- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Travel Insurance and Pregnancy: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

There’s a lot to think about when you’re pregnant — especially if you plan to travel. You’ll want to make sure your health care and your trip costs are covered if something goes wrong.

And while travel insurance for pregnancy may sound like a must-have, remember that not all plans will cover your specific needs. At the moment, there isn't a specific insurance option for those who are pregnant. Rather, pregnant people will need to consider travel insurance that includes coverage for trip cancellation and interruption, as well as emergency medical and evacuation costs.

Your decision to buy travel insurance while pregnant will depend on how much of your trip is nonrefundable, where you’re going and what coverages you already have. These coverages may include trip interruption insurance from your credit card issuer or emergency medical coverage from your current health insurer.

Here’s what you need to know to choose the best travel insurance for pregnancy.

Trip cancellation or interruption due to pregnancy

Most travel insurance policies will reimburse you for all or a portion of your nonrefundable travel costs if you have to cancel your trip for a covered reason. But for pregnant people, covered reasons are a little more complicated.

For most policies, normal pregnancy is not a valid reason to cancel your trip if you already knew you were pregnant when you purchased the insurance. But pregnancy may be a valid reason to cancel if you learn you're pregnant after you’ve booked your trip and paid for an insurance policy.

For example, if you prepay for a trip a year in advance, purchase Allianz travel insurance, and a few months later find out you’re pregnant and need to cancel your trip, the company will likely reimburse you for all or a portion of your lost travel costs. But you’ll have to prove that you learned about your pregnancy after you purchased the policy.

On the other hand, if you knew you were pregnant when you purchased the policy, you will likely not get reimbursed if you canceled your flight due to morning sickness, for example.

» Learn more: Can you fly while pregnant? It depends.

Trip cancellation or interruption due to complications of pregnancy

If you have complications during your pregnancy, travel insurance may cover your trip costs regardless of when you learned you were pregnant.

Keep in mind that only specific complications — like gestational diabetes, preeclampsia, hyperemesis gravidarum or miscarriage — are eligible, and a doctor must advise you not to travel due to your diagnosed condition.

» Learn more: What to know about Cancel For Any Reason (CFAR) travel insurance

Medical coverage for pregnant travelers

If you’re traveling domestically, your regular health insurance may be all the coverage you need. Check with your provider. If you’re going abroad, there’s a good chance your health insurance will not reimburse you for medical expenses while traveling. So for pregnant people traveling internationally, travel medical insurance is probably a good idea.

Secondary travel health insurance can be surprisingly affordable. Secondary plans kick in after you’ve used any applicable primary insurance coverage from your current health insurer.

Searching InsureMyTrip.com, we found secondary international medical insurance plans starting at $14 for a 30-year-old California resident traveling to France for 12 days in September. For this price, you receive coverage up to $50,000.

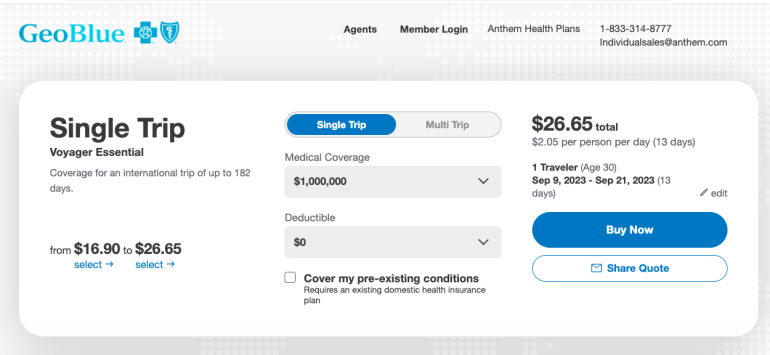

Want higher coverage limits? They’re available. For the same 30-year-old California-based traveler headed to France, GeoBlue 's Voyager Essential plan offers $1 million in travel medical coverage with a $0 deductible for $27 — again, that’s for the whole trip, not per day. This plan is not secondary coverage, meaning you can buy it even if you don’t have a primary health insurer.

» Learn more: Can I get travel insurance for pre-existing medical conditions?

Emergency medical evacuation due to pregnancy

If you’re traveling to large city, a health care facility is likely a short drive away. But if you’re traveling someplace remote, emergency transportation coverage , like a helicopter, can be a literal lifesaver. Covering this service with an insurance plan can save you a bundle.

Some credit cards give you automatic emergency medical evacuation when you use the card to book your trip, like the Chase Sapphire Reserve® . But if you didn’t use a credit card with emergency evacuation coverage or need higher limits, you may want to buy travel insurance. Most comprehensive plans include emergency medical evacuation insurance, but make sure it’s covered before you purchase your plan.

» Learn more: The best credit cards for travel insurance benefits

Where to buy insurance for traveling while pregnant

Different travel insurance companies have a variety of plans with varying coverage.

A policy from Travel Guard that was perfect for your nonpregnant friend when she traveled to Machu Picchu may not be as good as a policy from Travelex or Nationwide if you’re pregnant and cruising through Europe. Comparison shop and carefully note what’s covered and the deductible limits before you buy.

» Learn more: The best travel insurance companies

Travel insurance while pregnant recapped

You may not need travel insurance for pregnancy, especially if you’re traveling domestically and your trip is fully refundable — but don’t assume that’s always the case.

Read up on your existing coverage from your health plan and any insurance offered by your credit card . Then you can explore a little more of the world before baby arrives, knowing you’re covered for any scenario.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Travel During Pregnancy: What Does Travel Insurance Cover?

Some of the most common questions we get at Allianz Global Assistance are about traveling while pregnant. While most pregnant women can safely travel without incident, sometimes complications arise and customers wonder, "What does travel insurance cover?"

Here’s the quick answer: Travel insurance can cover certain situations that result from unforeseen pregnancy complications, or a pregnancy that occurs after you’ve purchased your plan. Travel insurance typically does not cover trip cancellations or other travel losses resulting from normal pregnancy.

Like any other kind of insurance, travel insurance includes specific coverage definitions and restrictions. Read your agreement carefully, and if you have any questions about coverage, call. Pregnant women should consult their doctors with concerns and questions about safe travel.

If you’re pregnant, or you might be soon, it’s wise to protect upcoming trips. Maximize your coverage window by purchasing travel protection as soon as possible. Our most popular plan is OneTrip Prime , which includes substantial benefits for trip cancellation/interruption and medical emergencies.

Read on for a detailed guide to travel insurance and pregnancy from Allianz Global Assistance.

Pregnancy Complications: What Does Travel Insurance Cover?

You're in the first trimester of your pregnancy and feeling fine — until you begin feeling extremely nauseous a week before you're supposed to fly to New York on business. Your doctor diagnoses you with hyperemesis gravidarum, a severe and serious form of morning sickness, and you end up in the hospital on the day of your scheduled flight. Can travel insurance reimburse you for the canceled trip?

Yes. Travel insurance from Allianz Global Assistance can cover losses resulting from unforeseen pregnancy complications, such as pre-eclampsia, gestational diabetes or hyperemesis gravidarum. That means your travel insurance may reimburse you for nonrefundable trip costs lost if you must cancel or interrupt your trip because of pregnancy complications. The illness, injury, or medical condition you’re experiencing must be disabling enough to make a reasonable person cancel their trip, and a doctor must advise you to cancel it. For example, normal morning sickness would not be a covered reason for trip cancellation. When you’re filing a claim for trip cancellation/interruption related to a pregnancy complication, you’ll need documentation from your physician.

All travel insurance plans from Allianz Global Assistance include access to 24-Hour Emergency Assistance . If you experience a medical emergency while traveling, or any other problem, contact our hotline via phone or the TravelSmart TM app for rapid assistance. If your plan includes emergency medical benefits, your insurance may reimburse you for the cost of emergency medical care that you received for covered pregnancy complications while traveling.

Please note that travel insurance does not cover the chance that a complication might occur. For example, if you delivered prematurely with your first two pregnancies, your doctor might advise you to cancel the trip to Paris you planned for the sixth month of your third pregnancy. However, this is still considered a normal pregnancy because no complication has been diagnosed. Travel insurance would not cover the trip cancellation.

Surprise Pregnancy and Trip Cancellation

You and your spouse are planning a week-long European river cruise to celebrate your third anniversary. Tickets are hard to come by, so you book your trip a year in advance. You schedule the flights and purchase your travel insurance — and two months later, you discover you're pregnant. Will travel insurance cover your trip cancellation?

On some plans, Allianz Global Assistance lists pregnancy as a covered reason for trip cancellation if you find out you are pregnant after purchasing your policy. For your trip cancellation to be covered, you must provide medical records to verify the pregnancy occurred after that date. Please see your policy documents for your plan’s specific coverage. And if you’re planning a trip now, don’t wait to buy travel insurance! Get a quote today.

Late-Term Pregnancy and Trip Cancellation

You decide to plan a babymoon getaway so you and your sweetie can enjoy some time together before the baby arrives. You book your plane tickets and a bed-and-breakfast on the beach. You're feeling fine and getting excited. Then your doctor advises you, as a precaution, not to travel in the eighth month of pregnancy. Will travel insurance cover this pregnancy-related trip cancellation?

No. In this scenario, there are no medical complications with your pregnancy, so the cancellation will not be covered. Please understand that Allianz Global Assistance is not disagreeing with your doctor's recommendation not to travel — you should do what's best for you and your baby's health. However, most travel insurance plans from Allianz Global Assistance do not include normal pregnancy as a covered reason for trip cancellation (except as described above.)

Airline Rules for Flying While Pregnant

You're flying to Los Angeles to see your sister one last time before the baby's born. But when you get to the gate, the airline won't let you on board because you're too close to your due date. Will your travel insurance plan reimburse you for the missed flight?

No. Being refused service by a carrier because of normal pregnancy is not a covered reason for trip cancellation. Cruise ships and airlines have very specific rules about travel while pregnant. Here are selected airline pregnancy policies, but you should also call your travel supplier to check before you book your trip. Please note that this information is subject to change.

- American Airlines: A medical certificate is required to fly within four weeks of your delivery date in a normal, uncomplicated pregnancy. Travel is not permitted within seven days of your due date on domestic flights under five hours, or within four weeks of your due date on international flights, unless you get a medical certificate and clearance from a Special Assistance Coordinator. 1

- Delta: Delta does not impose restrictions on flying for pregnant women. However, ticket change fees and penalties cannot be waived for pregnancy. 2

- JetBlue: Pregnant passengers expecting to deliver within seven days are prohibited from travel, unless they provide a doctor's certificate dated no more than 72 hours prior to departure stating that the passenger is physically fit for air travel and that the estimated date of delivery is after the date of the last flight. 3

- Southwest: Southwest has no pregnancy prohibitions, but recommends against air travel beginning at the 38th week of pregnancy. 4

- United: To fly in or after your 36 th week of pregnancy, you must provide the original and two copies of an obstetrician’s certificate, dated within three days (72 hours) prior to your flight departure, that says you’re fit to fly. 5

Travel Insurance and Childbirth

You're enjoying your babymoon vacation in Cozumel when suddenly you feel the first twinge of labor. Twelve hours later, you're the proud mother of a baby girl. Will travel insurance cover the cost of labor and delivery?

No. Normal childbirth is not covered by travel insurance from Allianz Global Assistance. However, if complications arise in delivery, the costs of emergency medical care may be covered. Also, attending the childbirth of a family member can be a covered reason for trip cancellation, depending on your plan.

While travel insurance from Allianz Global Assistance can't cover every possible pregnancy scenario, we want to do our best to help! Our Assistance team is available 24 hours a day to provide expert advice and aid.

Related Articles

- Traveling While Pregnant: Key Considerations

- The Essential Packing Checklist for Flying With An Infant

- Great Babymoon Destinations in the US

- JetBlue.com

- Southwest.com

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Pregnancy travel insurance - here's what to know before you book

--> BY Jessica Humphries

Last updated . 20 December 2023

Relish the excitement of your travel plans with your blossoming baby bump by securing the right cover.

Enjoying a journey with a little one on the way? The thrill of travel is irresistible, but let’s face it – the logistics can pile up faster than you can say ‘jetlag’, and Mama – you’ve got enough on your plate. If your adventurous side still calls, despite having a baby on board, navigating the realm of travel insurance becomes a whole new adventure. Fear not, we’ve got everything you need to know about travel insurance when you’re pregnant right here.

Key things to consider before buying coverage

When you’re planning your trip with a baby on board, there are some things you’ll need to consider straight-up.

How far along are you?

We know you’ve heard the question a million times, but here’s where it really counts. When it comes to pregnancy and travel insurance, most insurers graciously cover single, uncomplicated pregnancies following natural conception. However, there’s a catch – the coverage window varies.

The best time to travel is within your second trimester.

Some providers extend their umbrella up to 30 weeks, while others gently fold it at 23 to 26 weeks pregnant. Most importantly, remember – the stork won’t deliver coverage for birth-related costs or newborn expenses. So, if you can, keep your window wide and travel within the sweet spot (more on that later).

Is pregnancy considered a ‘pre-existing medical condition’?

Thankfully, pregnancy isn’t generally considered a pre-existing medical condition when you’re obtaining travel insurance. If you’re under 26 weeks (at the time of travel) with just one bub on board, you may not need to declare it at all. However, honesty is key, especially if you’re dealing with a more complex pregnancy. Disclose the details to your insurer to make sure you’re covered.

Be prepared with pregnancy travel insurance for your safety.

What to look for in a pregnancy travel insurance policy

It’s time to dig into the details. Here’s what you’ll need to keep an eye out for in your travel insurance to make sure you and your bump have a smooth ride.

Travelling while pregnant can be a fulfilling experience. (Image: Josh Bean)

The benefits buffet

Navigating pregnancy with travel insurance is like entering an extensive buffet – enticing, filled with numerous options, and just a tad overwhelming. Yet, the crucial factor lies in the details. Delve into the fine print to ensure you grasp the details of the nitty gritty.

Tick off the benefits of your pregnancy coverage.

If you identify any gaps, ask your insurer about tailored policy add-ons for a personalised experience. Alternatively, explore other options that cater specifically to your unique pregnancy needs.

- Make sure your policy covers (on top of standard travel insurance staples):

- Unforeseen pregnancy challenges.

- Emergency medical coverage abroad: including expenses for unexpected illnesses, complications, or severe injuries related to your pregnancy.

- Trip cancellation protection.

- Around-the-clock travel assistance.

Make sure that your policy covers unexpected pregnancy challenges.

Cancellation considerations

If there’s ever a time when last-minute travel plans can swiftly change, it’s during pregnancy. Your pregnancy might even be a time when you consider locking in your coverage before finalising your booking. Locking in coverage ensures that in the event of unexpected pregnancy complications leading to a trip cancellation, you’re covered – no strings attached.

Consider last-minute travel changes especially when you’re travelling with a child.

Find out what’s excluded

Navigate the exclusion territory carefully. Be aware that certain conditions, like conception through IVF, expecting multiples, or planning travel after the approved gestational weeks, may lead to limited or no coverage.

Common exclusions:

- Conception through assisted reproduction (IVF).

- Seeking reimbursement for childbirth or newborn healthcare expenses if you give birth on your trip.

- Travelling against medical advice from your doctor.

- Expecting twins (or more!).

- Planning travel beyond the approved weeks according to your provider.

- Dealing with pregnancy complications (previous miscarriages or premature labour, gestational diabetes etc.) – disclose them to avoid issues.

- Routine pregnancy check-ups abroad.

Remember, some exclusions can be lifted with premium payments or a medical assessment.

Trimester travel tactics: A travel roadmap for every stage

When planning your travels, take your pregnancy stage into account for a seamlessly enjoyable journey tailored to each trimester.

First-trimester trail

The first 12 weeks are the opening act of your pregnancy journey. While generally safe for travel, be aware that morning sickness might steal the show. Consider scheduling your adventures post-week 12 to dodge any queasy interludes.

You may experience morning sickness during your first trimester.

Second-trimester bliss

The perfect time for a babymoon, your second trimester offers you a golden ticket to travel bliss, sans complications. Chat to your doctor, pack your bags, and make the most of this worry-free window.

Always check with your doctor for any pregnancy reminders before travelling. (Image: Lucas Favre)

Third-trimester reality check

Some airlines may give side-eye glances if you’re deep into the third trimester, and many travel insurance providers will cap their coverage around the 26-week mark. If leisure is the plan, think twice before boarding that flight.

It’s best to travel with a companion.

As you embark on this exciting journey with a baby on board, remember that a well-informed approach to travel insurance during pregnancy is your ticket to peace of mind. From navigating coverage windows to crafting your personalised pregnancy passport and considering trimester-specific tactics, your wanderlust need not be put on hold. Embrace the adventure, plan wisely, and savour every moment of this unique chapter in your globetrotting story. Safe travels, mama!

Travelling during pregnancy can be your first milestone as a family.

For more tips and advice, read our travel insurance hub to help you navigate the ins and outs of what to do before you head overseas.

Leave your comment, cancel reply.

Save my name, email, and website in this browser for the next time I comment.

You might also like

Ski holiday insurance – the facts you need to know

Heading to the hills? Stay fancy-free in a winter wonderland by decoding the ins and outs of ski travel insurance first. As majestic snowflakes blank...

Everything you need to know about cruise insurance

Before setting sail, getting the lowdown on cruise insurance is a must. Standard travel insurance might not cut it, so making sure you have the right ...

10 ways to save money on your travel insurance

Dreaming of your next getaway? While travel insurance is a must, there’s no need to break the bank. Ready to make your travel dreams a reality but ...

How to get travel insurance when you have a medical condition

Don’t let pre-existing conditions be a roadblock to your wanderlust. Learn the ropes of securing the right travel insurance for a hassle-free advent...

Here’s what you’ll really want from your insurer when travel goes wrong

Turn hiccups into manageable adventures by finding the coverage you’ll wish for when plans hit a bump. Embarking on a travel adventure is a journey...

Here’s why travel will return bigger and better than before

Don’t cry because the ‘best years’ are behind you; smile because we now have the tools to travel bigger and better than ever before, writes Dilv...

Travel Advice: Important information about cover for Coronavirus. Read more . View the latest travel warnings here .

Here’s how travel insurance works when you’re pregnant

Pregnant and want to travel? If your doc gives you the a-ok, here how your travel insurance covers you, in case of a medical emergency or bump-related travel cancellation.

Planning a babymoon? Or a third trimester trip? Will your travel insurance cover you? Use our guide to answer all your pregnancy-related travel insurance concerns. We’ll look at:

- When it’s safe to travel pregnant

- Airline rules for pregnancy

- Standard travel insurance cover

- Optional extra cover for pregnancy

- What you’re not covered for

- Health risks while travelling pregnant

How many weeks?

Bringing a little explorer into the world? We’re excited for you! And if you’re sneaking in a little exploring of your own before D day, we’re even happier for you! That’s because we believe in the magic travel, and expecting mothers should be no exception.

If you’re thinking of taking a holiday overseas while pregnant, you’re not alone. According to research by finder.com.au , one in five mums take a holiday in their third trimester. The study found that younger mothers are more likely to make the trip, with almost a quarter of mums under 30 enjoying a getaway while pregnant, compared to 16% of those aged over 40. Unsurprisingly, most mums are looking to stay closer to home that late in their pregnancy, and are about three times as likely to travel domestically rather than overseas. But that doesn’t stop 5% of expecting mums from jetting off overseas, even while heavily pregnant.

The World Health Organization (WHO) however, advises against air travel for pregnant women after the 36th week of pregnancy or four weeks before the expected date of childbirth. Since labour can begin at any time during the last few weeks, it is recommended to avoid traveling during this period. Instead, WHO recommends that the safest time for expecting mums to travel is in the second trimester.

Airlines and pregnancy

It’s also important for you to know any airline restrictions placed on pregnant travellers before you book your trip. Airline restrictions around flying while pregnant vary. Another factor is length of the flight itself.

Both Qantas and Virgin Australia for example, allow women without pregnancy complications to travel on flights more than four hours in length up to the end of the 36th week for single pregnancies, and the end of the 32nd week for twins or more.

For flights less than four hours, you can usually travel up to the end of the 40th week in a single pregnancy and the 36th week for a multiple pregnancy.

But both airlines require women travelling after 28 weeks of pregnancy to carry a note from their doctor or midwife confirming their due date and pregnancy details. For Virgin Australia travellers, this letter needs to be dated no more than 10 days before travel.

And if you have complications, you have to travel with a medical clearance form signed by your doctor.

Check out the pregnancy policies of popular airlines departing Australia:

Air Asia , Emirates , Jetstar , Virgin Australia , Qantas , Singapore Airlines.

What to expect from Australian travel insurers

Typically, travel insurance offers cover for emergency medical treatment while travelling, and this extends to medical emergencies pregnant women might experience. So if you’re pregnant, and you fall sick, or break a leg, and these events are in no way related to your pregnancy, you’ll be able to claim the hospital trip.

It’s really important to know that cover is provided to you, but not provided for childbirth or the health of a newborn child. When a medical emergency is pregnancy related – let’s say you need help with debilitating nausea – your ability to claim is going to largely depend on 3 questions – your due date , our doctor’s approval , and whether or not your emergency relates to fertility treatment, triplets and known complications.

Travel with Jane looks after expecting mums with two levels of cover. First we’ll look at the benefits offered under our standard cover, and then we’ll explore an optional extra for pregnancy – our Pregnancy Add-on.

What we cover as standard

Travel with Jane offers emergency medical cover for expecting mums up to 26 weeks in the case of a single baby, and 19 weeks in the case twins. That’s 2 weeks more than a lot of the competition.

What you are not covered for

Pregnancy-related costs will not be covered in any of the following circumstances if you have not purchased a Pregnancy Add-on . (More on that next)

- if you have experienced any pregnancy complications prior to purchasing your policy

- multiple pregnancies arising from services or treatment associated with an assisted reproductive program, including but not limited to in vitro fertilisation;

- a single pregnancy after 26 weeks

- a pregnancy with twins after 19 weeks

- for childbirth at any time

- neonatal care

What we cover in our optional extra Pregnancy Add-on

Get extra cover for more weeks with our Pregnancy Add-on . We’re really proud of this! An optional extra made specifically for pregnant women.

- Single pregnancy up to and including 32 weeks gestation

- Multiple pregnancy up to and including 23 weeks gestation

If you’re up to 32 weeks pregnant with a single child, or up to 23 weeks with twins when an incident occurs, and you have written certification from a medical practitioner that you are fit to travel up to ten days prior to your departure, your emergency medical costs are covered under our Pregnancy Add-on. The maximum payout under this benefit is is $1 million.

Just to be clear, even with our Pregnancy Add-on, emergency childbirth coverage includes the costs related to your birth and post-birth medical care. It won’t cover your newborn’s medical costs. The costs that come with looking after a newborn after an emergency birth can vary greatly. If we covered this risk, it pushes up premiums across the board.

Conditions you’re covered for

If you purchase the Pregnancy Add-on, any medical expenses related to specific pregnancy-related complications otherwise excluded by this policy (see: What we don’t cover at all p. 59 of the PDS ) are covered subject to policy limits and exclusion. This includes:

- toxaemia (toxins in the blood);

- gestational diabetes (diabetes arising as a result of pregnancy)

- gestational hypertension (high blood pressure arising as a result of pregnancy)

- pre-eclampsia (where you develop high blood pressure, carry abnormal fluid and have protein in your urine during the second half of pregnancy)

- ectopic pregnancy (a pregnancy that develops outside of the uterus)

- molar pregnancy or hydatidiform mole (a pregnancy in which a tumour develops from the placental tissue

- post-partum haemorrhage (excessive bleeding following childbirth);

- retained placenta membrane (part or all of the placenta is left behind in the uterus after delivery)

- placental abruption (part or all of the placenta separates from the wall of the uterus)

- hyperemesis gravidarum (excessive vomiting as a result of pregnancy);

- placenta praevia (when the placenta is in the lower part of the uterus and covers part or all of the cervix)

- miscarriage

- emergency caesarean section

- a termination needed for medical reasons

- premature birth more than 8 weeks (or 16 weeks if you know you are having more than one baby) before the expected delivery date.

Your pregnancy-related medical costs will not be covered by Travel with Jane’s Pregnancy Add-on in this situations:

- a single pregnancy after 32 weeks

- a pregnancy with twins after 23 weeks

Main health risks of flying

Deep vein thrombosis, or DVT, is the main health concern for pregnant women on planes.

This is when a blood clot forms in a deep vein of the leg, which can cause complications such as pain, inflammation and swelling. The greater danger with these clots is that they can dislodge and travel through the circulatory system, blocking blood supply to the lungs.

The risk of DVT is higher when pregnant and being immobile for long periods is also a risk factor, so it’s worth keeping in mind for any sort of travel, including long car trips.

To reduce your risk keep well hydrated, make sure you’re well mobilised during the flight and wear compression stockings.

Childbirth overseas

If you are travelling in your third trimester OR you unexpectedly go into labour overseas there are a few things to consider. Citizenship rules change from country to country, so it’s a good idea to understand the local laws before travelling.

If you are an Australian citizen and you give birth overseas, you’ll need to apply for your child’s Australian citizenship and passport before you can return home. For application forms and more information visit the Department of Immigration and Border Protection website.

Vaccinations for pregnant women

As a pregnant woman, you are at risk of serious complications if you contract malaria or viral hepatitis E. Certain standard vaccinations can also be harmful to your baby when you’re pregnant.

We recommend you get in touch with your doc before you travel to ensure you have the right vaccinations for your trip. Nothing is more important than protecting the health of you and your baby.

Check here to see the list of vaccines recommended by the Australian Department of Health

Whether it’s a week in the tropics or a local trip reached by car, planning a babymoon is one of the latest trends in pregnancy. But what is a babymoon exactly? It’s a chance for expecting parents to get away, unwind and emotionally prepare for the exciting changes that lie ahead.

Choose the Best Seat If you’re travelling by airplane, try to get a spot on the aisle so you can get up and stretch your legs. The same goes for a car ride -factor in time to stop along the way so you can get out and take a short stroll and toilet break. Take care of your feet and legs, where swelling can really take hold.

Take It Slow A babymoon probably isn’t the time for mountain biking or other strenuous physical activity. Be smart by pacing yourself and building in lots of downtime to nap and read.

Suitable accommodation You’ll want to make sure that wherever you pick, you have access to:

- A large comfy bed with extra pillows

- Healthy menu options

- Quality, hygienic food service setup

- Day spa with staff trained in ante-natal massage and therapies

- A nearby hospital or doctors

A local OB/GYN Try not to worry in advance, but be prepared for any kind of pregnancy complication by obtaining the name and number of a local OB/GYN. You’ll have peace of mind just knowing you can call someone if you have a concern.

Pregnancy travel checklist

It’s good to be well prepared for an upcoming journey. It’s even more important when you’re pregnant, with more to consider for you and your unborn baby. Check these steps before you jet off.

- Check the airline restrictions for flying while pregnant

- Register with Smartraveller – let the Australian Government know where you’re going, so they can contact you in an emergency.

- Visit your GP or OB/GYN– discuss your travel plans and get the relevant vaccinations. You will most likely need a medical certificate confirming you’re fit to travel.

- Research your destination – consider the foods, cultures and climates of the places your visiting. Know what to avoid, particularly while pregnant.

- Pack correctly – pack clothes that take your changing shape into account and keep you comfortable.

Understand your cover

Conditions and exclusions apply to every cover level and optional pack. View our Combined Product Disclosure Statement and Financial Services Guide for full details. Sub-limits apply. Not sure? Our friendly team are here to help. Get in touch

We support women who challenge the gender pay gap

Since Day 1 Travel with Jane has been about levelling the playing field for women in Australia. In 2020, we’re taking the fight global. Stay tuned to learn how you can support the women who tackle the gender divide here and abroad.

Love cool stuff? Subscribe to our newsletter

Join our mailing list for exclusive invites to travel insurance sales, competitions and giveaways. Plus travel inspiration and tips for women who love to travel & make the world a more equal place.

- Help and Support

- Travel Insurance

- Travel Insurance and Pregnancy

Pregnancy Travel Insurance

Everything you need to know about holiday insurance when pregnant.

If you and bump are planning a trip abroad, add pregnancy holiday insurance to the top of your checklist.

If you’re pregnant and planning a trip abroad, pregnancy travel insurance will no doubt be at the top of your checklist. But before you’ve even booked your holiday, many women will be concerned about whether they can fly, so let’s start there.

Can I fly while pregnant?

Flying while pregnant is a decision for mum and doctor; if your doctor or obstetrician gives you the green light to fly then you can.

According to the Royal College of Obstetricians and Gynaecologists , the safest time for pregnant women to fly is before 37 weeks if carrying one baby, or 32 weeks if carrying twins.

After this stage, there’s a chance you could go into labour, so it’s best to avoid going too far from home.

If you’re still hoping to travel, it's important to speak to your doctor or midwife and check it’s safe. They may advise against it if you have had any complications with your pregnancy.

If you’re over 28 weeks pregnant, the airline may ask to see a letter from your midwife or doctor. Some airlines have their own restrictions in place so it’s best to check their websites before you book.

Covid-19 - what our travel insurance covers

Our travel insurance now covers you for certain events related to Coronavirus (COVID-19), provided you have proof of a positive Covid-19 test and your cover is active at the time of the event.

What we cover

We provide cover for some costs related to Covid-19: please see Section 1 'emergency medical costs and repatriation' and Section 2 'cancelling or cutting short your trip' in your policy book for full details on what's covered.

We'll cover you if:

- you were diagnosed with Covid-19 before your trip was due to start

- a close relative died or became seriously ill as a result of Covid-19 before your trip was due to start

- you weren't allowed to board your pre-booked outbound travel due to symptoms of Covid-19

- an insured person or a close relative died during the trip because of Covid-19

- you couldn't take part in an excursion due to you self-isolating after getting Covid-19

What we don’t cover

You won't be covered if:

- you had reason to believe your trip may be cancelled, postponed or cut short when you booked it, purchased your policy or started your trip

- any government or public authority imposes travel restrictions or quarantine on a community, location, or vessel because of Covid-19 (this includes, but is not limited to, local lockdowns, entry requirements, being denied entry and airspace closures)

- you have to quarantine after arriving in the UK or abroad

- the Foreign Commonwealth & Development Office (FCDO) change their advice to avoid ‘all travel’ or ‘all but essential travel’ to your destination because of Covid-19

For more information about how Coronavirus (COVID-19) affects your travel cover, see our FAQ page . And remember to check the policy booklet carefully before you buy to make sure our cover meets your needs.

What does Pregnancy Travel Insurance cover?

Admiral Pregnancy Travel Insurance covers emergency medical treatment costs and repatriation as standard, up to £20million depending on the level of cover chosen.

We’ll only cover complications of pregnancy and childbirth abroad (as described in the ‘Definitions’ section of our policy wording). This includes treatment needed due to complications resulting from a pregnancy such as an emergency caesarean up until 40 weeks.

There’s no cover for routine medical care such as check-ups, pre-natal care, the costs of natural labour and childbirth after 32 weeks (or 24 weeks in the case of twins or multiples) or post-natal care. There’s also no cover if the carrier denies you boarding.

Three levels of Pregnancy Travel Insurance

Read the full list of benefits in the policy summary booklet .

Not all insurers will cover pregnancy after a certain stage when it’s more likely you could have a normal birth, which isn’t considered a medical emergency.

What stage this is, and the medical care that’s covered, varies from insurer to insurer so check this thoroughly before taking out your travel insurance.

Is pregnancy a medical condition for travel insurance?

Whether you need to declare your pregnancy depends on your insurer’s guidelines. For Admiral Travel Insurance, pregnancy isn’t considered a pre-existing condition , so there's no need to tell us before you travel.

However, make sure you tell us about any medical conditions you have because of your pregnancy, such as:

- Gestational diabetes

- High blood pressure

If you don't tell us, you might not be covered should you need medical assistance.

What happens if I go into labour abroad?

At the early signs of labour, you should try to stay calm and go to the nearest hospital as soon as possible. If it’s a medical emergency, please call us immediately so we can help - +44 (0)292 010 7777.

If you’re planning to have your baby abroad, you’ll need to speak to your doctor in the UK first. You’ll also need to apply for a Maternity S2 to cover the costs of your care because most policies don’t cover planned overseas births.

Be aware lots of airlines won’t allow new-borns on flights until they’re two-weeks-old, or even longer for premature babies. Have a plan in place if you need to stay away longer than expected and ask the airline when you’ll be able to fly home.

What if I have a pre-existing condition?

A pre-existing condition is a short or long term illness or injury you have or have had before you buy travel insurance. This includes having symptoms, tests, diagnosis or medical treatment for a condition.

You can declare your pre-existing conditions during the quote process to see if we can offer cover. If you’re unsure what needs to be declared or if you're unable to find your condition on the medical conditions list, please contact us on 0333 234 9913 .

Your pre-existing conditions won’t be covered unless you’ve:

- Declared them all on your policy

- Received written confirmation that we’ll cover your medical condition

- Paid any additional premium in full

Policy terms and conditions apply. Please note, if you’ve had a positive diagnosis of Covid-19 and been prescribed medication, received treatment, or had a consultation with a doctor or hospital specialist for any medical condition in the past two years, this needs to be declared on your policy.

If you don’t tell us about your pre-existing conditions or give us incorrect information, your policy may be invalid, and we may refuse all or part of any claim you submit.

For a quote with us, click the green button above.

The MoneyHelper directory

If you require cover for more serious medical conditions, MoneyHelper may be able to help you find specialist travel insurance through their medical directory.

If you wish to get in touch with them you can call them on 0800 138 7777 or find them online . (Monday to Friday 8:00-18:00, closed on Saturday, Sunday and bank holidays.)

Things to check before travelling while pregnant

Your questions answered

Do you need special travel insurance when pregnant.

Admiral single trip and annual travel insurances cover pregnancy and you won’t pay more for your cover as it’s not considered a pre-existing medical condition. You’ll get the standard cover for things like:

- Lost luggage

- Travel disruption

- Lost or stolen belongings

But we’ll also cover the costs of any emergency medical treatment you receive as the result of complications during your pregnancy.

Do I have to declare I’m pregnant on travel insurance?

Pregnancy is not considered a pre-existing medical condition so you don’t need to let us know before you fly. You should let us know about any conditions relating to your pregnancy to make sure you’re properly covered.

Can I fly after 32 weeks?

This is up to you and your doctor to decide – if it’s safe for you to do so and your doctor says it’s OK then you can fly. In terms of insurance, with Admiral you’re covered up to 40 weeks, but we strongly advise you get medical permission to fly in later stages of pregnancy. There's no cover for the costs of natural labour and childbirth after 32 weeks, or 24 weeks in the case of twins or multiples

I’ve just found out I’m pregnant and I don’t wish to travel. Am I covered?

No, you'll only be able to claim for cancellation due to pregnancy if your doctor advises against travel due to specific medical complications.

Take a look at our Travel Insurance and Pregnancy page for more information.

Does being pregnant affect my insurance?

Pregnancy isn’t considered a pre-existing medical condition , so there’s no need to tell us before you travel.

However, make sure you tell us about any medical conditions you have because of your pregnancy, such as gestational diabetes or high blood pressure. If you don’t, you might not be covered should you need medical assistance.

We will only cover complications of pregnancy and childbirth abroad (as described in the ‘Definitions’ section of our policy wording) so you aren't covered for routine medical care such as check-ups, pre-natal care, normal childbirth and post-natal care. There is also no cover if the carrier denies you boarding.

Getting the most out of your trip

Going anywhere nice.

Off to one of the destinations below? Take a look at our guides for some hints and tips on what you need to remember.

Travel insurance that suits you

Whether you're travelling solo, with your family, or with a little one on the way, read our guides to make sure our cover is right for you.

Family Travel Insurance

Student travel insurance, travelling while pregnant, travel insurance over 65, travelling with medical conditions, travel insurance upgrades.

Whether you want the adrenaline rush of a skiing holiday, or fancy taking to the seas on a cruise, you'll need to add extra cover to your policy.

Cruise Travel Insurance

Ski travel insurance, gadget travel insurance, adventurous sports insurance, single trip insurance, annual trip insurance.

Suggested companies

Avanti travel insurance, allclear travel insurance, admiral insurance.

Staysure Travel Insurance Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.7.

356,765 total

Most relevant

Changing my Credit Card Details - My reason for contacting Staysure by…

My reason for contacting Staysure by telephone today was that there was no obvious way to change my credit card details online. However, whilst talking to one of your colleagues, by chance, having pressed all the keys that seemed relevant I came across a Change Credit Card Details, this has now helped me to achieve my objective. The downside was that I had to pay the Premium today instead on the 1st May 2024.

Date of experience : 12 April 2024

I was wrong!

Through my fault I misunderstood why I was not getting my proper refund on my policy. Thankfully a very patient employee finally sorted me out and explained where I was going wrong. I hope she doesn’t get too many customers like me! Thank you young lady, I’m very grateful the problem was solved. Regards to her from Mrs Elizabeth Clarke

The process of up grading my existing…

The process of up grading my existing policy and renewing for 2024/25 was made problem free by your advisor this morning. Can’t remember her name but she was very helpful Also policy details where already in my inbox shortly after finishing call.

The helpful young man who helped me get…

The helpful young man who helped me get through the questions fill in form was there all the time helping me to get the best insurance for me at 89. Years old it’s hard for us to work out and at no time did he once make me feel old I have been with stay sure insurance now for years thank you and your staff it makes me feel so safe kindest regards rosemary slais 🌹❤️

Date of experience : 03 April 2024

Grace was very pleasant & patient in…

Grace was very pleasant & patient in answering my queries. Nothing was too much trouble in helping me as much as she could. I'll be using Staysure again as the service is so good & reasonably priced for insurance holiday quotes.

Chose Staysure Insurance as they had a competitive Price and friends had used them in the past

i HAVE BEEN SHOPPING AROUND FOR TRAVEL INSUANCE FOR SEVERAL WEEKS AND I HAVE DECIDED TO USE STAYSURE, AS THEY QUOTED ME A FAIR PRICE, AND ALTHOUGH OTHER COMPANIES QUOTED LESS, THE REVIEWS FOR STAYSURE CONVINCED ME TO USE THEM. AS THEY SAY YOU ONLY FIND OUT HOW GOOOD THEY ARE WHEN YOU MAKE A CLAIM

Amazing young lady - so helpful

The young lady who I spoke to was kind, polite, very helpful and knowledgeable and extremely professional, she sorted out my renewal and saved me some money to what it said it was going to be on your renewal email !!! I can’t find her name on the emails so you can give her some prsise

The customer services lady was very…

The customer services lady was very helpful when we were able to make contact. Your telephone system is useless we tried all afternoon trying to Make contact on all your phone numbers and kept getting cut off. Eventually at 16.50 we tried one last time and made contact. Your phone system needs upgrading or you will be loosing customers.

Date of experience : 11 April 2024

ThanksMy policy was renewed automatical

My policy was renewed automatically as l had no changes. As my ipad could not download the paper work l requested hard copies which arrived by return of post. Thank you.

Date of experience : 31 March 2024

Happy Customer

Found website easy to use and very helpful. Very explanatory in the terms and conditions. Also like the price as cheapest I could find on the comparisons web sites. I was with them last year as well and had no trouble setting things up. would recommend to anybody going abroad as easy to use.

Your system is too pedantic

Your system is too pedantic. After everything was done except payment for which I had to transfer the money into my credit card co. This was to come the following day and the person was not on duty and arraned for some one else to do this for her. On the actual day, however, I had to go all those things all over again, which I thought quite unnecessary. All the instructions supposedtedly were left in in place by the first person I spoke with.

Date of experience : 05 April 2024

The patience of the lady dealing with…

The patience of the lady dealing with application. Helpful & gaining our confidence in Staysure. It's a minefield & difficult to take it all in. We were very grateful for her understanding & showing us the way.

Date of experience : 04 April 2024

Excellent service from staysure

Used staysure last year for my travel insurance. Very helpful and friendly. Reassuring to be able to speak to real person as I’m not tech savvy!! James talked me through my policy and was more than helpful and understanding of my needs. Highly recommend staysure.

Good staff and product but ...

Good staff and product but something is deeply broken inside their system. It transpired, when I was querying the cost of renewal, that we had been overcharged by 20% the previous year. There was nothing to be done about this but they did discount our renewal as an apology. I also noticed that, although they had on record my date of birth the system had calculated my age incorrectly for at least two years! Needless to say, as I was actually a year old than it had calculated the renewal premium was increased.

Excellent informative customer service

The agent that I spoke to was extremely helpful patient and informative. She talked me through the process and was able to answer any of my queries and took her time explaining anything I was uncertain about.

we have used this company many times…

we have used this company many times over the last 5years, Always found them excellent value even with health conditions. would always recommend them

Unable to log in to my Staysure account.

I found it very annoying that I was unable to log in with my user name and password to change my credit card details. The same problem recurred after a password reset. However, I was able to speak to a helpful person on the phone who renewed the policy, using the new credit card as I would have done on line.

Well I was in a predicament .

Well I was in a predicament . Long story short my policy lapsed all good though managed to get covered and enjoyed the remaining days on holiday lesson learned

Have had travel insurance with you for…

Have had travel insurance with you for many years. Never had a problem at all. That is why I continue to use you company. You give plenty of notice as too when it is due for renewal. Very efficient.

Travel insurance

Once again your agent, Sarah, was very thorough and patient, despite a complex list of medical issues. She was able to provide us with the cover we needed.-

COMMENTS

Get Pregnancy Travel Insurance with up to Unlimited Medical Expenses. 24/7 Medical Support. Most Pre-Existing Conditions Covered. Get a Quote Today! ... Staysure Travel Insurance is administered by Howserv Limited which is registered in England and Wales number 03882026. Registered office: Britannia House, 3-5 Rushmills Business Park, Bedford ...

Trip cancellation or interruption due to pregnancy. Most travel insurance policies will reimburse you for all or a portion of your nonrefundable travel costs if you have to cancel your trip for a ...

Travel insurance companies use different definitions for "complications of pregnancy," so be sure to ask for details when choosing a travel insurance plan. The most generous travel insurance ...

Travel insurance from Allianz Global Assistance can cover losses resulting from unforeseen pregnancy complications, such as pre-eclampsia, gestational diabetes or hyperemesis gravidarum. That means your travel insurance may reimburse you for nonrefundable trip costs lost if you must cancel or interrupt your trip because of pregnancy complications.

When it comes to pregnancy and travel insurance, most insurers graciously cover single, uncomplicated pregnancies following natural conception. However, there's a catch - the coverage window varies. The best time to travel is within your second trimester. Some providers extend their umbrella up to 30 weeks, while others gently fold it at 23 ...

Pregnancy - Staysure Support ... © Staysure 2023

Airlines request a medical certificate if travelling after 28 weeks of pregnancy. Most airlines won't allow air travel after 36 weeks for a single pregnancy and 32 weeks for multiple pregnancies. You also need travel insurance to cover both yourself and your unborn baby in the event you need to give birth unexpectedly during your trip. 4.

Staysure travel insurance overview Staysure was formed in 2004, specialising in cover for over-50s with pre-existing medical conditions , though its policies are available to younger customers too. We've reviewed three of its policies: Signature (most comprehensive), Comprehensive, and Basic (least comprehensive).

Medical Conditions. Can I fly with a heart condition? Can I get cover for a terminal prognosis? Can I take out travel insurance if I am currently being diagnosed, under referral, awaiting an operation or haven't been discharged from outpatient care? Can you quote if my condition has not yet been diagnosed?

What to expect from Australian travel insurers. Typically, travel insurance offers cover for emergency medical treatment while travelling, and this extends to medical emergencies pregnant women might experience. So if you're pregnant, and you fall sick, or break a leg, and these events are in no way related to your pregnancy, you'll be able ...

A standard travel insurance policy can provide cover for you during your pregnancy. Most annual multi-trip policies will still cover you if you're pregnant and travelling within the specified time frame of your pregnancy, usually before 28 weeks. Remember, every policy is different, and it's crucial to understand the specifics of what's included.

In terms of insurance, with Admiral you're covered up to 40 weeks, but we strongly advise you get medical permission to fly in later stages of pregnancy. There's no cover for the costs of natural labour and childbirth after 32 weeks, or 24 weeks in the case of twins or multiples. I've just found out I'm pregnant and I don't wish to travel.

Save 20% in our New Year Sale! Get award-winning Travel Insurance with Unlimited Medical Expenses. UK Contact Centres. No Upper Age Limit. Get a Quote Now!

Your Staysure policy could cover you for: Cancellation or cutting your trip short. Travel insurance should cover you if you are forced to cancel or cut your trip short, also known as curtailing. Pre-existing medical conditions. If you live with any medical conditions, you should look for a policy that can cover them.

I have used this company for a few years now - sadly, my husband passed away last year, and we had to cancel our travel plans - Staysure dealt with our claim speedily and efficiently, I will always use this company. Date of experience: 09 April 2024. Useful. Share. Read 2 more reviews about Staysure Travel Insurance.

Pregnancy or childbirth if it was known at the time of booking. ... Travel insurance can also cover you against unexpected costs if something on your trip doesn't go to plan, or if you need emergency medical treatment. ... Staysure Travel Insurance is administered by Howserv Limited which is registered in England and Wales number 03882026 ...

When it comes to cruise travel insurance, you must ensure all the countries/destinations you're calling to are listed on your policy. Making changes to your destinations via your MyStaysure account is quick and easier, Click here for more information about how to do this.

25 February 2022 at 9:04AM. We bought an annual multi-trip comprehensive cover policy with Staysure for our recent trip overseas. The price was very competitive but the company seems to purposely make it really difficult to claim. 1. Phonelines are not manned 'because of covid' - all calls are directed to their website.