Quick links

Get the Amex GBT Mobile app

Traveling with Amex GBT

Get Support

Useful resources for travelers

Amex GBT Mobile app user guide Overview of key app features.

Neo training for new users

Concur Travel training for new users

Neo Info Hub

Neo key booking tips

Concur Travel key booking tips

Benefits of traveling with Amex GBT

Travel confidently with the Amex GBT Mobile app

Live itinerary – 24/7 chat – Disruption support

Have questions?

Amex GBT travel counselors are available 24/7 to support you. Get in touch through your Amex GBT Mobile app or call the number on your itinerary.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

What can we help you with today?

For fastest service, choose the number that best describes your call

Personal Accounts

Phone

Customer Service

Already a Card Member?

Get help with your existing account.

1-800-528-4800

Hearing Impaired TTY

Relay: Dial 711 and 1-800-528-4800 24/7

Make a Payment

Pay your bill by phone. You can also make a payment online .

1-800-472-9297

Apply for a Card

Apply for a Personal card today. You can also apply online .

1-888-297-1244

8 am - 11 pm EST, 7 days

Check Application Status

Ask about the application status of a new account.

1-877-239-3491

Mon – Fri: 8 am - 12 am EST

Sat: 10 am - 6:30 pm EST

American Express Serve

Click here to apply.

1-800-954-0559

American Express Gift Cards

1-877-297-4438

8 am - 12 am EST, 7 days

Gift or Travelers Cheques

More contacts here .

1-800-221-7282

MyCredit Guide Customer Care

833-421-3385

Mon – Fri: 9 am - 10 pm ET (excluding holidays)

General Inquiries

American Express

P.O. Box 981535

El Paso, TX 79998-1535

Bill Payment

P.O. Box 96001

Los Angeles, CA

90096 – 8000

Bill Payment (Overnight)

Attn: Express Mail Remittance Processing

20500 Belshaw Ave

Carson, CA 90746

General Inquiries (Prepaid Products)

American Express Global Payment Options

Executive Consumer Relations

115 W. Towne Ridge Parkway

Sandy, UT 84070

Open a Savings account or manage your existing account online .

1-800-446-6307

General Inquiries or Make a Deposit

American Express National Bank

P.O. Box 30384

Salt Lake City, Utah 84130-0384

Personal Loans

You can also apply for a loan or manage your loan account online .

1-844-273-1384

Mon - Fri: 9 am - 8 pm EST

P.O.Box 1270 Newark,

NJ 07101-1270

Attn: Express Mail Remittance Processing 20500 Belshaw Ave

Get help with your existing Personal Checking account.

1-877-221-2639

1-888-556-2436

Mon - Fri: 9 am - 6 pm EST

Open an Account

If you already have a personal Card, you can learn more and apply online.

Salt Lake City, UT 84130

Small Business Cards

Get help with your existing American Express account.

1-800-492-3344

Pay your bill by phone. You can also make a payment online .

Apply for a Small Business Card today by phone.

1-800-519-6736

Mon - Fri: 9 am - 12 am EST

Weekends: 9 am - 6 pm EST

American Express P.O. Box 981535

Corporate Cards

Customer Service (for Card Members)

1-800-528-2122

Customer Service (for Program Administrators)

888-800-8564

8 am – 8 pm EST

Corporate Membership Rewards (for Program Administrators)

844-617-4612

Platinum Customer Service (for Card Members)

1-800-492-3932

Global Dollar Card Customer Service (for Program Administrators)

1-800-597-5500

Business Line of Credit & Payment Accept

1-888-986-8263

Mon - Fri: 8 am - 9 pm EST

Sat: 10 am - 6 pm EST

P.O. Box 570622

Atlanta, GA 30357

Accounts Payable (AP) Automation Solutions

- For card-related inquiries , such as credit limit, card maintenance, plastic card disputes, adding plastic users, supplemental users, and additional Program Administrators, the Card Member needs to reach out to the phone numbers listed under the Small Business and Corporate sections above.

- For program-level support , such as program level management, payments, rewards, ordering new employee cards/replacing cards, and program level reporting, the Program Administrator needs to reach out to the phone numbers listed under the Corporate section above

- If you are a buyer using an accounts payable (AP) automation solution other than American Express One AP or Synaptic, please reach out to that solution directly.

- If you are a buyer using American Express One AP or Synaptic, or a supplier with a virtual card inquiry across all accounts payable automation solutions, please reach out to the below:

American Express One AP (for US Small Business and Corporate Buyers)

1-844-358-4025

Mon - Fri: 8 am - 6 pm ET

Synaptic (for US Small Business and Corporate Buyers)

1-855-431-2430

Virtual Card Inquiries Across All Accounts Payable (AP) Automation Solutions (for US Suppliers)

1-844-264-9373

Business Checking

Get help with your existing Business Checking account.

1-855-497-1040

Ask about the status of a new account.

Mon - Fri: 9 am - 6 pm EST

Learn more and apply to open an account online.

Applying by phone is unavailable.

Apply Online

Business Loans

You can also manage your loan account online.

1-888-781-6972

1-800-528-5200

Mon - Fri: 8 am - 8 pm EST

Prospective and New Merchants

More info here .

1-800-445-2639

Air, Hotels, Car Rental and Cruises

Reservations for Air, Hotel and Car Rentals

1-800-297-2977 ; outside US, 1-312-980-7807

1-800-297-5627

Mon - Fri: 9 am - 9 pm EST

Sat - Sun: 10 am - 6 pm EST

Membership Rewards

You can manage and learn more about your Membership Rewards account by phone or online .

1-800-297-3276

Mon - Fri: 9 am - 12 am

Sat - Sun: 10 am - 6.30 pm EST

Connect With Us

>> Connect with Amex on Facebook

About American Express Global Business Travel

American Express Global Business Travel (Amex GBT) is the world’s leading B2B travel platform, providing software and services to manage travel, expenses, and meetings and events for companies of all sizes. We have built the most valuable marketplace in B2B travel to deliver unrivalled choice, value and experiences. With travel professionals in more than 140 countries, our customers and travelers enjoy the powerful backing of American Express Global Business Travel.

Visit amexglobalbusinesstravel.com for more information about Amex GBT, and follow @amexgbt on Twitter , LinkedIn and Instagram .

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Capital One Quicksilver benefits guide 2024

Credit Cards Lee Huffman

United Airlines credit cards have a secret perk that makes it easier to book awards

Credit Cards Jason Steele

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Full List of American Express Card Customer Service Numbers [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3126 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![amex travel uk contact Full List of American Express Card Customer Service Numbers [2024]](https://upgradedpoints.com/wp-content/uploads/2021/01/customer-care-representative.jpeg?auto=webp&disable=upscale&width=1200)

American Express Personal Card Customer Service Numbers

American express business card customer service numbers, american express corporate cards customer service numbers, american express travel and membership rewards customer service numbers, american express customer service alternate methods of contact, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you want to contact American Express Customer Service regarding your personal, business, or corporate card, you’ve come to the right place. Whether you want to make a payment, apply for a new card, dispute a fraudulent charge, or simply have questions about your account, you can use the following customer service phone numbers.

The best number to call may vary depending on the purpose of your call, so we’ve broken out some common areas of concern. We’ve also included some alternate contact methods so you can choose the best way to get in touch with American Express. That said, the general customer service line is always a good place to get started.

If you need to talk to someone regarding one of the Amex credit cards , you’ll want to use the phone numbers in this section.

Customer Service for Personal Cards: 800-528-4800 or contact the number on the back of your card for the following American Express personal cards:

- American Express Cash Magnet ® Card *

- American Express ® Gold Card

- American Express ® Green Card *

- The Amex EveryDay ® Credit Card *

- The Amex EveryDay ® Preferred Credit Card *

- Blue Cash Everyday ® Card from American Express

- Blue Cash Preferred ® Card from American Express

- Delta SkyMiles ® Blue American Express Card

- Delta SkyMiles ® Gold American Express Card

- Delta SkyMiles ® Platinum American Express Card

- Delta SkyMiles ® Reserve American Express Card

- Hilton Honors American Express Aspire Card *

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass ® Card

- Marriott Bonvoy Brilliant ® American Express ® Card

- The Platinum Card ® from American Express

* All information about these cards has been collected independently by Upgraded Points.

Hot Tip: This list includes all cards that American Express currently issues. If you hold a card that is not listed, you are still able to call the phone numbers listed or call the number listed on the back of your card for assistance.

To Report Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Make Payments by Phone: 800-472-9297

Apply for a Card: 888-297-1244

Check Application Status: 877-239-3491

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you have an American Express business card , this is the section you’ll want to use.

Customer Service for Business Cards: 800-492-3344

- Amazon Business American Express Card*

- Amazon Business Prime American Express Card *

- The American Express Blue Business Cash™ Card

- American Express ® Business Gold Card

- The Blue Business ® Plus Credit Card from American Express

- Business Green Rewards Card from American Express *

- The Business Platinum Card ® from American Express

- Delta SkyMiles ® Gold Business American Express Card

- Delta SkyMiles ® Platinum Business American Express Card

- Delta SkyMiles ® Reserve Business American Express Card

- The Hilton Honors American Express Business Card

- Lowe’s Business Rewards Card from American Express *

- Marriott Bonvoy Business ® American Express ® Card

- The Plum Card ® from American Express

Hot Tip: If you have a card that is not listed, you can still call the phone numbers listed or refer to the number listed on the back of your card for assistance — this just means that your card may no longer be open to new applicants.

To Report a Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Apply for a Card: 800-519-6736

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you hold a corporate card that your employer manages, these are the customer service numbers you’ll want to reference.

General Customer Service for American Express Corporate Cards: 800-528-2122

- American Express ® / Business Extra ® Corporate Card*

- American Express ® Corporate Gold Card*

- American Express ® Corporate Green Card*

- Corporate Platinum Card ® by American Express*

Platinum Customer Service: 800-492-3932

Bottom Line: We’ve included the numbers for cardholders only. If you’re a Program Administrator, you’ll need to call 888-800-8564 for customer service support.

If you’re looking to book or change travel through American Express or have questions about your Membership Rewards account , here are some good numbers to use.

Reservations for Air, Hotel, and Car Rentals:

- Inside the U.S.: 800-297-2977

- Outside the U.S.: 312-980-7807

Reservations for Cruises: 800-297-5627

Membership Rewards Customer Service Number: 800-297-3276

Company Website: americanexpress.com

General Inquiries Mailing Address: American Express P.O. Box 981535 El Paso, TX 79998-1535

Payment Mailing Address: American Express P.O. Box 650448 Dallas, TX 75265-0448

Customer Login: global.americanexpress.com/login

Secure Chat: Log into your American Express account and click the blue Chat box in the bottom right corner. This secure chat function will allow you to speak with an American Express representative.

Twitter: Tweet questions to @AskAmex

Facebook: Send messages via Facebook

In the event you need to contact American Express, you can use this post as a resource. It includes the various ways you can contact American Express, including by phone, chat, and social media. And could come in handy if you need to do things like make a payment, dispute a charge, or even apply for a new card.

The information regarding the Amazon Business American Express Card, American Express ® / Business Extra ® Corporate Card, American Express ® Corporate Gold Card, and American Express ® Corporate Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The information regarding the American Express Cash Magnet ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the American Express ® Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information for The Amex EveryDay ® Credit Card has been independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the The Amex EveryDay ® Preferred Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Business Green Rewards Card from American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Corporate Platinum Card ® by American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the Blue Cash Everyday ® from American Express, click here . For rates and fees of the Blue Cash Preferred ® Card from American Express, click here . For rates and fees of the Delta SkyMiles ® Blue American Express Card, click here . For rates and fees of the Delta SkyMiles ® Gold American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum American Express Card, click here . For rates and fees of Delta SkyMiles ® Reserve American Express Card, click here . For rates and fees of the Hilton Honors American Express Card, click here . For rates and fees for The Hilton Honors American Express Surpass ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here . For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the Amazon Business Prime American Express Card, click here . For rates and fees of The American Express Blue Business Cash™ Card, click here . For rates and fees of the American Express ® Business Gold Card, click here . For rates and fees of The Blue Business ® Plus Credit Card from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the Delta SkyMiles ® Gold Business American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum Business American Express Card, click here . For rates and fees for the Delta SkyMiles ® Reserve Business American Express Card, click here . For rates and fees of The Hilton Honors American Express Business Card, click here . For the rates and fees of the Lowe’s Business Rewards Card from American Express, click here . For rates and fees of the Marriott Bonvoy Business ® American Express ® Card, click here . For rates and fees of The Plum Card ® from American Express, click here .

Frequently Asked Questions

Does amex have live chat.

American Express has a live chat feature that allows you to speak directly with an American Express representative 24/7.

To access this chat, log on to your American Express account and click the blue Chat box in the bottom right corner. American Express suggests doing this from a desktop for the best results.

What is the number for American Express customer service?

American Express has a few customer service lines depending on your card type:

- Personal cards — 800-528-4800

- Business cards — 800-492-3344

- Corporate cards — 800-528-2122

You can also contact the number on the back of your card as well.

How do I dispute a charge on my American Express card?

Once you see a charge on your card that you don’t recognize or see charges for services you believe are incorrect, you’ll want to contact American Express customer service immediately. Whether you have a personal, business, or corporate card, the best number to call is 800-528-4800 .

You can also log on to your account and do the following:

- Visit Account Services

- Select Inquiry and Dispute Center from the side menu

- Click on Open a Billing or Payment Dispute

How do I verify my American Express card?

Once you receive your new American Express card in the mail, you’ll have to confirm that you’ve received it for it to be activated. You can confirm receipt online or by calling the phone number listed on the sticker on the front of your new card.

With either method, you’ll need to provide the card number and 4-digit security code.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travel uk contact American Express Green Card — Full Review [2023]](https://upgradedpoints.com/wp-content/uploads/2018/03/American-Express-Green-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

The Guide to American Express Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

American Express travel insurance vs. coverage provided by AmEx cards

Complimentary travel insurance provided by amex cards.

Trip cancellation and interruption insurance

Trip delay insurance

Car rental loss and damage insurance

Baggage insurance

Premium global assist.

Global Assist Hotline

Standalone American Express travel insurance plans

Should you use the complimentary benefits or purchase a policy, amex travel insurance recapped.

You can get AmEx travel insurance via your card or as a standalone policy.

AmEx cards typically include coverage for trip delays, interruptions, cancellations, baggage and car rentals.

Coverage tends to be secondary.

Policies vary by card.

American Express has two different types of travel insurance offerings: standalone travel insurance plans that customers can purchase and travel insurance that is included as a complimentary benefit on certain cards.

So if you’re thinking about getting travel insurance before a trip, get familiar with American Express travel insurance benefits that are included on your credit cards. Knowing what protections you already have will prevent you from spending money on a separate policy with benefits that overlap.

A standalone travel insurance policy from American Express may offer more robust coverage, but depending on your needs, the travel insurance perks provided by your AmEx card may be sufficient.

If you primarily want specific coverage for cancellations, delays or rental cars and baggage, it’s likely your card will be enough.

If, however, you’re mainly concerned with emergency health coverage while traveling , you’re better off with a separate medical insurance policy because the benefits provided by credit cards are limited in those areas. You can purchase this from American Express directly or shop around other travel insurance companies .

» Learn more: How to find the best travel insurance

There are six travel insurance benefits offered on many American Express cards:

Trip cancellation and interruption insurance .

Trip delay insurance .

Car rental loss and damage insurance .

Baggage insurance plans .

Premium Global Assist Hotline .

Global Assist Hotline .

Here's a closer look at each.

Trip cancellation will protect you if you need to cancel your trip for a covered reason (more below), and you will be reimbursed for any nonrefundable amounts paid to a travel supplier with your AmEx card. Bookings made with Membership Reward Points are also eligible for reimbursement. Travel suppliers are generally defined as airlines, tour operators, cruise companies or other common carriers.

Trip interruption coverage applies if you experience a covered loss on your way to the point of departure or after departure. AmEx will reimburse you if you miss your flight or incur additional transportation expenses due to the interruption. American Express considers the following to be covered reasons:

Accidental injuries.

Illness (must have proof from doctor).

Inclement weather.

Change in military orders.

Terrorist acts.

Non-postponable jury duty or subpoena by a court.

An event occurring that makes the traveler’s home uninhabitable.

Quarantine imposed by a doctor for medical reasons.

There are many reasons that are specifically called out as not covered (e.g., preexisting conditions, war, self-harm, fraud and more), so we recommend checking the terms of your coverage carefully.

If you want a higher level of coverage for trip cancellation, consider purchasing Cancel For Any Reason (CFAR) travel insurance . CFAR is an optional upgrade available on some standalone travel insurance plans. This supplementary benefit allows you to cancel a trip for any reason and get a partial refund of your nonrefundable deposit.

Alternately, if you want what essentially amounts to CFAR insurance on your flights specifically, purchase your fares through the AmEx Travel portal and tack on Trip Cancel Guard for an extra fee. Trip Cancel Guard guarantees you an up to 75% refund on nonrefundable airfare costs when you cancel at least two days before departure, regardless of why. This isn't as comprehensive as other CFAR policies, but it can add some peace of mind for people who want the cash back (as opposed to a travel credit) for flights they may not take.

AmEx cards with trip cancellation, interruption coverage

The following American Express credit cards offer trip cancellation and trip interruption coverage:

on American Express' website

Additional AmEx cards that offer trip cancellation and interruption coverage include:

The Business Platinum Card® from American Express .

Centurion® Card from American Express.

Business Centurion® Card from American Express.

The Corporate Centurion® Card from American Express.

The Platinum Card® from American Express for Ameriprise Financial.

The American Express Platinum Card® for Schwab.

The Platinum Card® from American Express for Goldman Sachs.

The Platinum Card® from American Express for Morgan Stanley.

Corporate Platinum Card®.

Delta SkyMiles® Reserve Business American Express Card .

Terms apply.

Covered amount

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Coverage is secondary and applies after your primary policy provides reimbursement. Claims must be filed within 60 days. To start a claim, call 844-933-0648.

This benefit will reimburse you for reasonable, additional expenses incurred if a trip is delayed by a certain number of hours. Examples of eligible expenses include meals, lodging, toiletries, medication and other charges that are deemed appropriate by American Express. It makes sense to use your judgment in terms of what will get approved based on your policy's fine print.

Acceptable delays include those that are caused by weather, terrorist actions, carrier equipment failure, or lost/stolen passports or travel documents. There are also plenty of exclusions, such as intentional acts by the traveler.

AmEx cards with trip delay insurance

The reimbursable amount depends on which card you hold.

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period.

As expected, the more premium travel credit cards offer higher compensation for shorter delays. Trip delay insurance is offered on the following American Express credit cards:

When you decline the collision damage waiver offered by the car rental agency, you will be covered if the car is damaged or stolen through your AmEx Travel Insurance. Depending on the card you have, the coverage is $50,000 or $75,000.

» Learn more: How AmEx car rental insurance works

In addition, the cards offering car rental damage and theft insurance up to of $75,000 also provide secondary benefits:

Accidental death or dismemberment coverage.

Accidental injury coverage.

Car rental personal property coverage.

To qualify, you must decline the personal accident coverage and personal effects insurance provided by your car rental company.

The entire rental must be charged on the American Express credit card to receive coverage for car rental loss and damage. And keep in mind that you do still need liability insurance when making your rental car reservation (you may have this through your personal auto insurance policy), as these credit card-provided coverage options don't include personal liability.

AmEx cards with car rental coverage

American Express lists over 50 different cards on its site that come with one of the two forms of car rental insurance. Cards that link to the Tier 1 policies are the $50,000-coverage cards, and Tier 2 policies are the $75,000 cards.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

The amount reimbursed is calculated as whichever is lowest:

The cost to repair the rental car.

The wholesale book value (minus salvage and depreciation).

The invoice purchase price (minus salvage and depreciation).

Here are some key exclusions to be aware of with this coverage:

These policies don't cover theft or damage that was caused by a driver’s illegal operation of the car, operation under the influence of drugs/alcohol or damage caused by any acts of war.

Policies don't cover drivers not named as "authorized drivers" on your rental agreement.

The benefit only covers car rentals up to 30 consecutive days.

Not all cars are included in the policy. Certain trucks, vans, limousines, motorcycles and campers are excluded from coverage.

Insurance protection doesn't apply in Australia, Italy, New Zealand and any country subject to U.S. sanctions .

You can file a claim online or call toll-free in the U.S. at 800-338-1670. From overseas, call collect 216-617-2500. Your claim must be filed within 30 days of the loss. Additionally, some benefits vary by state, so check the policy for your specific card.

» Learn more: The guide to AmEx Platinum’s rental car insurance

As an American Express cardholder, you are eligible to receive compensation if your luggage is lost or stolen. This benefit is in addition to what you may receive from the carrier. However, the AmEx policy is secondary, which means that it kicks in after the carrier provides any compensation for losses.

AmEx provides this insurance to "covered persons," who are defined as:

The cardmember.

Their spouse or domestic partner.

Their dependent children who are under 23 years old (there are age exceptions for handicap children).

Some business travelers (Tier 2 coverage only).

To qualify, all covered individuals need to be traveling on the same reservation and must be residents of the U.S., Puerto Rico or the U.S. Virgin Islands.

AmEx cards with baggage insurance

Naturally, the higher-end cards offer more protection — but even the basic cards have decent coverage. The compensation limits per person are as follows (note that the maximum payout per covered person for lost luggage is $3,000 on all of these cards).

Below are the limits for cardholders of the The Platinum Card® from American Express , The Business Platinum Card® from American Express , The American Express Platinum Card® for Schwab, The Platinum Card® from American Express for Goldman Sachs, The Platinum Card® from American Express for Morgan Stanley, Hilton Honors American Express Aspire Card , Marriott Bonvoy Brilliant™ American Express® Card, Centurion® Card from American Express and Business Centurion® Card from American Express:

Baggage in-transit to/from common carrier: $3,000.

Carry-on baggage: $3,000.

Checked luggage: $2,000.

Combined maximum: $3,000.

High-end items: $1,000.

Disclosure: Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

And here are the coverage limits for cardholders of the American Express® Gold Card , American Express® Business Gold Card , American Express® Green Card , Business Green Rewards Card from American Express , Hilton Honors American Express Surpass® Card , Marriott Bonvoy™ American Express® Card, Marriott Bonvoy Business® American Express® Card , Delta SkyMiles® Reserve American Express Card , Delta SkyMiles® Reserve Business American Express Card , Delta SkyMiles® Platinum American Express Card , Delta SkyMiles® Platinum Business American Express Card , Delta SkyMiles® Gold American Express Card and Delta SkyMiles® Gold Business American Express Card , The Hilton Honors American Express Business Card :

Baggage in-transit to/from common carrier: $1,250.

Carry-on baggage: $1,250.

Checked luggage: $500.

High-end items: $250.

Disclosure: Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

AmEx also offers limited reimbursement for high-end items (coverage varies by card), such as:

Sports equipment.

Photography or electronic equipment.

Computers and audiovisual equipment.

Wearable technology.

Furs (including items made mostly of fur and those trimmed/lined with fur).

Items made fully or partially of gold, silver or platinum.

Claims must be filed within 30 days of your baggage loss. To file a claim, call 800-645-9700 from the U.S. or collect to 303-273-6498 if overseas. You can also file a claim online.

» Learn more: Compare travel insurance options: airline or credit card?

This benefit helps with events like replacing a lost passport, missing luggage assistance, emergency legal and medical referrals, and in some instances, emergency medical transportation assistance.

The service can also help you figure out important travel-related details like customs information, currency information, travel warnings, tourist office locations, foreign exchange rates, vaccine recommendations for the country you’re visiting, passport/visa requirements and weather forecasts.

AmEx cards with Premium Global Assist

Premium Global Assistance is offered on the following American Express credit cards:

The Platinum Card® from American Express .

Delta SkyMiles® Reserve American Express Card .

Hilton Honors American Express Aspire Card .

Marriott Bonvoy Brilliant™ American Express® Card.

Services provided by Premium Global Assist Hotline

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, the Premium Global Assist Hotline may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility.

The hotline isn’t so much a concierge as a service that provides logistical assistance, which can include the following:

General travel advice

Emergency translation if you need an interpreter to help with legal or medical documents (cost isn't covered).

Lost item search if your belongings are lost while traveling.

Missing luggage assistance if an airline loses your luggage. The hotline will contact your airline on a daily basis on your behalf to help locate your bags.

Passport/credit card assistance if your credit card or passport is lost or stolen.

Urgent message relay if you need to contact a family member and/or friend in the event of an emergency.

Medical assistance

Emergency medical transportation assistance if the cardmember or another covered family member traveling on the same itinerary gets sick or injured and needs medical treatment (there are many conditions for this coverage; review your policy’s fine print).

Physician referral if you need a doctor or dentist (cardmember is responsible for costs).

Repatriation of remains in the event of death.

Financial assistance

Emergency wire service to get help obtaining cash (fees will be reimbursed).

Emergency hotel check in/out if your card has been lost or stolen.

Legal assistance

Bail bond assistance if you need access to an agency that accepts AmEx (cardmember is responsible for paying bail bond fees).

Embassy and consulate referral if you need help finding or accessing local embassies.

English-speaking lawyer referral if you’re traveling and need a list of available attorneys (cardmember is responsible for any legal fees).

To use this benefit, call the Premium Global Assist Hotline toll-free at 800-345-AMEX (2639). You can also call collect at 715-343-7979.

The main difference between the Global Assist Hotline and the Premium version is that some of the services that are fully covered by Premium Global Assist aren't covered in the more basic version (cited examples include emergency medical transportation assistance and repatriation of mortal remains).

You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility.

AmEx cards with Global Assist Hotline access

The Global Assist Hotline is available to holders of the following cards:

American Express® Gold Card .

American Express® Business Gold Card .

American Express® Green Card .

Business Green Rewards Card from American Express .

Delta SkyMiles® Platinum American Express Card .

Delta SkyMiles® Platinum Business American Express Card .

Delta SkyMiles® Gold American Express Card .

Delta SkyMiles® Gold Business American Express Card .

Delta SkyMiles® Blue American Express Card .

Hilton Honors American Express Surpass® Card .

Hilton Honors American Express Card .

The Hilton Honors American Express Business Card .

Marriott Bonvoy™ American Express® Card.

Marriott Bonvoy Business® American Express® Card .

The Amex EveryDay® Preferred Credit Card from American Express .

Amex EveryDay® Credit Card .

Blue Cash Preferred® Card from American Express .

The American Express Blue Business Cash™ Card .

The Blue Business® Plus Credit Card from American Express .

You can call the Global Assist Hotline toll-free at 800-333-AMEX (2639), or collect at 715-343-7977.

If you don’t have any of the credit cards above and are thinking about purchasing a policy from American Express or just simply want to price compare to see if you get better perks by purchasing a policy, you can go to the AmEx travel insurance website and input your trip plans to build a quote. You’ll need to provide your departure and return date, state of residence, age of traveler, number of travelers covered by the policy and the trip cost per traveler. Then, you can select the option of choosing a package or building your own.

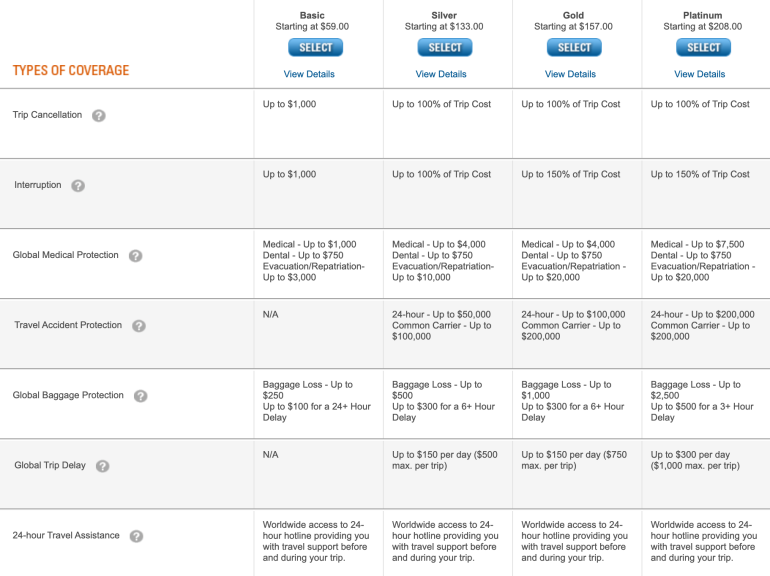

To see which plans are available, we input a sample $3,000, one-week trip by a 35-year-old from South Dakota. Our search result yielded four different plans ranging from $59 for a Basic plan to $208 for a Platinum plan.

Global medical protection (not included on AmEx cards)

Medical protection includes coverage for emergency healthcare and dental costs as well as medical evacuation and repatriation of remains . The limits increase as the plans become more expensive. Although AmEx cards offer an array of travel insurance benefits, medical coverage isn't included. So if medical protection benefits are important to you, a standalone travel insurance policy is what you’ll want to look for.

Travel accident protection (not included on AmEx cards)

Another benefit not included with AmEx cards is travel accident protection. This benefit provides coverage in case of death or dismemberment while traveling . Although this is a topic no one wants to think about, it's good to be familiar with this coverage. While travel accident protection isn’t offered on the Basic plan, all of the higher plans offer it.

Standalone policy benefits that are also included on AmEx cards

These elements of coverage are offered on the AmEx cards mentioned, although in some, the limits may be higher or lower.

Trip cancellation

The Basic plan only covers a trip up to $1,000, however, all the other plans cover 100% of the trip cost. To compare this with the perks included as a benefit on the cards, all AmEx cards that include trip cancellation coverage provide up to $10,000 per covered trip.

Keep in mind that, all the cards included have annual fees and the card with the lowest fee is the Hilton Honors American Express Aspire Card , with a $550 annual fee.

Trip interruption

Trip interruption coverage ranges from $1,000 on a Basic plan to 150% of trip cost on the Gold and Platinum plans. The trip interruption benefit offered by the AmEx cards is included on all the same cards that offer trip cancellation insurance, with the trip interruption limit capped at $10,000 per covered trip.

Global baggage protection

If your luggage is lost or stolen this benefit will provide monetary compensation to reimburse you for your lost items. AmEx cards offer baggage coverage as a complimentary benefit, with the higher-end cards naturally providing higher limits. Interestingly, the cards with the lower annual fees (i.e. Hilton Honors American Express Surpass® Card , annual fee $150 ) have a high limit as well, offering a total combined limit for lost luggage of $3,000, which is higher than the coverage offered by the standalone Platinum plan.

Global trip delay

If your trip is delayed, you’re eligible for reimbursement of any necessary expenses incurred up to a specific limit. The Basic plan doesn’t offer this benefit, but all the other plans do, with the Platinum plan providing up to $300 per day (maximum of $1,000 per trip). This coverage is also included on the higher-end AmEx cards.

AmEx cards offer key travel insurance benefits: trip cancellation and interruption insurance, trip delay insurance, car rental loss and damage insurance, baggage insurance, Premium Global Assist Hotline (or Global Assist Hotline). However, they don't offer any sort of emergency medical coverage. This is pretty typical of travel credit cards, as the travel insurance perks they offer don't provide coverage for emergency health care costs.

If you’re looking for emergency medical coverage, you’ll need to purchase a separate policy, such as the standalone one offered by American Express. The other limits provided in the American Express travel insurance policy are comparable to what you get on the AmEx cards, so it makes sense to shop around to make sure that the benefits you’re paying for are sufficient for your needs.

» Learn more: What to know about American Express Platinum travel insurance

Yes, if you have one of the cards listed above. If you have a credit card that isn’t listed in this guide or the card is no longer available by American Express, call the number on the back of your card for more information. Generally, AmEx offers a number of travel insurance benefits on its credit cards that shouldn't be overlooked.

Yes, but it depends on which card you have. To qualify for reimbursement, the trip cancellation must be for a covered reason. Refer to the section "Trip Cancellation and Interruption Insurance" for a list of cards and explanations of covered reasons.

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a separate travel insurance policy . If you only need emergency medical coverage , there are policies that provide that as well.

Call the number on the back of your card to ask for guidance. Some benefits may require authorization from American Express before coverage kicks in, so make sure you follow all the correct steps for reimbursement.

Refer to the AmEx credit card policy for the specific benefit because it will include instructions for submitting a claim. If you cannot find the policy, you should call the customer service number on the back of your American Express card for more assistance.

Yes. American Express offers travel insurance as a benefit of some of its cards, but it also sells standalone coverage that you can purchase out-of-pocket. The latter tends to be more comprehensive and customizable to your needs.

No, you do not get automatic travel insurance with American Express. It is available as a benefit on certain cards. Refer to your terms and conditions to learn if you are covered.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as repatriation of remains or medical evacuation coverage .

American Express offers a solid range of travel insurance protection across its credit cards, with the premium cards providing the most coverage. However, if you need insurance benefits with higher limits, we recommend purchasing a

separate travel insurance policy

. If you only need

emergency medical coverage

, there are policies that provide that as well.

American Express cards do not include medical coverage; instead, you will want to purchase a standalone travel insurance policy with medical protections, such as

repatriation of remains or medical evacuation coverage

American Express travel insurance offers a wide array of benefits, especially on its premium cards. Knowing what benefits are available to you is important in the event of unforeseen circumstances. Determine whether an individual policy is a better fit for your risk tolerance than coverage that is included on an eligible card, then go from there.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Underwritten by AMEX Assurance Company.

Baggage insurance plans

Please visit americanexpress.com/benefit sguide for more details.

Premium Global Assist Hotline

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

Card Members are responsible for the costs charged by third-party service providers.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

COMMENTS

Click to Chat. You have the opportunity to connect with a member of our online travel support team via our 'Live Chat' function, when an agent is available. Click to Chat is serviced: Monday - Sunday from 08:00 - 20:00. Mailing Address. American Express Travel. 5th Floor, 1 John Street. Brighton. East Sussex.

Click to Chat is serviced:Monday - Sunday from 08:00 - 20:00. Please Log in using your User ID and Password. For further guidance on our travel FAQs, contact information, as well as travel advice, visit our American Express online travel help centre.

To be eligible for THC program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card. Book Flights, Hotels, Car Rental and packages with American Express Travel. See our guides, find great deals, manage your booking and check in online.

Business Cards. View All Business Cards; Business Platinum Card; Business Gold Card; Why American Express for Your Business

The Licensed Marks are trademarks or service marks of, and the property of, American Express. GBT UK is a subsidiary of Global Business Travel Group, Inc. (NYSE: GBTG). American Express holds a minority interest in GBTG, which operates as a separate company from American Express.

We are committed to supporting our customers through any life event or on-going condition that is affecting day-to-day. life or finances. Please let us know your situation as early as possible so we can help you as best we can. Mental and physical health issues can affect the way you manage your account - we can offer support to you accordingly.

Contact American Express GBT today to connect with our team of business travel experts. Get information on business travel management, events & more. > > > ... GBT Travel Services UK Limited (GBT UK) and its authorized sublicensees (including Ovation Travel Group and Egencia) use certain trademarks and service marks of American Express Company ...

Booking Tools. Pre-negotiated rates and over 2 million options in accommodations. Those are just some of the many reasons why it's better booking through us. Explore business travel services from American Express Global Business Travel. Our 24/7 Proactive Traveler Care services can swiftly take care of everything.