- Credit Cards

- TD First Class Travel Visa Infinite Card Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel® Visa Infinite* Card Review 2024

Updated: Apr 25, 2024, 4:56pm

Fact Checked

Frequent travellers will find plenty of value in this card. Considering that it earns a minimum of 2 TD Rewards points on every dollar, it has flexible redemption options, plenty of insurance coverage, a travel credit of $100 when you book travel through Expedia ® for TD and a birthday bonus of up to 10,000 points, it easily earns its spot in your wallet.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

Table of Contents

Introduction, quick facts, td first class travel visa infinite card rewards, td first class travel visa infinite card benefits, how the td first class travel visa infinite card stacks up, methodology, is the td first class travel visa infinite card right for you, advertising disclosure.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Get an annual TD Travel Credit† of $100 when you book at Expedia® For TD.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

The TD First Class Travel Visa Infinite Card is considered to be one of Canada’s higher end travel credit cards, even though its annual fee makes it quite affordable. With easy earning potential, a flexible rewards program, and a generous insurance package, it’s definitely worth considering if you are a frequent traveller.

The travel perks and benefits aren’t quite as inclusive as other high-end credit cards. The absence of lounge access is a big one to note. Another downside is that the points cannot be converted into other rewards programs. That being said, for its price point, it’s quite competitive and still gives good value.

- Get an Annual Fee Rebate for the first year†. To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Cardholders will earn points for every dollar spent with accelerated rates on groceries, restaurants, recurring bill payments and travel booked through Expedia® For TD.

- Cardholders will benefit from an annual $100 travel credit when they book travel through Expedia® For TD as well as an annual birthday bonus of up to 10,000 TD Rewards Points.

- Cardholders can redeem points for a range of options at any time as long as they have at least 200 TD points available.

- No travel blackouts, no seat restrictions and no expiry for your TD Rewards Points as long as your account is open and in good standing.

Earning Rewards

Earning rewards with the TD First Class Travel Visa Infinite card is easy as you can earn on every purchase you make.

- Earn 8 TD Rewards Points for every $1 you spend when you book travel through Expedia For TD

- Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants

- Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments

- Earn 2 TD Rewards Points for every $1 you spend on other purchase

- Earn an annual Birthday Bonus of up to 10,000 TD Rewards Points, or 10% of the total number of TD Reward Points earned in the previous 12 months

There is an annual spend cap of $25,000 for each of the accelerated categories. Once you exceed that maximum, you’ll earn 2 TD Rewards Points for every dollar spent.

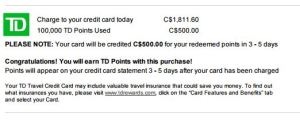

Here’s an example of how many TD Rewards Points you could get in the first year, including 100,000 TD Rewards Points (20,000 welcome bonus plus 80,000 points when you spend $5,000 within 180 days of account opening):

Redeeming Rewards

Rewards can be redeemed at any point, in increments of 200 points. You can redeem them for options such as travel (you’ll get the best rewards value if you book through Expedia For TD), Amazon purchases, gift cards, cash credits, and education credits. Redeeming points is easy and the multiple rewards options are attractive. However, some other top-tier credit cards allow you to convert points to other programs like airline or hotel partners for more flexibility, which this card is lacking.

Credit card reward perks include:

- Redeem your TD Rewards Points for your next trip at ExpediaForTD.com and get access to exclusive deals

- Link your eligible card to earn 50% more TD Rewards Points and Starbucks Stars

- Redeem your TD Rewards Points towards purchases at Amazon.ca with Amazon Shop with Points.

Rewards Potential

Cardholders will get the best value for their points by booking travel through Expedia For TD. However, if you like to book directly with hotels or airlines to get status points then it’s not the best rewards potential out there, since booking outside of Expedia For TD lowers the value of your points. With Expedia for TD, 200 points are equal to $1 off travel purchases. For travel booked outside of Expedia For TD, you need 250 points for that same dollar value.

That said, based on average Canadian spending, Forbes Advisor estimates this card could earn $127.34 in rewards value per year with Expedia and $111.67 with other travel partners (both calculations factor in the cost of the annual fee).

- Comprehensive travel insurance coverage.

- Discounts on car rentals with Avis and Budget Rent-A-Car.

- Link your card to Starbucks Rewards to earn 50% more TD points and Starbucks Rewards on Starbucks purchases.

More Card Benefits and Features

TD Rewards Program Benefits:

- Go places on points and redeem through Expedia for TD (where your points are worth more) or book through any other travel agency or website and use your points within 90 days of purchase.

- Shop online for merchandise and gift cards through TDRewards.com

- Pay with rewards and pay down your credit card balance with points.

Travel Benefits:

- Annual $100 TD Travel Credit on your first eligible travel credit purchase of $500 or more made with Expedia for TD

- Travel medical insurance, up to $2 million of coverage for the first 21 days (or the first four days if you or your spouse is aged 65 or older)

- Flight/trip delay insurance, up to $500 in coverage if your flight is delayed for over four hours

- Trip cancellation, up to $1,500 per person with a maximum of $5,000 for all insured persons

- Trip interruption, up to $5,000 per person, with a maximum of $25,000 for all insured persons

- Common carrier travel accident insurance, up to $500,000

- Emergency travel assistance services

- Delayed and lost baggage insurance, up to $1,000 per person if your baggage is delayed more than six hours or lost

- Auto rental collision/loss damage insurance, up to 48 consecutive days

- TD’s Credit Card Travel Insurance Verification Tool lets you check your insurance benefits

- Hotel/motel burglary insurance, up to $2,500 of coverage

Additional Benefits and Features:

- TD Payment Plans let you turn purchases of $100 or more into manageable six, 12 or 18 month payment plans

- Save a minimum of 10% off the lowest available base rate with Avis Rent A Car and Budget Rent A Car in Canada and the U.S. and 5% internationally

- Use Apple Pay, Google Pay or Samsung Pay where contactless payments are accepted

Visa Infinite Benefits:

- Complimentary Visa Infinite Concierge 24/7

- Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 hotels

- Visa Infinite Dining Series gives you access to exclusive gourmet events

- Visa Infinite Wine Country Program gives exclusive benefits at over 95 participating wineries in B.C., Ontario and Sonoma Valley, including discounts on wine purchases, complimentary tastings, private vineyard tours and more

- Visa Infinite Entertainment Access provides exclusive access to tickets to curated events

- Visa Infinite Troon Golf provides elevated Troon Rewards Silver Status at over 95 courses and 10% off green fees, merchandise and lessons

- Mobile device insurance, up to $1,000 of coverage in the event of loss, theft, accidental damage or mechanical breakdown

- Chip and PIN technology provides an added level of security

- Purchase security and extended warranty protection within 90 days or purchase, or double the warranty period (up to 12 months) if the item comes with a manufacturer’s warranty

- Visa Secure provides you with increased security and convenience when you shop online

- Instant TD Fraud Alerts whenever there is any suspected suspicious activity

- Set transaction limits, block international purchases or lock your credit card in the TD app

- Pay online with Click to Pay

Optional Benefits:

- Optional TD Credit Card Payment Protection Plan helps you with your payment obligations in the event of a covered job loss, total disability or loss of life

- Optional TD Auto Club Membership that provides 24/7 emergency roadside assistance

Interest Rates

- Regular APR: 20.99%

- Cash Advance APR: 22.99%

- Foreign Transaction Fee: 2.50%

- Annual Fee: $139 (Get an annual fee rebate in the first year; account must be approved by June 3, 2024)

- Any other fees: Additional cardholder $50.00 (To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024)

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Infinite* Privilege

While both travel cards, the TD Aeroplan Visa Infinite is a luxury travel card. The annual fee is a hefty $599, but it comes with considerably more perks and benefits. including lounge access and NEXUS card rebates. It also uses Aeroplan rewards rather than TD rewards. The TD Aeroplan Visa Infinite is a strong card, but it’s best for those who travel frequently and can offset the cost of the card with the included benefits.

TD First Class Travel ® Visa Infinite* Card vs. Scotiabank Scene+ Visa Card for Students

Students studying away from home may consider a travel card like the TD First Class Travel Visa Infinite Card to help offset the cost of flights home. However, with the annual fee and rewards earning potential, you might be better off sticking to a $0 annual fee card geared towards student spending. The Scotiabank Scene+ Visa card for students allows you to earn points that can be used for day-to-day expenses like dining out, entertainment and even banking.

TD First Class Travel ® Visa Infinite* Card vs. TD ® Aeroplan ® Visa Platinum* Card

With an annual fee of $89, the TD Aeroplan Visa Platinum is a bit more affordable. The earn rates aren’t as high, but it’s also a different rewards program. While TD Rewards points are best with Expedia, Aeroplan points are best with Air Canada. So your choice between these two cards should depend on who you are most likely to book travel with to get the best value for your points.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With the TD First Class Travel ® Visa Infinite*, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

The TD First Class Travel ® Visa Infinite* Card is a decent travel card . It’s easy to earn and redeem points and the suite of travel insurance is a huge perk. However, it has the best value for those who like to book their travel via Expedia. If you prefer to book directly with hotels or airlines or via other travel portals, then there are better travel credit cards out there where your rewards will go further.

Related : What is the best Canadian credit card

Frequently Asked Questions (FAQs)

Does the td first class travel visa infinite card have airline lounge access.

No, this card does not include airport lounge access .

Does the TD First Class Travel Visa Infinite Card have foreign exchange fees?

Yes, this credit card charges foreign exchange fees (or FX fees) at a rate of 2.5%. If you’re looking for a credit card without without foreign exchange fees , there are plenty available.

How many TD points do you need for a flight?

You need a minimum of 200 TD points to redeem them for rewards. If you book your flight through Expedia ® For TD the points value is 200 TD points per dollar.

Why should you get a travel rewards credit card?

A travel rewards card helps you earn points on everyday purchases (like groceries) that can be redeemed for travel-related expenses, like flights and hotels. You even earn points on travel-related bookings, earning 8 TD Rewards Points for every $1 you spend when you book travel through Expedia for TD.

How do you earn TD Rewards Points?

You earn points with travel bookings, shopping at a grocery store or eating at a restaurant, on recurring bill payments and everyday purchases.

How do you redeem TD Rewards Points?

You can redeem your TD Rewards Points when you book travel online through Expedia for TD, or any other travel provider. You can redeem your points on Amazon.ca with Amazon Shop with Points or shop for merchandise on TDRewards.com. Finally, you can also redeem TD Rewards Points to pay your credit card account balance on the TD app or EasyWeb.

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Hannah Logan is a Canadian freelancer writer and blogger who specializes in personal finance and travel. You can follow her adventures on her travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- TD Platinum Travel Visa Card Review

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Tim hortons credit card (tims card) review 2024, cibc costco mastercard review 2024: avid costco shoppers should not leave home without it, pc world elite mastercard review 2024, pc insiders world elite mastercard review 2024: earn the most pc optimum points in canada, cathay world elite mastercard review 2024: the only credit card in canada that earns asia miles, ja money card review 2024: earn cash back while learning about money management.

This browser is not supported. Please use another browser to view this site.

- Credit cards

- Newcomers to Canada

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage payment calculator

- Income property

- Renovations + maintenance

- Compound interest calculator

- Household finances

- Find a Qualified Advisor Tool

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- A Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Travel Visa Infinite Card

- Annual fee: $139 (annual fee rebate—conditions apply to qualify)

- Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries and restaurants; 4 points per $1 on recurring bills; and 2 points per $1 on all other purchases

- Welcome offer: You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024. Plus, you get an annual birthday bonus of 10% of your previous year’s points (up to 10,000 points).

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 TD Rewards point = $0.005 when redeemed for travel via Expedia For TD or $0.004 when redeemed through other providers and websites

- Recommended credit score for approval: 725 or higher

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $800 in value, including up to 100,000 TD Rewards Points and no Annual Fee for the first year. Conditions apply. Account must be approved by June 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

Mazda MX-5 review: The best used sports car

Mazda’s beloved two-seater convertible is fast, fun and fabulous to drive. Here’s how to find a good used one.

GMC Yukon review: The best used large SUV

The hardworking GMC Yukon offers the best value among used SUVs in Canada—especially if it has a Duramax diesel...

Kia Soul review: The best used small SUV

I peer deep into the Kia Soul for this review—and I like what I see. Find out why this...

Dodge Grand Caravan review: The best used minivan for most families

Canadian families adore the Dodge Grand Caravan. Here’s why it offers great value as a second-hand minivan—and what to...

Ford Escape review: The best used hybrid car

The Ford Escape entered its fourth and current generation in 2020—alongside a compelling hybrid-powered variant. Our review outlines its...

Ford F-150 review: The best used pickup truck

This hardworking pickup is still the bestselling vehicle in North America. Here’s how to choose a great pre-owned F-150...

Toyota Corolla review: The best used small sedan

The Corolla is Toyota’s bestselling vehicle, as it’s easy to see why. Here’s what we love about it, inside...

Lexus ES review: The best used small luxury car

If you want luxury without a sky-high price tag, consider Lexus’ entry-level sedan. Here’s what to look for when...

Genesis G90 review: The best used large luxury car

Looking for a used large luxury car? Consider a Genesis G90. Here’s why it’s one of Canada’s best pre-owned...

Honda Accord review: The best used car for families

This fun-to-drive, reliable and roomy ride is our pick for the best used family sedan in Canada—find out why.

TD First Class Travel® Visa Infinite* Card review

Welcome Offer Ends Jun 3, 2024

Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Rates & Fees

8 Points Earn 8 TD Rewards Points for every $1 you spend through ExpediaForTD†

6 Points Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants.†

4 Points Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments.†

2 Points Earn 2 TD Rewards points for every $1 you spend using your card.†

10% Bonus Points Each year, received a birthday bonus equal to 10% of the total number of points earned over the 12 preceding months.†

$100 Get an annual TD Travel Credit when you book at Expedia For TD†

USD The annual fee is in USD

$139 Annual Fee Annual fee is in USD. First additional cardholder is $50, subsequent cardholders are $0.

20.99% Purchase APR APR for purchases 20.99%†

22.99% Cash Advance APR APR for cash advances 22.99%†

22.99% Balance Transfer Rate APR for balance transfers 22.99%†

Good Recommended Credit Score

$60,000 Required Annual Personal Income

$100,000 Required Annual Household Income

By Tyler Wade & Scott Birke

Updated: April 23, 2024

More great credit card content

- Compare credit cards in Canada

- Best Canadian credit cards

- Best cash back credit cards

- Best travel credit cards

- Best rewards credit cards

- Best no annual fee credit cards

- Best credit card offers

- Best credit cards for rental car insurance

- Best student credit cards

This offer is not available for residents of Quebec.

The TD First Class Travel® Visa Infinite* Card stands out among travel credit cards for its nice welcome bonus, strong rewards rate on all purchases, and particularly massive earn rate for purchases via through Expedia® For TD†. It also offers substantial long-term value for those who have a TD All-Inclusive Banking Plan, as that membership rebates the card’s annual fees for the primary cardholder and an Authorized User.

This could underwhelm some travelers but may be forgivable for those who are just focused on getting as many free flights and hotel nights as possible.

Who's the TD First Class Travel® Visa Infinite* Card for?

A travel lover who wants to accumulate points fast on everyday spending without any loyalty to a particular brand of store, but ideally can be loyal to TD Bank and their booking portal Expedia For TD to find the best travels deals.

TD First Class Travel® Visa Infinite* Card Welcome bonus

Earn up to $800 in value † , including up to 100,000 TD Rewards Points, no Annual Fee for the first year † and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card † .

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points † .

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

Pros and Cons of the TD First Class Travel® Visa Infinite*

Major combined value for the welcome bonus (up to $800†)

Good base earn rate on all purchases

Huge earn rate when you book travel through Expedia® For TD†

Very flexible redemption options

$100 TD Travel Credit†

Visa Infinite Benefits

Great savings on annual fees for accountholders of TD’s All-Inclusive Banking Plan

Does not provide free lounge access

Charges foreign transaction fees

How to earn TD Points with the TD First Class Travel Visa Infinite

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other purchases made using your card†

Points don’t expire as long as your account is active, and the card has no caps on the total amount of TD Points that can be earned.

How to redeem your TD Points

Though there are a number of redemption options with TD Points, you get the best value when redeeming for travel via one of two methods:

1. Book Any Way†

The Book Any Way† redemption path allows you to charge eligible travel expenses to your credit card and then retroactively redeem your points for those expenses within 90 days of the expense date. Travel expenses may include but are not limited to:

- Air travel taxes

- Baggage fees

- Airport parking and shuttles

- Car rentals

- Local commuter transport, like trains, buses or subways

- Travel attractions and entertainment

Each point redeemed via Book Any Way† is worth $0.004 for the first $1,200 of any redemption and $0.005 for the remainder of any redemption above $1,200.

Expedia® For TD

Points can alternatively be redeemed for flights, hotels, vacation packages and rental cars via ExpediaForTD.com. Redeeming with this method yields a flat value of $0.005 per point. The site will indicate the dollar value of the TD points you have on hand, and then you apply those points to your travel purchase when checking out.

Aside from the high value in earning and redeeming rewards via ExpediaForTD.com, the platform also provides a nice price guarantee feature: If you find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in, Expedia will refund the difference between what you paid and the lower rate you found.

2. Other redemption paths

TD Points can also be redeemed for the following, though the value you get per point tends to be lower than what you get for the above two travel redemption methods.

- Amazon’s Shop with Points † : Select your TD card as your method of payment at Amazon.ca checkout , then automatically apply points toward your purchase. 10K TD Points can be redeemed for $33 (value of $0.0033 per point) and can be redeemed for Amazon.ca purchases either in part or in full.

- TD’s Shop the Mall † : Redeem points for clothing, electronics and computers from retailers like Roots, Zara, and the Body Shop.

- TD’s Shop the Catalogue † : Redeem points for merchandise including clothing, games, furniture, and appliances.

- Gift cards † at retailers like Bed Bath & Beyond, Best Buy, Canadian Tire, and more.

- Cash statement credit † for your TD card account. This requires a minimum 10K points to redeem. The first 10,000-point minimum is worth $0.005 per point and then each additional 400 points is worth $1 (0.0025 per point).

- Education credit † via HigherEdPoints.com . Credits must be purchased in minimum 62,500 points/$250 credit increments, for a redemption value of $0.004 per point.

TD First Class Travel Visa Infinite key benefits

- Excellent welcome bonus of up to $800 in value, including up to 100,000 TD Rewards Points and no annual fee for the first year.

- High earn rate on travel, groceries and restaurants, and recurring bills without loyalty to a particular store

- Comprehensive travel insurance

TD First Class Travel Visa Infinite travel insurance and other protections

You can check out our guide to credit card travel insurance to learn more about the different types of coverage listed above, and to review other Canadian travel credit cards that might have stronger travel insurance benefits.

TD First Class Travel Visa Infinite extra benefits

- $100 annual travel bonus

- Mobile device insurance

- Earn more at Starbucks when you link your card

- Save a minimum of 10% with Avis and Budget in Canada and the U.S. (5% savings elsewhere)

- Apple pay, Google Pay, or Samsung Pay to instantly use your credit card.

- Complimentary Visa Infinite Concierge 24/7 for any cardholder request

- Visa Infinite Luxury hotel collection, dining series, wine country, and entertainment access.

What people have to say about the TD First Class Visa Infinite

Redditor, alwaysdetermined points out that yes, the annual fee can be waived with TD's All Inclusive but notes "the All-Inclusive costs $29.95, but that account fee can be waived if you keep $5,000 in the account at all times."

Reddit user, SensitiveAward , has the card, says they travel multiple times a year and is please with the insurance coverage saying "TD [credit card] comes out cheaper" when comparing it to third-party travel insurance products.

However, some users say the Expedia For TD prices are higher than regular Expedia rates, so be sure to cross reference the two portals before booking (and clear your internet cache or browse in incognito to prevent tracking)

TD First Class Visa Infinite eligibility requirements, fees, and rates

- Minimum income: $60,000 individual and $100,000 household annual income

- Foreign transaction fee: 2.5%

- Annual fee: $139, $50 for each additional cardholder (fees can be waived with TD's All inclusive banking plan)

How does TD First Class Visa Infinite compare?

When comparing travel credit cards with similar annual fees, the TD First Class Travel® Visa Infinite* Card strengths and weaknesses are clear:

Its sign-up bonus eclipses the competition, which gives it an immediate punch of value. It’s also something of a no-brainer card for those who have TD’s All-Inclusive Banking Plan, as the annual fee rebate† effectively makes the card free to use year after year.

It’s less ideal for those who are unlikely to spend a significant amount at through Expedia® For TD, want to avoid the foreign transaction fees and want free airport lounge access.

TD First Class Travel Visa Infinite vs. Scotiabank Gold American Express® card

No foreign transaction fees, earns 6X Scene points for each $1 CAD on all eligible purchases at Sobeys and eligible grocers¹, 5X Scene+ points for every $1 CAD spent on other eligible groceries and 3X Scene+ points for every $1 CAD spent on gas, and has an all-encompassing travel insurance package.

TD First Class Travel Visa Infinite vs. BMO Ascend™ World Elite®* Mastercard®*

Includes complimentary membership in Mastercard Travel Pass provided by DragonPass,* with four annual complimentary passes. That’s a ~$128 USD value that renews every year*. Plus the up to 60,000-point sign-up bonus* and first year annual fee waiver* is still competitive with the TD card’s sign-up bonus.

*Terms and conditions apply

Drawback: There are increased earn rates but you earn only 1 point for every $1 spent everywhere else where they do not apply.*

Is the TD First Class Travel Visa Infinite worth it?

Yes, for its welcome bonus alone it's a great card. You'll also get a first year annual fee rebate, high earn rate in everyday spending, 10% annual birthday bonus, a $100 annual travel credit, and comprehensive travel coverage.

Is TD First Class Travel good?

Yes, especially if you're a TD client. You can't lose with its awesome welcome bonus, high earn rate in everyday spending, special perks like its birthday bonus and $100 annual travel credit (nearly negating its annual fee), and full suite of insurance coverage.

Does TD First Class Travel have lounge access?

No, there is no airport lounge access with the TD FIrst Class Travel Visa Infinite. Check out the BMO Ascend or Scotiabank passport for cards with similar annual fees that include airport lounge access .

What does TD First Class Travel Cover?

It's the full suite of travel insurance as well as purchase protection and rental car. Check out all the details in the TD First Class Travel review insurance section.

About our authors: faces of finance

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca. He was the host and producer of the Real Money Talk podcast. He's the father of two, husband to one, and loves all things tiny.

Scott Birke is a finance editor and writer with an interest in credit cards, investing, saving money and personal finance. Scott joined Wise Publishing from Finder, and his byline has appeared in the National Post, Mountain Life and Rock and Ice. When he's not trying to help Money.ca readers save money by comparing better financial products, he can be found riding his snowboard or mountain bike or listening to his small (but growing) vinyl collection.

Latest Articles

Quebec liquor board to cull spirits from shelves as local distillers struggle

Canadian business: 5 things to watch for this week

Fair share: the right office solution can take finding the right partner

Bidders express interest in buying all or part of SaltWire newspaper business

Planning a summer trip to Quebec's Îles-de-la-Madeleine? You'll have to pay up.

Globe wins seven newspaper awards; CP recognized for CSIS investigation

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

- $139 annual fee – First year free

- Earn 20,000 TD Rewards points after your first purchase

- 80,000 additional points when you spend $5,000 in the first 180 days

- Annual $100 travel credit (accommodations & vacation packages)

- Birthday bonus of up to 10,000 points

- Earn 8 points per $1 spent when you book on Expedia for TD

- Earn 6 points per $1 spent on groceries and dining

- Earn 4 points per $1 spent on recurring bills

- Earn 3 per $1 spent on all other purchases

Welcome bonus and earn rate

The TD First Class Visa Infinite Card is one of TD’s most popular cards. The welcome bonus is typically quite generous and hovers between 80,000 – 145,000 TD Rewards points. The welcome bonus is comparable to cards on my list of the best travel credit cards in Canada .

As for the earn rate, you’ll get 8 points per dollar spent on Expedia for TD purchases. 6 points per dollar spent on groceries and dining. 4 points per dollar spend on recurring bills and 3 points on all other purchases.

To give you some perspective, when using TD Rewards points on Expedia for TD purchases, 1 point is worth $0.50. That means the base earn rate gets you 1.5% back in travel rewards, which is quite good.

Although the card has an annual fee of $139, it’s usually waived for the first year. You can also get the annual fee waived every year if you have a TD All-inclusive bank account.

Benefits and perks

If you’re reading my TD First Class Travel Visa Infinite Card review, then you’ll want to know about all the benefits. What’s interesting is that this card recently had an update and now comes with some pretty fun perks.

$100 annual travel credit

When you book accommodations or vacation packages on Expedia for TD worth at least $500, you’ll get a $100 credit back on your credit card. This is a pretty unique benefit that puts money back in your pocket, but it does not apply to all travel categories. In addition, this benefit only applies to individual bookings and is not cumulative.

10% birthday bonus

One unique perk is the birthday bonus worth up to 10,000 TD Rewards points. To earn this bonus, TD will give you 10% of the points you’ve earned in the year leading up to your birthday. Welcome bonuses don’t count. For example, if you earned 93,000 TD Rewards points in the year leading up to your birthday, you’d earn 9,300 extra TD Rewards points on your birthday.

Save on rental cars

Cardholders get at least 10% off the base rate when renting vehicles in Canada and the U.S at Avis or Budget and paying with your TD Aeroplan Visa Infinite Card. If you’re travelling internationally, you’ll save at least 5% at participating locations.

Travel insurance

- Travel medical – $2,000,000 for 21 days / 4 days if you’re 65 or older

- Trip cancellation – up to $1,500 per person / $5,000 total

- Trip interruption – up to $5,000 per person / $25,000 total

- Flight/trip delay insurance – $500 per person – 4 hours

- Delayed and lost baggage – up to $1,000 / 6 hours

- Auto rental collision/loss damage – 48 consecutive days / $65,000

- Hotel/motel burglary insurance – $2,500

- Common carrier travel accident – $500,000

The travel insurance included is competitive and comparable to my list of the best credit cards with travel insurance , but it does lack two major types of travel insurance.

The 21 days of travel medical insurance is pretty good, but like many other credit cards, it only gives 4 days if you’re 65 or older. You’ll obviously need more coverage if you fall into that age range.

Note that was this card, you only need to charge 75% of your trip costs for your flight/trip delay and hotel/motel burglary insurance to apply. However, for trip cancellation and auto rental collision, you need to charge 100% of the cost to your card.

Mobile device insurance

Many people aren’t aware that the TD First Class Travel Visa Infinite Card comes with mobile device insurance. When you charge at least 75% of the total device or monthly plan cost to your card, you’ll be insured for up to $1,000. That said, like other mobile device insurance plans, depreciation applies when making a claim. Both cellular phones and tablets count as mobile devices.

Purchase insurance

- Purchase security – 90 days

- Extended warranty – Up to 1 additional year

The purchase security insurance covers your good from theft, loss, and damage for 90 days. With extended warranty, you your warranty doubled up to one additional year.

Visa Infinite benefits

- Concierge service – The Visa Infinite Concierge is available 24/7 and can help you secure concert tickets, make dinner reservations and more.

- Luxury Hotel Collection – You’ll get exclusive benefits such as resort credits and room upgrades when booking accommodations through the Visa Luxury Hotel Collection.

- Dining Series – Get access to some culinary events, such as celebrity chef meetups and tasting menus.

- Wine Country program – Your Visa Infinite Card gets you discounts and free wine tastings at participating wineries in British Columbia, Ontario and Sonoma Valley.

- Entertainment access – Throughout the year, cardholders get invites and exclusive access to the Toronto International Film Festival.

- Troon Golf – Troon Rewards Silver Status is given to cardholders. With your status, you’ll get 10% off green fees, merchandise and lessons.

How to redeem your points

TD Rewards allows you to book travel in multiple ways, giving you more options. Given the flexibility, many people love TD Rewards. However, your points will have a different value depending on how you redeem them.

Expedia for TD

Expedia for TD is TD’s main travel redemption option. 200 TD Rewards points get you $1 off Expedia for TD travel bookings. This essentially makes one TD Reward point worth .5 cents. Expedia for TD is nearly identical to Expedia.ca. That means you’ll get access to a large inventory of flights, hotels, car rentals, all-inclusive packages and attraction tickets.

To redeem TD Rewards points on Expedia for TD, you have to log in to TD Rewards and click on the Expedia for TD link. When you’re ready to pay, you’ll be given the option to use your TD Rewards points. Generally, Expedia has very competitive prices.

Booking on your own

TD Rewards points can also be used to offset travel expenses you charge directly to your TD First Class Travel Visa. The redemption rate is 250 points = $1 (or a value of .4 cents per point). That means you get 20% less value than using your points on Expedia for TD. That said, when you make a travel purchase on your own that’s more than $1,200 in value, any amount that’s $1,201 or above would have a redemption value of 200 points for $1.

Even though you get less value by booking on your own, there are a few reasons to consider this option. The first reason is that you are not restricted to what is available on Expedia for TD, so you can use points for bookings on Airbnb or booking.com. The second reason why booking on your own travel is handy is that most hotel chains will require that you book directly with them to enable loyalty membership status and perks.

TD First Class Travel Visa Infinite Card eligibility

- You’re a Canadian citizen, or you’re a permanent resident

- You’re at least the age of majority in the province or territory where you reside

- You have a minimum annual personal gross income of $60,000 or a household income of $100,000

As a Visa Infinite card, there are very specific eligibility requirements. Even though there’s no formal credit score requirement listed, you’ll likely need your credit score to be at least 700 to be approved. That’s because a credit score of at least that number would put you in good standing or higher.

How the TD First Class Visa Infinite compares

As a mid-tier travel rewards credit card, the TD First Class Travel Visa Infinite Card has a lot of competition. Not only does it compete with other bank credit cards, but there are also airline credit cards worth looking at too.

TD First Class Visa Infinite Card vs. Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite Card is a very popular travel credit card since it gives you get six free annual airport lounge passes and has no foreign transaction fees. The earning rate of this card is similar to what TD offers. The overall insurance package offered by TD is slightly better.

TD First Class Visa Infinite Card vs. American Express Gold Rewards Card

Another great mid-tier travel card is the American Express Gold Rewards Card . Although the card has an annual fee of $250, you get an annual $100 travel credit and a Priority Pass Membership with four free annual Plaza Premium airport lounge passes. What makes this card stand out is the fact that you earn American Express Membership Rewards points. These points can be transferred to Aeroplan at a 1:1 ratio.

TD First Class Visa Infinite Card vs. TD Aeroplan Visa Infinite Card

If your goal is to travel for less, then the TD Aeroplan Visa Infinite Card should also be considered. With this card, you’ll earn Aeroplan points on all eligible purchases. This is relevant because Aeroplan is Air Canada’s loyalty program and one point can easily be worth between 1.5 – 2 cents each. In addition, by having this card, you get your first checked bag free and preferred pricing on Aeroplan redemptions.

Final thoughts

My TD First Class Travel Visa Infinite Card review is positive. It’s an ideal card for people in the following situations:

- You want to save on travel – TD Rewards points are highly flexible and best used via Expedia for TD.

- You bank with TD – If you have an All-Inclusive Banking Plan, the annual fee is waived for this card.

- You want insurance – The included travel and purchase insurance with this card is excellent.

Although Expedia for TD may not be the best rewards program out there, it’s easy to understand and there are no blackout dates. Plus, the overall insurance package you get with this card is excellent. That said, the earn rate for this card is not as good as other cards out there.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

Hi Barry! Thanks for another great post. I currently use the AMEX cobalt as my everyday card and wanted to get a supplementary card to use when AMEX is not accepted. I currently have an All-Inclusive banking plan with TD, which would waive the annual fee for the TD First Class Travel Visa Infinite Card & the TD Aeroplan Visa Infinite Card. Which one would you recommend between the two?

Hey Sylvia.

It sort of depends on your goals. If you got the TD Aeroplan VI card, you could pool the points with your Cobalt since those points can be converted to Aeroplan. The TDFCTVI is good if need to make non-Aeroplan bookings such as car rentals or hotel bookings.

You state the following: “Note that was this card, you only need to charge 75% of your trip costs for your travel insurance to be valid.” However, my review of the wording indicates that under Trip Cancellation, you must charge the full cost of your trip to the card to get coverage. This is under the definition of Covered Trip.

You’re right. the 75% only applies to hotel/motel burglary and trip delay.

Calculating rewards with the new and improved TD First Class Travel makes it a good competitor to the Aeroplan card. I feel like it’s hard to get a good value with Aeroplan (2 cpp). More than often international travel gives around 1.4 cpp making the First Class card more valuable (if booking something via Expedia to get the $100 credit that is. Am I missing something? Would the Aventura or RBC Avion otherwise be better?

Hey Philippe,

I haven’t had too much trouble finding Aeroplan value between 1.8 – 2 CPP. Then again, I booked most of my travel before there was crazy demand.

Aventura and Avion both have a fixed travel program where you can get a higher CPP, but I personally find Aeroplan to be more valuable. I typically try to collect American Express Membership Rewards points and then transfer them to whatever program gives me good value when I need to make a redemption.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

TD First Class Travel Visa Infinite Card Review

By Stefani Balinsky | Published on 20 Jul 2023

Is it me or is TD throwing benefits at you with this card? The TD First Class Travel ® Visa Infinite * credit card has an aggressive offer of up to 135,000 points and an easy earn rate that includes Starbucks. Yes, I invoked the name of that coffee chain and I meant it. Want to know something else? TD First Class Travel ® Visa Infinite * earns TD points that you can redeem on Amazon.ca. So, is this credit card a hot-cup-of-goodness or just lukewarm at best? Let’s find out.

Welcome Offer

- Up to 135,000 bonus TD Rewards Points

- Annual fee rebated for the first year

The TD First Class Travel ® Visa Infinite * Welcome Offer is really good. You can earn up to $1,100 worth of welcome offers in the first year, including 135,000 bonus points, the annual fee rebated and travel benefits. Here’s how:

TD gives you 20,000 points when you make your first purchase on the card in the first 3 months of opening the account. Next, you can earn another 115,000 points if you spend $5,000 on the card within the first 180 days of opening the account. Then, you could earn a birthday bonus of up to 10,000 TD Rewards Points. You also get an annual TD Travel Credit of $100 when you book at Expedia for TD. Finally, you get a free 12 month† Uber One membership worth $120. As always, terms and conditions apply. To get the annual fee rebated for the first year, you must make a purchase on the card within the first 3 months of opening the account.

The annual fee is usually $139 for the primary cardholder, $50 for the first additional cardholder and $0 for subsequent cardholders. You have to have a minimum personal annual income of $60,000 or an annual household income of at least $100,000 to qualify.

TD First Class Travel ® Visa Infinite * interest rates

Actually, these rates are pretty standard. You need to remember that this is a travel perks card and not a low-interest credit card. Nearly all credit card interest rates are in the 19.99% to 23.99% range. Plus, most cards have different interest rates for cash advances. If you live in Quebec, you may be subject to different rates. Of course, the best choice is to pay off your credit card balance each month and to pay back any cash advance even faster.

The TD First Class Travel ® Visa Infinite* points calculator

Inflation is not your friend, but it can help you make better spending decisions. In that same vein, the TD First Class Travel ® Visa Infinite* has a points calculator to help you decide if your spending and this credit card are good for your situation.

Let’s set the scene. You are an average Canadian family who might spend $14,000 on groceries this year, or $1,166.66 a month. You might also fill up at least one car once a week. According to StatsCan, the Canadian average fuel price for unleaded gas at a self-service station was $1.616 at the beginning of Summer 2023. If you fill up your car once a week, you spend $419.84 a month on gas for a 60 L fuel tank. How many points would you earn with the TD First Class Travel ® Visa Infinite* ?

With the average spending on gas and groceries alone, you could earn 194,245 points in the first year including the welcome offer. That is $971 in travel dollars. Plus, you only ate and gassed up the car. If you have other expenses on the card, your first-year points total can be higher.

Remember, the spending amounts and points earned are for demonstration purposes only. Actual points accrual depends on your individual shopping habits. Use the TD points calculator to estimate how many points you could earn in the first year.

Earn points on the little things

- 8 TD points/$1 Expedia for TD bookings

- 6 TD points/$1 on groceries & restaurants

- 4 TD ponts/$1 on recurring bill payments

- 2 TD points/$1 on all other card purchases

The TD First Class Travel Visa Infinite * lets you earn 2 TD points for every $1 spent. It’s a nice ratio. If you book travel with your card through Expedia for TD , you earn 8 TD points for every dollar spent. Then, you earn 6 TD points per $1 spent on groceries and restaurants and 4 TD points on recurring bill payments on your account.

If you use your card at Starbucks, you earn 50% more TD points and 50% more Stars at Starbucks. This feature is about lifestyle. Even if you don’t want to travel yet and don’t always get Starbucks, the card lives up to its slogan of ‘Earn points on the little things.’ Plus, your points do not expire so you can save them for all things big and small.

Redeeming your TD points

Thankfully, your TD points are redeemable in really extensive ways. You can use the points to buy gift cards or merchandise off of TD Rewards. They have weekly deals where you can get merchandise for less points. If you want a financial reward, you can use your points to pay off some or all of your TD credit credit card balance. Also, you can use your points to book travel with Expedia for TD.

TD First Class Travel ® Visa Infinite* is your Canadian Amazon credit card

- Redeem TD Points on Amazon.ca with Amazon Shop with Points

You don’t need to get the Amazon credit card, because you can use your TD First Class Travel Visa Infinite* card on Amazon and redeem your TD points for merchandise. That is right, the Amazon points you’ve always wanted are TD points. Of course, there are more details, but you can exchange your points on Amazon for free stuff.

What is Expedia for TD?

- Earn & redeem TD Points on Expedia for TD

- No blackout dates

Finally! Expedia for TD is a travel booking site that allows travellers to use their TD Rewards points with an Expedia-like experience. It is exclusive to TD credit card holders and the site often has exclusive deals. Plus, it is a great way to spend and earn TD points simultaneously. You earn 8 TD Points/$1 when you book travel through Expedia for TD. There are no blackout dates and you can modify your plans easily.

TD First Class Travel ® Visa Infinite* insurances

If you read Hardbacon credit card reviews, you know that we take a deep look at the insurances you get with your card. The TD First Class Travel ® Visa Infinite * is a travel affinity card, so it should stand out for all-things travel-related. In terms of insurance, it has the requisite ones. Let’s take a look:

- Travel medical insurance

- Trip cancellation/interruption

- Flight/trip delay

- Delayed or lost baggage

- Common carrier accident

- Auto Rental Collision/Loss Damage Insurance

And that is on top of their Emergency Travel Assistance Services and a $100 Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

First, a word about TD’s online travel insurance tool

TD and its online tools are outmaneuvering the competition. This is the first time I’ve found an online tool that shows me my credit card insurance coverage based on the card I use, the number of people I am travelling with, and the duration of the trip. It makes it easier for me to decide if I need extra travel insurance or if I should split my trip costs over different TD credit cards.

Travel emergency medical insurance

TD offers a solid but average emergency medical insurance policy. If I travel with my spouse or dependents, each one of us is eligible for $2,000,000 per trip. Of course, not every procedure is guaranteed a payout. As with every medical insurance plan, it covers eligible procedures and services. You have to check what is accepted before agreeing to the treatment. Your coverage is good for 21 days as long as you or any of the other travellers is under age 65. If you travel with someone over age 65 and they are a spouse, child, or the primary cardholder, they are only covered with TD’s emergency medical insurance for only the first 4 days.

Trip cancellation/interruption insurance and flight/trip delay

That handy online tool shows that you can have up to 5 travellers in your party and that your trip cancellation insurance is a maximum of $5,000. Per person, there is a $1,500 coverage. However, your maximum trip coverage is $5,000. If you are more than 5 people travelling and you are paying with one card, you might want to buy extra cancellation insurance.

Trip interruption insurance is slightly more generous. Each person has a $5,000 interruption policy. Again, the maximum for the trip for all persons combined is $25,000. Yet another instance of checking what is best for you and maybe buying extra travel interruption coverage.

Your flight/trip delay insurance covers up to $500 per insured person if your flight/trip is delayed for over 4 hours.

Delayed or lost baggage insurance

It’s true that not every credit card offers this type of coverage. TD First Class Travel ® Visa Infinite* cardholders have $1,000 in insurance coverage per person if their baggage is delayed more than 6 hours or if it is lost. Again, this is OK coverage.

Common carrier accident insurance

This is a terrible what-if scenario. If you are or one of your dependents is on a common carrier like a bus, train, ferry, rented car, cruise ship, limousine, or plane and it is involved in an accident, you are covered. You are eligible for up to $500,000 of coverage for covered losses. The amount depends on your injuries.

TD First Class Travel ® Visa Infinite* and auto rentals

If you book your auto rental with your TD First Class Travel ® Visa Infinite* credit card, you are covered for 48 consecutive days. If you are in an accident, the driver must not be legally intoxicated and there must have been no violation of the rental agreement by the primary cardholder.

You also benefit from a great rate through Avis auto rentals. When you use your TD First Class Travel ® Visa Infinite* credit card, you save a minimum of 10% off the lowest available base rates in Canada and the U.S. If you rent a car outside of Canada and the US, the minimum is 5% off the lowest base rate available at participating Avis or Budget locations.

TD First Class Travel ® Visa Infinite* ’s other benefits

Other than everything listed already, having a TD First Class Travel Visa Infinite* credit card means that you can do the following as well:

- Sign up for TD Auto Club membership, where you get 24-hour road assistance

- Purchase security and extended warranty protections

- Instant fraud alerts

- Mobile device insurance up to $1,000

- Hotel/Motel Burglary Insurance up to $2,500

- Access to the TD app

- Click to pay

- Optional balance protection insurance

- The choice to set up structured payment plans

The most interesting thing to me is the click-to-pay feature and instant fraud alerts. It keeps pace with how customers expect banks to use technology to enable easy transactions but also immediate contact if fraud is suspected. Basically, it is a sign of good service.

Who is the TD First Class Travel ® Visa Infinite* credit card good for?

The base earn rate of the TD First Class Travel Visa Infinite is a decent 2 points per $1 spent, with more aggressive points for grocers, restaurants, travel and recurring bills. The insurance is decent, too.

OK, but the real advantages kick in if you use the card to book travel. You redeem fewer points for travel if you do it through Expedia for TD, a site exclusive to TD credit card customers. Plus, if you book travel with your TD card, you have access to excellent online tools to calculate how much insurance you have from your card.

Furthermore, using your card for everyday purchases stretches your dollar on two key sites: Amazon.ca and Starbucks. Hear me out: Amazon is a retail behemoth in Canada, and Starbucks is also a near-daily retail destination.

Amazon lets you use TD points for Amazon purchases. The same goes for Starbucks, but in reverse. You earn 50% more points when you buy Starbucks with your credit card.

This card makes good in its promise to earn points on the little things. If you want to travel and don’t want to use Aeroplan, this travel card is a good choice. If you are interested in Amazon purchases and love your Starbucks, this is the only card for you.

TD First Class Travel ® Visa Infinite* Rating

Benefits and perks of the td first class travel ® visa infinite*.

- Redeem TD points on Amazon.ca

- Earn 50% more TD points when you use your card at Starbucks

- Accelerate points earning for travel with Expedia for TD, food, and recurring bills

- 2 points for every $1 spent on everyday purchases

- Points never expire

- No travel blackout dates

- Welcome Offer up to 135,000 TD Rewards points

- Annual fee for the primary card rebated for the first year

- Decent purchase interest rate and cash advance interest rates

- Comprehensive travel insurances including emergency medical, trip interruption, and trip cancellation

- Fantastic online tools to estimate points calculation as well as travel insurance coverage

For complete and current information about any product, please visit the provider’s website. Terms and conditions apply.

Stefani Balinsky

When you use our links to explore products, we may earn a fee but that in no way affects our editorial independence. Some of these links are from our partners and terms apply.

Advertiser Disclosure

Terms Apply

The information for the TD First Class℠ Visa Signature® Credit Card has been collected independently by U.S. News and the card is not currently available on the site. The information has not been reviewed or provided by the card issuer and it is accurate as of the date posted.

TD First Class℠ Visa Signature® Credit Card

Credit Needed

Good/Excellent

$89 (waived the first year)

Rewards Rate

3X Miles on travel and dining purchases

Why Trust U.S. News

Your trust is important to us. To earn it, we conduct a rigorous, unbiased analysis with a transparent methodology, and maintain strict editorial standards and independence.

The TD First Class℠ Visa Signature® Credit Card is a travel rewards card. The rewards program offers 3 miles for every dollar in dining and travel purchases, and 1 mile per dollar on all other purchases. The TD First Class℠ Visa Signature® Credit Card charges an annual fee of $89 (waived the first year) . The card offers a 0% introductory APR on balance transfers for the first 12 months after opening an account. After that, the APR for purchases and balance transfers is 17.74% variable.

Best Features

Sign-up bonus: New cardholders receive a 25,000 -mile sign-up bonus when you make $3,000 in purchases within the first six billing cycles after opening an account .

12-month 0% APR introductory period on balance transfers: The TD First Class℠ Visa Signature® Credit Card offers a 12-month 0% APR introductory period on balance transfers (3% balance transfer fee, $5 min). After that, the APR is 17.74% variable.

No foreign transaction fee: The 3% foreign transaction fee that many credit cards charge is waived by the TD First Class℠ Visa Signature® Credit Card.

Annual fee: The TD First Class℠ Visa Signature® Credit Card requires an $89 (waived the first year) annual fee.

Introductory APR period only for balance transfers: The 12-month 0% APR introductory period offered by the TD First Class℠ Visa Signature® Credit Card only applies to balance transfers, not purchases.

- Rates and Fees

- Highlights from Issuer

- Issuer Name TD Bank

- Credit Needed Good/Excellent

- Annual Fee $89 (waived the first year)

- Regular APR 17.74%

- Balance Transfer Fee $5 or 3% of the amount of each transfer, whichever is greater

- Cash Advance Fee $10 or 3% of advance, whichever amount is greater

TD First Class℠ Visa Signature® Credit CardBenefits

The TD First Class℠ Visa Signature® Credit Card provides cardholders with benefits including:

- Visa Zero Liability protection

Maximizing Rewards