5 years ago

Travel and subsistence for directors, what you need to know.

Travel and subsistence costs are one of the most troublesome areas for business owners and company directors.

At PGM we’re here to help, by giving you the run down on travel and subsistence costs.

So what exactly is ‘Travel and Subsistence’?

Travel and subsistence is defined as “ any accommodation, food and drink costs that you incur whilst you are away from your permanent workplace while working for the company”. These expenses are tax deductible when they are incurred wholly and exclusively for the purpose of your business, trade, profession or vocation.

It’s worth noting that food and drink purchased close to your company’s premises does not meet the criteria of ‘work related’.

Claiming your subsistence expenses

Subsistence expenses can only be claimed under the rules for claiming travel. This means that they must be incurred in direct conjunction with being required to travel for work. The hard and fast rule is that an expense must also be ‘reasonable’ . A typical scenario could be claiming lunch on an airport connection or dinner expenses when required to stay overnight at a hotel.

Proximity and timing is important

Expenditure incurred shortly after leaving home, or arriving home is disallowed by HMRC, as this is deemed a personal choice and not seen as a necessity.

Allowable subsistence costs

Subsistence costs incurred while making client or supplier visits, occasional onsite working or travel to and from events and training courses fits the criteria of allowable travel expenses. However inviting your client for a dinner would be treated as client entertaining and that is specifically not tax deductible.

Tracking your travel and subsistence expenses.

Gone are the days of frantically trying to find that receipt, wedged in your work diary or hidden somewhere in your wallet or purse to claim that expense. At PGM we offer bookkeeping and digital record tracking, making your accounts preparation more efficient and therefore making your business more efficient. Save time by recording expenses in real time through your smartphone with our digital solutions.

Just click here to book a free 30 minute business consultation with our team and learn more about the benefits of our cloud accounting solutions.

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

7 Rules You Should Know About Deducting Business Travel Expenses

:max_bytes(150000):strip_icc():format(webp)/DanielRathburn-a16946b87e45469aaae5b4998db2397a.jpeg)

- What Is Your "Tax Home"?

Charges on Your Hotel Bill

The 50% rule for meals, the cost of bringing a spouse, friend or employee.

- Using Per Diems To Calculate Employee Travel Costs

Combined Business/Personal Trips

International business travel.

- The Cost of a Cruise (Within Limits)

Frequently Asked Questions (FAQs)

Helde Benser / Getty Images

The IRS has a specific definition for business travel when it comes to determining whether these expenses are tax deductible. The agency says business travel is travel that takes you away from your tax home and is "substantially longer than an ordinary day's work." It requires that you sleep or rest while you're away from home, and that you do so. The travel must be "temporary." This means it can't last a year or more.

Key Takeaways

- You can deduct expenses that take you away from your tax home for a period of time that would require you to spend the night.

- Your tax home is the city or area where your regular place of business is located.

- You’re limited to 50% of the cost of your meals.

- Your trip must be entirely business-related for costs to be deductible, but special rules apply if you travel outside the U.S.

What Is Your "Tax Home"?

Your tax home is a concept set by the IRS to help determine whether a trip is tax deductible. It's defined by the IRS as the entire city or general area where your regular place of business is located. It's not necessarily the area where you live.

Your tax home can be used to determine whether your business travel expenses are deductible after you've determined where it's located. You can probably count your expenses during travel as business deductions if you have to leave your tax home overnight or if you otherwise need time to rest and sleep while you're away.

Check with a tax professional to make sure you're accurately identifying the location of your tax home.

Charges for your room and associated tax are deductible, as are laundry expenses and charges for phone calls or for use of a fax machine. Tips are deductible as well. But additional personal charges, such as gym fees or fees for movies or games aren't deductible.

You can deduct the cost of meals while you're traveling, but entertainment expenses are no longer deductible and you can't deduct "lavish or extravagant" meals.

Meal costs are deductible at 50%. The 50% limit also applies to taxes and tips. You can use either your actual costs or a standard meal allowance to take a meal cost deduction, as long as it doesn't exceed the 50% limit.

The cost of bringing a spouse, child, or anyone else along on a business trip is considered a personal expense and isn't deductible. But you may be able to deduct travel expenses for the individual if:

- The person is an employee

- They have a bona fide business purpose for traveling with you

- They would otherwise be allowed to deduct travel expenses

You may be able to deduct the cost of a companion's travel if you can prove that the other person is employed by the business and is performing substantial business-related tasks while on the trip. This may include taking minutes at meetings or meeting with business clients.

Using Per Diems To Calculate Employee Travel Costs

The term "per diem" means "per day." Per diems are amounts that are considered reasonable for daily meals and miscellaneous expenses while traveling.

Per diem rates are set for U.S. and overseas travel, and the rates differ depending on the area. They're higher in larger U.S. cities than for sections of the country outside larger metropolitan areas. Companies can set their own per diem rates, but most businesses use the rates set by the U.S. government.

Per diem reimbursements aren't taxable unless they're greater than the maximum rate set by the General Service Administration. The excess is taxable to the employee.

If you don't spend all your time on business activities during an international trip, you can only deduct the business portion of getting to and from the destination. You must allocate costs between business and personal activities.

Your trip must be entirely business-related for you to take deductions for travel costs if you remain in the U.S., but some "incidental" personal time is okay. It would be incidental to the main purpose of your trip if you travel to Dallas for business and you spend an evening with family in the area while you're there.

But attempting to turn a personal trip into a business trip won't work unless the trip is substantially for business purposes. The IRS indicates that “the scheduling of incidental business activities during a trip, such as viewing videotapes or attending lectures dealing with general subjects, will not change what is really a vacation into a business trip."

The rules are different if part or all of your trip takes you outside the U.S. Your international travel may be considered business-related if you were outside the U.S. for more than a week and less than 25% of the time was spent on personal activities.

You can deduct the costs of your entire trip if it takes you outside the U.S. and you spend the entire time on business activities, but you must have "substantial control" over the itinerary. An employee traveling with you wouldn't have control over the trip, but you would as the business owner would.

The trip may be considered entirely for business if you spend less than 25% of the time on personal activities if your trip takes you outside the U.S. for more than a week.

You can only deduct the business portion of getting to and from the destination if you don't spend all your time on business activities during an international trip. You must allocate costs between your business and personal activities.

The Cost of a Cruise (Within Limits)

The cost of a cruise may be deductible up to the specified limit determined by the IRS, which is $2,000 per year as of 2022. You must be able to show that the cruise was directly related to a business event, such as a business meeting or board of directors meeting.

The IRS imposes specific additional strict requirements for deducting cruise travel as a business expense.

How do you write off business travel expenses?

Business travel expenses are entered on Schedule C if you're self-employed . The schedule is filed along with your Form 1040 tax return. It lists all your business income, then you can subtract the cost of your business travel and other business deductions you qualify for to arrive at your taxable income.

What are standard business travel expenses?

Standard business travel expenses include lodging, food, transportation costs , shipping of baggage and/or work items, laundry and dry cleaning, communication costs, and tips. But numerous rules apply so check with a tax professional before you claim them.

The Bottom Line

These tax deduction regulations are complicated, and there are many qualifications and exceptions. Consult with your tax and legal professionals before taking actions that could affect your business.

IRS. " Topic No. 511: Business Travel Expenses ."

IRS. " Publication 463 (2021), Travel, Gift, and Car Expenses ."

IRS. " Here’s What Taxpayers Need To Know About Business-Related Travel Deductions ."

What are the Allowable Limited Company Expenses?

Understanding what you can or can't claim as limited company expenses is tricky-and here's where our article comes in to guide you along.

Introduction

As a limited company director, you want to run your business in the most tax-efficient way possible.

One way to achieve this is to correctly claim for allowable business expenses so that you don't have to pay more tax than you are legally obliged to.

It can be tricky figuring out what you can or cannot claim, and this is where our guide comes into play.

We'll run through the different expenses you can claim, but remember that this isn't a definitive guide. Check out our resource hub on limited company tax topics for more information, or consult our specialist accountants at GoForma if you need personalised advice.

In the world of UK businesses, understanding allowable limited company expenses is crucial for financial success. In this article, we will explore what these expenses mean and why they are important for businesses operating in the UK. By gaining a clear understanding of allowable expenses, you can optimize your financial management and maximize tax efficiency. Understanding what you can or can't claim as limited company expenses is tricky, let's deep dive into the complete limited company expenses guide.

What are Allowable Business Expenses?

Understanding allowable limited company expenses.

Allowable limited company expenses refer to the legitimate costs that businesses can deduct from their taxable income, ultimately reducing their tax liability.

Allowable business expenses are essential costs that aren't taxable. These expenses are considered essential and are spent solely for business-related purposes. Knowing which expenses qualify as allowable is essential to ensure compliance with HMRC regulations and make the most of available tax reliefs.

These expenses can be deducted from your income, reducing the tax you need to pay. For example, if your revenue is £35,000 and your allowable expenses total £5,000, you'll be taxed on £30,000.

Importance of Limited Company Allowable Expenses HMRC

Understanding allowable expenses is very important for businesses in UK for below reasons.

- It helps minimize tax burdens, allowing businesses to retain more of their hard-earned profits.

- Being knowledgeable about allowable expenses enables businesses to make informed financial decisions and allocate resources effectively.

- It ensures compliance with tax laws and regulations, avoiding potential penalties and legal issues.

What Expenses can I Claim as a Limited Company Director?

We'll run through the different expenses you can claim, but remember that this isn't a definitive guide. Check out our for more information, or consult our specialist accountants at GoForma if you need personalised advice.

What are the Advantages of Using Limited Company Expenses?

Using limited company expenses offers several advantages for businesses. Here are some key benefits:

- Tax Deductions: By claiming allowable business expenses, a limited company can reduce its taxable profit, resulting in lower tax liabilities. This can help maximize the company's retained earnings and provide more funds for business growth and investment.

- Business Efficiency: Properly managing and claiming expenses can improve overall business efficiency. It allows you to track and control costs, identify areas for potential savings, and make informed financial decisions based on accurate expense data.

- Professional Image: Claiming legitimate business expenses can help project a professional image to clients, customers, and stakeholders. It demonstrates that the company operates in a responsible and transparent manner, which can enhance trust and credibility.

- Compliance with Tax Regulations: By correctly identifying and claiming allowable expenses, a limited company ensures compliance with tax regulations. This helps avoid penalties, fines, and potential audits from tax authorities.

- Financial Planning and Forecasting: Tracking and analyzing expenses provides valuable financial data for budgeting, forecasting, and business planning. It allows you to assess profitability, cash flow, and make informed decisions to drive the company's growth.

What are the Allowable Employee Expenses?

Allowable Employee Expenses List:

Employee or staffing expenses refer to the costs related to employing and supporting the workforce within the business. Some examples of allowable staffing expenses include:

- Salary - The salary and National Insurance contributions (NIC) you receive as an employee of your company can be claimed as allowable expenses. If your salary exceeds the NIC threshold, you must pay NICs

- Christmas party and annual event expenses - You can claim the costs of hosting an annual staff party as long as the following conditions apply: - Your cost per person shouldn't exceed £150 (including VAT ). Your employees may invite a partner; if they do, your total budget for an employee and an additional guest will be £300. - The main purpose of the event is to entertain your staff members. As such, most of the event attendees should be your employees. Note that the per-person budget of £150 applies annually, so you can claim for several staff events as long as the costs fall within the budget. See EIM21690 for more information.

- Lunch Expenses - When your employees are performing their work duties, it's common for them to encounter personal expenses, such as purchasing lunch while on assignments or incurring travel costs to meet clients. As an employer, you have the option to reimburse these expenses to your employees through the payroll system. This means that you can compensate them for the money they spent on these work-related expenses, ensuring that they are not financially burdened by these costs.

- Gifts and trivial benefits - You're not required to pay tax and National Insurance contributions, nor notify HMRC about gifts or benefits for an employee if it meets the following conditions: - It costs £50 or less to provide - It isn't a cash or cash voucher - It's not a reward for their performance - It's not included in terms of their contract - The total does not exceed £300 in the financial year.... You must pay tax on gifts and benefits that don't meet the above conditions.

- Healthcare expenses - If you provide private medical insurance for an employee, this is considered a benefit in kind . You must pay National Insurance contributions at 15.05% (2022/23 tax year), and your employee will pay personal tax. From 6 April 2023, employers are liable to pay an additional 1.25% as a separate health and social care levy. The new social care levy will apply to employee deductions, including earnings of employees above the state pension age. However, existing reliefs will continue to apply to apprentices under 25 and employees under 21 earning less than £50,270 annually. Not that even though the rate of national insurance is set to increase for the 2022-2023 tax year, the threshold at which national insurance starts to be paid will also increase. This will reduce the overall national insurance bill or offset some of the additional contributions that must be made. The following health benefits are exempt , so you're not required to report to HMRC, or pay tax and National Insurance on the following: - Medical check-up or health screening (one check-up per year is exempt) - Medical insurance or treatment for an employee working overseas

- Childcare costs - As of 4 October 2018, the Childcare Voucher scheme has been phased out by the government, so new applicants are no longer accepted. If you've set up for this scheme, you can go on receiving and using the vouchers as long as the scheme continues to run. Parents can now apply to the Tax-Free Childcare scheme. This initiative was rolled out in 2017 and was designed to replace employer-supported childcare gradually. Under the scheme, the government will contribute 20p for every 80p you pay, up to a threshold of £2,000. This means you'll receive £2,000 per year for each child, for childcare costs of up to £10,000. Further information is available on the Gov.uk website .

- Pension contributions - After you've set up an agreement with a pension provider, you can contribute to your pension and get 100% tax relief as an allowable expense. Your contributions are tax-free as long as the amount falls under the annual allowance. The annual allowance is rising to £60,000 on 6 April 2023. It is £40,000 for the 2022/23 tax year and £60,000 for 2023/24 and beyond. The allowance covers all your private pensions, including your personal and workplace pensions. Bear in mind that pension decisions are often complicated and require careful consideration. We recommend speaking with a financial advisor for personalised advice before you make any contributions.

Business Entertainment Expenses Limited Company

You can claim for the costs of entertaining or potential clients. However, these aren't allowable deductions for Corporation Tax purposes.

Download our free Limited Company Expenses Guide

Our limited company expenses guide talks through all the different expense categories you can claim for along with key examples and how this can impact your corporation tax.

- Allowable business expenses

- Employee expenses

- Travel expenses

- Office & equipment expenses

- Professional services expenses

- General expenses

Thanks for downloading our free guide! We've sent you an email with your guide. You can also schedule time with an accountant below or create an instant online quote.

What Expenses can I Claim for Business Travel?

Limited Company Travel Expenses

Limited company mileage allowance.

As a limited company director, you can claim back mileage from HMRC if you use your vehicle for business trips and have paid for the fuel costs. HMRC defines these trips as journeys you make 'wholly and exclusively' for business purposes. These include:

- Trips taken to complete work (i.e. deliveries)

- Trips between two workplaces for the same job

- Going from an employee's home to a client

- Going to a temporary workplace

You can claim the following rates:

Note: You can only claim the cost of fuel if your company owns the car.

Business Travel Expenses

You can claim travel-related expenses if the trip is made wholly and exclusively for business purposes and isn't considered 'ordinary commuting'. According to HMRC, a commute is defined as a trip that you make between your home and a permanent workplace. You can claim the following:

- Costs associated with running a car or vehicle, such as fuel expenses, parking fees, tolls, vehicle insurance and vehicle repairs and servicing

- Transport fares for flights, as well as rides taken via train, bus, taxi and ferries

- Meals and accommodation for overnight business trips

Office-related Expenses You Can Claim

Use of Home as Office Limited Company

1. claiming a flat rate.

If you use your home office, you can claim a rate of £6 per week as allowable business expenses.

HMRC doesn't require you to keep a receipt for this. Additionally, this isn't considered a benefit in kind, so you don't have to pay tax on the amount.

2. Apportionment of Home Bills

Alternatively, you can claim a proportion of household costs used by the business. The allowable expenses you can claim will vary depending on the situation. You can typically claim for utilities and other household expenses (but only for mortgage and council tax if you are self-employed).

This method requires you to work out the rooms you use for your business, the amount of time you use these rooms for business activities and the proportion of your utilities that you can allocate to business use.

For example, you may dedicate your study room for business purposes for half a day during the weekdays and require lighting and heating for all your hours spent on business activities.

A rental agreement must be established between you (the homeowner) and your limited company to claim proportional costs. The rules can be complicated, so we recommend consulting an accountant before you set up a rental agreement.

General Office Expenses

You can claim for basic office expenses, such as postage, stationery, printing costs, accountancy and other consumable office supplies.

Stationery and Equipment Expenses

Computers, printers and software are examples of equipment you can claim as business expenses.

You can also claim office furnishings like tables and chairs as long as they are primarily used for business purposes.

Plant and Machinery

From 1 April 2021 until 31 March 2023, a 130 per cent super-deduction applied. Companies purchasing qualifying plant and machinery assets could have claimed a 130% super-deduction capital allowance and a 50% first-year allowance for qualifying special rate assets.

These reliefs only applied to businesses subject to corporation tax, so they weren't available for sole traders, partnerships or limited liability partnerships. They applied only to purchasing new plants and machinery (including computing equipment), not second-hand assets.

Under the Annual Investment Allowance (AIA) , businesses could have claimed tax relief on 100 percent of plant and machinery investments up to the threshold (currently £1 million).

Further information is available on HMRC's factsheet .

Communications: Mobile Phone, Landline and Broadband Expenses

1. mobile phone expenses.

If your mobile phone contract is between your company and the provider and is used solely for business purposes, you can claim the entire bill as an allowable expense.

You can claim the costs incurred for business calls if you have a personal contract. You're also able to reclaim the VAT element of the business calls.

Further information is available in our guide to claiming mobile phone expenses when self-employed .

2. Landline Expenses

If your landline contract is solely for business use, you can claim the cost as an allowable expense. You can also claim for business calls you've made using your home phone line.

3. Broadband Expenses

If your residential broadband contract is in your company's name, you can claim a full deduction for the expense provided that personal use of the broadband connection is 'insignificant' .

If the connection is used for business and personal purposes, you'll need to pay a benefit-in-kind charge on the amount paid for by the company.

If you have a personal broadband plan, you can claim the costs of using the broadband connection for business activities. You'll need to show your business and personal usage separately, such as providing a copy of an itemised bill.

Professional Services Expenses You can Claim

Business Insurance

You can claim insurance policy costs if you prove the policy is strictly taken up for business purposes.

Common types of include professional indemnity, public liability, employer's liability and business contents.

Company Formation Costs

The costs you incur to register your company can be claimed as allowable expenses. These costs can range from fees for professional services to printing costs, equipment purchases and software expenses.

Financial and Legal Expenses

1. professional fees expense.

The costs incurred for engaging professional services - such as hiring an accountant, lawyer or architect - can be claimed as an allowable expense if these services are carried out solely for business purposes.

2. Bank, Credit Card and Other Financial Costs

Bank charges, including credit card fees and loan interest, can be claimed as business expenses.

3. Bad Debts like Unpaid Invoice

Company expenses related to bad debt, such as unpaid invoices, occur when a business is unable to collect payment from a customer or client. It is considered an expense because the expected revenue from the sale or service has not been received, resulting in a financial loss for the company.

To claim bad debts as a business expense, the value of the transaction needs to be included in your company's turnover, and you must be sure that your customer will not recover the debts.

Marketing, Advertising and PR Costs

You can reclaim your marketing, advertising and PR expenses as long as these are used solely for business purposes. This applies to both one-off costs and ongoing fees.

Here are a few examples of common marketing and advertising expenses you may incur:

- Creating a website

- Costs of web hosting

- Purchase of domain names

- Online and print ads

Professional Development Expenses

Professional development costs can be claimed as an allowable expense if the course content directly relates to your trading activity.

Training courses you attend to learn a new skill - which you can use to expand into a new industry or offer different services - aren't allowable unless you can show that these courses are helping you build up on your existing skills or knowledge.

Professional Subscription

Subscriptions can be claimed as an allowable expense as long as these subscriptions are directly relevant to your business and are included in the HMRC list of approved professional bodies .

What Other Expenses can I Claim?

Eye Test Expenses and Glasses

You can claim for vision tests only if you must use visual display equipment as part of your day-to-day work.

The costs of glasses or contact lenses can be claimed only if these are prescribed for screen-based work and aren't a general prescription.

Books, Journals and Magazines

You can only claim the cost of magazine subscriptions, books and journals if they are relevant to your business.

For example, industry-specific journals related to your profession, like a journal on decarbonisation, could be deemed relevant as they could be a source of information to help you stay up-to-date with the latest developments.

Building a website could be claimed as an expense if the money earned from the website exceeds the cost of developing the website.

It is always good to speak to your accountant to determine eligibility.

While donations aren't considered allowable business expenses, they are deductible against your Corporation Tax bill.

This applies when you gift the following to a charity:

- equipment or trading stock (items that your business makes or sells)

- land, property or shares in another company (shares in your own company don't qualify)

- employees (on secondment)

- sponsorship payments

How do I Claim My Tax Deductible Expenses Limited Company?

To claim tax-deductible expenses in the UK, follow these steps:

- Understand Allowable Expenses: Get familiar with the types of expenses that are eligible for tax deductions. In the UK, allowable expenses typically include costs that are incurred wholly and exclusively for business purposes.

- Keep Accurate Records: Maintain detailed records of your expenses, including receipts, invoices, and supporting documents. These records will serve as evidence to support your claims and comply with HMRC requirements.

- Classify Your Expenses: Categorize your expenses into appropriate categories, such as office expenses, travel costs, professional fees, or marketing expenses. This will help you accurately report them on your tax return.

- Complete Your Self-Assessment Tax Return: If you're self-employed or a director of a limited company , you will need to complete a self-assessment tax return. Include your tax-deductible expenses in the relevant sections of the form, such as the "Self-Employment" or "Business Expenses" section.

- Be Aware of Specific Rules and Limits: Some types of expenses may have specific rules or limits on the amount you can claim. For example, there may be restrictions on claiming expenses for entertainment or personal use items. Stay informed about these rules to ensure compliance.

- Seek Professional Advice: If you're unsure about which expenses are tax-deductible or how to accurately claim them, it's advisable to consult with a qualified accountant or tax advisor. They can provide personalized guidance based on your specific circumstances and help you maximize your allowable deductions.

- Retain Documentation: Keep your expense records and supporting documents for at least five years, as HMRC may request to review them for audit purposes.

LTD Company Expenses List:

- Operating Expenses: - Rent and utilities - Office supplies and equipment - Insurance premiums - Business rates - Telephone and internet expenses - Property maintenance and repairs - Business insurance

- Professional Services: - Accounting and bookkeeping fees - Legal fees - Consultancy and advisory services - IT and software services - Marketing and advertising expenses - Professional membership fees - Training and development costs

- Staffing Expenses: - Employee salaries and wages - Employer National Insurance contributions - Pension contributions - Recruitment expenses - Staff training and development costs - Employee benefits (such as health insurance or childcare vouchers)

- Travel and Subsistence: - Business-related travel expenses - Accommodation costs during business trips - Meals and entertainment expenses - Mileage or vehicle expenses

- Business Premises: - Rent or mortgage payments for business premises -Property insurance - Business rates and council tax - Maintenance and repairs

- Office Expenses: -Office furniture and equipment - Printing and stationery - Computer hardware and software -Postage and delivery costs

- Marketing and Advertising: - Website development and maintenance - Advertising campaigns - Graphic design and printing - Online marketing expenses

- Financial and Bank Charges: - Bank fees and charges - Merchant service fees - Interest on business loans or overdrafts - Professional fees for financial services

Non-allowable Ltd Company Expenses

Non-allowable limited company expenses refer to costs that are not eligible for tax deduction or cannot be claimed as legitimate business expenses. Here are some common examples:

- Personal expenses: Any expenses that are purely personal in nature, such as personal clothing, personal travel, or personal entertainment, cannot be claimed as business expenses.

- Fines and penalties: Fines, penalties, and legal fees incurred as a result of breaking the law or regulations are generally not allowable expenses.

- Capital expenses: Costs associated with purchasing or improving fixed assets, like property or equipment, are typically considered capital expenses and are not fully deductible in the year of purchase. Instead, they are typically claimed through capital allowances over a period of time.

- Dividends: Dividend payments made to shareholders are not considered allowable expenses. Dividends are distributed from profits after tax and are subject to dividend tax rather than being deductible as an expense.

- Private healthcare and insurance premiums: Personal health insurance or private medical expenses are generally not allowable as business expenses.

- Entertaining clients: Expenses incurred for purely entertainment purposes, such as lavish client dinners or tickets to sporting events, are usually not allowable as business expenses.

Frequently Asked Questions on Limited Company Expenses

- How Much Does an Accountant Cost for a limited company in 2023? The cost of hiring an accountant for a limited company in 2023 can vary depending on factors such as the size and complexity of your business, the scope of services required, and the accountant's location and experience. On average, you can expect fixed fee packages ranging from £1,000 to £5,000 or more per year, and hourly rates between £75 to £150 or more. Additional services and online accounting software may have separate costs.

- Can I claim for my business vehicle as a tax deduction if I don't own it myself? Yes, you can claim for your business vehicle as a tax deduction even if you don't own it yourself. If you use a vehicle for business purposes, you can claim the expenses associated with its use as a tax deduction. This applies whether you own the vehicle, lease it, or use it under a hire or rental agreement. However, it's important to note that the specific tax rules and allowable deductions may vary depending on factors such as the type of vehicle, its usage, and the tax regulations in your jurisdiction. Consulting with an accountant or tax advisor is recommended to ensure compliance and maximize your eligible deductions.

- Are all revenue expenses allowable for tax purposes? Not all revenue expenses are allowable for tax purposes. While many revenue expenses incurred for the purpose of running the business are typically allowable, there are certain expenses that may not be eligible for tax deductions. Some common examples of non-allowable expenses include personal expenses, fines and penalties, capital expenditures, and expenses not supported by appropriate documentation.

- What expenses can I claim for employees? Common expenses you can claim for employees include salaries and wages, employer National Insurance contributions (NICs), and pension contributions.

- Should I buy or rent my office space for my limited company? The decision to buy or rent office space for your limited company depends on various factors such as your budget, long-term plans, and specific business needs. Renting provides flexibility and lower upfront costs, while buying offers long-term stability and potential investment benefits. Consider your financial situation, growth projections, and the local property market before making a decision.

- Can I claim rent as a business expense limited company? Yes, you can claim rent as a business expense for your limited company, as long as it is incurred solely for business purposes.

- Can you claim food expenses in Ltd company? Yes, you can claim food expenses as a limited company under certain circumstances. If the food expenses are incurred wholly and exclusively for business purposes, such as business meetings or when traveling for business, they may be considered allowable expenses.

Get In Touch

To book a call with one of our certified accountants, visit our calendar to book a FREE consultation here.

Download our free Small Business Accounting Guide

Our small business accounting guide walks through absolutely everything you need to know if you're considering starting a limited company. From different taxes, limited company advantages/ disadvantages, how to pay yourself, and what your key filing requirements are.

- When to register a Ltd company

- When to register for VAT

- How to take money out of your company

- Dividend tax rates

- Limited company expenses & corporation tax

- Annual accounts and deadlines

%20(1).webp)

Book a free 20 minute call with an accountant to talk though starting, registering or switching your company.

- Book a time online instantly

- Registering for VAT

- Self assessment

- Sole trader vs limited company

- Dividends and personal tax

- Registering your company

Read more of our free business tax guides

Speak to an accountant

Get a free 20 minute consultation about starting your business

Business accounting from £35

01865 582064 | [email protected] | Book an appointment

- Search for:

Travel for employees or directors

Are your, or your employees’, travel costs taxable?

Travel costs for employees and directors are always tax deductible for the company. The company includes such costs as an expense in its accounts and only pays tax on the profits which are stated after deducted all such expenses.

However, some travel costs paid for by your company may need to be included on payslips or as a taxable benefit in kind.

These notes apply to directors (including owner managers of companies) and any employees of the company – all referred to as “employees” below. References to “travel expenses” include all travel and associated subsistence and accommodation costs.

Travel expenses that are not taxable on the employee

Travel in performance of duties (ITEPA 2003, s. 337)

Travel in performance of an employee’s employment duties is not taxable. Such journeys include visiting a client’s premises on occasional irregular basis. For an example an IT engineer visiting various sites from their main workplace, as and when the need arises, would be travelling in the performance of duties.

This category does not include regular travel between home and work as this is before and after the performance of duties, rather than during the performance of duties.

Travel between workplaces (of the same employment) is not taxable on the employee or director only if attendance at both workplaces is a requirement of the work. If your company has more than one office and you are required to travel between them in order to carry out your duties then this would not be taxable.

Home is usually not counted as a workplace for this purpose. The only exception is if the nature of duties are such that they have to be carried out home (e.g. home is a bed and breakfast business, a farmhouse for the business of training dogs for the disabled in a home environment – per HMRC guidance).

Travel for necessary attendance at a temporary workplace (ITEPA 2003, s. 338)

Travel to a temporary workplace will not be treated as a taxable benefit for the employee. This is assuming that the employee is required to attend this temporary workplace to fulfil their employment duties (there must be a necessity to attend the temporary work place, not just a preference to do so).

An employee’s expenses of travelling to a customer’s place of business or to a supplier would not be taxable. The employee may travel there directly from home without first going to their normal place of work, or return directly home after the visit.

Note, travel from home or any non-workplace to a permanent workplace or permanent work area is not be covered by this rule even if home is also a workplace. Therefore travel from home to permanent workplace is taxable.

Consequence of travel expenses that are not taxable on the employee

No entries are required on payslips for the above types of travel.

As long as the company is reimbursing actual expenditure then no P11D entries are needed. If payments are made for round sums or an allowance is paid in advance then P11D will be required to show the expenses, which can also be claimed as deduction on P87 or self-assessment tax return.

Travel that is taxable on the employee

All other travel expenses paid by the company, including all travel to a permanent workplaces (except travel between workplaces), all commuting and all private travel are taxable on the employee or director and subject to national insurance.

If the employee pays for the travel and the employer reimburses this, the grossed up amount must be shown on payslips. There is full tax and NI on this amount. No P11D entry is required.

If the employee arranges the travel but the company pays the supplier directly, the amount must be shown as taxable on P11D but subject to national insurance (employees and employers) on payslips.

If the company arranges and pays for the travel then no entries needed on payslips. The amount is taxed by being recorded on P11D and Class 1A (employers only) NI is paid on P11D(b).

Temporary workplaces

Workplaces attended to perform a task of limited duration and the task does not last ( and is never considered likely to last) more than 24 months or most of the period of the employment are temporary workplaces.

An employee may work occasionally at one site for many years but the site may remain a temporary workplace because the visits are occasional. An employee may work full-time at a particular site for a period of up to two years and it can still be treated as a temporary workplace.

If an employee spends many hours per week for more than two years at a particular place, then it can no longer qualify as a temporary workplace. Also if attendance is for the most or all of the period of employment then it cannot be a temporary workplace, even if the duration is less than two years.

Permanent workplaces

Usually your main place of work will be a permanent workplace.

It is possible to have more than one permanent workplace. Permanent workplaces include but are not restricted to:

Any workplace attended to perform a task that is not of limited duration; or

Anywhere that is attended more than 40% or work time, and will be so for more than two years (or most or all of the duration of the employment); or

Any work base at which tasks are allocated; or

Any place attended regularly to perform duties of employment but is not a temporary workplace.

Subsistence

HMRC define subsistence as “the reasonable and necessary cost of a meal/snack incurred by an employee whilst undertaking allowable business travel. The travel must occupy the whole or a substantial part of the working day encompassing the normal meal breaks.”

Obviously this definition is subject to some interpretation, However you should be happy that you could explain to HMRC how the subsistence claims you have made fall within this definition. There is a risk that HMRC could try to reclassify these as staff entertainment which would be taxable of the employees.

The above is general information only. If you are in any doubt about whether you or your employees may be taxable on any of the travel expenses paid by your company, then please contact us regarding specific advice.

Sign up to our Newsletter

Signup for our newsletter to get notified about news and updates.

- 0191 281 1292

- All Agricultural Journals M&A Technology Sector Snapshot Careers Human Capital Report Financial Journals Wealth Management Budget Factsheets Corporate Finance Business Tax Personal Tax Accounts and Business Services Audit and Assurance Search for:

Clear advice, Creative thinking

- Accounts and Business Services

- Audit and Assurance

- Business Tax

- Corporate Finance

- Outsourced | FD

- Personal Tax

- Wealth Management

- Agriculture and Landed Estates

- FCA Regulated Businesses

- Infrastructure and Renewables

- Legal Sector

- Manufacturing

- Professional Services

- Property Investment

- Public Sector & Not for Profit

- Recruitment, Training and Skills

- Trusts & Estates

- Testimonials

- Agricultural Journals

- Financial Journals

- Tax Card 2024/25

Travel and Subsistence for Directors and Employees

Travel and subsistence expenditure incurred by or on behalf of employees gives rise to many problems.

We highlight below the main areas to consider in deciding whether tax relief is available on travel and subsistence.

Employees with a Permanent Workplace

Many employees have a place of work which they regularly attend and make occasional trips out of the normal workplace to a temporary workplace. Often an employee will travel directly from home to a temporary workplace and vice versa.

An employee can claim full tax relief on business journeys made.

Business journey

A business journey is one which either involves travel:

- from one place of work to another or

- from home to a temporary workplace or

- to home from a temporary workplace.

Journeys between an employee’s home and a place of work which he or she regularly attends are not business journeys. These journeys are ‘ordinary commuting’ and the costs of these have to be borne by the employee. The term ‘permanent workplace’ is defined as a place which the employee ‘regularly’ attends. It is used in order to fix one end of the journey for ordinary commuting. Home is the normal other end of the journey for ordinary commuting.

Subsistence payments

Subsistence includes accommodation and food and drink costs whilst an employee is away from the permanent workplace. Subsistence expenditure is specifically treated as a product of business travel and is therefore treated as part of the cost of that travel.

Anti-avoidance

Some travel between a temporary workplace and home may not qualify for relief if the trip made is ‘substantially similar’ to the trip made to or from the permanent workplace.

‘Substantially similar’ is interpreted by HMRC as a trip using the same roads or the same train or bus for most of the journey.

Temporary postings

Where an employee is sent away from his permanent workplace for many months, the new workplace will still be regarded as a temporary workplace if the posting is either:

- expected to be for less than 24 months, or

- if it is expected to be for more than 24 months, the employee is expected to spend less than 40% of his working time at the new workplace.

The employee must still retain his permanent workplace.

Site-based Employees

Some employees do not have a normal place of work but work at a succession of places for several days, weeks or months. Examples of site-based employees include construction workers, safety inspectors, computer consultants and relief workers.

A site-based employee’s travel and subsistence can be reimbursed tax free if the period spent at the site is expected to be, and actually is, less than two years.

There are anti-avoidance provisions to ensure that the employment is genuinely site-based if relief is to be given. For example, temporary appointments may be excluded from relief where duties are performed at that workplace for all or almost all of that period of employment. This is aimed particularly at preventing manipulation of the 24 month limit through recurring temporary appointments.

Other Employees with no Permanent Workplace

Travelling appointments.

For some employees, travelling is an integral part of their job. For example, a travelling salesman who does not have a base at which he works, or where he is regularly required to report. Travel and subsistence expenses incurred by such an employee are deductible.

Home based employees

Some employees work at home occasionally, or even regularly. This does not necessarily mean that their home can be regarded as a place of work. There must be an objective requirement for the work to be performed at home rather than elsewhere.

This may mean that another place becomes the permanent workplace for example, an office where the employee ‘regularly attends’. Therefore any commuting cost between home and the office would not be an allowable expense. But trips between home and temporary workplaces will be allowed.

If there is no permanent workplace then the employee is treated as a site-based employee. Thus all costs would be allowed including the occasional trip to the employer’s office.

The home may still be treated as a workplace under the objective test above. If so, trips between home and any other workplace in respect of the same employment will be allowable.

How we can help

Full tax relief can be given for travel and subsistence costs but there are borderline situations.

We can help you to decide whether an employee can be paid expense payments which are covered by tax relief and do not result in a taxable benefit.

Please note that if you do make payments for which tax relief is not available, there may be PAYE compliance problems if the payments are made free of tax.

Please contact us if you require advice whether payments can be made to employees tax free.

Related Items

Pensions Automatic Enrolment

Capital Allowances

National Insurance

Pension Tax Reliefs

Micro Entity Accounting

Franchising

Money Laundering and the Proceeds of Crime

Construction Industry Scheme

Username or email address *

Password *

Remember me Log in

Lost your password?

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 511, Business travel expenses

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

You're traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day's work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you normally need to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time you spend at each location.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite. Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but aren't limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

- The airport or train station and your hotel,

- The hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Shipping of baggage, and sample or display material between your regular and temporary work locations.

- Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls while on your business trip. (This includes business communications by fax machine or other communication devices.)

- Tips you pay for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, public stenographer's fees, computer rental fees, and operating and maintaining a house trailer.)

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming .

If you're a member of the National Guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040 , Form 1040-SR , or Form 1040-NR as an adjustment to income.

Good records are essential. Refer to Topic no. 305 for information on recordkeeping. For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses .

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The complete guide to corporate travel policies

How to write a travel & expense reimbursement policy for nonprofits.

?)

Start writing your own corporate travel policy with our comprehensive template

What are common non-profit travel expenses.

- Dining costs

- Per diem allowance

- Accommodation costs

- Miscellaneous businesses expenses (for example, tips to bellhops)

- Travel expenses (airfare, train ticket, ground transportation)

- Cost of organizing events (workshops, seminars, fundraisers, host fees)

Learn how to write a comprehensive business travel policy with our ebook.

Nonprofit travel expense reports and itemized receipts.

- Expenses reimbursed are towards nonprofit business purposes

- Excess reimbursements are returned within a reasonable period of time

- Expenses are recorded and accounted for within a reasonable period of time

- Location of travel expenses

- Employees involved during the expense

- The business purpose of such expenses

- Exact dates when expenses were incurred

Nonprofit reimbursements as taxable wages

- Include payments on the employee’s IRS Form W-2

- Withhold income taxes and share of Social Security and Medicare taxes from the payments

- Must pay 7.65% share of an employee's Social Security and Medicare taxes on the payments

- Deduct expenses as miscellaneous itemized deductions

- Report travel reimbursements as taxable income on tax returns

Nonprofit travel expense receipt exemption

- Non-lodging costs below $75

- A transport expense receipt that isn’t readily available

- Adoption of a per diem allowance method for out-of-town travel

Mileage reimbursement for nonprofit travel

- 56 cents per mile for business purposes

- 14 cents per mile for charitable organizations

- Cost of gas

- Lease payments

- Repair-related cost

- Cost of tire changes

- Insurance and registration fees

- Destination

- Date(s) of travel

- Purpose of visit

- Fuel cost receipt

- No. of miles driven

- Repair-related cost receipt

Nonprofit travel advances

Best practices for nonprofit travel policy.

- Timeline for submitting expenses

- Budget management audit processes

- Reimbursement rates for different items

- Steps to make a reimbursement request

- Estimate time for reimbursement approval

- Preferred travel agencies for airline or hotel reservations

How to improve travel policy compliance with Travelperk

Wrapping up.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

What Expenses Can I Claim as a Company Director?

Company directors are entitled to claim certain expenses. This is the case whether you’re the sole director of a limited company, or the managing director of a small business.

In this post we’ll outline some of the expenses you can claim as a company director, along with any limits.

Please note that you should pay for all business expenses from a business bank account . Keep all of your personal expenses separate through paying for them from your personal account.

Be sure to check out our guide to allowable expenses for the self-employed , too.

Allowable Expenses For a Limited Company Director

Director salary.

Your salary as a limited company director is an allowable expense, and so too are your National Insurance contributions.

It’s up to you to decide how much your business pays you. Just make sure that the arrangement you decide on is in line with IR35 regulations. You can read our essential introduction to IR35 .

You can also claim up to 100% tax relief on any contributions you make to your pension scheme – whether it’s for you, as a director, or for your employees.

Business Premises

If you rent external office space, your business can cover the cost of the rent, your utility bill payments, and any other associated expenses.

If you work from a home office, you can either claim:

- Basic allowance – Up to £26 a month if you work at least 25 hours per month from home.

- Apportioned cost – You can claim money back from your business to spend on household bills if you work one day a week from your home office. For this, you’ll have to calculate how much of your bills can be attributed to business use – whether that’s rent, mortgage payments, and utilities. You may ultimately have to provide HMRC with evidence to support your apportioned cost claim. Read our full guide to running a business from home .

Professional Services and Business Expenses

Your business can cover the costs of numerous professional services, including:

- Accounting and bookkeeping.

- Legal costs associated with starting a business.

- Marketing and advertising.

- Website design and hosting.

- Clothing and laundry bills (provided your work requires a protective uniform).

- Telephone and broadband costs.

You can also claim tax relief on some of these services. But check with HMRC for more information about which service costs are allowable expenses.

Other Tax Deductible Expenses

Certain other expenses can be tax-deductible, including:

- Entertainment – though you can’t claim tax relief for the costs of entertaining clients, you can do so for entertaining staff. This only applies to events that you hold every year, which are open to every employee, and which do not cost any more than £150 per head.

- Postage, stationery, and office supplies.

- Employee training and development – so long as the training’s relevant to their current role.

- “Trivial benefits” for employees. Read our full guide to what counts as a trivial benefit .

- Charity donations. Find out what ty pes of donations are tax deductible for limited company directors .

When it comes to cars, there are different rules for allowable expenses depending on whether you’re driving a personal vehicle, or a company-owned vehicle.

You can sometimes claim tax relief for the fuel costs associated driving for work. However, the tax relief is usually only available if you’re travelling “on the job” rather than “to the job”. So you can claim relief if you’re travelling in the performance of your duties, but not for your standard commute.

It’s also possible to apply for tax relief if you purchase a car directly through the business – though you will have to pay tax if you drive this car for private use.

For more details of allowable expenses, limits, and exceptions, check the latest HMRC guidance here .

Other Travel Expenses

Your business can cover the costs of travelling by rail or plane to see a client and HMRC won’t consider it a taxable benefit. HMRC also doesn’t consider hotel accommodation as a taxable benefit if it’s covered by your business – but only if the hotel stay was for business purposes.

You can also apply for tax relief on parking fees and road tolls, while your business can cover the cost of food purchased during business trips.

You can get full tax relief for some forms of insurance. Examples include:

- Public liability insurance.

- Professional indemnity insurance.

- Contents insurance.

- Employer’s liability insurance.

Business insurance provides an essential safety net that will help you keep your company afloat when you’re faced with unexpected situations. Read our full guide to why you need business insurance .

We specialise in providing insurance to small businesses, start-ups and the self-employed. We tailor insurance to meet your needs and protect the specific risks you face as a limited company director.

If you have any questions or would like to discuss your options, please contact our Tapoly team at [email protected], call our helpline on +44(0)207 846 0108 or try our chat on our website.

- AMCA Connect / Members Login

- Middle East

AMCA Board of Directors Travel Reimbursement Policies

AMCA is a not-for-profit organization.AMCA’s policy is to reimburse directors for all ordinary and necessary expenses they incur in connection with their AMCA Board service in accordance to this policy.This Board of Directors’ Travel and Expense Reimbursement Policy addresses how and when members of the Board of Directors (“Directors”) are reimbursed for travel and other expenses related to AMCA business and meetings.

This Policy applies to Directors. This Policy addresses Director business travel and expense reimbursement for only the winter and summer Board meetings.

3. Meetings

Currently, AMCA has three Board meeting per year (winter, summer and the Annual meeting). The Directors are expected to participate in all three meetings. The Board meeting associated with the Annual meeting is not covered under this Director’s reimbursement policy.

4. Reimbursement

AMCA will pay a Director for approved out-of-pocket travel expenses for only the winter and summer board meetings (not the Board meeting associated with the Annual Meeting), including:

- Coach and Business class.

- Expense capped at $7,500.

- Domestic travel – not reimbursed.

- Arrive the day before the first business meeting.

- Depart the day after the last business meeting.

- Executive Committee (if attending this meeting) – 3 nights total

- Non-executive Committee – 2 nights total

- For the duration of the meeting, AMCA will cover all reasonable hotel expenses (i.e. WiFi).

- AMCA will reimburse up to 2 bags per leg/trip

- Home to/from airport

- Airport to/from AMCA meeting site (hotel)

- Car Rental during specific meeting dates

5. Expense Reports:

Expenses should be submitted promptly after the activity occurred. The U.S. IRS requires:

- All expenses must be submitted within 60 days of occurrence.

- All receipts are to be attached for each reimbursable expense.

6. Examples of expenses not covered

The following expenses are presumed not to be reasonable or necessary. These expenses are not eligible for reimbursement unless the Board decides to reimburse:

- Child care.

- Non-sponsored activities (i.e. golfing, horseback riding, etc ).

- Fitness center, including massages and saunas.

- In-room movies and mini-bar charges.

- Life insurance, flight insurance, personal automobile insurance, and baggage insurance.

- Loss/theft of cash, airline tickets, personal funds, or property.

- Lost baggage or excess baggage charge for personal items.

- "No-show" charges or penalties for flights, hotel, and car service if incurred due to non-business-related changes in schedules.

- Parking or traffic fines, personal automobile repairs.

- The personal travel portion of a business trip.

- Tips or service gratuities in excess of 20%.

- Discretionary upgrades (air, hotel, car, etc.)

- Energy Efficiency

- High-Performance Air Systems

- Fire & Life Safety

- Certified Product Search

- Listed Product Search

- Certification Checklists

- CRP Violations

- Seals & Labels

- Suspended Products

- Articles & Technical Papers

- Publications & Standards

- Videos & Presentations

- Online Training

- AMCA inmotion Magazine

- AMCA Outreach Activities

- Meetings & Events

- Board Of Directors & Staff

- Privacy Policy

- AMCA Strategic Plan

- AMCA Mission Statement

- Become A Member

- Find Members

- Member Sign-in

Air Movement and Control Association International, Inc.

- Tax Planning

- Making Tax Digital

- Business Planning

- Exit Strategy

- Software Support

- Tax Investigation

- Management Buyout

- Finance News

- About The Team

- Client Area Login

- Client Area FAQs

Board meeting travel expenses - tax deductible?

One of your company’s directors has to make a round trip of nearly 300 miles to attend a board meeting. What’s the tax and NI position if the company pays for or reimburses the director for their travel expenses?

Travel expenses tax treatment

Payment or reimbursement of the directors’ travel expenses (including subsistence and accommodation costs) for attending a board meeting may or may not be taxable dependent on a number of variables. It’s even possible that payments to one director are taxable while to the others they aren’t.

Directorship equals employment

For tax purposes directors count as employees. This is largely true for NI purposes too. This means that a director’s travel expenses are exempt if either of the following conditions apply. The journey is:

- made in the course of doing their job, e.g. a sales director whose role involves visiting customers etc.; or

- for a temporary purpose required by their job, e.g. a director of a building firm visiting a site to carry out a survey.

- Board meetings are part of a director’s job. The first condition for tax and NI exemption won’t apply but the second might. However, there’s a major hurdle to clear first.

Trap. If the travel is “ordinary commuting” the above rules don’t apply and therefore payment or reimbursement of travel expenses is taxable and liable to NI, usually as a benefit in kind.

What is ordinary commuting?

Ordinary commuting is travel between your home and your “permanent place of work”. In typical HMRC style it defines this as a place which is not a temporary workplace. That’s not very helpful, but to be fair it goes on to define a temporary workplace as “somewhere the employee goes only to perform a task of limited duration or for a temporary purpose.” So attending a place day-to-day to carry out the duties of your job makes it your permanent workplace. Thus a director who normally works at the head office will be commuting if they attend a board meeting there even if they make a special trip out of normal hours to attend. Therefore, if the company pays their travel costs it is a taxable benefit in kind.

Working from home

In our subscriber’s query two of the directors work from home, which means that is their permanent workplace. They rarely visit head office and only then for a temporary purpose, e.g. to attend a board meeting. The second of the conditions mentioned above therefore applies to those journeys and payment/reimbursement of the travel expenses is exempt.

Tip. Even if the head office was also a regular workplace for one of the homeworking directors, travel between their home and head office is tax and NI exempt.

A movable feast

To prevent the directors who work from home always having to travel for board meetings, our subscriber could arrange for some to be held near where they live, say at a nearby hotel. In that case the travel etc. expenses for the other directors could be paid tax and NI free because the second condition for the exemption would apply to them.

This article has been reproduced by kind permission of Indicator – FL Memo Ltd. For details of their tax-saving products please visit www.indicator-flm.co.uk or call 01233 653500.

Privacy Preference Center

Privacy preferences.

Understanding travel expenses

While volunteer board members may not expect to be rewarded for their services, the absence of any remuneration can leave them unduly out of pocket.

Observers of not-for-profit (NFP) boards will have noticed a renewed focus recently on skills diversity. Many NFP boards have set out to attract not only industry professionals but also legal, tax and media specialists to assist them in achieving their aims while minimising risk.

Historically, it was more difficult for boards to attract and retain qualified board members. Now, however, as more industry and technical professionals seek to give something back to their communities, more are signing up to join NFP boards, usually on a voluntary basis.

While board members may not expect to receive payment for their services, the absence of reimbursement for incidental expenses can leave board members unduly out of pocket. It is crucial to find a balance between recognising and compensating volunteers for the costs they incur in providing their services, and minimising costs to the NFP.

For example, directors may incur travel expenses in carrying out their duties, including transport, accommodation, meals and incidentals. Where an NFP reimburses or pays a travel allowance, fringe benefits tax (FBT) may apply, depending on whether the director is considered an employee under the FBT rules. Paid directors are generally subject to FBT, whereas benefits provided to volunteers are generally outside the FBT regime.

The following considers an NFP covering travel expenses as an example of how an NFP may effectively compensate volunteer directors for out-of-pocket expenses.

Travel expenses

With some consideration and planning, NFPs may be able to effectively structure the engagement of their directors to compensate the directors for costs incurred without giving rise to additional FBT, or to enable the director to claim an income tax deduction for costs incurred.

Non-deductible travel expenses

With both Treasury and the Australian Taxation Office (ATO) focused on work-related deductions, NFPs should be mindful of the proposed changes and commentary in structuring director agreements. The ATO's Draft Taxation Ruling (TR) 2017/D6 provides guidance on when an employee's travel expenses are deductible. The Draft Ruling is intended to supersede and clarify a number of historical positions adopted by the ATO regarding deductible travel.

Generally, a tax deduction is available for work-related travel expenses, including air fares, accommodation, meals and other incidentals. The Draft Ruling specifies there are four categories of travel:

- Ordinary home to work travel

- Remoteness of the work location

- Requirement to move continually between work locations

- Requirement to work away from home for an extended period

- Co-existing work location travel (working in more than one location)

- Relocation travel (relocating from a usual place of residence to undertake work duties).

Directors may only claim an income tax deduction where travel is because of special demands or in respect of multiple work locations.

A Melbourne-based director flies to and from Sydney to attend board meetings and a charity's annual gala event. If the director volunteers their time and services and receives no compensation for the travel costs incurred, no personal tax deduction may be available.

The ATO will not allow a deduction for the travel expenses where the reason for travel is merely home to work or vice versa. There is no deduction for travel expenses incurred because a taxpayer decides to live away from where their work duties are required to be carried out. Further, because the director volunteers their time and services, a deduction may also be denied because there is no nexus between the costs incurred by the director and any income-producing activities.

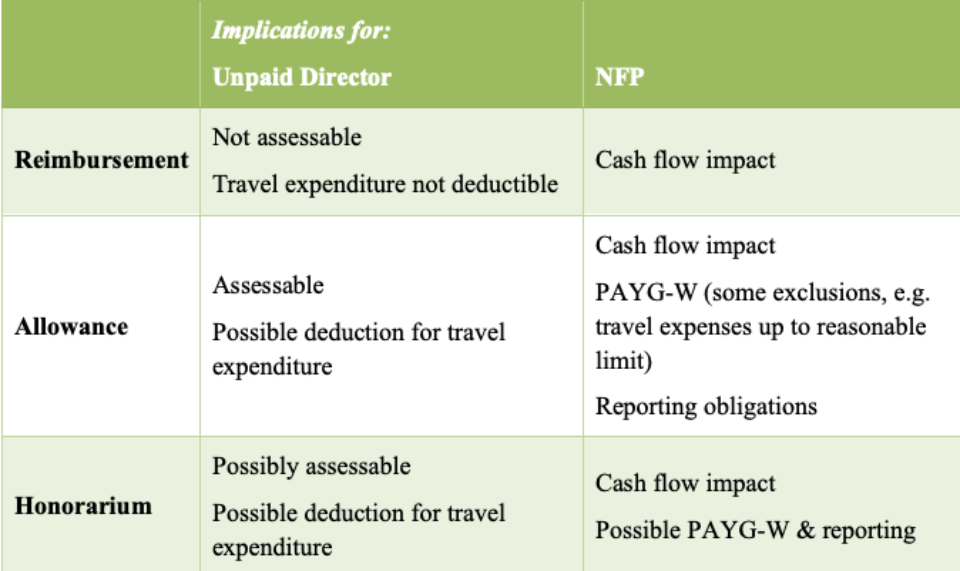

Options for NFPs

Subject to the terms of the NFP constitution or establishment documentation, the method of compensating directors for travel expenditure in light of deductibility considerations may take different forms, including reimbursements, allowances or honorariums.

Each of these is considered further below.

1. Reimbursements

The NFP may choose to make selective or proportionate reimbursement of expenses incurred by the director. Reimbursements are provided for actual expenditure only.

2. Allowances

An allowance for expenses expected to be incurred by the director may be paid by the NFP irrespective of the actual expenses incurred.