How to redeem Chase points

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Chase Ultimate Rewards points are considered especially valuable for a few reasons, including the variety of available redemption options.

- Redemption options like cash back or statement credits offer a value of one cent per point, while certain travel redemptions can be worth two cents per point or more.

- Certain Chase credit cards offer 25 to 50 percent more value when redeeming points for travel through Chase, which makes these cards especially attractive.

When you start racking up rewards with a Chase credit card , you may be inclined to redeem your points for easy options like cash back, Apple products or even gift cards. However, some of the best redemptions available for Chase points fall within the travel realm, whether that means using points in the Chase travel portal or transferring rewards to partners.

If you’re not exactly sure how to redeem your Chase points or which redemptions fetch the most value, this quick guide offers some tips to help you get the most bang for your buck when it comes to redemption choices.

How can I redeem my Chase points?

To redeem your Chase points, log in to your Chase account — either on your desktop browser or the mobile Chase app — and navigate to the Ultimate Rewards portal from your account. If you haven’t signed up for an account yet, make sure to do it as soon as possible so you can actually use your rewards.

When you click on the link to the Ultimate Rewards portal, it will launch as a separate dashboard from your Chase account. Once there, you can choose from multiple menu options to redeem points, including cash back, Chase Dining, gift cards, Pay Yourself Back and more. Once you choose your redemption option, follow the screen prompts to complete the process of redeeming your points for the selected award.

If you have multiple Chase accounts that earn Ultimate Rewards points, choose the specific card you want to access, and you’ll see how many points are available to redeem. There is an option to toggle between your different card accounts and switch cards as needed. If you don’t have enough points for your preferred redemption options, you can transfer points from one card to another within the Ultimate Rewards portal with the “combine points” feature.

Review your redemption options

Once you’re inside the Chase Ultimate Rewards portal, you should be able to see various redemption options on the side menu or when you click “Earn / Use” at the top. These include:

- Pay with points with Amazon.com or PayPal

Apple Store

- Pay Yourself Back

Transfer to travel partners

Here’s a quick breakdown on these options, along with their value compared to other available redemptions.

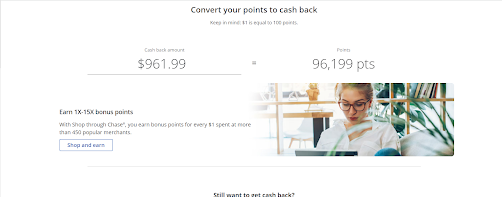

Unlike many travel credit cards , choosing cash back doesn’t lower the value of your points. You’ll get one cent per point for your rewards, plus the option to deposit your cash into an account of your choice or as statement credit on the card you earned the points with.

Chase Sapphire, Freedom and Ink cardholders can also redeem rewards with Chase Dining , though those with a Sapphire credit card also have access to the Sapphire Private Dining Series. You can use your points toward curated dining experiences, home meal kits and more. However, redemption values and options vary.

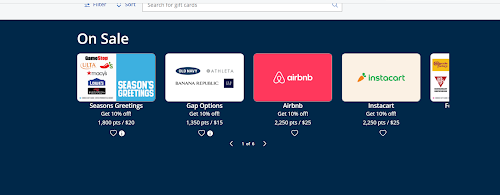

You’ll typically get one cent per point for gift cards, but there are often special promotions that let you get better values from time to time. For example, you might get a $100 gift card for 9,000 points instead of 10,000 points if there’s a 10 percent off sale that week.

Gift card options also vary and can change over time. Popular options that tend to be available all the time come from stores like Lowe’s, Airbnb, Kohl’s, DoorDash and Ulta.

Pay with Points with Amazon.com or PayPal

Pay with Points lets you redeem your points for purchases made through Amazon.com or PayPal at the checkout screen. However, this redemption option is only worth 0.8 cents per point, meaning 100 points add up to 80 cents.

This is a nice option to have but not necessarily the best way to redeem your points — especially since you can redeem for statement credits at a rate of one cent per point instead.

You can also use your points towards Apple products like Apple Watches, Airpods, iPhones, iPads, Macs and accessories. As long as you have 20 percent of the purchase price in Chase points, you can use cash for the remaining points portion of your purchase.

Prices at the Apple Store are comparable to the prices on the regular Apple website. There are sometimes promotions as well, especially around the holiday season. The most recent promotion added 50 percent more value to points redeemed for Apple products, but only if you had the Chase Sapphire Reserve. Meanwhile, cardholders with the Chase Sapphire Preferred got 25 percent more value for their points at Apple.

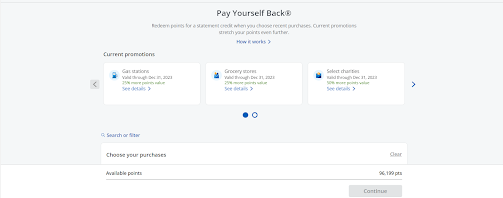

Chase Pay Yourself Back

Chase Pay Yourself Back lets you get more value for rewards when redeeming for statement credits toward eligible spending categories, which can change over time.

The main advantage of Pay Yourself Back is that your points will be worth more in dollars than if you redeemed them for a statement credit using the cash back method.

You can also book travel accommodations from hotels to airlines to rental cars through the Chase Ultimate Rewards portal. If you’ve got the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card , you’ll even get a 25 percent boost in points value when booking travel through the portal. With the Chase Sapphire Reserve® , on the other hand, you get 50% more value for rewards when redeeming for travel through Chase.

With your Chase Sapphire Reserve, you’ll earn 10X on hotels and car rentals booked through the portal and 5X points on airfare booked through Chase. Meanwhile, the Chase Sapphire Preferred Card lets you earn 5X on all travel booked through the portal.

It’s important to remember you don’t need the full amount of points to book travel on the Chase Ultimate Rewards portal, either. If you’re short on points for a redemption, you can still book with a combination of rewards and cash.

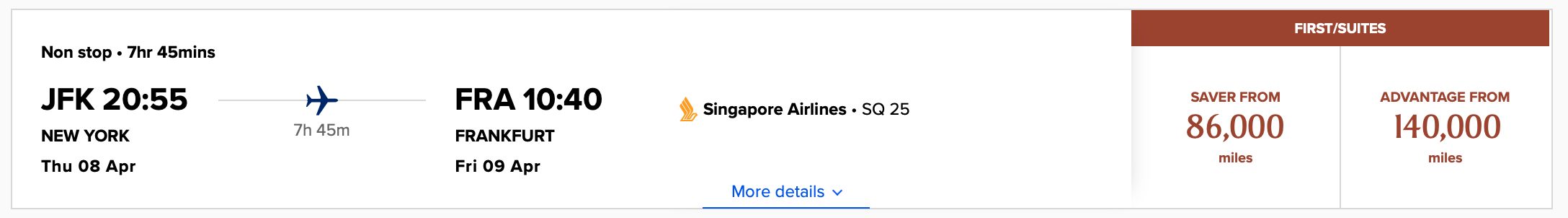

The last — and arguably most valuable — redemption option is to transfer your points to Chase travel partners . Points can be transferred to a number of partners at a 1:1 ratio if you have an eligible Chase credit card like the Chase Sapphire Preferred, the Ink Business Preferred or the Chase Sapphire Reserve. Your points are typically worth with this redemption option, but this is especially true if you’re booking international airfare or domestic airfare in a premium cabin.

Transfer partners available with eligible Chase cards include:

Airline partners

- Aer Lingus, AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards®

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

Hotel partners

- IHG® Rewards Club

- Marriott Bonvoy®

- World of Hyatt®

What’s the best way to redeem my Chase points?

Generally speaking, redeeming points for travel through Chase or transferring to travel partners leads to getting the highest value for your points. This is due to the 25 percent to 50 percent more value eligible Chase cardholders get when they redeem points for travel through Chase, as well as the enhanced redemption values many Chase airline and hotel partners offer.

It’s not uncommon to transfer points to a Chase travel partner and get two cents per point in value or considerably more than that. However, you’ll want to compare the cost of booking through the Chase portal or transferring points to a partner to know which option requires the lowest total number of points.

That said, if you rarely travel, redeeming your points for cash back, statement credits or gift cards instead might make the most sense. All of these options make using rewards easy, especially since redemptions for statement credits and cash back start at just $.01.

Redeeming your points at checkout with Amazon.com or PayPal, on the other hand, fetches the lowest value for your points. However, there may come a time when this particular redemption option makes sense for you, such as during the holiday season or when making a big purchase.

The bottom line

Earning credit card rewards that fall within the Chase Ultimate Rewards program is smart for a few reasons, including the fact that it’s one of the most flexible rewards programs out there.

Still, knowing the ins and outs of this program and its available redemption options can help you get the most value out of your rewards. You worked hard to earn your points, so you might as well enjoy them.

Related Articles

Chase Ultimate Rewards guide

How to redeem credit card rewards

Chase transfer partners: How to get the best value

How to transfer Chase points

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase travel portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase travel portal with Ultimate Rewards® points.

How to use the Chase travel portal

- How to earn and redeem Chase Ultimate Rewards points

How to get started with the Chase travel portal

How to book flights through the chase travel portal, how to book rental cars, cruises, and other travel activities, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex℠ .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 60,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account.

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

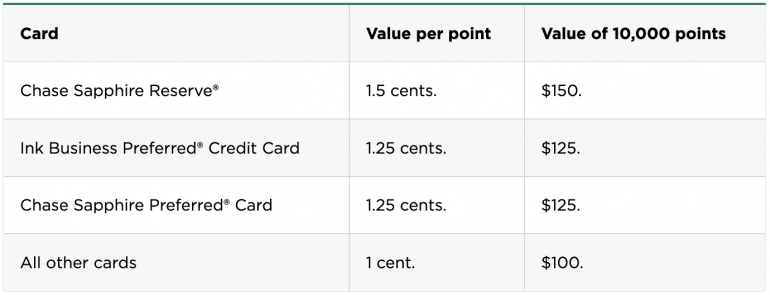

The card you're using to redeem UR points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel℠ with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth $750 towards travel and the Chase Sapphire Reserve's is worth $900 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

To reach the Chase travel portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase UR points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

The next screen is your credit card's main dashboard, showing how many UR points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences, or reimburse yourself for certain recent charges through Chase's Pay Yourself Back tool . This is also where you can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase travel portal.

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

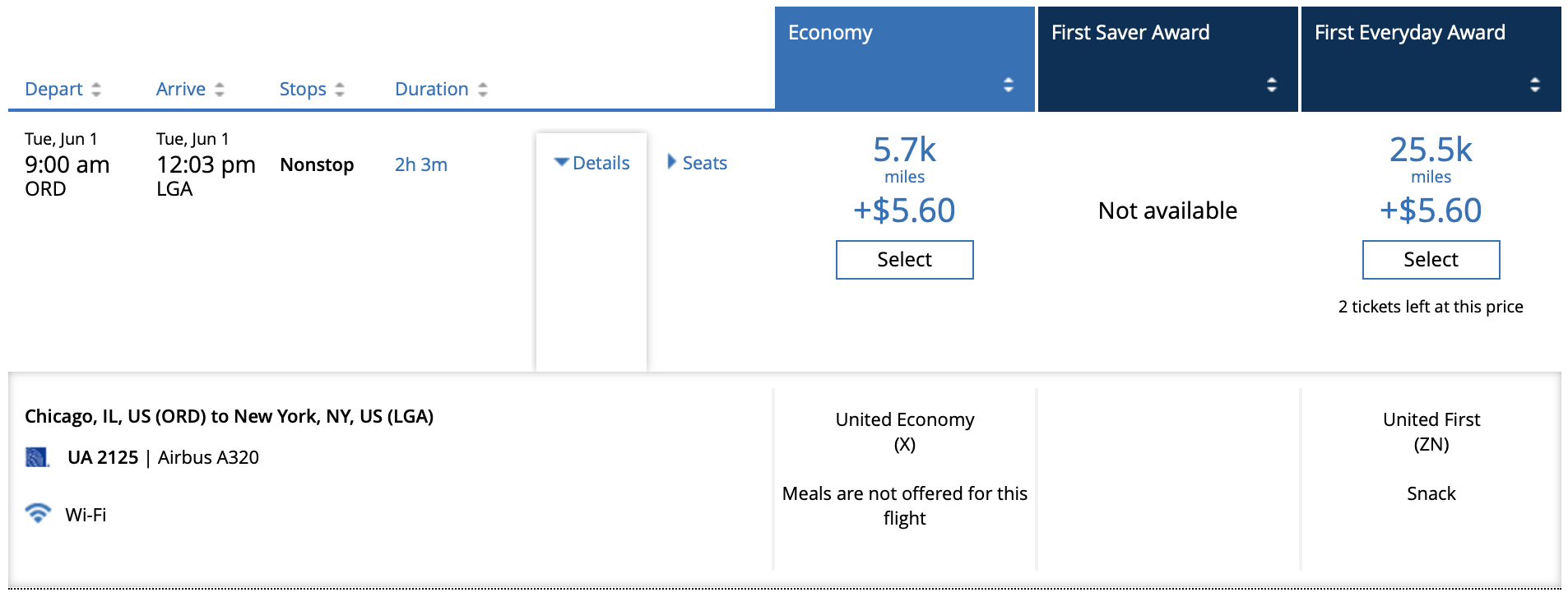

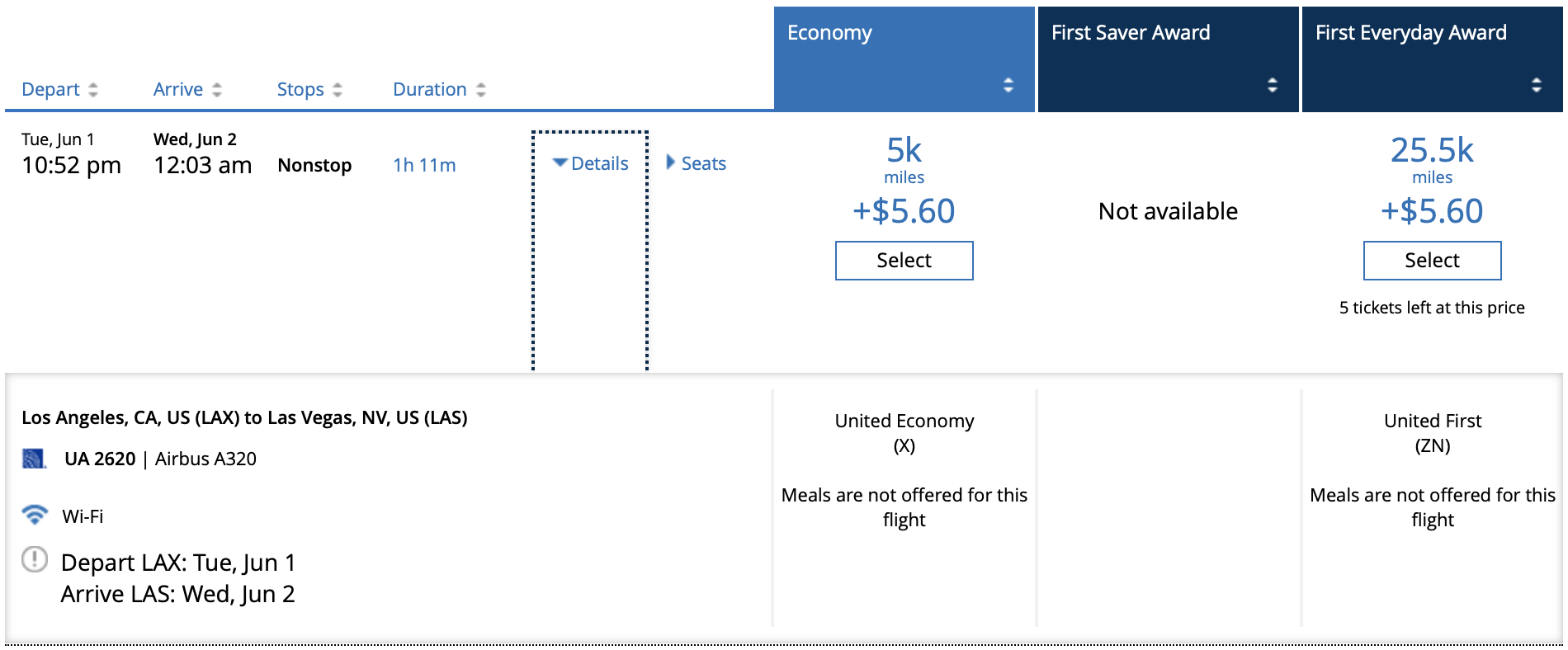

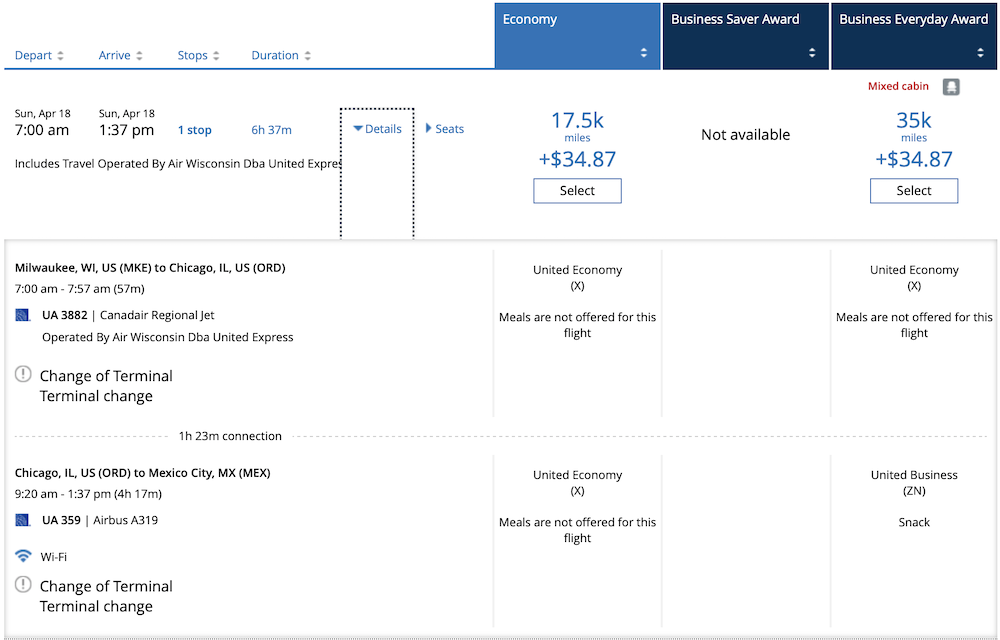

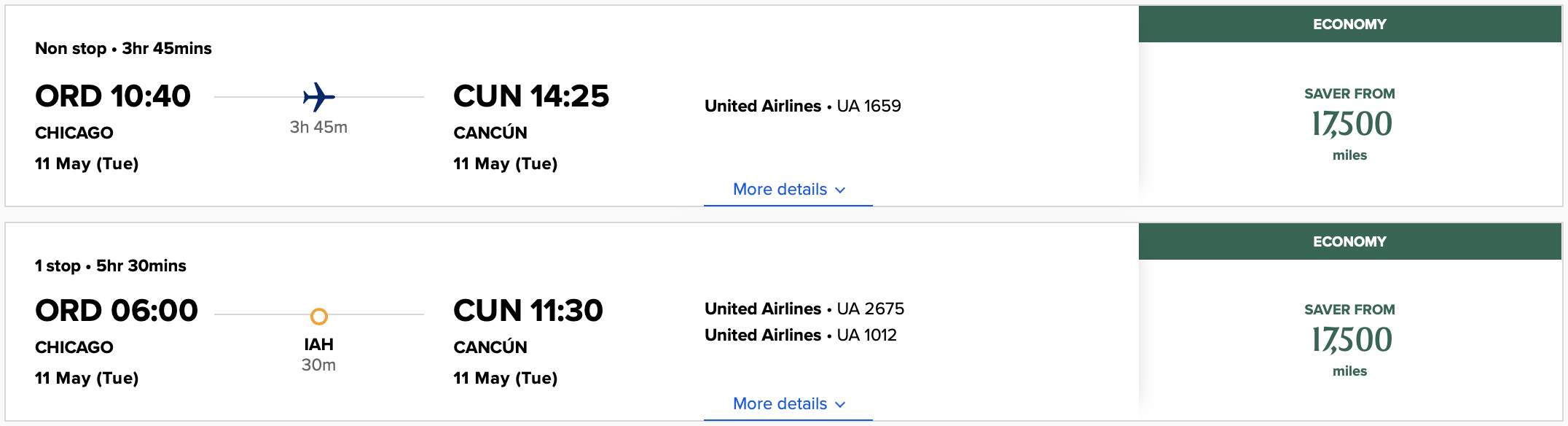

There are a few pros and cons to consider when booking flights through the Chase travel portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase travel portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase travel portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase travel portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

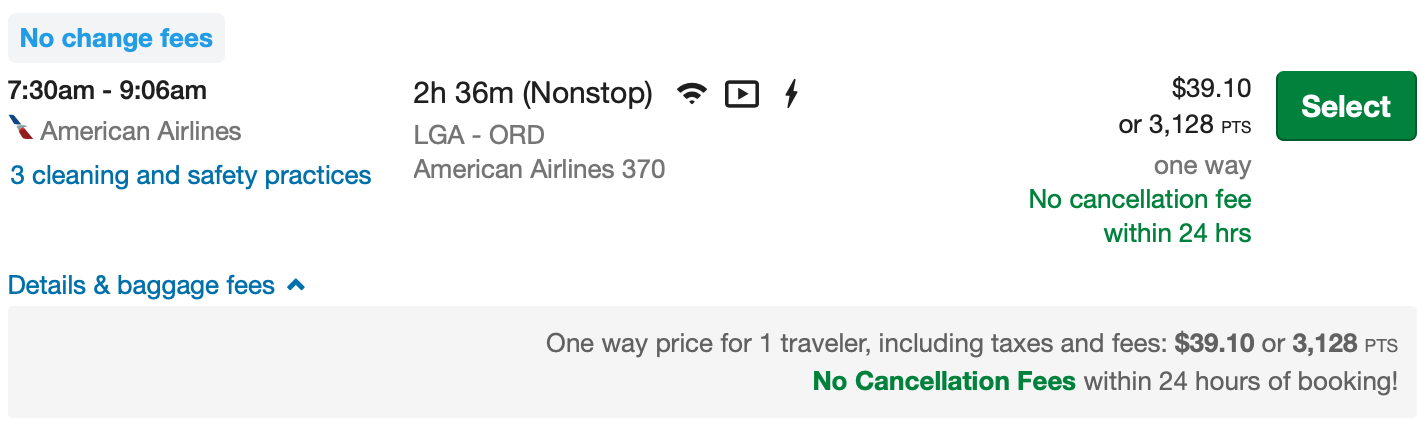

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin with sample dates of Feb. 1–7, 2024, booked through the travel portal with a Chase Sapphire Preferred card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

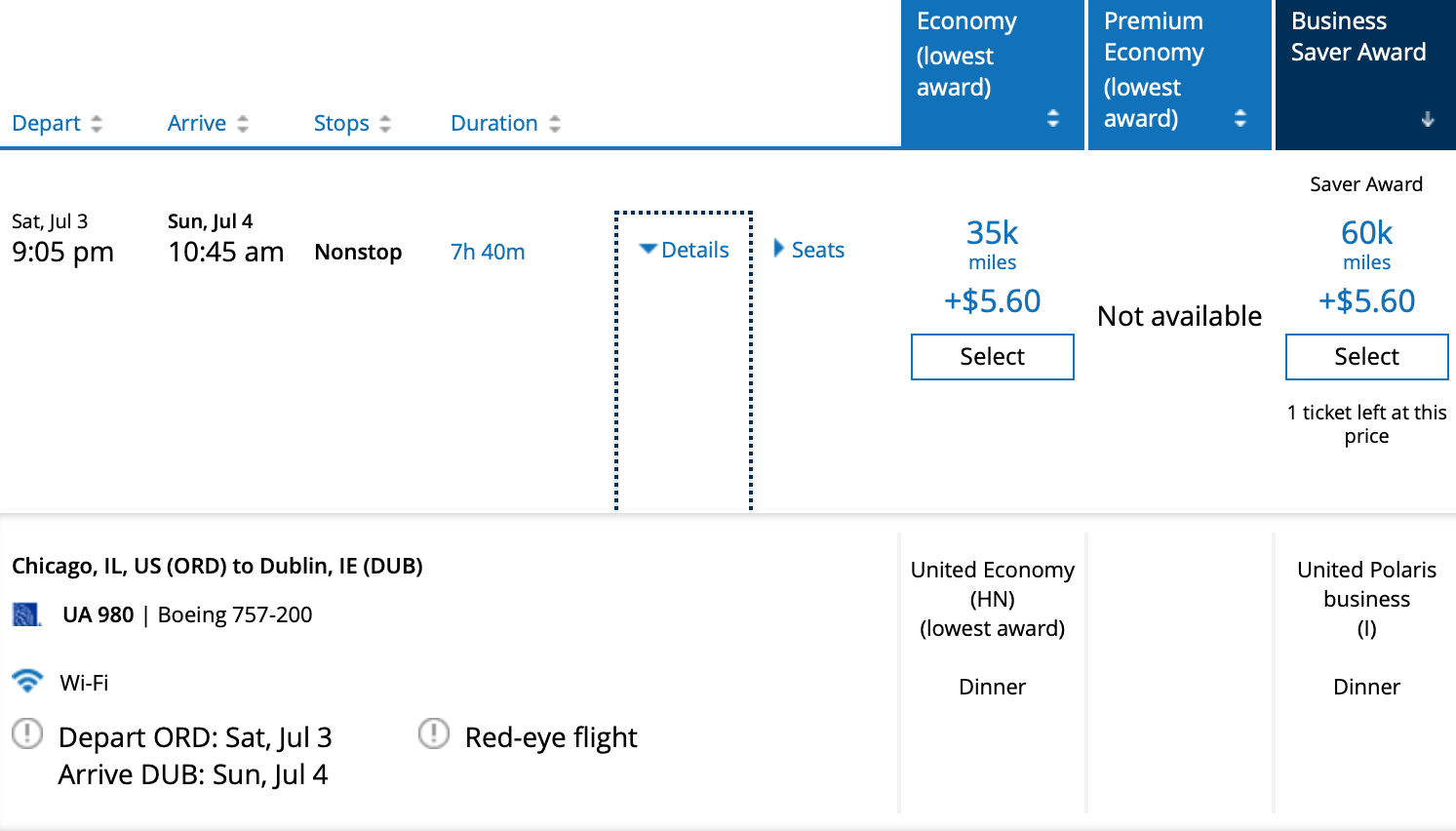

How to book hotels through the Chase travel portal

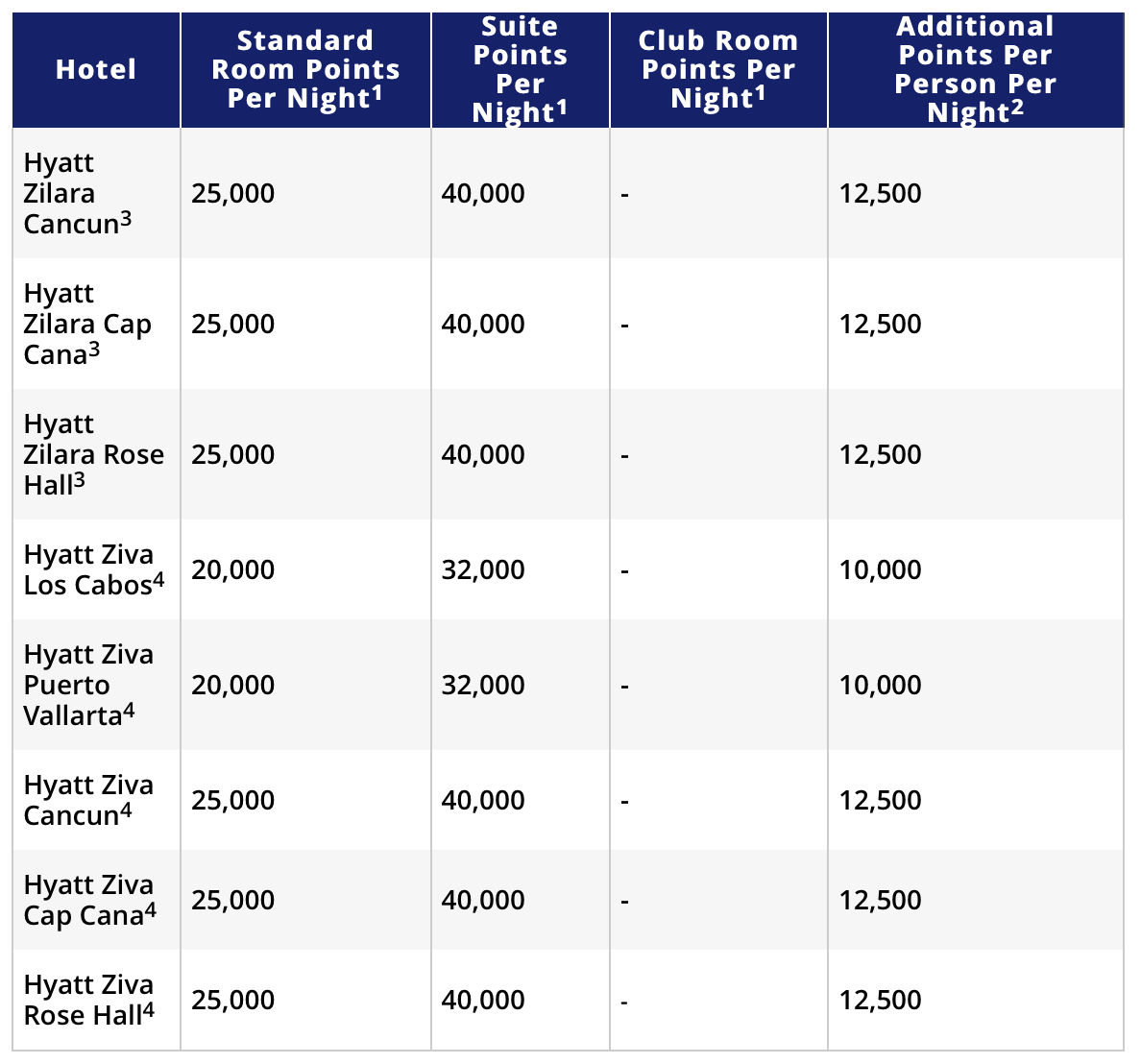

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase travel portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase travel portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in Downtown Austin from Feb. 1–7, 2024. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase travel portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase travel portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin from February 1–7, 2024, booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

Booking through the Chase travel portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex℠ has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- 5 things to avoid if you’re applying for a mortgage Kelsey Neubauer

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

- What is the Chase Travel Portal?

Benefits of Using the Chase Travel Portal

Chase ultimate rewards credit cards.

- Points Value

- How to Use the Portal to Book Travel

Chase Travel: Explore Destinations and Savings with Chase Ultimate Rewards

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex℠, Chase Freedom® Student credit card. The details for these products have not been reviewed or provided by the issuer.

- The Chase Travel℠ portal works just like an online travel agency.

- You can use points, cash, or a combination of both to book flights, hotels, rental cars, and more.

- Several Chase cards offer better redemption values or bonus points when you book through the portal.

The Chase Travel Portal℠ is an online booking platform for flights, hotels, rental cars, cruises, activities, and vacation rentals, similar to an Online Travel Agency (OTA). If you're a Chase Ultimate Rewards® cardholder, you can use points to book travel through the portal — or pay with your card or a combination of points and cash.

Chase Ultimate Rewards is one of the most flexible and lucrative credit card rewards programs, and its benefits can be even greater depending on the Chase cards you have. With a no-annual-fee card like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , your points are worth 1 cent each toward travel booked through the portal.

But if you have a Chase travel credit card like the Chase Sapphire Reserve® , Chase Sapphire Preferred® Card , or Ink Business Preferred® Credit Card , you'll get 25% to 50% more value when you redeem your points for travel, plus the ability to transfer your points to Chase airline and hotel partners .

Some Chase cards also offer bonus points for paid bookings you make through the portal. Chase added lucrative new bonus categories to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, including certain types of travel booked through the portal.

Here's everything you need to know about booking airfare, hotels, and more through the Chase travel portal — and how to make the most of your Chase Ultimate Rewards points.

What Is the Chase Travel Portal?

The Chase Travel portal works like any other Online Travel Agency (such as Travelocity or Priceline), and the searches you do for hotels, airfare, and more will produce similar results to what you see on that OTA.

You must be a Chase credit card customer to use Chase travel to book with cash or with points. In fact, you'll only access the Chase Travel portal when you log into your account management page with Chase.

Chase travel lets you book travel directly with Chase Ultimate Rewards points, use your credit card to pay, or combine the two. This is one of the main benefits of using Chase travel — you can spend the rewards points you earn directly on the travel you want without having to worry about dealing with specific hotel or airline loyalty programs.

There are a few other key benefits to know:

- You'll still earn airline miles and work toward elite airline status: You won't earn points or elite night credits when you book a hotel stay with Chase travel because it's considered a third-party booking. However, you can earn airline and elite-qualifying miles on flights you book as long as your frequent flyer number is attached to the reservation.

- Your points are worth more with certain Chase credit cards: Also be aware that some Chase credit cards give you more than the standard rate of 1 cent per point when you redeem your rewards for travel through Chase. We'll go into more detail on the cards that offer this perk below.

- The Chase Travel portal is easy to use: If you don't want to deal with a bunch of hotel and airline award charts, booking through Chase travel can help keep your rewards game simple. You'll always be able to use your points for any booking you want without having to worry about blackout dates or capacity controls you would normally encounter with loyalty programs.

To be eligible to use the Chase Travel portal, you'll need a Chase credit card that earns Chase Ultimate Rewards points .

No-annual-fee Chase cards open to new applicants (points are worth 1 cent each through the Chase Travel portal):

- Chase Freedom Unlimited® (read our Chase Freedom Unlimited review )

- Chase Freedom Flex℠ (read our Chase Freedom Flex review )

- Chase Freedom® Student credit card (read our Chase Freedom Student review )

- Ink Business Unlimited® Credit Card (read our Chase Ink Business Unlimited review )

- Ink Business Cash® Credit Card (read our Chase Ink Business Cash review )

Chase travel rewards cards open to new applicants (points are worth more with Chase travel, plus these cards allow you to transfer points to airline and hotel partners):

- Chase Sapphire Reserve® (read our Chase Sapphire Reserve review )

- Chase Sapphire Preferred® Card (read our Chase Sapphire Preferred review )

- Ink Business Preferred® Credit Card (read our Chase Ink Business Preferred review )

If you have more than one Chase card, you can transfer your Chase Ultimate Rewards points between accounts. It makes the most sense to pool your points in the account that gives you the best redemption value — for example, if you pair the Chase Freedom Unlimited® and Chase Sapphire Reserve®, moving all of your Chase Ultimate Rewards to your Sapphire Reserve account will increase the value of your points when you redeem through the Chase Travel portal.

To pool your points onto one card, log into your Chase online account, navigate to the "Redeem" section for your Chase Ultimate Rewards card, then select the option to combine points in the "Earn/Use" tab:

From there, you can move your Chase points between accounts in any increments you want.

Points Value in the Chase Travel Portal

Some Chase credit cards give you a bonus when you redeem points through the Chase Travel portal. Here's a summary of how much your points are worth with each Chase card:

It's important to note that Chase Ultimate Rewards points are worth, on average, 1.8 cents apiece based on Personal Finance Insider's points and miles valuations . That's because it's possible to get outsized value when you transfer points to partners for award travel.

How to Use the Chase Travel Portal

Using the Chase Travel portal is a breeze, but it all starts with logging into your online account management page. From there, you'll click on the right side of your screen where it shows your Chase Ultimate Rewards account balance.

Once you click on the account balance, you'll have the option to select the card you want to access. And remember, this step can be important because some cards give you more value from your points when you redeem them for travel.

How to book a flight through Chase travel

Once you are logged into your Chase Ultimate Rewards account, you'll see different travel options to search for at the top of the page.

To search for a flight, make sure the prompt is on "Flights" and begin searching for the flight you want. Enter your departure airport, destination, travel dates, and the number of passengers.

Once your flight options pop up on the screen, you can filter your results by the number of stops, the airlines you want to fly, and arrival times.

Note that each of your flight options will include a payment amount in points as well as a cash price.

You can also click on "Details and baggage fees" in order to find out the cost of carry-on luggage or checked baggage, as well as whether your flight charges any change fees.

When you click to "Select" a flight option, you'll get a rundown of what is and isn't included in the fare you selected. You may also get a note that you can upgrade before you check out.

Once you settle on a flight you want, you'll be taken to the "Trip Details" page that shows the final cost of your flight in points or in cash, as well as a summary of the added costs you may be charged for baggage or change fees.

After you agree to the terms, you'll be taken to a final payment page where you can decide how you want to pay. You have the option to cover your flight entirely in points if you want, but you can also choose to pay with your Chase credit card or with a combination of points and your credit card.

During the booking process, make sure to add your frequent flyer number to your reservation. That way, you can earn miles on your booking and your flight will count toward elite status requirements. You'll also want to add your Known Traveler Number or Redress number if either applies to you.

If you forget to do it during your booking, however, you can add your frequent flyer information to your flight later on using the airline's website.

How to book a hotel through Chase travel

Booking a hotel through Chase is similarly easy, and you'll find a lot of different types of lodging options available. For example, you'll find properties from major hotel brands, but you'll also find rental condo options and boutique hotels.

To search for a hotel, enter the destination, dates, and the number of people you want to have in your room. Once you're presented with your options, you can filter hotels based on the hotel name you're looking for, the area or neighborhood, price point, guest rating, property type, and more.

Once again, you'll see a price listed in points as well as a cash price per night.

These prices do not include taxes and fees, however, so your price in points or cash will be higher by the time you get to the final booking page. Also be aware that the price listed is the lowest you can get for the property, but that better or upgraded rooms and suites will cost more in points.

The major downside to booking a hotel through the Chase portal is that you won't earn hotel points or elite night credits for your stay, because it's considered a third-party booking. There's also a risk that the property won't recognize your hotel elite status or give you the perks you'd normally be entitled to, like late checkout or free breakfast . This shouldn't be an issue if you're booking an independent or boutique hotel, but if you're looking for hotel points or status, it's something to be aware of.

You'll have the option to select a hotel you want as well as a room type at the property you're considering. You can also pay with your booking with points, your Chase credit card, or a combination of the two.

How to book a rental car through Chase travel

You can also book a rental car through Chase travel using the same set of steps. Once you log into your Chase Ultimate Rewards account, click on "Cars" and then select the destination and dates.

Once you are presented with your search results, you can select the types of cars you prefer, like an economy car or an SUV. You can also filter results based on a price range, the number of passengers you have, the rental car company, and the type of transmission you prefer (manual or automatic), as well as the total area you want to search in.

Note that, once again, taxes and fees are not included on the initial search page. Instead, they are added to your total cost when you select a rental car. You can also pay for a rental car through Chase with points, your credit card, or a combination of the two.

How to book activities with the Chase Travel portal

Chase also lets you book a variety of activities through the portal, which they refer to as "Things to Do." Chase activities can include excursions like snorkeling or scuba diving, as well as tours of museums and historic sites. But you can also book more practical options through their activities tab, including airport pickups and other types of transportation.

To search for activities, enter the destination and dates for your trip. You'll be shown a price in points and in cash that does include taxes and fees. You can also filter options based on the type of activity, your interests, and more. Once again, you have the option to pay for activities with your points, your credit card, or a combination of the two.

How to book a cruise through Chase travel

If you're a cruise enthusiast, you should know you can also book cruises through Chase travel. When you select "Cruises" at the top of the Chase Ultimate Rewards search page, you'll be presented with a list of featured cruises and cruise specials.

You can also search for cruises based on the destination or the name of the cruise line. Note, however, that only cash prices are listed for each cruise on the portal, and that you'll have to call Chase to make a booking.

Either way, you can absolutely use your Chase points to pay for all or part of your cruise. Just have your credit card number handy and call their customer service line at 855-234-2542.

How to book a vacation rental through Chase

Chase also offers a selection of vacation rentals, which can include vacation condos, luxury villas, and more. To search, click on "Vacation Rentals" at the top of the main page, then enter your destination, dates, and the number of people in your party.

Once you start your search, you'll have the option to filter results based on the local neighborhood you want, star ratings, price range, guest rating, property type, and more. Like hotels through Chase, the price you are shown excludes taxes and fees, but they will be added to your total once you make a selection.

Also be aware that the price shown in your search results is for the lowest-tier option for each property, and that a larger rental or upgraded rental may cost more in points.

When you book vacation rentals through Chase, you can pay with points, your Chase card, or a combination of the two.

Use the Chase Travel portal to book Luxury Hotel & Resort Collection properties

If you have the Chase Sapphire Reserve®, you can book properties within the Luxury Hotel & Resort Collection. This list of more than 1,000 properties can be reserved ahead of time, and you'll get extra benefits with each stay such as:

- Daily breakfast for two

- A special benefit worth up to $100

- Complimentary internet access

- Room upgrades when available

- Early check-in and late checkout

One detail to note with this program is the fact that you cannot pay with points. Instead, your online booking will reserve your room, and you'll be charged for the stay when you check out from the hotel.

Should you transfer Chase points instead?

While you can book travel through the Chase Travel portal directly, many people prefer to transfer points to Chase airline and hotel partners instead. Doing so could let you get more value for each point you redeem , but you'll have to run the numbers to find out for sure.

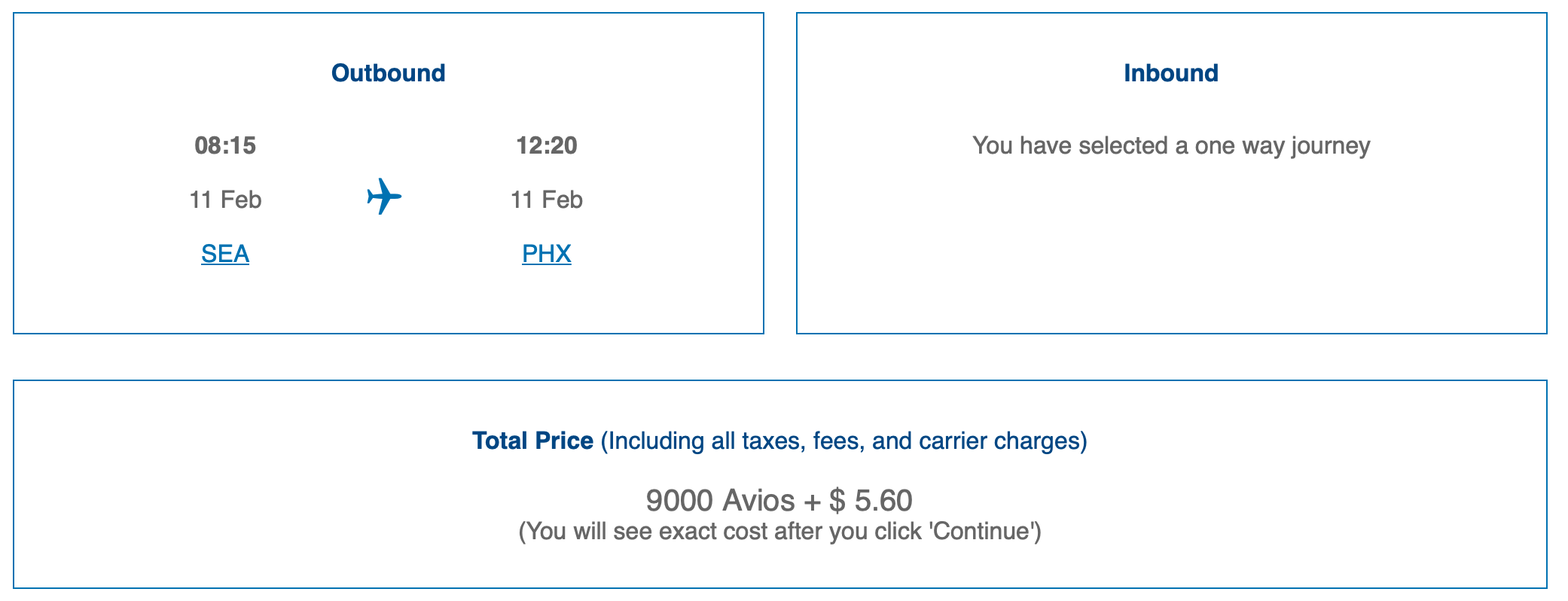

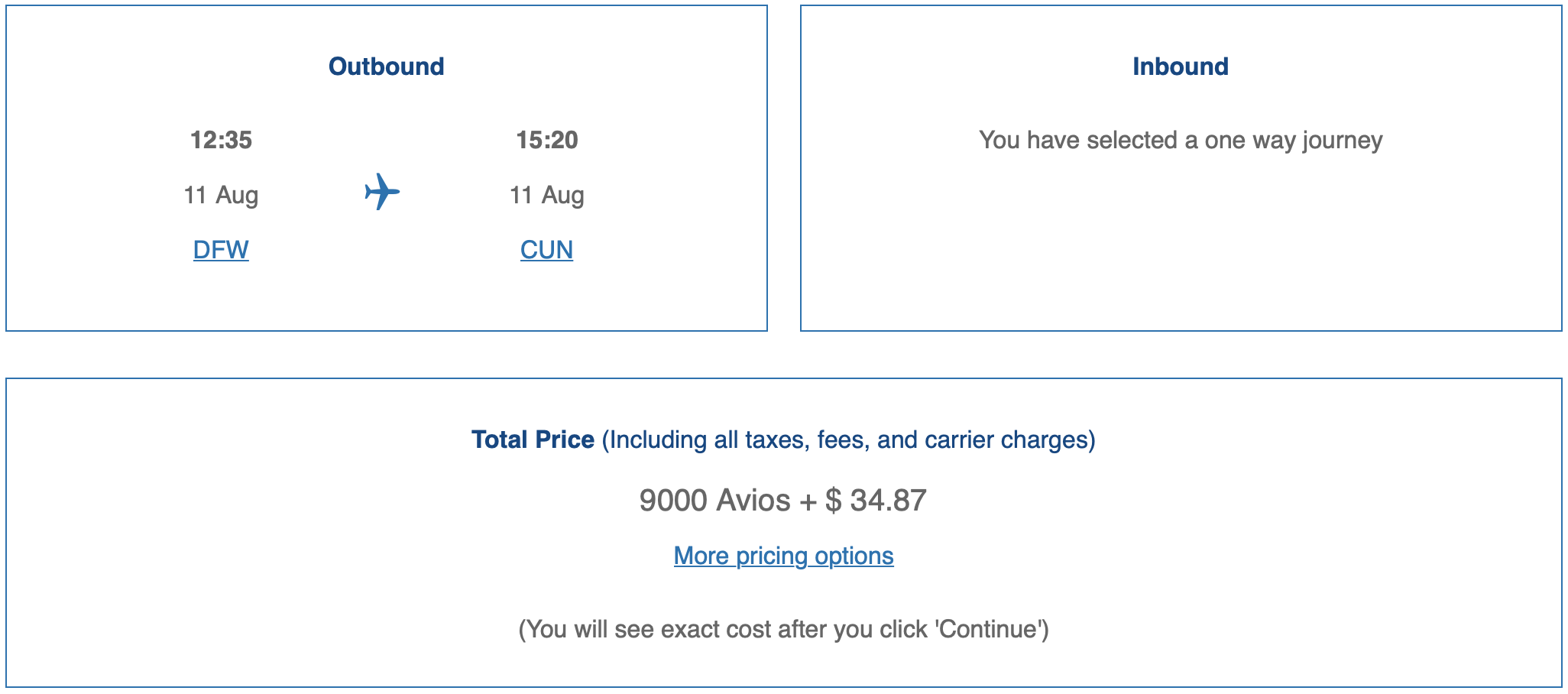

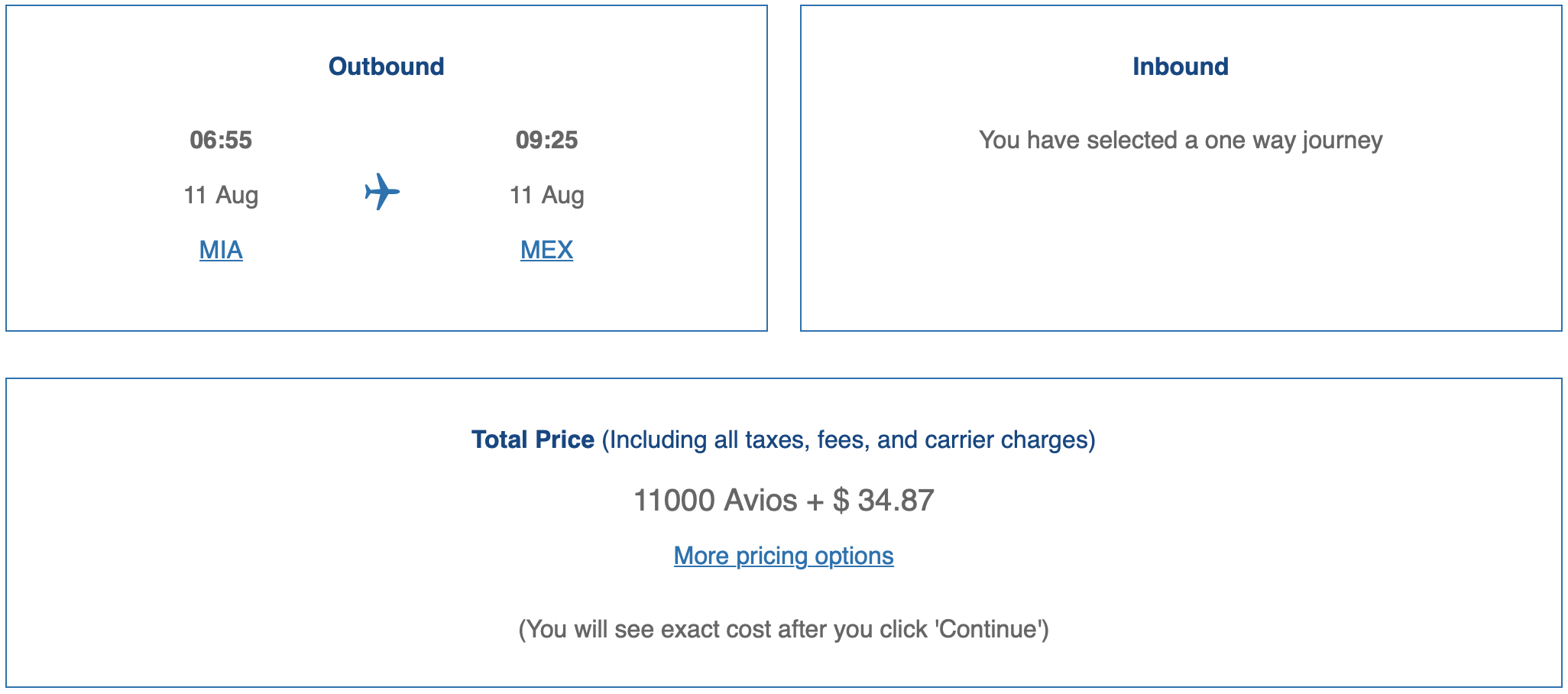

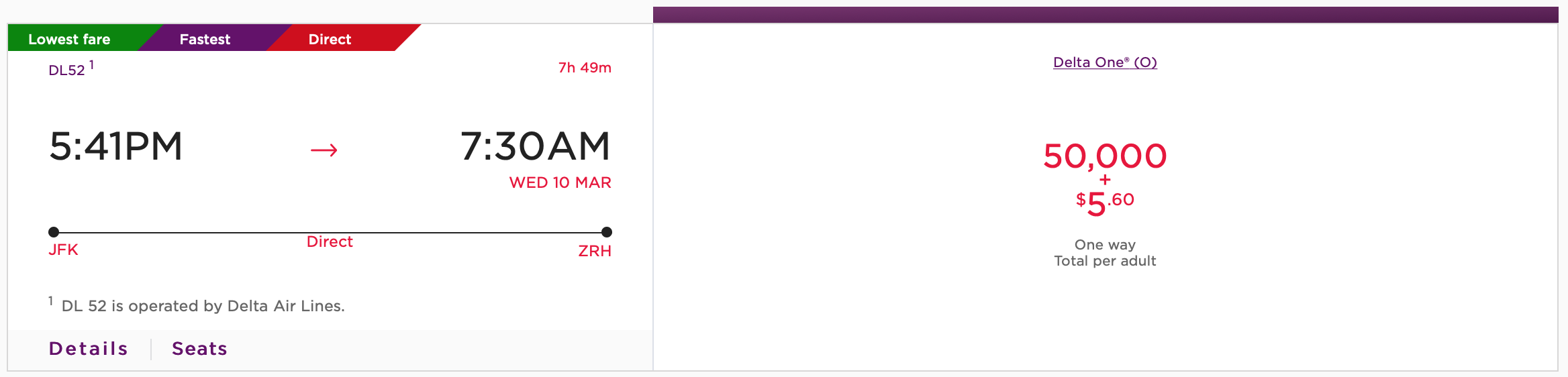

Here's a good example of how transferring points to a Chase airline or hotel partner can be a better deal, as well as the math you'll need to do to figure this out on your own. Take this one-way flight on Air France from Chicago to Paris, for example, and assume you have the Chase Sapphire Reserve® card, so you're getting 50% more value when you redeem points through the Chase Travel portal.

If you were to book this flight through Chase Travel, you would owe 39,607 points with the Chase Sapphire Reserve®, compared with the cash price of $594.10.

However, you could book an award ticket on the exact same flight through Flying Blue (Air France's loyalty program) directly if you transferred your Chase points there first. In this case, the identical flight would set you back 22,000 miles plus $109.44. This means you would transfer 22,000 miles from Chase to your Flying Blue account, and pay the taxes and fees in cash, or by redeeming points for a statement credit to your account.

When you compare, you'll find that booking with miles directly is a better deal. After you subtract the taxes and fees from the cost of booking through Flying Blue, you wind up with a value of around 2.2 cents per mile.

With the Chase Travel portal, on the other hand, you're forking over 39,607 points for the same flight, and you're getting a value of 1.5 cents for each point if you have the Chase Sapphire Reserve®.

Accessing Chase Travel is simple. If you're a Chase credit cardholder with Chase Ultimate Rewards points, you can log in to your Chase online account. Once logged in, navigate to the 'Travel" or "Rewards" section, where you'll find the Chase Travel portal. From there, you can search and book flights, hotels, and other travel services using your earned points or card benefits. It's a convenient way to plan and manage your travel adventures.

Chase Travel refers to the travel booking and rewards platform offered by Chase Bank. It's part of the Chase Ultimate Rewards program, allowing cardholders to use their earned points to book flights, hotels, car rentals, and other travel-related expenses. Chase Travel provides a convenient way to plan and book your trips while taking advantage of the rewards and benefits associated with Chase credit cards.

To earn 5% on Chase Travel, consider using a Chase credit card that offers bonus rewards on travel purchases. Cards like the Chase Sapphire Preferred or Chase Sapphire Reserve often offer 5 points per dollar spent on travel booked through the Chase Travel portal. Additionally, taking advantage of limited-time promotions and special offers can also help you maximize your rewards when booking travel with Chase.

Bottom Line

Keep in mind that, no matter which Chase credit card you have, there are other ways you can use your rewards points. You can redeem Chase points for statement credits or cash back, or cash them in for gift cards or merchandise. And if you have a premier Chase travel credit card, you can transfer your points to Chase airline and hotel partners at a 1:1 ratio.

However, booking travel through Chase can make your life considerably easier — especially if you don't like dealing with complicated hotel and airline programs. You may not get as much value from your points as you would if you booked a premium flight with airline miles, but the Chase Travel portal does offer the flexibility to book the flight you want without any blackout dates or hoops to jump through.

The Chase Travel portal offers yet another way to maximize rewards earned with a Chase credit card. Just make sure to consider all your options and the value you're getting for your points before you pull the trigger.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What’s the Value of Chase Ultimate Rewards Points?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Chase points value when booking through the portal

Chase points value when transferring to partners, chase points calculator, credit cards that earn chase ultimate rewards®, how did we determine the value of chase points.

Chase Ultimate Rewards® points are some of the most sought-after travel rewards points out there ( here's how they compare to AmEx Membership Rewards ). They are flexible, popular and valuable. But how valuable?

Based on our most recent analysis , Chase points are worth between 1 cent and 2.2 cents each, depending on how they’re used and which card they were earned with.

This wide range of values is due to the complexity of Ultimate Rewards® redemption options. Like most credit card reward points, they have a baseline value when used to either book travel directly through a portal or they can be transferred to partners. But Chase adds an additional layer of complexity by offering separate baseline values depending on the card. Let’s break it down.

» Learn more: Best Chase credit cards

In Chase's travel portal, the Chase Ultimate Rewards® points value depends entirely on which card you have — or rather, which card is associated with the points you’re using (if you have several cards).

Note: These values only represent the simplest and most direct way of using Chase points. And there isn’t any wiggle room here; you can’t search for deals that will yield more than 1.5 cents per point with a Chase Sapphire Reserve® , for example. The values are fixed when using points to book through the travel portal.

» Learn more: The guide to Chase's travel portal

There’s lots of wiggle room here. So much, in fact, that it’s hard to pin down a specific value across all of Chase’s transfer partners. Our estimate of 1 cent to 2.2 cents is based on the higher-value transfer options, but that doesn’t mean all the options are equal — far from it.

The table below shows the transfer partners for which we have data-driven point and mile valuations. In short: The estimated value of Chase Ultimate Rewards® points when redeeming with partners ranges from 0.7 cents to 1.9 cents.

Of course, the value of Chase points depends on the value of these transfer partners, but there is another factor to consider: how many high-value transfer partners the Chase Ultimate Rewards® program has. This affords more options for travel rewards hobbyists who are willing to dive into these programs and find the best deals.

Comparing Chase points to other programs with fewer high-quality transfer partners is like comparing a $100 bill to a $100 Olive Garden gift card. They’re technically worth the same amount, but one has a broader range of uses than the other.

» Learn more: How to transfer Chase Ultimate Rewards® points to travel partners

Use our Chase points calculator below to determine the value of any number of Chase Ultimate Rewards® points to dollars. This is useful for comparing the value of promotions and sign-up offers or in assessing the value of an existing cache of points.

Note: Chase's cash-back credit cards technically earn that cash in the form of Chase Ultimate Rewards®. One point equals 1 cent in those cases.

Chase Sapphire Preferred® Card

5 points per $1 spent on all travel purchased through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not purchased through Chase.

1 point per $1 spent on other purchases.

Through March 2025: 5 points per $1 spent on Lyft.

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

10 points per $1 spent on Chase Dining purchases through Chase.

10 points per $1 spent on hotel stays and car rentals purchased through Ultimate Rewards®.

5 points per $1 spent on air travel purchased through Chase.

3 points per $1 spent on travel and dining not booked with Chase.

Through March 2025: 10 points per $1 spent on Lyft.

Sign-up bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

» READ OUR REVIEW of the Chase Sapphire Reserve®

Chase Freedom Flex℠

5% cash back on rotating bonus categories, on up to $1,500 spent per quarter (cash back comes in the form of Chase Ultimate Rewards®).

5% back on travel purchased through Chase.

3% back at restaurants.

3% back at drugstores.

1% back on all other purchases.

Sign-up bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» READ OUR REVIEW of the Chase Freedom Flex℠

The Chase Freedom Flex℠ replaced the original Chase Freedom® , but holders of the original card were able to keep using it. That card offers the same 5% in rotating categories and 1% elsewhere, but not the bonus rewards on travel, dining and drugstores.

Chase Freedom Unlimited®

6.5% cash back on travel purchased through Chase during your first year, 5% after that.

4.5% back at restaurants during your first year, 3% after that.

4.5% back at drugstores during your first year, 3% after that.

3% back on all other purchases during your first year, 1.5% after that.

Note that all first-year elevated earn rates are applied only up to $20,000 in total spending during the initial cardholding year.

Sign-up bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

» READ OUR REVIEW of the Chase Freedom Unlimited®

Ink Business Preferred® Credit Card

3 points per $1 spent on the first $150,000 per year in combined spending on travel and select business categories.

1 point per $1 spent on all other purchases.

Sign-up bonus: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. .

» READ OUR REVIEW of the Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

5% cash back on office supply store purchases and internet, cable and phone services, on up to $25,000 spent per year combined.

2% back at gas stations and restaurants, on up to $25,000 spent per year combined.

Sign-up bonus: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

» READ OUR REVIEW of the Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

1.5% cash back on all spending.

Sign-up bonus: Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

» READ OUR REVIEW of the Ink Business Unlimited® Credit Card

» Learn more: The best travel credit cards

For our NerdWallet estimate of 1 cent to 2.2 cents per Ultimate Rewards® point, we factored in three variables:

The value of these points when used to book travel directly with the credit card’s travel portal.

The value of the airline and hotel points to which these points can be transferred, when applicable (based on separate analyses).

The number of top-tier travel transfer partners, as determined by our expert panel.

The overall value is determined as: A weighted average between (1) and (2), with the weight determined by (3). The program with the largest number of high-value partners receives a 100% weight on (2), and a program with zero high-value partners receives a 50% weight on (2).

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1%-5% Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% on Chase travel purchased through Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

$200 Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

You earned your Ultimate Rewards sign-up bonus—Here are the 4 best ways to spend it

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Tell me if this sounds familiar: you have 60,000 Chase Ultimate Rewards points to redeem, and right before you cash them in for a $600 statement credit, you think to yourself:

Nah. There has to be a better way.

So you hit the back button and stare at your 60,000 points, wondering just how much value you can truly squeeze out of them. $750? $1,000? Maybe even $1,200 or more?

Well, I’m here to tell you that all three are possible. Chase Ultimate Rewards points can indeed be worth up to 2 cents per point (CPP)–but only if you know where to look.

So let’s uncover the best redemption options for Chase Ultimate Rewards in 2024!

For Sapphire cards

The first thing you should know about redeeming Chase Ultimate Rewards points is that Chase Sapphire cards have slightly different redemption options than Chase Freedom cards.

The primary difference is that the two Sapphire Cards–the Chase Sapphire Preferred ® Card and the Chase Sapphire Reserve® –allow you to transfer your points to one of Chase’s 14 travel partners.

The second difference is that the Preferred and Reserve get a 25% and 50% redemption bonus on every point redeemed through Chase Travel℠, respectively. So your 60,000-point welcome bonus with each card is worth $750 in travel with the Preferred and $900 with the Reserve.

As a result, transfers and travel redemption instantly become your two best options when redeeming Chase Ultimate Rewards points with these cards. Let’s have a look at both in a little more detail.

Chase Sapphire Preferred ® Card

Intro bonus.

Rewards Rates

- 5x 5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit)

- 3x 3x points on dining at restaurants, including takeout and eligible delivery services

- 2x 2x points on travel purchases not booked through Chase

- 1x 1x points on other purchases

- 5x 5x points on Lyft rides through March 31, 2025 (that's 3x points in addition to the 2x points you already earn on travel)

- Valuable welcome bonus

- Extensive list of transfer partners

- Extra value on travel redemptions

- No premium travel perks

- Has an annual fee

- Additional perks: $50 annual hotel credit, trip cancelation/interruption insurance, auto rental collision damage waiver, complimentary Doordash and Instacart+ membership along with quarterly Instacart+ credits

- Foreign transaction fee: None

Transfers – up to 2 CPP

When you visit Ultimate Rewards after you log into your Chase account and select your Sapphire Preferred or Reserve account, you should see an additional option on the far right dropdown menu for Transfer points to partners.

Here’s where you’ll see Chase’s 14 transfer partners, which all accept Chase Ultimate Rewards points at at least a 1:1 ratio. Sometimes you’ll get even more, thanks to bonus offers listed at the very top:

Here’s a complete list of Chase’s travel partners as of April 2024:

Now, if each partner takes Chase Ultimate Rewards points at a 1:1 value, which partner should you pick for maximum value?

The answer is probably Hyatt. While most of the loyalty programs on this list have points valued in the 0.8 to 1.2-cent range, various estimates pin the value of a single World of Hyatt Credit Card point to around 2 cents each.

So, provided you’re a fan of Hyatt, there are definitely ways you can stretch ~60,000 Chase Ultimate Rewards points to $1,200 in Hyatt value–and enjoy a well-deserved weekend at the Hyatt Regency Clearwater Beach on the Gulf Coast of Florida.

World of Hyatt: Everything you need to know

Travel – up to 1.5 CPP

Even if your travel plans don’t involve one of the transfer partners above, you can always redeem your Chase Ultimate Rewards through Chase Travel for a redemption value of 1.25 CPP if you have the Preferred and 1.5 CPP if you have the Reserve.

If you’ve never used the Chase Travel portal before, know that it’s surprisingly robust and very easy to use. You can book hotels, flights, rental cars, cruises and “activities” (e.g. food tours, skydiving lessons and more). I’ve used it countless times to book flights and hotels, and you get a confirmation email from both Chase and the travel vendor when you do (which is extra comforting).

Just be mindful that if you book a hotel room through Chase Travel, you typically won’t qualify for loyalty points or rewards on the hotel side. Plus, you’ll definitely want to use up your annual travel credits ($50 with the Preferred, $300 with the Reserve) before using up your points.

An under-the-radar use of Ultimate Rewards points is redeeming them for activities. You can get 1.25 or 1.5 cents per point by buying airport transfers, catamaran tours, or cooking classes through the portal.

For Freedom cards

As mentioned, Chase’s trio of Freedom-branded cards (the Chase Freedom Rise℠ , Chase Freedom Flex℠ and Chase Freedom Unlimited ® ) lack the option to transfer points to travel partners. They also don’t get 25% or 50% travel redemption bonuses like the Sapphire cards, so your list of the best redemption options isn’t quite as “spicy.” Even still, it has plenty of kick–and you won’t have to look far to get more than a penny per point in value.

Chase Freedom Rise℠

Intro bonus.

- 1.5x Unlimited 1.5% cashback on all purchases (Cash Back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back)

- Great for building credit

- No annual fee

- Earns rewards

- Foreign transaction fee

- Strongly encourages banking relationship with Chase to be approved

- Additional perks: Cell phone insurance, car rental insurance

- Foreign transaction fee: 3% of the amount of each transaction in U.S. dollars

Pay Yourself Back – up to 1.25 CPP

Under Ultimate Rewards > More ways to use, you’ll see that 5,000 points are pretty much worth $50 across the board.

But wait – what’s this?

Somehow, the Pay Yourself Back option–which lets you cover past purchases with points–has a 25% multiplier. Let’s investigate.

From the Pay Yourself Back dashboard, you can see that there’s a temporary 25% bonus on select charitable donations–which is awesome. It may not help you pay your bills per se, but it’s a great redemption option nonetheless that helps you stretch your points to 1.25CPP.

Gift cards – up to 1.1 CPP

In a similar vein, Chase often has “sales” on gift cards that you can’t always see from the main Ultimate Rewards dashboard.

But if you go to Shopping & Experiences > Redeem for gift cards, you’ll see that some of your options are 10% off–meaning your points suddenly carry a redemption value of ~1.1 CPP with select merchants:

You can also filter by Sale to see all of your current options in one easy view:

Again, your options may be limited here–but if you were planning on doing some home improvement (and rewarding yourself with pancakes after), there are some good savings to be had from this redemption option.

The takeaway

So there you have it–the four best redemption options for Chase Ultimate Rewards in 2024. From a weekend getaway at the Grand Hyatt to a fresh banana cream cheesecake, there are plenty of ways to redeem your points for more than a penny each in value.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

What are the best ways to use chase points.

When it comes to transferable points currencies, the Chase Ultimate Rewards ® program offers high value and flexible redemption options. Using designated Chase credit cards for daily purchases can earn you rewards like cash back to spend on hotels, airfare, merchandise and more.

How do I earn Chase rewards points?

Begin by applying for the Chase Freedom or Chase Sapphire credit cards. Getting any of the credit cards will allow you to earn points.

You can also earn cash back rewards points with other Chase credit cards and travel cards that you can apply for online, but starting with one of the top two Chase credit cards listed above can help you maximize your points earning potential.

How can I redeem my Chase Ultimate Rewards?

There are multiple ways to redeem your Chase Ultimate Rewards points. Cash back is a redemption option, but some products have redemption options that are more popular than cash back. Travel expenses are also up there, but there are other options if you don't travel or would simply prefer to turn those points into usable cash for other expenses.

- Apply them to your bill: Ultimate rewards points can be used as a statement credit applied to your monthly balance. They convert at the rate of one cent per point.

- Pay Yourself Back ® program: This was introduced during the COVID-19 lockdown of 2020 and is available for Freedom, Sapphire and Ink cards. You can choose to receive a statement credit on one or more of your eligible purchases.

- Redeem them for a gift card: The standard conversion rate is the same as statement credits, but Chase regularly offers gift cards for discounted prices.

- Pay for merchandise: Point values vary depending on which card you have and which redemption option you choose. They're generally lower than what you can get for statement credits or gift cards, but only for Amazon and Paypal. Rewards points can be used to pay for all or part of your purchases. They can help you get all of the latest products on Amazon or Apple merchandise, including a full offering of the Apple ® Ultimate Rewards store.

- Book travel through the Chase portal: This is where Ultimate Rewards points are most valuable. You can book hotels, airfare and vacations at 1.5 cents per point with Sapphire Reserve. Sapphire Preferred is 1.25 cents per point. There's additional earn when booking through Chase Ultimate Rewards on select products.

- Transfer to airline and hotel partners: Chase has a partner network that includes multiple airlines and hotel chains. You can transfer points at a rate of 1:1.

- Book Chase Experiences and Chase Dining: This is a program that offers experiences such as dining and sporting events. Redeem your points for exclusive events curated around your passion with select cards. Your points can also be redeemed for takeout, reservations or exclusive culinary experiences.

The best ways to use your Chase points

If you're looking for affordable flights, nights at luxury hotels or all-inclusive vacation packages for yourself and the family, Chase Ultimate Rewards is the program for you. It's easy to use and you'll earn as you spend. But keep in mind, there are options other than travel to suit all customers.

To make sure you get maximum value for your Chase points, utilize our partner network. Some of the bigger names on that list include Southwest Airlines, Marriott, United Airlines and Hyatt Hotels. If you're looking to cash out your points, check into Chase's Pay Yourself Back® program. The conversion rate varies based on the card. If you redeem for cash back, you can use the money to travel, shop, dine out or give it to charity.

Chase Sapphire is an official partner of the PGA Championship .

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

5 top ways to redeem the Chase Sapphire Preferred's 80,000 point sign-up bonus

Some offers mentioned below are no longer available. View the current offers here .

If you're new to the points and miles game, it can be a bit overwhelming at first, to say the least. My first piece of advice for friends and family members just getting into the hobby is simple: Pick up a good travel rewards credit card . Doing this gives you a way to earn points on everyday purchases and earn a huge sum of points with its included sign-up bonus.

One of the best cards to start with is the Chase Sapphire Preferred Card. It's a solid beginner travel credit card that's currently offering a best-ever 80,000-point sign-up bonus (after you spend $4,000 on purchases in the first three months of account opening and up to $50 in statement credits towards grocery purchases within the first year of account opening, worth $1,650 per TPG's most recent valuation . The card earns Chase Ultimate Rewards points , which can be used to book everything from first-class flights to luxurious hotel stays.

Thinking of applying a Sapphire Preferred but not sure how to use the points? You're in the right place.

While there are many ways to redeem Ultimate Rewards points for maximum value, I'll give you a look at my favorite uses of the 80,000 Ultimate Rewards points in this article — let's dive in!

New to The Points Guy? Sign up for our daily newsletter and check out our beginner's guide .

A look at the Sapphire Preferred's sign-up bonus

The Sapphire Preferred offers a stellar sign-up bonus of 80,000 Ultimate Rewards points after you spend $4,000 in the first three months, making it an ideal candidate for your first travel rewards card . It also awards 2x points per dollar spent on broad definitions of both travel and dining purchases (1x on all other purchases).

Plus, the current welcome bonus also offers a $50 grocery statement credit that helps offset the first year's annual fee and makes this a best-ever public offer.

You'll also enjoy primary car rental coverage and pay no foreign transaction fees when using the card outside the U.S. In addition, the annual fee is a modest $95, making this card affordable for less-frequent travelers who are newer to the world of points and miles.