Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Start planning your next adventure

All members can redeem Avion points, pay with a credit card or both

Fly on any airline with exclusive pricing & benefits for Avion Elite

Get exclusive deals on hotels, resorts and more around the world

Car rentals

Access a fleet of rental cars, trucks and vehicles at home and abroad

Book flights plus hotel packages to thousands of destinations

Things to do

Catch a show, tour sites & attractions, treat yourself to authentic local cuisine and more

Fly over 500 airlines with exclusive pricing & benefits for Avion Elite

Book all-inclusive vacations to thousands of destinations

Catch a show, tour sites & attractions, treat yourself to 5-star dining and more

Already a member? Sign in to get the latest travel offers

How many points do you need to travel?

Avion Elite members get there sooner with exclusive fixed-points pricing on any airline, any flight, any time. No blackout dates or advance seating restrictions, even during peak periods.

Quick Getaways

- Within or to an adjacent province/territory

- Within or to an adjacent U.S. state

Max Ticket Price* $350

Explore North America

- Anywhere in Canada/U.S. except Hawaii and Alaska

Max Ticket Price* $750

Holiday Destinations

- Western Canada/U.S. to Mexico, Hawaii, Alaska

- Eastern Canada to Bermuda, Central America, Caribbean

Max Ticket Price* $900

Take a Vacation

- Eastern Canada/U.S. to Mexico, Hawaii, Alaska

- Western Canada to Bermuda, Central America, Caribbean

Max Ticket Price* $1,100

Visit Europe

- Major gateway in Canada/U.S. to destinations in Europe

Max Ticket Price* $1,300

100,000 pts

See the World

- Major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Max Ticket Price* $2,000

*Excluding any applicable taxes, surcharges and fees.

Max Ticket Price* $175

Max Ticket Price* $375

Max Ticket Price* $450

Max Ticket Price* $550

Max Ticket Price* $650

Max Ticket Price* $1,000

Avion Elite members can also redeem for hotel stays, car rentals and more, using this simple conversion:

You also have the flexibility to redeem for flights using this conversion, including paying taxes and fees * If you are an RBC Avion Visa Infinite Privilege for Private Banking, RBC Avion Visa Infinite Privilege, RBC Avion Visa Infinite Business or RBC Commercial Avion Visa cardholder, you can redeem your points at the rate of 100 points = $2 CAD for first or business class air fare, including paying taxes and fees.

Still have questions? Visit our Travel FAQs page

Family vacations or bucket-list trips, eligible Avion Premium members 1 can redeem using this conversion:

Redeem a minimum of 1,000 points – the remaining balance can be paid with a credit card.

ION & ION+ credit card holders and Avion Rewards Core Accounts redeem using a conversion rate of 172 points = $1 (minimum 2,500 points)

Road trips, weekend getaways or vacations, Avion Select members can redeem travel using this conversion:

Redeem a minimum of 2,500 points – the remaining balance can be paid with a credit card.

Travel sooner 2 as an Avion Elite member

Get the RBC Avion Visa Infinite card to become an Avion Elite member and enjoy exclusive benefits to help you travel sooner 2 on points with any airline, any flight and anytime.

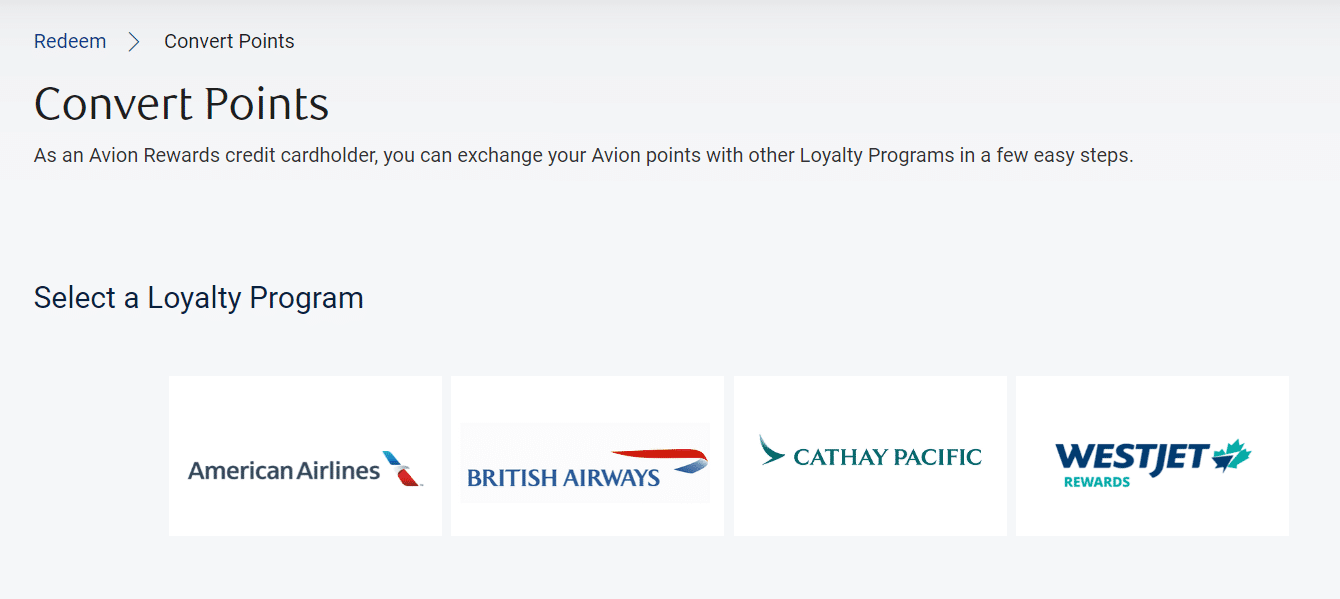

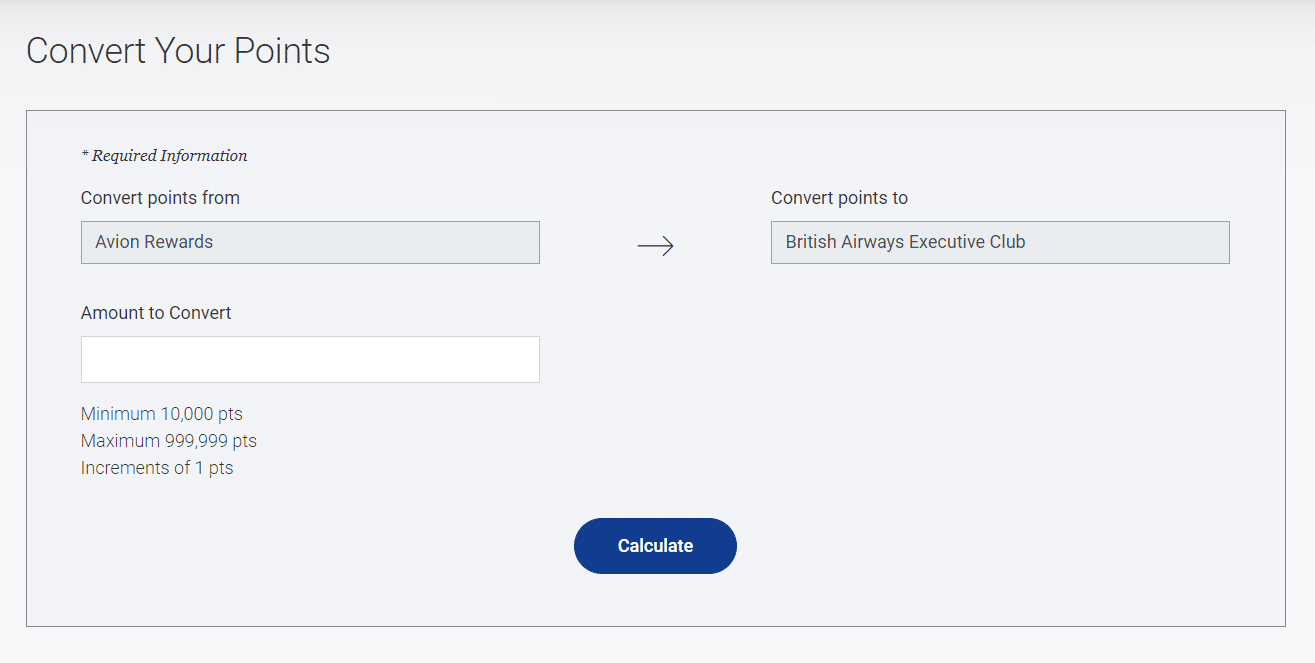

Convert points for travel

Avion Premium and Elite members can convert points to other loyalty or frequent flyer programs, so you can fly and earn your own way. 1

WestJet Rewards

American Airlines

British Airways

Cathay Pacific

Frequently asked questions

Still have questions? Check our Travel FAQs

Avion Rewards travel

Redeem your points for flights, hotels, car rentals, and more.

How many Avion points do you need to travel?

Rbc avion visa credit card holders.

Choose any airline, any flight, any time. There are no blackout dates or advance booking restrictions, even during peak periods.

Avion credit card holders can also redeem for all type of travel, using this simple conversion:

Redeem points using this conversion rate for hotel stays, car rental, cruises, and more. You can also use it for flights when you don’t want to redeem from the Air Travel Redemption Grid above.

Want to travel sooner?

With an RBC Avion credit card, you could be travelling sooner with any airline, any flight, any time. Apply for an RBC Avion Visa Infinite card today and get.

View Legal Disclaimers Hide Legal Disclaimers

Redeeming Avion points for your travel needs is easy

Just use this conversion rate if you’re:

- redeeming for a flight not using the Air Travel Redemption Schedule;

- redeeming for a hotel stay, car rental, cruise or vacation package;

- paying any amount above the maximum dollar value within a category;

- paying taxes, surcharges and fees.

If you are an RBC Avion Visa Infinite Privilege for Private Banking, RBC Avion Visa Infinite Privilege, RBC Avion Visa Infinite Business or RBC Commercial Avion Visa cardholder, you can redeem your points at the rate of 100 points = $2 CAD for first or business class air fare, including paying taxes and surcharges and fees.

Don’t forget, if you’re short a few points, you can always purchase travel by redeeming your points and using your credit card.

For more information, see our Avion Rewards Terms and Conditions .

How to redeem Avion Rewards points for financial rewards

When logged into RBC Rewards, if you look under the Shop & Redeem menu, you’ll see there’s an option to use your points for RBC financial rewards. Assuming you have financial products with RBC, you can use your points for the following:

- Add to your existing investments

- Mortgage payments

- Repayment to your line of credit.

It takes 12,000 RBC points to get $100 in financial products which gives you a value of .83 cents per point. At first glance that may seem like a lot, but think about the long term. With mortgage and line of credit payments, you’re basically paying off your loan earlier which you immediately save on the interest. If you’re adding to your investments, you can take advantage of compound interest which could make your redemption very valuable in the long run.

If you use your points for a financial reward that’s put towards your RRSP , you could also get a tax break. Putting in your TFSA would allow you to invest with tax free gains. It’s a win-win situation, but you won’t see the reward for many many years.

Redeeming Avion Rewards points for merchandise, statement credits, and charitable donations

The final three redemption options for your RBC Rewards points are merchandise, statement credits, and charitable donations. Although the RBC Rewards merchandise catalogue is quite large and there are some quality products available, the number of additional points required for the value is not worth it at all. I would advise avoiding using your points for merchandise. That said, there are occasionally discounts on merchandise redemptions, so sometimes the transactions aren’t a terrible deal.

Using your points for a statement credit is an even lower value. It takes 17,200 points to get $100 off your statement. That means your points would be worth .58 cents per point. Unless you’re facing financial difficulties, you’re better off redeeming your points for anything else.

RBC Avion points transfer partners

I love programs that let you convert points to other loyalty programs since it adds flexibility and value. Avion Rewards has one of the most extensive and valuable lists of conversion partners when it comes to Canada’s bank travel reward programs. American Express Membership Rewards is better, in my opinion, but RBC Rewards isn’t far behind.

Here is the list of programs you can convert Avion points to, but note that except WestJet Rewards, only Avion cardholders can transfer their points to the following partners:

- WestJet Rewards : 1,000 RBC points = $10 WestJet dollars

- Hudson’s Bay Rewards : 1,000 RBC points = 2,000 HBC Rewards points (worth $10 at Hudson’s Bay)

If you are an Avion cardholder you can also benefit from these conversion options:

- American Airlines : 10,000 RBC points = 7,000 AAdvantage miles

- Cathay Pacific Asia Miles : 10,000 RBC Points = 10,000 Asia Miles

- British Airways : 10,000 RBC points = 10,000 Avios miles

It’s hard to put an exact value on airline miles since there are so many variables, but generally speaking, their value is around a minimum of 1.5¢ per mile for economy tickets. Often you can get double the value if you’re booking in business class. That said, WestJet Rewards uses a dollar system, so they have a fixed value.

It’s a good idea to log into RBC Rewards often since they have many redemption promotions throughout the year, which boost your points’ value. In addition, RBC Rewards had a few transfer bonuses (10% to 30% bonus points) for Westjet, Asia Miles, British Airways Avios Miles, and American Airlines AAdvantage Miles. That meant you got extra value when transferring your points to a partner.

Of particular interest is how you can transfer your points to WestJet dollars. Nothing stops you from holding an RBC Avion card and the RBC WestJet World Elite Mastercard. Both cards come with good sign up bonuses so you could quickly rack up those WestJet dollars. For example, the RBC Avion card typically has a welcome bonus of 15,000 points which can be transferred to WestJet for $150 WestJet dollars. The WestJet RBC World Elite Mastercard’s standard bonus is $250 and a companion voucher. When you combine the two, you’ll have $400 in WestJet dollars without having to spend much. No purchase is required to get the bonus with the Avion card, and you only need one purchase with the WestJet Card.

Do RBC Rewards points expire?

There’s a lot of conflicting information out there about when RBC Rewards points expire. I have confirmed that RBC Avion points don’t expire as long as you have an active eligible RBC Royal Bank credit card. If you cancel your card, you have 90 days to redeem them before losing them. The first-in, first-out rule you may have read about online is an old outdated article. RBC really needs to delete that page. If you’re unsure when your points expire, you could always call customer service to confirm.

How RBC Avion compares to others

RBC Avion Rewards is easily one of the best travel loyalty programs of Canada’s big five banks. There are many reasons why I rank RBC Rewards so high, including:

- No blackout dates

- No minimum number of points to redeem

- A fixed points flight program

- Many transfer partners to convert points to

- Many promotions for redemptions

- Value of points

In my opinion, RBC Rewards is only second to American Express Membership Rewards . American Express holds the first place because RBC Rewards lacks an option to book travel on your own (you can only book through their portal) and because RBC Rewards credit cards don’t really have any increased earn rates which limit how fast you can earn points. You can also read my reviews of CIBC Rewards , BMO Rewards , TD Rewards and Scene+ to see how RBC Rewards compares.

How to earn RBC Avion Rewards

To earn RBC Rewards, you must have a credit card account that earns you RBC Rewards. As you can imagine, the easiest ways to earn points are via credit card sign up bonuses and everyday purchases you make on your RBC Rewards credit card. Currently, there are six personal credit cards and two business credit cards that will earn you RBC Rewards points. To make things a bit complicated, RBC Rewards has two tiers of RBC Rewards points: regular and Avion RBC Rewards points. Points from an Avion account have more redemption options, and these options are the most valuable ones. With this in mind, the RBC Visa Infinite Avion card is arguably the best card to earn Avion points and is one of the best RBC credit cards .

RBC Avion Visa Infinite Card

- $120 annual fee

- 35,000 Avion points on approval

- 20,000 Bonus points when you spend $5,000 in the first 6 months

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

The sign up bonus for new cardholders is typically 15,000 points which isn’t much compared to some of the best travel credit cards in Canada . That said, the RBC Visa Infinite Avion Card often has promotions where the welcome bonus is 25,000 – 35,000 points, and the annual fee for the first year is waived. Whenever a promo like that comes around, it’s worth signing up for the card.

The earn rate of 1.25 points per $1 spent on travel is decent, while the 1 RBC Reward point earned per dollar spent on all other purchases, including bill payments, is pretty common. Here’s something that many people don’t realize. You don’t need to make any purchases to get the bonus. The terms and conditions say you get it after the first statement.

Another little-known trick is that you can switch from the RBC WestJet World Elite Mastercard to the RBC Visa Infinite Avion Card and vice versa. This is useful if you’re not able to maximize your points and want to try something new. That said, be sure to use up your points before you make any changes.

The RBC Visa Infinite Avion Card also provides good travel insurance when travelling outside Canada. Not only do you get travel medical, but you’ll also be covered for trip cancellation/interruption, delayed and lost baggage, hotel/motel burglary and more. Obviously, some exclusions apply, so read the certificate of insurance for complete terms.

Link to your Petro-Points card

RBC has a deal in place with Petro-Canada where you can save 3 cents per litre at Petr-Canada, 20% extra Petro-Points, and 20% extra RBC Rewards points.

To be eligible, you just need to add your Petro-Points number to your RBC online banking account. You would link your Petro-Points card to all of your eligible RBC debit or credit cards.

Final thoughts

Avion Rewards is one of the best bank travel rewards programs . The RBC Visa Infinite Avion card may not give you the best signup bonus or have the highest earn rate, but there’s no denying that once you have the points, they’re easy to use. There are no blackout dates and no minimum points required to make a redemption, so you’ll never run into any issues using your points. If you’re a fan of RBC, check out my RBC InvestEase review and find out how you can reduce your investment management fees.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

97 Comments

Can you explain more on the comprehensive cancellation insurance for traveling? For flight

What I mean is you get travel medical, trip accident, trip cancellation, lost luggage, etc. You cAN READ THE FULL DETAILS HERE.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-infinite-avion/rbc-visa-infinite-avion-certificate-of-insurance.pdf

Barry choi, What about outright flight cancellation by company with no booking possibility ? this happened to me 5 years ago and Avion card could not do anything!

When saying trip cancellation … talking from whom??

What do you mean by company with no booking possibility? With fight cancellation, it only applies to reasons that are outlined in your insurance policy.

When should I pay for a flight as opposed to redeeming points. I want to go to Vancouver – Honolulu -L.A. – Vancouver. Points 45000 plus $266 Cash $960 Plse advise and thx,Lawrence

45,000 Rewards points would be worth $450 + $266 for taxes = $716. Since the value of your redemption via the fixed travel program is $960, you come out ahead using the fixed program.

How much is 28906 rbcrewards point please

10,000 points = $100 so you have $289 at the base value. Your points are worth more if you use the RBC Rewards Air Travel Redemption Schedule

Hi. I have 10500 pts and I purchased my ticket for $2000 whose base fair is $1400. What’s the best way to go with the schedule?

You need 15,000 points to make a claim within or to an adjacent Province/Territory/U.S. State. That fare has a maximum base price of $350 so you can’t use the fixed redemption schedule.

you could just 10,000 points to redeem $100.

Sorry Barry. I have 105000 points. I missed a zero. Can you please update your response?

If you’ve already paid for your ticket, you can’t use the air redemption schedule. Assuming you didn’t 100K points gets you a flight from any major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Hi Barry, thanks for the article and for all the Q&A work as well !!

I’m looking at making the switch to Amex. I have 160k reward points I’ve saved up over the years. Looking to cash out or use these points up somehow with the best value. Appears as tho 10,000 points for $100 value is about the best offer from RBC rewards? Also, do you know if these points expire if I got rid of my RBC Avion card?

Yup, 10K points for $100 is indeed the best value. You lose all your points if you cancel your card. Your best bet would be to transfer your points to WestJet Dollars or hotels.com giftcards as they have good value.

I product switched to the RBC British Airways Visa almost 4 months ago. My account has remained in good standing however, I haven’t received the welcome bonus of 15k points yet. I have called RBC multiple times and each time I have been told that BA awards the points but when I speak to BA, they say that RBC needs to award the points. Do you have any idea who should be awarding the points? Thanks in advance for any help you can provide.

In theory, it should be BA that actually issues the points but RBC would have to authorize it.

I would advise escalating the case with RBC first to see if that resolves anything.

If I wish to use my Avion Rewards points to pay off my credit card bill, is it straight 100 points/per every $1?

No, it takes 172 points to claim $1 in statement credit so you’re devaluing your points quite a bit if you were to go that route.

Is this card best to earn miles to book a points first class flight from Vancouver to Tokyo?

I just noticed RBC is offering 50% more points if converted to Avios, does the same offer ever happen with AA points?

The 50% bonus is quite rare. I’ve never seen it with AA.

Is it worth it to convert your Avion points to BA Avios given the 50% bonus on until Dec 15th? I live in Vancouver and typically fly to Hawaii in Winter and Europe in summer. Your insight is much appreciated.

If you plan on using those BA points, then yes, it’s a great deal. That said, I’m not sure which airlines you can use BA Avios points to get you from Vancouver to Hawaii.

Hi, is it worth buying the air Canada gift cards at a 10% discount? Are they easy to use and are there any hidden charges / rules to these we should know about?

Buying the gift cards gives you a guaranteed discount of 10%, but you might get better value if you used your points on the fixed travel program. It’s honestly a personal choice but I imagine you wouldn’t have any issues with using the gift cards. As far as I know there are no additional charges or rules, but read the fine print before you commit.

Do my RBC rewards expire at any point

Not as long as you have a credit card account that earns you RBC Rewards active with them that’s in good standing.

RBC Reward points expire after 3 years on a First In, First out basis.

That is incorrect. If you refer to handbook, the first page states that RBC points don’t expire.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-platinum-avion/rbc-visa-platinum-avion-benefits-guide.pdf

The reference to points expiring after 3 years is old and should have been removed from the website.

my mistake, you are correct. I believe my knowledge was outdated.

I just logged into my RBC Rewards and I see that I have a – 69K point balance. How is it possible to end up with a negative reward points balance?? I have never even used my rewards and forgot that it was even available. Any help would be appreciated.

You’d have to check with RBC about that

Do you think it is worth keeping the RBC Infinite Avion card beyond the first year? Is it worth the $120 per annum annual fee considering that I am also paying fees for amex gold card and BMO cash back card?

Thanks for your insight

Hi Viviene,

I personally wouldn’t keep three credit cards with annual fees. Of the three cards you mentioned, I’d probably drop the BMO cash back card but that’s because I prefer travel points. Who do you bank with? Do they waive the fee for any cards?

I bank with BMO but it’s a joint account and the waiver goes towards my partner’s BMO MC world elite card. I figure the cashback we get each year more than pays for the annual fee.

What does RBC Avion offer that justifies its fee? It seems as if it would take a long time to build up any significant number of points.

Well it’s really for you to decide based on your spending. E.g. if you moved all the spending from your cash back card to the RBC card, you could more in points for flights than what the annual fee would cost you. I think the RBC Rewards fixed flight travel chart offers good value especially if you’re looking at short haul flights. However, that may be redundant since you have the Amex Gold which also has a fixed points program.

How would you compared the two fixed points program? I tend to focus on transferring my Amex points to Avios and haven’t really looked at the Amex fixed points program. I also feel that the Amex Gold has more to offer than the RBC card in terms of travel insurance and flexibility on how to use points. But I may be wrong….

Both programs have their sweet spots. Amex is arguably better since you have more transfer partners. The Amex Gold has a slightly higher earn rate on travel. but RBC Rewards has occasional promos where if you transfer your points to BA, you get 25 or 50% more points.

I do agree that the Gold Amex is a better overall card.

Is there anyway I can browse through options for say a vacation package, that would be qualified for if I had 150000 points? For example my 150000 points would allow me to go to Cayo Largo Cuba, or Puerto Plata Dominican Republic or Cozumel Mexico…you get the idea.

It doesn’t give you an option to search for results based on X points. All really allows you to do is search by price from low to high after you’ve selected a country.

I have always been a fan of the RBC Avion program until today when I tried to change a departing flight and was told that all the flights I chose were “not available” although there were clearly seats for sale on both the airline website AND Expedia. RBC only offered a few very poor flight options. I thought “any flight” meant “any flight”. I have never encountered this before. We ended up buying new flights from the airline after spending over 30 minutes on hold, suffering through a painfully frustrating conversation with an agent and draining the battery on my phone.

I’m going to bail on Avion after learning that they recognize an Air Canada fuel surcharge of 570$ per ticket to europe in a time of extended, sustained low fuel prices. It was going to cost me 1100$= in fees when flights can be purchased outright for just over 1600$.

Value lost due to poor decisions at Avion….. adios!

That’s Air Canada’s fault, not Avion.

How long does it take to convert RBC points into Asia Miles? Is it instantaneous or do you have to wait 6-8weeks?

It usually takes 4-5 days for the transfer to Asia Miles

I have around 200k in avion points. I am trying to figure out the best option for using them as we are moving to Europe for a year. I looked into the flights but almost 1/2 goes to the taxes, etc. I was wondering if it was best to use them while we are there for short trips. So, what would be the best value? (ie rental car, hotels, ?), anything else?

Points for flights to Europe are typically of low value due to the fees. Using them within Europe is also not a good value since you wouldn’t be able to use the fixed travel program. You could use the RBC travel portal when you’re abroad and book points at 10,000 points = $100 in travel.

Alternatively, you could convert your points to WestJet dollars at a 1:1 ratio. On occasion, there are promos where you can convert to hotels.com giftcards which can be a good value.

Hi Barry, we have ~250,000 RBC Avion points and I’m trying to maximize getting to FCO (Rome) this summer from YYZ (Toronto.) We also have 90,000 in Aeroplan.

Traveling with a 15 month old so really wanted to optimize for lie-down seats. But they are pricey. ($8000 for two seats on AC’s direct flights.)

Can you suggest a way to optimize our points to make it work?

Flying from Toronto to Europe is one of the worst redemptions regardless of the program due to high airport taxes. With Aeroplan, you need 110K points for a return business flight so that won’t really work.

For RBC, I don’t think you can use your points for business so that doesn’t really help.

The best value I can think of right now and this is honestly not the greatest solution is to consider transferring your points to WJD. If you have the WestJet World Elite Mastercard, you can use the companion voucher for premium economy. I just booked two flights from YYZ to LGW for $2400. Of course, you would still need to get a flight to Rome and you’d only be redeeming your points at a 1% value.

IMO, you’re better off paying cash for this route and saving your points for later.

Help. We have 175000 Avion points. Looking to use them from YVR to LHR. If I use the points for 3 fares return it looks like another $700 each on top !!!! With Aur Canada. Flights in September are approximately $700 each return. Can you give any advice. I have not checked if BA charges the same.

Flights to Europe are a terrible value due to the high taxes. You’re better off saving your points for a different redemption.

Is it possible to use Avion points to pay for an upgrade on an already booked flight? Is it worth it? Looking at this for a flight from Houston to Auckland on Air New Zealand.

You’d have to call and ask. You definitely can’t do upgrades via the RBC Travel portal.

Is there a time limit to redeem accumulated points? And I wld like to purchase a gift card for electronics?

Your points don’t expire as long as you have an active RBC credit card that’s in good standing.

I am a bit lost with car rental points… if my rental was $800.00 how many points would I need

That falls under travel so it would cost you 80,000 points.

Barry, Can RBC Avion Visa Infinite cardholders redeem for a Premium Economy class seat instead of Economy class? Thanks!

RBC Rewards is a full service travel agency so you can book premium economy, but it’ll cost you more points. It’s unlikely you’d be able to book premium under the Air Travel Redemption Schedule since the price would exceed the maximum base price.

Barry, RBC Avion Visa Infinite redemption schedule From Canada to Hong Kong: 100,000 points. Maximum ticket price: $2,000.

Normally the Air Canada Premium Economy ticket from Canada to Hong Kong costs close to (less than) $2,000. It’s not worth to redeem Economy class, which is about $1,000 or less. That’s why I would like to know whether I can redeem Premium Economy class or not.

As long as the base ticket price is below $2,000, you should be able to redeem a premium economy flight using your RBC Rewards points.

Hi Barry, I’m totally torn between Scotia Passport and RBC AVion? Which one do you really prefer if we plan on going US visits and Asian Countries as well?

Both cards a bit different. The Scotiabank card is a good all-in-one card since it has no forex fees, but the RBC Avion has a fixed points travel chart which can be of good value. Since you’re based in Canada, Air Canada/Aeroplan cards are good for US travel thanks to the new Buddy Pass. WestJet companion vouchers can also be handy.

Barry, early thanks for answering my question. I am contemplating on utilizing approx. 111,000 Avion points for Best Western gift cards. I presume the gift cards are in Canadian funds? Travel contemplated is in the U.S. once the ban is lifted. How is the difference in currency handled by U.S. based Best Westerns?

The gift cards are only worth it if you’re getting an equal value to your RBC Avion points. E.g. 1,000 points = $10. Yes, the cards would come in CAD. If you use them outside of Canada, you would be subject to the exchange rate at the hotel which will definitely have a markup.

Avion $350 air fare fee for interprovincial travel is useless to many Canadians outside the Upper / Lower Canada belt. Many interprovincial one way tickets are $350 or more. I’ve amassed nearly a million dollars over the years on my Avion card, and travel with my family of 6, using the points. I always have to wait for airlines to post sale prices before I can use the points, because their reward amount is set too low. Its not a cheap card either. I’ve never complained, but its been the same price system for over 10 years. Hello! Inflation!

Paying the taxes on flights is also a bummer. I’ve often just bought sale priced flights with cash, because the Avion rewards taxes where close to half the flight cash amount. Didn’t see the point in wasting them.

How do I book a business class seat? We’d like to go back to Europe next year and want to fly business class. I have over 300,000 points with Avion.

Two years ago we booked two business class seats after transferring points to British Airlines, What a nightmare!

I swore that I’d move to another point card to get better service, connections, etc.

Please help.

RBC has a travel rewards portal where you’d book your flights and then redeem your points.

Aeroplan is a lot easier these days, it’s worth considering switching to a card that earns you Aeroplan points.

We have 215000 points with RBC and travel to Mexico, US and are thinking of going from Edmonton to Amsterdam and returning to Edmonton from Rome. What are the best way to use our points. Is transferring points to Westjet a better deal than buying Westjet gift cards .

To maximize your value, you should use the RBC Air Trave Redemption schedule – https://www.rbcrewards.com/#!/travel/redemptionSchedule

It’ll cost 65,000 points to get to Europe with a max ticket value of $1,300. That works out to 2 cents a point which is double the normal value.

Ad for WJD, it’s a better value to transfer your points directly instead of buying gift cards

Any luck with product switching lately and receiving the welcome bonus of 15,000 points for Avion Infinite?

Darn. Seems to still work for WJ MC. Perhaps makes sense to PS to a no AF card and then cycle back.

I recently “purchased” airline tickets using Avion points. Unfortunately I mistakenly selected the Flexible Points Pricing and as a result ended up using roughly twice as many points as would have been needed under the Fixed Points Pricing. The difference is somewhere around 35,000 points. I requested that Avion reverse this mistake but was advised that it was their policy to not allow such a change. I requested to talk to a manager, but they basically advised that this wasn’t going to happen (they told me it would take 6 weeks). Any advice.

Unfortunately, it’s unlikely they’ll reverse the charges. This happens with all points programs.

Hi Barry… I have over 1 Mil points… and on flight can I upgrade to Exec or 1st Class with my points ?? I don’t see it anywhere when i am looking at the booking … Any ideas. Thanks Mike

In the RBC Avion travel portal, you should be able to choose premium economy or business class seats for your flights.

What are the pros & cons of flex points vs flexible points booking w Avion? How do I know which we should use?

All rbc rewards and avion rewards points can be used on any travel purchase made through the RBC travel portal.

I have been reading your awesome feedback from Avion customers! I recently tried to receive information from the RBC Rewards program call centre and it was horrific – unprofessional and unknowledgeable agents, transferring me first to Expedia and then to Air Canada. They wore me down. I then went online and read reviews on the performance of the program – from what I saw, every customer who had to make a change on their travel booking experienced exactly the frustration I did.. Has this program gone down hill in recent years on their customer service assistance?

The program itself is fine, but I imagine every travel operator is experiencing customer service issues. I guess the real problem is knowing who to call. If you book travel through the Avion travel portal, technically speaking, you will go through them to make changes even if you booked an Air Canada flight.

Hi Barry, I’m unsure whether to use my avion infinite Visa card to pay a Europe bike tour purchase as the surcharge is 4 percent or pay with an e-transfer. The foreign currency rate I’m billed at was 1.49. I look forward to your response. Also, if I pay with an e-transfer will I have any travel protection? Thanks in advance! Barbara

Hey Barbara,

A 4% surcharge is quite a bit. That said, an e-transfer may come with fees too. I personally would just choose what’s cheaper. That said, if you don’t pay with your credit card, you don’t get any protection if you need to cancel your tour for a qualifying reason.

Hi Barry, Thank you for your responses. I really appreciate it! Barbara

Regarding financial rewards, more specifically applying a credit to an existing RBC mortgage: is the cash value going to be considered a lump sum payment or something else? I ask this because the options to pay down a mortgage faster are limited to double-up payments upon each scheduled payment, and one lump sum payment (aka prepayment) of up to 10% of the initial principal per year. I already used my yearly lump sum and I’m concerned that I wouldn’t be allowed to redeem my Avion points towards my mortgage or I may be allowed to do so, but I could be issued a penalty for not following the rules. I couldn’t find anything online about what the value of the points redeemed is considered to be.

Hey Stephanie,

If I had to guess, it would count as a prepayment. You’d have to call them to find out for sure.

Too old to travel. So thinking of using my Avion points to buy RBC merchandise. How can I see what is available if I don’t do any banking transactions on a computer?

You need to go to the RBC Avion website to see what items are available for redemption – https://www.avionrewards.com/index.html

On the web site that I see, the first thing that they want is your Visa number. And that is exactly why we don’t do money matters on line.

Avion Rewards is a credit card rewards program. Using your credit card number is how you log in.

Hello I redeemed 130,000 points for a flights to Barcelona from Toronto and had to cancel. What is the value of these points so that I can make a travel insurance claim

That’s a value of $1,300.

Hi Barry, Thought you might be interested in my experience being transitioned from HSBC World Elite MC to RBC Avion Visa. Since I don’t have anything that spells out the fees, conversion rate, etc. I called the RBC conversion team. They are waiving the $120 annual fee for the first year and that’s it. Although the HSBC card did not charge the 2.5% foreign conversion fee, the RBC card does. The extra points which HSBC gave for travel expenses are likewise not available with the RBC card. It seems to me that if I wanted this card I would be better off applying for it and getting the bonus. Very disappointing.

You should have received paperwork about the details of your new card. HSBC World Elite MC holders being switched the Avion Visa Infinite will still get no FX fees on their card.

You’re correct about losing the travel credit after the first year.

The Avion card is a clear downgrade, I mention a few other options in this article – https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-hsbc-clients-may-not-love-their-new-rbc-credit-cards-but-rbcs-avion/

Thanks Barry. I don’t subscribe to the Globe but I assume you suggested the Scotiabank Passport Visa as an alternative. I don’t want to take up your time with all this but I applied for the Scotia card and it developed into a real mess. I’m still trying to find out what happened, currently waiting to hear back from their Escalated Customer Concern team.

I suggested a few.

The Amex Cobalt for high earn rate, Rogers Mastercard for Costco (if you use Rogers), and Platinum for high end travel benefits. If you want no FX, the Scotiabank card is indeed good, but I like the EQ Bank card cuz it has no fees.

I’ll def check into the EQ card, thanks again.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

RBC Avion : How to Use Your RBC Avion Points for Travel Rewards

RBC Avion Rewards Credit Cards

There are several RBC Avion credit cards part of the Avion Rewards program . One of the best is the RBC Avion Visa Infinite Card .

It has excellent insurance, including one for mobile devices, which is rare. In addition, as a welcome offer, it offers a lot of points with little effort.

Other cards that earn Avion Points are:

- RBC Avion Visa Infinite Card

- RBC ION+ Visa Card

- RBC ION Visa Card

- RBC ® Avion ® Visa Infinite Privilege* Card

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite Business Card

- RBC Avion Visa Business Card

With this exceptional offer for the RBC Avion Visa Infinite Card, you can earn up to 55,000 Avion points:

- 35,000 Avion points on approval

- 20,000 Avion bonus points when you spend $5,000 in your first 6 months

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

For example, with the current welcome offer, you can get 55,000 British Airways Avios Points or 550 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

And you’ll benefit from a wide range of insurance coverage: Trip Cancellation and Interruption Insurance, Out-of-Province/Country Emergency Medical Insurance, Rental Vehicle Collision/Loss Damage Insurance, Mobile Device Insurance.

How to Use Your Avion Points for Travel Rewards

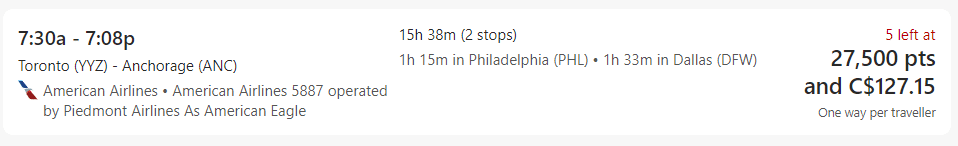

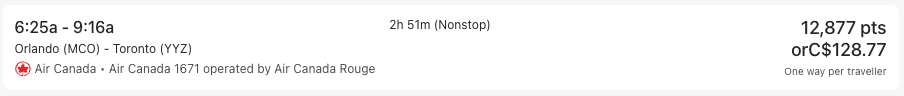

Use the fixed fare chart for airline tickets.

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program . This is described in detail in this article .

Depending on the destination, 15,000 to 100,000 Avion points are required per ticket.

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

Use the Flexible Fare Chart for Airfare

The Flexible Fare Plan uses 100 Avion points for a $1 discount on your airfare. The transaction must be made directly on the Avion Rewards website, using the flight search tool.

For example, with the flat rate fare, 35,000 points will get you a round-trip ticket anywhere in Canada and the U.S., up to a value of $750.

If you choose to purchase that same $750 ticket with the flexible fare structure , you will need 75,000 points. So using the flexible fee schedule would be more of a disadvantage in this case. It’s up to you to make your calculations, depending on the number of points you have banked.

Redeem Avion Points for Any Trip

For even more flexibility, book your hotel, car rental, cruise or airline tickets as you wish on the Avion Rewards site to have your account credited.

Avion credit cardholders can redeem 100 Avion points to deduct $1 from this travel expense. For example, for a night at the hotel that cost $200, 20,000 points are required to bring the balance down to zero.

For ION and ION+ credit card holders, it’s different. They redeem their points using a conversion rate of 172 points = $1.

Buy Gift Cards

There are approximately 250 gift cards to purchase with Avion points. About ten of these geared towards travel. For example, buying a gift card for future stays at Fairmont or Best Western hotels. Or Tim Hortons, for roadtrips !

Generally, the cost is 1 cent per Avion point, so 5,000 points for a $50 gift card .

Uber is different, with 7,000 points for $50.

Transfer to Other Airline Loyalty Programs

Did you know that it is possible to transfer your Avion points to other airline loyalty programs? We explain how in our tutorial on this subject:

Another way of exchanging RBC points in the event of technical problems

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

During that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want;

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of ticket purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their fare structure.

Frequently asked questions about the Avion Rewards program

How many avion points are needed for a free airline ticket.

Depending on the destination, 15,000 to 100,000 Avion points are required.

Can I buy a ticket for another person?

Yes , make sure that the person’s personal information is written down perfectly at the time of booking.

What is the definition of a basic Avion Rewards account?

These are the people enrolled in the Value Program , who earn Avion Rewards points.

Where can I redeem my Avion Rewards points for travel?

Go to the site Avion Rewards or click on the Avion Rewards icon in your RBC Direct Banking session. Then go to the Travel section.

All posts by Caroline Tremblay

Suggested Reading

Maximizing the Canadian RBC Avion Redemption Schedule For Travel

In a previous post on RBC's Visa Infinite Avion, TPG contributor Ola briefly described the benefits of the Avion Redemption Schedule. In this post, he elaborates on how it works and how to maximize it. The Redemption Schedule is available exclusively to RBC's "Avion" brand card holders.

Air Travel Redemption Schedule

The Redemption Schedule above is taken directly from RBC Rewards, and is classified into different regions mostly based on distance. Each region is assigned a fixed number of points required to travel to it. Flights must originate either from Canada or the US . So you can't use this schedule to go from Europe to Asia for example. There is a maximum ticket price associated with each region and the required RBC Rewards point level. However, RBC Avion is a hybrid points program , so you can also redeem your points for a fixed value of 100 points per $1, if such a redemption makes more sense for your ticket.

Insider Tips For the most part the chart is pretty easy to read, but there are just some points to clarify:

1. The maximum amount of value you can pull from your points in terms of the redemption schedule's maximum ticket value amounts is 2.33 cents .

2. The maximum price in the schedule does not include taxes . Taxes can either be charged to your credit card or paid using 100 points per $1.

3. The schedule applies to roundtrip economy class flights . However, business class tickets can be booked using the maximum amount in the redemption schedule and the difference between the economy and the business class ticket fare paid by charging it to your credit card or using points at the fixed rate of 100 points per $1.

4. Travel to Bermuda, Mexico, Hawaii, Alaska, Central America, and Caribbean has two different "required points" levels depending on where the flight originates. These destinations require less points with a lower maximum price when traveling from Eastern Canada/U.S. and some require less when traveling from Western Canada/U.S. For instance, flying to the Caribbean from Eastern Canada would require 45,000 points, but getting to the same destination would require 55,000 points from Western Canada.

5. The maximum price does not mean that you cannot book a ticket that costs more than the maximum price using your points. If you find a flight that is higher in cost, you can redeem the maximum amount in the chart and pay the rest by credit card or at 100 points per $1 .

6. Make sure to calculate the value of each points redemption. If you find a ticket that costs less than the maximum amount, you want to check if it's less than the value of the required points. The way to do this is by dividing the required point amount by 100. So 15,000 points would equal $150. If the ticket you find costs less than $150, then you should not use the redemption schedule, instead you should redeem using RBC's 100 points per $1 rate.

Maximizing the Redemption Schedule If you're an Avion card holder and want to get the best value for your points for travel using the Redemption Schedule, you should keep three things in mind:

1. Book flights as close as possible to the maximum price level. The closer you get to the maximum amount, the more value each point has. For example, if you're redeeming 100,000 points with a maximum price limit of $2000, and you find a flight that costs $1000, each point will equal 1 cent in value. But if you find a flight that costs $2000, each point will equal 2 cents, that's double the value, quite a difference.

2. If a ticket to your final destination costs less than the maximum amount allowed under the redemption schedule limits, you can add as many stopovers as you want to boost the price until you reach the maximum price. Mind you though that the stopovers may affect the taxes you're paying.

3. Try to find flights with low taxes. Even though flights must be booked through RBC travel, always do your own research and call them at 1-877-636-2870 with the exact flights that you want. Look at different options on different days (if your schedule is flexible) and try to find flights with low taxes and fuel surcharges. One of TPG's answers to a Sunday Reader Question mentions some tips on different airlines and their surcharges. Just remember, your flights must originate from Canada or the US.

Booking Rules Here are the program's rules for booking, changes and cancellations, so keep them in mind because they will affect the cost and value of any awards you book through RBC Avion.

1. Booking has to be done through RBC Rewards travel . Booking by phone costs $30 per passenger per flight. Booking online is free.

2. Booking has to be done 14 days in advance of departure date . If you wish to book less than 14 days in advance, you can only book tickets using the fixed-value rate at 100 points per $1.

3. Tickets are non-refundable , meaning that you will not get a statement credit or points back if you end up having to cancel your trip. However, you will get the monetary value back if you buy cancellation and interruption insurance, if you want to have that option.

4. You can change or cancel tickets for a fee . RBC charges $25 per alteration, per airline ticket, on top of what the actual airline charges for the alteration. If you cancel a ticket without insurance you will get a credit on the airline for what the value of the ticket would have been if you had purchased it, minus the change/alteration fees, that you must use within a year.

5. If you wish to purchase points to reach a redemption threshold, you must have at least half the required amount of points for your destination. There is a minimum of 1,000 and maximum of 15,000 for purchasing points. Every 1,000 points cost $40 (2.5 cents each) plus applicable taxes, so I wouldn't recommend it unless you only need a few thousand to get to a particular award.

Have any more questions about how the RBC Avion Redemption Schedule works? Leave a comment below and I'll get back to you with answers. [card card-name='Premier Rewards Gold Card from American Express ' card-id='22035076' type='javascript' bullet-id='1']

By Sandra MacGregor

Fact Checked: Scott Birke

Updated: April 01, 2024

Play article

( mins)

( )

More rewards programs

- Best travel rewards programs

- Best loyalty rewards programs

- Best Aeroplan credit cards

- Aeroplan guide

- Best Air Miles credit cards

- Air Miles guide

- Scene+ guide

- Aeroplan vs. Air Miles vs. Avion

RBC Credit Cards

- Best RBC credit cards

- RBC Avion Visa Infinite review

- WestJet RBC World Elite Mastercard review

- RBC ION+ Visa review

- RBC Visa Platinum Card review

Avion Rewards guide

Rbc rewards are now avion rewards.

RBC Avion Rewards, overseen by the Royal Bank of Canada, the biggest of the Big Five banks, is one of the most popular loyalty programs in Canada. Though it offers an impressive variety of redemption options overall, the program is particularly appealing to frequent fliers who covet the bank’s Avion credit cards. Whether you’re a more casual Avion Rewards earner or a seasoned jet setter, our RBC Avion Rewards guide will help you decide if Avion Rewards is the loyalty program you’ve been looking for, or if you should keep up the hunt for the perfect spending and travel companion.

How do you earn Avion Rewards points?

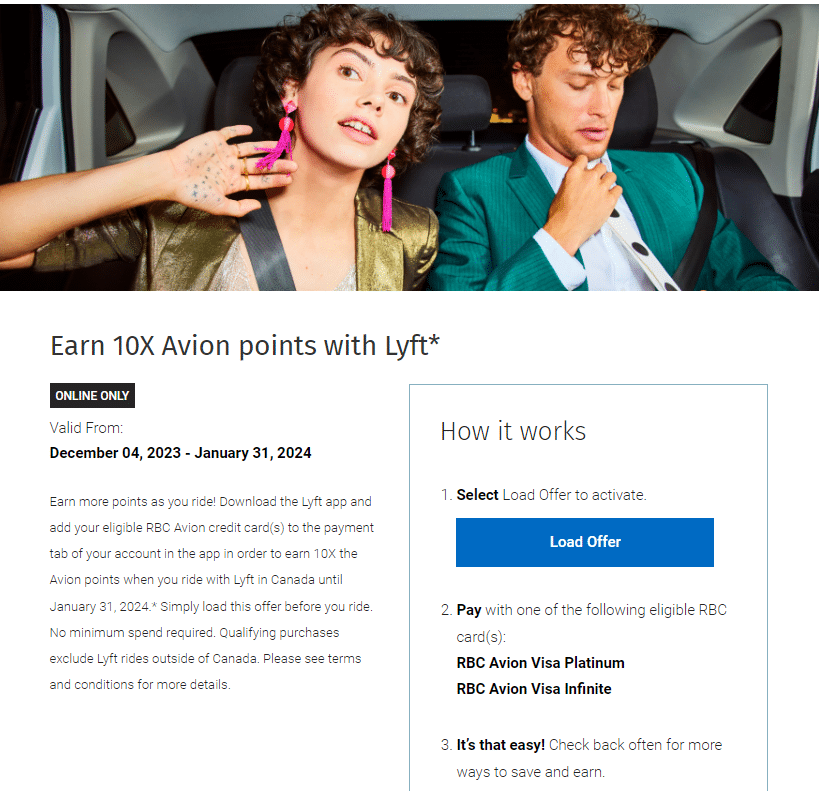

The best way to earn RBC Avion Rewards points is by making purchases with an RBC Avion credit card such as the RBC Avion Visa Infinite and RBC ION+ Visa. Our full list below and summary RBC Avion Rewards chart shows all the RBC credit cards you can use to rack up points and how much they earn.

- RBC Avion Visa Infinite

- Rates & Fees

1 Earn 1 Avion point for every dollar you spend*.

25% extra Avion points on eligible travel purchases

$1,500 mobile device insurance

3¢/L savings on fuel at Petro-Canada and always earn 20% more Avion points

50 Be Well points for every $1 spent on eligible products at Rexall

20% off at Hertz and earn 3x the Avion points

$0 delivery fees for 12 months from DoorDash

$120 Annual Fee $50 for each additional card

20.99% Purchase APR

22.99% Cash Advance APR

22.99% Balance Transfer Rate

Very Good Recommended Credit Score

$60,000 Required Annual Personal Income

- RBC ION+ Visa

3 Avion Ion points† per $1 on qualifying grocery, dining, food delivery, gas, rideshare, public transit, EV charging, streaming, digital gaming and online subscriptions

1 Avion Ion point per $1 on all other purchases

$48 Annual Fee $4 per month

22.99% Cash Advance APR 21.99% for residents of Quebec

22.99% Balance Transfer Rate 21.99 for Quebec residents

Good Recommended Credit Score

Full list of Avion Rewards credit cards that earn Avion points

The following RBC Royal Bank credit cards earn Avion points on net purchases and are points-earning credit cards:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Privilege for Private Banking

- RBC Avion Visa Platinum

- RBC ION Visa

- RBC Rewards Visa Preferred

- RBC Visa Gold Preferred

- RBC Visa Platinum Preferred

- Signature RBC Rewards Visa

- RBC Rewards Visa Gold

- RBC Rewards+ Visa

- RBC U.S. Dollar Visa Gold

- RBC Visa Classic II

- RBC Visa Classic II Student

- RBC Mike Weir Visa

- RBC Avion Visa Business

- RBC Avion Visa Infinite Business

- RBC Royal Bank Visa CreditLine for Small Business

- RBC Commercial Avion Visa

Refer to RBC Page for up to date offer terms and conditions.

There's no distinction between the points earned from a standard RBC card vs. an Avion card, like the RBC Avion Visa Infinite . Both cards earn Avion Rewards points—though some Avion cardholders may mistakenly refer to their points as such. The difference between an Avion card and a standard RBC rewards card is that Avion cards are intended to appeal to those looking specifically for travel rewards cards. Avion cards have higher annual fees, better welcome offers, and feature additional travel-friendly perks (like good travel insurance packages and exclusive experiences). Finally, though both Avion and non-Avion cardholders use the same travel portal to redeem points, Avion cardholders get better value for their points when redeemed for travel.

If you don’t feel comfortable using credit, keep in mind that you can still earn RBC Rewards points with a debit card. If you enrol an eligible RBC bank account (such as the RBC Day to Day Banking or Advantage Banking accounts) in the Value Program you can earn RBC points every time you use your debit card.

What can Avion Rewards be used for?

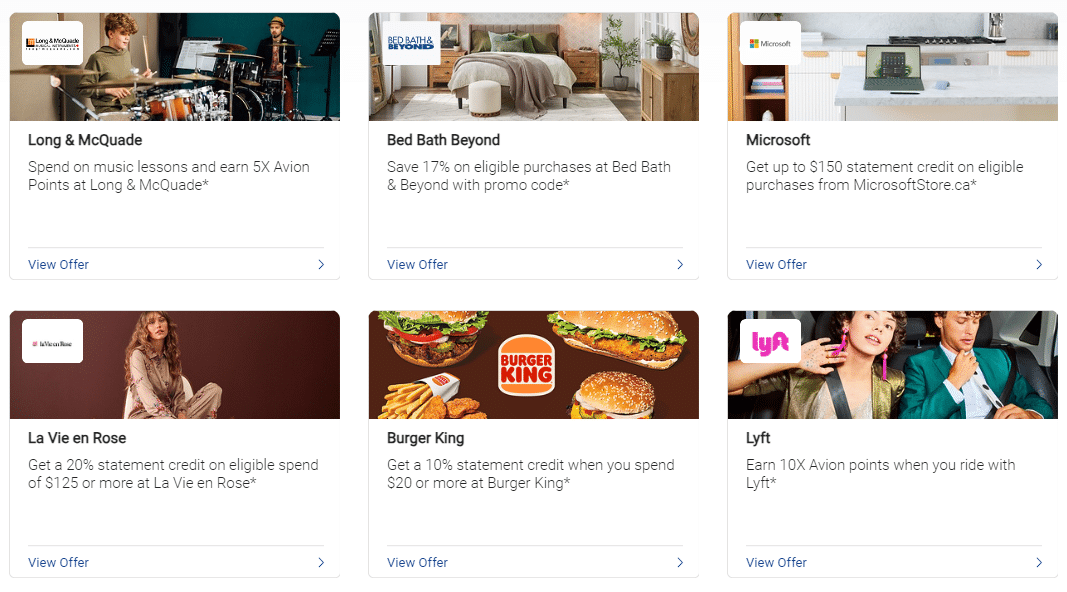

Avion Points value varies substantially depending on how they are redeemed, and Avoon Rewards can be redeemed for a wide variety of purposes, including travel, merchandise, charitable donations, paying with points and gift cards. You can also use the Avion Rewards ShopPlus browser extension to earn money back when shopping online.

Redeeming travel points For Avion and Non-Avion cardholders

When you want to redeem your RBC Rewards for travel, you’ll notice that there’s a different redemption option based on whether you have an RBC Avion card or not.

If you don’t have an Avion card, then your redemption options for travel are very straightforward: 100 points = $1 travel value. To redeem your points for travel you simply sign in to the RBC Rewards Travel page and select a travel purchase. There is no minimum number of points required to redeem for travel, and if you don’t have enough points to cover a full travel redemption you can pay the remaining balance with your credit card.

If you are an Avion cardholder, you can select round-trip flights on any airline based on the Air Travel Redemption Schedule. The number of points you need to redeem depends on your destination, and each destination has a maximum ticket price (not including fees and taxes). If you exceed the maximum ticket price, RBC lets you charge the additional cost to your credit card or pay the difference at a rate of 100 points = $1.

It’s clear from the travel redemption schedule that Avioners get more value for their points when they redeem them for travel compared to non-Avioners. Whereas the value of one point for non-Avioners is locked in at 1 point = 1 cent, Avioner point values range from 2 cents to as high as 2.33 cents per point.

Note that while there are redemption differences between Avion and non-Avion cardholders, there are some important benefits that both cardholders share. Both can redeem their points for a number of different travel-related purchases, such as flights, cruises, vacation packages, hotels, and car rentals. Furthermore, both enjoy no blackouts or seat restrictions when they book their travel. Plus, both can use RBC Rewards points to cover air travel fees and taxes at a rate of 100 points per $1.

RBC Avion Rewards points conversion

Another appealing feature of the Avion Rewards program is that you can transfer your Avion points to a few other participating loyalty programs.

All Avion Rewards cardholders can convert their Avion Rewards points into WestJet dollars and Hudson’s Bay Rewards points. For every 100 RBC Rewards points converted, you receive 1 WestJet dollar (minimum 1,000 pts needed to convert). For every 500 RBC Rewards points converted, you receive 1,000 Hudson’s Bay Rewards points (minimum 500 pts needed).

RBC Avion cardholders have even more conversion options. They can transfer points to the aforementioned programs, but they can also convert RBC Rewards points to other participating travel rewards programs:

- American Airlines (10,000 RBC Rewards points = 7,000 AAdvantage miles)

- Cathay Pacific’s Asia Miles (10,000 RBC Rewards points = 10,000 Asia Miles)

- British Airways (10,000 RBC Rewards points = 10,000 Avios)

Note that all cardholders can also transfer RBC Rewards points to a second RBC Rewards account held in their name. You can also transfer RBC Rewards points to a family member or friend if they have an RBC Rewards account.

Other Avion Rewards redemption options

The Avion Rewards program is incredibly flexible and points can be redeemed for an impressive variety of pursuits outside travel, including merchandise, charitable donations, and gift cards. You can also put points toward an RBC Financial Reward, by transferring them to accounts like an RBC investment portfolio or RESP . Finally, you can take advantage of a relatively new feature called Pay With Points that lets you pay bills, pay down your credit card statement, or even make purchases in-store with an eligible digital wallet app like Google Pay.

Here’s a look at what your Avion Rewards points are worth:

- Merchandise : $0.006–$0.0085 per point. Point value varies because there’s a wide range of items you can redeem points for, including Bose stereos, Fitbit smartwatches, Cuisinart kitchen appliances, and more. RBC Rewards also has an impressive range of Apple products like MacBook Pro and iPhones.

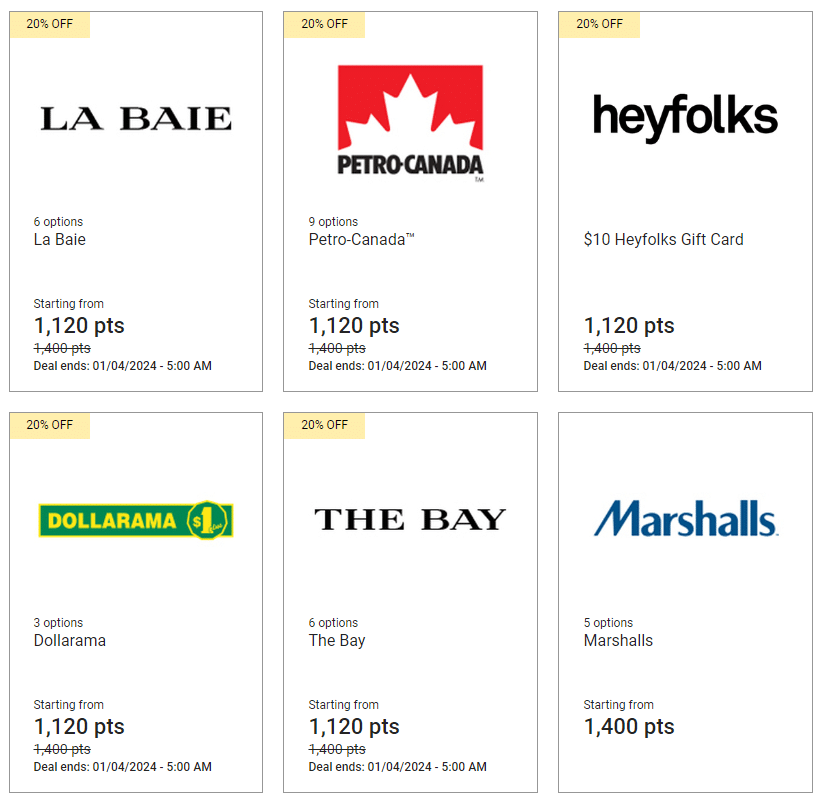

- Gift Cards : $0.0071–$0.01 per point. When redeeming points for gift cards, points usually have a value of $0.0071 each. However, sometimes RBC Rewards will have special bonuses where the points needed for a redemption are reduced, which gives your points more value. For example, normally you need 1,400 points to redeem for a $10 Amazon.ca gift card but sometimes the same $10 Amazon.ca gift certificate is available for only 1,000 points, bringing your point value up to one cent per point. There is a good selection of gift cards aside from Amazon.ca, including Best Buy, Air Canada, A&W and more.

- Charitable Donations: $0.01 per point. Redemptions can be donated to Hope Air, Own The Podium, Ronald McDonald House Charities, and The David Foster Foundation.

- RBC Financial Reward: $0.0083 per point. You can contribute to your RBC investment portfolio, RBC personal loan, RBC mortgage, RBC line of credit, and more.

- Pay With Points: $0.0058 per point. If you use Pay with Points to pay down your statement credit you get the worst value for your points.

Redeeming points is a straightforward process: Head to the Rewards portal and sign in when you’re ready to redeem. There may be minimum redemption requirements depending on what redemption option you use. For example, there are set point minimums required when you convert points to other loyalty programs, as well as a minimum of 12,000 points needed to redeem points for RBC Financial Rewards.

Do Avion Rewards expire?

Avion Rewards points never expire as long as your account remains open and in good standing. However, you’ll have limited time periods to redeem your points after closing your account: 90 days for self-serve, online point redemption and 365 days to redeem by calling in to the RBC advice centre.

Other Avion Rewards program benefits

RBC has point-earning partnerships with both Rexall and Petro-Canada. With Petro-Canada, you earn 20% more RBC Rewards points when you use a linked eligible RBC Rewards credit card to make purchases. You also instantly save 3 cents per litre at Petro-Canada locations. With Rexall, RBC cardholders with a linked debit or credit card earn 50 Be Well points (Rexall’s rewards program) per $1 they spend at Rexall stores.

RBC also has a new partnership with DoorDash that gets eligible cardholders a free DashPass subscription for up to 12 months, as well as unlimited deliveries with no delivery fees on orders over $12.

Is RBC Avion Rewards the best travel program in Canada?

So how does RBC stack up? To get a sense of how competitive the RBC Avion Rewards program is, it’s helpful to compare it to the two other most popular travel rewards programs in Canada: Aeroplan and AIR MILES .

The new Aeroplan flight award chart features dynamic pricing, so the value you get for an Aeroplan point depends on numerous factors like flight distance, exact destination, and route popularity. Since Aeroplan recently revamped its program, point values now generally range anywhere from about 1.5 cents per point to as high as 2 cents, which is a lower range than the travel redemption values for Avion cardholders. Unlike Avion, Aeroplan points cannot be transferred to other loyalty programs, but you can transfer points from some other loyalty programs to Aeroplan. That said, there’s a larger selection of Aeroplan credit cards issued by multiple financial institutions (TD, CIBC, and Amex) and they tend to feature more travel perks than Avion cards, including the likes of free checked bags, NEXUS application rebates, and free airport lounge visits.

AIR MILES, while not strictly a travel reward program, gives you the best (if not the most consistent) value when you redeem them for travel. Value ranges anywhere between 8 to 25 cents a point, depending on when and where you fly. However, AIR MILES are slow to add up because AIR MILES credit cards typically only earn 1 MILE per $5–$25 you spend, depending on the card. It’s also worth noting that unlike with RBC, the values for Aeroplan points and AIR MILES don’t change based on which credit card they were earned with. So although an entry-level Aeroplan or AIR MILES card might earn points at a slower rate than a card with a high annual fee, the ‘class’ of the card doesn’t affect how much its points are worth when it’s time to redeem.

All told, I recommend RBC Avion Rewards to those who meet the income and credit score requirements for an Avion card, and who are willing to pay an Avion card’s annual fee for access to its high-value point redemptions. Avion is particularly appealing for those who find themselves making a lot of short-haul flights within Canada or to nearby U.S. states, for which your points get exceptional value. It’s also a great option if you fly frequently with American Airlines, Cathay Pacific, or British Airways, and you like the flexibility of transferring your points to one of those loyalty programs in order to maximize value and get free flights.

On the other hand, if you only qualify for an entry-level, non-Avion card, there are other travel rewards programs or even cash back credit cards out there that might offer more sign-up bonus points, better regular earn rates, and better value for your points.

Pros and cons of RBC Avion Rewards program

Flexible program with lots of redemption options

Points can be earned with your debit card if you have a qualifying bank account

You can convert points to several other participating loyalty programs

Non-Avion credit cards have weak to non-existent welcome bonuses and ho-hum earn rates

Must have an Avion credit card to get maximum point value when redeeming for travel

Relatively low value for points when redeeming for statement credits

Avion Rewards Guide , RBC Royal Bank, Dec 22, 2023

About our author

Sandra MacGregor has been writing about finance and travel for nearly a decade. Her work has appeared in a variety of publications like the New York Times, the UK Telegraph, the Washington Post, Forbes.com and the Toronto Star. She spends her free time travelling, and has lived around the globe, including in Paris, South Korea and Cape Town.

Latest Articles

Federal budget announces measures for open banking, predatory lending and bank fees

B.C. construction sector seeks support as workers shortage, late payments persist

TC Energy pipeline rupture sparks wildfire near Edson, Alta.

Liberals raise capital gains tax on wealthiest Canadians to pay for agenda

Unifor withdraws Amazon union applications, citing 'suspiciously high' employee data

Some of the winners and losers in the 2024 federal budget

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

This browser is not supported. Please use another browser to view this site.

- Credit cards

- Newcomers to Canada

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage payment calculator

- Income property

- Renovations + maintenance

- Compound interest calculator

- Household finances

- Find a Qualified Advisor Tool

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- A Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

The best RBC credit cards in Canada for 2024

Discover the best RBC credit cards, whether you’re looking for cash back, travel points or low interest.

Why trust us

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners .

The best RBC credit cards in Canada by category

By Sandra MacGregor on March 1, 2024 Estimated reading time: 7 minutes

Royal Bank of Canada offers an array of credit cards catering to various preferences and spending habits. Whether you prioritize travel rewards with Avion points, seek the flexibility of cash back, or prefer unique benefits like WestJet dollars, RBC has a card for you. With credit cards spanning the Visa and Mastercard networks, cardholders can tailor their shopping experience to suit their preferences. Let’s explore the standout features of the best RBC credit cards in Canada.

Best RBC travel credit card

At a glance: The RBC Avion Visa Infinite is a premium travel credit card that has a flexible rewards program and exclusive benefits. Cardholders earn 1 Avion point per $1 spent, and a boosted 1.25 points on eligible travel expenses (like flights, cruises and car rentals).

RBC Avion Visa Infinite

- Annual fee: $120

- Earn rate: 1.25 Avion points per $1 spent on travel (including flights, hotels, taxis and public transit) and 1 point per $1 on all other purchases.

- Welcome bonus: You can earn 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months*. Apply by April 30, 2024. Apply online and get a response in as little as 60 seconds.

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 RBC Avion point = Up to $0.023 when redeemed for travel using RBC’s Air Travel Redemption Schedule.

- Recommended credit score : None specified

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

- RBC Avion points can be worth as much as $0.023 each when redeemed for travel, which is a high value among travel rewards cards.

- Avion has a lot of travel redemption flexibility. You can redeem your points for travel using RBC’s Air Travel Redemption chart, transfer points to select airlines (including WestJet), and redeem for travel purchases through RBC.

- There are no blackout periods or seat restrictions, even during periods of high demand.

- Exclusive access to concert tickets, including Taylor Swift .

- Impressive travel insurance coverage, including trip cancellation and interruption and emergency medical. It even features mobile device insurance of up to $1,500.

- You’ll pay a foreign transaction fee of 2.5% on all purchases not in Canadian dollars.

- The highest earn rate is 1.25%, which is not very high for a premium card; other premium cards feature significantly higher earn rates.

- The personal annual income requirement of $60,000 (or household income of $100,000) may be too high for some applicants.

Best RBC airline travel credit card

At a glance: With perks like a yearly round-trip companion voucher, free checked bags and Boingo Wi-Fi access, the WestJet RBC World Elite Mastercard makes an attractive travel buddy. In fact, it’s the best credit card in Canada for frequent WestJet flyers—full stop. Cardholders earn 2% back in WestJet dollars on purchases of WestJet flights and vacation packages and get 1.5% back on all other spending. One WestJet dollar has a value of one Canadian dollar.

WestJet RBC World Elite Mastercard

- Annual fee: $119

- Earn rate : 2% back in WestJet dollars on WestJet flights and vacations packages and 1.5% back on all other purchases

- Welcome offer : You can earn up to $450 in WestJet dollars with the WestJet RBC World Elite Mastercard. Plus, get a Round-Trip Companion Voucher Every Year – for any WestJet destination starting from $119 CAD (plus taxes, fees, charges and other ATC).

- Annual income requirements : Personal income of $80,000 or household income of $150,000

- Point value: 1 WestJet Dollar = $1 CAD when redeemed for eligible flights or vacation packages

- Recommended credit score: None specified

- Interest rates : 20.99% on purchases, 22.99% on cash advances

- Travel perks include complimentary first checked bags for the primary cardholder and up to eight companions.

- Get an annual round-trip companion voucher for any WestJet destination, starting at $119 (plus taxes, fees and other charges) or opt to exchange it for four lounge vouchers.

- Extensive travel insurance, including emergency medical, trip interruption and flight delay coverage.

- Cardholders can save up to $0.03 on fuel at Petro-Canada and can also earn Rexall’s Be Well points.

- The card grants access to over 1 million Boingo Wi-Fi hotspots worldwide.

- WestJet dollars can’t be used to pay for taxes and fees.

- Unlike with Aeroplan, for example, rewards are not flexible as they can only be used for WestJet flights and WestJet vacations.

- A minimum personal income of $80,000 (or $150,000 household income) is required to apply.

Best RBC no-fee travel rewards credit card

At a glance: The RBC ION Visa is a no-annual-fee rewards credit card that gives you 1.5 Avion points per $1 spent on groceries, rides, gas (and EV charging), streaming, subscriptions and digital gaming. Get 1 point per $1 spent on all other purchases.

RBC ION Visa

- Annual fee: $0

- Earn rate: 1.5 Avion points per $1 spent on groceries, rideshares, daily transit, gas, EV charging, streaming, digital gaming and subscriptions; and 1 point per $1 on all other purchases

- Welcome bonus: You can earn 3,500 Avion points upon approval

- Annual income requirement: None

- Some redemption flexibility. You can redeem your points for travel, statement credits, merchandise, gift cards and more.

- Enjoy fuel savings at Petro-Canada, a three-month free DashPass subscription, and Be Well points with purchases at Rexall pharmacies.

- Good for gamers: The RBC ION Visa is one of the only cards in Canada that lets you earn rewards on gaming subscriptions, digital downloads and in-game purchases.

- The card features purchase security and extended warranty insurance.

- The RBC Avion rewards program includes three different membership tiers: Avion Select, Avion Premium and Avion Elite. The RBC ION Visa is part of the Avion Premium tier, meaning you can’t redeem your points through RBC’s Air Travel Redemption Schedule—which offers the highest value for your points. That feature is part of Avion Elite, which requires having an RBC Avion card.

- The card has limited insurance coverage.

Best RBC cash back credit card

At a glance: With the RBC Cash Back Preferred World Elite Mastercard, you’ll earn cash back on all your purchases. You’ll get 1.5% on the first $25,000 charged to the card annually and 1% thereafter. Enjoy additional benefits like instant fuel savings at Petro-Canada, Be Well points at Rexall and $0 delivery fees for 12 months from DoorDash.

RBC Cash Back Preferred World Elite Mastercard

- Annual fee: $99

- Earn rate: 1.5% back on all your purchases

- Welcome bonus: You can earn unlimited cash back, no limit to what you can get back

- Annual income requirement: Personal income of $80,000 or household income of $150,000

- Recommended credit score for approval: None specified

- The annual fee of $99 is lower than many other premium cards.

- If you link your RBC card to your Petro-Points account, you’ll save $0.03 cents per litre on gas at Petro-Canada and also get a 20% bonus of Petro-Points.

- You can earn 50 points per $1 spent at Rexall when you link your RBC card and your Rexall Be Well card.

- Card comes with a 12-month free DashPass subscription.

- Weak insurance offering compared to other premium cards. It only includes rental theft and car damage, purchase protection and extended warranty.

- The boosted rate of 1.5% is capped at your first $25,000 spent annually.

Best RBC no-fee cash back credit card

At a glance: Like some of the best cash back credit cards in Canada , the RBC Cash Back Mastercard offers cash back with no annual fee. Earn up to 2% on groceries and up to 1% on all other purchases. Benefit from instant fuel savings at Petro-Canada, enhanced Be Well points at Rexall and $0 delivery fees for three months from DoorDash.

RBC Cash Back Mastercard

- Earn rate: 2% cash back on groceries and 1% back on all other purchases

- Welcome bonus: You can

- The card comes with purchase security and extended warranty protection.

- Save $0.03 per litre on fuel at participating Petro-Canada stations and earn 20% more Petro-Points.

- Get 50 Be Well points per $1 spent at Rexall.

- Enjoy a complimentary DashPass subscription for the first three months.

- The unusual rewards structure requires cardholders to read the fine print carefully to understand the spending limits at which their rewards will increase or decrease. You’ll get 2% cash back on groceries for the first $6,000 spent, which then drops to 1% per additional dollar spent in the category. For all other purchases, you’ll get 0.5% cash back on the first $6,000 spent—and 1% thereafter.

- Very limited insurance offering, with only purchase security and extended warranty.

Best RBC low-interest credit card

At a glance: For individuals trying to tackle credit card debt, the RBC Visa Classic Low Rate Option is a valuable card. It offers a consistent 12.99% interest rate for purchases and cash advances—that can’t be said of all low-interest credit cards in Canada . While it may lack extensive perks, it does provide advantages like discounts at Petro-Canada and complimentary delivery services through DoorDash.

RBC Visa Classic Low Rate Option

- Annual fee: $20

- Welcome offer: None

- Annual income requirement: None

- Interest rates: 12.99% on purchases, 12.99% on cash advances, 12.99% on balance transfers

- With its affordable $20 annual fee and no minimum income requirement, this card is within reach for the majority of Canadians.

- Additional cards are available at no cost.

- Enjoy RBC Offers, which gives cardholders access to deals and savings.

- Earn more Petro-Points and get a discount on fuel at Petro-Canada.

- The card comes with a three-month complimentary subscription to DashPass.

- This card doesn’t come with any travel insurance.

- While the low interest rate is a boon to those with credit card debt, it doesn’t feature a balance transfer promotion, so you can’t move debt from a higher-interest card.

More of Canada’s best credit cards :

- Best credit cards in Canada

- Best travel credit cards

- Best travel insurance credit cards

- Best Air Miles credit cards

- Best no foreign transaction fee credit cards

Advertisement

Table of contents

- Top RBC credit cards at a glance

- Best RBC cards by category

About Sandra MacGregor

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.