We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy

Travel Insurance

Why choose travel insurance.

ICICI Lombard General Insurance company limited introduces the "Smart Traveller" travel insurance policy to deal with any of the contingencies while travelling abroad.

Travelling away from home for business or leisure without travel insurance can be quite worrisome. Medical treatment for illness, cancellation of trips, loss of important documents or financial emergency are among the few risks that may turn your dream holiday into an overseas nightmare.

In order to suit the different segments of overseas travel insurance needs, we have tailored three exclusive product variants for online purchase for individuals and families.

Plan UIN Number:

- IRDA/NL-HLT/BAXAGI/P-T/V.I/222/13-14

Ways to open:

Online, Branch

Features & Benefits

Product feature.

Single trip policy:

- This is a Single trip policy pre underwritten by the insurance provider

- This policy covers individuals with a minimum age of 3 months and maximum age of 85 years

- Minimum number of days per trip should be 2 days and is extendable up to a maximum of 356 days

Schengen policy:

- This is a Single trip policy applicable for individuals having valid Schengen visa and are travelling to Schengen countries/regions

- Minimum no. of days per trip shall be 2 days and is extendable up to a maximum of 356 days

Annual Multi Trip policy:

- This policy covers two or more trips to different destinations overseas during the Policy period

- This policy covers persons individuals with a minimum age of 3 months and maximum 70 years

- Minimum number of days per trip shall be 2 days and per trip the duration should not exceed more than 30 days, 45 days, and 60 days as per the plan chosen

Key Inclusions

Smart Traveller (Individual / Family Travel) insurance includes:

- Medical expenses for in-patient and out-patient treatment, medical aid for injuries, pathological tests, daily allowance, etc.

- Personal Accident, Accidental Death & Permanent Total Disablement incurred during the trip

- Reimbursement of actual expenses incurred towards loss of passport, travelers cheques, traveling tickets/documents

- Compensation for loss or delay of checked-in baggage

- Reimbursement of expenses towards trip delay and cancellation

- Damage to contents at home of the insured in India, caused by Fire, Allied perils, burglary while the insured is on an overseas trip

We strongly recommend you to note the complete list of Inclusions by clicking on the Apply Today.

Key Exclusions

Smart Traveller (Individual / Family Travel) insurance excludes:

1. Any pre-existing condition, cosmetic surgery, pregnancy, etc. unless medical assistance provided to save the insured’s life.

2. Losses arising from any delay, detention, confiscation by the customs officials or public authorities

3. Loss of valuables, money, tickets, passes or any other item will not be payable

4. Trip Cancellation and / or Interruption due to strike, plan change of the travelers, cancellation by an airline, or tour operator, etc.

5. Non Allopathic treatment e.g. - Ayurvedic, Yogic, Homeopathic, Unani treatment(s)

We strongly recommend you to note the complete list of Exclusions by clicking on the Apply Today.

Key Things You Should Know

The Policy provides cover against emergency medical expenses for an individual and/or families while overseas along with covering travel related contingencies like loss of important documents, trip cancellation/delay, emergency accommodation, Personal liability and financial emergency assistance, among others.

This policy also covers the Total loss of checked – in baggage of the insured for the corresponding flight of the licensed carrier. Other valuables can also be covered if declared specifically and agreed by the Insurance provider.

This insurance policy can be offered only for overseas travel.

Family Floater option is available under this policy and can be extended to the traveller’s family including spouse and to a maximum of 2 dependent children upto the age of 23 years.

In case of family floater option, the individual premium for the spouse would be a maximum of 75% of the premium for the senior most member insured under the policy. Premium for each dependent child would be a maximum of 50% of the premium for the senior most member. However the overall Sum Insured for the entire family as mentioned in the plan can be used by any or all the members of the family.

Purchase of insurance product is purely voluntary and is not linked to availment of any other facility from the bank.

This policy also covers the Total loss of checked – in baggage of the insured during the course of flight of the licensed carrier. Other valuables can also be covered if declared specifically and agreed by the Insurance provider.

Kindly refer to the “Key Exclusions” section to understand the terms not covered under this policy.

Policy wordings

- Smart Traveller Insurance Policy Wordings (PDF, 12.4 MB) Smart Traveller Insurance Policy Wordings (PDF, 12.4 MB) Download

Product brochure

- Smart Traveller Insurance Policy Brochure (PDF, 152 KB) Smart Traveller Insurance Policy Brochure (PDF, 152 KB) Download

Apply for Smart Travellers Insurance policy

Want to talk.

Contact us today to have your questions answered

You might be interested in

Smart health Insurance

This comprehensive Health Insurance policy is flexible and affordable, available in 4 different plan options to suit your needs

Smart Super Health

Cover for hospitalization expenses incurred in India for treatment of Illness, disease or injury

Motor Insurance

Motor Insurance offers a comprehensive protection to your car and its passengers keeping you protected on the road

Important Information

Terms & conditions.

Insurance is the subject matter of solicitation.

The Insurance products are offered and underwritten by ICICI Lombard General Insurance Company Ltd., ICICI Lombard House, 414, Veer Savarkar Marg, Prabhadevi, Mumbai – 400025, India.

The Hongkong and Shanghai Banking Corporation Limited, India (HSBC) (IRDAI Regn. no. CA0016) whose India corporate office is at 52/60, M. G. Road, Fort, Mumbai – 400001, India, does not underwrite the risk or act as an insurer.

The contract of insurance is between the insurer and the insured and not between the bank and the insured. The Hongkong and Shanghai Banking Corporation Limited, India does not underwrite the risk or act as an insurer. HSBC will receive 15% commission on the premium amount from ICICI Lombard General Insurance Company for this transaction. For more details on risk factors, terms and condition please read the Customer Information Sheet carefully before concluding a sale.

Website: www.icicilombard.com Call : 18001032292 SMS : Claim or Service or Renew or Call Back to 5667700 Email : [email protected]

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS. IRDA clarifies to public that:

IRDA or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of the phone call and number.

Connect with us

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards 2024

- Best Sign-Up Bonuses

- Instant Approval Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Credit Cards for Bad Credit

- Balance Transfer Credit Cards

- Student Credit Cards

- 0% Interest Credit Cards

- Credit Cards for No Credit History

- Credit Cards with No Annual Fee

- Best Travel Credit Cards

- Best Airline Credit Cards

- Best Hotel Credit Cards

- Best Gas Credit Cards

- Best Business Credit Cards

- Best Secured Credit Cards

- Best American Express Cards

- American Express Delta Cards

- American Express Business Cards

- Best Capital One Cards

- Capital One Business Cards

- Best Chase Cards

- Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Milestone Mastercard Review

- Destiny Mastercard Review

- OpenSky Credit Card Review

- Self Credit Builder Review

- Chime Credit Builder Review

- Aspire Card Review

- Amex Gold vs Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture vs Venture X

- Capital One SavorOne vs Quicksilver

- How to get Amex pre-approval

- Amex travel insurance explained

- Chase Sapphire travel insurance guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- All credit card guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- India Travel Insurance

On This Page

- Key takeaways

India travel information & requirements

Do i need travel insurance to visit india, what does travel insurance for india cover, what isn’t covered by travel insurance for india, how much does travel insurance for india cost, tips for getting the best india travel insurance, faq: india travel insurance, related topics.

Travel Insurance for India: U.S. Visitor Requirements & Quotes

- You must have a visa and a valid passport to visit India .

- Although travel insurance isn’t required, it’s advisable to at least purchase travel medical and medical evacuation coverage because India won’t accept your U.S. health insurance .

- More comprehensive policies can also cover other travel mishaps , such as trip cancellations and delays, lost baggage and car rentals.

- According to our research, our top picks for travel insurance for India come from Seven Corners, Tin Leg, and AXA Assistance USA ( skip ahead to view these plans ).

- Costs for travel insurance vary, but you can typically find basic medical coverage for less than $1 per day .

- To view multiple plans at once and find the best coverage to suit your needs, try using an online comparison tool .

India is a vast and diverse country. Each region offers a vibrant culture and mesmerizing architecture. This enthralling country also comes with a unique set of risks, which means that buying travel insurance for India should be a top priority before departure.

Whether you’re taking a luxury train journey through a wild jungle or camel trekking in the Thar Desert, comprehensive coverage helps you manage expenses in case of emergencies or unexpected delays.

Finding the right coverage for India travel can be a complicated process.

This guide covers critical information to help you pick an adequate policy, including:

- An overview of India travel requirements

- Typical travel insurance coverage options for India

- The cost of travel insurance for a trip to India

Our top picks for the best india travel insurance

- Seven Corners: Best Value for Robust Coverage & Medical Emergencies

- Tin Leg: Best Rated Overall

- AXA Assistance USA: Best for Budget Friendly Travelers

Our top picks for travel insurance for India

Seven corners.

AXA Assistance USA

Are there covid-19 restrictions for u.s. tourists.

No, as of February 13, 2023, there are no COVID-19 restrictions for U.S. tourists.

Do I need a visa or passport to travel to India?

You need both a visa and a passport to travel to India . You can apply for an eVisa online. If you’re approved, you can travel in India for up to 60 days. Make sure to apply at least four days before you’re scheduled to arrive. To stay longer, you must apply for a standard tourist visa at the nearest Indian consulate or embassy.

Before you apply, check the expiration date on your passport . The document must be valid for at least six months after the application date. Indian immigration officials require two blank pages to accommodate visas and stamps.

Is it safe to visit India?

India can be a safe destination for savvy tourists — however, you must exercise a great deal of caution . Petty crime is common, as are scams. Female travelers must be especially careful as there have been many reports of sexual assault and violence against women, including tourists. The U.S. Department of State advises women to dress according to local custom and avoid traveling alone in India.

There is also a chance of terrorism and civil unrest throughout India, particularly in the northeastern states, central and eastern India and areas near the Pakistan border.

Can a US citizen buy health insurance in India?

As a citizen of the US traveling to India, it is far more beneficial for you to purchase a travel insurance policy before you leave for your vacation. Doing so prepares you for early unforeseen circumstances such as delayed flights or canceled bookings. NRIs (non-resident Indians) may be able to purchase health insurance in India. Still, as U.S. travel insurance companies are fully regulated, you are far safer securing your coverage within the states.

India does not require tourists to have travel insurance . However, traveling in India can come with a significant amount of risk. A travel insurance policy covers medical care and medical evacuation, so you can move around the country with peace of mind. If you become injured or sick, you won’t be saddled with an expensive medical bill.

Travel insurance also protects you from other unexpected circumstances that could affect your trip. If a natural disaster forces you to cancel or a political protest disrupts your plans, your policy can help reduce the financial impact.

It can also help you prepare for other risks, such as those discussed below.

Risk of pickpockets and tourist scams

Pickpockets and petty thieves run rampant in India, often targeting unsuspecting tourists. They operate in crowded tourist destinations, such as airports and famous sites like the Taj Mahal.

Tourist scams are another common occurrence in India. Scammers try to lure travelers with false promises, only to extort them for money or put them in dangerous situations. In other cases, criminals drug visitors before robbing them. Travel insurance with coverage for personal items can help pay to replace stolen items.

Risk of canceled day trips or tours

Tours and day trips are a popular way to see sights in India. Since many operators have little to no oversight, they may cancel these excursions at the last minute without reimbursing you. Certain travel insurance policies can reduce the risk of financial loss by covering nonrefundable costs for interrupted or canceled tours.

Risk of political demonstrations

Political demonstrations in India can be large and disruptive. In some cases, they affect airlines, train lines and major roadways. When a demonstration arises before or during your trip, you may have a hard time reaching your destination. In some cases, widespread protests make it too dangerous for foreigners to visit the affected areas. A travel insurance policy can help you recover the costs of canceling the trip, rebooking flights, or making unexpected hotel stays.

Risk of severe weather conditions

Many parts of India experience severe weather at various times throughout the year. In southern India, the monsoon season often brings severe flooding; the northern part of the country sees intense dust storms. Dangerous heat waves are possible across most of the country. While you can’t predict serious weather events, you can use insurance to prevent significant financial losses if storms affect your trip.

As with any type of insurance, every plan offers different types and levels of coverage.

We break down some of the most common coverage types below.

Trip cancellation insurance

Trip cancellation coverage helps you recover prepaid, nonrefundable trip costs if you have to cancel your plans. Travel to India is expensive, especially if you’re booking popular hotels and tours. If you fall ill a week before your flight and you’re too sick to travel, insurance can ensure that you don’t lose money in the process.

Trip delay insurance

This type of insurance covers the extra expenses that arise if your India trip is held up due to circumstances beyond your control. If your connecting flight from Amsterdam to New Delhi is pushed to the next day, insurance can cover a last-minute hotel booking and taxis to and from the airport. Keep your receipts, and you might also be able to get reimbursed for meals and nonrefundable hotel stays in your final destination.

Trip interruption insurance

Trip interruption coverage kicks in if unexpected circumstances require you to cut your vacation short. As long as the reason for the interruption is covered, the policy will typically refund the non-refundable costs of the rest of the trip . It might also cover the flight back to the U.S.

Travel medical insurance

If you get hurt or fall ill while you’re exploring India — a possibility, given the country’s inconsistent safety regulations — travel medical insurance covers the costs. In most cases, you’ll need to pay the healthcare bills first and file a claim for reimbursement. Some plans will work directly with the medical provider to settle bills if you need hospitalization after an accident or a bout of dengue fever.

Medical evacuation insurance

Medical evacuation coverage pays for your transportation in case of a medical emergency. It’s critical for trips to India — healthcare facilities aren’t always available away from major cities. That means if you’re injured while trekking in the Himalayas or cruising in Kerala, you may need to be transported a long distance by air to get to a hospital. When the situation is serious enough, a medical flight back to the United States may be necessary.

These services are expensive, but evacuation coverage can take care of the bill. Make sure you choose a policy with a high limit when traveling to India, particularly if you’re planning an adventurous itinerary to rural parts of the country.

Insurance for personal items

Personal item coverage helps you pay for damaged, lost or stolen belongings. Given the risk of theft and pickpocketing in India, this type of insurance is essential. Limits can vary considerably between policies; you may need to shop around to find adequate coverage if you’re packing computers, phones and cameras.

Rental car coverage

This type of insurance pays for damage to your rental car. It’s usually offered as an add-on for an extra fee, but don’t skip it if you’re renting a car in India — road conditions and driving safety are well below U.S. standards in many areas.

Every travel insurance policy comes with exclusions, which are things the plan will not cover. For example, if your policy excludes preexisting medical conditions , it won’t pay cancellation costs if you have to cancel due to a chronic health condition.

Standard travel insurance exclusions are:

- Pregnancy (except for complications)

- Anxiety and mental health

- Routine medical or dental procedures

- High-risk activities

- Extreme sports and professional sports

- Trips that go against medical advice

- Storms that have already been named

- Illegal activities

It’s also important to note that your policy might refuse to cover anything for which you don’t have the appropriate documentation. If you need to seek medical care, or you plan to file a claim for trip cancellation or interruption, call the provider immediately to ask about documentation requirements.

We found that travel insurance for a trip to India can cost as little as $1 per day for the most fundamental medical and medical evacuation coverage. A more comprehensive plan that covers trip cancellations and interruptions will cost around $7 to $11 per day.

To give you a better idea of how much travel insurance costs for a trip to India, we requested quotes from four leading travel insurance providers.

We used these details for all of our quotes:

- Age : 35 years old

- Destination : India

- Trip Length : 7 days

- Trip cost : $2,000

- Date: September 2024

You can see our quotes for basic travel insurance in the table below. Prices range from less than $1 per day to $6 per day .

Example Where Plan Doesn’t Reimburse the Full Trip Cost

Our quotes for policies that include trip cancellation and trip interruption coverage are in the following table. Prices range from around $7 to $11 per day .

Example Where Plan Does Reimburse the Full Trip Cost

It’s important to note that the cost of India travel insurance is different for everyone.

Providers base your policy premium on factors such as:

- Trip duration

- Cost of the trip

- Current health insurance

- Elapsed time between policy purchase and first trip deposit

A wide range of providers offer travel insurance to India.

These tips can help you select a plan that provides ample coverage and peace of mind:

Research your destinations.

If you’re traveling to rural parts of India, make sure your insurance policy includes a high limit for medical evacuation. That way, you’re less likely to incur high bills for medical flights.

Check emergency procedures.

Some providers deny medical claims if you fail to call the emergency assistance line before seeking help. That’s not always possible in areas of India that don’t have cell service.

Consider how you’re traveling around India.

Travel insurance policies don’t apply to every mode of transportation. If your plans include hitching a ride or renting a motorcycle in India, make sure it’s covered in case of an accident.

Examine the risk level of activities.

Read the policy exclusions carefully to ensure that your intended activities are covered.

Buy a policy as soon as possible.

By buying as soon as you book the trip, you’ll be protected for longer. Coverage usually starts from the purchase date.

Can I use my U.S. health insurance in India?

No, you cannot use most standard U.S. health insurance policies in India.

Can a U.S. citizen buy travel insurance in India?

A few insurance providers allow you to purchase travel insurance after you’ve started your trip in India. However, you may be subject to higher fees or a waiting period before you can make a claim.

Is it better to buy travel insurance from India or U.S.A.?

It’s best to buy travel insurance for India while you’re still in the United States. You can buy it from a domestic or international provider — just make sure the company is reputable and that the policy applies to American travelers.

Imogen Sharma is a freelance writer with an extensive portfolio, covering topics such as finance, business management, investing, and startups. Before becoming a full-time writer, Imogen managed high-volume fine dining restaurants in London with a knack for pricing and P&L management that contributed to sustained growth.

Imogen has contributed bylined and ghostwritten content for thought-leading publications in business, finance and technology. Topics covered include business loans, personal loans, startup funding and real estate investments.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions April 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Spain Travel Insurance Plans + Tips for a Safe Spain Vacation

Italy Travel Insurance: Trip Requirements, Tips & Safety Info

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Tips & Quotes for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Tourist Information & Tips

Best UK Travel Insurance: Coverage Tips & Plans April 2024

Travel Insurance for Trips to the Bahamas: Tips & Safety Info

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review April 2024

Travel Insurance for Thailand: US Visitor Requirements & Tips

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review April 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review April 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for April 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review April 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At the LA Times Compare our mission is to help our readers reach their financial goals by making smarter choices. As such we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information to all readers. Learn how we are compensated by our partners.

Top Travel Insurances for India You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Known for its explosion of rich culture, colour, and food, India is an attractive travel destination for travelers on a budget. Whether you're travelling to India to experience the country's cultural heritage, visit its iconic landmarks and natural attractions, take part in adventure sports, or enjoy delicious and diverse cuisine, you will find India an excellent travel destination! Although travelling to India can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to India and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

India Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for India:

Best Travel Insurances for India

- 01. Should I get travel insurance for India? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to India scroll down

Heading to India soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for India?

No, there's no legal requirement to take out travel insurance for India.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to India or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for India:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to India. It lets you choose between various plans tailored to meet the specific needs of your trip to India, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for India:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to India? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to India

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

No, you'll not be required to take out travel insurance for India. However, we strongly encourage you to do so anyway, because the cost of healthcare in India can be high, and taking out travel insurance will mitigate some or all of the risk of covering those costs yourself if you need medical attention during your stay.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Fraud warning

Please be cautious of any special offers you see on social media or via messages, and avoid opening links or downloading any apps you receive from these sources inviting you to register to benefit from special offers. These links or apps may contain malware that can take over your phone. Please also refrain from inputting your account information, passwords or any other personal information into such apps or websites. Learn more .

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

Travel Care

Go on a totally fuss-free, carefree holiday with travel care.

Not all who wander are lost, but your luggage certainly could go missing. That's just one of the unexpected events that could put a dampener on your travel plans - there might also be flight delays, accidents or lost passports to contend with.

Travel Care provides a comprehensive suite of coverage and Allianz's Authorised Representative's emergency hotline (+603-76283919 or +603-79653919) is available 24 hours a day to support you through any emergency you might face, so you and your loved ones can have a stress-free trip filled with beautiful memories.

Stand to receive a Touch 'n Go eWallet Reload PIN worth up to RM50

Be one of the first 200 customers to purchase travel care with the promo code 'hsbc23' and get a touch ‘n go ewallet reload pin worth up to rm50. promotion period 27 november 2023 - 30 april 2024., ¹allianz travel care ("this plan") is underwritten by allianz general insurance company (malaysia) berhad (company no. 200601015674 (735426-v)) ("allianz general") and hsbc bank malaysia berhad ("hsbc malaysia") is the intermediary in distributing this plan. travel care customer campaign promotion terms & conditions apply..

- Overseas and domestic travel coverage This includes coverage for luggage and travel delays, and for overseas travel, the coverage also includes loss or damage to your travel documents, personal luggage and valuables, and more

- Accidental death and permanent disability coverage

- Emergency medical evacuation and repatriation programme

- Reimbursement of medical expenses We'll reimburse the necessary and reasonable medical, surgical or hospital charges, and emergency dental treatment fees incurred as a result of accidental bodily injuries, illness or death during your trip

- Option to purchase rider plans to extend your coverage when you participate in certain sports or events during your travels

What your coverage includes

What you need to know, are you eligible.

You're eligible for a Travel Care plan if you belong to one of the following categories:

- Malaysian citizen or permanent resident

- valid work permit or student pass holder

- legally employed in Malaysia

You'll also be able to get coverage for your spouse and child if they legally reside in Malaysia.

Good to know

Emergency contact information .

If there's an emergency when you're travelling, you can call the Allianz 24-hour emergency hotline on +60 3 7628 3919. Toll fees may apply.

Cover for COVID-19

Travel Care covers medical expenses for COVID-19 treatment, subject to policy terms and conditions. Your diagnosis must be certified by a medical practitioner, and you'll also need to provide a supporting lab report or medical report that states your diagnosis.

Cover for high-altitude mountaineering

You can get cover for high altitude mountaineering by contacting Allianz via email on [email protected] , or by calling 1300 22 5542.

What options for Travel Care plans are available?

The following plans are available:

- Adult Plan/Adult Annual Plan: if you're aged 18-70 years old

- Child Plan/Child Annual Plan: if you're aged 30 days-17 years old

- Senior Citizen Plan: if you're aged 71-80 years old

- Family Plan: if the policyholder is aged 18-70 years old, the policyholder's 1 selected legal spouse is aged 18-70 years old and the policyholder's child/children is/are aged 30 days-24 years old

- Under family plan, the payment per individual will be based on the limit under an adult plan and/or child plan, as the case may be subject to the maximum limit as stated in the Schedule of Benefits in the brochure and policy document.

- Maximum period of coverage per journey/trip is 200 days for one way or return trip.

- Maximum period of coverage per journey/trip is 90 days for annual policy.

- Maximum period of coverage per journey/trip for High Altitude Mountaineering activities is 30 days.

- Each trip must begin and end in Malaysia except for one way trip.

- Maximum period of coverage per journey/trip is 30 days for one way/return trip or annual policy.

- Premium is subject to Service Tax.

- Customer may opt for Automatic Renewal (for annual policy only). This policy is deemed to be automatically renewed and the applicable premium will be charged upon expiry unless otherwise instructed.

For other key terms and conditions, please refer to the Product Disclosure Sheet in the link below.

Ready to apply for Travel Care?

Get a quote via mobile banking or online banking.

If you have an HSBC debit or credit card, you can apply via our mobile banking app or through online banking. Go to the homepage, select 'Products and services', and choose 'Travel Care'. We'll help you apply by filling in information from your records.

Get a quote without logging on

If you have an HSBC debit or credit card, you can also get a quote without logging on to mobile banking.

Scan the QR code to get the app

Download the HSBC Malaysia Mobile Banking app on your iOS or Android device.

- Learn more about mobile banking

Need help? Check out our step by step mobile guide .

The information provided on this page is not a contract of insurance. The descriptions of cover are a brief summary for quick and easy reference. The precise terms and conditions that apply are in the policy document. Allianz Travel Care ("this Plan") is underwritten by Allianz General Insurance Company (Malaysia) Berhad (Company No. 200601015674 (735426-V)) ("Allianz General") and HSBC Bank Malaysia Berhad ("HSBC Malaysia") is the intermediary in distributing this Plan. This Plan is exclusively for HSBC Malaysia Credit and Debit Cardholders only. Please read and understand the Product Disclosure Sheet (PDS), Brochure and Policy Wording before signing up.

- Product Disclosure Sheet (PDF) Product Disclosure Sheet (PDF) Download

- Brochure (PDF) Brochure (PDF) Download

- Policy Wording (Domestic) (PDF) Policy Wording (Domestic) (PDF) Download

- Policy Wording (Overseas) (PDF) Policy Wording (Overseas) (PDF) Download

- Allianz General Insurance Company - Privacy Notice (PDF) Allianz General Insurance Company - Privacy Notice (PDF) Download

Important Notes

1. The benefits payable from this insurance product are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to certain limits. Please refer to PIDM's TIPS Brochure, the PIDM website , or contact Allianz General Insurance Company (Malaysia) Berhad to get more information about the Takaful and Insurance Benefits Protection System(TIPS)

2. For after-sales service, you can contact Allianz by [email protected] or on 1300 22 5542 .

3. You may find out more about our coverage by visiting your nearest Allianz branch.

Related products

HSBC UniversalLegacy plan

Leave a lasting legacy for the ones who matter.

HSBC UniversalIncome plan

Continue to pursue your passions even in your golden years.

HSBC HealthPlus plan

Make your health a priority by preparing for the unexpected.

Connect with us

- Companies & Markets

Banking & Finance

- Reits & Property

- Energy & Commodities

- Telcos, Media & Tech

- Transport & Logistics

- Consumer & Healthcare

- Capital Markets & Currencies

HSBC changes insurance head after Hingston’s surprise exit

THE head of HSBC Holdings’ insurance business is unexpectedly leaving the Asia-focused lender after two years in the post, and will be replaced by veteran insider Ed Moncreiffe.

Greg Hingston will pursue opportunities outside the firm, according to a statement from the bank. Moncreiffe has been with HSBC for 18 years and held a number of leadership roles including head of life and pensions Brazil. The changes are effective immediately.

“Insurance, one of our fastest-growing businesses, is integral to our strategy to become a leading global wealth manager,” said Nuno Matos, who runs HSBC’s wealth and personal banking business.

“We will build our recent investments in HSBC Life to capture new opportunities in Hong Kong and supercharge growth in mainland China, Singapore and India, while continuing to deepen penetration in the UK and Mexico.”

Hingston, who took over as global chief executive of HSBC’s insurance unit in January 2022, closed the group’s first acquisition in the sector in a decade, building out the China business.

The lender has been expanding in Asia with billions of US dollars in fresh investments and in February 2022 completed its purchase of AXA SA’s Singapore unit, a deal that effectively doubled the size of its insurance business in the city state.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

HSBC recently reported fourth-quarter profit fell 80 per cent after taking unexpected charges on holdings in a Chinese bank and from selling its French retail operations. However, rising interest rates globally boosted HSBC’s full-year earnings to a record.

The bank is several years into a strategy of pivoting its business increasingly towards the faster-growing markets of Asia, where it makes most of its money.

Disposals of businesses in France and Canada have been balanced by acquisitions of insurance and wealth management assets in Asia, a region with swelling ranks of the rich. BLOOMBERG

KEYWORDS IN THIS ARTICLE

- KKR, HSBC talk up China opportunities after lengthy sell-off

- HSBC’s Quinn targets lifting wealth business in China, India

- HSBC helps funds navigate India’s bond market as inclusion nears

- HSBC chairman says Asia business spinoff ‘will not happen’

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Absolutely no urgency to cut US interest rates: Federal Reserve’s Daly

Less than half of us banks ready to borrow from federal reserve in emergency, georgieva selected for second term as imf managing director, citi profit drops as costs rise for employee severance, deposit insurance, bernanke urges boe to speak more clearly on direction of rates, wells fargo profit shrinks more than 7% on lower interest income, support south-east asia's leading financial daily.

Get the latest coverage and full access to all BT premium content.

Browse corporate subscription here

- International

- Opinion & Features

- Startups & Tech

- Working Life

- Events & Awards

- Breaking News

- Newsletters

- Food & Drink

- Style & Travel

- Arts & Design

- Health & Wellness

- Paid Press Releases

- advertise with us

- privacy policy

- terms & conditions

- cookie policy

- data protection policy

SPH MEDIA DIGITAL NEWS

MCI (P) 064/10/2023 © 2024 SPH MEDIA LIMITED. REGN NO. 202120748H

Indian life insurers may post muted Q4 earnings, HSBC says

** HSBC expects India's life insurance companies to report margin compression and muted annualised premium equivalent growth in Q4

** ICIL down 0.5%

** HSBC expects asset management cos to perform well in Q4 due to strong net inflows, systematic investment plans, gains in equities

** NIPF up 1.6%; HDFC AMC up 0.9%

HSBC pulls out of Argentina at a $1 billion loss as Asia pivot continues

HSBC Holdings Plc agreed to sell its business in Argentina, and will book a $1 billion charge in the first quarter from the disposal as the lender hones its focus on faster growing Asian markets.

The bank will sell the operations to Grupo Financiero Galicia for $550 million, subject to some price adjustments, according to a statement on Tuesday. The deal includes all of HSBC Argentina’s business, which ranges from banking to asset management and insurance, as well as $100 million of subordinated debt.

The move “enables us to focus our resources on higher value opportunities across our international network,” Chief Executive Officer Noel Quinn said in the statement. The Argentine unit has “limited connectivity” to the rest of the business and creates “substantial earnings volatility for the group when its results are translated into US dollars,” he said.

HSBC Argentina, which has more than 100 branches, 3,100 employees, and about one million customers, made a profit before tax of $239 million in 2023. The bank said in February that Argentine President Javier Milei’s move to devalue the peso by more than 50% shrunk the bank’s profit before taxes by $548 million in the fourth quarter.

HSBC said it will recognize about $4.9 billion of historical foreign currency translation reserve losses when the deal closes. That reflects cumulative losses over the years from the translation of the unit’s Argentinian peso-denominated book value into US dollars, which are already reflected in the bank’s CET1 ratio, a key measure of capital strength.

The impact of the transaction will be excluded from HSBC’s dividend payout calculation, which remains at 50% for 2024. It is expected to complete within the next 12 months.

HSBC, based in London, has been disposing of operations across the world as it has pivoted to focus more on Asia. It has exited some business in North America and France as it builds out in India, Singapore and China. It’s several years into a strategy of pivoting its business increasingly toward the faster-growing markets of Asia where the bank makes most of its money.

Royal Bank of Canada completed the purchase of HSBC’s Canadian unit in March. HSBC has said it will recognize an estimated gain on sale of $4.9 billion in the first quarter and declare a special dividend of about $4 billion as a result.

The lender is also exploring the sale of various businesses in Germany including its wealth-management, custody and fund administration units, people familiar with the matter said earlier this month.

Disposals of businesses in markets like those have been balanced by acquisitions of insurance and wealth management assets in Asia, a region with swelling ranks of the wealthy.

What Bloomberg Intelligence Says

HSBC’s expected pretax loss of $1 billion on the sale of its Argentinian unit is equivalent to about 3% of 2024 consensus pretax profit and should have limited impact on its CET1, dividend capacity and planned share buybacks. Hyperinflation has been a drag on Argentinian operations, as seen in a $500 million pretax profit hit in 4Q, and the sale will also be in line with the bank’s plan to strengthen its focus on Asia.

Latest in Finance

- 0 minutes ago

IMF has gloomy outlook for world economy: ‘Without a course correction, we are indeed heading for ‘the Tepid Twenties”

European Central Bank declines to cut rates because ‘domestic price pressures are strong and are keeping services price inflation high’

The CEO of Norway’s $1.6 trillion sovereign wealth fund has a fun side gig: Hosting a podcast that features top C-suite execs like Elon Musk, Michael O’Leary, and Ana Botín

Germany set to permanently pay for reliance on Russian gas—as power chief says ‘significant structural demand destruction’ means it will never fully recover from energy crisis

French IT firm Atos was once a crown jewel valued at $15 billion. Now, it’s drowning in debt, and the government is helping it stay afloat

Gymshark’s millennial billionaire CEO says he never thinks about his wealth because ‘it’s not a measure of success’ and ‘none of it’s real’

Most popular.

Workers at Elon Musk’s Boring Co. accidentally dug too close to a supporting column of the Las Vegas monorail last year, forcing officials to briefly halt service

In-N-Out’s billionaire heiress says she stood in line for 2 hours to land a job at her own store when she was just a teenager to shake the ‘stigma of being the owner’s kid’ and ‘earn respect’

$2.3 billion hedge fund manager on his move from New York to Florida: ‘I know of no business that has generated long term success by driving away its highest paying customers’

Air Canada pilots land a Boeing 737 in Idaho after another in-flight emergency

The ‘Oracle of Wall Street’ expands on why the ‘crisis of the American male’ will send home prices crashing 30%: Gaming, rampant loneliness, and not enough single women homebuyers

Meet a Missouri dad who went from a ‘full-on bigot’ to fighting bathroom bans on behalf of his 16-year-old daughter: ‘When it was my child, it just flipped a switch’

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

TravelSure makes travel safer with over 50 benefits and COVID-19 coverage to take care of you, even before take off.

Special offers

From now till 6 May 2024, enjoy 35% premium discount for Single-Trip plans and 15% premium discount for Annual plans.

- COVID-19 coverage COVID-19 coverage is automatically included for Single and Annual plans. Get up to SGD250,000 medical expense coverage when you travel overseas. Please refer to the COVID-19 section for more information.

- Overseas medical expenses Be covered up to SGD1,000,000 for overseas medical expenses.

- Replacement of traveller Pays for the charges incurred for change of traveller due to you or insured person not being able to travel as a result of serious injury, illness or death 30 days prior to the trip.

- Delayed departure Pays for additional administrative and travel expenses incurred to book alternative transport to the same destination should there be delays to the public transport.

Summary of benefits

The limits shown above are based on Individual sum insured. Learn more about the full coverage details .

How to buy TravelSure

Buy travelsure online now.

- Contact MSIG Singapore

- Submit your claims online

Important Notes

This product is underwritten by MSIG Insurance (Singapore) Private Limited ("MSIG") and distributed by HSBC Bank (Singapore) Limited ("HSBC"). It is not an obligation of, a deposit in or guaranteed by HSBC. Full details of the terms, conditions and exclusions of this insurance are provided in the policy and will be sent to you upon acceptance of your application by MSIG. This is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice.

This policy is protected under the Policy Owner's Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). For more information on the scheme, please visit the General Insurance Association www.gia.org.sg or SDIC www.sdic.org.sg websites.

The information and opinions contained in this website are for information only, have been obtained from sources believed to be reliable, but HSBC makes no representation or warranty as to their adequacy, completeness, accuracy or timeliness for any particular purpose, are subject to change without notice, and are not intended for distribution to, or use by, any person or entity outside Singapore or in any jurisdiction or country where such distribution or use would be contrary to law, regulation or rule. HSBC does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

Where specific products are advertised and/or recommended, please note (a) the recommendation is intended for general circulation; (b) the recommendation does not take into account the specific investment objectives, financial situation or particular needs of any particular person; (c) advice should be sought from a financial adviser regarding the suitability of the products, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the recommendation, before the person makes a commitment to purchase the products; should the person choose not to do so, he should consider carefully whether the product is suitable for him; in particular, all relevant documentations pertaining to the product should be read to make an independent assessment of the appropriateness of the transaction; and (d) this advertisement has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.

HSBC, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in, the product(s) mentioned here. HSBC may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). In addition, HSBC, their directors and/or employees may also perform or seek to perform broking, investment banking and other banking or financial services for these product providers.

To the extent permitted by law, HSBC accepts no liability whatsoever for any direct indirect or consequential losses, claims or damages arising from or in connection with the use of or reliance on the information, opinions or contents herein.

You might also be interested in

Get ready to travel with HSBC

Plan your trip around the latest COVID-19 travel requirements and check out exciting travel related offers/benefits.

Overseas Study Insurance

Enjoy comprehensive protection for unexpected events such as accidents, study interruptions and holiday travel disruptions while studying overseas.

When it comes to the things that make your house a home, you can have peace of mind with our home insurance plans.

Car insurance

Protecting you and your passengers while you are on the road, with the flexibility of choosing your preferred car workshop and more

Connect with us

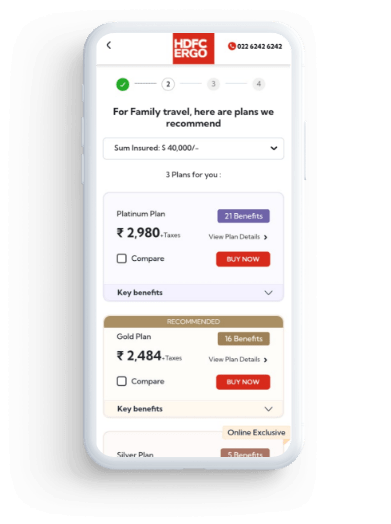

From flight delays to medical emergencies, we got you covered. Secure your trip with HDFC ERGO Explorer. Travel Worry-free.

#1.5 crore+.

Happy Customers

Cashless Hospitals

24x7 In-house

Claim Assistance

Travel Insurance - Your Safety Net at Foreign Shores

A medical or dental emergency can catch you off guard in a faraway land, derail your travel plans, and cost you dearly, as medical expenses in a foreign land can be high-priced. However, international travel insurance can save you from such expenses. Apart from this, it also provides reimbursement for essentials in case of delay or loss of check-in baggage, covers for loss of passports, visas, identity proof, etc. It also provides assistance in case of theft, burglary, accident assistance and medical evacuation in times of crisis. So, whether you travel overseas solo or with your family, remember to get travel insurance to enjoy a memorable and relaxed holiday. Many countries have also made it mandatory to get travel insurance before entering their borders. Check out HDFC ERGO’s travel explorer to explore the world confidently with 21 benefits and 3 tailor-made plans, just for you. You can buy travel insurance online from the comforts of your home. In addition, we offer medical facilities at 1Lac+ cashless hospitals** worldwide.

Introducing HDFC ERGO Travel Explorer

To make your travels filled with excitement and keep worries at bay, HDFC ERGO brings you the all-new international travel insurance, packed with more benefits than you can imagine. Explorer's got your back, whether it is a medical or dental emergency, loss or delay of your checked-in baggage, flight delays or cancellations, theft, robbery or loss of passport when overseas. It comes with up to 21 benefits packed in one, and 3 tailor-made plans just for you.

Schengen approved travel insurance

Competitive premiums, increased sum insured limit, medical & dental emergencies, baggage mishap, in-trip crisis, here's why you need hdfc ergo's travel insurance, covers emergency medical assistance.

Met with an unexpected medical emergency, in a foreign territory? Travel insurance, with its emergency medical benefits, is just the friend you need during such a toughtime. Our 1,00,000+ cashless hospitals are there to take care of you.

Covers Travel Related Inconveniences

Flight delays . Loss of baggage. Financial emergency. These things can be quite unsettling. But with travel insurance backing you up, you can keep calm and carry on.

Covers Baggage-Related Hassles

Buy #SafetyKaTicket for your travel. Whenever you’re travelling abroad all baggage carries all your essentials, and we cover you against baggage loss and baggage delay for checked-in baggage.

Affordable Travel Security

Secure your international trips without breaking the bank. With affordable premiums for every kind of budget, the benefits of travel insurance far outweigh the costs.

Round-the-clock Assistance

Time zones don’t get in the way of a good travel insurance plan. No matter what time it is in your part of the world, dependable assistance is just a call away. Thanks to our in-house claim settlement & customer support mechanism.

1 Lac+ Cashless Hospitals

There are a million things you can take on your trips; worry shouldn’t be one of them. Our 1 Lac+ cashless hospitals networked worldwide will make sure your medical expenses are covered.

Travel Insurance Plans For All Types Of Travellers

Travel plan for individuals.

If you’re flying solo in your search for new experiences, the HDFC ERGO Individual Travel Insurance, with its host of inbuilt benefits that make your travel experience smooth and seamless, is the trusted companion you need to take along for company.

Travel plan for Families

Family vacations are when you make memories that transcend time and last across generations. Now, with the HDFC ERGO Family Travel Insurance, give your loved ones the security they deserve as you and your family take off into the sunset for the vacation of your dreams.

Travel plan for Frequent Fliers

The HDFC ERGO Annual Multi-trip Insurance is tailored just for you, so you can secure multiple trips under one comprehensive insurance plan. Enjoy multiple trips, easy renewals, in-house claim settlement and so much more.

Travel plan for Students

Planning to pursue higher education at foreign destinations, then do not leave your home without a valid travel insurance. It will secure your prolonged stay and make sure you concentrate only on studies.

Travel Plan for Senior Citizens

Whether planning to go for a leisure holiday or visit a loved one, secure your trip with HDFC ERGO’s Travel Insurance for Senior Citizens to get cover from any medical or dental emergencies that can catch you off guard overseas.

Compare Travel Insurance Plans

So, have you compared the plans and found the one that suits you best, what does hdfc ergo travel insurance policy cover .

- Medical Coverage

- Journey Coverage

- Baggage Coverage

Emergency Medical Expenses

This benefit covers hospitalization, room rent, OPD treatment, and Road Ambulance costs. It also reimburses expenses incurred on Emergency Medical Evacuation, Medical Repatriation and Repatriation of mortal remains.

Dental Expenses

We believe dental healthcare is just as important as hospitalization due to physical illness or injury; hence, we cover dental expenses which can occur during your travel. Subject to policy terms and conditions.

Personal Accident

We believe in seeing you through thick and thin. In the event of an accident, while traveling abroad, our insurance plan provides a lump sum payment to your family to assist with any financial burdens caused by permanent disablement or accidental death.

Personal Accident : Common Carrier

We believe in being by your side through ups and downs. So, under unfortunate circumstances, we will provide a lump sum payout in case of accidental death or permanent disablement arising out of an Injury whilst on a Common Carrier.

Hospital cash - accident & illness

If a person is hospitalized due to injury or illness, we will pay the per day Sum Insured for each complete day of hospitalization, up to the maximum number of days stated in the Policy Schedule.

Flight Delay & Cancellation

Flight delays or cancellations may be beyond our control, but worry not, our reimbursement feature allows you to meet any essential expenses arising from the setback.

Trip Delay & Cancellation

In case of a trip delay or cancellation, we will refund the non-refundable portion of your pre-booked accommodation and activities. Subject to policy terms and wordings.

Loss of Passport & International driving license

Losing important documents can leave you stranded in a foreign land. So, we will reimburse expenses related to obtaining a new or duplicate passport and/or international driving license.

Trip Curtailment

Don't worry if you have to cut your trip short due to unforeseen circumstances. We'll reimburse you for your non-refundable accommodation and pre-booked activities as per the policy schedule.

Personal Liability

If you ever find yourself liable for third-party damage in a foreign land, our travel insurance helps you compensate for those damages effortlessly. Subject to policy terms and conditions.

Emergency Hotel Accommodation for Insured Person

Medical emergencies may mean you need to extend your hotel booking by a few days more. Worried about the added expense? Let us take care of it while you recover.subject to policy terms and conditions

Missed Flight Connection

Don't worry about unexpected expenses due to missed flight connections; we will reimburse you for the expenses incurred on accommodation and alternate flight booking to reach your destination.

Hijack Distress Allowance

Flight hijacks can be a distressing experience. And while the authorities help sort out the issue, we'll do our bit and compensate you for the distress it causes.

Emergency Cash Assistance Service

When traveling, theft or robbery can lead to a cash crunch. But don't worry; HDFC ERGO can facilitate fund transfers from the insured 's family in India. Subject to policy terms and conditions.

Loss Of Checked-In Baggage

Lost your checked-in baggage? Don't worry; we'll compensate you for the loss, so you don't have to go without your essentials and vacation basics. Subject to policy terms and conditions.

Delay of Checked-In Baggage

Waiting is never fun. If your luggage gets delayed, we'll reimburse you for essentials like clothing, toiletries and medication so you can start your vacation worry-free.

Theft of baggage and its contents

Theft of baggage can derail your trip. So, to ensure your trip stays on track, we'll reimburse you in case of baggage theft. Subject to policy terms and conditions.

The above mentioned coverage may not be available in some of our Travel plans. Please read the policy wordings, brochure and prospectus to know more about our travel insurance plan.