The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

‘Go home’: Too much tourism sparks backlash in Spain

MADRID - Anti-tourism movements are multiplying in Spain, the world’s second-most visited country, prompting the authorities to try and reconcile the interests of locals and the lucrative sector.

Rallying under the slogan “The Canaries have a limit”, a collective of groups on the archipelago off north-west Africa are planning a slew of protests on April 20.

The Canaries are known for volcanic landscapes and year-round sunshine, and attract millions of visitors from all over the world.

Groups there want the authorities to halt work on two new hotels on Tenerife, the largest and most developed of the archipelago’s seven islands.

They are also demanding that locals be given a greater say in the face of what they consider uncontrolled development which is harming the environment.

Several members of the collective Canaries Sold Out began an “indefinite” hunger strike last week to put pressure on the authorities. “Our islands are a treasure that must be defended,” the collective said.

The Canaries received 16 million visitors in 2023, more than seven times its population of around 2.2 million people.

This is an unsustainable level given the archipelago’s limited resources, Mr Victor Martin, a spokesman for the collective, told a recent press briefing, calling it a “suicidal growth model”.

‘Social revulsion’

Similar anti-tourism movements have sprung up elsewhere in Spain and are active on social media.

In the southern port of Malaga on the Costa del Sol, a centre of Spain’s decades-old “soy y playa” or “sun and beach” tourism model, stickers with unfriendly slogans such as “This used to be my home” and “Go home” have appeared on the walls and doors of tourist lodgings.

In Barcelona and the Balearic Islands, activists have put up fake signs at the entrances to some popular beaches warning in English of the risk of “falling rocks” or “dangerous jellyfish”.

Locals complain a rise in accommodation listings on short-term rental platforms like Airbnb have worsened a housing shortage and caused rents to soar, especially in town centres. The influx of tourists also adds to noise and environmental pollution and taxes resources such as water, they add.

In the north-eastern region of Catalonia, which declared a drought emergency in February, anger is growing over the pressure exerted on depleted water reserves by hotels on the Costa Brava.

“Our concern is to continue to grow tourism in Spain so that it is sustainable and does not generate social revulsion,” vice-president Jose Luis Zoreda of tourism association Exceltur said on April 16 when asked about the protests.

The group said it expects Spain’s tourism sector will post record revenues of €202.65 billion (S$290 billion) in 2024.

Loudspeaker ban

Before Covid-19 brought the global travel industry to its knees in 2020, protest movements against overtourism had already emerged in Spain, especially in Barcelona.

Now that pandemic travel curbs have been lifted, tourism is back with a vengeance – Spain welcomed a record 85.1 million foreign visitors in 2023.

In response, several cities have acted to try to limit overcrowding.

The northern seaside city of San Sebastian in March 2023 limited the size of tourist groups in the centre to 25 people and banned the use of loudspeakers on guided tours.

The southern city of Seville is mulling over charging non-residents a fee to enter its landmark Plaza de Espana, while Barcelona removed from Google Maps a bus route popular with tourists to try to make more room for locals.

Housing Minister Isabel Rodriguez said over the weekend that “action needs to be taken to limit the number of tourist flats” but also stressed that the government is “aware of the importance of the tourist sector”, which accounts for 12.8 per cent of Spain’s economic activity. AFP

Join ST's Telegram channel and get the latest breaking news delivered to you.

- Environmental issues

Read 3 articles and stand to win rewards

Spin the wheel now

Spain's 2023 tourism revenue seen 5% higher than before pandemic

- Medium Text

- 2022 tourism revenues were 2.1% below 2019 level

- 2023 forecast could see tourism account for 12.2% of GDP

Coming soon: Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here.

Reporting by Inti Landauro and Corina Pons Editing by Kirsten Donovan and Mark Potter

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Russian missiles hit the port of Pivdennyi in Ukraine's southern Odesa region on Friday, destroying grain storage facilities and foodstuffs they contained, President Volodymyr Zelenskiy and other officials said.

Russell Bentley, a U.S. national, has died in the Russian-controlled city of Donetsk in Ukraine, Margarita Simonyan, head of Russia's state media outlet RT, wrote on Telegram on Friday.

World Chevron

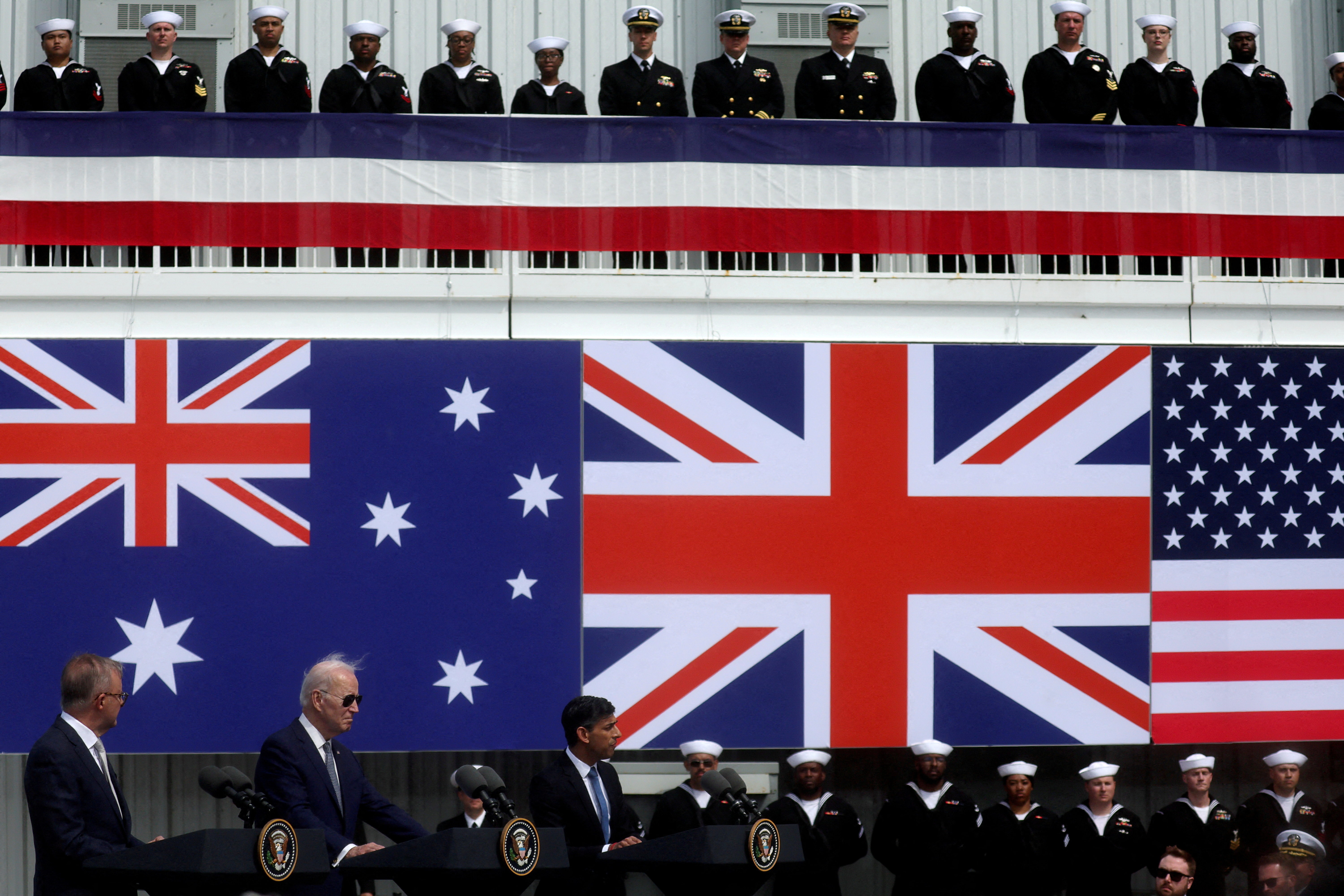

US expects to finalize new AUKUS trade exemptions in next 120 days

The U.S. State Department said on Friday it fully expects to finalize new trade exemptions for the AUKUS defense project with Australia and Britain in the next 120 days, signaling a further delay in the move, but offering the prospect of a positive outcome in the project to counter China.

A court in the Azerbaijani capital Baku on Friday remanded the head of an independent media outlet for two months on charges of smuggling, Turan news agency reported, the latest move against independent journalists in the ex-Soviet state.

Iraq's Popular Mobilization Forces, an official security force, said its command post at Kalso military base about 50 km (30 miles) south of Baghdad was hit by a huge explosion late on Friday, and two security sources said it resulted from an air strike.

- Hotel Industry and Tourism

Spanish Tourism Satellite Account. Latest data

Latest press releases.

Tourism activity reached 155,946 million euros in 2022, 11.6% of GDP, which was 3.9 points more than in 2021. The characteristic branches of tourism generated more than 1.9 million jobs, 9.3% of total employment.

- Press release

- Nota informativa. Revisión Estadística 2024 de las Cuentas Nacionales

- Dissemination calendar

Most popular tables

Did you know....

The Spanish Tourism Satellite Account (STSA) is a summary statistic composed of a set of accounts and tables, based on the methodological principles of national accounts and presenting the different economic parameters of tourism in Spain, for a given reference date. The current base is 2010.

It essentially consists of three types of components:

- - Supply accounts and tables, in which an attempt is made to characterise the production and cost structures of tourism companies.

- - Demand tables which intend to characterise, from an economic point of view, the different types of tourists, national tourism compared with international, the types of goods and services demanded, etc.

- - Tables that interrelate supply and demand, which facilitates obtaining some integrated measurements of the contribution of tourism to the economy via variables such as GDP, production or employment.

- Hotels & Accommodation

- Travel Agencies & Travel Booking Websites

- Car rental & Parking

- Bus, train and transfer

- Experiences & activities

- Entertainment (Books, games, fun etc.)

- Equipment, travel gadgets and other

- Exclusive travel discounts

Tourism In Spain – 50+ Statistics, Numbers And Trends

Updated on May 29, 2023 by Axel Hernborg

Spain is one of the leading countries in the tourism industry. According to the CaixaBank Research facility, Spain received 4.1 million tourist arrivals in December 2022, and 4.28 million in December 2019.

While the Spanish Government website, La Moncloa , shows this has increased to 4.3 millio n in February 2023.

Statista shows that Spain received their second-highest tourism figures in 2019, reaching a total of 83.5 million .

In 2020 they came in third with 18.93 million tourist arrivals, and in 2021 they came in second with 31.2 million arrivals.

Although international tourism was dramatically reduced because of the pandemic, Spain continued to uphold their high-ranking tourism status throughout the global crisis.

Spain is successful in the tourism industry because of its rich cultural and natural attractions.

Its exceptional infrastructure, the quality of its transportation, and hotel density also make the country more desirable to visit and travel to.

Here we are going to mention some of the top trends and statistics in Spain’s tourism industry.

Table of contents

- 1 How The Tourism Industry Affects The Local Residence

- 2 Where Are Most Spanish Tourists From?

- 3 How Much Do Tourists Spend In Spain?

- 4 How Tourism Contributes To Spain’s Economy

- 5 Tourism Industry Insight

- 6 How Do Spanish Tourists Travel

- 7 What Aspects Of Tourism Does Spain Concour

- 8 Hong Kong Has Overtaken Spain’s First Place Podium

- 9 Where Do Most Tourists Visit?

- 10 References

How The Tourism Industry Affects The Local Residence

According to the Eurostat database, the average European Union country will have 55.9% of its residents participating in tourism-based jobs.

The country with the most tourism-based jobs was the Netherlands as 81% of the working population contributed to tourism in 2021.

In comparison, the Spanish have less than the average, with only 54.1% of the working population contributing to tourism in the same year.

Despite the country not putting all of its workforces into tourism, this country is still excelling in the industry.

The reason for this dominating presence comes from the large interest from neighbouring rich countries such as the UK, Germany and France (sourced by Statista).

Each of these wealthy countries lacks warm weather but can afford the short trip over to the low-cost locations of Spain.

This allows Spain to house many tourists through cheap prices and desirable weather conditions.

Where Are Most Spanish Tourists From?

- Spain’s biggest fans are the British, as 15,121.9 thousand tourists travelled to the country in 2022.

- Second was France with 10,096 thousand tourists .

- Third was Germany with 9,768.6 thousand tourists .

- Fourth was Italy with 4,011.1 thousand tourists , but Statista has grouped all of the Nordic countries into one reaching a total of 4,291.2 thousand tourists .

All these figures come from Statista’s 2022 data which showed more than 15 million UK tourists travelling to Spain.

How Much Do Tourists Spend In Spain?

- Foreign tourists spent 5.07 billion euros ($5.37 billion) while on holiday in the country in March 2021 , up from a mere 544 million euros a year earlier.

- Spain closed the first quarter of 2021 with good data on arrivals and tourist spending, with the hope that the trend will intensify in the summer period.

- The number of tourists flocking to Spain in March 2022 was still 1.6 million short of the number who arrived in March 2019 before the COVID-19 pandemic.

- The amount spent in March 2019 was 6.03 billion euros .

How Tourism Contributes To Spain’s Economy

- In 2021, Spain’s tourism sector brought in €97,126 million . This had a GDP of 8.0%.

- 2020 was just 2.2 GPD points before 2021 showing a general size in tourism-based interest.

- In 2021, the tourism sector created 2.27 million jobs and accounted for 11.4% of employment in the country.

- Spain recorded a total of 36 million tourists in 2020 .

- In 2020 , Spain ranked 8th in the world in absolute terms.

- With 0.77 tourists per resident , Spain ranked 55th in the world. In Southern Europe, it ranked 6th.

- Spain generated around 81.25 billion US dollars in the tourism sector alone.

- Spain’s Tourism corresponds to 6.3% of its GDP and approximately 40% of all international tourism receipts in Southern Europe.

- In comparison to pre-pandemic years, Spain reached 11.8% GDP in 2017 and in 2018 13.5% of employment was dedicated to tourism. This created 2.6 million jobs directly.

- By comparison, 2019 showed the first sign of change reaching just 5.4 GDP from the 81,868,500 tourist arrivals. This created 958,100 jobs , just 5% of the total employment.

Tourism Industry Insight

- Spain has begun to prepare a new Strategy for Sustainable Tourism for 2030 .

- The Strategy of Sustainable Tourism aims to transform Spanish tourism into a model of both sustained and sustainable growth to maintain the country’s leading position in tourism.

- This strategy also aims to protect the assets on which the sector depends .

- The Strategy will contribute to the achievement of UN Sustainable Development Goals and meet both medium and long-term challenges of sustainable tourism in terms of socioeconomic, environmental, and territorial impacts.

- Digitalization and modernization of all the various elements of the sector is a high priority and aims to improve the position of Spain as a leading global tourism destination.

- Spain is seeking new mechanisms to boost destination innovation through the deployment of information and communication technologies to create different and highly competitive services.

- Saudi Arabia and Spain have agreed to work together to identify several fields in which they can work together to revitalise the tourism sector after the COVID-19 pandemic.

How Do Spanish Tourists Travel

- Using OECD Tourism’s data on tourism industry enterprises we can learn which travel industry accepts the most tourists. These travel sectors are measured in employee amount and number of facilities needed. These industries need more employees to handle more tourists, thereby showing a secondary indication of tourism interaction .

- 2019 had the most people employed in the tourism industry in recent years, reaching 2,604,899 employees .

- 2020 had 2,33,736 tourism employees and 2021 had a slight increase to 2,367,560 employees .

- OECD Tourism separates the travel sector into air, railway, road and water.

- In 2019 , 52,334 people travelled by Air, 24,784 travelled by railway, 231,537 travelled by road, and 8,932 travelled by water.

- In 2020 , 44275 travelled by air, 21, 709 travelled by railway, 213,837 travelled by road, and 8,613 travelled by water.

- In 2021 , 46,061 travelled by air, 27,098 travelled by railway, 185,815 travelled by road, and 6,410 travelled by water.

- Using this data, we can summarise that most Spanish tourists travel by road. This is a large majority. The second most popular is air, then by railway and the least popular by a large count is by water.

- Despite the most popular travel method being roads, the most lucrative is air transport . In 2020, Spain received €6,125 million on air travel, €1,149 million on road travel, €685 million on railways, and €483 million on water transport.

- This trend is reflected in both domestic tourism and inbound tourism. However domestic travellers are more likely to travel by water than inbound tourists .

What Aspects Of Tourism Does Spain Concour

- In 2019, the World Economic Forum reported that Spain continued to hold the top spot for tourism competitiveness. This forum looks at 140 countries and bases the strength of their tourism sector on population, finances and repeats returns.

- Spain was in the top 3 in 2019 , with its local competitors such as the UK and Germany barely making it into the top ten.

- Spain is the second most visited country in the world .

- It has the third-best infrastructure in the world and the third-best cultural assets.

- A large portion of the tourism domination comes from golf.

- Golf attractions bring in 1.2 million foreign tourists every year .

- In 2020, this sector brought in €12.769 billion alongside 121,393 jobs both directly and indirectly.

- Golf is considered the catalyst of Spain’s economy, as prices rise during golf tournaments.

- The profits from golf affect 88% of all other tourism industries such as transport, shopping, restaurants and hotels.

- In 2018, a record 1,195,000 tourists reported practising their golf before a tournament, purposefully elongating their stay. On average a golfing tourist will spend 11.9 days in the country , while a non-golfing tourist will stay for 7.4 days on average.

- Tourism Specialists such as Invest In Spain believe that diversification is needed to prevent large losses in seasonal tourism, as only 85% of golf-based working contracts are permanent full-time contracts.

- The increase in golf-based tourism has created a wave of foreign second-home owners.

Hong Kong Has Overtaken Spain’s First Place Podium

- Spain used to be the top-ranked tourist destination, however, in 2020, Hong Kong stole that title .

- Spain is still the top tourist destination in all of Europe and is currently ranked third in the world as Hong Kong and the USA creep into second and third place.

- Spain still takes the lead in online searches for holidays, but a large drawback comes from the 2017 terrorist attack in Barcelona.

- Spain has managed to ease fears of a repeat attack due to its strong internet presence in advertising and social media.

- Although Italy is currently in 7th position in the global tourism ranking, it is presenting itself as a threat to Spain, coming for the European crown ( Check out our guide to Italy tourism right here ).

Where Do Most Tourists Visit?

- According to Invest In Spain, the most popular destination for Spanish tourists is Catalonia. This area received 19.4 million tourists in 2020 which was 0.08% more than in 2019.

- The second most popular is the Balearic Islands with 13.7 million tourists in 2020. However, this is 1.2% less than in 2019.

- This is the Canary Islands with 13.1 million tourists in 2020. Again this was lower than anticipated as 4.4% fewer tourists visited the area.

- The area which has lost popularity is Madrid with just 7,638,375 tourists in 2020.

- https://www.caixabankresearch.com/en/sector-analysis/tourism/spanish-tourism-sector-strong-start-2023

- https://www.lamoncloa.gob.es/lang/en/gobierno/news/Paginas/2023/20230403_international-tourists.aspx

- https://www.statista.com/statistics/261729/countries-in-europe-ranked-by-international-tourist-arrivals/

- https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Tourism_statistics&oldid=587265

- https://www.statista.com/statistics/447683/foreign-tourists-visiting-spain-by-country-of-residence/

- https://www.statista.com/statistics/447683/foreign-tourists-visiting-spain-by-country-of-residence/#:~:text=The%20United%20Kingdom%20was%20the,foreign%20visitors%20to%20Spanish%20territory .

- https://www.worlddata.info/europe/spain/tourism.php

- https://www.ine.es/dyngs/INEbase/en/operacion.htm?c=estadistica_C&cid=1254736169169&menu=ultiDatos&idp=1254735576863#:~:text=Tourism%20activity%20reached%2097%2C126%20million,%2C%2011.4%20%25%20of%20total%20employment .

- https://www.oecd-ilibrary.org/sites/8ed5145b-en/index.html?itemId=/content/component/8ed5145b-en#:~:text=Spanish%2520domestic%2520tourism%2520is%2520also,(%252B1.9%2525%2520from%25202017)

- https://www.investinspain.org/en/industries/tourism-leisure

- https://www.oecd-ilibrary.org/sites/fbfbf269-en/index.html?itemId=/content/component/fbfbf269-en

- https://www.investinspain.org/en/news/2020/NEW2020844637_EN_US

Hello! I am Axel, tripplo.com’s travel savings, deals and discounts expert and founder. I have been in the travel deals and discounts industry for almost a decade now. It’s me who publish and update most of the content and discounts on tripplo.com! I also have a podcast in which I share valuable information about how to get the best travel deals and discounts.

No Comments

Leave comment, or cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Login To Your Account

Register your account, recover your account.

Company information:

Next stop for Spanish tourism excellence: Sustainability

Tourism is vital to Spain. The country’s natural attractions and cultural assets draw crowds from around the world—making many of its communities reliant on tourism. Pre-pandemic, Spain was the second-largest tourism destination in the world, drawing 84 million visitors in 2019 who brought over €92 billion in revenue. 1 “Spain: Economic and infrastructural situation,” Climate ADAPT, Climate ADAPT website, updated March 15, 2021; “Satellite account of tourism in Spain,” INE, January 7, 2022. Travel and tourism accounted for around 14 percent of Spain’s total GDP and provided one in eight jobs. In some communities, tourism contributed to over 20 percent of all economic activity . While these figures plummeted during COVID-19, travel and tourism is recovering and Spain remains dependent on success in tourism.

Spain’s tourism sector now faces new challenges. Fears of a global recession, and geo-political uncertainty, could put pressure on tourism. And as travel resumes in an era of high inflation, Spain will likely face stiff competition from several destinations that also offer sunshine and coastal vacations at similar, or lower, prices—Egypt, Greece, and Turkey, for example.

The sector also faces physical and economic threats due to climate change. The Mediterranean basin is getting warmer: the number of days above 37°C in southern Spain is expected to double by 2050 and rising temperatures increase the risk of drought, water stress, wildfires, and floods. 2 “ A Mediterranean basin without a Mediterranean climate? ” McKinsey Global Institute, May 2020. Extreme weather is already evident as the pre-summer season of 2022 saw temperatures climb above 40°C in Seville. 3 “Spain is hit by the hottest pre-summer heatwave for 20 years as temperatures climb to 43 C,” Euronews, June 14, 2022. An increase in the number of “too hot” days could discourage tourism, particularly in peak season. For instance, a 2022 survey by a travel insurance company found that 65 percent of UK holiday makers thought Spain would be too hot to visit by 2027. 4 Charlotte Elton, “Spain, Greece, Turkey: Most Brits think holiday hotspots will be ‘too hot’ to visit by 2027,” Euronews, September 9, 2022.

Of course, Spain’s tourism sector cannot combat climate change alone. But this backdrop underscores the urgency to act. Globally, tourism is a significant contributor to emissions, and Spain can play a role in emissions reduction. In 2019, tourism was responsible for about 11 percent of greenhouse gas emissions, worldwide. Of this, the largest emissions came from domestic and international tourism in China, India, and the United States. Compared to these top three, Spain ranks at number 16 for emissions from tourism. 5 Sustainability in travel 2021: Quantifying tourism emissions for destinations, Skift Research, June 2021. Considering the size of Spain’s tourism industry, the country compares well against these destinations, but there is room for improvement.

Spain can set itself apart by prioritizing sustainability, including environmental issues such as water usage, plastic waste, carbon emissions, and social issues such as how tourism affects local communities. Globally, travelers are becoming more aware and are seeking out vacations with less impact on the environment and on local communities. Sustainability could become a key differentiator.

Furthermore, sustainable travel could draw discerning premium travelers who will likely be willing to pay for offerings that uphold their values. But efforts to draw these travelers will need to extend beyond marketing and involve real operational changes. Gen Z travelers, in particular, don’t care what tourism businesses say about their sustainability efforts, they want to see it in practice. 6 Dawit Habtemariam, “Tourism’s sustainability pitch needs to be more subtle for Gen Z,” Skift, March 8, 2023. Gen Zs, who typically have a heightened awareness of climate change, are looking for eco-friendly accommodation options. Skift found that 38 percent of Gen Zs across the world would consider staying in green accommodation on their next holiday, compared to the 33 percent response rate of those over 25. 7 Mary Ann Ha, “Meeting the high expectations of the Gen Z traveler: New report,” Skift, June 21, 2022.

This article examines the key aspects of sustainability that are relevant to travel and tourism and suggests ways in which stakeholders across Spain’s tourism sector could prioritize and invest in sustainable offerings. Such actions can ensure that this important sector remains competitive, and help to safeguard its assets for future generations.

Spain is a leading destination, but faces strong competition and a tough operating environment

The physical and economic consequences of climate change, global economic environment, strong competition, and changing consumer preferences all put pressure on the sector. Worldwide, rising inflation could prompt consumers to cut back on travel, or “downtrade” to cheaper destinations. While “revenge travel” boosted tourism as travel restrictions eased, the threat of a looming recession could dampen appetite for travel.

European travelers want to visit beaches that are conveniently close, warm, and affordable. The largest outbound markets for sun and beach tourism include Germany, the United Kingdom, Scandinavia, the Netherlands, Belgium, and Austria. Spain is a popular destination for sun and sand, accounting for almost one-third of international overnight trips to the EU’s coastal areas in 2021. 8 Eurostat dataset: Nights spent at tourist accommodation establishments by degree of urbanization and coastal/non-coastal area, accessed January 18, 2022. But, Spain competes with other destinations, in the Mediterranean and beyond, that cater to these tourists.

Even if overall demand falls, select locations across the country are at risk of over-tourism. Pre-COVID-19, a World Economic Forum report placed Spain first out of 140 competitive countries in travel and tourism. 9 The Travel & Tourism competitiveness report 2019, World Economic Forum, September 4, 2019. The report warned that one-third of international arrivals are concentrated in the top ten countries, and this concentration can lead to severe pressure, and negative effects, on tourism infrastructure and services as well as local populations.

Several Spanish beach destinations have struggled with unruly visitors, and some cities have experienced an anti-tourism backlash in the wake of overcrowding. 10 “Irish tourist seriously injured in fall from balcony in Spain,” Murcia Today, May 5, 2022; “Why Barcelona locals really hate tourists,” Independent , August 12, 2017. Authorities have stepped in to manage the situation in specific locations. For example, in 2020, Spain introduced new laws to limit alcohol consumption at all-inclusive resorts in the Balearic Islands. 11 “Britons limited to six drinks a day in Ibiza and Majorca on all-inclusive breaks,” Evening Standard, April 29, 2022. And several cities, including Madrid and Barcelona, introduced stricter regulations for private short-term accommodation rental to tourists to protect the long-term housing market. 12 “Barcelona wants to ban renting private rooms to tourists,” Bloomberg, February 5, 2021; “Barcelona takes on Airbnb,” New York Times, September 22, 2021.

These efforts could make tourism more sustainable for the long term. But the industry itself may be adding to conditions that make tourism unsustainable for the local workforce. Seasonality is a major hurdle in this regard. The country’s core tourism destinations have high seasonality, leading to peaks and troughs in employment. Unemployment reaches around 20 percent in the low season (exhibit).

A focus on all aspects of sustainability can improve the sector’s (and the country’s) perception and reputation—and ultimately affect tourists’ willingness to visit.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

What sustainability means for travel and tourism.

Sustainability is becoming increasingly important to travelers. In 2022, Booking.com found that more than 70 percent of global travelers intend to travel more sustainably over the next year (a 10 percent increase on the company’s 2021 survey) and 35 percent said that the sustainability efforts of accommodation and transport providers play a strong role in their booking decisions. 13 Sustainable travel report 2022 , Booking.com.

But what does sustainable travel mean? According to the World Tourism Organization, sustainable tourism addresses the needs of visitors, the industry, the environment, and host communities based on three interdependent factors: 1) social sustainability (respect for the socio-cultural authenticity of host communities, support for local businesses, and levels of tourism that are acceptable to local communities); 2) environmental sustainability (measures to reduce environmental impact and preserve natural heritage and biodiversity); and 3) economic sustainability (business models that achieve economic growth without negatively impacting social, environmental, or cultural aspects of communities). 14 “Sustainable development,” UNWTO website.

By improving environmental and social sustainability, organizations across the travel and tourism value chain can strengthen their business models and reach economic sustainability. Without considering social and environmental factors, economic viability may be difficult to reach or maintain in the long term.

Several countries are taking an integrated approach to tourism development with the goal of becoming more resilient, sustainable, and inclusive. In some instances, this means adapting a country’s tourism offerings to reduce seasonality and the strain it puts on local infrastructure and resources. Increasing visitors in off-peak periods can lead to year-round jobs and businesses. For example, Slovenia has committed to 20 projects to transform mountain destinations into year-round resorts for active holidays outside of ski season. 15 OECD tourism trends and policies 2022, OECD. And Norway’s “Norway all year round” plan aims to spread tourist traffic across several locations and seasons. The plan intentionally does not market Norway as a cruise destination and aims to attract travelers in source markets who are available to travel all year round, and have the means to do so. 16 “Making Norway an all-year-round destination,” Sustainable Tourism in the North website.

Transforming the tourism workforce

New Zealand’s Tourism Industry Transformation Plan begins with a focus on the workforce as the core element of developing a thriving tourism system. The plan paves the way for better experiences for those within the industry as a way to deliver better outcomes for employees, businesses, and visitors.

The plan puts forward new ways of working, for instance, to improve employment standards and practices relating to decent pay and career progression, and to provide fit-for-purpose education and training.

Another innovation “embrace the flux, enable the flex” aims to reframe the tourism industry’s attitude to seasonality. Rather than the peaks and troughs being a barrier to attracting and retaining employees, the industry can use peaks and troughs to its advantage to upskill people, provide consistent employment, and reduce barriers to people holding multiple jobs across the year and across sectors.

One of the initiatives involves collaboration between tourism and conservation employers to help employees maintain stable employment, remain in regions with limited employment offerings, and support the wider community. It also enables tourism employees to gain local conservation knowledge and skills, and those workers can then share their expertise and insights with visitors and increase the value of the tourism offering in the region.

Source: Tourism Industry Transformation Plan: He Mahere Tiaki Kaimahi, Better Work Action Plan, New Zealand Government, March 2023.

Other country-level social and economic sustainability initiatives focus on the tourism workforce. New Zealand recently launched a transformation plan aimed at improving conditions for those who work in the tourism industry, as a basis for transforming the entire sector (see sidebar “Transforming the tourism workforce”).

Travel businesses have also taken steps to reduce the effects of seasonality on the local workforce, for example, by sharing staff. In Geneva, the Ice Castles attraction that has a four-month winter season shares staff with the Lake Geneva Ziplines & Adventures company. This provides extra work and helps to retain staff at both businesses each season. 17 Nathan Andrew, “How to maximize the value of tourism shoulder season,” Blend, August 2021.

The social, environmental, and economic aspects of sustainability are intertwined in global consumers’ perspectives. Booking.com respondents around the world said they chose sustainable options because they wanted to reduce their impact on the environment, have a more locally relevant experience, or believed that sustainable properties treat communities better. 18 Sustainable travel report 2022 , Booking.com.

Spanish respondents held similar views on sustainability as their global counterparts—they are concerned about waste and energy consumption, and 79 percent intend to walk, cycle, or take public transport during future trips. Respect for local communities is important, too, as 68 percent want authentic experiences that are representative of local culture. In addition, 68 percent will go out of their way to avoid popular destinations and attractions to avoid contributing to overcrowding. 19 Sustainable travel report Spain 2022 (Informe Global Sobre Turismo Sostenible 2022) Booking.com.

Considering that in 2019, 45 percent of tourism spend in Spain was domestic, Spanish traveler sentiment is particularly relevant to Spain’s tourism offerings, for locals and international tourists alike. 20 Global travel service data from Oxford Economics.

Globally, hospitality providers may be at risk of not meeting customer expectations around sustainability as there is a gap between what consumers want and what exists in the market. An earlier Booking.com survey spanning 30 countries—Spain being one of them—found that one-quarter of accommodation providers had not implemented any sustainability measures; and for those that had, only one-third actively informed their customers about the measures they had taken—and this usually happened at check-out. 21 Sustainable travel report 2021, Booking.com.

Taking action on sustainability (and actively communicating what has been done) could bridge this gap, attract new travelers, and help Spain’s tourism sector to flourish while doing good for local communities and the planet. Much of McKinsey’s research on sustainability shows that doing well and doing good are not mutually exclusive —these actions reinforce each other. Industry-wide commitment to sustainability could help to differentiate the sector, and respond to consumer needs, thereby increasing the chances of economic sustainability.

How sustainability-related initiatives provide a unique experience

Destinations around the world have demonstrated that environmental and social sustainability initiatives can protect resources and promote local communities—and become flagship projects that garner international recognition and draw visitors looking for meaningful and authentic travel experiences.

- A Dutch partnership between national NGOs and local communities created a new way to maintain beaches without threatening biodiversity. The initiative involved locals and tourists and led to a new certification method, a first around the world. In 2021, Goeree-Overflakkee was awarded the first “Green Beach” certification, and in 2022 became known as the cleanest beach in the Netherlands. 1 “Green Destinations top 100 stories 2022: Together for a new standard in biodiverse green beaches,” Green Destinations website.

- The Greek region of Attica was named the world’s leading sustainable tourism destination in 2022 by the World Travel Awards based on its cultural wealth, natural beauty, modern infrastructure, and the comprehensive plan implemented by the region in order to turn Attica into the first “green” region. 2 “World's leading sustainable tourism destination 2022,” World Travel Awards website.

- Visitors to Hiiumaa island in Estonia usually rely on private cars to visit key attractions. To provide visitors with a lower-carbon mobility option and a more authentic, nature-based experience of the island, a local entrepreneur created an electric bicycle network (including solar power loading stations) which has become popular with tourists and locals. 3 “Green Destinations top 100 stories 2022: Carbon neutral and local, new opportunities in tourism and public transport in Estonian’s green island Hiiumaa,” Green Destinations website.

- In Istria, Croatia, around half of tourists stay in small, private accommodation. Eco Domus is a certification program that teaches private accommodation providers sustainability practices on topics including water, food, health, and light and noise pollution. The aim is to provide better quality, and more sustainable, local offerings. 4 “Green Destinations top 100 stories 2022: Eco Domus, eco-friendly accommodation,” Green Destinations website.

Of course, taking action requires time, resources, and investment. Individual hotels or tourism businesses may have little incentive to redefine core offerings or invest in infrastructure to demonstrate that sustainability is important to them. But businesses that begin to differentiate themselves could reap the benefits. Many destinations in the region provide examples of how sustainable offerings can become a drawcard for visitors, and earn international acclaim and prestige (see sidebar “How sustainability-related initiatives can offer tourists a unique experience”).

The path toward eco-friendly travel in China

Actions to advance sustainability across spain’s tourism sector are emerging.

Spain developed a Sustainable Tourism Strategy 2030, a national agenda to help the tourism sector address medium- and long-term challenges including socioeconomic and environmental sustainability. 22 “Sustainable tourism strategy of Spain 2030,” Spain’s Ministry of Industry, Trade and Tourism. Even though this national sustainability strategy is in place, there are limited mechanisms to help small businesses partake and contribute. This is particularly challenging as small- and micro-sized businesses make up the vast majority of all businesses in the country’s tourism sector. According to Statista, micro-size businesses account for around 92 percent of Spain’s travel, tourism, and hospitality businesses. Small businesses make up just over 7 percent, and medium and large businesses account for the remaining half a percent. 23 Statista, Distribution of businesses in the tourism sector in Spain in 2020 by size, June 2022.

This fragmentation can halt progress and collective action, for instance in emissions reduction. Spain’s large hospitality providers are making efforts to reduce carbon emissions, and many are pioneers in the field: Melia opened Menorca’s first carbon-neutral luxury hotel in 2022, showcasing carbon-neutral operations, “intelligent” energy-efficient buildings, and circular models for water resources. 24 Tom Otley, “Melia opens Villa Le Blanc By Gran Meliá in Menorca, Spain,” Business Traveller, July 20, 2022. Iberostar has committed to becoming carbon neutral by 2030—a target that is 20 years ahead of many other international hospitality brands. 25 “Iberostar will be carbon neutral by 2030, 20 years ahead of the industry’s global target,” Iberostar press release, November 8, 2022.

In general, smaller and medium-size providers’ goals and targets are less ambitious than those of international peers, presumably because the economic benefits of such actions are unclear, or they may fear first-mover disadvantages like higher costs. Various Spanish hotel chains have committed to reducing emissions by 20 to 35 percent, with timelines ranging from 2030 to 2035. By comparison, many international brands have committed to net zero by 2050 and have strict measures in place to achieve this.

According to the Greenview Hotel Footprinting Tool, which calculates the carbon footprint of a hotel stay anywhere in the world, Spain is among the best-performing countries in terms of low-carbon room footprint and meeting footprint. While this tool points to a strong focus on water-, waste- and emissions-reduction in Spanish hotels, it is difficult to assess what actions many smaller hotels and other tourism businesses are taking on the sustainability front.

Sustainable tourism in Valencia

Valencia claims to be the first city in the world to track the carbon footprint of all tourism activities in the city and has committed to achieving carbon-neutral tourism by 2025. 1 “Valencia becomes the first city in the world to verify and certify the carbon footprint of its tourist activity,” Valencia Tourism official website, July 10, 2020.

Valencia’s official tourism website features sustainable tourism as a key element and makes sustainable offerings visible. For instance, the website encourages visitors to reduce emissions by taking public transport or traveling by bicycle and to support the local economy by shopping at smaller, local stores. It also offers tips on how to be a “responsible tourist who is committed to the environment at all times” such as using energy and water sparingly, recycling, reducing plastic, and respecting local residents.

In this way, the city has positioned itself as “the city taking care of the planet” and made sustainability its differentiating factor.

Even though there may not be concerted and unified action on social and environmental sustainability across the sector, success stories exist of initiatives being put in place that make sustainability a key differentiator (see sidebar “Sustainable tourism in Valencia”). Sector-wide efforts could increase investment into sustainable offerings, make these more visible to tourists, and ultimately position Spain as the destination of choice for sustainable travel.

How Spain could become a sustainable destination of choice

Individual travel and tourism businesses’ environmental and social sustainability efforts need to achieve critical mass if Spain is to become known as a leading destination for sustainability-conscious travelers. These actions are also vital to preserve the sector’s economic sustainability. Collective and concerted action is required to build momentum. All stakeholders have a role to play in addressing the sector’s rationale for action, setting a clear course, and developing the support structure to achieve it.

Identify the value at stake. The sector could take a high-level view to evaluate the status quo, benchmark where Spain could be, and quantify the costs and benefits of prioritizing sustainability throughout the sector, at scale. All stakeholders including policy makers, government, and industry could jointly develop a sustainable travel concept for the sector with a clearly articulated justification for action.

Costa Rica provides an example of a national tourism strategy focused on sustainability. The industry is aligned with national objectives to protect the country’s forests and biodiversity. National parks, nature reserves, and protected areas make up around one-quarter of Costa Rican territory and the sector promotes ecotourism and sustainable offerings that support the conservation of these areas. 26 “Costa Rica, a country committed to the environment,” Aquae Fundacion, July 6, 2021.

Spain’s stakeholders could also agree on industry-wide standards, as having these in place would likely accelerate the transition to sustainable tourism. Standards that align the motivations of different stakeholders and take into account the interests of all parties have a greater chance of adoption. For example, including mandatory sustainability criteria in the hotel star rating system could bring the motivations of hotel owners and operators into alignment. 27 “The path toward eco-friendly travel in China,” McKinsey, March 14, 2023. Setting unified sector sustainability targets could also boost the credibility of sustainability claims or commitments made by individual businesses.

Define a strategy. This includes establishing initiatives to address specific concerns such as decarbonization, water usage, waste management, or overcrowding and setting targets and practical actions to achieve them. For instance, one initiative in Costa Rica—as part of its conservation effort—is a ban on single-use plastic in national parks, biological reserves, and national monuments. 28 “Costa Rica, a country committed to the environment,” Aquae Fundacion, July 6, 2021.

In another example, Iceland set a strategy to reduce seasonality—a long-standing challenge for Icelandic tourism. In 2010, close to half of travelers visited the country during the summer months of June, July, or August. The travel industry, with support from the government and others, launched an international marketing campaign to promote Iceland as a year-round destination. Winter activities such as viewing the Northern lights, snowmobiling, and glacial treks became popular with visitors. Between 2010 and 2019 the share of tourists that visited in summer fell from around 50 to 34 percent, while tourist arrivals continued to grow. 29 Icelandic Tourist Board, Isavia, visitor departure statistics.

Once the strategic direction is set, sector-wide initiatives can be put in place. In New Zealand, a collaborative and concerted effort involving public and private organizations gave rise to the Tiaki Promise, a pledge that encourages visitors to take care of the country’s natural resources: “While traveling in New Zealand, I will care for land, sea, and nature, treading lightly and leaving no trace; travel safely, showing care and consideration for all; and respect culture, traveling with an open heart and mind.” One collaborator in the initiative, Air New Zealand, released an in-flight safety video that introduced the promise to travelers. 30 Kresentia Madina “The Tiaki Promise encourages tourists to care for New Zealand’s nature,” Green Network, August 26, 2022.

It is also important to rank individual measures to address challenges to ensure that competing priorities do not hinder progress. Collective action will have the most impact if all stakeholders are committed to the same issues.

Many travel and tourism businesses across the world have developed and successfully marketed sustainable products and services, such as low-impact tourist offerings that are less harmful to the environment or local communities. In fact, many travel guides publish editions dedicated to sustainable offerings. 31 Examples include Fodor’s Green Travel: The world’s best eco-lodges and earth-friendly hotels and Lonely Planet’s The sustainable travel handbook . Spain’s tourism providers could follow suit. And the sector could make travelers more aware of existing sustainable travel options through communications campaigns to draw sustainability-conscious travelers from across the globe.

Travel and tourism businesses could also extend sustainability efforts across their value chains. Examples include working with suppliers to ensure linen and towels are sustainably produced, procuring energy-efficient equipment, or engaging local communities by sourcing local food suppliers. There are also opportunities for businesses to collaborate and design sustainable offerings that combine products and services, such as sustainability-focused tours featuring carbon-neutral accommodation, electric ground transportation, and trips to local businesses.

Globally, hotel chains have partnered with sustainability-related businesses or action groups to advance their own sustainability initiatives. These actions also help to strengthen the hotel’s brand and reputation for sustainability consciousness. For instance, the luxury hotel, resort, and spa operator Six Senses partnered with the United States Coalition on Sustainability and the action platform SustainChain in an initiative to remove single-use and disposable plastics from its operations. 32 “Six Senses is the first hospitality brand to partner with the United States Coalition on Sustainability and SustainChain,” Six Senses press release, April 26, 2021. And as part of its pathway to net zero, the Radisson Hotel Group partnered with Ecovadis, a sustainability ratings provider, in a collaboration that aims to extend the EcoVadis rating to the group’s global supply chain. 33 “Radisson Hotel Group increases focus on supply chain sustainability; announces partnership with Ecovadis,” Radisson Hotel Group press release, December 16, 2021.

Spanish tourism and hospitality providers might consider similar collaborative partnerships and initiatives to build momentum for industry-wide action and raise global travelers’ awareness that Spain is committed to sustainability.

Provide guidelines and support. Smaller businesses may lack the knowledge or resources necessary to act on sustainability. Actions could be taken to bridge knowledge gaps and secure funding, at government or industry association level. Funding programs, incentive schemes, or financial instruments can accelerate adoption of sustainable solutions, especially for smaller businesses. For example, South Africa’s Green Tourism Incentive Program targets small tourism businesses like lodges and guest houses. The program funds water- and energy-efficiency assessments and recommends the optimum green solution for the business. The bulk of the cost to implement the solution is also funded by the program. 34 “The Green Tourism Incentive Programme,” Industrial Development Corporation, October 4, 2021.

The industry could also draw on available resources and convene stakeholders to share knowledge and expertise. For instance, the World Tourism Organization provides resources and guidelines for building a circular economy, reducing food waste, and tackling plastic pollution. 35 “Sustainable development,” UNWTO website.

Regulation could be put in place to support change. Regions or cities could look to establish regulations that ensure tourism activity is environmentally and socially sustainable. Progress has been made in this regard, as the Law on Circularity and Sustainability in Tourism, approved by Parliament in May 2022, made the Balearic Islands the first sustainable destination by law. 36 “Balearic Islands, sustainable tourism is now a law,” Excellence Magazine, June 21, 2022. This regulation protects seasonal tourism workers, considers local residents’ quality of life (for instance by blocking an increase in the number of beds for the next four years), reduces waste, and protects natural resources. It will also introduce a hotel classification system based on the concrete actions taken to promote sustainable tourism.

Regulatory bodies and industry associations could also support business owners with guidance, encourage implementation through incentives, and enforce regulations through penalties for non-compliance.

Spain’s tourism sector has an opportunity to further develop existing sustainability efforts, thereby protecting the future of the sector. A sector-wide focus on environmental and social sustainability can also act as a key differentiator and draw visitors who are consciously trying to travel more responsibly. Furthermore, all stakeholders could benefit if existing initiatives, and new investments, are made more visible and attractive to tourists.

Javier Caballero is a partner in McKinsey’s Madrid office, Margaux Constantin is a partner in the Dubai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Daniel Riefer is a partner in the Munich office.

The authors wish to thank Lisa Kropacek for their contribution to this article.

Explore a career with us

Related articles.

Spain’s tourism renaissance will drive economic growth this year

The recovery of the tourism sector in Spain is expected to continue, putting the industry at the centre of economic growth this year. However, due to macroeconomic uncertainty, high price pressure in the sector and lagging long-haul travel, it may take until 2024 for the number of international visitors to return to pre-pandemic levels

Spain's tourism revival expected to continue despite macroeconomic challenges

Despite macroeconomic challenges, Spain's tourism sector rebounded strongly in 2022. The country saw a remarkable increase in the number of international visitors, rising by 130% from 31.2 million in 2021 to 71.6 million in 2022, showing a strong appetite to travel again after two years of strict travel restrictions. Although disposable income was under severe pressure in many European countries last year, consumers refused to cut back on their travel spending. That being said, the number of international tourists entering Spain still remained 14% below pre-pandemic levels, proving that there is still a long way to go to full recovery.

Number of international visitors entering Spain, in absolute values and as % of 2019 levels

Challenges on the horizon: factors hindering the growth of international tourism in spain.

There are several factors that could hamper the growth of international tourism. One is that for Spain's main source countries, the UK and Germany, which accounted for 22% and 13% of international visitors in 2019 respectively, the economic outlook looks bleak. In the UK, the cost-of-living crisis has hit hard and we expect the UK economy to grow by only 0.2% this year. Meanwhile, the German economy has contracted over the past two quarters and is officially in a technical recession. We expect economic growth in Germany to stagnate this year. While the sharp fall in purchasing power is not currently deterring Europeans from travelling, it could cause price-sensitive travellers to swap Spain for cheaper destinations.

Unfavourable exchange rates are also encouraging British travellers to choose Turkey over southern European countries including Spain. A recent report by the European Travel Commission showed that Turkey had 69% more arrivals from the UK in the first quarter of this year than in 2019, while the number of arrivals in Spain was lower than in 2019. This shift in preference can be attributed to the significant price difference. The depreciation of sterling against the euro, combined with the continued devaluation of the Turkish lira against the euro, has made travelling to Turkey much more affordable for British tourists than visiting southern European countries such as Spain.

Another factor hampering recovery is the current travel restrictions on Russian travellers. In 2019, Spain welcomed 1.3 million visitors from Russia, accounting for about 1.6% of total tourist arrivals. This particular group of visitors will be completely absent in 2023. And Spain will not get a boost from Chinese tourism this year either. Although Chinese tourists are eager to travel again, they are favouring domestic trips or visits to neighbouring countries. The number of Chinese tourists visiting Spain was relatively modest even before the pandemic: about one million Chinese tourists travelled to Spain in 2019, which was only 1.3% of the total number of visitors that year.

Business travel to Spain bounces back to pre-pandemic levels

Spain is witnessing a remarkable recovery in business travel after the sharp decline during the pandemic. In the first quarter of 2023, the number of international business travellers increased by 48% compared to the same period last year, returning to pre-pandemic levels. Business travellers represent a significant proportion of the total number of visitors. In 2019, 5.4 million foreign visitors visited Spain for professional reasons, or 6.5% of the total number of foreign visitors in 2019. This means that more than one international arrival in 20 comes to Spain for business reasons.

Last year, business travel recovered more slowly than leisure travel. Due to the shift online during the pandemic, many companies became more selective about the necessity and frequency of business travel, opting more for digital meetings or conferences. In addition, economic uncertainty and the energy crisis also caused a pullback in business travel at the turn of the year. While business travel was already at 96% of its pre-crisis level in October 2022, it fell to 74% in December as many companies adopted cost-saving measures and reduced their travel budgets.

Business travel has been steadily catching up since the beginning of this year. The Spanish economy has recovered strongly from the energy crisis, growing by 0.5% in the first quarter, and business confidence has returned. In March, the number of international business travellers was already back to 94% of the 2019 level. We expect that the recovery will persist throughout this year, resulting in half a million additional business travellers visiting Spain compared to 2022. Towards the end of the year, however, we might see a slight decline again if the pace of recovery slows and the US economy falls into recession.

Number of international visitors coming to Spain for professional reasons, in % of their number in 2019

Outlook for international travel in 2023.

Despite the headwinds, the first months of 2023 already showed a promising start for international tourism in Spain this year. In the first quarter, the number of foreign visitors reached 97% of pre-pandemic levels. Falling energy prices and stable labour market conditions may have underpinned the tourism sector. If this trend continues into the summer peak, it is likely that tourism figures in the summer months could match or even exceed 2019 levels for the first time.

The recovery in international travel is expected to continue into 2023, albeit at a slower pace than last year. The tourism sector is benefiting from continued strong travel appetite and a slightly improved economic outlook, thanks to a sharp fall in energy prices. However, persistent macroeconomic concerns will slow the pace of recovery, especially in the second half of this year. All in all, we expect a total of 80.7 million tourists to visit Spain in 2023, up by 13% from the previous year but still 3% below the pre-pandemic level. It will probably take until 2024 for the annual number of international tourists to reach 2019 levels again.

Number of international visitors entering Spain each year, including ING forecast (in millions)

Inflationary challenges in the tourism sector remain elevated.

Inflation in the tourism sector remains stubbornly high, with significant pressure on all tourism activities. The consumer price index (CPI) for tourism and hospitality, a specific category within the broader index measuring price changes for tourism and hospitality-related goods and services, stood at 8.1% in April. This figure is just slightly below the peak level of 8.5% recorded in August 2022. Since the start of the pandemic, prices for tourism products and services have risen by an average of 16%.

Inflationary pressures can be attributed to two main factors. First, there are general inflationary pressures due to the increased cost of labour, raw materials and other inputs, which are passed on to consumers. In addition, sustained high demand and consumers' increased willingness to spend on travel and accommodation have given travel and accommodation providers greater pricing power. This allows them to capitalise on this higher demand by raising prices more easily.

Price pressures in the tourism sector show no signs of cooling yet

Increased price levels also have negative consequences. They may lead to a drop in domestic demand, especially among price-conscious travellers or those with limited disposable income. Moreover, potential international visitors may opt for alternative destinations that offer similar travel experiences at more affordable prices. Those who still visit Spain will adjust their spending patterns to mitigate the impact of high prices.

In March, foreign tourists spent an average of €168 per day, up 7% from March 2022. However, given average inflation of 8.1% in the tourism sector, this equates to a 1% drop in real spending. It seems that, in order to cope with significant price increases, visitors are cutting back on certain expenses, such as choosing cheaper accommodation, budget-friendly restaurants and cost-effective activities. In addition, many travellers shorten their trips as another effective strategy to reduce overall travel costs. While the average duration of a trip was 8.0 days in March last year, it has now dropped to 7.6 days.

Tourism will be the main catalyst for economic growth this year

Tourism is a significant contributor to Spain's GDP. According to data from the World Travel and Tourism Council (WTTC), for the year 2019, tourism represented 12.4% of Spain's GDP. This includes the direct impact of sectors such as accommodation, catering, transport and tourist attractions. Taking into account indirect effects as well, tourism's total contribution to Spanish GDP reached 15.2%.

Further recovery of the tourism sector will play a central role in the country’s growth this year. After a significant decline during the pandemic, Spanish tourism could further restore its importance to the Spanish economy. With household consumption declining and expected interest rate hikes dampening investment dynamics, tourism will be a key driver of growth this year. Our forecast is for growth of 1.9% for Spain, surpassing the eurozone's expected growth rate of 0.5%.

Tourism injected €187 BILLION into Spain’s economy last year, new figures show

TOURISM was one of Spain’s main economic growth areas last year, accounting for nearly €187 billion and a record 12.8% of the country’s Gross Domestic Product.

The figures have been compiled by Exceltur- a national association that brings together some 30 big tourist-related companies.

Growth in 2023 was 13.1% and was spread out over all months of the year, including the last quarter, well after the high season period.

It means that tourism accounted for 70.8% of the Spanish economy’s growth with Exceltur predicting a positive 2024.

Figures released this week showed that 2023 was a record year for Spain’s airports with passenger numbers surpassing the previous best five years ago.

Also based on the first 11 months of 2023, last year is also expected to produce record numbers of foreign visitors to Spain.

Foreign demand for Spain grew significantly last year, driven by both the sharp increase in higher-spending markets and the repositioning of higher-value segments in traditional markets.

The Central European and United Kingdom markets along with the US markets grew, compensating for the decline in German and Nordic visitors.

“We are proud that tourism is the mainstay of the Spanish economy and that it has also created more and better jobs,” said the executive vice-president of Exceltur, Jose Luis Zoreda.

If it were not for tourism, the Spanish economy would have grown by 0.8% last year, instead of the 2.4% estimated by the Bank of Spain, according to Luis Zoreda.

The forecasts for 2024 are also very positive, although more moderate, as corporate results will continue to be affected by accumulated inflation, as well as increases in salary and financial costs.

“In the year 2024, all the records of economic value that Spanish tourism has had in its history will be surpassed,” Zoreda explained.

According to Exceltur, this year will consolidate the progress of tourism activity in Spain.

It’s predicting a rise in tourist revenues to reach a record €202 billion accounting for 13.4% of Spain’s GDP- contributing 41.4% of the projected real growth of the Spanish economy.

- Spain’s tourism industry exploded in 2023 with a record-breaking 283 million passengers landing at its airports

- German and British tourists to Spain failed to match pre-pandemic figures despite a record-breaking year in 2023 – apart…

- Exceltur figures

- Foreign visitors to Spain

- Holidays in Spain

- National News

- The Olive Press

- Tourism boosts economy

- Tourism money helped Spain's economy

Related Articles

‘Madeleine McCann suspect Christian Brueckner abused my four-year-old daughter during dog walks in the park – while taking sick pictures of her’

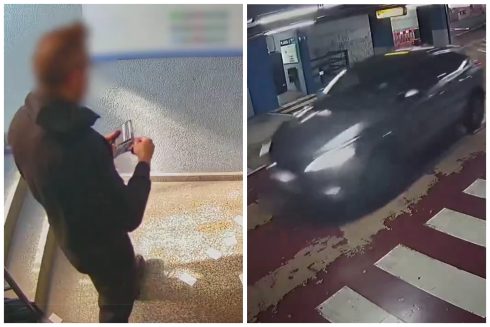

WATCH: Moment Audrey Fang’s ‘killer’ is arrested during raid at his hotel after his car was caught on CCTV: Suspect, 43, will remain in prison in Spain while the investigation continues

Protests against ‘excessive’ tourism are expected to erupt across Spain tomorrow: Malaga, Madrid, Barcelona and Granada will show support to main event on the Canary Islands

Alex Trelinski

Alex worked for 30 years for the BBC as a presenter, producer and manager. He covered a variety of areas specialising in sport, news and politics. After moving to the Costa Blanca over a decade ago, he edited a newspaper for 5 years and worked on local radio.

Leave a Reply Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

From Liverpool to Malaga: Meet the former England international who has joined a fifth-tier football club in Spain – after discovering it during a holiday to the Costa del Sol

Spanish tennis legend Rafa Nadal under fire after he signs up as Saudi ambassador for the sport

Latest from lead.

Airport expansions in Spain: Both Alicante and Valencia will increase their capacity following record-breaking passenger numbers this year

Young expat, 27, plunges to his death after ‘trying to jump between two fourth floor windows’ on Spain’s Costa del Sol after he ‘forgot his keys’

More from the olive press.

SPORTING SUCCESS: The Knee, Hand and Shoulder Unit of the Orthopedic Surgery and Traumatology Service of Hospital Quirónsalud Marbella deals with many golf, tennis/padel and watersports injuries

Olive Press subscription deal: Get three months for the price of one – then for less than €1.25 a week… as new website sees visitor numbers soar

- 19th April 2024 | Spain’s electricity cheapest in Europe, at €0 for half the hours in April

- 19th April 2024 | Puig Brands (Carolina Herrera, Paco Rabanne, Jean Paul Gaultier…) to go public on May 3, with valuation over €12.7 billion

- 19th April 2024 | Bankinter: 1Q24 First Take – Slight beat versus consensus, NII dynamics supportive

- 18th April 2024 | IMF revises growth projections upwards, signals “soft landing” for global economy

Tourism In Spain Ends 2020 With Worst Figures In 25 Years

Posted By: The Corner 6th January 2021

The Covid-19 pandemic has caused a great crisis for the tourism sector, which in Spain will end 2020 with the worst figures in decades.

In 2019, Spanish tourism saw growth for the seventh consecutive year , with over 83.7 million tourists and a total expenditure of 92.278 billion euros. This was despite the fact the sector was affected by the bankruptcy of tour operator Thomas Cook.

However, the coronavirus broke the upward trend. In April, due to the complete closure of the borders to prevent the spread of the virus, tourism fell by 100% compared with the previous year.

The latest data from the National Institute of Statistics (INE), which measures the evolution until October, shows that Spain received 17.9 million international tourists during the first ten months of the year. Meanwhile, spending declined by 77.3%.

In the following months, the EU countries again tightened restrictions on mobility. In Spain, there was a new state of alarm, with the approval of different lockdowns. And on November 23rd, it introduced the obligation of having to present a negative PCR test to access the country . The tourism sector considered this a “dissuasive” measure. In light of all this, tourism agents estimate the total figure for international visitors in 2020 will not exceed 20 million.

In its latest estimates, made in October, Exceltur expected that the levels of tourism GDP and income from foreign tourism in 2020 will be equivalent to those of 25 years ago , with a fall in tourism activity of 106.16 billion euros. So the direct and indirect activity of the sector in 2020 would be 46.43 billion euros, equivalent to the levels of 1995.

In June, the Government approved a plan to boost Spain’s tourism sector valued at 4.262 billion euros . The aim is to seek the transition to a “more sustainable and inclusive” economic model, taking advantage of the fact the industry has strategic status.

About the Author

Privacy Overview

Covid-19 crisis devastates Spain’s tourism industry

The sector has recorded its worst semester ever, with a 97% drop in visitors and 750,000 jobs at risk.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/NZI44TTU2A4VUQNAJL3MD4OD4E.jpg)

Spain’s tourism industry continues to feel the impact of the coronavirus crisis . According to figures published Monday by the National Statistics Institute (INE), just 204,926 international visitors arrived in Spain in June, a drop of 97.7% from the same month in 2019. This culminates the worst semester on record for the Spanish tourism industry , with just 10.78 million visitors, a fall of 71.7% from the same period in 2019. Tourist spending in the first half of the year has also plummeted 70.6% to just €11.84 billion.

This means that the sector has lost 27.3 million visitors and €28.4 billion in revenue in the first half of the year compared with the same period last year. And the new outbreaks, coupled with travel advisories issued by several countries , suggest that things will not improve significantly during the second half of the year.

It is the most catastrophic summer season in the last 50 years José Luis Zoreda, deputy president of Spanish tourism lobby Exceltur

The tourism sector has been one of the hardest-hit by the coronavirus pandemic and the resulting global restrictions on travel. In mid-March, the Spanish government declared a state of alarm in a bid to curb the spread of Covid-19, which limited all non-essential trips to the country. That month, international visitors fell by two thirds. The situation worsened in April and March, with zero tourist arrivals recorded – a previously unthinkable figure in a country where tourism accounts for 11.9% of gross domestic product (GDP). In mid-June, German tourists visited Spain’s Balearic Islands on a pilot program, and on June 21, the state of alarm came to an end and Spain reopened its borders to countries within the Schengen Area (with the exception of Portugal, which reopened on July 1). But despite laxer travel restrictions, Spain’s tourism industry has been unable to bounce back.

All of Spain’s regions recorded a sharp drop in the first half of the year, with tourists arrivals falling 92.2% in the Balearic Islands, 74% in Catalonia, 72.5% in Andalusia and 63.8% in Madrid. Tourist spending also fell in line with the drop in visitors. Although this figure does not represent exactly how much visitors spend in a destination, given that it also includes travel costs, which are paid in the country of origin, it is a good indication of the dire situation the tourism industry is facing. According to the latest figures from the INE, tourists in Spain spent €133 million in June – just 1.4% of the figure from the same month last year.

Making matters worse, several European countries have since issued warnings against travel to regions in Spain, while the United Kingdom, Norway and Slovenia have reimposed quarantine measures on travelers from the country.

Industry groups believe this will result in even greater losses than the €40 billion forecast, and warn that 750,000 jobs may be at risk in the second semester. “It is the most catastrophic summer season in the last 50 years,” says José Luis Zoreda, the deputy president of Spanish tourism lobby Exceltur.

Tourist spending in the first half of the year plummeted 70.6% to just €11.84 billion

“The Spanish tourism industry is facing the most difficult summer in its history,” agrees Juan Ignacio Pulido, a professor of applied economics at the University of Jaén. “We have had other challenging periods, like the crisis of 2008 and 2009, September 11 [terrorist attacks in New York] and the SARS virus in 2003, but there is no comparison to the [2020] fall in tourist numbers.”

The crisis has also impacted air travel. In the first half of the year, 43.5 million travelers passed through airports run by Spain’s airport operator AENA, a fall of 66% from last year’s figures, and 50% less than in 2009, when Spain was suffering from the fallout of the financial crisis. Indeed, in June, more travelers arrived in Spain by road than by plane.

“What is happening is that the recovery is being very slow,” says Javier Gándara, the president of the Airline Association (ALA). The association indicates that there was a 40% drop in flights in June from the same period in 2019. And according to Gándara, the travel warning and quarantine measure introduced by the British government “are going to make the recovery much slower.”

The United Kingdom is the main source of tourists to Spain – in 2019, one in every five visitors to the country was British. Although it’s not yet known what impact the travel measures will have on the sector, Exceltur’s Luis Zoreda warns that in the Mediterranean region , “the Spanish tourism industry will not in any way be able to compensate for the fall in foreign visitors.”

English version by Melissa Kitson .

More information

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/2BOQVQGRD5CBJMIVGP7W45Y5UA.jpg)

Spain’s economy posts historic 18.5% quarterly fall due to coronavirus lockdown

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/OYRYBSYODFGRBJSX6AAYQGVJFE.jpg)

UK’s new quarantine rule spells disaster for Spanish travel industry

- Francés online

- Inglés online

- Italiano online

- Alemán online

- Crucigramas & Juegos

Please wait while your request is being verified...

- Bremain History

- The Bremain Team

- Members’ Issues & Anxieties

- Our Mission

- Our Stories

- Mike Parker’s Story

- Martin Robinson’s Story

- Sandra’s Stretton’s Story

- Mike Zollo’s Story

- The Local ES

- Events 2024

- Bremainers Ask

- Bremain Glossary of Terms

- Pro-EU Groups

- How the WA affects you!

- Official Negotiation Links

- Support & Advice

- Votes for Life – the restoration of overseas voting rights

- Write to Politicians

- Get in Touch

Tourism and the Spanish economy

Apr 27, 2021 | Bylines , News

Bremain Chair Sue Wilson writes for Yorkshire Bylines:

The economies of countries around the world have been hard hit by the Covid-19 pandemic. In some cases, like the UK, the severe impact has in part been due to poor or late decisions on safety measures. Elsewhere, the reliance of some countries on certain industries has also been a significant factor. In Spain, that industry is tourism.

Lockdown restrictions in Spain were stricter than most other European countries. Having watched the crisis unfold in Italy, the Spanish authorities took decisive action. Whilst many of those restrictions have now been lifted, the country is still under a ‘state of alarm’, although this is expected to be lifted on 9 May.

Regional governments have the authority to set their own pandemic measures. Where I live in the Valencian community, the measures are some of the strictest in the country, but they have been effective. This region now has the lowest covid infection rates in the whole of Europe.

The immediate impact on tourism

But covid has had a direct and devastating effect on the tourism industry, not least here in Spain. In 2019, over 83.5 million visitors contributed over €92bn to the Spanish economy. In 2020, the number of visitors was down to 20 million, with revenues down by 75 percent – figures not seen for 50 years.

Though 2021 is expected to see those numbers recover by around 40 percent, that will still represent a significant downturn in a sector that’s responsible for 12.4 percent of GDP and 2.9 million jobs. The Balearic Islands have been hardest hit. Visitor numbers dropped from 13.6 million in 2019 to just 1.6 million in 2020, with UK visitors alone falling by 82 percent.

Long-term impact on tourism in Spain

According to the Laboratory of Tourism Analysis and Innovation, even in 2022 revenue levels are not expected to reach normal levels – a view that was supported by the Funcas think tank, back at the start of this year. At that time, the Spanish government was rather more optimistic, expecting an increase in visitors from Easter, but that never really materialised.

The minister for industry, trade and tourism, Reyes Maroto, told El Pais, “Our country’s tourism is facing the worst crisis in its entire history”. She said this was because “the two elements that define the very essence of travel are affected: mobility and confidence”.

The EU’s recovery package is set to offer hope

Despite the impact that the pandemic and the fall in visitors have had on the Spanish economy, the outlook for recovery looks hopeful. Spain is in line for a significant chunk of the EU’s €750bn covid recovery package.