A part of Watch Media

Cargo volumes on fronthaul voyages hit hardest during outbreak

The so-called fronthauls are hardest hit during the coronavirus crisis, according to new numbers from analyst firm Sea-Intelligence.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

- Access all locked articles

- Receive our daily newsletters

- Access our app

Get full access for you and your coworkers

Share article, related articles:.

Container lines could deliver combined profit of USD 9 billion in 2020

For subscribers

Clarksons: Maersk headed for improved operating profit in 2020 despite coronavirus

Container lines face a challenge in the second quarter

Sign up for our newsletter.

Stay ahead of development by receiving our newsletter on the latest sector knowledge.

Front page now

Opinion: Container lines should make contingency plans for Middle East unrest

- Opinion: The climate is paying a high price for detours south of Africa

- Opinion: Even progressive carriers could struggle to reach climate goals

Taylor Maritime targets ship sales in firming dry bulk market

DHL to pay large compensation in discrimination case

Baltimore's trapped ships start leaving as new channel opens

J. Lauritzen finds Svitzer stock appealing ahead of Copenhagen listing

Russia will now be able to insure tankers via India

Danish military investigates partnership with Scan Global after criticism

CMA CGM launches EUR 200m climate fund

Industry expects soaring demand for LNG

DSV criticizes peers' use of Russian railways: "A matter of principle"

Forwarders lament lack of clarity around UK border checks of food

Norden was caught out by early recovery in dry bulk

Further reading.

Scan Global stands firm despite criticism of train freight through Russia

Maersk ship reportedly targeted by Houthi attack again

Gianluigi Aponte personally contacted car carrier ahead of bid

Experienced Solicitor for Shipping / Offshore / Transportation

Vessel Manager - Offshore Wind Industry

Mechanical Engineer

HSEQ Engineer – Offshore Wind Industry

QEHS Manager

Sales Director

Project Coordinator

Project Engineer - Offshore Wind Industry

Operations Manager or Senior Operations Manager

International Sales Manager - Offshore Wind and Maritime Industry

Scandlines is looking for a sharp Supply Chain Supporter M/F

Technical Sales Manager - Offshore Wind Industry

Latest news

- Opinion: Container lines should make contingency plans for Middle East unrest |

- Taylor Maritime targets ship sales in firming dry bulk market |

- DHL to pay large compensation in discrimination case |

- Baltimore's trapped ships start leaving as new channel opens |

- Russia will now be able to insure tankers via India |

- J. Lauritzen finds Svitzer stock appealing ahead of Copenhagen listing |

- Danish military investigates partnership with Scan Global after criticism |

- Industry expects soaring demand for LNG |

- CMA CGM launches EUR 200m climate fund |

- Tax authorities file a bankruptcy petition against Cleaves Securities |

The Virtual Shipbroker

The Ship broker blog, shipbroker and chartering information, ship broker salaries, Shipbroker database, shipbroker jobs, ship broker training and courses - all from a real bulk shipping insider Nick van der Hoeven Copyright 2024 https://www.instagram.com/virtualshipbroker/

- Shipbroking/Chartering Books

- Voyage Estimation

- Maritime Consultant

- Performance Hacks

Thursday, April 30, 2009

Shipping economics - fronthaul / backhaul, 10 comments:.

Thanks, so true about commodity markets. While on the topic of cycles, if you look at the TC 4 AVG CAPE & PANAMAX you can definitely see cyclical trends which are consistent year in year out.

what's front haul and back haul in shipping???

I thought that was what the post was about?

hi! thanks for very good job with the explanation of fronthaul and backhaul. I would like to ask what is the ECSA season with reference to dry-cargo shipping and when does this season end and start. Many Thanks

ECSA to Asia is considered fronthaul...atleast is has been...

Excellent blog - will definitely get the ebooks - in the meantime, can you define clarify the terms "Worldscale" and "Time Charter Equivalent" and how shipping companies derive/arrive at these figures when they report their financial results.....?

Hi - Worldscale is a tanker ship term. Not my gig! Basically its a way of pricing the ships. Time charter equivalent refers to price of a ship on a daily basis. So if a ship charged say 50 bucks per metric tonne to carry 50,000 mt of coal - that will have some kind of time charter equivalent - whihc means an equivalent daily rate which could be for example USD 10,000 per day. There is no way you can figure out if the Time charter equivalent rates are kosher without knowing how to do a voyage calculation and without having all the cargo and ship details. So bottom line is you need to accept what the reports are telling you. Hope this helps - and yes do buy my books! Keeps my children in food and clothing for another week. VS

Insightful.

DO YOU THINK THAT A VESSEL BALLASTING FROM INDIA OR PMO OR CHINA TO EAST COAST SOUTH AMERICA AND REDELIVERED IN THE CONTINENT CAN BE CONSIDERED A BACKHAUL TRIP FOR A PANAMAX VESSEL?

No, that wud be a T.a trip, trans-Atlantic trip

- Veson Support

- Q88 Support

- System Status

- Support FAQ

- Veson University

IMOS - Backhaul Exposure Method

The Trading P&L Summary supports displaying Net P&L on physical cargo inclusive of a backhaul voyage, ensuring correct exposure reporting for world round voyages.

In order to properly expose your world round voyages, inclusive of backhaul, follow these steps:

- Create your first Voyage Estimate that will be your Fronthaul voyage. This Estimate should include correct cargo, itinerary, market bunker prices and targeted Freight Rate, as well as other voyage costs, for more accurate P&L reporting.

- Set this Voyage Estimate as a Benchmark Estimate and save the Voyage Estimate.

- Copy this Estimate; this new copy is your World Round Voyage Estimate.

- Set it as a Benchmark Estimate.

- Add the Backhaul Cargo as a second Cargo to the Estimate.

- Set this as the Backhaul Cargo by selecting the B check box in the Cargoes table. (Depending on settings, you may need to scroll right in the Cargoes table.)

- Complete the remaining details such as market bunker prices and other voyage costs.

- Lock and change the TCE or Freight Rate on the Backhaul Cargo to set your targeted Freight Rate.

- Right-click the Backhaul Cargo in the Cargoes table and then click Create Cargo .

- Right-click the Backhaul Cargo and then click View Cargo .

- Set the Exposure Method to Benchmark Estimate .

- Set the Benchmark M2M Basis to Backhaul .

- In the Benchmark Estimates Table, add the Fronthaul Benchmark Estimate and set its Category to Fronthaul .

- Save and close the Cargo.

- Save the World Round Estimate and close.

The Backhaul Cargo exposure is calculated in the following way:

- The system calculates the Fronthaul benchmark Freight Rate.

- In the World Round Estimate, the bunker market rates and the Fronthaul benchmark Freight Rate are plugged in.

- The TCE is locked, and the market rate is entered, while applying the change on the Backhaul Cargo only.

- This gives you the World Round benchmark Freight Rate.

Please note, these errors can depend on your browser setup.

If this problem persists, please contact our support.

- Advertising

- Shipbuilding

- Coastal/Inland

- Law & Regulations

Trade War All About the Eastbound Transpacific -BIMCO

May 8, 2018

© vladsv / Adobe Stock

When two of the world’s top trading partners get entangled in a stand-off, where the outbreak of a trade war could become the extended tool of intense negotiations, BIMCO says we’d better prepare for what may come while hoping that it will never take place.

The U.S. is China’s largest trading partner measured by value – and China is the largest one-country trading partner that the U.S. has.

“The global shipping industry naturally gets concerned when two nations of huge importance to most shipping sectors get in the ring to fight a trade war – gloves off,” says Anastasios Papagiannopoulos, BIMCO President and Principal of dry bulk shipping company Common Progress.

“I am still hopeful that world trade will not implode and encourage the involved parties to avoid a brutal and harmful escalation that will affect the shipping industry badly.”

What matters the most?

There may be a lot of talk concerning Chinese plans for tariffs on U.S. pork, fruit and wine, and while bound to hurt the U.S. exporters of these products, the potentially lost TEUs containing these goods doesn’t really matter to the transpacific shipments on containers.

What matters to the container shipping industry is volumes that may be lost on the essential leg of a transpacific voyage from China into the U.S.

In container shipping, the fronthaul of any trade dictates the amount of shipping capacity deployed on that trade lane. The fronthaul leg of a trade lane, being that which holds the higher container volume transported as compared to the return leg (backhaul).

BIMCO’s Chief Shipping Analyst Peter Sand comments, “The shipping industry is concerned with a lower level of U.S. containerized imports which may become a result of a trade war between the U.S. and China.

“If fronthaul volumes go down, oversupply of ships develops causing utilization to drop alongside freight rates and earnings on the transpacific networks.”

In many aspects, backhaul shipments only serve to cover a part of the repositioning costs of a ship to the next fronthaul voyage – they don’t generate profits.

Why is it all about the cargo moving into the U.S.?

When container alliances and individual carriers optimize their global networks, which they constantly do, they try to match shipping capacity with that of shipping demand. As more containers move from China to the U.S., than the other way around, that part of the trade is the constraining element in the optimizing matrix.

Only when we have growing cargo movements on the fronthaul leg, is more shipping capacity required – meaning there is an increasing demand for ships. Compare this to cargo movements growing on the backhaul leg, where you are nowhere near the limit of using the deployed shipping capacity at full extent. That demand growth will not result in a need for more ships – it will only deliver a higher utilization of ships where available space is amble.

Which cargoes matter?

1.8 million TEU of Chinese imports from the U.S. and up to 3 million TEU exported from China into the U.S. will be subject to these higher tariffs, according to Drewry’s senior manager for container research, Simon Heaney. Nearly 2.5 percent of total global containerized trade can be affected.

Admittedly the tariff lists are long on both sides, and single products with a huge impact on shipping demand, besides soya bean are difficult to find. Nevertheless, we do know that U.S. whiskey exports may come to a complete stop without global shipping ever knowing about it. That commodity is on the list due to political reason, as we have highlighted previously in our focus series of the potential trade war.

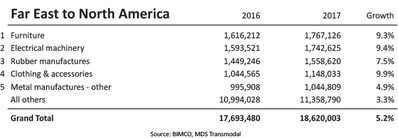

Which cargo groups are relevant to pay closer attention to?

Top 5 Commodities (SITC at a two-digit level) on Far East to North America trade lane:

Top 5 Commodities (SITC at a two-digit level) on North America to Far East trade lane:

“For the shipping industry, importers and exporters in either country involved in transpacific shipments of containers this uncertainty is a huge burden to handle.

As the countdown continues we get ever closer to disruptions – not just of container shipping but also dry bulk shipping in the case of steel, aluminium and soya beans”, Peter Sand ends.

Related News

European shipowners welcome 40% production benchmark for clean fuels.

The last plenary of the European Parliament in Strasbourg has adopted a new law which aims to scale up industrial capacity…

First Ship Departs Baltimore Through Limited Access Channel

The first commercial vessel transited through a newly opened channel in the Port of Baltimore following the deadly collapse…

Russia Reinsurer Backs Firms to get India Marine Insurance Permit

Russia's state-owned reinsurer has given financial backing to three Russian insurance firms, allowing them to get Indian…

Houthis Target Two American Ships

A coalition vessel successfully engaged one anti-ship ballistic missile (ASBM) launched from the Iranian-backed Houthi "terrorist…

Sponsored Content

Revolutionized fleet management with abs wavesight nautical systems™ mobile.

As the maritime industry continues to rapidly advance with increasingly stringent regulations and ever-evolving technology, staying ahead of the curve requires embracing innovative technological

Chris-Marine’s solutions help to prolong engine lifetime

Abnormal liner wear and seized or broken piston rings can result in costly consequences.

AST is now AST Networks, bringing you remote connectivity wherever you are

AST has developed and grown, increasingly providing full-service network solutions, far beyond traditional satellite services.

Third Assistant Engineer - Mixed Work Schedule

Third officer - mixed work schedule, chief steward, third assistant engineer (d), second assistant engineer (d).

Subscribe for Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week

- Breaking News

- Customs & Trade

- Ports/Terminals

- SCMAP Perspective

- IT in Logistics

- Narrow Channel

- Circle of Safety

- Across Borders

- Did You Know?

- In Their View

- PISFA at Work

- The Export Advocate

- Press Releases

- PortCalls Archives

- Updates for Customs E-Lib Subscribers

Bimco identifies trade lane, cargoes at stake in a trade war

“The global shipping industry naturally gets concerned when two nations of huge importance to most shipping sectors get in the ring to fight a trade war—gloves off,” said Anastasios Papagiannopoulos, Bimco president and principal of dry bulk shipping company Common Progress.

“I am still hopeful that world trade will not implode and encourage the involved parties to avoid a brutal and harmful escalation that will affect the shipping industry badly.”

The U.S. is China’s largest trading partner measured by value, and China is the largest one-country trading partner that the U.S. has. But with the current trade tensions between the two nations, “what matters to the container shipping industry is volumes that may be lost on the essential leg of a transpacific voyage from China into the US,” said Bimco.

In container shipping, the fronthaul of any trade dictates the amount of shipping capacity deployed on that trade lane. The fronthaul leg of a trade lane, being that which holds the higher container volume transported as compared to the return leg (“backhaul”).

Bimco’s chief shipping analyst Peter Sand commented: “The shipping industry is concerned with a lower level of US containerised imports which may become a result of a trade war between the US and China. If fronthaul volumes go down, oversupply of ships develops causing utilisation to drop alongside freight rates and earnings on the transpacific networks.”

In many aspects, backhaul shipments only serve to cover a part of the repositioning costs of a ship to the next fronthaul voyage—they don’t generate profits.

When container alliances and individual carriers optimize their global networks, which they constantly do, they try to match shipping capacity with that of shipping demand. As more containers move from China to the U.S. than the other way around, that part of the trade is the constraining element in the optimizing matrix, Bimco explained.

“Only when we have growing cargo movements on the fronthaul leg, is more shipping capacity required—meaning there is an increasing demand for ships. Compare this to cargo movements growing on the backhaul leg, where you are nowhere near the limit of using the deployed shipping capacity at full extent. That demand growth will not result in a need for more ships—it will only deliver a higher utilisation of ships where available space is amble.”

About 1.8 million TEUs of Chinese imports from the U.S. and up to 3 million TEUs exported from China into the U.S. will be subject to higher tariffs ensuing from the trade face-off, according to Drewry. Nearly 2.5% of total global containerized trade can be affected.

Bimco said that of the cargo groups that are relevant to pay closer attention to, the top commodities on the Far East to North America trade lane are furniture, electrical machinery, rubber manufactures, clothing and accessories, and metal manufactures—others.

The top five commodities on the North America to Far East trade lane are pulp and waste paper, cork and wood, meat and meat preparations, vegetables and fruit, and ores and scrap.

Photo: BenBench

RELATED ARTICLES MORE FROM AUTHOR

Marcos inaugurates batangas passenger terminal building, tanza barge terminal opens, offers alternative to trucking, ati earmarks p2.7b for 2024 capex, editors' picks, local sales of goods from ecozones may be covered by paper-based co, ph promotes use of biofuels in aviation, popular category.

- Breaking News 8100

- Ports/Terminals 5825

- Customs & Trade 5423

- Maritime 4900

- Press Releases 4624

- 3PL/4PL 2904

- Aviation 2812

- Latest News 2696

- Editors' Picks 2298

- Economy 1506

- Exclusives 812

PortCalls Asia

PortCalls Asia is a news and data provider for cargo transport and logistics professionals which began publication in 1996. It focuses on Asian news but also covers developments elsewhere.

Contact us: [email protected]

Copyright © 2021 PortCalls Asia. All rights reserved.

- Portcalls Archives

Privacy Overview

- Privacy Policy

- Dry Cargo Magazine

- Dry Cargo Handling Directory

- Magazine Advertising

- Online Banner Advertising

- Newsletter Banner Advertising

- Online Lead-Generating Content

- DCi Media Pack

- Editorial Programme

- Advertising Rates

- Latest News

- Trade & Commodities

- Shipping & Transport

- Ports & Terminals

- Engineering & Equipment

- Regional Focus

Dry Bulk Shipping Report

- 13 March 2023

- Dry Bulk | Trade & Commodities | Shipping & Transport

High rates on idle capesize bulker route 'significant'

The Baltic Exchange has placed spot rates for capesize bulkers sailing to China and Japan from Europe in the vicinity of $80,000 per day

A lofty rate for a seldom-traveled capesize bulker route may not accurately reflect the physical market but still means plenty for this dry bulk sector, pundits say.

The Baltic Exchange's time-charter equivalent (TCE) for trips to China and Japan from the European Continent/Mediterranean has been hovering around $80,000 per day since gaining about $27,000 per day in the past month.

Trending Today

Lomar Shipping bosses took home more pay from shipmanagement arm after loss

Chinese tanker giant orders up to 10 new ships in chemical carrier drive

As Houthis and pirates menace shipping, shipowner Christopher Fjeld targets maritime security play

TradeWinds is part of DN Media Group. To read more about DN Media Group, click here

- 317-208-5565

- Truckload & LTL

- Cross Border

- Managed Transportation

- Logistics Services

- Freight Guides

- Terms & Definitions

- About InTek

- Our Partners

- Community Support

Headhaul vs Backhaul Freight Market: Why it Matters for Pricing

January 31, 2020 • Rick LaGore

Truckload • Intermodal Transportation • Logistics & Supply Chain

Freight pricing is the number one topic discussed, whether a buyer, seller or freight market analyst. As we shared in the comprehensive article entitled Freight Costs: An Insider’s Look on Freight Pricing Buyers Should Know there are numerous factors that drive a freight rate either up or down.

Factors that Impact Freight Rates

- Overall Economic Conditions

- Market Capacity

- A Freight Provider’s go to Market Pricing Strategy

- Mode Required to Make Required Transit

- Mode Required for Physical Space Required for the Freight

- Special Handling and / or Requirements at Origin or Destination

- Spot, Contract or Special Project Pricing

- Balance of the Supply of Trucks in a Given Market vs. the Demand for Trucks

- Economics of the Freight Lane Itself

While all the above components have an impact on freight pricing, the economics of the lane itself is the ultimate driver of price the motor carrier or freight broker .

The reason to understanding the concepts of headhaul and backhaul is they are the keystone to the freight pricing equation for each carrier.

With the above in mind, let’s dive into the definition of headhaul and backhaul.

Definition of Freight Headhaul

Headhaul freight markets are created when there is an imbalance in a lane where the demand for the lane by shippers is greater than the supply of freight capacity provided by freight providers.

Characteristics of a headhaul freight market include: freight carriers have plenty of choices; carriers can typically demand a higher price and the carrier may deadhead into the market to tap into the higher rate optioned freight.

Definition of Freight Backhaul

A backhaul is the lower of the rates in a round trip origin and destination pair.

Backhaul markets are those markets where the imbalance of capacity occurs when there is less demand by shippers than there is for carriers in the market. The favorable nature creates lower prices for shippers because carriers are willing to negotiate price to get out of the market with freight on their truck versus running empty.

As an example of a backhaul lane, consider outbound Florida. For most of the year Florida has more inbound freight volume than outbound freight volume.

Characteristics of a backhaul market include: carriers have few options to get out of the market; increased chance of deadhead miles out to gain access to a market for the next load; and carriers often takes losses on the lane because they are forced to lower pricing to get out of the market..

Definition of Deadhead Miles in Trucking

Deadhead miles can be defined as anytime a freight carrier is moving its trucks without revenue producing freight on board.

Deadhead miles are costly for the carrier and something they measure with the finest of microscopes when figuring pricing for a shipper.

Headhaul freight markets often cause carriers to deadhead into the destination, meaning they can only find freight out of the market but have no option to get into the market.

The opposite can occur when a freight carrier has its truck in a backhaul market and has not options to get out of the market without deadheading to the next closest origin point it can pick up another revenue producing freight load.

More on the Importance of Headhaul & Backhaul Freight Lanes

With the cyclical nature of freight and its flows throughout the year, markets can be both a headhaul and backhaul market at different times during the year. A great example of this is when intermodal “peak season” hits in late third quarter and early fourth quarter every year when there is a higher demand to move the holiday retail product inland to the stores for their holiday shopping needs.

Markets can also change the balance of the entire network of how freight is balanced throughout the year when a natural disaster occurs in a given region. An example of this occurred in the summer of 2017 when hurricanes hit both Florida and Texas in a few short weeks. All of a sudden, the citizens of those areas were in need of food, shelter and clothing because of the disasters.

The intermodal spot rate pricing chart InTek publishes every week helps shippers and freight analysts see the changing tides in freight demand through a given period in time.

When analyzing a freight lane or singular market for the demand and supply swings that cause headhauls and backhauls it is worth reviewing the Tender Rejection Chart published by FreightWaves . The FreightWaves analysis provides macro detail or micro lane-by-lane detail on the ebbs and flows of a freight market being a headhaul or backhaul market based on the percentage of freight carrier tenders being accepted and rejected over a period of time.

A more efficient logistics market that reduces the amount of deadhead miles also improve the sustainability of a shipper's supply chain .

The last idea to leave you with is the balance of a freight market is key when studying a shipper’s supply chain network for them to optimize on service and price.

Next Step on Freight Pricing

This article was written just to get the ideas flowing on the importance of headhaul, backhaul and deadhead markets. Additional articles we suggest reading that take a deeper dive into freight pricing include:

- Freight Contract Rates vs. Spot Rates - Comprehensive Guide

- Freight Costs: An Insider’s Look on Freight Pricing Buyers Should Know

- Freight Pricing Methods Defined: Contract -Project - Spot

- How to Negotiate Best Intermodal & Truckload Market Pricing

- Cost of Managed Transportation Services

- Cost of Intermodal Transportation

If you're ready to take the next step, at InTek Freight & Logistics, we can help. Just tell us what you need and we'll discuss how our expertise can help with the unique shipping challenges your business faces. Rather do a bit more research first? View our Freight Guides for comprehensive articles and eBooks on all things freight and logistics.

Share This:

Get Updates

Featured articles.

- Freight & Shipping Costs (40)

- Freight Broker (57)

- Freight Forwarder (2)

- Intermodal Transportation (162)

- International & Cross Border Logistics (35)

- Logistics & Supply Chain (355)

- Logistics Service Provider (74)

- Managed TMS (48)

- Supply Chain Sustainability (10)

- Transportation Management System (37)

- Truckload (110)

- Warehousing & Distribution (40)

- Explore Ciena

Our solutions

Our solutions power the world’s most adaptive networks to address ever-increasing digital demands for richer, more connected experiences for all users

EXPLORE OUR SOLUTIONS

Access and aggregation, open line systems, enterprise edge, secure networking, operations and automation.

- Network transformation

Drive next-generation business services at the network edge

- Universal aggregation

- 4G/5G converged xHaul

- 5G automation

Evolve your metro network to become more simple, scalable, and sustainable

- Coherent routing

- Metro optical architectures

- On-demand wave services

Maximize capacity and operational efficiencies with our innovative, flexible long-haul solutions

- High-capacity switching and transport

- Submarine networking

Gain more visibility and optimize your photonic network assets with our intelligent open line systems

- Programmable photonics

Accelerate your edge service revenue, including high-value cloud networking and security services, with our comprehensive enterprise edge solutions

- Secure access service edge

- Software-defined edge

- Edge routing and switching

Mitigate security risks and ensure the confidentiality, integrity, and availability of data

- Data security and encryption

- Quantum secure communications

Simplify network and services management with intelligent automation and software-defined control

- Multi-layer network control

- Intelligent automation

Accelerate your network transformation with our industry-leading experts, field-proven analytical tools, and tailored approach and methodology

Navigator Network Control Suite

See clearly, act with insight. Discover multi-layer optimization from one point of control.

Our solutions by industry

- Education (K-12)

- Federal government

- Regional service provider

- Research and education

- State and local government

- Transportation

Our insights

Network innovation insights from the experts

SELECT A TOPIC:

- Routing and switching

- Next Gen Metro and Edge

More choices to converge your network: Introducing new members of the WaveRouter Family

The WaveRouter family is getting bigger, by going smaller. Ciena’s Joe Marsella explains how you can now get the benefits of WaveRouter in more capacities and form factors to converge your metro networks.

WaveLogic 6 Extreme - Evolving to 1.6Tb/s Networking

Joe Shapiro, Vice President PLM, explains the business benefits of evolving to 1.6T technology with Ciena's WaveLogic 6 Extreme for network providers. Learn more about the technology that delivers unrivaled high bandwidth connectivity and the performance required with next-generation 800G routing data paths and associated wholesale services.

Episode 75: Pushing the limits of connectivity with Vocus

On this episode of the Ciena Insights Podcast, Jarrod Nink, Chief Operating Officer at Vocus offers an insider's perspective to how the Australian network provider is capitalizing on this surging demand for bandwidth.

Intelligent Data - Driven Operations with AIOps

CSPs are looking to use AIOps to broaden the scope of network management and improve operational efficiency at each stage of the network lifecycle, by combining big data with AI/machine learning (ML).

Our company

We’re a global leader in optical and routing systems, services, and automation software

- About Ciena

- Corporate Governance

- Sustainability

Our success is rooted in people

Our commitments to diversity, social impact, well-being, and sustainability, empower our people to improve their lives and lift those around them.

Press Release

Ciena reports fiscal fourth quarter 2023 financial results, customer story, dish expands first-of-its-kind cloud-native 5g network with blue planet’s automation platform, investor relations.

Connect with us

- Contact sales

- Contact support

- Executive Briefing Center

General Inquiries

North America: 1-800-921-1144

International: +44 20 7012 5555

North America: 1-800-207-3714

Global offices

North and South America

- United States

Europe, Middle East, and Africa

- Middle East

- Netherlands

Asia Pacific

- South Korea

Spotlight on 4G/5G fronthaul networks

View the entire 5G xHaul Series:

- Part 2: Spotlight on 5G midhaul networks

- Part 3: Spotlight on 4G/5G backhaul networks

Ciena recently announced major additions and enhancements to our 5G Network Solutions , including three new routers optimized for the xHaul transport network, Network Slicing and Dynamic Planning enhancements to our Blue Planet Automation Software, and professional Services to help operators along their unique 4G to 5G journey. Not familiar with xHaul and why it’s absolutely critical to the success of 5G? Let me explain.

What is xHaul?

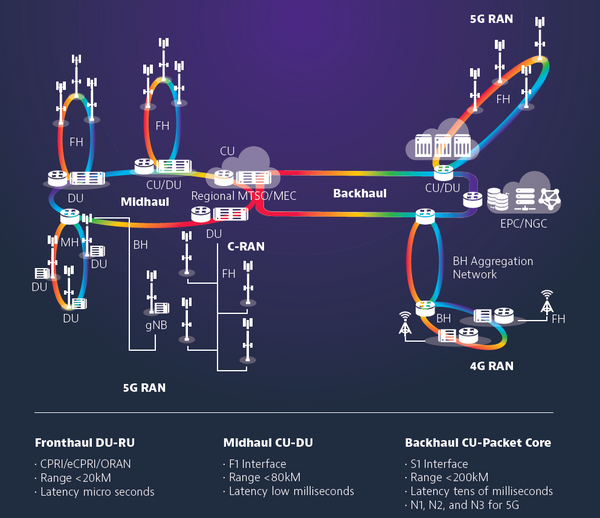

xHaul refers to fronthaul, midhaul, and backhaul transport networks that interconnect cell sites to each other, to the core network, and ultimately to data centers, where accessed content is hosted. Why am I talking about data centers?

Well, video will represent 76% of all mobile traffic by 2025 , and guess where most video content is located? You got it, at nearby and distant data centers, meaning the entire fixed wireline network between the Radio Access Network (RAN) and data centers must be upgraded to realize the full guaranteed end-to-end performance promise that 5G Network Slicing is expected to deliver. Mobile Network Operators (MNOs) will use 5G Network Slicing to support three main categories of use-cases, each with its own network performance requirements:

- enhanced Mobile Broadband (eMBB), which requires significant wireline capacity increases

- massive Machine-Type Communications (mMTC), which requires analytics-driven automation to optimally connect millions to billions more machines (think massive IoT)

- ultra-reliable Low-Latency Communications (urLLC), which requires Multi-access Edge Computing (MEC) and deterministic packet-optical transport to achieve extremely low and deterministic latency targets

Why are these categories important? Because as data traverses the end-to-end network, across both the wireless and wireline domains, network operators must be able to guarantee a network slice’s performance over its entire lifecycle. In the wireline domain, this means specific traffic management capabilities are required in the fronthaul, midhaul, and backhaul networks that go well beyond simply increasing capacity to properly support 5G services.

Where is xHaul?

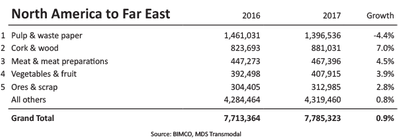

In 4G, the fronthaul transport network connects Remote Radio Heads (RRHs) to distant centralized/cloud Baseband Units (BBUs), while backhaul connects BBUs back to 4G Evolved Packet Core (EPC). In 5G, the New Radios (NR) are connected to the BBU, which can be disaggregated (and virtualized) into a Central Unit (CU) and a Distributed Unit (DU). The new midhaul interconnects the CU to the DU via a new, standardized 3GPP F1 interface. 5G backhaul, initially where operators are focused on to deliver new eMBB services, is essentially the same as in 4G, albeit carrying much more traffic due to higher performance, higher bandwidth 5G New Radios (NRs).

Figure 1 : High-level 4G C-RAN vs. 5G C-RAN architecture

There’s a momentous shift happening in the industry with a move to break open 4G fronthaul networks. While based on a published Common Public Radio Interface (CPRI) specification, these fronthaul networks ended up being closed and proprietary. MNOs were forced to buy RRHs and BBUs from the same vendor and to transport fronthaul traffic over costly, and often unavailable, dark fiber due to CPRI’s very high (and inefficient) capacity and stringent latency requirements. With 5G – this can and will change.

Why open xHaul networks?

With help from organizations such as the operator-led O-RAN Alliance , 5G fronthaul and midhaul network interface specifications are open and defined in a structured format. This allows MNOs to purchase RUs, DUs, CUs, and the associated transport networks between them, from anyone, as long as the equipment complies with the O-RAN specifications. These open specifications will lead to increased vendor competition providing greater choice, faster innovation, best-in-breed network designs, and a broader and more secure vendor ecosystem.

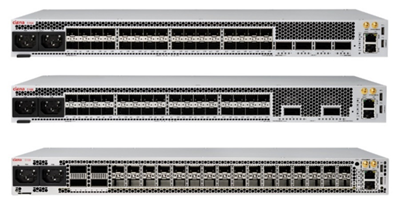

Ciena proactively believes in openness and that’s why we introduced our new, multi-vendor interoperable 5164, 5166, and 5168 Routers – to help MNOs break free from vendor lock-in once and for all. Because both 4G and 5G will coexist for many years to come, xHaul networks must support both of these standards for many years to come. The best way to cost-effectively do so, is through an open, interoperable, and converged transport network that unifies fronthaul, midhaul, and backhaul over a common transport network infrastructure.

Why multi-vendor interoperable xHaul networks?

Focus on the fronthaul network

Ciena’s 5164, 5166, and 5168 Routers support both standard and Time-Sensitive Networking (TSN) Ethernet, as well as soft (Segment Routing) and hard (FlexEthernet / ITU-T G.mtn) network slicing. They also benefit from Ciena’s Blue Planet intelligent automation software and Ciena’s Adaptive IP lean IP implementation enabled via open APIs and they support streaming telemetry to provide network-wide benefits that go beyond the routers themselves.

Let’s focus on the fronthaul capabilities of the 5168 router and its numerous fronthaul interfaces, which make it different from the 5164 and 5166 routers. To converge and simplify 4G and 5G fronthaul and midhaul traffic onto a common and converged xHaul network, the 5168 router supports the following fronthaul and midhaul interfaces:

- Common Public Radio Interface (CPRI)

- evolved Common Public Radio Interface (eCPRI)

- IEEE 1914.3 Radio-over-Ethernet (structure-agnostic and structure-aware) interface (4G CPRI into Ethernet)

- ORAN interface

- 3GPP F1 interface (including O-RAN Open F1 profiles)

- CPRI-to-eCPRI Interworking Function (IWF)

- CPRI-to-ORAN, including L1 Offload processing

Fronthaul network performance

All the above 4G/5G fronthaul and midhaul interfaces are packet-based and require new and strict levels of latency and jitter assurance requirements to ensure the successful transmission of packets across the fronthaul network. Similar technologies across midhaul and backhaul networks are leveraged to achieve the strict performance requirements of new 5G use cases, such as those associated with urLLC.

Just as service providers seek to leverage best-in-breed technologies to design and build the highest performance networks for their users, at Ciena we’re always looking for opportunities to offer value added programmability to further increase the capabilities and performance of our solutions. One specific example of this is in the fronthaul domain where we’re working together with Intel to deliver best-in-breed packetized CPRI transport via Radio-over-Ethernet (RoE) and a CPRI-to-eCPRI Interworking Function (IWF). Intel’s Field Programmable Gate Array (FPGA) technology provides the required performance, flexibility, and programmability we need to implement multiple fronthaul specifications today. In addition, Intel FPGA technology permits field upgrades should future deployment requirements change for any reason. By working together with Intel, we’re able to leverage their expertise in vRAN-enabling programmable and acceleration technology to enable the deployment of converged 4G/LTE and 5G mobile networks in the most efficient and cost-effective way.

What about midhaul and backhaul?

Check out the other two blogs in this series on the midhaul and backhaul parts of the wireline network that are also critical to 5G supporting the guaranteed end-to-end network slices that will unleash a new wave of exciting new eMBB, mMTC, and urLLC applications and use-cases.

What’s in your fronthaul network?

Laying the foundation for 5G in Asia-Pacific

5g is your business – even if you are in the wireline business.

A practical vision for rolling out 5G networks

When a leading global service provider was looking to roll out its 5G network infrastructure, a next-gen cell-site router was a k ...

5G network design is full of challenges, but ther ...

Mobile Network Operators must balance the daunting challenges of profitability, urgency, and uncertainty as they roll out 5G netw ...

Without an innovative new approach to xHaul, 5G m ...

Backhaul has traditionally been the afterthought when it comes to planning next-generation cellular networks. But in the 5G era, ...

- Application Emulation

- UE Emulation

- Cloud UE Emulation

- Core Emulation

- O-CU Simulator

- Security Validation

- Test as a Service (TaaS)

- Ethernet Test

- High-Speed Networks

- Optical Manufacturing Test

Compute, Storage, Transport

- PCI Express

- SAS and SATA

- Fiber Channel, Ethernet, FCoE, NVMeoF

- Protocol Analyzers

- Exercisers and Generators

- Antenna Alignment and Monitoring

- Asset and Data Management

- Cell Site Installation and Maintenance

- Cable and Antenna Analyzer

- Interference Hunting

- RF Analysis

- Attenuators

- Bit Error Rate

- Copper, DSL, WiFi and Broadband Test

- DOCSIS Test

- Essential Fiber Optic Testers

- Fiber Characterization

- Fiber Identifiers

- Fiber Inspection and Cleaning

- Fault Locators

- Fiber Optic Sensors

- Fiber Optic Light Sources

Fiber (cont.)

- MPO Testing

- Optical Multimeter

- Optical Power Meters

- Optical Spectrum Analyzers (OSA)

- OTDR Testing

- PON Testing

- Remote Fiber Test and Monitoring

- Virtual Test and Activation

Network Assurance

- Ethernet Assurance

Service Assurance

- 5G Service Assurance and Analytics

- Fiber Service Assurance

- HFC and Cable Service Assurance

- Location Intelligence

- MNO Assurance and Analytics

- Transport Assurance

Lab and Manufacturing

Deployment and maintenance, railway and mission-critical.

- ERTMS Monitoring

- FRMCS Monitoring

- Railway Cybersecurity

- REC Monitoring

- Mission Critical Assurance

Performance and Threat Visibility

- End-User Experience

- Enriched Flow Collection

- Network Data Collection

- Packet Analysis

- Packet Capture Collection

- Packet Meta-Data Collection

- Threat Exposure Management

Test and Certification

Land mobile and military radio.

- Communications Service Monitors

- Land Mobile Radio Test

- Military Radio Test

- Modular Instrumentation

- Software Defined Radio and System Solutions

- ADS-B Compliance

- Aircraft Fuel Quantity Test Sets and Interfaces

- Antenna Couplers

- Distance Measuring Equipment (DME)

- Fiber Optic Avionics

- GPS Signal Simulators

- Military Avionics

- Navigation and Communication

- Radio Altimeters (RADALT)

- Radio Frequency Automatic Test Equipment (RF ATE) Systems

- Tactical Air Navigation System (TACAN)

- Traffic Collision Avoidance System (TCAS)

- Transponder and Interrogator

Custom Optics

- Custom Optical Filters

- Light Shaping Optics

- MicroNIR Spectrometers

- Brand Protection

- ChromaFlair Pigments

- Security Pigments

- SpectraFlair Pigments

Products by Family

- CellAdvisor

- Multiple Application Platform (MAP)

- Observer Platform

- Optical Network Tester (ONT)

- OneExpert (ONX)

- SmartPocket V2

- T-BERD / MTS

Products by A-Z List

Discontinued products.

- Instrument Care Plans

- Refurbished Equipment

- Repair and Calibration

- System Maintenance and Contracts

- Training and Certification

- VIAVI Automated Lab-as-a-Service for Open RAN (VALOR)

- Order Services

- Ethernet Service Activation Test

- Fiber Construction

- Fiber Optic Sensing

- Fiber Network Solutions

- HFC Network Test

- MPO Connector Testing

- Passive Optical Network (PON)

- Rural Broadband

- Test Process Automation (TPA)

- Transport Network Operations

- 5G Solutions

- 5G Security

- Cell Site Installation

- Cloud-Based Testing

- RAN Intelligence Solutions

- RAN Energy Savings

- 5G Synchronization

- NITRO Cable

- NITRO Enterprise

- NITRO Fiber

- NITRO Fiber Sensing

- NITRO Transport

- NITRO Wireless

Virtual and Cloud Infrastructure

- Artificial Intelligence and Machine Learning

- Cloud Workflow Management

- Copper Certification

- Edge Computing

Performance Management and Security

- WAN Performance Testing

Physical and Network Infrastructure

- Data Center Interconnect

- Tier 1 (Basic) Fiber Optic Certification

- Tier 2 (Extended) Fiber Optic Certification

- Cloud Monitoring

- End-User Experience Monitoring

- High-Fidelity Threat Forensics and Remediation

- Network Performance Monitoring

- Unified Communications

- Fiber and Copper Test and Certification

VPN Management

- VPN Management Solution

Network Equipment Manufacturers

- 5G Network Equipment Manufacturers

- Analytics Enablement

- Coherent Optics Testing

- Field Deployment

- Non-Terrestrial Networks for 5G

- Open RAN Security Test

- Scalable Manufacturing

- Technology and Service Introduction

- Test and Development

- General Aviation

- Military Aviation

- Optical Coatings and Filters

Government and Defense

- Public Safety

- Software Communications Architecture (SCA)

Custom Optics and Pigments

- Anti-Counterfeiting

- Consumer Electronics

- Custom Color Solutions

- Government and Aerospace

- NIR Spectroscopy

- Spectral Sensing

Contractors

- Enterprise and Data Center

- Residential Broadband Services Installation

- Solutions for Field Technicians

- Solutions for Installers

- Solutions for Operations Managers

Learning Center

- What are Cloud Solutions?

- What is 5G Energy Consumption?

- What is 5G Testing?

- What is a Hyperscale Data Center?

- What is End-User Experience Monitoring?

- What is Fiber Construction?

- What is Fiber Testing?

- What is OTDR Testing?

- What is Packet Capture?

- What is PCIe 6.0?

- What is RF Interference?

- View All Topics

Customer Support

- Customer Portal

- Customer Service

- Technical Support

- Return Material Authorization (RMA)

Support Resources

- How-To Videos

- Knowledge Base

- Quick Cards and Tech Tips

- Software Downloads

- Warranty, Quality and Compliance

- Awards and Recognition

- Environment, Social, and Governance (ESG)

- Our Locations

- Together with VIAVI

- Career Paths

- Search and Apply

- Early-Career Program

- Life at VIAVI

- What We Value

News and Events

- In the News

- News Releases

- Subscription Center

- Locate a Partner

- Partner Portal Login

- Data Privacy and Data Security

- Product Environmental Compliance

- Privacy Policy

- Terms and Conditions

Learn about fronthaul and its important role in the advancement of 5G

What is fronthaul.

Fronthaul is defined as the fiber-based connection in RAN infrastructure between the Baseband Unit (BBU) and Remote Radio Head (RRH). Fronthaul originated with LTE networks when operators first moved their radios closer to the antennas. This new link was established to supplement to the backhaul connection between the BBU and central network core.

As new 5G use cases roll out, flexible fronthaul configurations have become an essential ingredient for balancing the latency, throughput and reliability demands of advanced 5G applications.

Next-generation RAN is resulting in increased fronthaul fiber deployment and a greater reliance on multiplexing, virtualization and split fronthaul architecture. This has placed eCPRI fronthaul among the most important 5G technologies in operator surveys. VIAVI provides a comprehensive solution for fronthaul performance testing including fiber link verification, synchronization, and timing test capabilities, as well as virtual and assurance-based options.

Evolution of Fronthaul

The evolution of fronthaul in mobile networks has mirrored the increasing reliance on optical fiber for broadband networks, as bandwidth and latency requirements in both domains have continued to drive fiber deployments deeper and higher. Prior to the release of 4G, fiber was used primarily for transport networks. Higher performance standards, the development of multiple input, multiple output (MIMO) technology and advanced radio coordination practices dovetailed with the arrival of remote radio solutions and the introduction of fronthaul to the optical fiber lexicon.

The Common Public Radio Interface ( CPRI ) protocol was first established in 2003 by a consortium of OEM's to define and standardize the transport, connectivity and control specifications between the BBU and RRH. CPRI was based on co-located Physical Layer (PHY), Data Link Layer and Network Layer architecture in the BBU with fronthaul providing the link between the RRH and the PHY layer of the BBU. The stringent delay budget of CPRI limited the physical separation between BBU and RRH positions.

CPRI uses a synchronistic data transfer protocol with bitrates dependent on antenna quantity thus creating transfer rates that do not adjust for variation in user load. This is analogous to a train leaving the station devoid of passengers on one trip, then returning to find an overflow of travelers waiting for the next.

The tagging burden of CPRI is high and statistical multiplexing is limited. These inherent CPRI inefficiencies have been workable for 4G/LTE fronthaul, but are highly impractical, as well as expensive, to scale for massive MIMO, high bandwidth, and low latency 5G transport. The innovative solution, as defined by 3GPP TR 38.801 , IEEE and ITU-T calls for the functional split of BBU elements.

The components of this new architectural model are defined as the RU (previously known as RRH and RRU), Central Unit (CU) and Distributed Unit (DU), with the new link between the CU and DU appropriately referred to as midhaul . RAN virtualization has enabled BBU functions to be located or collocated within the various elements, depending on which functional split between OSI layers best suits the use case requirements. The flexibility of split architecture is essential for optimizing key use cases on 5G fronthaul networks simultaneously.

Fronthaul vs Backhaul

Split RAN architecture has reshaped the traditional definitions of fronthaul and backhaul. In its earliest incarnation, backhaul was simply described as the connection between the wireless network and wired network through either cable or optical fiber. Fronthaul became a necessary addition when the ante for bandwidth and efficiency was raised with LTE and a new link connected centralized baseband units to individual radio heads.

When you bring together fronthaul and backhaul architecture (as well as midhaul), it is also known as crosshaul (or x-haul or xhaul ).

Network function virtualization (NFV) has created new opportunities for modularity and customization that break down the existing paradigm even further. DU and/or CU functions can be integrated with the RU, the DU may be combined with the CU or each element can function independently at separate locations. In each instance, the backhaul still provides the connecting link to the core.

O-RAN Fronthaul

Traditionally, large equipment vendors have implemented CPRI in a proprietary fashion which has limited operators to a single-vendor approach to fronthaul network architecture. Breaking down this siloed ideology is the fundamental concept behind Open RAN (O-RAN). The O-RAN ALLIANCE is committed to a structured migration towards multi-vendor, autonomous RAN elements.

For O-RAN fronthaul, open, virtualized architecture using generic hardware and software will facilitate interoperability among combinations including open distributed units (O-DU) and open radio units (O-RU) from different vendors. This standardization will level the competitive playing field and spur innovation while allowing operators to transparently and cost effectively mix and match fronthaul elements.

Fronthaul Networks

Achieving gigabit speeds and 1-millisecond latency raises the bar for all aspects of 5G infrastructure including the established boundaries of fronthaul transport capacity. Fiber is transmission media that can overcome these obstacles with scalable fiber management and flexibility needed to meet the ever increasing fronthaul demands. Dark fiber , if available, is the most cost-effective option for an immediate fronthaul network capacity boost. This solution also offers one of the best options, with fast deployment and the lowest impact on latency.

Wave division multiplexing ( WDM ) can enable more efficient use of fronthaul fiber links. By transmitting over multiple wavelengths, traffic from several antennas can be sent through the network over a single dark fiber. Coarse WDM (CWDM) enables operators to transmit up to 18 channels simultaneously. The passive nature of CWDM reduces cost and complexity. Dense WDM ( DWDM ), designed to take advantage of erbium doped fiber amplifiers, can create up to 96 independent channels. DWDM can be deployed either actively or passively depending on the distance required. Hybrid WDM options can also increase throughput by transmitting multiple DWDM frequencies over select CWDM channels.

Passive optical networks (PON)

Passive optical networks ( PON ) utilize optical splitters to create a point to multi-point topology. Passive fiber splitting in support of statistical multiplexing is a potential counterbalance for the density of RU connections inherent to massive MIMO technology.

Each additional split introduced within a 5G fronthaul network can double the existing capacity, but also introduces a minimum 3dB loss even under ideal connection conditions. New innovations like WDM-PON combine enabling technologies by overlaying new wavelengths onto legacy PON networks without compromising the bandwidth of existing fixed access services. Additionally, NG-PON2 is emerging and utilizes WDM with multiple 10G wavelengths, both up and downstream, to deliver a symmetrical 40 Gbps service. NG-PON2 uses different wavelengths to G-PON and XG/ XGS-PON to allow for service co-existence of all three on the same PON network.

5G Fronthaul

High-level use cases for 5G include Enhanced Mobile Broadband (eMBB), Massive Machine Type Communication (mMTC) and Ultra-Reliable Low Latency Communications (uRLLC). Each use case presents distinct challenges for 5G fronthaul performance. uRLLC applications such as autonomous vehicles with 99.9999% availability requirements must be maintained coincident with highly distributed or data intensive 5G applications such as the IoT or ultra - high density streaming.

The split fronthaul architecture considered optimal for one use case may be restrictive or even prohibitive for others making flexibility of paramount concern. By desegregating the network, incorporating a high level of virtualization and implementing packet-based synchronization, these three very different 5G use cases can be effectively supported on the same network at the same time.

5G Fronthaul Architecture

The evolution of 5G fronthaul architecture has created eight discrete functional deployment options each with inherent benefits and drawbacks with respect to latency, capacity and complexity. Each option is defined by the division points chosen between Physical, Data and Network layers with respect to RU, DU and CU configuration and location. Option 8 is equivalent to the current CPRI configuration with the high-level split occurring between the low Physical layer of the BBU and the RRH.

Fixed wireless applications delivering high bandwidth services to users in fixed locations are conducive to option 2, which places real-time functions within the radio head and creates an RU/DU functional element. Since high level coordination of multiple radio elements is not necessary, placing more functionality at the RU location can reduce the bandwidth and latency burden placed on the fronthaul, thereby allowing the CU to be positioned dozens of kilometers from the radio head.

Conversely, for the eMBB use case, options 6 and 7 pair only physical layer radio functions with the RU with the additional layers remaining in the CU/DU. This is more conducive to the coordination of multiple radios in mobile applications and reduces the fronthaul bitrate support. These options also introduce more stringent latency requirements that limit the geographic separation between RU and DU.

eCPRI Fronthaul

To standardize the split architecture of 5G fronthaul components, the CPRI consortium released the initial Enhanced Common Public Radio Interface ( eCPRI ) protocol in 2017. The stated purpose for eCPRI fronthaul adoption is to decrease data rate demands between radio equipment (eRE) and radio equipment control (eREC) while limiting complexity. Synchronistic CPRI data transfer is replaced by more efficient, packet-based protocols employing Ethernet or IP.

The future proof eCPRI fronthaul interface optimizes radio performance by using coordination algorithms to analyze and prioritize traffic in real time. The eCPRI protocol identifies three planes that are necessary for interaction between eRE and eREC. These planes include the user plane, the synchronization plane, and the control and management plane. The user plane transport definitions standardize data frame, packet, and header formats while the synchronization and control and management planes are not explicitly limited by eCPRI protocols.

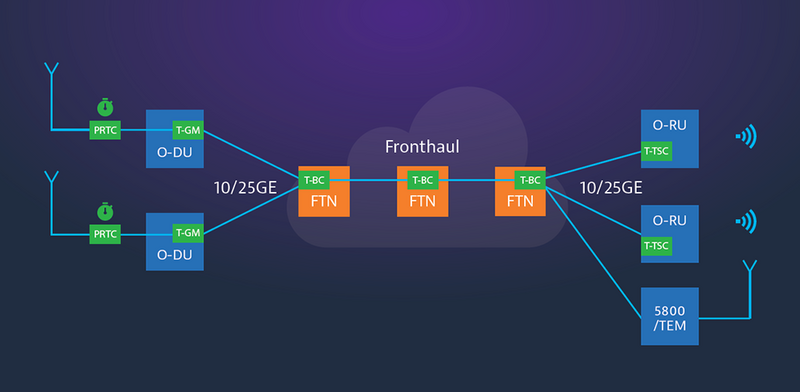

Fronthaul Transport Network Nodes (FTN)

When CPRI and eCPRI are deployed simultaneously in a converged fronthaul configuration, a fronthaul transport network node (FTN) can be used to manage the Ethernet access ring. This scenario requires an effective test solution to ensure delay and synchronization requirements are within specifications.

The VIAVI T-BERD/MTS-5800-100G can be used to validate FTN performance in the lab, perform eCPRI tests, and accurately measure throughput, delay, and jitter. These flexible handheld network testers can also effectively perform GPS signal stability testing, PTP timing error testing, and Ethernet activation via the RFC 2544 and Y.1564 test methodologies.

Fronthaul Testing

5G fronthaul networks are heavily reliant on fiber connectivity for optimal performance. Next generation fronthaul architecture also necessitates complex real time spectrum analysis, timing and synchronization test capabilities. The VIAVI Timing Extension Module (TEM) can supplement the handheld T-BERD/MTS-5800 series network testers by providing nanosecond-precise 5G fronthaul timing and synchronization test capability in a rugged, field portable package. The TEM can also perform precise PTP timing error and PDV measurements.

The breadth of fronthaul deployment options makes an all-in-one base station analyzer with fiber testing, 5G service activation, Ethernet line rate, and OTN test capabilities invaluable in the lab as well as the field. The portable CellAdvisor 5G test instrument provides a complete solution for 5G fronthaul verification, cell site installation and commissioning, massive MIMO and antenna beam validation, along with integrated fiber inspection and validation functions.

Reliance on fiber division and multiplexing through PON and WDM technologies also increases the complexity of fronthaul fiber testing requirements, making traditional visual fault locator (VFL) and power monitoring practices insufficient in some instances.

The VIAVI suite of fiber optic tools extends from handheld fiber inspection and cleaning tools to powerful FiberComplete solutions to detect adverse events in complex fiber runs and perform bi-directional insertion loss (IL), optical return loss (ORL), and OTDR testing .

As fronthaul networks continue to leverage PON technology to meet the growing capacity demands, fronthaul testing practices will benefit from dedicated PON solutions for building, activating and maintaining 5G fronthaul installations. This includes wavelength selective PON power meters for flexibly adjusting to the deployed PON technology standards, centralized PON testing to validate and map PON networks, and PON-specific OTDR test solutions.

Understanding 5G: 2nd Edition

Practical Guide to Deploying and Operating 5G Networks

5G Fronthaul Handbook

Get answers to the tough questions on how to ensure your transport network is up to the challenge of 5G.

Tools and Techniques for Successful Implementation, Maintenance and Monetization

Featured Download

5G Fronthaul Transport Test Use Case

Request Immediate Access to the Fronthaul Handbook and Dive into Use Cases

Learn more about Fronthaul from VIAVI today!

Are you ready to take the next step with one of our fronthaul products or solutions? Complete one of the following forms to get going:

- Contact a product expert in your region

- Request a demo

- Request a quote

- 5G Lab and Performance Test

- Service Activation and Troubleshooting

- Wireless Network Test

Frontline to buy 24 VLCCs from Euronav amid expected tanker market upswing

Does the UK need the North Sea for its energy future?

Global LNG freight rates stable despite recent vessel availability fluctuation

Bunker Fuel Price Assessment

Oil will keep drawing strength from Middle East geopolitics, OPEC+ strategy for now

- Make Decisions With Conviction

For full access to real-time updates, breaking news, analysis, pricing and data visualization subscribe today.

- LNG | Oil | Shipping

- 09 Oct 2023 | 15:38 UTC

- Author Thomas Washington Alec Kubekov

- Editor Aastha Agnihotri

- Commodity LNG , Oil , Shipping

Previous merger attempt failed

VLCC orderbook at record low of around 2%

Others' expectations are more bearish

- Thomas Washington Alec Kubekov

- Aastha Agnihotri

- LNG , Oil , Shipping

Dirty tanker firm Frontline is to buy 24 modern VLCCs from Euronav, ending a drawn-out corporate dispute, as the company hopes for limited vessel supply and growing demand to lead to insufficient tonnage and high freight rates.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Global oil demand is forecast to grow by 2.2 million b/d to 102.8 million b/d in 2023, reaching pre-pandemic levels for the first time, analysts at S&P Global Commodity Insights said in September. Growth is expected to moderate to 1.7 million b/d in 2024, still higher than the long-term growth trajectory, they added.

To meet demand for 2024, the shipping industry needs another 92 VLCCs or equivalent carrying capacity but only 17 VLCCs are on order, Frontline CEO Lars Barstad said in a presentation Oct. 9.

The current orderbook-to-fleet ration is at 2%, its lowest on record, and historical trends across shipping segments including LNG tankers and containers show that low orderbooks lead to a following period of high freight rates, Barstad said.

Platts, part of S&P Global, assessed freight on the Dirty West Africa-Far East 260,000 run at $16.17/mt Oct. 10. It has averaged $22.96/mt through 2023 to date, against a five-year average of $19.27/mt.

The new acquisitions grow Frontline's fleet by 57% in dwt terms and 37% in terms of sailing days, Barstad said.

Nine of the 24 vessels are equipped with exhaust gas cleaning systems, which allow the vessel to burn 3.5% sulfur fuel, typically cheaper than the standard 0.5% sulfur fuel oil, and still comply with international sulfur regulations.

Possible overconfidence

The West of Suez VLCC sector experienced bearish pressure through the third quarter of 2023, with sources pointing to a lengthy tonnage list, low inquiry levels due to project OPEC+ oil production cuts until the end of the year, uncertainty over China's economic prospects, weakness in the Persian Gulf and US Gulf markets and a seasonal summer downturn.

Despite, most market participants believing that rates will firm moderately in the fourth quarter of 2024 due to seasonal factors, a UK-based VLCC broker cautioned against excessive optimism, noting that growth would likely be solid rather than spectacular.

"When we had that recent jump in rates, the momentum built up and people got carried away to an extent – owners have been way higher in their ideas," the broker said.

However, sources have also indicated significant owner resistance to fixing what will likely be their final fronthaul voyage of the year at rates which they deem to be too low.

Turning a page

The Frontline-Euronav transaction puts an end to the deadlock arising from their "entrenched differences over strategy," Euronav said in its own statement Oct. 9.

The agreement involves two of Euronav's shareholders, CMB and Frontline. CMB will acquire Frontline's 26.12% stake in Euronav and Frontline acquires the 24 tankers. Euronav's pending arbitration action against Frontline and affiliates will consequently be terminated, Euronav said.

Following months of merger talks amid strong opposition from the Saverys family, Euronav's largest shareholder, Frontline announced in January it would no longer pursue the merger of the two tanker giants.

The Saverys family, which founded Euronav, said it would block a full legal merger after winning the power to do so under Belgian law by amassing a 25% shareholding.

Euronav should move away from crude transportation to focus on green technology, according to the Saverys, but the proposal was rejected by Euronav's management.

To continue reading you must login or register with us.

It’s free and easy to do. Please use the button below and we will bring you back here when complete.

- Shop at FS.com

- Help center

- Chinese (traditional)

Learn more

- Case Study

- Knowledge Center

- Encyclopedia

Getting Started (118)

Product Updates (105)

News & Announcements (52)

Self Service (11)

Troubleshooting Guide (6)

Client Reviews (5)

Configuration Guide (5)

Product Testing (4)

Installation Guide (3)

Hear It from Experts (1)

Optics and Transceivers (97)

Switches (97)

Networking Devices (62)

Network Cabling and Wiring (59)

Optical Networking (18)

Networking (84)

Fiber Optic Communication (53)

Data Center (29)

General (26)

Wireless and Mobility (7)

Business Type (6)

Routing and Switching (5)

United Kingdom (1)

- Product Updates

- Networking Devices

- Case Study

- Knowledge Center

- Encyclopedia

What Is 5G Fronthaul in Wireless Networks?

The adoption of fronthaul technology has risen in recent years, driven by increased demand for the centralized radio access network (C-RAN) installations and the emergence of 5G technology. Fronthaul in 5G technology supports all generations of wireless communications. Fronthaul configurations and adaptability are critical for balancing the latency, reliability, and throughput requirements of advanced applications on a 5G network. In this post, the article explains the concept, evolution, and different types of fronthaul networks, compares fronthaul and backhaul as well as the challenges facing 5g fronthaul.

What Is Fronthaul?

5G fronthaul refers to the portion of a communication network that connects baseband processing units (BBUs) with remote radio heads (RRHs) in a C-RAN architecture. It enables the transmission of high-speed data, control signals, and synchronization between the BBUs and RRHs. In a traditional cellular network, each base station consists of both the baseband processing unit and the radio head, which are located together at the cell site. However, in C-RAN architecture, the baseband processing units are centralized in a data center or a central location, while the remote radio heads are distributed at cell sites. The fronthaul connects these two components. Therefore, it is the optical network links that connect multiple RRHs with a centralized BBU. These links strengthen the backhaul connection between BBUs and the central network core while helping data transfer quickly.

The Evolution of Fronthaul

Fronthaul in wireless networks evolved as the demand for bandwidth and low latency grew. Furthermore, its market expanded in line with the growing need for optical networks for broadband services. The evolution of fronthaul has gone through several phases to meet the increasing demands of advanced communication networks. Here is a brief overview of the development of it:

Analog Fronthaul: In the early days of cellular networks, fronthaul connections were primarily analog-based, using coaxial cables to transmit analog signals between baseband units and remote radio units. This approach had limitations in terms of capacity and flexibility.

Digital Fronthaul: With the transition to digital communication systems, fronthaul evolved to support digital signals. Digital fronthaul allowed for higher capacity and improved signal quality. It involved the digitization of baseband signals and their transmission over dedicated fiber optic cables using protocols like Common Public Radio Interface (CPRI) or Open Base Station Architecture Initiative (OBSAI).

Compression and Line Rate Evolution: As data rates and capacity requirements increased, the need for efficient transmission of fronthaul signals became crucial. Compression techniques were introduced to reduce the bandwidth requirements of fronthaul links. Additionally, line rate evolution occurred, where higher-speed fronthaul interfaces, such as CPRI/eCPRI, were developed to support the growing data demands of advanced radio technologies like LTE and 5G.

Splitting Options: Fronthaul architectures evolved with the introduction of centralized radio access networks (C-RAN). This allowed for the separation of baseband processing units (BBUs) and remote radio heads (RRHs), creating more flexibility and scalability. Fronthaul evolved to support different splitting options between BBUs and RRHs, such as the traditional distributed RAN (D-RAN) and the more centralized C-RAN architecture.

Ethernet-Based Fronthaul: Ethernet-based fronthaul emerged as an alternative to dedicated fiber-based solutions. Ethernet fronthaul utilizes Ethernet protocols and switches, providing a cost-effective and flexible solution. It enables the convergence of multiple services on a single network infrastructure, supporting both fronthaul and backhaul traffic.

Cloud-Based Fronthaul: With the advent of cloud computing and virtualization technologies, the concept of cloud-based fronthaul has emerged. It involves centralizing baseband processing functions in cloud data centers, reducing the need for dedicated physical fronthaul links. Cloud-based fronthaul offers flexibility, scalability, and efficient resource utilization.

What Are the Different Types of Fronthaul Networks?

As the foundation for 5G core network architecture, various types of fronthaul networks increase speed and reduce latency. This includes the following:

Enhanced common public radio interface (eCPRI): This fronthaul network architecture helps standardize the split architecture inherent in 5G fronthaul components that separate the RRHs from the BBU. It decreases the data rate demand and complexity between the radio equipment and radio equipment control.

Wavelength-division multiplexing ( WDM ): Wave division multiplexing (WDM) allows for more efficient use of fronthaul fiber lines. Traffic from several antennas may be routed across the network using a single dark fiber that transmits over many wavelengths. Coarse WDM (CWDM) allows operators to transmit up to 18 channels concurrently. The passive nature of CWDM minimizes both cost and complexity. Dense WDM (DWDM), which takes advantage of erbium-doped fiber amplifiers, may generate up to 96 independent channels. DWDM can be deployed actively or passively, depending on the desired distance. Hybrid WDM solutions can potentially boost throughput by sending various DWDM frequencies across specific CWDM channels.

Passive optical networks (PONs): Passive optical networks use optical splitters to form a point-to-multipoint topology. Passive fiber splitting in support of statistical multiplexing can counteract the massive MIMO technology's high density of RU connections.

Fronthaul VS Backhaul

The Split RAN architecture has transformed the conventional definitions of fronthaul and backhaul. Initially, backhaul referred to the connection between wireless and wired networks using cable or optical fiber. However, the introduction of Long-Term Evolution (LTE) raised the requirements for bandwidth and efficiency, leading to the addition of fronthaul, which connected centralized baseband units to individual radio heads. When fronthaul, backhaul, and midhaul architectures are combined, it is referred to as crosshaul (or xhaul).

The emergence of Network Function Virtualization (NFV) has further revolutionized the existing paradigm by offering opportunities for modularity and customization. Functions such as Distributed Units (DU) and/or Centralized Units (CU) can be integrated with Radio Units (RU), the DU and CU can be combined, or each element can function independently at separate locations. In all cases, the backhaul remains the crucial link to the network core.

Challenges to 5G Fronthaul

High-level 5G use cases, including Enhanced Mobile Broadband (eMBB), Massive Machine Type Communication (mMTC), and Ultra-Reliable Low Latency Communications (uRLLC), each pose specific challenges for 5G fronthaul performance. For instance, uRLLC applications like autonomous vehicles with stringent 99.99% availability requirements need to coexist with highly distributed or data-intensive 5G applications such as the Internet of Things (IoT) or ultra-high-density streaming.

The split fronthaul architecture, which may be optimal for one use case, can prove restrictive or even prohibitive for others, highlighting the critical need for flexibility. By separating the network, incorporating extensive virtualization, and implementing packet-based synchronization, these three distinct 5G use cases can be effectively supported simultaneously on the same network.

The evolution of fronthaul continues as new technologies and standards are developed to support emerging communication requirements, such as higher data rates, low latency, and network slicing in 5G wireless networks. These advancements aim to enhance network performance, facilitate network densification, and enable the deployment of advanced wireless technologies. Choose 5G wireless products on FS.com to boost your network performance.

- # Optics and Transceivers

- # Optical Networking

- # Wireless and Mobility

You might be interested in

Email Address

Please enter your email address.

Please make sure you agree to our Privacy Policy and Terms of Use.

Cloud-based Networks Grow with Your Business

Anchor Your Hybrid Cloud Networking Strategy

- Network Cabling and Wiring

- Buying Guide

- Fiber Optic Communication

- Optics and Transceivers

- Data Center

- Ethernet Patch Cords

- Business Type

- Routing and Switching

- Optical Networking

- Best Practices

- 10G Network

- Home Networking

Fiber Optic Cable Types: Single Mode vs Multimode Fiber Cable

May 10, 2022

Layer 2 vs Layer 3 Switch: Which One Do You Need?

Oct 6, 2021

Multimode Fiber Types: OM1 vs OM2 vs OM3 vs OM4 vs OM5

Sep 22, 2021

Running 10GBASE-T Over Cat6 vs Cat6a vs Cat7 Cabling?

Mar 18, 2024

PoE vs PoE+ vs PoE++ Switch: How to Choose?

Mar 16, 2023

- Create Account

Main navigation dropdown

Publications, enhanced fronthaul for 5g and beyond, publication date, manuscript submission deadline, 30 july 2021, call for papers.

Fronthaul is the fiber-based connection in the radio access network (RAN) infrastructure. Fronthaul links territorially dispersed remote units (RU) to distributed units (DU) in regular or open RAN. With the fifth generation (5G) roll out worldwide and the active research on technologies beyond 5G, fronthaul has become a critical part of RAN to balance the throughput, delay, reliability, and security. Advanced applications of 5G and beyond (also called 6G) require the fronthaul connection to support features such as high speed, ultra-low latency, supporting frequency and phase synchronization, traffic protection, and secure data privacy. Fronthaul plays an important role in network operations for macro and small cells, distributed antenna systems with RAN sharing, and evolution toward openness and virtualization of RAN. Network controller coordination of fronthaul access networks (FAN) and RAN is also an open topic.

This Special Issue promotes enhanced fronthaul interface and the associated transport technologies as an essential building block of the 5G & 6G RAN infrastructure. It will present the latest research endeavors, industry implementations, as well as standard development in the field of fronthaul. This Special Issue will also investigate the theoretical and practical challenges to encourage a joint effort from both academia and industry. Authors are invited to submit articles on topics including, but not limited to:

- Fronthaul challenges and new applications in 5G & 6G

- New technologies and solutions for 5G & 6G fronthaul

- Standards and recommendations on fronthaul enhancement

- Experiments, trials, open testing and integration and implementations of enhanced fronthaul

- Fronthaul network management, data security, and reliability

- Traffic patterns, network slicing and communication models

- Network controller coordination of FAN and RAN

- RAN openness, virtualization, and sharing with enhanced fronthaul

- Opportunities and challenges in joint efforts from academia and industry in 5G & 6G fronthaul

Submission Guidelines