- Sector: Services

- Industry: Online Service/Marke...

Easy Trip Planners Share Price

- 43.80 -0.66 ( -1.47 %)

- Volume: 62,49,118

- 43.90 -0.57 ( -1.28 %)

- Volume: 12,44,450

- Last Updated On: 19 Apr, 2024, 03:59 PM IST

- Last Updated On: 19 Apr, 2024, 03:51 PM IST

Easy Trip Planners Shar...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Easy Trip Planners share price insights

Company has spent less than 1% of its operating revenues towards interest expenses and 11.68% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

White Spinning Top was formed for Easy Trip Planners

Stock gave a 3 year return of 309.46% as compared to Nifty Midcap 100 which gave a return of 108.77%. (as of last trading session)

Easy Trip Planners Ltd. share price moved down by -1.47% from its previous close of Rs 44.45. Easy Trip Planners Ltd. stock last traded price is 43.80

Insights Easy Trip Planners

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 51.74

- EPS - TTM (₹) 0.85

- Dividend Yield (%) 0.00

- VWAP (₹) 43.72

- PB Ratio (x) 21.34

- MCap (₹ Cr.) 7,761.54

- Face Value (₹) 1.00

- BV/Share (₹) 2.09

- Sectoral MCap Rank 16

- 52W H/L (₹) 54.00 / 37.00

- MCap/Sales 16.86

- PE Ratio (x) 51.86

- VWAP (₹) 43.71

- MCap (₹ Cr.) 7,779.26

- 52W H/L (₹) 54.00 / 37.01

Easy Trip Planners Share Price Returns

Et stock screeners top score companies.

Check whether Easy Trip Planners belongs to analysts' top-rated companies list?

Easy Trip Planners News & Analysis

Announcement under Regulation 30 (LODR)-Press Release / Media Release

Easy Trip Planners Share Analysis

Unlock stock score, analyst' ratings & recommendations.

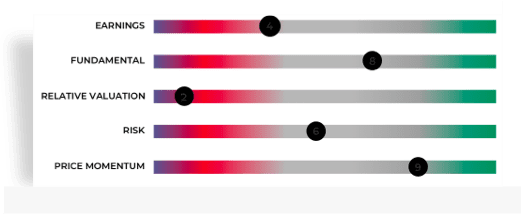

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Easy Trip Planners Share Recommendations

Recent recos.

Mean Recos by 2 Analysts

That's all for Easy Trip Planners recommendations. Check out other stock recos.

Analyst Trends

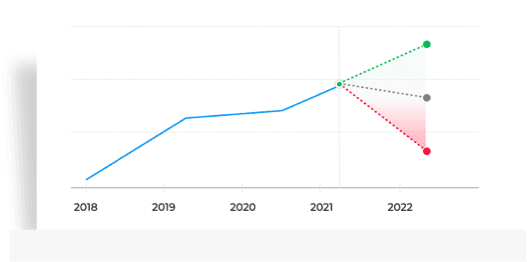

Easy trip planners share price forecast, get multiple analysts’ prediction on easy trip planners.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Peer Comparison

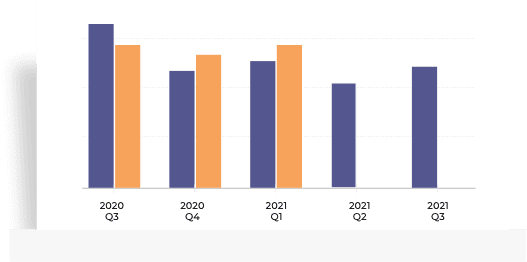

Easy trip planners stock performance, ratio performance.

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

- There’s no suggested peer for this stock.

Peers Insights Easy Trip Planners

Easy trip planners shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, easy trip planners board meeting/agm, easy trip planners dividends, about easy trip planners.

Easy Trip Planners Ltd., incorporated in the year 2008, is a Small Cap company (having a market cap of Rs 7,761.54 Crore) operating in Services sector. Easy Trip Planners Ltd. key Products/Revenue Segments include Commission (Air Passage), Income From Advertisement, Other Services and Other Operating Revenue for the year ending 31-Mar-2023. For the quarter ended 31-12-2023, the company has reported a Consolidated Total Income of Rs 165.31 Crore, up 14.35 % from last quarter Total Income of Rs 144.57 Crore and up 18.19 % from last year same quarter Total Income of Rs 139.87 Crore. Company has reported net profit after tax of Rs 45.68 Crore in latest quarter. The company’s top management includes Mr.Nishant Pitti, Mr.Prashant Pitti, Mr.Rikant Pittie, Mr.Satya Prakash, Justice(Retd)Usha Mehra, Mr.Vinod Kumar Tripathi, Mr.Ashish Kumar Bansal, Ms.Nutan Gupta, Mr.Priyanka Tiwari. Company has S R Batliboi & Co. LLP as its auditors. As on 31-12-2023, the company has a total of 177.20 Crore shares outstanding. Show More

Nishant Pitti

Prashant Pitti

Rikant Pittie

Satya Prakash

Vinod Kumar Tripathi

Ashish Kumar Bansal

Nutan Gupta

Priyanka Tiwari

- S R Batliboi & Co. LLP S R Batliboi & Associates LLP

Online Service/Marketplace

Key Indices Listed on

Nifty 500, S&P BSE 500, S&P BSE 250 SmallCap Index, + 9 more

223, FIE Patparganj Industrial Area,East Delhi,Delhi, Delhi - 110092

http://www.easemytrip.com

More Details

- Chairman's Speech

- Company History

- Directors Report

- Background information

- Company Management

- Listing Information

- Finished Products

FAQs about Easy Trip Planners share

- 1. What's the Easy Trip Planners share price today? Easy Trip Planners share price was Rs 43.80 as on 19 Apr, 2024, 03:59 PM IST. Easy Trip Planners share price was down by 1.47% based on previous share price of Rs. 44.6. In last 1 Month, Easy Trip Planners share price moved up by 1.04%.

- Stock's PE is 51.74

- Price to Book Ratio of 21.34

- EPS (trailing 12 month) of Easy Trip Planners share is 0.85

- 3. Which are the key peers to Easy Trip Planners? Top 10 Peers for Easy Trip Planners are Just Dial Ltd., Infibeam Avenues Ltd., Nazara Technologies Ltd., CarTrade Tech Ltd., Yatra Online Ltd., Matrimony.com Ltd., IndiaMART InterMESH Ltd., One97 Communications Ltd., FSN E-Commerce Ventures Ltd. and PB Fintech Ltd.

- Promoter holding have gone down from 74.9 (31 Mar 2023) to 64.3 (31 Dec 2023)

- Domestic Institutional Investors holding have gone down from 2.98 (31 Mar 2023) to 2.35 (31 Dec 2023)

- Foreign Institutional Investors holding has gone up from 2.06 (31 Mar 2023) to 2.18 (31 Dec 2023)

- Other investor holding has gone up from 20.06 (31 Mar 2023) to 31.17 (31 Dec 2023)

- 5. What has been highest price of Easy Trip Planners share in last 52 weeks? In last 52 weeks Easy Trip Planners share had a high price of Rs 54.00 and low price of Rs 37.00

- 6. What's the market capitalization of Easy Trip Planners? Easy Trip Planners share has a market capitalization of Rs 7,761.54 Cr. Within Services sector, it's market cap rank is 16.

Trending in Markets

- HDFC Bank Q4 Results

- Q4 results today

- Wipro Q4 Results

- HDFC Bank Q4 Results Preview

- Sensex Today

- Wipro Q4 Results Live Updates

- Infosys Share Price

- Faalcon Concepts IPO

- Vodafone Idea FPO

- Ramdevbaba Solvent IPO

Easy Trip Planners Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- PRO Exclusives

- Free Newsletter

Easy Trip shares jump on bonus, stock split announcement

By Staff Writer

- 10 Oct 2022

Share article on

Africa-focused Acre Impact Capital raises $100 mn for first close of debut fund

Investec nears halfway mark for second private credit fund, hits first close

Sensex, Nifty recover intraday losses on Friday but end in red for the week

Equirus onboards former Sharekhan BNP exec as MD & COO

Decline in income from asset divestments caps Blackstone's Q1 earnings growth

Sanad gets LP top-up for MENA-focused MSME debt fund

- Easy Trip Planners Share Price

The Economic Times daily newspaper is available online now.

Easy trip planners rises over 6% as firm announces stock split, bonus issue.

“The Board at its meeting held today i.e., 10th October 2022, has inter-alia, considered and approved sub-division/split of each existing equity share of the face value of Rs 2 into two equity shares of the face value of Re 1 fully paid-up, and the issue of three bonus equity shares for every one fully paid-up equity share,” the company said in a BSE filing.

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today .

Top Trending Stocks: SBI Share Price , Axis Bank Share Price , HDFC Bank Share Price , Infosys Share Price , Wipro Share Price , NTPC Share Price

- View More Stories

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

EaseMyTrip Board Approves Bonus Shares, Stock Split; Key Details Investors Must Know

Curated By : Aparna Deb

Last Updated: October 10, 2022, 14:23 IST

New Delhi, India

EaseMyTrip.com

Easy Trip Planners operates the popular ticketing platform EaseMyTrip.com

Easy Trip Planners Board Approves Stock Split: Easy Trip Planners Shares of online travel company Easy Trip Planners surged 6 per cent to Rs 428 on Monday after the company announced that its board has approved a stock split in the ratio of 1:2. The travel agency has also given its nod to the bonus issue of three shares for every one share held.

“This is to inform that the board at its meeting held today i.e., 10th October, 2022, has inter-alia, considered and approved the following items subject to shareholder’s approval: Sub-division/Split of each existing equity share of face value of Rs 2/- into 2 equity shares of face value of Rs 1/- fully paid- up and the issue of three bonus equity shares for every one fully paid-up equity share,” the company announced in an exchange filing today.

It added that bonus shares will be issued out of free reserves created out of profits of the company available as at March 31, 2022 and the estimated date by which such bonus shares would be credited/dispatched would be within 2 months from the date of board approval i.e. by December 8, 2022.

Why is Easy My Trip Going for a Stock Split?

A stock split increases the number of shares that are outstanding by issuing more shares to the current shareholders. A company engages in stock split decision to make its stock more affordable if its price levels are very high, which in thus would lead to increase in liquidity in the stock. Meanwhile, bonus shares are fully paid additional shares issued by a company to its existing shareholders.

Explaining the rationale, it said that “the company and its subsidiaries have grown significantly, in terms of business and performance, over the years. This is reflected in the share price of the company. As and when the stock price rises further, it will be increasingly difficult for small potential shareholders to partake in the company’s future. Keeping with the spirit of inclusion and in order to reward the shareholders. the Board of Directors at its meeting held today, approved and recommended the said corporate actions.”

Further, Easy Trip Planner’s board has also announced a hike in Authorised Share Capital from Rs 75,00,00,000 to Rs 200,00,00,000 and an alteration in Capital Clause of Memorandum of Association.

Meanwhile, the travel agency, launched in 2008, debuted on the bourses last year on March 19, 2021. Easy Trip Planners operates the popular ticketing platform EaseMyTrip.com. The company is enrolled in the business of booking services related to travel and tourism.

Read all the Latest Business News and Breaking News here

- EaseMyTrip IPO

- Easy Trip Planners

Easy Trip Planners Share Price

Company overview, fundamentals, what’s in news.

Moneycontrol • 3d

Why EaseMyTrip CEO Nishant Pitti wants to own an airline and make movies?

Upstox • 1mo

EaseMyTrip ties up with Zoomcar to provide pre-booked self-drive cars in India

Moneycontrol • 1mo

EaseMyTrip and PNB collaborate to launch travel-focused credit card

Livemint • 1mo

EaseMyTrip, Jeewani Group partner with Radisson Hotel Group!

What should investors do with EaseMyTrip, Hindustan Copper?

Easy Trip Planners stock jumps 7% on leap year travel discounts

Moneycontrol • 2mo

HFT Scan: Algo traders zoom in on Easy Trip Planners, Dish TV India

EaseMyTrip profit up 9.6% at Rs 46 crore in December quarter

EaseMyTrip co-founder Rikant Pittie buys commercial property in Gurugram

10 stocks with Ayodhya Ram Mandir link rally up to 148% in January

Easy Trip Planners Limited owns the online travel platform EaseMyTrip.com. The travel platform, one of the largest and fastest-growing internet companies in India, provides end-to-end solutions such as rail & bus tickets, hotels and holiday packages, and air tickets as well as ancillary value-added services.

EaseMyTrip, which is listed on the National Stock Exchange and BSE, provides its users with access to over 400 foreign and Indian airlines and more than 20 lakh hotels. It also facilitates train tickets and taxi rentals for major Indian cities. The travel platform has reported a compounded annual growth rate of 59% in profit after tax during the FY20 to FY23 period.

Headquartered in New Delhi, EaseMyTrip was founded by Nishant Pitti, Rikant Pitti and Prashant Pitti in 2008. The company was started as an internet travel platform to provide complete solutions to users during a trip. From flight bookings to cabs for sightseeing, it offers one-stop solutions to users. The promoters have around 65% stake in the company while the public shareholders own the rest.

EaseMyTrip has offices in cities such as Delhi, Gurugram, Noida, Mumbai and Bengaluru. Its global offices are in the Philippines, Thailand, Singapore, UK, USA, New Zealand and UAE. Riding on the back of investments in modern technology and a strong business model, the company has been profitable since 2008.

Business operations

EaseMyTrip offers a range of travel-related products and services such as airline tickets, hotels, holiday packages, bus tickets, rail tickets and taxis. It also provides value-added services such as travel insurance, visa processing and tickets. The online travel agent operates across three distribution channels.

In FY23, acquired a 75% stake in Nutana Aviation, a chartered flight company based in Gujarat’s GIFT city.

Business to Business to Customer (B2B2C): Under this channel, the company provides travel agents access to its website to book domestic travel airline tickets to cater to the offline travel market in India. EaseMyTrip started as a B2B2C firm in 2008.

Business to Customer (B2C): The B2C distribution channel primarily focuses on the growing Indian middle-class population’s travel requirements. Started in 2011, the channel offers a host of services directly to users with the option of no-convenience fee.

Business to Enterprise (B2E): The distribution channel started in 2013 provides end-to-end travel solutions to corporates.

EaseMyTrip’s presence in three distinct distribution channels provides it with a diversified customer base and a wide distribution network.

The company claims a customer base of 14 million users and more than 1 million hotel partners in India and globally. It had a look-to-book ratio of 3.88% with a 98% booking success rate. It has 753 employees as of March 31, 2023.

EasyMyTrip share price has dropped around 30% since its listing in March 2021. The market capitalisation as of December 28 is around ₹6,875 crore.

Financial Highlights:

- The gross booking revenue was ₹8,050.6 crore for FY23 as against ₹3,715.6 crores, an increase of 116.7% YoY.

- The adjusted revenue was at ₹674.9 crore in FY23, a 68.6% increase YoY as compared to adjusted revenue of ₹400.4 crore in the previous fiscal.

- EBITDA for FY23 stood at ₹191.3 crore against ₹146.9 crore in FY22, a growth of 30%.

- EBITDA margins were at 41.2% against 58.8% in FY22.

- Profit after tax for FY23 stood at ₹134.1 crore as against ₹105.9 crore in the corresponding period.

Easy Trip Planners Key indicators

Featured in, investment checklist: (4/6).

Equity returns

Dividend returns

Safety factor

Growth factor

Debt vs Equity

Profit factor

The investment checklist helps you understand a company's financial health at a glance and identify quality investment opportunities easily

Analyst ratings: Sell

This analysis is based on the reviews of 2 experts in the last 7 days

Financial ratios

Profitability, operational, easy trip planners shareholder returns, revenue statement.

No data available at the moment

Balance sheet

Easy trip planners share price history, shareholding info, corporate actions, dividend • ₹0.1/share, ex date 19 dec 2023, bonus • 3:1, ex date 21 nov 2022, split • 1:2, ex date 18 nov 2022, bonus • 1:1, ex date 28 feb 2022, dividend • ₹1/share, ex date 18 nov 2021, ₹0.1 per share, similar stocks, people also bought, investment calculators.

Brokerage Calculator

Margin Calculator

MF Return Calculator

SIP Calculator

NPV Calculator

Future Value Calculator

SWP Calculator

ELSS Calculator

Option Value Calculator

NPS Calculator

PPF Calculator

Compound Annual

National Savings

Sukanya Samriddhi Yojana

Compound Interest Calculator

Atal Pension Yojana Calculator

Gratuity calculator

Simple Interest Calculator

Fixed Deposit Calculator

GST Calculator

HRA Calculator

Lumpsum Calculator

Upcoming IPOs

Bidding dates

Apr 23 - Apr 25

Price per share

₹93.00 - ₹98.00

₹395.00 - ₹415.00

₹44.00 - ₹44.00

Key indices

Nifty Next 50

Nifty Midcap 50

NIFTY SMLCAP 50

Frequently asked questions

What is the easy trip planners share price today, what is today’s high & low stock price of easy trip planners, what is the market capital of easy trip planners shares today, what is the easy trip planners stock price high and low in the last 52 weeks on the nse, what is the easy trip planners stock symbol, can i buy easy trip planners shares on holidays, can i do stock trading on my phone.

By signing up, you agree to receive transaction updates from Upstox.

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Easy Trip Planners share price

NSE: EASEMYTRIP BSE: 543272 SECTOR: Travel Services 318k 1k 322

Price Summary

₹ 44.15

₹ 43.05

₹ 54

₹ 37.01

Ownership Below Par

Valuation expensive, efficiency excellent, financials very stable, company essentials.

₹ 7779.26 Cr.

₹ 7807.21 Cr.

₹ 3.75

₹ 37.46 Cr.

₹ 65.41 Cr.

₹ 0.94

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 12 Indices.

NIFTYMIDSMALL400

NIFTYSMALLCAP250

NY500MUL50:25:25

NIFTYTOTALMCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The company has shown a good profit growth of 61.8220337463151 % for the Past 3 years.

- The company has shown a good revenue growth of 45.0015532868995 % for the Past 3 years.

- Company has been maintaining healthy ROE of 48.7523748414983 % over the past 3 years.

- Company has been maintaining healthy ROCE of 62.9349509192411 % over the past 3 years.

- Company has a healthy Interest coverage ratio of 42.5390608549168 .

- The Company has been maintaining an effective average operating margins of 21.787623694466 % in the last 5 years.

- The company has an efficient Cash Conversion Cycle of 58.689716750067 days.

- Company has a healthy liquidity position with current ratio of 2.21423447300998 .

- The company has a high promoter holding of 64.3 %.

Limitations

- Company has contingent liabilities of 147.079 Cr.

- Company has negative cash flow from operations of -93.476 .

- The company is trading at a high PE of 46.7 .

- The company is trading at a high EV/EBITDA of 33.913 .

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2021 15 Sep 2021

Ratings & Research Reports

- Research Monarch Networth Capital 29 Sep 2022

- Research Edelweiss 9 Mar 2022

- Research Edelweiss 29 Sep 2022

- Research Edelweiss 28 Jun 2022

- Research Edelweiss 24 Nov 2021

Company Presentations

- Concall Q4FY22 7 Jun 2022

- Concall Q4FY21 23 Jul 2021

- Concall Q3FY24 15 Feb 2024

- Concall Q3FY22 25 Feb 2022

- Concall Q2FY23 14 Dec 2022

- Concall Q2FY22 17 Nov 2021

- Concall Q1FY23 20 Sep 2022

- Concall Q1FY22 31 Aug 2021

- Presentation Q4FY22 27 May 2022

- Presentation Q4FY21 30 Apr 2021

- Presentation Q4FY21 17 Jun 2021

- Presentation Q3FY24 12 Feb 2024

- Presentation Q1FY23 29 Sep 2022

Company News

Easy trip planners stock price analysis and quick research report. is easy trip planners an attractive stock to invest in.

Stock investing requires careful analysis of financial data to find out the company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement. This can be time-consuming and cumbersome. An easier way to find out about a company's performance is to look at its financial ratios, which can help to make sense of the overwhelming amount of information that can be found in a company's financial statements.

Here are the few indispensable tools that should be a part of every investor’s research process.

PE ratio : - Price to Earnings' ratio, which indicates for every rupee of earnings how much an investor is willing to pay for a share. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Easy Trip Planners has a PE ratio of 46.5907882140198 which is high and comparatively overvalued .

Share Price : - The current share price of Easy Trip Planners is Rs 43.8 . One can use valuation calculators of ticker to know if Easy Trip Planners share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Easy Trip Planners has ROA of 25.8327981631199 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Easy Trip Planners has a Current ratio of 2.21423447300998 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. Easy Trip Planners has a ROE of 46.8629209609928 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. Easy Trip Planners has a D/E ratio of 0.1691 which means that the company has low proportion of debt in its capital.

Inventory turnover ratio : - Inventory Turnover ratio is an activity ratio and is a tool to evaluate the liquidity of a company's inventory. It measures how many times a company has sold and replaced its inventory during a certain period of time. Easy Trip Planners has an Inventory turnover ratio of 0 which shows that the management is inefficient in relation to its Inventory and working capital management.

Sales growth : - Easy Trip Planners has reported revenue growth of 84.5868762346474 % which is fair in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of Easy Trip Planners for the current financial year is 43.2830265058896 %.

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for Easy Trip Planners is Rs 0 and the yield is 0 %.

Brief about Easy Trip Planners

Easy trip planners ltd. financials: check share price, balance sheet, annual report, and quarterly results for company analysis.

Easy Trip Planners Ltd. is a leading online travel agency that offers a wide range of travel services, including flight and hotel bookings, holiday packages, rail tickets, and bus tickets. The company leverages technology to provide convenient and efficient travel solutions to its customers. With a strong focus on customer satisfaction and technological innovation, Easy Trip Planners has established itself as a prominent player in the travel industry.

Easy Trip Planners Ltd. Share Price Analysis

Easy Trip Planners Ltd.'s share price reflects the market's perception of the company's performance and future prospects. Ticker's pre-built screening tools provide an in-depth analysis of the share price, enabling investors to make informed decisions based on the company's market valuation and price movements.

Easy Trip Planners Ltd. Balance Sheet

The balance sheet of Easy Trip Planners Ltd. provides a snapshot of the company's financial position, including its assets, liabilities, and shareholders' equity. Investors can access the company's annual reports on our website to gain insights into its financial health and stability. Ticker's premium features offer tools such as DCF Analysis, BVPS Analysis, Earnings multiple approaches, and DuPont analysis to evaluate the fair value of the company based on its balance sheet.

Easy Trip Planners Ltd. Annual Report

Easy Trip Planners Ltd.'s annual reports offer a comprehensive overview of its performance and operations throughout the year. Investors can download these reports from our website to delve into the company's strategic initiatives, financial results, and future outlook. Analyzing the annual reports can provide valuable insights for long-term stock investors.

Easy Trip Planners Ltd. Dividend Analysis

Dividends are an essential aspect of a company's financial performance and can be indicators of its stability and growth. Investors can evaluate Easy Trip Planners Ltd.'s dividend history and policies to assess its commitment to rewarding shareholders. Ticker provides research reports and credit ratings to assist investors in their dividend analysis.

Easy Trip Planners Ltd. Quarterly Results

Understanding Easy Trip Planners Ltd.'s quarterly results is crucial for investors to track the company's performance and growth trajectory. Utilizing our premium tools, investors can perform a fair value calculation based on the company's quarterly results, enabling them to make informed investment decisions.

Easy Trip Planners Ltd. Stock Price Chart

Ticker offers stock price charts that provide a visual representation of Easy Trip Planners Ltd.'s stock performance over time. By analyzing historical price movements, investors can identify trends and patterns, aiding in their investment strategies and decisions.

Easy Trip Planners Ltd. News

Staying abreast of recent developments and news related to Easy Trip Planners Ltd. is essential for investors. Ticker provides access to the latest news and market updates, empowering investors with valuable information for stock analysis and decision-making.

Easy Trip Planners Ltd. Concall Transcripts

Concall transcripts offer valuable insights into management discussions, strategies, and future plans of Easy Trip Planners Ltd. Investors can access these transcripts on our website to gain a deeper understanding of the company's direction and performance.

Easy Trip Planners Ltd. Investor Presentations

Easy Trip Planners Ltd.'s investor presentations provide a detailed overview of the company's business model, financial performance, and growth strategies. Our website offers downloadable access to these presentations, allowing investors to analyze the company's prospects and investment potential.

Easy Trip Planners Ltd. Promoters and Shareholders

Understanding the key stakeholders, including promoters and major shareholders, is vital for investors analyzing Easy Trip Planners Ltd. Ticker provides insights into the company's ownership structure, enabling investors to assess the level of insider confidence and institutional support.

Ratio Delete Confirmation

- TN Navbharat

- Times Drive

- ET Now Swadesh

business economy

Easy Trip Planners approves stock split, issue of bonus shares; stock price jump over 2%

Updated Oct 10, 2022, 12:15 IST

Easy Trip Planners approves stock split, issue of bonus shares; shares jump over 2

Who Is Elie Buechler? Columbia Rabbi Urges Jewish students To 'Return Home' Amid Protests

Lando Norris Delighted With ‘Surprise’ Podium Finish At Chinese Grand Prix, Reveals His Pre-Race Bet

Who Was Eva Evans? NYC TikTok Influencer And 'Club Rat' Director Dies

China-Led SCO Shifts Anti-Terror Focus, ISIS-K And Baloch Extremists On Radar To Combat '3 Evils'

Horoscope Today: Astrological Predictions on April 22, 2024, for all Zodiac Signs

Do Aur Do Pyaar Director Shirsha Guha Thakurta: 'It's Not A Film About Infidelity, It's About Love'

Social Security Recipients Declined By 13,500 In March: Data

Maldives Election Results: Mohamed Muizzu's People's National Congress Party Secures Dominant Victory

Tirumala Tirupati Temple Trust Earns Over Rs 1600 Crore Annually In Interest - Details

Ludhiana's Skyline Set To Transform With Hampton Sky Realty's 12-Acre Commercial Project - Details

Meet Srishti Dabas: From RBI Professional To Civil Services Top Scorer

Tesla Slashes Prices Of Model Y, Model X, and Model S Ahead Of Q1 Earnings

Meet Pooja Dadlani, Mega Star Shah Rukh Khan's Manager, Who Has A Monthly Salary Of Over Rs 60,00,000

- Trending Stocks

- HDFC Bank INE040A01034, HDFCBANK, 500180

- Jio Financial INE758E01017, JIOFIN, 543940

- Vodafone Idea INE669E01016, IDEA, 532822

- Indian Renew INE202E01016, IREDA, 544026

- Infosys INE009A01021, INFY, 500209

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Remove Ads Get Premium Content Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Personal Finance

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Pitchcraft REA

- Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- Moneycontrol /

- Share/Stock Price /

- Travel Services /

+151.15 (+0.69%)

+599.34 (+0.83%)

Easy Trip Planners Ltd.

BSE: 543272 | NSE: EASEMYTRIP | Represents Equity.Intra - day transactions are permissible and normal trading is done in this category Series: EQ | ISIN: INE07O001026 | SECTOR: Travel Services Travel Services

- Portfolio | Watchlist

- Set SMS Alert

- Today's L/H

- F&O Quote

- Historical Prices

- Pre Opening Session Prices

- Technical Chart

- Moving Average

- Pivot Table

- Moving Averages

- Board meetings

- Announcements

- Mgmt Interviews

- Research reports

- Balance sheet

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Financial Graphs

- Directors report

- Chairman's speech

- Auditors report

- Top Public SH

- Large deals

- Competition

- Latest price

- Stock Performance

- Total assets

- Fund Manager holdings

Prev. Close

43.88 (1500)

43.90 (1600)

43.80 (101)

Splits Summary

Easy Trip Planners had last split the face value of its shares from Rs 2 to Rs 1 in 2022. The share has been quoting on an ex-split basis from November 21, 2022.

Splits History (Easy Trip Planners)

Quick links

- Stock Views

- Brokerage Reports

Corporate Action

- Board Meetings

Information

- Company History

- Listing Info

- Large Deals

- Shareholding

- Top Shareholders

- Promoter Holding

- Balance Sheet

- Nine Monthly Results

Annual Report

- Directors Report

- Chairman's Speech

- Auditors Report

- Notes to Accounts

- Finished Goods

- Raw Materials

- Board of Directors

Peer Comparison

- Price Performance

- Total Assets

- Price of SBI on previous budgets

Related Searches

You got 30 day’s trial of.

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Privacy Policy

- Historical Data

- Targets Short Term (Tomorrow, Weekly)

- Targets Long Term (Yearly)

Hot Stocks To Watch Today (19 Apr 2024): TRIL, Gallantt, Berger Paints Hit Milestones Yesterday, Setting Stage for Market Surprises!

Stocks To Watch Today - Apr 18, 2024: TRIL, Honeywell, Berger Paints, and More Create Record Highs Yesterday

Hottest Stocks on 19 Apr 2024! NIFTY 50, Bajaj Finance, Mahindra & Mahindra, and more!

Top Stock Market Insights on 18 Apr 2024: Nifty 50 Swings, Bharti Airtel Hits High, Apollo Hospitals Dipped The Most

Hottest Stocks Making Waves on 16 Apr 2024 - Nifty 50 dips 0.43%, Eicher Motors and Aegis Logistics soar high

Mon 15 Apr 2024 Market Highlights: ONGC up 5.71%, Honeywell Automation has been on a 9-day green streak!

Fri 12 Apr 2024 Market Highlights: Sun Pharma Droped 4%, Indian Energy Exchange has been on a 10-day green streak

Select Page

Easy Trip Split History From 2021 to 2024

- 1: Easy Trip Split History Table From 2021 to 2024

- 2: How Many Times Easy Trip Share Split?

Updated: Fri 19 Apr 2024

The most recent share split of Easy Trip occurred 2 years ago with ex-split date of Mon, 21 Nov 2022. Easy Trip has given split 1 times in the past, you can find its complete split history in below table.

Stay ahead of the market! Get instant alerts on crucial market breakouts. Don't miss out on key opportunities!

Join our WhatsApp group

Join our Telegram group

Your phone number will be HIDDEN to other users.

Easy Trip Split History Table From 2021 to 2024

How many times easy trip share split.

In the past 3 years, Easy Trip share has been split 1 times. If you had purchased 1 share in 2021 then by 2024 after 1 splits your 1 share would be converted to 2 shares.

- Easy Trip Share Price History

- Easy Trip Price Target Tomorrow

- Easy Trip Price Long Term Target

- Easy Trip Dividend History

- Easy Trip Bonus History

Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own research before making any investment.

Recent Posts

- Tata Steel share price

- 162.10 1.31%

- Tata Motors share price

- 963.20 -0.84%

- NTPC share price

- 350.90 -0.14%

- ITC share price

- 424.80 1.40%

- Power Grid Corporation Of India share price

- 281.70 0.54%

- HDFC Bank Share Price

- Reliance Industries Share Price

- TCS Share Price

- Infosys Share Price

- HUL Share Price

₹ 15,000 turns to ₹ 70,000 in 2 years" data-reg = "Two bonus shares, one stock split: ₹ 15,000 turns to ₹ 70,000 in 2 years">Two bonus shares, one stock split: ₹15,000 turns to ₹70,000 in 2 years

Multibagger ipo issued bonus shares in february and november 2022.

Multibagger IPO: Easy Trip Planners shares have remained a money making stock for its allottees ever since it made its debut on Dalal Street in March 2021. The public issue of Easy Trip Planners Ltd or EaseMyTrip was launched in March 2021 at a price band of ₹ 186 to ₹ 187 per equity share. The public issue was offered in lot size of 80 company shares and the stock listed at a premium of near 13 per cent on Dalal Street. After this positive debut, Easy Trip shares went on to ascend further. However, the allottees who had a long term perspective didn't earn from this stock price rise only. The company has announced bonus shares on two occasions and one stock sub-division that also helped an allottees shareholding to grow many folds.

EaseMyTrip bonus share history

As mentioned above, Easy Trip Planners declared bonus shares twice after successful listing. It first traded ex-bonus stock in February 2022 for issuance of bonus shares on 1:1 ratio. This means, Easy Trip Planners gave one bonus share to eligible shareholders for carrying one share of the company. similarly, in EaseMyTrip shares traded ex-bonus stock in November 2022 for bonus share issue. This time, the company had declared bonus shares in 3:1 ratio, which mean three stocks for carrying one share of the company on bonus shares record date.

EASY TRIP PLANNERS

In November 2022, EaseMyTrip shares traded ex-split as well. While trading ex-bonus stock in November 2022, this stock traded ex-split as well on the same date. The company board had declared stock subdivision in 1:2 ratio.

Impact on bonus shares, stock split

As an allottee was allotted 80 shares per lot of Easy Trip Planners IPO, its shareholding jumped to 160 (80 + 80) shares after issuance of bonus shares in 1:1 ratio in February 2022. After issuance of bonus shares in 3:1 ratio in November 2022, net shareholding of the allottees went further up at 640 (160 x 4). After 1:2 stock split, allottees' shareholding went further up to 1280 (640 x 2).

Click here to read latest stock market news

₹ 15,000 turns to ₹ 70,000 in 2 years

As Easy Trip Planners IPO was launched at an upper price band of ₹ 187 apiece in March 2021 and one lot of the IPO comprised 80 shares of the company, minimum investment of an allottee in this stock would have been ₹ 14,960 ( ₹ 187 x 80).

Easy Trip Planners share price today is around ₹ 55 per share. If an allottee had remained invested in this scrip despite positive listing on Indian bourses, its 80 shares would have surged to 1280 EaseMyTrip shares and absolute value of one's ₹ 14,960 would have grown to ₹ 70,400 in these near two years. So, an allottees near ₹ 15,000 would have grown to around ₹ 70,000 in these two years, if it had remained invested in Easy Trip Planners shares throughout its journey from primary to secondary market till date.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!

Get the best recommendations on Stocks, Mutual Funds and more based on your Risk profile !

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

- EASY TRIP PLANNERS LTD.

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

Easy Trip Planners Ltd.

NSE: EASEMYTRIP | BSE: 543272

Expensive Performer

43.80 -0.65 ( -1.46 %)

52W Low on Aug 23, 2023

7.5M NSE+BSE Volume

NSE 19 Apr, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Below industry Median

TTM PE Ratio

TTM PEG Ratio

PEG TTM is much higher than 1

Price to Book Ratio

Very Low volatility

Split history for Easy Trip Planners Ltd.

Easy trip planners ltd. has split the face value 1 time since nov. 21, 2022. easy trip planners ltd. had last split the face value of its shares from ₹2 to ₹1 in 2022.the share has been quoting on an ex-split basis from nov. 21, 2022..

IMAGES

VIDEO

COMMENTS

The last bonus that Easy Trip Planners had announced was in 2022 in the ratio of 3:1. The share has been quoting ex-bonus from November 21, 2022. Bonus History (Easy Trip Planners)

In the past 3 years, Easy Trip shares have issued a bonus 2 times. If you had purchased 1 share in 2021, then by 2024, after the 2 bonus issue, your holding would have increased from 1 share to 3 shares. For more insights into Easy Trip Planners Limited, explore these additional resources:-. Easy Trip Share Price History.

You can view Announcement Date, Record Date, Ex-Bonus Date and Bonus Ratio history of Easy Trip Planners Ltd. Bonus History. Announcement Date. Bonus Ratio. Record Date. Ex-Bonus Date. 10/10/2022. 3 : 1. 22/11/2022.

The shares of Easy Trip Planners Ltd closed today at ₹ 398.15 apiece, up by 1.12% from the previous close of ₹ 393.75. In trade today the stock recorded a total volume of 1,140,257 shares ...

Easy Trip Share Price: Find the latest news on Easy Trip Stock Price. ... TTM EPS See historical trend : 0.85 (+22.92% YoY) TTM PE See historical trend : ... Ex-Bonus Ratio + See More. Ex-Split ...

Share on Facebook; Tweet; Share on LinkedIn; Share via Whatsapp; My Notes. 9 S. 5 W. 2 O. 7 T. 7,584.3 Market Cap Below industry Median ... Bonus history for Easy Trip Planners Ltd. Easy Trip Planners Ltd. has given 2 bonuses since Feb. 28, 2022. The last Bonus that Easy Trip Planners Ltd. anoununced was in the ratio 3:1 with ex-date of Nov. 21 ...

What's the Easy Trip Planners share price today? Easy Trip Planners share price was Rs 43.80 as on 19 Apr, 2024, 03:59 PM IST. Easy Trip Planners share price was down by 1.47% based on previous share price of Rs. 44.6. In last 1 Month, Easy Trip Planners share price moved up by 1.04%. 2.

Easy Trip Planners has fixed Wednesday, March 02, 2022 as the record date, for the purpose of ascertaining the eligibility of shareholders entitled for issue of bonus equity shares of the company ...

10 Oct 2022. Credit: 123RF.com. Shares of travel agency Easy Trip Planners Ltd, on Monday traded with gains of 1.9% in mid-day trade at Rs 409.85 apiece on BSE after announcement of a bonus issue and stock split. The stock had risen to as much Rs 419 per share in early trade on Monday. The company's board approved bonus issue of three shares ...

Dividend history for Easy Trip Planners Ltd. Easy Trip Planners Ltd. has declared 3 dividends since April 27, 2021. In the past 12 months, Easy Trip Planners Ltd. has declared an equity dividend amounting to ₹0.10 per share. At the current share price of ₹44.8000, Easy Trip Planners Ltd.'s dividend yield is 0.22%. Ex-Date.

"The Board at its meeting held today i.e., 10th October 2022, has inter-alia, considered and approved sub-division/split of each existing equity share of the face value of Rs 2 into two equity shares of the face value of Re 1 fully paid-up, and the issue of three bonus equity shares for every one fully paid-up equity share," the company said in a BSE filing.

Easy Trip Planners Ltd on Monday informed that its board has approved bonus issue of three shares for every one share held i.e., 3:1 ratio and also has given nod for the stock split in the ratio ...

Easy Trip Planners Bonus Share Ex-Date, Record Date, Ratio, Easy Trip Planners Share Price NSE: Easy Trip Planners has given a positive yield of 45 per cent so far this year. The stock has a 52 range of Rs 476.50 to Rs 239.00 and has a market cap of Rs 8.51 trillion crore. Get more Markets News and Business News on Zee Business.

Easy Trip Planners Board Approves Stock Split: Easy Trip Planners Shares of online travel company Easy Trip Planners surged 6 per cent to Rs 428 on Monday after the company announced that its board has approved a stock split in the ratio of 1:2. The travel agency has also given its nod to the bonus issue of three shares for every one share held ...

Easy Trip Planners Share Price - Get NSE / BSE Easy Trip Planners Stock Price with Fundamentals, Company details, Market Cap, Financial ratio & more at Upstox.com. ... Easy Trip Planners Share Price history. Day Open Close Day's change; Tue, Apr 16 2024 ₹43.10 ₹44.60 +3.36%. Mon, Apr 15 2024 ... Bonus • 1:1 Ex date 28 Feb 2022. Dividend ...

A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Easy Trip Planners has a PE ratio of 46.38 which is high and comparatively overvalued . Share Price: - The current share price of Easy Trip Planners is Rs 43.60. One can use valuation calculators of ticker to know if Easy Trip Planners ...

Bonus shares will be issued out of free reserves created out of profits of the company available as at March 31, 2022 and the estimated date by which such bonus shares would be credited/dispatched would be within 2 months from the date of board approval i.e. by December 8, 2022., Companies News, Times Now ... Easy Trip Planners cited the ...

Updated: Fri 12 Apr 2024. Share Price History Tomorrow Target Long Term Target Dividend History Bonus History Split History. The most recent dividend given by Easy Trip was of ₹2 with ex-dividend date of Tue, 27 Apr 2021. Easy Trip has given dividend 3 times in the past, you can find its complete dividend history in below table.

Easy Trip Planners had last split the face value of its shares from Rs 2 to Rs 1 in 2022. The share has been quoting on an ex-split basis from November 21, 2022. Splits History (Easy Trip Planners)

Easy Trip Planners on Wednesday announced that its board at its meeting today recommended issuing 1 bonus share for every 1 held i.e., in 1:1 ratio, which is subject to shareholders approval. The ...

In the past 3 years, Easy Trip share has been split 1 times. If you had purchased 1 share in 2021 then by 2024 after 1 splits your 1 share would be converted to 2 shares. Disclaimer: Information is provided 'as is' and solely for informational and educational purposes, not for trading purposes or advice. We highly recommend to do your own ...

EaseMyTrip bonus share history. As mentioned above, Easy Trip Planners declared bonus shares twice after successful listing. It first traded ex-bonus stock in February 2022 for issuance of bonus ...

Split history for Easy Trip Planners Ltd. Easy Trip Planners Ltd. has split the face value 1 time since Nov. 21, 2022. Easy Trip Planners Ltd. had last split the face value of its shares from ₹2 to ₹1 in 2022.The share has been quoting on an ex-split basis from Nov. 21, 2022. Ex-Date.