10 Safest Cities in Mexico

Featuring charming towns, ancient ruins, and picturesque beaches, Mexico is the 7th most popular country to visit in the world.

However, there is a dark underbelly that many tourists consider before visiting – violent crime because of drug cartels and organized crime.

Street or public transit robbery or theft has a rate of 6,900 victims per 100,000 inhabitants.

Also, Mexico has seen an 84.1% homicide rate increase since 2015, five Mexican cities have the highest homicide rates on Earth and the country has the ninth-highest homicide rate.

Tijuana topped this list with 134 deaths via homicide per 100,000 inhabitants.

Despite these high crime rates, it does not mean the entire country experiences violent crimes against property and humans.

There are plenty of safe cities in Mexico to visit.

To learn more, keep reading!

8. Playa Del Carmen

7. puerto vallarta, 5. san miguel de allende, 4. sayulita, 2. mexico city, 1. huatulco, be careful with your cash, be cautious of the cuisine, know emergency numbers, try to blend in, utilize mass transit during the day and taxis at night, mexico safety overview, when is the best time to visit mexico, what type of food is typical in mexico, should i bring cash, traveler’s checks, or credit cards.

The 10 safest cities in Mexico include:

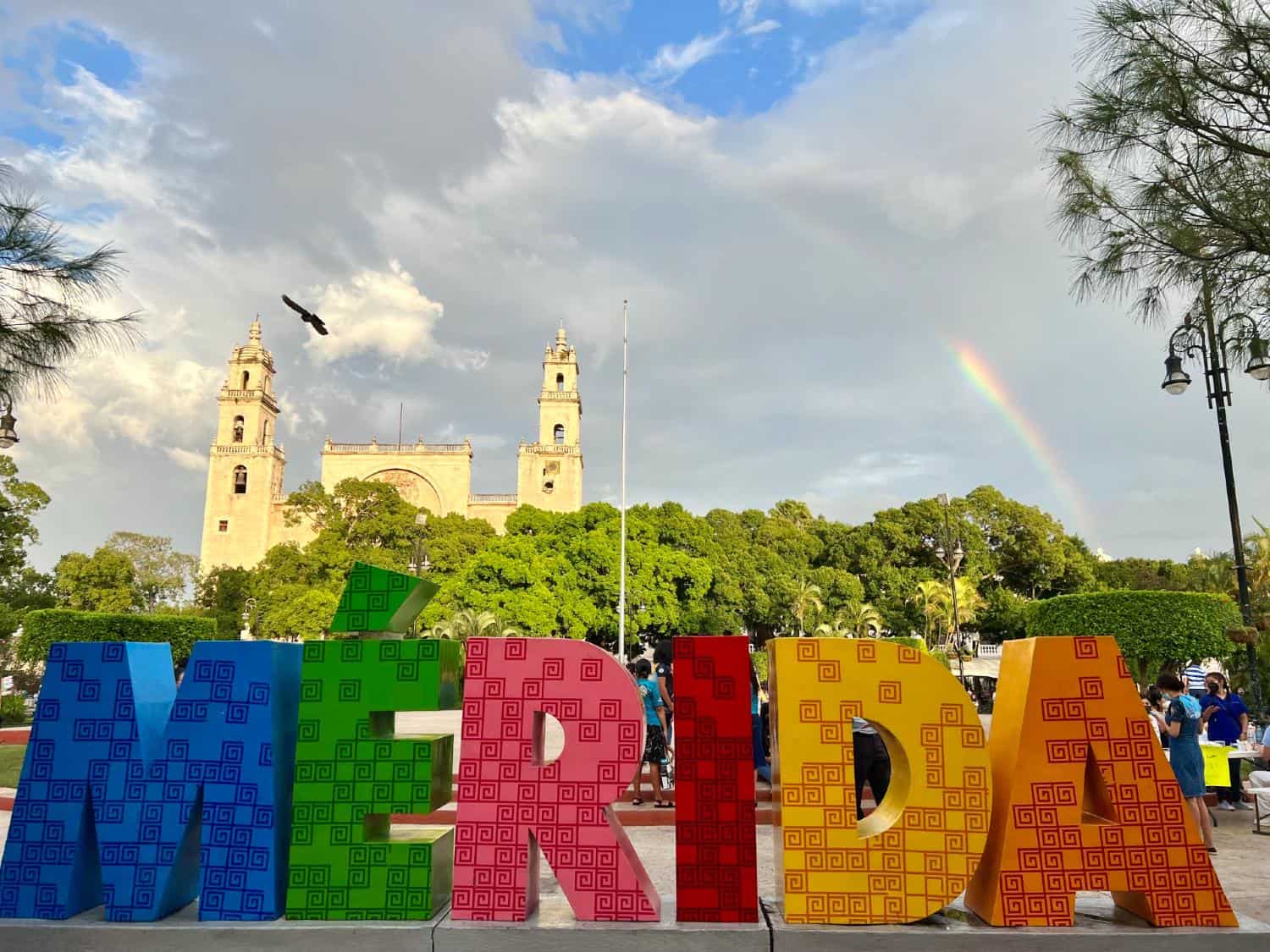

Considered the safest city in the country and Latin America, the greatest safety concern you will experience in Merida is the traffic.

This Yucatan capital is located close to incredible archeological sites, offers amazing food, and is well-known for its colonial architecture.

While Merida has the occasional pickpocket, violent crime in this city is virtually non-existent.

In any case, it is always best to take normal precautions, as you would in any city.

With swaying and relaxing palm trees perched across white sand beaches, Tulum is one of the safest Mexican cities and one of the most popular over the past decade.

Also, one of the best party cities in Mexico, Tulum has something for everyone.

From beach houses to glamping, extensive restaurant options, and proximity to Mayan ruins, Tulum is centrally located for tourists from around the world.

While this is a safe place to visit, always be aware of your surroundings and watch your belongings when taking mass transit.

As one of the most famous coastal cities in Mexico, Playa del Carmen is close to beautiful cenotes and Mayan ruins.

With crystal clear, sparkling blue waters and long white beaches, Playa del Carmen has become a popular tourist destination in recent years.

As a result, it is a safe destination in Mexico, suitable for families and solo travelers.

While there have been some recent drug-related violence incidences in nearby cities, the State of Quintana Roo has a very small amount of violent crime directed at visitors.

Regardless, it is always best to take the necessary safety precautions such as staying away from recreational drugs and not wandering around alone at night.

Another reputable destination, known for its beautiful marine life, bustling nightlife, and pristine beaches, Puerto Vallarta is another one of the safest destinations in Mexico.

In addition to being family-friendly, Puerto Vallarta is an excellent destination for same-sex couples and has been uninvolved in cartel conflicts.

As a result, crime rates are significantly lower than rates in major U.S. cities.

Theft, pickpocketing, and bag snatching occasionally occur, so it is best to remain vigilant at all hours of the day and night.

Another beautiful Mexican beach city, La Paz is located on the Baja California peninsula and is considered one of the safest destinations in the country.

Although the city is flat, it is surrounded by mountains, adding more adventure options for visitors.

The city has a low crime rate with the beaches and town limits regularly patrolled by police.

Visitors only need to worry about petty theft, like pickpockets and purse-snatchers, like in any city.

As a popular destination for ex-pats with 8,000 American, British, and Canadian residents living in the city, San Miguel de Allende boasts amazing heritage sites, excellent restaurants, and stunning Spanish colonial churches.

San Miguel de Allende is not a well-known tourist destination but has many attractions to offer.

Additionally, crime rates in the city are low, but you must keep an eye out for your belongings while riding public transport and be cautious while wandering around at night.

Located only 30 miles from Puerto Vallarta, Sayulita is the ideal destination for surfers and nature lovers.

In addition to being friendly and safe, Sayulita’s economy is primarily based on tourism.

Locals understand English well and are very welcoming to visitors from the United States , Canada , and across the globe.

While the crime rate is incredibly low, there is a considerable number of stray dogs, so it is important to stay away from them.

If you approach, and they feel threatened, they may bite you.

With so many amazing attractions in and near Cancun , the government keeps the hotel zone incredibly safe for visitors.

Generally, it is safe to get around the city via taxi or mass transit but be on the lookout for pickpockets.

As one of the top destinations in the country, Cancun has created a well-developed travel infrastructure with countless resorts, attractions, shops, nightclubs, bars, and restaurants, all of which are patrolled by police.

Despite having a reputation for kidnapping and violent crime, Mexico City is safe, especially in the city center.

At the beginning of the 2010s, Mexico City’s crime rate drastically decreased while the police presence increased.

That trend continues into the early 2020s and the result has been visitors reporting feeling safe.

Mexico City is a cultural gem with over 150 museums, many street art pieces, and colorful markets that you do not want to miss.

Despite the safety improvement, take all regular precautions while visiting.

Located in Oaxaca , Huatulco offers countless surf spots and water activities, making it an excellent destination for families.

Huatulco is often considered safer than multiple U.S. cities, but visitors should be aware that some organized crime exists in the area.

Luckily, tourists are not bothered by these criminal activities.

Huatulco offers a glimpse of Oaxaca’s rich heritage, with half the population speaking Indigenous languages.

While the area is not as popular as other beach towns, this is still an appealing and safe destination.

5 Safety Tips for Traveling to Mexico

While there are many safe destinations in Mexico, crime and violence still exist, like in any country.

However, you can keep yourself safe by following these safety tips:

Be smart and do not flash your cash or valuables in public, or you will be asking for trouble.

Also, never carry around all your credit cards or cash at the same time.

Just bring what you need for the day.

Mexico has amazing street food but you should choose wisely.

To avoid becoming ill, go to the stalls with lines or people flocking to eat there.

This is critical for traveling to any foreign country, including Mexico.

Keep a list of emergency numbers on your phone and a separate piece of paper.

Try to wear what the locals wear.

That means if everyone is wearing jumpers and jeans, then do not wear vest tops, sandals, and shorts.

This does not mean you should be uncomfortable, but do not dress for a day at the beach when you are simply walking around the city.

Blending in will help make you less of a target to criminals.

Depending on where you are, mass transit could be dangerous at night.

Therefore, use it during the daylight hours and rely on taxis and other private transport at night.

- https://www.statista.com/statistics/983394/mexico-crime-rate/

- https://www.visionofhumanity.org/mexico-peace-index-2021-by-the-numbers/

- https://www.visitmexico.com/en/faq

READ THE FULL REPORT: Mexico Safety Review

- OVERALL RISK: MEDIUM

- TRANSPORT & TAXIS RISK: LOW

- PICKPOCKETS RISK: HIGH

- NATURAL DISASTERS RISK: LOW

- MUGGING RISK: MEDIUM

- TERRORISM RISK: LOW

- SCAMS RISK: HIGH

- WOMEN TRAVELERS RISK: LOW

Frequently Asked Questions

Although there are regional differences in weather, Mexico is best to visit from mid-September to mid-May.

The Gulf of Mexico is susceptible to hurricanes throughout the summer and fall, and into November, so plan accordingly.

April and May are the hottest months with June through September having the most rain.

As mentioned, street food is an excellent option and can range from seafood and vegetables to liquors, wines, cheese, fruits, and meats.

In any case, be cautious of what you eat and never drink the water from the tap as you will fall ill.

Bottled water is inexpensive in Mexico, so stock up at the beginning of your trip.

In case there is a safety issue, it is advisable to bring all three.

In smaller towns, cash exchanges and ATMs may be limited, or non-existent and credit cards may not be used, so it is important to have all three.

In major cities and shopping areas, all major credit cards are accepted.

Keep local currency and traveler’s checks on hand in case you need them in more remote areas.

Additional Resources

1 Comment on 10 Safest Cities in Mexico

Merida’s colonial architecture and delicious food make it a must-visit, despite the occasional pickpocket; Tulum is perfect for beach lovers and party-goers alike; Playa Del Carmen offers stunning beaches with minimal crime rates; Puerto Vallarta boasts beautiful marine life without any cartel conflicts to worry about.

Leave a Comment Cancel reply

Popular destinations.

Safety Index

Recent reviews & comments.

- Silvian on 17 Pros and Cons of Living in Canada

- Shan on Brisbane

- dummy above me on Saudi Arabia

- amora on 15 Pros and Cons of Living in Jamaica

- M.... on Amman

Popular US States

- Pennsylvania

Get Daily Travel Tips & Deals!

By proceeding, you agree to our Privacy Policy and Terms of Use .

The 8 Safest Places in Mexico for Travelers

Ed Hewitt started traveling with his family at the age of 10 and has since visited dozens of countries on six continents. He wrote for IndependentTraveler.com for more than 20 years, producing hundreds of columns on travel and offering his expertise on radio and television. He is now a regular contributor to SmarterTravel.

An avid surfer and rower, Ed has written about and photographed rowing competitions around the world, including the last five Olympic Games.

He's passing his love of travel on to the next generation; his 10-year-old son has flown some 200,000 miles already.

Travel Smarter! Sign up for our free newsletter.

“Is my destination safe?” It’s a question many American travelers have asked themselves as they pour over the State Department’s travel advisories and color-coded maps .

Mexico is a vast country, with heaps of beautiful and interesting places to see, and some 28 million Americans safely travel there each year. To help you plan your own trip, I’ve gathered some of the safest places to visit in Mexico, complete with information on why you should go and where to stay.

The Safest Places in Mexico

Keep in mind that incidents can happen even in the safest places in Mexico, and destinations that don’t appear on this list could still be great spots for a vacation. No matter where you go while traveling abroad, you’ll want to follow common-sense rules such as drinking only in moderation, getting a cab instead of wandering around after dark, and leaving your valuables at home.

Mexico City

Despite a longstanding reputation as a dangerous city to visit, Mexico City only has an advisory to exercise increased caution, and for good reason; the downtown core in particular is considered quite safe, and the city has numerous attractions for visitors—including street art, colorful markets, and more than 150 museums.

Where to Stay: The small, beautifully decorated Nima Local House Hotel is one of the best luxury hotel options in the city. For a more affordable option, consider the Chillout Flat Bed & Breakfast , which earns plaudits for friendly service and homemade granola.

Nima Local House

Chillout Flat B&B

The 5 Best Things to Do in Mexico City

As Playa del Carmen has been the site of some troubling violence in the past, the coastal town of Tulum to the south may be a safer alternative. It is also less touristy than other resort towns on the Yucatan Peninsula, offering well-preserved ruins of the former Mayan city walls and other historic structures right in town. The State Department has explicitly stated there are no restrictions on travel to Tulum or to Chichen Itza, the magnificent archaeological site just an hour up the road.

Where to Stay: Guests appreciate the clean, comfortable rooms and fast Wi-Fi at the centrally located Posada Luna del Sur .

A beach town located in Oaxaca to the southwest of Puerto Escondido, Huatulco offers tons of water activities such as snorkeling and scuba diving, some nearby surf spots, and tours of coffee farms to boot. Huatulco is considered one of the safest places in Mexico.

Where to Stay: For an indulgent resort experience you can’t do much better than Secrets Huatulco Resort & Spa , where amenities include multiple swimming pools and tennis courts, yoga classes, watersports, and nine restaurants.

Merida and Valladolid

Gerardo Tanaka Pacheco, Senior Account Executive for MSL Group, the public relations firm for VisitMexico.com , recommends these two towns as great alternatives to other nearby tourist hot spots. “A lot of people go to Playa del Carmen and Tulum, but on the Yucatan Peninsula there are these two beautiful colonial cities that are so welcoming, colorful, and full of traditions that travelers won’t regret visiting them,” he says.

Merida is a walking-friendly town that is connected to Chichen Itza by a toll road, which is considered the safest way to travel in Mexico if you are driving. The Mayan influence remains strong here, and the area has its own style of cuisine that diverges considerably from what you will find in other parts of Mexico.

Midway between Merida and Cancun is Valladolid, a colorful and friendly city that’s within easy driving distance of several beautiful cenotes.

Where to Stay: In Merida, consider snagging a poolside room at the Luz En Yucatan . In Valladolid, you can’t go wrong at the centrally located Hotel Posada San Juan .

Luz En Yucatan

Hotel Posada San Juan

10 Travel Safety Mishaps and How to Avoid Them

Pacheco says that Bacalar, also on the Yucatan Peninsula, is “an amazing place, kind of unknown and definitely uncrowded. This is one of my favorite secrets spots in Mexico; the lagoon there is unbelievable.”

Called the Lake of Seven Colors, the lagoon stretches for 42 kilometers and is fed by underground rivers. Like Todos Santos mentioned below, Bacalar holds the official designation as a “Pueblo Magico,” or Magical Town, due in large part to the lagoon. In addition to being one of the safest places in Mexico, Bacalar is also very affordable.

Where to Stay: At the Bacalar Lagoon Resort , you can get a view of the lake right from your cabana.

Another UNESCO World Heritage Site located on the western coast of the Yucatan Peninsula, Campeche is a walled Spanish colonial city that has been superbly restored. The walled center is somewhat of a museum piece, but the life of the town surrounding it might even be the main attraction. There are also significant Mayan ruins in the state of Campeche, of which the city is the capital; these aren’t as well known as the famous ruins to the east, and as such they’re less crowded.

Where to Stay: Try for a balcony room or suite at the modestly priced Hotel Socaire .

Queretaro’s streets are a wondrous mix of old and very old, as grid-like Spanish streets connect to the pre-Hispanic winding lanes from the time of the Otomi. From rock climbing and art galleries to architecture sightseeing, there is a ton to do in this central Mexican city.

Where to Stay: La Casa del Atrio , across from the Museo de Arte , is both popular and affordable.

Is Cabo San Lucas Safe? Swimming Dangers, Drinking Water, and More

Todos Santos

This surf town in Baja California Sur features world-class waves and lots of natural beauty—and it’s just far enough north of touristy Cabo San Lucas to offer respite from the crowds. Todos Santos is slowly becoming more popular, but its stone streets and uncrowded beaches have earned it the official Pueblo Magico designation.

Where to Stay: La Poza Boutique Hotel & Spa has a fantastic oceanfront location at very reasonable rates.

You Might Also Like:

We hand-pick everything we recommend and select items through testing and reviews. Some products are sent to us free of charge with no incentive to offer a favorable review. We offer our unbiased opinions and do not accept compensation to review products. All items are in stock and prices are accurate at the time of publication. If you buy something through our links, we may earn a commission.

Top Fares From

Don't see a fare you like? View all flight deals from your city.

Today's top travel deals.

Brought to you by ShermansTravel

Australia: Upscale, 8-Night Cairns, the Gold...

Down Under Answers

Greenland: Luxe, All-Incl. 11-Nt Exploration Small-Ship...

Swan Hellenic

Ohio: Daily Car Rentals from Cincinnati

Trending on SmarterTravel

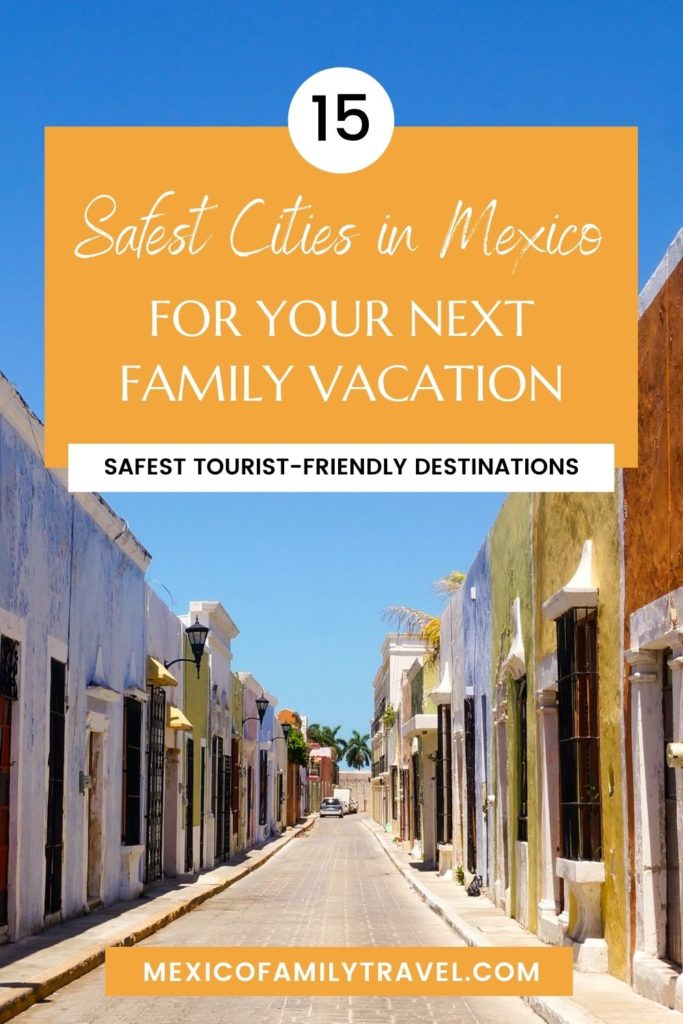

The 13 Safest Cities In Mexico For Tourists

Embark on a journey through some of Mexico’s safest destinations as we unveil the thirteen cities where tranquility, adventure, and safety come together.

In a country that pulsates with rich culture, vibrant history, and picturesque landscapes, you can explore these cities with safety as your companion.

Experience the historical charms of San Miguel de Allende or sunbathe on the beaches of Cancun to enjoy Mexico’s unique allure.

From cobblestone streets to sandy shores, revel in the beauty and hospitality of a country that not only captivates the heart but also promises a worry-free travel experience.

Top 13 Safest Cities In Mexico To Visit

You can plan your next vacation in one of these thirteen safest cities in Mexico.

1. Merida, Yucatan

Located in the heart of the Yucatan, Merida is not just a regular city; it’s rather a sanctuary of cultural splendor without compromising your safety.

Crowned as the second safest city in the continent , right after Quebec, Canada, Merida has a low crime rate and a rich traditional history.

Soak yourself in the artistic vibe of the city. Roam around and marvel at the colonial architecture that comes with a vibrant history and savor mouthwatering food.

Make sure you visit iconic landmarks like Palacio del Gobierno and the Cathedral of San Ildefonso that stand tall in the city center. Navigate through the lively streets, dodge the traffic, and take day trips to nearby hotspots like Cancun and Playa del Carmen.

When you’re out and about in one of the safest vacation spots in Mexico, keep your belongings close as like most famous tourist locations, Merida too isn’t safe from the epidemic of pickpockets.

2. Mexico City

The crowning jewel of tourism is the country’s capital, Mexico City. While it once had a tainted reputation, this vibrant metropolitan city has transformed into a haven for travelers and is now considered one of the safest places in Mexico.

With increased police presence from 2009 to 2011, the city center has seen a notable drop in crime rates. Feel the pulse of this cultural wonderland, where every corner tells a tale of history and art.

When you’re in the capital don’t miss out on their delectable local cuisine and explore the cultural treasures. But it’s best to keep away from the extreme northern and southern neighborhoods, and around Tepito or Merced, especially after dark.

While you embrace the city, remember to be street-smart and uncover the magic of Mexico City.

3. Playa del Carmen, Quintana Roo

Dive into the beach wonderland of Playa del Carmen, located on the Caribbean Coast of Mexico. Over the last few years, this beach town has become a go-to paradise for digital nomads and retirees.

They have all been lured into this area thanks to its expanding economy, wallet-friendly living, and fast WiFi. You’ll notice the town’s multicultural flair with international cuisine restaurants, yogic vibes, chic cafes, and apartments with a spectacular view of the beachfront and ocean.

Enjoy the magic of Playa del Carmen, where the beach is your office and life is like a vacation. Safety is the name of the game here. Low crime rates make it one of the safest Mexican cities.

Yet, like any popular destination, you need to be cautious wherever you go and try to avoid walking around at night, especially in dimly lit areas.

4. Querétaro City

Nestled in the heart of Mexico, get ready to fall in love with Queretaro, the perfect amalgamation of safety and charm.

Picturesque cobblestone streets with friendly vibes. With lots of ex-pats all around, Queretaro City is all about art, rich history, and a culinary scene so good that it’ll have your taste buds dancing after each bite.

Things here are very pocket-friendly, and with a low cost of living, this destination is ideal for the budget traveler. You can visit a variety of UNESCO World Heritage Sites like Sierra Gorda, a mesmerizing biosphere reserve.

But remember to stick to the Centro Historico (Historic Downtown Area), and Queretaro will be safe for you, including solo female travelers.

You can also jump on a historic bus tour and let the city take you in. Trust me, there’s a lot to see in and around the area.

Located two hours from the hustle and bustle of Mexico City, an escapade to Puebla is not just a trip, it’s a lifestyle upgrade. This city is the perfect combo of safety, cleanliness, and affordability.

This gem is a stone’s throw away from Veracruz’s beaches, numerous hiking trails around volcanoes, and a convenient day trip away from the country’s capital.

Where you’re considering beach bumming, hiking, or exploring around, Puebla is the place to be. You can fly in with ease thanks to its own airport and seamless connection to other cities.

You can also live in large and spacious apartments without burning a hole in your pocket. I’d also recommend checking out Puebla’s renowned Talavera pottery and buying some souvenirs.

Also, make sure to visit the UNESCO World Heritage sites of Cholula, where ancient wonders will simply wow you. You can easily add Puebla to your list of safe places to travel in Mexico.

6. Valladolid

Step into the enchanting world of Valladolid, it has to be the ultimate combination of the cheapest and safest place to visit in Mexico. It’s a budget traveler’s dream come true.

Located in the Yucatan state, this city is the perfect blend of new-world vibes and old-world charm, making it a must-visit place. The streets are lined with colonial-styled buildings and haciendas that have been transformed into fun cafes, open-air restaurants, and boutiques that sell one-of-a-kind items.

Valladolid offers all the safety where petty crime and criminal activity are pretty much non-existent. Explore the heart of downtown, where food, nature, history, and art collide to create the most vibrant fiesta.

With bustling markets and top-notch restaurants, every corner of the city has something to offer. You can even go for safe road trips to explore the city and beyond.

This has to be one of the most popular tourist destinations in the Caribbean. Cancun is the place where the sea, sun, sand, and safety create the perfect symphony for vacation bliss.

This tourist hotspot is known for its pristine beaches and opulent resorts. Besides being a tropical paradise, it’s a guaranteed ticket to worry-free fun!

The local government’s recent investments in increasing safety have resulted in making it one of Mexico’s safest havens, including surveillance cameras on street corners and police patrolling the area.

The city is also well-connected with a budget-friendly 24-hour bus to get around. You can also opt for other reliable forms of transport like taxis, public transport, and even popular cab services like Uber and DiDi. Consider Cancun to be a worry-free destination where safety meets adventure.

Escape to the best-kept secret of the Yucatan Peninsula, which is nestled just off the coast like a precious pearl. Isla Holbox is a car-free paradise that some also consider to be Cancun’s chic cousin. Although they are located 2 hours apart, the experiences they provide are very different.

Over here, you’ll find no chain restaurants, skyscrapers, or even cars. Once a sleepy fishing town, it is now a dreamy haven, fiercely guarded against mega-resorts and chain hotels.

Experience the bliss of a gentle sea breeze around you with sand between your toes and beaches kissed by serenity, away from the touristy chaos of Cancun.

With crime rates so low that they’re almost non-existent, you can enjoy the island carefree. It’s so small that everyone knows each other by name, so there is really no place to hide crime. So take that moonlit stroll and enjoy this haven of safety and serenity.

9. Puerto Vallarta, Jalisco

Puerto Vallarta is one of the safest travel destinations where you can enjoy the sun-soaked beaches and vibrant culture without a care in the world. This tourist hotspot isn’t just a pretty face; it is said to be one of the safest beach towns in Mexico, and you won’t regret visiting.

The city is guarded by a troop of police officers, surveillance cameras in all corners of the road, and a community that is committed to keeping their town safe. With the tourism industry majorly contributing to their revenue, local authorities take tourist safety very seriously.

You will enjoy top-notch infrastructure, buzzing connectivity, and a retiree-friendly vibe, it is a haven for ex-pats looking to enjoy the Mexican vibe. A town where neighborhood watch groups thrive, the community there is also LGBTQ+ friendly.

But beware, as petty crimes like bag-snatching and pickpocketing may still sneak a peek. So standard precautions should be taken as you enjoy this beautiful beach town.

10. San Miguel de Allende, Guanajuato

With UNESCO’s nod of approval, San Miguel de Allende is a World Heritage Site where cobblestone streets tell tales and the charm is as abundant as the vibrant art that colors the city.

The vibe of the place screams historical. It’s like a living canvas of history with colonial buildings, picturesque churches, and an outstanding local food scene. The city’s reputation for safety has attracted over 8,000 American, Canadian, and British ex-pats, who enjoy the charm of San Miguel.

In 2020, San Miguel was the first non-beach destination in Latin America to earn the World Travel and Tourism Council’s “Safe Travels Stamp”. The city is not just an art lover’s dream, it is filled with history, culinary delights, and safety.

11. Oaxaca City

Dive into the experience that is Oaxaca City, where traditions are vibrant, and every corner sings a melody of Mexico’s rich history and culture. Cradled by the Sierra Madre mountains, this haven is visually captivating.

From the flamboyant Day of the Dead fiesta to historic architecture, the city’s corners have a tale to tell. Oaxaca City has a lot to offer to its visitors, like mouth-watering local cuisine, including world-famous mole sauces and artisanal mezcals. It’s truly the food capital of Mexico.

Tantalize your tastebuds with delights like Tlayudas, roasted Chaipulines, and Enfrijoladas. And don’t forget to explore the lanes of local markets to soak yourself in the city’s culture.

Safety is sure a huge priority for Oaxaca, with crime rates at an all-time low and the locals are very warm and hospitable too! The city is the perfect combination of safety and gastronomical bliss.

12. Campeche

On the shore of Mexico, where safety meets serenity, Campeche is truly the jewel of the Gulf. With vibrant and colorful buildings, military fortifications, and historically rich culture, this city is a noted World Heritage Site by UNESCO.

Campeche is a vibrant city that is also a safe haven when it comes to the country’s cartel chaos. So you can enjoy some leisurely strolls as you marvel at the Baroque architecture-lined city walls.

You can also explore and learn more about Mayan culture and history at local museums and architectural sites. Then you can take a quick bus or walk to one of the beaches and enjoy some time in the sun. This is the perfect Mexican getaway where safety meets relaxation.

13. Cozumel Island

Just a stone’s throw away from Playa del Carmen, Cozumel Island is all about Caribbean bliss. The biggest island off the Yucatan Peninsula, this isn’t just any vacation destination, it’s a break from the crowded and commercialized destinations like Cancun and Tulum.

With lush tropical forests, natural reserves, and secluded beaches, this is an untouched haven for those seeking a relaxing and unfrequented vacation, away from the chaos of life.

If you time your visit right, Cozumel will feel like a private paradise. Explore the Mayan ruins, mangrove swamps, and national parks at your own pace.

The island is fringed by the Mesoamerican Reef, the world’s second-largest barrier reef (after the Great Barrier Reef in Australia), which makes it a scuba diver’s dream come true. You must expect nothing less than a tranquil and safe vacation.

What Mexican states are ranked by safety?

The eight safest states in Mexico for tourists and Ex-pats in 2024 are Yucatan, Chiapas, Baja California Sur, Mexico City, San Luis Potosi, Guanajuato, Queretaro, and lastly, Puebla.

What state in Mexico has the least crime?

Yucatan State has the lowest crime rates in Mexico. It is categorized as a Level 1 Zone and has no travel advisories by governments. A Level 1 Travel Zone only needs to exercise ‘regular precautions’ while visiting this state. Yucatan State has been considered safe for quite a long time.

Is Mexico City safer than New York City?

If you directly compare Mexico City and New York City, the stats give you a clear picture. Mexico City has a higher a higher homicide rate than New York. However, crimes in both cities are concentrated in certain parts. So it’s ideal to stick to the safer parts when visiting.

Final thoughts

In a vivid world of diverse Mexican wonders, safety adds an extra stroke of color to the traveler’s palette. From the lively streets of Puerto Vallarta to the tranquil beaches of Campeche, each city is an adventurous ride without a worry.

Mexico is home to welcoming locals and improved security measures that allow travelers to explore the cities with peace of mind.

So get ready to travel to the heart of Mexico and experience the vibrant culture, rich history, and diverse landscape.

Playas y Plazas

33 Safest Cities, States & Beaches in Mexico 2024

Sharing is caring!

Mexico is a marvelous place to visit. It is one of the world’s top travel destinations due to its people, natural beauty, and tourist infrastructure. Mexico also makes the international headlines for safety problems. This is my attempt at a data-driven analysis of the safest places to visit in Mexico from the perspective of the people who live there.

Safety is an important consideration when traveling to Mexico because there is a lot of bad information out there.

I am updating this article after reading about a gentleman who was express kidnapped in Puebla . Before traveling to Puebla, he read a nonsense article listing Puebla as one of the safest places in Mexico. Only later did he realize that locals consider Puebla to have a number of security concerns.

I grew up next to Tijuana and I have lived in Guadalajara since 2009. Security is important to me. I take an active role in our community association and stay up to date on current national trends. Because I often travel to dangerous places in Mexico, I want to be aware of the ways I can mitigate risk. Accurate and up-to-date information is crucial to my travel planning.

It is much easier to avoid danger if you are aware of the common threats.

Let’s have a look at the safest places in Mexico according to the data.

33 Safest Cities, States & Beaches in Mexico

This article is based on statistics published by the Mexican government’s Secretariado Ejecutivo del Sistema Nacional de Seguridad Pública (SESNSP) on crime rates, Instituto Nacional de Estadística y Geografía (INEGI) on a survey of the perception of safety by local residents, and the U.S. State Department Travel Advisory reports .

There is always somebody ready to declare Tijuana as one of the safest places to visit in Mexico based on their personal experience of spending one day there.

I love Tijuana but I wouldn’t send my elderly mother there unaccompanied like I would send her to Puerto Vallarta. 83% of the people who live in Tijuana perceive the city as unsafe and the rate of homicides and disappearances are high no matter what you compare it to.

It is best not to rely on one single data point but use multiple sources of information to create a more nuanced picture of the safest places to visit in Mexico.

There are differences between the perception of security issues by Mexican nationals and foreigners. In San Miguel de Allende for example the expat community speaks little Spanish, consumes very little local media nor follows politics. It is a bubble within the larger state of Guanajuato and many residents are unaware of the situation just a short distance away in Irapuato, Celaya, and Salamanca.

Safety in Mexico is one of those issues that gets people really worked up. There are both sensationalists and deniers. Questions about safety in Mexico on the big online discussion forums are often received with rude comments that can quickly descend into petty arguments.

Some people who see the US news media sensationalizing the violence in Mexico go so far as to say that the violence in Mexico is no different than the violence in the United States. If you grew up in inner-city Saint Louis or inner-city Chicago I get the analogy. Most of us did not.

An honest assessment of the security situation in Mexico will allow travelers to make the best decision for their individual situation.

Honestly, there is little comparison between the types of gun violence in Mexico and the United States. In the US crazy people with guns try to kill as many strangers as possible before taking their own life.

In Mexico, gun violence is business-related with specific targets and the perpetrators try to escape afterward. The collateral damage in Mexico is negligible compared to the United States. Robberies exist in both countries but the dramatic shootouts that make the international press are very different.

Instead of comparing Mexico City to a small pueblo like Yelapa or Sayulita, I will be examining similar categories such as the safest states in Mexico, the safest cities in Mexico, the safest border crossings, the safest beaches in Mexico, and the safest Pueblos Mágicos in Mexico.

Common sense isn’t enough to avoid dangerous situations in the popular tourist areas of major metropolitan areas. The popular scams in São Paulo right now probably look a little different from the scams in Mexico City. A part of enjoying safe activities is identifying the dangerous activities so they may be avoided.

Another thing to keep in mind is that the security situation can change quickly. Colima went from one of the safest places in Mexico to one of the least safe places in Mexico in less than five years. Currently, 87% of the population of Colima considers the city to be unsafe.

Tijuana has a constant ebb and flow of violence. Guadalajara is a beautiful city that is constantly in the news for security problems.

The Safest States To Visit In Mexico

Mexico is a really big country with very diverse travel experiences. There are both safe and unsafe experiences that can be very close together. The state of Jalisco for example has Puerto Vallarta which is a popular destination on the Pacific coast famous for beautiful beaches.

In recent years the small towns along the border with Michoacán and Zacatecas have experienced an uptick in violent crime. Looking at the crime rate and specifically, the homicide rate statewide will give us a better picture of the regional security situation in Jalisco . Puerto Vallarta is lovely but there are pockets of instability in the Stae of Jalisco and one must be careful about being in the wrong place at the wrong time.

Interestingly, the number of homicides in these five safest states combined represents only 1% of the total number of homicides in Mexico. These states have some of the smallest populations in Mexico but they are also some of the safest places in Mexico to travel.

1. Yucatán – The Safesst State in Mexico

Before we get started let’s talk about the difference between the Yucatán Peninsula and Yucatán State. Yucatán State is the northern portion of the Yucatán Peninsula that is bordered on the east by Quintana Roo State and bordered on the west by Campeche State. Both the peninsula and the state are famous for white-sand beaches and Mayan ruins such as the iconic Chichen Itzá. Yucatán State is a great place to travel, backpack, and road trip in Mexico because there are lots of popular tourist destinations in a small area.

In 2021 Yucatán was home to 42 of Mexico’s 33,308 intentional homicides. There is a total population of 2.3 million inhabitants. The state population ranks 22nd in Mexico and the gross state product per capita is ranked 21st in the country. It is one of the smaller and least developed states in Mexico.

While English has become more common in the last couple of years, Spanish and Mayan are the two primary languages.

The capital city of Mérida has a minor airport and is in close proximity to the beach towns, ancient ruins, pueblos mágicos, and lots of great food. This is the perfect place to start an adventure in Mexico. It is the safest part of the country to travel around and explore a few different experiences.

My ideal road trip through Yucatán State would start in Mérida and probably finish in the state of Quintana Roo. It would include the Uxmal archeological site which is not as crowded as Chichen Itzá. I would visit the Pueblo Mágico of Izamal which is called the Yellow City because most of its buildings are painted yellow. After that, I would head to the beach.

Sisal is another Pueblo Mágico right on the water. Celestun is right on the Campeche border and is famous for its flock of flamingos. Then I would pass by the pink lake of Las Coloradas before finishing at Vallodolid and Chichen Itzá. A trip to Yucatán isn’t complete without a picture of the iconic El Castillo pyramid.

2. Baja California Sur

Much like Yucatán State, Baja California Sur is a state within the larger peninsula. Baja California is the northern half of the Baja Peninsula and Baja California Sur is the southern half of the peninsula. Baja California Sur is very different from Baja California when it comes to safety. In 2021 Baja California Sur was home to only 51 of Mexico’s 33,308 intentional homicides.

While Baja California Sur occupies a rather large area there are very few people who live here. It is the state with the second smallest population in all of Mexico with 798,447 inhabitants or 0.6% of the population of Mexico. Baja California Sur is also the newest state admitted to the United States of Mexico, along with Quintana Roo, and is considered to be the 31st of 31 states.

Safety in Baja California Sur is less about violent crime than it is about being prepared for the wilderness. The Baja Peninsula is an amazing destination for outdoor enthusiasts because of its natural beauty. It can be dangerous because of the desert conditions and vast wilderness. A modern hospital could be a long way away.

My ideal road trip through Baja California Sur starts in San Ignacio to admire the Jesuit mission and plan a whale-watching trip to San Ignacio Bay. From there I would embark on some crazy 4-wheeling trails to the world-famous Scorpion Bay surf spot. I would cross the peninsula to Loreto where I would get my scuba certification and dive into the Loreto Bay National Park.

From Loreto, it is a long drive down to La Paz to snorkel with the whale sharks and visit the most beautiful beach in Mexico, Balandra Bay. The foodie scene in Todos Santos is really exciting with destination restaurants like Jazamango by Javier Plascencia and Agricole Cooperativa which is a farm and restaurant.

Cabo San Lucas is a little crazy with nightclubs and excesses but there are tons of great beaches and the east cape is undeveloped for the time being. I would finish up in Cabo Pulmo to swim with the manta rays and look into some more scuba diving.

3. Aguascalientes

The State of Aguascalientes is a pocket of tranquility in a sea of violence. Neighboring Zacatecas is a mess right now. Lagos de Moreno on the Jalisco border needs a little security detail, and so does most of Guanajuato. Aguascalientes may not be on the cover of international destination magazines but that might be reason enough to visit. It is part of the Bajío region and is home to a lot of traditional Mexican culture.

In 2021 the state of Aguascalientes ranked third overall with the lowest number of homicides at 86. Just like Yucatán and Baja California Sur, Aguascalientes is a small state with a population of 1.4 million people which represents just over 1% of the total population of Mexico. Unlike Baja California Sur and Yucatán, Aguascalientes is more densely populated. It isn’t Mexico City but it is only three places behind the capital when it comes to population density (inhabitants per square kilometer).

The economy of Aguascalientes is good. The gross state product per capita is ranked 10th in the country. Ranching is big business and includes both agriculture and livestock. There is a huge automobile manufacturing industry that is visible from the toll roads coming into the state. The World Bank consistently ranks Aguascalientes as one of the best places to do business in Mexico.

My ideal trip to Aguascalientes would be in April or May for the Feria de San Marcos . This is considered to be one of, if not the largest state fair in Mexico. It is billed at the Feria de San Marcos, La Feria de México. There are typical fair events like rides, games of chance, concerts, and livestock exhibitions but the real draw are the bullfights. I would read the book Mexico: A Novel by James Michener to really get an idea of the draw that the event has had on people throughout Mexico but also including Spanish and US aficionados. I suspect the imaginary town of Toledo in Michener’s book was influenced by Aguascalientes but the name was changed to protect the innocent.

There is a great birria restaurant referenced in the Cronicas del Taco series on Netflix. The engraver and caricaturist José Guadalupe Posada was originally from Aguascalientes and there is a small museum dedicated to his work and legacy there.

4. Campeche

Campeche is located in the southeast part of Mexico on the Yucatán Peninsula and is another under-the-radar international travel destination. Even within Mexico, it is a little under the radar. I think that Alan x el Mundo did a great job coving Campeche as well as Mariel de Viaje. The people that I know on the Pacific coast of Mexico probably don’t have Campeche on their travel list just yet.

The State of Campeche borders Yucatán, Quintana Roo, Guatemala, and Tabasco, and is only 10 km away from Chiapas in a couple of places. There are less than a million people residing in the entire state making it the third smallest population in Mexico. In 2021 there were 96 intentional homicides. Even petty crime in the capital is low by most standards. San Francisco de Campeche has a low perception of insecurity by its residents. People really like living there.

The city center of San Francisco de Campeche has cobblestone streets and brightly colored colonial architecture. It is a really nice town and one of the gems of the Yucatan Peninsula.

The ancient Mayan city of Calakmul and surrounding tropical forests are a protected region and Unesco world heritage site and a highlight of the state.

5. Tlaxcala

The history of Tlaxcala is really interesting because the original people of the region allied themselves with Hernán Cortez and the Spanish during the conquest of Tenochtitlán. They reaped some benefits because of it.

There was far more of the original history that was documented in the original Nahuatl because the Tlaxcalteca aristocracy was left in place during much of the colonial era. In contrast, the Aztec royalty was destroyed. To this day, Tlaxcala is a hub of indigenous cultures where Nahuatl is proudly spoken in public and perceived differently than it may be in other parts of the country.

Tlaxcala has a population of 1.35 million inhabitants making it the fifth smallest state in the republic. It borders Puebla, Hidalgo, and Mexico State. In 2021 there were 124 intentional homicides.

The most important tourist attractions in Tlaxcala are the archaeological site of Cacaxtla and the town of Val’ Quirico which looks like a medieval or renaissance era Italian village. In the mountain forest near Mexico State, there is a firefly sanctuary that is popular with 4×4 enthusiasts. There is great camping on some historic properties.

The Safest Cities To Visit In Mexico

I am going to change gears as we move from the safest states in Mexico to the safest cities in Mexico. Looking at the state-wide data we saw the rate of intentional homicides as an indicator of safety. As we move into the city data we are going to be looking at surveys that the National Statistics and Geographic Institute conducts on the perception of insecurity. The survey asks people if they feel unsafe where they live and has coverage in 75 of the largest cities throughout Mexico. These surveys are conducted quarterly and there are some national trends and correlations that we will cover later on.

The most common places that people feel unsafe are ATMs in public places , public transportation, Banks, local streets, and the highway. Places like home, work, and the mall rank much safer.

6. San Pedro Garza García, Nuevo León

San Pedro Garza Garcia is one of the municipalities that comprises the Monterrey Metropolitan Region and has a population of 162,169. It is a very wealthy area where the median home price is approaching the equivalent of US$1 million. This is the southwest part of the Monterrey Metropolitan Region and it has been settled continuously since the 16th century.

In the first quarter of 2022, 11.7% of the population felt unsafe in their city. In the second quarter, the number increased to 15.1%. There is no other city of any substantial size with a perception of safety like that. Nothing else comes close.

There are plenty of new highrises with vanguard architecture. The main attraction is shopping at designer boutiques, technology stores, car dealerships, and high-end restaurants. PANGEA is consistently rated as one of the best restaurants in Mexico and Latin America. I would leverage any social capital available to play a round of golf at Club Campestre de Monterrey Country Club. It is an amazing course.

There are a lot of really enjoyable experiences in San Pedro Garza Garcia that aren’t always associated with Mexico, like golf. San Pedro Garza Garcia is a pleasant surprise for many travelers. Experienced business travelers may be in the know about the area but not many people outside that group will be recommending it as a tourist destination.

7. Benito Juárez, CDMX

La Ciudad de México is a major city with both safe and unsafe municipalities . Benito Juarez borders the Cuauhtémoc municipality which includes touristy Roma and Condessa. Benito Juarez is a local area that includes Narvarte, Del Valle, Tlacoquemecatle, and Xoco.

My wife has family in both Del Valle and Xoco, and we love visiting the area. There are some of my favorite restaurants in Mexico City like the Chamorros de Tlacoquemecatle, Tlayudas el Tasajo, and the Almanegre coffee shop. Xoco is right across Avenida Río Churubusco from Coyoacán. The municipality is as centrally located as Mexico City can be.

Once you have finished checking out Roma and Condessa make sure to spend a little time in Benito Juarez.

8. Tampico, Tamaulipas

The state of Tamaulipas has a nasty reputation for crime and drug cartels because of the northern border region near Matamoros, San Fernando, and Nuevo Laredo. If you look at the map you will notice that Tampico is a long way away from the complicated US border region. The perception of insecurity by local residents was 20.4% in Q1 of 2022 and 27.6% in Q2 which is a stark contrast to the rates in Reynosa and Nuevo Laredo. Even the US State Department travel warning for Tamaulipas mentions the lower rate of violent criminal activity compared to the rest of the state.

Tamaulipas is one of those states where security can change quickly. A friend of mine who helps expats relocate to Mexico with their pets drives through Tamaulipas all the time. He says that everyone commenting on the security situation in Tamaulipas has never actually traveled to Tamaulipas. He says that the Mexican authorities have a strong presence along the freeways and the roads are in excellent condition. The CANACAR (National Chamber of Commerce for automobile cargo shipping) recognized Tamaulipas for having the safest freeways in Mexico in 2022.

Tampico isn’t at the top of my list of places to visit but I will admit that I was surprised that the perception of insecurity was so low. It just goes to show that there are a lot of destinations that we may make assumptions about without having all of the facts. Or that the facts have changed. 2011 was not a good year for Tamaulipas.

9. Saltillo, Coahuila

Saltillo is the capital of the northern state of Coahuila. Coahuila is known as the land of wine and dinosaurs. There is an excellent dinosaur museum in Saltillo as well as some nice wine bars. The Valle de Parras wine region is a resort town only an hour outside of Saltillo that was the first officially recognized winery in the Americas dating back to the 16th century. Both Saltillo and Coahuila were important theaters in the War of Independence, the Mexican-American War, the Reform War, and the Revolution

It is safe to say that Coahuila has a very different security situation than the neighboring state of Nuevo Leon. The corridor from Saltillo to Piedras Negras is considered to be the safest border crossing into Texas and quite possibly into the United States. In Q1 24.1% of the population of Saltillo reported feeling unsafe in the city. The figure rose to 29.8% in Q2

The Saltillo Cathedral is reason enough to visit the area. It is one of the finest examples of baroque and churrigueresco architecture in Mexico.

10. Los Cabos, Baja California Sur

I love Cabo. It is an easy, safe trip from the west coast of North America because there are so many direct flights. Cabo San Lucas can feel like a foreign country within Mexico because of the massive hotels and the English speakers outnumber the Spanish speakers.

San Jose del Cabo on the other hand still has the essence of a smaller Mexican city with the main square and a lot of options for nature lovers.

It is easy to still find virgin beaches just a short distance outside of the city. The east cape of the Baja Peninsula is famous for clear water and abundant marine life. In the summertime the surf is world-class and people flock to the beaches to test their luck. The best beaches get crowded but there are usually enough waves that everyone stays happy.

In the first quarter of 2022, 28.5% of the population of Los Cabos felt the area was unsafe. The number rose to 30.7% in the second quarter. Considering there were only 51 murders in the entire state in 2021, Los Cabos is easily one of the best cities in Mexico. I am planning another trip to Los Cabos and Baja California Sur right now.

11. Mérida, Yucatán – Widely Recognized As Safest City in Mexico & Latin America

We already talked about Yucatán but Mérida is often cited as the safest city in Mexico. With its lovely historic center and delicious regional food, it is no surprise that Mérida is one of the most enjoyable places to visit in Mexico.

It is very hot in Mérida so it is important to plan activities early in the day and late in the afternoon. It would be best to avoid the mid-day sun on a long photography walk. Try to maximize the golden hour.

One of the favorite activities in Mérida is walking the streets of the center to appreciate the historic architecture, restaurants, and boutiques. I don’t think that any trip to Mérida is complete without a sunset photo at the Monumento a La Patria traffic circle on Paseo de Montejo.

It is highly recommended to make time for a day trip to the beach, an archeological site, or one of the pueblos mágicos in the area. Staying for a night or two at one of the restored hacienda boutique hotels will easily be one of the highlights of your trip.

The perception of safety in Mérida is very good. In the first quarter of 2022, only 22.4% of the population felt it was unsafe. The number rose to 34.1% in Q2 but there was a note about the statistical margin of error due to the large change. No matter how you look at it, Mérida is easily one of the safest places to travel in Mexico.

12. Los Mochis, Sinaloa

I have been talking this article over with everyone in my orbit. Los Mochis and Sinaloa in general came as a bit of a surprise but after talking it over, the general consensus is that this part of Mexico is very safe. While Sinaloa has a reputation there is no struggle for control. There is one organization that controls everything, unchallenged. The state of Quintana Roo by contrast has multiple organizations struggling for control of the local drug trade.

Los Mochis is an important federal transportation hub with the ferry terminal in Topolobampo, the Chihuahua-Pacifico train line, and the Interstate 15 freeway. These are important pieces of transportation infrastructure and the federal government is invested in keeping them safe.

Much like the rest of Sinaloa, the history of Los Mochis is rooted in agriculture. There is an exceptional botanical garden in town. The best local museum is called El Trapiche Interactive Museum of Los Mochis in a reference to the history of sugar cane production which made the early caudillos rich.

Make it a point to stop and eat when coming through the area. There are good seafood restaurants and stalls on almost every corner. I loved Mariscos El Farallón and Mariscos el Tungar but there are tons of great places to eat both formal and informal.

Los Mochis is one of the best places to break up the drive down Interstate 15 because of the abundant hotels with safe parking and cool things to do.

13. San Nicolás de los Garza, Nuevo León

Monterrey has not one but two of the safest cities in Mexico. San Nicolás de los Garza is on the northeast side of the Monterrey Metropolitan Region. While the median home price in San Pedro Garza García is ridiculously expensive, the prices in San Nicolás de los Garza are much more reasonable. It is a working-class suburb of the second-largest city (metropolitan region really) in Mexico. Monterrey is considered the best city for industry and big business. The government has a very close relationship with the United States and there are a lot of US companies that have set up their headquarters in the area.

14. Cuajimalpa de Morelos, CDMX

Nestles in between Álvaro Obregón and Mexico State on the far west side of Mexico City is the Delegation of Cuajimalpa. Many travelers will pass by Cuajimalpa on their way into Mexico City as they descend from La Marquesa on the freeway to Toluca. Few will stop.

The municipality includes neighborhoods like Cuajimalpa, San Mateo Tlaltenango, and Lomas de Santa Fe. Lomas de Santa Fe is futuristic and luxurious. San Mateo Tlaltenango is a wealthy suburban enclave and Cuajimalpa is a middle-class suburban area. My brother-in-law grew up in this area and has helped me maximize my time here.

Lomas de Santa Fe is an excellent place to use as a staging ground for accessing Mexico City. The traffic in Mexico City is nuts and there are certain times of day that you do not want to be on the road because of traffic and Hoy No Circula restrictions.

When you are driving into Mexico City from elsewhere you never really know what time you will arrive because of traffic considerations. Lomas de Santa Fe is right off the freeway and has tons of hotels with safe parking and awesome restaurants.

This super modern part of Mexico City is probably something you weren’t expecting.

In the first quarter of 2022, the insecurity factor was 41%. In the second quarter of 2022, that figure dropped to 37%. These figures are significantly lower than most of Mexico City.

Benito Juarez is the only other municipality with a similarly low perception of insecurity. Most other municipalities have rates twice that. 83% of residents in Azcapotzalco believe the area to be insecure.

15. Tepic, Nayarit

Tepic is an important stop along the Highway 15 corridor from Nogales down the west coast of Mexico. It is a very old city that has managed security well. Just ten years ago, the security situation was very different. Things can change quickly.

Most people don’t realize that Tepic is only 30 minutes from the beach. The new toll road from Tepic to San Blas makes Tepic feel like a beach city. I grew up in San Diego where many neighborhoods are more than 30 minutes from the beach. If you really want to surf, 30 minutes is nothing.

One of the best parts of living in Tepic is the affordability. Compared to Guadalajara and Puerto Vallarta, Tepic is downright cheap.

There is also a much more traditional society. There is a lot of farming close to the city and visible campesino culture.

I found Downtown Tepic to have a nice collection of historic buildings and good restaurants.

In June of 2022, 40% of the population considered Tepic to be an unsafe place. By June of 2023, that figure had dropped to 30% of the population. Those are phenomenal numbers that any city in Mexico would be proud of.

16. Santiago de Querétaro, Querétaro

One of the things that people love about Querétaro is that it is kind of boring. It doesn’t make the headlines, it is under the radar, and it feels like the suburbs.

Querétaro is a very popular place for people to relocate to from Mexico City once they get tired of the traffic and pollution. There is lots of industry, an educated population, and lots of fun things to do nearby.

The state of Querétaro is home to the best wine region in Central Mexico. San Miguel de Allende is just a short distance away, and Sierra Gorda is still reletively unknown outside of the region.

Besides a little bit of football hooliganry, Querétaro is a very safe place to live and visit. In June of 2022, 54% of the population considered Querétaro to be unsafe. That number dropped to 42% in June of 2023.

It is interesting to see more and more expats choose Querétaro as their home base. People are more open to making friends because there are so few people that grew up here compared to other places. Merida and Guadalajara have a reputation for being insular. If you don’t speak Mayan or didn’t go to elementary school with a group, it can be hard to break into the social scene. Querétaro is different.

The Safest Border Crossings in Mexico

Border crossings have a bad reputation for being dangerous places. Criminal organizations make lots of money by transporting contraband across the border.

Drugs and migrants are smuggled into the United States while guns and cash slip into Mexico. I grew up next to San Ysidro and occasionally travel through Nogales and Ciudad Juarez. I also read the newspapers and know that Reynosa and Nuevo Loredo have horrible reputations.

If you read Paul Theroux’s travelogue On the Plain of Snakes the first third of the book is about all the problems along the 3,000 km long border.

I was really surprised to learn that one of the safest cities in Mexico was the border town of Piedras Negras.

17. Piedras Negras, Coahuila

An acquaintance of mine in the On The Road In Mexico forum on Facebook had to set me straight. I thought all border towns were sketchy. It turns out that Piedras Negras is not only the best border crossing into Mexico but it is also one of the safest cities in the entire country.

In the first quarter of 2022, only 22.2% of the population considered Piedras Negras to be unsafe. The figure rose to 28.5% in Q2 but that is still one of the best perceptions of insecurity in all of Mexico, border city or not.

It seems that Eagle Pass and Piedras Negras have become the preferred border crossing to enter and exit Texas. When looking at the map it would appear that Monterrey to Nuevo Laredo would be the easiest route to San Antonio. Saltillo to San Antonio by way of Piedras Negras adds about 70 miles but is considered to be a much safer route with a more relaxed border crossing.

18. Tecate, Baja California

Tecate is a small town and designated Pueblo Mágico between Tijuana and Mexicali. It may not be the most magical of the Pueblos Mágicos in Mexico but it is the easiest place to cross in and out of Mexico from California. It is a little out of the way from San Diego but that is what keeps the crowds at bay. There isn’t the same volume of commuter traffic that major cities like San Diego and Tijuana see every morning and afternoon.

The borderline in Tecate is consistently shorter than the wait in San Ysidro, Otay Mesa, and Mexicali. Tecate has been my parent’s favorite way to access the Valle de Guadalupe wine region for some years. I am not 100% sure how my mom heard about Tecate but I am so glad she shared this hidden gem with me. I am used to the chaos and heavy border traffic of Tijuana but I wouldn’t want my mom crossing at rush hour. When you know the border wait is going to be long it is well worth the extra drive out to Tecate.

Rancho La Puerta is an amazing resort and spa that would make a great first stop on a trip down the Baja Peninsula.

19. Nogales, Sonora*

I am putting Nogales in here with an asterisk because it does have some security issues but it is the best place for passenger vehicles to access the Pacific coast of mainland Mexico.

Nogales is a major gateway to the United States. It is much faster to use US Highway 8 or US Highway 10 than it is to drive the slow and dangerous Mexico Highway 2 along the border. Sonoyta and Caborca have some significant safety problems.

Mexico Highway 15D is the main artery running from the western United States all the way down to Guadalajara and Mexico City.

Because of the Mariposa West border crossing, it is easy to get into Mexico and onto the toll road south. You don’t need to go into Nogales unless you need to purchase something or get pesos from an ATM .

If you are driving from California to Puerto Vallarta, then Nogales is the best border crossing to use.

The Safest Beaches in Mexico

An interesting characteristic of Mexican geography is that the major metropolitan areas are usually located in the center of the Country. Mexico City, Monterrey, and Guadalajara are all a long drive from the beach. Much of the coast is made up of small towns that do not have a population large enough to be considered by the national surveys on security.

20. Puerto Vallarta, Jalisco – One of the Safest Beach Vacation Spots in Mexico

Puerto Vallarta is one of the safest and most treasured parts of Mexico to visit for good reason. But in addition to just visiting the city of Puerto Vallarta, I recommend traveling around the entire bay area. From Cabo Corrientes in the south to Punta Mita in the north, there are dozens of spectacular beaches for each type of travel. And they are ALL safe. There has been an uptick in the instances of petty theft but overall, Puerto Vallarta and the surrounding areas are one of the safest places to visit in Mexico.

Once upon a time, Puerto Vallarta was a small fishing village nestled between the Sierra Madre Mountains and the Bay of Banderas. John Huston, Elizabeth Taylor, and Richard Burton changed everything in the 1960s. When Richard Burton was cast as the lead in Night of the Iguana he brought his famous girlfriend along to the set. Elizabeth Taylor and Richard Burton had just fallen in love on the set of Cleopatra but they were both married to other people. The international celebrity gossip went into overdrive and the international paparazzi swarmed. Puerto Vallarta got so much publicity it inevitably became the next hot Mexican beach destination.

Puerto Vallarta has remained enchanting after all of these years. The town has grown like crazy but the Romantic Zone still feels like you are stepping back in time. It is easy to find secluded Jalisco beaches hidden in the jungle or watch the mega yachts land at the marina. There is something for everyone.

21. Puerto Escondido, Oaxaca

Puerto Escondido is the surfing capital of Mexico and during the summer months, professional surfers and photographers from around the world set up camp here. While there is some petty theft the biggest danger in Puerto Escondido is the ocean. It is not safe to swim in Playa Zicatela for most of the year. Swimmers must use the beaches closer to town that are protected from the open ocean swells.

Playa Zicatela is the main surfing beach with big waves and strong currents. On the south end of the beach is La Punta Zicatela surf spot where the waves are a little smaller and more predictable because they break off of a point. A little bit closer to town there are beaches Playa Manzanillo and Playa Carrizaillo which are the safest beaches for swimming. All of the beaches in Puerto Escondido are stunning.

It is important to observe the ocean conditions before getting into the water in Puerto Escondido.

22. Isla Holbox, Quintana Roo

Holbox is easily one of the most beautiful beaches in all of Mexico. The size of the island has restricted some of the big-box development that is prevalent in other parts of the Riviera Maya such as Playa del Carmen and Cancún. The population of full-time residents is little more than 1,000 people and the whole area is an ecological reserve called Yum Balam.

The island is little more than a sand bar just 7 km off the coast. There is a ferry connecting the mainland but no cars are allowed. The best way to get around is on bikes or golf carts.

Even though Holbox is an incredibly small and laid-back destination there are quite a lot of activities to dive into. The Caribbean waters are warm and shallow making them safe for swimming. There are whale sharks, bioluminescence, kayaking, cenotes, and excellent snorkeling. It is a paradise for outdoor enthusiasts.

The town has a lot of style and there are a fair amount of murals and interesting small businesses to keep you occupied for a week or longer. The friendly locals love their island and want to protect it from becoming overdeveloped like Tulum.

23. Todos Santos, Baja California Sur

Todos Santos is a tiny town situated on the Pacific coast of Baja California Sur in the municipality of La Paz and located one hour north of Cabo San Lucas. It is more like three towns because Pescadero, Cerritos, and Todos Santos are just a few minutes away from each other by car. The area is an oasis in the middle of the desert and is known as a boutique destination for outdoor enthusiasts with particularly good food. This is one of the best places to learn to surf in Mexico because of the consistency of small waves perfect for beginners.

Jesuit priests built a mission here in the early 1700s called Santa Rosa de las Palmas de Todos Santos. That mission was destroyed by the natives ten years later. The mission that stands today was built by Dominican priests in the 1800s and has been modernized ever since. In the post-colonial period, Todos Santos was an important center for sugar cane production. The town is so picturesque because of the 19th-century buildings that have been restored and painted bright colors. It reminds me a lot of a much smaller version of Mazatlan’s historic downtown.

Many people are just passing through Todos Santos on the way to or from Los Cabos. It is worth it to stay for a few days just to eat at all of the restaurants in town. There are high-end places like Javier Plascencia’s Jazamango and simple shacks selling some of the best fish tacos you will taste in this lifetime. Doce Cuarenta, the local coffee shop, looks historic from the outside and ultra-modern on the inside.

If you are thinking about learning to surf then Todos Santos should be at the top of your list of places to give it a try.

24. Sayulita, Nayarit

Puerto Escondido may be the capital of the professional surf industry in Mexico bu t Sayulita is the best place for beginners to catch their first waves and hone their skills. There are lovely beaches in every direction and lots of fun things to do in Sayulita.

Sayulita is located in the state of Nayarit just one hour north of Puerto Vallarta. The Puerto Vallarta International Airport makes the trip to Sayulita very easy because of the large number of direct flights from across North America. It is a relatively safe destination devoid of most violent crime. The biggest concern is petty theft and scams at the gas station on the way into town. I was blown away reading the Google Maps reviews about how many people, Mexicans and tourists alike, have short-changed.

Sayulita has the best nightlife in the area. Punta Mita is a 25-minute drive down the peninsula and has a lot of waves but not as much nightlife for a younger crowd.

25. Huatulco, Oaxaca

The seven bays of Huatulco are one of the most ecologically pristine tourist destinations in Mexico. The federal government built Huatulco as an international destination with conservation in mind.

I found the snorkeling in Huatulco to be excellent but the food was not nearly as good as the food in Oaxaca City.

Huatulco is home to some of the safest resorts in Mexico for families with little kids. The bays protect the beach from the massive swell energy that Oaxaca is famous for. Just down the road at Barra de la Cruz the waves can be 10+ ft while the shore of Tagolunda is flat as a lake.

Huatulco is a special place that is as safe as it gets.

26. Mazatlán, Sinaloa

I am really happy to be able to include Mazatlán on this list now. The percentage of the population that considers Mazatlán to be unsafe dropped from 54% to 42% from 2022 to 2023.

The first thing that comes to mind when I tell people how much I love Mazatlán is the cartel. Oh my gosh, Sinaloa. The important thing to remember is that there is not struggle for control of the plaza like Tijuana or Chiapas. Puerto Vallarta is in the same boat. There is one organization that is firmly in control without a rival.

My family and I stop in Mazatlán almost every year when we drive to the United States. We usually spend a couple of nights because the hotels are cheap and the seafood is so good.

Mazatlán is one of the best surf towns in Mexico with a range of great surf spots for beginners to pros.

The Safest Pueblos Mágicos To Visit In Mexico

The Mexican Secretary of Tourism created the Pueblo Mágico program to promote smaller and off-the-beaten-path destinations with unique tourism experiences. Many of the destinations have significant culinary and historical contributions to the national identity.

Many of the Pueblos Mágicos are very small towns that do not figure into national rankings on security. Ajijic, Sayulita, and Tapalpa all have populations below 20,000.

27. Ajijic, Jalisco

There are dozens of charming towns all around Lake Chapala but Ajijic is the only Pueblo Mágico. The region has been a popular vacation destination for both Mexicans and international visitors alike for more than 100 years.

Today, Ajijic has one of the largest concentrations of expats in Mexico. Many of them are of retirement age and there is a burgeoning elder care industry taking shape.

The weather and sunsets in Ajijic are considered to be excellent. Plus, there are many artists in the community who want to make the town even more beautiful. The Ajijic Museo de Arte is way nicer than you would expect in a town this small.

Overall, Ajijic is an incredibly safe community. The only dangers are uneven sidewalks and water pollution.

28. Tequisquiapan, Querétaro

Located just 2.5 hours away from Mexico City and less than an hour away from Santiago de Querétaro, Tequisquiapan is a favorite destination for wine enthusiasts.

The picturesque town is a favorite weekend getaway for chilangos and the yearly Wine and Cheese Festival is a huge party. Freixenet, La Redonda, and Viñedos Azteca are three of the most popular vineyards that offer excellent tours and tastings.

Interestingly, Revolutionary President Venustiano Carranza spent a lot of time in Tequisquiapan and decreed that the small town be known as the “Center of Mexico”, more symbolically than geographically.

The regional economy is dedicated to tourism and the local authorities are invested in keeping it safe. The biggest dangers in the area are Sunday drivers after one too many glasses of wine.

29. Loreto, Baja California Sur

Loreto is an important part of the history of the Baja Peninsula. Misión de Nuestra Señora de Loreto Conchó was founded on October 25th, 1697, and the first successful Spanish settlement on the peninsula.

The colonization of the Californias was spearheaded by Loreto. Even though the Jesuits were expelled from all Spanish dominions in the 18th century, both Franciscan and Dominican missionaries would continue their work.

Today, the town is a mecca for outdoor enthusiasts. The Loreto Bay is a protected national park with a wide variety of marine life. The desert trails are a favorite for hikers and there is a mountain biking community that is taking off.

The entire state of Baja California Sur is one of the safest places in Mexico and Loreto has both natural beauty and a lot of history. The sunrise over the Sea of Cortez is marvelous.

Loreto is a favorite destination for snowbirds because of its natural beauty and good security situation.

30. Valladolid, Yucatán

Valladolid is about the halfway point along the drive from Cancún to Mérida. Most people just use Valladolid as a staging point to access the Mayan ruins at Chichén-Itzá.

The Pueblo Mágico is so beautiful and safe that it deserves a few more days to explore. It is a small town so it is easy to see the entire downtown area walking.

Yucatán has a unique blend of Mayan and Spanish cultures that is on display in Valladolid. From the traditional clothing to the food, the mestizo identity is different from the center of the country.

31. Tapalpa, Jalisco

Tapalpa is a favorite destination for wealthy Tapatíos (people from Guadalajara) to go horseback riding in the forest. The town is less than two hours away from Guadalajara but a world away.

Located in the Sierra Madre Occidental, Tapalpa is in the mountains above Sayula not far from the Nevado de Colima Volcano.

There are lots of outdoor activities in Tapalpa. The Piedrotas de Tapalpa is a rock formation in a green field with climbing, rappelling, ziplining, horseback riding, and some restaurants.

On the way into town you will pass the paragliding cliffs and probably see a couple of gliders.

The Salto del Nogal hike leads to the highest waterfall in the state of Jalisco with some spectacular views of the area.

The food in Tapalpa is enough to book a trip. The town is famous for borrego (lamb) al pastor, birria, tamales de acelga, rompope, and pajaritos. Pajaritos are concoctions of unpasteurized cow milk, right out of the udder, mixed with chocolate, Nescafe, sugar, and cane alcohol.

Alpine forest is not what most people imagine when they think about Mexico. Tapalpa will exceed your expectations.

32. Pátzcuaro, Michoacán

Pátzcuaro is one of the most beautiful Pueblos Mágicos in Mexico with a vibrant Purépecha culture. The food and art are heavily influenced by the native people in the area and it is common to hear the Purépecha language spoken in the street.

Day of the Dead in Michoacan is one of the coolest experiences in all of Mexico.

33. San Carlos Nuevo Guaymas, Sonora

In early 2023, the Mexican Secretay of Tourism announced 45 new Pueblos Mágicos bringing the total to 177. While there has been a bit of criticism saying that there are too many places to visit now, I sure liked San Carlos.

San Carlos is a resort town built to explore the Sea of Cortez. It is essentially the new suburb of Guaymas and was developed for tourism. There is a big difference between a pueblo mágico like Pátzcuaro or Tequila but that shouldn’t take anything away from San Carlos.

I suggest you sit out by the pool and watch the sunset over the Cero Tetakawi and tell me that San Carlos isn’t magical. After driving through the desert, jumping in the water will always be magical.

Safest Places To Visit In Mexico Map

I always find it helpful to look at a map. The Mexico Map above shows the safest places to visit in Mexico divided into several different categories.