- Stand Up for Free Enterprise

The State of the Travel Industry in 2023: Current Trends and Future Outlook

Kentucky chamber ceo: we must protect the free enterprise system, how franchising can help fuel the american dream, microsoft president: responsible ai development can drive innovation, suzanne clark's 2024 state of american business remarks, rhythms of success: the free enterprise tune of a small business.

January 12, 2023

Featured Guest

Tony Capuano CEO, Marriott International, Inc.

Chip Rogers President & CEO, American Hotel & Lodging Association (AHLA)

As COVID-19 restrictions have continued to ease, the travel and hospitality industries have seen a resurgence in customers. Companies like Marriott have seen percentage increases in revenue and rate, even topping pre-pandemic levels.

During the U.S. Chamber of Commerce’s 2023 State of American Business event, Chip Rogers, President and CEO of the American Hotel and Lodging Association , and Tony Capuano, CEO of Marriott International, Inc. , sat down for a fireside chat. Read on for their insights on the post-COVID state of the travel industry, a shifting customer base, and the outlook for 2023 and beyond.

2022 Demonstrated the Power and Resilience of Travel

After declines amid the pandemic, 2022 brought about a positive recovery for the travel industry.

“[2022] reminded us of the power and resilience of travel,” said Capuano. “If you look at the forward bookings through the holiday season, [you’ll see] really strong and compelling numbers … so we’re really encouraged.”

“The only caveat I would give you about that optimism is, as you know, the booking windows are much shorter than we’ve seen them in a pre-pandemic world,” he added. “So those trends can change more quickly than we’re accustomed to."

The ‘Regular’ Customer Segments Are Shifting

At the start of pandemic recovery, industry leaders believed leisure travel would lead travel recovery, with business travel closely behind and group travel at a distant third, according to Capuano. While some of those predictions have held, others have shifted.

“Leisure [travel] continues to be exceedingly strong, and group [travel] has surprised to the upside,” he explained. “Business travel is perhaps the tortoise in this ‘Tortoise and the Hare,’ slow-and-steady recovery.”

However, Capuano noted customer segments are becoming less and less strictly defined.

“[There’s] this trend we've seen emerge over the pandemic of blended trip purpose … [where] more and more folks are combining leisure and business travel,” he said. “If this has staying power, I think it’s absolutely a game changer, as we get back to normal business travel and hopefully maintain that leisure travel.”

To accommodate this shifting demand, Marriott has focused on expanding offerings to accommodate both the business and leisure sides of travelers’ trips.

“[We’ve had] a very big focus on [expanding bandwidth], so that if [we’ve] got 300 rooms full of guests on Zoom calls simultaneously, we’ve got the bandwidth to cover it,” Capuano added. “[We’re also] being more thoughtful about fitness, leisure, and food and beverage offerings — and having the flexibility to pivot those offerings as somebody sheds their business suit on Thursday and changes into shorts and flip flops for the weekend.”

2023 Offers Hope for Continued Growth in the Travel and Hospitality Sectors

As the travel and hospitality sectors continue to grow and shift in the post-pandemic era, Capuano shared reasons for optimism in 2023.

“Number one, it's our people,” he emphasized. “When you see their passion, their enthusiasm, their resilience, their creativity, and just how joyful they are to have their hotels full again … it's hard not to be filled with optimism.”

“If you look at how far the industry has come over the last few years,” Capuano continued, “any lingering doubts folks may have had about the resilience of travel — and about the passion that the general public has to explore cities and countries — it's hard not to be excited about the future of our industry.”

- Post-Pandemic Work

From the Series

State of American Business

View this online

9 Key Takeaways From CLIA's 2024 State of the Cruise Industry Report

Cruising is officially back.

Last year, demand surged ahead of pre-pandemic levels as 31.7 million travelers sailed aboard cruise ships, according to Cruise Lines International Association’s (CLIA) annual State of the Cruise Industry report. The 2023 numbers represent a 7 percent uptick from 2019, the last full year before the Covid-19 dampened the industry. (For comparison, 20.4 million people took a cruise in 2022.)

"Cruise continues to be one of the fastest-growing and most resilient sectors of tourism— rebounding faster than international tourist arrivals—and a strong contributor to local and national economies,” says Kelly Craighead, CLIA’s president and chief executive officer.

Here are nine other key takeaways from the new report.

1. Demand Will Remain High In 2024

Last year was good, but CLIA expects this year to be even better. The association is forecasting that 35.7 million travelers will cruise in 2024.

2. Capacity Is Also Growing

To help meet the increased demand, cruise lines are adding more ships. CLIA is forecasting that global cruise capacity will grow at least 10 percent—from 677,000 lower berths in 2024 to 745,000 lower berths in 2028.

3. Younger Generations Are Excited to Cruise

Intent to cruise is also strong, with 82 percent of all previous cruise guests reporting that they will cruise again—a 6 percent increase from 2019.

The average age of cruise travelers is now 46 years old, and 36 percent of cruisers are under the age of 40. Millennials (32 percent), Gen Z (33 percent) and Gen X (23 percent) now make up the largest proportion of cruisers.

Younger generations are also enthusiastic about cruising, with 81 percent of millennials and 84 percent of Gen-Xers who have cruised before reporting they plan to cruise again. (Baby Boomers also still love to cruise: 84 percent said they plan to take another voyage.)

4. A Growing Number of Travelers Are Cruising For the First Time

Over the past two years, 27 percent of travelers are new-to-cruise, which represents a 12 percent increase from the past year.

5. Expedition Cruises Are Hot

Expedition cruises are becoming increasingly popular, according to CLIA. The association recorded a 71 percent increase in travelers sailing on expedition cruises between 2019 and 2023.

At the same time, passengers are also increasingly interested in accessibility: 45 percent of travelers book an accessible tour excursion on their most recent voyage.

6. Travel Advisors Are Key

Travel advisors remain critical to the cruise industry, with 73 percent of cruisers reporting that travel advisors have a meaningful influence on their decision to cruise.

7. Cruise Lines Continue to Make Progress on Sustainability

Cruise lines are investing in a wide range of technologies to make their ships more efficient, including propulsion technologies with conversion capabilities for future alternative fuels. Other sustainability upgrades include advanced wastewater treatment systems, underwater noise and vibration reduction systems, water conservation systems, exhaust gas cleaning systems and more.

Shoreside electricity is also becoming increasingly common: 120 ships (52 percent of global capacity) now have the capability to plug in while in port.

8. Cruising Continues to Make an Economic Impact

In 2022, the cruise industry generated $138 billion to the global economy, 1.2 million jobs and $43 billion in wages. CLIA expects the economic impact will be even greater in 2023, because of the uptick in passengers.

Cruising also creates economic ripple effects: 63 percent of cruisers say they have returned to a destination that they first visited via cruise ship for a longer stay.

9. The Industry Is Attracting Women

For the first time, CLIA released a new skills and workforce report called “ An Ocean of Opportunity .” It finds that cruising is an especially attractive industry for women, with 94 percent of women seafarers working in the cruise industry. What’s more, women hold around 40 percent of senior leadership roles at cruise companies.

Delta expects summer travel demand to produce record second-quarter revenue

- Medium Text

Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here.

Reporting by Rajesh Kumar Singh in Chicago Additional reporting by Deborah Sophia in Bengaluru Editing by Pooja Desai, Chizu Nomiyama and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Salesforce is in advanced talks to buy Informatica, WSJ reports

Salesforce is in advanced talks to acquire data-management software provider Informatica , the Wall Street Journal reported on Friday, citing people familiar with the matter.

How does the travel industry actually work?

You may be new to the travel industry, investigating a career in travel or just trying to research a bit about the industry ahead of your next adventure. There’s a mass of information out there and it can be overwhelming to wrap your head around. Lucky for you, our team of travel experts have been hard at work to give you a bird’s eye view of the travel industry as a whole .

The travel industry has gone through many evolutions with a variety of external factors contributing to who has access to travel, where they are travelling to and what the travel industry looks like overall.

A few important travel industry statistics

Let’s start by setting the scene…the travel industry is HUGE and the numbers certainly prove it .

Source: Statista

A brief history of the travel industry

We are fortunate to live in a globalised world meaning that travel is reasonably accessible. At the press of a button, most people are able to book a flight and jet off to wherever our wallets will take us.

But, it hasn’t always been so easy. To help you understand how the industry has developed to the point it has today and where it might head in the future, here is a travel industry timeline.

Before the mid 20th century, travel was reserved for the extremely wealthy. It was expensive and it was time-consuming (can you imagine having to travel on a boat for 3 weeks…. or 3 months!). The concept of a ‘travel industry’ had not yet formed; it was more a collection of hotels, restaurants and coachlines who all operated independently from one another.

1950 – 2000

After the Second World War, travel suddenly started to become accessible for many more people due to the development of commercial airlines. Although they were originally still very expensive, costs started to reduce over the years and more people were able to invest in seeing the world.

The industry grew and grew, and many saw a gap in the market for people wanting to travel but not having the knowledge, or time to organise it themselves – travel agents and tour operators started to establish themselves!

2000 – 2019

The travel industry has undoubtedly boomed, and the way that people travel is almost unrecognisable from the early 20th century. With smartphones, we now have unlimited apps at our fingertips, specifically designed to make every aspect of travel easier.

For travellers, there are websites and apps to help them plan their travel, help them while travelling and to give them inspiration for their next trip! For travel agents and tour operators, itinerary software has streamlined much of their processes, from itinerary planning to customer relationship management. Now all this technology is amazing, and helps our lives in many ways, but has also resulted in fragmentation of the travel industry with travellers choosing to plan and manage their trips themselves or online increasingly.

2020 and the future of travel

Due to the pandemic and the pause in travel, both countries and travellers worldwide re-evaluated travel and how it should be conducted. Countries who experienced over-tourism considered ways to encourage more sustainable travel in their destinations . For travellers, Covid triggered them to start thinking about their bucket list destinations and working with travel designers to plan and book them. This resulted in tourism returning with a significant rise in 2022, although the industry is indicating it might be plateauing in 2023/2024 .

How does the industry actually work?

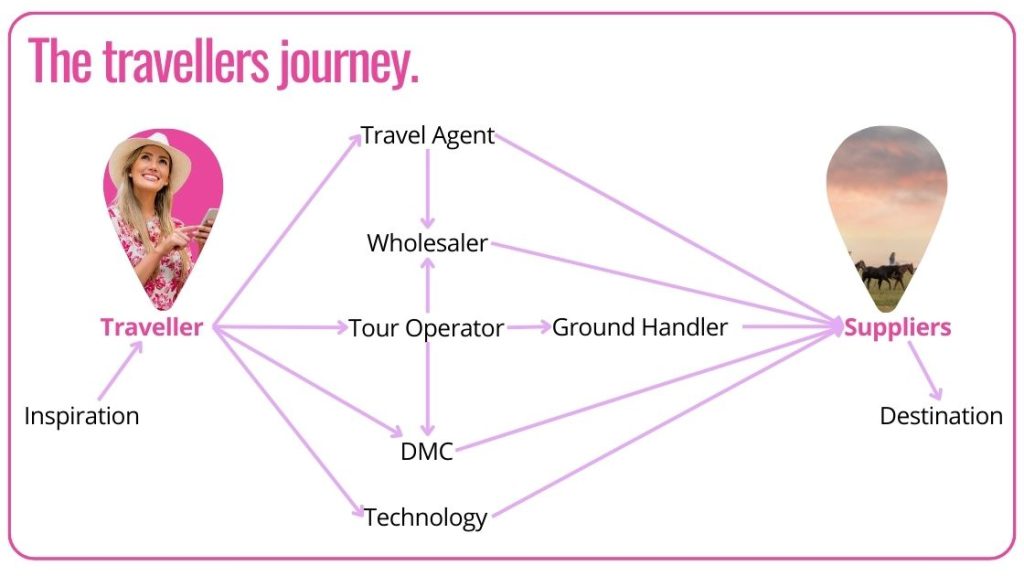

You may be thinking to yourselves, how does travel actually function as an industry . How does it all fit together? You are not alone, it’s a complex industry notorious for its jargon, terminology and abundance of acronyms!

As you can see there are a few key players to remember:

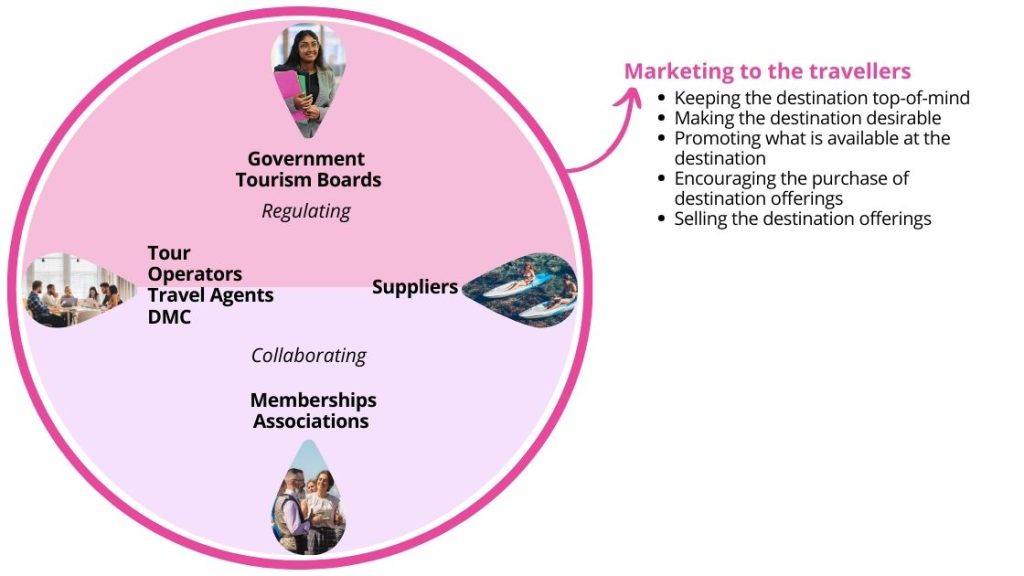

Tourism Boards and Government organisations: Usually run or overseen by local or national governments. These boards set in place regulations for the other players in the industry. They also market countries or cities as tourist destinations for potential travellers

Suppliers/Vendors: Suppliers (or Vendors) are the hotels, the restaurants and the activity providers that travellers eat, stay and partake in on their travels. Travellers may liaise with and purchase from suppliers directly if they are organising their own travels, or communications with suppliers may be managed entirely by a middle-man (AKA, the tour operator, travel agent, travel wholesaler or DMC).

Tour Operators: Tour Operators design itineraries, often tailor made, for their customers, liaising with suppliers to organise and book the travel itinerary (partially or start to finish)

Travel Agents: Travel agents liaise with tour operators to book packages and tours for their clients. As such, tour operators will often focus on a certain destination or market area, whereas travel agents can focus on selling the whole world – with a comprehensive list of suppliers in their books

Destination Management Companies (DMC’s) : Organisations that specialise in offering tours, logistics, and planning services for a particular destination. They often re-sell their services to tour operators

Ground Handlers : A ground handler takes care of some day to day operations and tour management such as picking customers up from the airport and arranging sightseeing tours

Associations and Memberships: These organisations exist to provide support, promotion, and opportunity to other players in the travel industry. All of them operate with a slightly different mission, whether it’s to promote sustainable business practices, celebrate the luxury travel market or to connect travellers with LGBTQ friendly travel businesses

Travellers: Arguably the most important cog in the wheel. Everyone in the tourism industry sets out to meet travellers’ needs – to ensure they keep coming back for more!

The beauty of the travel industry supply chain is how all of these key players work together creating one of the worlds biggest industries.

Interested to learn more?

The ultimate A-Z glossary for the Travel industry. Understand the different terms, jargon and acronyms.

For a taste of the luxury end of travel, explore our list of Exclusive luxury travel communities

To discover more about sustainable tourism, download our ebook focusing on how to elevate travel design with sustainability.

Travel designers- meet the influencers you should work with.

Understand the role travel influencers play in the industry and why tour operators should be following, interacting and collaborating with them. Explore eight global travel influencers who are inspiring travellers daily.

Tourism news websites you can trust

In the tourism industry it can be hard to differentiate the reliable travel news sources from the not-so-trustworthy ones. In this blog we summarise the top travel news websites that tour operators, travel agencies and DMC’s should pay attention to.

How to set your team up for success when introducing new software

Making changes happen is hard. Especially when it is something that will create a significant impact on the way you work, like new software. We discover what change management is and how it can assist you, your leaders and your team in creating new processes that will make you more successful in the long run. Is it time for a change?

How can tour operators contribute to sustainable tourism?

Sustainability is a key pillar of tourism, with a growing number of people interested in travelling responsibly and sustainably. We explore the easy ways in which your tour operator business can make a positive change. You can help to encourage economic growth and protect our environment whilst also watching your business flourish… could it get better?

Reimagining the $9 trillion tourism economy—what will it take?

Tourism made up 10 percent of global GDP in 2019 and was worth almost $9 trillion, 1 See “Economic impact reports,” World Travel & Tourism Council (WTTC), wttc.org. making the sector nearly three times larger than agriculture. However, the tourism value chain of suppliers and intermediaries has always been fragmented, with limited coordination among the small and medium-size enterprises (SMEs) that make up a large portion of the sector. Governments have generally played a limited role in the industry, with partial oversight and light-touch management.

COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024. This puts as many as 120 million jobs at risk. 2 “International tourist numbers could fall 60-80% in 2020, UNWTO reports,” World Tourism Organization, May 7, 2020, unwto.org.

Reopening tourism-related businesses and managing their recovery in a way that is safe, attractive for tourists, and economically viable will require coordination at a level not seen before. The public sector may be best placed to oversee this process in the context of the fragmented SME ecosystem, large state-owned enterprises controlling entry points, and the increasing impact of health-related agencies. As borders start reopening and interest in leisure rebounds in some regions , governments could take the opportunity to rethink their role within tourism, thereby potentially both assisting in the sector’s recovery and strengthening it in the long term.

In this article, we suggest four ways in which governments can reimagine their role in the tourism sector in the context of COVID-19.

1. Streamlining public–private interfaces through a tourism nerve center

Before COVID-19, most tourism ministries and authorities focused on destination marketing, industry promotions, and research. Many are now dealing with a raft of new regulations, stimulus programs, and protocols. They are also dealing with uncertainty around demand forecasting, and the decisions they make around which assets—such as airports—to reopen will have a major impact on the safety of tourists and sector employees.

Coordination between the public and private sectors in tourism was already complex prior to COVID-19. In the United Kingdom, for example, tourism falls within the remit of two departments—the Department for Business, Energy, and Industrial Strategy (BEIS) and the Department for Digital, Culture, Media & Sport (DCMS)—which interact with other government agencies and the private sector at several points. Complex coordination structures often make clarity and consistency difficult. These issues are exacerbated by the degree of coordination that will be required by the tourism sector in the aftermath of the crisis, both across government agencies (for example, between the ministries responsible for transport, tourism, and health), and between the government and private-sector players (such as for implementing protocols, syncing financial aid, and reopening assets).

Concentrating crucial leadership into a central nerve center is a crisis management response many organizations have deployed in similar situations. Tourism nerve centers, which bring together public, private, and semi-private players into project teams to address five themes, could provide an active collaboration framework that is particularly suited to the diverse stakeholders within the tourism sector (Exhibit 1).

We analyzed stimulus packages across 24 economies, 3 Australia, Bahrain, Belgium, Canada, Egypt, Finland, France, Germany, Hong Kong, Indonesia, Israel, Italy, Kenya, Malaysia, New Zealand, Peru, Philippines, Singapore, South Africa, South Korea, Spain, Switzerland, Thailand, and the United Kingdom. which totaled nearly $100 billion in funds dedicated directly to the tourism sector, and close to $300 billion including cross-sector packages with a heavy tourism footprint. This stimulus was generally provided by multiple entities and government departments, and few countries had a single integrated view on beneficiaries and losers. We conducted surveys on how effective the public-sector response has been and found that two-thirds of tourism players were either unaware of the measures taken by government or felt they did not have sufficient impact. Given uncertainty about the timing and speed of the tourism recovery, obtaining quick feedback and redeploying funds will be critical to ensuring that stimulus packages have maximum impact.

2. Experimenting with new financing mechanisms

Most of the $100 billion stimulus that we analyzed was structured as grants, debt relief, and aid to SMEs and airlines. New Zealand has offered an NZ $15,000 (US $10,000) grant per SME to cover wages, for example, while Singapore has instituted an 8 percent cash grant on the gross monthly wages of local employees. Japan has waived the debt of small companies where income dropped more than 20 percent. In Germany, companies can use state-sponsored work-sharing schemes for up to six months, and the government provides an income replacement rate of 60 percent.

Our forecasts indicate that it will take four to seven years for tourism demand to return to 2019 levels, which means that overcapacity will be the new normal in the medium term. This prolonged period of low demand means that the way tourism is financed needs to change. The aforementioned types of policies are expensive and will be difficult for governments to sustain over multiple years. They also might not go far enough. A recent Organisation for Economic Co-operation and Development (OECD) survey of SMEs in the tourism sector suggested more than half would not survive the next few months, and the failure of businesses on anything like this scale would put the recovery far behind even the most conservative forecasts. 4 See Tourism policy responses to the coronavirus (COVID-19), OECD, June 2020, oecd.org. Governments and the private sector should be investigating new, innovative financing measures.

Revenue-pooling structures for hotels

One option would be the creation of revenue-pooling structures, which could help asset owners and operators, especially SMEs, to manage variable costs and losses moving forward. Hotels competing for the same segment in the same district, such as a beach strip, could have an incentive to pool revenues and losses while operating at reduced capacity. Instead of having all hotels operating at 20 to 40 percent occupancy, a subset of hotels could operate at a higher occupancy rate and share the revenue with the remainder. This would allow hotels to optimize variable costs and reduce the need for government stimulus. Non-operating hotels could channel stimulus funds into refurbishments or other investment, which would boost the destination’s attractiveness. Governments will need to be the intermediary between businesses through auditing or escrow accounts in this model.

Joint equity funds for small and medium-size enterprises

Government-backed equity funds could also be used to deploy private capital to help ensure that tourism-related SMEs survive the crisis (Exhibit 2). This principle underpins the European Commission’s temporary framework for recapitalization of state-aided enterprises, which provided an estimated €1.9 trillion in aid to the EU economy between March and May 2020. 5 See “State aid: Commission expands temporary framework to recapitalisation and subordinated debt measures to further support the economy in the context of the coronavirus outbreak,” European Commission, May 8, 2020, ec.europa.eu. Applying such a mechanism to SMEs would require creating an appropriate equity-holding structure, or securitizing equity stakes in multiple SMEs at once, reducing the overall risk profile for the investor. In addition, developing a standardized valuation methodology would avoid lengthy due diligence processes on each asset. Governments that do not have the resources to co-invest could limit their role to setting up those structures and opening them to potential private investors.

3. Ensuring transparent, consistent communication on protocols

The return of tourism demand requires that travelers and tourism-sector employees feel—and are—safe. Although international organizations such as the International Air Transport Association (IATA), and the World Travel & Tourism Council (WTTC) have developed a set of guidelines to serve as a baseline, local regulators are layering additional measures on top. This leads to low levels of harmonization regarding regulations imposed by local governments.

Our surveys of traveler confidence in the United States suggests anxiety remains high, and authorities and destination managers must work to ensure travelers know about, and feel reassured by, protocols put in place for their protection. Our latest survey of traveler sentiment in China suggests a significant gap between how confident travelers would like to feel and how confident they actually feel; actual confidence in safety is much lower than the expected level asked a month before.

One reason for this low level of confidence is confusion over the safety measures that are currently in place. Communication is therefore key to bolstering demand. Experience in Europe indicates that prompt, transparent, consistent communications from public agencies have had a similar impact on traveler demand as CEO announcements have on stock prices. Clear, credible announcements regarding the removal of travel restrictions have already led to increased air-travel searches and bookings. In the week that governments announced the removal of travel bans to a number of European summer destinations, for example, outbound air travel web search volumes recently exceeded precrisis levels by more than 20 percent in some countries.

The case of Greece helps illustrate the importance of clear and consistent communication. Greece was one of the first EU countries to announce the date of, and conditions and protocols for, border reopening. Since that announcement, Greece’s disease incidence has remained steady and there have been no changes to the announced protocols. The result: our joint research with trivago shows that Greece is now among the top five summer destinations for German travelers for the first time. In July and August, Greece will reach inbound airline ticketing levels that are approximately 50 percent of that achieved in the same period last year. This exceeds the rate in most other European summer destinations, including Croatia (35 percent), Portugal (around 30 percent), and Spain (around 40 percent). 6 Based on IATA Air Travel Pulse by McKinsey. In contrast, some destinations that have had inconsistent communications around the time frame of reopening have shown net cancellations of flights for June and July. Even for the high seasons toward the end of the year, inbound air travel ticketing barely reaches 30 percent of 2019 volumes.

Digital solutions can be an effective tool to bridge communication and to create consistency on protocols between governments and the private sector. In China, the health QR code system, which reflects past travel history and contact with infected people, is being widely used during the reopening stage. Travelers have to show their green, government-issued QR code before entering airports, hotels, and attractions. The code is also required for preflight check-in and, at certain destination airports, after landing.

4. Enabling a digital and analytics transformation within the tourism sector

Data sources and forecasts have shifted, and proliferated, in the crisis. Last year’s demand prediction models are no longer relevant, leaving many destinations struggling to understand how demand will evolve, and therefore how to manage supply. Uncertainty over the speed and shape of the recovery means that segmentation and marketing budgets, historically reassessed every few years, now need to be updated every few months. The tourism sector needs to undergo an analytics transformation to enable the coordination of marketing budgets, sector promotions, and calendars of events, and to ensure that products are marketed to the right population segment at the right time.

Governments have an opportunity to reimagine their roles in providing data infrastructure and capabilities to the tourism sector, and to investigate new and innovative operating models. This was already underway in some destinations before COVID-19. Singapore, for example, made heavy investments in its data and analytics stack over the past decade through the Singapore Tourism Analytics Network (STAN), which provided tourism players with visitor arrival statistics, passenger profiling, spending data, revenue data, and extensive customer-experience surveys. During the COVID-19 pandemic, real-time data on leading travel indicators and “nowcasts” (forecasts for the coming weeks and months) could be invaluable to inform the decisions of both public-sector and private-sector entities.

This analytics transformation will also help to address the digital gap that was evident in tourism even before the crisis. Digital services are vital for travelers: in 2019, more than 40 percent of US travelers used mobile devices to book their trips. 7 Global Digital Traveler Research 2019, Travelport, marketing.cloud.travelport.com; “Mobile travel trends 2019 in the words of industry experts,” blog entry by David MacHale, December 11, 2018, blog.digital.travelport.com. In Europe and the United States, as many as 60 percent of travel bookings are digital, and online travel agents can have a market share as high as 50 percent, particularly for smaller independent hotels. 8 Sean O’Neill, “Coronavirus upheaval prompts independent hotels to look at management company startups,” Skift, May 11, 2020, skift.com. COVID-19 is likely to accelerate the shift to digital as travelers look for flexibility and booking lead times shorten: more than 90 percent of recent trips in China were booked within seven days of the trip itself. Many tourism businesses have struggled to keep pace with changing consumer preferences around digital. In particular, many tourism SMEs have not been fully able to integrate new digital capabilities in the way that larger businesses have, with barriers including language issues, and low levels of digital fluency. The commission rates on existing platforms, which range from 10 percent for larger hotel brands to 25 percent for independent hotels, also make it difficult for SMEs to compete in the digital space.

Governments are well-positioned to overcome the digital gap within the sector and to level the playing field for SMEs. The Tourism Exchange Australia (TXA) platform, which was created by the Australian government, is an example of enabling at scale. It acts as a matchmaker, connecting suppliers with distributors and intermediaries to create packages attractive to a specific segment of tourists, then uses tourist engagement to provide further analytical insights to travel intermediaries (Exhibit 3). This mechanism allows online travel agents to diversify their offerings by providing more experiences away from the beaten track, which both adds to Australia’s destination attractiveness, and gives small suppliers better access to customers.

Governments that seize the opportunity to reimagine tourism operations and oversight will be well positioned to steer their national tourism industries safely into—and set them up to thrive within—the next normal.

Download the article in Arabic (513KB)

Margaux Constantin is an associate partner in McKinsey’s Dubai office, Steve Saxon is a partner in the Shanghai office, and Jackey Yu is an associate partner in the Hong Kong office.

The authors wish to thank Hugo Espirito Santo, Urs Binggeli, Jonathan Steinbach, Yassir Zouaoui, Rebecca Stone, and Ninan Chacko for their contributions to this article.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

Hospitality and COVID-19: How long until ‘no vacancy’ for US hotels?

A new approach in tracking travel demand

- Travel & Tours

- Family Travel

- Travel Tips

- Destinations

- Write For Us

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

By signing up, you agree to the our terms and our Privacy Policy agreement.

The Travel Industry Card: A Comprehensive Guide

In a world where excursions have become a vital part of our lives, savvy globetrotters are continuously searching for procedures to make their trips not only the most memorable but also the most price-pleasant. One such device that has gained recognition in contemporary years is the travel industry card . In this text, we can delve into the world of adventure company gambling playing cards, exploring what they are, how they work, and the way they can be your key to unlocking low-cost adventures.

What are Travel Industry Cards?

Travel organization playing cards, often called excursion good buy playing cards or adventure memberships, are specialized gambling playing cards designed to offer vacationers superb perks, discounts, and privileges. These cards are not the best reachable for common travelers, but additionally, they are searching to make the most of their vacations without breaking the bank.

How Travel Industry Cards Work:

Travel organization cards operate on the principle of partnerships and collaborations between some of the cardboard companies and numerous groups within the travel region. These collaborations can encompass airlines, resorts, automobile apartment offerings, eating locations, or even amusement venues. As a cardholder, you benefit from getting admission to a plethora of discounts and blessings while you book offerings from those partnered corporations.

Key Features and Benefits:

Discounted Rates: Enjoy reduced expenses on flights, hotel motels, and different travel-associated charges. Travel enterprise cards regularly offer unique offers that are not to be had by the general public.

Priority Access: Some gambling cards provide priority boarding, take-a-look-in, or protection to get the right of entry, making sure you spend much less time waiting and more time taking part in your holiday spot.

Loyalty Points and Rewards: Many adventure business enterprise playing cards encompass praise programs, allowing you to accumulate factors with every transaction. These elements can be redeemed for destiny journey fees, upgrades, or maybe freebies.

Global Acceptance: Whether you are touring domestically or across the world, those gambling-playing cards are broadly famous. Making them a flexible and valuable partner for any adventurer.

Travel Insurance: Some adventure organizations offering playing cards provide complimentary travel coverage. Providing peace of mind in case of sudden events.

Choosing the Right Travel Industry Card:

When choosing a tour employer card, consider your tour behavior, favored destinations, and the types of benefits that align collectively with your wishes. Some playing cards cater to common flyers at the same time as other’s popularity on inn stays or apartment cars. Take the time to look at annual costs, interest expenses, and the variety of partnerships every card offers.

Conclusion:

In conclusion, an Adventure Corporation card may be your passport to a world of much less pricey adventures . By leveraging distinct discounts, priority admission, and loyalty rewards. Those cards empower travelers to make the most of their journeys without compromising on terrific. Before embarking on your subsequent journey, find out the arena of adventure industry cards and unfasten up the door to a more enriching and variety-pleasant tour experience.

The Worldkitetour is a well-known travel blog where you can find all the tips and tricks related to travel and lifestyle. https://worldkitetour.com

Related Posts

5 best places to visit in switzerland – must visit, exploring the beauty of ryan bonaminio park.

You must be logged in to post a comment.

Type above and press Enter to search. Press Esc to cancel.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

Industry perspectives: looking ahead for the travel industry.

March 03, 2023 By U.S. Travel Association

Over the last several weeks, many travel businesses released their Q4 earnings and shared their latest expectations. These insights and perspectives help us understand how some of the largest travel corporate players are viewing the state of the economy and its impact on the travel industry as well as the main factors they are monitoring that may hinder their continued growth.

Despite continued inflation, the overall labor market remains on solid ground and consumers continue to spend. In the near-term, an impending recession is looking less and less likely. Most travel industry CEOs are extremely optimistic and are finally looking beyond 2019, focused on future growth opportunities rather than recovery.

Recent quarterly insights and trends shared with members reiterated many of the same themes heard throughout Q4 earning reports.

Here is a deeper dive into their perspectives.

Ending the year strong

Despite economic concerns, nearly all travel organizations reported solid fourth quarter growth—and in some cases higher than 2019 levels.

United Airlines CEO Scott Kirby reported stronger than expected fourth quarter profit as consumers continued to shell out for airline tickets despite broader economic worries. Demand for air travel is still outpacing the industry’s ability to meet it, airline executives have said, citing delayed plane deliveries, training backlogs and other constraints. Strong demand has helped keep airplane seats packed and fares relatively high.

Delta Air Lines, CEO Ed Bastian said “I’ve never seen a more constructive backdrop for the industry. Demand remains strong as passengers return to the skies.”

And airline executives have said there isn’t evidence of a slowdown. United said it expects its revenue in the first quarter to be 50% higher than the same period last year.

Marriott International, CEO Tony Capuano : “2022 was a very strong year for the company. After achieving global RevPAR recovery in June, we finished the year on a real high note. It is abundantly clear that people love to travel.”

And many executives remain optimistic for what’s ahead.

Hilton Worldwide, CEO, Chris Nassetta : "As our performance demonstrates our team members have proven that we can handle whatever comes our way and because of our hard work and discipline, we are incredibly well positioned for the future, with the pivotal moment with great opportunities ahead and a new golden age of travel. And we're more confident than ever that our team is pleased to deliver in 2023 and beyond."

Host Hotels CEO Jim Risoleo : “While macroeconomic headwinds continue to dominate the headlines, we remain optimistic about the state of travel for several reasons. First, although leisure rates are moderating, they remain well above 2019 levels. Second, in the fourth quarter, we booked 400,000 group rooms for 2023. Third, while business transient demand has been uneven, revenue driven by this segment improved in Q4. Small and medium-sized businesses are driving the business transient recovery, and they represent a larger share of our corporate demand today.”

Avis-Budget CEO, Joe Ferraro : “Overall, the Americas had a great quarter and a terrific year, and we see positive trends going into January and February. Demand is strong and forward-looking reservations show this and our price discipline we saw in the fourth quarter is continuing into the first [quarter].”

Marriott International, CEO Tony Capuano : “Lodging is a cyclical business and it’s not immune to downturns in the macroeconomic environment. To date, however, we have not seen signs of demand softening.”

Higher costs, labor and supply chain shortages continue to constrain growth.

Despite continued growth, delayed deliveries of new planes, outdated technology infrastructure and logjams in hiring and training pilots hindered airlines’ ability to grow last year and are likely to impact capacity and pricing power in the coming months. Still, most airlines are aiming to return to 2019 capacity levels by the summer.

While positive for employees, also driving up labor costs and putting pressure on profits, some airlines, including Spirit and Delta plan to increase pay and negotiate new contracts for pilots and other employees to retain higher quality labor.

In addition to increased labor costs, travel organizations were negatively impacted by increased costs across the board.

Disney plans to reorganize the company to primarily reduce costs and improve efficiency.

Disney CEO Bob Iger commented : “This reorganization will result in a more cost-effective, coordinated and streamlined approach to our operations, and we are committed to running our businesses more efficiently, especially in a challenging economic environment. In that regard, we are targeting $5.5 billion in cost savings across the company, including reducing the workforce by approximately 7,000 jobs.”

Avis-Budget CEO, Joe Ferraro : We continued to focus on cost discipline and deliver results that showcase the streamlined and lean operating structures we built during the pandemic. We are keenly aware of the inflationary pressures we face in 2023 and will continue to combat rising costs with sustainable productivity gains driven by technology and data.

Hertz CEO Stephen Scheer said Hertz's profitability had been pressured as it incurred high maintenance costs to address out-of-service levels. Rising costs and supply shortages faced by automakers have made it more expensive for car buyers in an uncertain economy.

Leisure travel is still the main driver of growth but business travel—particularly group is gaining momentum.

Hilton Worldwide, CEO, Chris Nassetta: We don’t see leisure slowing down. On the business-transient side, there’s still strong and growing demand, even pent-up demand. And on the group side, we finished the second half of last year with people getting more comfortable and planning events like crazy. The economics of supply and demand are just really good.

While leisure travel continues to drive rates, group business saw the biggest quarter-over-quarter improvement, with RevPAR fully recovered to 2019 levels. Group bookings now are up 23% year-over-year and nearly back to 2019 levels.

IHG CFO, Paul Edgecliffe-Johnson highlighted that the U.S. leisure demand has sustained, and business travel demand recovery continues to improve. “The momentum behind leisure travel has not subsided, with both occupancy and rate outperforming 2019 in the fourth quarter. We have not seen any indication that demand or pricing power is waning.”

Business demand continued to pick up steadily through the year…rates surpassed 2019 levels in March, occupancy recovered to within 98% of 2019 levels in the fourth quarter…despite some predictions, business travel is alive and well.

Delta Air Lines: Corporate travel demand was steady through the quarter, with corporate domestic sales 80% recovered to 2019 levels. We expect Q1 2023 revenue to be up 14% to 17% higher versus 2019.

And [results were positive] in a recent corporate survey, with 96% of respondents expecting to travel as much or more in Q1 than Q4, led by financial services. The new year bookings reflect the survey optimism and are accelerating.

Marriott International, CEO Tony Capuano said that demand for leisure travel in the U.S. held strong, and group travel topped pre-pandemic levels. Demand for business travel was nearly 90% recovered to pre-pandemic levels as companies sent their employees on the road once again.

Travel by workers from large employers is still recovering more slowly than smaller businesses. Yet, overall demand for business travel is trending positively, even amid layoffs and belt-tightening in some sectors such as technology.

Group revenue, which includes conferences, weddings and other large gatherings, is pacing 20% above 2022 levels this year, boosted by both more bookings and higher prices.

Choice Hotels CEO, Pat Pacious: We’ve been highlighting consumer and industry trends that are driving a significant uptick in travel demand. And we’ve made deliberate investments to reap the benefits from them. Specifically, we are capitalizing on long-term fundamentals, such as remote work, retirements, rising wages and the reshoring of American manufacturing. We see these trends as strong tailwinds for our company’s long-term growth.

Looking ahead, our optimism is further reinforced by the strengthening of our business transient and group segments. In 2022, we drove year-over-year increases in our business travel bookings. At the same time, the revenue generated from our business managed accounts more than doubled when compared to 2019. We expect business travel in our key industry verticals to increase, fueled by the onshoring of the U.S. supply chain and significant nationwide investments in infrastructure.

Avis-Budget CEO, Joe Ferraro : The [fourth] quarter showed strong commercial demand. In fact, it was the highest amount of commercial volume we have seen during the fourth quarter in company history and well above levels we achieved in 2019. It's apparent that the commercial customer is traveling and using our brands at an elevated level.

International is rebounding but still has a way to go.

Hilton Worldwide CEO Chris Nassetta: The international markets are opening up. And people…across the world are traveling. [While] Asia Pacific is opening up…it will take a little bit more time, as we saw in Japan in the fourth quarter. …we are already starting to see significant travel within China and we expect a big tailwind from there…. particularly, in the second half of the year.

Marriott International issued upbeat guidance for this year as the recovery of cross-border travel, the reopening of China and recovery of business trips are expected to sustain demand.

Delta Air Lines CEO Ed Bastian reported that international recovery is well underway although revenue continues to be led by the trans-Atlantic. We are seeing robust demand across our expanded footprint in Europe and expect the spring and summer to set new record revenues.

China remains a big question market. We're not going to get ahead of ourselves in terms of capacity and publish a schedule for the summer that we don't know if we can fly, and we don't know if the demand will be there. So, we'll let demand drive what we're going to fly in China.

“We're going to be very mindful to see how demand warrants and how this opens up. In terms of international demand for 2023 we just don't know yet.”

SeaWorld Entertainment, CEO, Marc Swanson : “Though attendance of 21.9 million guests in the fiscal year topped 2021′s figure, lagging international visitor totals and bad weather kept SeaWorld from reaching pre-pandemic 2019 numbers…. Excluding international guest visitation, attendance increased by approximately 10% when compared to the fourth quarter of 2019.”

IHG CFO, Paul Edgecliffe-Johnson remarked that : “Greater China saw significant volatility during 2022. But the recent relaxation of travel restrictions is leading to a rapid return of demand, and we expect to see a much stronger performance in 2023.”

And Malaysian based Resorts World on the global economy:

“The slowdown in the global economy is expected to persist as tightening monetary policy conditions aimed at managing inflationary pressures and continued disruptions from ongoing geopolitical conflicts are expected to continue weighing on economic activity. International tourism is expected to rebound to near pre-pandemic levels in certain regions, although prevalent challenges in the global environment could delay its recovery. In line with the improving optimism surrounding international travel, the broad-based recovery of the regional gaming sector is expected to remain intact, aided by the re-opening of key markets and pent-up demand.”

In This The Itinerary

U.S. Travel

For more information about this blog, please contact us at:

202.408.8422

Record $517K raised to empower future leaders in travel industry management

- April 11, 2024

The University of Hawaiʻi at Mānoa Shidler College of Business ’ School of Travel Industry Management ( TIM school) held its 22nd annual Celebrate a Legacy in Tourism gala on April 10, at the Sheraton Waikīkī. Also marking the college’s 75th anniversary, this year’s fundraiser raised a record-breaking $517,000 thanks to the generous support of the hospitality and Hawaiʻi business community.

“We’re proud to recognize Mufi Hannemann, Holden Lim and Kyo-ya as trailblazers in their industry, who continue to inspire current and future graduates,” said Shidler College Dean and First Hawaiian Bank Chair of Leadership Management Vance Roley. “Further, it’s incredible that over half a million dollars has been raised to support student scholarships. We applaud the efforts of our volunteer table sales committee and the 2024 honorees to greatly amplify our impact.”

2024 honorees

Celebrate a Legacy in Tourism honors individuals who have made significant and long-term contributions to Hawaiʻi ’s tourism industry. This year, the Legacy in Tourism Award was presented to Muliufi “Mufi” Hannemann; Holden Lim, BBA ’89 was inducted into the TIM Alumni Hall of Honor; and Kyo-ya Hotels & Resorts, LP received the Distinguished Service Award.

Hannemann was honored with the Legacy in Tourism Award for his vast contributions to the tourism industry and dedication to fostering the development of students. As president and CEO of the Hawaiʻi Lodging & Tourism Association, chair of the Hawaiʻi Tourism Authority board, and board member of the U.S. Travel and Tourism Advisory Board, Hannemann has played a pivotal role in shaping the state’s tourism landscape. His founding of the Pacific Century Fellows and service to the TIM school as an advisory council member further showcases his commitment to nurturing future leaders.

Lim, president of Hospitality Link International, Inc. , was presented with the TIM Alumni Hall of Honor award, recognizing his professional achievements and continued support of the TIM school. Lim’s career in the hospitality industry began in 1989 at the Westin St. Francis in San Francisco and over the years, he contributed significantly to firms like HVS International and Sonnenblick-Goldman Company, orchestrating over $4.5 billion in real estate transactions. Lim remains engaged with the TIM school, currently serving on the TIM Alumni Association as secretary.

Kyo-ya Hotels & Resorts, LP , was recognized with the Distinguished Service Award for their contributions to Hawaiʻi ’s tourism industry and the community, providing many hours of service and volunteer hours to various local causes. Kyo-ya expanded its footprint across Hawaiʻi and California, including iconic properties like The Royal Hawaiian and Sheraton Maui. Additionally, Kyo-ya serves as a pipeline for hospitality careers, hiring numerous graduates from UH and mentoring high school and college students, ensuring the continuity of generations in the islands.

This year’s presenting sponsor was Marriott International; contributing sponsors were Bank of Hawaii; Central Pacific Bank; First Hawaiian Bank; Hawaiʻi Lodging & Tourism Association, Iron Workers Stabilization Fund & Iron Workers Local 625; KV & Associates and Stanford Carr Development; Kyo-ya Hotel & Resorts, LP ; “Sheraton Old Timers” group; and The Westin Maui and Trinity Investments. Hawaii Business magazine once again served as the 2024 media partner.

To support the TIM school or Shidler college, contact Jennifer Lieu, director of development at [email protected] . For a full list of past honorees click here .

Related Posts:

- $425K raised to support UH Travel Industry…

- UH TIM professor earns Pacific Business News’…

- 20th annual TIM School fundraiser honors Roy…

- previous post: UH Mānoa hits academic rankings record with 8 subjects in U.S. top 20

- next post: NCIS Journey: Mānoa students go behind the scenes

If required, information contained on this website can be made available in an alternative format upon request. Get Adobe Acrobat Reader

About Calendar COVID-19 Updates Directory Emergency Information For Media MyUH Work at UH

Gagana Samoa

Kapasen Chuuk

Kajin Majôl

ʻŌlelo Hawaiʻi

- Administrative

A Boeing supplier says it tried using Vaseline, cornstarch, and talcum powder to lubricate a door seal before settling on Dawn dish soap: NYT

- Boeing supplier Spirit AeroSystems said it was being innovative when it used soap as a lubricant.

- Besides the soap, FAA auditors say they saw Spirit mechanics use a hotel key card to check a door seal.

- Spirit said both practices were approved by Boeing and the FAA.

A supplier for Boeing said it tried using other household products like Vaseline and cornstarch as a lubricant before it settled on using liquid Dawn soap , The New York Times reported on Thursday.

In March, The Times reported that Federal Aviation Administration's (FAA) auditors saw Spirit AeroSystems' mechanics applying soap to a door seal.

The mechanics were also seen using a hotel key card to check a door seal, per an audit report obtained by The Times.

"People look at the hotel key card or Dawn soap and think this is sloppy. This is actually an innovative approach to solving for an efficient shop aid," Spirit spokesperson Joe Buccino told The Times.

According to Buccino, Spirit also tried using other household products such as Vaseline, cornstarch, and talcum powder as a lubricant before settling on liquid Dawn soap.

Buccino said the Dawn soap became their top choice because it didn't cause the door seal to degrade over time.

Related stories

Spirit told The Times that Boeing had approved both practices. The company added that the soap and the key card-like device were documented for use under FAA's standards as factory tools, also known as shop aids.

The company's chief technology officer, Sean Black, told The Times that Spirit came up with the key card-like device after seeing workers using a hotel key card to check gaps.

"Our workers routinely find creative ways to make the process of building fuselages more efficient. In this case, workers created the door rigger seal tool, which allows our teams to test the door seals without any risk of degrading the seal over time," Black told the outlet.

A spokesperson for Boeing confirmed to The Times that it had indeed approved Spirit's use of the soap and key card-like device, while an FAA representative declined The Times' request for comment.

The audit, the FAA said, was part of its ongoing investigation into Boeing after a door plug on an Alaska Airlines flight blew out in January while the plane was still midair.

The controversy surrounding Spirit's unorthodox engineering practices takes place amid heightened scrutiny of the quality of Boeing's planes. The aircraft manufacturer has come under the spotlight following repeated quality assurance lapses .

On Wednesday, the head of the National Transportation Safety Board (NTSB) said in a Senate hearing that she was considering surveying every Boeing employee about the company's safety culture .

"I don't think there's anyone at Boeing, from Dave Calhoun down, that doesn't want to know what happened. They want to know, and they want to fix it, and we're there to help," NTSB chief Jennifer Homendy said.

Representatives for Boeing, Spirit, and the FAA did not immediately respond to a request for comment from Business Insider sent outside regular business hours.

Watch: 5 cleanings that keep the travel industry running

- Main content

A travel boom is looming. But is the industry ready?

An increase in travel is expected between countries which have moderate COVID-19 caseloads and vaccine access. Image: Unsplash/William Hook

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Vik Krishnan

Darren rivas, steve saxon.

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- A new age of travel could be on the horizon, as vaccinations increase and caseloads become more manageable.

- A McKinsey survey reveals that travel is the second-most-desired activity in the U.S., after eating out.

- However, if the travel industry is not prepared, it could buckle under this new pressure.

- Building capacity, investing in digital innovation and revisiting commercial approaches will be key if countries want to seize value from this surge.

If things go well, we might be at the threshold of a new age of travel. Although COVID-19 variants may affect conditions, it seems only a matter of time before travelers in some parts of the world hit the road and take to the skies again, thanks to rising vaccination rates and manageable caseloads. Some countries have begun gingerly relaxing travel restrictions and reopening borders.

As the worst effects of the COVID-19 pandemic ebb, most indicators point to travel coming back—with a vengeance—as people look to reconnect, explore new destinations, or revisit reliable favorites. Many just want to get away from the confines of their homes. A McKinsey survey reveals traveling to be the second-most-desired activity among respondents (in first place: dining out). In the United States, air travel has hit two million daily passengers, closer to the prepandemic level of around 2.5 million than to the low of around 90,000, in April 2020. Hotel reservations and rental-car bookings are surging.

All these trends should taste sweet for the industry, but ill-prepared companies may find themselves facing the wrath of a cohort of leisure-focused vacationers who might already be struggling to keep up with new travel protocols. If the industry doesn’t work to increase capacity now, the ecosystem may buckle under the pressure, forcing travelers to endure long wait times and inflated prices.

This article projects two broad trajectories of how travel will likely bounce back, comparing countries that have near-zero caseloads with those that have more, but manageable, caseloads and higher vaccination rates. In both scenarios, travel companies that don’t prepare themselves for the forthcoming influx of travelers risk missing out on a valuable opportunity to recoup losses incurred during the height of the pandemic. On the flip side, we believe that by focusing on four key areas—building capacity, investing in digital innovation, revisiting commercial approaches, and learning from critical moments—travel companies can seize value as they exceed the needs and demands of their customers.

The tale of two travel recovery paths

Wherever in the world you look, you’ll see people itching to travel. Most high-income earners have not lost their jobs. In the United States, the savings rate among this demographic is 10 to 20 percent higher now than before the pandemic, and such people are eager to spend their money on travel. Leisure trips are expected to lead the rebound, with corporate travel trailing behind.

A recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA), revealed that 57 percent of them expected to be traveling within two months of the pandemic’s containment, and 72 percent will do so as soon as they can meet friends and family. In our China travel survey, we see more and more respondents yearning for leisure trips further afield; 41 percent say they want their next trip to be outside China, the highest level we’ve seen, despite borders remaining sealed.

Yet it’s worth noting that despite the near-universal desire to travel, countries will likely manage their plans to reopen differently. Two main factors come into play here: current COVID-19 caseloads and vaccination rates. People living in countries with limited access to vaccines and uncontainable levels of cases—such as a number of countries in Africa and Southeast Asia—will continue to be bound by tight travel restrictions for some time to come.

Have you read?

These could be the most popular travel destinations after covid-19, covid-19 could change travel – but not in the way you think, how the travel industry can influence sustainable growth, travel will take off in and between countries with manageable caseloads.

We can expect a surge in travel in (and between) countries with manageable and moderate COVID-19 caseloads and vaccine access. These regions are willing to accept rising case levels as long as death and hospitalization rates stay low. In many European countries and the United States, a significant portion of the population has been inoculated. Such people feel safe enough to travel both domestically and internationally, especially with the introduction of safety measures such as the EU-issued digital health certificates given to people vaccinated against COVID-19. Despite fluctuating rates of new caseloads in these regions, the efficacy of the vaccine so far (to reduce the spread of the disease and avoid its worst effects) gives many people enough feeling of security to travel.

Countries in Europe that have gotten used to living with manageable caseloads of COVID-19 have begun to welcome visitors without asking them to quarantine: Iceland (March 2021), Cyprus (May 2021), and Malta (June 2021). In addition, Europe is open to vaccinated US travelers. After the US Centers for Disease Control and Prevention (CDC) started approving cruise vessels with conditional sailing certifications to enter the country, a Florida federal court ruled in June 2021 that CDC-issued regulations should serve only as nonbinding guidelines, further reducing restrictions on tourists.

If past instances serve as indicators, we’ll see travel demand soaring once travel restrictions are eased and freedom of mobility returns.

Domestic trips will lead the recovery of travel in near-zero countries

However, a slightly different picture is emerging for countries with near-zero caseloads. Countries in this group include Australia, China, New Zealand, and Singapore. Their governments face a difficult trade-off. They can open up national borders without quarantines—which will almost certainly lead to increased local transmissions of COVID-19 and an increase in new cases, especially in countries with low vaccination rates, such as Australia and New Zealand. Or, they can choose to continue imposing strict restrictions and quarantine measures until the pandemic has truly passed, which would deter all but the most determined of travelers. Unlike places that have adjusted to living with COVID-19, even a moderate increase of cases in countries with caseloads near zero would likely be unacceptable to the public.

That’s not to say there are no travel opportunities in these countries. First, we’ll likely see increased interest in domestic travel, especially for large countries with sizable home markets, such as Australia and China, which have traditionally been net exporters of tourists. With few international destinations open to visit, this group of travelers will likely seek out vacation experiences within their nations’ borders. China has seen hordes of tourists flood many scenic destinations and tourist sites, especially during peak travel seasons.

Second, even though travel bubbles have had only limited success so far, it may soon be possible for territories with very low COVID-19 caseloads and no local transmissions to open up access to each other. Mainland China, for instance, has been allowing citizens to travel to and from Macau without quarantine requirements. Hong Kong and Singapore have also restarted negotiations on a potential travel bubble between the two cities. The key is establishing common standards and trust in the public-health protocols and testing regimes of the participants in the travel bubble.

Four actions travel players must consider

Despite these promising signs, the tourism industry will likely struggle to capitalize on the imminent spike in travel demand, especially in Europe and the United States. From airlines and car rentals to hotels and airport restaurants, the entire travel supply chain is already showing signs of strain. Wait times at security checkpoints are stretching into hours at some airports, while popular vacation destinations, including Arizona, Florida, and Hawaii, are facing rental-car shortages.

Needless to say, bad news travels fast, and a negative experience can quickly become fodder for a viral video and bad publicity, leading customers to look for alternatives more in their control, including nearby drives and rental properties.

While the process is daunting, clear-sighted travel leaders know that preparing their organizations for a surge of travelers is also an opportunity to redefine their value propositions and make their offerings distinctive. This will not only reinstill confidence in travel but also increase customer loyalty. Leaders and executives would be wise to focus on the following four areas.

1. Bring back capacity

The most pressing imperative for all companies across the travel supply chain is bringing back capacity or, at the very least, ensuring that they’re able to do so. Many contract and temporary workers in the restaurant industry who were laid off during the pandemic have found other employment and are reluctant to go back to their former jobs, resulting in a labor crunch. In the United Kingdom, more than one in ten workers left the hospitality sector last year. In the United States, there was still a shortfall in April of around two million leisure and hospitality jobs—far greater than before the pandemic. Global aviation capacity levels are still well below prepandemic levels as many planes remain in long-term storage and staff remain furloughed. We believe that even though reactivating airline pilots and cabin crews, preparing grounded aircraft for service, and rehiring and training service staff can be pricey, the cost of standing by and doing nothing would be higher.

2. Invest innovatively to improve the entire customer journey

While cash might continue to be in short supply, an area still worth considering for overinvestment is digital operations. Remember that the customer experience is shaped across the entire end-to-end journey, from booking to travel to the return home. Even seasoned travelers will have to adapt to new protocols, such as digital health certificates and safety measures. Travelers now need more, not less, assistance. Furthermore, certain critical journeys and moments—such as a family vacation, an important business trip, or a last-minute emergency—carry a disproportionate weight in consumers’ minds when they plan their next trip. The anticipated volume of traffic during the summer and peak holiday periods will only compound these issues and bring about greater inconvenience in the overall system.

In our work in this sector, we have found that if even one pain point in the customer journey is not satisfactorily resolved, the entire perception of a travel company can be degraded. The industry needs to make sure that processes are smooth for reopening and that adequate assistance is available for travelers to help them adapt to new ways of traveling. It is likely that international trips will need additional documentation for some time. These requirements will vary by country and potentially by transit hub. They may include proof of COVID-19 vaccination (when, as well as which vaccine) and testing requirements (type of test and recency).

As the long wait times at airport checkpoints attest, manually navigating these complexities at the check-in desk is highly inefficient and prone to human error. Some airports are testing camera-powered and AI-based digital technologies to monitor crowd densities and reduce time spent standing in line—which makes the airport experience more bearable for travelers and ensures safe physical distancing. Autonomous robots are also being deployed to maintain hygiene standards; some are equipped with UV-light cleaners to disinfect areas, and others are outfitted with body-temperature sensors to help minimize the risk of virus outbreaks.

3. Reimagine commercial approaches

Travel companies may rethink their commercial approaches. The profiles of airline passengers and hotel guests will be different: more leisure guests, later booking windows, and higher demand for flexible tickets. Historical booking curves are no longer a good indicator of current behavior. Travel companies need to use every source of insight they can to anticipate demand and optimize pricing . Flexible pricing models can also ease customer discomfort with today’s heightened levels of unpredictability. For example, EasyJet now offers a Protection Promise program that gives fliers free changes up to two hours before the flight.

Hotels will need to find new purposes for meeting and conference spaces, which will be slower to fill. Airlines need to figure out how to fill intercontinental business class, likely with premium leisure promotions. For all travel companies, the boom may be higher in traveler numbers than in profits, as the most lucrative corporate business has been slow to return.

One year on: we look back at how the Forum’s networks have navigated the global response to COVID-19.

Using a multistakeholder approach, the Forum and its partners through its COVID Action Platform have provided countless solutions to navigate the COVID-19 pandemic worldwide, protecting lives and livelihoods.

Throughout 2020, along with launching its COVID Action Platform , the Forum and its Partners launched more than 40 initiatives in response to the pandemic.

The work continues. As one example, the COVID Response Alliance for Social Entrepreneurs is supporting 90,000 social entrepreneurs, with an impact on 1.4 billion people, working to serve the needs of excluded, marginalized and vulnerable groups in more than 190 countries.

Read more about the COVID-19 Tools Accelerator, our support of GAVI, the Vaccine Alliance, the Coalition for Epidemics Preparedness and Innovations (CEPI), and the COVAX initiative and innovative approaches to solve the pandemic, like our Common Trust Network – aiming to help roll out a “digital passport” in our Impact Story .

4. Learn from critical moments—and the wider ecosystem

Aside from streamlining processes and personalizing the customer experience, investing in digital analytics can allow companies to identify opportunities to differentiate their services. Companies would also be able to discern emerging trends and hiccups before they turn into nightmares. Industry players, such as online travel agents, may also be a trove of useful insights pertaining to how the external ecosystem is evolving; their experiences may be beneficial for hotels and airlines to explore potential partnerships with them.

The various parts of the travel industry have to work together as a whole to usher in a safe return of travel. Even as individual companies improve their internal operations, they should also keep a close eye on industry-wide developments, watching for collaboration opportunities. The industry and governments will have to reach consensus on safety standards and requirements. The IATA travel pass is a plug-in that could be used on airlines’ mobile apps, for example. Currently being tested by many airlines as a way to ensure passenger health, the app would allow travelers to manage verified certifications for COVID-19 vaccines and test results. Governments, in turn, could consider accepting and embedding the app into the flight check-in workflow.

It’s been a long time coming, but we see several factors aligning that could lead to a short-term travel boom, although not all countries and customer segments will boom at the same time. With continued perseverance, travel companies can ensure that travel is not just back but better.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Travel and Tourism .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How Japan is attracting digital nomads to shape local economies and innovation

Naoko Tochibayashi and Naoko Kutty

March 28, 2024

Turning tourism into development: Mitigating risks and leveraging heritage assets

Abeer Al Akel and Maimunah Mohd Sharif

February 15, 2024

Buses are key to fuelling Indian women's economic success. Here's why

Priya Singh

February 8, 2024

These are the world’s most powerful passports to have in 2024

Thea de Gallier

January 31, 2024

These are the world’s 9 most powerful passports in 2024

South Korea is launching a special visa for K-pop lovers

- How to get a Russian Visa

- Getting started and what's the price

- About Visa House

- Tourist Visa

- Business Visa

- For a HQ Specialist

- Private Visa

- For a member of the family

- Transit Visa

- Visa-free entry

- Contact the Consulate

- Documents to be submitted

- Consular Questionnaire

- Consular Fee

- Check your Visa

- How to register your visa

- Migration Card

- Arrival Notification

- Before entering Russia

- Crossing the border

- Useful Hints

- Russian Visa News

- Tourist Visa Invitation

- Business Visa Invitation

- Travel Insurance

- Delivery of documents

- Flight tickets booking

- Hotel booking

- Notarized translation

- Additional Visa Services