- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Seniors in April 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

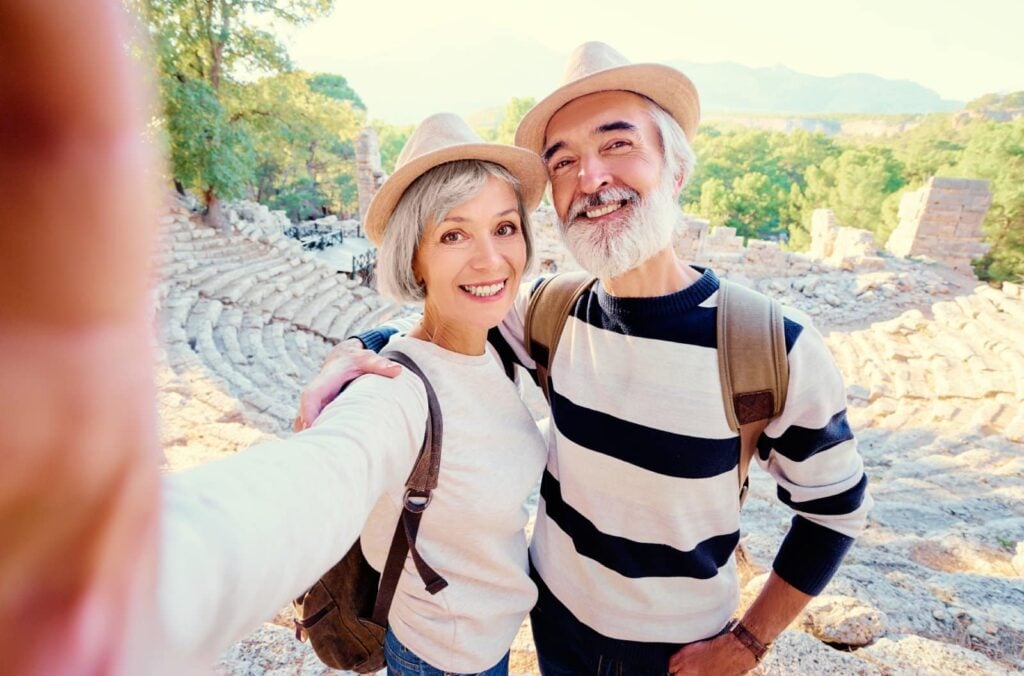

As an older adult, you may look forward to traveling the world when you retire. Whether taking a single trip or traveling extensively, health concerns and sickness can derail even the best plans.

One way to address those risks is to purchase one of the best travel insurance policies for older adults . We cover multiple insurance carriers and provide policy premiums and benefits examples to help you find the best travel insurance to meet your needs.

This is the shortlist of the best travel insurance for older adults:

HTH Travel Insurance .

John Hancock .

TravelSafe .

Seven Corners .

World Nomads .

Factors we considered when picking a travel insurance policy

Choosing the right travel insurance policy is an important decision. Yet, the best travel insurance company depends on your needs and budget. Here are the factors we focused on when making this list.

Available policy types . The best travel insurance companies offer multiple policy types to meet the needs of various travelers.

Policy coverage limits . How much will the policy cover if you need to make a claim?

Exclusions . Do you have pre-existing conditions that may affect your ability to travel, increase the potential for medical treatments during your trip or cut your trip short? What would cause the insurance company to deny a claim?

Cost . How much does the insurance company charge for a basic policy? Is this price affected by your age, length of the trip or overall health condition?

Website usability . We value insurance companies that make it simple for travelers to compare options, get a quote and purchase a policy online.

Customization . Are the insurance company's policies customizable to meet a traveler's needs or must they choose from a rigid set of options?

What matters most to you also impacts which travel insurance is best for you. Whether it's medical evacuation, pre-existing conditions or the repatriation of remains, each policy's coverages and limits differ.

Additionally, policy premiums can vary widely based on the length of coverage and your age. If you frequently travel, buying an annual policy instead of policies for each trip may make more sense. Additionally, your premiums may be much different as a new retiree at 65 compared with someone in their 70s or 80s.

You may be able to save money on your travel insurance policy by taking advantage of credit card benefits. For example, many travel cards include trip cancellation, delay and interruption benefits, luggage protection and rental car coverage at no additional charge when using the card to book flights and rent cars.

» Learn more: How to find the best travel insurance

An overview of the best travel insurance for older adults

We requested quotes from multiple travel insurance companies for a 10-day trip to Madrid in July 2023. Our hypothetical traveler is a 65-year-old man from California who is spending $8,000 for the trip. His trip cost includes airfare plus prepaid hotels and excursions.

On average, the price of a policy offered by the listed companies was about $514, with a median price of $609.

* Cost refers to the basic coverage cost if multiple options are available.

There are various coverage options and price points when comparing travel insurance policies for older adults. While the lowest-priced options in the chart are the most affordable, their policies offer different coverage. For example, policies from HTH Travel Insurance only provide medical coverage but not trip interruption, delay or cancellation protection.

Comparing coverage limits and exclusions when selecting a policy is important so you are satisfied when making a claim.

» Learn more: Is Cancel For Any Reason travel insurance worth it?

Top travel insurance options for older adults

Let's look at our six travel insurance policy recommendations for older adults.

HTH Travel Insurance

What makes HTH Travel Insurance great:

Medical benefits of up to $1 million with deductibles as low as $0.

Access to English-speaking doctors in more than 180 countries.

Insurance covers hospital care, surgery and prescription drugs.

Here's a snippet from our HTH Travel Insurance review:

"HTH has a few travel insurance policies. These include medical plans and trip protection plans, so you'll want to decide what type of coverage you require."

Since Medicare doesn't cover healthcare needs when traveling outside the United States, some travelers purchase healthcare-only policies such as this one from HTH Travel Insurance. For our test trip, their healthcare-only coverage cost is just $90. However, keep in mind that this plan only provides medical coverage — if you want insurance for things like trip cancellation , trip interruption or baggage delay, you'll need to purchase a different plan.

John Hancock

What makes John Hancock great:

Emergency medical evacuation coverage starts at $250,000 per person.

Trip interruption coverage of 125% of trip cost.

Trip delay benefits start at six hours.

Here's a snippet from our John Hancock review:

"John Hancock offers three different plans for travelers depending on their needs: Gold, Silver and Bronze. As you'd expect, the Gold level comes with the most coverage and the highest price, while the Bronze level costs the least."

John Hancock's basic coverage cost for our test trip is $616, which is slightly above average. This policy is ideal for travelers worried about health problems requiring an emergency medical evacuation during their trip.

What makes TravelSafe great:

Coverage for pre-existing conditions is available if the policy is purchased within 21 days of booking travel.

Includes a $500 benefit for missed connections or trip delays.

Trip cancellation protection of up to $10,000.

Here's a snippet from our TravelSafe review:

"TravelSafe insurance offers two different plan types: Basic and Classic. Both of them only cover single trips; the company doesn't sell multi-trip or year-long plans. The TravelSafe Basic plan offers a lower level of protection than the company's more expensive option, TravelSafe Classic."

TravelSafe's basic coverage cost for our test trip is $855. While this policy has a higher price, it offers coverage for pre-existing conditions if you buy it within 21 days of booking your trip.

Seven Corners

What makes Seven Corners great:

Lost baggage benefits of $500 per person (per item limit of $250).

Delayed bags are reimbursed up to $100 per day ($500 max).

Trip delay of up to $200 per day per person after six hours ($600 maximum).

Here's a snippet from our Seven Corners review:

"The RoundTrip Basic plan is a good comprehensive travel insurance option and offers 100% trip cancellation (for trips up to $30,000), 100% trip interruption, $100,000 for emergency medical expenses (secondary coverage), $250,000 for medical evacuation/repatriation, lost luggage, baggage delay and other benefits."

Seven Corners' basic coverage cost for our test trip is $602, which is slightly above average. It offers superior protection against lost or delayed luggage, which can really put a damper on your travel plans.

What makes Tin Leg great:

Trip cancellation and interruption for COVID included at no extra charge.

Coverage extended up to seven days for medical quarantine .

Sports equipment is covered under baggage loss coverage.

Here's a snippet from our Tin Leg review:

"Tin Leg offers nine different travel insurance coverage policies. Prices vary for each depending on your itinerary and trip costs. The Basic plan is exactly what it sounds like: a policy for low-risk trips. It includes coverage for trip cancellation, delay and interruption, plus missed connections, emergency medical and evacuation, and lost and delayed luggage coverage."

Tin Leg's basic coverage cost for our test trip is $844. COVID's impact on retirees can be severe, so having a policy with generous benefits regarding coronavirus is critical. One of the best features includes up to one week of additional coverage at no charge if you're medically quarantined.

World Nomads

What makes World Nomads great:

Covers more than 200 adventure activities.

Ability to extend coverage while traveling.

Emergency medical coverage of $100,000 for all policies.

Here's a snippet from our World Nomads review:

"World Nomads offers the Standard and Explorer travel insurance plans and excels in sports/activity-related travel insurance coverage while offering solid trip delay, baggage delay and lost luggage protections. The provider offers insurance plans for travel to nearly any country and is available to residents of most countries."

World Nomads' basic coverage cost for our test trip is $74. However, take note of the coverage limits on its policies, which can be much lower than the cost of your trip. Its Basic policy coverage caps trip cancellation or interruption at $2,500, which could leave a large gap in comparison to our traveler's $8,000 trip cost.

Best travel insurance for older adults recapped

The types of insurance plans for older adults — and how much they cost — vary significantly. There are options for those who only want to cover medical costs and plans for those who want coverage for any travel mishap that might befall them.

Other things to consider are pre-existing medical conditions, what types of activities you're doing and how long you'll be traveling.

Your chosen policy will depend on your travel needs and your comfort with risk. The upfront cost may be well worth it if you need to make a claim on an expensive injury, a canceled flight or a medical evacuation.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Seniors & Retirees: 5 Top Picks

Allianz Travel Insurance »

Trawick International »

GeoBlue »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Seniors and Retirees.

Table of Contents

- Rating Details

- Allianz Travel Insurance

- Trawick International

While anyone planning a trip overseas can benefit from having a travel insurance plan in place, older travelers need to prioritize this coverage more than others. The fact is, senior travelers and retirees have unique worries and risks to think about any time they travel far from home. These risks increase their need for travel health insurance and emergency medical coverage, as well as coverage for emergency medical evacuation that applies anywhere in the world.

Which travel insurance options work best for seniors? There are many travel insurance plans that were created with retirees in mind, although you'll want to compare them side by side. For example, you may want to look at coverage limits for medical expenses and coverage for preexisting conditions above all else.

U.S. News editors compared more than 20 of the top travel insurance companies to find the best plans for seniors. This list does the heavy lifting for you as you search for the best senior travel insurance of 2023, so read on to learn about the top picks.

- Allianz Travel Insurance: Best Annual Coverage

- Trawick International: Best Premium Travel Insurance for Seniors

- GeoBlue: Best Travel Medical Coverage for Expats

- IMG Travel Insurance: Best for Short-Term Travel Medical Coverage

- WorldTrips: Best for Flexibility

Best Travel Insurance for Seniors and Retirees in Detail

Available to senior travelers of all ages

Coverage for preexisting conditions is offered

Relatively low limits for emergency medical expenses

- Coverage for COVID-19

- Trip cancellation coverage up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical evacuation coverage up to $100,000

- Baggage loss coverage up to $1,000

- Baggage delay insurance up to $200

- Travel delay coverage up to $600 ($200 daily limit)

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

- 24-hour hotline for assistance

- Concierge service

- Preexisting condition coverage (must be added to plan within 14 days of first trip deposit or payment)

Customize plan with optional CFAR coverage

Incredibly high limits for medical expenses and emergency evacuation

Coverage is for trips up to 30 days if you're age 80 and older

- Up to $15,000 in trip cancellation insurance

- Up to $22,500 in trip interruption coverage

- Up to $1,000 for trip delays ($200 daily limit for delays of 12-plus hours)

- Up to $1,000 for missed connections

- Up to $150,000 for emergency medical expenses

- Up to $1 million in emergency medical evacuation coverage

- $750 in emergency dental coverage

- $2,000 in coverage for baggage and personal effects

- $400 in baggage delay coverage

- 24/7 noninsurance assistance services

Get comprehensive health insurance that applies overseas

Preventive and routine care included

Age limits apply for new applicants and renewals

- Preventive and routine care

- Professional services like surgery

- Inpatient medical care

- Ambulatory and therapeutic services

- Rehabilitation and therapy

Get overseas medical coverage for single trips or multiple trips

Plans were created with seniors and retirees in mind

Lower maximum coverage limits for travelers ages 80 and older

Limited nonmedical travel insurance benefits

- Inpatient and outpatient medical coverage such as for physician visits, hospitalization and surgery

- Emergency and nonemergency medical evacuation coverage

- Coverage for emergency reunions

- Return of mortal remains

- Trip interruption coverage worth up to $5,000

- Lost luggage coverage worth up to $250 (up to $50 per item)

- Coverage for terrorism worth up to $50,000

- Accidental death and dismemberment coverage worth up to $25,000

Customize your deductible and premiums

Generous medical limits for travelers ages 65 to 79

Limited medical coverage for travelers older than 80

- Up to $1 million in emergency evacuation coverage

- Medical benefits like hospital room and board, chiropractic care, and more

- Coverage for repatriation of remains

- Up to $25,000 in personal liability coverage

- Up to $10,000 in trip interruption insurance

- Up to $1,000 in coverage for lost checked luggage

- Up to $100 per day in coverage for travel delays of 12-plus hours

- Up to $1,500 in coverage for bedside visits

- Up to $100,000 in coverage for emergency reunions

Frequently Asked Questions

You can purchase some travel insurance plans (but not all) if you're older than 80 years old. However, your premiums may be higher and you'll typically qualify for lower coverage limits overall. Make sure you compare the best travel insurance plans for seniors to find the right fit for your needs.

Since seniors and retirees are more likely to face a medical emergency during a trip, most travel insurance plans for seniors include coverage for emergency medical expenses and emergency medical evacuation. Coverages vary among plans, as do limits, so make sure to compare options before you book a trip overseas.

Why Trust U.S. News Travel

Holly Johnson is a professional travel writer who has covered international travel and travel insurance for more than a decade. Johnson has researched and compared all the top travel insurance options for her own family for trips to more than 50 countries around the world, and she has successfully filed claims during that time. Johnson lives in Indiana with her two children and her husband, Greg, a travel agent who has been licensed to sell travel insurance in 50 states.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

What Older Travelers Need to Know About Getting Travel Health Insurance

While most of us tend to feel younger than we are — and are likely to be healthier and more fit than our parents were at our age — there's no denying that it's prudent for older travelers to think about purchasing travel health insurance coverage before taking a trip, especially when venturing outside the US. The odds of getting sick or having to address a chronic medical issue while traveling increase as we age.

At age 65 and older, many US citizens are eligible for Medicare (read about the eligibility requirements here ). Medicare, however, does not cover health care services or supplies for recipients traveling outside the country, except in rare cases.

There are three ways Medicare-eligibles can get health coverage while traveling abroad. Some specific Medigap policies (Medicare supplement insurance) provide this type of coverage. Travelers need to assess the type of Medigap policy they have and the specific circumstances under which coverage is provided. There's also Medicare Advantage and other Medicare programs (as opposed to Original Medicare) that may provide such coverage. Again, travelers need to determine the specifics of the coverage offered by their plans. But if neither of the above applies, older travelers should consider purchasing a travel insurance policy that provides health coverage.

We asked Stan Sandberg, co-founder of the travel insurance comparison site TravelInsurance.com , some health insurance questions that commonly arise for older travelers. This interview has been edited for clarity and length.

Related: Is Credit Card Travel Insurance Sufficient?

In general, how does age affect the cost of travel insurance?

Stan Sandberg: Similar to other actuarial-based insurance products, the older you are, the more costly your insurance will be. This is true both for medical-only plans and for trip cancellation insurance. The good news is that the travel health insurance cost increases related to age aren't as great as you might expect — especially if you are healthy with no pre-existing conditions.

A sample of 23 products we offer on TravelInsurance.com shows an average price increase of just under $85 for an 85-year-old versus an 80-year-old. For healthy buyers the same ages without a pre-existing condition , the increase is less than $35. And based on a $2,000 trip (looking across the same 23 products), the average premium for a comprehensive travel insurance plan, including trip cancellation coverage, is $109.25 for a 50-year-old; $140.90 for a 60-year-old; and $183.99 for a 70-year-old. So the increase is about 30% from ages 50 to 60, and about 30% from ages 60 to 70.

Do all, or some, policies have age limits?

Some policies, in particular travel medical policies, have an age limit. But for most trip cancellation policies, travelers won't start seeing fewer plans until they celebrate their 101st birthday!

What is the difference between annual travel insurance policies and single trip insurance for older travelers?

Annual plans cover multiple trips taken during a one-year period. Irrespective of age, however, the coverage limits of annual plans are cumulative, so a traveler could theoretically exhaust the benefits with a single claim on a first trip. Since seniors often have more time to travel, annual plans can be attractive to those who travel more than four times a year. But potential purchasers should carefully compare the costs and coverage of an annual plan with those offered as Medicare supplements.

What about obtaining insurance when you have pre-existing medical conditions? Is there any way around such exclusions?

Most policies exclude losses that stem from a pre-existing condition. (A pre-existing condition is defined as any prior injury, illness, disease or other type of medical condition for which a person sought care in the six to 12 month period prior to the effective date of the policy.) However, some policies offer a "pre-existing condition exclusion waiver" that allows coverage of pre-existing conditions. To qualify, purchasers must meet certain requirements. These typically include:

- Purchasing the travel insurance policy within a defined time period (usually seven to 21 days from when the initial payment for the trip was made. )

- Travelers need to insure 100% of their pre-paid and nonrefundable trip costs.

We recommend that travelers speak to a licensed agent and read the fine print before purchasing a policy with an exclusion waiver.

What do travelers who do a lot of cruising need to know about travel health insurance?

Most travel insurance plan benefits apply to cruisers and non-cruisers alike, but some plans will have certain benefits [like] returning to land for medical evacuation that are designed specifically for cruisers.

What additional protections does trip cancellation and interruption insurance offer?

Although it adds to the cost, this option can cover the reimbursement of trip costs due to a range of unexpected circumstances — from last-minute illnesses to severe weather and natural disasters.

A Cancel for Any Reason (CFAR) upgrade offers the most flexibility, reimbursing up to 75% of total trip costs for a cancellation of any reason up to 48 hours prior to trip departure. This benefit also has to be purchased within seven to 21 days of the initial trip payment and 100% of pre-paid and nonrefundable trip costs need to be insured.

What is medical evacuation insurance? What does it cover?

Generally speaking, emergency medical evacuation coverage will pay for transportation to the nearest hospital or medical facility that can treat you if one is not available at your location.

The coverage may also cover Medical Repatriation or the cost of transportation back to the US when your condition improves and you're cleared to travel home. Policies may also include coverage for transporting children home if you are hospitalized for an extended period. Or if you're traveling alone, the coverage may pay to bring someone to your bedside if you have an extended hospital stay.

In the event of a death during a trip, some plans may also include Return of Remains coverage that would cover the cost of bringing back the deceased.

What are some other caveats to keep in mind when pricing travel health insurance?

Pricing can vary somewhat between states, so the state where you reside may affect pricing. And remember, even if you have coverage from a Medigap plan, it can have deductibles, lifetime coverage limits up to $50,000 and limitations on trip length.

If you are traveling in a group, you might ask the sponsor about the availability of group travel insurance. Group plans are designed for easy administration by a group leader, who manages member sign-ups and changes — and the pricing for group plans doesn't change based on a traveler's age.

Thus, for senior travelers, group policies may be more cost-effective compared to nongroup, individual policies. However, individual policies can have higher coverage limits and more options available if travelers want to tailor their coverage.

Related: The Best Credit Cards With Travel Protections

Bottom Line

Buying travel health insurance is complicated under any circumstances because it's difficult to compare products (policies) from different insurers and wade through the fine print. But for older travelers — for whom the costs of insurance tends to be higher and the purchasing options fewer — these decisions can be daunting.

Of course, travelers always need to first understand the benefits and limitations of the health insurance policies they currently have in place (think: Medicare and private health insurance) to determine what additional coverage is necessary to protect their health as well as the financial investment in a trip.

Third-party insurance sites — like TravelInsurance.com , Squaremouth.com and InsureMyTrip.com — can help consumers compare the provisions and costs of different policies and, hopefully, avoid potential landmines.

Comparison sites like these offer consumers the ability to chat online, speak to agents by phone, and/or correspond by email after hours to help answer specific policy questions. In addition, the sites can help connect travelers with insurance providers in the unlikely event of the need to file a claim.

Feature photo by Hero Images / Getty Images.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance for seniors in April 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:00 a.m. UTC April 1, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Tin Leg and Trawick International offer the best travel insurance for seniors, according to our analysis of plans’ cost and coverage limits.

Best senior travel insurance plans of 2024

- Tin Leg: Gold

- Trawick International: Safe Travels First Class

- Seven Corners: Trip Protection Choice

- Generali Global Assistance: Premium

- Nationwide: Prime

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 840 coverage details evaluated.

- 84 rates reviewed.

- 5 levels of fact-checking.

Top-rated travel insurance for seniors

Best plan for seniors

Average cost for seniors, covers covid, medical & evacuation limits per person, what you should know.

For the amount of coverage you get, Tin Leg’s Gold plan is competitively priced. It includes $500,000 in emergency medical benefits and another $500,000 in medical evacuation coverage.

Pros and cons

- Excellent $500,000 per person in primary emergency medical coverage.

- Very good emergency medical coverage of $500,000 per person.

- Eligible for pre-existing medical condition exclusion waiver if conditions are met.

- “Cancel for any reason” coverage of 75% available.

- No “interruption for any reason” upgrade available.

- Hurricane and weather coverage kicks in only after a 48-hour delay.

- Lowest baggage and personal item loss coverage of our top-rated senior plans.

- Lowest travel delay coverage of our top-rated senior plans.

- No rental car coverage option.

Trawick International

Trawick International’s Safe Travels First Class policy is a relatively inexpensive option that comes with $1 million in emergency medical evacuation coverage and a high per person limit for baggage and personal items loss.

- Second-cheapest of our best senior plans.

- Best-in-class medical evacuation coverage of $1 million.

- Pre-existing condition coverage available if conditions are met.

- Baggage loss coverage of $2,000 per person is the best among our top senior plans.

- No “interruption for any reason” coverage upgrade available.

- Travel delay benefit takes 12 hours to kick in.

- Lower emergency medical benefit of $150,000 is secondary coverage.

Seven Corners

Seven Corners’ Trip Protection Choice plan has high emergency medical and medical evacuation limits, as well as rare coverage for non-medical evacuation. In addition to “cancel for any reason” coverage, you can also pay extra for “interruption for any reason” coverage.

- Excellent $1 million emergency medical evacuation coverage plus $20,000 for non-medical evacuation.

- Great “interruption for any reason” coverage of 75% available.

- The most expensive of our top-rated senior travel insurance plans.

Generali Global Assistance

Generali Global Assistance’s premium plan offers trip interruption coverage of up to 175% of your trip cost. Most top-rated competitors offer a maximum of 150%.

- Top-notch $1 million per person in medical evacuation coverage.

- Solid baggage loss coverage of $2,000 per person.

- “Cancel for any reason” coverage of 75% available.

- Baggage must be delayed for 12 hours before benefits kick in.

- Missed connection coverage of $1,000 per person only applies to cruises and tours.

- Emergency medical expense benefit is secondary coverage.

Nationwide Prime travel insurance offers an exceptional 200% coverage for trip interruption.

- If you need to cut your trip short for a covered reason, you can be reimbursed up to 200% of your prepaid trip cost.

- High travel delay coverage of $2,000 per person ($250 per day limit).

- “Cancel for any reason” coverage of 75% is available.

- Low missed connection benefit of $500 per person for cruises and tours only.

- No “interruption for any reason” coverage available.

Compare the best travel insurance for seniors

Methodology

Our insurance experts analyzed cost and coverage data from 21 plans to determine the best senior travel insurance. For this rating, we only scored travel insurance plans that offer the option to buy “cancel for any reason” (CFAR) coverage .

The benefits we scored out of a possible 100 points include:

Cost: 50 points. We scored the average cost for each travel insurance policy for a variety of international trips and traveler profiles.

Medical expenses: 15 points. Travel insurance plans that offer travel medical expense benefits of $500,000 per person were given the highest amount of points.

Medical evacuation: 15 points. Travel insurance plans with emergency medical evacuation benefits of $500,000 or more per person were given the highest number of points.

Pre-existing medical condition exclusion waiver: 20 points. Travel insurance plans that cover pre-existing medical conditions if the policy is purchased within a required timeline received points.

What is covered by travel insurance for seniors?

The best travel insurance bundles several types of insurance to provide financial protection before and during your trip.

A comprehensive senior travel insurance plan will include the following coverage types:

- Trip cancellation insurance .

- Trip delay insurance.

- Trip interruption insurance.

- Travel medical insurance.

- Emergency medical evacuation .

- Baggage loss and delay coverage.

What’s the most important travel insurance coverage for senior travelers?

Health is a top concern for older travelers. Travel insurance for senior citizens should have high coverage limits for trip interruption, travel medical insurance and emergency medical evacuation.

“Since Medicare doesn’t provide coverage abroad, it’s important for senior travelers to pay close attention to policies’ medical benefits, including emergency medical, medical evacuation and pre-existing conditions,” said James Clark, a spokesperson for the travel-insurance comparison site Squaremouth, the company behind Tin Leg travel insurance.

Older travelers should also pay attention to whether a travel insurance plan’s emergency medical coverage is primary or secondary.

“When traveling outside the U.S., seniors should know that it’s recommended to purchase a travel insurance plan that includes primary emergency medical coverage,” said Berkshire Hathaway Travel Protection vice president, Carol Mueller.

“Senior travelers on Medicare who purchase a travel insurance plan with secondary medical coverage will need to first try to get Medicare to cover their emergency travel medical expenses, which in many cases is limited to no coverage,” said Mueller. “Avoid the hassle and choose a travel insurance plan with primary medical coverage.”

How to choose the best senior travel insurance

Senior travelers shopping for travel insurance should look for plans with these benefits:

- Emergency medical expense coverage of at least $250,000. This pays for emergency medical expenses you incur during your trip and includes medical coverage for COVID-19 .

- Emergency medical evacuation coverage of at least $500,000. This pays to transport you to the nearest adequate medical facility for you to get the care you require when a physician says your illness or injury is severe enough to warrant it. Emergency medical evacuation coverage may also pay to fly a loved one to be with you and to fly you home for further treatment or recovery.

- Preexisting condition coverage. Some plans include a preexisting condition waiver as long as you buy travel insurance within a certain number of days of making your first trip deposit, you insure the full value of your trip and you are medically able to travel at the time of departure. Having a waiver will give you coverage for medical conditions documented in your health history in the 60 to 180 days before you buy your plan, with some exclusions.

- Trip interruption coverage of 150%. Trip interruption insurance reimburses you for unused, prepaid, nonrefundable trip expenses if your trip is unexpectedly interrupted while you’re in transit or at your destination. It can also cover travel costs associated with having to change your plans, such as needing to buy a last-minute economy ticket for a one-way flight home. Buying an extra ticket can push your claim over 100% of your original trip expenses, so it’s wise to look for a plan that reimburses up to 150%.

- “Cancel for any reason” (CFAR) upgrade available. For an additional cost, you can sometimes add “cancel for any reason” coverage to your travel insurance plan. This typically reimburses up to 75% of nonrefundable trip expenses if you decide not to travel for a reason not covered by your policy, as long as you cancel at least two days before you’re scheduled to travel.

How much does senior travel insurance cost?

The average cost of senior travel insurance is $434 per trip , based on our analysis of rates for older travelers. For senior trips with “cancel for any reason” (CFAR) coverage, the average cost of travel insurance increases to $629.

Travel insurance for seniors typically costs around 7% to 9% of your total prepaid, nonrefundable trip expenses. Adding CFAR coverage can add 45% or more to that cost.

How much you pay for travel insurance will depend on the age of you and your fellow travelers, the length of your trip and the total of your nonrefundable trip costs.

Compare senior travel insurance rates

Average senior travel insurance costs are based on rates for international trips for travelers ages 65 and 70, with CFAR coverage and without. Travel insurance plans have different levels of benefits, which can account for price differences.

How to save money on travel insurance for seniors

Travel insurance companies don’t typically offer discounts. But if you can get a senior discount on any of your travel itself, you’ll have a smaller trip cost to insure. This will lower the cost of your senior travel insurance.

Getting quotes from multiple travel insurance providers is also a great way to save money. Every policy offers more coverage in some areas and less in others. Depending on what coverage is most important to you, certain policies will give you more value than others.

More: What does travel insurance cover?

Is CFAR worth it for senior travelers?

CFAR coverage adds to the cost of your plan, but older travelers may want to consider a travel insurance policy with both trip cancellation insurance and “cancel for any reason” coverage, said Clark.

CFAR benefits offer maximum flexibility to cancel your plans due to illness, injury or any other reason and will reimburse a percentage of your nonrefundable trip costs, usually 50% or 75%. The only caveat is that you’ll need to cancel at least two days before you plan to travel.

When shopping for travel insurance, look for CFAR-related fine print. You often must buy CFAR within a certain number of days of making your first trip deposit, such as 14 days. You are also usually required to insure the full value of your nonrefundable trip expenses.

More travel insurance for seniors resources

- What is travel insurance?

- What does travel insurance cover?

- Average cost of travel insurance

- Is travel insurance worth it?

- Best COVID travel insurance

- Best cruise travel insurance

Best senior travel insurance FAQs

If you rely on Medicare for health insurance and you’re traveling internationally, buying senior travel insurance with excellent emergency medical insurance and emergency medical evacuation benefits is a good idea.

“One of the most important considerations for travelers with existing health issues is to find a plan that offers a preexisting condition exclusion waiver,” said Stan Sandberg, cofounder and CEO of TravelInsurance.com.

To qualify for the waiver, you’ll usually need to purchase your trip insurance policy within seven to 14 days of making your initial trip payment. Some premium policies may extend this coverage if you buy them before or within 24 hours of making your final trip payment, he said.

Even with a waiver, medical bills related to certain excluded conditions such as dementia or depression may not be covered, so read the policy carefully to see if your preexisting conditions qualify.

More: Is travel insurance worth it?

Tin Leg’s Gold plan and Trawick International’s Safe Travel First Class plan provide the best travel insurance for seniors for the price, according to our analysis. These are the only plans to merit 5 stars in our rating.

Yes, you can get travel insurance over 80, but it will cost you more.

Yes. If you’re shopping for travel insurance over 80, for instance, you’ll pay an average of 18% of your total trip cost. That is considerably higher than the average cost of travel insurance for a 30-year-old, which is only 5%.

Travel insurance for the elderly varies by insurer when it comes to upper age limits . If you are concerned about finding the best travel medical insurance for seniors over 7 0 , start with an online comparison site like Squaremouth where you only have to enter your age and trip details once to see which policies are available to you.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

Travel Insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travel Insurance Mandy Sleight

Travelex travel insurance review 2024

Best travel insurance companies of April 2024

Travel Insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

Survey: Nearly 85% of Americans avoid family over the holidays

Travel Insurance Kara McGinley

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

The Best Travel Insurance Plans for Seniors

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Nomadic Matt's Travel Site

Travel Better, Cheaper, Longer

The Best Travel Insurance Companies for Seniors

When it comes to planning a trip, there is one expense far too many travelers overlook: travel insurance .

It’s a boring topic to research and read about — and it is an added expense many budget travelers aren’t excited about paying. Chances are nothing is going to go wrong, right? Why not just save the money and spend it on more travel?

Unfortunately, as many people have learned the hard way — myself included — things can go wrong at the drop of a hat. I’ve had my luggage lost, had brand new gear broken, and needed emergency medical help while traveling (on multiple occasions).

And these are just the “serious” incidents. I’ve also experienced countless flight delays and cancellations — events that are also covered by travel insurance.

In short, things can (and will) go wrong on the road. Why not make sure you’re prepared?

This is especially important for older travelers.

While older travelers generally have a bit more sense than younger backpackers (when was the last time you saw a 65-year-old jumping a burning skipping rope at the Full Moon Party in Thailand or bombing down Death Road in Peru?), there are often health and medical issues that need to be considered.

Even if you’re a healthy 55+ traveler, buying travel insurance is a necessary step in your planning. It will cover you for delays and cancelations, injuries, and worse. It’s a safety net for you and your loved ones that will not only help you avoid massive medical expenses but also provide you with peace of mind so you can enjoy your trip without worry.

I never leave home without it. You shouldn’t either.

Here’s everything you need to know about buying travel insurance as an older or senior traveler.

What to Look for in a Comprehensive Insurance Policy

Insurance is a billion-dollar business, and everyone wants their hand in the cookie jar. Consequently, you face a mind-numbing number of companies and policies, some with terminology that can be confusing and overwhelming.

So, what should you do?

First, make sure your travel insurance offers a high coverage limit on your medical expenses. Most travelers can get by with $100,000 USD in coverage. However, if you’re older or have a medical condition, then you may want more ($250,000-500,000 USD would be my suggestion).

High coverage limits are important because if you get sick, injured, or need serious attention and have to seek professional care, you’ll want to make sure your high hospital bills are covered. The worst thing you can do is go cheap and get a policy with a $20,000 USD coverage limit, then break a leg and reach that limit before they are done taking care of you.

Second, you want to make sure your travel insurance policy covers emergency evacuation and care that is separate from your medical coverage. For example, if you are hiking in the woods and you break your leg, your policy should cover your evacuation to the nearest acceptable medical facility.

If a natural disaster occurs and you need to be evacuated to somewhere else, your plan should cover that as well, ideally up to $300,000 USD.

Additionally, make sure you understand if your evacuation coverage will pay for you to get home or if it will just send you to the nearest acceptable facility. For example, if you break your leg abroad, most insurance policies will pay for your hospital bills. However, they won’t pay for you to get home since it’s not a life-threatening injury requiring advanced care.

Standard emergency evacuation coverage frequently only pays for a flight home if your current facility is inadequate or if it’s “medically necessary.”

In short, double-check if your company will cover the cost of your flight back home if you need it.

If you’d prefer not to stay in a foreign hospital for treatment and recovery, you should look into a medical transport membership program like Medjet , which ensures that, should you be hospitalized abroad, you’ll be able to be repatriated — something many travel insurance policies can’t guarantee ( read more about Medjet in my comprehensive review ).

Third, great travel insurance plans always include the following provisions:

- Coverage for most countries (including the places you plan on visiting)

- Coverage for injury and sudden illnesses

- Coverage for lost, damaged, or stolen possessions, like jewelry, baggage, documents, etc.

- Some coverage for your electronics (and the option for a higher coverage limit)

- Coverage for cancelations for hotels, flights, and other transportation bookings if you have a sudden illness, death in the family, or some other emergency

- Coverage for political emergencies, natural disasters, or strife in the country that may cause you to head home early

- Financial protection if any company you are using goes bankrupt and you are stuck in another country

- 24/7 assistance (you don’t want to call to be told to call back later)

A quick note on electronics: Most companies only have a small limit (usually up to $500 USD per item), as part of their basic coverage. You can often buy supplemental insurance for more coverage. If you’re traveling with lots of expensive gear, make sure you buy supplemental coverage.

Additionally, as an older traveler, you may also want:

- Policies that cover preconditions (if you have them). Since most policies exclude these, you’ll need to shop around for a plan that will cover them.

- Insurance plans that include a “cancel for any reason” clause. If you think you may need to cancel your trip before you depart and don’t want to risk losing your money, find a policy that offers this. It’s less common (and more expensive), but it might be useful if you have a medical condition that might impact your trip.

The Best Travel Insurance Companies for Senior Travelers

Here’s a quick overview of Medjet :

- Extensive medical transport coverage

- Offers regular coverage up to age 74 (with extended coverage up to age 84)

- Coverage for COVID-19

- Limited time spent in foreign medical facilities

- Both short-term and annual plans

- Available to residents of the US, Canada, and Mexico

Insure My Trip

As an older traveler, this is the best place for you to shop around and get a quote. You’ll be able to find policies for travelers over 70 as well as plans that have a “cancel for any reason” clause. It also offers policies that include coverage for certain pre-existing conditions.

Here’s a quick overview of IMT :

- Comparisons of plans from over 20 different companies to ensure you get the best one

- Guaranteed low prices

- Coverage for travelers over 65

- “Anytime advocates” ask the insurer to give your claim a second look if you think it was unfairly denied

A Note on COVID-19 (and Other Pandemics)

As many travelers learned the hard way in 2020, most travel insurance policies historically did not cover pandemics. Until recently, that really wasn’t a concern for most travelers, including me. Prior to 2020, I never really gave the “pandemic clause” much thought when reading my insurance policies.

However, these days pandemic coverage is at the forefront of every traveler’s mind (and rightly so).

Fortunately, over the past few years, insurance companies adapted and most companies now provide limited coverage for COVID-19 (or other pandemics). This limited coverage usually includes trip cancellation or delay, though some also have medical coverage for COVID or transportation home (as is the case with Medjet ).

Before you buy a plan, read the fine print regarding pandemics and COVID-19. Make sure you fully understand what is and is not included so you can take appropriate action should a situation arise. When in doubt, call them and speak to a representative. Don’t risk your health on assumptions!

Everyone should buy travel insurance before they leave home — regardless of their age. While most travelers only experience minor hiccups, such as delayed flights or lost baggage, it’s always better to be safe rather than sorry should a health emergency arise.

However, older travelers in particular should make sure they have the coverage they need in case something goes awry. While their options are usually less robust (and more expensive), there are still plenty of affordable ones to ensure you are protected as you enjoy your well-earned travels.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight Find a cheap flight by using Skyscanner . It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation You can book your hostel with Hostelworld . If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

- SafetyWing (best for everyone)

- Insure My Trip (for those 70 and over)

- Medjet (for additional evacuation coverage)

Want to Travel for Free? Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip? Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip? Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

Got a comment on this article? Join the conversation on Facebook , Instagram , or Twitter and share your thoughts!

Disclosure: Please note that some of the links above may be affiliate links, and at no additional cost to you, I earn a commission if you make a purchase. I recommend only products and companies I use and the income goes to keeping the site community supported and ad free.

Related Posts

Get my best stuff sent straight to you!

Pin it on pinterest.

Essential Guide to Over 50s Travel Insurance

Traveling is an exciting experience that should be enjoyed at any age. For those over 50, exploring new destinations and embarking on thrilling adventures becomes even more appealing. However, it is important to prioritize your safety and peace of mind when planning your next trip. This is where over 50s travel insurance comes into play.

Understanding Over 50s Travel Insurance

Over 50s travel insurance is a specialized insurance policy designed to provide coverage and protection for individuals who are 50 years of age or older. It offers a range of benefits that cater to the specific needs of mature travelers. Whether you are planning a relaxing beach holiday or an adrenaline-fueled adventure, having the right travel insurance can ensure that you have a worry-free trip.

Key Benefits

Medical Expenses Coverage: As we age, there may be an increased likelihood of requiring medical assistance while traveling. Over 50s travel insurance provides coverage for emergency medical expenses, ensuring that you receive the necessary care without worrying about the financial burden.

Trip Cancellation or Interruption: Life is unpredictable, and unexpected circumstances such as illness or family emergencies may force you to cancel or cut short your trip. Travel insurance for over 50s covers non-refundable expenses, allowing you to recoup your financial investment.

Baggage and Personal Belongings: Losing your luggage or having items stolen can be a major inconvenience. With over 50s travel insurance, you can receive compensation for lost, damaged, or stolen belongings, giving you peace of mind throughout your journey.

Emergency Assistance: In unfamiliar surroundings, it is reassuring to know that help is just a phone call away. Over 50s travel insurance offers round-the-clock emergency assistance services, including medical advice, legal support, and emergency evacuation if necessary.

Pre-existing Medical Conditions: Over 50s travel insurance takes into account pre-existing medical conditions and provides coverage for any related emergencies that may occur during your trip. It is important to disclose these conditions during the application process to ensure full coverage.

Choosing the Right Policy

Before purchasing over 50s travel insurance, it is crucial to assess your individual needs and compare policies from different providers. Here are some factors to consider:

Coverage Limits: Different policies offer varying levels of coverage for medical expenses, trip cancellation, and personal belongings. Ensure that the policy you choose aligns with your travel plans and provides adequate coverage in case of unforeseen events.

Exclusions and Limitations: Familiarize yourself with the exclusions and limitations of the policy. Some insurance policies may not cover certain activities or have restrictions on destinations, so it is important to review these details to avoid any surprises.

Claim Process: Research the ease and efficiency of the claims process. Choose an insurance provider that has a reputation for handling claims fairly and efficiently, as this will greatly impact your experience in the event of filing a claim.

Additional Coverage Options: Some travel insurance policies offer add-ons such as coverage for high-value items, adventure activities, or rental car protection. Assess your specific needs and consider adding these options to enhance your coverage.

Cost Considerations

When considering the cost of over 50s travel insurance, it’s essential to understand the factors that influence pricing. Firstly, your age plays a significant role, as insurers often adjust premiums based on age brackets. Older travelers may face higher premiums due to perceived increased risk.

The duration and destination of your trip also impact the cost. Longer trips and visits to destinations with higher healthcare costs or greater risk factors may result in higher premiums. Additionally, the level of coverage you select affects pricing. Basic plans may offer limited coverage at a lower cost, while comprehensive policies provide more extensive protection at a higher price.

While it’s natural to seek the cheapest policy available, it’s crucial to assess the value you’re receiving. Opting for the lowest-priced plan may leave you underinsured and vulnerable to significant expenses in case of emergencies. Instead, consider the potential risks and costs associated with travel mishaps such as trip cancellations, medical emergencies, or lost luggage.

To strike the right balance between affordability and coverage, compare quotes from multiple insurers. Look for policies tailored to the needs of older travelers, offering comprehensive benefits like emergency medical coverage, trip cancellation protection, and assistance services. Some insurers may offer discounts or special rates for over 50s, so be sure to inquire about available savings.

Ultimately, the goal is to find a policy that provides adequate coverage for your travel needs without breaking the bank. By carefully considering your options and prioritizing protection over price alone, you can enjoy peace of mind knowing you’re prepared for whatever your journey may bring.

Traveling after 50 can be a fulfilling and enriching experience, and having the right protection in the form of over 50s travel insurance is essential. It provides the peace of mind and financial security necessary to fully enjoy your adventure. By understanding the key benefits, comparing policies, and carefully considering your needs, you can select the right travel insurance policy that will protect you on your next journey. So, pack your bags, explore the world, and let over 50s travel insurance be your trusted travel companion.

Travel Insurance For Over 50s and Seniors: What You Need to Know

Regardless of how often you travel, it’s important to consider that health concerns may get in the way of the best experience. Thinking about good travel insurance is critical, especially if you travel solo at fifty-plus . In this article, we cover what type of travel insurance to choose, the best options for travel insurance companies for senior travellers and those over 50, and information to help you select the one that best suits you and your travel plans.

Table of Contents

Our Top Picks for the Best Travel Insurance for Over 50s

Here is what we recommend for travel insurance for travellers over 50s and seniors. Here’s a website that compares several companies on the market from the US: Travel Insurance Comparison Site, Safety Wing for long-term travellers from the US, and Cover-More from Australia for Australian residents.

Safety Wing ↗

The best travel insurance for US frequent and long-term travellers up to 69 years to international destinations worldwide.

Cover More ↗

The best Travel Insurance +65 for Australian citizens, with a wide range of international plans and covers.

Travel Insurance ↗

The best Travel Insurance comparison online tool in the US. Compare different insurance plans from +10 insurance companies.

- Travel insurance

- Over 50 travel insurance

Over 50s travel insurance

Compare travel insurance for over 50s, choose add-ons like golf and sports cover, personal possessions and money cover, compare different types of policies such as business, single trip or multi trip, what is over 50s travel insurance.

It’s simply travel insurance that covers you in your 50s. There’s nothing particularly different or specialist about travel insurance for over 50s. Prices won't really be all that different compared to someone in their 20s or 30s.

You might see price increases or fewer insurers if you have a pre-existing health condition, but this would be the same for someone of any age. There’s no upper age limit with these policies, so you might see less insurers in the results only when you get into your 80s or 90s.

Insurance naturally goes up in price the older you get for travel, but being in your 50s, you don’t really have to worry too much in terms of price and availability of insurers.

What does travel insurance cover?

An over 50s travel policy will cover the same as a standard policy. This may include:

- Medical treatment and return travel to the UK if you’re unwell or are injured on holiday

- Cancellation cover if your holiday is cancelled or you can't go on your trip

- Baggage, personal possessions and money cover if your items are lost or stolen

An over 50s travel insurance policy might offer slightly enhanced medical benefits or no age limits on the cover.

It’s important to check exactly what is and isn’t covered to get the best value cover. Terms will vary between different policies and insurance companies.

What doesn't it cover?

Common exclusions for over 50s travel insurance include

- Travelling against FCDO advice. When travelling, always follow the latest government advice .

- Failure to declare any pre-existing medical conditions. If you have a medical condition, you should get a pre-existing conditions insurance quote to make sure you're covered on your trip.

- Incidents involving alcohol or drugs.

- Activities or sports, unless you've included them as extras. Let your insurer know if you're doing anything such as skiing or adventure sports.

- Waiting too long to report an incident. You need to declare any lost or stolen personal possessions usually within 24 hours. But this should be detailed in the policy.

Make sure you're familiar with all the exclusions on your policy before you travel, and always make sure you're honest when getting a quote.

How much does over 50s travel insurance cost?

The cost of your policy varies depending on:

- Where you’re travelling - for example, travelling to the USA is likely to cost more than Europe

- How long you’re away for - the longer the trip, the more you're likely to pay

- If you have a pre-existing medical condition

- If you want to add any extras to your policy, like golf or cruise cover

Here are the average costs of 1 week policies for some of the most popular destinations around the world: 1 :

1 The cheapest over 50 policies by worldwide destinations. Based on 1 adult aged 55, with no previous medical conditions travelling for 1 week. Confused.com data - February 2024.

We compare 43 trusted travel insurance companies to find you our best deals

What are the main types of over 50s cover?

There are several types of cover to choose from, each designed to suit a different type of trip. They include:

Single trip travel insurance

Covers you for 1 trip to a single destination. Depending on the insurer this could be up to a month or longer.

Annual travel insurance

Sometimes known as multi-trip, this type of cover is for people who make multiple trips in a 12-month period. It usually covers you for an unlimited number of trips in a year, but each trip is usually limited to 31 days. Some travel insurance providers offer policies that cater for longer individual trips.

Backpacker travel insurance

Could be useful if you're planning on going travelling around multiple countries. These policies cover you for between 1 and 18 months and may be ideal sabbaticals from work or early retirement.

Business travel insurance

Provides cover for your laptop and other business equipment while abroad, as well as any company money that’s lost or stolen.

What optional extras are available?

To get the right level of cover for your trip, you can add optional extras to your policy:

- Golf cover insures your equipment. This isn't always available with over 50s cover, so check your policy.

- Cruise cover covers your cruise for unscheduled stops or missing a port. It also covers you for medical emergencies on board and cabin confinement.

- Specialist sports cover includes water and winter sports.

- Gadget cover can help if the cover limit on a standard policy isn’t high enough for your gadgets.

- Single item cover for those travelling with items that exceed the single item limit, like a watch or jewellery.

Compare over 50s travel insurance quotes

What information do i need for an over 50s travel insurance quote.

To get a quote we'll need information about:

- The dates you’re travelling

- The country or countries you’ll be visiting

- Any pre-existing medical conditions

For annual trips, you don’t need to include specific travel dates or holiday details as you may not have booked them all. But you do need to specify the parts of the world you want to include.

Can I get a quote with a serious pre-existing medical condition?