8 apps that will help track your travel expenses

Keeping track of travel expenses can be challenging. With paper receipts, email receipts and not being handed any receipt at times, it's important to be organized for both the business and leisure traveler.

Fortunately, for those who are not the best at having a good grasp on their expenses, there are many apps that can simplify your life. These apps help with expense reports, budgeting purposes, tax preparation and splitting expenses among friends.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

With something for everyone, here are the best apps to help you keep track of your expenses.

TrabeePocket

TrabeePocket is a straightforward app that allows you to keep track of your expenses for a given trip. Before you even start your trip you can add all prepaid expenses to the "preparing" tab. This allows you to account for your flights and any tours you might have booked in advance. Once your trip begins you can easily add all additional travel expenses. You can categorize your expenses into eight different categories, but with the paid version, you can add as many additional categories as you want if you have very specific expenses you want to track. The free version also only allows you to track one currency per trip, but the paid version allows you to track multiple currencies in one trip file.

Not only will TrabeePocket serve as a place to file your expenses, it also helps you on the budgeting front as well. You can set a monthly budget and have your expenses track against that overall number. If you are earning income during your travel, you can also enter income to a specific trip expense.

One neat feature of this app is that you can take pictures and tie it to a specific expense. This is great for the backpacker or family traveler who wants to remember exactly what the expense was used for, or to keep track of trip suggestions. Business travelers can also use this feature by taking a picture of a receipt if it is needed for a corporate expense report.

Cost: Free; Upgraded version is $1.99 and includes some additional options (i.e., multiple currencies, additional categories, view and export expense report)

Download: Google Play Store or iTunes App Store

Trail Wallet

Trail Wallet is very similar to TrabeePocket, but unfortunately is not available to Android users. With this app, you can add as many categories as you want to separate expenses and everything is color coded to make the app more visually appealing. (Unlike TrabeePocket, you do not need to pay for an upgraded version to add more categories).

When you enter your travel expenses, you'll tie it to both a trip and a date. This allows you to view your expenses at a Month View or Trip View. You can also spread expenses across multiple dates so you can see your daily expenses for a certain trip. This is handy if you are on a daily budget to ensure you're not exceeding the amount you can spend on a particular day.

One nice feature of this app is that you can add as many currencies as you'd like within a certain trip. This comes in handy if you are paying in multiple currencies — for example, flight and hotel costs in USD, but food expenses in euros.

This app caters more toward individual or family travel as you cannot invite friends to add expenses. You can, however, take pictures of receipts and tie them to a specific expense, and then export the images — perfect for keeping all receipts or for business travelers for expense purposes.

Cost: Free for the first 25 expense items added to a single trip; Upgraded version is $4.99 which allows you to enter an unlimited number of expenses per trip.

Download: iTunes App Store

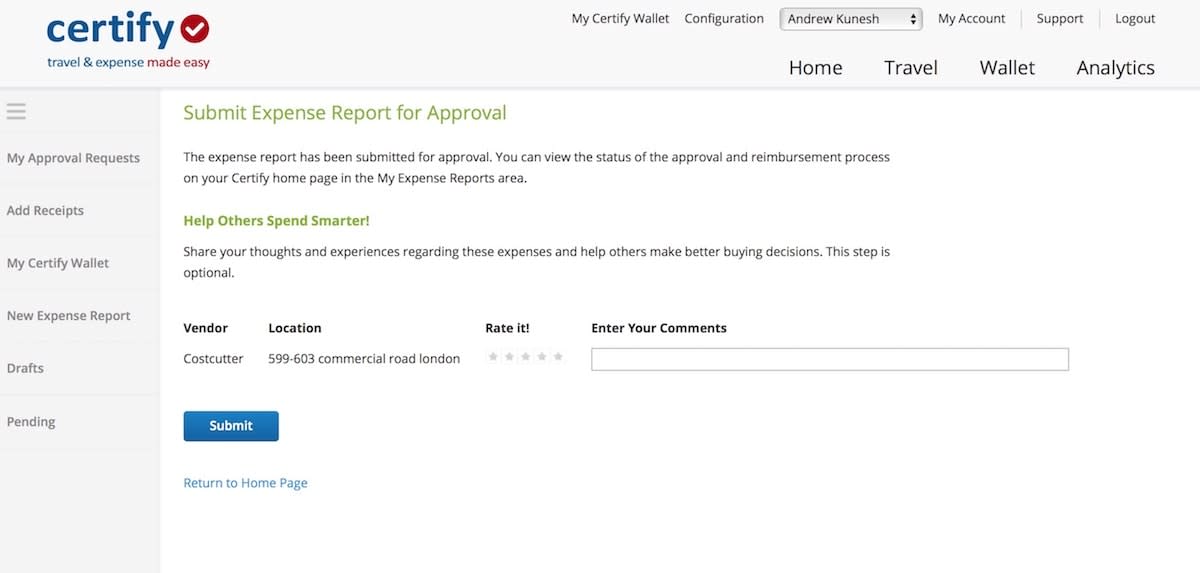

Concur is one of the top expense programs for business travel. This app is definitely more involved then some of the others on the list, but it has all the bells and whistles for keeping your expenses fully organized. If you work for a large corporation, you might already find that this is the required app to use for your business expenses.

Expenses from corporate credit cards will automatically be uploaded and you can also manually add out-of-pocket expenses. For manually entered expenses, employees can take a picture of their receipt which will be included in their expense report. For the business traveler with many paper receipts during the week, this app helps ensure that all expenses are reimbursed properly.

If you run a small-business, this is a great platform for you and your employees to use as it allows you to manage expenses and prepare expense reports. When I worked for a large consulting company, I used this program on a weekly basis. Being able to keep track of my work expenses to ensure I was reimbursed with every amount paid out of pocket was huge. For solo and group travelers, this is not the app I suggest using as there is no need to pay the monthly fee as there are many other free apps available.

Cost: Fee depends on number of users and account type.

Related: 5 tips to turn business travel into family vacations

Tripcoin is a very simple app to use that will track all of your expenses against a particular trip. You can tie each expense to a specific category, enter a city location and a defined date and time. You can also include notes and a screen shot to keep better track of every purchase you make.

This app has an atheistically pleasing filter capability, where you can look at expenses between a given date, within a certain category, a type of payment method or within a particular country. There is also a real-time currency converter or you can set custom currency exchange rates if needed.

Best of all, you can automatically back up all of your data by enabling the Dropbox integration. With many of the other apps listed here, if you lose your phone or if your data gets wiped out, you will lose all of the expenses entered. If this does happen, with this specific app, all of your expenses are saved and can be re-imported.

Unfortunately, this app is only available for iPhone users.

SplitWise is one of my personal favorites and an app I've been using for years. If you are traveling in a group , this is the app for you. The best, and unique feature, is that you can have friends or family members join a group and everyone can enter all expenses incurred for the joint trip. The app will then itemize expenses and tell each individual how much they owe to make things equal. You can even designate which expenses should be split among certain individuals. Like most of the other apps, you can also take include a picture and notes for every expense entered.

I have used the app for friend and sibling trips, including bachelorette parties, group ski trips and even just day trips. Aside from travel expenses, you can even use it to split up expenses among roommates or just everyday purchases with friends.

Cost: Free; Upgraded version is $2.99/month ($29.99/year) which includes receipt scanning, currency conversion and more.

Tricount is a simple app, but a great choice for group travel . It works very similar to SplitWise where you can split expenses among multiple travelers in your group. Everyone can add their own expenses and designate the specific amount (or percentage) for each individual within the group. At the end of the trip, you'll then receive a breakdown of what everyone owes each other.

The app supports multiple currencies and allows you to take pictures of images or receipts to go along with every expense entered.

Cost: Free; Upgraded version is $0.99 and allows you to have an ad-free experience.

Related: 30 essential travel apps every traveler needs to know

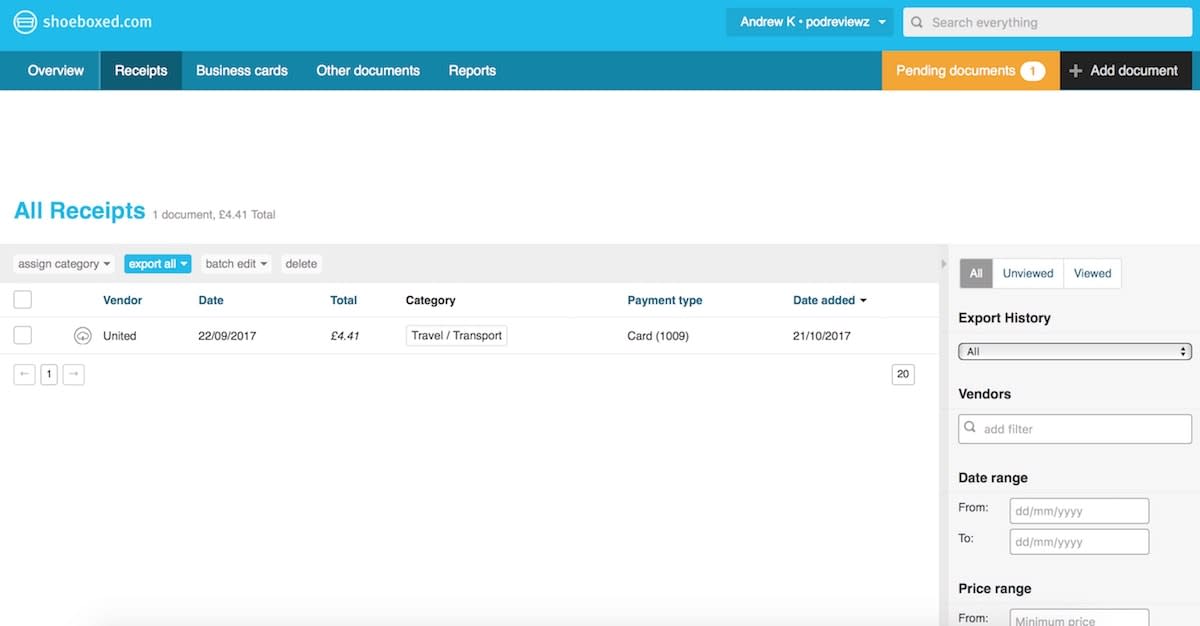

If keeping track of receipts is high on your priority list, then the Foreceipt app will be perfect for your needs. You can attach a receipt with all expenses entered and all images will automatically be saved to your Google Drive account. Additionally, all email receipts can be tracked as well by forwarding them directly to Foreceipt email address and including your unique ID.

Other features include the capability to batch upload bank transactions and downloading excel reports for tax return purposes — perfect for those who need to write off travel expenses.

Within the app, Foreceipt allows you to enter your income, bills and travel expenses to track against your overall budget. You can also tie all travel expenses to one of many pre-populated categories.

With these more involved capabilities, business travelers and those who own small businesses will probably find this app more useful than solo or group travelers.

Cost: Free; Upgraded version is $3.99/month ($38.99/year) and includes more receipts scans per month, email receipts and expense reports.

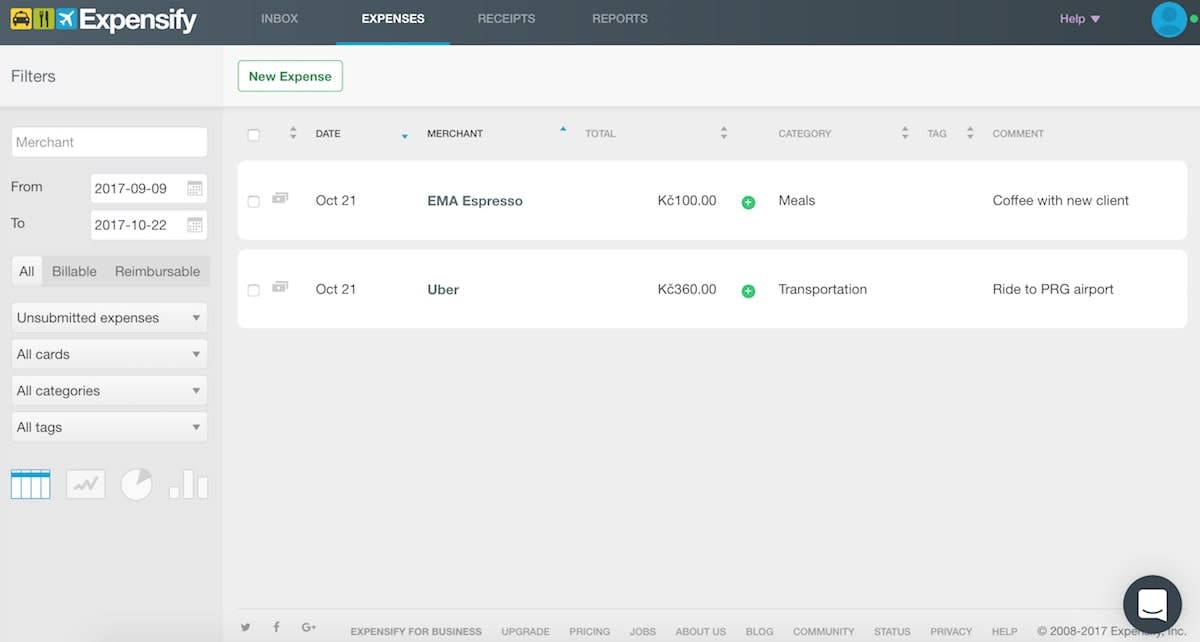

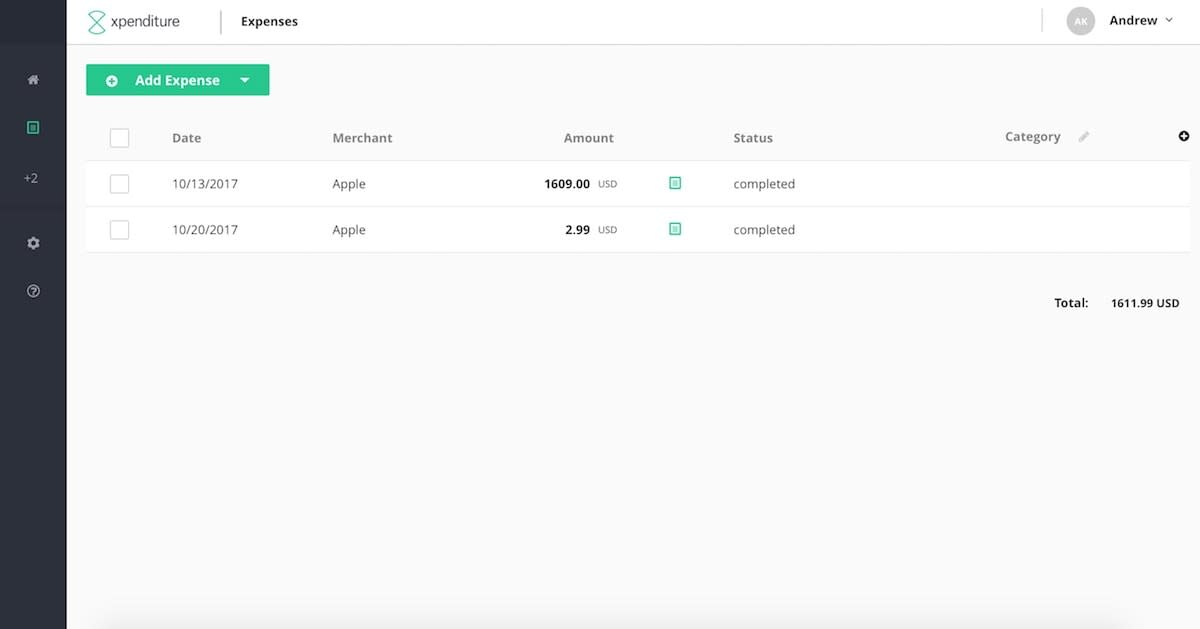

Expensify caters toward both individual and group travelers traveling primarily for business. This app allows you to complete all the simple tasks such as documenting your expenses and taking a picture of your receipt, but goes one step further where you can submit your expenses to your manager or accountant (or really whomever you'd like).

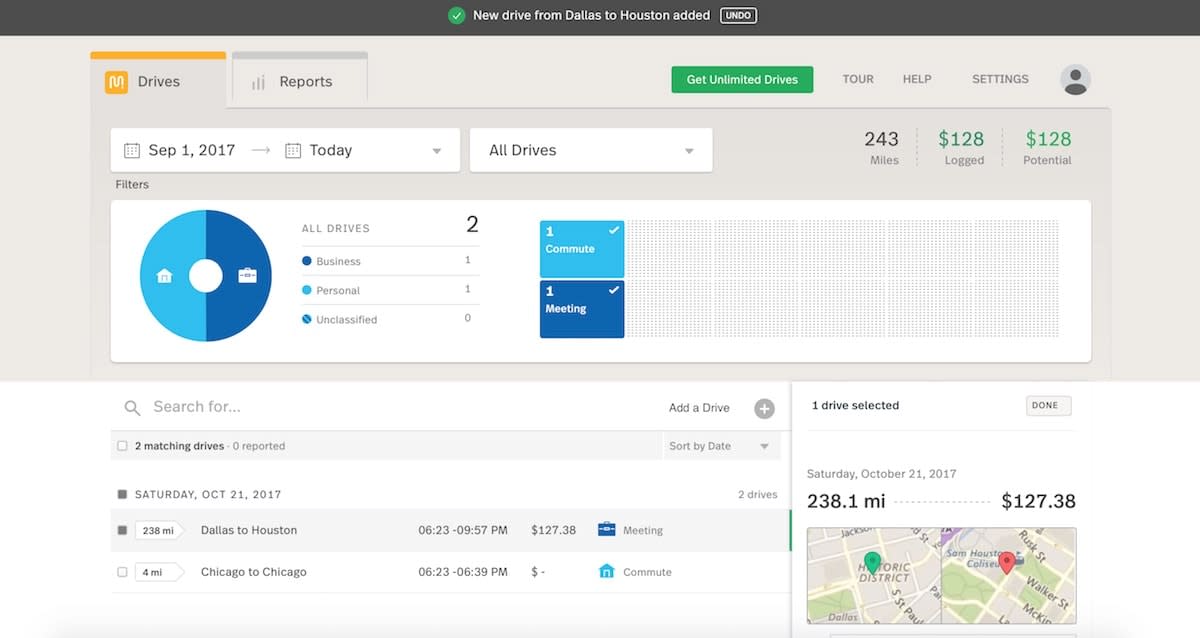

For those who need to keep track of mileage driven, this app allows you to not only manually enter your information but also has a GPS calculator which you can turn on to track your distance. You can also enter your time worked, which helps those needing to track billable hours.

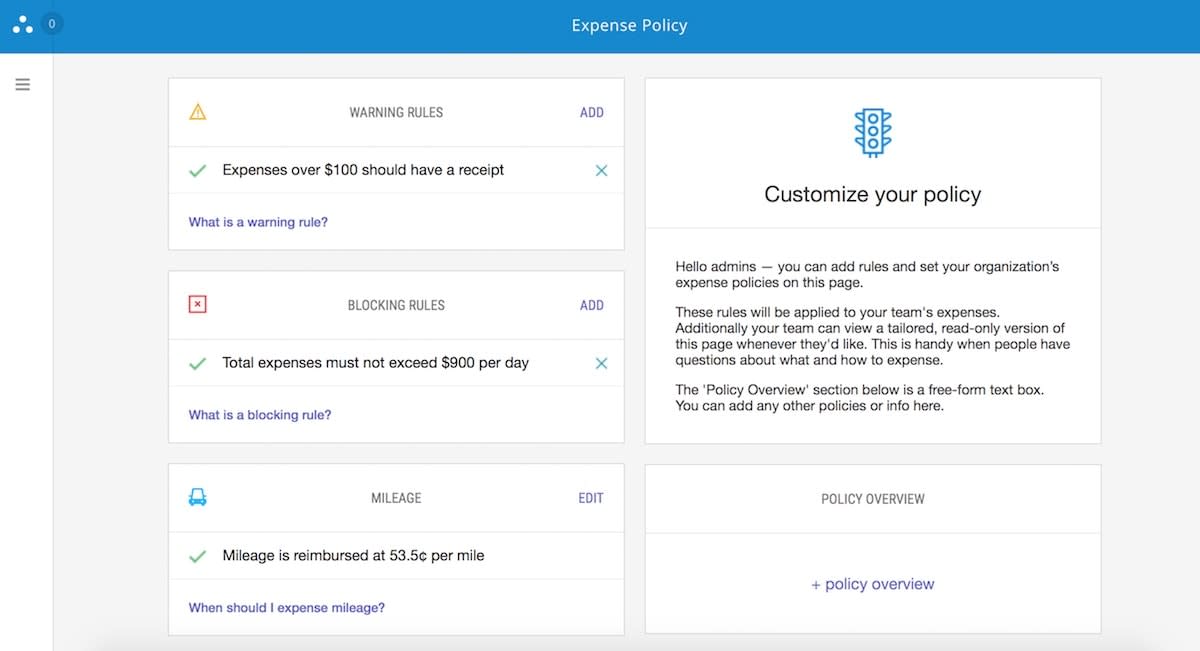

The app also features more than just a place to submit your expenses, as you can keep track of business operations and even set expense policies.

On the feel good front, Expensify will also donate $2 for every $1,000 in expenses to Expensify.org. These donations are given to a broad range of campaigns to help organizations around the world.

Cost: Free up to five scans a month; Upgraded version is $4.99/month per user giving you unlimited scans and additional automatic capabilities.

Bottom Line

With many apps to keep track of your expenses, it helps to find one that fits your needs. Whether you are traveling for business or pleasure, with a group or on your own, there are many apps out there that work well depending on your needs.

Home > Finance > Accounting

The 4 Best Expense Tracker Apps for Small Businesses in 2023

Data as of 8/17/22. Offers and availability may vary by location and are subject to change. *Current sales price: 90% for three mos. or 30-day free trial. Offer available for new customers only, **When billed annually

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Our top business expense tracker app is FreshBooks . Its well-reviewed accounting software app lets you track expenses, upload receipts, and sync payments. Its scalable plans make it s a good fit for many types of business owners.

But FreshBooks is just one of the best business expense tracker apps. Below, we review FreshBooks, Expensify, and more apps for small businesses like yours.

- FreshBooks : Best total accounting solution

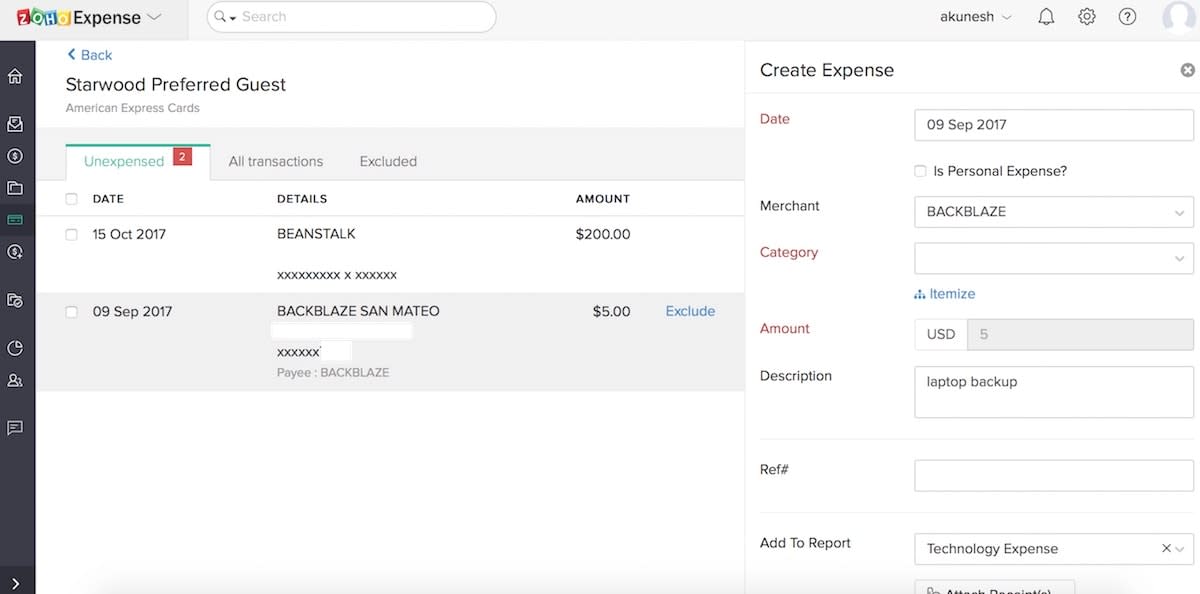

- Zoho Expense : Best automation

Top feature comparison: Best small-business expense trackers

Data as of 1/12/23. Offers and availability may vary by location and are subject to change. *Current sales price: 90% off for three mos. or 30-day free trial. Offer available for new customers only. **When billed annually

By signing up I agree to the Terms of Use and Privacy Policy .

FreshBooks: Best total accounting solution

Starting at $1.50/mo.*

- Mileage, time, and billable expense tracking

- Automatic expense categorization

- Third-party app required for employee reimbursement

Data as of 1/12/23. Offers and availability may vary by location and are subject to change. *Current sales price: 90% off for three mos. or 30-day free trial. Offer available for new customers only.

FreshBooks’s accounting software includes built-in expense tracking, so you don’t need to invest in two apps to manage your business’s costs. Instead, FreshBooks syncs with your bank account and credit cards, automatically importing and categorizing expenses, plus generating reports that help you make sense of your profit and loss .

And if you frequently bill your clients for expenses, FreshBooks’s excellent invoicing simplifies the process. Use FreshBooks’s app to track your time, expenses, and mileage during a project, then transfer over the final billable expense to your client’s invoice (which you can also create and send with the FreshBooks app).

FreshBooks doesn’t offer a free plan, but the company frequently offers frequent long-term sales. You can also save by paying for FreshBooks annually instead of monthly. Unfortunately, the cheapest plan limits you to invoicing just five clients a month. Freelancers with a higher client volume will need at least the $25-a-month Plus plan, which increases your client limit to 50 a month.

Zoho Expense: Best automation

Starting at $0.00/mo.

- Automatic billable expense tracking

- Employee travel features

- Corporate card options

Data as of 1/12/23. Offers and availability may vary by location and are subject to change.

Zoho Expense focuses on employee travel. (It’s billed as an “end-to-end travel and expense” solution, not simply an expense tracker.) Along with the typical expense tracker features, Zoho Expense lets you book rooms, set travel budgets, and pre-approve travel expenses well before employees leave. Like Zoho’s accounting software, Zoho Books, Zoho Expense automates just about everything that can be automated, including employee expense approval and reimbursement.

Zoho Expense’s free plan includes up to 1 user (plus an accountant) who can collaborate on expense tracking and travel management. For 10 users and pre-travel approval, you’ll need the Premium plan, which costs $2.50 per user per month if you pay annually (paying monthly costs $3 per user per month). The Premium plan also requires you to have at least ten users—which ups the cost to $30 per per month, paid annually.

Zoho Expense syncs with Zoho Books, Xero, and QuickBooks Online, but accounting software costs an additional $12 to $30 a month on top of your Zoho Expense payment.

Wave Accounting: Runner-up

Free for life

- Free expense tracker, receipt scanner, and accounting

- Unlimited expense tracking, invoicing, and receipt uploads

- No employee reimbursement or corporate card features

Wave Accounting is a truly free accounting software solution with fewer limits than many paid plans. As one of the best free expense tracker apps, Wave lets you track unlimited expenses and scan an unlimited number of receipts—while paying nothing, ever.

Unlike paid competitors like FreshBooks and QuickBooks Online, Wave Accounting doesn’t have an accounting-specific mobile app (though it does have separate receipt, invoice, and payment acceptance apps). And while it’s great for freelancers, Wave doesn’t have any employee reimbursement or corporate card features.

QuickBooks Self-Employed: Runner-Up

Starting at $15.00/mo.

- Easy TurboTax syncing and tax assistance

For help with all things tax-related, try QuickBooks Self-Employed. As an Intuit product, QuickBooks Self-Employed syncs seamlessly with Intuit TurboTax, which makes claiming the right tax write-offs easier at the end of the year. Like the heftier QuickBooks Online , QuickBooks Self-Employed is incredibly intuitive—it’s hard to find a more user-friendly mobile app.

Since QuickBooks Self-Employed was built for contractors and freelancers, it doesn’t include any employee-based spending tracker features. And at $15 a month, QuickBooks Self-Employed offers fewer invoicing and expense-tracking features than FreshBooks, which costs the same per month.

The takeaway

Business expense trackers are a solid investment for freelancers, solopreneurs, and other small-business owners who want to analyze costs and submit correct write-offs at tax time.

For flexibility and affordability, the best expense tracker app is Expensify . If you want accounting software with built-in expense tracking, try FreshBooks , QuickBooks Self-Employed , or Wave Accounting . For traveling and driver-focused alternatives, we like Zoho Expense and Everlance . And if physical receipts are taking over your office, Shoeboxed can start digitizing your data and categorizing your expenses right away.

Most business expense trackers have free plans, free trials, or both. Feel free to try different providers on for size before you commit—you’ll want an app that syncs with your accounting software, works for both you and your employees, and organizes expenses in a format you can follow.

Want to expand your business by trimming expenses? Check out our article on bookkeeping basics to learn more about income and expense management.

Related content

- FreshBooks vs. QuickBooks Online

- The 9 Best QuickBooks Alternatives in 2023

- Wave vs. QuickBooks Online

What are business expense trackers?

Business expense trackers obviously track your business’s expenses—but the best expense trackers don’t stop there. They also (usually automatically) categorize your expenses so you can identify areas to cut costs and simplify tax write-offs at the end of the tax year. Top business expense trackers should also include receipt scanning software so you can upload expenses on the go. Finally, expense tracking apps need to sync with your accounting software to save time and eliminate redundant data entry. (Some accounting software, like QuickBooks , includes built-in expense tracking and receipt scanning).

While self-employed business owners technically can use personal budgeting apps to track expenses, we don’t recommend it. They aren’t comprehensive enough to track a business’s needs, and they lack a lot of features most business expense trackers include. (For instance, personal finance apps don’t automatically track mileage—a must if you’re a freelancer with mileage-based tax write-offs or an employer whose employees travel for work.)

If you’re interested in becoming a better personal budgeter, check out our reviews of the year’s best budgeting apps . But personal finance apps like Mint and YNAB work only when applied to your personal life, not your business life.

Business expense tracking FAQ

Expensify is one of the best spending tracker apps for small businesses. It’s also super accessible: Expensify syncs with just about every accounting software system, including QuickBooks Online and Xero .

Remember, though, that Expensify might be the best business expense tracker app for some businesses—but not necessarily all businesses. Many accounting software solutions ( QuickBooks included) have built-in expense tracking options that scale up as your business grows.

Not sure Expensify is the right expense tracking software for you? Most money tracking apps for businesses offer free basic plans or free trials. Expense tracking is essential to good business budgeting, so feel free to try out different options until you find one you prefer.

Most expense tracker apps offer free basic plans. For instance, Expensify is free for freelancers who upload only 25 expenses a month. Free accounting software , like Wave Accounting and ZipBooks, also includes expense tracking with their free plans.

But if you want to use a company card, reimburse employees for business expenses, and get in-depth expense reporting for tax time, even the best free expense tracker app won’t cut it. Still, you have affordable options. Expensify’s small-business plans start at $4.95 a month. And accounting software like FreshBooks can cost as little as $15 a month (or less if you lock in FreshBooks’s frequent deals, like saving 60% for 6 months).

What is the best way to track expenses if I’m self-employed?

Whether you’re a part-time freelancer or a small-business owner with one or two employees, expense tracker apps are the easiest, fastest way to track business expenses.

You can always use spreadsheet software to track expenses by hand: for instance, Microsoft Excel offers expense tracking templates. (If you want a truly free option, Google Sheets is easy to customize to your business’s budgeting needs.) But even if you log just a few business expenses a month, we recommend an expense tracker app over spreadsheets.

Why? For one thing, expense tracking apps usually automate expense tracking, which gives you more time to focus on your business. They also let you track mileage, which is important for tax write-offs at the end of the year, and scan or upload receipts to ensure all your expense data is in one place. Many also double as bill management apps, especially accounting software with built-in expense and billing solutions.

Budget tracker a pps like Mint and YNAB are excellent for getting your personal finances in line, which can make you a more financially savvy business owner. But we don’t recommend using personal finance or budgeting apps for tracking business expenses , even if you’re self-employed. For one thing, it’s too easy to accidentally label personal expenses as business expenses (or vice versa), which makes taxes harder instead of simpler. Feel free to use both types of apps, but as soon as you become self-employed, make sure to separate your business and personal finances ASAP.

Methodology

To find and rank the best expense trackers for small businesses, we analyzed several key business budget and spending features:

- Expense tracking features, including recurring expense categorization, billable hours and expense tracking, types of tax categories, and receipt capturing

- Ease of use, including customizability, automatic expense tracking, and automatic accounting software integration

- Mobile app ratings and reviews on both Google Play and Apple’s App Store

- Travel-based features, including mileage tracking, travel planning, and GPS tracking

- Employee-facing features, including employee reimbursement and budget approval

- User limits

- Pricing and affordability

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Accounting | Buyer's Guide

10 Best Business Expense Tracker Apps for 2024

Published May 2, 2024

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Eric Gerard Ruiz, CPA

This article is part of a larger series on Accounting Software .

- Quick Comparison

- 1. Best Overall With Real-time Card Feeds

- 2. Best for Zoho Books Users

- 3. Best for Assisted Expense Processing

- 4. Best for Solopreneurs

- 5. Best for Startup Corporations & LLCs

- 6. Best for BILL Users

- 7. Best for Real-time Expense Reporting

- 8. Best Tracker in a Complete Bookkeeping System

- 9. Best Free

- 10. Best for Freelancers

- Our Methodology

- How to Choose an Expense Tracker

- When to Use an Expense Tracker

- Accounting Software vs Expense Tracker

Bottom Line

The best business expense tracker app must be able to track business expenses from incurrence to reimbursement. It must also have features that can categorize business expenses, organize expense entries by status, generate expense reports, and reimburse expenses using different reimbursement methods. Aside from these, bonus features like prepaid card issuance and third-party card integration can enhance overall ease of use.

With that premise, here are our recommendations for the best business expense tracker apps.

Standalone Business Expense Trackers:

- Fyle : Best overall with real-time card feeds

- Zoho Expense : Best for Zoho Books users

- Rydoo : Best for assisted expense processing

- Expensify : Best for solopreneurs

- Ramp : Best for startup corporations and limited liability companies (LLCs)

- BILL Spend & Expense : Best for BILL users

- Emburse Spend : Best for real-time expense reporting

Expense Trackers Within Accounting Software:

- QuickBooks Online : Best expense tracker in a complete bookkeeping system

- Wave : Best free simple expense tracking and accounting

- FreshBooks : Best for freelancers

Why You Can Trust Fit Small Business

The Fit Small Business editorial policy is driven by the mission to provide you with the best answers to your small business questions. Our meticulous evaluation process makes us a trustworthy source for insights and tips in selecting the best business expense tracker app. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

For our roundup of business expense tracker apps, we created a special rubric that evaluates the features of our chosen providers. This gives our audience our unbiased opinion about the software’s capabilities and fitness for your organization.

When to Supplement Bookkeeping Software With Expense Tracking Software

The main goal of accounting software is to record, summarize, and report financial transactions in financial statements. With that goal, all decent accounting software can record and summarize expense transactions. However, most accounting software stop there and don’t offer additional expense features like expense approval, employee reimbursements, or debit and credit cards. Expense tracker integrations fill in the feature gaps in accounting software.

Here are some reasons why your business might need an expense tracker to supplement accounting software:

- Less work for the accounting team : Once employees have access to their expense tracker accounts, they can send and submit expense reports and receipts on a self-service basis. This means that the accounting department will not be burdened with the additional work of collecting expenses from employees. Instead, employees can submit expenses to the expense tracking software and the accounting team can import all expense data to the accounting software.

- Expense tracking via cards : Standalone expense trackers can either issue prepaid cards or integrate with corporate card programs. Using cards is an efficient way of tracking expenses since all expense data will automatically sync card feed transactions upon transmission. An expense tracker reduces data entry, and employees only need to upload the receipt to the expense entry once it’s recorded in the expense tracker.

- Workflows and approval routing : Expense tracking features within accounting software often don’t have workflows and approval routing features. By using a separate expense tracker, you can create custom workflows and approval rules to ensure that all expenses submitted are within allowable limits or company policy. This series of approval workflows ensures that the accounting department will record legitimate business expenses in the books of accounts.

- Emphasis on employee accountability : If employees submit expenses, they’ll be held accountable for all the figures they submit as business expenses. This means that if reported expenses aren’t legitimate business expenses or are outside allowable limits, managers can reject and prevent reimbursement of such expenses.

Comparison of Business Expense Tracker Apps

- Standalone Expense Trackers

- Accounting Software With Expense Trackers

Best Standalone Business Expense Tracker Apps

Fyle: best overall with real-time card feeds.

- Has real-time updates on transactions charged to Visa and Mastercard cards

- Is compatible with any Visa or Mastercard credit or corporate card

- Offers automatic receipt attachment via SMS after using Visa card

- Has a clean and intuitive user interface (UI) User Interface

- Is expensive if compared with other expense trackers

- Has limited capabilities in the Standard plan

- Has no free trial

Plans & Pricing

Fyle has no free trial, but you can request a product demo to learn the software:

- Standard: $8.99 per active user, per month with a minimum of five users

- Business: $14.99 per active user, per month with a minimum of 10 users

- Enterprise: Custom pricing

Why We Like It

Fyle is a convenient solution if you already have a corporate card program using Visa or Mastercard. If your corporate card is affiliated with either of these two payment networks, all transactions will automatically reflect in Fyle. This real-time card feed enables you to track and review expenses as they are incurred. However, Fyle’s expense tracking solution is still worth it even if you use cards that don’t partner with payment gateways like Visa and Mastercard.

Our Evaluation

Fyle scored high in expense tracking because of the flexibility that it offers in recording, submitting, reviewing, and approving expenses. It allows employees to submit expenses and receipts in various ways and admins to set up multiple approval workflows to ensure the legitimacy of expenses.

Its clean and attractive interface and accessible customer support options earned Fyle high marks in ease of use. Users will not have a hard time navigating around the software and can easily access support via email, live chat, and a comprehensive knowledge base.

On the flip side, Fyle didn’t score as well in card programs because it doesn’t issue prepaid cards. Users can only integrate third-party corporate cards within Fyle. However, we don’t consider this as a major miss because Fyle’s real-time Mastercard and Visa feeds compensate for this missing feature. If you prefer prepaid cards instead of corporate card programs, we recommend Emburse because it also has real-time expense reporting and issues company prepaid and credit cards.

- Deciding Factors

- Real-time feeds for Mastercard and Visa cards : Fyle offers real-time tracking of Visa and Mastercard transactions. Your transactions are reported automatically in the system the moment you use the card—you won’t have to wait for bank feeds that take several hours before they are fetched from your corporate card provider. After using the card, the cardholder will receive an SMS requesting them to send a picture of the receipt.

- Send receipts via email : Besides real-time card feeds, Fyle offers convenient expense tracking on Gmail, Slack, and Outlook. It can recognize expenses and receipts sent through these platforms and pick them up automatically for recording.

- Send receipts via SMS : When you use an enrolled card in Fyle for payments, it will send an SMS asking you to capture the receipt and send it. This feature helps employees send receipts right away after the transaction occurs.

- Approvals through email or communication platforms : Although Fyle has an outstanding approval workflow system within the web app, approvers can also approve expenses on Gmail, Outlook, Slack, and Microsoft Teams.

- Businesses using Mastercard and Visa cards : Through Fyle’s real-time card feeds, expense approvers can approve or reject expenses as they are reflected in Fyle. This feature can help businesses speed up expense processing.

- Remote teams : Remote team members won’t ever forget to submit receipts because Fyle will send an SMS to ask them to submit receipts right after the transaction. This feature ensures that remote employees always attach receipts for documentation purposes.

- Expense monitoring and compliance : Fyle has extensive approval workflow features and automation that allow small businesses to review submitted expenses. With these workflows in place, you can ensure that all submitted and approved expenses are within company allowable limits and policy.

Zoho Expense: Best Expense Tracker for Zoho Books Users

- Integrates well within the Zoho environment

- Has fraud detection features

- Has end-to-end travel expense management

- Has a steep learning curve

- Has a confusing UI for first-time users

- Requires at least 200 active users for the Enterprise plan

You can try the paid plans for 14 days or start with the Free plan to get acquainted with the software:

- Free: $0 for three users

- Standard: $5 per user, per month; minimum of three active users

- Premium: $8 per user, per month; minimum of three active users

- Enterprise: $12 per user, per month; minimum of 500 users

We recommend Zoho Expense for Zoho Books users because of its seamless integration with the accounting software. You can process all expenses within Zoho Expense and transmit via an integration link to Zoho Books for recording. Besides Zoho Books, users of other Zoho products like Zoho CRM or Zoho Mail can enjoy direct integration for expense processing and single sign-on (SSO) features.

Zoho Expense received high marks in our evaluation and is only a few points behind Fyle, our best overall pick. Its expense tracking features score took a hit because the platform doesn’t allow employees to submit expenses via SMS, and its card programs received only above-average marks because Zoho Expense doesn’t have real-time card feeds, something that Fyle offers.

Besides that, Zoho Expense doesn’t issue prepaid cards. If you’re leaning towards real-time card feeds for Mastercards and Visa, look into Fyle. Otherwise, we recommend Emburse for prepaid card issuance with real-time feeds.

- Batch recording of expenses : When managing expenses, you can create entries one by one or by batch and upload receipts from suppliers. Bulk-adding expenses is a great feature because it saves a lot of data entry time and helps the bookkeeper enter similar expenses in one window.

- Workflow rules : You can use the platform to track reimbursable expenses from employees and apply approval workflows to ensure that all reimbursement requests are legitimate or allowable expenses. You can either use simplified approval or make custom approvals.

- Approval presets : Zoho Expense comes with approval presets that you can use right out of the box for simple approvals.

- Zoho users : If your business is currently using Zoho services, you can utilize the seamless integration with other Zoho products.

- New freelancers : Zoho Expense’s free plan is perfect for individuals who have just started working as a freelancer. The free plan comes with 5GB of receipt storage and 20 receipt autoscans. As a single user, the free plan is enough for a freelancer’s expense needs.

Rydoo Expense: Best for Assisted Expense Processing

- Offers easy migration from competitors' apps to Rydoo

- Has add-on for assisted expense approval

- Can integrate with multiple enterprise resource planning (ERP) packages

- Has affordable pricing

- Has no reimbursement system

- Has no detailed expense reporting features, expense filters, and forecasts—these are only available as an add-on called Rydoo Insights

- Is not ideal for freelancers because of minimum user requirement

- Essentials: $12 per user, per month; minimum of five users

- Pro: $14 per user, per month; minimum of five users

Rydoo is our best pick for assisted expense processing because it offers controller services. This feature allows a team of reviewers from Rydoo to review receipts and expenses before they are forwarded to the approver. It also reduces the time needed to review expenses since approvers will not need to check if expense submissions are complete with receipts and other documents. With the help of Rydoo, all they need to do is to check if the expense is within company policy.

In our buyer’s guide, Rydoo received the highest score in pricing because it offers small businesses the most flexible pricing plan. You can choose to pay monthly or annually—and all plans are on a pay-per-user basis. It also has custom-priced plans for organizations looking for specific features.

Its card program features score took a hit in our evaluation because Rydoo Cards are separate from the expense management platform. Regardless, Rydoo can still integrate third-party corporate cards with its system for tracking card transactions.

Alternatively, we recommend Expensify for affordability and accessibility. You can even get Expensify for free if more than 50% of business expenses are paid using Expensify cards. Besides Expensify, Fyle is a good alternative if you have an existing corporate card program. Its real-time card feeds for Mastercard and Visa can help in faster reporting of expenses.

- Controller services : Rydoo’s team of experts can do the repetitive work of checking if all expense submissions are complete. This means that approvers can focus on reviewing expense submissions, not on checking if required attachments or documents are present.

- Multiple card options : Rydoo can integrate with third-party corporate card programs for expense tracking, but they also issue Rydoo Cards that are charged separately. This feature offers a lot of flexibility to companies that have existing third-party corporate programs but want to also issue prepaid cards through Rydoo Cards.

- Real-time expense tracking : With Rydoo, users don’t need to consolidate all expenses in an expense report. They can submit expenses right away and receive feedback or approval from approvers.

- Local compliance for a global workforce : Rydoo’s system is capable of addressing local rules and regulations in different countries and jurisdictions. If you have employees working outside the US, Rydoo’s features can help ensure that expenses comply with local laws.

- Giving per diem to employees : Rydoo has a dedicated per diem management module that allows managers to issue per diem to employees based on country- or region-specific rates. This module ensures that your company follows per diem laws in certain countries and regions.

Expensify: Best for Solopreneurs

- Offers a free plan that can issue unlimited Expensify cards

- Accepts third-party corporate cards

- Offers zero cost per user if 50% of expenses are charged using Expensify cards

- Has limited SmartScans in the free plan

- Has expensive per-user pricing

- Can’t integrate third-party corporate cards in the Free plan

- Free : $0 with 25 SmartScans per month and unlimited Expensify cards

- Collect : $20 per user, per month, with unlimited SmartScans and Expensify cards

- Control : $36 per user, per month, with unlimited SmartScans and Expensify cards

The Collect plan features premium features like expense approvals, expense rules, and automated clearing house (ACH) reimbursements. Meanwhile, the Control plan includes everything in Collect, plus additional features like NetSuite and Sage Intacct Integrations and multiple expense approvers.

Expensify is the only option on the list of standalone business expense trackers that can issue unlimited prepaid cards in the free plan. Ramp is also a free option in this guide, but it doesn’t accept self-employed individuals in its program. That’s why Expensify is the best pick for self-employed individuals.

Expensify scored well in expense tracking because it has most of the features we want to see in an expense tracker. It missed a little around submitting receipts via text and restricting certain vendors in reimbursements, though these aren’t major features in our evaluation. However, we would appreciate it if Expensify could add those in the future to provide a smoother and better experience for users.

On the contrary, it didn’t get high marks in card programs. This is because Expensify has a requirement that businesses must have 50% of business expenses in Expensify Cards to get Expensify for free. If the requirement isn’t met, then you have to pay the monthly price.

We find this requirement cumbersome for small businesses with existing corporate cards because they might pay regular per-user fees if they don’t meet the 50% requirements. This also comes at a disadvantage if most of the business expenses are tied to corporate cards, not Expensify cards.

- Ability to integrate third-party corporate cards and issue prepaid cards : Expensify is the only provider listed here that accepts third-party corporate cards and issues prepaid cards. Some expense trackers in this guide either accept third-party cards or issue prepaid cards. We like this feature because it provides more flexibility to users. For instance, corporate cards can be given to managers while prepaid cards can be issued to employees for allowances.

- Tracking expense statuses : Users can easily see expense status based on colors. This feature enables users to visually identify expenses that need to be reported, approved, or reimbursed without reading the details. Aside from that, it allows you to filter out expenses based on the particular status that you want to see.

- Self-employed individuals and sole proprietors : Expensify accepts self-employed individuals and sole proprietors without requiring them to have specific bank account balances.

- Issuing unlimited prepaid cards : In the free plan, users can already issue unlimited Expensify cards. There’s no need to upgrade to a paid plan.

Ramp: Best for Startup Corporations & LLCs

- Offers free expense management platform and corporate cards

- Has artificial intelligence (AI)-powered receipt capture for faster data entry

- Provides access to over 1,000 integrations with productivity software and banks

- Doesn’t issue credit cards

- Can’t carry card balances to the next period

- Has limited customer support

- Doesn’t accept sole proprietors and self-employed individuals

Ramp’s expense management feature and corporate card issuance are free to use. However, Ramp imposes strict requirements and limits the platform to registered businesses. Sole proprietors and self-employed individuals aren’t qualified.

We recommend Ramp for startups because it’s a free expense tracker that also issues prepaid cards. Since most startups are registered as corporations or LLCs in the US, they can easily qualify for Ramp. Besides that, Ramp is highly scalable and can accommodate the fast-changing environment of startups. You don’t have to worry about paying more as your startups grow because Ramp doesn’t limit the number of users in the system.

If you’re not qualified because you are a sole proprietor or self-employed individual, we suggest looking into Expensify. It’s like Ramp because you can issue unlimited Expensify cards in the free plan, but it doesn’t impose strict requirements.

In our evaluation, Ramp earned the highest score in expense tracking features. It missed on only one feature—and that is restricting certain vendors in expense reimbursements. We don’t consider this a major feature but having it can further enhance user experience.

In terms of card programs, Ramp didn’t score well because it can only issue prepaid Visa cards. Moreover, it doesn’t feature real-time card feed transactions. Our best alternative to Ramp would be Expensify. We recommend it because you can get it for free if you process 50% of business expenses through Expensify cards. Besides that, it doesn’t have strict registration requirements.

- Multiple integration options: Ramp has more than 1,000 integrations in accounting, expense automation, productivity, and security. This makes Ramp easy to integrate into your business processes and systems.

- Discounts: Ramp gives discounts and additional rewards if you use the card to pay for subscriptions or purchases from its partner companies, like Slack and Amazon Web Services. Read our Ramp Card review to learn more.

- Spending limits per card: You can set spending limits and approval thresholds to control all spending that gets charged to Ramp cards. In case employees pay out-of-pocket, Ramp allows electronic and manual reimbursements to employees, provided the reimbursement is within the expense policies set by the company.

- Startups : Ramp is free software that captures all essential startup needs in a single platform. You get card issuance, expense tracking, bill pay, and cash back rewards. The 1.5% cash back rewards can help startups save money on every purchase made using Ramp cards.

- Established small businesses with large teams : Small businesses with a large workforce will benefit most from Ramp’s free plan because they don’t have to pay per active user, unlike other choices on this list.

BILL Spend & Expense (Formerly Divvy): Best for BILL Users

- Comes free with a BILL subscription

- Issues virtual prepaid and credit cards

- Can track reimbursements in real time

- Is exclusive for BILL users

- Has no mileage tracking features

- Doesn’t have phone support

BILL Spend & Expense is free for BILL users and comes with unlimited users. Here is BILL’s pricing for your reference:

- Essentials : $45 per user per month for Billing (accounts payable or A/P) or Invoicing (accounts receivable or A/R)

- Team : $55 per user per month for Billing (A/P) or Invoicing (A/R) with accounting software integration

- Corporate : $79 per user per month for both Billing (A/P) or Invoicing (A/R) and accounting software integration

- Enterprise : Custom pricing; includes Billing (A/P) or Invoicing (A/R) plus premium support

BILL Spend & Expense is an expense tracking software integrated within BILL. We recommend it for BILL users because it’s free and supplements BILL’s accounts payable tracking. Users can also issue prepaid corporate cards through the BILL Divvy Corporate Card program. This program allows businesses to issue corporate cards to employees. However, BILL also issues prepaid cards if you don’t want credit cards.

In our evaluation, BILL Spend & Expense aced pricing and received a high score in expense tracking features because it allows users to create expense policies, design approval workflows, and process expense reimbursements. It missed on some nice features like mileage tracking and per diem allocations.

It took a hit in card programs because BILL Spend & Expense only issues virtual cards. It would be better if it had physical card issuance as well. Besides that, the issue cards are limited to the Visa network only. Adding Mastercard or other networks provides more flexibility for some users. Our recommended alternative is Fyle because you can issue physical cards that can either be Visa or Mastercard.

- Virtual card : Through BILL Spend & Expense, you can issue as many virtual cards as you need. You can freeze individual cards, adjust spending limits, and manage recurring payments per card. Aside from virtual cards, physical cards are also issued.

- Budget management : Aside from expense tracking, BILL Spend & Expense can also create spending budgets. BILL matches expenses with budget so that you don’t go over budget.

- Approval workflows : BILL Spend & Expense can create multi-level or simple workflows. Depending on the process complexity, users have the flexibility to design workflows for reviewing and approving expenses.

- BILL users : Since it’s integrated within BILL, we recommend BILL Spend & Expense for tracking expenses. This app is a good addition to BILL’s accounts payable tracking.

- Issuing credit cards : The BILL Divvy Corporate Card can offer business credit to companies. Having credit can help in speeding up business spending and paying it off at a later date.

Emburse Spend: Best for Real-time Expense Reporting

- Has real-time expense reporting

- Assigns specific cards for different purposes

- Can issue prepaid or credit Emburse Cards

- Charges a monthly fee for connecting third-party corporate cards

- Doesn’t include credit card issuance in the Emburse Spend plan

- Limits 150 free automated clearing house (ACH) payments for non-Emburse cards

As a standalone software, Emburse Spend’s pricing is quote-based depending on the business size and features enabled. However, Emburse cards are unlimited and free to issue for Emburse Spend users. Emburse earns money from the transaction fees charged to vendors when you use Emburse Cards.

Emburse Spend is another provider in this guide that offers real-time expense reporting; the other one is Fyle. What separates Emburse Spend from Fyle and the others on our list is it also has real-time corporate card reconciliation. Another thing that makes Emburse Spend stand out is it offers credit cards aside from prepaid cards, which gives more financial flexibility in managing cash flow.

Emburse Spend didn’t get a high overall score in our evaluation due to two major reasons. First, its pricing score is just above average because pricing is undisclosed. We appreciate transparent pricing since it can help users make a decision right away. Besides that, adding Emburse credit cards to Emburse Spend may entail additional costs in the custom quote.

Small businesses on a budget should consider Zoho Expense as an affordable expense tracking solution.

- Credit cards: Issuing credit cards enables you to finance business expenses without prefunding them like debit cards. This can help you better plan out cash flow. These cards are also controllable and you can set credit limits to different cards.

- Application programming interface (API) feature: Emburse Spend’s API can help you create customized solutions for expense tracking and card issuance that are tailor-fit to your processes.

- Real-time card reconciliation: Whenever you use an enrolled card in Emburse Spend, it will show in the platform automatically and possibly route it to specific approvers if it matches routing conditions. Approvers can approve expenses right away after they review each item.

- Businesses wanting credit cards: Emburse credit cards are controllable to enforce company spending limits and policies. With limits in place, Emburse Spend can automatically spot out-of-policy transactions and alert you of these instances. Moreover, cards can be shared with a group, department, or team, so you can budget on a granular level.

- Real-time expense tracking: You don’t need for departments or teams to submit expense reports to review expenses. Every employee can submit expenses right away and approvers can review them as they enter the system. This process makes it faster to approve expenses and makes it easier to address problems with expense submissions.

Best Accounting Software With Expense Tracking Features

Quickbooks online: best expense tracker in a complete bookkeeping system.

- Is both a full bookkeeping system and an expense management tool

- Integrates with multiple third-party apps

- Has a wide network of accountants and bookkeepers

- Is expensive if all you need is expense management

- Has no employee expense reports or reimbursement

- Simple Start : $30 per month for one user

- Essential : $60 per month for three users

- Plus : $90 per month for five users

- Advanced : $200 per month for five users

We picked QuickBooks Online, our best small business accounting software , as it offers detailed expense tracking. It can automatically categorize expenses from card feeds and enable users to directly add more expenses within the platform. You can also assign expenses to classes and locations, making it easier to allocate expenses to particular items.

QuickBooks Online did well in our evaluation, but its scores aren’t high compared to other options on this list. Its expense tracking and card program scores took a hit, which is understandable given that it’s not a standalone expense tracker.

Users must enter expenses into QuickBooks Online, which limits the number of users to 25 at its highest plan. Its expense tracker is more than enough, however, for a small business with minimal expenses from employees.

If you want a dedicated expense tracking solution, we recommend Fyle. It integrates with QuickBooks Online, allowing you to fill in QuickBooks Online’s missing expense tracking capabilities easily.

- Automatic feeds: You can sync corporate cards and bank accounts for automatic feeds. These automatic feeds make bank reconciliation easier as QuickBooks Online will fetch them from your card provider automatically.

- Built-in expense tracking: Since expense tracking is part of QuickBooks Online’s accounting system, all expense entries are recorded in the accounts once you hit save.

- Access to US-based ProAdvisors: One of QuickBooks Online’s advantages is its vast network of ProAdvisors. You can either find a bookkeeper via QuickBooks Live or look for independent ProAdvisors within your area. See our guide on how to find a QuickBooks ProAdvisor or read our review of QuickBooks Live .

- Businesses looking for a complete bookkeeping solution : QuickBooks Online is the only provider on this list that provides a complete bookkeeping solution. It is versatile and can fit into many industries like nonprofits, construction companies, and retail businesses.

- Businesses with inventory : QuickBooks Online can track inventory costs and cost of goods sold (COGS), making it a good pick for businesses selling inventory. With the help of its expense tracker, you can also track how much you spend on inventory-related expenses, such as shipments and packaging.

Wave: Best Free Simple Expense Tracking & Accounting

- Has a free plan for basic accounting, including invoicing and income and expense tracking

- Is easy to set up and use

- Has access to assisted bookkeeping options through the Wave Advisor program

- Lets you add receipt scanning for an affordable fee in the free plan or access it for free in the paid version

- Only accommodates a single user in the free plan

- Doesn’t let you connect bank accounts unless you upgrade to the paid plan

- Isn’t a good fit for businesses that sell inventory

- Has no class and location tracking

- Has limited customer support in the free version

Wave offers a free plan (Starter) which includes basic accounting features, including invoicing and income and expense tracking. With the free plan, you can add receipt scanning for $11 per month.

You can upgrade to the paid plan (Pro) for $16 per month if you need to connect your bank accounts and use receipt scanning without any additional fees.

There’s nothing fancy in Wave since everything is straightforward when recording expenses. The free Starter plan allows you to upload transactions from a bank statement and then quickly categorize them.

The Pro plan goes a step further and has bank and credit card feeds that automatically import transactions. We chose Wave for simplicity because it’s a good pick for users with a small volume of expenses to process.

Wave scored fairly in our evaluation even though it has limited features. We docked it for expense tracking features because it lacks some of the advanced features that we’re looking for, such as approval workflows and email integrations. Additionally, it took a hit in our evaluation of card programs since you can only connect to bank and card feeds for reconciliation when you upgrade to the paid plan.

If you think Wave isn’t enough for your needs, we recommend QuickBooks Online if you’d like to have accounting software with enhanced expense tracking features. However, if you want standalone software, Expensify’s free plan is our best recommendation, especially for issuing unlimited cards.

- Free expense tracking, accounting, and invoicing: Wave offers a free plan that doesn’t skimp on accounting features. It can even record recurring expenses, which is a feature often present in paid software. But in Wave, you get that for free.

- Receipt scanning: For only $11 per month, you can scan receipts in Wave’s free plan. You also have the option to upgrade to the paid plan for $16 per month which includes unlimited receipt scanning at no extra cost.

- Gig workers: Wave’s free version is ideal for gig workers who want a simple expense tracking app. Given that they have fluctuating incomes, going for Wave is a cost-effective solution.

- Occasional sellers: If you join bazaars or similar events, you can use Wave to track all expenses for that particular event. You don’t need advanced features like approval workflows because you’re just tracking expenses for a single event—and Wave is more than enough for that.

FreshBooks: Best for Freelancers

- Offers a simple and easy-to-navigate interface

- Can assign tracked expenses to individual projects

- Is ideal for freelancers and solopreneurs with minimal accounting needs

- Imports and auto-creates expense entries from credit card transactions

- Requires bank feed connection to track cash flow

- Has no expense reimbursement feature

- Has no expense approval flow

- Has no inventory accounting features for companies with inventory that want an expense tracker

You can try any FreshBooks plan for 30 days before subscribing:

- Lite: $19 per month for five billable clients

- Plus: $33 per month for 50 billable clients

- Premium: $60 per month with unlimited billable clients

- Select: Custom-priced depending on company needs

You can add additional users for $11 per month.

FreshBooks is suitable for freelancers and solopreneurs because of its project accounting features and easy-to-use interface. The software makes it easy to do accounting even if you don’t have the background or knowledge.

Its expense tracking features allow you to track categories, record expenses in different currencies, and import credit card transactions. On top of that, FreshBooks tops our list of the best mobile accounting apps for service-based businesses.

FreshBooks’ expense tracking features’ score is decent since the platform has all the basic features and some advanced ones. What it missed are approval workflows, automatic approval limits, and adding per diem rules. However, even though it lacks these, we believe freelancers won’t need them in daily bookkeeping.

If you’re planning to expand your business, FreshBooks is not a good choice. We recommend QuickBooks Online because it has approval workflows and is a more complete accounting software. It can also integrate with other dedicated expense trackers on this list.

- Project accounting : FreshBooks is suitable for project-based freelancers and solopreneurs because of its outstanding project accounting module. Its expense tracking features are also in this module, where you can add project-related expenses and have the option to bill them to clients.

- Easy-to-understand interface : The platform’s highlight is simplicity and ease of use. FreshBooks’ design is straightforward and has no significant learning curve.

- Freelancers with no background in accounting : If you want to do-it-yourself (DIY) accounting, FreshBooks is our best pick. You don’t need experience in accounting software because you can easily navigate around FreshBooks to access all its features.

- Service providers : With the help of FreshBooks’ project accounting module, service providers can track time and expenses for the services they provide. If ever they incur expenses on behalf of clients, they can add them as billable expenses and then add them to invoices.

How We Evaluated the Best App for Business Expenses

We evaluated our best business expense tracker apps based on the following criteria:

- Expense Tracking

- Card Programs

- Ease of Use

15% of Overall Score

Pricing is an important part of your decision. In evaluating this criterion, we considered factors, such as a free trial, monthly and annual billing options, scalability, plan customizability, and price comparison with competitors.

40% of Overall Score

Since we’re evaluating expense trackers, we placed significant weight on expense tracking features. We evaluated this criterion based on the major expense workflow steps: recording, review, approval, and reimbursement.

25% of Overall Score

We include card programs in our rubric since we believe that expense tracking should be tied to the business’ card program. Here, we considered whether the provider can issue cards or enroll in third-party corporate programs.

20% of Overall Score

The ease of use score revolves around customer support channels, integrations, user reviews, and our expert rating. The software must make it easy for users to access support in case of problems. Moreover, it must have adequate integrations with other software so that it would be easier to insert it into existing business processes. We looked at user reviews from third-party websites for the user review scores. We weighed the comments and made sure that we remained objective in our evaluation.

How to Choose a Business Expense Tracker

Every business has different needs in reporting and reimbursing expenses. Sometimes, manual tracking of expenses is more cost-efficient and beneficial for businesses with very few employees, such as fewer than 10. But as your team grows, an app for tracking business expenses can speed up and standardize the process.

Here are some factors you should consider in choosing an expense tracker:

- Affordability: Consider your budget. Can you spare a few dollars per employee for an expense tracker? If yes, then do you think paying annually at a lower monthly cost can give you more savings? Alternatively, would a monthly plan at a higher cost be cash flow-friendly? These are only some of the questions that you need to consider.

- Integration: A small business expense tracker that can’t integrate with your accounting software requires more work for your accountant. It would be best if the expense tracker could automatically export expense data to your accounting software to reduce data entry.

- Reimbursement capabilities: Some business expense trackers can process debit and ACH transfers for reimbursements. Having a built-in reimbursement system makes it easier to reimburse instead of doing it manually in your online banking app or a third-party reimbursement software.

- Security: Data breaches aren’t rare nowadays. Big and small companies alike can be a target for hackers. Hence, your expense tracker must have bank-level security features to protect your data from breaches. All the providers in this guide have bank-level security features.

- Compliance: Not all expenses can be reimbursed, especially if it is beyond the allowance or is outright nonreimbursable. Your expense tracker must have approval workflows in place so that all approved expenses are business expenses.

When to Use a Business Expense Tracker

Not all businesses need an expense tracker, as some small businesses can manage expenses adequately through a basic bookkeeping system. However, getting an expense tracker becomes important if you meet one or more of the scenarios below:

- There are expenses passed on to customers. Professional and personal services sometimes bill clients or customers for expenses incurred. Many expense trackers allow you to assign expenses to customers and even projects, so the information will be easy to gather when it is time to bill the client.

- There is a high volume of reimbursable expenses. Some companies reimburse the out-of-pocket expenses of their employees. Considering that documentation will be a challenge, having an expense tracker can help employees record their expenses. The tracker facilitates everything and can require the proper documentation to be attached prior to submitting the expense. The digital process and complete documentation will make the submission, approval, and reimbursement process go much faster.

- There is a need to streamline business processes. A streamlined business process flow leads to cost reduction. If your business grows and expands to a larger area, expense tracking via traditional methods can be difficult and costly to manage. Instead of hiring new employees to satisfy the demand for processing, getting a business expense tracker can help you save money. With automated and integrated tracking features, you can retain your current workforce and let them use these tools to reduce their load.

What's the Difference Between Accounting Software and a Business Expense Tracker?

Accounting software tracks income, expenses, liabilities, and assets and provides financial statements to monitor your business performance. By definition, accounting software tracks expenses—but sometimes, it requires manual entry and doesn’t provide for reimbursements to employees.

Meanwhile, expense trackers provide for the easy recording of expenses, often by scanning a receipt. Some accounting software has this feature built-in, whereas other accounting software needs to be integrated with an expense tracker.

An expense tracker can also help monitor your expenses with detailed charts and reports. Many developers go a step further by including an employee expense submission, approval, and reimbursement process. Others even offer integrations with ride-hailing and travel apps to record expenses automatically.

Frequently Asked Questions (FAQs)

Are business expense tracker apps safe to use.

Yes, business expense tracker apps are safe to use because of bank-level data security like secure sockets layer (SSL) 256-bit encryption and two-factor authentication (2FA). While that may be the case, proper password hygiene and other such practices are still necessary to enhance the security of expense tracker apps.

Can I track business expenses for free?

Yes, you can, with free options, such as Zoho Expense Free, Emburse Spend, and Ramp, which are good for basic business expense tracking. Other free software on the market may focus more on personal expense tracking rather than business expenses.

The best business expense tracker app isn’t the same for everyone. The apps we’ve recommended in our guide perform well in a given area or business function and are the best for their intended use—although each has its respective drawbacks. We suggest that you analyze your business’s needs and choose the app that can best meet them.

About the Author

Find Eric Gerard On LinkedIn

Eric Gerard Ruiz, CPA

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Since joining FSB, Eric has used his expertise and authority in curating and writing content about small business accounting and bookkeeping, accounting software, financial accounting and reporting, managerial accounting, and financial management.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Toll Free - 8443165544 Monday - Friday

- Receipt Management

- Expense Management

- Mileage Tracking

- Corporate Card Reconciliation

- Direct Feed Integration

- Expense Report Management

- Expense Report Automation

- Purchase requests

- Simplified Approvals

- Custom Approvals

- Expense Auditing

- Reimbursement

- Expense Rules

- Collaboration

- Customization

- Solutions By Industry Consultants Solution to help consultants manage their expenses Education Educational institutions need not worry about their expenses Healthcare Healthcare manufacturers can manage expenses easily Manufacturing Manufacturing expenses are no longer a pain Non-profits Go on your mission and don't worry about expense reporting Marketing Market your offering and leave your expense reporting to us By Size Self-employed Be your own boss, we'll handle your expenses Small Business Grow your business, we'll handle your expense management Enterprise Major deals require your time, leave the expense management to us

- Partner With Us

- Resources Mobile Apps Access Zoho Expense on iOS, Android, iPadOS, MacOS, and WatchOS Integrations Make employees lives easier by integrating with several apps Webinars Learn about Zoho Expense from our experts Forums Post your queries, get answers, and find important updates FAQ Find answers to frequently asked questions here Help Docs Get comprehensive user guides for each module Business Guides Get insights into travel and expenses in the business world All Resources

- Mobile Apps

- Integrations

Travel and Expense Management Software for Growing Businesses!

What Zoho Expense brings to the table.

Purchase request, manage all the aspects of your expense reporting and business travel., travel management, expense reporting, travel and expense management the easy way., spend control, audit & compliance, zoho expense is extensible, enhance expense reporting experience for your employees., improving t&e management globally.

Sit back and relax while we take care of your expense reporting

All-encompassing mobile apps.

What is expense management software?

Expense management software helps businesses streamline spending—from employee expenses, reimbursement, and corporate travel to operational spend—by automating expense reporting , enforcing policies , and streamlining approvals .

Who should use an expense management software?

Expense management software are used by employees to record and submit expenses, finance teams to track expenses and reimburse employees , and travel teams to manage business travel . CFOs and CEOs can use them to get insights on their business spending, too.

Why do organizations need expense management software?

Without expense management software, your organization will find it difficult to manually manage receipts , expense reports , and travel expenses . Expense management software has a direct impact on optimizing business spend, while drastically cutting down time on manual data entry and management.

Why should businesses avoid using spreadsheets to manage expenses?

Managing expenses via spreadsheet becomes tedious as the size of the organization increases. Using spreadsheets to manage business travel and expenses is neither efficient nor safe. Accountants need to ensure that there are no formula errors, as it may lead to costly financial mistakes during monthly or yearly financial calculations—and it's also expensive in terms of manually managing policy violations and fraudulent claims.

Why should organizations automate the expense management process?

A manual expense reporting process is a pain for employees—as well as travel and finance teams—as it involves a lot of work to create reports, approve or rectify them, and manually check for duplicate and fraudulent claims. Automating your expense management process helps in reducing manual work and improving compliance and policy adherence.

How should one evaluate expense management software for their organization?

Before investing in expense management software, businesses need to have evaluation criteria in place . Some of the main reasons for implementing expense management software are to help save time, increase compliance , and simplify the reimbursement process . If you're unsure about gathering requirements by yourself, talk to a product expert , explain what you're looking for, and let them suggest the best plan that suits your business needs.

How to choose expense management software?

Here are some of the key points to consider before choosing expense management software:

No hidden costs

Active-user-based pricing is one of the most cost-effective methods of pricing, where you end up only paying for the users who are actually using the product.

Ease of use

Businesses need to keep track of countless activities, so managing expenses and travel requests should be streamlined, and the software should provide an overall user-friendly experience.

Data security

As expense management software deals with a lot of sensitive data—like employee bills, business spend details, corporate cards, and travel documents—it's important that the software is compliant with all security standards .

Scalability

Changing software and migrating data is exhausting. So when you decide to implement expense management software at your organization, it should be able to meet your requirements when your business expands . The software that you choose should also align with your growth strategy and help you scale your business.

A reliable support team should be available to help you resolve any issues or questions. You should also closely examine how easy it is to get in touch with the team via mobile or email.

What's the best expense management software?

We may be a little biased here, but Zoho Expense is used by businesses of all sizes in 150+ countries across the globe. For more than 7 years, Zoho Expense has been serving world-class software for businesses and delivering user-friendly experiences for their employees. Sign up for a free trial today and start your expense management journey with Zoho Expense.

- Expense Reporting Automation

- Direct Feeds

- Expense Report Approval

- Expense Policies

- Online Reimbursements via ACH

- Zoho Books Integration

- Zoho CRM Integration

- Zoho People Integration

- QuickBooks Integration

- Quick Links

- All Features

- Become a partner

- Expense Reporting Mobile Apps

- Free Expense Report Generator

- Free Expense Report Template

- GDPR and Zoho Finance

- Help Documentation

- Feedback Forum

- Essential Business Guides

- Expense Reporting for:

- Enterprises

- Small business

- Self-employed

- Non-profits

- Manufacturing

- Consultants

- Select Edition

- United States Global Australia Bahrain Canada Germany India Kenya Mexico Oman Saudi Arabia United Arab Emirates United Kingdom United States

- Available On

- Connect with us

- Call us (or) Send us an Email

- Toll Free - 8443165544

- Books Online Accounting Software

- Inventory Online Inventory Management

- Billing End-to-End Billing Solution

- Checkout Online Payments Software

- Invoice 100% Free Invoicing Solution

- Commerce Ecommerce Software

- Practice Practice Management Software

This field is mandatory.

Type the characters you see in the picture above

By clicking Submit , you agree to our Privacy Policy .

Here's what our customers are saying about us

Puma has been using Zoho Expense in Oceania for over 3 years and our users have found the web interface and the phone apps to be feature rich and always improving.The look and feel is modern and pleasing to the eye. Puma has recently expanded the usage of Zoho Expense to multiple new regions around the globe, and throughout, the Zoho team has been extremely supportive to the unique requirements of each region and helped to make the onboarding experience painless.

Mark Hawkins

Director, Operations PUMA SEA

We started using Zoho Expense across our whole IFFCO group for Travel and Expense Management as one of the key aspects to keep control on spends. It was a challenge to manage employee spend and expense reporting across our multiple office locations with disparate solutions. We found Zoho Expense as a very powerful and flexible tool which allows us to accommodate many different expense policies and compliances in respect to many different countries' regulations.

Jaroslaw Pietraszko

Director ERP & Digital Transformation, IFFCO Group

The Zoho Expense team has provided us with the best features—especially the receipt auto-scan, which eases our expense reporting journey with its mobile functionality. Our employees use Zoho Expense and its features extensively, particularly the mobile app. Above all, with the Zoho Analytics integration, we always get the insights we need with multiple dashboards to analyze our business spend. We’re one of those happy customers who are looking forward to seeing many new features and integrations within the application.

CHRO, Tata Play Fiber

Rated by the best

The 7 Best Expense Tracking Apps for Smarter Business Travel

Expense reports aren’t fun. Manually scouring through paper receipts then keying in every transaction from the past month is stressful—another thing you don't have time for at the end of the month.