Star Alliance Gold status, an eligible United credit card or have purchased the Premier Access add-on. Passengers flying in business class, first class or United Polaris also receive Premier Access.

» Learn more: United elite status: What you need to know

United’s Premium Plus seats are up to 19 inches wide and feature a 38-inch seat pitch, providing up to 7 more inches of legroom than most standard economy and Economy Plus seats. Seats also recline 6 inches, meaning you have more room to spread out and get comfy.

Since the seats are bigger, there are also less seats per row compared to economy. As seen in the image above of United’s Boeing 777-200, the Premium Plus cabin has eight seats per row while the economy cabin has 10 seats per row. Note that depending on the plane, the number of seats per row may differ, but there will still be less seats per row in Premium Plus vs. economy.

Premium Plus seats are closer to the front of the plane so you can get to your seat and off the plane faster, and each has an adjustable leg rest, footrest, power outlet and USB outlet.

» Learn more: United Airlines seat selection: What to know

With a Premium Plus ticket, you’ll also have access to discounted United Club passes when booking select long-haul international flights, so you can kick back and relax in style before, after or during a layover on long travel days.

Entertainment

Don’t worry about bringing your own technology for entertainment purposes: Seatback screens in Premium Plus are up to 13 inches (compared with the standard 9 inches). You’ll also get premium noise-reducing headphones and a Saks Fifth Avenue blanket and pillow on select long-haul international flights.

Food and beverages

Alcoholic beverages are free in Premium Plus. In regular economy, alcoholic drinks are only free on transatlantic flights, flights between the U.S. and some South American countries, and certain transpacific flights.

United’s Premium Plus food choices are also different from those provided to economy passengers. On select long-haul international flights, there are upgraded dining options. On premium transcontinental routes, passengers get a complimentary hot entree, fruit and dessert. Example menu items may include chicken katsu or portobello mushroom and caramelized onion ravioli.

» Learn more: United vs. American Airlines — which is best for you?

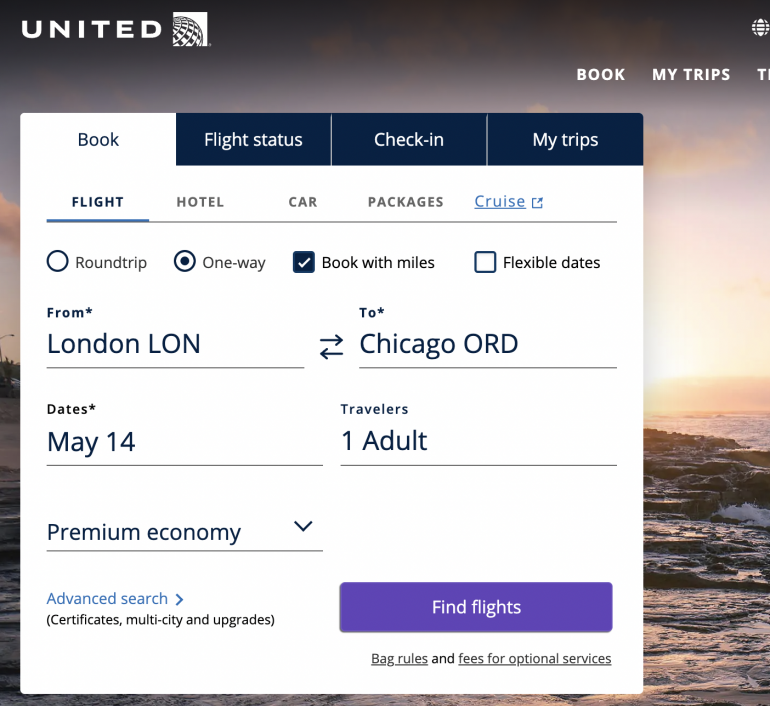

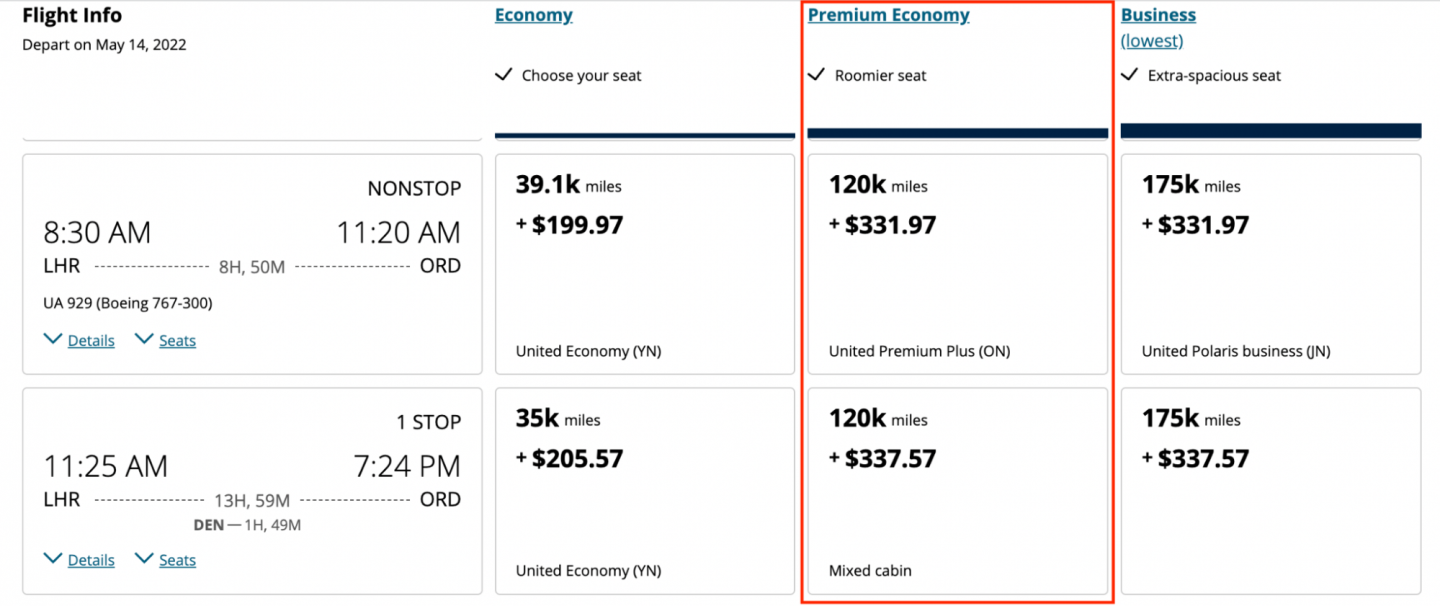

It’s not as easy or straightforward to find a Premium Plus fare as it is to locate, say, a business or first class ticket. Start on United.com and enter your travel dates and destinations.

Make sure to choose “Premium economy” where you see the cabin class and, if you want to book an award ticket, choose “Book with miles.” Then, select “Find flights” to start the search.

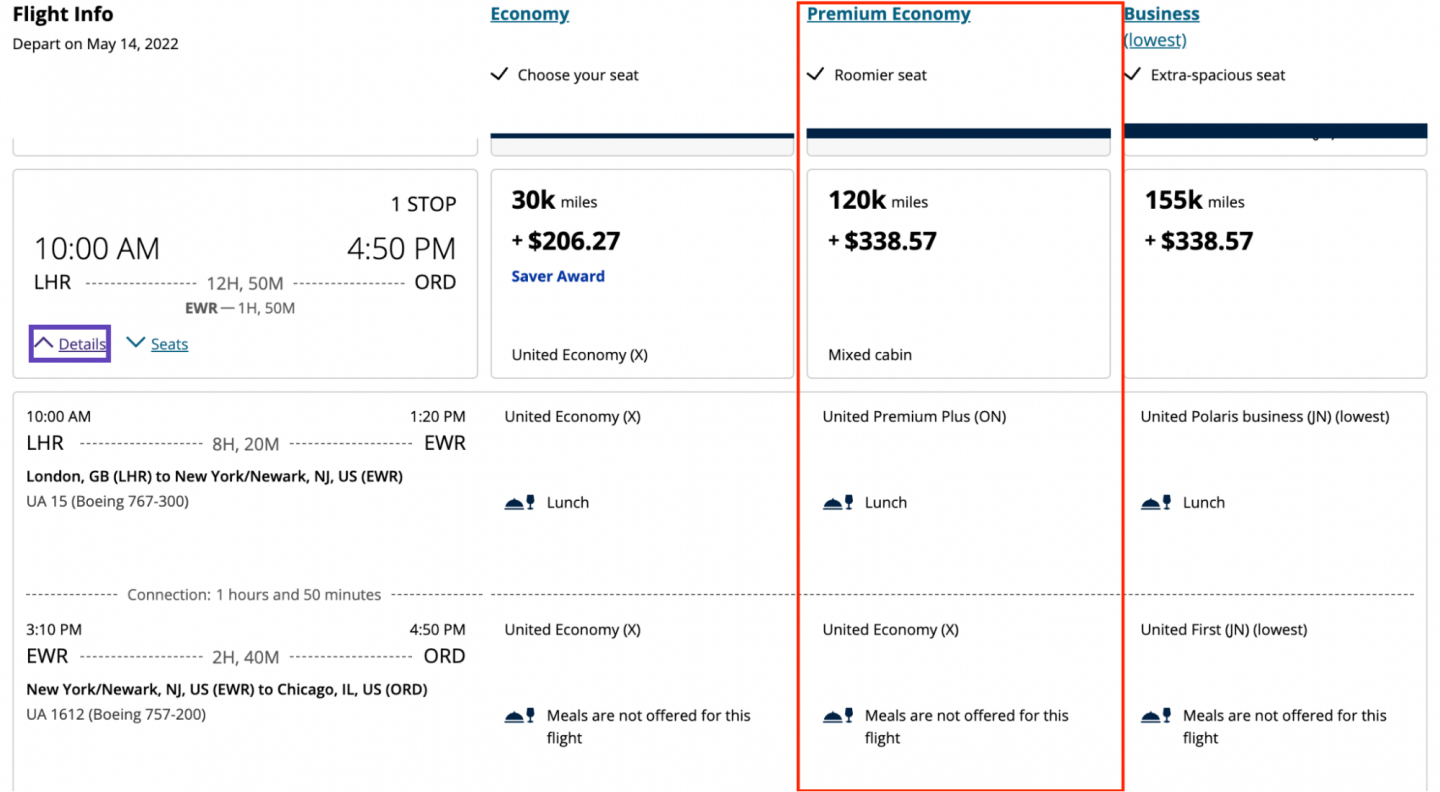

When the flight options populate, look under the premium economy column to see if a Premium Plus seat is available. You may encounter a ticket with the label “Mixed cabin.”

Some flights that include connections may not offer Premium Plus seating on all flight segments. It’s a good idea to look more closely at the ticket to view the seat type offered with the premium economy ticket. Select “Details” for any flight you’d like to view, and you will see the available seat type listed for each flight segment.

After choosing your flight, you’ll be able to select your seat choice as you complete the booking process. However, you can also preview the seats available by selecting “Seats,” which is right next to “Details.”

United’s economy offerings are divided into four ticket types:

Basic economy (the most restrictive).

Economy Plus.

Premium Plus (premium economy).

So then what is United’s Economy Plus, and what’s the difference between Economy Plus and Premium Plus?

» Learn more: United Premium Plus vs. Economy Plus: Does it make a difference?

Premium Plus is United’s premium economy fare and comes with the perks mentioned above, including Premier Access, upgraded food, free alcoholic drinks, discounted United Club lounge access, baggage allowance, roomier seats in a separate cabin and enhanced entertainment options.

Economy Plus, on the other hand, is an economy seat with more legroom that’s located near the front of the economy cabin or by the exit row. Economy Plus is an option that you can purchase during or after booking a standard economy ticket. You can also purchase an annual Economy Plus subscription. If you’re a United elite member, you can select an Economy Plus seat for free when you buy a standard economy fare.

Worth noting, when you're in Economy Plus, you don't get a free checked bag. However, if you use a United-branded credit card, you can get your bag fees waived, as well as enjoy priority boarding and, depending on the card, even access the United Club airport lounges. Credit card options include:

on Chase's website

$0 intro for the first year, then $95 .

• 2 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and hotels (when booked directly with hotel).

• 1 mile per $1 on all other purchases.

• 3 miles per $1 on United purchases.

• 2 miles per $1 at restaurants, select streaming services and all other travel.

• 4 miles per $1 on United purchases.

• 2 miles per $1 at restaurants and all other travel purchases.

• 2 miles per $1 on United purchases, gas stations and local transit and commuting.

• First checked bag free for you and one companion on your reservation.

• 2 United Club one-time passes each year .

• Credit of up to $100 every four years for TSA PreCheck, Global Entry or NEXUS.

• Priority boarding.

• No foreign transaction fees.

• First and second checked bag free for you and one companion on your reservation.

• $125 United purchase credit per year (good on airfare).

• Two 5,000-mile award flight credits per anniversary year.

• Priority boarding .

• Access to United Club airport lounges.

Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Earn 80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open.

» Learn more: How to choose a seat on a plane

Here’s how to get the most out of every Premium Plus award booking on United.

1. Book Premium Plus using United miles

Booking with miles is typically a great way to save money and get the best value out of points. In one search for flights from LAX to London, an economy ticket cost $2,288 for a refundable fare or 30,000 miles for a valuation of 7.6 cents per mile. A Premium Plus fare cost $2,714 or 56,600 miles for a valuation of 4.8 cents per mile.

Since NerdWallet values United miles at 1.2 cents per mile, both of these tickets reflect a great use of miles. But ticket prices can vary greatly, so make sure to do the math before booking to see if you’re getting a good return on your mileage investment.

2. Book Premium Plus using Star Alliance partners

Since United is a member of Star Alliance, you may be able to find a good deal on award flights when booking a United Premium Plus ticket using partner airline miles. You can search for United award availability using Avianca LifeMiles , Air Canada Aeroplan or Singapore Airlines KrisFlyer .

3. Take advantage of lounge pass discounts

If your flight includes multiple stops, the option to purchase a discounted lounge pass may come in handy to assuage the pain of long-haul international flights and extended layovers. You can purchase a pass during booking to guarantee access.

4. Travel off-peak to save miles

United doesn’t publish a set award chart . Instead, mileage requirements for award flights are based on a variety of factors, including demand. So booking during off-peak times and seasons may provide you with a better deal.

» Learn more: Which United credit card should you get?

Hovering somewhere between business class and regular economy is United Airlines Premium Plus. It offers roomier seats in a separate cabin, free alcohol, upgraded meals, free checked bags and discounted United Club lounge access, but it may come at a cost when booking with miles.

Additionally, flights that offer this class of service can be tricky to find. But if Premium Plus is available, it’s worth checking to see if you can score a good deal for long flights.

United’s premium economy product is called Premium Plus. It is available on select transcontinental domestic routes and some long-haul international flights. Premium Plus seats are larger and in a separate cabin.

When flying Premium Plus, passengers get enhanced food options, free alcoholic beverages, discounted United Club lounge access, Premier Access, additional baggage allowance and upgraded entertainment options.

Yes, those flying in Premium Plus receive discounted access to United Club lounges. United doesn’t disclose the cost of lounge access for Premium Plus passengers, but the price of entry should be lower than the $59 United Club day pass.

Unless it's an involuntary change imposed by United (e.g., oversold flight, canceled flight, flight change or inability to accommodate a passenger in a premium cabin), Premium Plus seats are nonrefundable if canceled more than 24 hours after booking.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-2x Earn 2 miles per $1 spent on dining, hotel stays and United® purchases. 1 mile per $1 spent on all other purchases

50,000 Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

1x-2x Earn 2 miles per $1 spent on United® purchases, dining, at gas stations, office supply stores and on local transit and commuting. Earn 1 mile per $1 spent on all other purchases.

75000 Earn 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open.

1x-3x Earn 3x miles on United® purchases, 2x miles on dining, select streaming services & all other travel, 1x on all other purchases

60,000 Earn 60,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first 3 months your account is open.

Find cheap flights to Moscow Sheremetyevo Airport

Search hundreds of travel sites at once for deals on flights to moscow sheremetyevo airport.

Save 22% or more Compare multiple travel sites with one search.

Track prices Not ready to book? Create a price alert for when prices drop.

Filter your deals Choose cabin class, free Wi-Fi and more.

Bundle and save Save money when you bundle your flight + hotel.

Flights to Sheremetyevo - Travel Insights & Trends

Get data-powered insights and trends for flights to sheremetyevo to help you find the cheapest flights, the best time to fly and much more., how long is the flight to moscow sheremetyevo airport, the duration of your flight to moscow depends on your departure and arrival airports. obviously any flights that include a layover will also be longer. the most popular routes to moscow on kayak are from boston , which takes 11h 50m, san francisco , which takes 19h 20m, los angeles , which takes 20h 30m, and new york , which takes 22h 15m., when to book flights to sheremetyevo, faqs - booking moscow sheremetyevo airport flights, how far is moscow sheremetyevo airport from central moscow.

Central Moscow is 18 miles away from Moscow Sheremetyevo Airport.

How does KAYAK find such low prices on flights to Moscow Sheremetyevo Airport?

KAYAK is a travel search engine. That means we look across the web to find the best prices we can find for our users. With over 2 billion flight queries processed yearly, we are able to display a variety of prices and options on flights to Moscow Sheremetyevo Airport.

How does KAYAK's flight Price Forecast tool help me choose the right time to buy my flight ticket to Moscow Sheremetyevo Airport?

KAYAK’s flight Price Forecast tool uses historical data to determine whether the price for a flight to Moscow Sheremetyevo Airport is likely to change within 7 days, so travelers know whether to wait or book now.

What is the Hacker Fare option on flights to Moscow Sheremetyevo Airport?

Hacker Fares allow you to combine one-way tickets in order to save you money over a traditional round-trip ticket. You could then fly to Moscow Sheremetyevo Airport with an airline and back with another airline.

What is KAYAK's "flexible dates" feature and why should I care when looking for a flight to Moscow Sheremetyevo Airport?

Sometimes travel dates aren't set in stone. If your preferred travel dates have some wiggle room, flexible dates will show you all the options when flying to Moscow Sheremetyevo Airport up to 3 days before/after your preferred dates. You can then pick the flights that suit you best.

Which airline offers the most flights to Moscow Sheremetyevo Airport?

Of the 6 airlines that fly to Moscow Sheremetyevo Airport, Aeroflot offers the most flights, with around 1,501 per week, followed by Smartavia with 75 flights per week.

Top tips for finding cheap flights to Moscow Sheremetyevo Airport

- Enter your preferred departure airport and travel dates into the search form above to unlock the latest Moscow Sheremetyevo Airport flight deals.

Prefer to fly non-stop to Moscow Sheremetyevo?

Find which airlines fly direct to Sheremetyevo, which days they fly and book direct flights.

Nonstop departures

United States to Moscow Sheremetyevo

Aeroflot, Air China, Air Serbia, +19 more

Aeroflot, Air China, +20 more

Aeroflot, Air Algerie, Air China, +21 more

Aeroflot, Air Algerie, +22 more

Aeroflot, Air Algerie, Air China, +23 more

Aeroflot, Air Algerie, +24 more

Aeroflot, Air China, Air Serbia, +17 more

Aeroflot, Air China, +18 more

Nonstop returns

Moscow Sheremetyevo to United States

Book cheap moscow plane tickets, round-trip flight deals, search by stops, one-way flight deals, flights to moscow sheremetyevo airport, destination:.

Moscow Sheremetyevo Airport (SVO) Russia

Return flight deals:

Moscow Sheremetyevo Airport - United States

Cabin classes:

Browse origins:.

- Flights »

- United States

Browse destinations:

- Worldwide »

- Moscow Sheremetyevo Airport

IMAGES

VIDEO

COMMENTS

These credits can be used to book travel on United, United Express, and partner-operated flights purchased on our website or app. You can also apply future flight credits toward some non-ticket items, like Economy Plus ® seating. If you choose to apply your credits towards non-ticket items, you'll need to do that when booking your ticket as ...

Redeeming United flight credits is easy. Just go through the process of booking a ticket, and when you get to the payment page, select "Travel credits" as the payment method. Redeem United flight credits during the booking process. You can combine multiple flight credits toward the cost of a ticket, though you can't combine flight credits ...

Future flight credit. Unlike ETCs, future flight credits can be used to cover the cost of partner flights, even those without a United flight on the same itinerary, as long as those flights are available to book via United, either on United's own website or by calling reservations at (800) 864-8331.

For all other Basic Economy tickets, you're allowed one small personal item that fits under the seat in front of you, such as a shoulder bag, purse, laptop bag or other small item that is 9 inches x 10 inches x 17 inches (22 cm x 25 cm x 43 cm) or less. Mobility aids and other assistive devices are also permitted.

To use your travel credit, search and select your flight as usual. At checkout, choose travel credit as your payment option. If you are a MileagePlus member, your travel credits should appear ...

When comparing United Airlines Basic Economy versus Economy versus Economy Plus, the differences lie in the little perks. ... Here are our picks for the best travel credit cards of 2024, including ...

Food and drinks. From packaged snacks and snackboxes to wine and multi-course meals, there are a lot of dining options in United Economy. We use contactless payment on board, so if you want to buy food or drinks, make sure to save a form of payment before your flight. On every flight. Free soft drinks, juices, tea and fresh brewed illy coffee.

Step-by-step guide to using your United travel funds. Applying your travel funds to a United flight is both easy and intuitive. First, you'll want to search for a flight directly on the United ...

Searching for premium economy award tickets using the 30-day United award calendar shows that we can save thousands of points by adjusting travel dates by a few days. Flexibility is your friend if ...

Booking a flight in the "W" fare class or higher requires 40 PlusPoints, while lower-priced fare classes require double that amount. These fare class codes also come into play when making flight changes. If only a higher fare class is available, you may need to pay the price difference, even when using United's same-day change policy.

United has two types of economy fares: economy and basic economy. Basic economy provides a lower-priced fare but may place restrictions on seat assignment, boarding, carry-on baggage, upgrades, changes, refunds, elite earning and elite benefits. This guide will answer common questions about these restrictions and the basic economy experience on ...

Unless you're elite or have a United credit card, basic economy class passengers can expect to pay $35 (or $30 if prepaid) for the first checked bag and $45 ($40 if prepaid) for the second checked ...

Go to My Trips to cancel your reservation and start the refund process. If your ticket was purchased in the last 24 hours, it may qualify for our 24-hour booking policy. The refund amount will vary based on the situation. Credit card refunds will be processed within seven business days of the request. All other refunds will be processed within ...

If you want an Economy Plus subscription for yourself and up to eight companions, you can expect to pay: $1,099 for domestic flights, excluding Alaska and Hawaii. $1,199 for flights within North America and Central America. $1,299 for flights throughout United's network. Whether or not that's worth it really depends on your travel patterns.

Choosing the best United credit card for your travel needs can help you score nearly free travel and can make your flights more convenient too. ... inflight food, beverages and Wi-Fi, Economy Plus ...

Notably, United's move to make basic economy more flexible follows a similar announcement from Delta late last year. Delta's basic economy fares are now cancelable for partial travel credit, with domestic flights or flights to the Caribbean, Central America or Mexico subject to a $99 cancellation fee those from the U.S. or Canada to any other ...

Economy Plus subscriptions. Sit in Economy Plus on every eligible flight for a year, starting at $599. You can buy a subscription for yourself and up to eight companions. You can also customize your plan based on where you travel most. Subscribe now.

Upgrading a United Airlines ticket from basic economy to economy is a simple process and a great option for travelers who might need a few extra perks. ... You want a travel credit card that ...

The United States has targeted several companies in the tower as it seeks to penalize Russian ransomware gangs, which encrypt their victims' digital data and then demand payments to unscramble it.

Economy Plus seats on a United Airlines Boeing 777-200. KYLE OLSEN/THE POINTS GUY ... United credit cards with an annual fee allow you to earn 25 PQPs for every $500 you spend on the card, but limits apply. For example, the Explorer Card earns a maximum of 1,000 PQPs per calendar year. ... car rentals and cruises through the United travel ...

Using a travel rewards credit card has long been celebrated as an easy strategy to travel the world for less. Consumers can apply for rewards credit cards and earn points and miles on everyday ...

1: Off-kilter genius at Delicatessen: Brain pâté with kefir butter and young radishes served mezze-style, and the caviar and tartare pizza. Head for Food City. You might think that calling Food City (Фуд Сити), an agriculture depot on the outskirts of Moscow, a "city" would be some kind of hyperbole. It is not.

United Quest SM Card. $125 annual United purchase credit. 3x miles on United purchases. 2x miles on dining, all other travel and select streaming services. Two 5,000-mile anniversary award flight credits - terms apply. Free first and second checked bags - terms apply. Up to 6,000 Premier qualifying points.

In one search for flights from LAX to London, an economy ticket cost $2,288 for a refundable fare or 30,000 miles for a valuation of 7.6 cents per mile. A Premium Plus fare cost $2,714 or 56,600 ...

Find cheap tickets to Moscow Sheremetyevo Airport from anywhere in United States. KAYAK searches hundreds of travel sites to help you find cheap airfare and book the flight that suits you best. With KAYAK you can also compare prices of plane tickets for last minute flights to Moscow Sheremetyevo Airport from anywhere in United States.

Fact Notes (a) Includes persons reporting only one race (c) Economic Census - Puerto Rico data are not comparable to U.S. Economic Census data (b) Hispanics may be of any race, so also are included in applicable race categories Value Flags-Either no or too few sample observations were available to compute an estimate, or a ratio of medians cannot be calculated because one or both of the median ...