You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Owners

Other Accounts

Help & Support

Personal Cards

Popular Personal Cards

Business Cards

Corporate Cards

Online Travel

Travel Resources

Business Travel

Travel Money

All Insurance Services

Travel Insurance

Benefits and Offers

Manage Membership

Corporations

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience all the features in the website.

American Express

Card insurance.

Experience the powerful backing of American Express with complimentary insurance.

Using your Insurance

Make a claim

Insurance with your Card

Confirmation of Insurance Benefit

Your Card insurance explained

Your American Express ® Card may include complimentary domestic and international Travel Insurance, as well as retail insurances like Card Refund and Purchase Cover, and/or Smartphone Screen Cover.

Terms, conditions and exclusions apply (such as maximum age limits, pre-existing medical conditions and cover limits). Use the dropdown menu below for more information.

You should review your Card Insurance T&Cs in the ‘ Insurance with your Card ’ section below, to understand when you are covered.

If you have Travel Insurance included on your Card - You, any Additional Card Members, your/their spouse and dependent children (aged 25 years or younger) are eligible for domestic or international Travel Insurance. You will need to use your eligible American Express Card or Membership Rewards Points to:

Domestic Travel Insurance:

- Pay $500 or more on accommodation, or,

- Pay the full amount of your outbound ticket for a flight, cruise, bus or train to your destination.

International Travel Insurance:

- Pay the full amount of your outbound ticket for a flight or cruise leaving Australia.

Other important things to know (both domestic and international insurance):

- You must be aged 79 years or younger at the time of the qualifying travel purchase to be eligible for insurance cover.

- Cover only applies to Australian residents

- There is no cover for one-way trips where you have no plans to return to your home or work in Australia.

Other Terms, conditions and exclusions apply (such as maximum age limits, exclusions for pre-existing medical conditions and cover limits).

You should review your Card Insurance T&Cs in the ‘ Insurance with your Card ’ section below, to understand when you are covered and what you are covered for.

If you have Travel Insurance included with your Card, see below for information about coverage when travelling in relation to COVID-19:

Domestic Travel

Cover may be provided:

- If you need to amend or cancel your trip because you or your travelling companion, close relative or a person you’re visiting for the main purpose of your trip are diagnosed with COVID-19.

Cover is not provided for:

- Cancellation or trip changes due to border closures or travel advisory warnings related to COVID-19; or

- Medical expenses related to COVID-19.

International Travel

- If you need to amend or cancel your trip as a result of border closures or upgraded travel advisory warnings related to COVID-19 that occur after you have booked your trip.

- For medical expenses you incur if you’re diagnosed with COVID-19 during your trip.

Cover is not provided if:

- The country you’re travelling to is subject to a Government 'Do Not Travel' warning or if borders are closed before your trip starts – even if you have an exemption to travel from the Australian government. However, if you need to amend or cancel your trip due to such a situation, the costs of cancellation and amendment are covered if the warning or border closure occurred after you booked and met the eligibility criteria.

Benefit Exclusions

Claims arising from or caused by COVID-19 will not be paid if:

- You're travelling against a treating doctor's advice.

- You travel after the Australian government has issued a ‘Do Not Travel’ warning or despite borders being closed, even if you have received an exemption from the Australian government to travel.

- You receive a refund, credit note or voucher for the amounts you’re claiming (for example, if an airline or hotel provide you with a credit refund). Please refer to 'Important things to Know About This Policy’ section within your Card Insurance T&Cs.

Retail Item Cover

If your Card has retail insurances - your eligible items are covered when you purchase them using your American Express ® Card and/or Membership Rewards ® Points.

Cover only applies to Australian residents. Other Terms, conditions and exclusions apply (such as cover limits, waiting periods and excesses).

Get your Confirmation of Insurance Benefit Letter

If you are a Card Member who has a Card with Complimentary Travel Insurance and need written confirmation that your American Express ® Card includes insurance benefits for border entry purposes, CHUBB Insurance can provide a letter confirming the travel insurance benefit on your Card.

IMPORTANT : This letter is not confirmation that you or anyone else is covered by the policy. To be eligible for cover, you must meet all the eligibility requirements of the policy.

As with all insurance policies - cover is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits). For more information on eligibility, see the ‘ Your Card Insurance Explained ’ section above.

It is important that you read your Card Insurance Terms and Conditions before you travel, to determine if you and your travel plans are covered. You can find the Insurance Terms and Conditions in the ‘ Insurance with your Card ’ section below.

Once you have read the above, click here to access the tool

If you hold an American Express ® Platinum Rewards Credit Card or an American Express Velocity Gold Card, please call CHUBB Insurance on 1800 236 023 to get your Confirmation of Insurance Benefits Letter.

Please note that the email with your Confirmation of Insurance Benefit Letter could take up to 15 minutes to be received.

In the event of a medical emergency

Should the unexpected occur whilst you’re travelling make sure you contact Chubb Assistance soon as practicable on +612 9335 3492. Chubb Assistance will ensure you receive fast and effective treatment from a doctor who speaks your language. Your claim may be affected should you not contact us as soon as practicable.

Lodge your claim via the Chubb Claim Centre for American Express.

Advise all claims to Chubb within 30 days of a claim event or as soon as reasonably practicable. You must submit all supporting documentation e.g. Medical reports, police reports, declarations, receipts or other such evidence Chubb may request to assist Chubb in the prompt resolution of your claim.

For all other concerns, call the Chubb Claim Centre on +61 2 9335 3492

Insurance included with your Card

Please click on your Card below to view your insurance.

The American Express ® Platinum Card

The American Express ® Gold Card

The American Express ® Rewards Advantage Card

The American Express ® Green Card

The American Express Explorer ® Credit Card

The American Express ® Platinum Reserve Credit Card

The American Express ® Platinum Edge Credit Card

The American Express Cashback ® Credit Card

The American Express Essential ® Rewards Credit Card

The American Express Essential ® Credit Card

The American Express ® Platinum Rewards Credit Card

The American Express ® Platinum MoneyBack Credit Card

The American Express ® Gold Credit Card

The Qantas American Express Discovery Card

The Qantas American Express Premium Card

The Qantas American Express Ultimate Card

The American Express Velocity Escape Card

The American Express Velocity Gold Card

The American Express Velocity Platinum Card

The David Jones American Express Card

The David Jones American Express Platinum Card

The American Express Elevate Card

The American Express Elevate Premium Card

Terms and Conditions

The insurance on American Express Cards is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits). You must use your American Express Card to pay for your trip in order to be covered under the travel insurance and pay for eligible items for those items to be covered under the retail insurance benefits. It is important you read your American Express Card Insurance Terms and Conditions and consider whether the insurance is right for you. We do not provide advice about the insurance or whether it is appropriate for your objectives, financial situation or needs. This insurance is underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb.

American Express Australia Limited (ABN 92 108 952 085). AFSL No. 291313.

® Registered Trademark of American Express Company

Small Business Cards

The American Express ® Platinum Business Card

The American Express ® Gold Business Card

The American Express ® Business Card

American Express ® Business Explorer Credit Card

The American Express ® Qantas Business Rewards Card

The Qantas American Express ® Business Credit Card

The American Express Velocity Business Card

The American Express ® Platinum Business Credit Card

The American Express Corporate Platinum Card

The American Express

Corporate Gold Card

The American Express

Corporate Card

American Express ® Qantas Corporate Platinum Card

American Express ® Qantas Corporate Gold Card

The American Express ® Qantas Corporate Card

The American Express Corporate Meeting Card

The American Express Business Travel Account

For American Express® Westpac Altitude Black and American Express® Westpac Altitude Platinum Cards, The American Express® Westpac Altitude Card insurance is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits) - see the full terms and conditions available here. You must use your American Express Westpac Altitude Card to prepay $500 of travel costs in order to be covered under the overseas travel insurance. AWP Australia Pty Ltd ABN 52 097 227 177, AFSL 245631 (trading as Allianz Global Assistance) under a binder from the underwriter, Allianz Australia Insurance Limited ABN 15 000 122 850, AFSL 234708, has issued an insurance group policy to Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714 (Westpac). This site does not take into account your objectives or financial situation.

Travel Alert – Important information regarding the Coronavirus (COVID-19), please click here

IMPORTANT INFORMATION REGARDING COVID-19

- Where there are no applicable advisories issued by the New Zealand government or a New Zealand government agency (such as MFAT) to “Do not travel overseas” or “Do Not Travel” or that borders are closed, this Policy will provide limited cover for costs incurred from having to cancel Your Journey or One Way Trip to an approved country because You contracted Coronavirus Disease 19 (COVID-19). The Policy also provides limited cover for Journey curtailment, overseas medical expenses, and mortal remains repatriation because You contracted COVID-19 in an approved country. The list of approved countries is specified below. See Section 19 – COVID-19 Cover of this Policy for full details of the cover, as well as the limits that apply as specified in the Schedule of Benefits.

- Apart from the limited cover provided in Section 19 – COVID-19, this Policy does not cover and We will not (under any other section of the Policy) pay for claims of any kind directly or indirectly arising from, relating to or in any way connected with the Coronavirus Disease 19 (COVID-19) (or any mutation or variation thereof) and/or its outbreak. To the extent that any term or condition in the Policy may be inconsistent with this exclusion, this exclusion shall prevail.

- The approved countries are: Australia, Armenia, Azerbaijan, Bahrain, Bangladesh, Bhutan, Brunei, Cambodia, China, Fiji, Georgia, Hong Kong, India, Indonesia, Iraq, Israel, Japan, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Laos, Lebanon, Macao, Malaysia, Maldives, Marshall Islands, Micronesia, Mongolia, Myanmar, Nepal, New Zealand, Northern Cyprus, Oman, Pakistan, Palestine, Papua New Guinea, Philippines, Qatar, Samoa, Saudi Arabia, Singapore, Solomon Islands, South Korea, Sri Lanka, Taiwan, Tajikistan, Thailand, Timor, Turkey, United Arab Emirates, Uzbekistan, Vanuatu, Vietnam and Yemen.

AMERICAN EXPRESS TRAVEL INSURANCE

Don’t travel without it

Cover for COVID-19

* This policy provides cover for costs incurred from having to cancel, curtail or change your trip because you contract COVID-19 and it is first diagnosed after the policy is issued. The Policy also provides cover for overseas medical emergency expenses incurred on your overseas trip, and transportation of remains or burial if you die during your trip, as a result of you having contracted COVID-19 which was first confirmed or diagnosed while on Your Trip (unless you were COVID-19 positive when your trip began, or you travel against a government issued “Do Not Travel” warning or border closure).

We do not cover trip cancellation, curtailment or change due to border closures caused by COVID-19. Limits apply and vary with each plan. See Policy Wording and PDS for full terms, conditions and exclusions.

- What is covered

Cover for COVID-19

Cover for overseas medical expenses, emergency medical evacuation, and trip cancellation, curtailment or change, due to your Covid-19 diagnosis. See details above.

Medical Expenses

Provides cover for repatriation/evacuation, cost of overseas emergency medical treatment, emergency dental treatment and extra accommodation costs, in the event of a medical emergency while on your overseas trip. Excludes claims arising from pre-existing medical conditions.

Travel Inconveniences

The Policy provides cover if you need to cancel, curtail or change your trip due to certain unforeseen circumstances including injury or illness (excluding pre-existing medical conditions). The Policy also covers trip delay by providing additional hotel accommodation (room only) if your flight is cancelled or extensively delayed (waiting periods apply), as well as cover for lost or damaged personal baggage and travel documents (theft report required, limits and sub-limits apply, excludes items stolen if left unattended in a public place).

24-hour Worldwide Assistance

We support you with advice and assistance services 24 hours a day, seven days a week for medical or other emergencies while on your overseas trip and which are covered by the policy.

Optional add-ons

Options include snow sports cover, cruise cover and rental vehicle excess cover (additional premiums apply).

Cover for accidental death, hijack and kidnap cover, and cover for personal liability incurred, while on your overseas trip (excluding liability for use of vehicles or watercraft). Cover also provided for loss of income due to an overseas injury causing temporary total disablement

Travelling against Government advice? We will not cover losses, pay or reimburse any costs, under any section of this Policy, arising from circumstances where: (a) prior to the Issue Date specified on Your Certificate of Insurance in the case of a claim for Cancellation; or (b) prior to You starting a Trip for all other claims under the Policy; an Australian State, Territory or the Federal Government or a government agency (such as DFAT) issued a ‘Do Not Travel’ warning or advising that borders are closed, for the destination You planned to travel to. Please refer to who.int, smartraveller.gov.au, dfat.gov.au or other government sites for further information.

Travel Insurance

Protect yourself and your belongings when you travel with American Express Travel Insurance. You can choose from a range of plans and cover options.

Single Trip Insurance

Our Single Trip policies are designed to provide cover for a single trip away. You can choose from a number of different plans, such as Essential, Comprehensive or Ultimate.

Coverage Optional Add-Ons

You can select from a range of optional extra covers to customise your policy. These include Rental Vehicle Excess, Snow Sports Cover and Cruise Cover.

This frequently asked questions (FAQ) document has been prepared to address some frequent coverage queries relating to the American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS) . The FAQs are a summary only, they are not an exhaustive list of the coverage, terms, conditions or exclusions in the Policy.

Limits apply and vary with each plan. Please refer to the Policy Wording and PDS for further information on the terms, conditions and exclusions of the policy.

If I am diagnosed with COVID-19 during my overseas trip, will my overseas medical expenses be covered?

Yes, if you are first diagnosed with COVID-19 while on your overseas trip and require immediate medical treatment, cover is provided for the cost of medical treatment incurred overseas. Except where you were COVID-19 positive when your trip began, or you travel against a government issued “Do Not Travel” warning or border closure.

If I’m positive with COVID-19 when my trip begins, will I be covered for COVID-19 related medical expenses during my trip?

No, you’re not covered for medical expenses incurred during your trip if you were diagnosed with COVID-19 before your departure.

If I become ill with COVID-19 before or during my Trip, will I be able to claim for costs I incur for the Cancellation or Curtailment of my Trip?

Yes, cover is provided for costs arising from a necessary and unavoidable trip cancellation or curtailment as a result of an unforeseen illness (including COVID-19) where:

- you first contract and are diagnosed with COVID-19 after the policy is issued;

- a doctor confirms the illness in writing; and

- the illness is not a pre-existing medical condition.

I no longer want to travel because I am worried about the spread of COVID-19. Are my trip cancellation, curtailment or change costs covered?

No, cover is not available in this scenario. Simply no longer wishing to travel is not covered under the Policy.

If I need to cancel, curtail or change my trip due to a COVID-19 border closure as announced by any departure or destination government, am I covered?

No, cancellation due to COVID-19 government related travel advisories and/or border closures is not covered.

If I am diagnosed with COVID-19 after commencing my trip and subsequently issued with a quarantine order, will I be covered for the quarantine costs?

Yes, additional travel or accommodation expenses incurred are covered (within the benefit limitations) as a result of a mandatory quarantine order by a local government or public health authority. Except where you travel against a government issued “Do Not Travel” warning or border closure.

I have been classified by a public health authority as a close contact with a person diagnosed with COVID-19 and have been required to isolate as a result of this contact. Is there any benefit that I can claim?

No, cover is not available in this scenario.

Do I need to be vaccinated against COVID-19 to be eligible for the COVID-19 cover under this policy?

No, you do not need to have the COVID-19 vaccination to be eligible for cover under this policy. However, you will not be covered for any claim for cancellation, curtailment or trip change where you do not meet the vaccination protocols required by your transport provider or by any government authority (in Australia or at the destination) prior to departure.

Is there an option to purchase COVID-19 Cover on a stand-alone basis?

No, COVID-19 cover is not available on a stand-alone basis.

Are Pre-Existing Medical Conditions covered?

This policy does not cover any pre-existing medical conditions. If you have a pre-existing medical condition, this cover may not be right for you. Before you purchase a policy, you should consider whether a medical condition is considered pre-existing based on the definition of ‘Pre-Existing Medical Condition’ which is found on page 10 of the American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS).

What is a "Pre-Existing Medical Condition"?

A Pre-Existing Medical Condition generally means any medical or dental condition, illness, injury or disease that you previously required or continue to require treatment for, or that is under investigation at the time the policy is issued. It’s important to check the full definition of “Pre-Existing Medical Condition” on page 10 of the American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS) before making your purchase, as variable limits and time restrictions apply to specified conditions.

If I need medical treatment during my overseas trip, will my overseas medical expenses be covered?

Yes, if you suffer an unforeseen illness or injury on an overseas trip which requires immediate medical treatment, cover is provided for your medical expenses incurred overseas. It’s important to always check the American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS) , which excludes claims arising from pre-existing medical conditions and participation in certain sports.

Is cover provided for trip cancellation, curtailment or change due to a natural disaster at my intended travel destination?

Yes, provided there had been no official publication (prior to the purchase of the policy) warning that the natural disaster had occurred or was likely to occur. Please note that natural disasters do not include epidemics or pandemics (which are excluded under the policy).

I am unable to obtain my passport, entry visa or other required documentation in time and need to cancel my trip. Is this covered?

No, failure to hold or obtain all required documentation for your trip is not covered.

If I need to cancel my trip due to an illness or injury before my departure, am I covered?

Yes, cover is provided for trip cancellation which is necessary and unavoidable as a result of an unforeseen illness or injury as confirmed by a doctor in writing. The illness or injury must first be contracted or occur after the policy is issued. It’s important to check American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS) for details on pre-existing medical conditions which are not covered.

Is a video camera (or any other item) on loan or hire for the trip covered?

No, any items loaned, hired or entrusted to you are not covered

What happens if my luggage is delayed by the airline when I’m on my trip?

We will reimburse essential emergency clothing and toiletry expenses incurred (as required for a 24-hour period, up to the benefit amount under ‘Delay of Personal Baggage’ applicable to your chosen plan) if your luggage is delayed for 12 hours or more. If your luggage is delayed for more than 36 hours, the limit is increased up to the benefit amount under ‘Extended Delay of Personal Baggage’ applicable to your chosen plan.

Who is eligible for cover under the policy?

All people covered under the policy must be Australian residents and 79 years of age or younger. You must purchase your policy before your trip commences, and the trip must start and end in Australia.

When can I purchase my American Express Travel Insurance policy?

You can purchase the policy up to 12 months before your trip commences.

Will my policy be valid if I start or end my trip outside of Australia?

No. Your trip must begin and end in Australia for your policy to be valid.

Is there a maximum age on the policy?

Yes. Covered persons must be 79 years of age or younger before the date your policy is issued.

Do I need to undergo a medical examination to apply for the policy?

No. However, please note that pre-existing medical conditions are not covered.

Will I be covered if I purchased the policy after the commencement of my trip?

No. Cover is only applicable if your travel insurance is purchased before you start your trip.

Is there a maximum travel period on the policy?

Yes. The maximum trip duration is 180 consecutive days.

Is pregnancy covered under the policy?

The policy provides limited pregnancy cover. Pregnancy related claims are covered under the following sections of the policy:

- Overseas medical expenses cover - If you have a sudden and unexpected pregnancy related injury or illness which occurs before the end of the 23rd week of your pregnancy

- Trip cancellation and amendment cover - If you have a sudden and unexpected injury or illness arising from your pregnancy that a doctor confirms will prevent you from commencing or continuing the trip.

There is no cover for costs associated with childbirth or the health of a newborn child, or for claims arising from any pre-existing medical condition (including any medical condition related to a previous pregnancy or if you have experienced pregnancy complications prior to purchasing the policy).

If my flight is delayed, am I covered?

Yes. We will reimburse additional accommodation expenses (up to the benefit amount under ‘Delayed, cancelled, overbooked or missed onward flight’ applicable to your chosen plan) if your flight is delayed for 6 hours or more. If your flight is delayed for more than 30 hours, the limit is increased up to the benefit amount under ’Extended Delayed, cancelled, overbooked or missed onward flight’ applicable to your chosen plan.

Is there a cooling off period?

Yes. You may cancel your policy for any reason within 14 days of issue (cooling-off period). You will receive a full refund of the premium you paid, provided:

- you haven’t started your trip; or

- you haven’t made a claim; or

- you don’t want to make a claim or exercise any other right under the policy.

What is Chubb Assistance? How does it work?

Chubb Assistance is an emergency assistance service. Support is available for emergency advice and assistance services 24 hours a day, 7 days a week for medical or other emergencies while on your overseas trip and which are covered by the policy. In the event of a medical or similar emergency, simply call our emergency response team on +61 2 8907 5666 to get immediate assistance and help accessing vital services in your local area where covered by the policy

Further Questions?

Please contact Chubb on 1800 139 149 or email us on [email protected] for any questions you may have.

Any Questions?

Contact Chubb on 1800 139 149

(Monday - Friday: 8:30 am to 5:00 pm)

American Express Travel Insurance is issued and underwritten by Chubb Insurance Australia Limited ABN 23 001 642 020, AFSL № 239687 (Chubb) and distributed by American Express Australia Limited, ABN 92 108 952 085, AFSL № 291313 (American Express). Chubb and American Express only provide general advice and do not consider your objectives, financial situation or needs. To decide if this product is right for you, please read the American Express Travel Insurance Policy Wording and Product Disclosure Statement (PDS) . Terms, conditions, exclusions and sub limits apply. The Target Market Determination for this product can be found here . Please take this opportunity to also read the American Express Financial Services Guide (FSG) and Chubb Privacy Statement .

© American Express Company

Frequently Asked Questions

When can i purchase my american express travel insurance.

Single Trip:

You can purchase up to 9 months before your journey commences. Cover for Trip Cancellation and Amendment Cover is provided from the issue date (the date we agree to provide insurance) until the end of your period of insurance, as stated on your certificate of insurance.

All other cover starts from the start date (the date your journey begins) and continues until the end of your period of insurance.

What is the cooling off period?

You have fourteen (14) days from the time you are issued your certificate of insurance that you are covered under your policy to decide if this insurance meets your needs.

You may cancel it within the fourteen (14) days cooling-off period. You will receive a full refund of the premium you paid, provided:

If you request to cancel your policy outside the cooling-off period, we may:

- refund any unused proportion of your premium (from the date the refund request was received until the end date on your certificate of insurance); and

- minus any administration fee;

Are Pre-Existing Medical Conditions Covered?

This policy does not cover any pre-existing medical conditions . If you have pre-existing medical conditions, this cover may not be right for you. Before you purchase a policy, you should consider whether a medical condition is considered pre-existing based on within this policy.

Is there a maximum travel period that the American Express Travel Insurance Single Trip will cover?

Yes – the maximum journey period is 180 consecutive days.

Chubb Assistance is a 24 hour emergency help line. In the event of a medical or similar emergency overseas, you simply call (reverse charge) the number shown on the card (+61 2 8907 5666) and Chubb Assistance will assist in locating immediate assistance or vital services in your area.

We support you with emergency advice and assistance services 24 hours a day, seven days a week for medical or other emergencies covered by the policy. Our international resources and global network of skilled medical and travel specialists will be there for you in the event of an overseas emergency, giving you the help and support you need, when and where you need it.

In the event of a medical or similar emergency, simply call our emergency response team on +61 2 8907 5666 to get immediate assistance and help accessing vital services in your local area where covered by the policy.

I’m pregnant - Can I get cover?

If you are or become pregnant after the issue date on your certificate of insurance, you are covered for claims that arise from your pregnancy, under:

- if you have no elevated clinical risk factors: This injury or illness occurs before the end of the 23rd week of your pregnancy, which is calculated from the last known date of your menstrual period or calculated from staging ultrasound; or

- If you have elevated clinical risk factors: This injury or illness occurs before the end of the 19th week of your pregnancy, which is calculated from the last known date of your menstrual period or calculated from staging ultrasound; and

- is not otherwise excluded within the policy

- you have a sudden and unexpected injury or illness that prevents you from going on the trip, and

- such injury or illness is confirmed by medical evidence provided by a treating doctor, and

- is not otherwise excluded within the policy.

- United States

- United Kingdom

American Express Travel Insurance Review

Our verdict: american express travel insurance covers all the basics but excludes pre-existing medical conditions so if you have one, you might want to look elsewhere..

In this guide

Summary of American Express International Comprehensive policy

How does american express travel insurance cover covid-19, what policies does american express offer, here's a breakdown of american express travel insurance features, standard features, optional add-ons, how to make an american express travel insurance claim, here's the bottom line about american express travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- American Express makes claiming easy, with an online portal, email and phone options.

- The loss of income benefit is particularly strong, paying a monthly benefit of up to $2,000 for a maximum of 5 months if you're seriously injured while on holiday and subsequently unable to work.

- Pre-existing medical conditions are excluded and there's no option to add them on for an additional fee. Even American Express warns that its policy might not be right for travellers with pre-existing medical conditions.

- Even the most comprehensive American Express policy, Ultimate Plan, has a $20,000 limit on cancellation costs. There are many brands which offer unlimited cancellation cover .

Compare other options

Table updated August 2023

American Express has you covered if you're diagnosed with COVID-19 before you head on holiday or while you're away. Here's what you can expect:

- Any costs incurred from having to cancel, delay or change your trip because you or a travelling companion are diagnosed with COVID-19 - that includes additional accommodation and travel expenses.

- Overseas emergency medical costs if you need treatment for COVID0-19 while on your trip

- Transport of your remains or burial costs if you die as a result of COVID-19 during your trip.

There are some scenarios that are not covered by American Express including costs incurred as a result of mandatory quarantine or isolation, border closures or government travel bans.

Also, if you were diagnosed with COVID-19 before heading on your trip but you went anyway, you won't be covered for any COVID-related overseas medical expenses.

American Express offers four insurance policies to travellers. The Essential, Comprehensive and Ultimate plans are available to travellers heading overseas while the Domestic plan is for travellers staying in Australia.

Comprehensive

The insurer of this product is Chubb Insurance Australia Limited. It comes with a cooling-off period of 14 days and choice of $200 standard excess for international plans.

These are some of the main insured events that American Express will cover. These benefits apply across all international policies.

- Overseas medical treatment

- Lost, damaged or stolen property

- Trip cancellation or amendment

- Additional accommodation and transport

- Theft of money

- Luggage and travel delay

- Kidnap and hijack

- Personal liability

- Accidental death

American Express also offers three add-ons that provide cover for a wider range of risks.

- Rental vehicle excess cover. If your rental vehicle is damaged, this benefit will cover the cost of the insurance excess. Does not apply to campervans, motorbikes or scooters.

- Snow Sports Cover. Cover for equipment and cancellation expenses if you're going skiing, snowboarding, tobogganing or snowmobiling. .

- Cruise Cover Extends your insurance policy to cover cruises and any cruise-related claim.

Unfortunately, travel insurance doesn't cover everything. Generally, American Express will not pay your claim if it relates to:

- Unlawful, wreckless or unreasonably unsafe behaviour by you

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition

- An act of war, invasion or revolution

- Insolvency of a travel agent , tour operator or accommodation provider

- Mandatory quarantines or isolations

- You being unfit to travel or travelling against medical advice

- Childbirth or pregnancy complications after the 24th week of gestation or if you have had previous pregnancy complications

- A multiple pregnancy or one where the conception was medically assisted

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

Make sure you review the American Express PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

You can submit your claim online via the Chubb Claims Centre for American Express .

Alternatively, you can phone Chubb on 1800 139 149, Monday to Friday, 9am to 5pm AEST.

Travellers with pre-existing medical conditions might want to look elsewhere as they won't be covered by policies and American Express won't consider adding them for an extra fee.

Further, there appears to be no cover available for travellers wishing to ride a motorbike or scooter, even if you have a valid licence.

If you're still not sure about American Express, you can compare other travel insurance companies here .

How long do I have to make a travel insurance claim?

You have 60 days from your return date to submit your travel insurance claim. If you're still waiting on documentation to support your claim but worried you won't make the deadline, you can start the process and submit the additional documentation later.

Is there an age limit for American Express travel insurance?

Yes, American Express does not offer travel insurance to people over 80. However, there are plenty of other providers that offer travel insurance to over 80s ..

Do I have to have an American Express credit card to get American Express travel insurance?

No, you do not have to be an American Express customer to take out a travel insurance policy.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds.

More guides on Finder

The best travel insurance policies are different for each individual traveller.

We take a look to see if you are fully protected by insurance if your Airbnb trip goes wrong.

South Korea has become a tourist hotspot in recent years, and is usually a very safe choice if you travel smart.

Everything you need to know about taking your pet overseas including rules for flying with pets and how to prepare for your trip.

Find out how travel insurance for trip disruption actually works and policies from Australian brands.

Find out how travel insurance covers accidental death and what will be paid from in the event of a claim.

Beware when swimming at Byron, Ballina, Bondi and Bells.

Learn more about travel insurance brokers, how they are paid and the way they can help you find comprehensive travel cover.

Is travel insurance a worthy investment? Find out why travel insurance is an invaluable travel item.

Guide to high-risk travel insurance: What is and isn't covered.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

24 Responses

We are planning a trip to Switzerland and Italy June 2019 for about 3 weeks. My mother has just turned 85 and still lives independently at her home. Would we be covered if during our time away, she passed away and we needed to fly home? She has the normal age related issues but does not have any other issues other than old age. We have heard that a lot of insurers do not cover this. Thanks

Thank you for getting in touch with Finder.

The American Express travel insurance offer cover in case of death of a relative during the trip.

If you are looking for a travel insurance that can help you recover your cancellation costs including pre-booked tickets and hotels, costs associated with returning home at short notice and costs associated with resuming your journey at a later date due to family/relative emergency at home, please refer to our travel insurance for family emergency to start comparing your options.

I hope this helps.

Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers, Jeni

Hi I’m heading to Bali and wondering if your Ultimate policy cover the Volcano if it goes off

Thank you for your question.

You have contacted finder.com.au, a comparison and information service and not actually an American Express Travel Insurance.

American Express Travel Insurance covers medical emergency expense cover, travel cancellation cover, transport accident cover, travel inconvenience insurance and baggage, money and documentation cover.

It would be best to contact American Express directly as this would require for you to check the complete coverage of the insurance.

Hope this helps!

Best regards,

Is AMEX Travel Insurance available for Cruise travel to an Island within Australia?

Thank you for your inquiry.

According to the American Express Travel Insurance product disclosure statement (PDS), “cover for any cruise travel will be based on Your chosen geographical region.” Meaning that you should be covered by your standard policy. However, you should review the PDS for the exact costs covered for cruise related claims. For more information about the costs covered by AMEX or the definitions related to Australian waters, you should contact them directly.

I hope this information has helped.

Cheers, Harold

Do you insure travellers age 80 and 93

American Express Travel Insurance has different age limits for different policies:

- Ultimate and comprehensive policies have a maximum age limit of 89 years old.

- Essential policy has a maximum age limit of 79 years old.

- Basic policy has a maximum age limit of 69 years old.

- Domestic policy has a maximum age limit of 79 years old.

If you would like to check which insurers provide cover for 80 and 93 year old travelers, please head to our seniors travel insurance page.

All the best, Zubair

I am a 45yo male and had a stroke just over 12 months ago. Although my stroke was not for medical reasons (I have no risk factors) and I have been advised by my neurologist that everything has healed and I now have no more likelihood of having another stroke than the average person, it is still considered a pre-existing condition by the insurers I have spoken with. Are you aware of any travel insurance policies that would provide me with cover?

Thanks for your question. Both Cover-More and InsureandGo consider most conditions after a medical assessment. They may be a good starting point.

I hope this was helpful, Richard

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Travel Insurance

Hold tight!

We're currently revamping our travel insurance vertical. In the meantime, you can get a free online travel insurance quote through Fast Cover today!

Disclaimer:

We’ve partnered with Fast Cover, however, we do not act on their behalf. For questions relating to travel insurance policies, contact Fast Cover directly.

If you click on an affiliate link on our website and then make a purchase of the product or service, we may receive monetary compensation.

Fast Cover Travel Insurance provides travel insurance for a variety of trip types. You can get a travel insurance quote at fastcover.com.au or call 1300 409 322.

- Fastcover.com.au

- 1300 409 322

- [email protected]

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

American Express Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

307 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3166 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1176 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Purchase Travel Insurance

Travel insurance and the covid-19 virus, package policy options, custom select coverage options, pricing by age, cancellations and changes, to other travel insurance companies, to credit card travel insurance, travelinsurance.com, insuremytrip, squaremouth, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

We frequently discuss the travel insurance coverages that are offered complimentary on most credit cards . We do so because these benefits, especially the long list of travel insurance coverages on premium cards, can save you money, offer peace of mind during your travels, and provide help if something goes wrong.

These complimentary coverages are useful and can offer more than adequate coverage for most trips. However, if you’re investing in an expensive trip or 1 that involves multiple travel providers, purchasing a comprehensive travel insurance policy is a prudent move. You’d also want a travel insurance policy if your trip has a complicated itinerary or if you’re anxious about the possibility of having to cancel any portion of the journey.

Additionally, it’s imperative that if you’re worried about having medical coverage while traveling, you’d want to purchase a travel insurance policy that provides medical coverage.

Fortunately, travel insurance is widely available, reasonably affordable, and simple to secure. There are several reputable travel insurance companies , highly-rated by financial rating organizations such as AM Best , that offer nearly endless options from which to choose.

American Express Travel Insurance , underwritten by AMEX Assurance Company, is one of those highly-respected, highly-rated, established companies offering comprehensive travel insurance solutions.

Join us while we check out the types of policies the company offers, any limitations of which to be aware, and additional options for protecting your next trip appropriately.

Travel insurance can help you avoid losing the investment you made when booking your trip, reimburse you for covered expenses should your trip be disrupted due to a covered event, or pay for emergency medical services.

Policies are designed to cover disruption due to the reasons listed in the policy you purchased. These reasons consist of events that are unforeseen and unexpected.

Here are a few situations where travel insurance could cover your loss:

- You or a covered family member become ill and you must cancel your trip. Trip insurance can cover prepaid non-reimbursable expenses.

- You are injured in an accident during your trip and need to be evacuated to a hospital by air ambulance.

- You become ill during your trip and must return home versus continuing on your journey.

- Your flight is delayed or canceled and you must stay at a hotel and incur expenses for lodging and incidentals.

Whether you should purchase travel insurance or not is a personal decision. If losing your trip investment or having to pay for extra expenses if the trip is disrupted makes you uncomfortable or would present a financial burden, then you should purchase a comprehensive travel insurance policy.

If worrying about having to cancel your trip or having it disrupted during your journey is an issue, purchasing a travel insurance policy will definitely deliver some peace of mind, both prior to and during your trip.

For more tips on buying travel insurance in general, you’ll find valuable information in our guide to buying the best travel insurance .

Bottom Line: The longer, more expensive, and more complicated your trip, the greater the need for a comprehensive travel insurance policy.

When you purchase travel insurance and your trip is canceled, you expect to have coverage. However, not all cancellations are covered — only those specifically listed in your policy.

Once COVID-19 was declared a pandemic, it became a known event and therefore is not covered on travel insurance policies. While it’s reasonable to want to cancel your trip due to fear of COVID-19, canceling a trip due to the fear of any illness is not a covered reason on any travel insurance policy.

There is also no coverage for canceling a trip due to a U.S. State Department announcement warning of COVID-19 in a particular area.

In order to have coverage for voluntary trip cancellations, you would need to purchase “Cancel for Any Reason Insurance” (CFAR) . CFAR is not a stand-alone insurance policy — it is an add-on coverage you select when you purchase a travel insurance policy or coverage you may be able to add to a travel insurance policy after purchase, within an initially specified timeframe.

CFAR insurance is expensive, does not cover the entire cost of your trip, and not all companies sell the coverage, including American Express Travel Insurance.

Additionally, there is a small window of time when you are able to purchase the coverage, including during your initial purchase or up to 10 to 21 days after the purchase, depending on the company.

While American Express Travel Insurance does not cover trip cancellation due to fear of contracting COVID-19, there may be coverage in certain circumstances. For example, if you become sick with the virus and have to cancel your trip as a result, you may have coverage under trip cancellation insurance.

Additionally, if you become ill with the virus during your travels, you may have coverage under Travel Medical Protection. Terms and conditions apply.

Bottom Line: Travel insurance does not cover canceled trips due to fear of getting COVID-19 or a government declaration that a specific destination is unsafe. Cancel for Any Reason Insurance must be purchased to cover these voluntary cancellations.

American Express Travel Insurance Options

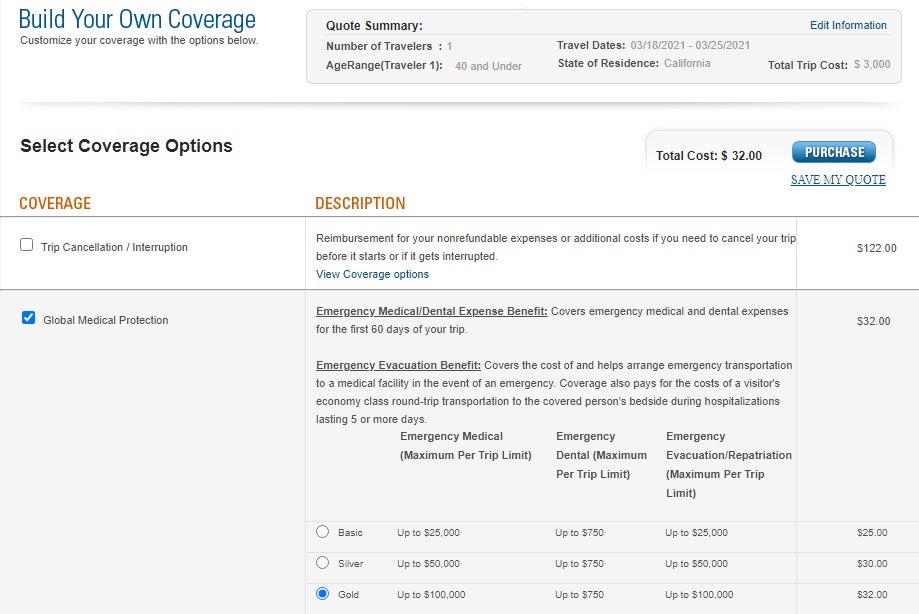

American Express offers you 2 options when it comes to purchasing travel insurance. You can select a package policy that includes several types of coverages in 1 plan or you can build your own travel insurance plan and select just the coverages that are important to you.

Coverage is worldwide except for where it would violate U.S. trade or economic sanctions. All permanent U.S. residents are eligible to purchase travel insurance with American Express.

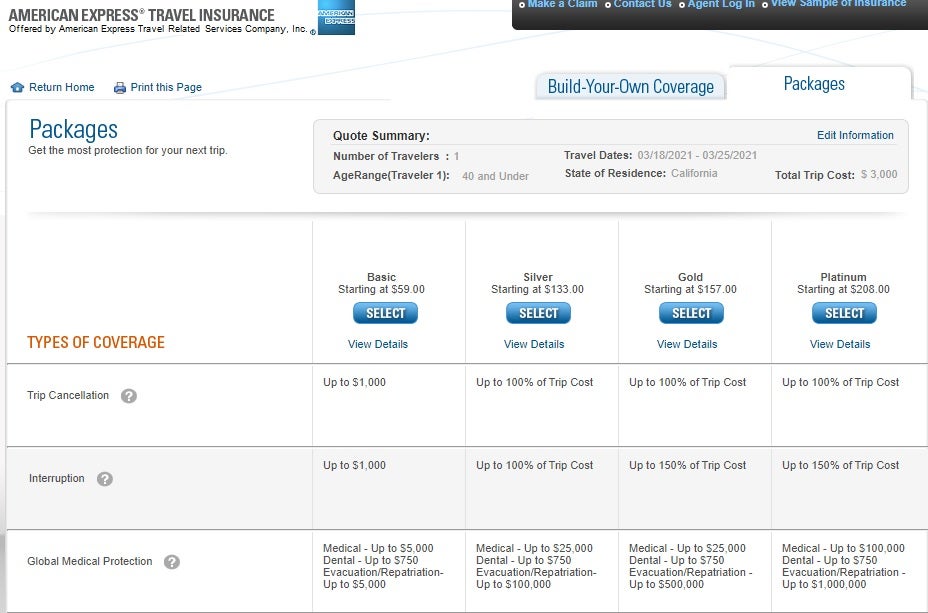

American Express Travel Insurance offers 4 levels of travel insurance package policy plans — a Basic Plan, Silver Plan, Gold Plan, and Platinum Plan. Each has its own levels of coverage and associated premium cost.

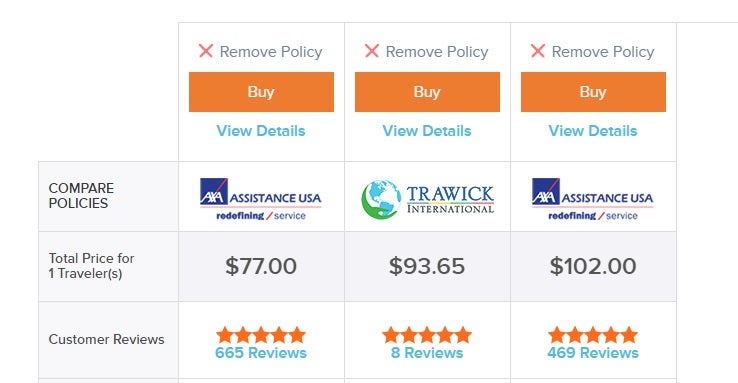

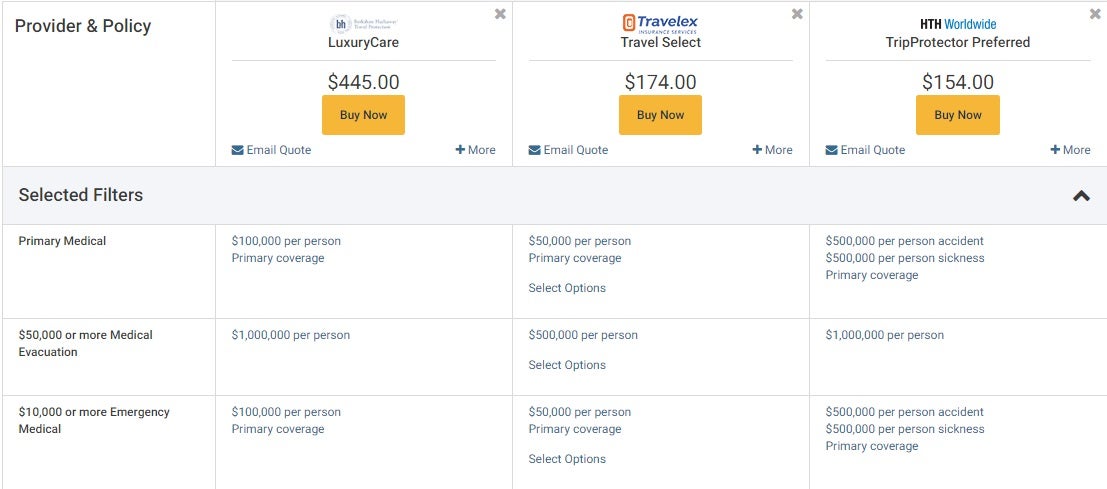

Let’s take a look at the package policy offerings and pricing. We chose a week-long trip for a 40-year old that cost $3,000. Prices ranged from $59 to $208 to cover the entire trip.