Best Travel and Overseas Spending Credit Cards in HK | MoneySmart

Find a Overseas Spending Credit Card for your vacation to enjoy air miles, cash rebate and all sorts of travel benefits, including free airport lounge access, travel insurance and overseas spending offers.

Looking For The Right Credit Card?

Create a free account, do a 1-min quiz and we'll match you with your perfect card..

- Welcome Offers

- Online Shopping

- Overseas Spending

- Best Credit Cards

- Octopus Card AAVS

- Annual Fee Waiver

- Bill Payment

- Digital Wallets

- Business Card

- Supermarket

- Entertainment

Refine Your Results

.jpg)

Standard Chartered Smart Card

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.hk’s Terms of Use and Privacy Policy

Already have an account? Login

【Free PHILIPS RO Water Dispenser !】From now until 15 April 2024, New Cardholders who successfully apply for Standard Chartered Smart Card now via MoneySmart to get PHILIPS RO Water Dispenser ADD6910/90(value: HK$2,788) or $1,200 ParkNshop vouchers or $1,200 Apple store gift card !

Are all your details correct?

Standard Chartered Cathay Mastercard

【Free BRUNO Oval Hot Plate!】From now until 30 April 2024, new Cardholders who successfully apply for for Standard Chartered Cathy Mastercard now via MoneySmart to get BRUNO BOE053-BGY Oval hot plate (Value: $1,598) or $900 ParkNshop vouchers / $900 Apple store gift card / AirSim sim card with $900 value!

DBS Black World Mastercard

【 Quick! Apply Today for Exclusive HomePod mini! 】 From now until 30 April 2024, customers who successfully apply for DBS Blackworld Mastercard via MoneySmart, can enjoy a HomePod mini (retail price: HK$749) or HK$500 Apple Store Gift Card/ Klook Voucher/ PARKnSHOP Supermarket Voucher! You can also earn the bank welcome offer of up to 42,000 miles at the same time!

American Express Explorer® Credit Card

WeWa UnionPay Diamond Card

【MoneySmart Exclusive Offer】Want to get extra $300 vouchers from MoneySmart? From now until 14 April 2024, new customers who successfully applied for WeWa UnionPay Diamond Card via MoneySmart, can enjoy 3,000 SmartPoints without further spending! Use your SmartPoints to redeem vouchers of your choice worth HK$300 in the Rewards Store (over 20+ brand vouchers including Apple / Wellcome/ HKTVmall etc)!. Click here for more details. T&C applied. (fulfilled by MoneySmart)

【PrimeCredit x MoneySmart】From now until June 30 2024, s uccessfully applied WeWa UnionPay Diamond Card through MoneySmart and earn extra HK$200 cash rebate + Welcome offer: Delsey S-Series 30 inch Front Loader Expandable Suitcase or Panasonic nanoe® Hair Dryer (EH-NA9K) or HK$500 Cash Rebate or up to HK$90,000 Interest-free and Handling Fee-free Cash Instalment Program or Tertiary Student: HK$400 Klook e-Gift Card (Extra reward will be fulfilled by PrimeCredit)

AEON CARD WAKUWAKU

【Limited Time Offer】From now until 30 April 2024, apply for the AEON CARD WAKUWAKU through MoneySmart, you can exclusively enjoy extra 3,000 SmartPoints and free to redeem HK$300 vouchers (over 20+ brand vouchers including Apple / Wellcome/ HKTVmall etc). Alternatively, you can convert them into HK$200 cash and cash out directly! Click here to explore limitless possibilities (T&C applied)!

New AEON Customers successfully applied AEON CARD WAKUWAKU through “AEON HK” Mobile App and input the welcome offer code “MSWAKU” to enjoy an extra HK$200 cash rebate (Offer by AEON) and up to 16% cash rebate + HK$400 cash rebate ! Enjoy a 6% cash rebate on online spending ! Earn 3% cash rebate on purchases in Japan and enjoy waived transaction fees on foreign currency transactions (except charges imposed by Cards Associations)!

Standard Chartered Cathay Mastercard - Priority Banking

Fubon Visa Platinum Card

sim Credit Card

【🔓UNLOCK EPIC REWARDS: Earn a HomePod Mini or HK$500 Cash Coupon - Take your pick!】 From now until 30 April 2024, customers apply for a designated sim credit card through MoneySmart ( sim Credit Card/ sim World Mastercard®️) successfully to get a HomePod mini (Retail Price: HK$749) or HK$500 Apple Store Gift Card/ PARKnSHOP Voucher/ HKTVmall E-vouchers! Including the sim welcome offer of HK$500, you can enjoy up to HK$1,249 rewards in total!

💡Quick Reminder: Speed up your approval process - After completing your online application, please screenshot your reference ID (which should be 88-XXXXXXXXX-X-03XX-thesim) , and conduct digital ID verification on the sim Credit Card App. Complete the verification within 3 hours after application, and sim will offer an additional HK$50 cash rebate!

Standard Chartered Cathay Mastercard - Priority Private

CNCBI GBA Dual Currency Credit Card

Citi Prestige Card

-minv1-min.jpg)

DBS LIVE FRESH

From now until 30 April 2024, apply for designated cards through MoneySmart( DBS Eminent Card/ DBS Live Fresh/ DBS Compass Visa)successfully to get HK$200 Apple Store Gift Card or HK$200 Klook Voucher or HK$200 ParknShop Voucher!

Citi The Club

Wewa unionpay diamond card (applicable to designated full-time university /tertiary students).

AEON UnionPay Credit Card

Citi PremierMiles Card

The Platinum Card

(1) (1) (1).jpeg)

American Express Gold Business Card

CNCBI Motion Credit Card

Disclaimer: At MoneySmart.hk, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. For any discrepancy in product information, please refer to the financial institution’s website for the most updated version. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

Best Travel / Overseas Spending Credit Cards in Hong Kong 2023

Foreign transaction fee.

Credit cardholders will be charged foreign transaction fees for transactions made in foreign countries during your travel and through online shopping. The charge ranges from 1-2%, depending on the card issuer. JCB charges 1-1.95%, American Express charges 2% while Visa/ Mastercard issued by local banks charge 1.95% for each foreign transaction.

While most of the Union Pay credit cards (excluding Hang Seng and HSBC) exempt cardholders from overseas charges, the exchange rate is usually higher than Visa/ Mastercard. Moreover, the rewards of Visa/Mastercard are often more attractive. Therefore, when deciding which credit card to use during your travel, it is not wise to only consider the transaction fee. It is best to consider all factors including transaction fee, exchange rate, card rebate, etc. to be smart with money.

Credit Card Overseas Charges- DCC Markup Fee

Credit card overseas charges do not only apply to foreign transactions made in foreign countries while travelling, and it also applies to transactions made online from your home country where the vendor is in an oversea country. Very often, merchants will provide you with the option to either pay in local currency or Hong Kong currency. If you decide to pay in Hong Kong currency, you will be charged at least a 4% DCC markup fee (Dynamic Currency Conversion (DCC) Service Charges). To avoid that, you should always pay in local currencies wherever possible.

Credit Card Travel Promotions

Hang Seng Credit Card

From now until 31 December 2022, spend HK$5,000 or above with the registered Hang Seng Credit Card including Hang Seng Visa Infinite Card / Hang Seng Prestige World to enjoy up to 6% Cash Dollars rebate.

BOC Credit Card

With BOC Travel Rewards Visa Signature Card, you can enjoy up to 8% rebate for overseas spending throughout the year, and a maximum of HK$500 cash rebate per month.

Things you need to know about credit cards for foreign transactions

Location limits, unionpay may not be the best option.

Travel/ Overseas Spending Credit Cards Frequently Asked Questions

Are there any charges using unionpay credit cards overseas, what currency should i use in foreign transactions, do cardholders get the exchange rate on the day of spending, what do cardholders need to pay attention to on overseas spending.

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

- HSBC EveryMile Credit Card

Limited-time offer – get up to $1,300 RewardCash (or 26,000 miles) when you apply for an HSBC EveryMile Credit Card. T&Cs apply.

Earn miles faster and spend them the way you want.

Earn unlimited miles at a rate as low as HKD2 = 1 mile, and enjoy a wide range of complimentary travel perks.

- A total of up to $1,300 RewardCash (or 26,000 miles) when you apply on or before 30 April 2024 [@cards-welcomeoffer],[@cards-mtr-visa-2024-offer],[@cards-cash-instalment-200rc-offer]

- Earn miles at a rate as low as HKD0.4 = 1 mile[@cards-milescalculation]

- Extra $200 RewardCash for new credit card customers who successfully apply for a Cash Instalment Plan[@cards-cash-instalment-200rc-offer]

- Enjoy an "Interest-free Payment Holiday" for the first two months[@cards-em-payment-holiday-offer]

- First year annual fee waiver[@cards-annualfeewaiver]

Limited-time offer of up to $1,300 RewardCash

New credit card customers may enjoy a limited time welcome offer of up to $1,300 RewardCash upon successful application of an HSBC Visa Credit Card by 30 April 2024 and using the card to take an MTR ride.[@cards-welcomeoffer],[@cards-mtr-visa-2024-offer],[@cards-cash-instalment-200rc-offer]

Earn and enjoy rewards, no matter where you are

Make your spending go the extra mile

Shop and spend towards your next trip

Flexible RewardCash conversion[@cards-everymilerewardplus]

Enjoy these exclusive benefits, travel benefits.

- Enjoy up to 15% off when you book a hotel anywhere in the world through Agoda[@cards-agodatandc]. Learn more about the offer on Agoda's website .

- Enjoy HKD300 in spending rebate when you spend HKD5,000 or more in a single transaction on the Cathay Pacific app via Apple Pay[@cards-cathayspendrebate] . T&Cs apply .

- Treat yourself with up to 6 complimentary visits to the Plaza Premium Airport Lounge or free meals at selected airport dining outlets in Hong Kong and overseas per promotion period[@cards-everymiletandc], [@cards-loungelocations]. T&Cs apply . See full list of lounges and dining outlets (PDF)

Insurance and concierge benefits

Protect yourself and accompanying family members with our complimentary multi-trip travel insurance[@cards-everymiletandc],[@cards-axaunderwriting], which also covers your mobile phone and any trip cancellations.

For queries, please call AXA's dedicated customer service hotline at (852) 2894 4680 . Read the policy factsheet (PDF) to learn more.

- Get the support you need no matter where you are, with a dedicated 24/7 Visa concierge hotline[@cards-visaconcierge].

Additional benefits you can enjoy

- Activate your virtual card once your application has been approved Once your application has been approved, you can activate your virtual card and add it to your mobile wallets. Start shopping online and making mobile payments with your card right away for a faster, hassle-free experience!

Things you should know

Eligibility.

An annual income of HKD240,000 or above

Important information

- HSBC EveryMile Credit Card welcome pack (PDF) HSBC EveryMile Credit Card welcome pack (PDF) Download

- Welcome offers terms and conditions (PDF) Welcome offers terms and conditions (PDF) Download

- Terms and conditions for the credit card interest-free merchant instalment plan applicable to personal credit card cardholders (PDF) Terms and conditions for the credit card interest-free merchant instalment plan applicable to personal credit card cardholders (PDF) Download

- HSBC Credit Card Terms (PDF) HSBC Credit Card Terms (PDF) Download

- Key facts statement (PDF) Key facts statement (PDF) Download

- Credit card fees and charges Credit card fees and charges Modal

- Bank tariff guide for HSBC Retail Banking and Wealth Management customers Bank tariff guide for HSBC Retail Banking and Wealth Management customers Modal

- Notes about over-the-limit facility arrangement Notes about over-the-limit facility arrangement Modal

- Chip card information Chip card information Modal

Apply online now

With hsbc personal internet banking, without hsbc personal internet banking, new to hsbc.

View our Credit Card Key Facts Statement .

Frequently asked questions

Will i still earn rewardcash when i pay my bills online .

Yes, you will earn $1 RewardCash for every HKD250 you pay towards your bills online using any of the following cards:

- HSBC Premier Credit Card

- HSBC Visa Signature Card

- HSBC Red Credit Card

- HSBC Visa Platinum Card

- HSBC Pulse UnionPay Dual Currency Diamond Card

You'll be awarded RewardCash only for the first HKD10,000 in eligible online bill payments made using an eligible credit card in each monthly statement cycle.

Please note that you won't earn any RewardCash for payments to the Inland Revenue Department, or for policy loan repayments to insurance companies made with any credit card.

Can I redeem RewardCash in online banking?

Yes, you can redeem RewardCash in HSBC Online Banking. But if you hold an HSBC EveryMile Credit Card, please note that you can only make redemptions on the HSBC Reward+ app.

Can I add an additional cardholder to my credit card?

Yes, you can add an additional cardholder to any HSBC credit card you hold unless it's an HSBC EveryMile Credit Card or an HSBC Visa Gold Card for students.

Which frequent flyer and hotel loyalty programmes can I convert my RewardCash into miles or points for?

Frequent flyer programmes

- Asia Miles™

- British Airways Executive Club Avios*

- Etihad Guest

- Emirates Skywards

- Finnair Plus

- Flying Blue

- Infinity MileageLands*

- Turkish Airlines Miles&Smiles

- Qantas Frequent Flyer

- Qatar Airways Privilege Club*

- Singapore Airlines KrisFlyer*

Hotel loyalty programmes

- ALL - Accor Live Limitless*

- IHG® Rewards

- Marriott Bonvoy™

Note: This list may be updated from time to time without prior notice. Conversion is instant for all programmes except those marked with an *, which may take up to 2 weeks.

Where can I upload supporting documents for my credit card application?

If you've already submitted your application for a credit card, you can upload the supporting documents for it via our online form .

- Other frequently asked questions

Get more from your card

Using your credit card , red hot offers red hot offers this link will open in a new window, red hot rewards , year-round offers year-round offers this link will open in a new window, remarks .

- To borrow or not to borrow? Borrow only if you can repay! T&Cs apply.

Top 6 Credit Cards in Hong Kong with Great Travel Rewards

Best travel credit cards in hong kong 2017.

Advertisement

Everyone loves to travel, but the expense that comes with it is something that stays in your mind while travelling, which can ruin the point of travelling. Luckily, credit card companies offer a variety of rewards and perks for travelling! Listed below are the greatest credit cards with the most rewards to offer.

1. Bank of East Asia Visa Signature Card

The ultimate card that spoils you with hotel and dining privileges as well as bonus points for shopping overseas, the Asia Visa signature card provides an enticing deal for the shopaholic!

- Annual fee waiver

- Visa payWave function

- Up to 20% off at luxury hotels

- Up to 35% off on limousine service

- Buy 1 Get 1 on selected restaurants

- Unlimited 6X bonus points in dining outlets in Hong Kong

- Unlimited 4X bonus points for overseas spending

- Free 7-day family travel insurance

- Convert bonus points for travel cash

- Luxury hotel privileges

- 10% off on movie tickets

- Year-round enterrtainment & merchant offers

2. CitiBank PremierMiles Card

Those who are aim for leisure and not for business trips may want to consider the PremierMiles card as its mission is to make travelling easier for you with its benefits and welcome gift offers.

Welcome gift offer of two options:

- American Tourister Bon Air (Retail Price of HK$1,659)

- 216,000 points redeemable for 2 sets of round-trip ticket to Taipei

- HK$4 = 1 Mile for overseas spending

- HK$8 = 1 Mile for local spending

- 1% Rebate local spending

- 2% Rebate Overseas spending

- Free travel insurance

- Complimentary access to Hong Kong International Airport Plaza Premium up to 4 times in a year

- Asia miles on both overseas and local transactions

- Annual fee waiver for minimum of $100,000 annual spending

3. CitiBank Prestige Card

From VIP access to airport lounges worldwide, to premium 24-hour concierge services, and from mile rates to relationship points, you get more rewards the longer you do business with CitiBank.

Welcome offer:

- 180,000 points (15,000 miles) upon payment of annual fee of HK$2,500

- HK$4 = 12 points (1 mile) on overseas spending

- Up to 30% extra Annual relationship points

- HK$6 = 12 points (1 mile) on local spending

- Priority Pass – access to airport lounges

- Complimentary 4 th night at any hotel

- Complimentary travel insurance

- Extended warranty insurance

4. Bank of China Visa Infinite Card

For the luxurious money-makers out there, this card showers you with premium services as well as extra gift points when you spend on overseas transactions.

- 6X Reward gift points (HK$2.5 = 1mile) for dining and overseas spending

- 48% off on airport limousine pick up service

- 24-hour concierge service

- Priority Pass – Access to airport lounges worldwide

- Complimentary travel insurance for up to $1,000,000

- Gift points reward program (HK$1 = 1 point)

- 56-day interest-free payment period

5. Standard Chartered Asia Miles Credit Card

The go-to card for any traveler wanting to rack up those Asia miles, your air miles can also be converted to other rewards!

- 30,000 Asia miles for spending HK$37,500

- HK$4 = 1 Asia Mile for dining, online and overseas transactions

- HK$6 = 1 Asia Mile for local transactions

- Additional HK$2 = 1 Asia mile for dining at select restaurants by Asia Miles

- 10% rebate for tax refund valued at $325 or above

6. Bank of China Commercial Card

The BoC Commercial card works great as a companion for your business if you often travel to different countries and regions.

- Premium airport lounge service

- Gift points you can convert for mileage (Asia Miles, PhoenixMIles, Eastern Miles, Sky Pearl Club)

- Instant Rewards – Redeem HK$1 cash discount for every 250 gift points

- Visa commercial offers

- Visa airport to limousine program

Final Thoughts

Travelling doesn’t have to put a lot of expenses on your back when you have all these great credit cards that offer cashbacks, discounts, and extra air mileage for your spending pleasure. Are there other credit cards that offer travel perks? Let us know your thoughts in the comment section!

© Copyright Cardable 2017. All Rights reserved

As a Mastercard credit cardholder, you will not be held responsible for unauthorized transactions if you have exercised reasonable care in safeguarding your card from loss or theft and you promptly reported any loss or theft of your card to your issuer. If these conditions are not met and you suspect that you have an unauthorized transaction on your Mastercard, contact your bank as other additional protections may apply.

- Product/Services

BOC Travel Rewards Visa Signature Card

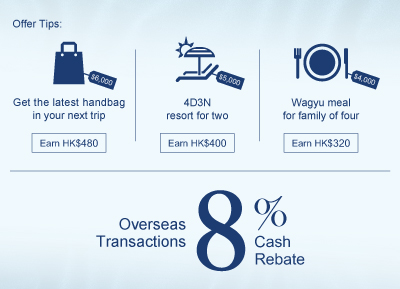

8% year-round cash rebate on overseas transactions.

Enjoy 8% cash rebate on overseas transactions! No registration is required.

Remark: Each overseas retail transaction of HK$500 or above is entitled to 8% cash rebate when the accumulated overseas transaction amount reaches HK$6,000 in any one month, plus three or more local retail transactions conducted in the same month. Each Applicant's Card account (main card and additional card combined in the calculation) is eligible for a maximum of HK$500 cash rebate in each month.

Terms and conditions of "8% Year-Round Cash Rebate on Overseas Retail Transactions"

Additional Benefits for BOC Travel Rewards Visa Signatrure Card Cardholders

- Card Faces to Choose From

BOC Travel Rewards Visa Signature Card offers a choice of either red or blue card face for your selection.

- Visa Personal Concierge Service #

Just simply make a phone call or browse the web page in anywhere of the world, the card offers concierge service to help you with your lifestyle needs. Services provided include: assistance on trip planning, flight and hotel reservations, restaurant reservations, car rental, performance ticket booking, etc.

# For details, please visit www.visa.com.hk. The offer is provided by Visa and subject to related Terms and Conditions.

BOC Credit Card (International) Ltd (the "Company") accepts no liability for the quality of or any other matters relating to the products and services provided by Visa and the merchants. The merchants are solely responsible for all obligations and liabilities relating to the products and services on offer. The Company, Visa and the merchants reserve the right to suspend, change, or terminate the offers or amend the offer terms and conditions at their sole discretion without prior notice. All matters and disputes will be subject to the final decision of the Company, Visa and the merchants.

Other Privileges

- Annual Fee Offer Perpetual annual fee waiver for both main cards and additional cards

- Convenient and Flexible Repayment The 56-day interest-free payment period The availability of different settlement channels all makes it even more convenient and flexible

- "SMS" Alert Service Whenever you use your BOC Card, our alert system will evaluate the transaction. SMS will be sent to your registered mobile phone if deemed appropriate so as to best protect you against any type of card abuse. If you cannot recognize the transaction as your own, please immediately call our 24-hour Customer Services Hotline: (852) 2581 5188.

- Rewards Whenever You Spend You can earn 1 Gift Point upon HK$1/ RMB¥1 spending with your card. You can choose whatever you love from a variety of rewards. Please click here for more details.

For details, please call our 24-hour Customer Services Hotline (852) 2581 5188

Reminder: To borrow or not to borrow? Borrow only if you can repay!

- The above products, services and offers are subject to the relevant terms.

- The Company reserves the right to amend, suspend or terminate the above products, services and offers, and to amend the relevant terms at any time at its sole discretion.

- In case of any dispute, the decision of the Company shall be final.

- Should there be any discrepancy between the English and Chinese versions of this promotion material, the Chinese version shall prevail.

- Online Enquiry

- Branch Locator

From Hong Kong to Singapore: Incorporation Services with Spring Discounts! Explore Today!

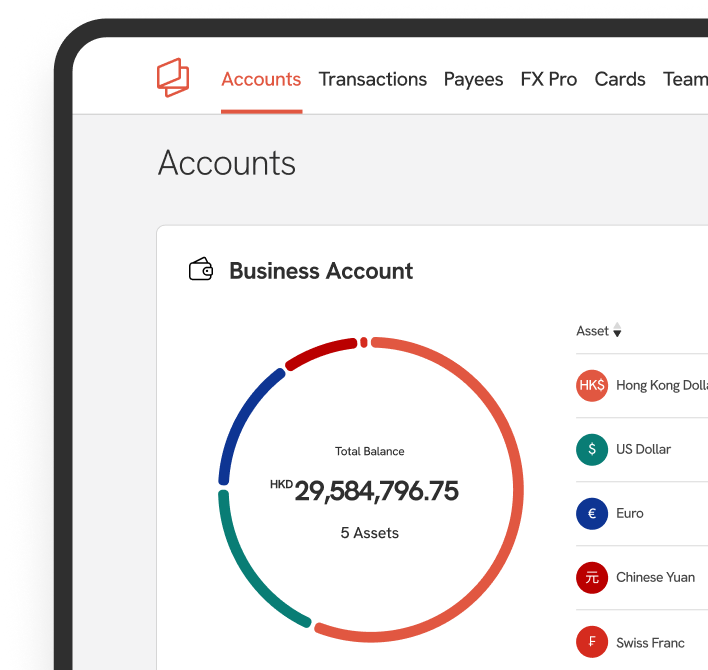

Hong Kong Business Account

International and local payments

Payment Cards

Foreign Exchange

Get rewarded

Business Guides

Business Account Reviews

Comparisons

Company Secretary Reviews

Whitepapers & E-Books

Industry Newsletters

PayPal Fee Calculator

Stripe Fee Calculator

Invoice Generator

About Statrys

Customer reviews

Partner Programs

5 Best Credit Cards in Hong Kong [2024]

4 minute read

5 Best Credit Cards in Hong Kong

In Hong Kong (and elsewhere), a credit card means more than a tap-to-pay; it is a powerful tool to maximise savings and earn rewards.

No wonder that credit card is one of the primary payment methods for Hong Kong residents' everyday spending and dominates more than half of the in-store payment market in Hong Kong.

But not all credit cards are created equal. Some offer better benefits than others, depending on how you use them and what you spend on. That's why it's essential to compare.

Be at ease. We've done all the research for you! Here are the five best credit cards in Hong Kong for 2023 and what to consider before choosing one.

Credit cards are widely accepted as a payment method throughout Hong Kong, providing a convenient and reliable payment option. Nowadays, all my cards are on my Apple Pay, making payment super easy.

Key Things to Consider When Choosing Credit Cards

Before we see the list, we need to know what to look for. Here are important factors to consider.

Spending Preferences

What and where you spend will determine the best credit card fit. Say you fly a lot, get a card with air miles, hotel spending discounts, and longue access. If you're a committed online shopper, get a card with a generous cashback.

Rewards Programs

A close look at the reward program will show how well the offer facilitates your lifestyle.

Common credit card reward programs include:

- Air Travel Miles: A reward program where you earn points or miles for each travel-related eligible purchase. You can redeem these points for discounted flights, hotel stays, airport lounge access, baggage fee waivers, and other travel perks.

- Cashback: Cashback is a program that gives a percentage of your spending back through statement credits, direct deposits, redeemable points, and more. Some cards offer a flat rate on all purchases, while others provide higher rates for specific categories.

- Discounts/ Gift cards: Earn points for eligible spending and redeem them for discounts and gift cards at retail, restaurant, and entertainment sites. Some cards may provide bonus points and exclusive deals at participating merchants.

Annual Fees

Annual fees are fees paid each year to keep the credit card active. They vary depending on the card's tier and benefits.

Consider comparing whether a card's benefits are worth the fee by taking your preferences into account.

For instance, a card with a high annual fee might not be the best choice if you're primarily interested only in cashback, as it often comes in a small percentage.

On the other hand, if you use a lot of travel perks, such as airport lounge access and travel insurance, a card with a reasonable or even higher fee could still be a good deal.

Moreover, when handling annual fees, the key is to leverage the card's benefits to ensure that the value you gain exceeds the fee.

Some cards offer a waived annual fee for the first year or even for life. If you've been a loyal customer, consider contacting your bank to request a waiver of annual fees.

💡Tip: A survey indicates that 70% of credit card annual fee waiver requests are successful.

Interest Rate

The interest rate is the interest you must pay if you don't clear your complete statement by the due date.

The rate is usually expressed as the total yearly cost of borrowing, called an annual percentage rate or APR . The lower the APR, the better, which means less interest over time.

The due date is typically within 50 to 60 days.

Evaluating the interest rate is vital because it directly affects the cost of carrying a balance on the card, and high rates can hinder financial stability. We recommend prioritising low-interest rates.

📌 Note: It's best to pay full balances on time for a healthy credit profile, but if in debt, it’s worth negotiating with the credit card issuer for a possible reduction.

Ease of Use

Look for broad acceptance, a simple application process, an easy redemption process, a user-friendly app or web interface, a digital wallet, and helpful customer service.

After all, ease of use means convenient purchases, timely payments, and hassle-free benefits enjoyment.

A factor that influences my decision now is the convenience of the payment process. I own multiple cards from different banks — some banks with a well-designed app and a user-friendly interface and others with a lagging technology. It's a little more frustrating opening the latter because the payment flow isn't as smooth.

Minimum Spending Requirement

The minimum spending requirement is the amount you must spend using your credit card to enjoy certain rewards or to waive specific fees.

Choosing a credit card with a minimum spending requirement higher than your usual expenses may lead to overspending and debt. Conversely, a lower minimum limit the rewards you can get compared to cards with higher spending thresholds.

To avoid these pitfalls, pick one that suits your budget, and find ways to meet the minimum spending without overspending, such as paying utilities, buying gift cards for future use, planning ahead for big purchases, or covering large expenses for friends/family and getting reimbursed.

Annual Income

Annual income is the amount earned in a year and is a standard requirement for a credit card application.

Applying without meeting income requirements will lead to rejection. While getting rejected does not directly lower your credit score in the long run, hard inquiries during the application process can stay up to two years and can impact your score for a few months.

❗ Caution : Providing false information in credit card applications is illegal.

Taking these factors into account should lead you to the best credit card. And to help you navigate the sea of options, here are our top picks and what they offer.

🔎 Note: All information provided below is dated 19 July 2023 and may have been updated since. Please check each credit card provider's website for the latest information.

1. HSBC Red Credit Card

Best feature : Cashback rewards program, no annual fee

The Hong Kong and Shanghai Banking Corporation, commonly known as HSBC, is the largest bank in Hong Kong and the 2nd strongest bank in Asia Pacific , according to The Asian Banker.

This prominent bank offers a variety of credit cards, with one of the best being the HSBC Red Credit Card.

The HSBC Red Credit card provides various rewards and benefits for shopping, dining, supermarkets, local and overseas spending, instalment plans, virtual cards, digital wallets, and an annual fee waiver.

Let's break down the key benefits, interest rates, and requirements.

HSBC Red Credit Card's Key Benefits

- Up to 4% cash rebate for the first HKD 12,500 spent online, followed by a 1% cash rebate for any additional online spending

- 2% cash rebate for local supermarket

- 1% cash rebate for local and abroad spending

- Up to 500 RewardCash as a welcome offer

- New customers signing up for a Cash Instalment Plan with their credit card can receive up to 200 RewardCash.

- RewardCash is yours to share with family and friends.

- Other time-limited bonus

- Perpetual annual fee waiver

HSBC Red Credit Card Annualised Percentage Rate

- 35.42% APR for purchases

- 35.94% APR for cash advance

- Interest-free period up to 56 days

HSBC Red Credit Card Eligibility

- At least 18 years old

- An annual income of HKD 120,000 or above

🔎 Learn more about HSBC credit cards: HSBC Credit Card Key Facts Statement HSBC Credit Card Terms HSBC Credit Card Fee and Charges

2. Chartered Cathay Mastercard®

Best feature : Travel miles reward program

Standard Chartered Bank Hong Kong is a part of the British multinational Standard Chartered PLC. It has an established presence in Hong Kong, having acquired licenses, and has been operating since 2004.

The Chartered Cathay Mastercard offers a unique travel miles reward program, allowing you to earn miles through their banking services. The card comes in three tiers, each offering more welcome miles, lounge access benefits, and priority check-in as you move up the tiers.

The followings are the top deals, interest rates, and requirements.

Chartered Cathay Mastercard Key Benefits

- Exclusive offer up to 60,000 - 100,000 welcome miles

- Earn Miles through banking

- 1 Asia Mile per HKD 2- HKD 6 eligible spending

- 3 Asia Miles per HKD 4 spending at partner restaurants

- Complimentary lounge access

- Discounts on partner hotel bookings

- Annual fee waived for the first year, and an HKD 2,000 (or more, depending on your card tier) annual fee for the following years.

Chartered Cathay Mastercard Annualised Percentage Rate

- 35.70% APR for retail purchases

- 35.93% APR for cash advance

Chartered Cathay Mastercard Eligibility

- Hong Kong resident

- A minimum annual income of HKD 96,000 or above

🔎 Learn more about Chartered Cathay Mastercard Chartered Cathay Mastercard Key Facts Statement

3. Citi Prestige Card

Best feature : Generous reward program

Citi holds a prominent reputation as a global financial services provider and stands among the most significant foreign financial institutions in Hong Kong.

Their "Citi Prestige Card" credit card offers year-round dining privileges featuring exquisite MICHELIN dining, travel insurance, lounge access, quick cash availability, a "PayLite" pay-in-installment program for big purchases, and promotional services at Hong Kong International Airport.

Moreover, cardholders can take advantage of the convenient Citi Mobile App, serving as a digital banking platform and a points balance monitor.

Here's a breakdown of the major benefits, interest rates, and requirements.

Citi Prestige Card's Key Benefits

- 1 Mile per HKD 4 of eligible overseas spending

- 1 Mile per HKD 6 of eligible local spending

- Thank You Gift up to 20,000 Miles yearly

- Annual Relationship Points up to 30%

- Enjoy a welcome offer of up to 2 business class round trips to Europe* (3,120,000 points) and HKD 25,500 in cash rebate

- Complimentary fourth-night stay

- Access to over 1,300 airport lounges worldwide

- Over 800 offers on retail, spa, dining, and shopping

- Annual fee of HKD 3,800

Citi Prestige Card Annualised Percentage Rate

- 34.28% APR for retail purchase

- 35.81% APR for cash advance

- Interest-free period up to 58 days

Citi Prestige Card Eligibility

- A minimum annual income of HKD 600,000 or above

🔎 Learn more about Citi Prestige Card Citi Prestige Card Key Facts Statement Citi Prestige Card Welcome Offer Terms and Conditions

4. Hang Seng enJoy Card

Best feature : A shopping reward program

Hang Seng Bank, a renowned Hong Kong-based financial institution, offers the enJoy Card in collaboration with the Yuu Reward Club , a favorite among young Hong Kongers for its attractive rewards program compatible with Hong Kong Maxim's Group, one of the leading Asia food and beverage companies.

Their primary perks, rates, and criteria include

Hang Seng enJoy Card's Key Benefits

- Up to 120,000 Points as a welcome offer

- 2x - 4x points and up to 2% cash rebate on eligible local spending, offline and online

- 1 point per HKD 1 on other retail spending

- Exclusive discount at 2,000+ enJoy Card Designated Merchant outlets, such as restaurants, online shops, and IKEA

- All-in-one Yuu reward app, a centralized platform for all earning and redeeming activities.

- Mobile payments, Apple Pay, Google Pay™, and Samsung Pay.

- Annual fee of HKD 1,500 for principal card and HKD 750 for supplementary card

Hang Seng enJoy Card Annualized Percentage Rate

- 35.72% APR for retail purchase

- 35.98% APR for cash advance

- Interest-free period up to 56 days

Hang Seng enJoy Card Eligibility

- Hong Kong residents

- Minimum annual income of HKD 150,000 or above (Except Full-time University/Tertiary Students).

🔎 Learn more about Hang Seng enJoy Card Hang Seng enJoy Card Term and Condition (Key Fact Statement included inside)

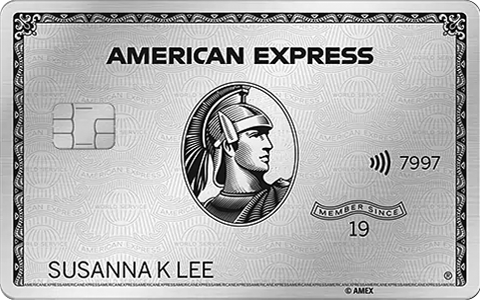

5. American Express Platinum Card

Best feature : A turbo reward program

Lastly, the list concludes with the global card provider, American Express, also known as Amex. This is another card that can help you save a good deal on hotel expenses, high-end stores, and restaurant spending.

American Express Platinum Card is one of its popular products, covering air miles, room nights, movie privileges, a year-round Expedia Hong Kong offer, cash vouchers, dining savings at designated Cafe Deco and Maxim's Chinese Cuisine Group, shopping protection, and more.

Here is a closer look at the primary benefits, interest rates, and qualifications.

American Express Platinum Card's Key Benefits

- Welcome offer up to HKD 2,960

- 1 Air Mile per HKD 5

- Up to 3 points per HKD 1

- Up to 50% savings at partner restaurants

- 2X points when spent at partner supermarkets, gas stations, and more

- 6 membership reward points for every HKD 1 spent, equivalent to a cashback of up to 2%

- Year-round 8% savings on selected hotel booking at designated Expedia website

- Broadway Circuit Movie Privileges

- 3% savings on Citi Super's restaurants, supermarkets, and lifestyle stores.

- Shopping protection

- Annual Fee of HKD 2,200

American Express Platinum Card Annualised Percentage Rate

- 35.96% APR for retail purchase

- APR for cash advance is not applicable.

American Express Platinum Card Eligibility

- Hong Kong or Macau resident or citizen

- An annual income of HKD 300,000 or above

🔎 Learn more about American Express Platinum Card American Express Card Term and Condition (Key Fact Statement included inside)

Final Thoughts

To get the most out of your credit card rewards, examine the full terms and conditions, diversify the cards you use for different purposes, keep an eye on bonus caps and limits to maximise your benefits, and redeem them before expiration.

A good credit score is key at the end of the day, so always pay your bills on time and in full.

And if you are looking for an alternative payment method in Hong Kong for your business, virtual cards, and Neobank 's payment card can be another great option.

Statrys Prepaid Mastercard® for business offers

- HKD denominated card

- Payment in any currency (This card is denominated in HKD but can be used to make payments in any currency. However, please note that conversion fees will apply.)

- Physical and virtual card

- Point-of-sale purchases

- Live transaction

- Spending analytic

- Excellent customer support

Open a Business Account

No minimum deposit. No maximum transaction. Support from an account manager.

What's the best credit card to get?

There is no definite answer, as the best credit card will depend on your lifestyle. However, some general factors that you may want to look for are: • Wide acceptance and compatibility • Low annual fees or fee waivers • High rewards or cashback rates • Low APR

Which credit card is number 1?

There is no conclusive answer to which card is number 1, as the best credit card will depend on your need. For example, HSBC Red Credit Card and Hang Seng enJoy Card are best for shopping rewards. In contrast, Standard Chartered Cathay Mastercard®, American Express Platinum Card, and Citi Prestige Card are best for travel rewards.

What credit card is used in Hong Kong?

Five major credit card issuers in Hong Kong are Visa, Mastercard®, American Express, UnionPay, and JCB. Visa and Mastercard® have the largest market share, followed by American Express, UnionPay, and JCB.

What type of credit card is most widely accepted?

The most widely accepted credit cards are Visa and Mastercard®. They are commonly compatible with various merchants, ATMs, online platforms, and digital wallets in Hong Kong and worldwide.

In this article

Related articles

How to Open a Bank Account in Hong Kong [2024 Guide]

Banking Insights

What Is a Virtual Bank Account? How It Works & Benefits

8 Virtual Banks in Hong Kong: How Do They Compare?

5 Best Debit Cards in Hong Kong [2024]

Browse Banking Insights

Looking for a business account.

100% online application

No account opening fee, no initial deposit

Physical and virtual cards

Best Credit Cards & Banks with Airport Lounge Access (Hong Kong)

Looking for a little luxury during your travels through Hong Kong? Escape the airport crowds and experience the comfort of airport lounges with the help of credit cards and banks. Enjoy a range of features and benefits as many offers complimentary lounge visits, access to the Priority Pass network, and rewards programs to help enhance your journey.

Discover the different lounge programs available, including Priority Pass, Plaza Premium, Lounge Key, and Cathay Pacific Lounges. We’ll explore the unique amenities and eligibility criteria for each to ensure you find the perfect fit for your travel style and needs. Upgrade your airport experience with the best credit card or bank for you, and enjoy a little extra luxury on your travels through Hong Kong .

1. Citi Prestige Card

Why We Like It The Citi Prestige Card is one of the best travel credit cards in Hong Kong that offers a range of travel benefits and rewards. With this card, you can enjoy unlimited access to over 1,000 Priority Pass airport lounges worldwide. Additionally, you can earn reward points for every HKD 1 spent, which can be redeemed for travel, shopping, and dining. Below we have discussed many other benefits that come with this card, which would definitely help you make the right choice.

• Intro Offer: New customers can earn up to 120,000 reward points as a welcome gift upon card activation.

• Annual Fee: The annual fee for the Citi Prestige Card is HKD 3,800.

• Lounge Access Details: With the Citi Prestige Card, you can enjoy unlimited access to over 1,000 Priority Pass airport lounges worldwide. You can also bring one guest with you free of charge.

Get Citi Prestige Card Now!

2. american express explorer® credit card.

Why We Like It The American Express Explorer Credit Card offers a generous welcome bonus, travel credits, and travel insurance, making it an excellent choice for frequent travelers. It also offers access to the Global Lounge Collection program, providing cardholders with access to over 1,200 airport lounges worldwide.

• Intro Offer: The card offers a welcome bonus of up to 200,000 Membership Rewards points for new cardholders who meet the spending requirements.

• Annual Fee: HKD 2,800 per year

• Lounge Access Details: Cardholders can enjoy unlimited access to the American Express Global Lounge Collection program, which includes over 1,200 airport lounges worldwide, including Centurion Lounges, Plaza Premium Lounges, and Delta Sky Clubs.

Get American Express Explorer® Credit Card Now!

3. the platinum card®.

Why We Like It The Platinum Card is one of the most premium credit cards in Hong Kong, offering a range of exclusive travel benefits and rewards. Cardholders can earn Membership Rewards points on their spending, which can be redeemed for flights, hotel stays, and more. The card also offers comprehensive travel insurance and global concierge services, making it a great choice for frequent travelers.

• Intro Offer: New cardholders can earn up to 50,000 Membership Rewards points when they spend HK$15,000 within the first 3 months of card membership.

• Annual Fee: HK$7,800

• Lounge Access Details: Cardholders can enjoy unlimited access to over 1,000 airport lounges worldwide, including Priority Pass lounges, Centurion Lounges, and Delta Sky Clubs. They can also bring a guest with them for free.

Get The Platinum Card® Now!

4. hsbc everymile credit card.

Why We Like It With the HSBC EveryMile Credit Card, you can earn reward points on every transaction and redeem them for airline tickets, hotel stays, and more. Plus, the card offers complimentary travel insurance, airport lounge access, and discounts on dining, shopping, and entertainment.

• Intro Offer: New cardholders can enjoy welcome offers such as HKD 800 worth of spending rebate and extra 2,000 reward points.

• Annual Fee: The annual fee for the primary card is HKD 1,800.

• Lounge Access Details: The HSBC EveryMile Credit Card offers complimentary access to over 1,000 airport lounges worldwide through the LoungeKey program.

Get HSBC EveryMile Credit Card Now!

5. standard chartered cathay mastercard.

Why We Like It The Standard Chartered Cathay Mastercard is an excellent option for frequent travelers to Hong Kong, offering a range of travel benefits, including airport lounge access, priority check-in, and a wide range of travel insurance options. Cardholders can earn Asia Miles on all eligible spending, with accelerated earn rates for spending on Cathay Pacific flights and dining.

• Intro Offer: New cardholders can earn up to 60,000 Asia Miles by meeting specific spending requirements.

• Annual Fee: HKD 1,800

• Lounge Access Details: Cardholders receive complimentary access to over 1,000 Priority Pass airport lounges worldwide, including 5 visits per year for the primary cardholder and 2 visits per year for supplementary cardholders. Cardholders can also enjoy access to the Plaza Premium Lounge at Hong Kong International Airport.

Get Standard Chartered Cathay Mastercard Now!

Types of lounge programs in hong kong.

Priority Pass Priority Pass is a popular airport lounge access program that provides travelers with access to over 1,300 lounges in more than 600 cities worldwide. It offers access to independent lounges, as well as those run by airlines. Members of Priority Pass can enjoy various benefits such as comfortable seating, complimentary refreshments, and high-speed Wi-Fi. Priority Pass membership is available for purchase to anyone, regardless of their frequent flyer status or credit card membership.

Plaza Premium Plaza Premium is a global airport hospitality service provider that operates over 180 lounges in more than 50 airports worldwide. It offers lounge access to all travelers regardless of their airline or class of travel. Plaza Premium lounges are known for their stylish design, comfortable seating, and a wide range of amenities such as complimentary food and drinks, shower facilities, and business center services. Plaza Premium also offers additional services such as meet and greet, airport transfers, and spa services at selected locations.

LoungeKey LoungeKey is a lounge access program offered by Mastercard that provides cardholders with access to over 1,000 lounges in more than 130 countries. LoungeKey allows travelers to enjoy comfortable seating, complimentary refreshments, and high-speed Wi-Fi at participating lounges worldwide. Cardholders can also use their LoungeKey membership to purchase additional services such as spa treatments, meals, and shower facilities at selected locations. LoungeKey membership is available to Mastercard cardholders who have a valid credit, debit, or prepaid card.

Cathay Pacific Lounges (The Pier/The Wing) Cathay Pacific, the Hong Kong-based airline, operates several lounges in Hong Kong International Airport, including The Pier and The Wing. The lounges offer a wide range of amenities to travelers, including comfortable seating, complimentary food and drinks, high-speed Wi-Fi, and shower facilities. The lounges also provide a quiet and relaxing atmosphere for travelers to unwind before their flight. Access to the Cathay Pacific lounges is available to first and business class passengers, Marco Polo Club members, and oneworld frequent flyers with Emerald and Sapphire status.

Hong Kong Airport Lounge FAQ

Can I access China or Singaporean lounges with a Hong Kong credit card? It depends on the specific lounge program and credit card. Some lounge programs, such as Priority Pass, have lounges in China and Singapore that can be accessed with a Hong Kong credit card. However, it is important to check with the lounge program or credit card issuer to confirm which lounges can be accessed with the card. Additionally, some lounges may have specific entry requirements, such as a certain airline membership or class of service, so it is important to check these requirements before attempting to access the lounge.

Can I access other Asian countries lounges with a Hong Kong credit card? Yes, it is possible to access other Asian countries’ lounges with a Hong Kong credit card that offers lounge access benefits. However, the availability of lounges and access requirements may vary depending on the specific credit card and lounge program. It is recommended to check with the credit card provider or the lounge program for details on participating lounges and access policies.

Which Hong Kong credit card offers free lounge access? (i.e., no annual fee) There are very few credit cards in Hong Kong that offer free airport lounge access without an annual fee. However, some credit cards may offer limited complimentary lounge access or discounted lounge rates. Here are a few credit cards that offer free airport lounge access:

• Citibank Clear Card: Offers 2 complimentary lounge visits per year at Plaza Premium Lounges in Hong Kong International Airport. • Citibank Ultima Card: Offers unlimited access to Priority Pass lounges worldwide. • Standard Chartered Asia Miles Mastercard: Offers 2 complimentary visits per year to Plaza Premium Lounges in Hong Kong International Airport. • American Express Platinum Credit Card: Offers complimentary access to over 1,200 airport lounges worldwide through the Priority Pass program. • HSBC Visa Signature Card: Offers 1 complimentary access per year to designated Plaza Premium Lounges in Hong Kong International Airport.

Note that some credit cards may have certain conditions or restrictions that apply, so it is important to read the terms and conditions carefully before applying for a credit card.

Which Hong Kong banks offer airport lounge access? In Hong Kong, several banks offer airport lounge access as a benefit for their credit cardholders. These banks include:

• Citibank • HSBC • Standard Chartered Bank

It’s important to note that lounge access may vary depending on the specific credit card and the level of access it provides. Some credit cards may only provide access to certain lounges or have limited access, while others may provide unlimited access to a wider range of lounges. It’s best to check with the bank directly or review the credit card’s terms and conditions for more information on lounge access.

Conclusion In conclusion, airport lounge access is a highly sought-after feature for frequent flyers, providing a comfortable and convenient experience before boarding their flights. With the rise of premium credit cards, many banks and credit card issuers have started offering complimentary access to airport lounges, providing a competitive edge to their products.

While most of the credit cards require payment of annual fees, some cards offer lounge access with no annual fees, such as the HSBC Red Credit Card and Bank of China Travel Credit Card. It is important to note that the lounge access policies may vary depending on the credit card issuer and the lounge program. Before applying for a credit card, it is advisable to check the details of the lounge access program, including the eligible lounges, guest access, and any other fees or restrictions.

Overall, credit cards with airport lounge access provide a great value proposition for frequent travelers, offering an enhanced travel experience and added benefits such as travel insurance, rewards points, and other perks. It is worth considering these credit cards if you are a frequent traveler and want to make the most out of your airport experience .

Register your company in Hong Kong with our special Spring discounts!

Have any questions about your new company in Hong Kong?

Fill the form and we will reach out soon!

Your First Name

Your Last Name

Your phone number

Chat with us on WhatsApp

Scan the QR code or click the link below

Add us on Wechat!

Top 6 Credit Cards in Hong Kong: A 2024 Guide

Register your company with Air Corporate

Pay less, get more, enjoy a 10% off.

100% online and hassle-free

- Citi Prestige Card

- DBS Black World Mastercard

- HSBC Red Credit Card

- Standard Chartered Cathay Mastercard

- Hang Seng enJoy Card

- American Express® Platinum Credit Card

A credit card is an incredibly powerful tool. Not only does it help you pay for high-value purchases and build your credit history, but it also offers a variety of perks, such as reward points and airline miles.

Not all credit cards are created equal. They vary in terms of benefits, and their suitability depends on your spending habits and financial goals. Picking a credit card in Hong Kong is far from a straightforward task.

What to Consider Before Choosing a Credit Card

It is incredibly overwhelming to pick the right credit card, given the countless options available in the market.

Here are some key factors to help you choose the best credit card in HK that suits your financial needs:

Annual Percentage Rate

The APR on your credit card denotes the interest rate chargeable if you don't pay the full outstanding amount at the end of your credit cycle.

Some issuers offer promotional APR at 0% to attract new customers, and no interest is charged during the initial 12-21-month period. Once the promotional period is over, regular APR kicks in.

When choosing a credit card in HK , opt for an APR lower than the average credit card interest rate. Even though the Hong Kong Monetary Authority (HKMA) doesn't impose any interest rate restrictions on the card issuer, they cannot charge disproportionately high-interest rates.

The amount you pay to the card issuer every year to maintain your account is known as the annual fee.

A credit card with a higher annual fee usually entitles you to more perks and benefits. Similarly, cards with low or no annual fees typically offer fewer perks.

Credit Limit

Your credit limit is the maximum amount of money you can spend using your credit card. The card-issuing bank determines it based on a few factors, such as your monthly income, creditworthiness, employment status, and more.

The initial credit limit depends on your credit score and income. It can change subject to the issuer's discretion. Pay attention to the minimum limits when researching credit cards in Hong Kong, as the final limit is only disclosed once your application is approved.

Cash Advance Fees

Be aware of any fees associated with taking cash advances using your credit card. These fees can be a flat amount or a percentage of the amount advanced and are typically higher than the APR for purchases. Note that some credit cards charge foreign transaction fees for transactions made in a foreign currency.

Rewards Programs

Consider the credit card's rewards program. This could include a cash rebate, airline miles, points, travel insurance, or other benefits. Make sure to understand which are eligible transactions for earning rewards. Some cards may exclude certain categories or offer bonus points on specific purchases. Choose a program that aligns with your spending habits and goals.

Local and Overseas Spending

Consider how much you spend locally versus overseas. Some cards offer better rewards programs for specific types of spending, so choose a card that aligns with your spending habits.

Top 6 HK Credit Cards to Choose in 2024

Choosing the right credit card can make or break new credit card customers' financial journey.

Here’s a look at the top 6 credit cards in Hong Kong you can choose from:

1. Citi Prestige Card

Citibank credit cards can be good, but it depends on your spending habits and financial goals. An ultra-premium travel and lifestyle credit card, the Citi Prestige Card from Citibank has an excellent rewards program. For high-income credit card customers, this one is a top choice for all the perks it provides.

- Annual fee - HKD 3,800

- Annual Percentage Rate - 34.28%

- 58 days interest-free period

- Every HKD 6 spent locally earns you 1 airline mile

- Every HKD 4 overseas spending earns you 1 airline mile

To apply, you should:

- Be at least 18 years

- Have a minimum income of HKD 600,000

- “FlexiBill" installment program allows you to convert your bill into smaller payments

- Receive 20,000 Miles every year as a Thank You gift

- Get a free night stay when you book any hotel for a minimum of 4 consecutive nights

- High annual fees and minimum income requirement

- No travel insurance or purchase protection

2. DBS Black World Mastercard

DBS's Black World Mastercard is a great choice for those looking for a credit card that offers airline miles without any expiry date.

- Annual fee - waived for the first year, subsequently HKD 3,600

- Annual Percentage Rate - 34.58%

- 60 days interest-free period

- Every HKD 4 spent overseas earns you 1 airline mile

- Have a minimum income of HKD 240,000

- 45% off when you redeem the rewards for air tickets and hotel accommodations on iGO Rewards

- Welcome offer of up to 42,000 miles

- New customers get an extra 2,000 Miles for successful accumulation of Octopus Automatic Add-Value transactions totaling HKD1,000 or more

- High annual fees

- No travel insurance

3. HSBC Red Credit Card

If you enjoy shopping online or at local supermarkets, there’s probably no better card than HSBC Red Credit Card -- thanks to the generous rewards offered for every swipe. Issued by HSBC Bank, this one stands out for various reasons:

- Annual fee - Permanently waived

- Annual Percentage Rate - 35.42%

- 56 days interest-free period

- 4% RewardCash on your initial HKD 12,500 online spending and an ongoing 1% RewardCash for subsequent online expenditures every month

- 2% RewardCash for local supermarket spending

- be at least 18 years

- have a minimum income of HKD 120,000

- You can share the RewardCash with family and friends

- Earn an additional HKD 200 RewardCash when you apply for a Cash Instalment Plan

- RewardCash can be redeemed for air miles or offset both monthly spending and individual transactions

Some rewards/offers may be time-limited

4. Standard Chartered Cathay Mastercard

Formerly known as Asia Miles Mastercard, Standard Chartered credit cards are the only HK credit cards that allow you to earn miles by using banking services. They are also popular for having the lowest air mile conversion rate.

- Annual fee - HKD 2000, first year fee waived

- Annual Percentage Rate - 35.70%

- Earn 1 Asia Mile on Cathay and HK Express for every HKD 2 spent

- Earn 1 Asia Mile per HKD 4- HKD 6 eligible spending on dining/food delivery platforms, online and overseas

- Earn 40,000 Asia Miles when you make a new deposit of HKD 100,000

- have a minimum income of HKD 96,000

- Welcome offer of up to 60,000 Miles

- No cap on the Asia Miles earned every month

- Additional discount on hotel bookings through Agoda and Expedia

5. Hang Seng enJoy Card

This credit card is a collaboration between Hang Seng Bank and Yuu Rewards Program. Anyone who uses a credit card for daily expenditures can enjoy extra rewards offered by this card.

- Annual fee - perpetual annual fee waiver if you apply between 1 January and 30 June 2024, otherwise HKD 1500

- Annual Percentage Rate - 35.72%

- Up to 4X yuu Reward Points all year round for swiping enJoy Card at the enJoy Card Designated Merchants

- For other retail spending, every HKD 1 spent earns 1 point

- have a minimum income of HKD150,000 (except for full-time university / tertiary students)

- be a resident of Hong Kong

- 120,000 yuu Points for new customers and 80,000 yuu points for existing customers

- A centralized Yuu reward app available for earning and redeeming point

- Local spending earns 2% cashback

6. American Express® Platinum Credit Card

This American Express credit card is a premium offering that provides a diverse range of privileges. While most of these pertain to travel, you can also earn reward points and redeem them for shopping, gym memberships, and digital entertainment.

To apply, you must:

- be at least 18 years old

- have a minimum annual income of HKD 300,000

- be a resident of Hong Kong or Macau

- Annual fee - HKD 2200

- Annual Percentage Rate - 35.96%

- Spending HKD 1 earns you up to 3 points for the first HKD 120,000 spent. For spending above HKD 120,001, every HKD 1 spent fetches you 1 point

- Points can be redeemed for complimentary flights, airline upgrades, and companion tickets

- Attractive introductory offers include 4 complimentary movie tickets and cash vouchers up to HKD 500

- Complimentary travel insurance

- Year-round Buy-1-Get-1-Free offer on Fridays on 3D, 2D, and IMAX

- Steep annual fees

Bottom Line

The multitude of options available in the market makes it challenging to find the perfect HK credit card for you. It helps to research and compare various credit cards in Hong Kong to identify what works best.

No matter what your end goal is, don’t settle for the first card that comes your way. Looking to open a company bank account in Hong Kong ? Let Air Corporate help you!

Is Hong Kong credit card friendly?

Most commercial establishments, transport service providers, and businesses in Hong Kong accept credit cards. However, smaller businesses may only accept cards for high-value transactions.

Are foreign nationals eligible for a HK credit card?

Most banks in Hong Kong issue credit cards to non-residents. Some even offer specific credit cards for expatriates or individuals residing in Hong Kong for a short duration.

Usually, the applicant needs to furnish proof of identity, proof of income, and proof of residence along with their credit card application.

Which credit card is widely accepted in Hong Kong?

Typically, most businesses accept VISA, Mastercard, and American Express. However, acceptance may vary from business to business.

For many years, I worked at big accounting and company secretary firms in Hong Kong. I started Air Corporate to make the life of entrepreneurs and SMEs easy.

Your Hong Kong company and business account. Online and Simple.

0% Capital Gain Tax

0% tax on offshore profit

0% Value Add Tax (VAT)

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 6 best travel money cards for hong kong in 2024.

Hong Kong is a vibrant place to visit with culinary delights, cultural sites and a gateway to the rest of the world, it has a lot to offer visiting Australians.

In Hong Kong you are likely to pay for accommodation, food, transport and entertainment as well as withdraw cash from ATMs with your card. So which is the best card for international travel to take with you?

It's easy, to save you lots of time, we have compared a large number of travel cards to take to Hong Kong for Australians in 2024 and have summarised their best points.

Best 6 Travel Money Cards for Hong Kong in 2024:

- Wise Travel Card for best exchange rates

- Revolut Card for low fees

- Travelex Money Card - Best all rounder

- HSBC Global Everyday Debit Card for best debit card you can use in Australia too

- Bankwest Breeze Platinum Credit Card for lowest interest rate

- ING One Low Rate Credit Card with no annual fee

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is an excellent choice for those traveling to Hong Kong, providing a range of features that cater specifically to the needs of international visitors. This card allows access to over 40 currencies at the intermarket exchange rate, which is recognized as the most economical rate worldwide. For travelers visiting Hong Kong, this means the ability to convert their home currency into Hong Kong Dollars (HKD) at highly competitive rates, ensuring cost-effective currency exchange during their stay in this vibrant city. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all rounder no matter if you are heading to the bustling streets of Hong Kong or visiting the serene Lantau Island.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as Wise or Revolut , the support network if the card is lost or stolen is very good. This service can be extremely useful when journeying across the cosmopolitan city of Hong Kong.

HSBC Everyday Global Travel Card

- Great exchange rate offered for Hong Kong dollars (HKD)

- No ATM fees at HSBC tellers

- No initial card, closure, account keeping or monthly fees

- No cross currency conversion fees

- 10 Currencies can be loaded are HKD, AUD, USD, EUR, GBP, CAD, JPY, NZD, SGD and CNY (currency restrictions on CNY)

- No maximum balance for any currency

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Travel Card offers a great exchange rate for Hong Kong dollars, ATMs, so you can withdraw cash without the hefty overseas ATM fees.

In addition it does not charge an ‘international transaction fee’ so you can spend in Hong Kong and online in Australia and not pay an additional 3%.

Finally, on top of the excellent currency exchange rate, there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

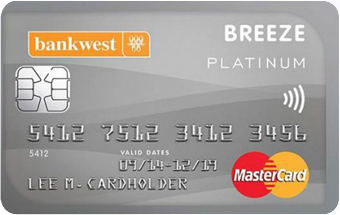

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling throughout Hong Kong.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places in Hong Kong.

ING One Low Rate Credit Card - No Annual Fee

- No annual fee

- Up to 45 days interest free on purchases

- Lowest cash advance interest rate of 11.99%

- Use instalment plans to pay off your purchases over time at a lower interest rate

ING One Low Rate Credit Card

- 11.99% interest rate on purchases

- Make payments from your mobile with pay with Apple Pay and Google Pay

- International ATM fee and Foreign currency conversion fee are waived when you deposit $1,000 into your Orange Everyday each month, and make 5+ card purchases that are settled. Otherwise they are the higher of 3% or at least $3

- Put repayments on auto payment each month to pay the minimum balance or full amount

The ING One Low Rate credit card is a great option to take to Hong Kong as it charges no annual fee and offers a low interest rate for purchases and cash advances of 11.99%. The cash advance interest rate is very low and about 50% less than most of its competitors who charge around 22% on cash advances.

Furthermore the ING One Low Rate credit card has no international transaction fees, so you can save money on your travels and when you buy goods from overseas. It's a handy backup card to have in your wallet when travelling through Hong Kong.

Learn more about the best credit, debit and prepaid cards for travel

Best Travel Credit Card Australia

Best Prepaid Travel Cards

The best travel card for Hong Kong is the Wise Multi Currency card for tap or swipe large transactions like accommodation and restaurants. Wise offers the best exchange rate for Hong Kong dollars globally and charges no international transaction fees.

HSBC Global and Citibank Plus cards are the best for ATM withdrawals and great exchange rates for Hong Kong dollars. Both these cards charge no international transaction fee and can be used within Australia without penalties.

The best credit cards for Hong Kong are the BankWest Platinum Breeze and ING One Low Rate as they have the lowest interest rates on the market with and charge no international transaction fees.

Yes you should buy Hong Kong dollars before you travel to Hong Kong. Having Hong Kong dollars on hand when you arrive at the airport will make your life a lot easier. The airport is also the most expensive place to exchange currency, so you will save a lot of money as well. Even though Hong Kong is card friendly, having cash on hand will always be handy for small purchases, tipping and paying for transport.

HSBC and Citibank have the best travel money cards for Hong Kong. Both have lots of ATMs within Hong Kong, both offer fantastic exchange rates for the Hong Kong dollar and both offer ‘no international transaction fees’.

You can place money on your travel money card online and paying by direct debit from your bank account will cost you the least. Log in to your bank account, transfer your funds into the travel money card and the money should be there within 24 hours.

Yes, travel money cards are a good idea to take to Hong Kong? They provide better security than cash, as you can access your account without your pin code. They are useful for paying large bills for accommodation or restaurants as travel cards are less bulky.

Yes you can use your Australian debit card in Hong Kong and if they are linked to Mastercard or Visa. Most Australian debit cards will charge an international transaction fee of 3% plus give a very poor exchange rate for Hong Kong dollars adding another 5% to purchase fee and if you use a non affiliated ATM you will be charged an additional $5 for a withdrawal.

Yes you can get prepaid international debit cards for Hong Kong and Wise , HSBC and Citibank offer the most competitive cards in the market. Other older style prepaid cards like Australia Post, Cash Passport, Travel Money Oz and Travelex have lots of charges like load, unload, inactivity, ATM withdrawals and initial card fees.

As a general rule, working out how much money to take to Hong Kong depends on where you go and your type of travel. If you travel on a budget to Hong Kong it can cost from $70 a day. If you travel in the middle range throughout Hong Kong it can cost from $140 per day. Finally if you travel with luxury throughout Hong Kong it can cost anywhere from $300 per day.

No you can not use Australian dollars or American Cash in Hong Kong. The currency in Hong Kong is the Hong Kong dollar. There are 6 bank notes with different colours, they are $10, $20, $50, $100, $500 and $1,000. There are 3 coins, they are 13 different coins 10¢, 20¢ and 50¢.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

CREDIT CARDS

Citi plus credit card is dedicated for citi plus account holder. join citi plus now to enjoy more rewards, citi plus account holder, apply for citi plus credit card now, want to be a citi plus account holder.

- Credit Cards

Be spoilt with Citi’s wide range of credit cards, not only can you fund your daily expenditure, but also enjoy all the privileged offers and enhanced experience, So apply online today!

Apply for Citibank Credit Cards Online

Showing 5 of 5 for Most Popular cards

Citi Prestige Card

Apply to get

- 30,000 Miles (360,000 Points)

- Complimentary 4th night at any hotel

- Local Spending : HK$6 = 12 Points (1 Mile); Overseas Spending : HK$4 = 12 Points (1 Mile)

- Complimentary global airport lounge access

- Extra bonus points for increasing cardholding year

Citi PremierMiles Card

- 20,000 Miles (240,000 Points)

- As low as HK$3 = 1 mile for overseas spending

- Complimentary worldwide lounge access

- Free travel insurance

Citi Cash Back Card

- HK$1,200 Cash Rebate

- Auto rebate with no cap all year round

- 2% rebate on Local dining

- 2% rebate on Local hotel spending

- 2% rebate on spending in foreign currency

Citi Rewards Card

- Enjoy 5X Points for all wallet transactions (Apple Pay, Google Pay and Samsung Pay)