Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Great Britain Tourism Survey (GBTS) 2021/2022/Q1 2023 report

This publication will provide the volume and value of domestic overnight tourism trips taken by residents in Great Britain to England and Great Britain during 2021, 2022 and Q1 2023

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

GOV.WALES uses cookies which are essential for the site to work. Non-essential cookies are also used to tailor and improve services. By continuing to use this site, you agree to our use of cookies.

Domestic GB tourism statistics (overnight trips in Wales): April to December 2021 (revised)

Data on overnight trips and day visits by British residents to destinations throughout Britain for 2021.

This file may not be fully accessible.

In this page

Introduction.

This is a revised release of the main estimates for the volume and value of domestic overnight tourism trips taken by British residents in Wales and Great Britain in 2021. The statistics published in this release cover the period from the start of April to the end of December 2021. Data is not available for January to March 2021, due to coronavirus (COVID-19) restrictions on travel during this period.

This release provides revised estimates for all reported measures including the estimates of the volume and value of overnight trips taken in Wales and Great Britain. Two separate revisions have been made to the survey data. The first revision is designed to manage the impact of individual reported trips that were identified as having a disproportionate impact on the overall estimates of trip volumes and expenditure. The second revision involves a recalibration of the volume and value estimates for the period from April 2021 to April 2022, due to a change in survey questions implemented in May 2022. Analysis showed that the change led to a substantial and unexpected reduction in trip volumes reported from May 2022 onwards. The effect of these revisions has been to reduce the monthly and total estimates for trip volume and expenditure reported in this publication for the period from April 2021 to December 2021, to make them comparable with estimates reported from May 2022 onwards. Where data in a table or chart has been revised, this is noted in the title of the table or chart.

Further information on these revisions is provided in the revised GBTS Background Quality Report 2021 .

This report includes estimates for the main purpose of overnight trips; holidays, visits to friends and relatives (VFR) and business trips, with the definitions for each of these provided in the relevant section of this report.

The report includes estimates and details of overnight trips taken in Wales, and in Great Britain for comparative purposes. Detailed results for England and Scotland are being published by VisitEngland and VisitScotland .

These statistics are used to monitor domestic tourism demand and measure the contribution and impact of domestic tourism on the visitor economy. A key purpose of these statistics is to uncover insights into market trends over time. Changes in survey methodology introduced in 2021, together with the interruption in data collection due to COVID-19, mean that results published in this release are not directly comparable with data published for 2019 and previous years. Please refer to the section on comparability and coherence .

The statistics are labelled as ‘experimental’ to enable testing and further modification to meet user needs. Further information on this is available on the Office for National Statistics website . We are keen to check that the new tourism statistics meet user needs and invite you to provide feedback on the information in this output at [email protected] .

Main points

Wales trips.

- Between April and December 2021, Great Britain (GB) residents took 6.21 million overnight trips in Wales with 22.67 million nights and £1,231 million spent during these trips.

- 50% of overnight trips taken in Wales were holidays, 29% were visits to friends and relatives and 5% were for business purposes.

- Approximately 7% of all GB trips included an overnight stay in Wales, whilst the share of total GB nights was also 7% and the share of spend lower at 6%.

- There was a gradual increase in overnight trips taken in Wales from April 2021 onwards with a peak volume of 1.07 million trips taken in August.

- The average duration of Wales trips during the reporting period was 3.7 nights with an average spend of £198 per trip.

Great Britain trips

- Between April and December 2021, Great Britain residents took 86.2 million overnight trips in Great Britain with 302.6 million nights and £19.85 billion spent during these trips.

- 38% of overnight trips taken in GB during this period were holidays, 37% were visits to friends and relatives (VFR) and 6% were for business purposes.

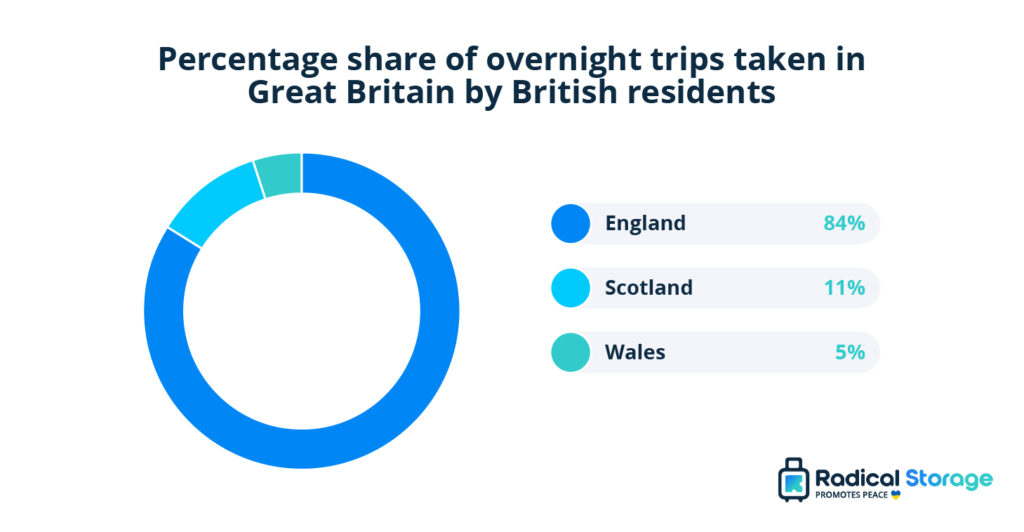

- 85% of trips taken in GB included an overnight stay in England, 11% included an overnight stay in Scotland and 7% included an overnight stay in Wales.

- There was a gradual increase in overnight trips taken in GB from April 2021 onwards with a peak volume of 14.3 million trips taken in September.

- The average duration of GB trips during the reporting period was 3.5 nights with an average spend of £230 per trip.

Trips, nights and spend to GB nations, 2021

Source: Great Britain Tourism Survey (GBTS), April to December 2021

[Note 1] Percentages do not sum to 100% as some trips included visits to more than one nation.

In the period from the start of April to the end of December 2021, there were 86.2 million overnight trips taken in GB by British residents with a total of 302.6 million nights and a total expenditure of £19.85 billion. During the same period there were 6.21 million overnight trips taken in Wales with a total of 22.67 million nights and a total expenditure of £1.23 billion. Approximately 7% of all domestic overnight trips by British residents were taken in Wales, compared to 85% taken in England and 11% taken in Scotland. The share of total GB nights taken in Wales was 7%, but the share of spend was lower at 6% due to a lower average spend on trips taken in Wales.

[Note 1] Low base size for business trips to Wales, data should be treated with caution.

Figure 1: Proportion of trips, nights and spend in Wales by main purpose of trip (April to December 2021, revised) [Note 1]

Description of Figure 1: A stacked bar chart that shows holidays accounted for the majority of trips, nights and spending from GB residents who took trips to Wales.

[Note 1] Percentages for Wales nights do not sum to 100% due to a rounding issue.

Holiday trips made up the largest proportion of overnight trips taken in Wales between April to December 2021. This was followed by trips to visit friends and relatives (VFR). Business trips made up the lowest proportion of overnight trips to Wales and for GB as a whole. Trips for ‘miscellaneous’ purposes include a wide range of trips (see section on definitions ), but the largest volume of miscellaneous trips taken in Wales were those being taken overseas that included an overnight stay in Wales, trips for a personal event and trips for a public event. A higher proportion of trips taken in Wales between April and December 2021 were for holidays (50%), compared to GB as a whole (38%). Trips taken in GB were more likely to be for VFR (37%) compared to Wales (29%) and business trips taken in GB made up a higher proportion of total trips taken in GB (6%) compared to Wales (5%).

Characteristics of GB and Wales trips

The average number of nights per trip to Wales (3.7) was slightly higher than for GB as a whole (3.5) due to a higher proportion of holiday trips in Wales and a longer average length of holidays taken in Wales (4.2) compared to GB as a whole (3.9). The average length of VFR trips taken in Wales and GB were similar.

Despite the longer average trip lengths in Wales, the average expenditure on trips taken in Wales is lower than GB with an average spend per trip of £198 and an average spend per night of £54. There is a lower average spend on trips taken in Wales for all trip purposes. The average spend per night on overnight business trips (£61) and holidays (£58) in Wales is notably higher than visits to friends and relatives (£34).

Figure 2: Volume and proportion of trips taken in Great Britain and Wales by main location visited (April to December 2021, revised) [Note 1]

Description of Figure 2: A stacked column chart showing trips to large cities/large towns made up the largest proportion of GB trips, while in Wales there was a more even spread of trips to different types of location.

[Note 1] The numbers within the coloured segments are the number of trips taken to each main location in millions. For instance, from April to December 2021, there were 1.53 million tourism day trips to a countryside/village location taken in Wales.

There was an even spread of trips to different types of location across Wales. A much higher proportion of trips taken in Wales were to the seaside and coastal areas compared to GB as a whole. In contrast, a much lower proportion of trips to Wales were taken to large city and towns. This reflects the higher proportion of holiday trips taken in Wales, as well as more rural and coastal destinations in Wales.

Figure 3: Volume and proportion of trips and spend where a region of Wales is main place of visit (April to December 2021, revised) [Note 1] [Note 2]

Description of Figure 3: A stacked column chart showing that of the Welsh regions, North Wales received the most trips and the highest spending from GB residents.

[Note 1] Low base sizes for some regions – data should be treated with caution.

[Note 2] The numbers within the coloured segments are the number of trips taken in Wales in millions, and the amount spent on trips taken in Wales in millions of pounds, for each region of Wales. For instance, from April to December 2021, there were 1.26 million tourism day trips to South West Wales.

North Wales was the most visited region in 2021. It was the main destination for 29% of trips taken. This compares to South East Wales, the main destination for 24% of trips taken in Wales. South West Wales was the main destination for 20% of trips, and Mid Wales was the main destination for 11% of trips taken in Wales. The remaining trips in Wales were to various destinations where the main place visited was outside of Wales.

Figure 4: Volume and proportion of trips taken in Great Britain and Wales by main type of accommodation used (April to December 2021, revised) [Note 1]

Description of Figure 4: A stacked bar chart showing that serviced accommodation was the most commonly used type of accommodation for GB residents taking trips in GB and in Wales.

[Note 1] The numbers within the coloured segments are the number of trips taken in Wales and in Great Britain in millions, where a certain type of accommodation was used as the main type of accommodation. For instance, from April to December 2021, serviced accommodation was the main type of accommodation used on 2.04 million trips to Wales.

Trips to Wales in April to December 2021 were most likely to be in serviced accommodation or caravan/camping/glamping although a private home (including the home of friends/relatives and second homes) was used in a substantial number of trips. Compared to GB, visitors staying in Wales were more likely to stay in caravan and camping accommodation, but there was lower use of serviced accommodation and private homes.

Profile of visitors taking trips to Wales

[Note 1] Low base size for Scotland, data should be treated with caution.

GB residents living outside of Wales generated three quarters of all overnight trips taken in Wales, with residents of England generating the most trips and expenditure. Residents of Wales generated 1 in 4 trips taken in Wales in 2021.

Figure 5: Volume and proportion of trips taken in Great Britain and Wales by age group (April to December 2021, revised) [Note 1]

Description of Figure 5: A stacked column chart showing trip-takers aged 25-34 years were the largest age group of visitors to Wales, while among visitors to GB, those aged 55 or older were the largest age group of trip-takers.

[Note 1] The numbers within the coloured segments are the number of trips taken by each age group in millions. For instance, from April to December 2021, visitors aged 45 to 54 took 1.01 million trips to Wales.

Trips to Wales were spread across different age groups, but those in the age range 25 to 34 years old generated the highest volume of trips taken in Wales. Visitors from the age group 55 years or older made up a higher proportion of visitors to GB than to Wales. Wales visitors had a slightly larger average travel party size of 3.1 visitors compared to 2.8 visitors for GB, and 37% of trips taken in Wales included children in the travel party compared to 34% in GB as a whole.

Figure 6: Volume of trips in millions in Great Britain by month of visit (April to December 2021, revised)

Description of Figure 6: A column chart showing the volume of domestic trips taken in GB increased from April to September, decreased from September to November, and then increased again in December.

There was a gradual increase in domestic overnight trips taken in Great Britain from April 2021 onwards with trips peaking in September, which recorded the highest level of holiday trips. Trips were lower in October and November, but increased again in December, which recorded the highest monthly volume of visits to friends and relatives.

[Note 1] Low base sizes for April, May and November, data should be treated with caution.

There was a gradual increase in domestic overnight trips taken in Great Britain from April 2021 onwards with trips peaking in September, which recorded the highest level of holiday trips. Trips were lower in October and November but increased again in December which recorded the highest monthly volume of visits to friends and relatives.

Figure 7: Volume of trips to Wales in millions by month of visit (April to December 2021, revised)

Description of Figure 7: A column chart showing that the volume of domestic trips taken to Wales increased from April to August, decreased from August to November, and then increased again in December.

Similar to the pattern across GB, there was a gradual increase in domestic overnight trips taken in Wales from April onwards, but trips peaked in August, which recorded the highest monthly volume of holiday trips. Similar to GB as a whole, the volume of trips taken in Wales was lower in the October and November but increased in December, which recorded the highest monthly volume of visits to friends and relatives.

Quality and methodology information

Definitions.

To qualify as an eligible GB Domestic Overnight Trip the following criteria must be met:

- The trip involved a stay of at least one night in one or more of the GB nations; England, Scotland or Wales.

- The trip is not taken on a frequent basis (less often than once a week).

- For GB Domestic Overnight Holiday Trips; the main purpose of the trip was for holiday, pleasure or leisure.

- For GB Domestic Overnight VFR Trips; the main purpose of the trip was for visiting friends and relatives, including VFR trips that were combined with a holiday.

- For GB Domestic Overnight Business Trips; the main purpose of the trip was for business.

- For GB Domestic Overnight Miscellaneous/Other Trips; the main purpose of the trip was for another type of trip taken not covered by the above classifications including personal events, public events, or for study, medical, religious purposes, or any overnight stay in GB as part of an overseas trip.

Other definitions used in this publication

An estimate of what the grossed-up number of overnight trips undertaken by the population would be if the survey sample is representative of the whole GB population. The reported volume of trips is an estimate of trips by individuals, so that a travel party of two people would count as two individual trips.

An estimate of what the total expenditure relating to the volume of overnight visits undertaken by the population would be if the survey sample is representative of the whole GB population.

An estimate of what the grossed-up number of nights spent on overnight trips undertaken by the population would be if the survey sample is representative of the whole GB population.

These definitions and the associated qualifying criteria have been revised as part of the new combined GBTS/GBDVS survey to align with agreed international standards. These changes impact the comparability of the published domestic overnight tourism estimates for 2021 with 2019 and previous years.

Methodology

In 2019, Visit Wales, VisitScotland and VisitEngland, undertook a review of the requirements and methods for producing the official GB domestic tourist statistics, to future-proof the data collection methods, whilst maintaining the reliability and robustness of the information reported. As a result, substantial changes were introduced as part of a new combined online survey collecting data on both domestic overnight trips as well as domestic day trips. This represents a fundamental change in the way data is collected for overnight visits including moving from the previous in-home face to face survey method to a new combined online survey covering both domestic overnight trips and day trips.

The sample for the new combined online survey is a non-probability-based design sourced from 4 ESOMAR accredited online panel providers and includes quotas for key demographic variables to make the overall sample as representative as possible of GB population. The target annual sample size for the survey of overnight visitors is 60,000 completed interviews. Fieldwork for the new survey started in England and Wales in April 2021 and the number of interviews achieved for the period April to December 2021 is 47,008 interviews for GB residents including 6,840 interviews with Welsh residents. Not every person who is interviewed will have taken an eligible overnight trip and so the base sizes used for trip estimation are lower than the number of interviews. Base sizes are published in the GBTS Background Quality Report 2021 .

As part of the survey changes, a revised weighting scheme has been introduced to improve efficiency, whilst making the results as representative as possible of the GB population. However, the use of a non-probability online sample limits the extent to which the survey responses are truly representative of the full GB population, a limitation of similar online sample surveys. The new weighting scheme uses the National Statistics Socio-economic Classification (NS-SEC) mapped to approximate social grade for population statistics, for the purpose of quotas and weighting to the GB population. The change to using NS-SEC as the population statistics source will impact the estimation and reporting of trips compared to the previous reporting of social grade used for GBTS in 2019 and previous years. We are planning to introduce a new question in the survey during 2023 that captures household income that will be used to analyse and report on trips taken by different household income bands from 2023 onwards.

Further details of the changes to survey method, sample design, estimation approaches and the effects of applied caps and recalibration are available in the ‘ GBTS Background Quality Report 2021 ’.

Comparability and coherence

Statistics for domestic overnight tourism have been collected in a broadly similar way since 1989. However, the changes in survey methodology introduced in 2021, together with the interruption in data collection due to COVID-19, means that results published from April 2021 onwards are not directly comparable with data published for 2019 and previous years.

As part of the survey, respondents are asked about any overnight trips they have taken in the 4 full weeks prior to their date of interview (reference period). Trip and expenditure estimates are reported for individual calendar months as well as for quarterly and annual periods. As the interview reference periods do not exactly correspond with calendar months an adjustment is made using a ‘seasonal smoothing factor’ to improve monthly comparisons within and between years. The monthly estimates are subject to limitations on sample size and seasonal fluctuations in trip taking across the year. The monthly pattern of visits in 2021 will have also been influenced by any COVID-19 restrictions in place limiting travel at different times of the year. Users are advised to be aware of these limitations when making month on month comparisons.

The statistics produced from the Great Britain Tourism Survey in 2019 and previous years have been designated as official statistics, which provides reassurance to users that the statistics are produced to the very highest professional standards of trustworthiness, quality and value, set out in the Code of Practice for Statistics (Office for National Statistics) . Due to the changes in methodology and the impact of the COVID-19 pandemic, the survey results for 2021 have been labelled as ‘experimental statistics’ (Office for National Statistics) . The new survey and statistics have undergone a comprehensive programme of quality assurance including piloting of the survey, analysis of changes to the trip definitions, testing the impact of the new weighting scheme and a review of caps and imputation rules. Changes to the survey methodology and estimation have taken account of a review and advice provided by the Methodology Advisory Service of the Office for National Statistics.

As the statistics are produced using a non-probability online survey method, they are subject to the limitations and potential sources of bias and error associated with such surveys. These include:

- coverage error: due to part of the GB population not having online access

- sampling error: using a sample to measure the behaviour of the full GB population

- sample bias: including differences between people with online access and who are online panel members compared to those who are not

- measurement error: due to respondents entering incorrect values

- non-response error: including survey refusals and drop-outs and the availability of ‘don’t know’ and ‘prefer not to say’ options

The GBTS data are weighted to correct for any imperfections in the achieved sample that might lead to bias and to rectify any differences between the sample and the target GB population. The survey uses a mix of accredited online panels to mitigate for possible panel specific biases, and the mix of panels is kept consistent over time. Demographic quotas are used to align the sample with the GB population. The survey script and data processing include bespoke checks to verify the accuracy of responses. Imputation is used to cover missing data and caps are used to minimise the impact of extreme values that are entered. Further caps were applied for this revised release, to mitigate the impact of individual trips that were identified as having a disproportionate impact upon the estimated volume of trips, bednights and spend. It is not possible to measure standard sample errors due to the non-probability sample being used, but base sizes are reported for eligible trip takers and users are advised to consider and be cautious of small base sizes, particularly for monthly data and lower-level geographies, when drawing inferences from the statistics.

Further details of quality assurance and trip base sizes are provided in the ‘ GBTS Background Quality Report 2021 ’.

These statistics are used both within and outside the Welsh Government to monitor domestic tourism demand and measure the contribution and impact of domestic tourism on the visitor economy. A key purpose of these statistics is to uncover insights into market trends over time. The estimates released for 2021 will provide insights on the impact of COVID-19 on visitor levels and provide a baseline to measure performance across subsequent years.

As far as possible, the new combined GBTS and GBDVS survey provides consistency with previous information collected, but new questions capture enhanced information on activities undertaken, booking methods and responder profiles including protected characteristics. It is envisaged that this additional information will be of value for the various users of the survey. The current questionnaire is included in the GBTS 2021 Background Quality Report.

The survey sponsors are planning to engage with the priority users of the statistics to check the new survey information meets their needs and we encourage users of the statistics to provide feedback on the data and this output at [email protected] .

Timeliness and punctuality

All outputs adhere to the Code of Practice by pre-announcing the date of publication through the upcoming calendar. Furthermore, should the need arise to postpone an output this would follow the statement on revisions, errors and postponements . We aim to publish data as soon as possible after the relevant research time period. Disruption to the new combined GBTS and GBDVS survey due to COVID-19 and comprehensive testing and quality assuring of the new statistics have resulted in the reporting of 2021 statistics to be later than normal. It is anticipated that future results for Wales will be published on a quarterly basis, to ensure estimates are supported by robust trip base sizes. Specific publication timings will be notified on the WG website, but the aim is to publish quarterly statistics for Wales approximately 9 to 10 weeks after the end of each quarter based on the 4 week survey trip taking reference period and to allow for quality assurance and reporting timescales.

Further information

A summary of changes made to the GBTS survey in 2021 compared to 2019 and previous years

GBTS Background Quality Report 2021

Estimates for domestic overnight tourism in England are available from VisitEngland

Estimates for domestic overnight tourism in Scotland are available from VisitScotland

Contact details

Statistician: David Stephens Email: [email protected]

Media: 0300 025 8099

SFR 212/2022 (R)

Share this page

- Share this page via Twitter

- Share this page via Facebook

- Share this page via Email

- radicalstorage.com

UK Tourism Statistics 2023

- Post author By Giacomo Piva

- Post date June 9, 2023

We’ve put together some of the latest UK tourism statistics using recent data and reports including market size, the number of tourists visiting the UK, and the most popular tourist attractions to visit.

Key Statistics

Uk tourism market size, how many tourists visit the uk each year, overseas visitors spending in the uk, number of nights spent in the uk, most-visited towns and cities in the uk, most-visited uk tourist attractions, outbound tourism from the uk, uk domestic tourism statistics, where do british people stay on holiday, london tourism statistics.

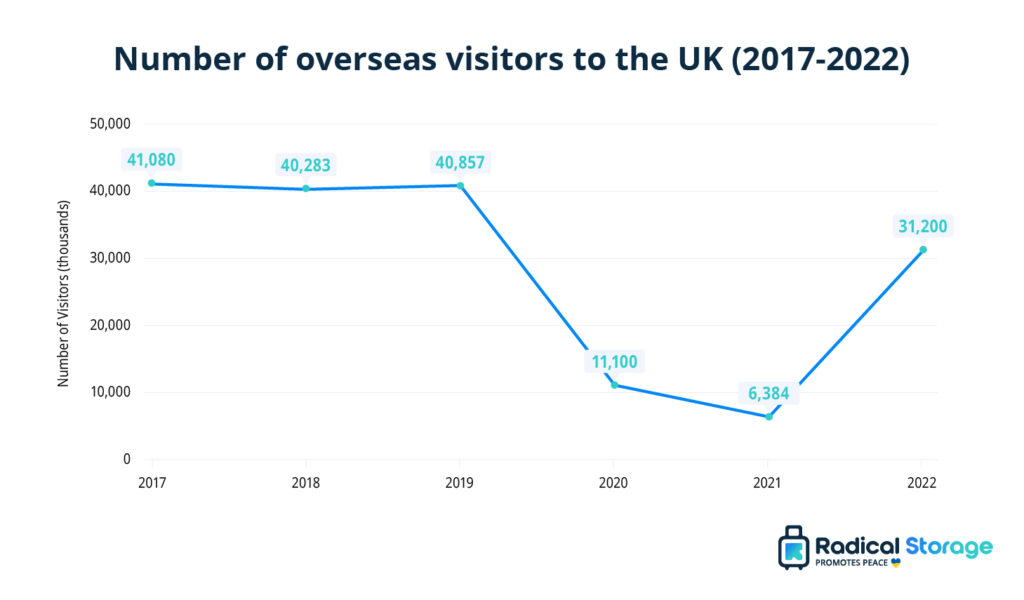

- 31.2 million people visited the UK from overseas in 2022, a 388.7% increase from 2021 as a result of travel restrictions being lifted after COVID-19.

- The UK’s travel and tourism industry is worth an estimated £31.38 billion ($39.14 billion USD) and is expected to reach £33.41 billion ($41.67 billion USD) by 2027 .

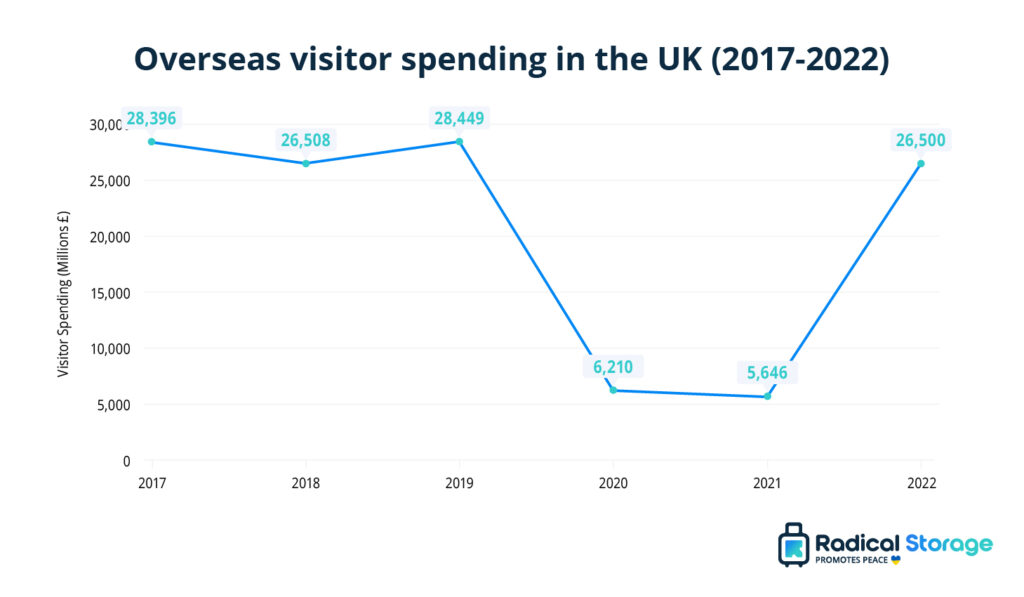

- Overseas visitors spent £26.5 billion in the UK in 2022, climbing back up to pre-pandemic levels after dropping significantly in 2020 and 2021.

- London is the most-visited city in the UK with 16.1 million overseas visitors in 2022 , followed by Edinburgh with 1.8 million visitors .

- The most-visited attraction in the UK is the Crown Estate at Windsor Great Park with 5.6 million visitors in 2022.

- Visitors from China spend the most on average in the UK with £8,779 per visit , which is approximately 10 times the average amount spent by all visitors from around the world.

- Visitors to the UK from Poland spend the least on average at £321 per visit .

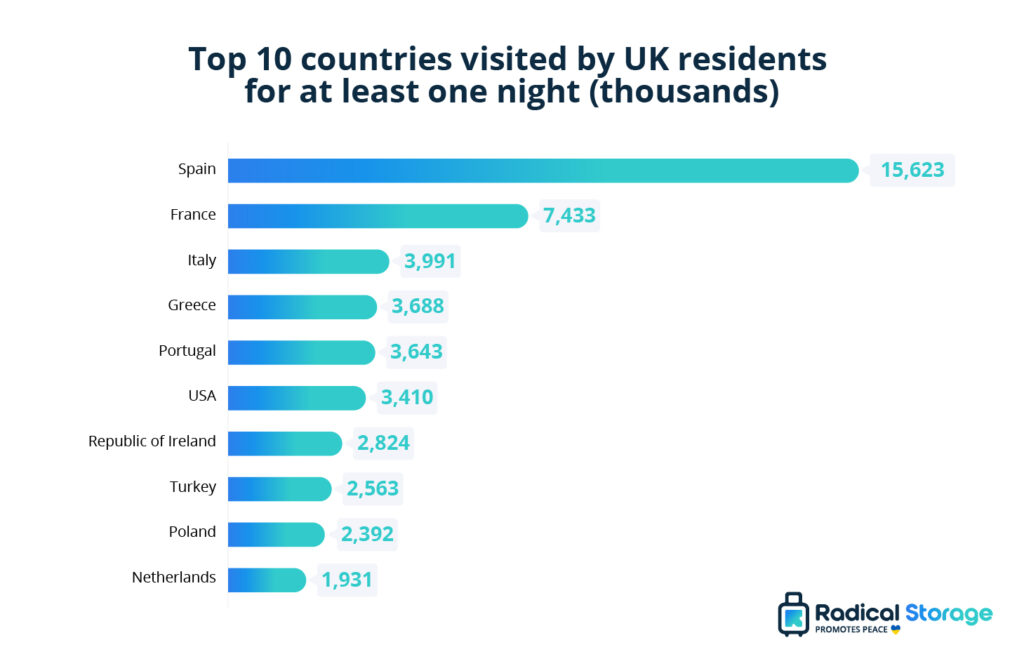

- Spain is the most-visited country by UK residents, with 15.6 million visits of at least one night, followed by France with 7.4 million visits .

- 46% of British travellers say their budget is £200 or less for a trip in the UK, with 76% saying they will prioritise value for money when booking a holiday.

Revenue in the UK’s travel and tourism industry is estimated at £31.38 billion in 2023 and is predicted to reach £33.41 billion by 2027 with a CAGR of 1.58% between 2023 and 2027. [ 1 ]

How many people work in tourism in the UK?

The latest figures show that 3.3 million people work in the tourism industry in the UK, and this is expected to grow to 3.8 million by 2025. [ 2 ]

In 2022, 31.2 million people visited the UK from overseas, a 388.7% increase from 2021 but visitor numbers had not yet fully recovered to 2019 levels.

The number of overseas visitors to the UK remained fairly consistent in the years prior to 2020 when the COVID-19 pandemic led to travel restrictions. There were 40.8 million international visitors in 2019, and this dropped by 279.2% to 11.1 million in 2020.

Sources [ 3 ] [ 4 ]

Visitor spending in the UK also remained consistent in the years between 2017 and 2019, with overseas visitors spending £28.4 billion in the UK in 2019. This figure dropped to £6.2 billion in 2020 as a result of the COVID-19 pandemic and dropped further to £5.6 billion in 2021.

The latest figures show visitor spending has roughly returned to pre-pandemic levels, with overseas visitors spending £26.5 billion in 2022.

Sources [ 4 ][ 5 ]

Average spend per visit by country

The average amount someone spends on a trip to the UK varies depending on which country the visitor travels from. The average amount spent on a trip to the UK across visitors from all countries is £875. Visitors from China spent the most on average with £8,779 per visit (roughly 10 times the amount spent on average by all visitors). This was followed by visitors from the Middle East (not including UAE) with an average of £3,754 per visit.

Visitors who spent the least on average when visiting the UK were from Poland (£321) and Hungary (£364).

Data from 2020 was not available due to the COVID-19 pandemic.Source [ 6 ]

The number of nights spent in the UK by overseas visitors decreased slightly from 312.6 million in 2017 to 298.6 million in 2019, a 7.3% decrease in this period.

Unsurprisingly, like the number of visitors and the average spend, the number of nights spent in the UK by international visitors was also affected by COVID-19. Figures for 2021 show that overseas visitors spent 93.5 million nights in the UK, a 70% decrease compared to 2019.

Sources [ 3 ]

London is consistently the most-visited city in the UK, with 16.1 million overnight visitors from overseas in 2022. The second most visited city is Edinburgh with 1.8 million visitors, then Manchester with 1.2 million, followed by Birmingham with 803,000.

Source [ 4 ]

You’ll find a number of popular tourist attractions across the UK, from museums and art galleries to parks and beaches; let’s take a look at the most-visited attractions in the UK.

The most popular attraction in the UK in 2022 was the Crown Estate at Windsor Great Park which attracted 5.6 million visitors. Coming second on the list was the National History Museum with 4.6 million visitors, followed by the British Museum with 4 million visitors.

Source [ 7 ]

Outbound tourism statistics from the ONS show that UK residents mostly visit countries in Europe, with 51.9 million visits to European countries in 2022. This means that visits to Europe make up 79.5% of outbound travel by people living in the UK. [ 8 ]

Most-visited countries by UK residents

The most popular country for UK residents to visit in 2022 was Spain, with 15.6 million visits of at least one night. This was followed by France with 7.4 million visits, and Italy with 3.9 million visits.

Holidaying in the UK has become a popular pastime for British people, with staycations offering a number of benefits compared to travelling abroad. Let’s take a look at some of the latest domestic tourism statistics for the UK.

- In 2021, there were 118.9 million overnight trips taken in Great Britain by British residents. Of these trips, England was the most popular destination with an 84% share of the trips (100 million trips). Scotland was the second most popular destination with an 11% share of the trips (13 million trips). Wales was the third most popular destination with a 5% share of the trips (6 million trips).

- The average length of stay for a domestic overnight trip in Great Britain was 3.5 nights.

- The total expenditure on domestic tourism in Great Britain in 2021 was £27.2 billion.

- Of this expenditure, £22.2 billion was spent in England, £2.8 billion was spent in Scotland, and £2.2 billion was spent in Wales.

Sources [ 9 ] [ 10 ]

Why do people choose a staycation in the UK?

- The desire for budget-friendly holidays is on the rise, with 46% of people saying their budget for a staycation is £200 per person or less, and 75% say they will prioritise value for money when looking to book a holiday.

- Holidaymakers want to explore the outdoors – 44% of people said they would like to see more national parks in the UK on their next holiday.

- People want to take a trip with their pets, with 40% of UK travellers saying they will look for pet-friendly accommodation for a UK staycation.

- Scotland is becoming a popular destination for British travellers with 40% of respondents saying Scotland is top of their list for a UK holiday. [ 11 ]

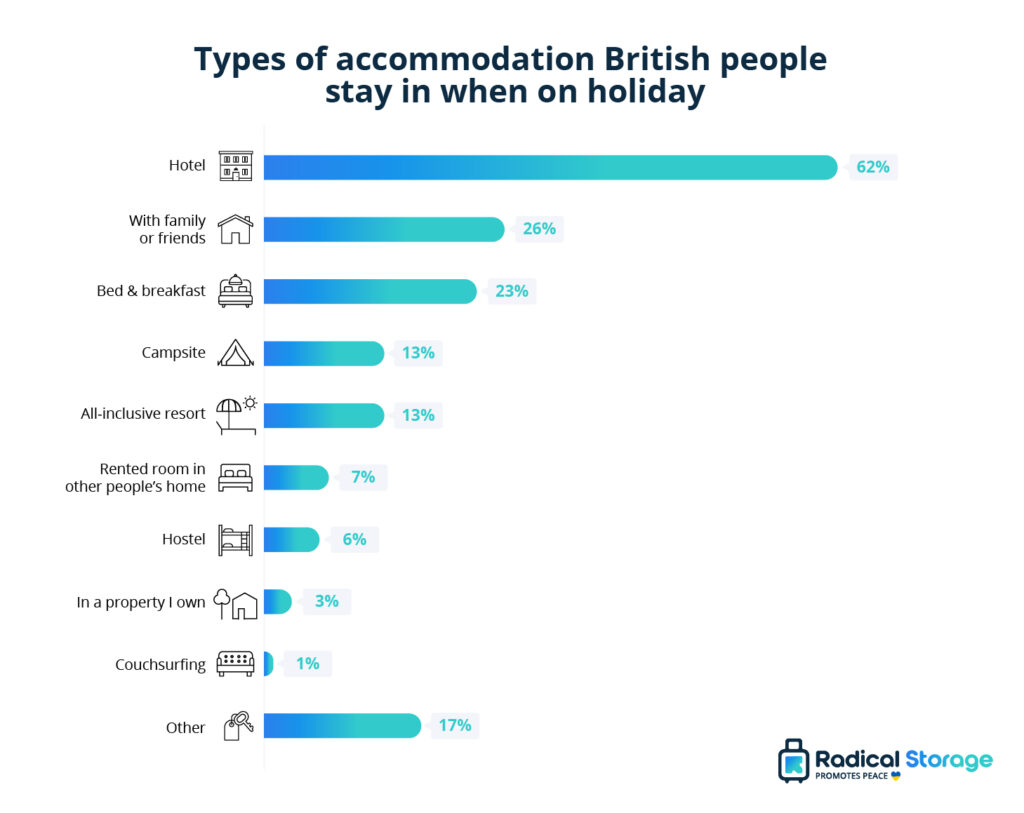

We looked at the types of accommodation British people choose to stay in when they go on holiday, either abroad or in the UK.

The most popular accommodation was a hotel, with 62% of people saying they had stayed at a hotel while on holiday in the past three years. This was followed by staying with family or friends (26%), and staying at a bed and breakfast (23%).

Source [ 12 ]

According to the Greater London Authority, there were 11.2 million international visits to London in 2022. This is an increase of 260% from 2021 when there were 3.5 million international visits to London. The increase in tourism is due to a number of factors, including the easing of travel restrictions after COVID-19, the strong pound, and London continuing to be a popular destination for tourists. [ 13 ]

Total visits to London

In 2021, there were 7.8 million visits to London from national and international tourists, with a total spend of £7.56 million. This was a 64% decrease in spending compared to the pre-pandemic figure of £2.1 billion in 2019.

Most popular visitor attractions in London

The two most-visited attractions in London also fall in the top three most visited tourist sites in the UK, the Natural History Museum and the British Museum. Third on the list is the Tate Modern Gallery with 3.8 million visitors, and next is the Southbank Centre which received 2.9 million visitors in 2022.

More London tourism facts

- One in seven jobs in London is related to the travel and tourism industry, and this sector makes up 12% of London’s GDP.

- Visiting London is the third biggest reason people say they come to the UK, and the city accounted for 53% of international visits to the UK in 2019.

- 15% of people who visit London from overseas come as part of a longer trip, including other areas in the UK. [ 15 ]

[1] https://www.statista.com/outlook/mmo/travel-tourism/united-kingdom

[2] https://www.visitbritain.org/sites/default/files/vb-corporate/Documents-Library/documents/foresight_165_regional_activities.pdf

[3] https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/timeseries/gmat/ott

[4] https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/articles/traveltrends/2022

[5] https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/datasets/overseasresidentsvisitstotheuk

[6] https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/articles/traveltrends/2021

[7] https://www.alva.org.uk/details.cfm?p=423

[8] https://www.ons.gov.uk/peoplepopulationandcommunity/leisureandtourism/datasets/ukresidentsvisitsabroad

[9] https://www.visitbritain.org/gb-domestic-overnight-tourism-latest-results

[10] https://www.gov.wales/domestic-gb-tourism-statistics-overnight-trips-2021-html

[11] https://www.traveldailymedia.com/top-five-reasons-for-expected-staycation-boom-in-2023/

[12] https://yougov.co.uk/topics/travel/trackers/what-type-of-accommodation-do-brits-stay-in-when-on-holiday

[13] https://www.london.gov.uk/who-we-are/what-london-assembly-does/questions-mayor/find-an-answer/tourism-london-6

[14] https://www.cityoflondon.gov.uk/things-to-do/tourism-trends-and-strategies/tourism-statistics

[15] https://www.london.gov.uk/press-releases/mayoral/tourism-may-not-recover-until-middle-of-decade

By Giacomo Piva

Giacomo Piva, CMO and Co-founder at Radical Storage Giacomo Piva has worked in the travel industry since 2008 across multiple niches including tourist transportation, luxury travel, and ecotourism. He now focuses on growing the global luggage network, Radical Storage , which is currently available in over 500 cities, in the likes of London, Paris, New York, and Rio de Janeiro. Giacomo has a bachelor's degree in Communication Science and an in-depth experience across travel marketing, especially in improving a brand’s digital presence within the industry.

- Information for...

What are you looking for?

Our annual performance and reporting.

Attracting more visitors, increasing spend, strengthening the economy: as a focused and highly effective agency, our activity really counts. Explore how we consistently exceed targets set by the UK Government, add value to the English and British tourism industry, and contribute significantly to the economy.

Our key achievements

We generated an additional visitor spend of £673 million in 2022 to 2023, as a result of our activities from April 2021 to June 2022.

With an investment of £16,790,111, our international ‘Welcome to Another Side of Britain’ campaign generated an incremental value of £190,593,728 – equivalent to 193,712 additional visitors, and over 3,500 jobs created.

In 2022, our Business Events Growth Programme approved 27 applications for business events in 12 cities, with a potential value of £57 million.

Our ExploreGB Virtual event saw 4,000 online B2B meetings take place between UK suppliers and international travel trade, to promote products and destinations.

The VisitEngland Awards for Excellence 2022 achieved an AVE of £626,000 and reached 12 million people on social media.

In 2022, our free Taking England to the World training helped 419 businesses in England learn how to reach international visitors. We received 100% positive feedback.

Our latest Annual Review

Vb annual review 2022 - 2023.

Learn more about our activity from 2022 to 2023 – including our key campaigns, Destination Development Partnerships pilot, and international networking events.

Rebuilding international visitor value

In February 2023, we launched our new multi-million pound international GREAT campaign to drive tourism to Britain. ‘See Things Differently’ positions Britain as a dynamic, diverse and welcoming destination, and focuses on countries where we are seeing strongest recovery – including the US, Canada, Gulf Cooperation Council (GCC) nations, France, Germany and Spain.

In Europe and the GCC, the campaign plays on Britain’s affinity with tea. ‘Spill the tea’ taps into motivations for immediate travel based on our latest research. In Canada and the US we showcase Britain’s regional diversity, sharing a warm welcome in a range of regional accents, encouraging visitors to come and experience these destinations for themselves.

Our research and insights

Getty Images

Explore how our work influences visitor trends, spend and sentiment, by browsing the latest quarterly data for Britain overall and by area. Includes market forecasts, the conditions impacting tourism, and Britain’s competitive position.

Annual reports

Browse our accounts and figures in these statutory reports.

22-23 VisitBritain/VisitEngland Annual Report

21-22 visitbritain/visitengland annual report, 20-21 visitbritain/visitengland annual report, 19-20 visitbritain/visitengland annual report, 18-19 visitbritain/visitengland annual report, 17-18 visitbritain/visitengland annual report.

VisitBritain

Our role is to drive a thriving tourism industry, creating economic prosperity across Britain. Discover how we intend to achieve this through our corporate priorities, and learn more about our structure, senior team and global reach.

The latest news, straight to your inbox

Sign-up for our fortnightly newsletter to receive our latest international market intelligence, partnership marketing opportunities, events and news.

Explore our curated information for...

Everything you need to inspire your clients. Discover new products, experiences and itinerary ideas – plus useful resources and the latest market insights.

Reach new customers and increase your profitability. Drive sales with our tools, events and training, find out about quality assessment and get expert guidance from the England Business Advice Hub.

Build sustainable and valuable growth. Learn about England’s new destination management structure, find expert advice, and boost your proposition with our training and toolkits.

Access resources for business events to support your business development and event strategy. Discover England, Scotland and Wales' business event offering for your next conference, incentive, exhibition or event.

Discover our media centres, image and video library and latest press releases, plus contacts for our corporate and consumer press teams.

Studying tourism at school, college or university? We’ve gathered essential resources and data for students of tourism, plus information about our internships.

- Travel, Tourism & Hospitality ›

Leisure Travel

Vacation travel behavior in the United Kingdom - statistics & facts

What are the most popular travel destinations for uk vacationers, how do uk vacationers book their holidays, key insights.

Detailed statistics

Travel & Tourism market revenue in the United Kingdom 2018-2028, by segment

Distribution of travel and tourism expenditure in the UK 2019-2022, by type

Share of Britons taking days of holiday 2019-2023, by number of days

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Destinations

Leading holiday travel destinations visited by UK travelers 2019-2022

Outbound tourism visits from the UK 2019-2022, by purpose

Related topics

Travel and tourism in the uk.

- Travel and tourism in the United Kingdom (UK)

- Hotel industry in the UK

- Package holidays in the United Kingdom (UK)

- Domestic vacations in the United Kingdom (UK)

Travel agencies and tour operators

- Travel agencies in the United Kingdom (UK)

- Travel agency industry

Online travel agencies

- Booking Holdings Inc.

- Expedia Group, Inc.

- Trip.com Group

- Tripadvisor

Recommended statistics

- Premium Statistic Travel & Tourism market revenue in the United Kingdom 2018-2028, by segment

- Premium Statistic Travel & Tourism market revenue growth in the UK 2019-2028, by segment

- Premium Statistic Number of users of vacation rentals in the UK 2018-2028

- Premium Statistic Number of users of package holidays in the UK 2018-2028

- Premium Statistic Package holidays consumer price index (CPI) annual average in the UK 2003-2022

- Premium Statistic Share of UK household spend on package holidays abroad 2020-2022, by income group

Travel & Tourism market revenue in the United Kingdom 2018-2028, by segment

Revenue of the Travel & Tourism market in the United Kingdom from 2018 to 2028, by segment (in billion U.S. dollars)

Travel & Tourism market revenue growth in the UK 2019-2028, by segment

Revenue growth of the travel and tourism market in the United Kingdom (UK) from 2019 to 2028, by segment

Number of users of vacation rentals in the UK 2018-2028

Number of users of vacation rentals in the United Kingdom from 2018 to 2028 (in millions)

Number of users of package holidays in the UK 2018-2028

Number of users of package holidays in the United Kingdom from 2018 to 2028 (in millions)

Package holidays consumer price index (CPI) annual average in the UK 2003-2022

Consumer price index (CPI) of package holidays annually in the United Kingdom (UK) from 2003 to 2022

Share of UK household spend on package holidays abroad 2020-2022, by income group

Share of weekly household expenditure on package holidays abroad in the United Kingdom (UK) in financial years 2020 and 2022, by disposable income decile group

Outbound holidays

- Premium Statistic Outbound tourism visits from the UK 2019-2022, by purpose

- Premium Statistic Number of holiday visits abroad from the UK 2011-2022

- Premium Statistic Number of monthly holiday visits abroad from the UK 2018-2023

- Premium Statistic Average length of stay on holidays abroad from the UK 2011-2022

- Premium Statistic Share of Britons taking holidays abroad October 2022, by age group

- Premium Statistic Outbound holiday expenditure from the UK 2011-2022

- Premium Statistic Leading holiday travel destinations visited by UK travelers 2019-2022

- Premium Statistic Leading holiday travel destinations visited by UK travelers 2019-2022, by spending

Number of visits abroad from the United Kingdom (UK) from 2019 to 2022, by purpose (in millions)

Number of holiday visits abroad from the UK 2011-2022

Number of holiday visits abroad by residents of the United Kingdom (UK) from 2011 to 2022 (in 1,000s)

Number of monthly holiday visits abroad from the UK 2018-2023

Number of monthly overseas holiday visits from the United Kingdom (UK) from January 2018 to September 2023 (in 1,000s)

Average length of stay on holidays abroad from the UK 2011-2022

Average length of stay on holiday visits abroad from the United Kingdom (UK) from 2011 to 2022 (in nights)

Share of Britons taking holidays abroad October 2022, by age group

Share of individuals who took overseas holidays from the United Kingdom (UK) in the past 12 months as of October 2022, by age group

Outbound holiday expenditure from the UK 2011-2022

Spending on holiday visits abroad by residents of the United Kingdom (UK) from 2011 to 2022 (in million GBP)

Leading holiday travel destinations visited by residents of the United Kingdom (UK) in 2019 and 2022 (in 1,000 visits)

Leading holiday travel destinations visited by UK travelers 2019-2022, by spending

Leading holiday travel destinations visited by residents of the United Kingdom (UK) in 2019 and 2022, by spending (in million GBP)

Domestic holidays

- Premium Statistic Domestic tourism trips in Great Britain 2018-2022, by purpose

- Premium Statistic Number of domestic overnight vacations in Great Britain 2010-2022

- Premium Statistic Average number of domestic vacations taken per person in the UK 2011-2022

- Premium Statistic Share of Britons taking domestic holidays October 2022, by age group

- Premium Statistic Domestic tourism expenditure on vacations in Great Britain 2010-2021

- Premium Statistic Domestic vacation spending per trip in Great Britain 2010-2021

- Premium Statistic Leading regions for spring staycations in the UK 2023

- Premium Statistic Leading regions for summer staycations in the UK 2023

Domestic tourism trips in Great Britain 2018-2022, by purpose

Number of domestic overnight trips in Great Britain from 2018 to 2022, by purpose (in millions)

Number of domestic overnight vacations in Great Britain 2010-2022

Number of domestic overnight holiday trips in Great Britain from 2010 to 2022 (in millions)

Average number of domestic vacations taken per person in the UK 2011-2022

Average number of domestic holidays taken per person in the previous 12 months in the United Kingdom (UK) from 2011 to 2022

Share of Britons taking domestic holidays October 2022, by age group

Share of individuals who took domestic holidays in the United Kingdom (UK) in the past 12 months as of October 2022, by age group

Domestic tourism expenditure on vacations in Great Britain 2010-2021

Spending on domestic overnight holiday trips in Great Britain from 2010 to 2021 (in million GBP)

Domestic vacation spending per trip in Great Britain 2010-2021

Average domestic holiday spending per trip in Great Britain from 2010 to 2021 (in GBP)

Leading regions for spring staycations in the UK 2023

Leading regions for travelers' next spring staycation in the United Kingdom as of May 2023

Leading regions for summer staycations in the UK 2023

Leading regions for travelers' next summer staycation in the United Kingdom as of May 2023

Planning and booking

- Premium Statistic Preferred methods to book the next overseas holiday in the UK October 2022

- Premium Statistic Preferred methods to book the next overseas holiday in the UK October 2022, by age

- Premium Statistic Share of Britons likely to book all-inclusive holidays 2015-2022, by age

- Premium Statistic Share of British adults planning an overseas holiday 2023, by type

- Premium Statistic Most searched travel terms on Google in the UK 2022-2023

- Premium Statistic Leading holiday travel provider websites in the UK Q4 2023, by share of voice

- Premium Statistic Package holiday bookings by brand in the UK 2023

Preferred methods to book the next overseas holiday in the UK October 2022

Preferred methods to book the next overseas holiday among individuals in the United Kingdom (UK) as of October 2022

Preferred methods to book the next overseas holiday in the UK October 2022, by age

Preferred methods to book the next overseas holiday among individuals in the United Kingdom (UK) as of October 2022, by age group

Share of Britons likely to book all-inclusive holidays 2015-2022, by age

Share of individuals likely to book all-inclusive holidays in the United Kingdom from 2015 to 2022, by age group

Share of British adults planning an overseas holiday 2023, by type

Share of adults planning an overseas holiday from the United Kingdom (UK) as of April 2023, by type

Most searched travel terms on Google in the UK 2022-2023

Volume of Google search for travel-related terms in the United Kingdom (UK) from November 2022 to April 2023

Leading holiday travel provider websites in the UK Q4 2023, by share of voice

Leading websites for holiday searches in the United Kingdom in 4th quarter of 2023, by share of voice

Package holiday bookings by brand in the UK 2023

Package holiday bookings by brand in the UK as of December 2023

Travel behavior

- Premium Statistic Share of Britons taking days of holiday 2019-2023, by number of days

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by age

- Premium Statistic Share of Britons who did not take any holiday days 2019-2023, by gender

- Premium Statistic Attitudes towards traveling in the UK 2023

Share of individuals taking days of holiday in the United Kingdom from July 2019 to May 2023, by number of days

Share of Britons who did not take any holiday days 2019-2023, by age

Share of individuals who did not take any days of holidays in the United Kingdom (UK) from July 2019 to November 2023, by age

Share of Britons who did not take any holiday days 2019-2023, by gender

Share of individuals who did not take any days of holiday in the United Kingdom from July 2019 to November 2023, by gender

Attitudes towards traveling in the UK 2023

Attitudes towards traveling in the UK as of December 2023

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

COMMENTS

In terms of the distribution of travel and tourism spending in the UK, leisure spending constituted the dominant share, slightly increasing in 2022 compared to 2019 as business spending declined ...

Domestic overnight trips in 2023: The current data show a decline in 2023 overnight trips by 7% for both Great Britain and England. These declines seem to be driven by holiday trips, which dropped by 14% and represent the second largest share of trips (32% in Britain and 31% in England). On the other hand, UK overnight stays as part of an ...

Average spend per day was the same as in 2019 (£98 in 2019 and £100 in 2022) but average spend per visit remained high at £843; this was £696 in 2019 but £875 in 2021. UK residents spent £58.5 billion on visits abroad in 2022, an increase of £43.0 billion compared with 2021.

Details of a review of travel and tourism statistics, including reasons for the review, progress so far and future developments. ... For domestic travel and tourism, the main data source used is the Great Britain Tourism Survey ... Analysis of how industries related to travel and tourism in the UK have been affected by the coronavirus (COVID-19 ...

From International Passenger Survey (IPS), quarterly data. Annual estimates on visits and spending in the UK by overseas residents, by purpose and region of visit. New methods were introduced for producing the 2019 estimates and where back dated to 2009. The datasets presented since then contain estimates produced using the new method.

Tourism: statistics and policy (707 KB , PDF) UK tourism fell sharply due to the pandemic, though data indicates domestic tourism has largely recovered, and VisitBritain expects inbound tourism to recover by the end of 2024. In 2019, the sector accounted for £74 billion of economic output with domestic spending being higher than spending by ...

This publication will provide the volume and value of domestic overnight tourism trips taken by residents in Great Britain to England and Great Britain during 2021, 2022 and Q1 2023

Statistics for domestic overnight tourism have been collected in a broadly similar way since 1989. However, the changes in survey methodology introduced in 2021, together with the interruption in data collection due to COVID-19, means that results published from April 2021 onwards are not directly comparable with data published for 2019 and ...

The domestic sentiment tracker was launched in May 2020 in collaboration with VisitScotland and Visit Wales. Initially, the objective was to track trip intentions in reaction to the Covid-19 crisis and understand the trajectory of tourism recovery in the UK. Gradually, the survey started addressing the cost of living crisis and its impact on ...

Gain a deeper knowledge of travel and tourism with our industry-leading data and analysis. We provide expert research into the inbound and domestic visitor landscape across the nations - designed to help inform your business decisions, expand your expertise and identify key growth markets. These resources cover a wide range of topics, trends ...

Statistics on domestic tourism are produced by VisitEngland, Visit Wales and VisitScotland using the Great Britain Tourism Survey ... (NSI) to take the lead on tourism statistics, so the UK approach, where the NSI leads on some travel and tourism statistics but not others, is not unusual. However, the UK does seem to be unusual in its approach ...

In 2018 domestic tourists spent £24.0 billion in Great Britain. This was a 1% increase from 2017. £14.3 billion was spent by holiday makers, £4.7 billion by people visiting friends and relatives, and £4.4 billion by people travelling for business. Between 2006 and 2018, 2015 had the highest domestic tourism spend for the whole of Great ...

Summary. 2023: VisitBritain's estimate for the full year 2023 is 37.8 million inbound visits to the UK with £31.7 billion spent, 92% and 112% of 2019 levels respectively (spend 92% of 2019 when adjusted for inflation). This would set a record for spending in nominal terms.

Visits to the UK by overseas residents, visits abroad by UK residents and spending by travellers, using provisional passenger traffic data. UK Tourism Satellite Account: 2017 Annual inbound, outbound and domestic expenditure on tourism, internal tourism consumption and employment for the tourism industries. View all related statistical bulletins

Let's take a look at some of the latest domestic tourism statistics for the UK. In 2021, there were 118.9 million overnight trips taken in Great Britain by British residents. Of these trips, England was the most popular destination with an 84% share of the trips (100 million trips). Scotland was the second most popular destination with an 11% ...

Our key achievements. We generated an additional visitor spend of £673 million in 2022 to 2023, as a result of our activities from April 2021 to June 2022. With an investment of £16,790,111, our international 'Welcome to Another Side of Britain' campaign generated an incremental value of £190,593,728 - equivalent to 193,712 additional ...

Main points. Overseas residents made 40.9 million visits to the UK in 2019, an increase of 0.6 million compared with 2018. There were 93.1 million visits overseas by UK residents in 2019, an increase of 3% compared with 2018. UK residents spent £62.3 billion on visits overseas in 2019, an increase of 7% compared with 2018.

Find the most up-to-date statistics about holiday travel in the United Kingdom (UK) ... Premium Statistic Outbound tourism visits from the UK 2019-2022, by ... Premium Statistic Domestic tourism ...

Monthly real gross domestic product (GDP) is estimated to have grown by 0.1% in February 2024, following growth of 0.3% in January 2024 (revised up from 0.2% growth in our previous publication). Real gross domestic product is estimated to have grown by 0.2% in the three months to February 2024 ...