We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

- Edit my quotes

Norwegian Cruise Line Holdings Ltd. Ordinary Shares (NCLH)

- Nasdaq Listed

- Nasdaq 100

- Summary Live

- Real-Time Live

- After-Hours Live

- Pre-Market Live

- Charts Live

NEWS & ANALYSIS

- Press Releases Live

- Analyst Research Live

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

Bid Price and Ask Price

The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest ... Read More. amount that a seller is currently willing to sell. The numbers next to the bid/ask are the “ size ”. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. The data displayed in the quote bar updates every 3 seconds; allowing you to monitor prices in real-time. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a successful order execution. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visit Nasdaq Data Link's products page . ... Read Less.

Analyze your stocks, your way

Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data.

*Data is provided by Barchart.com. Data reflects weightings calculated at the beginning of each month. Data is subject to change.

**Green highlights the top performing ETF by % change in the past 100 days.

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com .

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Upgrade to FINVIZ*Elite to get real-time quotes, intraday charts, and advanced charting tools.

NEW: Revenue Breakdown and Options Chain

Gain deeper insights into company revenues with a detailed analysis of revenue sources. Explore the updated Options feature, providing in-depth data, and a 3D viewing option.

Norwegian Cruise Line Holdings Ltd

Ever heard of finviz*elite.

Our premium service offers you real-time quotes, advanced visualizations, technical studies, and much more. Become Elite and make informed financial decisions.

Upgrade your FINVIZ experience

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Interactive Stock Chart

Customize the view of stock chart with the ability to show key indicators such as Earnings, Dividends & Splits as well as filtering to view only Pre- and Post-Market prices.

Historical Data

Filter stock price historical data by date with the ability to view Opens, Highs, Lows, Closes, VWAPs, Volume % Change, Change, Trade Value and Trades.

Analyst Coverage

View the analysts and firms that follow our company.

- Email Alerts

- RSS News Feed

- New Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

norwegian cruise line holdings ltd.

Open Market

-0.62 (3.20%)

Volume: 4.54M

Last Updated:

Apr 9, 2024, 10:57 AM EDT

- Analyst Estimates

- SEC Filings

Norwegian Cruise Line ship to dock after testing showed no traces of cholera onboard

Concerns about a possible cholera outbreak onboard the Norwegian Dawn prompted Mauritius officials to keep the ship out of Port Louis over the weekend.

Norwegian Cruise Line scrapping Israel voyages in 2024 due to war with Hamas

Norwegian Cruise Line Holdings is scrapping visits to Israel in 2024 due to the Israel-Hamas conflict, the company said Wednesday as it put out its third-quarter earnings report.

Norwegian Cruise Line introducing tons of solo rooms for travelers

Norwegian Cruise Line recently announced a move that will see it further embrace solo travelers, bringing almost 1,000 new solo staterooms to its ships.

Norwegian Cruise Line reveals new routes for 2024 and 2025: 'Ultimate cruise vacation'

Norwegian Cruise Line announces its new sail itineraries for winter 2024, summer 2025 and winter 2025. Six ships will travel to the Greek Isles, the Caribbean, Alaska and more.

Norwegian Cruise Line eliminating COVID-19 testing, masking and vaccination requirements

Norwegian Cruise Line announced it is removing all coronavirus-related protocols effective Tuesday, Oct, 4, 2022. That includes testing, masking and vaccination requirements.

Carnival Cruise Line applies curfew for minor guests: 'Commitment to safety'

Carnival Cruise Line has implemented an age-based curfew for passengers who are 17 years old or younger. The company told FOX Business why it made the change.

Cruise ship operators are hard hit by labor crisis, recession anxiety

Labor shortages, inflation, and threats of a recessionary are creating a perfect storm for the cruise industry. Analysts have cut their revenue estimates for cruise operators by 5%.

CDC lifts travel warning for the cruise industry two years into pandemic

The CDC lifted its travel warning for cruises on Wednesday after two years of shifting advisories, lawsuits, and criticism from industry leaders who accused the agency of heavy-handed regulations.

Norwegian cruise ship hit with COVID-19 wave cancels mid-voyage

A spokesperson for Norwegian told FOX Business the ship docked overnight in St. Maarten on Thursday and will be back in New York "soon." The company did not offer an estimated arrival time.

CDC tells Americans to avoid cruises 'regardless of vaccination status' amid COVID-19 surge

The CDC sounded the alarm on cruises Thursday amid a surge in COVID-19 cases nationwide, raising its travel warning to the highest level and telling Americans to “avoid cruise travel, regardless of vaccination status.”

Norwegian Cruise Line Holdings Ltd.

About norwegian cruise line holdings ltd..

See all ideas

Analyst rating

See all sparks

Frequently Asked Questions

- Norwegian Cruise Line-stock

- News for Norwegian Cruise Line

The Latest Analyst Ratings For Norwegian Cruise Line

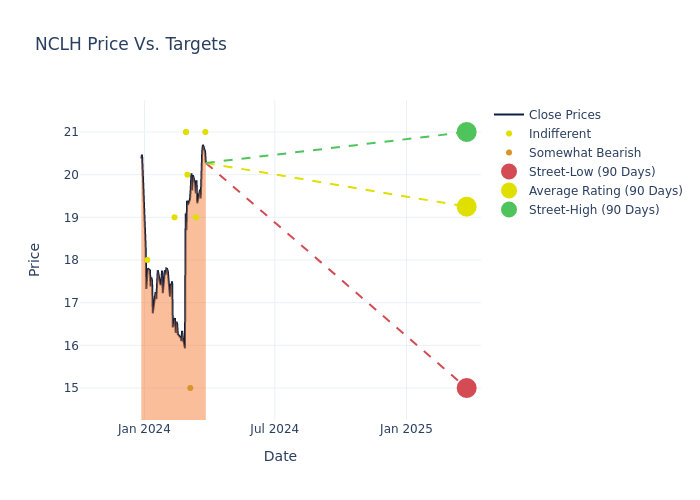

Norwegian Cruise Line (NYSE:NCLH) has been analyzed by 9 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

Analysts have set 12-month price targets for Norwegian Cruise Line, revealing an average target of $19.33, a high estimate of $21.00, and a low estimate of $15.00. Observing a 7.39% increase, the current average has risen from the previous average price target of $18.00.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Norwegian Cruise Line's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Norwegian Cruise Line. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Norwegian Cruise Line compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Norwegian Cruise Line's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Norwegian Cruise Line's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Norwegian Cruise Line analyst ratings.

Delving into Norwegian Cruise Line's Background

Norwegian Cruise Line is the world's third-largest cruise company by berths (around 66,500). It operates 32 ships across three brands —Norwegian, Oceania, and Regent Seven Seas—offering both freestyle and luxury cruising. The company redeployed its entire fleet as of May 2022. With five passenger vessels on order among its brands through 2028, representing 16,000 incremental berths, Norwegian is increasing capacity faster than its peers, expanding its brand globally. Norwegian sails to around 700 global destinations.

A Deep Dive into Norwegian Cruise Line's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Norwegian Cruise Line showcased positive performance, achieving a revenue growth rate of 30.76% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -5.36%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Norwegian Cruise Line's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -28.8%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.55%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 46.74 , Norwegian Cruise Line faces challenges in effectively managing its debt levels, indicating potential financial strain.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Norwegian Cruise Line News MORE

Related stocks.

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- TESLA, INC.

- NIPPON ACTIVE VALUE FUND PLC

- AMD (ADVANCED MICRO DEVICES)

- RHEINMETALL AG

- THE EDINBURGH INVESTMENT TRUST PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Trend-Following Stocks

- Momentum stocks

- Yield stocks

- Dividend Kings

- The Internet of Things

- Serial buyers

- Strategic Metals

- Bionic engineering

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Solar energy

- The Vegan Market

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Norwegian Cruise Line Holdings Ltd. Stock

Bmg667211046, hotels, motels & cruise lines, financials (usd), chart norwegian cruise line holdings ltd., latest news about norwegian cruise line holdings ltd., latest transcript on norwegian cruise line holdings ltd..

Analyst Recommendations on Norwegian Cruise Line Holdings Ltd.

Press releases norwegian cruise line holdings ltd., news in other languages on norwegian cruise line holdings ltd., quotes and performance, highs and lows.

Managers and Directors - Norwegian Cruise Line Holdings Ltd.

Etfs positioned on norwegian cruise line holdings ltd..

Delayed Quote Nyse, April 08, 2024 at 04:00 pm EDT

Company Profile

Income statement evolution, ratings for norwegian cruise line holdings ltd., analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector cruise lines.

- Stock Market

25% Off Benzinga's Most Powerful Trading Tools

Traders Win More with Benzinga's Exclusive News and Squawk

- Get Benzinga Pro

- Data & APIs

- Our Services

- News Earnings Guidance Dividends M&A Buybacks Legal Interviews Management Offerings IPOs Insider Trades Biotech/FDA Politics Government Healthcare Sports

- Markets Pre-Market After Hours Movers ETFs Forex Cannabis Commodities Options Binary Options Bonds Futures CME Group Global Economics Previews Small-Cap Real Estate Cryptocurrency Penny Stocks Digital Securities Volatility

- Ratings Analyst Color Downgrades Upgrades Initiations Price Target

- Ideas Trade Ideas Covey Trade Ideas Long Ideas Short Ideas Technicals From The Press Jim Cramer Rumors Best Stocks & ETFs Best Penny Stocks Best S&P 500 ETFs Best Swing Trade Stocks Best Blue Chip Stocks Best High-Volume Penny Stocks Best Small Cap ETFs Best Stocks to Day Trade Best REITs

- Money Investing Cryptocurrency Mortgage Insurance Yield Personal Finance Forex Startup Investing Real Estate Investing Credit Cards

- Cannabis Cannabis Conference News Earnings Interviews Deals Regulations Psychedelics

Unpacking the Latest Options Trading Trends in Norwegian Cruise Line

Investors with a lot of money to spend have taken a bullish stance on Norwegian Cruise Line NCLH .

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NCLH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga 's options scanner spotted 14 uncommon options trades for Norwegian Cruise Line.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $510,466, and 5 are calls, for a total amount of $322,320.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.0 to $27.5 for Norwegian Cruise Line over the recent three months.

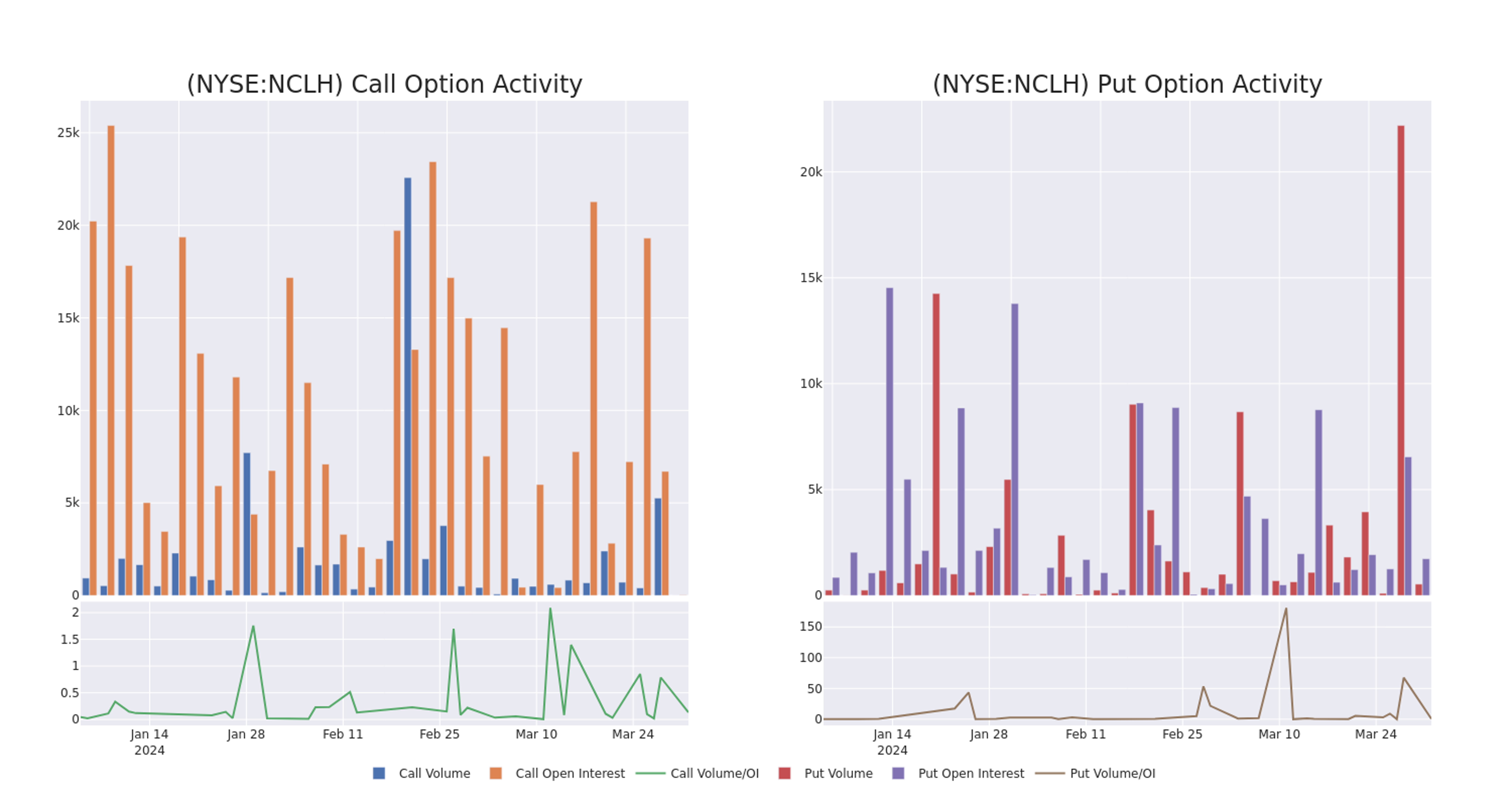

Volume & Open Interest Development

In today's trading context, the average open interest for options of Norwegian Cruise Line stands at 2634.88, with a total volume reaching 8,555.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Norwegian Cruise Line, situated within the strike price corridor from $17.0 to $27.5, throughout the last 30 days.

Norwegian Cruise Line Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

About norwegian cruise line.

Norwegian Cruise Line is the world's third-largest cruise company by berths (around 66,500). It operates 32 ships across three brands —Norwegian, Oceania, and Regent Seven Seas—offering both freestyle and luxury cruising. The company redeployed its entire fleet as of May 2022. With five passenger vessels on order among its brands through 2028, representing 16,000 incremental berths, Norwegian is increasing capacity faster than its peers, expanding its brand globally. Norwegian sails to around 700 global destinations.

In light of the recent options history for Norwegian Cruise Line, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Norwegian Cruise Line

- Currently trading with a volume of 11,509,674, the NCLH's price is down by -2.58%, now at $20.4.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

Professional Analyst Ratings for Norwegian Cruise Line

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18.333333333333332.

- Reflecting concerns, an analyst from Goldman Sachs lowers its rating to Neutral with a new price target of $19.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Underweight rating on Norwegian Cruise Line with a target price of $15.

- In a cautious move, an analyst from Mizuho downgraded its rating to Neutral, setting a price target of $21.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Norwegian Cruise Line, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

This major cruise line operator just announced its biggest ship order ever

One of the world’s leading cruise operators unveiled its biggest ship order ever on Monday.

Norwegian Cruise Line Holdings Ltd. will take delivery of eight ships between 2026 and 2036 across its three brands.

Norwegian Cruise Line will welcome four ships in 2030, 2032, 2034 and 2036, each with a capacity of close to 5,000 guests. The additions are subject to financing.

The vessels will follow the line’s previously announced Prima-Plus class vessels.

The upscale Oceania Cruises will take delivery of two 1,450-guest ships in 2027 and 2029, and luxury line Regent Seven Seas Cruises will add two ships in 2026 and 2029, each accommodating 850 passengers.

"This strategic new-ship order across all three of our award-winning brands provides for the steady introduction of cutting-edge vessels into our fleet and solidifies our long-term growth,” Harry Sommer, the company’s president and CEO, said in a news release . “It also allows us to significantly leverage our operating scale, strengthen our commitment to innovation and enhance our ability to offer our guests new products and experiences, all while providing opportunities to enhance the efficiency of our fleet.”

Specifics about the ships’ accommodations and amenities will be announced “in the coming months,” according to the release.

The company will also add a new multi-ship pier at its private Bahamas island, Great Stirrup Cay, scheduled for completion by late 2025. The pier will be able to accommodate two large ships at once.

Nathan Diller is a consumer travel reporter for USA TODAY based in Nashville. You can reach him at [email protected].

- Search Search Please fill out this field.

- Company News

What You Need To Know About Cruise Operator Viking’s IPO

:max_bytes(150000):strip_icc():format(webp)/IMG_20240304_1226223-6a0116b45ac8489eb38e68e672021b1c.jpg)

SOPA Images / Contributor / Getty Images

Key Takeaways

- Cruise operator Viking Holdings generated $4.7 billion in revenue last year, the company revealed in a Friday filing with the SEC, ahead of its planned debut on the New York Stock Exchange under the "VIK" ticker.

- While the cruise line has not disclosed the number of shares that will be offered or their pricing, Barron's estimated Viking's IPO could be valued at over $10 billion.

- Cruise stocks have started to rebound after reporting strong results amid a surge in demand as the industry works to recover from the billions in losses suffered during the pandemic.

Viking Holdings, the parent company of the Viking cruise line, filed an F-1 form Friday with the Securities and Exchange Commission (SEC) ahead of its planned initial public offering (IPO) that revealed the company made $4.7 billion in revenue in 2023.

Viking, which said Friday that it plans to debut on the New York Stock Exchange under the ticker "VIK," initially announced plans to pursue an IPO in February. While the cruise line has not disclosed the number of shares that will be offered or their pricing, Barron's estimated Viking's IPO could be valued at over $10 billion.

Viking's Business Metrics Show Growing Revenue

The cruise line generated $4.7 billion in revenue in fiscal 2023, compared to $3.18 billion in 2022, and $625.1 million in 2021. Viking posted a $1.86 billion loss last year, largely because of a refinancing program it undertook through private placement , a way to raise capital without undergoing an IPO.

Adjusting for those one-time losses, Viking said it reported earnings before interest, taxes, depreciation, and amortization (EBITDA) of about $1.09 billion for 2023.

Viking's luxury cruise business is divided between 80 river vessels and nine ocean ships, along with two expedition ships and a chartered river ship that operates in the Mississippi river. The cruise line expects to receive 18 new river ships by 2028, and six new ocean cruise liners by 2026.

Cruise Stocks Climb on Surge in Demand

In what could be a promising sign for Viking's debut, some cruise stocks have started to reverse losses suffered during the pandemic, with Norwegian Cruise Line Holdings ( NCLH ), Royal Caribbean Group ( RCL ), and Carnival Corp. ( CCL ) recently reporting record bookings.

As of Friday's close, Norwegian shares have gained 45% over the past 12 months, while Carnival shares have surged 55%, and Royal Caribbean shares more than doubled in value over the same period.

Securities and Exchange Commission. " FORM F-1 REGISTRATION STATEMENT ."

Viking Holdings. " VIKING FILES REGISTRATION STATEMENT WITH SEC FOR PROPOSED INITIAL PUBLIC OFFERING ."

Viking Holdings. " VIKING ANNOUNCES CONFIDENTIAL SUBMISSION OF DRAFT REGISTRATION STATEMENT FOR A PROPOSED INITIAL PUBLIC OFFERING ."

Barron's. " Cruise Operator Viking’s IPO Could Be Valued at Over $10 Billion ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1256222455-25f533bf070947d1ad7fb296822d6a36.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

COMMENTS

Find the latest Norwegian Cruise Line Holdings Ltd. (NCLH) stock quote, history, news and other vital information to help you with your stock trading and investing.

Get the latest Norwegian Cruise Line Holdings Ltd (NCLH) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment ...

NCLH | Complete Norwegian Cruise Line Holdings Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview.

On Friday 04/05/2024 the closing price of the Norwegian Cruise Line Ltd share was $18.87 on BTT. Compared to the opening price on Friday 04/05/2024 on BTT of $18.77, this is a gain of 0.56% ...

Discover real-time Norwegian Cruise Line Holdings Ltd. Ordinary Shares (NCLH) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stay ahead ...

Discover historical prices for NCLH stock on Yahoo Finance. View daily, weekly or monthly format back to when Norwegian Cruise Line Holdings Ltd. stock was issued.

View the latest Norwegian Cruise Line Holdings Ltd. (NCLH) stock price, news, historical charts, analyst ratings and financial information from WSJ.

Its brands include Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. The company was founded in 1966 and is headquartered in Miami, FL. Insider Trading Relationship Date Transaction Cost #Shares Value ($) #Shares Total SEC Form 4; Kempa Mark: EVP & CFO: Mar 08 '24: Sale: 20.01: 19,965: 399,532:

For the full year 2024, the company expects an adjusted profit of about $635 million, or $1.23 per share. 5 weeks ago - CNBC. Norwegian Cruise Stock Is Sailing Higher After Earnings. Demand Is at Record Levels. The cruise operator guided for an unexpected profit in the first quarter amid strong demand for its voyages.

View Norwegian Cruise Line Holdings Ltd. NCLH stock quote prices, financial information, real-time forecasts, and company news from CNN.

Mizuho sets $21 target for Norwegian Cruise Line shares. Tuesday, Mizuho initiated coverage on Norwegian Cruise Line Holdings (NYSE:NCLH) with an Underperform rating and a price target of $21.00 ...

Norwegian Cruise Line Holdings Ltd. historical stock charts and prices, analyst ratings, financials, and today's real-time NCLH stock price.

A Global Leader in the Cruise Industry. Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) is a leading global cruise company which operates the Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises brands. With a combined fleet of 32 ships with over 65,500 berths, these brands offer itineraries to approximately 700 destinations ...

Find the latest Norwegian Cruise Line Holdings Ltd. (NCLH) stock quote, history, news and other vital information to help you with your stock trading and investing.

Filter stock price historical data by date with the ability to view Opens, Highs, Lows, Closes, VWAPs, Volume % Change, Change, Trade Value and Trades.

Check out the latest NORWEGIAN CRUISE LINE HOLDINGS LTD. (NCLH) stock quote and chart. View real-time stock prices & the companies financial overview to help with your trading & investment.

Norwegian Cruise Line Holdings has secured financing for the Oceania and Regent ships, but questions about the delivery timing for Oceania's 2028 ship and the completion of financing for the ...

Norwegian Cruise Line Holdings Ltd. was founded in 1966 and is based in Miami, Florida. Corporate Governance Norwegian Cruise Line Holdings Ltd.'s ISS Governance QualityScore as of March 1, 2024 ...

NCLH Norwegian Cruise Line Holdings Options Ahead of Earnings Analyzing the options chain and the chart patterns of NCLH Norwegian Cruise Line Holdings prior to the earnings report this week, I would consider purchasing the 16.50usd strike price Calls with an expiration date of 2024-3-28, for a premium of approximately $1.00. If these options prove to be profi

Analysts have set 12-month price targets for Norwegian Cruise Line, revealing an average target of $19.33, a high estimate of $21.00, and a low estimate of $15.00. Observing a 7.39% increase, the ...

The group develops its activity under Norwegian Cuise Line, Oceania Cruises and Regent Seven Seas Cruises brand names. Net sales break down by source of revenue as follows: - ticket sales (60.6%): 1.8 million passengers carried in 2021; - onboard cruise services (39.4%). At the end of 2021, the company operated a fleet of 28 cruise ships with a ...

As previously said in the overview section, Norwegian is expecting 4 Prima Ships (which on average have 3,700 lower berths) to be delivered in 2025-2028, and 1 Allura ship which has 1,250 lower ...

Use our international stock ticker to check and convert stocks and shares easily in any currency you need. Thinking of buying or selling Norwegian Cruise Line Holdings Ltd stock that's listed in a currency different from your local one? Use our international stock ticker to check and convert stocks and shares easily in any currency you need.

Professional Analyst Ratings for Norwegian Cruise Line A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18. ...

Norwegian Cruise Line Holdings Ltd. will take delivery of eight ships between 2026 and 2036 across its three brands. Norwegian Cruise Line will welcome four ships in 2030, 2032, 2034 and 2036 ...

Viking posted a $1.86 billion loss last year, largely because of a refinancing program it undertook through private placement, a way to raise capital without undergoing an IPO. Adjusting for those ...