- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

A Deep Dive Into Trip.com Group 2020

Related reports.

- A Deep Dive into Google Travel Part III: Hotel Distribution From East to West April 2024

- India’s Travel Booking Landscape March 2024

- The Past, Present, and Future of Online Travel March 2024

- Skift Research Global Travel Outlook 2024 January 2024

Report Overview

China’s Trip.com, or as you more likely know it, Ctrip, is the world’s largest online booking site with more than $129 billion of travel sold in 2019. That’s fitting for the premier travel agency in the world’s largest outbound travel market.

This is a business everyone in travel needs to understand. If you haven’t bumped up against Trip.com yet, you almost certainly will at some point. it has big ambitions to expand internationally and that’s still the case even after the devastating impact of Covid-19.

Trip.com is unlike any U.S. or European booking site you may be familiar with, having built a complex web of strategic investments and partnerships throughout China and across the globe. It is mobile-first and offers a connected trip across a diverse range of products.

Deciphering Trip.com also offers insights into what the post-Covid world of travel will look like as China recovers faster than the rest of us. Here’s a hint: it features outside-the-box marketing campaigns and more business travel than you might expect.

Trip.com offers us a lesson in optimism and new growth, even after the industry’s worst even crisis.

What You'll Learn From This Report

- Trip.com’s business structure, including key segments and growth rates.

- How Trip.com stacks up to its global peers, Expedia Group and Booking Holdings.

- A detailed look into Trip.com’s complicated network of strategic investments, partnerships, and subsidiaries.

- Trip.com’s international and domestic growth strategies.

- The ways Trip.com has been impacted by COVID-19 and how it is responding to gain market share and return to growth.

Executive Summary

Trip.com is the world’s largest online booking site with more than $129 billion of travel sold in 2019. That’s fitting for the premier travel agency in the world’s largest outbound travel market.

Trip.com offers its customers a diverse range of products, with a huge offering of flights, hotels, tours, and dynamic packaging. Its mobile offerings integrate search, booking, customer support, and local ground transportation, which leads to 80%+ of bookings being done on a smartphone in 2019. This is when leading U.S and European travel websites – Booking.com and Tripadvisor for example – are only taking their first steps towards offering a more holistic travel experience.

Trip.com has built a complex web of strategic investments and partnerships throughout China and across the globe. Its investments in hotels, airlines, tour operators, car rental companies, and travel agencies generate almost as much revenue as its actual operating business does.

The company has big ambitions to expand internationally, even willing to go so far as giving itself a more global name after 20 years as Ctrip. And that’s still the case even after the devastating impact of COVID-19.

Trip.com is now seeing a strong domestic recovery. It is gaining market share, taking advantage of the crisis to improve its processes and launch innovative livestream marketing campaigns.

China was the first to experience the devastating impact of COVID-19. Perhaps it will also be the first to show us the way for travel. Trip.com offers us a lesson in optimism and new growth, even after the industry’s worst even crisis.

Business Overview

Trip.com Group, formerly known as Ctrip, is one of the most important travel companies on the planet. As the owner of the largest online travel agency in China, which itself is one of the largest travel markets in the world, the influence it wields is immense.

Trip.com group operates four notable travel brands. Its flagship brand is Ctrip, China’s largest online travel agency. Ctrip operates on a full-service model, similar to Expedia.com, offering flights, hotels, car rentals, cruises, tours and more. The group also holds a large stake in Qunar, another China focused booking site. It also sells travel through its network of over 8,000 offline retail stores throughout China. Outside of China, the company uses the more English-friendly Trip.com branding. Although these four major operations appear to be different on the front end, we believe that many supply and operations are shared on the back end.

Trip.com has rapidly grown its global supply reach by partnering with or acquiring other online travel agencies. For instance, the company has partnerships with Booking Holdings that allow the two businesses to sell each other’s inventory. And by acquiring Qunar, Trip.com Group has made inroads in adding domestic hotel inventory in second and third tier cities in China.

Finally, Trip.com Group also acquired the prominent UK-based metasearch site Skyscanner. This gives the group a notable presence in metasearch advertising space, similar to the approach taken by Booking Holdings (via Kayak) and Expedia Group (via Trivago)

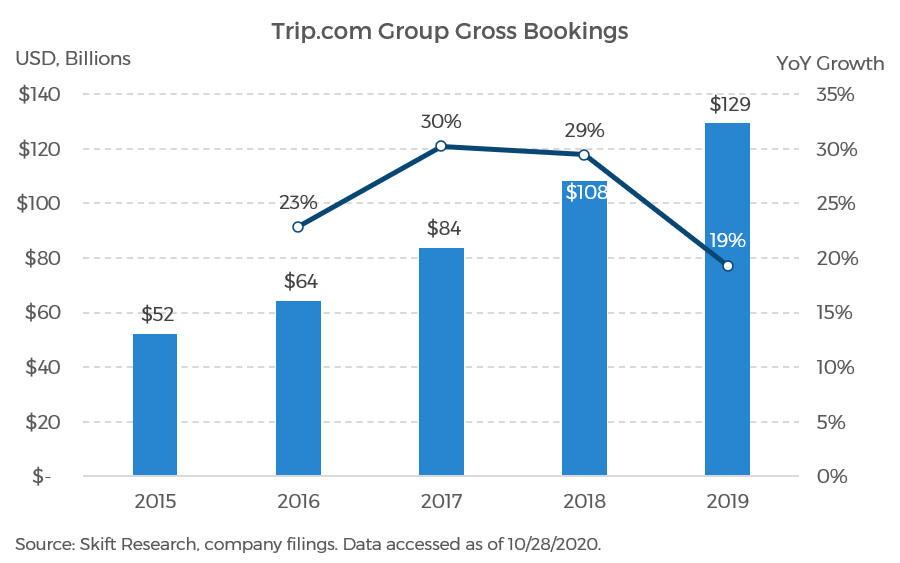

Trip.com is a powerhouse in travel, and in fact, when measured by gross bookings, it is the largest travel agency in the world with $129 billion of travel sold on its platform in 2019. Its bookings were growing rapidly before COVID-19, up 19% in 2019, and posting a ~30% growth rate in both 2017 and 2018.

Financial Performance

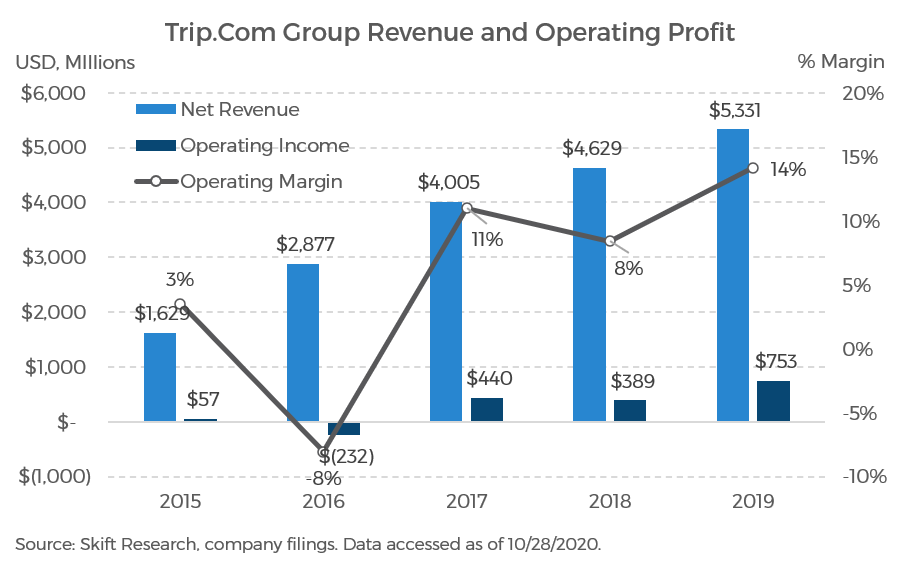

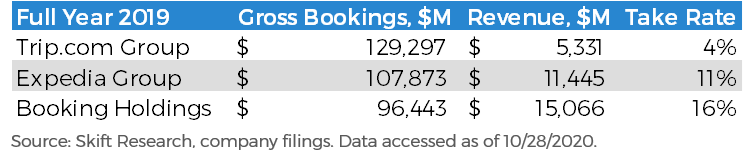

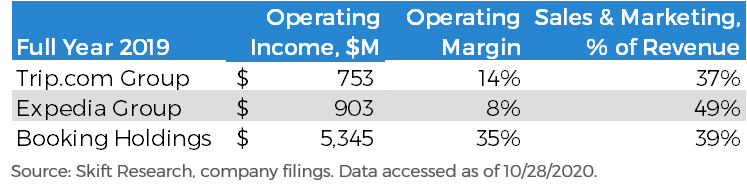

Trip.com may be the largest online booking site in the world by gross bookings, but the commissions it earns are quite small. The company has an effective take-rate of ~4%, leading to just $5.3 billion of revenue in 2019, not a travel industry record.

But still, that net commission revenue has been growing at a nice clip – a world-class 35% compound annual growth rate over the last four years. And what’s more is that Trip.com has a fairly consistent record of generating operating income and its margin was trending higher prior to COVID-19. 2019 was Trip.com’s best year for profitability since 2015, posting a 14% operating margin.

Marketing Spend

We believe the most important expense to track at an online travel agency is its marketing spend . At most booking sites this is the largest single expense and leveraging it properly is the key to growing sustainable profits.

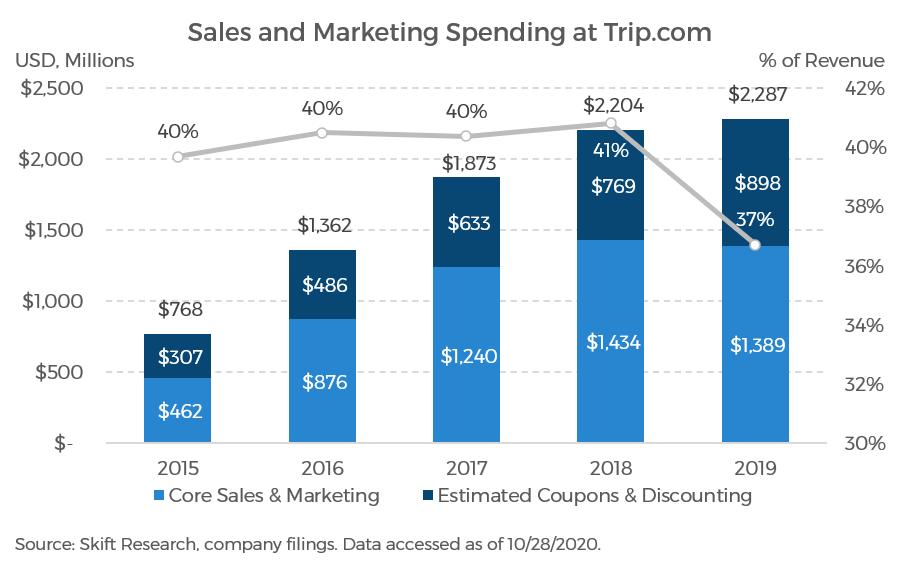

Trip.com reported ~$1.4 billion of sales and marketing expenses in 2019, down slightly from 2018. This includes $820 million of advertising spend.

In the West, most booking sites use a combination of brand advertising, metasearch, and online performance advertising campaigns to build a pipeline of shoppers at the top of the funnel. And while they have a reputation for cheap prices, these days, the largest booking sites are likely to honor rate parity clauses put in place by travel suppliers.

However, we find that Trip.com, in addition to these marketing tactics and channels, also employs extensive promotional discounting and coupon campaigns to convert lookers to bookers. This is very similar to the approach used by MakeMyTrip, which we discussed in our previous report on that company.

Coupons which reduce the purchase price are accounted for differently – as a reduction of revenue, rather than an expense. In a May 2017 earnings call, the company disclosed that its gross take rate on hotels was trending at 10–15% but after adjusting for coupons, the net take rate comes out closer to 8–10%. This is a major impact to revenue, especially when you consider that hotels are the most profitable product that Ctrip sells.

Based on these ranges, Skift Research estimates that Trip.com may have offered ~$900 million in coupons in 2019 on top of its previously discussed marketing spend. That is up from $769 million of coupons in 2018.

Before taking these promotions into account, marketing spends appeared to have declined in 2019. But we believe that there was much more of an internal shift, away from acquiring traffic and towards incentivizing purchase behavior. On an all-in basis, we believe that sales and marketing spending grew marginally in 2019 from $2.2 to $2.3 billion.

Still, the sales and marketing line item saw a favorable de-leveraging as revenue grew much faster overall. Adjusted sales and marketing as a share of revenue fell by an impressive four percentage points to 37% from 41%. Marketing has been trending at ~40% of revenue since 2015, so it was a positive development to see such a strong improvement last year.

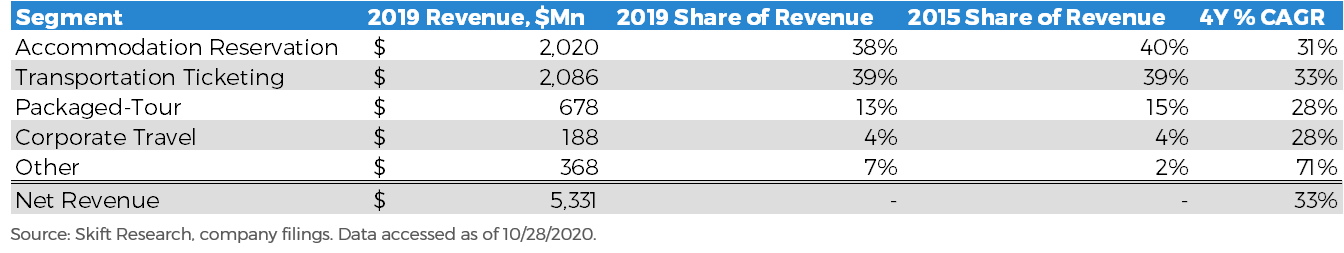

Trip.com operates across five business segments. These are based on the travel products sold, consolidated across multiple businesses, rather than reporting on a brand-by-brand basis. The segments are:

- Transportation Ticketing: Trip.com’s largest segment representing 39% of 2019 revenue, or just over two billion dollars. This segment represents revenue from selling airline tickets, railway, and bus tickets. A very high volume, but low margin business, Ctrip believes that it is the largest airline ticket distributor in China and the company even maintains its own central reservation system which can offer tickets to nearly all domestic regions of China, especially outside of tier 1 cities.

- Accommodation Reservation: This segment represented 38% of Trip.com’s revenue in 2019, or just over two billion dollars. Ctrip works with over 1.4 million hotels around the world. It is the largest distributor of hotels in China and sells the vast majority of its tickets on an agency model, earning a commission from the hotelier.

- Packaged-Tours: This business generated $678 billion, 13% of the group’s total. Primarily focused on the leisure market, Trip.com offers group and semi-group tours. This segment also offers a cross-selling opportunity by way of packaged tours that can include hotels, flights, cruises, and buses all in one.

- Corporate Travel: The smallest segment, at 4% of group revenues, $188 million dollars. This unit caters specifically to business travelers and in addition to offering booking capabilities provides corporates with reporting tools, industry benchmarking, cost analysis, and other travel management solutions.

- Other: The final catch-all segment that includes online advertising and financial services. 7% of revenue, representing $368 million. Typically, the “other” bucket would be the smallest reporting unit at a corporation, but at Trip.com it is much larger than the aforementioned ‘Corporate Travel’ line of business. It is also the fastest growing of Trip.com’s businesses. We believe that the vast majority of revenue in this segment is advertising from leading metasearch site Skyscanner which Trip.com acquired in late 2016.

Comparison to Western Peers

How does Trip.com’s business stack up against its two largest peers in the U.S. and Europe? Comparing Trip.com to Booking Holdings and Expedia Group reveals some striking differences in how the businesses are run.

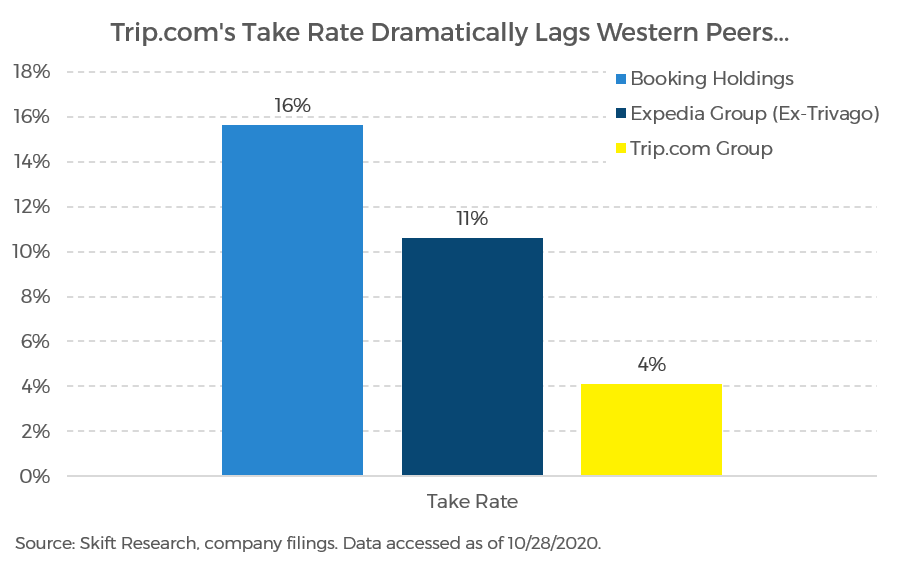

Let us start with what is by far the most notable: Trip.com’s abysmal take rate. China’s largest booking site earns just a 4% commission on average. By comparison, Booking Holding’s boasts a 16% effective take rate and Expedia Group can claim an 11% effective take rate.

There are two primary explanations for this divergence. The first is that Trip.com has a greater focus on selling flights. Trip.com generated 39% of its revenue from transportation ticketing in 2019. By contrast, Expedia earns just 7% of its revenue from air tickets. Booking doesn’t break this segment out explicitly, but we estimate it sells a third of the amount of flights as Expedia, effectively a negligible share of its total revenue.

It is not a coincidence that these two charts are direct inverses of each other as air tickets are notoriously unprofitable products to sell. Most major Chinese airlines have replaced their variable rate commissions with a fixed administration fee per ticket which we believe may be as little as $1–2 per ticket. Adjusting for lower ticket selling prices and carriers that still provide selling incentives, we believe that air ticket effective commissions may be as little as 1–2%.

The second issue is that it seems that hotel commissions are less profitable in China than in the U.S. and Europe. In these regions, major OTAs charge between a 15–25% commission depending on negotiations. Large brands can negotiate more favorable deals, but we believe that it is common for independent hotels to be paying 20%+ take rates.

In contrast, the Chinese market sees hotel commissions of 10–15%. And this is despite China being a fragmented hotel market with many independent operators who don’t have the same power as large brands to push back on rates.

In the long-term, this second issue might prove to be more within Trip.com’s power to solve by taking pricing power. Especially as it will become an even more important demand channel in the face of a COVID-19 slowdown.

These differences in economic leverage are crucial. Trip.com, as mentioned earlier, is the largest travel site in the world by booking volume, selling 34% more on its platform than Booking Holdings did. But because of its heavy skew towards air tickets and low commission, these record sales translated to middling revenue. Trip.com generated just about a third of the revenue that Booking Holdings produced.

What about profits though? Booking Holdings still stands out as a superstar with an impressive 35% operating margin coming off its already higher revenue base. But here, Trip.com acquits itself much better. Its 14% operating margin is nothing to scoff at and outperforms Expedia which comes in at the bottom of the pack with a mere 8% margin.

A key differentiator here is marketing spend. Normalized as a share of revenue, we can see that Trip.com is promoting itself at about the same rate as Booking Holdings. And it helps us understand why Expedia, which spends 10 percentage points more on a relative revenue basis than the other two, is struggling with its profit margin.

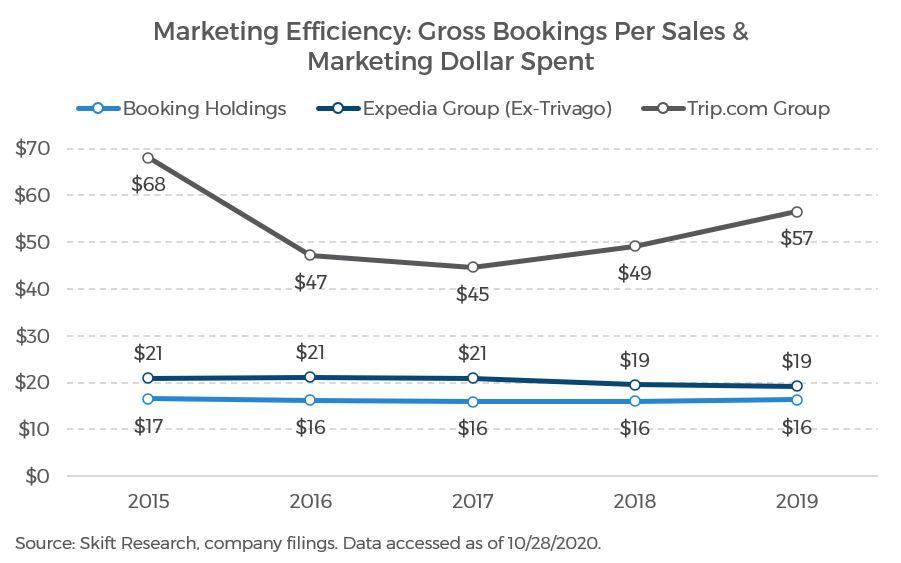

Another way to look at marketing spend is to measure how effective it is in driving bookings. The metric we use here is gross bookings per marketing dollar spend. Trip.com group stands out as being almost three times more effective in its marketing campaigns than Booking or Expedia. For every $1 it invested in sales or marketing, it saw $57 in travel booking on its platform.

This may reflect the pure math of selling more flights, an expensive component of any trip, but we should not discount that it also reflects sophisticated marketing techniques designed to attract a highly online audience.

Key Business Strategies

Below we will take a look into some of the unique expansion and growth pursued by Trip.com. This includes a look into its acquisition and investment strategy, its use of mobile, and its plans to grow in new markets.

Investments and Subsidiaries

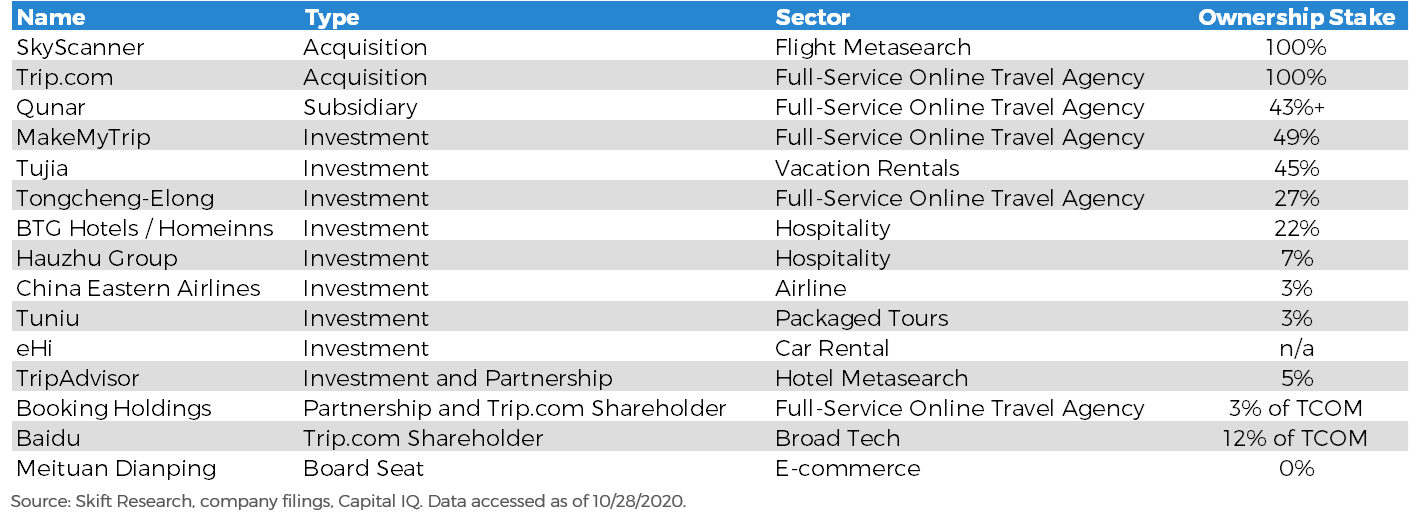

Trip.com makes extensive use of strategic investments and partnerships as a part of its growth and expansion strategy. It can almost feel as if there is hardly a major Chinese travel group that Trip.com does not have some connection to, either via a direct investment, strategic partnership, or board membership.

Yes, mergers and acquisitions are a standard tool of many travel companies. And plenty of online booking sites necessarily need to sign partnership agreements with their customers and suppliers. But we cannot think of a single online travel company with a more complex or expansive network of tie-ups. Trip.com pushes beyond the standard partnership approach of simple content sharing agreements, instead often opts to make strategic investments in prospective expansion markets.

Trip.com pursues a unique approach that feels more akin to a venture capital fund. This stands in contrast to many companies which view M&A is an all-or-nothing proposition with the target company being wholly acquired or passed on. Instead, Trip.com has built out a portfolio of small investments across a wide range of travel companies. The company will start with a small initial investment that usually leads to a board seat and then builds its equity investment from there over the course of many years. Over the last five years, Trip.com has invested more than $5.5 billion dollars in acquisitions and strategic investments.

Trip.com has used this strategy to strengthen its moat in China by deepening relationships with crucial travel suppliers. The company currently holds investments in leading Chinese suppliers of airlines, hotels, short-term rentals, tour operators, and car rentals. This includes minority, yet still substantial, stakes in China Eastern Airlines, Huazhu, BTG Hotels, Tujia, Tuniu, and more.

Trip.com has taken a similar investment-oriented approach to geographic expansion. Its primary foray into Europe has been by way of its Skyscanner takeover and its primary English-language site is operated through the Trip.com brand which was purchased in 2017. Trip.com also added significant exposure to the Indian travel market by acquiring a 49% stake MakeMyTrip. Management framed this holding as a long-term hedge against the China travel market maturing since India has similar demographics to what China had decades ago.

It’s not a one-way street either. Trip.com expanded its European hotel inventory via a partnership agreement with Booking Holdings that led to the Dutch travel site owning 5% of Trip.com and placing an observer on the Chinese company’s board (since COVID-19 hit BKNG has sold about half of this stake).

Trip.com has also been unafraid to invest in direct rivals, as a way to blunt competition. Most notably, Trip.com owns 43%+ of Qunar which is fully consolidated into the group’s accounts and operates as a de-facto subsidiary. Trip.com also holds a 27% stake in Tongcheng-Elong and has a cross-over with the Meituan’s board of directors.

The businesses that Trip.com has made major strategic investments in collectively generated more than $4.2 billion of revenue in 2019. Compare that to Trip.com itself which generated $5.3 billion. The company’s investments are responsible for almost as much revenue as its core business generates.

Subsidiaries

- Skyscanner: Trip.com bought out UK-based Skyscanner for $1.7B in December 2016. This gave Trip.com its first major inroads into English-speaking metasearch. Skyscanner is primarily centered around flights, which account for ~80%+ of its annual revenue. According to UK filings from 2018, Skyscanner had 1.78 bn visits, generated £261M of revenue (+22% y/y), and earned £50M in EBITDA (19% margin).

- Trip.com: Trip.com, formerly Gogobot, was acquired by Ctrip in November 2017. At the time it was a small travel startup of 30 employees. The acquisition for all intents and purposes was an expensive rebranding as part of a global expansion push. As best we can tell little remains of the original startup. Instead, in September 2019 Ctrip renamed itself to Trip.com Group, removing the C (which stood for China) to emphasize its international ambitions. Now Ctrip puts its content behind the Trip.com domain and branding when operating abroad.

- Qunar: Trip.com has had a long-standing investment in Qunar and it is fully consolidated into Trip.com’s financials since 2016, effectively making it a subsidiary, though it still operates semi-independently. Trip.com owns at least 43% of the Qunar, but we believe that its beneficial ownership stake is actually higher after taking into account Trip.com’s funding of Qunar employee compensation plans and LP investments in other Qunar investors.

Strategic Investments

- MakeMyTrip: MakeMyTrip is the largest online travel agency serving the growing Indian tourism market. Trip.com long held a 10% equity stake. In August 2019, it completed a deal with then-majority owner Naspers to up its stake in MakeMyTrip to 49%. In exchange Naspers received a ~5% ownership stake in Trip.com group. Trip.com now controls five out of ten MakeMyTrip board seats.

- Tujia: The “Airbnb of China,” Tujia is one of China’s largest short-term rental platforms, believed to have more than 1.4M global listings. Trip.com has been an investor since the company’s Series A and it was even a subsidiary until 2015. As this unicorn startup has grown and raised more equity, Trip.com’s stake in the business has been diluted, ultimately leading to Trip.com losing control of the business. It now owns less than half of outstanding shares and can no longer appoint board members. As a result, Tujia was consolidated from financial statements and is primarily an equity investment for the group.

- Tongcheng-Elong: Tongcheng-Elong is the third largest online travel site in China by gross bookings, selling $25B of travel on its platform in 2019. It consolidates several major sites including Elong (formerly owned by Expedia) and Ly.com. Trip.com has a minority investment alongside Tencent which also owns ~23% of Tongchen. Tencent owns mobile messaging service WeChat.

- BTG Hotels / Homeinns: Homeinns is one of the largest hotel budget chains in China. The founding group of Homeinns included two co-founders of Trip.com: Trip.com Executive Chairman of the Board James Jianzhang Liang and Director Neil Nanpeng Shen. Homeinns was acquired by BTG in 2016 and Trip.com wound up with a 22% stake in the new company. BTG is one of the three largest hotel brands in China. It is also a large tour operator. BTG earned more than $1.2B of revenue in 2019.

- Huazhu Group: Formerly known as China Lodging Group, Huazhu hotels is one of the largest hotel groups in China with more than 463,000 rooms. It is mainly focused on the economy chain scale. Qi Ji, a co-founder and current board member of Trip.com is also a co-founder and the current CEO of Huazhu Hotel Group. Cindy Xiaofan Wang, Trip.com’s CFO, also sits on the Huazhu board. Trip.com had been a pre-IPO investor in Huazhu. In 2019, Hauzhu paid Trip.com $10M in commissions.

- China Eastern Airlines: China Eastern is the second largest carrier in China. In 2016, Trip.com signed a strategic partnership and invested $463M in the business.

- Tuniu: Tuniu is a leading Chinese online travel platform that offers a large selection of packaged tours, with both organized and self-guided itineraries. It generated $328M of revenue in 2019. In 2014, Trip.com bought shares in the company through its investment arm and signed a strategic cooperation agreement. Tao Yang, Executive Vice President of Trip.com’s Travel Business Unit serves as a member of Tuniu’s board.

- eHi: eHi is a fast growing car-rental company targeting the Chinese travel market. Trip.com had previously owned a stake of ~14% of eHi. In 2018 it offered to sponsor a private take-out of the company but was outbid and in 2019, eHi was taken private by Teamsport. Trip.com retained its ownership stake in the newly merged company but at a diluted level that we cannot confirm. It has been reported that in April 2020 that Trip.com was in discussion to buy Car Inc, a rival Chinese car rental firm and merge it with eHi.

- Tripadvisor: In November 2019 Trip.com announced it would sign a strategic partnership with Tripadvisor. Trip.com would invest in Tripadvisor to the tune of a ~5% ownership stake. Jane Jie Sun, CEO of Trip.com was appointed to Tripadvisor’s board. Trip.com will gain access to Tripadvisor’s content and reviews for use on its websites. The two will also form a joint venture, Tripadvisor China, led by Trip.com, to build out what appears to be a Chinese-langauge version of Tripadvisor.

Other Partnerships

- Baidu: Baidu owns ~11% of Trip.com. Additionally, Robin Yanhong Li, Baidu’s co-Founder, chairman, and CEO is on Trip.com’s Board of Directors. Dou Shen, executive vice president of Baidu is also on Trip.com’s board of directors.

- Booking Holdings: Booking Holdings used to be a major shareholder of Trip.com with >5% ownership and an observer seat on Trip.com’s board. But with the coronavirus BKNG has been selling shares and reducing its holdings of TCOM. The two companies still have a partnership in place to distribute each other’s inventory.

- Meituan Dianping: Meituan is a large cross-industry shopping platform best known for food delivery. But it has branched out into a travel offering. In 2019 it sold more than 392 million domestic hotel room nights in China. Trip.com does not report room nights but it is possible that Meituan sold more room nights in China than Trip.com did, or at least the two are very close to each other in their domestic hospitality offerings. Trip.com does not have investments or formal partnerships with Meituan, but Trip.com co-founder and executive chairman Neil Nanpeng Sehn serves on Meituan’s board.

One of Trip.com group’s most important selling tactics is the use of mobile with billions of cumulative downloads of its app.

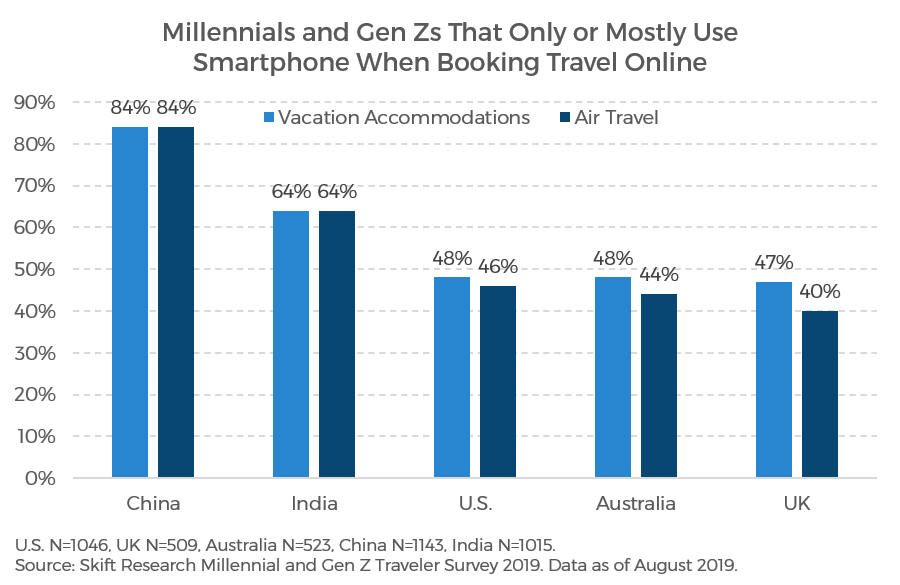

For those of us outside of China it is hard to overstate just how crucial this channel is. In the U.S. and Europe, mobile use for research and planning is more common but financial transactions are less frequent. That is not the case for Chinese travelers who both look and book via their mobile devices.

Data from our Millennial and Gen Z Traveler Survey speaks to the power of mobile transactions. 84% of young people in China use mostly or only their smart phone when booking flights or hotels. That’s more than twice the rate of individuals from the U.S., UK, or Australia.

These results are particularly relevant for Trip.com as its fastest growing consumer base is in this generational cohort. 50% of the site’s shoppers were under the age of 30 in 2019, up from just a third in 2013.

Trip.com makes extensive use of chat and micro-blogging platforms like Weibo and WeChat. For instance Trip.com offers a service called virtual tour manager that brings together travelers in the same destination in a WeChat group message managed by a Trip.com representative. These chat groups can be used to answer customer service questions and travel concerns in the local language. It also allows representatives to upsell or cross-sell products in-destination. In a dramatic case, Trip.com used the virtual tour manager service to communicate with its travelers that were in Las Vegas during the 2017 shooting to offer news updates and repatriation flights.

Trip.com also markets itself through WeChat and similar platforms. It can buy targeting ads against users on the services. It also has a marketing arm that partners with destination marketing organizations to help them get up to speed on using the app to attract travelers. For more details on these tactics, see Skift Research’s previously published WeChat Marketing Strategies for Global Travel Brands .

As a result of all the above, in 2019, more than 80% of Trip.com group’s transaction came from its mobile channel. That is a staggering, industry-leading figure. Booking Holdings generates perhaps half of its room nights via mobile and Expedia Group.com only about a third.

New Markets

Prior to COVID-19 Trip.com Group had two major paths for strategic, long-term growth. They were international expansion and further penetration out of the largest Chinese cities and into lower tier locations. We touch on each in turn.

International Expansion

Trip.com’s international ambitions have been no secret. After all, the company rebranded after 20 years to remove the Chinese ‘C’ from its name. But its international goals are actually running on two parallel tracks – one to promote outbound travel by Chinese nationals and the other to be able to sell into foreign markets.

Outbound Chinese travel is one of the most valuable tourism markets in the world. Chinese travelers took 166 million trips abroad in 2019, more than any other country in the world. We had previously forecast that China might approach 286 million trips abroad by 2029, though that number will now be set back by COVID-19.

In 2019 we estimate that Chinese outbound tourism expenditure totaled $277 billion. To put the magnitude of this spending into perspective, the U.S. came in second place with $157 billion of outbound tourism expenditure, followed by Germany at $104 billion.

Yes, there are many cross-borders trips to destinations like Hong Kong and Macau. But many millions of Chinese travelers are taking true international trips both close to home within Asia and long-haul trips to Europe and the U.S. Illustrative of this diverse mix was the top 10 shopping destinations for international Chinese travelers: Japan, UAE, UK, France, Singapore, U.S., Spain, South Korea, Italy, and Australia.

Catering to this market, Trip.com reported that in Q4 2019, just before COVID-19, its revenue growth from hotels excluding Greater China (which refers to Mainland China plus Hong Kong, Macau, and Taiwan) was 51% over Q4 2018. To put that in context, overall accommodation revenue, inclusive of domestic travel, only grew 12% in the same time period.

Another data point: in Q4 2019, international air tickets volumes grew by triple digits and had been doing so for every quarter over the last three years.

Overall, Trip.com generated 35% of its pre-COVID revenue from international travel, that includes both cross-border trips within the Greater China area and users in foreign countries. The company has a medium-term goal of pushing that ratio to 50%.

Just under 13% of total company revenue in 2019 came from users in foreign countries. And by extension that means that in 2019, 22% of total company revenue came from outbound Chinese travelers. The foreign business has been steadily growing in size at Trip.com, up from 2017, when 9% of sales came from outside of Greater China.

Additionally, we know that the majority of the Group’s ‘Other’ segment, accounting for 7% of group revenue in 2019, is Skyscanner’s advertising business. We can use that as a benchmark to roughly estimate that the actual international brand Trip.com therefore generated ~6% of group revenues in 2019, or $320 million.

That is respectable, but small compared to the big two western OTAs Booking Holdings and Expedia Group. Management of Trip.com Group acknowledges the international Trip.com brand is still in the early investment stage.

Finally, Trip.com Group has been investing and partnering internationally. Above we already discussed the significant investments that Trip.com has made in MakeMyTrip and TripAdvisor. It has also launched an overseas ride-hailing service which integrates with local ride-hailing services and is currently available in over 785 cities across 47 countries in Southeast Asia, the United States and Europe.

But all of this was before COVID-19. Obviously, the epidemic has put a halt to those ambitions. Trip.com’s international businesses have flipped from being growth drivers to significant drags on profitability. But we expect the setback to be temporary and for Trip.com to revive its international expansion plans when it is safe to do so.

Low Tier Cities

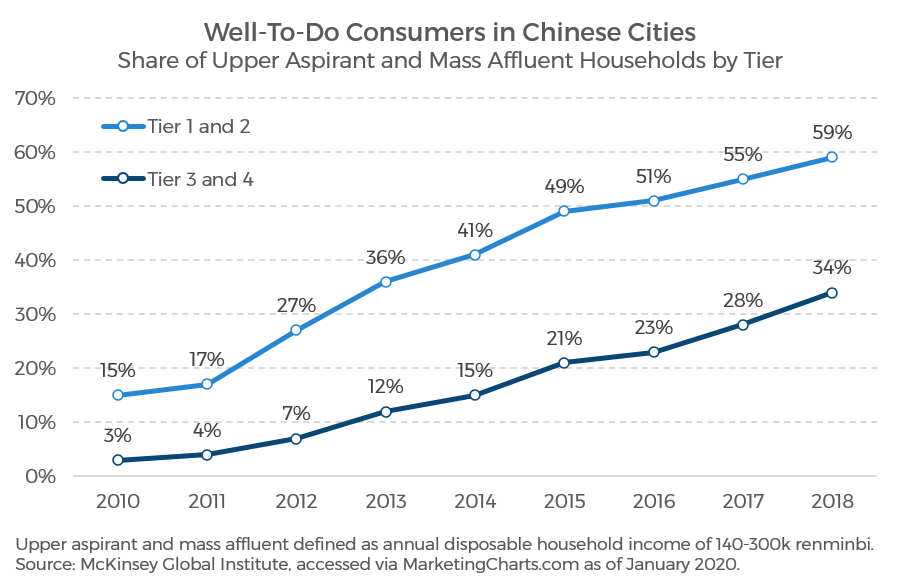

The other piece of Trip.com’s expansion strategy has been to meaningfully increase its presence in Tier two, three, and even Tier four Chinese cities.

This is a significant opportunity in these markets. The McKinsey Global Institute estimates that a third of Chinese middle class households live in Tier three or four cities. China has over 100 cities with more than one million people living in them. And Trip.com has significant headroom to grow here. It believes it has reached just 25–30% of the traveler population in first-tier cities and that its market penetration in lower-tier cities is “much less” than 10%.

A key part of this push has been adding offline travel agencies in these lower tier cities. Mostly operated on a franchise model, Trip.com added 1,300 stores in 2019 to bring its total count to 8,000 physical locations.

Management believes that in some smaller cities, this is the first time consumers are engaging with the Ctrip brand in a meaningful way. By combining offline and online channels, Ctrip reports 30% user growth on average in cities where it opened stores.

It is also crucial that Trip.com tailor its product offerings to its audience. For instance, most travel between lower-tier cities is by train, not by plane. And so, the company has had to expand its rail ticketing capabilities to complement existing air ticket offerings.

The results are beginning to pay off. In the fourth quarter of 2019, prior to COVID, Ctrip branded low-star hotel volume grew by 50% year-on-year, though those room nights were admittedly sold at lower daily rates.

This strategy works as a nice complement to the business’ international ambitions. It has been a relatively stronger performing segment since the outbreak of COVID-19, somewhat offsetting the huge disruption to international travel.

COVID-19 Impact and Response

We of course, need to talk about COVID-19. Trip.com has interesting lessons to teach the broader travel industry as China was both the first to experience the epidemic but is now also on the leading edge of health and safety measures to control the spread.

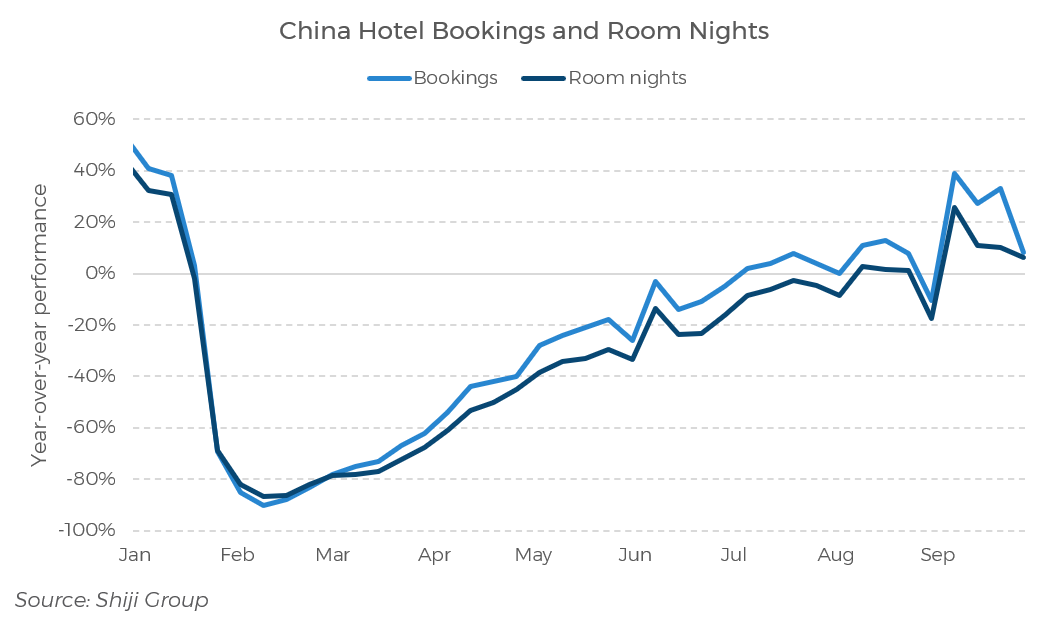

Our Skift Recovery Index is a real-time measure of where the travel industry at-large stands in recovering from the Covid-19 pandemic. It measures industry performance, relative to the same week last year. China’s current reading of 49, indicates that the Chinese tourism industry is still 51% below where it was at the same time last year. But this is a significant improvement from the troughs, more than double the output reading of 23.4 recorded in early April.

Domestic travel has been the key driver in China’s recovery. The government promoted domestic tourism during the recent Golden Week, taking place during the first week of October and data shows that 637 million people traveled during the 8-day holiday, spending nearly $70 billion in one week. Though impressive, that travel volume was still only 79% of those registered last year during the same holiday period.

With the virus contained within China and a population eager to return to travel, the country’s domestic tourism industry seems to be quickly approaching a full recovery.

Stunningly, Hotel data from Shiji shows that hotel bookings and room nights have been above 2019 levels since July, with very strong performance in September. Occupancy rates also climbed above 2019 levels for the first time in September since March 2020.

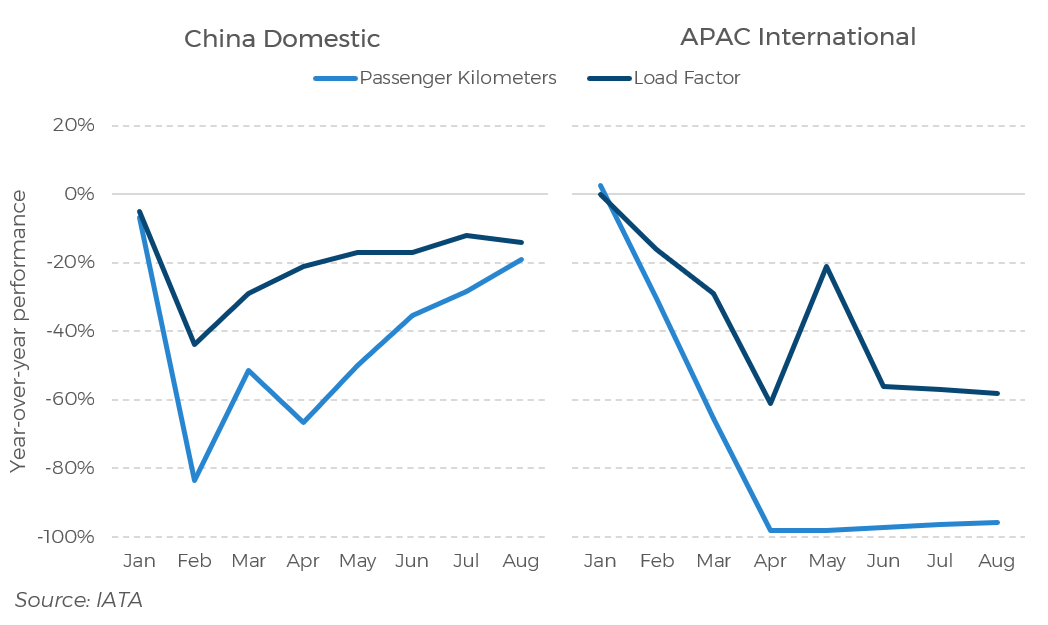

Domestic air travel is also clawing its way back to normalcy. IATA shows encouraging data with internal flight capacities and load factors sharply rebounding, and down “just” ~20% year-on-year.

However, the IATA data highlights just how devastated international travel has been. This is the flip-side to the domestic recovery: international travel is still virtually nonexistent out of China.

This explains why despite these strong domestic showings, the overall China Recovery index still shows the national down 51% year-on-year. China had such high outbound volumes and values in 2019, the country’s score in our index will inevitably be suppressed as long as international travel remains low. Because domestic travel is performing strongly, the country tracks considerably above the global average, but until some form of international travel returns, it is unlikely that China will score much higher than it currently does.

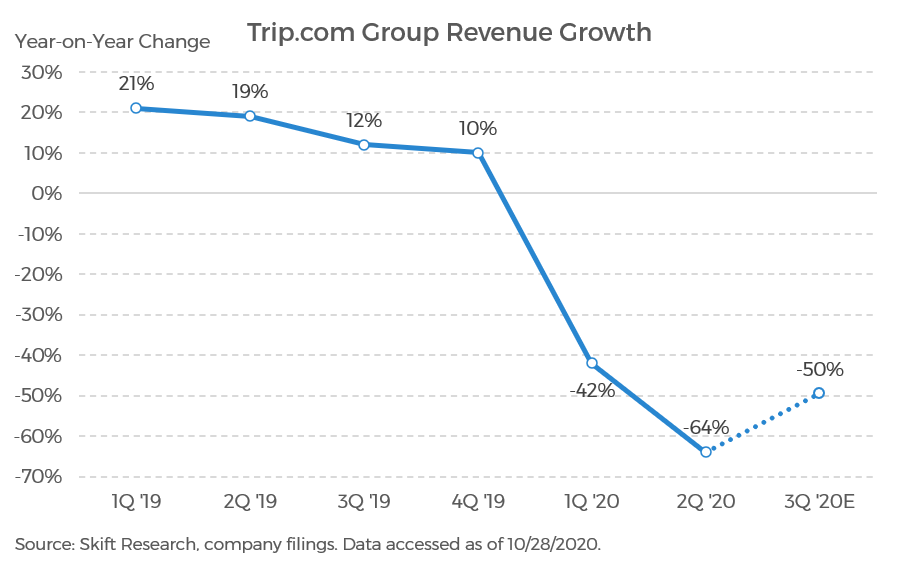

Trip.com specific data tells the same broad strokes. At the parent level revenue growth slowed in the fourth quarter of 2019, and then collapsed to -42% in the first quarter as the epidemic spread throughout China.

Trip.com’s chairman James Liang says that its activity in China bottomed in February but the decline in revenue deepened into the second quarter as the virus went global, shutting down international traffic. Trip.com’s overseas market hit the bottom in April.

Trip.com management expects that the company has already put the worst behind it and forecasts a sequential improvement in revenue for the third quarter. Though management still expects to see a 50% decrease next quarter compared to the same period last year, this implies a 68% acceleration in revenue from the second quarter into the third.

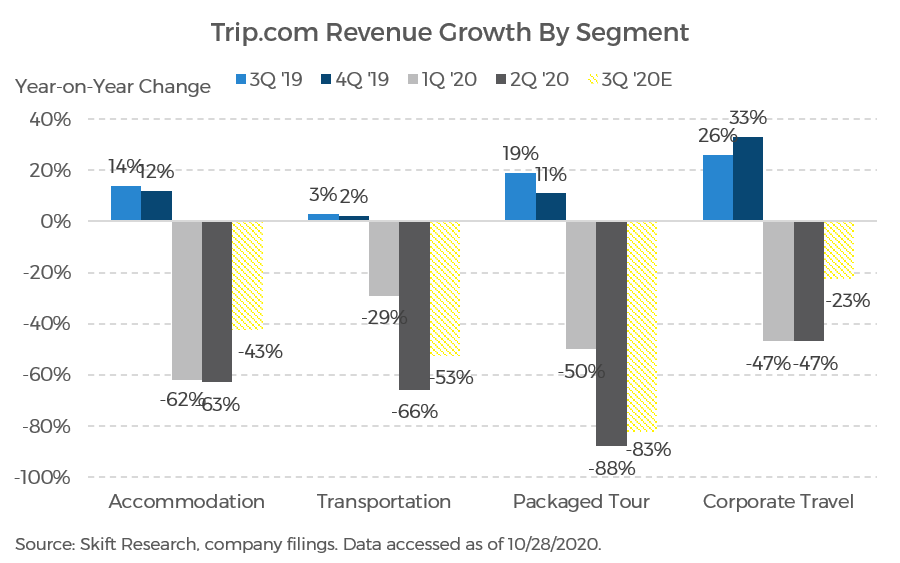

We can also get a quite nuanced view into the state of the Chinese travel recovery by examining how revenue has progressed at Trip.com’s different segments throughout the crisis. Accommodation revenue saw the greatest decline of any segment in the first quarter of 2020 when COVID-19 was primarily an issue affecting internal Chinese travel. But in the second quarter as lockdowns went global we can see how Trip.com’s segments levered to international travel took the brunt of the hit. This naturally includes the transportation segment, down -66% in Q2, but most notably packaged tour sales, down -88%.

The loss of Chinese packaged tour travelers in particular ties directly into the loss of tourism revenue across Southeast Asia. For example foreign arrivals in Thailand were down -71% in January – July this year, not coincidentally a very similar figure to the decline in packaged tours experienced by Trip.com. Trip.com expects that this business will remain the hardest hit and while it expects a broader snapback across other segments, packaged tours will likely remain down 80 – 85% in the third quarter.

It is also interesting to note sources of relative strength at Trip.com. Corporate travel, down ‘only’ -47%, stands out as Trip.com’s best performing segment in the second quarter, far outperforming Trip.com’s leisure-oriented segments. This challenges the prevailing narrative that corporate travel will be permanently impaired by the switch to remote during COVID-19.

CEO Jane Sun specifically called out that corporate travel “saw strong recovery momentum as business trips resumed” and expects it will continue to be her best performing segment into the end of the year. Management expects that corporate travel will be down 20 – 25% in the third quarter of 2020 compared to 2019, impling a 65% sequential acceleration from 2Q to 3Q.

Trip.com has also taken advantage of the crisis to rethink how it is doing business and launch new strategies to make it better, not just safer .

For instance, downtime has allowed Trip.com to improve its chatbot’s efficiencies by 3x. And Trip.com’s marketing campaigns have been entirely reset to focus on higher ROI. This includes discounts and coupons where effective and partnerships with local provincial destinations which underwrite incentives for the customer.

Perhaps Trip.com’s most interesting innovation has been doing massive live-streaming marketing campaigns . Since March, Trip.com co-founder and executive chairman James Liang has done more than 25 weekly live streams. His streams have sold more than $294 million in travel packages and hotels.

The quarantine version of a travel show, a given stream may be targeted to a specific destination, highlighting the region’s top attractions and Trip.com’s deals. These are particularly effective in the mid- to high-end domestic segment. The average product sold during these campaigns is priced at RMB 1,200 (~$180) and the experience has been so positive that Trip.com sees a 60% repeat customer purchase rate via live streaming.

Clear proof of the success of these initiatives is that Trip.com’s domestic air ticketing reservation volume tipped into positive growth territory in August. This is despite the fact that the overall Chinese dometic air market is still down 15–20% year-on-year. Thus Trip.com’s positive volume growth represents a significant growth in relative market share.

In addition to flights, the company saw a “full recovery” in domestic hotel volume in August and saw “double-digit” year-on-year growth in reservations at high-end hotels in early-September; though ADRs still remain depressed.

Management is even beginning to see some green shoots in international travel citing early efforts to establish travel corridors with Singapore and Korea.

China was the first to experience the devastating impact of COVID-19. Perhaps it will also be the first to show us the way for travel to recover. “We are increasingly optimistic,” says Executive Chairman James Liang, “that there will be more resumption of travel activity in major markets worldwide.”

- Travel, Tourism & Hospitality

Trip.com Group - statistics & facts

Development of trip.com group, covid-19 and business outlook, key insights.

Detailed statistics

Revenue of leading OTAs worldwide 2019-2022

Revenue of Trip.com Group 2012-2022

Net profit of Trip.com 2012-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Online Travel Market

Revenue of China's online travel agency market 2015-2022

Mobile Internet & Apps

Monthly active users of leading online travel apps in China 2024

Related topics

Recommended.

- Tourism industry in China

- Hotel industry in China

- Business travel and exhibition industry in China

- Chinese tourism in Europe

Recommended statistics

Industry overview.

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Revenue of leading OTAs worldwide 2019-2022

- Premium Statistic Marketing expenses of leading OTAs worldwide 2019-2022

- Premium Statistic Number of online travel booking users in China 2015-2023

- Premium Statistic Penetration rate of online travel booking in China 2015-2023

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Leading online travel agencies (OTAs) worldwide from 2019 to 2022, by revenue (in million U.S. dollars)

Marketing expenses of leading OTAs worldwide 2019-2022

Marketing expenses of leading online travel agencies (OTAs) worldwide from 2019 to 2022 (in million U.S. dollars)

Number of online travel booking users in China 2015-2023

Number of online travel booking users in China from 2015 to 2023 (in millions)

Penetration rate of online travel booking in China 2015-2023

Penetration rate of online travel booking in China from 2015 to 2023

Company financial figures

- Premium Statistic Revenue of Trip.com Group 2012-2022

- Premium Statistic Quarterly revenue of Trip.com Group Q4 2019-Q4 2023

- Premium Statistic Revenue of Trip.com 2017-2022, by region

- Premium Statistic Revenue of Trip.com 2012-2022, by product

- Premium Statistic Net profit of Trip.com 2012-2022

- Premium Statistic Quarterly net income of Trip.com Group Q4 2019-Q4 2023

- Premium Statistic Total assets of Trip.com 2012-2022

- Premium Statistic Total liabilities of Trip.com 2012-2022

- Premium Statistic Number of employees at Trip.com Group 2012-2022

- Premium Statistic Ad spending of Trip.com 2012-2022

Net revenue of Trip.com Group Ltd. in China from 2012 to 2022 (in billion yuan)

Quarterly revenue of Trip.com Group Q4 2019-Q4 2023

Net revenue of Trip.com Group Ltd. from 4th quarter 2019 to 4th quarter 2023 (in billion yuan)

Revenue of Trip.com 2017-2022, by region

Revenue of Trip.com Group Ltd. from 2017 to 2022, by region (in million yuan)

Revenue of Trip.com 2012-2022, by product

Revenue of Trip.com Group Ltd. from 2012 to 2022, by product (in million yuan)

Net profit of Trip.com Group Ltd. from 2012 to 2022 (in million yuan)

Quarterly net income of Trip.com Group Q4 2019-Q4 2023

Net income attributable to shareholders of Trip.com Group Ltd. from 4th quarter 2019 to 4th quarter 2023 (in billion yuan)

Total assets of Trip.com 2012-2022

Total assets of Trip.com Group Ltd. from 2012 to 2022 (in billion yuan)

Total liabilities of Trip.com 2012-2022

Total liabilities of Trip.com Group Ltd. from 2012 to 2022 (in billion yuan)

Number of employees at Trip.com Group 2012-2022

Number of employees at Trip.com Group Ltd. in China from 2012 to 2022

Ad spending of Trip.com 2012-2022

Advertising and promotion expenses of Trip.com Group Ltd. from 2012 to 2022 (in billion yuan)

Competitors

- Premium Statistic Channels used to plan international trips from China 2023

- Premium Statistic Leading online travel agencies used in China 2023

- Premium Statistic Monthly active users of leading online travel apps in China 2024

- Premium Statistic Online hotel booking platform market share in China H1 2020

Channels used to plan international trips from China 2023

Leading channels for outbound travel planning in China as of January 2023

Leading online travel agencies used in China 2023

Most popular online travel agencies among consumers in China as of June 2023

Number of monthly active user number (MAU) of the leading online travel apps in China as of February 2024 (in millions)

Online hotel booking platform market share in China H1 2020

Market share distribution of China's online accommodation booking platforms in the first half of 2020, based on transaction value

OTA consumers in China

- Premium Statistic Online travel agency usage in China 2023

- Premium Statistic Leading uses of online travel agencies in China 2023

- Premium Statistic Share of online travel platform users in China Q1 2023, by gender

- Premium Statistic Share of spending on online travel platforms in China 2023, by user gender

- Premium Statistic Share of online travel platform users in China 2023, by city tier

Online travel agency usage in China 2023

Online travel agency usage in China as of June 2023

Leading uses of online travel agencies in China 2023

Leading purposes for using online travel agencies in China as of June 2023

Share of online travel platform users in China Q1 2023, by gender

Share of number of online travel platform users in China in 1st quarter 2023, by gender

Share of spending on online travel platforms in China 2023, by user gender

Share of online travel platform transaction value in China in March 2023, by user gender

Share of online travel platform users in China 2023, by city tier

Share of number of online travel platform users in China in March 2023, by city tier

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Trip.com Group Ltd - Company Profile

All the data and insights you need on Trip.com Group Ltd in one report.

Trip.com Group Ltd Company profile

Unlock Trip.com Group Ltd profile and new opportunities for your business

- Save hours of research time and resources with our up-to-date, most comprehensive Trip.com Group Ltd. report available on the market

- Understand Trip.com Group Ltd position in the market, performance and strategic initiatives

- Gain competitive edge and increase your chances of success

- Save hours of research time and resources with our up-to-date Trip.com Group Ltd Strategy Report

- Understand Trip.com Group Ltd position in the market, performance and strategic initiatives.

Trip.com Group Ltd: Overview

- Share on Twitter

- Share on LinkedIn

- Segment Analysis

- SWOT Analysis

- Competitors

- Filing Analytics

- Theme Exposure

ICT Spend & Tech Priorities

Related keylists.

- Top 10 Online Travel Intermediaries in the World in 2021 by Revenue

- Top 10 Travel Intermediaries in Asia-Pacific in 2021 by Revenue

- Top 10 Travel Intermediaries in North America in 2021 by Revenue

- Top 10 Travel Intermediaries in the World in 2021 by Revenue

Trip.com Group Ltd (Trip.com Group), formerly Ctrip.com International Ltd, is an online travel service company. It provides hotel accommodation, airline tickets, train tickets and tour packages in China and Internationally. The company combines information on hotels and flights and facilitates its customers in booking hotels and flights. It has collaborations with several hotels in China and Internationally, serving travelers for hotel bookings. Its transportation ticketing service allows the customers to book tickets of all Chinese and major international airlines and domestic railways. The company caters to business and leisure travelers or frequent independent travelers in China. Trip.com Group is headquartered in Shanghai, China.

Trip.com Group Ltd premium industry data and analytics

IT Client Prospector provides intelligence on Trip.com Group Ltd’s likely spend across technology areas enabling you to understand the digital strategy.

Products and Services

History section provides information on new products, mergers, acquisitions, expansions, approvals, and many more key events.

Competitor Comparison

Key financial charts, sales growth, net income growth.

Have you found what you were looking for? From start-ups to market leaders, uncover what they do and how they do it.

Access more premium companies when you subscribe to Explorer

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Ctrip changing name to trip.com group to emphasize international business.

What’s in a name?

Ctrip will become the third major online travel agency to change its name since 2018. The new proposed brand for the Shanghai-based company would be Trip.com Group Ltd. That follows the Priceline Group rebranding to Booking Holdings in 2018, which was followed shortly thereafter by Expedia Inc. becoming Expedia Group.

So Ctrip’s major brands, including Ctrip, Trip.com, Qunar, and Skyscanner would all fall under the purview of the parent company, Trip.com Group Ltd. Ctrip announced the rebranding as part of its second quarter earnings call Tuesday in Shanghai.

“The new name reflects the services and products we provide, and can be easily remembered by global users,” Ctrip Executive Chairman James Jianzhang Liang said as part of the earnings announcement.

The rebrand is subject to a shareholder vote at Ctrip’s annual general meeting October 25.

Ironically, Expedia Group indirectly handed the Trip.com name to Ctrip. That’s because Expedia sold the name Trip.com to Gogobot, which in turn got acquired by Ctrip in 2017. Gogobot had rebranded to become Trip.com.

Ctrip CEO Jane Sun said Tuesday morning during an earnings call with financial analysts that international revenue could be 40 to 50 percent of Ctrip’s total revenue in the next three to five years, up from 35 percent in the second quarter.

International Headwinds

Although international business is expected to be a growth driver for the online travel agency, the ongoing protests in Hong Kong, political tensions with Taiwan, and the U.S-China trade war negatively impact third quarter guidance, Sun said.

In addition, according to a research report, the “average price of outbound air ticket dropped about 750 basis points year-over-year in July as a result of softer demand and macro uncertainties,” she added.

Ctrip is guiding for 10-15 percent revenue growth in the third quarter. In the third quarter of 2018, revenue climbed 15 percent.

The Largest MakeMyTrip Shareholder

Ctrip’s international ambitions became clear with a recent move in India. In the past few days, it completed a share exchange with Naspers which made Ctrip the largest shareholder of India’s MakeMyTrip, wielding 49 percent of MakeMyTrip’s voting power.

The China-based online travel company intends to start reporting MakeMyTrip’s gains and losses on its balance sheet using the so-called equity method as of August 30, Ctrip said.

For the second quarter, Ctrip posted net loss of $59 million compared to net income of $360 million a year earlier. The company attributed the loss largely to the plunging value of equity investments. Revenue in the second quarter increased 19 percent to $1.3 billion.

Note: This story has been updated to reflect the fact that the proposed new company name, Trip.com Group Ltd., is subject to shareholder approval.

Subscribe to Skift newsletters covering the business of travel, restaurants, and wellness.

- Car Rentals

- Airport Transfers

- Attractions & Tours

- Bundle & Save

- Custom Trips

- Destinations

- Trip.com Rewards

Trip.com Recommendations

Featured Hotel Destinations

- Best Hotels in Shanghai

- Best Hotels in Hong Kong

- Best Hotels in Las Vegas

- Best Hotels in Bangkok

- Best Hotels in Beijing

- Best Hotels in Guangzhou

- Best Hotels in NYC

- Best Hotels in Singapore

- Best Hotels in Kuala Lumpur

- Best Hotels in Dubai

- Best Hotels in Chicago

- Best Hotels in San Diego

- Best Hotels in Miami

- Best Hotels in New Orleans

- Best Hotels in Nashville

- Best Hotels in Boston

- Best Hotels in Orlando

- Best Hotels in Savannah

- Best Hotels in Charleston

- Best Hotels in Los Angeles

- Hotels in Bangkok

- Hotels in Da Nang

Popular Flights

- Flights from Cairo to Jeddah

- Flights from Dubai to Riyadh

- Flights from London to New York

- Flights from London to Dubai

- Flights from Kuala Lumpur to Singapore

- Flights from Dubai to Jeddah

- Flights from Orlando to San Juan

- Flights from Dubai to Mumbai

- Flights from Cairo to Riyadh

- Flights from Dubai to Delhi

- Flights from Bangkok to Phuket

- Flights from Shanghai to Beijing

- Flights from New York to Los Angeles

- Flights from San Francisco to New York

- Flights from New York to Miami

- Flights from Boston to Miami

- Flights from Dallas to Las Vegas

- Flights from Boston to Orlando

- Flights from Chicago to Phoenix

- Flights from Chicago to Miami

Featured Guides

- Attractions & Things to do in Illinois

- Attractions & Things to do in Chicago

- Attractions & Things to do in Nashville

- Attractions & Things to do in Las Vegas

- Attractions & Things to do in San Francisco

- Attractions & Things to do in New York

- Attractions & Things to do in Orlando

- Attractions & Things to do in Atlanta

Popular Attractions

- Universal Studios Hollywood

- Universal Orlando Resort

- Universal Studios Florida

- Louvre Museum

- Van Gogh Museum

- Tokyo Disneyland

- Ghibli Museum

- Tokyo DisneySea

- Universal Studios Japan

- Hong Kong Disneyland

Popular Airlines

- Alaska Airlines

- Spirit Airlines

- Copa Airlines

- Tap Air Portugal

- United Airlines

- American Airlines

- Vivaaerobus

- Air Senegal

- Kuwait Airways

- Sun Country Airlines

- Latam Airlines

- Frontier Airline

- Turkish Airline

Trip.com Links

- Trip.com App Android

- Trip.com App iOS

- Trip.com on Facebook

- Trip.com Reviews

- Trip.com Promo Code

- Trip.com Flight Deals

- Trip.com Hotel Discounts

- Customer Support

- Service Guarantee

- More Service Info

- Website Feedback

- About Trip.com

- Terms & Conditions

- Privacy Statement

- Do Not Sell My Personal Information

- About Trip.com Group

Other Services

- Investor Relations

- Affiliate Program

- List My Property

- Become a Supplier

Suggested companies

Booking.com.

Trip.com Reviews

In the Travel Agency category

Visit this website

Company activity See all

Write a review

Reviews 4.2.

77,125 total

Most relevant

Worked really well

Not really being a regular rail traveller I was a bit sceptical about using the service. However, armed with a newly purchased senior railcard I booked a one way ticket to Newport to pick up a car. The process worked extremely well and was amazingly competitively priced. They provided a full itinerary, with train and journey times for all the various connections, even the tube across London, which I was able to download to my phone via the App. The extra bonus was everything went to time 4 hours door to door. Would use again.

Date of experience : April 13, 2024

Reply from Trip.com

Hi MR T MASON, Thank you so much for your feedback. We appreciate your time and effort in writing a review for us. Please know that we will continue to provide interesting yet cheapest offers in the market to all our customers. Please keep using our app, and you might find a deal that suits your needs. Again, thank you, and have a great day. Best regards, Kaylee Trip.com

Good experience for flights and hotels

I am using Trip.com quite often for overseas trips to Asia. I find that they always have a large number of relevant offers for flights and hotels. Very easy to book on the website and offering a wide range of payment methods. They have been helpful in the past in case on cancelling or booking changes. Reimbursements arrived quickly.

Date of experience : April 15, 2024

Hi GERALD/RENNER, We appreciate you providing this positive feedback. It's wonderful to know that you find our APP/Website convenient for our customers. We are committed to delivering and enhancing this level of service, continuously striving to offer even better deals and promotions for our customers. Your ongoing support holds immense value to us, and we eagerly look forward to assisting you on your next journey with us. Thank you once again for choosing us. Best regards, Ella Trip.com

Only problem with your booking confirmation

In NHA Trang they could not give the boarding pass from KL to SIN. At the transfer counter I was rejected. Different booking refernce The sent me to immigration. To handle all this printing boarding pass at the kiosk was not possible. At the check-in counter I was rejected: too late. I bought a new ticket at air Asia. They made a typing error to change to my correct name took a long time. Make boarding pass online is not accepted because they cannot scan the mobile phone I strongly disrecomment you are not providing relevant information.

Date of experience : April 25, 2024

Dear HELMUT ERNST ARLT, Thank you for notifying us about this issue. We apologize for any inconvenience caused and assure you that we will check it further and contact you directly. Your feedback is highly valued, and we are taking it seriously. We appreciate your patience and understanding in this matter. Best regards, Madeline Trip.com

I did not receive the usual check-in…

I did not receive the usual check-in notice 24 hours before flight departure. I rely on third parties to send me this info so that I can ensure all is ok with my flight in advance. As a result, I was unable to see that the extra baggage check in fee I applied to our flight was actually never added and I ended up having to pay the ridiculously high baggage fee at the airport. Never using Trip.com again, will stick to my trusted sites, not worth saving a few bucks.

Dear CC, Thank you for bringing this issue to our attention. We sincerely apologize for any inconvenience you may have encountered. Kindly know that we will double-check the situation and contact you directly. We value your feedback and are committed to providing a satisfactory experience. Once again, we apologize for any inconvenience caused and appreciate your feedback. Best regards, Kylie Trip.com

Easily accessible to basic necessity

I booked 3 rooms. Out of the 3 rooms, 2 rooms hv bug issue. One of the room comes with mosquito net hence there is no issue with bug and can open the balcony sliding door whole day with no issue. Only living room hv celling fan. One bed only comes with one pillow. The front office does a good job in explaining everything in detail inclusive parking. Can easily access to basic necessity with no issue inclusive food and drink.

Date of experience : March 23, 2024

Dear Iris, We appreciate your effort in bringing this matter to our attention. We apologize sincerely for any inconvenience caused. Please be assured that we will check it further and reach out to you directly. Your feedback is highly valued, and we are taking it seriously. We thank you for your patience and understanding in this concern. Best regards, Bella Trip.com

Everything worked without a hitch!

This was a great experience. I booked an international hotel and made payment before the trip. When I arrived at the hotel they were ready for me. My payment was acknowledged and no money due other than taxes. The tax portion and amount had been clearly stated on the reservation details so it was no surprise and exactly the amount expected. Extremely pleased.

Date of experience : April 21, 2024

Hi Brad Keller, Thank you for taking the time to provide us with your positive feedback. We are thrilled to hear that you were satisfied with our APP/Website, and your kind words have made our day. At Trip.com, we are committed to providing our customers with the best possible deals and offers. We are pleased to hear that you have found our app/website useful, and we encourage you to continue using it to find more deals that meet your needs. We look forward to serving you on your next journey with us soon. Thank you once again for choosing Trip.com. Best regards, Angelina Trip.com

Love the room except the aircon unit need fixing

Front desk staff is very friendly, supported smooth and quick check in as well as check out. Glad to get the renovated room, nevertheless they keep it neat and clean. We love the bed and pillow with good support for back and neck. Just two items need attention, hope management look into fixing the air con unit which noise level is high and disturbed sleep, it is not resolved even with the technician visit. No floor towel is provided, asked and was told to deliver by 4pm but at the end I received a warm set by 11pm, hence I guess hotel keeps low volume of floor towel.

Date of experience : April 20, 2024

Hi SC Ng, Thank you for taking the time to leave us a positive comment. We are delighted to hear that you had a smooth booking experience with us. Your satisfaction is our top priority, and we are committed to providing you with the best possible service. Our user-friendly application/website is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Madeline Trip.com

Highly recommended

Our hotel is very reasonably priced and it was equipped with many amenities like microwave, stove, washing machine. The room is spacious with two twin size beds and the mattress and pillows is super comfortable. The location of the hotel is walking distance to many attraction but it is not in the busiest area so it is quiet at night.

Date of experience : April 18, 2024

Hi LEI MEI CHU, Thank you for taking the time to leave us a positive comment. We are delighted to hear that you had a smooth booking experience with us. Your satisfaction is our top priority, and we are committed to providing you with the best possible service. Our user-friendly application/website is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Emilia Trip.com

Always get the best deals on Trip.com

Always get the best deals on Trip.com , it's always offer lower rate / price than other websites.however , if Trip.com booking allows to pay by E wallet then it will be so much more convenient for userse.

Date of experience : April 24, 2024

Hi Lee Lexus, We sincerely appreciate your valuable feedback. Your time and effort in writing a review mean a lot to us. Rest assured, we are dedicated to consistently offering our customers captivating deals at the most affordable prices in the market. We encourage you to continue using our app/website, as you might discover a deal that perfectly meets your needs. Once again, thank you for your feedback, and we wish you a wonderful day ahead. Best regards, Ella Trip.com

Wonderful customer care team. Thanks to Monika Lu and Zhi Long

When an attraction is closed, though the booking is not permitted to cancel, Monika Lu and Zhi long assisted me in the best possible manner and contacted the service provider and made the refund for my booking in a smooth manner. Better experience for me as a customer and felt trip.com customer service was far better than klook, pelago, headout and other attraction booking platforms. Monika lu and Zhi long collected the needed pictures taken on the attraction and convinced the service provider to offer the customer a full refund. Im fully happy and satisfied and prepared to book most of my attraction and tours through trip.com in the future. Kudos to the entire trip.com team.

Hi karthick baskaran, Thank you for taking the time to provide us with such a wonderful review. We appreciate you sharing your experience with our customer support. Our team is dedicated to delivering exceptional customer experiences, and your feedback serves as a great source of motivation for us to maintain our high standards and exceed our customers' expectations. We are grateful for your choice in selecting our services, and we hope you have a fantastic day. Best regards, Kaylee Trip.com

I stayed in Ramada Wyndham Shanghai…

I stayed in Ramada Wyndham Shanghai recently. The service in the hotel is very good especially Snow Wu who quickly helped me and found a suitable room which enabled me to have a good night rest before a long flight.

Date of experience : April 23, 2024

Hi Guan, Thank you for taking the time to leave us a positive comment. We are delighted to hear that you had a smooth booking experience with us. Your satisfaction is our top priority, and we are committed to providing you with the best possible service. Our user-friendly application/website is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Kaylee Trip.com

World class service from Anna & Trip.com

My hotel booking had to be cancelled less than a month more to go due to external factors not involving Trip.com nor myself but even so, customer service manager Anna was superb. She handled the situation splendidly and took care of it with no issues. She took the right steps to help ensure my partner and I got a stay that was better than what I initially had even which shows that they look after their customers and not let us have to scramble to find a new accommodation. Thanks again Anna for your patience and help throughout the call. We look forward to booking with Trip.com for our future travels.

Hi Mahes Warren, I sincerely appreciate the time you took to provide this lovely review. It means a lot to us that you shared your experience with our customer support. Please be assured that we are constantly striving to provide the best possible customer experience to all of our valued customers. Your feedback serves as a great source of motivation for us to continue implementing our best practices and exceeding our customers' expectations. Again, thank you for choosing our services, and I hope you have a truly enjoyable and fulfilling day. Best regards, Kaylee Trip.com

I love Trip.com

I love Trip.com. You can find anything you need and all the reviews. I discovered that you can also book day trips and activities. I booked Tokyo Disney tickets and the experience was very pleasant and professional.

Hi Happy Traveler, Thank you for your kind words. We are so glad to hear that you are satisfied with our service. Here at Trip.com, we strive to provide the best customer service experience possible and your feedback is invaluable to us. We look forward to continuing to provide you with great service in the future. Best regards, Victoria Trip.com

Honestly give it a try.

I’ve used the Trip app for my last 3…trips. I don’t care who I use, loyalty is a myth. I just want the cheapest price and a simple system, both are offered on this app. Each time I’ve had flight prices that are cheaper than direct through Wizz with standard pricing and my rooms have been the same price as booking.com. Difference is this app offers both in the same place. Barely a day goes by without me looking for my next random adventure and flights are costing much less than the train into London and I’m only 20 minutes away from there.

Hi Andrew Willcox, We appreciate you providing this positive feedback. It's wonderful to know that you find our APP/Website convenient for our customers. We are committed to delivering and enhancing this level of service, continuously striving to offer even better deals and promotions for our customers. Your ongoing support holds immense value to us, and we eagerly look forward to assisting you on your next journey with us. Thank you once again for choosing us. Best regards, Natalie Trip.com

Business Trip for 1 night stay.

Like: The hotel have lift. Have hot shower, air conditioner works well. Every floor have iron and water dispenser. My room is non smoking room. Hotel in a strategic location. Nearby PLUS highway, got nearby halal eatery. Dislike: Towels are filthy dirty. I brought my own towel. Air conditioner emits smell of cigars smoke. Should have smoke alarm in non smoking room in order to ensure no one smoke in the room.

Date of experience : April 22, 2024

Hi Siti Noraini/Binti Nordin, Thank you so much for your time in leaving this positive review. I am delighted to know that you are satisfied with your stay. Our user-friendly application/website is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Riley Trip.com

Immediate resolution of query

I had serious concerns about third leg of my flight since layover was only 1 hr 10 mins, but the agent double verified it and gave me assurance that the flight won’t leave until we board the plane. That was a great relief and I was relieved, thanks to the wonderful agent.

Hi VIRAL KOTAK, Thank you for taking the time to leave us a positive comment. We are delighted to hear that you had a smooth booking experience with us. Your satisfaction is our top priority, and we are committed to providing you with the best possible service. Our user-friendly application is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Angelina Trip.com

Pleasantly surprised by Trip.com

I was pleasantly surprised by how good Trip.com is. I used the app on my recent trip to China to book hotels, airline tickets and a train ticket. The booking process was effortless. One airline cancelled the flight and I was immediately notified by Trip.com and almost immediately got a refund. Other airline trips, the train trip and the hotel bookings progressed smoothly; all I had to show was my passport. I highly recommend using Trip.com

Date of experience : April 12, 2024

Hello Eric/Sumithran, Thank you for leaving us this five-star review. Please note that we are striving every day to provide the best customer experience to our customers. Your feedback motivates us to continue our best practices and improve what we need to improve. We look forward to our next trip with you. Thank you for choosing us. Have a lovely day! Best regards, Una Trip.com

due to some misunderstanding so I…

due to some misunderstanding so I canceled my air tickets which is shown cannot refund.Soon I contacted with trip.com then I got efficient help and fast results to get restored the tickets. I feel all the way heartwarming from the platforms Again thank you so much trip.com 🙏

Hi An Hsiao, We sincerely appreciate the time you took to write this wonderful review. Your willingness to share your experience with our customer support is greatly valued. Rest assured that our team is dedicated to consistently providing the best possible customer experience. Your feedback serves as a strong motivator for us to maintain our high standards and go above and beyond to exceed the expectations of every customer. Thanks again for choosing us, and we hope you have a great day. Best regards, Riley Trip.com

Experience with Trip.com

Air Tickets and Hotel prices in Trip.com are reasonable compared to other providers around and promotional offers are customer oriented. Also great user interface of the mobile app goes to their credit.

Date of experience : April 26, 2024

Hi MOHAMMED JAMIL/ASHRAF, Thank you for taking the time to leave us a positive comment. We are delighted to hear that you had a smooth booking experience with us. Your satisfaction is our top priority, and we are committed to providing you with the best possible service. Our user-friendly application/website is designed to provide you with a range of options to plan your desired travel or vacation. We will continue to improve our services to ensure that you have the best possible experience with us. Thank you once again for choosing Trip.com, and we look forward to embarking on a beautiful journey with you soon. Best regards, Layla Trip.com

They fixed the issues

I booked a double room in Rome, but upon arrival, the hotel had mistakenly reserved a single room for us, which was unacceptable. I had to find a last-minute Airbnb, which significantly exceeded my budget. It took them some time to understand the situation and get a refund from the hotel. However, they eventually refunded us and did their best to compensate. A big thanks to Mina for her assistance!

Hi Oskar, We are committed to keeping our customers happy and are glad your concerns have been resolved. If there is anything else you would like to discuss or if you have any concerns, please do not hesitate to contact us. We will look into it and get back to you soon. Thank you! Best regards, March Trip.com

- Car Rentals

- Airport Transfers

- Attractions & Tours

- Bundle & Save

- Destinations

- Trip.com Rewards

- Customer Support

- Service Guarantee

- More Service Info

- Website Feedback

- About Trip.com

- Terms & Conditions

- Privacy Statement

- About Trip.com Group

Other Services

- Investor Relations

- Affiliate Program

- List My Property

- Become a Supplier

World’s best hotels for 2024

Stay somewhere award-winning.

Top experiences on Tripadvisor

More to explore

Top destinations for your next vacation

Travelers' Choice Awards Best of the Best

IMAGES

COMMENTS

Trip.com is a multinational travel service conglomerate with 45,000 employees. It is one of the world's largest online travel agencies with over 400 million users worldwide, and also the parent of Skyscanner.It is headquartered in Singapore.. The site provides booking services for flights, hotels, trains, car rentals, airport transfers, tours and attraction tickets, and claims to offer more ...

About Us. We are a part of the Trip.com Group, a NASDAQ listed company since 2003 (NASDAQ: TCOM) with over 45,100 employees and over 400 million members, making it one of the leading online travel agencies in the world. With more than 1.4 million hotels in 200 countries and regions, we've built an extensive hotel network to give our customers a ...