June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

How to Buy Travel Insurance for Long Trips

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of May 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 6:28 a.m. UTC May 2, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Preferred and Atlas Journey Premier plans get 5 stars in our rating because of the extensive coverage they provide for the price. Both plans come with high limits for important benefits such as emergency medical and evacuation, travel delay and missed connections. WorldTrips travel insurance also offers a pre-existing medical condition exclusion waiver if you buy a plan within 21 days of making your first trip deposit.

Best travel insurance of 2024

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel, WorldTrips has two top-rated travel insurance plans in our rating:

- Atlas Journey Preferred provides $100,000 per person in emergency medical benefits as secondary coverage, with the option to upgrade to primary coverage. Primary coverage means you don’t have to first file a medical claim with your health insurance company. Atlas Journey Preferred is also the best travel insurance for cruises with $1 million in coverage for emergency evacuation.

- Atlas Journey Premier costs more but gives you $150,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 411 reviews of policies purchased through the travel insurance comparison site since 2008.

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for missed connections

If you’re looking for good travel insurance for missed connections , it’s worth considering TravelSafe. Its Classic plan includes $2,500 in missed connection coverage for each person on the plan. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Best trip insurance for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. It’s also the best trip insurance for pet parents , with an optional Pet Bundle add-on that includes pet medical, pet kennel and pet return benefits.

- Cheapest of our best trip insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best travel insurance for cruise itinerary changes

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “Cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

Via TravelInsurance.com’s website

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable travel insurance plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

Looking to save? Discover cheap travel insurance options.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance quote requests on the Squaremouth website last month, these are the main benefits travelers are looking for in a travel insurance policy.

*Source: Squaremouth.com. Travel insurance quote filter usage from March 24 to April 23, 2024.

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Preferred and Atlas Journey Premier — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- ‘Just a parade of incompetency’: Spirit Airlines passengers with ‘nightmare’ stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

Cheapest travel insurance of May 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

4 Best Long-Term Travel Insurance in 2024 (w/ Prices)

Home | Travel | 4 Best Long-Term Travel Insurance in 2024 (w/ Prices)

Planning on taking an extended trip soon? Long-term travel insurance is the perfect choice for travelers who are embarking on a long-term trip and need medical- and travel-related coverage.

Of course, insurance for long-term travel isn’t necessary for every traveler, particularly if you don’t take trips that are longer than three months. However, long-stay travel insurance is useful for anyone who is studying abroad, working abroad temporarily, taking a gap year, or simply traveling for a long period of time.

When I first moved to the US, I wasn’t sure if I would stay permanently, so I purchased a long-term travel insurance policy from Heymondo , knowing that it would save me money and give me coverage if I experienced any medical emergencies. It was exactly what I needed at the time.

5% OFF your travel insurance

As soon as I decided to live in the US permanently, I switched to insurance with more medical coverage beyond emergency situations since extended-trip travel insurance is not suitable for expats who want routine medical care.

If extended-stay travel insurance is what you need, keep reading, because we have compared the best long-term travel insurance plans (Heymondo, World Nomads, Travelex, and SafetyWing) and can help you choose which of these is best for your trip.

What is long-term travel insurance?

Long-stay travel insurance coverage comparison

- Long-stay travel insurance price comparison

- Best long-term travel insurance companies

Long-term travel insurance is insurance for anyone taking a long-term trip who needs medical expenses and trip-related coverage. Any trip that lasts a minimum of 90 days and a maximum of one or two years (depending on the long stay travel insurance company) is considered a long-term trip.

Like other travel insurance, insurance for long-term travel provides medical- and travel-related coverage for incidents like emergency medical care, trip delays, baggage loss, and repatriation. It is not suitable, however, for anyone who is permanently living abroad, especially because it only covers emergency medical expenses and not routine medical care.

Long-term travel insurance vs. annual, multi-trip travel insurance

So, is long-trip travel insurance the same thing as annual, multi-trip travel insurance ? They might sound similar, but actually, insurance for long-term travel and annual travel insurance is completely different.

Long-term travel insurance is insurance for long trips that last three months or more, while annual travel insurance covers multiple shorter trips that happen within one year. With annual travel insurance, trips are restricted to 30-90 days, so it’s not a useful option if your trip will last any longer than that. Annual travel insurance is also only helpful if you’ll be taking at least four or more trips a year.

If you are going on a single, long-term trip or are taking multiple trips within a year that will last longer than 90 days, long-stay travel insurance is the best choice for you.

Who is insurance for long-term travel for?

There are several reasons you might need insurance for long-term travel . You might be taking an extended trip, working abroad, embarking on a gap year, or more. Below are the most common and useful reasons for buying travel insurance for long-term travel :

Extended stay travel insurance for long trips

If you’re about to take a long trip that will last at least three months, you will definitely want to have travel insurance coverage, particularly for emergency medical expenses.

Long-term travel insurance will work out to be the most affordable option for your trip, especially if you don’t plan on returning to your home country before 90 days have elapsed. If you plan on going back home before 90 days have passed, then annual, multi-trip travel insurance might be more helpful for you.

Long stay travel insurance for working abroad

Are you about to be working from another country for an extended but temporary period? Having travel insurance for working overseas is a must, as it’s very possible that you’ll need emergency medical care at some point during your time abroad.

Remember to put your country of residence as your home country, not the country you will be working in temporarily. Otherwise, you will not be covered since long-term travel insurance usually does not provide coverage in your designated country of residence.

Travel insurance for expats

Although it may seem like a great idea to use long-term travel insurance as travel insurance when moving abroad , long-stay travel insurance is not intended for expats. Long-stay travel insurance only covers emergency medical expenses, so it’s not suitable for someone who lives abroad permanently and will need routine medical care and check-ups.

On top of that, whatever country you move to will now be your country of residence. Insurance for long-term travel does not generally provide coverage in your designated country of residence, so you may not be eligible for coverage anyway.

Long-stay travel insurance for students

It’s incredibly exciting to study abroad, but accidents and mishaps can and do happen, so avoid paying for emergency medical expenses and replacing stolen valuables with your own money by getting extended-stay travel insurance .

Having long-term travel insurance coverage will be especially useful if you plan on taking weekend trips to other countries that are close to the country where you are studying abroad; you can still receive the same coverage for those smaller trips (just make sure to select worldwide coverage or, if you’ll just be traveling in Europe, Europe/EU coverage).

Round-the-world trip insurance

Taking a long-term trip around the world is many people’s dream. If you are lucky enough to get to live out that dream, it’s easy to make sure your extended-stay travel insurance worldwide will cover you everywhere you want to visit.

Just make sure you select “worldwide” or “around the world” coverage when you purchase your extended-trip travel insurance . That way, you won’t have to buy individual long-term travel insurance policies for each country you visit. Best of all, you’ll be covered for any spontaneous stops you make while traveling the world.

One-way travel insurance, the best gap year travel insurance

If you’re planning on spending a full year traveling the world, travel insurance for long trips abroad is exactly what you need. You’ll benefit from worldwide emergency medical coverage, so you can receive treatment if you get injured or fall ill, as well as travel-related coverage for baggage loss and trip delays.

I recommend purchasing a one-way travel insurance plan from Heymondo or SafetyWing since both companies allow you to renew your plan from month to month. That way, if you end up coming home unexpectedly early, you won’t lose out on any money.

Insurance for digital nomads

ith so many jobs transitioning to working from home right now, it’s easier than ever to work remotely from anywhere in the world. If you have the opportunity to travel the world while working, take it, but make sure you purchase digital nomad travel insurance before you leave.

You’ll want your insurance coverage to include electronics (laptop, tablet, etc.) so that you can easily replace these crucial pieces of technology for working remotely if they get lost or stolen. Additionally, if you’ll be trying to check a lot of places off your travel bucket list, choose worldwide coverage so that you’ll have the freedom and insurance coverage to go wherever you want.

There can be many considerations to keep in mind when purchasing long-term travel insurance , but coverage is certainly the most important aspect to consider when selecting the long-stay travel insurance you want to buy.

Below, you’ll find a long-stay travel insurance comparison that shows you the differences in coverage among the Heymondo, World Nomads, Travelex, and SafetyWing plans.

Long-term travel insurance price comparison

If you want a better idea of how much long-term travel insurance costs based on the length of your trip and/or the specific coverage you choose, below is a chart comparing the prices of 1-month, 3-month, 6-month, 8-month, and 1-year long-term travel insurance as well as the prices of long-stay travel insurance, annual multi-trip travel insurance, and cancellation insurance.

The price of long-term travel insurance will be impacted by several different factors, including your age, nationality, and state of residence (if you live in the US).

To give you an idea of how much insurance for long-term travel costs, I’ve used the example of a 30-year-old American citizen who lives in Pennsylvania and needs worldwide coverage to generate quotes for this long-stay travel insurance price comparison .

Best long-term travel insurance

As you can see from the charts above, each of the four long-term travel insurance plans I compared has its merits.

Heymondo offers the highest emergency medical expense coverage, plus it’s the only insurance for long-term travel that pays your medical expenses upfront, so you don’t need to file a claim after your trip to get reimbursed. I will say, however, that it’s not the cheapest long-haul travel insurance and it does have a deductible of $100 for emergency medical expenses. Still, I do think it is the best long-term travel medical insurance if you want ease and convenience.

SafetyWing ’s Nomad Insurance also provides very good coverage, but their deductible for emergency medical expenses is $250. In spite of this slight drawback, SafetyWing stands out as the best insurance for digital nomads since you can sign up for a plan and it will automatically be renewed every four weeks.

Travelex , on the other hand, has the cheapest travel insurance for long-term travel (for trips of six months or more). For shorter trips, there are other, cheaper options. Travelex’s plan has no deductible, but its emergency medical coverage is also very limited, so I would think twice before going on a long-term trip with such a small amount of coverage.

Last but not least, World Nomads offers the best gap year travel insurance. The emergency medical expense coverage is perhaps a little low, but it is at least higher than Travelex’s medical coverage. There is no deductible for medical expenses, but you will need to pay out of pocket and then file a claim to get reimbursed if you receive emergency medical treatment.

As you can see, the best long-stay travel insurance for you will depend on your needs and type of trip, so keep reading to learn more about each plan.

1. Heymondo , the best long-term travel medical insurance

Personally, I consider Heymondo the best long-term travel medical insurance since its Top plan provides the highest amount of emergency medical expenses and evacuation and repatriation coverage. It’s also one of the only types of travel insurance with COVID coverage that covers COVID testing required by a doctor. Moreover, you can easily extend your plan by anything from two weeks to eight months whenever you want to.

Best of all, you won’t have to worry about waiting to get reimbursed for medical expenses since Heymondo pays your medical expenses directly and upfront for you, removing the hassle of the claim-filing process. Heymondo also makes it easy to tailor your insurance for long-term travel to fit your needs since you can add optional electronic and/or adventure sports coverage to your plan.

Heymondo’s Top plan does have its limitations, though. There is a $100 deductible for medical expenses, which means you’ll have to pay $100 towards any medical bills before Heymondo pays the rest for you. This long-stay travel insurance also lacks trip cancellation coverage; you will need to buy that coverage independently here.

If you want cheap long-term travel insurance , Heymondo is ideal; its plans already provide very good value for the money, plus you can save an extra 5% on their insurance with the discount link below.

Heymondo is also the best travel insurance company for single trips. We currently have their travel insurance and have used their assistance app more than once. Heymondo has always been there to help us when things go wrong during our trips.

2. World Nomads , the best gap year travel insurance

If you’re taking a gap year, you’re probably interested in breaking out of your comfort zone and having a real adventure. In that case, World Nomads is the perfect travel insurance for living abroad for a year and trying new things.

Its Standard plan includes adventure sports and activities coverage, so you can try everything from trekking and ice fishing to hockey and horseback riding and still be covered for accidents and injuries. Moreover, you’ll benefit from solid overall coverage for emergency medical expenses, evacuation and repatriation, trip cancellation, trip delay, and baggage loss.

Even better, there’s a $0 deductible for medical expenses, so you won’t have to pay a cent out of pocket toward your medical bills. However, World Nomads’ long-term travel insurance is the most expensive out of all the ones I compared, so if you want to save a lot of money and get similar or better coverage, Heymondo may work better for you.

3. Travelex , the best travel insurance for long-term travel

Travelex ’s Travel Select long-trip travel insurance has a lower amount of emergency medical coverage than the other insurance plans I have compared, and I personally wouldn’t feel protected traveling with such a low amount of medical coverage on a long-stay trip. However, Travelex is a viable option if you’re traveling on a budget for more than six months because it’s really cheap (and has a $0 deductible for medical expenses)!

Travel-related coverage is another story since Travelex has the highest amount of trip cancellation and trip delay coverage of all the plans I compared. It’s the best plan to choose if you anticipate experiencing any travel mishaps. You’ll also enjoy great baggage loss and evacuation and repatriation coverage.

If you would rather benefit from more medical coverage for a similar price, Heymondo is the best choice for you.

4. SafetyWing , the best insurance for digital nomads

SafetyWing ’s Nomad Insurance lives up to its name by being the best insurance for digital nomads . Not only is Nomad Insurance a cheap long-stay travel insurance , but it also provides a high amount of medical-related and baggage loss coverage.

On top of that, you can choose to have your insurance renew itself automatically every 28 days. Automatic renewal will save you time and money; ensure you don’t forget to renew so you’re always covered; and provide you with more flexibility if you haven’t decided when to end your trip yet. Just select a start date (but not an end date) when you buy Nomad Insurance and keep renewing until you want to go home, at which time you can select an end date.

Nothing’s perfect, however, and unfortunately, SafetyWing’s Nomad Insurance is no exception. There’s a $250 deductible for medical expenses, which means you’ll have to pay $250 out of pocket for medical treatment before SafetyWing will cover medical expenses for you.

SafetyWing also lacks trip cancellation coverage, which can be very useful if you have to cancel a trip due to weather, illness, injury, or many other reasons. If you want a lower deductible, go with Heymondo instead, and if trip cancellation coverage is important to you, choose World Nomads or Travelex .

What does long-term travel insurance cover?

The best travel insurance for long-term travel will usually include the following types of coverage:

- Emergency medical expenses : This is probably the most important type of coverage as well as the coverage you are most likely to need while traveling. Accidents, injuries, and illnesses can happen at any time, so having emergency medical expense coverage will ensure that you don’t have to pay out of pocket for hospitalization or medical transportation.

- Evacuation and repatriation : Hopefully, you’ll never have to use evacuation and repatriation coverage, but it is useful to have. Insurance for long-term travel with evacuation and repatriation coverage will pay for the transportation costs of taking you from a remote area to the nearest hospital or sending you back to your home country if you fall seriously ill or have an accident.

- Trip delay : Unfortunately, travel does not always go smoothly; your flight could be delayed due to inclement weather or an airline issue. If that does happen, long-stay travel insurance ’s trip delay coverage will cover expenses, such as meals and accommodation, that are incurred because of a several-hour delay.

- Baggage loss : Even when you take precautions to keep your belongings safe, there’s still a chance an airline could lose or damage your bags, or a pickpocket could take your purse. In any case, long-term travel insurance with baggage loss coverage will reimburse you for any valuables that are lost or damaged, so you won’t have to replace them with your own money.

Is long-term travel insurance worth it?

Ultimately, yes, long-term travel insurance is worth it for extended trips, working abroad temporarily, and taking a gap year. It’s also a great alternative for international student insurance . In all of these situations, insurance for long-term travel will ensure that you get the medical- and travel-related coverage you need without having to break the bank.

As you’ve seen in the long-term travel insurance comparison chart above, Heymondo is the best long-stay travel insurance in terms of medical coverage. It offers the highest amount of emergency medical expense and evacuation and repatriation coverage.

Heymondo’s extended-stay travel insurance also provides the convenient flexibility of being able to renew your policy for periods from two weeks to eight months, which is perfect if you haven’t yet decided when you’ll end your trip. To top it all off, you can even get 5% off their insurance just for being a Capture the Atlas reader.

If you’ll be traveling for more than six months and you’re looking for the cheapest long-stay travel insurance, then Travelex may be better for you. Just be aware of their plan’s lower amount of medical coverage.

If you have any questions about long-term travel insurance, feel free to comment below and I will happily help you out!

Ascen Aynat

22 replies on “ 4 Best Long-Term Travel Insurance in 2024 (w/ Prices) ”

Hi Ascen, we are US citizens and plan to spend about 6 months of the year in California and 6 months abroad. We have lived in California and in the past had insurance with our jobs which will now be no more. So the question is when we are are in California what is our insurance option so we can visit doctors, dentists etc. Thank you

Hi Sonu, you need standard health insurance for California and travel insurance for traveling out of the States. Travel insurance won’t cover routinary medical appointments.

Let me know if you have any questions, Ascen

Good day. Could I get overlapping coverages to address different issues? Does any of these cover rental car collision insurance during any portion of the stay? If not, what do you recommend for that?

Yes, you can hire different travel insurance to get different coverages. That is no problem.

Hi my husband was diagnosed with mestatic melonma in 2021, Weve been traveling back and forth to Moffitt overvs year now. Weve paid out over $7000 just in lodging. Do you have a plan for this??

I’m sorry about that but there is no insurance that can cover that. That is not an unforeseen issue that occurred during a trip that is mostly what travel insurance cover.

Hi There is an age limit on Heymondo 49+ not included. I am 60. Can you recommend any long stay travel insurance for this age group? Thanks Karan

Hi Karan, I recommend checking our article on senior travel insurance for the best options for you.

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage.

Hi Marisas, please take into account that these long-term travel insurance are travel insurance. That means that they don’t cover routine health checks or chronic diseases. They only cover you under unforeseen problems. For example, if you hire one of these long-term travel insurance and have a car accident during a trip and need surgery, the travel insurance will cover but it won’t cover cancer treatment, for example.

Hi can you recommend a travel insurance for a 7 month European trip for wife and self age 59 CA residents- many thanks

Please check the coverage for the insurance recommended in this article and choose the one that is best for you.

Hi Were planning to travel continuously for one year to Europe, Asia & med cruise. Is there a travel insurance that can cover this? Most insurances will require you to go back to your home country (US) after 60 to 90 days. Thanks

Hi Nate, I don’t believe you need to get back to the US with the Heymondo Long-Term Travel Insurance. Have you checked it out?

Hi Ascen We are a male 57years and female 58 years and we are travelling to south Africa to include Botswana Namibia Mozambique,Angola Zambia and Lesotho, we are shipping our car from Australia into south africa and will be travelling for two years we both hold Australian and UK passports Could you please recommend a medical insurance for this trip , we are not to bothered about trip cancellation baggage etc any help would be appreciated We have used world nomads previously but would consider others as well Thank you ag and rg

Hi Antony, that trip sounds amazing! If you’re doing a long-term trip like that one, I recommend Heymondo since they pay all medical expenses in advance. Just be aware of the 100$ deductible per claim.

Said that their price is very competitive and they have very high coverage.

Looking for long term insurance for cancel for any reason plus Covid coverage.

I recommend purchasing separately a long term travel insurance with Covid Coverage (I recommend this one ), and a cancel for any reason policy.

Interesting that this features Travelex and then notes: “Can get similar or better coverage for a more affordable price” From whom?

As you can see in the different comparison charts (coverage comparison chart and price comparison chart), Travelex is the one with the lower coverage, by far, and it’s only worth checking for 6-month insurance or more.

Let me know if you have any questions,

Hi! Do you know if you need basic medical coverage from your home country before purchasing any of these insurance plans presented above? My situation is a bit complex. I am a Canadian citizen currently living abroad (non-resident of Canada), therefore I have no basic Canadian health coverage. I am currently covered by the country I reside in (Qatar), however, once I leave, I will no longer have a residency permit and therefore no coverage here either. So when I leave, I won’t have coverage anywhere. I am planning on leaving to travel for a year, so I need long-term travel and medical coverage. Thanks!

Hi Melanie, no you don’t need it. You will need just long-term travel insurance and you will be covered wherever you go. Also in your home country as long that you’re traveling there and use the insurance just for emergencies (not regular checks, ongoing problems, chronic diseases, and things like that). In your situation, I think the long-term travel insurance of MONDO is your best bet.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

sign up and keep track of your travel insurance events

How Much Does Travel Insurance Cost?

- Average cost of travel insurance

- Why are there different prices?

- Find out what it costs to insure your trip

If you’re asking yourself, “how much is travel insurance?”, then you’ve come to the right place. To give you an idea of what travel insurance might cost relative to your trip, we’ve put together some highlights for you. Read on to learn more about how much travel insurance costs, what travel insurance can do for you and decide for yourself if the price is worth it.

Also read: Is Travel Insurance Worth It? 3 Examples Where it Pays Off

What does travel insurance cost?

While travel insurance costs vary, the average is somewhere between 4-12% of your total trip cost *.

If you’re on the fence, then consider this: an emergency situation can cost tens of thousands of dollars, but the insurance plan might be a fraction of your trip cost . If you find yourself in this scenario, then it’s easy to justify the additional upfront expense for a travel insurance plan.

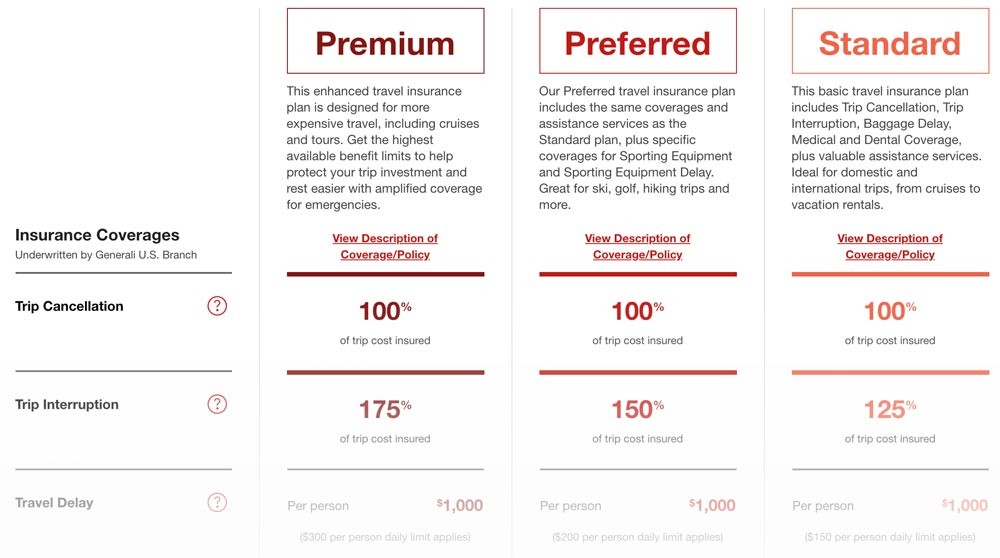

At Generali Global Assistance, we offer three different plans—Standard, Preferred and Premium—which we have laid out in a handy side-by-side comparison . Each plan has a different cost, but as you step up, you receive additional coverages and coverage limits. And, whether you’re purchasing by phone or online, it doesn’t matter; the price is the same.

Generali was selected as "Best Value" travel insurance by Business Insider

How We Calculate Your Travel Insurance Price

When you enter your information into our quote form, have you wondered what happens behind the scenes to get you the right price for travel insurance?

It’s simple to get a quote to insure your trip. You only need to answer a handful of questions and an instant later we give you custom prices for your trip and the choice between three plans with different levels of protection. You can get the quote in an instant, but in the background we’re crunching numbers to make sure you get an accurate price for the coverage you need.

We’ve found the sweet spot to ask you the right questions to offer you the best price we can, while making the quote form easy to fill out. Consider this when shopping around: If a company is asking you too few questions, they may not be able to find the most accurate price for your travel situation.

Find out more about the factors that affect the price of a travel insurance quote

Why the different costs? Coverage differences between plans

Before choosing a travel insurance plan, here’s a snapshot of some of the coverage differences for each plan:

• Medical and Dental coverage reimburses you for necessary medical, surgical and emergency dental care costs if you get sick or accidentally injured while on your covered trip. Coverage is in excess of your standard coverage , except where prohibited. It’s included in all three plans but the per person limits vary from $50,000 for Standard to $150,000 for Preferred and $250,000 for Premium.

• Trip Interruption is one of the most common reasons for making a travel insurance claim. Trip Interruption coverage provides reimbursement for unused, non-refundable, pre-paid trip costs if your trip is interrupted due to a covered event. Also, it provides reimbursement for additional transportation costs to return home or rejoin your group. Benefit limits vary by plan: 125% for Standard, 150% for Preferred and 175% for Premium.

Find out why you shouldn't just buy the cheapest travel insurance

• If you’re traveling with sports gear, then Sport Equipment Coverage is for you. It provides coverage for lost, stolen or damaged sporting equipment and is available with the Preferred plan up to $300 per person and Premium plan up to $500 per person, but not available in the Standard plan.

• If you have a Pre-existing medical condition , you could still have coverage, but only through the Premium plan . See if you meet the requirements and read the sample Description of Coverage or Policy for full details. Also, the Premium plan must be purchased prior to or within 24 hours of final trip payment.

Learn more about travel insurance: • What is Travel Insurance? • Travel Insurance Comparison: How to Choose the Right Plan • Top 5 Reasons to Get Travel Insurance

For a relatively small amount of the total trip cost, you can purchase travel insurance that can help protect against common mishaps like Trip Interruption , Trip Cancellation and Trip Delay . Costs can add up quickly for emergency medical care or events like a cancelled flight due to adverse weather or lost or stolen baggage . As a general rule of thumb, if you’re investing more in your vacation than you can afford to lose, then consider travel insurance from a reputable provider such as Generali Global Assistance .

If you’re still asking yourself, “how much does travel insurance cost?”, then you can get right to the point—plug your trip details into our Get a Quote page and find out exactly how much travel insurance will cost for your trip. And, if you need help buying travel insurance online, check out our Step-by-Step Purchase Guide .

*Actual travel insurance cost will vary depending on trip details.

Travel Resources

Average Customer Rating:

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

- 3 Months Travel Insurance

Instant Policy Delivery

Secure Online Purchase

Range of Working Activities

Six Different Policies

Option to Extend Duration

Cover for UK Residents

Wide Range of Sports

24 Hr Medical Assistance

3-Month Travel Insurance Policies UK

If you’re planning on embarking on an adventure for 3 months, a 90-day travel insurance policy is what you should be on the lookout for. Whether you’re embarking on a volunteering project abroad, a gap year , a solo backpacking adventure, or a family holiday, if you need travel insurance for a 3-month trip you’ll be able to find the right policy with us.

Many people have annual travel insurance policies with their bank or as part of their financial arrangements, but these will not usually cover a 3-month trip. The maximum individual trip duration on most annual policies is usually 31 days or 45 days, and these periods cannot be extended. For longer durations, you need to select a Long Stay Travel Insurance which is intended for an extended stay abroad, such as a 3-month trip.

Lucky for you, here at Navigator Travel Insurance we specialise in UK Long Stay Insurance, with these policies covering trip durations extending from 2 months to 18 months. In this article, we aim to share with you all of the details you should consider before securing travel insurance for a 3-month trip. With this, you can embark on your next adventure with the peace of mind of knowing that you’re covered whether you’ll be voluntarily teaching in Africa, hiring a motorcycle in America, or visiting your family in Australia.

What Does 90-Day Travel Insurance Cover?

Before choosing any travel insurance policy, it’s important to understand exactly what you are covered for whilst you are embarking on your travels. Like most standard travel insurance policies, travel insurance for a 3-month trip often covers you for the following:

Damage, Loss, or Theft of Your Luggage

If your baggage is lost, damaged, or stolen whilst you are travelling, you are normally covered for the costs associated with this. It’s not uncommon for baggage to be damaged or lost, especially if your journey involves multiple layovers, which is why your travel insurance for a 3-month trip can come in handy in offering you compensation for your losses.

Long-stay travel insurance for your 3-month trip will cover you up to a certain amount if your baggage is stolen, lost, or damaged, meaning you should get some level of compensation to cover your possessions. Make sure that you read the terms of your policy to determine the maximum amount of compensation that you can get, as you want to make sure that this will cover any, or all, of your possessions if they are to be lost, damaged, or stolen.

Emergency Medical Expenses

If you find yourself needing emergency medical attention whilst you’re on your travels, your 90-day holiday insurance policy should cover you for this. Before you embark on any adventure away from home, there’s always a chance that you will be involved in an accident or sustain an injury. Thus, you want to ensure that you are covered with a suitable travel insurance policy for any medical bills you wrack up as a result of this and that you are able to return home if you’re too ill to continue your travels.

Holiday Cancellation or Curtailment

90-day travel insurance policies should cover you for holiday cancellation or curtailment. This means that, should an event occur in which you have to cancel or cut your trip short, any expenses that you incur as a result of this should be partially, or fully, covered by your insurance provider.

What Does 3-Month Travel Insurance Not Cover?

Whilst it’s important to consider what your travel insurance for a 3-month trip does cover, it’s equally important to research what it does not cover too. Travel insurance for 90 days will offer you important cover, such as cancellations and baggage loss, theft, or damage as mentioned above, but there are some things that they often don’t cover you for, which we’ve detailed further below:

Injuries or Accidents Related to High-Risk Activities

There may be certain activities that are covered by your 90-day travel insurance policy but, normally, this excludes high-risk activities. This is because these activities are deemed more dangerous than other low-risk activities, meaning that there’s a higher chance that you may get involved in an accident or sustain an injury.

These high-risk activities may include rock climbing, bungee jumping, or even winter sports. So, it’s important to chat with your insurance provider to see if you’ll need additional cover to add to your 3-month travel insurance policy if you’ll be partaking in these types of activities.

Accidents Related to Drugs or Alcohol Misuse

If you get involved in an accident whilst under the influence of drugs or alcohol, any claim that you make on your 90-day holiday insurance policy is likely to be rejected. It may be easy to get carried away in the excitement of your trip, but should you get involved in an incident whilst you’re under the influence this can have serious financial and legal repercussions and can place others at unnecessary risk.

Travel to Regions Against Government Advice

If you’re choosing to travel to countries or regions around the world that the Foreign, Commonwealth, & Development Office (FCDO) advises against, you should take into account that your 3-month holiday insurance policy will likely not cover this. We always advise staying up to date on the FCDO advice on which regions are safe to visit and which aren’t, as this can change at any time and at short notice.

Pre-Existing Health Conditions

If you have a pre-existing health condition, you’ll need to discuss with your travel insurance provider whether you will be covered under their 3-month travel insurance policy.

If you have long-term or pre-existing medical conditions such as Crohn’s disease or Diabetes, this means you may have to have more in-depth conversations with a travel insurance provider to find a suitable travel insurance policy for you. In light of this, a standard 3-month travel insurance policy may not be suitable for your personal circumstances.

Change of Heart

If you simply decide closer to your departure time that you don’t want to embark on your trip anymore, this will not be covered by your 90-day travel insurance policy. The only circumstances in which you may be able to claim on your travel insurance plan is if the reasons for you not departing on your trip are a result of extenuating circumstances that are out of your control, not because of a change of heart.

How Much Does 3-Month Travel Insurance Cost?

Travel insurance pricing varies as it depends on the type of 3-month travel insurance policy you choose, and the level of cover that this offers. With each type of policy, you’ll find different inclusions and exclusions, and normally you’ll find that the more expensive the policy is the more you are covered for.