Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars Order Euros or US Dollars before 2pm and you can pick-up from most stores the next day

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros and US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

- Home ›

- Travel Money

Compare travel money exchange rates

Get the best exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Why compare exchange rates?

It's important to shop around for the best currency deals if you want to maximise your holiday money. Right now, there's a 5.7% difference between the best and worst euro exchange rates available online. It may not sound like a lot, but that's an instant saving of £57 if you were buying £1000 worth - just by choosing the best place to exchange your cash. Less-common currencies offer even more potential savings: you could get 11.2% more Turkish lira by going with the best deal. For Indian rupees, the saving is 8.3%, and for Thai baht it's 13.3%. That's a lot of extra Mekhong!

However, exchange rates aren't the only important factor when it comes to getting the best currency deal. Commission, delivery fees and payment surcharges can all affect the amount of currency you'll receive, which is why it's important to use a comparison website to check the best deals for you.

Our travel money comparisons can help you to get a great deal on your currency. We compare the exchange rates from a wide range of different providers, along with their fees and any other charges, so you can see how their rates stack up after all costs have been included. You can choose how you want to pay and whether you want to pick your currency up in person or get it delivered to your door. We'll even show you exclusive online-only deals that aren't available on the high street! Comparing is quick and easy - just select the currency you want to buy, tell us how much you want to spend and we'll do the rest.

It's almost always cheaper to buy your currency online compared to buying in-store.

- Some of the most competitive currency suppliers are online-only. Their operating costs are generally lower than high street stores, so they can afford to offer you better exchange rates

- Most suppliers offer free home delivery when you spend a minimum amount

- Many high street currency suppliers such as supermarkets and the Post Office offer better rates if you place your order online beforehand. By reserving your order online, you can guarantee the supplier's online rate and still collect your currency in person at a time that suits you

If you're spending less than £300, it can be more cost-effective to buy your currency in-store because the delivery charge may cancel out any savings you might have made on the exchange rate if you bought online. However, some currency suppliers charge a handling or processing fee for small orders when you buy in-store, so it's worth checking beforehand if you're only spending a smaller amount.

We recommend you place your order at least three working days before you need your currency. Most currency suppliers will dispatch your order on the same day they receive your payment if you pay before lunchtime, otherwise they'll post it on the next working day. Your order will be sent via Royal Mail Special Delivery which is a fully tracked and insured service that's guaranteed by Royal Mail to arrive on the next working day.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

The UK's favourite travel money home delivery service

- HUNDREDS OF THOUSANDS OF SATISFIED CUSTOMERS

- MARKET-LEADING, COMMISSION-FREE EXCHANGE RATES

- NATIONWIDE DELIVERY DIRECT TO YOUR DOOR

- FREE DELIVERY FOR ORDERS OVER £650 (£4.99 OTHERWISE)

- PICK A CONVENIENT DELIVERY DATE (INCLUDING SATURDAYS)

- FULLY INSURED ROYAL MAIL SPECIAL DELIVERY

- NEXT DAY DESPATCH ON OVER 50 CURRENCIES

- SECURE PAYMENT BY DEBIT CARD

- ORDERS FROM £250 TO £2500

Privacy Overview

Royal Mail strikes are expected in November.

We advise all our customers to order their travel money this month to reduce any inconvenience caused from any upcoming delays or backlogs next month.

Compare Exchange Rates

- Currency Converter

- Convert British Pounds To Australian Dollars

- Convert British Pounds To Euro

- Convert British Pounds to Japanese Yen

- Convert British Pounds To Turkish Lira

- Convert British Pounds To US Dollars

- Convert Australian Dollars To British Pounds

- Convert Euro To British Pounds

- Convert Japanese Yen To British Pounds

- Convert Turkish Lira To British Pounds

- Convert US Dollars To British Pounds

Order Travel Money & Foreign Currency Online for the best rates.

How are we cheaper and transparent?

Most banks and bureau de change add on various margins to the exchange rate that customers are not aware of making it harder for you to compare exchange rates on offer. We have gone one step further. To offer you low-cost exchange rates on your travel money whilst giving you to access to the live interbank exchange rate at the point of when you transact for complete transparency. Compare our currency exchange rates and see how much you could save. You can buy Turkish Lira here .

TOP RATED COMPANY ON TRUSTPILOT

Ranked 1st of 96 on Review Centre

- Travel Money

I have British Pounds

1 GBP = Your exchange rate

1 GBP = Real exchange rate

- Transfer Type

- Low cost transfer - 369.39 GBP fee Send money from your bank account

- Advanced transfer - 369.39 GBP fee Send from your GBP account outside the UK

The more you order the lower the fee

I want to buy

Featured in

Most bureau de changes, banks and currency brokers will state no commission or fee free but in reality, these are hidden within the rate of exchange. When you cannot see the interbank exchange rate it becomes harder to compare which is the best value? We're changing this to offer a fully transparent marketplace where there are no hidden fees and you have access to the live interbank exchange rate before you transact.

The Currency Club is re-writing the script!

We evaluate the euro-to-pound exchange rates offered by most of the UK's largest travel money companies. Our sophisticated algorithms help you sell Euros for Pounds and make sure you receive the most accurate buy-back rates for euros and can discover who is providing the best euro-to-pound exchange rates. And, if you need any detailed consultation on the exchange rate, our team will provide the same. Moreover, visit our website and learn the essential information regarding Euro/Pound exchange.

Have you got any leftover cash from your recent vacation? We can buy back foreign currency from you. At our bureaux de change, you can convert money into GBP. In whatever denomination that we sell, we will buy back.

Follow these simple steps:

To locate the closest branch, use our branch finder and choose "foreign currency."

Come with your cash, and we'll buy everything from you.

We're pleased to repay you for the holiday money you purchased from us if your trip is cancelled.

You're finally done!

This is how you can buy back currency . Transfers are pretty simple. Just follow a few simple steps, and you can exchange them to get the cash back.

The name of Turkey's currency is Turkish Lira. In the years 2005 to 2008, it was referred to as the New Turkey Lira. However, starting in 2009, the word "New" was omitted, and the currency was once more referred to as the Turkish Lira.

The Turkish Lira was a steady currency before its current value decline, primarily due to the pandemic.

You can get the best exchange rate for Turkish Lira on our website. We will compare prices in your area to provide you with the best possible deal.

With us, you can buy or sell Turkish Lira without paying any additional fees. The fees imposed for currency exchange differ amongst exchange companies. However, free software to exchange currencies will allow you to save money.

The official currency of the United States of America (USA), which has the largest economy in the world, is the US dollar. Given the USA's robust economy, it is not surprising that the USD is one of the strongest currencies in the world. As a result, the most common currency used for transactions worldwide is the US dollar, which is regarded as the standard. According to a recent Bank of International Settlements survey, the US dollar accounted for 88% of all foreign exchange transactions.

Contact us if you want to get the best exchange rate for USD . US Dollar exchange rates fluctuate throughout the day due to the high level of volatility in the currency exchange market. You can check the current exchange rates for the US dollar online and place an order to buy or sell US dollars at those prices.

You may buy and sell foreign money online with The Currency Club at real-time, transparent exchange rates. We have one of the best buy-back exchange rates . Compare the best exchange rates offered by hundreds of money changers in your area for more than 40 different currencies. Get your travel money quickly, easily, and affordable by ordering your foreign currency online at our best rates. With our range of currency brokers, check buy-back rates for euros, dollars, and more.

The best exchange rates can be found by comparing them.

View charges at a glance.

Apply right away

These rates are available only when you pay online - rates in branch will differ

Last updated on

Source: compareholidaymoney.com

*We capture the exchange rates being offered by airports and high street providers once a month and calculate what spread they are taking off the live interbank rate. We then compare that to what rates we are offering to calculate the savings you can make if you use us.

*Your potential saving has been calculated using our exchange rate and the most expensive provider's rate in the market at a given point in time.

What will you do with the savings you make on your travel money?

transacted £1 Billion

since company inception

currencies traded

How does it work?

Select the currency you wish to buy

Log in to your account or visit the home page and select the currency like change Swedish Krona to GBP and confirm the amount you wish to buy

Confirm your exchange rate

Our rates move with the market, once you confirm your order you fix your rate, go here for the best exchange rate for Turkish lira .

Select a delivery date

Royal Mail will require a signature from someone in the property at the time of delivery

Pay via bank transfer or credit, debit cards. We can only dispatch currency once we have received cleared funds

Confirmation and tracking information

We shall email you a dispatch notification once your currency is on its way to you and this mail will include your tracking details.

Delivery of currency

We use Royal Mail Special Delivery which is a fully insured and secure home delivery service

Frequently asked questions

How do i place an order with the currency club.

All orders are placed online via the website. Simply go to our homepage and complete the steps on the currency converter. Then follow the onscreen instructions. To check whether you have successfully placed the order, log in and check your Order History. Please not that all updates regarding your order shall be sent to your electronically via email so be sure to check your inbox.

If you are having trouble to order euros online with us , please do not hesitate to contact our customer services team.

Will I receive confirmation that my order has been accepted?

Yes. On successful completion of an order, you will receive an order acknowledgment email that we have received your currency order, followed by and Order Confirmation that we have received payment against your order. So, convert your pound to Indian rupee, today .

Are there any minimum and maximum limits per transaction?

The minimum order amount with The Currency Club is £100 worth of currency and the maximum is £7500 per order per day for home delivery. Please note that we can also handle larger requirements so please email us on [email protected] or ring us for further information on 020 7723 7000. So, keep these details handy when you sell US dollars with us .

I haven't received any email confirmation after placing my order, what should I do?

This shouldn't usually happen as the system is fully automated.

Firstly, try logging into your account. If you are facing an issue it could be that you have entered your email address incorrectly during the registration process. We can easily fix this if you call into our team.

If your email address has been entered correctly, check your junk/spam folder. Please make sure you add thecurrencyclub.co.uk to your safe senders list so you receive all communication from us regarding your order.

Why has my order been cancelled?

Orders can be cancelled due to a variety of reasons. An order can be cancelled automatically by the system if you have selected the low cost service and we do not receive payment in a timely fashion. It can also be cancelled if the card billing address does not match the delivery address or if we have run out of stock of the currency you have ordered. So, when you sell UAE dirham to GBP online , make sure you are completing all the steps properly.

New Service!

Cheaper, faster, easier international currency transfers.

Our members comments

Travel Blogger

Despite the proliferation of businesses taking their wares to the internet, most are simply doing the same old retail 'thing' but in another format.The Currency Club is different. The service is straightforward, accurate, excellent value and does not bombard the customer with pointless visual and virtual noises in the process. A company that does a straightforward job in a way that far exceeds the experience of the high street.Highly, recommended.

First time i've ordered currency online and was unsure at first. But the currency club had one of the best rates with free next day delivery. When i had a query i received a response within the hour! Fantastic service and will definitely use again!

What can I say, not only an incredibly easy transaction selling my dollars(I received payment on the same day TCC got them through the post from me) but i had actually made a mistake and was called to say i was owed $98 worth more than i'd stated on the form.I am most greatful for the honesty, it made my day to think that, even though i was really non the wiser, this company cares.Can i give 6 star review? Most definitely I will use them again...

First time i've used The Currency Club and it won't be last.Excellent service, very good rates both for the purchase and the "buy-back". would highly recommend.

A page for us to share with you our thoughts on everything to do with with foreign exchange and much more. From new product launches and widgets to political announcements, market insights and even where to head on your next holiday look no further, you'll find it all here.

September 2020

An update during the Covid-19 crisis..

These are really challenging times for everyone around the globe as we are bombarded with tragic news stories and adjust to a new "normal".

December 2020

Message from the CEO

The Currency Club's mission has always been to reduce the cost of foreign exchange for everyone. We launched our business ten years ago with this intention,and we deliberately focused on the retail travel money sector..

Guide to send money abroad cheaply

There can be multiple reasons for which you would need to send money abroad. Be it to pay for an item, to buy a property or just transfer money to a loved one.

October 2020

Who says cash is dead?

As a new year begins and the January blues sets in, many will return to their desks attempting to tackle their backlog of emails but at the same time distracted by which destination they should escape to next..

Using an ATM abroad? Read this..

According to Mintel research, 43% of holidaymakers used a debit or credit card last year and this seems to be on the rise with the 30-45 year age group.

Get your rate on the move!

Download our app to place travel money orders, send funds abroad and get alerts on the go.

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1488

- US Dollar 1.2284

- Australian Dollar 1.8541

- Bulgarian Lev 2.1546

- Canadian Dollar 1.6569

- Czech Koruna 27.3721

- Danish Krone 8.3219

- Hungarian Forint 432.5624

- Icelandic Krona 161.6722

- Indonesia Rupiah 18583.3588

- Mexican Peso 19.6468

- New Zealand Dollar 2.0289

- Norwegian Krone 13.1707

- Polish Zloty 4.7137

- South African Rand 22.4273

- Sweden Krona 13.0978

- Swiss Franc 1.1051

- Turkish Lira 37.1798

- Thai Baht 43.1601

- United Arab Emirates Dirham 4.2865

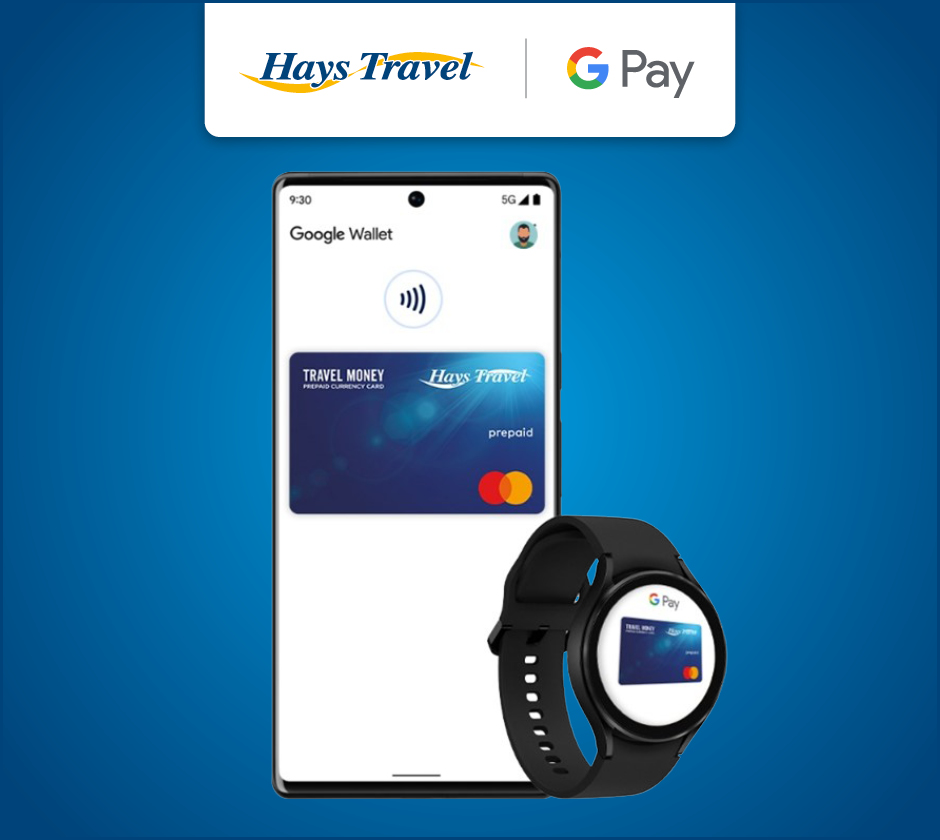

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance, travel money, exchange rate calculator.

Nectar members get better rates on travel money*

Our travel money rate sale is now on

Ends 09:30am Thursday 2 May 2024. Only available on foreign currency bought online or by phone. Not available instore, on sterling, or on travel money card home delivery orders and reloads. Sale rates are calculated by reducing our margin on the rates you would otherwise get. Currency fluctuations may cause exchange rates to vary during the sale period.

- Europe - Euro (EUR)

- USA - U.S. Dollar (USD)

- United Arab Emirates - UAE Dirham (AED)

- Australia - Australian Dollar (AUD)

- Canada - Canadian Dollar (CAD)

- New Zealand - New Zealand Dollar (NZD)

- Switzerland - Swiss Franc (CHF)

- Thailand - Thai Baht (THB)

- Aland Islands - Euro (EUR)

- American Samoa - U.S. Dollar (USD)

- Andorra - Euro (EUR)

- Anguilla - East Caribbean Dollar (XCD)

- Antigua and Barbuda - East Caribbean Dollar (XCD)

- Austria - Euro (EUR)

- Bahrain - Bahraini Dinar (BHD)

- Barbados - Barbadian Dollar (BBD)

- Belgium - Euro (EUR)

- Bulgaria - Bulgarian Lev (BGN)

- Chile - Chilean Peso (CLP)

- China - Chinese Renminbi (CNY)

- Cook Islands - New Zealand Dollar (NZD)

- Costa Rica - Costa Rican Colon (CRC)

- Croatia - Euro (EUR)

- Cyprus - Euro (EUR)

- Czech Republic - Czech Koruna (CZK)

- Denmark - Danish Krone (DKK)

- Dominica - East Caribbean Dollar (XCD)

- Dominican Republic - Dominican Peso (DOP)

- Ecuador - U.S. Dollar (USD)

- El Salvador - U.S. Dollar (USD)

- Estonia - Euro (EUR)

- Faroe Islands - Danish Krone (DKK)

- Fiji - Fijian Dollar (FJD)

- Finland - Euro (EUR)

- France - Euro (EUR)

- French Guiana - Euro (EUR)

- French Southern Territories - Euro (EUR)

- Greece - Euro (EUR)

- Greenland - Danish Krone (DKK)

- Grenada - East Caribbean Dollar (XCD)

- Guadeloupe - Euro (EUR)

- Guam - U.S. Dollar (USD)

- Haiti - U.S. Dollar (USD)

- Holy See (Vatican City State) - Euro (EUR)

- Hong Kong - Hong Kong Dollar (HKD)

- Hungary - Hungarian Forint (HUF)

- Iceland - Icelandic Króna (ISK)

- Indonesia - Indonesian Rupiah (IDR)

- Ireland - Euro (EUR)

- Israel - Israeli New Sheqel (ILS)

- Italy - Euro (EUR)

- Jamaica - Jamaican Dollar (JMD)

- Japan - Japanese Yen (JPY)

- Jordan - Jordanian Dinar (JOD)

- Kenya - Kenyan Shilling (KES)

- Kiribati - Australian Dollar (AUD)

- Korea, Republic of - South Korean Won (KRW)

- Kuwait - Kuwaiti Dinar (KWD)

- Liechtenstein - Swiss Franc (CHF)

- Lithuania - Euro (EUR)

- Luxembourg - Euro (EUR)

- Malaysia - Malaysian Ringgit (MYR)

- Malta - Euro (EUR)

- Marshall Islands - U.S. Dollar (USD)

- Martinique - Euro (EUR)

- Mauritius - Mauritian Rupee (MUR)

- Mayotte - Euro (EUR)

- Mexico - Mexican Peso (MXN)

- Micronesia, Federated States of - U.S. Dollar (USD)

- Monaco - Euro (EUR)

- Montenegro - Euro (EUR)

- Montserrat - East Caribbean Dollar (XCD)

- Nauru - Australian Dollar (AUD)

- Netherlands - Euro (EUR)

- Niue - New Zealand Dollar (NZD)

- Norfolk Island - Australian Dollar (AUD)

- Northern Mariana Islands - U.S. Dollar (USD)

- Norway - Norwegian Krone (NOK)

- Oman - Omani Rial (OMR)

- Palau - U.S. Dollar (USD)

- Panama - U.S. Dollar (USD)

- Philippines - Philippine Peso (PHP)

- Pitcairn - New Zealand Dollar (NZD)

- Poland - Polish Zloty (PLN)

- Portugal - Euro (EUR)

- Puerto Rico - U.S. Dollar (USD)

- Qatar - Qatari Riyal (QAR)

- Romania - Romanian Leu (RON)

- Saint Barthélemy - Euro (EUR)

- Saint Kitts and Nevis - East Caribbean Dollar (XCD)

- Saint Lucia - East Caribbean Dollar (XCD)

- Saint Martin (French part) - Euro (EUR)

- Saint Vincent and the Grenadines - East Caribbean Dollar (XCD)

- San Marino - Euro (EUR)

- Saudi Arabia - Saudi Riyal (SAR)

- Singapore - Singapore Dollar (SGD)

- Slovakia - Euro (EUR)

- Slovenia - Euro (EUR)

- South Africa - South African Rand (ZAR)

- Spain - Euro (EUR)

- Sweden - Swedish Krona (SEK)

- Taiwan - New Taiwan Dollar (TWD)

- Timor-Leste - U.S. Dollar (USD)

- Tokelau - New Zealand Dollar (NZD)

- Türkiye - Turkish New Lira (TRY)

- Turks and Caicos Islands - U.S. Dollar (USD)

- Tuvalu - Australian Dollar (AUD)

- Vietnam - Vietnamese Dong (VND)

- Virgin Islands, British - U.S. Dollar (USD)

- Virgin Islands, U.S. - U.S. Dollar (USD)

- No matches found

Exchange rates may vary depending on whether you buy instore, online or by phone.

^ Travel money cards are available on selected currencies only.

Buy travel money

Buy, exchange money and order foreign currency online, by phone, or at our bureaux.

How to get travel money with Sainsbury’s Bank

Need holiday money? Order currency online, by phone or visit a Sainsbury’s store with a bureau today. Or get a Sainsbury’s Bank Travel Money Card for easy and secure spending overseas.

There are various ways to buy travel money with Sainsbury’s Bank. Choose the method that’s easiest for you.

1. Buy currency online for home delivery. 2. Order currency online and collect instore. 4-hour click and collect available. T&Cs apply. 3. Buy currency via telephone. 4. Visit one of our bureaux to buy currency in a Sainsbury’s store.

Buy a prepaid travel money card

Our travel money card makes it safe and easy to manage and spend your holiday money. 1. Order for collection – Collect your travel money card from your nearest Sainsbury’s Bank bureau. 2. Order for delivery – We’ll send your travel money card straight to you. 3. Download the app or log in online – Check your balance, exchange between currencies, top up and manage your account.

Where can you get foreign currency with Sainsbury’s?

Get travel money delivered to you.

Order online or by phone and we’ll mail your holiday money to you securely via special delivery. Order more than £400 of foreign currency and get free delivery.

Collect travel money instore

Visit a store with an instore travel bureau to collect your travel money on your next weekly shop.

In a hurry? You can now order and collect Euros, US Dollars, and Travel Money Card pre-paid orders in as little as 4 hours with our click and collect travel money service^.

Click and collect currency the same day at a Sainsbury’s Bank travel money bureau when you:

- Order Euros, US Dollars, or a Travel Money Card

- Place your order on a Monday to Friday (excluding Bank Holidays), and

- Order at least 4hr before the bureau’s scheduled closure time

For orders made outside of this period, or for any other currency, you will be able to select your preferred collection date when placing your online order.

Get your travel money card delivered to you

We’ll send your travel money card straight to you, with your PIN arriving separately for security.

Visit one of our bureaux

We have stores with instore travel bureaux across the UK where you can pick up holiday money on the day.

Why use Sainsbury’s Bank for foreign currency

- Wide range of currencies, including USD and EUR We offer over 50 different foreign currencies, so it’s easy to get the holiday money you need.

- Nectar Prices Nectar members get better exchange rates both online, on the phone and at our bureaux. See our Nectar member benefits .*

- Currency buy-back Got holiday money left over when you get home? We’ll buy back most foreign currency, so you’re not out of pocket.

- Pick up your travel money in one of our stores Within travel bureaux across the UK, it’s convenient to pick up holiday money as you shop with Sainsbury’s Bank.

- Multiple ways to order and receive travel money Order online or by telephone, collect instore or receive holiday money by post – the choice is yours.

- 24/7 telephone assistance and online portal Our team are on hand to help with your travel money card any time of the day or night, no matter where you are in the world.

- Access to Western Union You can send an international money transfer instore with Western Union Money Transfer® services .

Choose your foreign currency

From Euro and US Dollar to Swedish Krona and Japanese Yen, we have more than 50 foreign currencies from all over the world.

Take a look at our most popular currencies.

Add to your travel money card to withdraw and spend on holiday.

US Dollar (USD)

Order by telephone and receive your travel money in the post.

Dirham (AED)

Order online for bureau collection or buy directly instore.

Turkish Lira (TRK)

Buy travel money at one of our bureaux de change.

Thai Baht (THB)

Order currency online and get free delivery over £400.

Canadian Dollar (CAD)

Get a travel money card instore to use on holiday in Canada.

Frequently asked questions

Are there any administration fees.

No, we don't charge any administration fees when you order currency from us.

Will I be charged for using my credit/debit card?

No, we don’t charge any extra when you buy foreign currency by card.

Some card providers may charge a cash advance fee and interest for buying currencies. Cash advance fees will not show on your travel money order, but you’ll be able to see them on your card statement. If you’re not sure, you should check with your card issuer.

There is no cash advance fee when you use a Sainsbury’s Bank Credit Card. No interest will be charged, as long as the full outstanding balance on the credit card is cleared during the current billing cycle. If a balance remains on the account at the end of the billing cycle, interest will be charged and may apply to the currency purchased.

Do I get any benefits for being a Nectar member?

Yes, you do. If you tell us your Nectar card number when you place your order, we’ll give you a better exchange rate*. Not a Nectar member? Sign up today .

When will I receive my home delivery order?

You can select a specific working day delivery date up to seven days in advance. Please note Saturday deliveries are not guaranteed. Also, if you’ve chosen a Monday delivery, Royal Mail may try to deliver on Saturday.

The earliest day you’ll be able to select for delivery is:

What are the home delivery fees?

How much money can i order online.

Orders for collection at any Sainsbury's Bank Travel Money Bureau or for home delivery are subject to a maximum value of £4,500 per person per day.

All home delivery orders are subject to a minimum value of £100** and a maximum of £2,500. There is no minimum order value for orders for collection at a Sainsbury's Bank Travel Money Bureau.

How long will my travel money card take to arrive?

We’ll send out your travel money card as soon as you order it, so it should be with you in three to five working days. You can also get a travel money card immediately at our bureaux if you need yours at short notice.

Can I exchange unused travel money?

Yes, we can buy back your foreign currency. Just bring your unused currency back to a Sainsbury’s Bank travel money bureau and we’ll exchange it back to sterling. Please note that we can buy back notes but not coins.

Terms and conditions

*Nectar members receive better exchange rates on single purchase transactions of all available foreign currencies. Excludes travel money card home delivery orders and online reloads. Exchange rates may vary depending on whether you buy instore, online or by phone.© You need to tell us your Nectar card number at the time of your transaction. No cash alternative is available. We reserve the right to change or cancel this offer without notice.

**You can order currency for a secure home delivery by 1pm on the day of your choice by Royal Mail (Mon- Sat). For next day delivery your order needs to be confirmed before 2pm (Mon- Fri). Please note that whilst Royal Mail make every effort to delivery on schedule, we cannot guarantee this as it is beyond our control. Highlands and Islands (including Channel Islands) are not guaranteed next day delivery. Delivery is free on all cash orders £400 or more (£4.99 for orders between £100 and £399.99). The minimum order for home delivery is £100. The delivery day quoted is dependent on the order day being a working day; if one of those days is a public holiday then additional day(s) will be added accordingly. All home delivery orders are sent via Royal Mail Special Delivery, unless we advise you otherwise, to your billing address, and a signature will be required upon delivery. A valid telephone number is required for home delivery. ^ For Euro, US Dollar and Travel Money Card only:

If you selected same-day collection your order will be available 4 hours from the initial order confirmation email received or if your order was placed before 6 am then the earliest your order will be available to collect is from 10 am. Please allow at least 4 hours for your order to be processed. Remember to check the bureau opening hours before collecting your order.

If you selected tomorrow or a future date your order will be ready from 10 am on your chosen collection date. For all other currencies

Your order will be available from 2.00 pm on your chosen collection date.

Your order should be collected within 72 hours or will be subject to cancellation. Sainsbury's Bank Travel Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Find more Terms & Conditions here

Nectar prices for Nectar members*

Royal Mail strikes are expected in December.

There are planned Royal Mail Strikes confirmed for the 14th, 15th, 23rd and 24th of December. Royal Mail have advised to expect delays during these two weeks and to allow several days extra time to receive your delivery.

Why queue up? No Fuss, Travel Money Delivered to your Home

The rate provided above is for indication only. we will apply the best BUY BACK rate on the day we receive your currency

These words inspire us

WHAT WE OFFER

Easy and Fast Ordering

Select the currency you wish to buy and confirm your exchange rate

Our rates move with the market once you confirm your order you fix your rate.

Select your delivery date and then Make Payment

Deliveries are made by 1pm Monday to Saturday. Select the date most convenient for you.

Receive your currency the next day via Royal Mail Special Delivery

You will be notified once your order is on its way to you. Royal Mail will require a signature upon delivery.

Place a buy back order online

Place your buy back order online and you will be provided with an indicative buy back rate. A form will be generated for you to print off. Sign and enclose the form with your currency

Send your currency to us via Royal mail special delivery

Please make sure the item has been insured to the correct value in the event of loss or theft and keep hold of the tracking ID. Send to the following address: TCC TCC, PO BOX 66831, London, W27TB

Payment to your bank account

Once we have received your item in the cash center the buyback rate at the time will be applied and we shall make payment to the bank account details you have provided. You can expect an email notification once the amount has been paid

BEST CURRENCY EXCHANGE RATES

Rapid Travel Money vs The Competition*

Buy Travel Money online for next day home delivery

Buy travel money for next day home delivery or place a click & collect and pick up at our central London branch.

Top Rated Company On Trustpilot

Travel money.

Your best exchange rate: 1 GBP =

Home Delivery (Free delivery for orders of £700 and upwards)

Click & Collect (105 Edgware Road,London, Marble Arch,W2 2HX)

experience in the foreign exchange market

1.3 Billion

worth of foreign exchange transferred

ranked out of 96 companies

satisfied customers

98% of users recommend us on Review Centre

How does it work?

Select the currency you wish to buy

Our rates move with the market once you confirm your order you fix your rate.

Confirm your exchange rate

Select a delivery date

Royal Mail will require a signature from same are in the property at the time of delivery.

You can get to pay via bank transfer or debit card. We can only dispatch currency once we have received cleared funds.

Confirmation and tracking information

We shall mail you a dispatch notification once your currency is on its way to you and this mail will include your tracking details.

Delivery of currency

We use Royal Mail Special Delivery which is a fully insured and secure home delivery service.

Buy Travel Money

The various options travellers now have when spending travel money abroad is incredibly varied from using credit cards, ATMs, travellers cheques and pre paid cards however along with them each one of them are the associated costs and fees.

Once you make all those comparisons, taking travel currency away with you on holiday still comes up tops and here are the reasons why we highly recommend it!

Budgeting becomes easy

Whether you're travelling with a bunch of friends or with family, you may wish to budget for the cost of your holiday and not find you have broken the bank balance upon your return. When you buy travel currency online, you have incorporated the cost of this and accordingly it is easier for you to keep a track of how much cash you are travel money you are spending as you physically see your foreign exchange deplete. Using credit cards abroad makes things a lot harder to keep track of what you have spent on and how much in total.

No hidden fees

Some people take a credit card when they travel abroad on business or pleasure. A card can be an easy and convenient way to pay for things but can be costly to use overseas. Credit cards charge a foreign transaction or usage fee when you spend with it abroad. The costs vary, but a fee of 3% is not uncommon for the luxury of using your card abroad and the fees can be more. So as an example, if you stay in a hotel and the bill comes to the equivalent of £200, the card company could load the cost by £7.50.

Travel Cash is accepted everywhere & anywhere you go

Whether you find yourself in the backwaters of southern India or a remote village in the Italian wine region, travel cash is widely accepted by every shop, hotel, restaurant and transport provider. You simply cannot go wrong having some travel currency on you. The convenience of having travel money in your pocket to pay for even souvenirs in markets can go a long way and don't forget the benefit of bargaining more when you pay in cash!

Transparency on rates and the rate improves with the more you order!

Savvy travellers know that the best exchange rates are found when buying euros, buying dollars or any exotic currencies online. When purchasing travel money online, you have the luxury of seeing exactly what the rates are and any additional charges (credit card or delivery costs). Furthermore, with The Currency Club, you can even capture a better exchange rate with the more travel currency you order. For those who are fans of using the ATMs when abroad take care. The typical charge for cash withdrawals from a foreign ATM is 2.5%. In other words, withdraw £500 and the transaction cost will be £12.50 for the privilege of the withdrawal. Furthermore, in many cases the banks will not provide you with a good foreign exchange rate either, so in which case you may get stung twice.

Taking travel cash feels good and gets you in holiday mood before you've even reached your destination

Just like you have that buzz when you have your passport and your suitcase in hand, the joy of having some colourful foreign exchange notes in your holiday purse or wallet is like the icing on the cake! You're off on holiday and we think simply having travel money on you makes that even more official!

Best currency exchange rates

*We capture the exchange rates being offered by airports and high street providers once a month and calculate what spread they are taking off the live interbank rate. We then compare that to what rates we are offering to calculate the savings you can make if you use us.

Furthermore, in many cases the banks will not provide you with a good foreign exchange rate either, so in which case you may get stung twice. That's why it makes sense to get your Travel Money from The Sterling FX - your preferred currency exchange in London.

Top Rated Company

Ranked 1st of 96.

I have used Sterling FX loads of times. On all these occasions, we have got one of the best rates available, the money has arrived the next day and we have the option of small denominations, which is great as usually large notes are not very welcome in shops/bars/restaurants/taxis etc. I could not be happier with Sterling FX's service.

Featured in

Get in touch with us today

International payments.

- Business & Corporate Clients

- Private Clients

- Product Suite

- Exchange Rates

- Regulatory Information

- Home Delivery

- Click & Collect

- Branch Services

- Refer a friend

- Partner with Sterling FX

- Affiliate Scheme

- Referral Partnerships

- White Label

- Who we work with

Quick Links

Registration Details

Sterling Consortium Limited is registered in England and Wales under company number 05850613 .

Sterling Consortium Limited is authorised and regulated by the Financial Conduct Authority as an Authorised Payments Institution (API Firm reference number 987941 ). Furthermore, we are governed by HM Revenue and Customs as a Money Service Business (MSB registration no. 12120971 ). The actual provision of travel money is not regulated by the FCA.

Copyright 2023 @ Sterling FX | Privacy | Website Terms | TM Terms | International Payments Terms

Privacy Policy

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Please note: Our website no longer fully supports IE11 , as such you may encounter issues using our website, please try an alternative browser such as Google Chrome, Mozilla Firefox, Microsoft Edge (Windows) or Safari (Mac).

ABTA Travel Money

ABTA is now bringing you one of the essentials when travelling abroad. With over 60 different currencies to choose from, ABTA Travel Money is a foreign exchange service which is convenient, reliable and has the ABTA badge of confidence.

Order Travel Money

Why choose ABTA Travel Money

- One of the widest ranges of currencies available online.

- Convenient next day home delivery.

- Pick up your travel money just 60 seconds later with Click & Collect*.

- Available to collect in over 190 locations across the UK.

- Get peace of mind with our Refund Guarantee for just £3.

*Depending on branch opening hours and stock availability.

ABTA is now bringing you one of the essentials when travelling abroad. With over 60 different currencies to choose from, ABTA Travel Money is a foreign exchange service which is convenient, reliable and has the ABTA badge of confidence. All you have to do is relax and look forward to your trip.

Delivery options

Click & collect .

Pay online and pick up your order where and when it is convenient.

- Click & Collect your order in just 60 seconds.*

- Choose from over 190 locations in the UK.

- Over 60 currencies, including euros and US dollars.

Home delivery

Have your travel money delivered directly to you with the home delivery service.

- Free delivery on orders over £500; a delivery charge applies under this amount.

- Fully insured next working day delivery with Royal Mail.

Get peace of mind with our Refund Guarantee

If your travel provider cancels your holiday, you can exchange any currency you bought for the same rate with our Refund Guarantee for just £3. All you need to do is add the Refund Guarantee when ordering online. Terms and conditions apply.

Get a great rate on your leftover foreign currency with ABTA Travel Money’s sell back service. All you need to do is go online to secure that day’s rate, then visit your chosen eurochange branch to sell back your travel money.

Why choose ABTA Travel Money

Frequently asked questions, can i choose where i have my order delivered to.

Your order can only be delivered to your debit card billing address.

Can I change the date of my delivery?

Unfortunately, it is not possible to change the date of delivery once an order has been placed.

Does someone have to be in for the delivery?

Yes, there will need to be someone in to sign for the delivery.

What ID do I need to take with me for collection?

For Click & Collect orders, you will need to take with you the debit card with which you made the order, your email confirmation and one of the following forms of ID:

- UK or EU photographic driving licence

- National ID card.

Please note that other forms of ID will not be accepted, and the order must be collected by the person who made the order.

If your question isn’t answered here, visit the website for more information.

Find out more

Need help?

If you need any assistance or have any questions, please get in touch with us by emailing [email protected] or phone 0330 174 9439.

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- Accessibility statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

- International Banking

- Lloyds Bank Logo

Everyday banking

Online services & more

How to get online

- Set up the Mobile Banking app

Register for Internet Banking

Log on to Internet Banking

- Reset your logon details

Mobile Banking app

- Setting up our app

- App notifications

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN services

- View your card details

- Report your card lost or stolen

- Order a replacement card

- View your PIN

- Payments & transfers

- Daily payment limits

- Pay someone new

- Cancel a Direct Debit

- Pay in a cheque

- Send money outside the UK

Statements & transactions

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Money management

- Understanding credit

- Managing someone's affairs

- Financial planning

- Personal Tax Services

Banking near you

Life events

- Buying a home

- Getting married

- Family finances

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer support

- Support & wellbeing

- Banking online

- Accessibility & disability

- Banking with us

- Feedback & complaints

Current accounts

Accounts & services

- Club Lloyds Account

- Classic Account

- Silver Account

- Club Lloyds Silver Account

- Platinum Account

- Club Lloyds Platinum Account

- Youth & student accounts

- Joint accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switching to Lloyds Bank

- Everyday Offers

- Rates & charges

- Save the Change

- Current account help & guidance

- Mobile device trade in service

Already bank with us?

Existing customers

- Upgrade options

- Mobile banking

Club Lloyds

The current account with exclusive benefits. A £3 monthly fee may apply.

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- World Elite Mastercard ®

- Cashback credit card

- Loan calculator

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Car finance options

- Car refinance

- Car leasing

- Credit cards help & guidance

- Loans help & guidance

- Car finance help & guidance

- Borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage to us

- Existing Lloyds Bank mortgage customers

- Buying to let

- Equity release

Mortgage calculators & tools

- Mortgage calculator

- Remortgage calculator

- Get an agreement in principle

- Base rate change calculator

- Overpayment calculator

- Mortgage help & guidance

- Club Lloyds offer

- Eco Home offers

- Mortgage protection

Already with us?

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Switch deal & borrow more

- Help with your payments

- Learn about Home Wise

- Your interest only mortgage

Club Lloyds mortgage offer

Our Club Lloyds customers could be eligible for an exclusive discount on their initial mortgage rate.

Accounts & ISAs

Savings accounts

- Instant access savings accounts

- Fixed rate savings accounts

- Club Lloyds savings accounts

- Children's savings accounts

- Joint savings accounts

- Compare savings accounts

- Compare cash ISAs

- Help to Buy ISA

- Stocks & Shares ISA

- Investment ISA

- Savings calculator