- Our Services

Welcome to Twelve04(Pty)Ltd

Twelve04(Pty) Ltd and our partners are prepared to offer a full range of solutions for community education and development for 21 st Century Learning project. These solutions are provided in both our unique integration of education and business models directed toward achieving world class results from academic participation as well as economic and community development. The Twelve04(Pty)Ltd

Our mission with our local and global partners is to accomplish this for the education program. Together we will introduce a unified and holistic plan that ensures meaningful and appropriate Education for job creation, economic and community development for all South Africans.

Our professional business service s allows us to focus and remain innovative including being current!

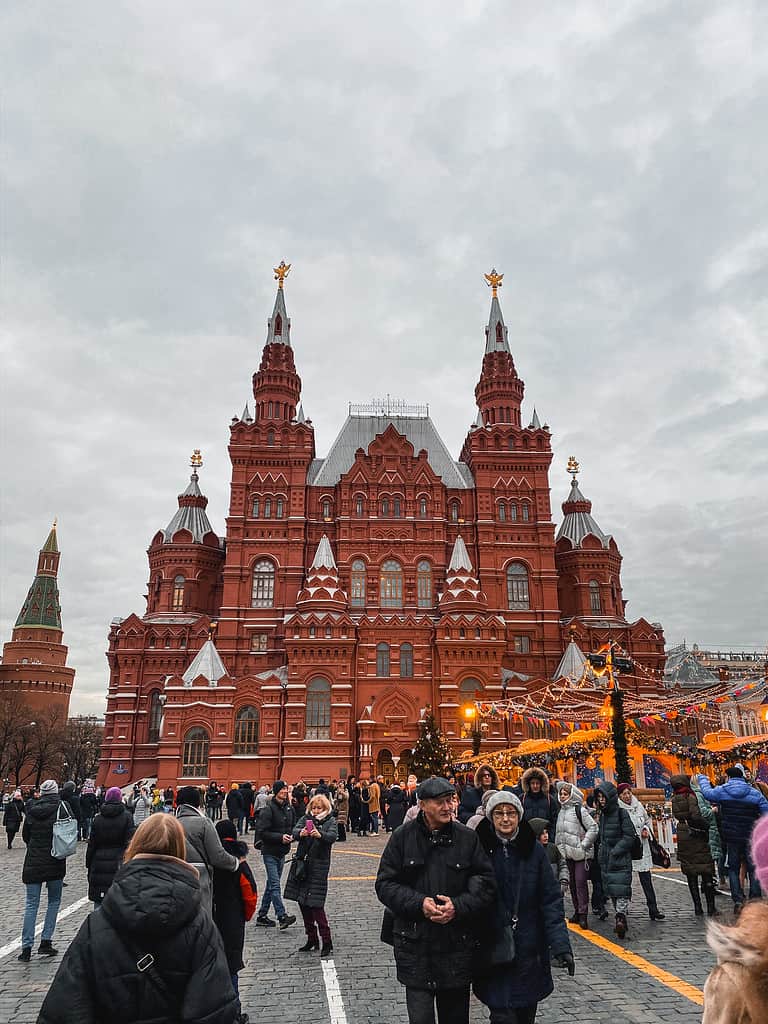

Travel Services

We provide travel management services for Corporate Clients, Government Departments/State Owned Entities, Leisure packages, Stokvel groups, Sport related travel packages and more...

Our services:

Accommodation

Conference packages

Shuttle/Transfer services

Visa applications

We analyze your business processes and provide support in all other areas of management so you can focus on your business.

More From Forbes

10 perfect jobs for people who love to travel.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

With many jobs requiring frequent travel, some professionals purposely seek out these opportunities ... [+] that afford them the chance to see the world.

My parents and extended family were almost all teachers and educators. With two months of summer off from work, along with plenty of vacation days, they had the privilege of enjoying both their work and traveling around the world.

They were bitten by the wanderlust bug. At family events, everyone would share their most recent exciting trip. My family seamlessly blended their love of travel, exploring new and different sites, with their occupation of teaching elementary, middle and high school students.

Is Frequent Traveling Compatible With Your Lifestyle?

With many jobs requiring frequent travel, some professionals purposely seek out these opportunities that afford them the chance to see the world. During the job search process, it is critical for professionals to consider how much travel is required to perform a specific role successfully. By carefully evaluating the travel requirements, candidates can make informed decisions about jobs that are a compatible fit for their circumstances, preferences and career aspirations.

Extensive travel can disrupt personal and family life, making it challenging to maintain a healthy work-life balance. Professionals with caregiving obligations may find frequent travel particularly burdensome or impossible.

However, for those who have wanderlust, a career that offers the opportunity to get paid to explore new places may be a dream come true. In these roles, accommodations and travel expenses are often covered, while you get to immerse yourself in different cultures.

The Best Romantic Comedy Of The Last Year Just Hit Netflix

Apple iphone 16 unique all new design promised in new report, rudy giuliani and mark meadows indicted in arizona fake electors case, jobs for travel lovers.

If you have been bitten by the travel bug, here are 10 occupations you should consider that will earn you a paycheck for traveling.

Traveling for work and meeting new people can strengthen your professional network and lead to potential clients and customers. Moreover, demonstrating that you can adapt to new environments can be a valuable soft skill in your career.

1. Flight Attendant

Average Base Salary: $39,077

Job Summary: A flight attendant is a trained individual who ensures the safety and comfort of passengers on an aircraft. They provide customer service, conduct safety demonstrations and respond to emergencies during flights.

Qualifications: Applicants are usually required to be at least 18 years old and have a high school diploma or GED. Successful completion of an airline-specific training program or orientation is necessary. This training is provided by the airline and covers aspects such as safety procedures, emergency protocols and customer service. Flight attendants must also be certified by the Federal Aviation Administration to work on each type of aircraft they serve on.

2. Airline Pilot

Average Base Salary: $108,544

Job Summary: An airline pilot is a professional responsible for flying and navigating airplanes, helicopters and other aircraft. Their duties include conducting pre-flight checks, developing flight plans, ensuring the safety and integrity of the aircraft and maintaining communication with the flight crew and air traffic controllers.

Qualifications: Airline pilots typically need a bachelor's degree, experience as a commercial or military pilot and must meet FAA requirements, including completing 250 flight hours with a pilot ground school. After you have passed your written ground school test and logged your hours, you will need to pass a check-ride with the FAA.

3. Management Consultant

Average Base Salary: $92,345

Job Summary: Management consultants work closely with domestic or international clients to provide business solutions to organizational issues involving maximizing business performance, business processes and revenue streams. A management consultant can offer expertise in a range of fields, such as business management, marketing, business strategy, supply chain and employee productivity.

Qualifications: Most employers require applicants to have completed, at minimum, a bachelor's degree in a business-related field, such as business administration, economics or finance.

Average Base Salary: $77,965

Job Summary: An auditor examines an organization's records, accounts and finances to ensure accuracy and compliance, as well as identify and mitigate risks. There are several disciplines within auditing, including financial; environmental, health and safety; external; internal; forensic and information technology. Because auditors attend frequent client meetings, they travel extensively to company sites, including internationally.

Qualifications: Similar to the education path of an accountant, aspiring auditors are required to hold a bachelor’s degree in accounting or a related field, like finance or business.

5. Tour Guide

Average Base Salary: $35,290

Job Summary: A tour guide leads visitors through historical sites, museums, geographic destinations or outdoor excursions, extolling relevant cultural, historical and practical knowledge.

Qualifications: Most tour guide jobs require at least the completion of a high school diploma, while some employers desire a four-year degree to lead a museum tour. Additionally, some states require you to obtain a tour guide license.

6. Pharmaceutical Sales Representative

Average Base Salary: $75,806

Job Summary: A pharmaceutical sales representative travels to different locations to sell pharmaceutical products and devices to healthcare professionals, such as doctors and nurses.

Qualifications: To become a pharmaceutical sales representative, most employers require at least a high school diploma or GED. Your qualifications will lie in your ability to build relationships and be persuasive.

7. Travel Nurse

Average Base Salary: $114,279

Job Summary: A travel nurse is a registered nurse or licensed practical nurse who works short-term contracts in various locations where healthcare facilities are understaffed. When contracts end, travel nurses either extend their stay at the same hospital or move on to a new location and opportunity.

Qualifications: Travel nurses must complete a state-approved nursing program, an associate degree in nursing or a B.S. in nursing to pursue licensure where they permanently reside. They must then pass the National Council Licensure Examination.

Typically, you cannot become a travel nurse right out of college, as clinical experience is generally required.

The Nurse Licensure Compact allows licensed RNs to practice legally in 39 participating states. If your location does not fall under the NLC, you must apply for state-specific licensure before you begin employment. Some states may fast track temporary licenses.

8. Construction Manager

Average Base Salary: $91,022

Job Summary: Construction managers oversee the development of buildings and infrastructure, managing tasks onsite, scheduling, budgeting and supervising projects from start to finish. Although they have a main office, construction managers travel to field offices on-site.

Qualifications: When hiring construction managers, most employers prefer they have a bachelor’s degree in construction science, construction management, architecture or civil engineering. However, it is possible to get hired with an associate degree in construction management or technology combined with relevant work experience in the field.

9. Professional Interpreter

Average Base Salary: $53,543

Job Summary: A professional interpreter enables communication between two or more parties who speak different languages. Interpreters can only render oral language, while translators specialize in written text. The most common areas of specialization include: conference, guide, media, public sector, medical and legal. Interpreters, especially liaison or escort interpreters, travel frequently to provide language support.

Qualifications: Professional interpreters are generally required to hold a bachelor's degree, while organizations like the United Nations recommend a master's degree. They should be highly proficient in at least two languages, including the source language (the language spoken by the interpreter) and the target language (the language in which they are interpreting).

10. Diplomat (Foreign Service Officer)

Average Base Salary: $97,246

Job Summary: The mission of a U.S. diplomat in the Foreign Service is to promote peace, support prosperity and protect American citizens while advancing U.S. interests abroad. American diplomats can be employed at any of the more than 270 international embassies or consulates.

Qualifications: While there is no specific academic degree or professional experience required to become an FSO, all applicants must undergo a rigorous hiring process. This consists of a written Foreign Service Officer test, a written personal narrative, an oral interview combined with role-playing exercises and a medical and security clearance review.

Diplomats are generally skilled negotiators with outstanding interpersonal skills who possess knowledge of foreign policy and languages.

Digital Nomad

Alternatively, the digital nomad lifestyle offers a unique work experience that comes with the autonomy of not being chained to an office. Like the name implies, it affords professionals with the opportunity to work remotely while traveling freely.

If you are looking for a job change that will be more suitable to your desire to travel, consider freelance projects or finding companies that offer remote positions. A downside to the digital nomad lifestyle is that you will be responsible to cover your own travel expenses, such as transportation, lodging and meals.

- Editorial Standards

- Reprints & Permissions

Twelve04 Travel in Polokwane

Coronavirus disease (covid-19) situation.

Twelve04 Travel

🕗 opening times, comments 0, nearest travel agency.

SEGO TRAVEL AGENCY

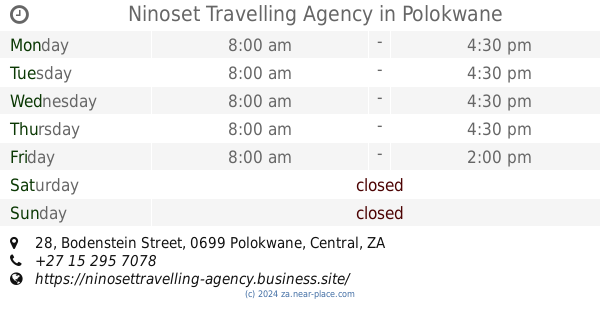

Ninoset Travelling Agency

Northern province tourism board.

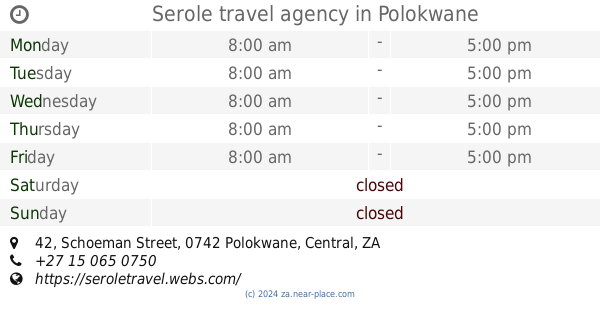

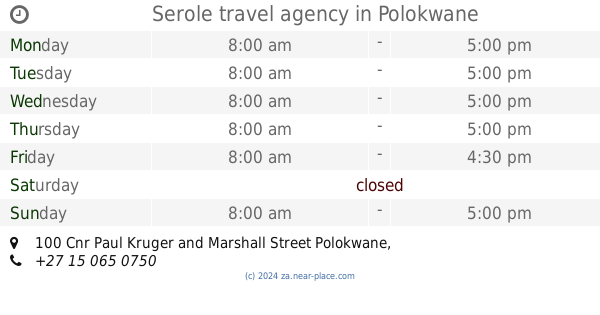

Serole travel agency

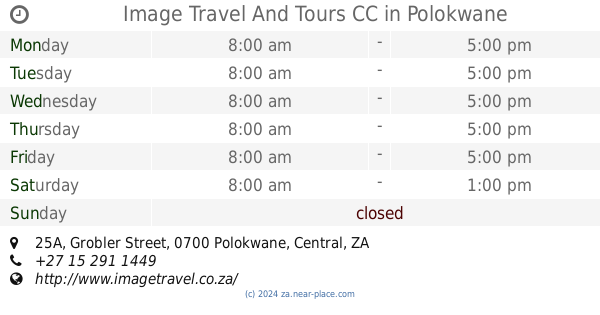

Image Travel And Tours CC

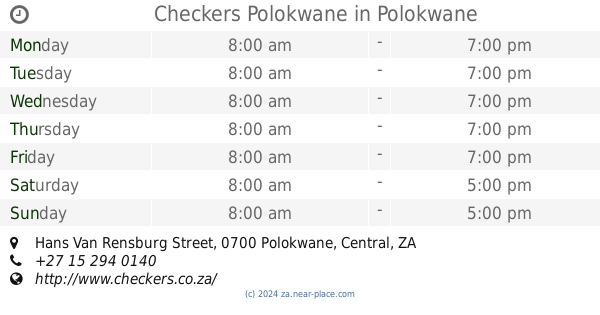

Checkers Polokwane

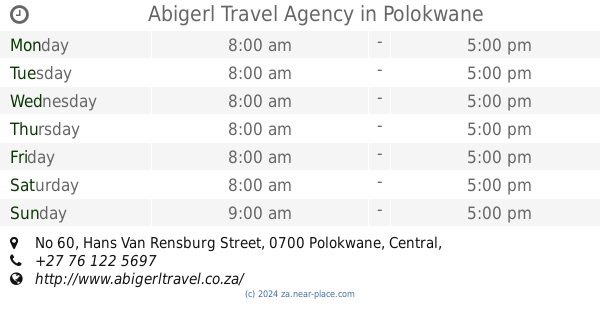

Abigerl Travel Agency

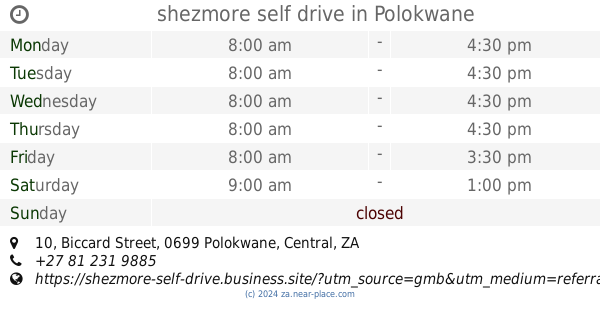

shezmore self drive

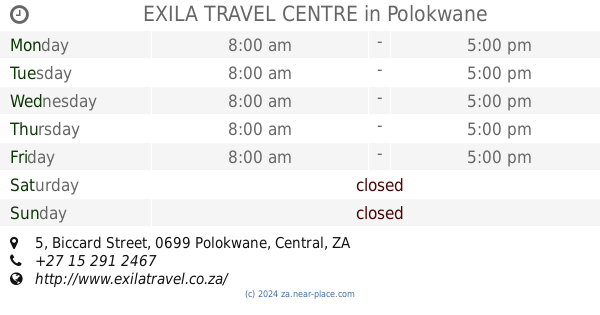

EXILA TRAVEL CENTRE

Freshlook travel and tour, asr travel agency.

XL Flight Specials Boledi Travel

Shoprite Pietersburg

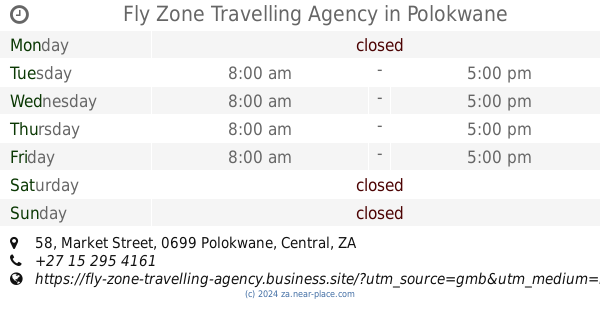

Fly Zone Travelling Agency

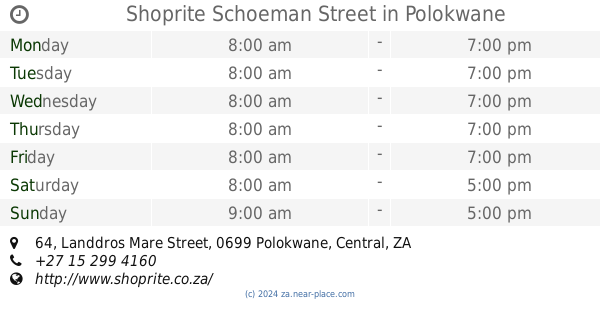

Shoprite Schoeman Street

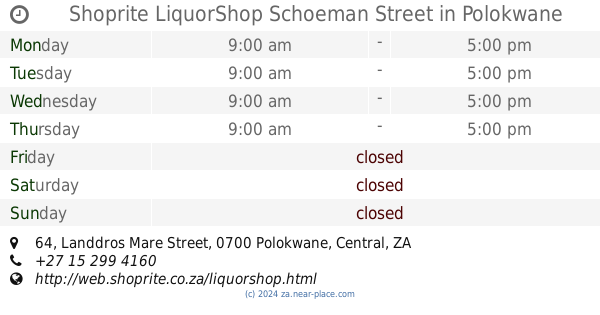

Shoprite LiquorShop Schoeman Street

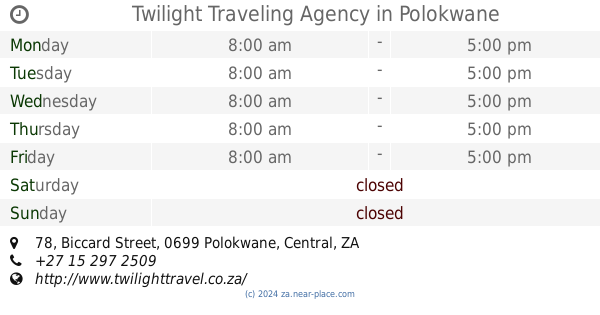

Twilight Traveling Agency

MAVI TRAVEL

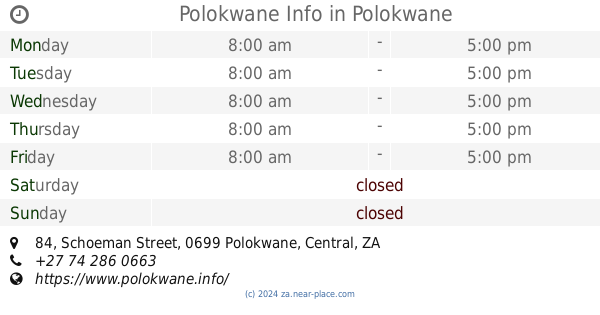

Polokwane Info

Moruleng travel and projects.

GreenSA Travel Centre

Charmap travel, 📑 all categories.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

WH Smith shares fall on lower growth after travel boom

- Medium Text

Sign up here.

Reporting by Prerna Bedi in Bengaluru; Editing by Varun H K

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

South Korea's public finances no longer a credit rating 'strength', Fitch says

South Korea's public finances are no longer a strength for its sovereign credit rating but are now a neutral factor requiring near-term efforts to contain the rise in debt, global ratings agency Fitch said.

The world's first doggy jet service will cost you $6K for a one-way ticket

Dogs will soon be able to experience their own “ fur st” class flight with the launch of the world’s first jet charter company specifically designed for man’s best friend.

BARK, the dog toy company that coordinates the popular treat subscription BarkBox, is partnering with a jet charter service to take away the challenges of long-distance traveling with dogs, according to a press release. BARK Air, as the company calls it, offers the “white glove experience typical of a human’s first-class experience and redirected all that pampering to pooches.”

Taking dogs on airplanes is, typically, a stressful endeavor with different airlines having different policies for pet travel. For example, American Airlines allows small dogs in a carrier to be placed under the seat in front, but larger dogs are put in the cargo space, which has been found to be stressful for the pet. For United Airlines , pets can fly in the cabin if there’s enough space, but they must fit in a carrier under the seat in front.

“We are excited to take the insights we’ve learned over years to create an experience that is truly dog-first, which is drastically different from just accepting dogs – from the ground to the skies,” said Matt Meeker, Co-Founder and Chief Executive Officer at BARK, in a statement.

First-time Fido's taking to the sky? Here are tips from my flight with a dog

Learn more: Best travel insurance

However, you’ll need to pay a hefty fee for the dog-friendly flight. For now, a ticket for just one dog and one human will run you at least $6,000 one way.

The first BARK Air flights will take off on May 23, and so far, there are only two flight routes available, both from New York’s Westchester County Airport. From New York to London’s Stansted Airport, it’ll cost $8,000 one-way and to Los Angeles’s Van Nuys Airport will cost $6,000 one-way. Tickets are available for purchase on April 11.

Not only does BARK Air allow dogs, it also focuses on the furry friends by treating them like VIPs, the press release said. BARK Air passengers can skip TSA checkpoints and screenings and instead experience a simple check-in process where they can meet the other dogs on the flight and the humans are served a meal cooked by on-site chefs.

When boarding, a BARK Air concierge is on-hand to ensure the dogs are socializing and adjusting to the environment well.

Each flight will undergo “Dogs Fly First” flight prep that includes “calming pheromones, music, and colors that pups prefer.” To make the flying experience easier and more enjoyable, dogs have access to various aids such as calming treats, noise-canceling ear muffs, and calming jackets.

During takeoff and descent, dogs are given a beverage of their choice to help their ears adjust to cabin pressurization. Of course, there will be plenty of treats on the flight.

Kathleen Wong is a travel reporter for USA TODAY based in Hawaii. You can reach her at [email protected] .

- Latest News

‘Bad Girls’: Donna Summer’s Expansion On Disco

Ella fitzgerald: just why is she so important, ‘king of the blues guitar’: why albert king still wears the crown, ‘on the threshold of a dream’: the moody blues’ ‘pathway of enlightenment’, ‘little broken hearts’: how norah jones turned hurt into art, best ella fitzgerald songs: 20 memorable jazz classics, ‘songs from the sparkle lounge’: how def leppard shined in the 00s, the warning share music video for ‘qué más quieres’, liana flores signs with verve records, unveils ‘i wish for the rain’, schoolboy q announces ‘blue lips weekends’ tour, loreena mckennitt announces ‘the mask and mirror live’, andrea bocelli announces 30th anniversary concert event and film in tuscany, abbey road studios to launch ‘stories in sound’ live experience, billy idol talks making ‘eyes without a face’ with vevo footnotes, post malone announces five new dates for ‘twelve carat’ tour of north america.

The Texan starhas added additional shows in Toronto, Boston, New York and Los Angeles to his itinerary.

Published on

Due to overwhelming demand, Post Malone has announced five additional dates for the just announced ‘Twelve Carat Tour’, an extensive 38-show outing across North America with special guest Roddy Ricch .

Post has added additional shows in Toronto, Boston, New York and Los Angeles. Produced by Live Nation, the tour kicks off on September 10 at CHI Health Center in Omaha, NE making stops in Boston, Philadelphia, New York, Dallas, Atlanta, Vancouver and more before wrapping up in Los Angeles, CA at Crypto.com Arena on November 16. Visit the Live Nation website for tickets and further information.

Malone recently released his anxiously awaited fourth full-length and one of the most anticipated albums of 2022 , Twelve Carat Toothache [Mercury Records/Republic Records]. In addition to massive anthems “Cooped Up” [with Roddy Ricch] and “One Right Now” [with The Weeknd ], the record boasts appearances from an all-star cast of guests, including Doja Cat, Fleet Foxes, Gunna, and The Kid LAROI. Musically, Post collaborated with longtime cohorts such as producers and co-writers Louis Bell, Billy Walsh, and Andrew Watt as well as Omer Fedi and more.

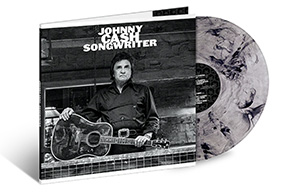

Johnny Cash, Nat King Cole, And Selena Gomez: Currently Trending Songs

From stage to page: 10 musicians who are also published authors.

Buy or stream Twelve Carat Toothache .

Post Malone’s ‘Twelve Carat’ Tour dates are as follows:

(*With Roddy Ricch) Sat Sep 10 – Omaha, NE – CHI Health Center Sun Sep 11 – St. Paul, MN – Xcel Energy Center* Wed Sep 14 – Chicago, IL – United Center* Thu Sep 15 – Milwaukee, WI – Fiserv Forum* Sat Sep 17 – St. Louis, MO – Enterprise Center* Sun Sep 18 – Columbus, OH – Nationwide Arena* Tue Sep 20 – Toronto, ON – Scotiabank Arena Wed Sep 21 – Toronto, ON – Scotiabank Arena Fri Sep 23 – Boston, MA – TD Garden Sat Sep 24 – Boston, MA – TD Garden Tue Sep 27 – Cleveland, OH – Rocket Mortgage FieldHouse Wed Sep 28 – Pittsburgh, PA – PPG Paints Arena Sat Oct 01 – Detroit, MI – Little Caesars Arena Sun Oct 02 – Indianapolis, IN – Gainbridge Fieldhouse Tue Oct 04 – Washington, DC – Capital One Arena* Thu Oct 06 – Philadelphia, PA – Wells Fargo Center*+ Fri Oct 07 – Newark, NJ – Prudential Center* Sun Oct 09 – Belmont Park, NY – UBS Arena* Wed Oct 12 – New York, NY – Madison Square Garden* Thu Oct 13 – New York, NY – Madison Square Garden* Sat Oct 15 – Columbia, SC – Colonial Life Arena* Sun Oct 16 – Nashville, TN – Bridgestone Arena* Tue Oct 18 – Atlanta, GA – State Farm Arena* Fri Oct 21 – Dallas, TX – American Airlines Center* Sat Oct 22 – Austin, TX – Moody Center* Tue Oct 25 – Houston, TX – Toyota Center* Wed Oct 26 – Ft. Worth, TX – Dickies Arena* Fri Oct 28 – Tulsa, OK – BOK Center* Sun Oct 30 – Denver, CO – Ball Arena* Tue Nov 01 – Salt Lake City, UT – Vivint Arena* Thu Nov 03 – Portland, OR – Moda Center* Sat Nov 05 – Seattle, WA – Climate Pledge Arena* Sun Nov 06 – Vancouver, BC – Rogers Arena* Thu Nov 10 – Los Angeles, CA – The Kia Forum* Fri Nov 11 – Las Vegas, NV – T-Mobile Arena* Sun Nov 13 – Los Angeles, CA – The Kia Forum* Tue Nov 15 – Los Angeles, CA – Crypto.com Arena* Wed Nov 16 – Los Angeles, CA – Crypto.com Arena*

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Federal travel regulation and related files

Ftr amendments (federal register), travel/per diem bulletins.

If you have any issues reading the documents, please contact Regulatory Secretariat by phone: 202-501-4755 .

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Spring Sale! Prices up to 10% OFF, book today and save!

Your London & UK Private Transfer Specialist

Up to 20% Cheaper Than Most Our Competitors, 98% Satisfaction Rate Based on +2000 5 Star Reviews, Reliable, Affordable and More Than Just a Transfer

Fill in your journey details

London airport transfers & more.

Heathrow Airport Transfers from £60.00*

Click here for more details

Gatwick Airport Transfers from £60.00*

Stansted Airport Transfers from £60.00*

Luton Airport Transfers from £60.00*

Our simple 3 step booking system.

Plan Your Trip

Fill in your journey details, whatever that might be

Get a Quote

Instant quote with an effortless process using our booking tool

We’ll confirm your journey via email and keep you updated

We have raving fans!

Find out more

Download the app

Booking your next journey with us is just a few clicks away! Get access to your booking history, live tracking, free calls to your driver or the office and much more.

Use “V99A99” for 5% off your next booking

Promo code valid only for bookings made via the app up to 31.08.2021

Twelve is not your regular private transfer service. We aren’t new in the business either, but yet we have created something new.

With over 10 years’ experience in the London minicab / private transfer business, we believe in offering a product that meets your expectations, but doesn’t tear a hole in your pocket. If you ever need a Heathrow transfer, a journey from London to Gatwick, private transfers from Stansted or a trip from Luton Airport to anywhere in the UK, be sure to count on us. Want to find out more?

What we offer

- 30 mins waiting time included

- 30 mins parking included

- Flight tracking + meet & greet included

- UK coverage for transfers to/from all London airports

- Special offers on transfers to/from all London area

- Groups of up to 8 passengers + luggage

- Executive vehicles available on request

- Meet & greet included

- Transfers to all UK ports/cruise terminals from London area/airports

- Special offers on transfers to/from Southampton, Dover or Portsmouth

- Transfers to/from all London airports to anywhere in UK

- Transfers to/from any location in London to anywhere in UK

- London Private Tours & UK Day Trips

- Coming Soon: Transfers to Paris – “Road Show”

- Chauffeur type services

- Free WiFi included

- Snacks and drinks included

- New Mercedes, BMW and Audi fleet

- Executive sedans for up to 3 passengers + luggage

- Executive MPV’s for up to 8 passengers + luggage

- Professional and knowledgeable drivers

- New & clean vehicles

- Over 95% customer satisfaction rate

- Reliable service and 97.5% on time

- Online bookings from any device within minutes

- Secure payments and wide range of cards or cash* accepted

- Affordable prices and value for money on each occasion

- Corporate accounts and offers for those that travel often

Why choose us?

Airport Specialist

30 Mins Waiting Time 30 Mins Free Parking Meet & Greet Included Flight Tracking Included

Customer Orientated

Reliable & On Time New & Clean Cars Great Offers & Discounts Great Customer Support

London Private Transfers Major Airports Covered Major UK Ports Covered UK Transfers & Much More

Our popular vehicle options

Up to 2 passengers* Up to 4 luggages* Budget option Options include VW Passat, Ford Mondeo, Toyota Prius or similar Get an instant quote

Up to 2 passengers* Up to 4 luggages* Free WiFi & refreshments Options include Mercedes E Class, BMW 5 Series or similar Get an instant quote

Up to 4 passengers* Up to 8 luggages* Perfect for small groups Options include VW Sharan, Ford Galaxy, Seat Alhambra, Toyota Prius+ or similar Get an instant quote

Up to 8 passengers* Up to 16 luggages* Ski or large luggage friendly* Options include VW Transporter, Vauxhall Viraro, Hyundai I800 or similar Get an instant quote

Latest news

New customer app and instant requests.

We are happy to announce that after months of hard work, our brand new customer app has been released for download on the App and Play Store. You now have the possibility to request a journey directly from your phone in a matter of minutes. That is not everything, as we also offer the option to book an instant journey (as soon as possible). Booking just got simpler, as we have completely removed all restrictions for short notice requests – plan your trip, get a fixed price, and depart within minutes.

With each and every airport and port pickup, you have included in the price 30 mins of free waiting and parking time. What this means is that starting from the actual scheduled pickup time (see flight tracking* and meet & greet* for more info), you have 30 mins on top, which should cover you for any delays occurred with luggage or passport control.

With any airport, port or train station pickup, you will automatically have included meet and greet, which means that one of our drivers will be waiting for you at the designated location (see pickup points* for more info) with a name board on display. You will also have all your driver/vehicle details provided prior to the journey.

All airport pickups come included with the flight tracking feature. We monitor your flight and reschedule your pickup time accordingly, should there be an earlier or delayed arrival (T&C’s apply). What this means in simpler terms… you provide us with the flight number and landing time; when the plane lands, our driver will be at the pickup point after 30mins (actual landing time + 30mins = pickup time). Remember, you also have 30 mins free parking and waiting time on us after this!

Due to the high demand, we always advise our customers to book in advance. You are getting the best price by doing so and you can avoid the disappointment of not being able to find a car with us when you need it the most. Be one step ahead and let us help you plan your transfer in advance.

Pre-paid bookings will be refunded in maximum 10 working days from the moment of cancellation. It can then take up to a further 4 working days for the funds to be credited and reach your account.

If a booking is cancelled less than 24 hours prior to the schedule pick-up time, there will be a cancellation fee applied, which depends on the time we were informed…

– More than 24 hours before pick-up time = no charge applied / full refund; – Between 24 and 3 hours before pick-up time = 30% of journey price; – Between 3 hours and up to the pick-up time = 50% of journey price; – Once journey has commenced (driver on the way or driver is arrived) = 100% of journey price;

If your flight is cancelled, you will be given the option to receive a full refund or reschedule your journey. In the event that your flight is diverted to a different airport then the one you were due to land on, you will be given the option to receive a full refund or reschedule your journey from the new airport (in the event that a price difference occurs, you will have to pay this). We will require proof of flight cancellation to qualify for a full refund (in the event that the journey was cancelled with less than 24 hours prior to pickup).

For more information, please visit our T&C’s page .

Payment options

Why not travel in style and comfort?

Book with us today and experience more than just a transfer, experience Twelve.

What are you waiting for?

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

- 1.32.12.1.1 Background

- 1.32.12.1.2 Authorities

- 1.32.12.1.3.1 CFO and Deputy CFO

- 1.32.12.1.3.2 Associate CFO for Financial Management

- 1.32.12.1.3.3 Travel Management

- 1.32.12.1.3.4 Travel Policy and Review

- 1.32.12.1.3.5 Relocating Employee

- 1.32.12.1.3.6 Business Units

- 1.32.12.1.3.7 CFO Relocation Coordinators

- 1.32.12.1.3.8 CFO Relocation Technicians

- 1.32.12.1.4 Program Management and Review

- 1.32.12.1.5 Program Controls

- 1.32.12.1.6 Terms/Definitions

- 1.32.12.1.7 Acronyms

- 1.32.12.1.8 Related Resources

- 1.32.12.2.1 Travel to the New Official Station Prior to the Report Date

- 1.32.12.2.2 Short Distance Moves

- 1.32.12.3.1 Service Agreements

- 1.32.12.3.2 Time Limits

- 1.32.12.3.3 Advance of Funds

- 1.32.12.4.1 New Appointee

- 1.32.12.4.2 Transferred Employees

- 1.32.12.4.3 Overseas Tour Renewal Travel

- 1.32.12.4.4 Senior Executive Service (SES) Separation for Retirement Last Move Home

- 1.32.12.4.5 Temporary Change of Station (TCS)

- 1.32.12.4.6 Return Separation

- 1.32.12.5.1 Travel Expenses

- 1.32.12.5.2 Per Diem at New Official Station

- 1.32.12.5.3 Use of More Than One Privately-Owned Vehicle (POV) for En Route Travel

- 1.32.12.6 Allowance for Househunting Trip Expenses

- 1.32.12.7 Allowance for Temporary Quarters (TQ) Subsistence Expenses

- 1.32.12.8.1 Actual Expense Method

- 1.32.12.8.2 Unaccompanied Air Baggage (UAB) Allowance

- 1.32.12.8.3 Temporary Storage of Household Goods

- 1.32.12.8.4 Household Goods Traffic Management Program

- 1.32.12.9.1 Extended Storage During Assignment to Isolated Locations Within the Continental United States (CONUS)

- 1.32.12.9.2 Extended Storage During Assignment Outside the Continental United States (OCONUS)

- 1.32.12.10.1 Transportation of Privately-Owned Vehicle (POV) to an Outside the Continental United States (OCONUS) Post of Duty

- 1.32.12.10.2 Return Transportation of a Privately-Owned Vehicle (POV) From an Outside the Continental United States (OCONUS) Post of Duty

- 1.32.12.10.3 Transportation of a Privately-Owned Vehicle (POV) Within the Continental United States (CONUS)

- 1.32.12.10.4 Emergency Storage of a Privately-Owned Vehicle (POV)

- 1.32.12.11 Allowances for Transportation of Mobile Homes and Boats Used as a Primary Residence

- 1.32.12.12.1 Title Requirements

- 1.32.12.12.2 Request for Reimbursement for Residence Sale and Purchase

- 1.32.12.13 Unexpired Lease

- 1.32.12.14 Allowance for Miscellaneous Expenses

- 1.32.12.15 Voucher Submission

- 1.32.12.16 Relocation Income Tax Allowance (RITA)

- 1.32.12.17 Relocation Debts

- 1.32.12.18 Forms

Part 1. Organization, Finance, and Management

Chapter 32. servicewide travel policies and procedures, section 12. irs relocation travel guide, 1.32.12 irs relocation travel guide, manual transmittal.

June 07, 2022

(1) This transmits revised IRM 1.32.12, Servicewide Travel Policies and Procedures, IRS Relocation Travel Guide.

Material Changes

(1) IRM 1.32.12.1.7, Acronyms, Updated acronyms.

(2) IRM 1.32.12.4.1(1)(Table A), New Appointee, Added that for new appointees assigned to first official station in Continental United States (CONUS), IRS must pay or reimburse Relocation Income Tax Allowance (RITA).

(3) IRM 1.32.12.4.1(1)(Table B), New Appointee, Added that for new appointees assigned to first official station in foreign or non-foreign Outside the Continental United States (OCONUS), IRS must pay or reimburse RITA.

(4) IRM 1.32.12.4.2(1)(Table E), Transferred Employees, Added that for transferred employees returning from foreign or non-foreign OCONUS official station to place of actual residence for separation, IRS must pay or reimburse RITA.

(5) IRM 1.32.12.4.4(2)(Table G), Senior Executive Service (SES) Separation for Retirement Last Move Home, Added that for eligible SES career appointees performing a Last Move Home (LMH) and meet the conditions for a separation retirement, IRS must pay or reimburse RITA.

(6) IRM 1.32.12.6(3), Allowance for Househunting Trip Expenses, Updated section for clarification.

(7) IRM 1.32.12.6(7), Allowance for Househunting Trip Expenses, Added paragraph to include provisions and calculations for lump-sum househunting trip expenses.

(8) IRM 1.32.12.7(24), Allowance for Temporary Quarters (TQ) Subsistence Expenses, Added paragraph to explain lump sum Temporary Quarters Subsistence Expense (TQSE) payments.

(9) IRM 1.32.12.7(25), Allowance for Temporary Quarters (TQ) Subsistence Expenses, Added paragraph to explain the calculation for lump sum TQSE payments.

(10) IRM 1.32.12.15(2), Voucher Submission, Added TQ as an expense type and grocery and utility receipts as required documentation.

(11) IRM 1.32.12.17(3), Relocation Debts, Updated section for clarification.

(12) This revision includes changes throughout the document for the following:

Updated the CFO office names and responsibilities

Per Executive Order 13988, references to he/she, him/her and his/hers were updated

Added minor editorial changes to include grammar and minor changes for clarification purposes

Updated links throughout the IRM

Effect on Other Documents

Effective date.

Teresa R. Hunter Chief Financial Officer

Program Scope and Objective

Purpose - This IRM provides the policies and procedures for IRS employees who perform official relocation travel in the interest of the government. It also provides guidance to supervisory and administrative personnel who authorize, direct, review or certify payments for reimbursement of relocation expenses.

Audience - All business units

Policy Owner - CFO, Financial Management

Program Owner - CFO, Financial Management, Travel Management office develops and maintains this IRM.

Primary Stakeholders - The primary stakeholders are employees relocating, domestically and internationally, who have been authorized relocation allowances in the interest of the government.

Program Goals - The goals of this IRM are to ensure that IRS employees receive clear guidance and comply with the IRS relocation policies.

The General Services Administration (GSA) is responsible for establishing governmentwide relocation policies and procedures.

This guide is intended to supplement the Federal Travel Regulations (FTR). The FTR is the regulation contained in 41 Code of Federal Regulations (CFR), Chapters 300 through 304, that implements statutory requirements and executive branch policies for travel by federal civilian employees and others authorized to travel at government expense.

The FTR represents the governing document for relocation policy for all IRS employees. This IRM supplements the FTR by providing IRS-specific policies and procedures where needed. If the FTR differs from the IRM, the FTR is the controlling legal authority.

This guide applies to all employees authorized by the IRS to relocate to a new official station in the interest of the government. It covers foreign and domestic relocations.

Authorities

5 U.S. Code (USC) Section 5707, Regulations and Reports

5 USC Section 5724, Travel and transportation expenses of employees transferred; advance of funds; reimbursement on commuted basis

5 USC Section 5726, Storage expenses; household goods and personal effects

5 USC Section 5737, Relocation expenses of an employee who is performing an extended assignment

5 USC Section 5738, Regulations

31 USC Section 901, Establishment of agency Chief Financial Officers

31 USC Section 902, Authorities and functions of agency Chief Financial Officers

31 USC Section 3726, Payment for Transportation

Department of Treasury Directives

Tax Cuts and Jobs Act of 2017

Federal Travel Regulation, Chapters 300-304

Responsibilities

This section provides responsibilities for:

CFO and Deputy CFO

Associate cfo for financial management, travel management, travel policy and review.

Relocating employee

Business units

CFO relocation coordinators

CFO relocation technicians

The CFO and Deputy CFO are responsible for the oversight of the IRS relocation program and also for:

Overseeing policies and procedures and employee compliance with relocation allowances.

Ensuring criteria is met for basic plus allowances and forwarding the requests to the Associate CFO for Financial Management for decision.

The Associate CFO for Financial Management is responsible for:

Establishing and maintaining policies and controls to ensure compliance on the relocation program for internal accounting operations and financial reporting.

Administering the relocation services contract. See IRM 1.32.13, Relocation Services Program, for additional information.

Approving requests for basic plus allowances for shipment of privately-owned vehicles (POV) within the Continental United States (CONUS) and use of the Relocation Services Program.

Travel Management is responsible for

Developing and issuing IRS relocation program policy.

Updating and maintaining this IRM.

Reviewing and approving an extension for an expired one-year time limitation for employees to claim relocation expenses for an additional one year not to exceed two years.

Travel Policy and Review is responsible for:

Reviewing requests for basic plus allowances and coordinating the requests to Travel Management for further elevation to the Associate CFO for Financial Management for a decision.

Educating customers on FTR and relocation policies.

Relocating Employee

The relocating employee is responsible for:

Signing a Form 4282, Twelve-Month Service Agreement, for a domestic location within CONUS or Form 10902, Overseas Transportation - Service Agreement, for a foreign location Outside the Continental United States (OCONUS) or Form 9803, Transportation Agreement, for posts of duty in a non-foreign OCONUS location.

Receiving an approved relocation authorization prior to incurring any relocation expenses.

Contacting the IRS gaining office and the designated CFO relocation coordinator to determine what relocation expenses are authorized and to ensure that the relocation authorization for basic moving expenses is signed before incurring any expenses. The IRS will not reimburse employees for any expenses incurred before the relocation authorization is approved.

Meeting all prerequisites for use of the basic plus relocation program such as marketing the residence for the specified time period before requesting the service.

Retaining copies of all relocation documents associated with the relocation.

Notifying the CFO relocation coordinator of any requirements to perform temporary duty at another location or locations en route to the new official station or while occupying temporary quarters. Employees must file a separate travel voucher in Concur for any temporary duty expenses.

Reading all furnished materials carefully to understand responsibilities; if employees are misinformed by a government official, the IRS has no legal basis to pay an unauthorized claim. Erroneous advice by an IRS representative does not bind the government to pay a claim that is in violation of regulations.

Submitting signed and approved Form 8741, Relocation Voucher, to the technician, with receipts and supporting documentation within 15 calendar days after completion of the relocation activity and ensuring claimed relocation expenses are correct.

Using the government travel card for official travel including purchases of common carrier transportation, baggage fees, meals, vehicle rentals and other relocation related expenses.

Paying all charges and fees associated with the government travel card by the due date on the invoice. Employees are liable for all charges.

Liquidating a relocation advance on a voucher or submitting a check to the debt collection unit for any amount due.

Paying all billing documents for overweight household goods shipments and non-allowed charges.

Paying all billing documents for withholding taxes associated with the relocation activities.

Ensuring that administrative leave is only used for official relocation activities.

Business Units

The losing office approving official is responsible for:

Reviewing and approving requests for administrative leave for relocation and ensuring the administrative leave is recorded properly for relocation activities prior to the employee’s en route travel.

Coordinating a report date with the gaining office approving official.

Reviewing and approving Form 8741, Relocation Voucher as necessary prior to the employee’s report date to the new official station.

The gaining office approving official is responsible for:

Informing the employee of their transfer within a time frame that provides the employee with sufficient time for preparation for the move.

Signing and verifying information in the service agreement.

Forwarding a copy of the service agreement to the servicing personnel office to be filed in the employee’s official personnel folder.

Signing and verifying information on the relocation authorization for basic moving expenses prior to the employee incurring any relocation expenses.

Signing the amendments, if necessary, to the relocation authorization for basic moving expenses.

Approving shipment of a POV to an OCONUS and/or non-foreign area for the new post of duty (POD) per guidelines of each OCONUS location.

Reviewing Form 8518, Request for the Use of the Relocation Services Contract.

Reviewing Form 14564, Request for Approval for the Basic Plus Allowance Shipment of Privately-Owned Vehicle.

Verifying that Form 8741, Relocation Voucher, are correct and filed within 15 calendar days after completion of each segment of the relocation activity.

Reviewing the requests for the use of the basic plus relocation allowances.

Submitting the requests for the use of the basic plus relocation allowances program to *CFO.Relocation Basic Plus [email protected] for review and submission to the Associate CFO for Financial Management.

Ensuring employees do not use excessive administrative leave for relocation travel and review any hours greater than 200.

Approving Form 4253-C, Relocation Travel Advance Requests.

The gaining budget office is responsible for:

Contacting the designated CFO relocation coordinator to initiate the preparation of the relocation authorization for basic moving expenses immediately to ensure the authorization will be signed by an approving official prior to incurring any expenses.

Providing the correct accounting data for the corresponding accounting string to ensure adequate funding is established to cover the employee’s relocation allowances and ensure funds are obligated for authorized relocation entitlements on the relocation authorization and amendments for basic moving expenses, and relocation authorization amendments for basic plus moving expenses.

Providing employees with a signed relocation authorization for basic moving expenses and relocation authorization amendment for basic plus moving expenses if necessary.

Forwarding signed copies of service agreements, relocation authorizations, amendments and extensions to the CFO relocation coordinator.

Routing any request for basic plus relocation allowances through the head of office or their designee to the Travel Management office for submission to the Associate CFO for Financial Management for decision.

The business unit head of office is responsible for:

Authorizing and approving basic relocation allowances program requests on relocation authorizations for basic moving expenses. This authority may be redelegated, in writing, by the business unit head of office to the director, Strategy and Finance or their equivalent.

Signing requests for use of the basic plus relocation allowances program for shipment of POV and use of the relocation services contract, and forwarding to *CFO Relocation Basic Plus [email protected] for coordination in obtaining the signature of the Associate CFO for Financial Management.

CFO Relocation Coordinators

The CFO relocation coordinators are responsible for:

Counseling and assisting relocating employees with relocation entitlements and allowances.

Preparing relocation authorizations for basic moving expenses and relocation authorization amendments for basic plus moving expenses for approval, if applicable.

Reviewing approved relocation authorizations for basic moving expenses, and relocation authorization amendments for basic plus moving expenses and obligating funding where necessary.

Amending relocation authorizations for basic moving expenses, and amending relocation authorizations for basic plus moving expenses, to revise obligations when an entitlement (or expense) was not previously approved.

Arranging for a professional carrier to pack, load, ship and store the employee’s household goods, unaccompanied air baggage (UAB), and POV, if applicable, and preparing the Internal Revenue Bills of Lading (IRBL) for authorized services.

Assisting employees with completing cost comparisons for shipping a POV.

Assisting employees with preparation of forms to request basic plus relocation allowances.

Assisting employees with requesting use of the relocation services contract. See IRM 1.32.13, Relocation Services Program, for additional information.

Establishing billing documents for overweight charges and non-allowed charges.

Establishing billing documents for withholding taxes associated with payments made to a third-party company on behalf of the employee.

CFO Relocation Technicians

CFO relocation technicians are responsible for:

Reviewing and paying relocation vouchers and invoices submitted for reimbursement.

Validating and entering information in the relocation system.

Processing Relocation Income Tax Allowance (RITA) reimbursement or billing document after reconciliation.

Processing third-party payments to moving companies for household goods services including shipment, storage and delivery.

Processing third-party payments to moving companies for shipment of POVs, if approved.

Processing third-party payments for use of the relocation services contract for home sale and property management services.

Program Management and Review

Internal controls are established to ensure the relocation program is managed effectively. Reviews are conducted to ensure vouchers and invoices are processed according to regulatory requirements and to ensure the expenses are included in gross income for tax compliance.

Program reports: The IRS completes the following reports:

Aging unliquidated relocation obligations

Open relocation voucher report

GSA Relocation Data Call Report

In accordance with 5 USC 5707 (c), Regulations and Reports , all agencies that spend more than $5 million on travel and relocation must provide an annual report to GSA by November 30. GSA provides the required data elements and report format for the annual report.

Program effectiveness: The CFO Travel Operations office completes the following to ensure the program is managed effectively:

Monthly performance matrix that measures whether or not corrective actions are necessary.

Surveys customers quarterly soliciting feedback from relocating employees on relocation voucher processing.

Program Controls

Travel Operations reviews for effectiveness by:

Conducting a weekly review of all relocation vouchers and invoices to ensure compliance with prompt payment processing guidelines.

Performing a review of open relocation obligations quarterly to ensure timely processing of relocation allowances and deobligation of excess amounts.

Reviewing relocation reimbursements and reconciling payments annually to ensure tax withholding and taxable income are recorded properly.

The following chart below describes the internal controls in place for using the relocation travel program:

Terms/Definitions

This section provides IRS terms to supplement the FTR Chapter 300, Part 300-3, Glossary of Terms .

The following terms and definitions apply to this program:

Actual report date - The date when an employee or new appointee physically reports to the new or first official station and performs any integral work related to the transfer or appointment.

Approving official - The manager authorized to approve relocation vouchers in accordance with Servicewide Delegation Orders pertaining to relocation travel.

Authorizing official -The head of office authorized to approve relocation authorizations in accordance with Servicewide Delegation Orders pertaining to relocation travel.

CFO relocation coordinator - The primary employee that provides relocation benefit counseling to relocating employees.

Centrally Billed Account (CBA) - An account set up for travelers who do not have a government travel card for official IRS travel expenses, such as airline and train tickets.

City-to-City - A form of travel to a place, away from an employee's official station, to which the employee is authorized to travel, which may involve an overnight stay or lodging expense.

Federal Insurance Contributions Act (FICA) Tax -- A payroll tax or employment tax imposed by the federal government on both employees and employers to fund Social Security and Medicare.

Foreign area (see also non-foreign area)-- An area that includes the Trust Territories of the Pacific Islands situated both outside the continental United States (OCONUS) and the non-foreign areas.

Gaining office -- The office where the employee will report and which will issue the relocation travel authorization and fund the travel.

Government travel card -- A credit card used to pay for authorized official travel and allowable travel-related expenses. Each travel card reflects an individual account established in the travel cardholder's name. This term is synonymous with travel card, credit card, government issued-travel card and individual billed account (IBA). The travel card is a credit card issued by a financial institution under contract with Treasury which can only be used to pay for authorized official IRS travel and allowable travel-related expenses.

Head of Office -- Any of the following IRS officials: Commissioner of Internal Revenue, Deputy Commissioners, Division Commissioners, IRS Chief Human Capital Officer, Chiefs, Chief Counsel, Chief of Staff, Directors reporting directly to the Commissioner or Deputy Commissioners and National Taxpayer Advocate.

Non-foreign area --The states of Alaska and Hawaii, an area that includes, the Commonwealths of Puerto Rico and the Northern Mariana Islands, Guam, the United States (U.S.) Virgin Islands and the territories and possessions of the United States (excludes the former Trust Territories of the Pacific Islands, which are considered foreign areas for the purposes of the FTR).

Internal Revenue bill of lading (IRBL) -- A contract using the actual expense method for transportation services between the United States (U.S.) Government and the carrier transporting the household goods, professional books, papers, and equipment (PBP&E), privately-owned vehicles (POV), and unaccompanied air baggage (UAB).

Official station -- The location where the employee regularly performs their duties. The geographic limits of the official station are the corporate limits of the city or town where the employee is located, or, if not in an incorporated city or town, the reservation, station or other established area having definite boundaries where the employee is located, not to exceed 50 miles from the employee's location. If the employee’s work involves recurring travel or varies on a recurring basis, the location where the work activities of the employee’s position of record are based is considered the regular place of work.

Permanent Change of Station (PCS) -- An assignment of a new appointee to an official station or the transfer of an employee from one official station to another on a permanent basis.

Relocation advance -- The prepayment of estimated relocation expenses to an employee with the expectation that the employee will account for amounts received by filing a relocation voucher.

Relocation authorizations -- The documents that authorize allowances on a relocation authorization for basic moving expenses and relocation authorization amendment for basic plus expenses, and other amendments for temporary quarters or any allowance not authorized on the original basic moving expense authorization that provide approval to relocate in the government's interest and are used to obligate relocation funds.

Relocation Income Tax Allowance (RITA) -- The payment to the employee to cover the difference between the withholding tax allowance (WTA), if any, and the actual tax liability incurred by the employee as a result of their taxable relocation benefits; Relocation Income Tax Allowance (RITA) is paid whenever the actual tax liability exceeds the WTA.

Relocation voucher -- Form 8741, Relocation Voucher, A written request for reimbursement of expenses supported by documentation and receipts incurred in the performance of a permanent change of station or temporary change of station, and for the liquidation of advances, if applicable.

Residence -- The one home from which an employee regularly commutes to and from work on a daily basis and which was their residence at the time an employee is officially notified by competent authority to transfer to a new official station.

Temporary Change of Station (TCS) --The relocation of an employee to a new official station for a temporary period while performing a long-term assignment, and subsequent return to the previous official station upon completion of that assignment.

Temporary Quarters Subsistence Allowance (TQSA) -- The Temporary Quarters Subsistence Allowance (TQSA) is an allowance provided to assist with temporary lodging, meals, laundry and dry cleaning while occupying temporary quarters at a new post and permanent residence is not yet available, or when an employee is getting ready to depart post of duty permanently and must vacate residence.

Temporary Quarters Subsistence Expenses (TQSE) -- The Temporary Quarters Subsistence Expenses (TQSE) is an allowance provided to reimburse actual subsistence expenses incurred by an employee and/or their immediate family while occupying temporary quarters. TQSE does not include transportation expenses incurred during occupancy of temporary quarters.

Transport -- A system or means of conveying people or goods from place to place by means of a vehicle, aircraft, or ship.

Withholding Tax Allowance (WTA) -- The amount provided by the agency to gross-up taxable relocation allowances, reimbursements or direct payments to a vendor to offset the federal tax withholding.

The following acronyms apply to this program:

Related Resources

Employees should review the following IRMs:

IRM 1.32.4, Government Travel Card Program, for information on the Travel Card Program and the Centrally Billed Government Travel Card Program

IRM 1.32.11, IRS City-to-City Travel Guide, for information on city-to-city travel, including domestic, foreign, invitational and emergency travel

IRM 1.32.13, Relocation Services Program, for information regarding the use of the relocation services contract

IRM 1.32.5, International Travel Office Procedures, for guidance on completing the necessary travel documents for international travel including the Form 1321, Authorization for Official Travel as well as visa and passport applications.

IRM 6.610.1, IRS Hours of Duty, for information on the use of administrative leave in connection with a government authorized relocation travel

Joint Federal Travel Regulations , for additional information on foreign and non-foreign OCONUS relocation

Publication 521, Moving Expenses , for additional information on the 50-mile distance and time test guidelines for moving expenses

Department of State Standardized Regulations (DSSR) for additional information on foreign and non-foreign OCONUS relocation.

Foreign Affairs Manual: United States (U.S.) Department of State , for additional information on foreign and non-foreign OCONUS relocation

Foreign Affairs Handbook - U.S. Department of State , for additional information on foreign and non-foreign OCONUS relocation

Delegation Order 1-3, Authorization of Employee Relocation Allowances and Approval of Relocation Reimbursements, for information on approval of relocation activities.

General Rules and Applicability

This section provides IRS guidance to supplement FTR Chapter 302, Subpart A, Part 302-1, General Rules .

The IRS may authorize the payment of relocation expenses to:

Attract qualified candidates willing to relocate

Attract a specific individual with a unique set of skills not easily found in the area

Accommodate a mandatory or directed reassignment

The rules governing the IRS ability to pay for relocation expenses for new and current employees are as follows:

The employee is transferring from one duty station to another for permanent duty and the new duty station is at least 50 miles from the old duty station. The distance test is met when the new official station is at least 50 miles further from the employee’s current residence than the old official station is from the same residence. For example, if the old official station is three miles from the current residence, then the new official station must be at least 53 miles from that same residence in order to receive relocation expenses for residence transactions. The distance between the official station and residence is the shortest of the commonly traveled routes between them. The distance test does not take into consideration the location of a new residence. This follows the distance guidelines found in Internal Revenue Service Publication 521, Moving Expenses. The business unit’s Deputy Commissioner (or the Chief of Staff for Commissioner direct-report organizations) may authorize an exception to the 50-mile threshold on a case-by-case basis.

The employee must sign a Form 4282, Twelve-Month-Service Agreement, for a domestic relocation (CONUS), a Form 10902, Overseas Transportation Service Agreement for a foreign (OCONUS) relocation or a Form 9803, Transportation Agreement for a non-foreign relocation (OCONUS).

Employees cannot incur any travel expenses prior to approval. The employee must begin their travel including transportation for the family and household goods after receiving an approved relocation authorization. All aspects of the relocation must be completed within one year from the report date of the transfer or appointment, including settlement of real estate transactions. The one-year limit can be extended for an additional year by the employee through their approving official. There is no authority to extend the relocation beyond the two years.

Relocation allowances are determined by the type of assignment as a new appointee, student trainee, transferee, overseas tour renewal employee, separating employee or an employee performing a temporary change of station.

The purpose of the relocation authorization is to:

Provide written approval authorizing the employee to incur relocation expenses.

Inform the employee of approved entitlements and allowances by listing the estimated amount for each allowance.

Obligate funds for relocation expenses.

Public Law 115-97 known as the "Tax Cuts and Jobs Act of 2017" was signed into law on December 22, 2017. The law suspended qualified moving expense deductions along with the exclusion for employer reimbursements and payments of moving expenses effective January 1, 2018, for tax years 2018 through 2025. Relocations that occurred prior to January 1, 2018, are still deductible.

The IRS has determined payment for extended storage of household goods for employees assigned to OCONUS locations will remain excluded from gross income and exempt from taxation. Additionally, transportation of an employee’s POV to, from and between the CONUS and a post of duty outside the continental United States, or between posts of duty OCONUS will remain excluded from gross income and exempt from taxation. Transportation of an employee’s POV within CONUS, however, will be included in the employee’s gross income and subject to tax liability for those payments.

Employees cannot relocate to the new official station before they have received an approved relocation authorization for basic moving expenses, before incurring permanent change of station (PCS) or temporary change of station (TCS). Employees must contact their assigned CFO relocation coordinator for assistance with entitlements and allowances for basic relocation allowances and basic plus relocation allowances.

The IRS has two relocation programs:

The basic relocation allowances program must be authorized on relocation authorization for basic moving expenses and approved by the business unit head of office or their designee as defined in Delegation Order 1-3, Authorization of Employee Relocation Allowances and Approval of Relocation Reimbursements. This authority may be redelegated, in writing, by the business unit head of office to the director, Strategy and Finance, or their equivalent.

The basic plus relocation allowances program must be authorized on the relocation authorization amendment and approved by the business unit head of office or their designee. The request is then forwarded to the Associate CFO for Financial Management for final approval. See IRM 1.32.13, Relocation Services Program, for additional information on requesting this program.

Relocating employees are entitled to all mandatory payments allowable under the basic relocation allowances program. The basic relocation allowances program includes mandatory allowances by move type as prescribed by the FTR:

En route travel to new POD for employees and immediate family

Miscellaneous expenses

Real estate transactions

Transportation of a mobile home or boat used as a primary residence in lieu of transportation of household goods

Transportation of household goods up to 18,000 pounds, with a 2,000 pound packing additive, and storage up to 60 days in a CONUS location or 90 days in an OCONUS location

Temporary storage for household goods may not exceed a total authorization of 150 days for CONUS locations or 180 days for OCONUS locations

Extended storage of household goods (for isolated official stations)

The Basic Relocation Allowances Program also includes discretionary allowances as prescribed by the FTR:

Househunting trip

Temporary Quarters Subsistence Expenses (TQSE) for up to 60 days

Extension of temporary quarters for an additional 60 days not to exceed a total of 120 days

Shipment of a POV to a foreign or non-foreign OCONUS location

Extension of temporary storage of household goods within CONUS – up to an additional 90 days not to exceed a maximum of 150 days and whenever there is an OCONUS origin or destination up to an additional 90 days not to exceed a maximum of 180 days

Under the Basic Plus Relocation Allowances Program, the IRS may pay the following additional relocation allowances:

Use of the relocation services contract

Shipment of a POV within CONUS

Employees must receive authorization for basic relocation allowances on, Relocation Authorization for Basic Moving Expenses, before requesting the basic plus relocation allowances on Relocation Authorization Amendment for Basic Plus Moving Expenses.

The business units must submit the request for basic plus relocation allowances to Travel Policy & Review, *CFO Relocation Basic Plus [email protected] mailbox for review. Travel Policy and Review will forward the request to the Associate CFO for Financial Management for approval or disapproval. The Associate CFO for Financial Management will return the package to Travel Policy and Review. Travel Policy and Review will provide copies of the approval or disapproval to the CFO relocation coordinator.

Relocation allowances are determined by the type of assignment as a new appointee, student trainee, transferee, overseas tour renewal employee, separating employee or employee performing a TCS.

Employees are required to use their government travel card for themselves and authorized family members, househunting trip and en route travel in accordance with the rules governing the mandatory use of the government travel card. Use of the government travel card for temporary quarters is encouraged but not required.

Employees must contact the Travel Management Center (TMC) to obtain transportation tickets for themselves and family members. Tickets may not be obtained from any other source.

Employees may contact one of the relocation coordinators for pre-transfer counseling. A list of the coordinators can be found on the relocation guidance website.

Information regarding a hardship relocation program can be found on the relocation guidance website, or by contacting the designated points of contact in the business unit.

In accordance with IRM 6.610.1.3.9(1), IRS Hours of Duty, employees who are authorized moving expenses are required to obtain management approval to be excused from duty for the purpose of completing certain relocation transactions. If activities associated with the relocation cannot be conducted outside the employee’s regular working hours, an employee may be granted excused absence to make arrangements and to transact personal business directly related to a permanent change in duty station. Such activities may relate to locating living quarters at the new POD (if a househunting trip was not authorized); sale of property; transportation and delivery of household goods; and securing utilities, driver's license and automobile tags. Excused absence may only be approved if the cost of relocation (travel and transportation of household goods) is paid by the IRS.

If a househunting trip is authorized, employees may be given a reasonable period of excused absence, up to 10 consecutive calendar days, that includes travel time.

Travel to the New Official Station Prior to the Report Date

The IRS requires the reporting date to be the date on which the employee physically reports for duty at their new official station. This date may be specified in the employee's service agreement. The reporting date will be the first day of the one-year time limit allowed to complete all applicable relocation activities. Effective transfer or appointment date will not always coincide with the reporting date.

Travel to the new official station prior to the report date may only occur if the travel assignment is determined to be distinct from the new assignment and can be legitimately classified as temporary duty travel, in which case the payment of per diem may be authorized. If the travel to the new official station is an integral part of the new assignment, payment of per diem is not allowed and the beginning date of the travel is considered the employee’s report date. The nature of the assignment may not be related to the new position.

Short Distance Moves

Relocation allowances for a short distance move, which is less than 50 miles from the old POD or residence, may only be authorized when it is determined by an IRS Deputy Commissioner to be in the best interest of the government with a written memorandum providing the exception. All reimbursable expenses for short distance moves are taxable income and cannot be waived.

Business units must submit a request to Travel Policy and Review when the travel and transportation expenses and applicable allowances in connection with the employee's transfer from their residence involves a distance of less than 50 miles within the same general local or metropolitan area. Travel Policy and Review will forward the request to an IRS Deputy Commissioner for approval or disapproval.

Employee Eligibility Requirements

This section provides IRS guidance to supplement FTR Chapter 302, Relocation Allowances, Subpart A, Part 302-1, General Rules , and 302-2, Employee Eligibility Requirements , including:

Service agreements

Time limits

Advance of funds

Service Agreements

A service agreement is a written agreement between the employee and the IRS, signed by the employee and an approving official, stating that the employee will remain in the service of the government for a period of time as specified in after the employee has relocated.

There are three types of service agreements:

Form 4282, Twelve-Month Service Agreement, (for domestic travel) - A written agreement between IRS and the employee that they will remain within the service of the government for a period of twelve months, after they have relocated; and includes a duplicate reimbursement statement that the employee nor an immediate family member has not received any other relocation benefits from another source.