- Life Stages

- Tax Breaks and Money

- View all Tax Center topics

What are the mileage tax deduction rules?

The mileage tax deduction rules generally allow you to claim $0.655 per mile in 2023 if you are self-employed. You may also be able to claim a tax deduction for mileage in a few other specific circumstances, including if you’re an armed forces reservist, qualified performance artist or traveling for charity work or medical reasons.

There’s a lot to unpack when talking about claiming mileage on your taxes. In this article, we’ll outline who can take a tax deduction for mileage, how to take the deduction, and other things you should consider.

If you use you your vehicle for business purposes, you should know that claiming mileage is one of two ways of claiming a tax benefit for car-related costs. The “actual car expense” method is the other way; it lets you claim a deduction for car insurance , deductible car repairs , among other costs.

Do you need help with mileage deductions on your taxes and other deduction possibilities? Check out our Guide to Gig Worker Taxes .

Who can take a tax deduction for mileage?

Before the Tax Cut and Jobs Act (TCJA) of 2017, employees were able to claim a tax deduction for mileage and other expenses that were not reimbursed by their employer. However, the TCJA suspended the deduction for employee business expenses, changing the mileage deduction rules so that most employees can no longer deduct mileage and other unreimbursed expenses.

Here’s who may still claim mileage on taxes:

- Small business owners. Self-employed taxpayers who file Schedule C or Schedule F.

- Other self-employed workers. This includes independent contractors, such as drivers for rideshare services.

- Certain types of employees. Specifically, qualified performing artists, reservists in the armed forces, and fee-based government officials are eligible to claim mileage

- Individuals traveling for volunteer work or for medical appointments.

File with H&R Block to get your max refund

Claiming mileage on your taxes.

How you deduct mileage for your taxes depends on your situation. So, if you’re claiming mileage as a medical or charitable expense, you won’t do it the same way as a business expense. The forms you use and the amounts you can deduct per mile will vary.

How to deduct mileage for taxes for the self employed

Self-employed individuals will report their mileage on the Schedule C form. In addition to providing the number of miles driven during the tax year, you’ll also need to answer a few questions about the vehicle, including when it was placed into service for business.

As mentioned above, the mileage rate for business owners and other self-employed workers is $0.655 in 2023.

If you’re not sure what to include as your business mileage, you’re not alone. We often get this question: “Can I deduct mileage to and from work?” The answer here is no; you’d just count the trips after arriving at work or first business destination.

For business owners, the trip from home to your main business location, such as an office or store, is not deductible. Trips driven from there to other business locations, such as to call on clients, and from your last stop back to your main place of business are deductible.

For rideshare drivers, such as Uber or Lyft, this means the drive from home to pick up the first passenger and the drive home after the last drop off are not deductible. Only the trips driven between the first business stop and the subsequent stops can be used for claiming mileage on your taxes.

Note: if your home office is your main business location, then trips from home to other business locations are deductible.

How to calculate mileage for certain employees

If you’re one of the types of employees listed above, you’ll also be able to claim mileage on your individual tax return at the rate of $0.655 in 2023. You’ll report your miles and also answer a few questions about the vehicle on Form 2106 .

Employees must follow the same rules that business owners and other self-employed workers follow. That is, commuting expenses – trips from home to your first destination – are not deductible. See IRS Publication 463 for more information.

How to deduct mileage for taxes in other situations

You can claim mileage for trips related to medical appointments or for volunteering or charity work if only if you’re claiming itemized deductions. You should investigate whether claiming the standard deduction (vs. itemized deductions) provides you a better tax benefit.

- Mileage for medical care is included in your medical deduction. The rate is $0.16 for 2023.

- Mileage for volunteer work is included in your charitable deduction. The rate is $0.14for 2023.

Limitations to know about when claiming mileage on your taxes

There are a few times when you won’t be permitted to claim the standard mileage rate option. This option is not allowed if you:

- Use five or more cars at the same time (as in fleet operations)

- Claimed a depreciation deduction for the car using any method other than straight line depreciation

- Claimed a Section 179 deduction on the car

- Claimed the special depreciation allowance on the car

- Claimed actual car expenses after 1997 for a leased car, or

- Are a rural mail carrier who receives a qualified reimbursement

What else should you consider when claiming a tax deduction for mileage?

Choosing the standard mileage rate vs. the actual car expense method has its own set of implications.

- If you want to use the standard mileage rate for a personally owned car, you must use that method the first year the car is used for business. You must make the choice by the return due date (including extensions) of the year the car is placed in service. If you choose to switch methods in later years, specific rules for depreciation will apply.

- If you chose the actual car expense method the first year the car is used for business, you must stick with that choice every year the car is used for your business.

Lastly, recordkeeping is a must for anyone who wants to claim a tax deduction for mileage. You’ll need comprehensive and contemporaneous records in the event the IRS wants to see them. Contemporaneous means you’re tracking your miles when you take business trips rather than trying to reconstruct them months or years later.

You could use pen and paper to keep track – or even log your miles from your computer – but there are also smartphone apps that can make tracking mileage a lot more convenient.

In addition to keeping records on your miles, you should also keep receipts for parking and toll fees. Even if you use the standard mileage rate, parking and tolls (other than parking and tolls related to your main place of business) may be deductible.

Have more questions about mileage deduction rules?

We understand you might want some help when it comes to claiming mileage on your taxes. That’s why we’re here.

Have a side business? Take control of your taxes and get every credit and deduction you deserve. File with H&R Block Online Deluxe (if you have no expenses) or H&R Block Online Premium (if you have expenses).

Have questions about self-employment taxes and other small business tax issues? Rely on our team of small business certified tax pros to get your taxes right and keep your business on track. Find out how Block Advisors can help with your small business taxes .

Our small business tax professional certification is awarded by Block Advisors, a part of H&R Block, based upon successful completion of proprietary training. Our Block Advisors small business services are available at participating Block Advisors and H&R Block offices nationwide.

Was this topic helpful?

Yes, loved it

Could be better

Related topics

Confused about tax deductions? Find out what adjustments and deductions are available and whether you qualify.

We can help you with your taxes without leaving your home! Learn about our remote tax assist options.

Find out about your state taxes—property taxes, tax rates and brackets, common forms, and much more.

Need to know how to claim a dependent or if someone qualifies? We’ll help you find the answers you need.

Recommended articles

Personal tax planning

Filing taxes for a deceased taxpayer: FAQs

Adjustments and deductions

Don’t overlook these 11 common tax deductions

New baby or house? How major life changes affect your taxes

No one offers more ways to get tax help than H&R Block.

Everything You Need to Know About Claiming a Mileage Tax Deduction

Do you drive for business, charity or medical appointments? Here are the details about claiming mileage on taxes.

About Claiming Mileage Tax Deductions

Getty Images

While other options may benefit taxpayers more, deducting mileage is often the go-to as it's the easiest to calculate.

Key Takeaways:

- Mileage deductions can add up to significant savings for taxpayers.

- Self-employed workers and business owners are eligible for the largest tax-deductible mileage rate.

- Mileage can be deducted for volunteer work and medical care, but IRS restrictions limit the amount you can claim.

- The Tax Cuts and Jobs Act of 2017 eliminated the ability of employees to deduct mileage for unreimbursed job-related travel.

- Only active-duty military members are eligible to deduct mileage related to moving and only when their move occurs because of new orders.

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam, but not everyone is eligible to write off their driving costs.

In the past, taxpayers had more options to deduct mileage and could claim unreimbursed travel while on the job.

“That’s not deductible anymore,” says Michelle Brown, managing director in the Kansas City, Missouri, office of accounting firm CBIZ.

The Tax Cuts and Jobs Act of 2017 eliminated itemized deductions for unreimbursed mileage and also significantly narrowed the mileage tax deduction for moving expenses. The latter can now only be claimed by active-duty military members who are relocating because of new orders.

Still, a mileage deduction exists for the following situations:

- Business mileage for the self-employed.

- Mileage related to medical appointments.

- Mileage incurred while volunteering for a nonprofit.

You need to know the rules for claiming mileage on your taxes and, more importantly, you need to keep careful records. Here's a breakdown of everything you need to know about how to claim mileage on your taxes.

Current Tax Deductible Mileage Rates

How much you can deduct for mileage depends on the type of driving you did. Business mileage is most common, but you can also deduct mileage accrued for charitable purposes or for receiving medical care.

“Those are itemized deductions,” says Nicole Davis, a CPA and member of the FreshBooks Accounting Partner Program. “That mileage rate is a lot lower than the business mileage rate.”

For the 2023 tax year, the IRS approved the following standard mileage rates:

- Self-employed/Business: 65.5 cents per mile.

- Charity: 14 cents per mile.

- Medical and Moving: 22 cents per mile.

For the 2024 tax year, standard mileage rates are:

- Self-employed/Business: 67 cents per mile.

- Medical and Moving: 21 cents per mile.

Mileage rates for business, medical care and moving are typically adjusted once at the start of each year. However, on rare occasions, the IRS might adjust rates mid-year to account for inflation or other economic factors. This most recently happened in 2022 and 2011. However, the standard mileage rate for charity is set by statute so the IRS can't adjust it.

Self-Employed Workers: What Mileage Is Deductible

When it comes to mileage tax deductions, the self-employed mileage deduction is the largest one available. It can be valuable to anyone with their own business, but especially for those working in the gig economy as delivery drivers, says Duke Alexander Moore, an enrolled agent and the CEO and founder of Duke Tax in Dallas, Texas, which specializes in tax services for content creators and entrepreneurs.

You can also rack up deductible business miles from meeting with clients, traveling to secondary work sites or running errands to pick up supplies. If a person drives for both business and personal purposes, only the miles related to the business are deductible. Business miles are considered only those driven from a person's principal place of business.

“We never want to confuse a commute as business travel,” Moore says.

Driving from home to a principal place of business is considered a commute, even for those who are self-employed or small business owners. Only those who have a home office as their principal place of business can deduct mileage when driving to and from home for business-related purposes.

How to Claim Mileage on Taxes

Self-employed workers can claim their mileage deduction on their Schedule C form, rather than the Schedule A form for itemized deductions. Mileage for self-employed workers isn't subject to any threshold requirements. In other words, all miles are deductible regardless of how much a person drives for work.

Is mileage considered an office expense? No, it doesn’t get lumped in with office expenses on a Schedule C. Instead, mileage can be claimed on line 9 for car and truck expenses.

Alternatively, people can claim their actual vehicle expenses for maintenance, repairs and fuel. Workers who use a vehicle for personal travel as well can deduct only a prorated percentage of expenses based on business use.

Taxpayers may want to calculate which option will result in the higher deduction, but for most, deducting mileage is easier and will result in greater tax savings.

“The standard mileage deduction is the gift that keeps giving,” Davis says.

Regardless of which method you use – standard mileage rates or actual expenses – plan to stick with it for the duration of the time you own a vehicle. Switching from mileage to actual costs could be difficult since you may need to factor in calculations for depreciation.

The IRS states that taxpayers who want to use standard mileage for their deductions must do so in the first year the vehicle is available for business use. Meanwhile, those who operate a fleet of vehicles – five or more – can deduct only actual expenses.

Itemize Your Deductions to Claim Medical and Charitable Mileage

Self-employed people aren't the only ones who can take advantage of mileage tax deductions, but everyone else will need to file a Schedule A form and itemize their deductions if they want to get in on the tax savings. Those who itemize may be able to deduct mileage for medical care and charity work.

But be aware that these deductions are not nearly as lucrative as those for self-employed workers. That’s because the reimbursement rates for medical and charitable mileage are considerably lower than what's offered for business travel. What’s more, there are thresholds and other limits on these deductions.

“Typically, you won’t see most people taking advantage of these,” Moore says.

Mileage accrued when driving to and from doctor visits, the pharmacy and the hospital can all count toward a medical deduction . But there's a catch: Only medical expenses – both mileage and other bills combined – in excess of 7.5% of your adjusted gross income can be deducted.

While it can be difficult to exceed the income threshold, if you had significant medical bills last year, it can be worthwhile to add up your annual mileage for doctor visits to boost your deduction amount.

If you drive to volunteer at your favorite nonprofit, that mileage is deductible as part of your charitable donations. The IRS allows volunteers to claim 14 cents per mile, but you have to be doing the volunteering yourself. You can't, for example, be driving a child to a volunteer activity. There is no threshold requirement for claiming these miles.

“In order to take advantage (of these deductions), you need to be itemizing,” Brown says.

With the standard deduction for married couples filing jointly set at $27,700 in 2023, Brown says few people are able to claim charity and medical mileage deductions because they get a greater benefit from taking the standard deduction than they do from itemizing.

The IRS Will Want to See Your Records

While deducting mileage can save tax dollars, think twice before claiming travel time you can't document. If you're audited , the IRS will want to see a log that includes dates, destinations and the reasons for travel. These travel logs should record exact mileage amounts.

“It’s something called substantiation,” Moore says. What’s more, the log is supposed to be updated throughout the year as a person drives.

“It could be handwritten; it could be an Excel spreadsheet; it could be an app,” Brown says.

MileIQ, TripLog and Everlance are a few of the apps available that automatically detect travel and log every trip. Users can then categorize their drives by purpose and run reports to document deductions. If you didn't track your travel in real time, Davis suggests looking back at your calendar to create a log before you claiming the deduction on your tax return.

During an audit, taxpayers will need to provide evidence of when they traveled and why. You may be able to piece that together based on bank records of purchases, calendar events and even your phone’s GPS tools.

Still, there is no guarantee the IRS will accept documentation compiled after the fact. It's better to keep a log right from the start rather than risk a deduction being disallowed during an audit.

What Happens During an IRS Tax Audit

Kimberly Lankford March 14, 2023

Tags: money , personal finance , taxes , tax deductions , tax returns , IRS

The Best Financial Tools for You

Credit Cards

Find the Best Loan for You

Popular Stories

Saving and Budgeting

Family Finance

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Your Money Decisions

Advice on credit, loans, budgeting, taxes, retirement and other money matters.

You May Also Like

Unexpected kid costs.

Erica Sandberg April 22, 2024

Here's Why the 60/30/10 May Be a Problem

Jessica Walrack April 19, 2024

Here's When You Don't Have to Tip

Geoff Williams April 19, 2024

7 Tips for Starting a Side Hustle

Jessica Walrack April 18, 2024

Why Is Your Tax Refund Delayed?

Kimberly Lankford April 16, 2024

Cheapest Restaurants to Feed a Family

Erica Sandberg April 15, 2024

How to File a Tax Extension

Kimberly Lankford April 12, 2024

Red Flags That Could Trigger a Tax Audit

The Other Tax Deadline on April 15

How to Calculate Your Effective Tax Rate

How to Get Free Help With Your Taxes

Kimberly Lankford April 11, 2024

File Taxes Directly With the IRS

Erica Sandberg April 11, 2024

Lifetime Learning Credit Tax Break

3 Odd Tax Deductions

Jessica Walrack April 10, 2024

What Is the Earned Income Tax Credit?

Geoff Williams and Tanza Loudenback April 9, 2024

Smart Ways to Gift Money to Children

Jessica Walrack April 8, 2024

How to File a Claim After a Disaster

Geoff Williams April 5, 2024

What Is a Personal Asset?

Erica Lamberg April 5, 2024

What Is a 1040 Tax Form?

Geoff Williams April 4, 2024

How to Create a Saving Strategy

Erica Lamberg April 3, 2024

- Search Search Please fill out this field.

- Tax Planning

How To Calculate Mileage Deductions on Your Tax Return

Mileage rates for 2022 and 2023, how to calculate mileage for taxes, who can deduct mileage for business, who can deduct mileage for moving, who can deduct mileage for medical reasons, who can deduct mileage for charitable reasons, how to claim mileage on your taxes, frequently asked questions (faqs).

Luiz Alvarez / Getty Images

If you use your vehicle for business or certain other activities, like traveling for medical treatment or charitable work, you may be able to deduct your costs for tax purposes, but the Internal Revenue Service (IRS) rules for doing so are strict.

Learn the IRS rules for deducting your mileage on your tax return, including how to choose a mileage method, what records you need, and how to claim the deduction at tax time.

Key Takeaways

- For business driving, you can choose between using the standard mileage rate or your actual costs when entering your deduction on Schedule C of your Form 1040.

- When calculating the deduction for miles driven for moving, you must be active-duty military transferring to a new permanent post.

- To deduct your expenses for driving to receive medical care, you can choose between standard mileage rates or actual costs.

- To claim mileage for traveling for volunteering work, you can use the standard mileage rate for charity work or you can deduct the cost of oil, gas, tolls, and parking fees.

The chart above shows the standard IRS mileage rates for tax years 2022 and 2023. The standard mileage rate is the amount you can deduct based on miles driven rather than your actual vehicle expenses.

Businesses often use these rates to reimburse employees for using their personal vehicles for job-related travel. If you’re self-employed, you can use them to determine your own deduction.

There are two ways to calculate your mileage for your tax return : using the standard mileage rate or calculating your actual costs.

Standard Mileage

The standard mileage rate is a simplified way of deducting your mileage. It is based on the number of miles driven instead of your actual costs. You keep track of your miles driven for IRS-approved purposes (business, medical activity, moving, or charitable work). Then, you multiply them by the correct mileage rate.

For example, if you drove your vehicle 1,000 miles for IRS-approved business purposes in 2022, multiply 1,000 miles x $0.58 per mile. You’ll be able to deduct $580.

To use the standard mileage rate for a car you own, you need to choose this method for the first year you use the car for business. You can then choose between deductions based on the standard mileage rate or actual costs in subsequent years. If you choose the standard mileage rate for a vehicle you’re leasing, you’ll need to stick with that method for the entire lease.

If you choose this method, you’ll need to log your miles to calculate your deduction at the end of the year. Keep a written mileage log in your vehicle, or download a mileage app to keep track.

Actual Costs

You can choose to deduct the actual costs of using your vehicle instead of deducting your mileage. If you’re using a vehicle for both business and personal reasons, you can deduct only the costs for business use. You can include the following expenses:

- Oil, tires, and repairs

- License and registration fees

- Depreciation of the vehicle or lease payments due to the percentage of miles you drive it for business purposes

You’ll need to keep records, such as receipts, to document your vehicle expenses. They will allow you to support your deduction in case you're audited. You should keep old tax records for at least three years after you’ve filed your return.

If you qualify for both mileage methods, try calculating both to see which results in a bigger deduction.

You can’t claim business mileage deductions for your commuting expenses between your home and your regular place of work. Your employer may reimburse you for some job-related travel, such as if you drive from your primary work location to meet with clients.

However, you aren’t allowed to deduct mileage that your employer doesn’t reimburse you for. The only exceptions are for:

- Military reservists

- State and local employees paid on a fee basis

- People who have job expenses related to an impairment

- Some performing artists

The rules are different if you’re self-employed, though. You still can’t deduct your mileage if you commute from your home to your primary business , but you can if you’re traveling from your business to meet with clients or visit a project site, even if your business is based out of your home.

The tax rules for ride-share drivers are similar. Ride-share drivers can deduct mileage according to the standard IRS rate or their actual costs.

You can deduct your mileage when moving only if you’re active-duty military and you’ve been ordered to a permanent change of station. Otherwise, this mileage deduction isn’t allowed.

You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 7.5% of your adjusted gross income (AGI). You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023, or you can deduct your actual costs of gas and oil. Deducting parking costs and tolls is also allowed.

You’re allowed to deduct mileage for your own treatment. You can also claim this deduction if you’re transporting a child to receive treatment or visiting a mentally ill dependent as part of a recommended treatment.

If you travel to perform volunteer work, you can deduct the standard amount for the year. Alternatively, you can deduct your costs of oil and gas but not other vehicle expenses like depreciation, maintenance, insurance, and fees.

You can also deduct your costs for parking and tolls while volunteering, no matter which deduction method you choose.

If you’re claiming a deduction for business mileage, you’ll report it using Schedule C on Form 1040. To claim mileage deductions for moving, medical treatment, or charitable deductions, you’ll need to itemize on your return. You’ll do so using Schedule A on your Form 1040.

No matter what type of mileage you’re deducting, be sure to keep thorough records. Keep a mileage log if you use the IRS standard mileage rate, or hold onto receipts if you’re deducting your actual costs. Be sure to store them with your other tax records so you’ll be covered in the event of an audit.

Is mileage for taxes round-trip or one-way?

If you are using the standard mileage rate, multiply it by the total, round-trip mileage that you drove for business, moving, medical, or charitable reasons.

How can I keep track of mileage for taxes?

If you are keeping a written log for a mileage deduction , you should include the date, destination, purpose, and miles driven for each trip.

IRS. " IRS Issues Standard Mileage Rates for 2023; Business Use Increases 3 Cents Per Mile ."

IRS. " Topic No. 510 Business Use of Car ."

IRS. " Moving Expense to and From the United States ."

IRS. " Here's Who Qualified for the Employee Business Expense Deduction ."

IRS. " Publication 463 (2022), Travel, Gift, and Car Expenses ."

IRS. “ Publication 502, Medical and Dental Expenses .”

IRS. " Publication 526: Charitable Contributions ," Page 6.

Tax season 2023: What exactly is the mileage rate? There's more than one.

Gas prices at the pump took one crazy trip in 2022 – and it's going to add another layer of complexity for those who claim mileage deductions on their 2022 tax returns.

What exactly is the standard IRS mileage rate? Important tip: It's not just one number for 2022 federal income tax returns.

An extremely volatile year for gas prices last year drove the Internal Revenue Service to take the unusual step of increasing some mileage rates for the second half of the year beginning in July. A midyear bump doesn't happen very often. The last time the IRS made such a move was back in 2011.

Cheaper gas slows inflation: Consumer price index report shows fall in gas prices helps inflation slow again in December

Gas expected to get more costly in 2023: Gas prices are down but projected to rise again. How much will gas cost in 2023?

What are the two mileage rates for 2022?

For the 2022 tax year, you're looking at two mileage rates for business use. A rate of 58.5 cents a mile applies to travel from January through June last year, and it's 62.5 cents per mile for trips from July through December.

Just to make things a tad more confusing, the IRS also announced that beginning in January, the standard mileage rate for business use is going up again to 65.5 cents per mile driven for business purposes in 2023. Remember, though, that rate does not apply to your 2022 tax return.

Another good tip: These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

Who can even take a mileage deduction?

As you're preparing to do your 2022 tax return, keep in mind that getting a tax break for claiming mileage isn't as simple as it used to be .

The IRS business standard mileage rate cannot be used to claim an itemized deduction for unreimbursed employee travel expenses under the Tax Cuts and Jobs Act, which remains in effect through 2025. If you're working for an employer who doesn't reimburse mileage for your travel, you're out of luck.

Taxpayers cannot deduct mileage for their regular moving expenses under the Tax Cuts and Jobs Act of 2017 either.

Taxpayers can claim a deduction for moving expenses if they are members of the armedforces on active duty and are moving under orders to a permanent change of station.

The IRS standard mileage rate is a key benchmark that's used by the federal government and many businesses to reimburse their employees for their out-of-pocket mileage expenses.It's also key at tax time for many, including self-employed individuals, who can claim business mileage on a tax return.

The IRS rate reflects the cost to fill up your tank, as well as other expenses associated with driving for business. The IRS notes: "The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs."

New parents and taxes: 2023 tax season guide for new parents: What to know about the Child Tax Credit and more

Your 2023 tax guide: Are you ready to file your taxes? Here's everything you need to know to file taxes in 2023.

Tax break remains for self-employed

The mileage deduction is often key for those who are running their own businesses.

A self-employed taxpayer who files a Schedule C can use the standard rate to deduct expenses from mileage incurred while doing business.

Besides the standard mileage rate, taxpayers have another option for calculating the deduction – actual expenses.

It is more complex for taxpayers to break down the actual costs for the deduction than to simply use the standard mileage rate. For example, you’d have to figure out what it costs to operate the car or truck for the portion of miles dedicated to business. That means taking into account the cost of insurance, gas, repairs, tires and other expenses.

You can only use one method – the standard mileage rate or the business portion of actual expenses – for the same vehicle.

"Many of my Schedule C clients use the mileage due to its simplicity," said George W. Smith, partner at Andrews Hooper Pavlik PLC in Bloomfield Hills, Michigan. "The only record they need to keep is mileage."

Some clients, he said, still go with actual expenses but that has been decreasing over time.

Mileage can be used by those who are self-employed people in a variety of fields, he said, as well as those who own rental properties and claim mileage for trips for repairs, maintenance, or collecting rent.

What's your tax bracket? What are the 2022 US federal tax brackets? What are the new 2023 tax brackets? Answers here

Before you file your taxes, check these tips: Tax return season 2023: What to know before filing your taxes

Medical mileage can be deducted – sometimes

As for medical mileage, it’s included with medical expenses Schedule A.

Lower mileage rates apply in different circumstances.

The IRS rate is 18 cents a mile for the first half of 2022 and 22 cents a mile for the second half of 2022 for deductible medical or moving expenses. (The medical or moving expense rate remains at 22 cents a mile for 2023.)

Mileage for medical purposes could be deducted if the transportation costs are mainly for – and essential to – your medical care. You can deduct qualifying medical expenses that exceed 7.5% of your adjusted gross income. And you'll have to itemize deductions – instead of taking the standard deduction – to claim medical expenses. Generally, you need a lot of medical expenses to garner any deduction.

An IRS rate of 14 cents per mile for mileage relating to work for charitable organizations remained at one rate throughout 2022 since that rate is set by statute, and it will remain at 14 cents a mile for 2023.

Tax backlog shrinks: IRS tax backlog smaller leading into 2023 tax season than it was in 2022

Tax deadlines for 2023: Tax season 2023 officially started: Here are key deadlines to keep in mind

How prices caused many twists and turns at tax time

Gas prices at the pump shocked drivers from one fill-up to the next throughout much of 2022.

After Russia launched a full-scale invasion of Ukraine in late February of last year , oil prices surged above $100 a barrel for the first time since 2014.

The U.S. national average peaked at $5.034 a gallon on June 16, 2022, according to data from GasBuddy.

In early June, the IRS took a fairly unusual step to make a special adjustment and raise the mileage rate by 4 cents a gallon for business travel during the last six months of 2022 because of the surge in gas prices .

Gas prices pulled back to a national average of $3.053 a gallon by Dec. 26, according to GasBuddy. And so far in 2023, we're seeing some relief but are still not edging below $3 a gallon on average.

The U.S. average was $3.386 a gallon as of Jan. 23, according to GasBuddy, up 9.3 cents from the week earlier and up 29.5 cents from a month earlier.

This year isn't expected to offer a smooth ride for drivers. "It could be expensive,” said Patrick De Haan, head of petroleum analysis at GasBuddy, who predicts that the national average could climb above $4 a gallon as early as May.

"Curveballs are coming from every direction," De Haan said.

More of your 2022 tax season questions answered

- File your taxes early for a chance to double your refund money with Jackson Hewitt

- 1099, W-4, W-2, W-9, 1040: What are these forms used for when filing your taxes?

- What are the 2022 US federal tax brackets? What are the new 2023 tax brackets? Answers here

- 2023 tax season guide for new parents: What to know about the Child Tax Credit, EITC and more

- IRS may owe you from 2020 taxes. Here's why and what you need to do to find out if you're owed

- What is OASDI tax on my paycheck? Here's why you and your employer pay this federal tax

- Do you have to report crypto on taxes? Yes. Here's what you should know about form 8949

- What is a 1098-E form? What you need to know about the student loan interest statement

- Is it better to pay someone to do your taxes or do them yourself? We'll help you decide.

- What is income tax? What to know about how it works, different types and more

- Is Social Security income taxable by the IRS? Here's what you might owe on your benefits

- Companies can deduct full cost of business meals on 2022 tax returns

- Who has to file a tax return: It's not necessary for everyone. Here are the rules.

- What is capital gains tax in simple terms? A guide to 2023 rates, long-term vs. short-term

Contact Susan Tompor: [email protected] . Follow her on Twitter @ tompor . To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter .

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

Standard Mileage vs. Actual Expenses: Getting the Biggest Tax Deduction

The IRS offers two ways of calculating the cost of using your vehicle in your business: 1. The Actual Expenses method or 2. Standard Mileage method. Each method has its advantages and disadvantages, and they often produce vastly different results. Each year, you’ll want to calculate your expenses both ways and then choose the method that yields the larger deduction and greater tax benefit to you.

Should you use the standard mileage or actual expenses method?

Can you switch between standard mileage and actual expenses methods, how are expenses categorized for rideshare businesses, how does the actual expenses method work, how does the standard mileage rate method work, example #1: part-time uber driver, example #2: full-time uber driver-partner, what are the pros and cons of the standard mileage method, what are the pros and cons of the actual expenses method, which is better, the standard mileage or actual expenses method, what form do you use to deduct self-employed car expenses, do you need to keep records of your mileage and vehicle expenses.

Key Takeaways

- The IRS offers two ways of calculating the cost of using a vehicle in a business: the actual expenses method and standard mileage rate method.

- To use the actual expenses method, add up all the money you actually spent operating your vehicle and multiply that figure by the percentage of the vehicle’s business use (e.g. if half your mileage is for business, multiply by 50%).

- To use the standard mileage method, keep track of the miles you drive for business throughout the tax year and multiply that number by the standard mileage rate.

- The standard mileage rate for 2023 is 65.5 cents per mile. This amount increases to 67 cents per mile for 2024.

If you drive for a company such as Uber, the business use of your car is probably your largest business expense. Taking this tax deduction is one of the best ways to reduce your taxable income and your tax burden.

This is doubly important because you have to pay two separate taxes on your ridesharing income—once for your income tax and once for your self-employment tax (the amount you contribute as a self-employed individual to Social Security and Medicare). Both taxes are based on the net profit of your business, which can be reduced by taking a deduction for the use of your car for your business.

The IRS offers two ways of calculating the cost of using your vehicle in your business:

- The actual expenses method , or

- Standard mileage rate method

Each method has its advantages and disadvantages, and they often produce vastly different results. Actual expenses might produce a larger tax deduction one year, and the standard mileage rate might produce a larger deduction the next.

If you want to use the standard mileage rate method in any tax year, you must do so in the first tax year you use your car for business. In later years you can choose to switch back and forth between the methods from year to year. Each year, you’ll want to calculate your expenses both ways and then choose the method that yields the larger deduction and greater tax benefit to you. If you use the actual expense method in the first year you are required to continue to use this method for that specific vehicle in future years.

Below you’ll find an easy-to-follow road map to choosing the best method for you, this year.

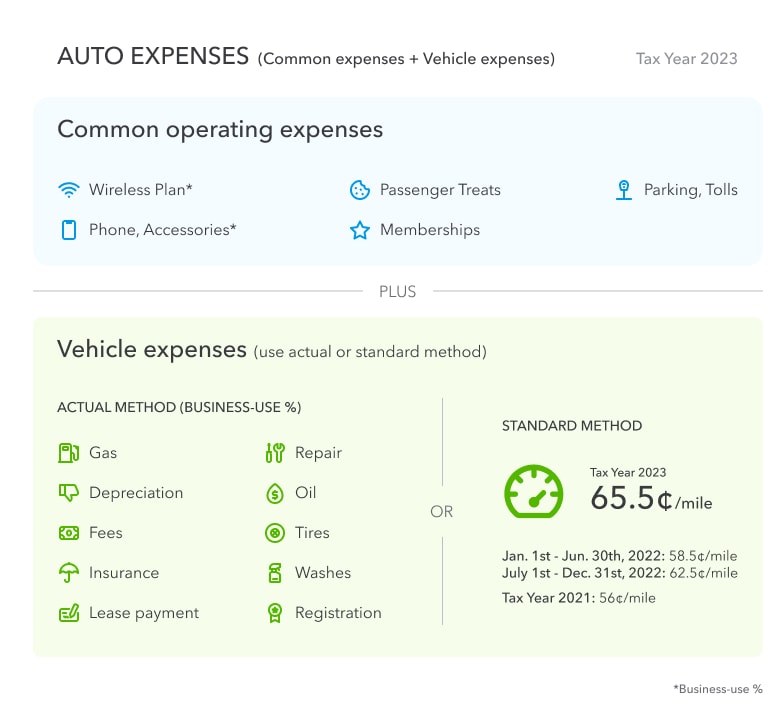

As a self-employed owner of a ridesharing business, you’ll report your business income as well as your business expenses on Schedule C. The chart below breaks total rideshare business expenses into two main groups for 2023:

- Common operating expenses and

- Vehicle expenses

Many of the items listed in the chart apply both to your business and to your personal use. For example, you might use the same phone and wireless plan for both your business and your personal life.

- For tax purposes, you need to calculate the percentage of each expense that applies to your business and deduct only that portion from your business income.

- The IRS can disallow expenses that are not supported by receipts, mileage logs, and other documentation.

For this reason, many people use a bank account or credit card separate from their personal accounts for all their business transactions. That way they can refer to their monthly statements or online records to accurately track their business expenses.

As the name suggests, the actual expenses method requires you to add up all the money actually spent in the operation of your vehicle. You then multiply this figure by the percentage of the vehicle’s business use.

- For example, if half the miles you drive are for business and half are for personal use, you will multiply your total vehicle expenses by 50% to arrive at the business portion (e.g. $9,500 total expenses x .50 business use = $4,750 business expenses).

Some of the costs you can include in your actual expenses are:

- Lease payments

- Auto insurance

- Maintenance (such as oil changes, brake pad replacements, tire rotations)

- New tire purchases

- Title, licensing, and registration fees

- Vehicle depreciation (use a depreciation table to calculate the amount, and then deduct only the portion that applies to the business use of your vehicle)

TurboTax Tip: Compute your mileage deduction using each method and then choose the method that yields that larger deduction.

The standard mileage rate method is a much simpler way of calculating the deduction for the business use of your car. It does not require you to track individual purchases and save receipts. Instead, you simply keep track of your business and personal mileage for the tax year. (Tip: Take a photo of your odometer on New Year’s Day and save it, so you can always see where your mileage stood at the beginning of the tax year.)

As with other tax deductions, you'll need to determine the percentage of your mileage that applies to your business.

- The best way to do this is with a mileage log. You can keep track of all of your mileage during the year and note what use is for business versus personal.

For 2023, the rate is 65.5 cents per mile. For example if you drove 5,000 miles for business evenly divided throughout the year you would get:

2,500 business miles x $0.585 plus 2,500 business miles x $0.625 = $3,275 standard mileage deduction.

Uber makes it easy to track your miles while using their app. The mileage reported on your Tax Summary includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. This is a good starting point for calculating your total business miles.

- You can add to this figure the business miles you drove without passengers, picking them up or to a central location after dropping them off.

- Remember to use only the miles driven for your business in calculating your deduction.

Since Uber does not keep track of the miles you drive without passengers, you’ll need to keep your own mileage log. It should include:

- the date you drove

- the starting and ending odometer readings

- a description of the business activity

- and the starting and ending times of each trip

If you don’t want to keep a log by hand, mileage and expense-tracking apps can help you keep an accurate tally of this all-important deduction.

When you use the standard mileage rate deduction, you can’t deduct individual expenses for your car. For example, if your transmission broke down and had to be replaced, you might be better off using the actual expense method to take advantage of this large expense. The only way to know for sure is to keep good records and to calculate your tax deduction both ways.

An Uber partner-driver drove 10,000 miles in 2023, and 5,000 of those miles were for business. The driver’s actual expenses included:

- $1,500 insurance

- $6,000 lease payments

- $400 repairs

- $500 car washes

These expenses total $9,500. Since the driver used the car for business purposes 50% of the time, the actual expenses deduction is $4,750 ($9,500 x .50 = $4,750).

Using these same figures to calculate the standard mileage rate deduction, the driver multiplies the business mileage (5,000 miles) by the standard mileage rate, for a standard mileage rate deduction of $3,275.

In this example, the Uber driver-partner is able to deduct $1,475 more by using the actual expenses method than by using the standard mileage rate method.

An Uber partner-driver drove 40,000 miles in 2023, and 30,000 of those miles were for business. The driver’s actual expenses include:

- $3,160 depreciation

- $1,200 repairs

- $750 car washes

These expenses total $11,300. Since the Uber driver-partner used the vehicle for business 75% of the time, the actual expenses deduction is $8,475 ($11,300 x .75 = $8,475).

Using the standard mileage rate method with these same numbers, the driver would multiply the number of miles driven for business (30,000) by the standard mileage rate (65.5 cents per mile for 2023), which comes out to $19,650.

In this example, the Uber driver-partner is able to deduct $11,175 more by using the standard mileage method than by using the actual expense method.

There are several benefits of using the standard mileage method, including:

- Often results in a larger deduction for those who do significant driving.

- Allows more flexibility, as you can switch to the actual expenses method in future tax years.

- Record-keeping is usually simpler; there are even apps that can do it for you.

- It’s typically easier to calculate your deduction using the IRS’s rate per mile.

However, the standard mileage method isn’t right for everyone. The potential drawback with this method is that you might end up with a lower deduction if you didn’t drive a lot throughout the year.

Consider the pros of using the actual expenses method when preparing to do your taxes:

- In 2023, depreciation is accounted for as 28 cents of the standard mileage rate of 65.5 cents per mile.

- For 2024, the depreciation amount is 30 cents of the standard mileage rate of 67 cents per mile.

- Often results in a larger deduction for those who do a moderate amount of driving.

- If you have a more expensive vehicle, you may be able to get a higher deduction.

- You had a large car-related expense, like a major repair.

Some of the potential cons of using the actual expenses method include:

- Inability to switch to the standard mileage method if you choose to use this method the first year

- More extensive recordkeeping

Note that what’s considered a pro or con depends on your circumstances when filing your taxes.

Which method is going to be best varies by taxpayer. When deciding which method to use, some factors you’ll want to think about include:

- How much you drive

- The value of the vehicle

- Whether you’re willing to be consistent about recordkeeping to track expenses

It’s also important to note that in order to use the standard mileage deduction rate, you must own or lease the vehicle you’re applying the deduction. When in doubt, speaking with a tax professional can help you determine which method you should use for calculating the business use of your car.

Whether you use the standard mileage or standard mileage method, you’ll deduct your self-employed car expenses on Schedule C of Form 1040.

As these examples show, the method you use to calculate the business use of your car can have a big impact on your total business expenses, your net income, and your tax burden. Keep complete records so you can calculate your deduction using both methods, and then choose the one that saves the most money for you.

The standard guidance from the IRS is to keep records of supporting documentation for the property until the period of limitations expires for the year in which you dispose of the property. However, keeping your taxes indefinitely can provide peace of mind and ensure you always have the records to recall should they come into question or if you need to refer to them when filing future returns. You can scan them digitally to keep them secure and save space.

With TurboTax Live Business , get unlimited expert help while you do your taxes, or let a tax expert file completely for you, start to finish. Get direct access to small business tax experts who are up to date with the latest federal, state and local taxes. Small business owners get access to unlimited, year-round advice and answers at no extra cost, maximize credits and deductions, and a 100% Accurate, Expert Approved guarantee.

Let a small business tax expert do your taxes for you

Get matched with a tax expert who prepares and files everything for you. Your dedicated expert will find every dollar you deserve, guaranteed .

TurboTax Full Service Business is perfect for partnerships, S-corps, and multi-member LLCs.

Small Business taxes done right, with unlimited expert advice as you go

Get unlimited tax advice right on your screen from live experts as you do your taxes. All with a final review before you file.

TurboTax Live Assisted Business is perfect for partnerships, S-corps, and multi-member LLCs.

*Available in select states

Looking for more information?

Related articles, more in self employment taxes.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

TaxCaster Tax Calculator

Estimate your tax refund and where you stand

I’m a TurboTax customer

I’m a new user

Tax Bracket Calculator

Easily calculate your tax rate to make smart financial decisions

Get started

W-4 Withholding Calculator

Know how much to withhold from your paycheck to get a bigger refund

Self-Employed Tax Calculator

Estimate your self-employment tax and eliminate any surprises

Crypto Calculator

Estimate capital gains, losses, and taxes for cryptocurrency sales

Self-Employed Tax Deductions Calculator

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

ItsDeductible™

See how much your charitable donations are worth

Read why our customers love Intuit TurboTax

Rated 4.5 out of 5 stars by our customers.

(153411 reviews of TurboTax Online)

Star ratings are from 2023

Your security. Built into everything we do.

File faster and easier with the free turbotax app.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible. If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Situations not covered:

- Itemized deductions claimed on Schedule A

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales (including crypto investments)

- Rental property income

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

Turbotax online guarantees.

TurboTax Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax for the current 2023 tax year and for individual, non-business returns for the past two tax years (2022, 2021). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

TurboTax Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Audit Support Guarantee – Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your 2023 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited business returns filed with TurboTax for the current 2023 tax year. Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals for this question-and-answer support, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. Additional terms and limitations apply. See Terms of Service for details.

TURBOTAX ONLINE/MOBILE PRICING:

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year 2023.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form 1040 and limited credits only, as detailed in the TurboTax Free Edition disclosures. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state(s) and one (1) federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after 11:59pm EST, March 31, 2024, you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here.

- Full Service $100 Back Offer: Credit applies only to federal filing fees for TurboTax Full Service and not returns filed using other TurboTax products or returns filed by Intuit TurboTax Verified Pros. Excludes TurboTax Live Full Service Business and TurboTax Canada products . Credit does not apply to state tax filing fees or other additional services. If federal filing fees are less than $100, the remaining credit will be provided via electronic gift card. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Must file by April 15, 2024 11:59 PM ET.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

- Pays for itself (TurboTax Premium, formerly Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2022. Actual results will vary based on your tax situation.

TURBOTAX ONLINE/MOBILE:

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund up to 5 days early: Individual taxes only. When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

- For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.

- Pay for TurboTax out of your federal refund or state refund (if applicable): Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details.

- Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live Assisted or as an upgrade from another version, and available through December 31, 2024. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not limited to multiple sources of business income, large amounts of cryptocurrency transactions, taxable foreign assets and/or significant foreign investment income. Offer details subject to change at any time without notice. Intuit, in its sole discretion and at any time, may determine that certain tax topics, forms and/or situations are not included as part of TurboTax Live Full Service. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. See Terms of Service for details.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare 2023 tax returns starting January 8, 2024. Based on completion time for the majority of customers and may vary based on expert availability. The tax preparation assistant will validate the customer’s tax situation during the welcome call and review uploaded documents to assess readiness. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service -- Verified Pro -- “Local” and “In-Person”: Not all feature combinations are available for all locations. "Local" experts are defined as being located within the same state as the consumer’s zip code for virtual meetings. "Local" Pros for the purpose of in-person meetings are defined as being located within 50 miles of the consumer's zip code. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through 11/1/2024. Terms and conditions may vary and are subject to change without notice.

- My Docs features: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2024. Terms and conditions may vary and are subject to change without notice.

- Easy Online Amend: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits. Make changes to your 2023 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10/31/2026. Terms and conditions may vary and are subject to change without notice. For TurboTax Live Full Service, your tax expert will amend your 2023 tax return for you through 11/15/2024. After 11/15/2024, TurboTax Live Full Service customers will be able to amend their 2023 tax return themselves using the Easy Online Amend process described above.

- #1 best-selling tax software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2023, tax year 2022. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2022.

- CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees . Limitations apply. See Terms of Service for details.

- TurboTax Premium Pricing Comparison: Cost savings based on a comparison of TurboTax product prices to average prices set forth in the 2020-2021 NSA Fees-Acct-Tax Practices Survey Report.

- 1099-K Snap and Autofill: Available in mobile app and mobile web only.

- 1099-NEC Snap and Autofill: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). Available in mobile app only. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

- Year-Round Tax Estimator: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). This product feature is only available after you finish and file in a self-employed TurboTax product.

- **Refer a Friend: Rewards good for up to 20 friends, or $500 - see official terms and conditions for more details.

- Refer your Expert (Intuit’s own experts): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details.

- Refer your Expert (TurboTax Verified Independent Pro): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 2/17/23 and may not reflect actual refund amount received.

- Average Deduction Amount: Based on the average amount of deductions/expenses found by TurboTax Self Employed customers who filed expenses on Schedule C in Tax Year 2022 and may not reflect actual deductions found.

- More self-employed deductions based on the median amount of expenses found by TurboTax Premium (formerly Self Employed) customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary.

- TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business, we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits, Entities electing to be treated as a C-Corp, Schedule C Sole proprietorship, Payroll, Sales tax, Quarterly filings, and Foreign Income. TurboTax Live Assisted Business is currently available only in AK, AZ, CA, CO, FL, GA, IL, MI, MO, NC, NV, NY, OH, PA, SD, TX, UT, VA, WA, and WY.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state software license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Report Center , for audited individual returns filed with TurboTax Desktop for the current 2023 tax year and, for individual, non-business returns, for the past two tax years (2021, 2022). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt.

TurboTax Desktop Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See License Agreement for details.

- Maximum Tax Savings Guarantee – Business Returns: If you get a smaller tax due (or larger business tax refund) from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Additional terms and limitations apply. See License Agreement for details.

TURBOTAX DESKTOP

- Installation Requirements: Product download, installation and activation requires an Intuit Account and internet connection. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers.

- TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details . Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity.

- Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 02/17/23 and may not reflect actual refund amount received.

- TurboTax Product Support: Customer service and product support hours and options vary by time of year.

- #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- Deduct From Your Federal or State Refund (if applicable): A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- Data Import: Imports financial data from participating companies; Requires Intuit Account. Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken (2021 and higher) and QuickBooks Desktop (2021 and higher); both Windows only. Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc., Quicken import subject to change.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Compare TurboTax products

All online tax preparation software

TurboTax online guarantees

TurboTax security and fraud protection

Tax forms included with TurboTax

TurboTax en español

TurboTax Live en español

Self-employed tax center

Tax law and stimulus updates

Tax Refund Advance

Unemployment benefits and taxes

File your own taxes

TurboTax crypto taxes

Credit Karma Money

Investment tax tips

Online software products

TurboTax login

Free Edition tax filing

Deluxe to maximize tax deductions

TurboTax self-employed & investor taxes

Free military tax filing discount

TurboTax Live tax expert products

TurboTax Live Premium

TurboTax Live Full Service Pricing

TurboTax Live Full Service Business Taxes

TurboTax Live Assisted Business Taxes

TurboTax Business Tax Online

Desktop products

TurboTax Desktop login

All Desktop products

Install TurboTax Desktop

Check order status

TurboTax Advantage

TurboTax Desktop Business for corps

Products for previous tax years

Tax tips and video homepage

Browse all tax tips

Married filing jointly vs separately

Guide to head of household

Rules for claiming dependents

File taxes with no income

About form 1099-NEC