Louisiana Farm Bureau® Insurance

Insurance Products

Camping trailer and motorhome.

Our insurance products protect your trailer or RV against accidents, damages, and liabilities.

Camping Trailer & Motorhome Insurance from Louisiana Farm Bureau Insurance

Among the wide range of insurance products Louisiana Farm Bureau insurance offers is Camping Trailer insurance. Camping Trailer insurance pays for damage to your fifth-wheel or bumper pull caused by accidents or from any other covered cause. Specifically, Louisiana Farm Bureau insurance offers Camping Trailer Physical Damage coverage.

Motorhome (RV) insurance pays for damage to your motorhome (RV) caused by accidents or from any other covered cause as well as providing liability protection for you and your family in the event someone is injured as a result of your negligence caused by the use of your motorhome (RV). Louisiana Farm Bureau insurance offers both Motorhome (RV) Liability Coverage and Motorhome (RV) Physical Damage coverage.

Coverage Options

Camping trailer physical damage coverage.

Damage to your camping trailer isn’t automatically covered. This is why Louisiana Farm Bureau insurance has such customized insurance products as Camping Trailer insurance. Specifically, Louisiana Farm Bureau insurance offers Camping Trailer Physical Damage coverage which pays for damage to your camping trailer because of an accident or from any other covered cause such as theft or vandalism.

Motorhome Liability Coverage

Louisiana Farm Bureau insurance has a variety of insurance products that provide you with peace of mind and security, for you and your family. As part of these offerings, Louisiana Farm Bureau insurance offers Motorhome (RV) Liability Coverage. Motorhome (RV) Liability coverage provides protection in the event someone is injured because of your negligence caused by the use of your motorhome (RV). Payments are also included for you and your family’s medical expenses from an accident involving your motorhome (RV).

Motorhome Physical Damage Coverage

If you own a motorhome (RV), you know quite well that motorhomes (RVs) are a significant financial investment. To protect your investment, Louisiana Farm Bureau insurance provides the option of Motorhome (RV) Physical Damage coverage which is designed to pay for repairs to your motorhome (RV) in the event it is damaged in an accident or from any other covered cause such as theft or vandalism.

For more information about insuring your camping trailer or motorhome, contact your local Louisiana Farm Bureau insurance agent .

Download the MOBILE agent App

MOBILE agent offers on-the-go convenience with 24/7 access to account information. Review your policies, report a claim, contact a local agent, or request emergency roadside assistance — all with a few taps of your screen.

- You are here:

- Home »

- Blog »

- » How Much Is Travel Trailer Insurance (Lower Average Cost)

How Much Is Travel Trailer Insurance (Lower Average Cost)

- November 22, 2018 /

- RVing 101 /

- By R. Geraldi

Having a home on wheels away from home is thrilling. Every day a new location, new people, and new sights. However, having a travel trailer, an RV, or a camper comes with some responsibilities.

If you’re an owner of a travel trailer or you are just renting one, insurance is something that should be your top priority. Ensuring your travel trailer is just as important as ensuring your house and car. It will give you a piece of mind. However, ensuring your travel trailer can be somewhat tricky. Camping trailer insurance rates vary based on the type of trailer and the type of insurance. Liability and collision insurances are a must, but you also have to think about theft and damage insurances.

Now, the first logical question is “how much is travel trailer insurance?” Depending on the type of your travel trailer, the cost to ensure a travel trailer varies.

Average Cost to Ensure a Travel Trailer

Travel trailer insurance rates can be anywhere between $170 and $1400 . The prices vary and depend on many factors — the size of the trailer, the state the trailer is registered in, how often you use the trailer, and how often it’s on the road.

Therefore, those who only use their travel trailers for vacations a couple of weeks a year won’t pay as much as those who genuinely use their trailers as homes away from home. Of course, owner’s driving record, as well as the value of the contents inside the trailer, all affect the average price for RV insurance .

Popup Camper Insurance Cost

If you paid for your popup camper on the spot or bought it used, you probably don’t have insurance. What’s more, you’re also wondering if you even need insurance on a popup camper. The answer is yes.

However, camper insurance cost varies based on several factors:

- the overall value of the camper

- the dimensions — the height and the width

- how often you use the camper

- how you store the camper when you’re not using it

If you’re lucky, you might be able to add the popup camper to your current auto or home insurance policy. However, in some cases, you might need to purchase the insurance individually. Nonetheless, you should make sure that your insurance covers:

- comprehensive damage (theft, weather damage, etc.)

Travel trailer insurance cost for popup campers can be as low as $125. What’s more, popup camper owners usually add their trailers to their existing auto insurance. That’s relatively inexpensive, and it includes the collision and liability coverage. Meanwhile, you can also get theft coverage under their homeowner insurance.

Do You Have to Have Insurance On a Travel Trailer

A simple answer to the question “do travel trailers need insurance?” is — yes. Here are a few reasons why.

Wrapping your head around the travel trailer coverage might be difficult. You already have auto insurance, and your car is towing the travel trailer, so that should be enough, right? No, it isn’t. Your auto insurance policy will extend to your travel trailer but only when it comes to liability. That means there’s no actual coverage for the travel trailer. If you cause damage to other people and their property — the insurance agency will cover the cost. However, when it comes to the damage done to your trailer, you’re on your own.

Therefore, you need better coverage. It’s best to go with an insurance policy that includes physical coverage as well.

Does a Tent Trailer Need Insurance

While tent trailer insurance isn’t obligatory or required by law, we strongly recommend it. As mentioned, you need to protect your property (in this case, your trailer) from any potential damages on the road.

Insurance will give you a piece of mind. Tent trailers are easy to damage — you might get hit while parked, or it might suffer damages from severe weather.

What States Require Travel Trailer Insurance

Minimum liability coverage is required in all the states in the USA. There’s a bare minimum you have to pay, no matter where you’re registered or where you intend to go.

Furthermore, some states require travel trailer owners to have uninsured/underinsured coverage. That means that you might have to pay extra and add a clause to your insurance policy. This will prove very useful if you cause any bodily harm or property damages to underinsured or uninsured drivers. In those cases, the injured or damaged party will get compensation above the limit of your insurance policy.

Does My Auto Insurance Cover My Travel Trailer

In short, the answer is — yes. However, your auto insurance policy covers your travel trailer only while it’s attached to your vehicle. As soon as you unhook the trailer from your car, the insurance is no longer applicable.

That means that your travel trailer is only insured while you’re driving. If you stop and unhook your trailer to go fishing, and a bolt of lightning hits it — you have no insurance and will have to cover the damages on your own.

The way around this is to purchase an insurance policy that’s specific to your travel trailer.

How Does Travel Trailer Insurance Work

Travel trailer insurance means that you are covered at all times, even when you detach your trailer from your car. What’s more, travel trailer insurance covers a lot of potential worst case scenarios.

An insurance policy for your travel trailer will make sure you are compensated for some or all your losses. If your trailer gets damaged or destroyed by other drivers or natural disasters, or if it gets stolen, you can file a claim with your insurance agency and get compensated for the damage.

What Does Travel Trailer Insurance Cover

While you can choose the type of insurance policy you want, there are some requirements when it comes to travel trailer insurance. Your policy depends on the type and size of your trailer, as well as how often you use it and for what purposes.

Typically, travel trailer insurance covers:

- comprehensive damage

It might seem unusual to have liability coverage, given that your travel trailer has no motor, and you can’t actually drive it. However, travel trailers have been known to unhook from the towing vehicles and cause extensive damage on the road. Therefore, liability coverage is essential.

Collision coverage ensures compensation in case of any damages from accidents. Meanwhile, the comprehensive damage coverage ensures you for damages done by harsh weather conditions like natural disasters. Furthermore, it will also ensure you against theft and vandalism.

You can also get commercial trailer insurance . This is a requirement for all those who use travel trailers for business purposes. For example, auto haulers, concession trailers, dump body and transfer boxes, etc. all need commercial travel trailer insurance.

What Should be Included

Typically, travel trailer insurance should include all mentioned above. Standard travel trailer insurance should cover the following:

- Collision coverage

- Property damage that’s limited to your travel trailer

- Protection in case of personal injuries to you or others

- Comprehensive damages like theft and natural disasters

- Uninsured or underinsured motorist coverage

- Property protection

However, if you’re looking to protect your travel trailer further, you can choose one of the many options of specialized coverage. Specialized coverage will ensure any custom equipment you may have, as well as personal effects. Furthermore, it will also cover total loss replacement, roadside assistance, and vacation liability.

Does Travel Trailer Insurance Cover Water Damage

Given that standard insurance policies don’t include regular wear and tear that also means they don’t cover water damage. Water damage is usually caused by natural aging of your travel trailer will not be compensated by your insurance agency.

If the water damage is a side effect of comprehensive damages , though, your insurance policy will cover it. However, a leaky roof caused by a bit of rust isn’t something you can claim to your insurance agency.

Travel Trailer Insurance Requirements

When it comes to travel trailer insurance requirements, the difference is clear. If you tow your travel trailer, the insurance is optional, and you are covered on the road under your auto insurance policy. However, if your travel trailer can get from one place to another without the towing (if you can drive it), then the insurance is obligatory.

All vehicles have to have insurance when on the road. Therefore, travel trailers are no exceptions. Every state requires at least a minimum liability coverage for travel trailers on the road.

Where to Get Travel Trailer Insurance

There are plenty of agencies out there that offer travel trailer insurance and RV insurance. Before making any decisions, make sure to check several of them out. However, many travel trailer owners are unsure if the agency is giving them a good deal or not. That’s especially true for first-time owners. If you’re unsure whether you should get an insurance policy with an agency or not, then make sure you check out all your options. We suggest comparing different agencies and their quotes.

You don’t have to run around town to do this. You can use online apps and websites that compare insurance companies and their quotes and see if your agent was telling you the truth when they said their agency is the most affordable. Websites like RVLifestyleExperts.com and RV America Insurance compare agencies and the travel trailer insurance cost estimate for you.

Is Travel Trailer Insurance Worth It

Travel trailer insurance is definitely worth it. When you’re on the road or camping with your friends and family, you don’t think about potential disasters that might strike. Of course not, that’s no way to live. What’s more, drivers who are constantly scared something might happen on the road are a liability. Therefore, you should always focus on driving instead of dwelling on the impending doom as nervous drivers often do.

However, that doesn’t mean that you should act as though nothing will happen. In 2015 alone, there were 6.3 million car-related accidents in the USA. Therefore, while you aren’t obligated to ensure your travel trailer if you’re towing it, in light of these statistics, it would be a wise decision.

Not to mention, accidents and damages done in other ways put your property at great financial risk. Many travel trailer owners don’t have enough financial strength to compensate even minor damages, let alone a total loss. If you’ve paid between ten and twenty thousand for your travel trailer, paying $900 a year to ensure it isn’t that steep of a price.

Travel Trailer Insurance Companies

As mentioned before, there are many insurance companies you can turn to for travel trailer insurance. They will give you camping trailer insurance rates and the travel trailer insurance cost estimate. That way, you’ll be able to make an educated decision and purchase a policy that has the best money to value ratio.

Some of the companies we would recommend are:

- Good Sam Insurance Agency

- RV Insurance

- National General Insurance

- Progressive Insurance

- RV America Insurance

- Geico Insurance

- Blue Sky Insurance

These are the agencies voted as top insurance agencies in 2018. Many of them offer online quotes, so you’ll be able to check them out without pesky calls from their sales departments.

The Best Insurance for Camper Trailers

The best insurance for travel trailers will keep you safe from liability, collision, and comprehensive damages. However, many agencies are known to throw in a couple of bonuses in insurance policies.

Some of the agencies we’ve mentioned offer clauses in their policies for full- time campers , for example. On the other hand, if you are a first-time camper, you can find a great deal with discounts for new owners.

How Much is RV Insurance in California

Travel trailer insurance average cost varies from state to state. For example, it makes a great difference whether you live in North Carolina or in Michigan, at least when it comes to camping trailer insurance rates and the average cost of RV insurance.

North Carolina has the lowest RV insurance rates — $860 per year . That comes up to $71.66 per month. However, the state of Michigan, on the other hand, has much higher average prices — $4490 per year, which comes around $374.16 per month.

When it comes to the state of California, it falls somewhere in the middle. In California, you’ll have to set aside between $800 and $4000 a year for RV insurance. Of course, the more luxurious the vehicle you own, the steeper the price. But the average is still not as high as in Michigan.

RV insurance rates will depend on many factors in all states, not just in California. The type of the RV, make, model, and the year of manufacturing will play a significant role when it comes to the travel trailer insurance rate estimate. Furthermore, how often you use your RV and your driving record can lower or increase your rates.

RV Insurance Cost in Florida

When it comes to RV insurance in Florida, it’s a bit different than in some other states. Mainly because Florida has very low minimum liability standards. In fact, they are the lowest in the entire country. Therefore, you might need to pay for additional coverage. RV accidents and damages can be very costly. The low minimum in Florida will not be able to cover it.

For RVs, Florida has strict insurance requirements. For accidents that include one person and for accidents that involve property damage, minimum liability insurance requirement is $10,000. Meanwhile, the minimum is $20,000 for accidents that involve more people.

Tips to Lower Your Trailer Insurance

There are some ways to deduct the costs of your travel trailer insurance. You can save money and pay a lesser monthly fee if you employ some of these strategies.

Combining Policies

One of the ways to save money on your travel trailer insurance is to combine policies. You probably already have an auto insurance policy and a homeowner insurance policy. You can combine them. What’s more, many agencies offer a multi-policies discount. So if you get two or more policies with one agency, you might get a hefty discount.

For example, consider getting your travel trailer insurance and travel insurance or auto insurance at the same company , and ask for a discount .

Quote Online

This is a simple yet effective way to save money. When you ask for quotes online, you avoid the salespeople on the phone. While they can be helpful, more often than not, they will try to get you to agree to a higher premium or additional features.

What’s more, getting quotes online is less complicated than getting them over the phone or in person. It gives you more time to think about what the most effective option might be. Furthermore, everything is transparent, and you can even customize your quote. If it’s crucial to you to get coverage only for the things you need and nothing more — online quotes are the way to go.

Keep a Good Credit Score

Your credit score is essential for travel trailer insurance. Just like with your auto insurance, the agency will ask for your credit score. That way, they measure your ability to pay back a loan. However, that isn’t the only thing that interests them.

Credit scores also tell them what the odds of you filing a claim are. Therefore, don’t be surprised if your rates are higher than you expect . Even if you’ve never had any accidents, that might be due to your bad credit score.

Some agencies offer employer discounts on business travel trailers. This is another handy way to save some money on your insurance policy. However, keep in mind that some agencies only offer discounts if the employer is contributing and paying at least a portion of the premium. What’s more, there are agencies that offer discounts only if the employer pays the entire premium.

Increase The Deductibles

When you raise your deductible, you’ll lower the premiums. The relationship between deductibles and the premiums is something to keep an eye out for. When you pay in on any claims that need to be paid out, that will have a positive effect on your premiums.

We hope we’ve managed to answer your question — how much is travel trailer insurance? On average, travel trailer insurance varies not only by state but based on many other factors as well. If you’re thinking of purchasing a travel trailer, then this is something you definitely need to consider.

Related Posts

Does CarMax Buy RVs? (CarMax RV Trade-In Guide)

300 Lbs Over Payload: What Happens If I Exceed My Payload?

Thor Vegas Problems (Windshield, Battery, Fridge, Swivel Chair)

Leave a Comment:

Already a member? Register your account

Vehicle Insurance

Home & property insurance, farm & crop insurance, business insurance, life insurance & more, health insurance, information center, farmers in action, agriculture, scholarships, news, features and videos, magazines (cultivate and farm bureau news).

Agents & Offices

Looking for something?

Login to your account.

Already a member but don't have an account? Register Now to manage your Insurance and Membership information.

Virginia Motorhome & RV Insurance

Go beyond the daily commute., go ahead, explore the open road and chase the horizon. we’ll make sure your recreational vehicle insurance policy gets the same attention to detail as the car you drive everyday, plus additional coverage you may need—like towing and labor when you’re on the road., get a free quote, get great coverage at an even better price. get an rv insurance quote today., why insure your rv with virginia farm bureau insurance, you'll support virginia agriculture.

When you get insurance with us, you become a Friend of the Farm ™ . Your membership helps support farmers and their families, agriculture, and the Virginia way of life.

You’ll Enjoy Exclusive Member Deals ® & Savings

Get access to member deals ® and savings at restaurants and retail locations nationwide.

You’ll Get Local, Personal Attention

Our agents live where you live, which means we’re right around the corner when the inevitable fender-bender or unexpected life event happens.

You Can Access Your Account Anywhere

Manage your policy from your mobile device or your computer. You can get car insurance quotes, request auto ID cards, and more wherever you are.

You’ll See Why Our Member Satisfaction Is So High

Our overall retention rate is hard to beat—92% of our members stay with us year after year. 1

You Get Coverage Tailored to Your Needs

Don’t settle for the minimum—make sure your coverage fits your life. Our agents customize your policy to fit your needs, budget, and the amount of coverage you need.

Get Coverage You Can Rely On

Personalized coverage from a local agent takes the guesswork out of your rv insurance. talk to an agent in your community., motorhome & rv insurance coverages, what are you driving—a campervan, travel trailer, or big motorhome it all affects what kind of coverage you may need, and finding the right fit can be tough. your local agent can customize an rv insurance policy with just the right options, discounts, and coverage for your vehicle. 2, liability coverage.

This basic RV insurance pays out when your motorhome or RV causes damage to someone or something else. If you drive an older model and don’t have many other assets to protect, you may not need much more coverage than this. Check with your local agent to find out.

Collision Coverage

This picks up where liability insurance leaves off—it covers your own vehicle when you cause an accident or hit a stationary object. This coverage is especially important if you drive a newer model campervan or carry a vehicle loan.

Other Than Collision Coverage

Sometimes called comprehensive coverage, this option covers damage to your RV not caused by a collision. It takes care of issues like fire, theft, vandalism, glass breakage, weather-related damage, and deer that come out of nowhere.

Medical Expense Benefit

This can offset your health insurance deductible and pay out for your passengers’ injuries if necessary. It’s also an added buffer if you’re liable in an accident that causes serious injuries.

Pet Coverage

Extend your insurance protection to your furry friends as well. If your dog or cat is with you during an accident and is injured or worse, this coverage goes toward vet bills or pays a death benefit (similar to life insurance). It’s built in to comprehensive coverage.

Uninsured Motorist Coverage

If someone else causes a crash and doesn’t have insurance, or if their insurance isn’t enough to repair or replace the damage they caused to you, this coverage kicks in.

Electronic Equipment Coverage

If you’ve upgraded your stereo, this option is for you. This protection applies to custom parts or equipment, devices, accessories, enhancements, and changes other than those installed by the original manufacturer that alter the performance of your vehicle.

Income Loss Benefits

Motorhome accidents can cause serious, life-altering injuries that may force you to miss time at work. This coverage can help provide for your family if accident-related injuries keep you off the job and cause a loss of income.

Towing & Labor

RV's break down at the most inconvenient times. This package includes towing, gas delivery, tire replacement, and more to get you back on the road as quickly as possible, no matter where or when you need help.

Customized Equipment Coverage

Non-electronic modifications to your RV require this coverage. You can insure the value of your custom seats, special furnishings, carpeting, or other interior customizations with this option.

Transportation Expenses

If your vehicle suffers damage that’s covered under your policy, your transportation expenses (such as rental car charges) can be covered up to a specified amount while your car is being repaired or replaced.

Other Coverage

Talking with your local agent is the best way to find out what riders or specific coverages are recommended for your specific situation.

Questions To Ask Your Agent

What does homeowners insurance cover.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Numquam esse delectus nemo ex amet dolorum ullam, voluptatibus adipisci molestiae quidem! Sequi culpa similique provident tempora laudantium dolore, numquam hic recusandae.

Why should I complete a home inventory?

How mcuh coverage do i need, should i get an umbrella policy too, home insurance discounts.

Teen Driver Discounts

We reward teens who keep their grades up and practice responsible driving habits. These discounts can save new drivers up to 25% on their premiums.

Good Driver Discounts

We appreciate safe drivers. Avoid accidents and violations in your household and you could save up to 5%.

New Policy Discounts

It pays to be a good driver. If you're a new policy holder with a safe driving record, you could save up to 25%.

Safety Features Discounts

You could save up to 30% just for having certain safety features in your car, such as anti-lock brakes.

Virginia Farm Bureau Insurance Reviews

14 years with farm bureau and the entire process far exceeds my expectations in all areas., william & april j., best insurance company been with farm bureau 40 years for home and auto, we always receive excellent service. thank you so much, john & carol b..

Explore Other Coverages

Related resources.

Are You Overdue for an Accident?

3 Common Gaps in Coverage

After the Accident: The Lifecycle of Claim

Get an auto insurance quote.

This post may contain affiliate links or mention our own products, please check out our disclosure policy .

How Much Does Travel Trailer Insurance Cost?

Published on July 1st, 2016 by Camper Report This post was updated on May 18th, 2023

Getting insurance for your travel trailer is a good idea. Travel trailer insurance costs might surprise you however. I recently got two quotes on what it would cost to insure my new trailer. I thought I’d just share the results here so you know what to expect.

- Quote #1 from Good Sam’s Insurance : $376 per year with a $250/$500 deductible. I didn’t check to see what their replacement plans were. I’m not sure if the trailer wrecks two years from now if they just give the value that the trailer costs that day, or if they give me the money to buy a new one.

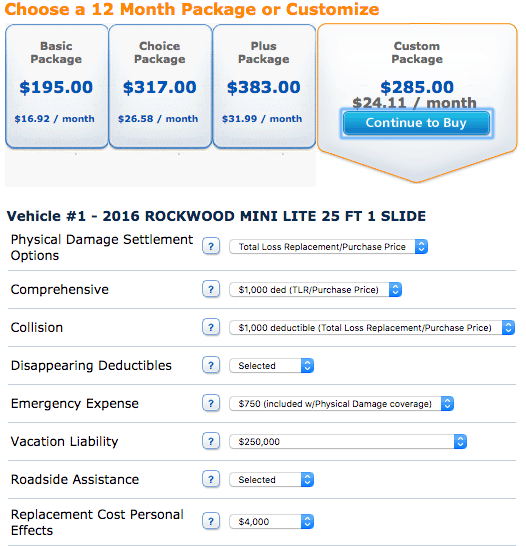

- Quote #2 from Progressive (Via USAA) : Depending on coverage, Progressive quoted between $179 and $383 per year. The quote that I’m going with is from Progressive and the final cost was $289 per year. I bank with USAA and I LOVE USAA, but they don’t insure trailers so they passed me off to Progressive. I get a slightly deduction in my car and home insurance through USAA if I get the trailer insurance through their third-party provider. So if you have USAA banking, be sure to go through them.

The Trailer I’m Insuring

Just so that you can ballpark your expense for insurance, the trailer I got the quotes from is a 2017 Rockwood Mini-Light 2504s. I paid $24,500 for it out the door (including, tax, title, fees, etc).

Exampel of Travel Trailer Insurance Costs

The best way to save money, I found, is to get your quote for insurance online and NOT on the phone! When you call in to the insurance place to get a quote, they won’t go through all of the options with you so as to make it less complicated. If you get it online, you can customize your quote to just exactly the coverage you need and nothing more.

DON’T MISS OUT ON CAMPER REPORT UPDATES

Sign up for the newsletter today.

Please enter a valid email address.

An error occurred. Please try again later.

Thank you for subscribing to the Camper Report newsletter, keep your eye on your inbox for updates.

I got a quote for $450 from Progressive on the phone, but then I went online to look at the coverage and found the insurance for under $285 for the coverages that I needed, and excluding other coverages that I didn’t need.

Factors to Consider when Buying RV Insurance

Replacement Cost – You have the choice of getting the full replacement cost, or just the actual value of the trailer. In my opinion, it’s worth paying to get the full replacement cost, so if you wreck your trailer 3 years from now, you get a new trailer instead of the value of your depreciated trailer.

Bodily injury – I found that this was actually very inexpensive to add to my policy to get $500,000 of coverage, so I added it. It was only $1 more to get $500k compared to $250k.

Roadside assistance – This one’s up to you. For me, the quote for roadside assistance was about $25 more per year.

Coverage for personal affects – I think this one is extremely important. Generators are pricey and they get stolen ALL. THE. Time! Get your personal affects covered.

In this article, we made a list of all of the things that travel trailer insurance covers. Be sure to check it out to know exactly what will be covered.

Best RV Insurance Companies to Call

It’s certainly worth checking a few companies to see who gives the best prices for camper insurance. Here are a few links to consider:

- Farmer’s travel trailer insurance

- Progressive travel trailer insurance This is the one I chose.

- Geico travel trailer insurance Not recommended to try online! You go through a million questions on their online page to get a quote, but at the end they don’t give you any prices. They just call you and the salesman will drive you nuts.

- Good Sam RV insurance

My Choice of Insurance

Travel trailer insurance cost is minimal. That is, compared to risks you take when RVing without insurance. I’m choosing the insurance from Progressive through USAA. I think knowing the company that is providing the insurance for your RV is important and I’ve always had good experiences with USAA so I think they’d work with a company that would take care of me.

Share this post:

Related posts:.

How Much Does It Cost To Insure An RV?

Does RV Insurance Cover Awning Damage?

Does RV Insurance Cover Rodent Damage?

About the author:, 21 thoughts on “how much does travel trailer insurance cost”.

VERY VERY Useful and important information!!! Thank You

Jim, thank you for this article. I feel like we are paying way too much. I tried Farmers Insurance but you can’t get an online quote from them. We currently have Progressive through USAA (we love them too) but they are charging us over $1000 a year for our travel trailer (2021 Winnebago Voyage 2831). We only took it out last year for a total of 22 days. I can’t figure out why that would be so much but I plan to call them (can’t do it online since we already have insurance through them). I went through the whole thing to find that out at the end. But I got a lot of information from your article and thank you so much.

Thanks, Jim, we appreciate your work here as we’re researching buying a new unit this spring. I’m sorry, Bloggin Brandi, you had a bad experience. I, too, used Progressive4USAA and had the perfect experience and will use them again. (However, nothing inside my trailer was ruined when my trailer was totaled…so not sure how that part works.) After a major learning experience about poorly-made Chinese tires while driving along in rural Pennslyvania many, many, many miles from home (and why I should have installed a TPMS), my total replacement insurance resulted in Progressive’s action to: 1) immediately reimburse my night-of-accident costs, 2) recommend a repair facility nowhere near my original dealership’s horrible repair department, 3) conferring with the TT maker and then the chassis manufacturer to determine if the shop’s recommended repairs would make it road worthy again, 4) and, when the manufacturer said it would not, offering to have their sub-contractor deliver a new (or used unit at lease one year newer than ours) to the location of my choice at the time of my choice. Finally, when I explained we were in the market for something bigger to tow with our recently purchased F250 diesel, the adjuster offered to (and did) issue a check as soon as I got to their closest office with my purchase receipt, title and lvlywf (to cosign, of course). While this happened to us in 2015, I also, recently, received a recall notice in the mail indicating that I should bring my TT into a shop to have the chassis reinforced because a flat tire while driving could result in the back-axle being ripped off and the chassis breaking in 4-5 places… y’all are welcome. Signed, Patient Zero. 🙂

I have USAA and had Progressive for my travel trailer until I was in a bad accident. Take it from me, I had all my receipts and documents. Photos, videos and NONE of my personal belongings were ever made whole. I lost so much and spent a year recovering in a medical facility. I would warn anyone who hasn’t had to file a claim with Progressive to think ahead. Even now with my Class B Van they are the cheapest, but I refuse to do business with them. I love USAA and NEVER have issues with them. I will pay more for insurance just to have piece of mind. Now, I went through Good Sam for insurance and they gave me a quote for Foremost. That is who I use now. Always do your research, read reviews, see what others have experiences. So thankful for all the info out online to help with these decisions and people sharing their stories!

Jim – we are looking to buy a used motor home that has high resale value – any suggestions – spending limit is $90,000.

Great article. Very informative and helpful. After dragging my feet for a couple of weeks I got serious and shopped. I would never have gone with Progressive if it had not been a suggestion of yours, they’re just not on my radar. But am I glad I did! Very user friendly website and affordable. Bought my first Travel Trailer, a 34′ 2018 Jayco 29BHDB, which I paid 32K for with upgrades, that I was able to insure for $234/mo. Thanks for the advice and keep up the good work!

I must be doing something wrong. I have a 2017 Wildwood travel trailer, with USAA…through Progressive…$64 a month!!

I’m looking to purchase a 2017 Towable camper. I checked with pur insurance “St. Farm” they based the quote on the MSRP price not what we are actually paying for it, which is good bit of a difference. Does anyone know if this is what they have to base the insurance off of?

I have USAA, which goes through Progressive for RV insurance. I have a new travel trailer bought at the very end of the season, so it hasn’t done a trip yet. Not until next Spring. Does anyone have USAA/Progressive? If so, do they offer seasonal insurance? As in, I don’t want to be paying on the insurance while it’s being stored at my home during the off-season.

Be careful with USAA, they left us high and dry after a stolen vehicle.

Agree, just Google USAA for the BBB. Even the federal government has investigated and sued them. They have been sued so much or really sad stories of those ripped off, they refuse to help. They are complete dirty company, not like the old days. Beware!

Things go wrong with campers when they are stored. Storms, trees fall, theft, never cheap out on insuring your investment.

This was SO helpful. Thank you for writing this.

Really appreciate your time and effort to put this out there

Thank you. VERY helpful info. Thanks for putting this out there.

We just bought a 28′ Winnebago Minnie, don’t know if that was a mistake or not. Past use of a Winnie was good and we liked the floor plan with its two entry doors and two to bathroom so we won’t disturb each other at night. We too have USAA and haven’t called yet. Finding your blog is wonderful and oh so helpful. Thank you for taking the time to share your experiences. If I start a blog, I’ll refer to yours.

Our new fifth wheel is a 336TSIK, considered 33 ft, six inches long, as that’s what’s pulled behind truck. If you measure from nose (over truck bed) to bumper, it’s actually 36’11”. Our broker says this unit is unstable to pull because of the length, that most with trailers over 35 feet park them permanently, that it can’t/shouldn’t be an add on to an automobile policy but should be added to home insurance policy (in order to get full replacement costs instead of depreciated value) so our total will be $1,100 year!!!! Holy smokes – this is crazy. I think they’re confused about trailer length of fifth wheels. It shouldn’t be rated as a 36 ft travel trailer if it’s a Chaparral 336.

Hello, question…. we bought a vintage travel trailer on EBay. The shipper has cargo insurance as he toes it to us. So, do we insure it now or once it is delivered to us?

This was helpful! We’re looking to buy our first travel trailer and I didn’t even know where too start looking at insurance!

So glad I found this sight. We re in the process of choosing our first travel trailer. I just checked with my insurance agent to get quotes based on our current trailer selection, and asked about all the items you mentioned above, so this article really helped me understand the different needs. My reason for responding concerns liability. I am a sports official, officiating at all levels up through High School. While the organizations I belong to have liability coverage for their officials, I carry an extra $2M umbrella policy. Cost is only $170 a year and is well worth it. Check with your insurance agent.

Thanks for the information. I do suggest to check the math on the personal effect coverage. Although generators get stolen all the time, the generator you(and I) chose is the same price as the deductible for that coverage.

Leave a Comment Cancel reply

Welcome please follow these guidelines:.

- Be kind and respectful.

- Keep comments relevant to the article.

- Avoid insults, threats, profanity, and offensive remarks.

- Refrain from discussing gun rights, politics, or religion.

- Do not post misleading information, personal details, or spam.

We may hide or remove comments at our discretion.

I have read and accepted the Comment Guidelines and Privacy Policy *

Follow Camper Report:

- Follow Us On Facebook

- Follow Us On Twitter

This post may contain affiliate links

Travel Trailer Insurance Cost: Complete Study and Comparisons

Travel trailer insurance cost and quotes.

This is a study I update twice per month about travel trailer insurance cost, analysis of their quotes and associated products.

I called several major companies that you see on TV: Geico, AllState, State Farm, Progressive and Nationwide, and I also obtained quotes from their website and from the phone.

To complete this benchmark analysis, I also called Good Sam’s and Foremost that are not first-tier insurance companies but are considered niche RV specialized companies.

It is always better to retrieve quotes directly from their website and not by the phone. The process is much faster on their website and you have more options to customize your request. In the phone, they just try to make it simple so you purchase.

I try to keep this travel trailer insurance cost study it as consistent as possible across all insurance companies. So we have for all of them the following categories compared thoroughly.

- Comprehensive coverage.

- Collision coverage.

- Personal effects.

- Roadside assistance.

- Vanishing deductibles that affect travel trailer insurance cost.

These categories are explained in detail below

Travel Trailer Insurance Cost: The RV Insured

When I called these RV insurance companies I asked specifically for insurance quotes for the following features in the insured object and the following attributes in the policyholder. These values can help you to calculate what applies in your case.

So below is my detailed travel trailer insurance cost request. I want an insurance for the following:

- Full-time RVers insurance without permanent RV surface lot : This is a full-time RVer that changes RV parks frequently.

- Travel trailer of 30´ thirty feet in length : Not an a-frame camper, not a teardrop camper or a pop-up camper. Not too large. Many companies will not insure an RV of more than 36 feet in length. If it is too large, only RV insurance specialists insure them and I wanted first-tier companies to quote me.

- Three years old : So it is kind of a new RV, but not quite old or very used. I wanted to retrieve a pretty decent quote. With only three years we avoid weird and unjustified depreciation curves handled by RV insurance companies.

- Excellent driving history in the prospective policyholder. I have never been involved in an accident. We also have a very good credit score so that helps us. Therefore, these results will be different for many of the readers of this article. I asked for prices in Indiana. Results may vary in some states, but in online quotes, they keep very constant from state to state.

Travel Trailer Insurance Cost: The Quotes

Quote #1 from Nationwide (Allied Nationwide in some states) : Nationwide actually quoted me for the whole entire year five hundred and seventy-five dollars ($ 575). That is forty-seven dollars a month ($ 47). As usual in the last couple of years, this is the lowest travel trailer insurance cost retrieved.

Quote #2 from Progressive (for non-USAA customers) : Now with Progressive, they quoted me a total of eight hundred and seventeen dollars ($ 817) for the whole year if I pay it in installments. This means I pay sixty-eight dollars ($ 68) a month. If instead, I was willing to pay the whole cost upfront, without utilizing installments, it would have been seven hundred and forty-four dollars ($ 744) for the year. As usual, it is more expensive to pay monthly than it is to just get it all out of the way. If you are a non USAA customer it is a bit more expensive. So I included both quotes.

Quote #3 from Geico : Their total quote was eight hundred and eight dollars ($ 808) for the entire year which is 67 dollars ($ 67) a month.

Quote #4 from Good Sam´s : The final quote was $ 1280 per year, which is very high. It is 106 dollars a month.

Quote #5 from Foremost : They offered a quote of 821 dollars for the entire year. You can pay in installments of $ 71 per month. There is a huge discount of 12 % in the travel trailer insurance cost if you also purchase their life insurance policy, a product line where they are specialists.

Quote #6 from Progressive (For USAA customers) : USAA does not have RV insurance, therefore, you are forwarded to their business partner Progressive. I had the same price as described above without USAA partnership, but with a discount of 11% in the final travel trailer insurance cost. As a consequence, if you are a USAA customer, Progressive could be the best option if your trailer is very large.

Quotes #7 and #8 : Allstate and State Farm do not offer RV insurance for full-time RVers anymore, so for this article update, they are not included in the quote.

Travel Trailer Insurance Cost Benchmarking: How Were The Insurance Quotes Retrieved?

To maintain consistency in my analysis, I investigated all the RV insurance companies, the same categories. So let´s see all these categories:

Collision Coverage :

With collision coverage, this is going to cover you in the event that something collides with your RV, or your RV collides with something else. Therefore, if a vehicle hits your RV or you hit another vehicle, that is where collision coverage is going to come in.

In the situation where the covered event occurs, if you were to sustain damages from something like that occurring and you had a $500 deductible, you would pay for the first five hundred dollars worth of damages. Then your insurance company would step in and pay anything in excess over that.

Comprehensive coverage

The comprehensive coverage will cover things that are more out of your control such as bad weather, hail storms, flooding, and fire. It may also cover an animal running out in front of your vehicle and you hit it. So that is what comprehensive coverage embodies.

Furthermore, another aspect you want to keep in mind with the comprehensive coverages, is that it is not going to cover events like rodent damage to your RV or heavy weight of snow on your RV, your tires blowing out, a tire puncture. Comprehensive coverage is not going to cover wear and tear of the vehicle.

These aforementioned events are usually under the umbrella of your responsibility. However, always read your own policy contract as this can differ from contract to contract. More protection means usually a higher travel trailer insurance cost.

Personal Effects Coverage

We study now the personal effects coverage. I have obtained coverage up to $2,000 which means that $2,000 worth of our belongings inside the RV and on the space occupied by the RV would be covered, as far as our clothes, jewelry, and any kind of electronic equipment that we have inside the RV were covered up to $2,000 worth.

Roadside Assistance Coverage

Another category is roadside assistance. Regarding roadside assistance I obtained the coverage for up to $2,000. This is going to cover you in the event that you break down, you have a flat tire, you need to be towed or something happens with your RV during the road journey and you need to stay in a hotel for an extended period of time. This category is going to help pay for the food and lodging.

Liability Coverage Insurance

Liability insurance coverage category now. When I called these companies, I received one hundred thousand coverage per person ($ 100,000) and three hundred thousand liability coverage per event ($ 300,000). All companies were moving near these values.

Liability insurance will cover any property damage or bodily injury of a person while they are on your RV lot. This perimeter represents that you are only responsible for anything that happens within 25 ft of your RV.

If you look at your RV policy there is a section called Vacation Liability (if you are not a full-time RVer) or Fulltimers Package (if you are a full timer and that is the package you purchased) that will tell you exactly what you are covered for.

You will see that the degree of coverage will influence the travel trailer insurance cost.

Thus, while you are out camping, if somebody´s child ran through your a lot slipped and fell (bodily injury), then you would be able to cover their medical bills of up to a hundred thousand dollars per person or three hundred thousand dollars per occurrence, as explained above.

Vanishing deductibles

Some of the companies offered vanishing deductibles, others did not. A helpful category if your driving history is good over time. This scoring process can diminish a lot the travel trailer insurance cost that you pay yearly.

Let´s discuss the price of full-time RVers insurance and the experience I had when I called around to all these companies.

Nationwide and Nationwide Allied: The “Agreed Value” Policy

Although their name is Nationwide they are not they actually told me that they do not offer insurance in the state of Indiana as Nationwide but as Allied Nationwide. Not just RV insurance but auto insurance as well, etcetera.

However, Allied is also a part of Nationwide. Therefore, Allied does offer insurance in the state of Indiana and it is in this study list included too.

Nationwide is willing to enter into a modality of insurance agreement called Agreed Value. In Agreed Value, the travel trailer insurance coverage is furnished for a predetermined amount settled upon by the RV insurance company and the insured subject.

What Agreed Value means in practice for you and me, is that they are agreeing that if your RV is in a total loss situation, they will pay what you paid for your RV.

In lieu of this Agreed Value principle, is the principle of Actual Cash Value. This Actual Cash Value is that they pay you the replacement cost minus the depreciation. In practice, for us RVers, this means that most insurance companies, and every one after Nationwide that I called, will only pay what your RV is worth considering depreciation.

Likewise, with the Actual Cash Value principle, that I could avoid with Nationwide, in the situation that the covered event results in a total loss, if you have paid twenty thousand dollars for the RV and it is now only worth fifteen thousand dollars as a consequence of RV depreciation, that is all the RV insurance company is going to pay you. Therefore, you will remain uncovered for the other five thousand dollars.

As explained above, Nationwide is offering the Agreed Value principle and they provided me a quote in to include the Agreed Value clause. It took about 24 minutes to obtain the quote through them through the phone, and only six to obtain it online. I considered that this was pretty fast, but it was faster through the website, that the same quote took six minutes.

Nationwide offered me also three different types of full-timers insurance that we analyze below: seasonal, travel, and non-travel, as follows below:

- Seasonal: Seasonal is the type of insurance that is for people who have a main home. They live in a home six months out of the year and then they travel the other six months out of the year.

- Travel: Travel type is that you live in your RV full-time 365 days a year, so you are a full-time RVer, and you travel the nation, the world, whatever you are going to do in your RV, but you are not stationary. You do not remain in a single place.

- Non Travel : Non-travel is where you actually live in your RV on a permanent lot. The RV does not move from the lot, that can be a campground or an RV park. So this would be non-travel.

Nationwide Travel Trailer Insurance Cost

Hence, with Nationwide I obtained the following

- Comprehensive coverage and the collision coverage with a five hundred dollar deductible, meaning, I am willing to pay for the first five hundred dollars worth of damages.

- Personal effects coverage: I got personal effects coverage to cover two thousand dollars.

- Roadside assistance coverage: Roadside assistance coverage is included, which covers two thousand dollars.

- Liability coverage: And finally, then liability coverage insurance in case somebody became injured on our lot surface while we are out camping. The coverage for this item is of a hundred thousand dollars per person and three hundred thousand dollars per occurrence.

Nationwide has anyway a vanishing deductible. In their case is that within 31 days of your policy contract they take $100 off of that deductible.

Therefore, within 31 days, your deductible goes from being five hundred dollars to four hundred dollars and then, every year that you are accident-free, it goes down another hundred dollars.

Thus, within your first year, you are already down to a three hundred dollar deductible. That is really incredible and very good.

Nationwide quote :

Nationwide actually quoted me for the whole entire year five hundred and seventy-five dollars ($ 575). That is forty-seven dollars a month ($ 47) of travel trailer insurance cost.

Progressive And The “Actual Cash Value” Policy

Progressive does the Actual Cash Value policy. As in Nationwide, and to do a proper benchmarking of my travel insurance cost analysis, I asked for the same coverages as in Nationwide. Progressive asked if I was a USAA member because I would get a discount in that case.

Likewise, in Progressive, they also asked how many years of experience do I have pulling an RV. This question was unique from Nationwide. In Nationwide they did not ask me any of that, so for people who do not have any experience pulling an RV this would affect them in the price, for example via a discount in the total travel trailer insurance cost if you do have experience.

In Progressive with comprehensive coverage and collision coverage, I received a $500 deductible. Personal effects covering $3,000. Roadside service in the United States and Canada and then $2,000 which would cover any hotels or food that you need in the event that you do break down and you need to stay somewhere for the night.

They have deductibles that reduce by 25% every year that you are accident-free. Therefore, within the first year 125 dollars, second-year another $125. So by the end of four years, you could be deductible free and in the event, something happens, Progressive will cover everything.

Progressive Quote

Now with Progressive; they quoted me a total of eight hundred and seventeen dollars ($ 817) for the whole year if I pay it in installments. This means I pay sixty eight dollars ($ 68) a month.

If instead, I was willing to pay the whole cost upfront, without utilizing installments, it would have been seven hundred and forty four dollars ($ 744) for the year. As usual, it is more expensive to pay monthly than it is to just get it all out of the way. If you can do the extra effort, the travel trailer insurance cost will be much lower if you pay the entire year of coverage in advance.

Allstate RV Insurance

The next company I called was Allstate. Allstate stated (as in previous updates of this article), that they do not offer RV full-timers insurance. So once more, Allstate is out of the list for now.

State Farm RV Insurance

The next one I called is State Farm. With State Farm, they forward you to a local agent. This local agent said that they do not offer full-timers RV insurance in most of the states.

Travel Trailer Insurance Cost From Geico: Discounts for CDL Holders

I called Geico after that and they asked me something that none of the companies asked me, that is if I normally utilize a specialized hitch, stabilizer, or weight distribution system and I answered yes to all of these questions.

Obviously, as we describe thoroughly in this article , with a weight distribution system in place, you avoid sway and have less risk.

They also asked me if I have a commercial driving license (CDL license) which I found tobe interesting, so I am assuming that they offer discounts for this because if you have it, it is a lower risk for them. It would be a more experienced RV driver and therefore, a less risky one.

With Geico, I received comprehensive and collision coverage with a $500 deductible. In the personal effects category, they offered $5,000. They have included $1,000 in emergency roadside service as well.

Geico also offered vacation liability of $100,000 in. However, if I did my research right, vacation liability is for people who are not RV full timing, so I am not sure if she just misquoted me or if maybe they don’t offer the full timers package liability or maybe that is just what they call it so it’s $100,000 for the total occurrence.

The other companies instead offer the “100 300 combination”. This is 100,000 per person 300,000 per occurrence.

Geico also offers, like their competitors, hotel, and travel expenses included in the event that your RV breaks down and you need to stay overnight somewhere. They offered this lodging within only 1,001 dollars, so they did not have the two thousand dollar limit that I was previously offered

Geico Quote

Their total quote for the travel trailer insurance cost was eight hundred and eight dollars ($ 808) for the entire year which is 67 dollars ($ 67) a month.

Good Sam´s: Expensive Option

As soon as I described my requirement, that for all companies was the same, a travel trailer about thirty feet in length, and three years old, he started to push me to insure also the towing vehicle, my truck. I said “no, thank you”, just the travel trailer for now.

He insisted on the advantages, and I repeated that I only wanted the travel trailer insurance cost in the form of a quote.

Then, he started asking me about my bodily injury limit. On your vehicle, your bodily injury limits are for the situation you injure somebody and the accidented person has to go to the hospital.

He wanted to know what I had on the truck because my property damage could not exceed my bodily injury limit which is completely wrong, and actually, both coverage items are not that related.

Most of the companies I called were around the $800 annual range except for Nationwide, who quoted me around the five hundred, which was pretty low. But here, the travel trailer insurance cost is the highest.

Good Sam´s Quote

So I said, please stop arguing with me all I want is the quote for the full-time RVers travel trailer insurance cost for the RV described.

He finally gave me the quote and with collision and comprehensive coverage and a $500 deductible, personal effects of three thousand dollars. Also including emergency roadside service hotel and travel up to fifteen hundred dollars.

Finally, also liability protection which is if somebody gets injured on our property.

So the final quote was $ 1280 per year, which is very high. It is 106 dollars a month.

Foremost RV Insurance: An Interesting Option If Combined With Other Products

I went also to Foremost, and I obtained again the same coverages, same deductibles and they offered a quote of 821 dollars of travel trailer insurance cost for the entire year.

So they were also kind of comparable to Progressive. The only difference is that they asked me if I had a life insurance policy of at least $50,000.

I had no idea why they asked that or what does the life insurance has to do with this. They explained to me that they offer discounts for having both products with them.

Travel Trailer Insurance Cost Study: Conclusions

In this update of the article, Nationwide or Allied Nationwide keeps the first place as the most convenient option: it is the cheapest, so it s the lowest travel trailer insurance cost in our list, it does not require a combination with other products, and has very good deductibles.

The second option, not far away, is Progressive, for the case that you are a USAA customer. There is an important synergy if you are also a member of the USAA that has an interesting discount as a result.

The third option is for Foremost, but only for the case when you purchase some other products from their portfolio, such as the insurance of the towing vehicle , so your truck, or a life insurance policy.

Anthony Foxx

I am Tony, an RV designer and RV developer. I create bill of materials for RV manufacturers for travel trailers and fifth wheels. I worked as a freelance transportation consultant for Lyft. As an RV development consultant, I create customization trees for RV manufacturers who want to offer a solution to prospective customers to design their custom RV with variant configuration. Apart from this, I sell in Indiana trailer hitches, hitch balls, goosenecks and weight distribution systems where I provide advice to customers who want to know which is their towing capacity, which hitch ball should they utilize and how to deploy a weight distribution system. I do my best to explain all these processes and their installation, here in RV Favorites.

FEATURED ARTICLES

RV Plumbing Maintenance

Camper Plumbing Maintenance and Repairs Doing plumbing repairs in your particular camping unit is a part of regular maintenance. Inspection at the beginning of the season is a must if your...

Clearance Between Truck And Fifth Wheel

How Much Clearance Is Needed Between Truck Bed And Fifth Wheel Minimum clearance between truck and fifth wheel must be 6" Lower than 6" may cause a direct impact or at least the underside of...

Mississippi Farm Bureau Insurance

Insurance Products

Make sure your RV or motorhome is covered on your adventures.

Personalized Motorhome & RV Insurance Policy Options

Motorhome and RV insurance doesn’t have to be complicated. When you talk to your local Mississippi Farm Bureau Insurance Agent, you’ll have all the help you need to determine what Motorhome or RV coverage options are right for you.

As one of the largest insurance writers in the state of Mississippi, Mississippi Farm Bureau Insurance can provide a full range of Motorhome and RV coverage options to meet your needs.

Liability Coverage

Provides protection for an insured’s activities for accidental bodily injury or property damage to a third party for which you are legally responsible.

Uninsured/Underinsured Motorist Coverage

Pays for damages sustained by you caused by an at fault driver who does not have liability insurance or does not have sufficient liability limits to pay for damages.

Collision Coverage

Pays for damage to your motor home or RV caused by collision with another motor home or RV or object. It also provides rental car coverage when your motor home or RV is being repaired as a result of a collision or other than collision loss. Emergency road service pays a limited amount for towing or labor to repair your auto that is disabled at the location where it breaks down. We will also pay for direct and accidental loss to facilities or equipment designed to be used with the motor home while such facilities or equipment is in or attached to the motor home. Facilities or equipment include but are not limited to cooking, dining, plumbing or refrigeration facilities or awnings and cabanas.

Other Than Collision Coverage

Pays for damage to your motor home or RV caused by things other than collision, such as fire, theft, glass breakage or animal collision.

Contact a Mississippi Farm Bureau Insurance Agent today to learn more about our full range of policy options.

Download the MOBILE agent App

MOBILE agent offers on-the-go convenience with 24/7 access to account information. Review your policies, report a claim, contact a local agent, or request emergency roadside assistance — all with a few taps of your screen.

RV Insurance South Carolina

Boat insurance.

Your boat wasn't a small investment; it was something you worked hard to get. You may think that covering your boat on your homeowner's insurance policy is enough. However, the basic boat coverage in a homeowner's policy may not cover all of your special needs.

Speak to your Farm Bureau Insurance agent today to discuss additional boat coverage.

Get a Quote

Motorcycle Insurance

Maybe you don't like to be confined by the walls of a car or maybe you just like to hop on your motorcycle as a break from your week. No matter how often you ride, you need to have insurance coverage that will protect you and your bike.

Your Farm Bureau Insurance agent can help you find a motorcycle insurance policy that meets your needs and state requirements. You've invested in your motorcycle; now make sure you have it properly covered.

Coverage options available through your Farm Bureau Insurance agent include:

- Liability coverage

- Collision coverage

- Other than collision coverage

- Uninsured and underinsured motorist coverage

- Medical Payments

ATVs, Golf Carts and Other Vehicle Insurance

In addition to insurance coverage for personal and commercial vehicles, RVs, motorcycles and boats, your Farm Bureau Insurance agent offers products and coverage options for a wide range of other vehicles and outdoor recreational vehicles, including:

- Motor scooters/Mopeds

- Personal watercraft (PWC)

RV Insurance

You love to travel and what better way to see the country, visit friends and family or just get away for a long weekend than in your RV. Whether you have a motorhome, a travel trailer, a toy hauler or another recreational vehicle, you want to make sure you have the same level of quality insurance as you have on your personal automobile.

Your Farm Bureau Insurance agent can help you protect your home away from home with specialized coverage options created specifically for RVs.

Some RV insurance coverage options available through your Farm Bureau Insurance agent include:

- Coverage if your RV is your full-time home

- Roadside assistance, including towing coverage for larger recreational vehicles

- Vacation Liability if you cause an accident while the RV is used as a temporary vacation residence

If you have a fifth wheel, truck camper, toy hauler or travel trailer, your Farm Bureau Insurance agent can provide you with a no-obligation RV insurance quote.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

RV Insurance Cost

Discover how RV insurance rates vary by model, location, etc.

Christine Lacagnina has written thousands of insurance-based articles for TrustedChoice.com by authoring consumable, understandable content.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

When shopping for coverage to protect your RV, it's handy to have some average cost figures in mind. If you don't use your RV full time, you could pay as little as $200 per year, while full-time RV drivers can pay as much as $3,000. Currently, the average cost of RV insurance for the US overall is $1,500 annually.

Luckily, an independent insurance agent can not only help you get equipped with all the RV insurance you need, but can also help you find the most affordable, yet quality, coverage. They are knowledgeable about RV insurance rates in their local areas and dedicated to customer service. They'll shop and compare quotes from multiple carriers for you. But first, here's a closer look at RV insurance costs.

How Much Does the Cost of RV Insurance Vary by Location?

Like many other types of coverage including car insurance , RV insurance costs vary by location. This year, the average annual cost of RV insurance in Washington, DC, is $2,610. RV owners in Texas pay an average of less than $1,500 per year, while those in Oregon pay even less, just under $1,100.

The most expensive state for RV insurance is Michigan, because of its local laws that require RV owners to purchase personal injury protection along with their regular coverage. RV owners in Michigan pay an average of $4,500 annually for their coverage, the highest in the nation, by far.

What Factors Influence the Cost of RV Insurance?

Also similar to car insurance, RV insurance's rates are influenced by many factors. For starters, the class of your RV greatly impacts your premiums.

Here's a breakdown of how RV class affects insurance rates:

- Class A: The biggest of the motorhomes, Class A RVs are the most expensive to insure by far. These RVs are expensive to purchase and might run on diesel fuel, often fitting up to 10 passengers. Coverage for Class A RVs averages $1,150 annually.

- Class B: Much smaller than Class A, Class B RVs include camper and sleeper vans and similar models. Class B RVs are often equipped with beds, kitchens, and even toilets. Coverage for Class B RVs averages $1,000 annually.

- Class C: Smaller than Class A but larger than Class B, Class C RVs fall into the middle of the pack, according to size. Class C RVs have truck or van bases and an overhead sleeping area for their passengers. Coverage for Class C RVs averages $900 annually.

An independent insurance agent can help you find the right coverage for your RV by its specific class and other distinguishing features.

Save on RV Insurance

Our independent agents shop around to find you the best coverage.

How RV Models and Specs Influence Coverage Rates

Other components that influence the cost of your RV insurance are your RV's model and other specs. These include its:

- Special features

Typically, the more expensive your RV is to purchase and repair or maintain, the more expensive its insurance rates are. Older RVs that are in worse condition can be seen as a larger risk to insurance companies and can cost more to insure. The amount of annual mileage your RV accumulates also influences your premiums, as being on the road more leads to more liability risk, and therefore higher rates.

The Type of RV Insurance Policy Influences Your Rates

Of course, the type of RV insurance you buy will also significantly affect your coverage rates. The simpler your coverage, the cheaper it's likely to be. And just like many other policies, those with a higher deductible tend to come with lower monthly or annual premiums.

Full coverage for an RV is more expensive and complex than basic coverage. Also, full-time RV drivers naturally require more coverage than part-time users who only take their RVs out on occasional trips. An independent insurance agent can help you get set up with all the coverage you need for your specific RV usage and break down how it influences your policy's rates.

Additional Factors That Influence Your RV Insurance Rates

There are more factors that can affect how much your RV insurance can cost. These include:

- Your RV driving experience: The more experience you have as an RV driver, the less risky you are to insure.

- Your driving records: Insurance companies consider your driving records when calculating the cost of your RV insurance, and award cheaper premiums to those with clean, accident-free histories.

- Your future mileage: RV drivers who travel farther distances are considered riskier to insure than those who don't.

- Your claims history: Like many other policies, your claims history also influences the cost of your RV insurance.

An independent insurance agent can help explain all the factors that could potentially influence the cost of your RV insurance in depth.

Common Discounts That Can Help You Save Big on RV Insurance

It's always helpful to know all the discounts that exist on the coverage you're shopping for. RV insurance comes with several discounts of its own. Check out some common examples below:

- Good driver discount: A clean driving history with no traffic violations or accidents can help cut your RV insurance costs.

- Military or professional: You can save money on your RV insurance premiums if you're a service member, healthcare worker, government employee, or teacher.

- Homeowner discount: Some insurance companies reward RV owners just for owning a traditional home along with their RV.

- Paid-in-full discount: Opting to pay your premium in full and up front can save you not only time and paperwork, but also money on your coverage.

- Storage discount: Your insurance company may cut you a break on your coverage costs if you store your RV in a carport or garage when not in use.

- Safety features discount: Installing safety features like anti-theft devices and airbags can help you reduce the cost of your coverage as well.

An independent insurance agent can help scout out any and all applicable RV insurance discounts that you qualify for to help you save the most money possible.

Best Insurance Companies for RV Insurance

Finding the best carrier for RV insurance is easy when you work with an independent insurance agent. They know which insurance companies to recommend to meet your needs, and can provide informed suggestions based on company reliability, rates, and more.

While many insurance companies might offer discount RV insurance, finding coverage could also depend on the area you live in. Here are a few of the top companies for discount RV coverage.

Why Choose an Independent Agent?

It’s simple. Independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Independent insurance agents also have access to multiple insurance companies, ultimately finding you the best discount RV coverage, accessibility, and competitive pricing while working for you.

https://www.nadaguides.com/RVs/shopping-guides/how-much-is-rv-insurance

AUTO INSURANCE

Recreational vehicles.

Coverage for your motorcycle, camper, ATV and more.

What protection can you get for your recreational vehicle?

Get the personalized service and coverage you need, so you can explore the outdoors knowing we have you covered.

- Off-road vehicles, including snowmobiles, dune buggies, golf carts, go carts and ATVs.

- RVs, motor homes, travel trailers and fifth wheels.

Motorcycle Insurance

Whether you ride your bike cross-country or enjoy a cruise down Indiana's country roads, we can offer protection to meet your unique needs.

What are your coverage options?

Liability Coverage If you cause an accident, covers damages for which you are responsible to someone else or their property .

Auto Damage Coverage Coverage to repair or replace your car in the event of a covered accident.

More Coverage Options

How can you save?

- Paperless Discount Go green and save 5% when you go paperless on qualifying auto policy premium.

- Accident-Free Discount Get rewarded for good driving whether you are a new client or have been with us for years.

More Ways to Save

Reach an Agent Get a Quote

Inside Story by Indiana Farm Bureau Insurance

Moving to Indiana? Tips to transfer your car insurance

Indiana farm bureau insurance | feb 15, 2024.

How to save money on motorcycle insurance with a multi-line discount

Indiana farm bureau insurance | dec 29, 2023.

Does a windshield claim increase your car insurance in Indiana?

Indiana farm bureau insurance | nov 3, 2023.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Farm Bureau Auto Insurance Review 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How Farm Bureau sells insurance