Feeling a money crunch? You could earn AARP Rewards points when you use our free financial resources.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

- AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

A Retreat For Those Struggling

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel

AARP National Park Guide

Discover Canyonlands National Park

25 Ways to Save on Your Vacation

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

Life & Home

Couple Creates Their Forever Home

Home Technology

Caregiver’s Guide to Smart Home Tech

AI Technology

The Possibilities, Perils of AI

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

Your Ultimate Guide to Mulching

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

Planning an International Trip? New Tourist Restrictions and Taxes Mean More Advance Planning

More destinations are implementing visitor-control measures in an effort to balance tourism with protection of cultural and historical sites.

Sheryl Jean,

When Linda Kuhlmann of Washington state visited Germany and Hungary last year, she found the Christmas markets so packed that she could barely move.

“They weren’t limiting the crowds,” says the 73-year-old, who has visited more than 70 countries, “but I almost wish they would have.”

That may change. While tourism-control measures — from Amsterdam to Zambia — aren’t new, they’re increasing as places become overrun by visitors .

More cities and countries are implementing tourist taxes, capping the number of visitors at popular sites, limiting cruise ship stops and even charging fines for bad behavior to help offset negative effects of so-called “overtourism,” enhance residents’ quality of life and protect cultural and historic landmarks.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Such measures, however, also raise the cost of travel for tourists and require planning further ahead with no guarantee they’ll be able to visit everything on their wish list. But some travelers also see the need.

Susan Black of Woodcliff Lake, New Jersey, thinks capacity controls in many places make sense to protect sites “as long as it’s not fleecing travelers.”

“If these places don’t have the infrastructure to handle the influx for popular sites, it puts too much pressure on local communities and travelers,” says Black, 66, who has visited more than 30 countries. “Who wants to wait in a five-hour line?”

Here are some new tourism measures for 2024 and beyond:

The Netherlands

In January, Amsterdam increased its tourism tax, the highest in Europe. The per-night tax, which went from 7 percent to 12.5 percent, applies to any overnight stay. The tax on a €175 ($189) room, for example, is €21.90 ($23.60). Cruise-ship passengers must pay €11 ($11.86) per person per day.

In January, Iceland resumed charging an accommodation tax, which was suspended during the pandemic, and extended it to cruise ships. The tax, which aims to generate funds for sustainability efforts and protect its unspoiled scenery, ranges from about $2 per overnight stay to slightly over $7, depending on the lodging.

ARTICLE CONTINUES AFTER ADVERTISEMENT

Since Feb. 14, each foreign visitor to the idyllic island of Bali must pay a new tourist tax of about $10. The tax can be paid upon arrival, but the Bali government recommends paying it beforehand on its tourism website.

In April, Greece is scheduled to launch a booking system to further limit the number of daily visitors to Athens’ Acropolis (from up to 23,000 now to 20,000) and other archaeological sites to tackle overcrowding and protect its most famous landmarks.

Holland America Line

Up to $200 onboard credit on select cruises

In January, Greece replaced its bed tax with a “climate resilience levy” to fund reconstruction after forest fires and flooding. Visitors pay the per-night tax, ranging from €1 to €10 ($1.08 to $10.77), at their lodging upon arrival during peak season, from March to October.

Starting in April, the city of Venice, which struggles with some of the world’s worst overtourism, will charge day-trippers an entry fee of €5 ($5.40) on 29 dates through July during the 8:30 a.m. to 4 p.m. peak hours. Visitors can pre-pay on a new website to get a QR code. Visitors staying in overnight lodgings are exempt but still must register. In June, Venice will limit the number of people in organized tour groups to 25.

Both measures aim to help regulate crowds and protect the fragile lagoon environment.

Barcelona is adding a city tourist surcharge on top of an existing regional tax. On April 1, under the city’s second phase of an increase, the fee will rise to €3.25 ($3.50). Visitors will pay up to €6.75 (about $7.30) in combined per-night taxes up to a maximum of seven nights, depending on the lodging type.

Valencia, which is about 220 miles south of Barcelona, plans to introduce a tourist accommodation tax later this year. It will range from about 50 cents to slightly more than $2 per night up to seven nights.

More changes are in store beyond this year.

In 2025, Denmark plans to impose a tax — it will average 100 Danish kroner ($14.37) — on air passengers to help fund its airline industry's shift to greener practices. Transit flights stopping over at a Danish airport will be exempt.

Also in 2025, the European Union plans to require travelers from about 60 countries, including the United States, to apply for travel authorization , which will cost €7 ($7.55). Adults age 70-plus don’t have to pay.

Such measures haven’t stalled global travel, which are expected to return to prepandemic levels this year. The U.N. World Tourism Organization has predicted the number of international tourists will reach 1.8 billion by 2030, up from 25 million in 1950.

“There’s no evidence that a tax situation is making tourists unhappy,” says Megan Epler Wood, managing director of Cornell University’s Sustainable Tourism Asset Management Program. “I think they’re most concerned about crowding and delays in traffic,” which can “ruin someone’s vacation.”

Wood thinks travelers will see more tourist control measures, especially since many cities are using tourism tax revenue to fund infrastructure like roads, improve neighborhoods and protect their environment and landmarks. Some of those efforts also will elevate travelers’ experience.

How to bypass the crowds

Some travelers are responding by changing how they travel. Here are some tips to avoid crowds.

Plan ahead: Planning way ahead is necessary as many attractions are issuing a limited number of timed tickets that must be reserved in advance. “You have to learn to play the game,” says Kuhlmann, who with husband, Jim, wants to visit the Anne Frank House on a visit to Amsterdam in July. “We can only get tickets six weeks ahead of time. I will set my alarm at 1 a.m. to get up … because they release them at 10 a.m. Central European time.”

Change visiting hours: Consider visiting sites in the early morning or late afternoon. Visit Iceland provides an online planning tool to help visitors avoid crowds at certain sites. It shows that 3 p.m. is the busiest time at Reynisfjara, a famous black sand beach.

Avoid peak seasons: Avoid traveling during the peak times of July, August and around Christmas.

Find lesser-known destinations : A 2022 survey by travel site Booking.com found that 61 percent of travelers are willing to skip popular tourist destinations or attractions to disperse the impact of their visit.

Instead of the Greek island of Santorini, consider the nearby islands of Naxos or Paros, which remain undiscovered by cruise ships, suggests Dimitris Tzimos, co-owner of Asimina Tours in White Plains, Maryland.

Still, “when you have someone arriving at a destination for the first time, it’s not easy to bypass these brand names,” he says. “It’s a once in a lifetime trip – say, to Santorini. How can you resist?”

Sheryl Jean is a contributing writer who covers aging, business, technology, travel, health and human-interest stories. A former reporter for several daily metropolitan newspapers, her work also has appeared in the Chicago Tribune and The Dallas Morning News and on the American Heart Association’s website.

Discover AARP Members Only Access

Already a Member? Login

MORE FROM AARP

4 Amazing Trips Abroad

5 Things to Know About the New European Fee Starting in 2025

Jamaica Travel Advisory: What You Need to Know to Stay Safe

Or Call: 1-800-675-4318

Enter a valid from location

Enter a valid to location

Enter a valid departing date

Enter a valid returning date

Age of children:

Child under 2 must either sit in laps or in seats:

+ Add Another Flight

Enter a valid destination location

Enter a valid checking in date

Enter a valid checking out date

Occupants of Room

Occupants of Room 1:

Occupants of Room 2:

Occupants of Room 3:

Occupants of Room 4:

Occupants of Room 5:

Occupants of Room 6:

Occupants of Room 7:

Occupants of Room 8:

Enter a valid date

You didn't specify child's age

There are children in room 1 without an adult

You didn't specify child's age for room 1

There are children in room 2 without an adult

You didn't specify child's age in room 2

There are children in room 3 without an adult

You didn't specify child's age in room 3

There are children in room 4 without an adult

You didn't specify child's age in room 4

There are children in room 5 without an adult

You didn't specify child's age in room 5

You have more than 6 people total

Please select a trip duration less than 28 days

There must be at least 1 traveler (age 12+) for each infant in a lap

Enter a valid From location

Enter a valid start date

Enter a valid drop location

Enter a valid drop off date

Select a valid to location

Select a month

Enter a valid going to location

Enter a valid from date

Enter a valid to date

AARP Value & Member Benefits

Hurtigruten Expeditions

5% off cruise fares and a €100 per person onboard credit

AARP Vacation Ideas

Ideas for every type of trip – from cruises to road trips

AARP Travel Center Powered by Expedia: Car Rentals

Up to 30% off select car rentals

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

COMPETITION AMONG AIRLINES GIVES CONSUMERS THE POWER OF CHOICE. LEARN MORE

- Our Priorities

- Airlines Fly Green

- News & Events

- Our Blog: A Better Flight Plan

- We Connect the World

Data & Statistics

- U.S. Government-Imposed Taxes on Air Transportation

Along with traditional income and payroll taxes, airlines and their customers (passengers and shippers) pay many special taxes and fees to a variety of authorities, both at home and abroad. Among the stated purposes of these taxes and fees are homeland (national) security, environmental protection, agriculture inspection, infrastructure enhancement, airport and airway operations and maintenance, and agency financing. U.S. and foreign taxes have grown in number, amount, and scope since the advent of air transport. The amount a passenger pays in taxes and fees on a ticket varies according to his itinerary, including the number of times he or she boards a new flight and at what airports. In addition to the special taxes and fees captured in the table below, the Federal Aviation Administration also charges overflight fees to operators of aircraft that fly in U.S.-controlled airspace, but neither take off nor land in the United States.

- Both (a) and (b) apply to domestic transport or to journeys to Canada or Mexico within 225 miles of the U.S. border; (a) is prorated on journeys between the mainland United States and Alaska/Hawaii

- Applies to the sale (to third parties) of the right to award frequent flyer miles

- Does not apply to those transiting the United States between two foreign points; $11.10 on flights between the mainland United States and Alaska/Hawaii

- Applies only to flights within the 50 states but is prorated on transportation of cargo between the mainland United States and Alaska/Hawaii

- Congress created the Leaking Underground Storage Tank (LUST) Trust Fund in 1986 to 1) provide money for overseeing and enforcing corrective action taken by a responsible party, who is the owner or operator of the leaking UST and 2) provide money for cleanups at UST sites where the owner or operator is unknown, unwilling, or unable to respond, or which require emergency action

- Funds TSA at $5.60 per one-way up to $11.20 per round trip (was $2.50 per enplanement up to $5.00 per one-way trip from 2/1/02 through 7/20/14); suspended 6/1/03-9/30/03

- Since 5/13/91 (passenger fee) and 2/9/92 (aircraft fee), funds agricultural quarantine and inspection services conducted by CBP per 7 CFR 354; APHIS continues to perform certain Agricultural Quarantine Inspection-related functions that are funded by user fee collections

- Since 7/7/86, funds inspections by U.S. Customs and Border Protection; passengers arriving from U.S. territories and possessions are exempt

- Since 12/1/86, funds inspections by U.S. Immigration and Customs Enforcement

The following table illustrates the application of government-imposed taxes/fees on a hypothetical domestic itinerary. Taxes/fees shown do not include those levied directly on the airline (e.g., income, property, franchise, sales/use, payroll, fuel).

Related Data

- Daily Jet Fuel Spot Prices

- A4A Passenger Airline Cost Index (PACI)

U.S. Passenger Carrier Delay Costs

- Annual Financial Results: U.S. Passenger Airlines

Annual Financial Results: World Airlines

- U.S. Airline Mergers and Acquisitions

U.S. Airline Bankruptcies

Quick finds.

- State of U.S. Aviation

- Domestic Round-Trip Fares and Fees

- A4A Presentation: Industry Review and Outlook

- U.S. Airline Traffic and Capacity

- Current Operation Status for U.S. Airports

- Past A4A Annual Reports (1937-2011)

Related News

Can You Deduct Your Vacation From Your Taxes? Experts Weigh In

Know what’s deductible and what’s not when it comes to submitting travel expenses on your taxes..

- Copy Link copied

If there’s a certain amount of work involved, you may be able to claim travel costs on your taxes.

Photo by GaudiLab/Shutterstock

People are traveling like crazy these days. The Sunday after Thanksgiving 2023 was the biggest single travel day in U.S. aviation history, with TSA screening more than 2.9 million passengers on November 26.

If you’re one of those travelers racking up frequent flier miles as quickly as you can fasten your seat belt, you may be looking for ways to recoup some of the cost. Can you legally write off your trip? If you’re self-employed (for example, if you’re an entrepreneur, freelancer, or consultant, or have an online business) and you did some work while on the road, there’s a good chance you can.

Here’s what it takes to get two thumbs up from the IRS.

Pass these four tests

For starters, your trip must have a business purpose, meaning it must include activities such as client meetings, attending a conference, being a guest speaker at a conference, doing research and development for the business, or holding a board meeting or annual shareholders’ meeting. The activity should have the potential to generate revenue.

“Don’t think you can take a personal trip, talk business for an hour and then try and deduct the whole amount of your trip. The intent of the trip needs to be business,” says Caitlynn Eldridge, founder and CEO of Eldridge CPA .

The second and third requirements deem that the trip must be both “ordinary and necessary,” according to IRS guidelines on business travel expenses . “An ordinary expense means it’s typical in your business, both [in terms of] amount [as well as in] frequency and purpose. Necessary means it actually helps you increase your profits or expand your business,” explains Tom Wheelwright, a certified public accountant and author of the book Tax-Free Wealth (BZK Press, 2018).

Lastly, every expense must be properly documented. To get a deduction for travel, Wheelwright said that you must spend more than half your time during the business day doing business and have everything documented. “So, if you spend four and a half hours a day doing business, it becomes deductible. You also must have documentation, which includes receipts, of what you did, and a log of your expenses,” says Wheelwright.

On receipts, write the name of the client who you had the meal with for further proof. “Save the emailed confirmation and receipt from the hotel reservation or conference ticket payment that show the dates, times, and name of the events as well as the receipts from the travel it took to get there and back [such as for gas or flights],” says Ben Watson, founder of Fiscal Fluency , a personal finance and business coaching company.

Note that for 2024, the IRS mileage reimbursement rate is 67 cents for employees or a self-employed individual traveling for work, up from 65.5 cents in 2023.

Know, too, that you must be away from home overnight—the IRS requires an overnight stay for the trip to qualify as business travel, Wheelwright says.

Domestic travel versus travel abroad

There’s a big difference between how you calculate deductions if the work trip was taken in the United States versus abroad. According to Wheelwright, “It’s an all-or-nothing test in the U.S., so either you spent more than 50 percent of your time on business, and it’s all deductible, or you spent 50 percent or less and none of it’s deductible.”

For international business travel, the deductions work differently. He explained that when you travel to another country, the deduction is proportionate. “For example, if you spent 40 percent of your time doing business in Italy, then 40 percent is deductible,” says Wheelwright.

Stick to the rules

If you normally stay in more modest hotels, trying to deduct a luxe property stay could raise red flags.

Photo by Yokwar/Shutterstock

It has to be a legitimate business trip. “You can’t simply do some work while on the beach and call it a business trip,” says Watson. But if you make it a “bleisure trip” by adding a couple days at the beach onto your preplanned business trip to the coast, you could still write off at least some of your lodging fees, he explained. If you do extend your trip for vacation, you can only deduct the expenses that were directly related to work and took place on the days that you conducted business. If you are traveling to multiple cities, keep in mind that each must have a business purpose.

You do have to work. If you are at a conference, make sure you fully participate, which means not just attending one or two sessions. If you only attend a small number of the business-related events, the entire purpose of the trip would be considered a personal trip with “incidental” business activities, Watson points out. Remember you need a log of what you did, and if it’s thin on details, it could prove problematic. “You don’t want to lose the ability to deduct transportation, lodging, meals, and other expenses,” says Watson.

If it’s a business trip of your own making, be sure it includes meetings with clients or participating in some work-related activity. “To demonstrate evidence of these events, it’s wise to put calendar appointments down in your phone in advance and hold onto receipts when the time comes to file your tax return and claim your deductions. Remember, the primary purpose of this trip is [supposed to be] for work,” says Riley Adams, a CPA and CEO and founder of WealthUp , a financial literacy website.

Don’t try to bend what “ordinary and necessary” means. “If you have the ability to accomplish the same business tasks while staying at a modest hotel as you would at the Four Seasons, you’ll have a hard time justifying the extra cost if you’re ever audited,” Watson cautions.

Stay at a place that is similar to places you normally stay on a business trip, so your expenses are considered “ordinary.” Wheelwright explains that if you usually stay at five-star hotels for your business trips, then the Four Seasons would fall into the same category. However, if you usually stay at hotels like the Comfort Inn, and suddenly switch to a luxury hotel, the high-end venue could raise red flags with the IRS. He says that it doesn’t matter whether you stay at a hotel or a vacation rental, the quality level and price tag should be similar to what is typical for your business trips.

When traveling with non–business companions, such as a spouse or family members, you may only deduct the cost of the lodging you would have paid if you were traveling alone—for example, if a single room costs $150 per night, and you paid $200 for a double room, you could only deduct at the $150 rate.

What can you deduct?

You can deduct 50 percent of the cost of business meals.

Photo by Rawpixel.com/Shutterstock

Personal meals are not deductible, but half the cost of food expenses related to business can be deducted. Expenses for your family’s meals and entertainment cannot be deducted unless they are actively engaged in the business and you can show that their expense is both ordinary and necessary.

Travel expenses are only deductible on the days in which the work-related event occurs. “For example, a taxi ride to the meeting, train to a conference, or plane ride to the event [are deductible],” says Adams. “Lodging, much like travel expenses, is deductible on the days in which business is set to occur.”

Understand too, that if you’re provided with a plane ticket paid for by your company, or you’re riding free because you’re redeeming frequent flier miles, your cost is zero, so you can’t deduct it.

But there are a couple of things you may not be aware of. For example, if you have to ship your baggage, you can deduct that cost; you also can deduct for tips for services, such as a tip to the waiter during a meal with a client.

Be strategic

It’s best to put your “vacation” days in the middle of the business days, advises CPA Greg O’Brien. “For example, if [a] business owner took a seven-day trip to Florida and spent five days meeting with clients or prospects and two days relaxing on the beach, this would still qualify as a deductible business trip. The trick is to stick the ‘vacation’ days in the middle of the business days,” he says.

By placing the vacation days in the middle, the travel days to and from are still considered business related, rather than personal.

Watson offers another tip: “Laundry, dry-cleaning and shoe-shine expenses are perfectly acceptable expenses if incurred shortly after returning home.”

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- International Business Travel Tax Deductions

Tax laws provide numerous deductions for business travel, including travel outside the U.S. To qualify for a deduction, expenses must be ordinary and necessary. This means that they are commonly accepted in your type of business, and they are helpful and appropriate for your job. They do not need to be absolutely essential. The expenses also must have been incurred for travel away from home, which is obvious for international trips. (Generally, this requirement means that you must stay outside the area of your normal tax home for much longer than an ordinary day’s work, such that you need to rest to handle your job duties while you are away from home.)

You can claim a deduction for expenses related to business travel only if it is temporary. The tax laws classify a period of working away from home in a single location as a non-deductible indefinite assignment if it lasts for over a year. An indefinite assignment also may arise if you spend many short periods that combine to comprise a long period in the same location.

Common Types of Deductible Business Travel Costs

Some examples of costs that you normally can deduct for business travel, whether domestic or international, include shipping and luggage costs, communications costs, laundry bills, and lodging. You can deduct the full cost of your lodging, regardless of how expensive it is. You also can deduct up to half the cost of any meals while you are traveling for business if they are not lavish or extravagant. You do not need to show that the meal was related to business.

- Half the cost of meals

- Transportation

- Shipping and luggage

- Communications

Transportation costs are also deductible in most cases. These include the costs of getting to the destination for your business trip, as well as costs for transportation while you are there. For example, you can deduct the cost of a plane ticket to another city and the cost of taking a taxi from the airport to your hotel or business site once you arrive. You also can deduct the cost of a car rental or any costs related to using your own car on the trip. In the unlikely event that you take a cruise ship or another form of luxury water travel to your destination, you will want to explore the special rules in these situations.

Transportation for International Business Travel

If you are traveling to a foreign country for business, you can deduct the full cost of your transportation to and from the country if your trip was entirely for business purposes. This means that you spent all of your waking hours during the trip handling matters related to your job. You also can deduct the full cost of your transportation to and from a foreign country if your trip is considered entirely for business purposes. This can be more complex.

An international trip will be considered entirely for business purposes if you do not spend more than one week outside the U.S., you spend at least 76 percent of your time on work-related activities, you did not have substantial control in planning the trip, or you can show that a personal vacation was not a major consideration in taking the trip. To qualify under the one-week rule, you must count the day on which you returned to the U.S. as part of the week, but you will not count the day on which you left the U.S. To qualify under the 76 percent rule, you must count both the day on which you left the U.S. and the day on which you returned to the U.S. To qualify under the substantial control rule, you cannot be related to your employer.

Some business expenses may still be deductible even if a trip is not taken entirely for business purposes.

Even if your trip does not fit into one of these categories, you may be able to take a limited deduction if you took the trip primarily for business purposes. (If your trip was primarily for personal purposes, you cannot take any deduction.) You will need to determine which days of the trip counted as business days and divide that number by the total number of days that the trip lasted. This will give you the percentage of the trip costs that you can deduct. A business day is defined as a day on which you needed to be present in the foreign country for business reasons, or a day on which you were principally engaged in business activity during working hours. If business days fall on either side of a weekend or holiday, those days can count as business days. Days in transit also count as business days.

Last reviewed October 2023

Tax Law Center Contents

- Tax Law Center

- Payroll Tax Law

- How the Tax Cuts and Jobs Act Legally Affects Individual Taxpayers

- Retirement Tax Deductions Under the Law

- Disability Payments & Legal Tax Exclusions

- Home Sale Tax Exclusions & Legal Requirements

- Calculating the Legal Tax Basis of a Home

- Real Estate Tax Deductions Under the Law

- Home Mortgage Tax Deduction

- Home Improvements and Repairs & Legal Tax Deductions

- Casualty Loss Tax Deductions Under the Law

- Vacation Homes & Legal Tax Deductions

- Job Expense Reimbursements & Legal Tax Deductions

- Home Office Tax Deductions for Employees & Legal Requirements

- Teacher and Educator Legal Tax Benefits

- Fringe Benefits & Tax Law for Employees

- Dependents Under Tax Law

- Child Tax Credits & Legal Eligibility

- Dependent Care Accounts Holding Tax-Free Funds for Child Care

- Adoption Tax Credits & Legal Eligibility

- Alimony & Tax Law

- Earned Income Tax Credits & Legal Eligibility

- Non-Itemized Tax Deductions Under the Law

- Remote Work & Income Tax Laws

- Lowering Personal Taxes Legally

- Paying Zero Taxes Legally

- Foreign Bank Accounts & Legal Tax Filing Requirements

- Amended Tax Returns & Legal Concerns

- Failing to File a Tax Return — Legal & Financial Consequences

- Estimated Tax Penalties & Legal Obligations

- Unemployment Benefits Under Tax Law

- Online Sales & Tax Law

- Foreign Tax Credit Law & Alternative Exclusions From Income

- Expatriation Tax Law

- Foreign Nationals & U.S. Tax Law

- Income Tax Laws: 50-State Survey

- Property Tax Law

- Sales Tax Law

- Gift Tax Law

- Excise Tax Law

- Business Tax Law

- Capital Gains Tax Law

- Alternative Minimum Tax Law

- Estate Tax Law

- Back Taxes, Tax Debts, and Your Legal Options

- Tax Audits & Legal Concerns

- Puerto Rico Legal Tax Incentives

- Tax Law FAQs

- Find a Tax Law Lawyer

Related Areas

- Small Business Legal Center

- Criminal Law Center

- Home Ownership Legal Center

- Estate Planning Legal Center

- Debt Relief & Management Legal Center

- Social Security and Retirement Planning Legal Center

- Related Areas

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

Understanding the Hidden Taxes and Fees Associated with Airline Travel

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

Written by TurboTaxBlogTeam

- Published Jul 26, 2023 - [Updated Sep 25, 2023]

Hopping on a flight can be an exciting and convenient way to reach your destination, but it’s imperative to be aware of the hidden taxes and fees that can add up quickly when you book your next trip.

Before you ready yourself for the next take-off and landing, let’s define and shed light on these rates and charges that will be applied to your tickets the next time you get ready to head to the airport. Airlines might impose different types of fees and taxes for domestic and international travel. These fees can include both government-imposed fees as well as fees imposed by airline companies, including the Passenger Facility Charge (PFC), the Federal Excise Tax, the International Arrival and Departure Tax, and additional payments (from food costs to checked baggage). Let’s learn more about them:

Government Taxes and Fees: There is a September 11 Security Fee (also known as U.S. Passenger Civil Aviation Security Fee) assessed by the U.S. government to help cover security costs. This fee is $5.60 per one-way trip when boarding in the U.S. It is possible that you could have multiple September 11 fees for trips that have multiple stopovers.

Passenger Facility Charge (PFC): This program allows fees up to $4.50 for every eligible passenger at commercial airports controlled by public agencies. These PFCs are capped at two charges on a one-way trip or 4 charges on a round trip for a maximum total of $18. These fees are used by airports for things such as enhancing safety, security, capacity, noise reduction, or to increase air carrier competition.

The Federal Excise Tax: Federal excise tax is typically imposed on the sale of things like fuel, airline tickets, heavy trucks and highway tractors, indoor tanning, tires, tobacco, and other goods and services. This 7.5% tax on profits is often hidden from the customer as it is typically part of the domestic airfare.

The International Arrival and Departure Tax: These taxes are applied to all flights arriving in or departing from the United States, Puerto Rico, or the US Virgin Islands, and the total may vary based upon currency exchange rates at the time of purchase.

Airline Fees : Checked baggage fees, seat selection fees (gone are the day when you can just have an aisle or window!), and change fees, to name a few, could pop up on your final receipt. You can avoid or minimize these sneaky and additional fees if you pack light and don’t exceed the weight limit for a carry-on (sometimes a tricky task!), or choose an airline with more flexible change policies.

Ancillary Fees : In-flight meals, WiFi, and additional entertainment could be considered ancillary fees. A few ways to lower costs: bring your food onboard (snacks included!) or download any entertainment beforehand so you don’t need to take out your wallet during your next flight.

Hidden Booking Charges : When booking your flight, you may incur additional fees from online travel agencies or third-party booking platforms (like Expedia, Travelocity, Orbitz, Kayak, and Hotels.com) . These fees can include service charges, convenience fees, or booking fees. To avoid these extra costs, consider booking directly through the airline’s official website or contacting customer service for assistance.

But there is good news: Airline Loyalty Programs can help offset some of the hidden taxes and fees. Earning and redeeming miles can lead to discounted fees or even free flights.

If you understand each component of your ticket, you can avoid unnecessary expenses and make better decisions when booking your flights. Remember to research the airline’s specific policies and ensure your bag is the appropriate size and weight; these two easy tips could minimize the impact of these hidden costs. Bon voyage!

Previous Post

Debt Ceiling Deal Passed, Averting Government Debt Default. Find Out…

Does Your State Have a Deadline Extension This Tax Season?

More from TurboTaxBlogTeam

12 responses to “Understanding the Hidden Taxes and Fees Associated with Airline Travel”

I��m not sure where you are getting your information, but good topic. I must spend some time learning much more or working out more. Thank you for fantastic information I used to be on the lookout for this information for my mission.

http://www.itestcomments123.com

There are a lot of necessaries in life. Food is necessary. Shelter is necessary. When you spend a Lot of Money on things you want, it is a personal choice. When you have to spend a Lot of Money on what is necessary it can be quite frustrating! Travel and Airfare is a necessary part of life for a lot of people. Getting Cheaper Airfare can make this necessary part of life less frustrating.

How can you miss the increase in airline travel fees? How does it help us to see this breakdown on where the funds supposedly go? Basically, they come out of our pockets.

Nice little interactive graphic. Applause to designer.

Very nice post. I just stumbled upon your blog and wished to say that I have truly enjoyed surfing around your blog posts. In any case I’ll be subscribing to your rss feed and I hope you write again very soon!

What’s Happening i’m new to this, I stumbled upon this I have found It absolutely useful and it has helped me out loads. I am hoping to contribute & help different customers like its helped me. Good job.

Were you a skilled reporter? You write quite well.

You sound like a perfectionist. Great weblog and fantastic writing abilities.

I believe this is among the most significant information for me. And i am happy reading your article. But should statement on some common issues, The web site style is wonderful, the articles is truly excellent : D. Just right job, cheers

Hi Jadan, We are glad that you found this post useful. Continue to check for more interesting topics.

Thank you, Lisa Lewis

A million drevirs are exploiting loophole in road tax payments. Jan 22, 2008 . If drevirs skip a month’s tax and renew their disc at the . only a335000 a year each in unpaid road tax 97 barely enough to cover the cost ..

Don’t know how these can be called “hidden”, they are listed plain as day in my recipt every time I purchase a ticket. Sometimes, lumped together in a couple section but nothing stopping me from looking up the extra charges.

Use of the word “hidden” is just a way of excusing laziness. And frankly, while I don’t like extra fees/taxes, I’m fine with them just summing these into a single line item and then referring me to a Web site for further information. I don’t need every bit of detail available to me on my receipt, which would just make it harder to read and after purchasing a couple tickets I wouldn’t care any longer.

its interesting analysis about fiscal matters is reflecting in this writing.

Leave a Reply Cancel reply

Browse related articles.

- Tax Deductions and Credits

Tax Write-Offs for Athletes

Tax tips for bloggers and freelancers.

- Self-Employed

Social Media Influencers: A Guide to Your Tax Return (a…

- Tax Planning

8 Tax Tips for the Military

What You’ll Need to File Your Business Taxes Befo…

- Tax Refunds

Where’s My Tax Refund if I Paid TurboTax Fees Out…

Self-Employed Tax Deductions Calculator 2023-2024

Surviving college and tax season: 7 tips for students.

6 Money Saving Tax Tips for the Self-Employed

- Latest News

Understanding the Tax Implications of Strikes on Worker…

The Economic Times daily newspaper is available online now.

You have to pay more for foreign tour packages from july 1, 2023: how to book smartly to save better.

If you are buying a foreign tour package from a travel agent, you have to pay a tax collection at source (TCS) of 20% from July 1, 2023. Budget 2023 has hiked the TCS rate for foreign remittances under the LRS from 5% to 20% (except for education and medical purposes). With this sharp rise in TCS, foreign trips are likely to become costlier soon.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Satcom in India has two puzzles to solve before taking off

Tens of thousands of Indian gig workers are toiling at the frontiers of AI

No plane, no gain: How Go First became less attractive to bidders

Powders and bars are old foam, Indians are voting for liquid soaps

Ashneer Grover, BharatPe and the mystery of an out-of-court settlement

The crucial 20 metres at Vizhinjam promises to be a USD200 million opportunity for India.

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

Complete guide to taxes and fees on airline tickets

Editor's Note

If you've ever looked at the price breakdown of a plane ticket, you may have noticed taxes and fees tacked on to the final fare price.

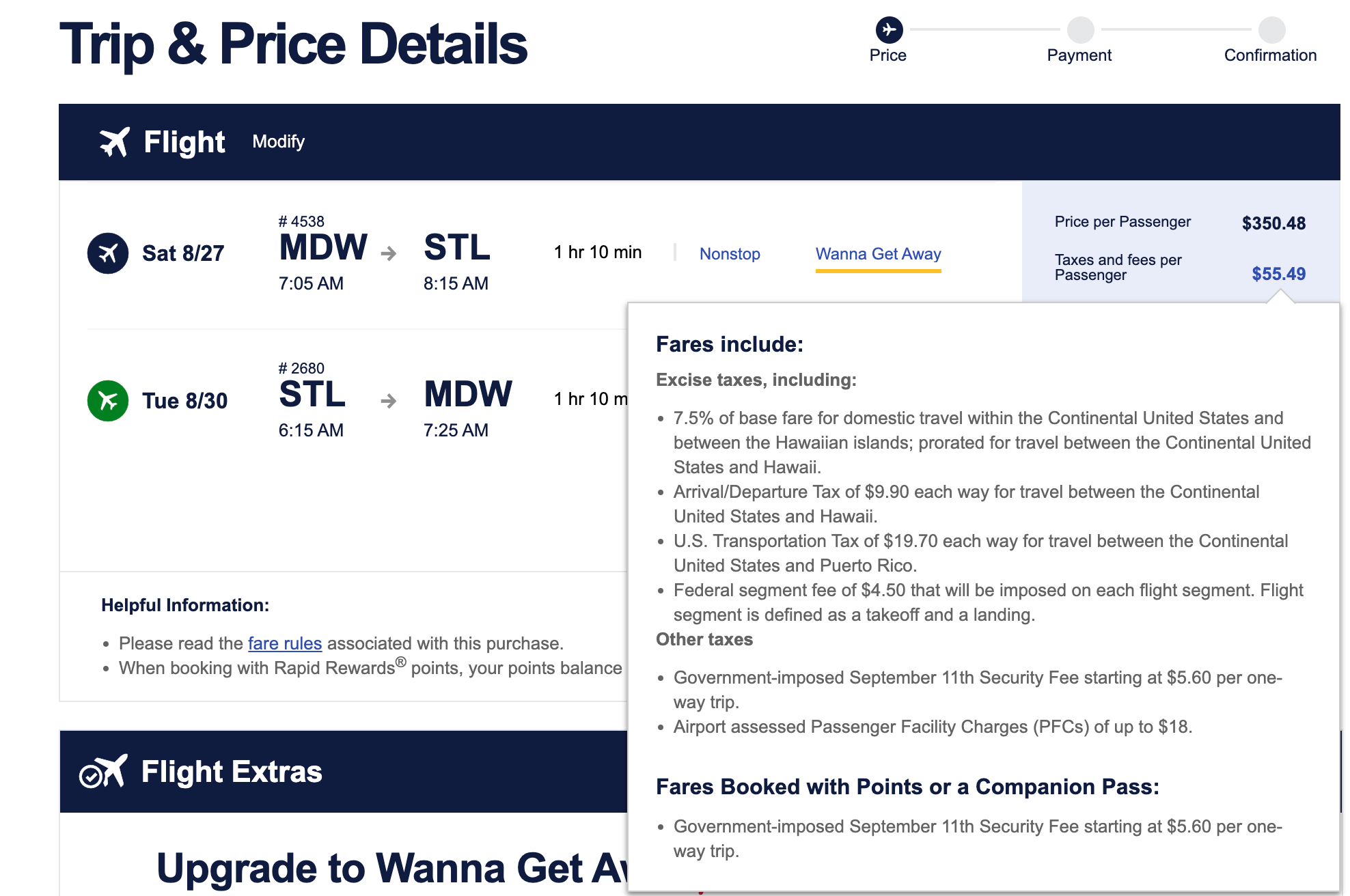

Some of these are required by the government of the country from which you are departing, such as the 7.5% excise tax for domestic flights and a segment fee that the U.S. government charges.

The second category of fees is surcharges imposed by the airlines.

You'll see these taxes and fees whether you use cash or redeem an award ticket; fees placed on award bookings can be especially high since airlines want to recover more than just the value of the redemption itself due to high fuel costs.

This guide examines these different ancillary costs of airline bookings so you're not caught off-guard the next time you book a flight.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

Government-imposed taxes and fees

When you book a flight with cash or miles, expect to pay various taxes and fees. These fees may be imposed by the country in which your trip starts, the country in which your trip ends or both.

The amount of these fees can vary significantly. For example, you've likely noticed a $5.60 fee for flights in the U.S.

The U.S. Transportation Security Administration instituted this fee, known as the Passenger Fee or the September 11 Security Fee, in response to the 9/11 attacks to help offset the costs of additional security. You'll see the fare tacked on to all flights from the U.S., regardless of carrier.

"The fee is collected by air carriers from passengers at the time air transportation is purchased," according to TSA. "Air carriers then remit the fees to TSA."

TSA raised the fee to its current price in 2014, but the round-trip fee cannot exceed $11.20. Most countries have similar charges for flights, often referred to as a passenger service charge.

For example, the United Kingdom applies an Air Passenger Duty on all international flights departing from the U.K. based on the distance traveled and the fare type. As a result, these fees for flights from the U.K. can range anywhere from $16.50 to $218, depending on the route and ticket type.

In addition to passenger service charges, virtually all countries impose an air transport tax. In the U.S., there's also a federal segment fee and a passenger facility charge of up to $18, determined by the U.S. airport(s) from which you are departing.

Other charges you might come across on U.S. flights are only applicable to certain routes. For example, there is a 7.5% base fare for domestic travel from the continental U.S. to Hawaii.

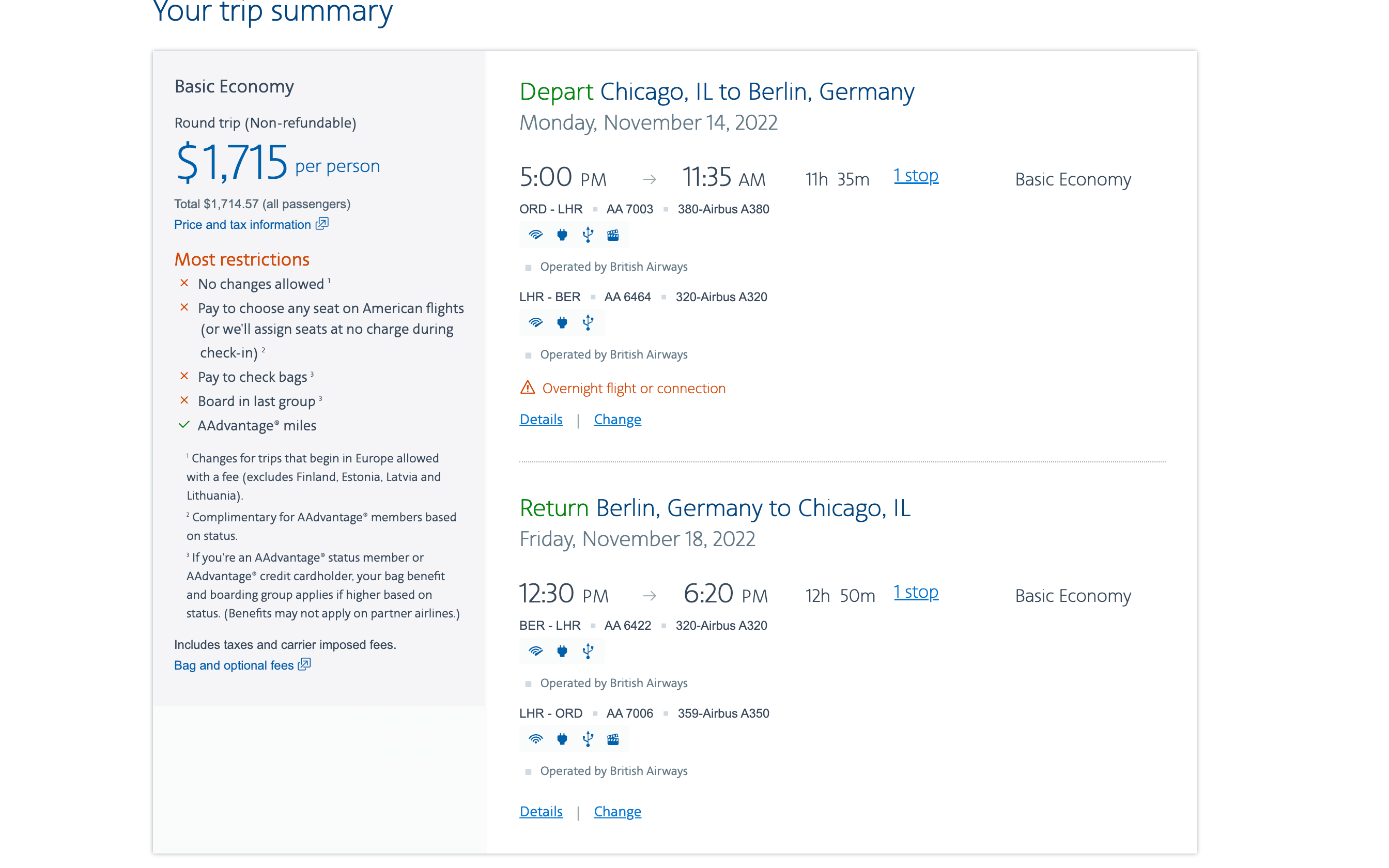

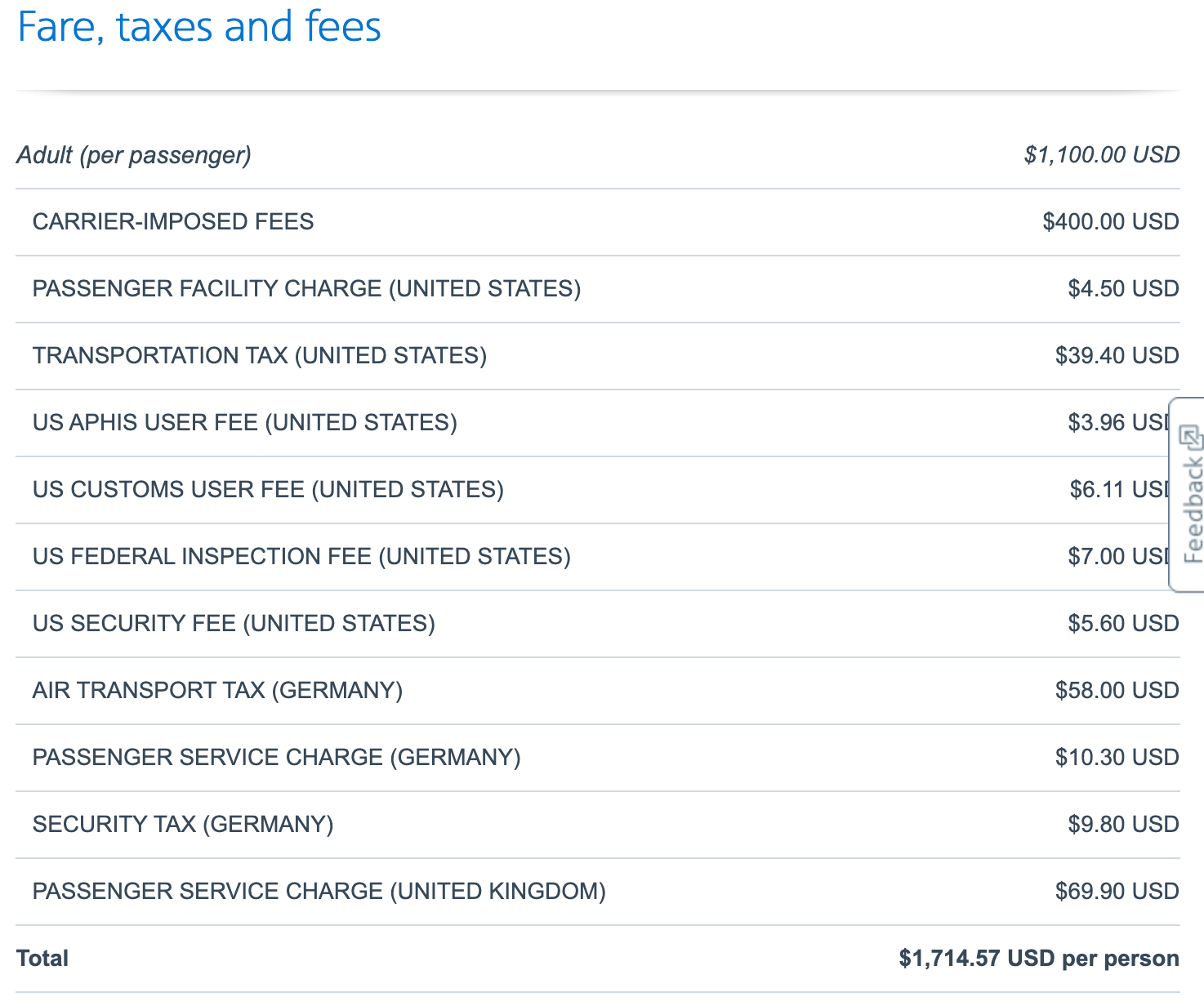

If you're flying internationally from the U.S. with a layover, know that you'll be on the hook for the taxes and fees of each country you take a flight from. For example, take a look at the below round-trip flight on American Airlines, from Chicago's O'Hare International Airport (ORD) to Berlin Brandenburg Airport (BER), with a layover each way at Heathrow Airport (LHR).

Although the base fare is only $1,100, the overall price includes more than $600 in taxes and fees; it includes a $5.60 U.S. security fee, $78 in German taxes and a $70 passenger service charge from the U.K.

Each carrier should provide a breakdown detailing the taxes and fees applied to your ticket. There's also $400 in carrier-imposed fees, which we will get to next.

Related: Everything you need to know about American Airlines AAdvantage

Carrier-imposed charges

In addition to government-imposed taxes and fees, you'll also see carrier-imposed fees.

In the case of award tickets, these fees come from the operating carrier, not the program you use to book your award ticket. However, you may or may not be liable for actually paying them depending on the loyalty program you use to book your award ticket.

This is where my warning comes in about these carrier charges being extremely expensive. I recently discovered this when attempting to book award travel through ANA Mileage Club .

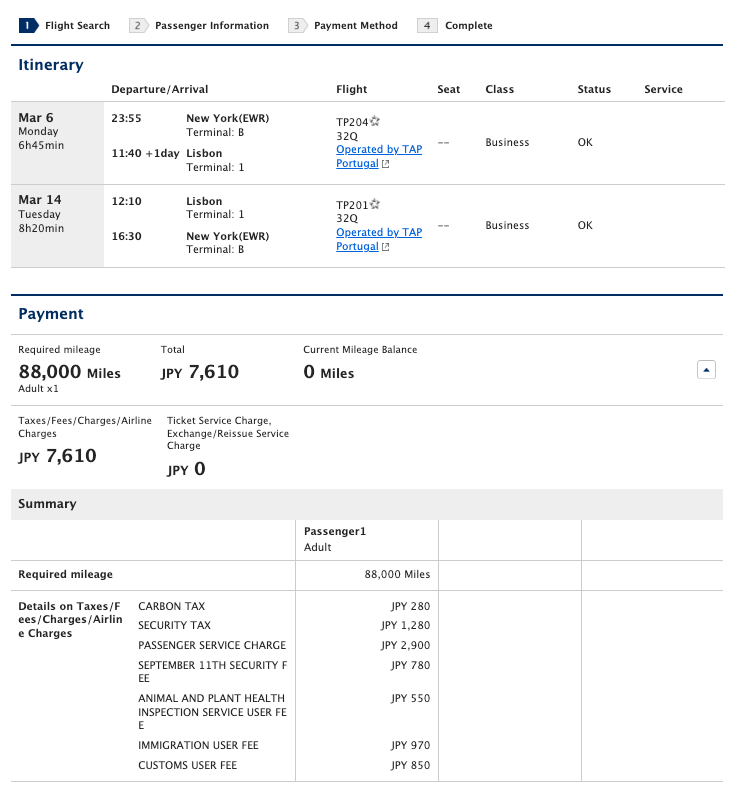

As we've previously covered , one of ANA's best sweet spots available for award travel is its 88,000-mile round-trip business-class award availability to Europe . This makes it a great option for booking tickets on other Star Alliance partners, such as Air Canada, United and Lufthansa.

The typical business-class award ticket to Europe through other programs — such as American AAdvantage and United MileagePlus — usually costs 115,000 to 154,000 miles round-trip. So, transferring points and booking through ANA is a seemingly fantastic deal.

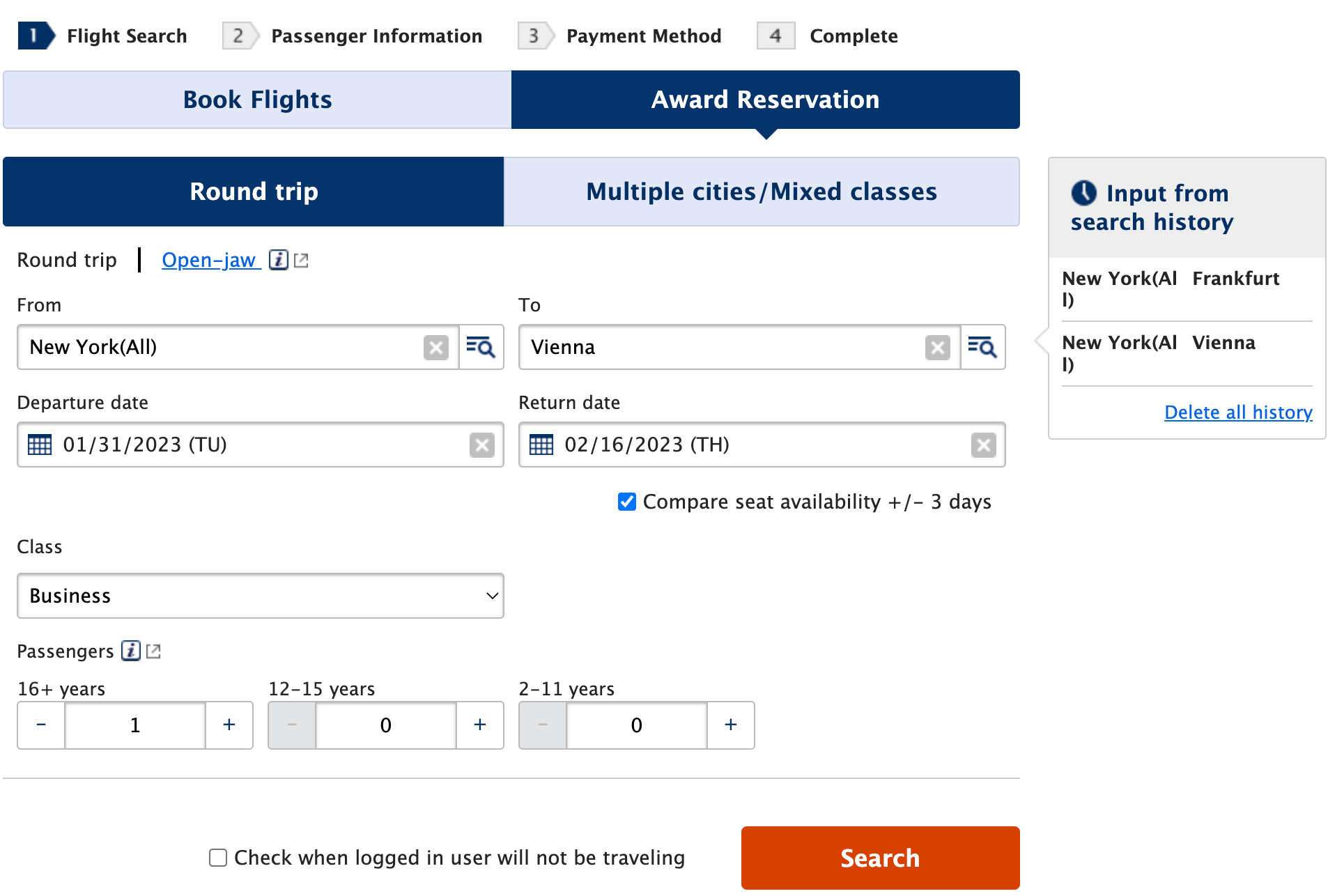

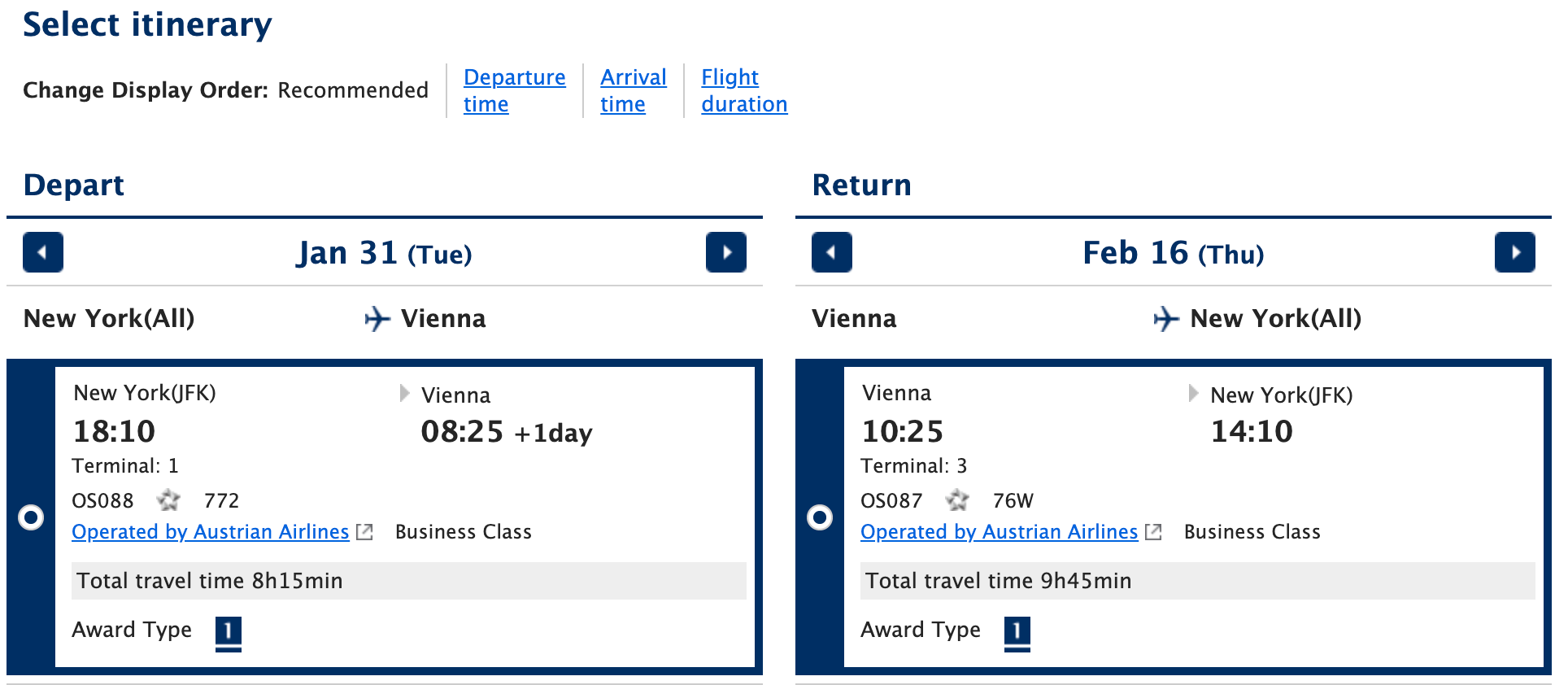

In conducting a test for this story, I searched for award availability on ANA for a round-trip ticket from John F. Kennedy International Airport (JFK) to Vienna International Airport (VIE).

You'll likely have to play around with your dates to find a round-trip flight with business-class fares on each segment. I eventually found a round-trip business-class ticket at the 88,000-mileage price tag for early 2023.

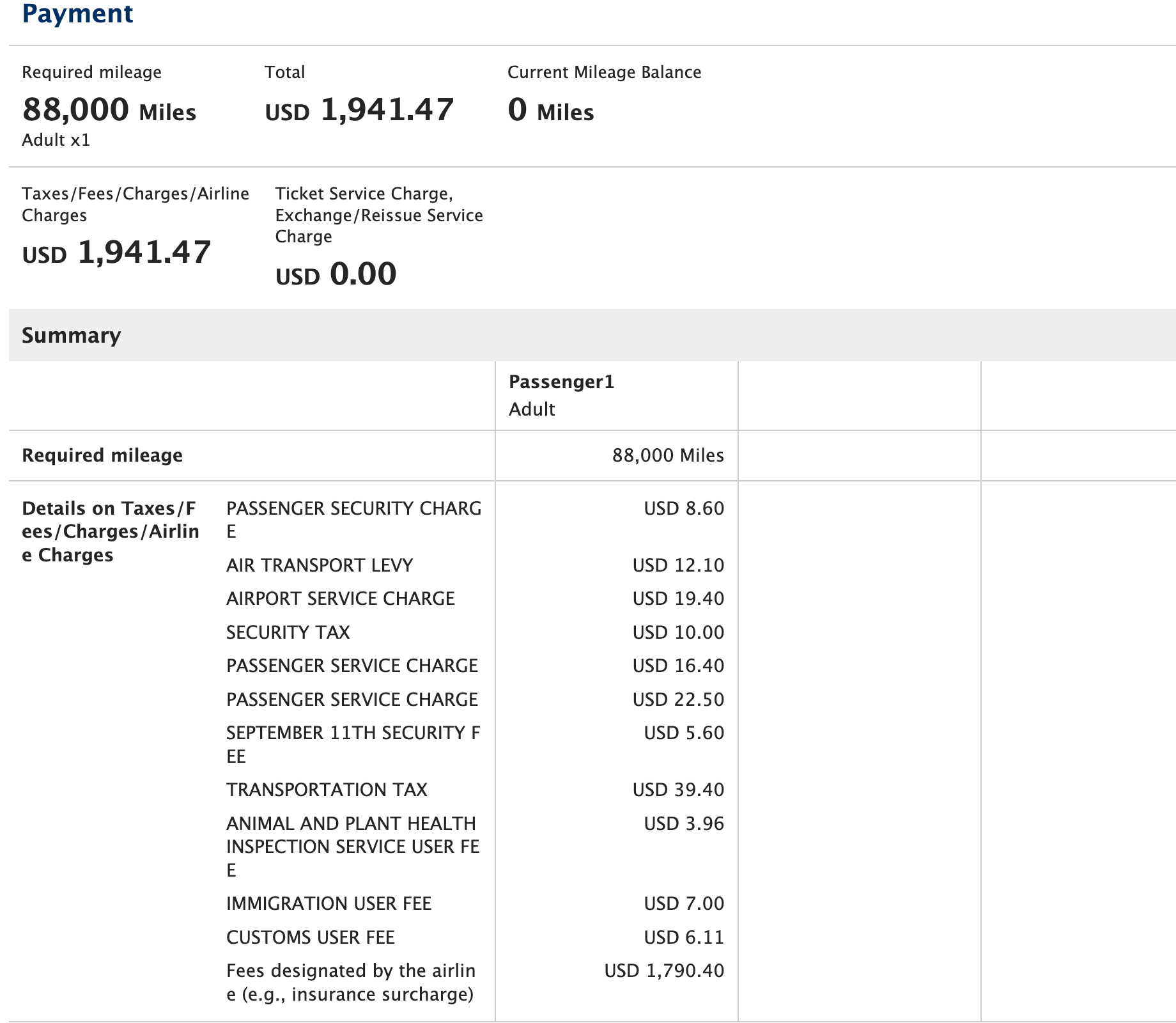

Although I was thrilled to find this, I was startled to see nearly $2,000 in taxes and fees tacked on to the base mileage fare; the fees were composed almost entirely of carrier-imposed surcharges.

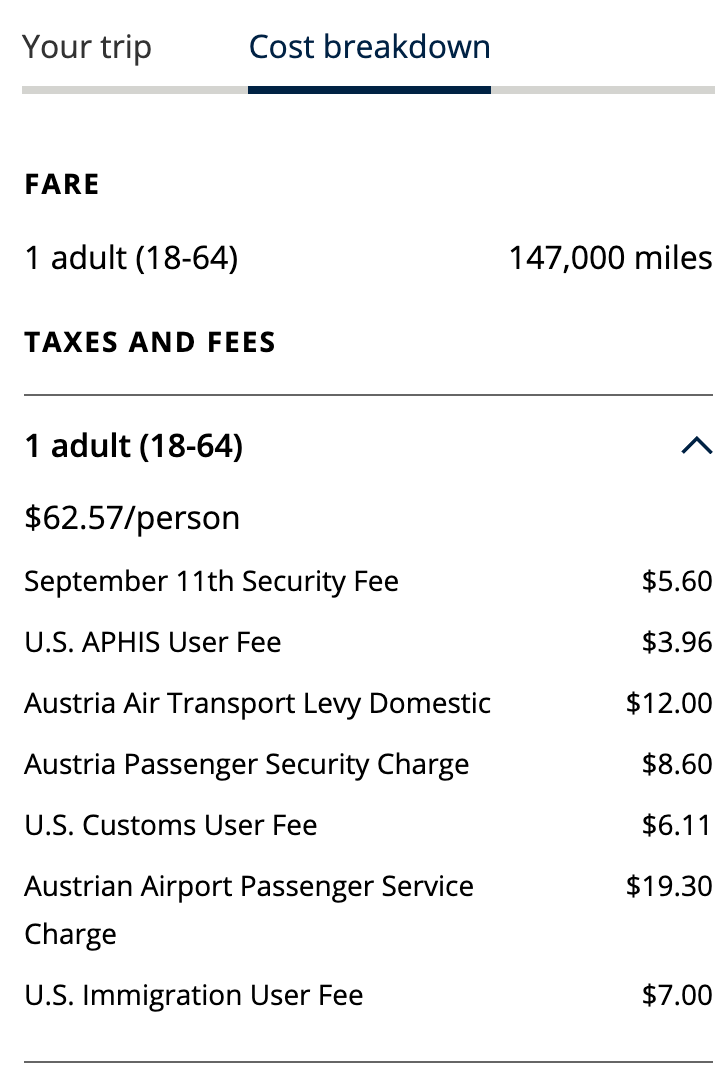

For context, booking the same flight through United would cost 147,000 MileagePlus miles plus just more than $62 in taxes and fees.

So what's the reason for this discrepancy? Austrian Airlines adds fuel surcharges — one of the most common carrier-imposed surcharges — to its award tickets. ANA Mileage Club passes these carrier-imposed surcharges on to the consumer while United MileagePlus doesn't charge them.

This example is precisely why it's important to know which frequent flyer programs pass on fuel surcharges to their customers . Regarding Star Alliance award tickets, other programs that don't pass these on include Air Canada Aeroplan and Avianca LifeMiles.

However, that doesn't mean all ANA Mileage Club award tickets will have high fees.

Thankfully, many airlines do not add fuel surcharges to award tickets. Some of these airlines are TAP Air Portugal, SAS and United, among others. No matter how you book an award ticket with one of these carriers — whether through United MileagePlus, ANA Mileage Club or another Star Alliance program — you'll only pay the government-imposed taxes and fees.

For example, this business-class award ticket from Newark Liberty International Airport (EWR) to Lisbon Airport (LIS) costs 88,000 miles and $56.67 in taxes and fees after currency conversion.

It's also important to note that these surcharges depend on the route you're flying and the class of service you're booking.

Related: How to fly business class to Europe with no fuel surcharges

Additional award-booking fees

Finally, it's also important to note the fees associated with the ticket itself; some airlines charge additional costs for award travel depending on how you book, including close-in fees and service fees for booking via phone.

Although most airlines have eliminated close-in booking fees for travel booked within a certain time frame of departure, some airlines still charge an extra fee for this.

Airlines may charge you extra to book via phone. For instance, United charges $25 for most United MileagePlus members (excluding Premier Platinum and Premier 1K elite members) and Alaska Airlines charges a $15 call center service charge plus a $12.50 booking fee each way for all of its partner bookings.

Additionally, some loyalty programs charge a fee for booking partner award tickets. Air Canada Aeroplan charges roughly $30 for all tickets booked with a partner airline. Likewise, Alaska Airlines Mileage Plan charges $12.50 per partner award ticket booked.

Finally, some frequent flyer programs will impose change or cancellation fees to modify or cancel an award ticket. Thankfully, most U.S. airlines ended this practice during the coronavirus pandemic.

Related: Everything you need to know about points, miles, airlines and credit cards

Bottom line

Award fees for airline bookings vary from frequent flyer program to frequent flyer program. Some pass on carrier-imposed surcharges while others don't. Likewise, some airlines add fuel surcharges, while others do not.

Before you make an award booking, browse through different airline booking portals to find a flight with the right combination of minimal miles and minimal surcharges.

For even more information on how to best avoid extra surcharges on bookings, read:

- How to avoid fuel surcharges on award travel

- British Airways increases fuel surcharges — here's how to avoid them

- Here's why you need a healthy stash of Avianca LifeMiles

- Sweet Spot Sunday: How to fly round-trip to Europe in business class for 88,000 miles

Additional reporting by Ethan Steinberg, Kyle Olsen and Andrew Kunesh.

Awesome, you're subscribed!

Thanks for subscribing! Look out for your first newsletter in your inbox soon!

The best things in life are free.

Sign up for our email to enjoy your city without spending a thing (as well as some options when you’re feeling flush).

Déjà vu! We already have this email. Try another?

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from Time Out about news, events, offers and partner promotions.

- Things to Do

- Food & Drink

- Arts & Culture

- Time Out Market

- Coca-Cola Foodmarks

- Los Angeles

Get us in your inbox

🙌 Awesome, you're subscribed!

These are all the destinations you’ll need to pay extra to visit this year

More and more popular travel destinations are introducing tourist taxes to tackle problems caused by overtourism – here’s what you’ll have to pay

This year, international travel is forecast to bounce back to the highest levels since 2019 – and while that’s great news for the tourism industry in general, many cities, attractions and entire regions are suffering under the weight of overtourism .

The potential for damage to historic sites, unhinged tourist behaviour and the simple issue of overcrowding are all common consequences of overtourism. That’s why a growing list of popular travel destinations have introduced a tourist tax, with the hopes of controlling visitor numbers and improving local infrastructure to better cater to higher visitor capacity.

Many countries and cities introduced a tourist tax in 2023, and many more are due to launch theirs in 2024. Tourist taxes aren’t a new thing – you’ve probably paid one before, tied in with the cost of a plane ticket or the taxes you pay at a hotel.

However, more destinations than ever before are creating this fee for tourists, and many places have increased the cost of existing ones. Here’s a full list of all the destinations charging a tourist tax in 2024, including all the recently introduced and upcoming tourist taxes you need to know about.

Austria charges visitors a nightly accommodation tax which differs depending on province. In Vienna or Salzburg , you could pay 3.02 percent per person on top of the hotel bill.

Belgium , like Austria, has a nightly fee. Some hotels include it in the rate of the room and add it separately to your bill, so read it carefully.

The rate in Brussels is charged per room, and varies depending on the size and rating of your hotel, but is usually around €7.50. Antwerp also charges per room.

Bhutan has always been known for its steep tourist taxes and charges. In 2022, the Himalayan kingdom tripled the amount it charged visitors in tax to a minimum of $200 per day , but that amount has since been lowered. In 2024, the daily fee for the majority of visitors is $ 100, and that is due to continue until August 31, 2027.

Bulgaria applies a fee to overnight stays, but it reaches a maximum of only €1.50.

Caribbean Islands

The following Caribbean Islands charge a tourist tax, ranging from between €13 to €45: Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, Bonaire, the British Virgin Islands, the Cayman Islands, Dominica, the Dominican Republic , Grenada, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Maarten, St. Vincent and the Grenadines, Trinidad and Tobago, and the US Virgin Islands.

The tax tends to be tied into the cost of a hotel or a departure fee.

Croatia only charges its visitors a fee of 10 kuna (€1.33) per night during peak season.

Czechia (also known as Czech Republic)

Czechia only applies a fee to those travelling to Prague . It doesn’t apply to those under the age of 18, and is less than €1 per person, per night.

France ’s ‘taxe de séjour’ varies depending on city, and tends to be added to your hotel bill. It varies from €0.20 to €4 per person, per night.

Earlier this month, Paris announced it would be increasing its fee by up to 200 percent for those staying in hotels, Airbnbs, and campsites, but that it plans to put the funds towards improving the city’s services and infrastructure.

READ MORE: The cost of visiting Paris will soar this summer – here’s why

Germany charges visitors a ‘culture tax’ (kulturförderabgabe) and a ‘bed tax’ (bettensteuer) in certain cities, including Frankfurt , Hamburg and Berlin , which tends to be around five percent of your hotel bill.

Greece ’s tourist tax is based on numbers. Specifically, how many stars a hotel has, and the number of rooms you’re renting. The fee was introduced by the Greek Ministry of tourism to help pay off the country’s debt, and can be anything from €4 per room.

Hungary charges visitors four percent of the price of their room, but only in Budapest .

Iceland is introducing a tourist tax to protect its ‘unspoilt nature’ this year, which will cost between €4 to €7 per night. It comes after annual tourist numbers reached an estimated 2.3 million per year.

In Indonesia , the only destination which charges a tourist tax is Bali , and the fee is set to increase this February to $10 (£7.70, €8.90, IDR 150,000) – but is a one-time entry fee, not a nightly tax. It apparently goes towards protecting the island’s ‘environment and culture.’

Much like in France, Italy ’s tourist tax varies depending on your location. Rome ’s fee is usually between €3 to €7 per night, but some smaller Italian towns charge more.

Venice finally announced in September that its tourist tax, a €5 (£4.30, $5.40) fee which will be applicable on various days during high season, will launch in 2024. It only applies to day-trippers rather than those staying overnight, though.

Japan has a departure tax of around 1,000 yen (€8).

Malaysia has a flat-rate tax which it applies to each night you stay, of around €4 a night.

New Zealand

New Zealand ’s tax comes in the from of an International Visitor Conservation and Tourism Levy of around €21 which much be paid upon arrival, but that does not apply to people from Australia.

Netherlands

The Netherlands has both a land and water tax. Amsterdam is set to increase its fee by 12.5 percent in 2024, making it the highest tourist tax in the European Union.

Portugal has a low tourist tax of €2, which applies to all those over the age of 13. It’s only applicable on the first seven nights of your visit and applies in 13 Portuguese municipalities, including Faro, Lisbon and Porto.

Olhão became the latest area to start charging the fee between April and October. Outside of this period, it gets reduced to €1 and is capped at five nights all year round. The money goes towards minimising the impact of tourism in the Algarve town.

Slovenia also bases its tax on location and hotel rating. In larger cities and resorts, such as Ljubljana and Bled, the fee is higher, but still only around €3 per night.

Spain

Spain applies its Sustainable Tourism Tax to holiday accommodation in the Balearic Islands to each visitor over the age of sixteen. Tourists can be charged up to €4 per night during high season.

Barcelona ’s city authorities announced they plan to increase the city’s tourist tax over the next two years – the fee is set to rise to €3.25 on April 1, 2024. The council said the money would go towards improving infrastructure and services. This is in addition to regional Catalan tax.

Switzerland

Switzerland ’s tax varies depending on location, but the per person, per night cost is around €2.20. It tends to be specified as a separate amount on your accommodation bill.

Thailand

Thailand introduced a tourist tax to the price of flights in April 2022, in a similar effort to the Balinese aim of moving away from its rep as a ‘cheap’ holiday destination. The fee for all international visitors is 300 baht (£6.60, $9).

The US has an ‘occupancy tax’ which applies across most of the country to travellers renting accommodation such as hotels, motels and inns. Houston is estimated to be the highest, where they charge you an extra 17 percent of your hotel bill.

Hawaii could be imposing a ‘green fee’ – initially set at $50 but since lowered to $25 – which would apply to every tourist over the age of 15. It still needs to be passed by lawmakers, but if approved, it wouldn’t be instated until 2025.

The European Union

Finally, the European Union is planning on introducing a tourist visa , due to start in 2024. The €7 application will have to be filled out by all non-Schengen visitors between the ages of 18 and 70, including Brits and Americans.

READ MORE: Why sustainable tourism isn’t enough anymore

Stay in the loop: sign up to our free Time Out Travel newsletter for all the latest travel news.

- Liv Kelly Contributing Writer

Share the story

An email you’ll actually love

Discover Time Out original video

- Press office

- Investor relations

- Work for Time Out

- Editorial guidelines

- Privacy notice

- Do not sell my information

- Cookie policy

- Accessibility statement

- Terms of use

- Modern slavery statement

- Manage cookies

- Advertising

Time Out Worldwide

- All Time Out Locations

- North America

- South America

- South Pacific

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Election with BT

- Economic Indicators

- BT-TR GCC Listing

Foreign travel to get expensive from July 1! Tax collected at source to jump from 5% to 20%

As per the announcement made in budget 2023, the tax collected at source (tcs) rate on foreign remittances, including bookings for tour packages, will rise sharply from 5 per cent to 20 per cent of the total transaction amount from july 1, 2023..

- Updated May 18, 2023, 7:41 PM IST

Due to the extended hiatus caused by Covid-19 and the desire to escape the scorching weather, travel bookings have surged by 30 per cent to 40 per cent this season. However, the surge can also be attributed to the impending increase in foreign travel expenses, which is set to take effect from July 1, 2023. As per the announcement made in Budget 2023, the Tax Collected at Source (TCS) rate on foreign remittances, including bookings for tour packages, will rise sharply from 5 per cent to 20 per cent of the total transaction amount from July 1, 2023. This means if the air travel costs Rs 50,000, the corresponding TCS amount would be Rs 10,000, which is equivalent to 20 per cent of the air travel cost.

Not only foreign tour packages but 20 per cent TCS rule also applies on credit cards on international transactions, which means even direct booking would come under the ambit of 20 per cent TCS, as per finance ministry circular issued on May 16. According to PTI report the ministry on May 16 notified the Foreign Exchange Management (Current Account Transactions) (Amendment) Rules, 2023, to include international credit card payments in the LRS.

Also WATCH: India’s automobile sector: Insights On Growth, CV & PV Sales, Hero Vs Honda, Maruti, Hyundai Vs Tata Motors, M&M & more

“The rate of TCS on LRS remittances including foreign travel bookings is all set to increase four-fold from 5 per cent to 20 per cent effective 1st July 2023. TCS at 5 per cent on LRS remittances was first introduced in October 2020, and it has already led to a significant loss of business for domestic travel and tour agents (DTAs) as customers now prefer booking overseas travel services with Global Travel Agents (GTAs), who have been escaping TCS compliance and hence can offer better pricing on their platforms. The proposed four-fold rate increase will widen the pricing gap as the upfront cost for travellers will increase further on DTAs, motivating them to book with GTAs," Mohit Kabra, Group CFO, MakeMyTrip told Business Today.

Investments and expenditures abroad are made by using the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India (RBI), which is available to all resident Indians. Through this scheme, an individual can remit up to $250,000 per financial year for such transactions. Once the rule comes into play Indian travellers will be subject to a 20 per cent tax collected at source by authorized banks or travel agents when making payments for international travel bookings, including airfare, hotel accommodations, or tour packages.

"The tax collected at source (TCS) shall be accumulated as an aspect of the payment and subsequently transmitted to the government. It is imperative for Indian travellers to take into account these supplementary financial obligations while strategizing their global adventures. The imposition of a 20 per cent TCS is likely to augment the overall expenditure incurred by individuals on their travel. However, the traveller can claim TCS credit while filing their tax return. So no overall impact will be seen," says Rikant Pittie, Co-founder, EaseMyTrip.

The new Tax Collected at Source (TCS) rules will also apply to transactions made with credit cards, added Pittie.

Undoubtedly, it is anticipated that foreign travel will incur greater expenses commencing July 1st, 2023, as a result of the enforcement of the 20 per cent TCS on foreign remittances for diverse objectives, including travel abroad. "It is mandatory for Indian globetrotters to take into account this supplementary financial obligation while devising their overseas excursions. The imposition of a 20 per cent TCS is likely to augment the immediate total expenditure incurred by individuals on their travel. However, there will be no difference in their travel costs as they can claim it while filing their return," says Pittie.

- #Foreign travel

- #Foreign travel expensive

- #TCS on foreign remittances

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- For International Visitors

- Know Before You Visit

Customs Duty Information

What is a customs duty.

Customs Duty is a tariff or tax imposed on goods when transported across international borders. The purpose of Customs Duty is to protect each country's economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.

Dutiable refers to articles on which Customs Duty may have to be paid. Each article has a specific duty rate, which is determined by a number of factors, including where you acquired the article, where it was made, and what it is made of. Also, anything you bring back that you did not have when you left the United States must be "declared." For example, you would declare alterations made in a foreign country to a suit you already owned, and any gifts you acquired outside the United States. American Goods Returned (AGR) do not have to be declared, but you must be prepared to prove to U.S. Customs and Border Protection the articles are AGR or pay Customs duty.

The Customs Duty Rate is a percentage. This percentage is determined by the total purchased value of the article(s) paid at a foreign country and not based on factors such as quality, size, or weight. The Harmonized Tariff System (HTS) provides duty rates for virtually every existing item. CBP uses the Harmonized Tariff Schedule of the United States Annotated (HTSUS), which is a reference manual that the provides the applicable tariff rates and statistical categories for all merchandise imported into the U.S.

Duty-Free Shop articles sold in a Customs duty-free shop are free only for the country in which that shop is located. Therefore, if your acquired articles exceed your personal exemption/allowance, the articles you purchased in Customs duty-free shop, whether in the United States or abroad, will be subject to Customs duty upon entering your destination country. Articles purchased in a American Customs duty-free shop are also subject to U.S. Customs duty if you bring them into the United States. For example, if you buy alcoholic beverages in a Customs duty-free shop in New York before entering Canada and then bring them back into the United States, they will be subject to Customs duty and Internal Revenue Service tax (IRT).

Determining Customs Duty

The flat duty rate will apply to articles that are dutiable but that cannot be included in your personal exemption, even if you have not exceeded the exemption. For example, alcoholic beverages. If you return from Europe with $200 worth of purchases, including two liters of liquor, one liter will be duty-free under your returning resident personal allowance/exemption. The other will be dutiable at 3 percent, plus any Internal Revenue Tax (IRT) that is due.

A joint declaration is a Customs declaration that can be made by family members who live in the same household and return to the United States together. These travelers can combine their purchases to take advantage of a combined flat duty rate, no matter which family member owns a given item. The combined value of merchandise subject to a flat duty rate for a family of four traveling together would be $4,000. Purchase totals must be rounded to the nearest dollar amount.

Tobacco Products

Returning resident travelers may import tobacco products only in quantities not exceeding the amounts specified in the personal exemptions for which the traveler qualifies (not more than 200 cigarettes and 100 cigars if arriving from other than a beneficiary country and insular possession). Any quantities of tobacco products not permitted by a personal exemption are subject to detention, seizure, penalties, abandonment, and destruction. Tobacco products are typically purchased in duty-free stores, on sea carriers operating internationally or in foreign stores. These products are usually marked "Tax Exempt. For Use Outside the United States," or "U.S. Tax Exempt For Use Outside the United States."

For example, a returning resident is eligible for the $800 duty-free personal exemption every 31 days, having remained for no less than 48 hours beyond the territorial limits of the United States except U.S. Virgin Islands, in a contiguous country which maintains free zone or free port, has remained beyond the territorial limits of the United States not to exceed 24 hours. This exemption includes not more than 200 cigarettes and 100 cigars:

- If the resident declares 400 previously exported cigarettes and proves American Goods Returning (AGR) , the resident would be permitted or allowed to bring back his AGR exempt from Customs duty.

- If the resident declares 400 cigarettes, of which 200 are proven AGR or previously exported and 200 not AGR or not previously exported, the resident would be permitted to bring back his 200 previously exported cigarettes tax and Internal Revenue Tax (IRT) free under his exemption.

- The tobacco exemption is available to each adult 21 years of age or over.

In December 2014, President Obama announced his intention to re-establish diplomatic relations with Cuba. The President did not lift the embargo against Cuba. Absent a democratic or transitional government in Cuba, lifting the embargo requires a legislative statutory change. Since the announcement, however, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) has amended the Cuba Assets Control Regulations (CACR), effective January 16, 2015, to authorize travel within certain categories to and from Cuba and to allow certain imports from and exports to Cuba.

All travelers, including those from Cuba, must comply with all applicable laws and regulations. This includes the Harmonized Tariff Schedule of the United States (“HTSUS”) (2016) limitations on personal exemptions and rules of duty extended to non-residents and returning U.S. residents.

Persons subject to U.S. jurisdiction are authorized to engage in all transactions, including payments necessary to import certain goods and services produced by independent Cuban entrepreneurs as determined by the State Department and set forth in the State Department’s Section 515.582 list located at FACT SHEET: U.S. Department of State Section 515.582 List . On October 17, 2016, the Office of Foreign Asset Control relaxed restrictions so authorized travelers, arriving direct from Cuba, are now able to bring Cuban merchandise for personal use back to the United States and qualify for the U.S. Resident exemption (HTSUS 9804.00.65, which allows up to $800 total in goods, and adults 21 and older may include 1 liter of alcohol, 200 cigarettes, and 100 cigars). This exemption also applies to travelers, arriving from any country in the world, with declared Cuban merchandise.

Declared amounts in excess of the exemption are subject to a flat 4% rate of duty, and any applicable IRS taxes, pursuant to HTSUS 9816.00.20 and 19 CFR 148.101, which impose a duty rate of 4% of the fair retail value on goods from a Column 2 country.

Regarding goods: The Department of State will, in accordance with the State Department’s Section 515.582, issue a list of prohibited goods. Placement on the list means that any listed good falls within certain Sections and Chapters of the HTSUS which do not qualify for this exception.

Regarding entrepreneurs : The Cuban entity must be a private business, such as a self-employed entrepreneur or other private entity, not owned or controlled by the Government of Cuba. Travelers engaging in these transactions are required to obtain evidence that demonstrates the goods purchased were obtained from a Cuban entrepreneur, as described above, and should be prepared to furnish evidence of such to U.S. Government authorities upon request. Evidence may include a copy of the entrepreneur’s license and/or an invoice and/or purchase order demonstrating the goods were purchased from a specific Cuban entrepreneur. Whether a traveler presents adequate evidence that a good qualifies from importation and that it was bought from a licensed independent Cuban entrepreneur shall be determined on a case-by-case basis by the inspecting CBP officer.

Imports under Section 515.582 (i.e., imports from licensed independent entrepreneurs not on the Department of State’s prohibited list) must comply with all current U.S. Customs and Border Protection (CBP) formal and informal entry requirements, as applicable. This means that, while there is no value cap on the amount of goods that may be imported under this provision, the applicable duties in the HTSUS must be considered.