How to enroll in Priority Pass with eligible credit cards

Editor's Note

A Priority Pass Select membership has long been one of the most valuable perks that are included as a benefit of certain travel rewards cards . There are now more than 1,400 Priority Pass lounges worldwide , and the lounge network is still growing.

While Priority Pass membership is provided as a benefit of select premium credit cards , you won't be able to access Priority Pass lounges by simply showing your credit card. Instead, you'll need to enroll your credit card before you can start visiting Priority Pass lounge locations.

Although some lounges will accept a digital card, some lounges require a physical card — so you'll want to enroll your card well before your first lounge visit, if possible.

Luckily, enrolling your card is a relatively simple process that can be done online or by calling your card issuer. Today, we'll walk you through the steps you need to take to do this so you can begin enjoying your Priority Pass membership . Enrollment required for select benefits.

American Express

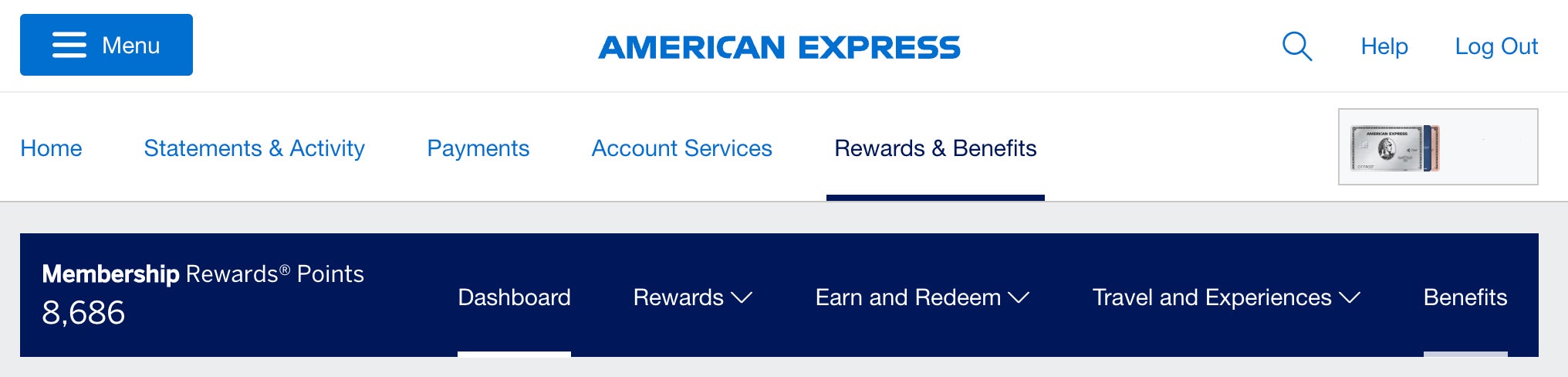

Once you're logged into your Amex online account, you'll want to ensure you've selected the right card. As you can see from the top right portion of the image below, I'm currently viewing the page for The Platinum Card® from American Express — but multiple other Amex cards also offer Priority Pass Select membership . Click on "Benefits & Rewards" to see all the perks that come with your card.

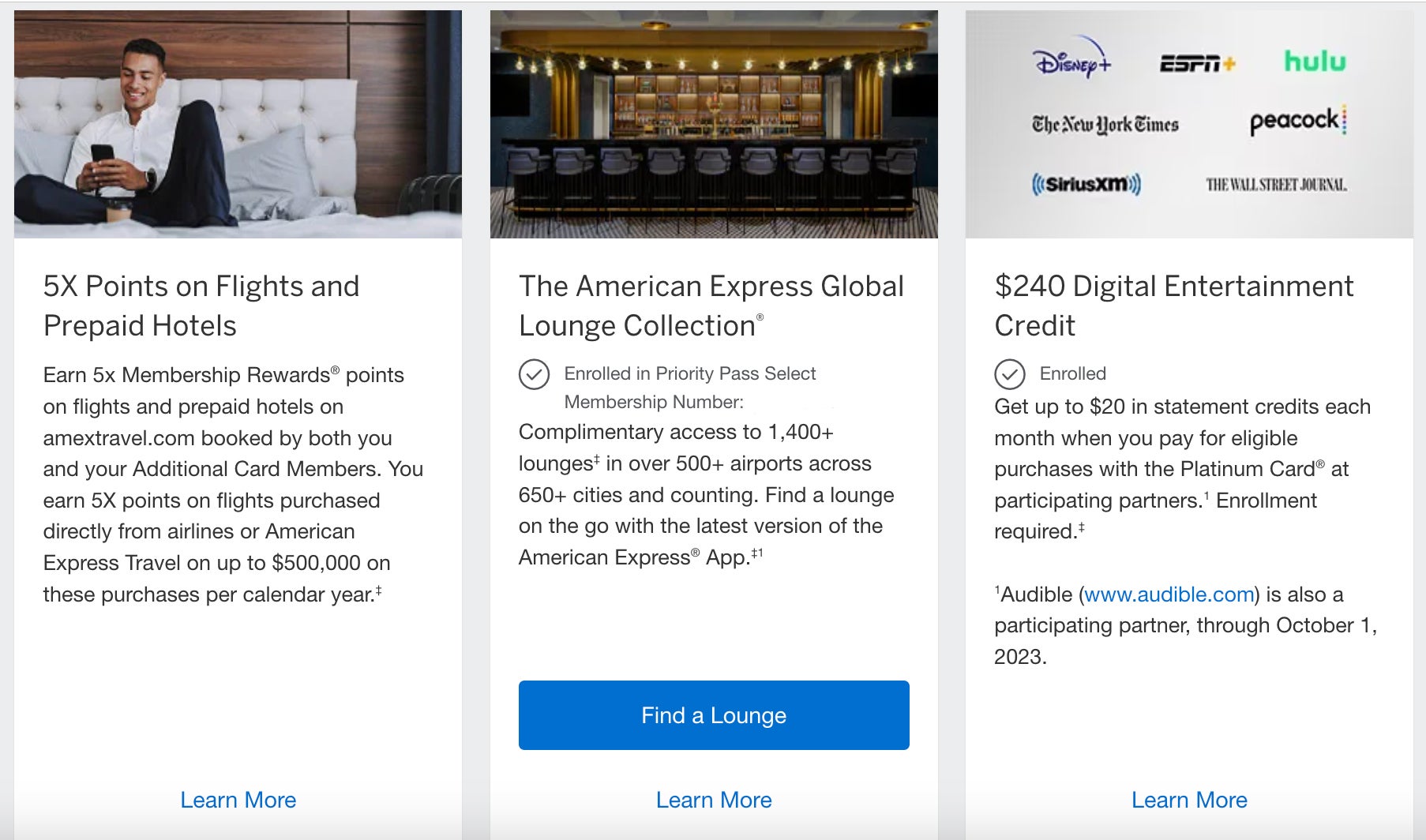

Given the sheer number of perks that come with the The Platinum Card® from American Express , you might have to scroll down a little until you find "The American Express Global Lounge Collection."

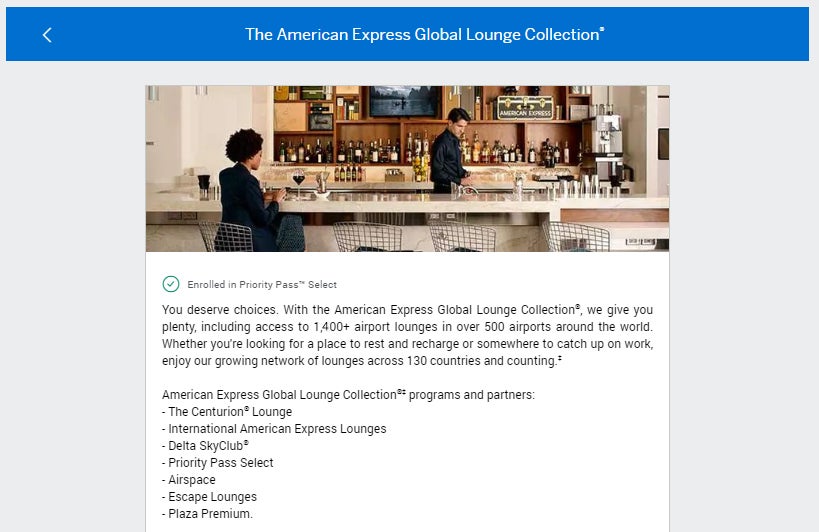

From there, you'll see a full description of the incredibly comprehensive lounge access that comes with the Amex Platinum , including access to Amex Centurion lounges and Delta SkyClubs when flying Delta . Note that you can also enroll in Priority Pass by calling the number on the back of your eligible American Express card. Enrollment required for select benefits.

If you add Platinum Card authorized users to your card , they must call the number on the back of their card to enroll themselves in Priority Pass. Remind them to also enroll in their other authorized user benefits during the call, including Marriott Gold Elite , Hilton Gold , Hertz Gold Plus Rewards , Avis Preferred and National Car Rental Emerald Club Executive status . Enrollment required for select benefits.

Related reading: Choosing the best American Express credit card for you

Capital One

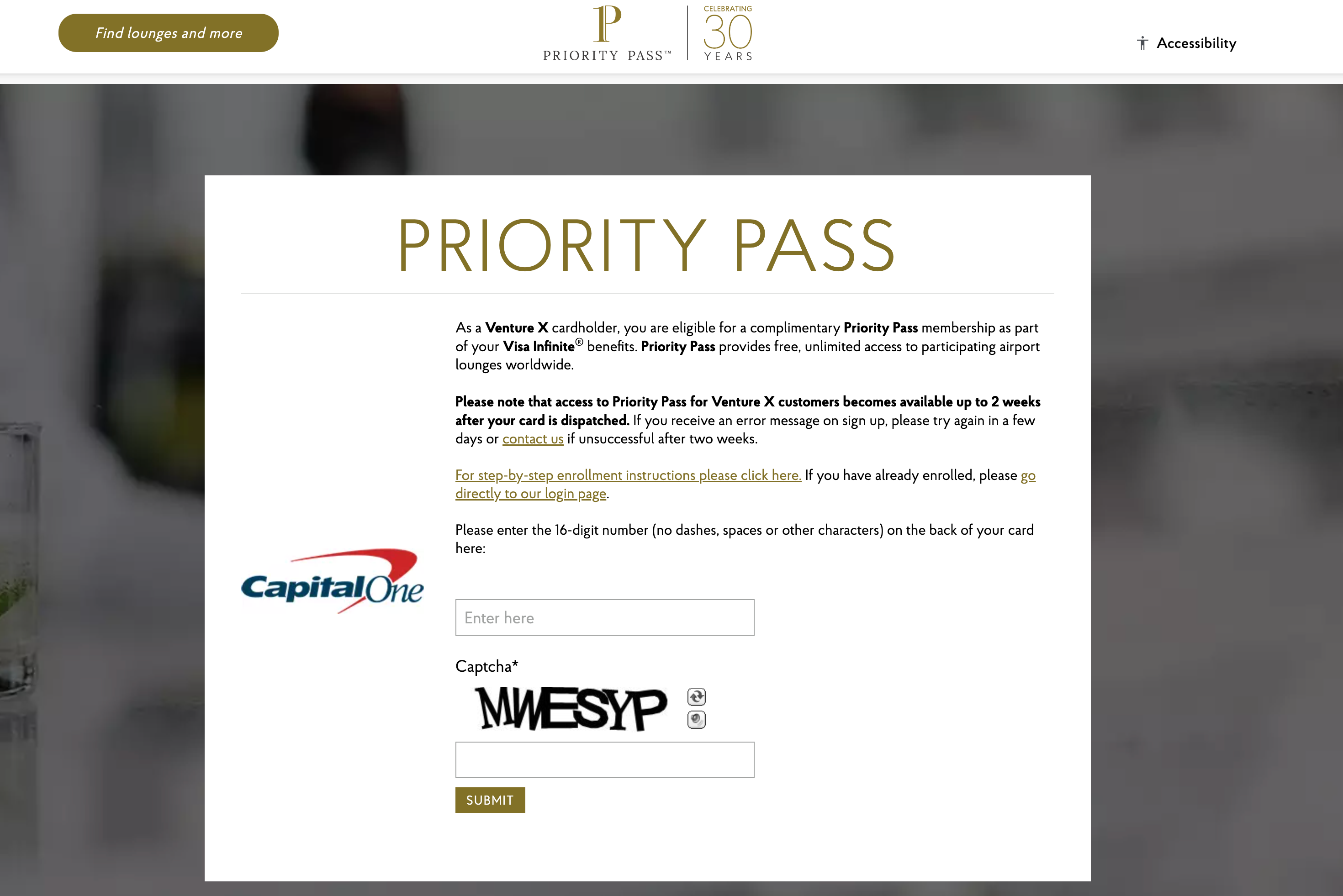

To activate a Priority Pass membership with an eligible Capital One card, such as the Capital One Venture X Rewards Credit Card (see rates and fees ), visit the Capital One Priority Pass page to start the sign-up process.

The Venture X card provides Priority Pass membership to the primary cardmember and authorized users who can bring up to two guests with each visit to a Priority Pass lounge.

If you're an account holder, you can also follow the link from your Capital One Priority Pass welcome email. Next, you will enter your 16-digit Venture X card number and then click "Submit." Be sure to select your country of residence to continue. The next few prompts will ask you to create an account by providing your address and billing details (for identification purposes) before clicking "Join."

Once enrolled, log in to your account through the Priority Pass website or mobile app to access a list of eligible lounges and to view your digital membership card.

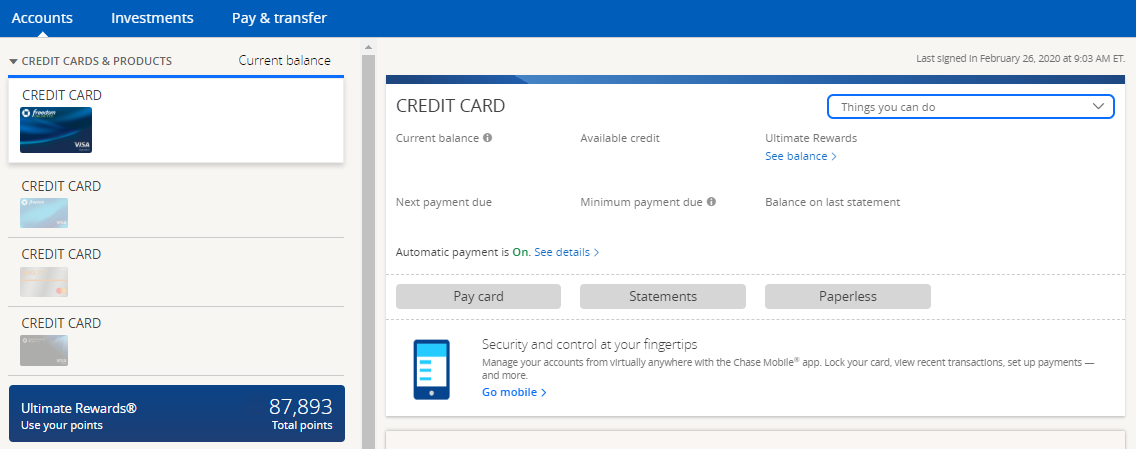

To activate a Priority Pass membership with an eligible Chase card, such as the Chase Sapphire Reserve , you'll want to make sure you're on the Ultimate Rewards area of the Chase website. You can reach this section by clicking on your point total in the bottom left-hand of your account page. Enrollment required for select benefits.

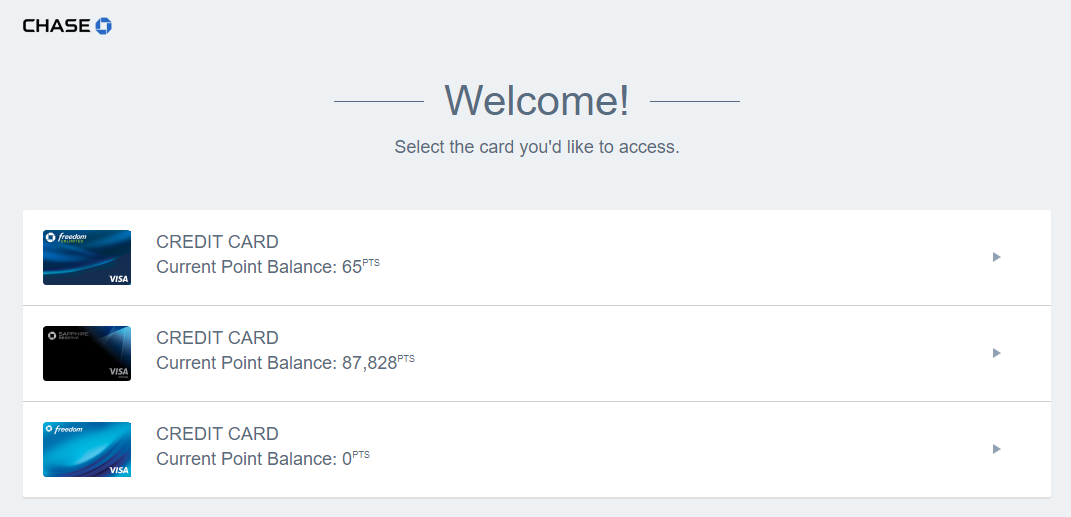

You'll then want to click on the card you're trying to enroll in.

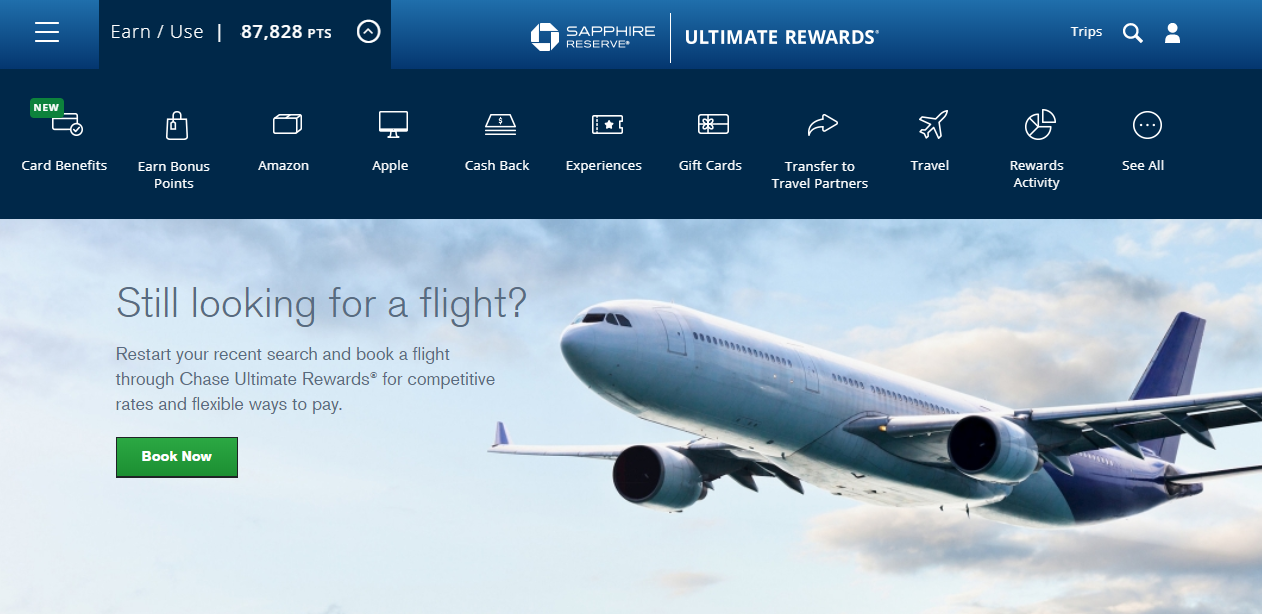

Now, click on "Card Benefits" in the top left corner.

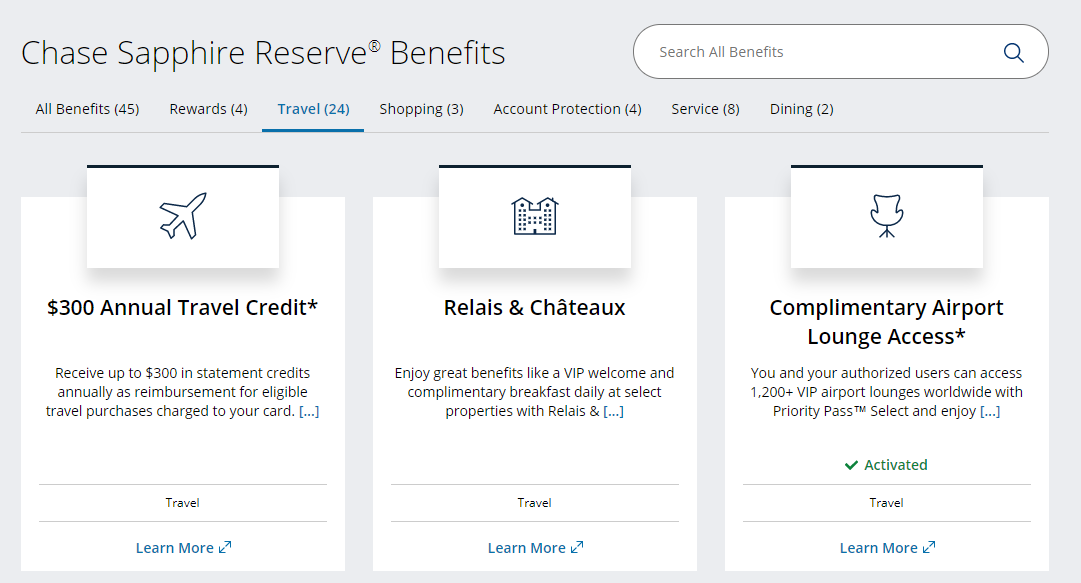

Scroll down until you see boxes with all of your card's benefits. Click "Travel" to see a box for "Complimentary Airport Lounge Access." As you can see, I've already activated my membership — but if you hadn't, you'd click the "activate now" button and follow the instructions on the screen.

If you add an authorized user to your account before activating your Priority Pass membership online, your authorized user will also be enrolled. Otherwise, you'll need to call the number on the back of your card to enroll your authorized user in Priority Pass. Enrollment required for select benefits.

Related reading: Chase Sapphire Reserve credit card review

The only Citi credit card to offer a Priority Pass membership is the Citi Prestige® Card (no longer accepting applications).

It had the most customer-friendly policy of all regarding Priority Pass enrollment. Citi Prestige cardholders were automatically enrolled in Priority Pass, so they could sit tight and wait for their card to arrive in the mail. Enrollment required for select benefits.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related reading: Citi Prestige 5x earnings: How to get the most out of dining and airfare categories, and beyond

The U.S. Bank Altitude Reserve Visa Infinite Card offers a 12-month Priority Pass Select membership. One cardmember per account can enroll, and their first four visits and four individual accompanying guest visits are waived during the first Priority Pass Select membership year. (Enrollment required for select benefits). You can log in to the U.S. Bank Altitude Reserve Card Benefit site to enroll.

The information for the U.S. Bank Altitude Reserve card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Valuable perks such as airport lounge access are the easiest ways to justify paying $350+ annual fees for premium credit cards , but if you forget to take advantage of them, the math starts to work against you. Enrolling your Priority Pass membership shouldn't take more than five minutes, and it can save you the inconvenience of arriving at an airport with a long layover only to realize that you don't have the lounge access you expected. Enrollment required for select benefits.

Related reading

- Everything you need to know about the Priority Pass program

- The best credit cards for Priority Pass lounge access

- Best credit cards for airport lounge access

- The best Priority Pass lounges around the world

- The best Priority Pass lounges in the U.S.

- Guide to lounge access with the Amex Platinum and Business Platinum

- AA, Delta and United lounges have limited access to customers flying with them: Here's what to do

- What's the best way to share lounge access with my spouse or family member?

Additional reporting by Danyal Ahmed & Katie Genter.

- Credit Cards

- TD Platinum Travel Visa Card Review: One of the Best Credit Cards for Expedia Loyalists

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD Platinum Travel Visa Card Review 2024

Updated: Mar 5, 2024, 12:47pm

The TD Platinum Travel Visa has plenty to offer, like no annual fee the first year, the ability to earn TD Rewards Points on purchases and a generous welcome bonus . However, when you look a little closer, there are some drawbacks, like conditions and caveats aplenty. Still, within the landscape of travel cards , the TD Platinum Travel Visa Card shines, but not nearly as bright as the competition. The main reason? Its affiliation with Expedia, both the card’s greatest strength and, paradoxically, its biggest limitation. That’s because the card’s offers are largely confined to Expedia getaways, demanding loyalty you may not want to give so readily.

- Generous welcome bonus.

- Better rewards program than most TD cards .

- Similarly-priced cards have better travel perks

Table of Contents

Introduction, quick facts, td platinum travel visa* card rewards, td platinum travel visa* card benefits, how the td platinum travel visa* card stacks up, methodology, is the td platinum travel visa* card right for you.

- Advertiser's Disclosure

Featured Partner Offers

TD Cash Back Visa Infinite* Card

On TD’s Secure Website

Welcome Bonus

Up to $500 in value†

$139 (rebated in the first year, account must approved by June 3, 2024)

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

TD® Aeroplan® Visa Platinum* Card

$89 (first year of annual fee rebated)

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Travel rewards for a low annual fee? Get the TD Platinum Travel Visa Card.

On TD’s Website

- Earn up to $370 in value†, including up to 50,000 TD Rewards Points†. Conditions apply. Account must be approved by September 3, 2024.

- Welcome Bonus of 15,000 TD Rewards Points when you make your first Purchase with your Card†.

- 35,000 TD Rewards Points when you spend $1,000 within 90 days of Account opening†.

- Pay no annual fee for the first year

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn up to 6 TD Rewards Points for every $1 spent on Expedia ® for TD †

- Earn 4.5 TD Rewards Points on every $1 you spend at your favourite eateries and grocery stores

- Earn 3 TD Rewards Points for every $1 of your recurring bill payments

- Earn 1.5 TD Rewards Points for every $1 you spend on everything else

- Includes travel insurance coverage

- Benefit from no travel blackouts, no seat restrictions and no expiry for your TD Rewards Points (as long as your account is open and in good standing)

- This offer is not available to residents of Quebec.

- † Terms and conditions apply.

When you think about a credit card that ties its perks to a popular online travel agency, TD Platinum Travel Visa Card immediately comes to mind. It’s almost as if TD had a tête-à-tête with Expedia and, together, they concocted an array of credit card benefits suited for the travel-savvy cardholder. If you’ve got a penchant for frequently booking through Expedia, TD Platinum Travel Visa Card isn’t just an option—it’s one of the best options. The world of travel rewards credit cards is vast, and in that sea TD Platinum Travel Visa stands out like a beacon for travellers anchored to Expedia.

Yet, while this card seems bespoke to a specific audience, what about the travellers who don’t necessarily pledge allegiance to Expedia? Here’s where things get a bit murky.

Do we love the fact that there’s no annual fee for the first year, a juicy introductory perk that could see you pocketing up to 50,000 TD Rewards Points? Absolutely. Is it phenomenal that you can bag 6 TD Rewards Points for every $1 on bookings through Expedia and up to 4.5 TD Rewards Points for every $1 you spend on everything else? Again, a resounding yes.

But, in the larger landscape of travel cards, where some offer travel perks like lounge access or extravagant concierge services, TD’s card feels a tad limited. Avid globe-trotters might find themselves yearning for a few more travel-related luxuries.

Would we recommend the TD Platinum Travel Visa Card? If Expedia is your go-to travel companion, yes, without any hesitation. But if you’re an indiscriminate traveller who casts a wider net to find the best deal, this might not be your catch of the day.

- Annual fee: Waived for the first year, then it’s $89 per year

- Reward rate: Ranging from 1.5 to 6 TD Rewards Points across diverse spend categories

- Flexibility: Points can be used for travel, merchandise or bill payments

- Introduction offer: Up to $370 in value and 50,000 TD Rewards Points, with certain conditions

- Insurance coverage: Comprehensive travel insurance included

Earning Rewards

Jumping into the rewards scene Collecting rewards with the TD Platinum Travel Visa Card can feel like striking gold. Each bite at a restaurant or grocery run puts 4.5 TD Rewards Points in your pocket. Your recurring bills? A nifty 3 points for each $1 you spend. And every other purchase earns you a steady 1.5 points. In the bustling world of reward credit cards, this one can hold its own. Plus, the TD Platinum Travel Visa Card offers a distinct Expedia advantage, turning everyday expenses into potential travel adventures.

Redeeming Rewards

With the TD Platinum Travel Visa Card’, you can convert your hard-earned points into exciting getaways on Expedia, choosing from a plethora of destinations. TD and Expedia have made redeeming points easy, so you can harness the full potential of your rewards on Expedia® For TD. You can also use your accumulated points to splurge on merchandise, even Amazon purchases. Plus, you can use TD Rewards Points to lower your credit card balance. While some cards make you jump through hoops for redemptions, TD’s portal makes redeeming your TD Rewards Points a breeze.

Rewards Potential

Savvy spenders who harness the card’s earning potential could pocket an impressive number of points towards travel, merchandise and more. Based on how Canadians typically spend, Forbes Advisor Canada estimates that cardholders can see an annual return of $312.42 worth of points, with the annual fee factored in, when you book travel with Expedia. When you book travel elsewhere, the annual return drops to $292.82 worth of points, with the annual fee factored in.

- First-year perks: No annual fee and up to 50,000 TD Rewards Points (Up to $370 in value)

- Dine and dash to points: Enjoy 4.5 TD Rewards Points on every $1 you spend at restaurants and grocery stores

- Expedia euphoria: Be the traveller that gets 6x TD Rewards Points for every $1 you spend on Expedia bookings, ensuring every trip, big or small, becomes a rewarding journey

- Security and peace of mind: Rest easy with comprehensive travel insurance that ensures that your voyages remain hiccup-free

Interest Rates

- Regular APR Min: 20.99%

- Cash Advance APR: 22.99%

- Balance Transfer APR: 22.99%

- Cash Advance fee: 1% ($3.50 minimum and $10 maximum)

- Balance Transfer fee: 3% maximum

- Foreign Transaction Fee: 2.5%

- Annual Fee: $89 (Get an annual fee rebate in the first year; account must be approved by September 3, 2024)

- Over Limit Fee: $29.00

- Late Payment Fee: $0

When evaluating the TD Platinum Travel Visa Card against some of its competitors, namely the TD Aeroplan Visa Platinum , American Express® Aeroplan®* Reserve Card and CIBC Aeroplan Visa Infinite Card, it’s clear that each has its unique strengths. While they may cater to different traveller preferences, from Expedia loyalists to Air Canada aficionados, picking the most suitable one for you depends on your travel habits, reward preferences and fee comfort levels.

TD Platinum Travel Visa Card vs. TD Aeroplan Visa Platinum Card

At face value, both cards come with an identical annual fee and APR, and both are generous with their first-year annual fee rebates. Yet, they’re tailored to different travellers. If Expedia is your go-to for travel bookings, the TD Platinum Travel Visa Card’s 6-point-per-$1 earn rate is unmatched. That said, TD Platinum Travel Visa Card offers a hearty welcome in the form of 50,000 TD Rewards Points, while TD Aeroplan Visa Platinum welcomes new cardholders with a 20,000 Aeroplan Point offer. But here’s the twist: TD Aeroplan Visa Platinum Card’s potential $500 value, along with the versatility of earning points in multiple ways, may out-woo the frequent traveller. However, for the everyday spender leaning into travel, TD Platinum Travel Visa Card’s reward structure, especially with groceries and dining , holds an edge.

TD Platinum Travel Visa Card vs. American Express® Aeroplan®* Reserve Card

When deciding between the TD Platinum Travel Visa Card and American Express Aeroplan Reserve Card, travellers have a lot to unpack. TD Platinum Travel Visa Card offers an attractive welcome bonus and a more affordable annual fee, especially with the first-year waiver. It’s also the perfect choice for dedicated Expedia customers looking to earn more rewards, faster than ever, on their getaways. On the flip side, the American Express Aeroplan Reserve Card offers a superior range of travel benefits, from lounge access to comprehensive insurance. But, with its higher annual fee, it’s geared towards frequent Air Canada travellers who’ll make the most of its perks. For the budget-conscious, TD Platinum Travel Visa Card takes the lead, but American Express Aeroplan Reserve Card is unrivalled when it comes to premium Air Canada perks.

TD Platinum Travel Visa* Card vs. CIBC Aeroplan Visa Infinite Card

Pitting the TD Platinum Travel Visa Card against the CIBC Aeroplan Visa Infinite Card is an exercise in balance. Both cards offer strong travel rewards, but they cater to slightly different demographics. TD Platinum Travel Visa Card, with its Expedia tie-in, is a dream for the site’s loyalists. Its annual fee is also modest, which is appealing for cardholders who balk at high yearly charges. Conversely, the CIBC Aeroplan Visa Infinite Card leans heavily into its Air Canada affiliation, granting perks like free checked bags and priority boarding. The card’s insurance coverage is also commendable. If you’re after broader travel flexibility and a cheaper fee, TD Platinum Travel Visa Card is your go-to. But, for frequent Air Canada flyers, CIBC Aeroplan Visa Infinite Card stands out.

When determining a rating for individual credit cards, the Forbes Advisor Canada editorial team factors in an exhaustive list of data points. With rewards, the scoring model used takes into account factors such as, but not limited to, rewards rates and categories, fees, welcome bonuses, and other benefits and features. Keep in mind, what may be best for some people might not be right for you. Conduct informed research before deciding which cards will best help you achieve your financial goals.

In short, the TD Platinum Travel Visa Card is a stellar choice for cardholders who frequently use Expedia. If you’re looking to cash in on a generous welcome bonus without a hefty annual fee, this is the card for you. It’s particularly suited to users who dine out or spend heavily on groceries , given the rewards rate. However, if you’re a travel enthusiast in search of comprehensive travel perks and insurance , you might find other similarly priced cards more appealing. While the TD Platinum offers decent protection features, there are more competitive options out there.

Related: Best Credit Cards To Use in Canada

Advertiser's Disclosure

Our partners are not responsible for anything reported by Forbes Advisor. To the best of our knowledge, everything is accurate at the time of publishing as of the date posted. For full information and details, please visit the advertiser’s website.

Frequently Asked Questions (FAQs)

Is the first-year annual fee really waived for the td platinum travel visa card.

Yes, as long as you activate your card and make your first purchase within the first three months of opening your account.

How do I earn the maximum welcome bonus for the TD Platinum Travel Visa Card?

To earn up to 50,000 TD Rewards Points, you must be approved by September 3, 2024. Once approved, activate your card and make your first purchase within the first three months. Also, remember to add any additional cardholders by September 4, 2024.

How does the TD Platinum Travel Visa Card's rewards program benefit frequent Expedia customers?

You earn 6 TD Rewards Points for every $1 you spend when you book your travel through Expedia For TD, making it a rewarding choice for cardholders who frequently use this platform.

What’s the earning rate for the TD Platinum Travel Visa Card on everyday purchases?

You earn 1.5 TD Rewards Points for every $1 you spend on everyday purchases. Plus, you can rack up 4.5 TD Rewards Points on every $1 you spend at restaurants and grocery stores.

Is the TD Platinum Travel Visa Card offer available to residents of Quebec?

Unfortunately, this offer isn’t available to Quebec residents.

Kevin Nishmas is an expert financial content writer with a long and successful history of working with Canada's largest financial institutions. His knack (and passion) for transforming complex personal finance information into clear, compelling content has landed him in leading business publications such as Report on Business, Advisor’s Edge, Benefits Canada and Investor's Digest of Canada.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Balance Transfer Credit cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD First Class Travel Visa Infinite Card

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Tim hortons credit card (tims card) review 2024, cibc costco mastercard review 2024: avid costco shoppers should not leave home without it, pc world elite mastercard review 2024, pc insiders world elite mastercard review 2024: earn the most pc optimum points in canada, cathay world elite mastercard review 2024: the only credit card in canada that earns asia miles, ja money card review 2024: earn cash back while learning about money management.

Health & Dental Quotes

- Health Insurance

- Dental Insurance

- Group Benefits

- Disability Insurance

- Critical Illness Insurance

Life Insurance Quotes

- Life Insurance

- No Medical Life Insurance

- Mortgage Life Insurance

- Funeral Insurance

Home and Auto Quotes

- Auto Insurance

- Home Insurance

- Condo Insurance

- Renters Insurance

Pet and Travel Quotes

- Travel Insurance

- Snowbird Travel Insurance

- Super Visa Insurance

- Pet Insurance

- Affordability Calculator

- Closing Cost Calculator

- Payment Calculator

COMPARE CREDIT CARDS

- Best Credit Cards in Canada

- Best No Annual Fee Credit Cards

- Best Rewards Credit Cards

- Best Cash Back Credit Cards

- Best Travel Credit Cards

- Best Business Credit Cards

- Best Student Credit Cards

- Best Credit Score Builder Cards

- Best Low Interest Credit Cards

- Best Balance Transfer Credit Cards

- Best No Foreign Exchange Credit Cards

OUR FEATURED CREDIT CARDS

- Neo Financial

CREDIT CARD REVIEWS

- Neo Financial Review

- Tangerine Money-Back Credit Card Review

- Scotiabank Value Visa Card Review

- Scotiabank No Fee Credit Cards Review

- Refresh Financial Secured Credit Card Review

- HBC Mastercard Review

CREDIT CARD GUIDES

- Annual Fee on a Credit Card - Is It Worth It?

- The Difference Between Mastercard and Visa: Answering Your Questions

- Purchases You Should Always Charge on Your Credit Card

- Why Having More than One Credit Card Makes Sense

- Spend to Earn: How to Earn Credit Card Reward Points Quickly

- Building Credit with a Credit Card

- Charge Card vs Credit Card: Understanding the Difference

- Easy Ways to Lower Your Credit Card Interest Rates

- Secured vs Unsecured Credit Card; The Best Way to Build Credit

- Personal Loans

- Business Loan

- Debt Relief

- Bank Accounts

- Free Credit Score

- Provincial Health Insurance Plans

- Insurance Companies

- Insurance Forms

- Insurdinary Reviews

CANADA RESOURCES

- My Service Canada Account: Step-by-Step

- SIN Number Application: Step-by-Step

- My CRA Account: Step-by-Step

- Canada Immigration 101

- Home 101: Understanding Your Home

- First-Time Home Buyer Guide in Canada

- Tax Resource for Canadians

- Beginner's Guide for New Drivers

- Canada's Food Guide

- Common Law Guide in Canada

- Pregnancy Guide for Canadians

- Renters and Landlords Guide

- Retirement Guide in Canada

- Best Places to Live in Canada

- Best Places to Retire in Canada

- 11 Best Places to Visit in Canada in the Wintertime

- Best Travel Destinations in Canada

- Best Travel Destinations for Canadians

- How to Log In

- How to Submit Claims

- 9 Benefits of Using A Health Insurance Broker

- Health Insurance for International Students in Canada

- The Complete Guide to Life Insurance

- Ultimate Guide to Buying Life Insurance at Every Age

- Best Life Insurance Options for Seniors

- Understanding Life Insurance for Children

- Understanding Life Insurance for Couples

- 6 Life Insurance Mistakes to Avoid

- Life Insurance for Drug Users

- Can Smokers Get Life Insurance

- Can Alcoholics Get Life Insurance

- Can I Get Life Insurance If I Have Asthma

- Can I Get Life Insurance If I Have Diabetes

- Can I Get Life Insurance If I Have Epilepsy

- Can You Get Life Insurance After A Stroke

- Can You Get Life Insurance with Cancer

- Canadiens Vs Maple Leafs - Digging Into The Rivalry

- How to Speak Canadian the Right Way

- Canada Road Trips

- How to Have a Side Hustle in Canada

- Top 5 Tourist Places in Each Province Revealed

- Top 5 Places to Go Glamping in Canada

- Best Free Tax Return Software for Canadians

- What Not to Post on Social Media while Traveling

- The Average Cost of Raising a Child in Canada

- The Real Cost of Owning A Pet in Canada

- The Real Cost to Build a House in Canada

- The Real Cost of Owning a Cottage in Canada

- The Real Cost of Owning a Boat in Canada

IN THE PRESS

- Insurdinary Surpasses 1000 Reviews!

- How Insurdinary Rakes in Great Reviews

- Optimize Your Finances with Insurdinary’s Expense Tracker App

- Insurdinary's Online Life Insurance Quoter: How It Works

- APOLLO Insurance Partners with Insurdinary

RESEARCH STUDY

- How COVID-19 Impacted Your Opinion on Life Insurance

- How COVID-19 Impacted Your Opinion on Travel Insurance

- Injured or Hospitalized While on Vacation

- How Do You Prefer to Buy Life Insurance

- Compare. Save. Get the Best Rates. Get Quotes Contact Us

TD Platinum Travel Visa Card Review

Did you know that Las Vegas and Cancún are the two most searched travel destinations by Canadians for the period between Oct. 1 and Dec. 31, 2021?

With the pandemic, travel has been the last thing on our minds. Oh sure, we’ve all been dreaming about those white sands and bright blue skies, but the reality has kept us grounded.

Is it time to book your next trip? Travel experts say that putting a small deposit now for something to look forward to in the future makes sense.

Even if it feels like it’s too soon to make any travel plans, you can start piling up your reward points with the TD Platinum Travel Visa* Card. Keep on reading for a detailed review of the TD Platinum Travel Visa* Card, and why it’s the right card for you!

Disclaimer: The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

Special Offer

Features and benefits, rates and fees, eligibility requirements, earning and redeeming points.

- How Does It Compare to Other Top Travel Rewards Credit Cards?

Pros and Cons

The reviews.

TD Platinum Travel Visa* Card

- Welcome Points: 60,000 points

- Annual Fee: $89

- Eligibility: Canadian resident, age of majority

- Rewards: 5 reward points per dollar of travel booked through Expedia for TD, 3 reward points per dollar of groceries, 2 reward points per dollar for every other purchase

If you apply for a TD Platinum Travel Visa* Card by December 5, 2021, you can take advantage of this amazing special offer. You can earn up to 60,000 TD Rewards Points .

This includes 15,000 TD Reward Points when you make your first purchase with your card within 3 months of opening your account. Make sure to activate your card and use your card within those 3 months.

You also get 45,000 TD Reward Points when you spend $1,000 within 90 days of opening your account. That is a total of 60,000 TD Rewards Points for purchases you would be making anyway.

But that’s not all.

You also get your first year with no Annual Fee for the Primary and Additional Cardholders (a value of up to $120).

Apply online today. Conditions Apply.

Finding the right credit card can be overwhelming with so many options to choose from. A TD Platinum Travel Visa* Card has several features and benefits that will appeal to you.

Whether you travel for business or personal, alone or with family – the features and benefits of this credit card will make you feel safer and protected during your travels.

TD Platinum Travel Visa* Card Travel Insurance

Travel brings with it uncertainty. Rather than worrying about going to a third party, with the TD Platinum Travel Visa* Card you can rest assured that you and your family will be protected through our travel insurance.

Remember to be eligible for this coverage, you need to buy your flight using your TD Platinum Travel Visa* Card

You can always compare travel insurance quotes online through Insurdinary.

Flight/Trip Delay Insurance

This visa card offers flight/trip delay insurance. This means that if your flight is delayed by more than 4 hours, you can get up to $500 of coverage.

In the pandemic era, you can breathe easier with this feature directly on your visa card.

Delayed and Lost Baggage

With tracking technology, you want to feel safe that the airline industry will not lose your bag. Unfortunately, statistics show that around 24.8 million bags were “mishandled” in 2018. It’s not surprising when there’s been an increase in the total number of air passengers.

Bags generally get lost when there’s a connecting flight. Sometimes your bag can be inadvertently picked up by someone else.

When you buy your flight with TD Platinum Travel Visa* Card, you can feel better about the fact that if your baggage is lost or if there is a delay for 6 hours or more you will be covered for $1,000 per insured person.

You can use this coverage towards purchasing essentials such as clothing and toiletries.

Common Carrier Travel Accident Insurance

You are also covered for up to $500,000 for covered losses while traveling on a common carrier (for example, a bus, ferry, plane, or train). This covers losses whether you are at the beginning or end of your trip.

If you need additional travel insurance, you can always look for travel insurance quotes at Insurdinary.

Emergency Travel Assistance

TD Platinum Travel Visa* Card is there for you if you run into any problems while traveling. They provide emergency travel assistance.

No matter what time, help is just a call away. Your visa card will have a toll-free number that you can call in the event of an emergency while traveling.

Priority Pass Membership Discount

With the TV visa card, you also receive an annual discount on a Priority Pass membership. This pass gives you access to around 1,200 VIP airport lounges worldwide.

You can sit down, stretch and enjoy a pre-flight bite and drink away from the crowds. With free wi-fi, you’ll be connected with family and colleagues.

Credit Card Travel Insurance Verification Tool

If you are not sure whether you have access to these benefits, you can always check with the TD Credit Car Travel Insurance Verification Tool .

TD Platinum Travel Visa Card Car Rental

The benefits with a TD Platinum Travel Visa* Card don’t stop with travel insurance. You also save with car rental and insurance.

Discounts with Avis Rent A Car and Budget Rent a Car

If you use your TD visa card to rent a car at Avis and Budget car rentals, you can save a minimum of 10% off the lowest available base rates in Canada and the U.S.

Even if you rent a car internationally, you’ll be able to save a minimum of 5% of the lowest available base rate at participating Avis and Budget locations.

Auto Rental Collision/Loss Damage Insurance

If you pay for your car rental using your TD visa card, you get the Auto Rental Collision/Loss Damage Insurance at no additional cost.

TD Auto Club Membership (Optional)

You also have the option to be covered 24 hours a day for emergency roadside assistance. So, if anything goes wrong on the road, you know that you have someone to call who can provide you with immediate assistance.

TD Platinum Travel Visa Card Rewards

The TD Platinum Travel Visa* Card allows you to earn reward points on your purchases. The more you spend, the more reward points you can earn.

You earn more points if you use your visa card when you book your travel online through Expedia for TD .

You can also use your visa card to book a trip from any other service provider, and then redeem your TD Reward Points towards that purchase within 90 days.

You can also use those TD Reward Points for travel-related purchases such as taxes, golf fees, and resort excursions.

Shop at Amazon.ca Using Points

Amazon is a household name for us all at this time. All those piled-up Amazon boxes outside your door can be free if you redeem your TD Reward Points. Conditions apply.

Learn more about how easy, flexible and extensive this amazing benefit is.

Pay Your Balance with Points

With Christmas and New Year coming up, you can also use your TD Rewards points to pay down your balance.

Online Shopping through TDRewards.com

There are tons of brand-name merchandise from gift cards, appliances, electronics, luggage and so much more. You can shop online and redeem your TD Reward points.

Below are the TD Platinum Travel Visa* Card rates and fees.

- It has an annual fee of $89.00. For every additional card, the fee will be $35.

- The purchase interest rate is 19.99%.

- If you want to make cash advances, remember the rate increases to 22.99%.

To be eligible for the TD Platinum Travel Visa* Card and all its features and benefits, you need to be:

- A Canadian resident

- The age of majority in your province or territory

Now you know all about the features and benefits of the TD Platinum Travel Visa* Card, so you’re probably wondering how you can earn those TD Reward Points and redeem them.

How to Earn Points

You can earn points by spending money on your everyday purchases. That coffee in the morning, your weekly groceries, the fancy dinner to celebrate a birthday, and anything else you purchase.

You can earn:

- 3 TD Rewards points for $1 spent on groceries

- 5 TD Rewards points for $1 spent on travel purchases on Expedia for TD

- 2 TD Rewards points for $1 spent on all other purchases

It’s as easy as tapping your TD Platinum Travel Visa* Card.

How to Redeem Points

Redeemed points are just as easy.

The best way to redeem is to book your travel through Expedia for TD. You can use Expedia for TD to book flights, hotels, or car rentals – basically, everything you can book on the regular Expedia site.

You can apply TD Reward Points at a rate of 200 points for each $1 spent (0.5 cents per point).

If instead, you choose to book through another service provider, you can get 250 points for each $1 spent (0.4 cents per point).

If you redeem your TD Reward Points to pay off your balance or purchase a gift card, you can get 400 points per $1 spent (0.25 cents per point).

As long as you have your TD Platinum Travel Visa* Card, your TD Rewards Points don’t expire. If you cancel your card, you have 90 days to redeem your points.

How Does It Compare to Others?

To figure out which card is best for you, compare interest rates, fees, and other features and benefits. You can easily compare credit cards through Insurdinary

There are about 54 credit cards offering a rewards program. To make your life easier, we have compared three different credits cards below.

RBC Avion Visa Business

- Welcome Points: 20,000 points

- Annual Fee: $120

- Eligibility: $60,000 minimum income

- Rewards: Earn 1 rewards point per dollar eligible spending

CIBC Aventura Visa Infinite Card

- Rewards: 2 reward points per dollar of travel booked through CIBC Rewards Centre, 1.5 reward points per dollar of gas and groceries, 1 reward point per dollar for every other purchase

As you can see, TD Platinum Travel Visa* Card has more welcome points and a lower fee, with lower eligibility requirements. You also get more reward points for all your purchases.

We have gone through all of the features and benefits of the TD Platinum Travel Visa* Card. Below we set out some of the pros and cons for you to review at a glance.

Some of the pros of getting the TD Platinum Travel Visa* Card are:

- 60,000 TD Reward points just for joining

- First-year with a zero annual fee

- Low annual fee

- More reward points for every dollar of purchases

- No minimum income requirements

- Great for travel enthusiasts

The cons of getting the TD Platinum Travel Visa* Card are set out below:

- Has an annual fee

- No medical travel insurance

- Limited benefits if you’re not a huge traveler

If you are looking for additional medical travel insurance or if you’re a snowbird traveler, then check out compare travel insurance quotes at Insurdinary.

TD has several different cards but the TD Platinum Travel Visa* Card has great reviews as being a comfortable middle ground between entry-level and premium travel.

You get a dynamic rate depending on spending habits. Your travel-related expenses will get you the most benefits. Plus, you get a generous introductory rate and features and benefits like car rental insurance and travel insurance.

Below are the commonly asked questions online:

If you are a travel enthusiast looking for a low annual fee credit card with many features and benefits like travel insurance and an amazing rewards program, you should get a TD Platinum Travel Visa* card. Apply for one today!

You don’t need a minimum annual income to apply for the TD Platinum Travel Visa* Card. A good credit score will improve your chances of getting approved. You can check your credit score for free with Insurdinary.

Get offers, promotions, tips, and advice from all Financial and Insurance institutions once a week.

By subscribing, you agree to our privacy policy . You can unsubscribe at any time.

- Advice & Tips

- Credit Cards

- Credit Card Reviews

Priority Pass App

- Accessibility

- Small Business

- English Selected

Home / Canadian Credit Cards / Travel Rewards Credit Cards in Canada

Canadian Credit Cards

Your region is currently set to

Travel Rewards Credit Cards in Canada

What is a travel credit card.

A Travel Credit Card is like other credit cards, except it allows you to earn travel Rewards Points on everyday purchases. Points can then be redeemed for flights, hotels and other eligible rewards items. A Travel Credit Card is an ideal choice for people who travel and are looking to optimize their spending.

Compare the Best TD Credit Cards for Travel Rewards points

Td first class travel® visa infinite* card.

Earn up to $800 in value FCT-ROC-18 , including up to 100,000 TD Rewards Points UDI-NQ-EN-11 and no Annual Fee for the first year UDI-NQ-EN-11 . Conditions Apply. Account must be approved by June 3, 2024.

Interest: Purchases

Interest: Cash Advances

View Details

TD Platinum Travel Visa* Card

Earn up to $370 in value UDINQEN13SUP18 , including up to 50,000 TD Rewards Points UDINQEN13 and no Annual Fee for the first year UDINQEN13 . Conditions Apply. Account must be approved by September 3, 2024.

TD Rewards Visa* Card

Earn a value of $50 UDINQEN14 , UDINQEN14plus in TD Rewards Points to use on eligible Amazon.ca purchases plus, no Annual Fee. Conditions Apply. Account must be approved by June 3, 2024.

TD Business Travel Visa* Card

Earn a value of up to $1,122 d1 , d25 in TD Rewards Points (that's up to 175,000 TD Rewards Points) d1 with no Annual Fee in the first year d1 . Conditions Apply. Account must be opened by June 3, 2024.

Benefits of a TD travel credit card

Aside from travel Rewards Points, you also enjoy additional perks - depending on the card you choose.

Affordable travel

If you love to globe-trot, a good travel credit card can make it more affordable without having to change your spending habits.

Redemption flexibility

You have the flexibility to choose how you want to redeem the points you've earned, whether on everyday perks or for travel.

Shop with confidence

Your Travel Credit Card allows you to make purchases safely and securely without the need for cash while travelling.

Travel with peace of mind

TD’s fraud detection systems can detect suspicious or unauthorized transactions, giving you the same security - home & abroad.

How to choose a travel credit card

You have a lot of choices when it comes to finding the best credit card for Travel Rewards Points, so it helps to know what to look for to get the most out of your card and your reward points.

Earning TD Rewards Points Choose a Travel Credit Card that best suits your spending habits. TD Travel Rewards Credit Cards are designed to help you achieve travel goals sooner by earning Rewards Points on everyday purchases.

Additional benefits There can sometimes be additional perks worth investigating. TD Travel Rewards Credit Cards come with exciting travel benefits such as Discounts and savings on rentals from Avis Rent-A-Car and Budget Rent-A-Car. You can also earn 50% more TD Rewards Points at participating Starbucks® stores. Conditions apply. Learn more .

Frequently Asked Questions

How do travel credit cards work.

Travel credit cards work like other rewards credit cards, except they award TD Rewards Points to cardholders for making travel-related purchases and offer them travel-related rewards. Travel rewards points are awarded when eligible purchases are made. Travel credit cards may include features like travel insurance and airport lounge access. Check the cardholder agreement for details.

What travel benefits come with TD travel credit cards?

TD travel credit cards have various built-in travel insurance benefits such as Flight/Trip Delay Insurance or Travel Medical Insurance and Emergency Travel Assistance Services may also be included. Review your Cardholder agreement for more details.

What is a TD Rewards Point worth?

TD Rewards Points have great value in travel savings. Every 200 TD Rewards Points redeemed is worth $1 in travel savings off the cost of travel purchases made through Expedia® for TD. Redemptions can only be made in 200 TD Rewards Points increments.

More options to serve you

Browse all td credit cards.

Compare our credit cards to find your preferred solution.

Need help choosing a card?

Answer a few simple questions and we'll suggest your ideal card based on your responses.

Add Additional Cardholders

Share the benefits of your TD Credit Card Account with up to 3 Additional Cardholders.

TD Fraud Alerts

Get text messages right to your mobile when we detect suspicious activity made with your TD Visa Credit Card. 5

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

Compare cards

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

Your province is set to

Annual interest rates, fees and features are current as of March 5, 2024 unless otherwise indicated and subject to change.

- $189: Annual Fee Rebate for the Primary ($139) and first Additional Cardholder ($50) for the first year;

- $100: TD Travel Credit on your first Eligible Travel Credit Purchase of $500 or more made through Expedia For TD;

- $50: TD Rewards Birthday Bonus equal to 10% of the number of TD Rewards Points earned while using the TD First Class Travel Visa Infinite* card over the 12 months preceding the Primary Cardholder’s birthday, up to a maximum of 10,000 TD Rewards Points (travel value at Expedia For TD of up to $50). Previously earned points on other Rewards Cards, Acquisition Bonus Points, or other Promotional Rewards Points earned do not count towards your Birthday Bonus;

- Welcome Bonus of 20,000 TD Rewards Points earned when you make your first Purchase with your Card (travel value at Expedia For TD of $100);

- Additional Bonus of 80,000 TD Rewards Points earned when you spend $5,000 within 180 days of Account opening (travel value at Expedia For TD of $400);

2 Account must be approved by September 3, 2024. Welcome Bonus of 15,000 TD Rewards Points will be awarded to the TD Platinum Travel Visa* ("Account") only after the first Purchase is made on the Account. To receive the additional 35,000 TD Rewards Points ("Additional Bonus") , you must make $1,000 in Purchases on your Account, including your first eligible Purchase, within 90 days of Account opening. Rebate of the Annual Fee is only for the first year for the Primary Cardholder and the first Additional Cardholder added to the Account. To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder Annual Fee Rebate you must add your first Additional Cardholder by September 4, 2024. Annual Fee Rebate will be applied within 2 monthly statements from the date of the statement with the first Annual Fee charge. The Primary Cardholder is responsible for all charges to the Account, including those made by any Additional Cardholder. Offer may be changed, withdrawn (excluding Quebec), or extended at any time and cannot be combined with any other offer unless otherwise indicated. This offer is not available customers who have activated and/or closed a TD Platinum Travel Visa* Account in the last 12 months. We reserve the right to limit the number of Accounts opened by and the number of TD Rewards Points awarded to any one person. Your Account must be in good standing at the time the Welcome Bonus points and Additional Bonus points are awarded. Please allow 8 weeks after the conditions for each offer are fulfilled for the Welcome Bonus TD Rewards Points to be credited to your TD Rewards Account.

3 Limited Time Promotional Offer includes a Welcome Bonus, Monthly Bonus, Mobile Wallet Bonus Offer and Annual Fee Rebate Offer (described below and collectively the "Offer"): Welcome Bonus of 30,000 TD Rewards points ("Welcome Bonus") is only available to the Primary Business Cardholder of TD Business Travel ® Visa Card account ("Account") with an Annual Fee of $149 ("$149 Account"). $149 Account must be opened and approved by June 3, 2024.

Welcome Bonus will be awarded to the Primary Business Cardholder of the $149 Account only after the first Purchase is made on the $149 Account, where such Purchase is made within 90 days of account approval. The “Primary Business Cardholder” means the individual who is issued TD Business Travel ® Visa Card account with an Annual Fee of $149. Please allow eight - twelve weeks for your Welcome Bonus Points to be awarded.

To qualify for a monthly bonus of 10,000 TD Rewards Points ("Monthly Bonus") in the first 12 months after Account approval (up to a total maximum of 120,000 Monthly Bonus Points), the Primary Business Cardholder must have at least $2,500 in net Purchases posted to their Account each month by the last day of each monthly billing period. Once you have earned 120,000 Monthly Bonus Points during the first 12 months following Account approval, you will no longer be eligible for additional Monthly Bonus Points. Purchases made during a billing period but posted after the end of that billing period will not count towards eligible Purchases for that month and count towards eligible Purchases for the next billing period. For example, if your monthly billing period is from March 15 to April 14, a Purchase made on April 14 (transaction date) and posts on April 15 (posting date) will not count for eligible Purchase for that month and will count towards spend in the next month's billing period. If the March 15 to April 14 period was your 12th monthly billing period, then the Purchase that was made on April 14 and posted on April 15 would not count toward this Offer.

Limited Time TD Business Travel ® Visa Card Promotional Offer ("Mobile Wallet Bonus"): Applies to the TD Business Travel® Visa Card that is also an $149 Account. Mobile Wallet Bonus starts March 5, 2024 and ends on June 3, 2024 (the "Offer Period"). The $149 Account will earn 25,000 bonus TD Rewards Points (the "Bonus Points") when a Primary Business Cardholder makes at least $250 eligible Purchases using an eligible mobile wallet (Apple Pay, Google Pay, or Samsung Pay), where such Purchases are made within 90 days of account approval that are not subsequently rescinded, the subject of a chargeback request or otherwise disputed.

The Annual Fee rebate portion of this Offer ("Annual Fee Rebate Offer") is available only for the first year after Account approval, for the (i) Primary Business Cardholder, and the (ii) first two Additional Cards issued for the same business if any. The rebate of the $49 Annual Fee for the first two Additional Cards issued on the same business, if any, is for the first year only. Account ("$149 Account") must be opened by June 3, 2024. To receive the Additional Cardholder first -year annual fee rebates for Additional Cardholders ("Additional Cardholder Annual Fee Rebate"), you must add your Additional Cardholders to your Account by June 4, 2024. The Annual Fee for any subsequent $149 Accounts or Additional Cards issued to the same business will continue to apply. The Annual Fee will be rebated within two monthly statements from the date of the charge. The full Annual Fee will be charged to the Primary Business Cardholder Account and the Additional Accounts (if applicable), after the first year. The Offer may be changed, withdrawn, or extended at any time and cannot be combined with any other offer unless otherwise indicated. This Offer is not transferable. If you have opened an Account in the last 12 months, you will not be eligible for this Offer. We reserve the right to limit the number of $149 Accounts opened by one person, and the number of Welcome Bonus points, the Monthly Bonus points and the Mobile Wallet Bonus Offer points awarded to any one business. Offers may be changed, withdrawn, or extended at any time and cannot be combined with any other offer unless otherwise specified. Your Account must be open, active in Good Standing at the time the Welcome Bonus points, Monthly Bonus points and the Mobile Wallet Bonus Offer points are awarded. Please allow 8-12 weeks after the conditions for each element of the Offer are fulfilled for the Welcome Bonus points, the Monthly Bonus points, and the Mobile Wallet Bonus points to be credited to the TD Business Travel ® Visa Card Account associated with the Primary Business Cardholder, as designated by the Business. Closing your Account or transferring to another TD Credit Card may result in forfeiture of any bonus points not yet awarded.

4 Account must be approved by June 3, 2024. To receive 15,152 Bonus TD Rewards Points awarded to the TD Rewards Account associated with the TD Rewards Visa* ("Account") , you must keep your Account open, active and in good standing for 90 days after Account opening. Offer may be changed, withdrawn (excluding Quebec) or extended at any time and cannot be combined with any other offer unless otherwise indicated. Your Account must be in good standing at the time the Welcome Bonus TD Rewards Points are awarded. Please allow 8 weeks after the conditions for each offer are fulfilled for the Welcome Bonus TD Rewards Points to be credited to your TD Rewards Account. This offer is not available customers who have activated and/or closed a TD Rewards Visa* Account in the last 12 months. We reserve the right to limit the number of Accounts opened by and the number of TD Rewards Points awarded to any one person.

5 You are responsible for ensuring the mobile phone number we have on file is accurate and for notifying us of any changes. We will send the TD Fraud Alerts text message instantly upon detection of suspicious activity; however, receipt of the text message may be delayed or prevented due to a variety of factors such as technology failures, service outages, or multiple third-party involvement. TD Fraud Alerts text messages will only be sent to customers who have a Canadian mobile phone number and a Canadian mailing address in their TD Customer Profile.

6 Offer ends September 3, 2024. The value of up to $370 could be earned in the first year of Account opening and is based on the combined value of:

- $124: Annual Fee Rebate for the Primary ($89) and first Additional Cardholder ($35) for the first year;

- Welcome Bonus of 15,000 TD Rewards Points earned when you make your first Purchase with your Card (travel value at Expedia For TD of $75;

- Additional Bonus of 35,000 TD Rewards Points earned when you spend $1,000 within 90 days of Account opening (travel value at Expedia For TD of $175;

Every 200 TD Rewards Points redeemed through Expedia For TD are worth $1 in travel savings.

7 1 TD Rewards Point is worth $0.0033 towards purchases at Amazon.ca that are eligible for the Shop With Points program. 3 TD Rewards Points minimum redemption. These are highlights of the Amazon.ca Shop with Points program for TD Rewards points (“SWP for TD”). SWP for TD is provided by Amazon.ca. To use your TD Rewards points to pay for an order at Amazon.ca, your eligible TD credit card must be linked to your Amazon.ca account. For more information, including how to enroll in SWP for TD and terms, conditions and restrictions, visit https://www.amazon.ca/tdrewards . Amazon.ca is operated by Amazon Services International, Inc. The Toronto-Dominion Bank and its affiliates are not liable or responsible for SWP for TD or any of the services and products offered/provided by Amazon.ca. SWP for TD may be amended or cancelled at any time without notice.

9 Offer ends June 3, 2024. The value of up to $1,122 could be earned in the first year of Account approval and is based on the combined value of:

- $247: Annual Fee Rebate for the Primary ($149) and up to two Fee Rebates for two Additional Cardholder ($49 each) for the first year; Additional Cardholders must be added by March 5, 2024.

- Welcome Bonus of 30,000 TD Rewards Points earned when you make your first Purchase with your Card (travel value at Expedia For TD of $150);

- Monthly Bonus up to 120,000 TD Rewards Points earned when you spend $2,500 in Purchases each month for the first 12 months of account opening (travel value at Expedia For TD of $600);

- Mobile Wallet Bonus Offer up to 25,000 TD Rewards Points earned when a Primary Cardholder makes at least $250 eligible purchases using an eligible mobile wallet (Apple Pay, Google Pay, or Samsung Pay), (travel value at Expedia For TD of $125); within 90 days of account opening.

® The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

* Trademark of Visa International Service Association; Used under license.

®Aeroplan is a registered trademark of Aeroplan Inc., used under license. Starbucks, the Starbucks logo, and other Starbucks trademarks, service marks, graphics, and logos used in connection with the Offer are trade names, trademarks or registered trademarks of Starbucks Corporation (collectively “Starbucks Marks” ).

* Trademark of Visa International Service Association and used under license.

® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank.

Amazon, the Amazon.ca logo and the smile logo are trademarks of Amazon Services International, Inc. or its affiliates.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 100,000 Points Earn up to 100,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of up to 10,000 TD Rewards Points†. Account must be approved by June 3, 2024.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

- Option to purchase TD Auto Club Membership†: and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation, up to $1,500 of coverage per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption, up to $5,000 of coverage per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

TD® Aeroplan® Visa Infinite* Card

- Annual Fee $139

- Rewards Rate 1x-1.5x Points Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Intro Offer Up to 50,000 Points Earn up to 50,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†. Account must be approved by June 3, 2024.

- Earn up to $1,200 in value†, including up to 50,000 Aeroplan points† (enough for a round trip to New York City†), and additional travel benefits. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.