An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 Per Diem Rates Now Available

Please note! The FY 2024 rates are NOT the default rates until October 1, 2023.

You must follow these instructions to view the FY 2024 rates. Select FY 2024 from the drop-down box above the “Search By City, State, or ZIP Code” or “Search by State" map. Otherwise, the search box only returns current FY 2023 rates.

Rates are set by fiscal year, effective Oct. 1 each year. Find current rates in the continental United States, or CONUS rates, by searching below with city and state or ZIP code, or by clicking on the map, or use the new per diem tool to calculate trip allowances .

Search by city, state, or ZIP code

Required fields are marked with an asterisk ( * ).

Search by state

Have travel policy questions? Use our ' Have a Question? ' site

Have a question about per diem and your taxes? Please contact the Internal Revenue Service at 800-829-1040 or visit www.irs.gov. GSA cannot answer tax-related questions or provide tax advice.

Need a state tax exemption form?

Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information , including any applicable forms.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Would you like to view this website in another language?

Travel allowance: A Comprehensive Guide for Employees

- Written by: Rinaily Bonifacio

- Last updated: 11 March 2024

This article will explain travel allowance, when and how you can use it, and tips for getting the most out of your expenses.

Table of contents

What is travel allowance?

How does business travel allowance usually cover, what is a flat travel allowance, what is the daily allowance, easy ways on how companies manage their procedures for business travel allowances, effective communication, how to manage business travel allowances.

Travel allowance is a type of compensation employers provide to cover employee travel expenses incurred when traveling for business purposes. It helps with employee travel costs, such as transportation, lodging, meals, and other incidentals while on the job. Depending on the company policy, travel allowance may be given in cash or as reimbursed expenses.

For example, some companies provide a fixed daily amount for meals and lodging that employees can use during their travels. Other companies cover expenses incurred by employees when they submit receipts after their trip has ended. This is known as per diem allowance or transport allowance.

Business travel allowance typically covers the cost of airfare, hotel accommodations, and meals. It may also include per diem allowances such as ground transportation, parking, and incidentals. The exact coverage will vary depending on the company's policies and the type of business trip.

A flat travel allowance is a set amount of money an employee provides for travel costs. The employee is responsible for managing the funds and ensuring they are used for the intended purpose. This allowance is typically used for short trips or employees who travel infrequently.

.png?width=323&height=124&name=img-16%20(1).png)

Employee scheduling and Time-tracking software!

- Easy Employee scheduling

- Clear time-tracking

- Simple absence management

A daily allowance, also known as a per diem, is a set amount of money provided to employees for money incurred daily while traveling for business purposes. It typically covers things such as

- Transportation

- And incidentals.

The allowance amount is usually based on the location and duration of the business trip and is intended to cover living costs for that specific location.

Daily allowances are provided in addition to other travel compensation types, such as lodging or airfare reimbursement. The amount and coverage of a daily budget will vary depending on the company's policies and the nature of the business travel.

Companies can manage their procedures for business travel allowances by establishing clear guidelines and policies. This should include information on who is eligible for the assistance, what travel costs are covered, and how to submit expense reports. Additionally, companies can use travel management software to track and approve payments and ensure company policy compliance.

It is also essential for companies to communicate effectively with employees about travel allowance policies so that they are aware of their rights and obligations. This can include providing training and support and regular updates on any policy changes.

By managing their procedures for business travel allowances in a clear and organized manner, companies can ensure that their employees have the resources they need to complete their business trips while also managing the company's expenses.

Another critical aspect of managing business travel allowances is to keep an eye on the per diem rates and lodging expenses. It is essential to ensure that these expenses are within the budget and are in line with the rates established by the General Services Administration (GSA). Companies should also consider implementing a system for meal allowance and car hire reimbursement, as well as for laundry services, parking fees, and other miscellaneous expenses.

To manage business travel allowances effectively, companies should establish clear guidelines for employees traveling within the continental United States and those traveling to foreign countries. This includes setting a budget for each travel and providing employees with the necessary forms for expense reporting and reimbursement.

In addition, companies can use data analysis to identify trends and patterns in travel expenses. This can help them make more informed decisions about travel policies and budgeting and potentially save money on future trips.

It's also important to consider the needs of business travelers and their families and to establish policies that support them. For example, companies may offer additional allowances for family members traveling with a business traveler or for international travel.

Overall, an efficient reimbursement system and clear travel policies can help ensure that employees are promptly reimbursed for their expenses and that the company's expenses are tracked and managed effectively. This can be a great way to manage business travel allowances and keep costs under control.

Written by:

Rinaily Bonifacio

Rinaily is a renowned expert in the field of human resources with years of industry experience. With a passion for writing high-quality HR content, Rinaily brings a unique perspective to the challenges and opportunities of the modern workplace. As an experienced HR professional and content writer, She has contributed to leading publications in the field of HR.

Please note that the information on our website is intended for general informational purposes and not as binding advice. The information on our website cannot be considered a substitute for legal and binding advice for any specific situation. While we strive to provide up-to-date and accurate information, we do not guarantee the accuracy, completeness and timeliness of the information on our website for any purpose. We are not liable for any damage or loss arising from the use of the information on our website.

Ready to try Shiftbase for free?

- Whistleblowing Policy

- First Aid in the Workplace

- Cell Phone Policy at Work

- Inclement Weather Policy

- Employee Non-disclosure Agreement

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

How will AI affect accounting jobs?

Tax attorney: Navigating the nuances of taxation in hybrid work arrangements

Legal Experts Weigh-in on Labor Department’s Upcoming Worker Classification Rule

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

IRS updates business travel per-diem rates

- Individual Income Taxation

The IRS issued its annual update Friday of special per-diem rates for substantiating ordinary and necessary business expenses incurred while traveling away from home ( Notice 2021-52 ).

The new rates are in effect from Oct. 1, 2021, to Sept. 30, 2022. Specifically, they are the special per-diem rates, including the transportation industry meal and incidental expenses rates; the rate for the incidental-expenses-only deduction; and the rates and list of high-cost localities for purposes of the high-low substantiation method.

The updated rates are effective for per-diem allowances paid to any employee on or after Oct. 1, 2021, for travel away from home on or after that date, and supersede the rates in Notice 2020-71, which provided the rates for Oct. 1, 2020, through Sept. 30, 2021.

Rev. Proc. 2019-48 provided general rules for using a federal per-diem rate to substantiate the amount of ordinary and necessary expenses for lodging, meals, and incidental costs paid or incurred for business-related travel away from home.

High-low substantiation method

For purposes of the high-low substantiation method, the per-diem rates are $296 for travel to any high-cost locality and $202 for travel to any other locality within the continental United States (CONUS), both slightly higher than last year.

The amount of these rates that is treated as paid for meals for purposes of Sec. 274(n) is $74 for travel to a high-cost locality and $64 for travel to any other locality within CONUS, both also slightly higher than last year.

The notice contains a list of the localities that are high-cost localities (localities that have a federal per-diem rate of $249 or more, $4 higher than last year) for all or part of the calendar year.

Incidental expenses

Since 2012, incidental expenses have included only fees and tips given to porters, baggage carriers, hotel staff, and staff on ships. The per-diem rate for the incidental-expenses-only deduction remains unchanged at $5 per day for any locality of travel.

Transportation industry

The special meals and incidental expenses rates for taxpayers in the transportation industry are $69 for any locality of travel within CONUS and $74 for any locality of travel outside CONUS, both $3 more than last year.

— Paul Bonner ( [email protected] ) is a JofA senior editor.

Where to find April’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

Travel and Expense

What is a travel allowance definitions and insights.

A travel allowance can be an effective way to manage employee travel expenses and manage costs for the employee.

When employees travel for business, there are myriad expenses, from hotels to taxis or ride-sharing services. Using a travel allowance can help give travelers flexibility and control while increasing compliance with tax regulations.

What Is a Travel Allowance?

A travel allowance is compensation paid by an employer to employees to cover expenses incurred when traveling for business. In addition to lodging and transportation, travel allowances are typically used for airfare, meals, and other expenses related to business travel. It is business travel compensation, provided either before or after travel is completed.

Managing business travel compensation can be complex and hard to manage. The way businesses handle travel compensation is changing, as leaders look to implement tools that aid travelers and companies alike.

Technology is transforming how companies manage all aspects of employee travel , including the creation and coordination of travel allowances.

Types of Travel Allowance

There are many types of travel allowances, which can be given upfront or based on a reimbursement schedule. Here is a look at some of the most common.

Fixed Travel Allowance

A fixed travel allowance is a flat rate that is offered to an employee, irrespective of the level of expenses incurred. Employees are responsible for managing their travel expenses and determining how to use the money best to accommodate their needs. It is commonly used with employees for short trips or who travel infrequently.

Typically, with a fixed allowance, if the employee spends less than the allocated amount, the employee can keep the difference. If the employee spends more, they are responsible for making up the difference. Businesses using fixed travel allowance should work with their tax professional to understand the implications of this practice.

Daily Travel Allowance

Also called a per diem, a daily travel allowance is an amount used for each day of travel and can be used for lodging, transportation, meals, and other travel expenses. Typically, a traveler will reconcile the per diem by submitting an expense report and receipts. The traveler will be reimbursed for any expenses they spent in excess and will return money that was unspent.

Travel Reimbursement

This travel allowance requires the traveler to submit receipts for actual expenses incurred, which are then reimbursed. This process can be cumbersome and time-consuming for the traveler. If reimbursement is not done in a timely manner, it can be burdensome for the employee, who is essentially lending money to the company. Fortunately, there are technologies available today to simplify this work.

Mileage Allowance

This type of allowance pays the employee for miles traveled on business. It is typically used when employees use their own car for business-related travel. Technologies can tracking and reimbursing for mileage simpler and more accurate.

Methods for Calculating Travel Allowances

When using travel allowances as part of a corporate travel program, one key consideration is how the travel allowances are calculated.

The process often has to consider the distance traveled and the time spent traveling. Here is one way to calculate a travel allowance.

Location and Days of Travel

Start by determining the location of the traveler at midnight on each day of travel. A day of travel is defined as a 24-hour period an employee is conducting business while traveling.

The day of travel ends when the next day starts or they return home from a business trip to their home or office. For example, if an employee leaves for a trip at 4 p.m., the first day of travel is from 4 p.m. that day until 4 p.m. the next.

Lodging allowances are provided based on whether an employee spends the night in accommodations other than their own home. Typically, lodging allowances are based on the location and the current price rates for various hotel categories, based on company preferences for the level of hotels allowed.

Unlike with other categories, usually lodging is an either/or determination. Employees are either allowed the lodging allowance or not based on the circumstances of the trip.

Like with lodging, meal allowances are usually based on the prevailing costs of meals in each location. It assumes that a traveler will have three meals a day.

Typically, a meal allowance covers both meals and incidentals, such as snacks. Often it is prorated based on the time in any given day a traveler is on the road.

The meal allowance may also be reduced if there are meals provided as part of the work travel, such as part of a conference registration fee or transportation ticket.

Managing Travel Allowances

Managing travel allowances is a complex task. Here are some tips on how to effectively implement and manage a program:

- Develop a Clear Policy. Travelers need to understand the specifics in your travel program and how allowances are used. The policy needs to spell out, for example, what expenses are allowed and not allowed and the ways in which allowances are calculated. Transparency is essential to ensure all employees understand how travel expenses are covered

- Consider Incidentals. Business travelers face many complexities and challenges. You want a policy that makes it easy for travelers to navigate while on the road. Be sure your policy covers costs that may arise, including parking, fuel, tips, laundry services, printing, internet fees, and luggage check fees

- Analyze Data. You need a system in place that collects and reports on travel data to allow you to better understand trends, shifts and challenges. With visibility into your travel program, you can make timely, well-informed decisions

Developing Travel Allowance Policies and Guidelines

If your company wants to develop a travel allowance policy, where should you begin?

The policy should be rooted in a broader travel policy which should consider the following:

- Scope. What aspects of business travel will your policy cover?

- Coverage. Determine which elements of travel the policy will cover, such as air travel, lodging, meals, incidentals, and ground transportation

- Reimbursement Types. Will your company use travel allowances and, if so, which types?

- Participation. How will policies be determined? Be sure to include staff from human resources, finance, and departments that frequently travel, in determining the policy

- Safety. Be sure your policy provides protection for employees while they are traveling

- Expense Reporting. Develop tools or adopt that will be used for the reporting of travel expenses, with an emphasis on scalability, technology integration, and ease of use

Technological Advancements in Travel Allowance Management

Technology is changing the way companies manage business travel . There are powerful platforms available today that integrate travel policies, allow for the booking of travel and itinerary management and provide robust data collection and travel.

Employees need access to easy-to-use tools that allow for the recording of receipts and other transactions, let them reconcile expenses and generate expense reports, and simplify approvals and routing.

SAP Concur solutions can provide companies with integrated business travel, expense, and invoice solutions. With SAP Concur solutions, companies can book travel, manage expenses, integrate with business systems, manage invoices, and more.

Learn more about how SAP Concur solutions can simplify your travel management .

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Travel allowances

Explains the PAYG withholding implications on travel allowances.

Last updated 24 August 2021

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties.

Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies.

You include the amount of the travel allowance in the allowance box on your employee's payment summary.

The exception applies if:

- you expect your employee to spend all of the travel allowance you pay them on accommodation, food, drink or incidental expenses

- you show the amount and nature of the travel allowance separately in your accounting records

- the travel allowance is not for overseas accommodation

- the amount of travel allowance you pay your employee is less than, or equal to the reasonable travel allowance rate.

If the exception applies, you:

- don't withhold tax from the travel allowance you pay your employee

- don't include the amount of the travel allowance in the allowance box on your employee's payment summary

- only include the allowance on their payslip.

If the first two exception conditions are met but you pay your employee a travel allowance over the reasonable travel allowance rate, you're required to withhold tax from the amount that exceeds the reasonable travel allowance rate. You also need to include the total amount of the travel allowance in the allowance box on your employee's payment summary.

You are always required to withhold tax from a travel allowance for overseas accommodation and include the amount of the travel allowance in the allowance box on your employee's payment summary.

Check the relevant Single Touch Payroll (STP) employer reporting guidelines to see how to report these payments through STP:

- STP Phase 1 employer reporting guidelines – allowances

- STP Phase 2 employer reporting guidelines – allowances

Reasonable travel allowance rate

Each year we publish the amounts we consider reasonable for claims for domestic and overseas travel allowance expenses.

- TD 2021/6 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2021–22 income year?

- TD 2020/5 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2020–21 income year?

- TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses

- Keeping travel expense records

- Tax return – allowances

- Tax return – work-related travel expenses

Travel Allowances, Mileage and Per Diem Rates

Expenses for travel on official business by University employees are reimbursed at the following rates set by State legislation , the Internal Revenue Service (IRS), the US General Services Administration (GSA), US Department of State and the Department of Defense as applicable.

Transportation by Vehicle

University travelers are encouraged to use a state-owned or leased vehicle through Fleet Services . If a state-owned or leased vehicle is not available, travelers should use the least expensive method of ground transportation to meet their business needs.

When a personal vehicle must be used, the allowable IRS mileage rate, effective Jan. 1, 2024 is:

Mileage reimbursements up to 350 miles (round-trip) are reimbursed at the full IRS rate. For trips which exceed 350 miles, mileage above the first 350 miles is reimbursed at fifty percent (50%) of the full rate. Please refer to 1501.4 – Procedure on Ground Transportation Expenses Including Mileage Rates for more information.

Lodging and Meals (Per Diem)

Per diem is the allowable amount for room and meals based on the destination and dates of travel as detailed below. See 1501.5 – Procedure on Per Diem Rates and 1501.6 – Procedure on Lodging Accommodations for more information.

Reimbursement for lodging may be made only in the amount documented by an itemized receipt of actual lodging expenses from a commercial lodging establishment.

Effective for travel beginning March 1, 2023, the University will now utilize the lodging per diem rates set by the US General Services Administration (GSA), US Department of State and Department of Defense as applicable. Travelers should secure lodging no more than 50% higher than the lodging rates set for their destination and dates of travel. Lodging rates only apply to the nightly room rate charged by the establishment and do not include taxes and fees. Lodging obtained in excess of these rates will require additional information.

For more information on lodging rates, excess lodging and third-party lodging information see 1501.6 – Procedure on Lodging Accommodations .

University travelers are only eligible for meal per diem when they make an overnight trip. Partial day per diem is possible when the partial day is the day of departure or return for a trip, but it must be in conjunction with an overnight trip taken. Reimbursement of meals outside of overnight travel is not permitted.

Tax and tips for meals are included in the per diem rate. The cost of meals included in other related activities (registration fees, conference costs, hotel registration, etc.) may not be duplicated in reimbursement requests.

Effective for travel beginning March 1, 2023, the University will now utilize the per rates set by the US General Services Administration (GSA), US Department of State and Department of Defense as applicable.

For employees, all rates are loaded in Concur and will populate based on the dates and location of travel and the meals selected by the traveler for reimbursement.

For all other travelers:

- Look up the rate based on the destination and dates of travel utilizing the links above.

- First and last day of travel are calculated at 75% of the day’s total rate, regardless of the traveler’s time of departure or time of return.

- If a meal was provided to the traveler and not paid for out of pocket, that meal must be deducted from the full day’s per diem rate. A breakdown of meal rates are included in the links above.

- If meals are provided to the traveler on the first or last day of travel, the 75% calculation is taken first and then the full meal rate is deducted. For example, if dinner is provided on the first day of travel for a location with a $65 per diem rate the calculation will be $65 x 75% = $48.75 – $26 Dinner = $22.75.

- Per diem reimbursement for a given day of travel will never be less than the incidental rate for that day, regardless of the calculations above.

For more information on per diem rates, see 1501.5 – Procedure on Per Diem Rates .

Service Owned By:

- Travel and Payment Card Services

Per diem is a daily allowance given to an employee to cover business travel expenses such as lodging, meals and incidentals while traveling for the company. Learn more about per diem .

Travel smart. Achieve more.

Get solutions for business travel that help you save time, money and stress.

- [email protected]

Home » Hot Topics » Germany per diem rates and how to manage employees travel expenses

Germany per diem rates and how to manage employees travel expenses

- 3 September 2022

One of the most frequently asked questions we get asked by our clients is how to manage employees travel expenses and Germany per diem rates. German regulations governing per diems, telecom expenses, hotel costs, meals reimbursements, mileage and so on, can often be confusing and different from an organization’s home-country rules.

Companies setting up shop in Germany are understandably concerned about how challenging it can be to stay compliant with German tax laws and want to avoid fines and reputational damage.

For this reason, we have decided to write this article with the aim of providing not only an overview on German travel expense reimbursements (as part of good expatriate management best practices ) but also to dissect and explain some of the finer details surrourding the complex circumstances companies face.

What are per diem rates?

According to Investopedia.com per diems (in German “ Tagespauschalen ”), from the Latin for “ by the day ”, refers to daily allowances paid to employees to cover costs incurred while on a business trip.

More specifically, the law in Germany talks about a lump sum for meals being paid to an individual as compensation for the expenses incurred in working outside their home and main workplace.

Moreover, an employment contract (or any other company issued policy) or collective bargaining agreement may also stipulate that per diems are to be used to reimburse employees.

Tax repercussions are likely (although as we will discuss in this article, not for all expenses categories) if employers choose to reimburse employees for actual expenses above the permitted per diem’s allowance instead.

On the other hand, there is less of an administrative burden for both companies and their employees when sticking with per diem rates as there is no need to:

– submit an itemized claim

– attach accompanying receipts

– update per diem rates each year in line the rising cost of living (the German Finance Ministry takes care of it)

What is not covered by Germany per diem rates

Now that we have a per diem definition and a law clarifying what per diem allowances are meant to cover in Germany, let us briefly look at what type of travel expenses, per diems are not meant to cover:

- Air fares

- Transport to and from the airport and/or meetings

- Hotel costs for staying overnight

- Breakfast, lunch and/or dinner whilst meeting clients

These types of expenses should be in fact be claimed as part of a separate expenses claim request (a template is provided towards the bottom of this article) for actual travel expenses incurred.

Per diem rates within Germany

When employees are traveling on business within Germany the costs of subsistence (drinks and meals) is typically reimbursed according to the applicable per diem rates which currently are:

– between 8-24 hours, 14 EUR

– for a full 24 hours day, 28 EUR

For the first and last day of travel, the applicable per diem rate is always 14 EUR.

Furthermore, there is also an overnight allowance of 20 EUR for accommodation.

In practice though, only self-employed individuals tend to claim this allowance via their German tax return as accommodation is usually fully paid by the employer for travelling employees.

Conditions for eligibility of per diem allowances

We have already discussed above what is not covered by per diem allowance.

Let us now look more specifically at what are some of the conditions to be fulfilled for employees to be eligible to claim the above mentioned per diem rates in full.

The main condition is that the full per diem meal allowances will only be paid if the employee actually covers the costs of their own food .

In the case of meals that the employee took and that are included for example in a hotel invoices (breakfast, lunch, dinner) or that the employer provided, there will be a compulsory reduction of the lump sum amount entitlement as follows:

– 20% reduction if breakfast is already included in hotel invoice

– 40% reduction if lunch / dinner are already provided by the employer.

It is also worth mentioning that meals provided by the employer for trips shorter than 8 hours are treated as fringe benefits and thus taxable on the employee are the following nominal values:

– breakfast, 1.77 EUR

– lunch or dinner, 3.30 EUR

Other conditions / rules attached to the eligibility for per diem rates in Germany include:

– hours can be added together for multiple trips within the same day

– The tax-free reimbursement can only be for 3 continuous months of business travel. These 3 months can then be reset after a 4 weeks break

– All expense invoices should be addressed to the company’s corporate address and if they exceed 150 EUR, they should state the VAT amount

Per diems outside of Germany

Considering that the cost of living between countries (and sometimes even between cities within the same country) can vary significantly, the German Ministry of Finance each year publishes a table with the up to date international per diem rates.

However, due to the Covid pandemic, the international per diem and overnight allowances issued by virtue of the German Federal Travel Expenses Act, have not been updated on January 1, 2022.

As a result, the tax-free per diem lump sums published by the BMF letter dated 3 December 2020 , on “Tax treatment of travel expenses and travel expense allowances for business and professional trips abroad from January 1, 2021” – Federal Tax Gazette Part I (BStBl I) page 1256, are also valid for the calendar year 2022.

Overview of other travel expense reimbursements in Germany

Entertainment.

Entertainment expenses for events in which only employees working for the same company took part are not accepted as an external party also needs to be involved.

Additionally, invoices for entertainment expenses reimbursements should clearly show the following information:

- Employee/s name/s

- Name/s of the people entertained

- The reason for the entertainment provided

- The place, date and signature

0.30 EUR/Km can be reimbursed tax-free. The lump sum rate covers all expenses related to the car such as insurance, depreciation, petrol / diesel, maintenance, car wash, etc.

Tax-free reimbursements for expenses incurred during business use for private cars can only be paid if the employees states on their expenses claims the driven KMs and other relevant details about the trip such as start / end KMs balance, details of the route taken and the reason for the trip.

Anything paid in addition to the 0.30 EUR/KM rate, will be deemed taxable.

This means that the amount will have to be split up in a tax-free part and a taxable part (taxed at individual income progressive tax rates).

Telecom expenses / home office

If the home telephone / mobile phone / internet contracts are between the telecommunication company and the employee and not between the telecommunication company and the employer, there are 4 possibilities to reimburse these expenses:

1) The employer can pay a monthly lump sum of 20% of the invoice amount up to a max. of 20 EUR tax free to the employee. Any additional reimbursements would be taxable.

2) If the employee highlights the costs incurred for the employer on the telecommunication company’s itemized bill every month, the employer can reimburse those costs tax-free.

3) If the employee highlights the costs incurred for the employer on the telecommunication company’s itemized bill for a period of 3 months, a typical percentage of total expenses concerning the employer can be calculated on the overall total bill, which can then be compensated tax free going forward every month. Any additional reimbursements above the calculated percentage apportionment would be taxable.

4) The employees could prove they have two different mobile phones / landline numbers so that they could clearly be differentiated between the one used for business purposes and the one used for private purposes. In such a scenario, all the expenses incurred for business purposes on the dedicated line / number can be reimbursed tax-free.

Hotel costs

Hotel stays during a business trip can be fully reimbursed tax free provided the invoice is addressed to the employer and not to the employee.

Other expenses

Other expenses such as flight, train or bus tickets can all be reimbursed in full tax-free.

Similarly, the following ancillary expenses can also be reimbursed tax-free for the full actual amount incurred:

– Storage of luggage (including luggage insurance)

– Letters to the employer or to business partners / clients

– Parking fees / tolls

– Rental car at the place of the destination

– Damages to the employee’s belongings if they are typical for business traveling

To help employees with their expenses claims, our travel expenses form may be downloaded here and used when submitting reimbursements requests (if the employer is not already providing one).

FAQ on Germany per diem rates and travel expenses reimbursements

Assuming the company chooses to reimburse the employee for the actual expenses amount incurred which happens to be above an allowable tax-free rate / per diem, does the employer have any compliance requirements in terms of reporting the difference .

(i.e. employer taxes and/or any requirements to report on the employee’s behalf with potential penalties if they don’t)?

Yes, the exceeding part is considered salary and as such subject to taxes and social security contributions.

As in the case of salary, the employer taxes the employee at source and has to fulfill his tax and social security obligations at all times.

The employee is the debtor of the income tax but the employer deducts it from him / her.

The employer is therefore responsible for withholding the applicable income taxes and social security contributions from the employee’s pay and thus liable, in case they do not.

Failure to do so could be deemed a criminal offence pursuant to Sec. 266a StGB (Criminal Law Act) .

Contact us should you require further clarifications on per diem rates and travel expenses reimbursements in Germany and/or have a look at some of the other insights we have published.

You might also be interested in:

Get our FREE International Expansion & Global Mobility guide now!

Telephone *

Company/Organisation *

Where are you located? * Choose a location Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua And Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia And Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile China Christmas Island Cocos (keeling) Islands Colombia Comoros Congo Congo The Democratic Republic Of The Cook Islands Costa Rica Cote D ivoire Croatia Cuba Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadeloupe Guam Guatemala Guinea Guinea-bissau Guyana Haiti Heard Island And Mcdonald Islands Holy See (vatican City State) Honduras Hong Kong Hungary Iceland India Indonesia Iran Islamic Republic Of Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakstan Kenya Kiribati Kosovo Kuwait Kyrgyzstan Lao People's Democratic Republic Latvia Lebanon Lesotho Liberia Libyan Arab Jamahiriya Liechtenstein Lithuania Luxembourg Macau Macedonia The Former Yugoslav Republic Of Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia Federated States Of Moldova Republic Of Monaco Mongolia Montserrat Montenegro Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands Netherlands Antilles New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Territory Occupied Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Saint Helena Saint Kitts And Nevis Saint Lucia Saint Pierre And Miquelon Saint Vincent And The Grenadines Samoa San Marino Sao Tome And Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia And The South Sandwich Islands Spain Sri Lanka Sudan Suriname Svalbard And Jan Mayen Swaziland Sweden Switzerland Syrian Arab Republic Taiwan Province Of China Tajikistan Tanzania United Republic Of Thailand Togo Tokelau Tonga Trinidad And Tobago Tunisia Turkey Turkmenistan Turks And Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States United States Minor Outlying Islands Uruguay Uzbekistan Vanuatu Venezuela Viet Nam Virgin Islands British Virgin Islands U.s. Wallis And Futuna Western Sahara Yemen Zambia Zimbabwe

Brief description of your enquiry * I accept * By entering your information, you permit us to reach out to you with future communications and you accept our Terms and Conditions & Privacy Policy

Terms & Conditions – Privacy policy – Cookie policy

Privacy Overview

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 511, Business travel expenses

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

You're traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day's work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you normally need to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time you spend at each location.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite. Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but aren't limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

- The airport or train station and your hotel,

- The hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Shipping of baggage, and sample or display material between your regular and temporary work locations.

- Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls while on your business trip. (This includes business communications by fax machine or other communication devices.)

- Tips you pay for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, public stenographer's fees, computer rental fees, and operating and maintaining a house trailer.)

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming .

If you're a member of the National Guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040 , Form 1040-SR , or Form 1040-NR as an adjustment to income.

Good records are essential. Refer to Topic no. 305 for information on recordkeeping. For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses .

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

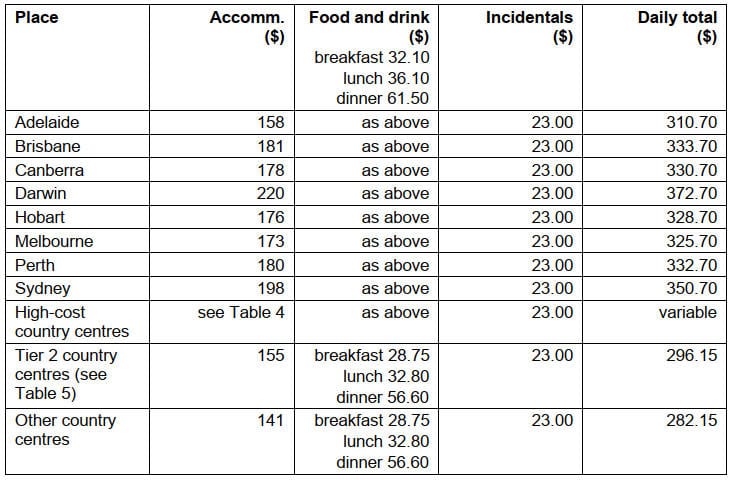

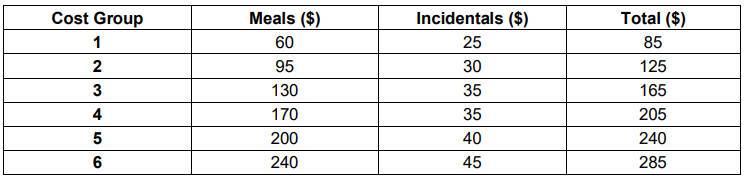

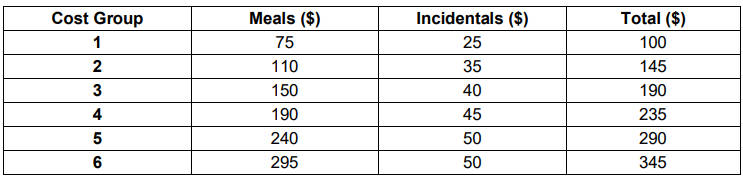

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

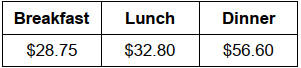

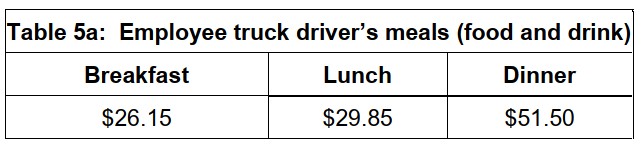

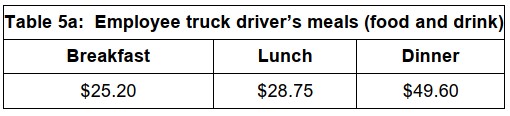

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

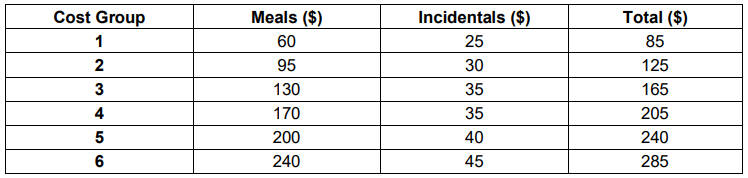

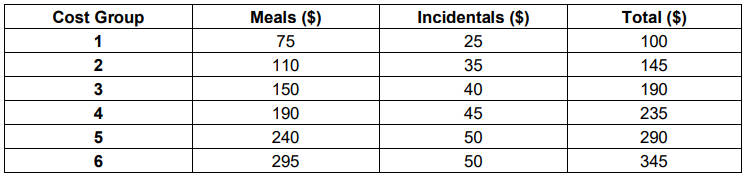

2023-24 Domestic Travel

Table 1:Salary $138,790 or less

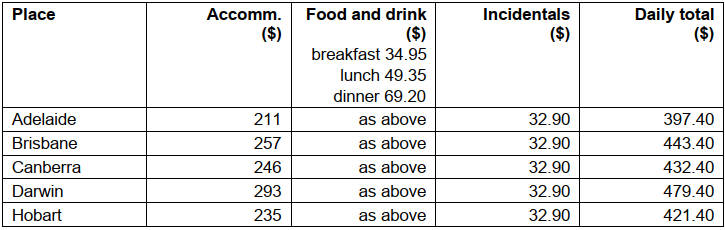

Table 2: Salary $138,791 to $247,020

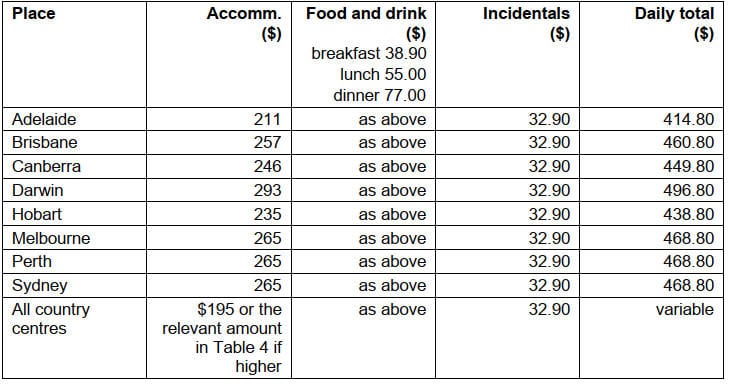

Table 3: Salary $247,021 or more

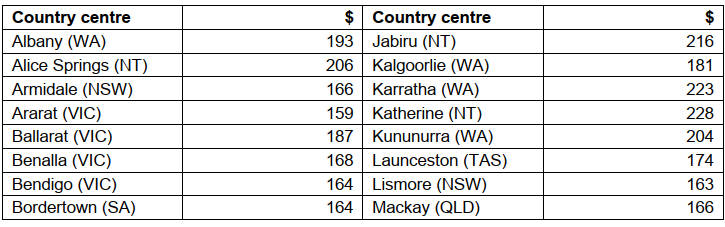

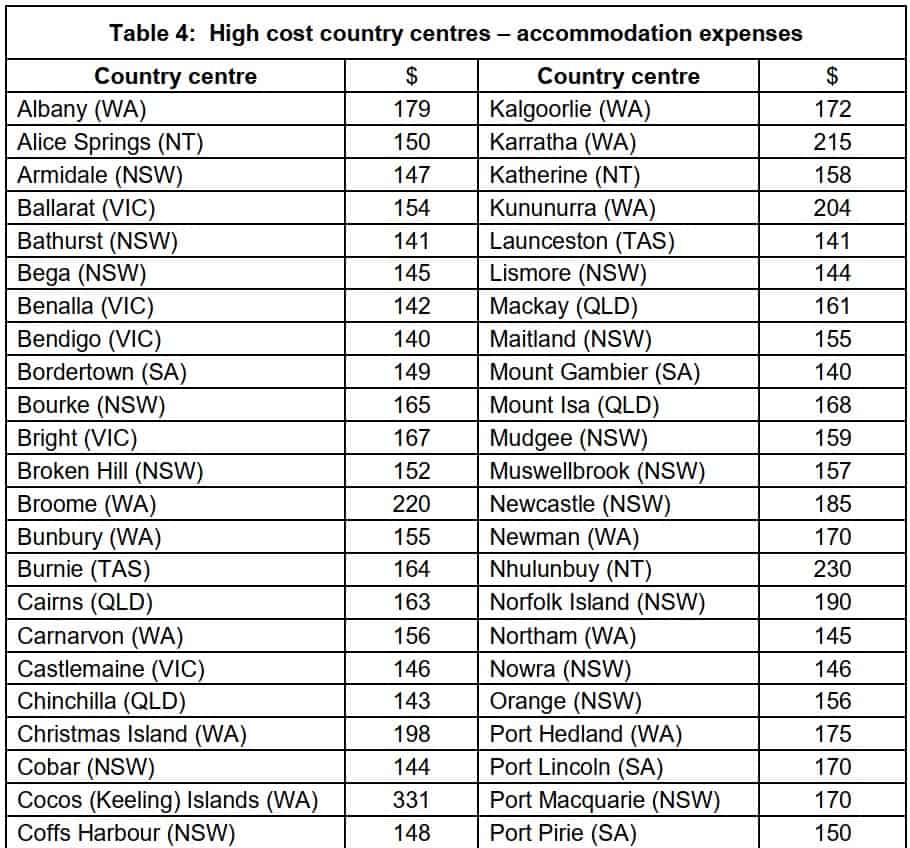

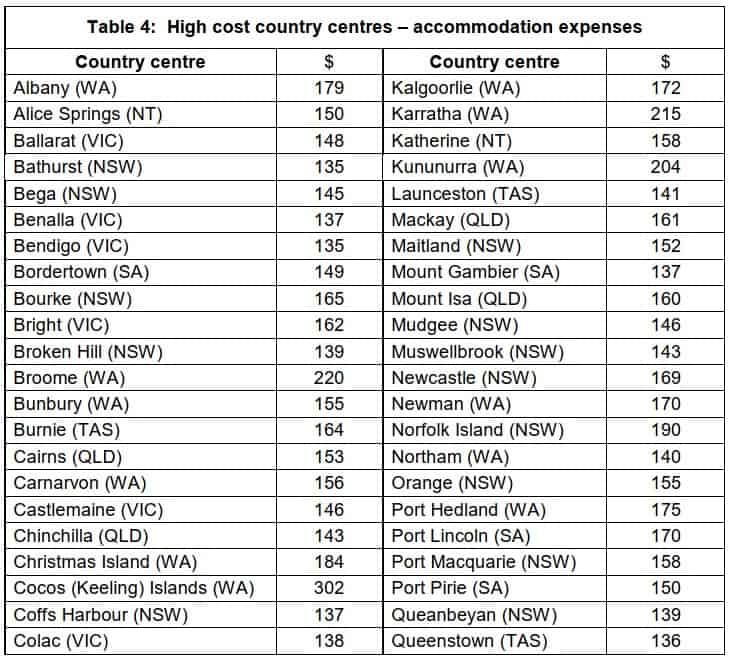

Table 4: High cost country centres accommodation expenses

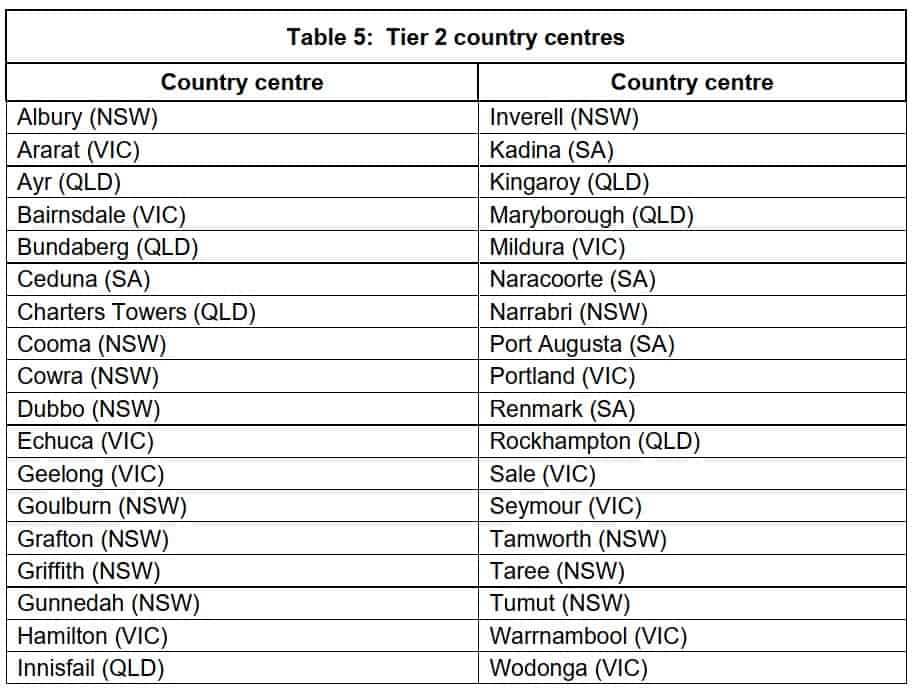

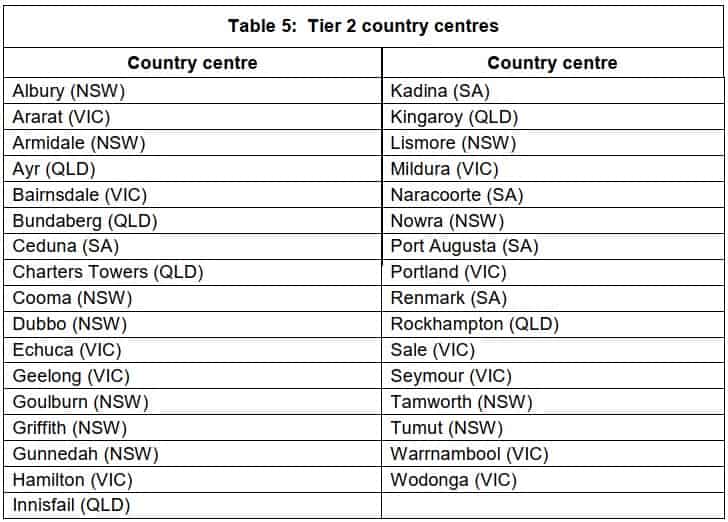

Table 5: Tier 2 country centres

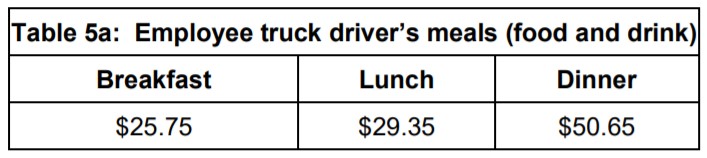

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

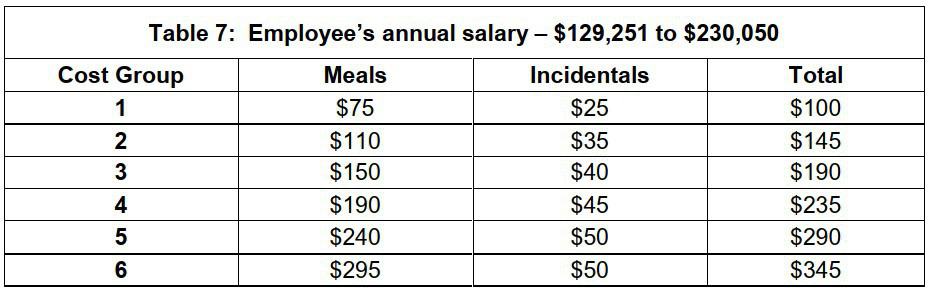

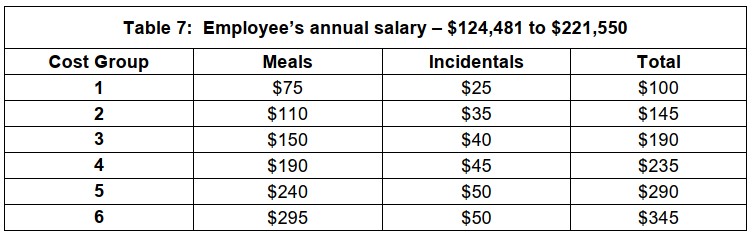

Table 7: Salary $138,791 to $247,020

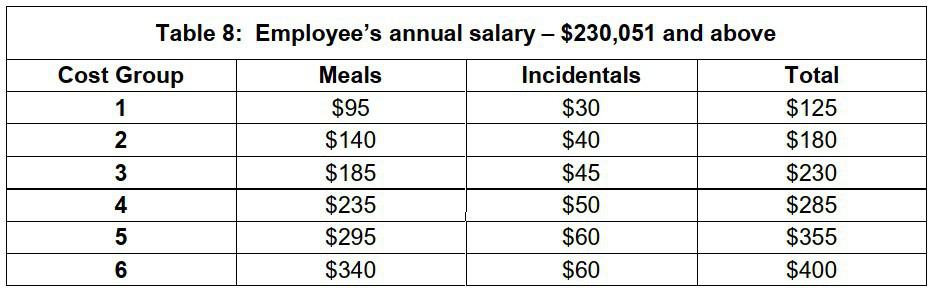

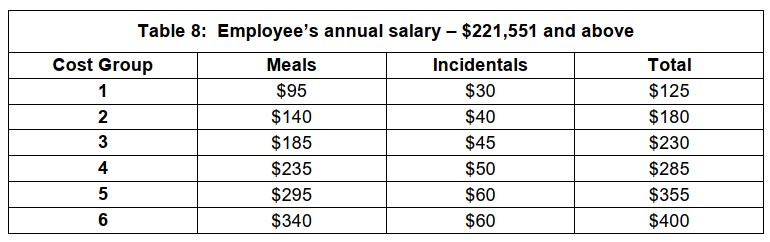

Table 8: Salary $247,021 or more

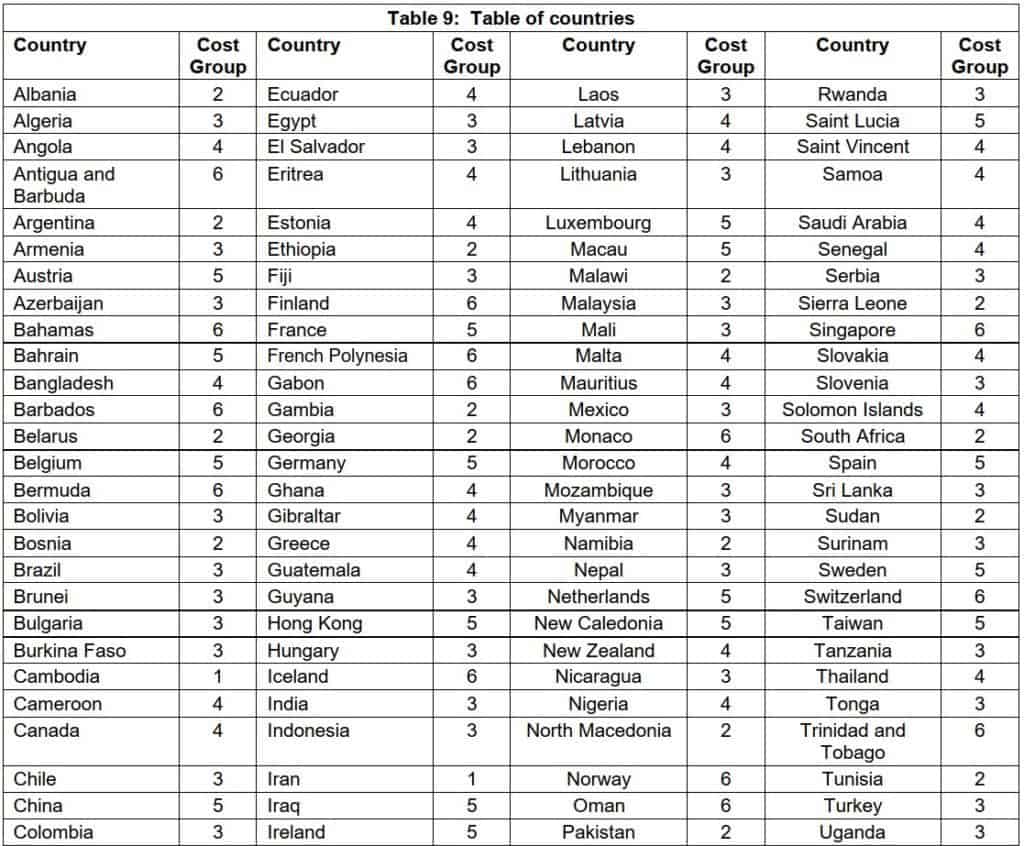

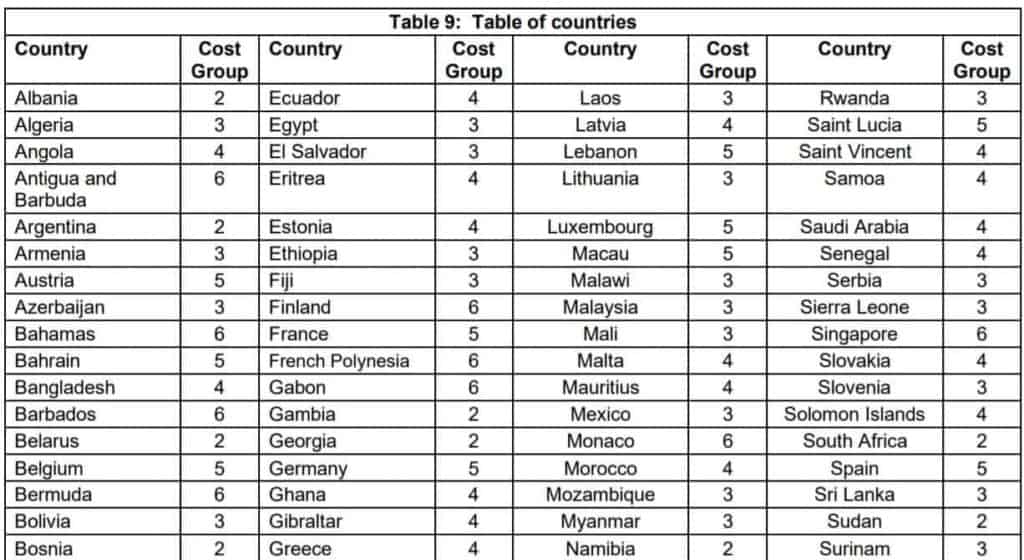

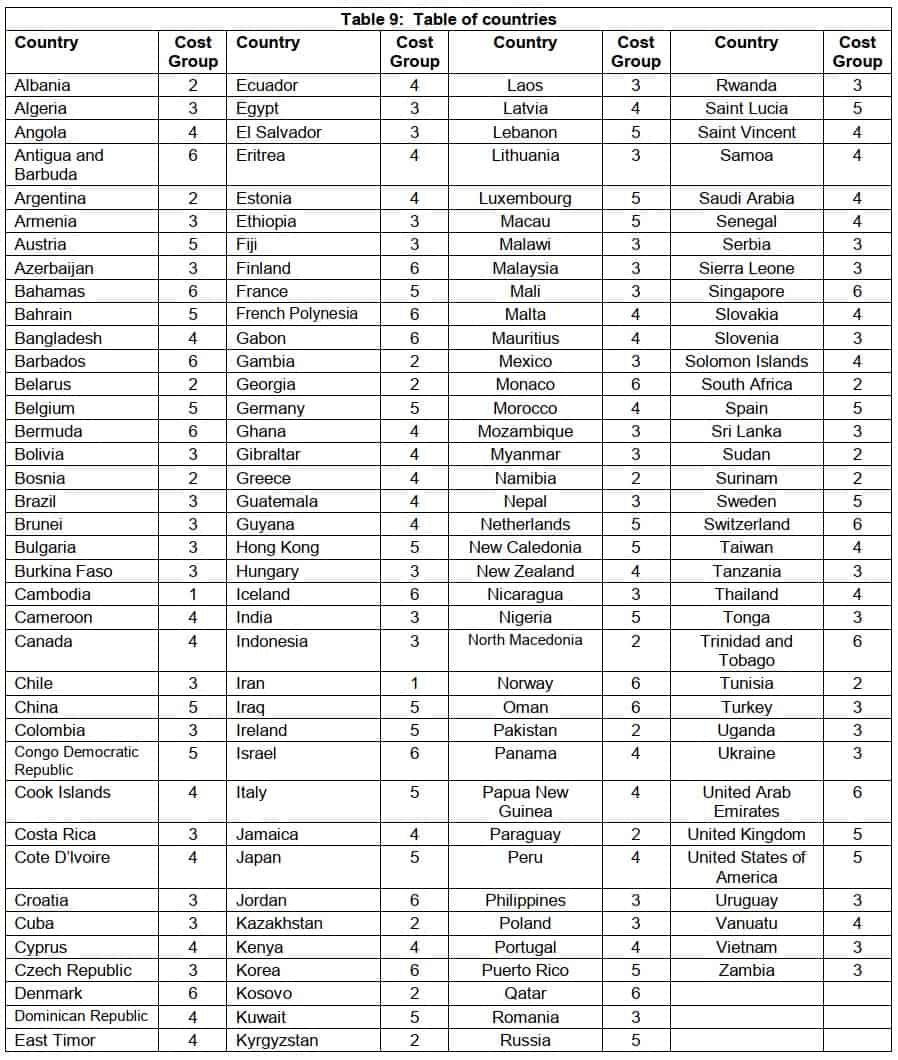

Table 9: Table of countries

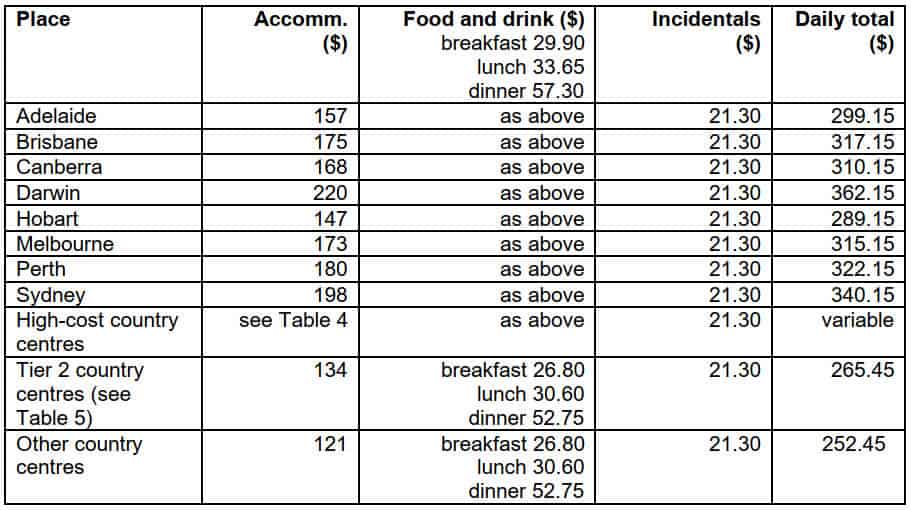

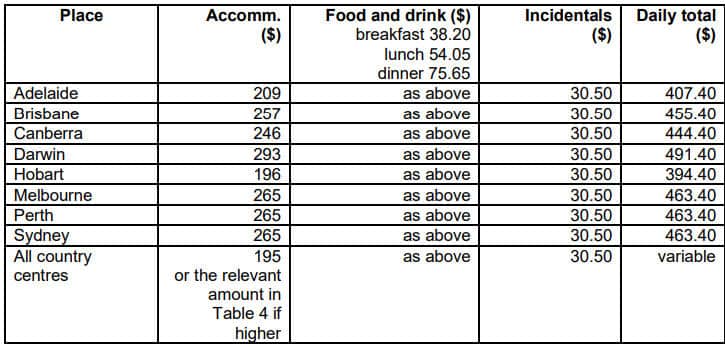

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

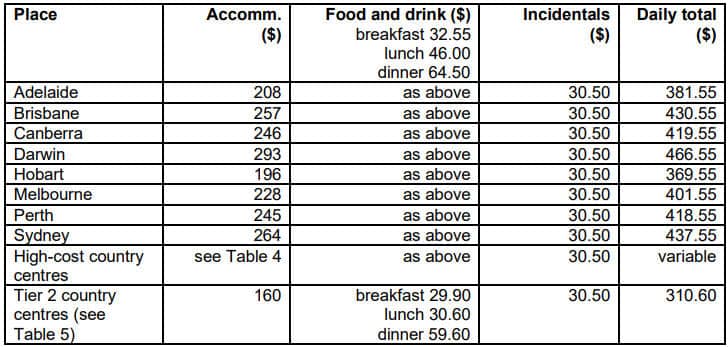

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

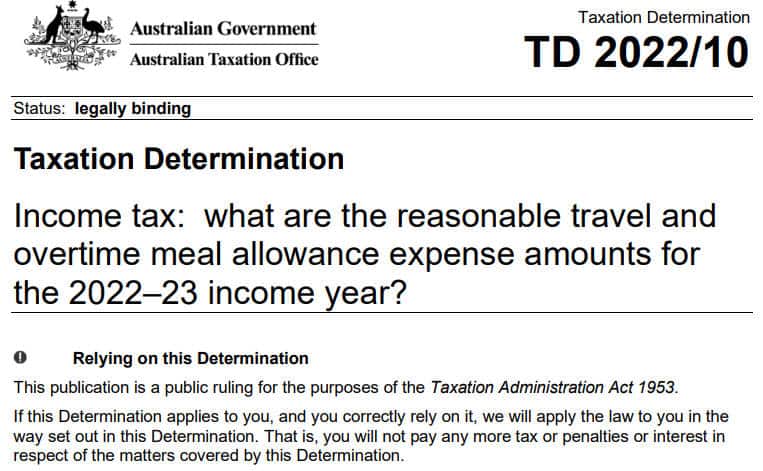

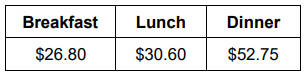

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

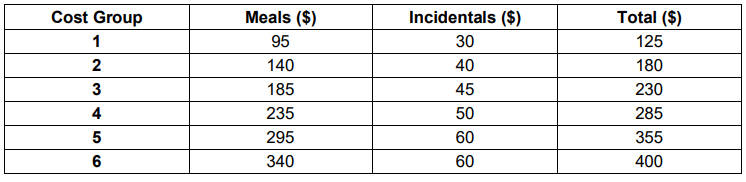

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

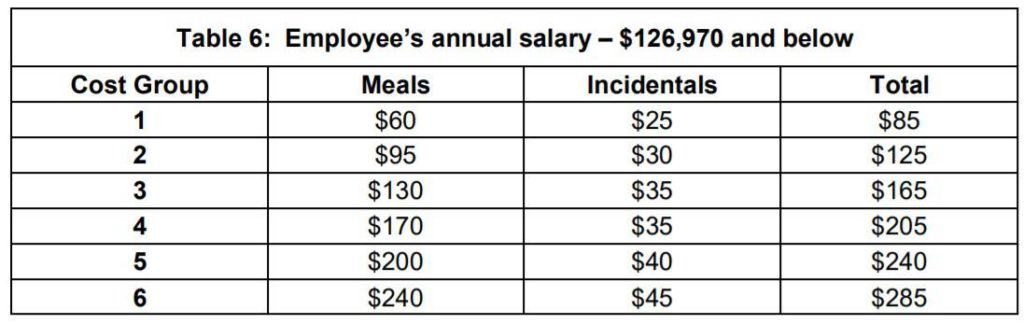

Table 6: Salary $133,450 and below

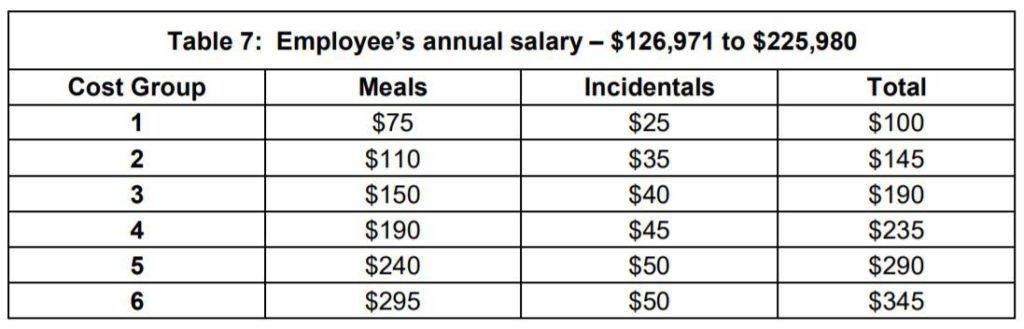

Table 7: Salary – $133,451 to $237,520

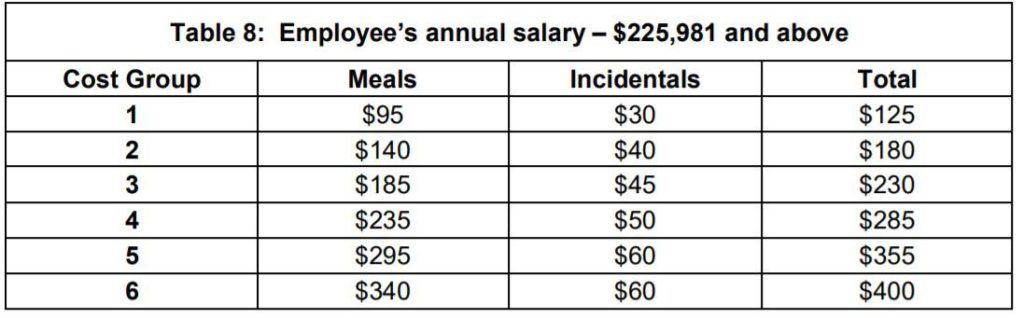

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

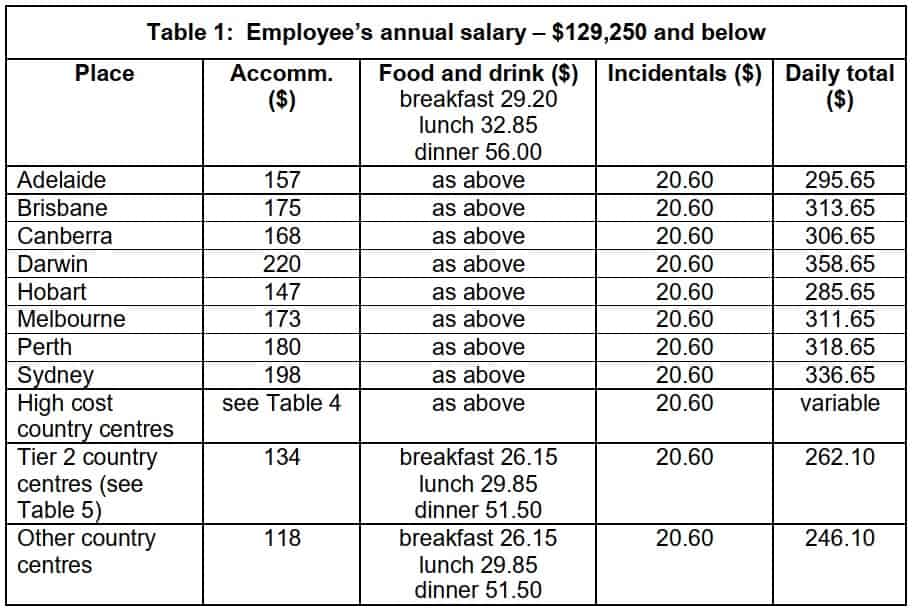

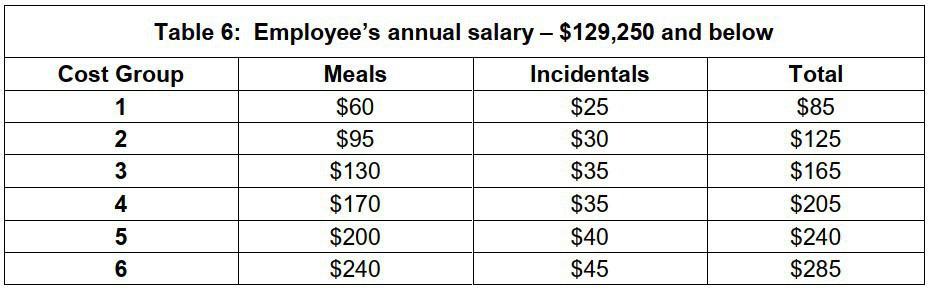

Table 1: Salary $129,250 and below

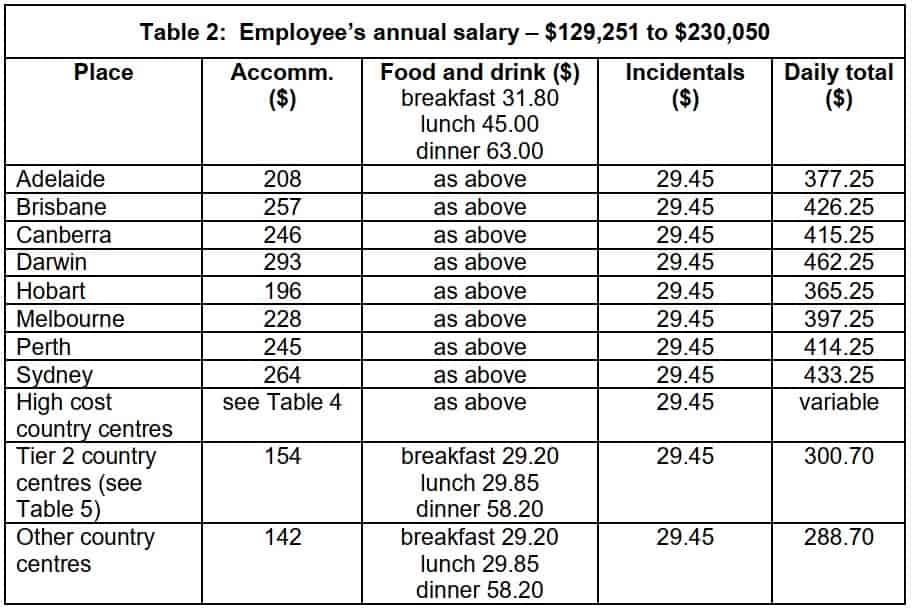

Table 2: Salary $129,251 to $230,050

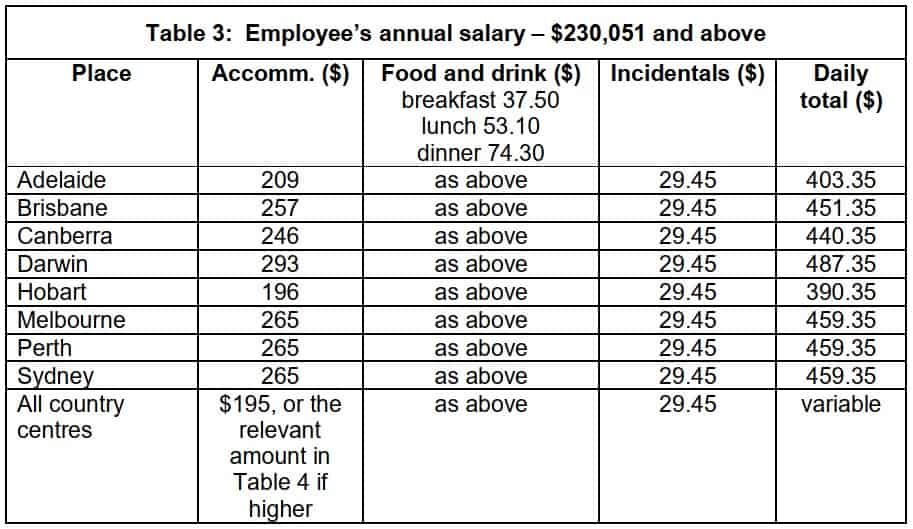

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

Table 7: Salary – $129,251 to $230,050

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

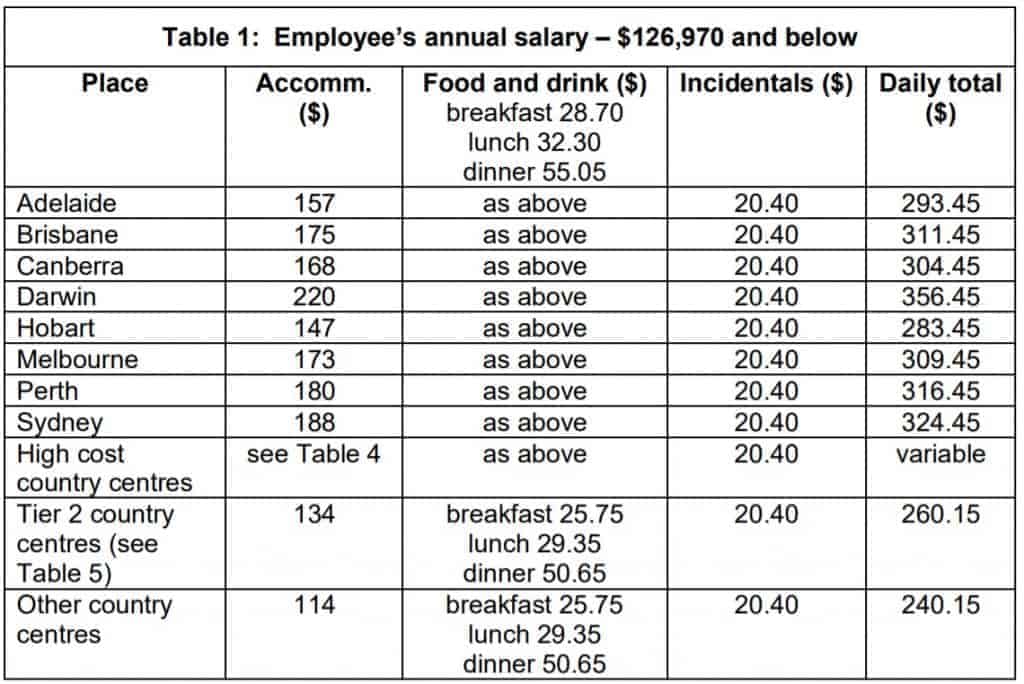

Table 1: Salary $126,970 and below

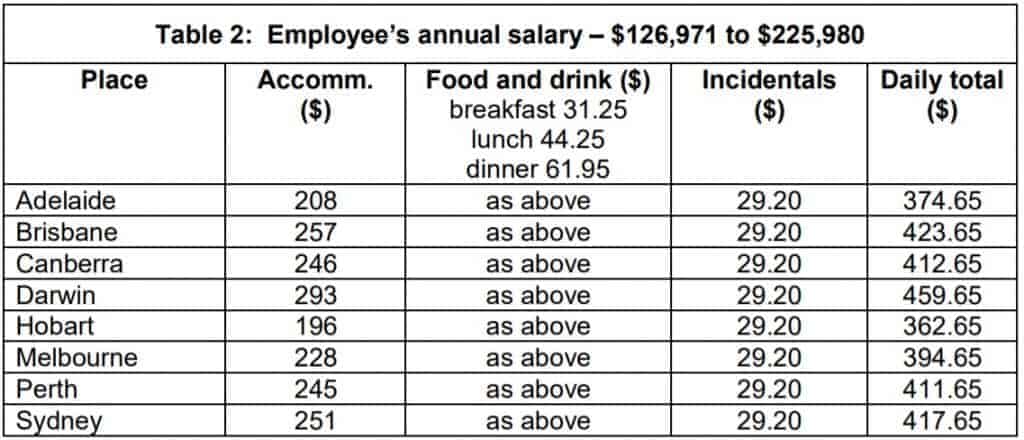

Table 2: Salary $126,971 to $225,980

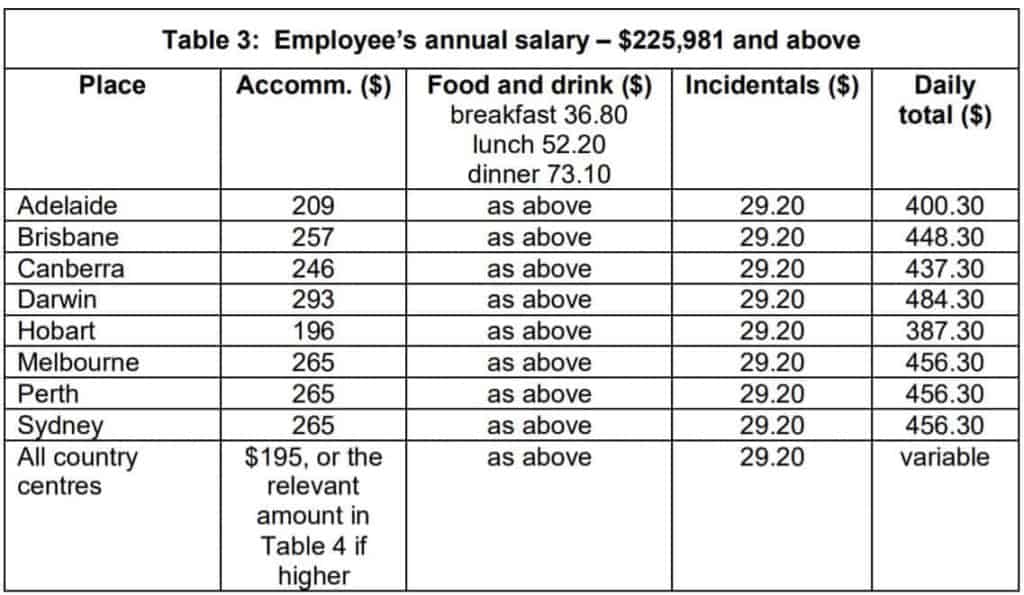

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

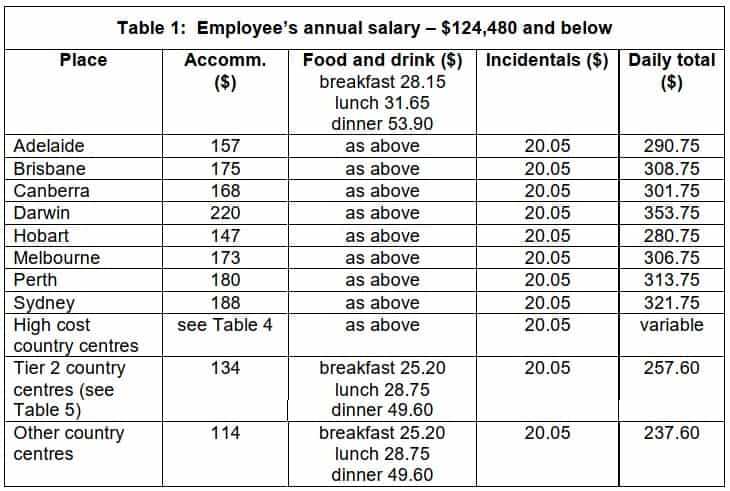

Allowances for 2019-20

The determination in sections:

Domestic Travel

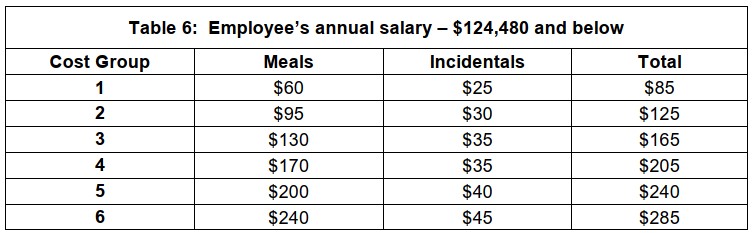

Table 1: Employee’s annual salary – $124,480 and below

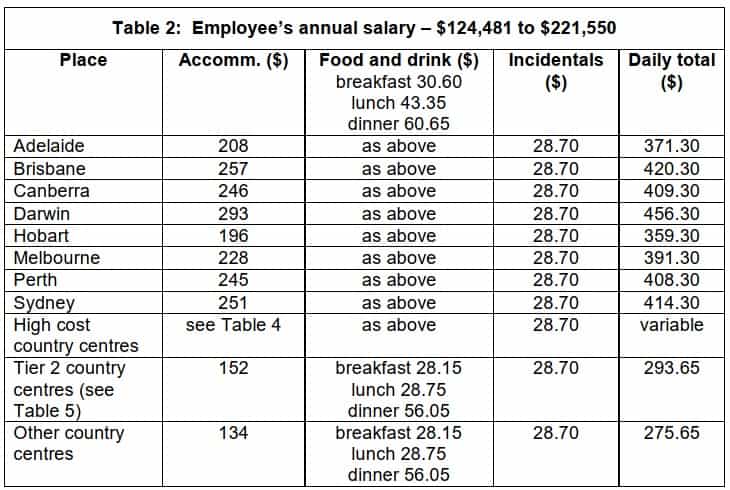

Table 2: Employee’s annual salary – $124,481 to $221,550

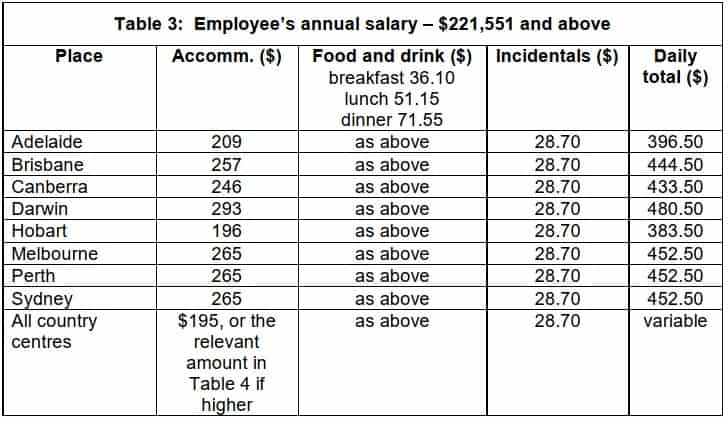

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

Travel diary

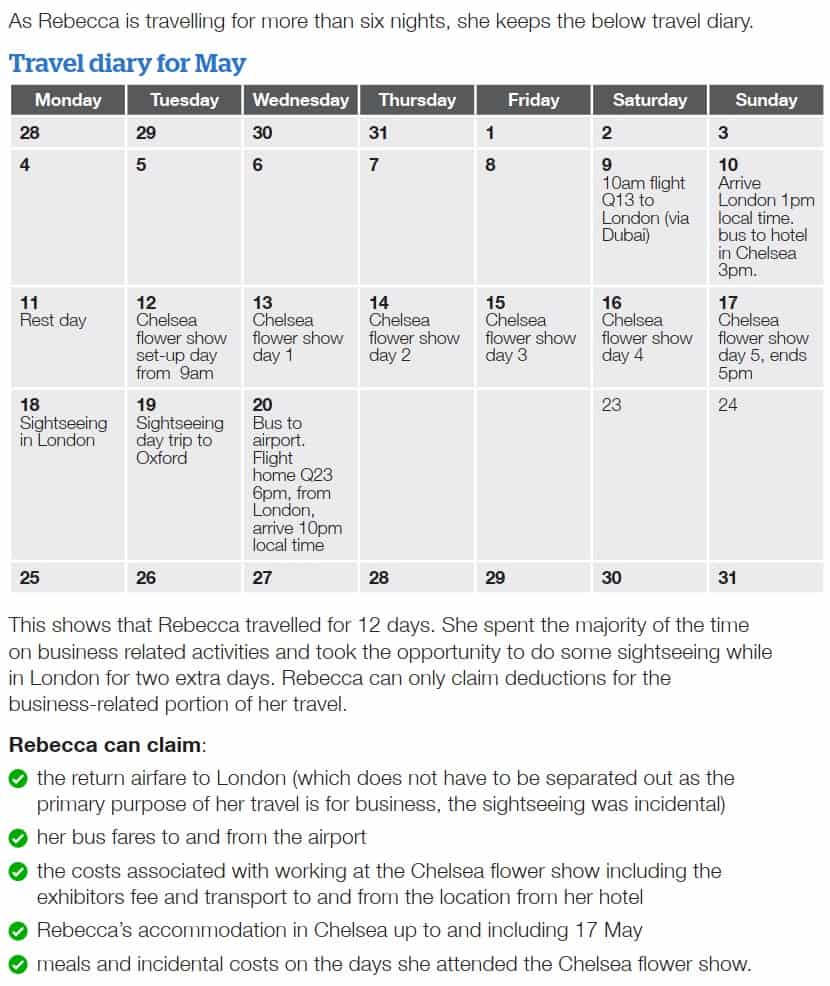

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Expenses and employee benefits

Expenses and benefits: travel and subsistence

As an employer paying your employees’ travel costs, you have certain tax, National Insurance and reporting obligations.

This includes costs for:

- providing travel

- reimbursing travel

- accommodation (if your employee needs to stay away overnight)

- meals and other ‘subsistence’ while travelling

Subsistence includes meals and any other necessary costs of travelling, for example parking charges, tolls, congestion charges or business phone calls.

There are different rules for reporting expenses relating to public transport .

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

Managing business travel expenses

Guide to hmrc subsistence allowance & expenses, what is a subsistence allowance, how do hmrc subsistence rates work.

- The cost of food or drink must be incurred after the business trip has started

- The trip must be beyond their usual commute and be done as part of official business.

- The journey must take the employee away from their normal place of work for 5 hours or more.

Is meal allowance taxable?

- a meal or beverage is not purchased

- the meal does not constitute additional expenditure

- the “staying with friends or relatives allowance” is claimed

- meals have been taken at home

- meals are provided during a training course, conference or similar activity

- meals are provided on the train or plane and included in the ticket cost

What are the HMRC domestic subsistence allowance rates?

- £5 for travel of 5 hours or more (£10 supplement if travel is ongoing at 8pm)

- £10 for travel of 10 hours or more (£10 supplement if travel is ongoing at 8pm)

- £25 for travel of 15 hours or more (and ongoing at 8pm)

Overnight accommodation rate UK

Meal allowance rates overseas, how does a business report subsistence allowance spend.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

7th Pay Commission TA DA – Travelling and Daily Allowance – Recommendation and decision by Govt

7th Pay Commission TA DA – List of Allowances Covered while on Travel and cadre-wise eligibility – Committee’s recommendation and Government approval.

7th Pay Commission TA DA – Allowances allowed relating to Travel.

7th Pay Commission TA DA – Travelling and Daily Allowance are payable to Government Employees who are on official tour subject to certain conditions.

The analysis and recommendations of 7th Pay Commission as far as this reimbursement is concerned is as follows.

Daily Allowance

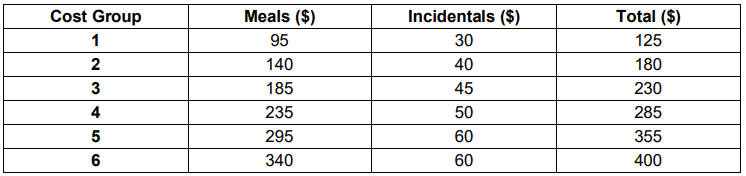

8.15.12 Daily allowance is meant to cover living expenses when employees travel out of their headquarters for work. Presently it is in the form of reimbursement of staying accommodation expenses, travelling charges (for travel within the city) and food bills, payable at the following rates:

For journeys on foot, undertaken in organizations like FSI, Survey of India, GSI, etc. for data collection purposes, an additional allowance of ₹7.5 per km travelled on foot shall be payable.

8.15.13 The existing dispensation is different for Railway employees who are paid a flat sum because they are currently not entitled to stay in any accommodation other than Railway rest houses. The lump-sum rates for Railway personnel are as follows:

8.15.14 Representations received regarding this allowance primarily deal with the reimbursement procedure, as it is claimed that getting hotel bills (in small towns) and food bills is not always practical.

Analysis and Recommendations