- Personal Finance Financial Advisors Credit Cards Taxes Retirement

- Insurance Auto Vision Life Dental Health Medicare Home Life Business Pet

- Investing Stocks Options ETFs Mutual Funds Futures IPOs Bonds Index Funds Forex Prop Trading

- Alternative investing Real Estate Startups Collectables

- Mortgage Rates Calculator Reviews Purchase Refinance Self-Employed

- Cryptocurrency Exchanges Price Action Apps Earn Crypto Wallets

What Is Contents Insurance?

Get the right amount of coverage you need to protect your valuables with Lemonade Home .

When you own a home, it’s wise to carry homeowners insurance to cover the structure — plus, your mortgage provider might require this insurance. Contents insurance protects your belongings in case of a covered peril, such as fire or theft. When purchasing your homeowners insurance, you can select your contents coverage limit based on the value of your possessions. Learn what you need to know about contents coverage and how to select the best options based on your belongings.

Understanding Contents Insurance

What does contents insurance cover, what contents insurance does not cover, how much contents insurance do you need, how much does content insurance cost, contents insurance coverage limits.

- Actual Cash Value vs. Replacement Cost

How to Get Contents Insurance

Compare the best contents insurance providers, protect your personal belongings from the unknown.

- Frequently Asked Questions

Contents insurance helps to protect your belongings in case of covered events. Here’s a look at some common scenarios in which homeowners and renters call upon this insurance coverage.

- Fire : If a fire damages part of your home, your contents coverage can provide funds to replace those items, such as smoke-covered furniture or singed linens.

- Theft : If a burglar infiltrates your home, contents insurance can help you replace expensive items, such as technology or certain pieces of jewelry.

- Water damage: A small leak can cause big damage to vanities, valuables and other items. You can replace those items with contents insurance.

- Property destruction : Sometimes anger causes people to do crazy things. So if a nasty neighbor or old acquaintance smashes your windows and damages your belongings, your insurance might step in to help you replace your damaged goods.

For the most part, contents insurance will cover replacing damaged or stolen items in your home. Here’s a look at what is covered.

- Inexpensive jewelry items (though fine jewelry will need a jewelry policy)

- Laptops/computers/monitors, etc.

- Small appliances that are not built into the home

- Smart home devices

- Smartphones

- Sporting equipment

- TVs and other media devices

While contents insurance provides coverage for many personal items, it also excludes other items.

- The full value of high-ticket items due to depreciation

- Vehicles such as those should be covered under an auto policy

- Features installed in your home, such as cabinets, flooring, etc. because those items are covered under dwelling insurance

- Lost or misplaced goods

- Goods that have coverage under another insurance policy

- Belongings that exceed your insurance coverage limits

- Items you’ve sold, given to acquaintances to borrow or were not in your possession at the time of the covered event

- Scheduled property, such as fine jewelry or art

- Events that relate to perils that are not covered, such as floods or earthquakes

One challenge that renters and homeowners face when purchasing their insurance is deciding how much contents coverage to purchase. Your goal should be to protect your most valuable belongings while managing the cost of your insurance.

To find how much coverage you need, follow these steps.

- Walk through your home taking photos or videos of your property.

- Write out your valuable items alongside their estimated value. Try to do this in a spreadsheet so you can add up their values quickly.

- When you have many items within a category, such as small kitchen appliances, you might want to estimate their value as a whole instead of each item individually.

- Don’t forget to go out into the garage. You likely have many valuables here including toys like bikes and tools.

- Once you have a value, round up to the nearest $10,000. For example, if you find that you have $55,000, round that up to $60,0000 and purchase contents insurance for that value.

Because content insurance is part of homeowners or renters insurance , you can’t buy it individually. Your location, insurance deductible, home value, whether you’re in a flood zone, the population density and much more will all impact your total insurance rate. However, renters insurance is $180 per year and homeowners insurance averages $2,153 per year. You should get quotes from multiple insurance policies before purchasing to ensure you’ve found the most affordable policy.

While you can add up your contents and value them to decide the best-case scenario to protect your belongings, you can also take 50% of your home’s value and use that for contents insurance. So if you have a $400,000 home, you might purchase $200,000 in contents coverage.

Renters don’t have that luxury and will need to decide how much “contents” coverage to get or purchase the amount of coverage their landlord requires.

Actual Cash Value vs. Replacement Cost

Some policies pay actual cash value for your belongings while others pay replacement cost. It’s important to know the difference. Actual cash value pays out the value of the item factoring in depreciation. Replacement cost will pay to replace an item based on today’s prices.

Replacement cost will cost more for your insurance, however, it also ensures greater financial comfort in case of an incident. Newer items are easier to cover with actual cash value because they will have less depreciation impact. You should discuss the matter with your insurance agent to determine the best policy for you that balances insurance premiums with financial impacts if you call upon your insurance coverage.

To get contents insurance, you’ll need homeowners insurance or renters insurance . The process for doing so looks like this.

- Reach out to an insurance agent with details about your home or rental unit. Or quote insurance with online carriers being thorough in how you answer the questions to ensure you get adequate coverage.

- Review pricing factors such as choosing an appropriate deductible limit that you can pay but that balances the price of your monthly deductible.

- Select the contents insurance that will provide coverage based on your personal property. Your agent likely used a formula of 50% of your home’s value to determine how much “contents” coverage you need. But if you need additional coverage, request an updated quote.

- Purchase the insurance and save your declaration pages somewhere secure in case you need to file a claim.

Find the best insurance providers to purchase quality homeowners or renters insurance with the contents coverage you need.

Contents insurance helps you protect your personal belongings from events you can’t predict, such as fire or theft. Make sure you have adequate coverage based on the value of your goods. Review your coverage with your agent annually to make updates as needed.

Frequently Asked Questions

Is it worth having contents insurance.

You should have contents insurance to cover your personal belongings from perils, such as fire or water damage. That way, you can replace your goods and return to life as normal as quickly as possible.

Do you need a receipt to claim contents insurance?

Your insurance carrier might request a list of items that were damaged or stolen as part of your claim. Some more expensive items might need proof of purchase. It’s wise to create a digital log of such items that you store on a cloud-based server for easy access.

How soon can you claim on contents insurance?

You should file a claim within 24 hours of a covered event to claim contents insurance. Otherwise, file a claim within 24 hours of discovering the loss or damage.

About Rebekah Brately

Rebekah Brately is an investment writer passionate about helping people learn more about how to grow their wealth. She has more than 12 years of writing experience, focused on technology, travel, family and finance. Her work has been published in Benzinga, Hearst Bay Area, FreightWaves and Dallas Observer publications.

A Practical Guide to Buying Travel Insurance

Travel insurance could be the difference between a huge medical bill or a modest copay. use these tips to find the best policy for your trip..

- Copy Link copied

It’s far better to buy travel insurance and never use it than to not be covered in an emergency.

Courtesy of Shutterstock

For many, travel insurance seems like an unnecessary additional expense. But if you get stuck in a costly situation—a medical emergency, a canceled trip due to a pandemic , a stolen camera—it suddenly becomes a totally worthwhile investment that saves, not costs, you money.

This was the case for writer Chris Ciolli. After years of traveling without a safety net, she invested in travel insurance on a recent trip during which she was rushed to the hospital at 3 a.m. for a slew of just-in-case tests. She ended up with an underwhelming diagnosis of gastritis, but also a slow trickle of medical bills—a few hundred dollars here, a thousand there—that totaled nearly $6,000. Fortunately, her monthlong $185 World Nomads policy covered everything after an initial $80 copay.

But even if you understand the benefits and you’re committed to buying travel insurance, choosing the right policy for your needs—and even knowing what those needs are—can be tricky. To help you choose the best travel insurance for your trip, we’ve consulted a number of travel agents, insurance industry professionals, and lifelong travelers for advice. In this guide, you’ll find everything you need to know, from travel insurance reviews and comparisons to common questions answered, to pick the best policy for your next trip.

What is travel insurance?

Travel insurance is a plan, similar to health or auto insurance, that protects you from expenses incurred during unforeseen mishaps while traveling, such as lost luggage, trip cancellations, or medical emergencies.

Although your current homeowner’s, renter’s, auto, or health insurance may cover you for certain things while traveling, it usually doesn’t cover everything—especially on international trips. A good travel insurance plan will cover the gaps.

Where do you get travel insurance?

Some very basic forms of travel insurance are included if you booked your trip with a credit card such as World MasterCard, Capital One Venture Rewards, and Chase Ink and Sapphire cards. With these plans, you may be protected regarding some delay, luggage, and travel accident expenses, but the coverage is usually pretty basic.

You can also purchase it as an add-on while booking flights, cruises, or hotels. These plans are also limited and will only cover you in the event of an unavoidable cancellation due to events such as a natural disaster or a death in your family. “While it may seem less expensive, it may not cover all of the components of your trip,” says Andrew David Harris, vice president and COO of Harris Travel Service . While both of these are better than nothing, the most comprehensive and best travel insurance policies are sold by providers such as World Nomads, Allianz Global Assistance, Seven Corners, or TravelEx. You can purchase these plans through your travel agent, but it’s often less expensive to book directly with the travel insurance provider or through a comparison website, like SquareMouth .

What does travel insurance cover?

Every traveler and trip is different, which is reflected by the variety of travel insurance plans on the market. No matter what plan or provider you choose, below are some common things travel insurance covers. Experts agree that before you buy, you should absolutely look for specific exclusions in the fine print on potential policies. If you’re unsure about something, reach out. A good insurance company will be responsive and willing to clarify your questions.

Trip cancellation and interruption

Most travel insurance policies will include some form of trip cancellation and interruption coverage to reimburse you for nonrefundable expenses, like a prepaid hotel or plane ticket. Unless you add cancel for any reason (CFAR) insurance to your plan, there will be a limited set of acceptable reasons to claim this. Illness, death of an immediate family member, and weather are commonly accepted reasons.

Trip delays and missed connections

Also common is reimbursement for additional expenses incurred if a trip is delayed and meets criteria set out by the provider. With World Nomads, your flight must be delayed by at least six hours to qualify.

Baggage and personal effects

Most plans will cover the cost of lost or damaged luggage and personal belongings as well as the cost of purchasing additional items if your luggage is delayed.

Emergency medical and dental care

This covers the cost of medical care when you get sick or have an accident in another country and usually includes medical evacuation. However, travel insurance isn’t a substitute for regular health insurance so nonemergency medical expenses (physicals, anything cosmetic, eye exams) aren’t covered. Childbirth isn’t covered either, even for pregnant travelers who go into labor prematurely.

Shannon O’Donnell, 2013 National Geographic Traveler of the Year and blogger at A Little Adrift , mentions another coverage gap travelers miss: “You’re only covered for what you’re licensed to do back home—if you don’t have a permit for a motorbike and you drive one in Southeast Asia, you might not be covered in an accident.”

Emergency medical evacuation

This covers the cost of an emergency transfer (in an ambulance or helicopter, for example) from an area with inadequate medical care to the nearest medical center with the services you need. It’s costlier but essential in isolated and politically unstable parts of the world.

Accidental death and dismemberment and repatriation

Experts say that “truckloads of coverage for hospital costs and medical repatriation home” are the most important things to look for. “The rest is just window dressing.” A lot of basic plans won’t include this in their coverage, but you can easily add this on with an upgrade to a more premium tier.

Concierge and 24/7 service

Daniel Durazo, director of Marketing and Communications for Allianz Global Assistance , says that “a good policy includes a 24/7 contact line for both medical and travel emergencies.”

Common travel insurance add-ons to consider

A basic plan is usually enough for most travelers, but it may not cover everything you need if you’re older, have pre-existing medical conditions, participate in sports while traveling, book an expensive trip, or travel with expensive gear (such as a high-end camera). If you fall into any of these categories, consider an add-on or upgrade.

Upgrade lost luggage, trip delay, and cancellation amounts

“Standard travel insurance levels cover more modest belongings and lodging,” advises Annette Stellhorn, president and Group Luxury Travel designer at Accent on Travel . If you’re traveling with expensive gear or spending a lot on your trip, consider upgrading to a tier that covers your costs adequately.

Additional coverage for adventure and high-risk travel

Stellhorn also notes that adventure and high-risk travel “require higher benefit amounts for medical evacuation, which can run more than $250,000.” And Judy Perl at Judy Perl Worldwide Travel says that “most insurance companies will not insure high-risk travel at all, with the exception of big companies like First Allied and Travelex .” Even fewer risky activities and sports may only be covered to a limit: that is, climbing to certain heights and diving to certain depths.

Most sports are covered up to a certain level of intensity; any higher and you may have to purchase a different tier of insurance. World Nomads, for example, will cover a slew of adventure travel activities and sports, but at an additional cost on top of its basic insurance.

Cancel for any reason (CFAR) insurance

It’s important to read the fine print of any insurance plan because, even if it includes trip cancellation coverage, this often only kicks in under certain circumstances. As many travelers found out recently, trips canceled due to the recent coronavirus pandemic were not covered unless they had a CFAR add-on .

Jennifer Wilson-Buttigieg, co-owner and copresident at Valerie Wilson Travel , explains that these plans “only cover 75 percent of trip expenses [and only] if travelers cancel their trips at least 48 hours in advance.”

Does travel insurance cover pandemics?

No. “Once actual events have unfolded, such as the coronavirus outbreak, they are considered known or foreseeable events and are no longer covered by most travel insurance policies,” says Afar’s Michelle Baran . The exception is if you chose to upgrade your plan to include a CFAR add-on.

What are the best travel insurance policies?

The best travel insurance policy will depend on you and your trip. You’ll want to make sure you have a plan that covers the cost of your entire trip and the activities you want to do and won’t leave you in the dark if you have preexisting conditions. The following are some of the best travel insurance partners to consider:

Best for: Older travelers and those with preexisting conditions.

While Allianz provides great travel insurance for any traveler, it’s especially appropriate for those with pre-existing conditions, since those are covered in every one of its plans. However, its basic coverage only covers up to $500 in lost or damaged baggage, so consider an upgrade if you’re traveling with more expensive equipment.

Get a quote: allianztravelinsurance.com

Best for: Medical coverage only

GeoBlue’s Voyager basic medical coverage is not a comprehensive travel insurance plan that covers a slew of scenarios; rather it provides travelers with basic medical travel insurance. The deductible is a high $500, but at $19 to $35 per trip, it’s an inexpensive way to protect yourself in case something catastrophic happens. If you’re adequately covered for travel mishaps like lost luggage or stolen goods by other insurance (like your credit card or homeowner’s insurance), this might be the plan for you.

Get a quote: geobluetravelinsurance.com

Best for: Traveling with kids

With TravelEx, travelers can choose between a basic or select travel insurance package with options to customize it according to their needs. Both plans cover standard things like trip cancellation and emergency medical services and are an all-around comprehensive option. However, its Travel Select plan also includes free coverage for any children under 17 traveling with you. For families, TravelEx Select is a great money-saving option.

Get a quote: travelexinsurance.com

How much does travel insurance cost?

Complete travel insurance packages can cost as little as $8 per day but vary depending on the length of the trip, destination(s), and the tier of travel insurance you choose. Some, but not all, travel insurance may also cost more for travelers with pre-existing conditions or older adults.

As a comparison, here are some examples of travel insurance costs for a 45-year-old traveler on a $5,000, one-week trip to Mexico:

- $138 for an explorer plan with World Nomads

- $179 for a basic plan with Allianz

- $248 for an essential plan with AIG

- $261 for a basic plan with Travelex

While some of these plans may seem expensive, keep in mind that if they provide you the coverage you need, they can be a huge money saver. Insurer World Nomads says that its average claim amount for 2017 was $1,634, and its most expensive claim—a medical evacuation of a child from Sitka, Alaska, to Seattle—was nearly $200,000. Suddenly, that $8 per day makes travel insurance worth it . But, as Michael Holtz, founder and CEO of the travel agency SmartFlyer , says, “People don’t think they need it until they need it.”

How do I buy travel insurance?

You should always buy travel insurance from an official, reputable provider or website, such as purchasing directly through the insurance provider, a travel agent, or a comparison website; these “offer a way to search, compare, and purchase from a wide array of plans,” says Stan Sandberg, cofounder of TravelInsurance.com .

Comparison sites to buy travel insurance include:

- Travelinsurance.com

- SquareMouth

- Insuremytrip

Sandberg strongly recommends consumers speak with a licensed agent when they are unsure about benefits. The website Elliott Report is another good resource and features a list of reputable travel insurance companies compiled by consumer advocate Christopher Elliott.

When to buy travel insurance

Generally, you should book your travel insurance as soon as you can after booking your flights and hotels. If you’re traveling to a destination affected by hurricanes , book sooner rather than later, because you can’t buy insurance to cover delays or cancellations related to a storm that already has a name.

People with preexisting conditions need to consider other factors. Most insurers will cover only expenses related to prior illnesses in very specific circumstances; travelers with preexisting conditions must book coverage within a specific time frame, usually between 14 and 21 days, following their initial trip reservation, and they must be medically able to travel on the date they purchase the insurance.

Your travel insurance policy period should be for the duration of your trip from door to door (no gaps or shortcuts, please) and cover you for every place you plan to visit, whether it’s in-state, out-of-state, or international. Some destinations are at higher risk than others, so insurers don’t offer the same coverage for the same price everywhere.

What does your existing insurance cover while traveling?

While your existing health, auto, renter’s, or homeowner’s insurance may cover a few things while you’re traveling, it likely doesn’t cover everything.

- Health insurance: Many U.S. health-care policies, including Medicare, don’t cover travelers on international trips. Some plans will cover you abroad, so check with your provider. If your health insurance only covers you domestically, both the Centers for Disease Control and the U.S. State Department recommend purchasing medical travel insurance.

- Travel insurance: Credit cards can provide limited coverage of some delay, luggage, and travel accident expenses, as well as part of your rental car insurance.

- Homeowner’s and renter’s insurance: Home contents or rental insurance may cover some lost, stolen, or damaged valuables or even offer a reasonably priced floater policy (an add-on to your regular policy that covers easily moveable property) if you travel with expensive equipment.

- Auto insurance: Within the United States, your primary auto insurance will almost always cover rental vehicles. There are a few exceptions for domestic rentals, like if your current auto insurance has low coverage limits. International car rentals are a different story. In Mexico, for example, rental car insurance is mandatory , even if you have insurance at home. Always be sure to check local rules before you reserve a rental car.

Tips for filing claims and getting reimbursed

Unlike most domestic health insurance policies, travel insurance doesn’t typically have a deductible. Some inexpensive policies will require you to pay a small, nonrefundable, initial policy excess amount before further costs up to the benefit limit are covered. Many policies work on a reimbursement plan: You pay upfront, save your receipts, and file a claim, then after processing, your insurance company pays you back for covered expenses.

Most policies require you pay non-emergency expenses out of pocket and submit your claim for reimbursement afterward. In a non-life-threatening emergency, call your insurer for instruction if you’re able; it will make the claims process easier, and the insurer may be able to direct you to a hospital or medical center where your care can be billed directly to it.

Hannah Logan, of the blog Eat Sleep Breathe Travel , says this step is especially important because the small print on many policies “reads that calling the contact number [may be] a requirement for coverage.”

No matter what, document everything. Whether it’s lost baggage, a medical expense, or damage to your rental car, gather and keep anything that can help your claims case: your original rental car agreement, receipts, photos, medical paperwork, a copy of your boarding pass.

Buying travel insurance is a little like packing a suitcase: It can seem overwhelming at first, but eventually it becomes routine and a necessary part of every trip. Once it does, you can travel worry-free, secure in the knowledge that you’ve saved yourself from a possible $6,000 mistake.

This article originally appeared online in 2018; it was updated on June 19, 2020, and on May 15, 2024, to include current information.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

- Search Search Please fill out this field.

What Is Travel Insurance?

Understanding travel insurance, how travel insurance works, comprehensive travel insurance.

- Trip Cancellation or Interruption

Damage and Baggage Losses Coverage

Rental insurance, travel health insurance.

- AD&D Coverage

Other Travel Insurance Coverage

How to get travel insurance, the bottom line.

- Personal Finance

What Is Travel Insurance, and What Does It Cover?

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Jackyenjoyphotography / Getty Images

Travel insurance is a type of insurance covering financial losses associated with traveling, and it can be useful protection for domestic or international travel. Whether you missed your flight to Florida, lost your bags in Berlin, or broke your ankle in Ankara, the best travel insurance companies can help remedy all kinds of travel mishap costs.

Key Takeaways

- Travel insurance can be purchased online, from your tour operator, or from other sources.

- The main categories of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, rental property and rental car coverage, medical coverage, and accidental death coverage.

- Coverage often includes 24/7 emergency services, such as replacing lost passports, cash wire assistance, and rebooking canceled flights.

- It's important to understand what's covered and what's not, and any limitations on coverage amounts and coverage requirements.

Travel insurance helps cover financial losses associated with surprise circumstances that could ruin a trip, including illness, injury, accidents, flight or other transportation delays, and other issues. This insurance costs 4% to 10% of a trip's price. So, for a $10,000 trip, trip insurance could cost between $400 and $1,000.

Premiums—or the price you pay for coverage—are based on the coverage type, your age, destination, trip cost, and more. Specialized policy riders focus on the needs of business travelers, athletes, and expatriates .

You may already have travel insurance coverage from your homeowners or renters insurance or your credit cards. Call your insurance agent to find out about your current travel coverage, and your credit card company to find out about any benefits you get when you purchase air or train tickets, rent a car, or book a hotel using the card. Many travel rewards cards come with built-in travel insurance and other travel benefits.

Travel insurance may be sold online by travel agents, travel suppliers (airlines, cruise lines), private insurance companies, or insurance brokers when booking your flight, accommodations, or car. Travel insurance companies include AIG Travel, Berkshire Hathaway Travel Protection, Generali Global Assistance, GeoBlue, Nationwide, and more.

Typically, you'll purchase coverage shortly after initial bookings for lodging, flights, or other transportation, activities, and rental cars. Some policies may require you to do so to retain full coverage. Here are some terms to know for travel insurance.

Primary and Secondary Coverage

If you buy travel insurance, you may have concurrent insurance coverage , meaning you're covered under more than one policy. When the travel coverage is primary, the travel insurance reimburses you first without needing to make a claim through another company—and sparing you potentially increased policy rates.

If the travel insurance coverage is secondary, you'll first need to attempt to file a claim with other coverage, such as an airline (lost baggage) or your own auto insurance (damaged car).

Coverage Requirements

There are usually stipulations spelled out on how you qualify for coverage. Your claim must fall under the types of coverage offered. For example, lost baggage insurance might include coverage for personal items, prescriptions, credit cards, and your passport or visa. You may also need to take extra steps to qualify for coverage, such as reporting the loss or theft to the police.

Policy Coverage Limits

This is the maximum amount you can receive for the claim. For example, you might only receive $500 per bag. You may not even receive more for expensive items such as jewelry or electronic devices. You might need to provide receipts for items over a certain amount. Without receipts, the insurer may only pay for repairs.

Some coverage might require you to pay a deductible, or flat amount, before covering the remainder of your claim up to the limit.

These are the conditions under which your coverage will not cover the loss. Each policy differs. For example, your baggage damage coverage may not cover losses caused by animals. It may exclude coverage of bicycles, hearing aids or other medical devices, keys, and tickets, or seizure by a government or customs official.

Pre-existing conditions may not be covered by travel medical insurance, or may only be covered if you buy a travel insurance plan within one to two weeks of booking your trip.

Comprehensive travel insurance includes many types of coverage listed below, bundled into one plan. Most commonly, comprehensive travel insurance bundles a 24-hour assistance line to help find doctors or get assistance in an emergency, reimburse you for trip cancellation , interruption and delay, baggage loss or delay, and medical expense and medical evacuation coverage.

Alternatively, you can purchase each coverage type separately. This may be wise if you already have coverage through other insurance or can cover your losses in many cases.

Trip Cancellation or Interruption Coverage

This insurance reimburses a traveler for some or all prepaid, nonrefundable travel expenses, and comes in the following forms:

- Trip cancellation : Reimburses you for paid travel expenses if you can't travel for a preapproved reason.

- Travel delay : Reimburses you for expenses if you can't travel because of a delay.

- Trip interruption : Reimburses you for travel costs if your trip is cut short.

- Cancel for any reason (CFAR) : Reimburses you for a portion of costs if you cancel the trip for any reason; typically more expensive than the other types listed above.

With most of the above, acceptable cancellation and interruption causes and reimbursement amounts vary by provider. Acceptable reasons for a claim might include the following:

- Your illness

- Illness or death in your immediate family

- Sudden business conflicts

- Weather-related issues

- Legal obligations such as jury duty

You may need to pay more or meet more requirements to file a claim for a cancellation due to financial default, terrorism in your destination city, or work reasons.

When traveling, register your travel plans with the State Department through its free travel registration website , the Smart Traveler Enrollment Program (STEP). The nearest embassy or consulate can contact you if there is a family, state, or national emergency.

Baggage and personal belongings being lost, stolen, or damaged is a frequent travel problem—and can quickly ruin a trip as you must shop for replacements. Baggage and personal effects coverage protects lost, stolen, or damaged belongings during travel to, in, and from a destination.

However, many travel insurance policies pay for belongings only after you exhaust all other available claims. Baggage coverage may have many restrictions and exclusions, such as only covering up to $500 per item and $250 for each additional item. You may be able to increase or decrease amounts, shop around for coverage, or increase limits by paying more.

For example, the insurance may not pay for lost and damaged luggage due to airline fault. Most carriers, such as airlines, reimburse travelers if baggage is lost or destroyed due to the airline's error. However, there may be limitations on reimbursement amounts, so baggage and personal effects coverage provide an additional layer of protection.

Vacation rental insurance covers costs from accidental damage to a vacation rental property. Some plans also offer trip cancellation and interruption to help reimburse costs when you can't use your vacation rental. Some of these reasons could include the following:

- Lost or stolen keys

- Unsanitary or unsafe vacation property

- Vacation rental wasn't as advertised

- The company oversold your vacation rental

Rental car insurance covers a rental car's damage or loss while on a trip, taking the place of the rental agency's collision damage waiver (CDW) or your regular car insurance policy. Policies vary and may cover collisions, theft, vandalism, and other incidents. Rental car insurance may be a secondary policy to your own car insurance. However, it doesn't cover your liability or legal responsibility for damage or injury you cause to others.

Medical coverage can help with unexpected international medical and dental expenses, and help with locating doctors and healthcare facilities abroad. As with other policies, coverage will vary by price and provider.

- Foreign travel medical coverage : These policies range from five days to one year or longer, and cover costs arising from illness and injuries while traveling.

- Medical evacuation: May cover airlift travel to a medical facility and medical evacuation to receive care.

Consult with your current medical insurers before purchasing a policy to determine whether a policy extends its coverage outside the country. Most health insurance companies pay “customary and reasonable” hospital costs if you become sick or injured while traveling, but few will pay for a medical evacuation.

The U.S. government doesn't insure citizens or pay for medical expenses abroad . Before purchasing a policy, read the provisions to see what exclusions, such as preexisting medical conditions, apply. Don't assume that the new coverage mirrors that of your existing plan. Routine medical care is typically excluded unless you buy a long-term medical plan intended for expatriates, missionaries, maritime crew members, or others abroad for extended periods.

Medicare or Medicaid generally don't cover medical costs overseas unless you have specific Medicare Advantage or Medigap plans covering emergency overseas care.

Accidental Death and Dismembership (AD&D) Coverage

If an accident results in death or serious injury, an AD&D policy pays a lump sum to surviving beneficiaries or you for an injury. The insurance usually offers three parts, providing coverage for accidents and fatalities:

- Flight accident insurance: Occurring during flights on a licensed commercial airliner.

- Common carrier: Resulting from public transportation such as train, ferry, or bus travel.

- General travel: Occurring at any point during a trip.

Exclusions that may apply include death caused by drug overdose or sickness. In addition, only some injuries may be covered, specifically hand, foot, limb, or eyesight. There are stated amount limits per injury.

Accidental death coverage may not be necessary if you already have a life insurance policy. However, benefits paid by your travel insurance coverage may be in addition to those paid by your life insurance policy, leaving more money to your beneficiaries.

Depending on your plan or package selected, you may be able to add the following travel insurance types:

- Identity theft resolution services

- School activity coverage

- Destination wedding coverage

- Adventure sports coverage

- Pet health as a reason for cancellation or delay

- Hunting or fishing activities as a reason for cancellation or delay

- Missed flight connections

Travel insurance varies in cost, exclusions, and coverage. Coverage is available for single, multiple, and yearly trips. To get travel insurance, you fill out an insurance company's application about your trip, including the following:

- Travelers going

- Destination

- Travel dates

- Date of first payment toward your trip

The insurance company reviews the information using underwriting guidelines to guide issuing a policy and the rate. If it accepts your application, the company will issue a policy covering your trip. If the company rejects your application, you can apply with another insurer.

When you receive your policy, you'll typically get a 10- to 15-day review period to review the contract's fine details. If you don't like the policy, you can return it for a refund. Read through the document and ensure the plan you purchased doesn't apply too many loopholes, and that it covers:

- Emergency medical care and transport back to the U.S.

- High enough limits to cover your costs or damages

- Regions you're traveling to

- Your trip duration or number of trips

- All activities you plan to enjoy

- Preexisting conditions and people of your age

Also, read through for any exclusions. For example, types of property covered, and whether property lost or damaged by the airline is covered, and how.

Do I Need Travel Insurance?

You might consider travel insurance if you can't afford to cancel and then rebook an expensive or long trip. You might also consider travel health insurance if your health insurance doesn't cover international costs. An alternative is to book an easily cancellable vacation—look for a pay-later hotel room and car rental options, flexible cancellation terms, and the ability to rebook without a fee.

What Is Not Covered by Travel Insurance?

Review the travel insurance policy to discover exclusions. According to NAIC, common travel policy exclusions are:

- A traveler's pre-existing health conditions

- Civil and political unrest at the traveler's destination

- Pregnancy and childbirth

- Coverage for those engaging in adventure or dangerous activities.

Pandemics may also be excluded from coverage.

How Can I Get Cheap Travel Insurance?

Your homeowners or renters insurance may provide some protection for personal belongings, and airlines and cruise lines are responsible for loss and damage to your baggage during transport. Also, credit cards may provide automatic protection for things like delays and luggage or rental car accidents if used for deposits or other trip-related expenses.

The main types of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, medical expense coverage, and accidental death or flight accident coverage. Before buying a policy, check to see if you already have coverage through your own health or car insurance or a credit card.

Mass.gov. " Travel Insurance. "

Minnesota Department of Commerce. " Travel Insurance ."

U.S. Travel Insurance Association. " Frequently Asked Questions ."

Texas Department of Insurance. " Should You Get Travel Insurance? "

National Association of Insurance Commissioners. “ Taking a Trip? Information about Travel Insurance You Should Know Before You Hit the Road .”

U.S. Department of State. “ Your Health Abroad. ”

Medicare.gov. " Medicare Coverage Outside the United States ." Page 4.

Medicare.gov. " Medigap & Travel. "

NAIC. " Travel Insurance ."

:max_bytes(150000):strip_icc():format(webp)/Primary-Image-how-much-does-travel-insurance-cost-7377124-c44e95776d284d3e84b756908efb5add.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

The search came up with nine results ranging in price from $74.40 to $179.18.

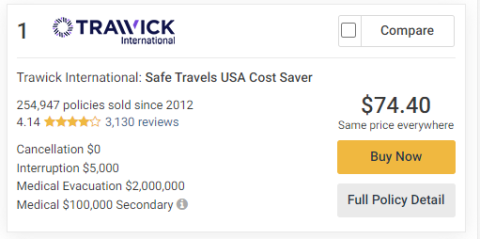

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

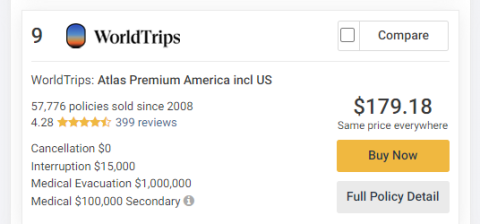

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

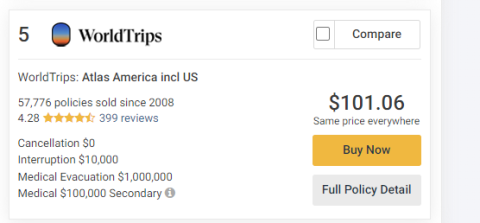

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

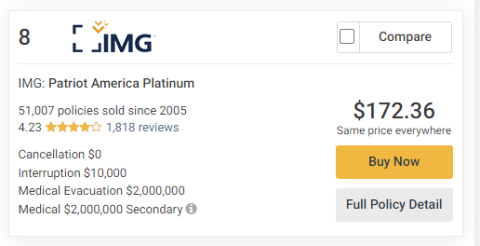

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Moving center

- What's your stuff worth

- Financial future

- Business insurance

- Event insurance

- Flood insurance

- Identity protection

- Landlord insurance

- Motorcycle insurance

- Pet insurance

- Power sports

- Travel insurance

- Disaster insurance coverage

- Calculators

- Pay-per-use

What is contents insurance?

By Allstate

Last updated : January 1

Whether you own or rent your home, the value of your stuff can quickly add up. So, what if the contents of your home — such as furniture, electronics and clothing — were damaged or stolen?

The good news is that renters , homeowners and condo insurance policies typically include coverage for the contents of your home. This coverage is sometimes known as "contents insurance," but is usually described in most insurance policies as personal property coverage .

Contents insurance helps pay to replace or repair your personal belongings if they're stolen or damaged by a covered peril, such as a fire. So, if someone breaks into your home and steals your laptop , or your clothing and furniture are ruined in a fire, you may find that contents insurance helps cover the loss.

It's important to understand the type of coverage you have and how much your policy may pay for a covered claim so you can be better prepared if you ever need to file a claim. Read on to learn about how contents insurance works, coverage limits and some things to consider.

get a personalized insurance quote today

Property coverage: actual cash value vs. replacement cost.

When you purchase a homeowners, renters or condo insurance policy, your insurer will typically allow you to choose between two types of personal property coverage to help protect the contents of your home: actual cash value and replacement cost.

- Replacement cost coverage helps reimburse you for the cost of replacing a damaged item with one of similar type and quality.

- Actual cash value coverage usually pays you the cash value of the contents you insured, but factors in depreciation of the item, the Insurance Information Institute (III) says.

Here is an example of how these two coverages work. Say you file an insurance claim after your five-year-old television was stolen. A contents insurance policy with actual cash value coverage will only reimburse you for a percentage of what you paid for it. Meanwhile, a policy with replacement cost coverage would likely provide enough coverage for you to purchase a replacement of the same quality at today's value.

Keep in mind that if you choose replacement cost coverage, your policy premium may increase.

Taking inventory

So, how do you know how much coverage — and what type — is right for you? One way to start is by creating an inventory of your belongings. In addition to listing or photographing your belongings, include details like serial numbers on electronics, makes and models, and year of purchase, suggests the III . It's also a good idea to attach any official documentation, such as receipts and appraisals, to your home inventory. Documenting the stuff you own, from electronics to shoes, can help give you a clearer picture of what you own and how much it's worth. That may help you decide how much personal property coverage you need, and may also come in handy if you need to file an insurance claim.

Contents insurance coverage limits

Whether you choose replacement cost coverage or actual cash value coverage, you will have a coverage limit and a deductible . A limit is the maximum amount your policy will pay toward a covered claim. A deductible is the amount you pay out of pocket before your insurer will help pay toward a covered claim. You may be able to choose your coverage limit based on the value of your belongings — for example, $50,000 of contents coverage. You may also be able to choose your deductible amount when you purchase coverage — $500, for example. This means if your belongings were destroyed in a fire, your insurer would pay up to $50,000, minus your $500 deductible, to help replace your stuff.

However, coverage limitations may apply for certain valuable items. Standard contents insurance typically limits coverage for certain types of valuable belongings like jewelry and furs, says the III. For example, say your diamond ring is stolen. While your personal property coverage may be higher than the value of the ring, you may find that a standard policy provides more limited coverage — for example, the policy may only pay up to $1,500 when a piece of jewelry is stolen.

This is where scheduled personal property coverage may help. Scheduled personal property —often referred to as rider , floater or endorsement — is an optional coverage you can purchase to provide additional protection for certain valuables such as art, antiques, furs, jewelry or musical instruments. To schedule an item, you'll typically need to have the item professionally appraised, according to the III. Other benefits to scheduling items may include coverage for a greater number of risks and no deductible payment if you need to file a claim.

Contents insurance and moving

Contents insurance typically covers your personal belongings while they're in your home or in transit to a new home, according to the III . However, this coverage usually doesn't pay for damage to your belongings when it was caused by movers —whether when they were packing the items or physically moving them. It's a good idea to talk to your insurance agent when you're buying a new home to understand how your belongings are covered during a move. It's also important to remember that you will need a new homeowners insurance policy when you purchase a new home. This is because a new home has different risks and needs that may require different coverages.

If you move any belongings into a storage unit , contents insurance may provide protection for the items against certain perils, such as fire or theft. However, keep in mind that coverage limits may be lower for items that are off premise. For example, if your homeowners insurance policy has a $75,000 personal property coverage limit, the coverage for your belongings kept offsite may be capped at $7,500. Be sure to check with your policy or consult with your agent to understand how much coverage you have for these items.

With a better understanding of how insurance helps protect the contents of your house or apartment, you can be prepared to select the coverages that are right for your situation.

Stories & tips for everyday life

- What is property and casualty insurance?

- Insurance premiums, deductibles, limits

- What’s an insurance endorsement?

- What is liability coverage?

- What is personal property coverage?

- Insurance and divorce

- Beware of insurance scams

- What is subrogation?

Travel insurance

This advice applies to England. See advice for See advice for Northern Ireland , See advice for Scotland , See advice for Wales

Travel insurance can give you extra protection if your holiday doesn't go as planned. So you should make sure you have cover if you're planning a trip away.

It's particularly important to take out travel insurance if you are travelling independently because you may find yourself stranded with no way to get home and no-one to help sort out your holiday problem.

Read this page for more information on what you need to think about before you take out a travel insurance policy.

travel insurance is essential, particularly if you are travelling independently

choose a policy that covers your needs

compare policies on the cover they offer as well as the cost

check if you have other insurance that will cover you away from home

Why take out travel insurance?

Travel insurance can protect you against the following things going wrong:

cancelling or cutting short your trip for reasons beyond your control

missed transport or delayed departure for reasons beyond your control

medical and other emergencies

personal injury and death

lost, stolen or damaged items, including baggage, passports and money

accidental damage or injury caused by you.

If you don't have travel insurance you will have to pay out of your own pocket to deal with a problem while you're away. Or you may lose money if you have to cancel a trip and can't get your money back. This could cost you thousands of pounds.

Older travellers

If an insurer or broker can’t offer you insurance because of your age, most of them will refer you to an alternative insurer or give details of a signposting service such as the British Insurance Brokers’ Association’s (BIBA’s) ‘Find a Broker’ service. You can use this service to find specialist insurers who can offer specific types of cover based on factors such as age and medical condition.

You can find the BIBA’s ‘Find a Broker’ service by phoning their helpline on 0870 950 1790 or by going to their website at www.biba.org.uk .

Where can you buy travel insurance?

Travel insurance is widely available. You can buy it from:

insurance companies

retailers and supermarkets

travel agents

online comparison websites

holiday companies.

Sometimes, travel insurance might be included as an extra service offered through your bank account or credit card. You should check how much you're paying for this and what kind of cover it offers. For example, cover may be limited for your spouse or partner. It might be better to buy a stand alone policy.

Your travel agent may offer you travel insurance as part of a package holiday. You can opt for this if you want to but you don't have to buy this insurance. The travel agent is breaking the law if they try to make you take it out or charge you more for your holiday because you refuse to accept it. If this happens, you should get advice.

Before you buy holiday insurance

It's important to get the right type of cover for your needs. Think about:

where you're travelling to. For example, if you're travelling to the United States you will need extra medical cover

how old you are. Travel insurance can cost more if you're over 65. There are special policies for older travellers which may be worth looking at

how often you travel. If you go away several times a year, it may be better to buy an annual travel policy rather than several single-trip policies

what you'll be doing while you're away. You may need extra cover if you're taking part in dangerous sports, such as skiing or scuba diving

whether you're travelling independently or on a package holiday. Package holidays usually offer you greater protection if things go wrong with transport or accommodation so you may not need to make a claim on your travel insurance

how you're travelling. Cruises and budget airline flights may not be covered by some insurance policies.

What cover should travel insurance include?

Your travel insurance should always include the following cover:

medical expenses and cover for getting you home if you're injured or fall ill abroad

personal injury and cover for accidents or damage caused by you

cover for lost or damaged items

cover for lost or delayed baggage

cover for cancellation or missed departure.

How much you pay for your insurance depends on the amount of cover you're likely to need. You should never under-insure yourself just to save money. However, you may be able to keep costs down.

The European Health Insurance Card (EHIC)

If you're a UK resident and have a European Health Insurance Card (EHIC), you can still use it to get healthcare in EU countries until it expires.

If you don't have an EHIC or it has expired, you can apply for a UK Global Health Insurance Card (GHIC) on the NHS website. You can use a GHIC to get healthcare in EU countries at a reduced cost or sometimes for free. You should still get travel insurance before your trip - even if you have an EHIC or GHIC.

Home contents insurance

Check if your household contents insurance policy covers you for items you take away from home. If it does, you could choose a larger excess on your travel insurance policy. The excess is the amount that your insurer won't pay out for the claim and is typically between £50 and £100. If you choose a higher excess, your travel insurance may cost less.

More about household contents insurance

Choosing the right insurer

The cheapest policy may not offer best value for money, so it's important to check what the policy includes as well as how much it costs.

You can check what different policies offer and how much they cost by using an online comparison website. However, comparison websites usually only offer general cover. If you have particular needs, it may be better to find an insurer that offers specialist cover.

Making a claim on your travel insurance policy

Problems with making a claim on your travel insurance policy

If you need more help

Other useful information

Getting medical treatment while travelling in Europe www.gov.uk

Information on travel insurance if you have a pre-existing medical condition or disability at www.moneyhelper.org.uk

Information on travel insurance for people with pre-existing medical conditions from Tourismforall at www.tourismforall.org.uk

Getting travel insurance if you have cancer from Macmillan Cancer Support at www.macmillan.org.uk

Help us improve our website

Take 3 minutes to tell us if you found what you needed on our website. Your feedback will help us give millions of people the information they need.

Page last reviewed on 20 February 2020

What is contents insurance?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our content is backed by Coverage.com, LLC, a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed . Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal loans

- • Home equity loans

- Connect with Jerry Brown on Twitter Twitter

- Connect with Jerry Brown on LinkedIn Linkedin

- • Insurance coverage

- • Auto insurance

- Connect with Amelia Buckley on LinkedIn Linkedin

The Bankrate promise

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation of how we make money . Our content is backed by Coverage.com, LLC, a licensed entity (NPN: 19966249). For more information, please see our Insurance Disclosure .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most — price, customer service, policy features and savings opportunities — so you can feel confident about which provider is right for you.

- We guide you throughout your search and help you understand your coverage options.

- We provide up-to-date, reliable market information to help you make confident decisions.

- We reduce industry jargon so you get the clearest form of information possible.

All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure we’re putting accuracy first.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.