Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

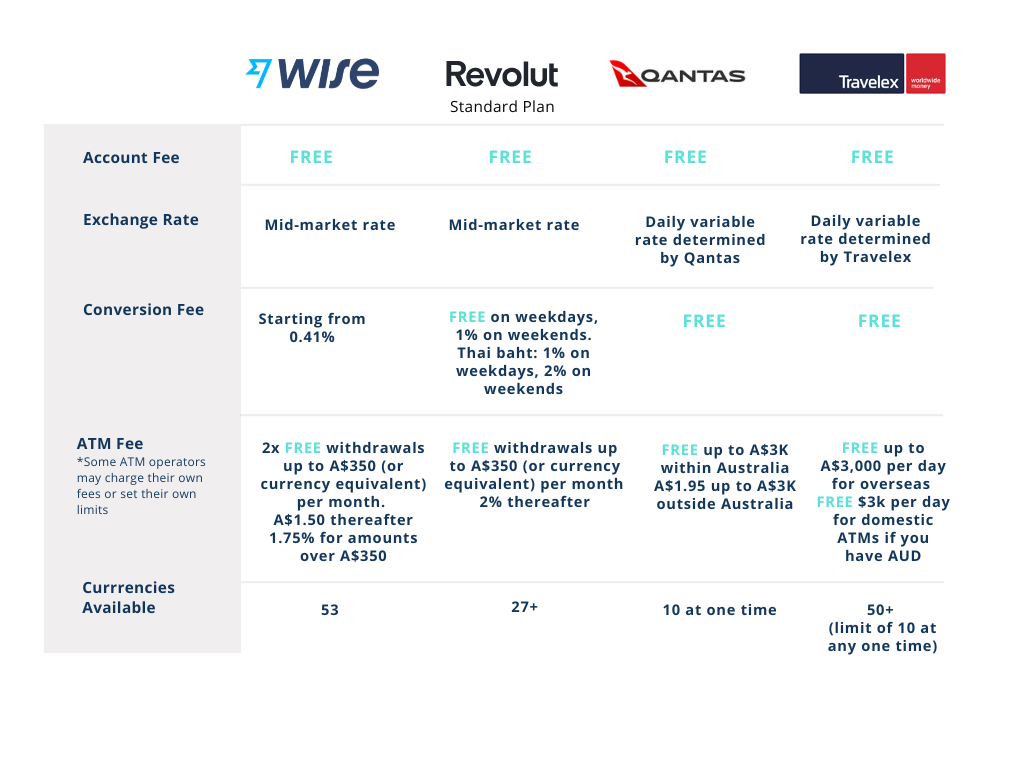

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

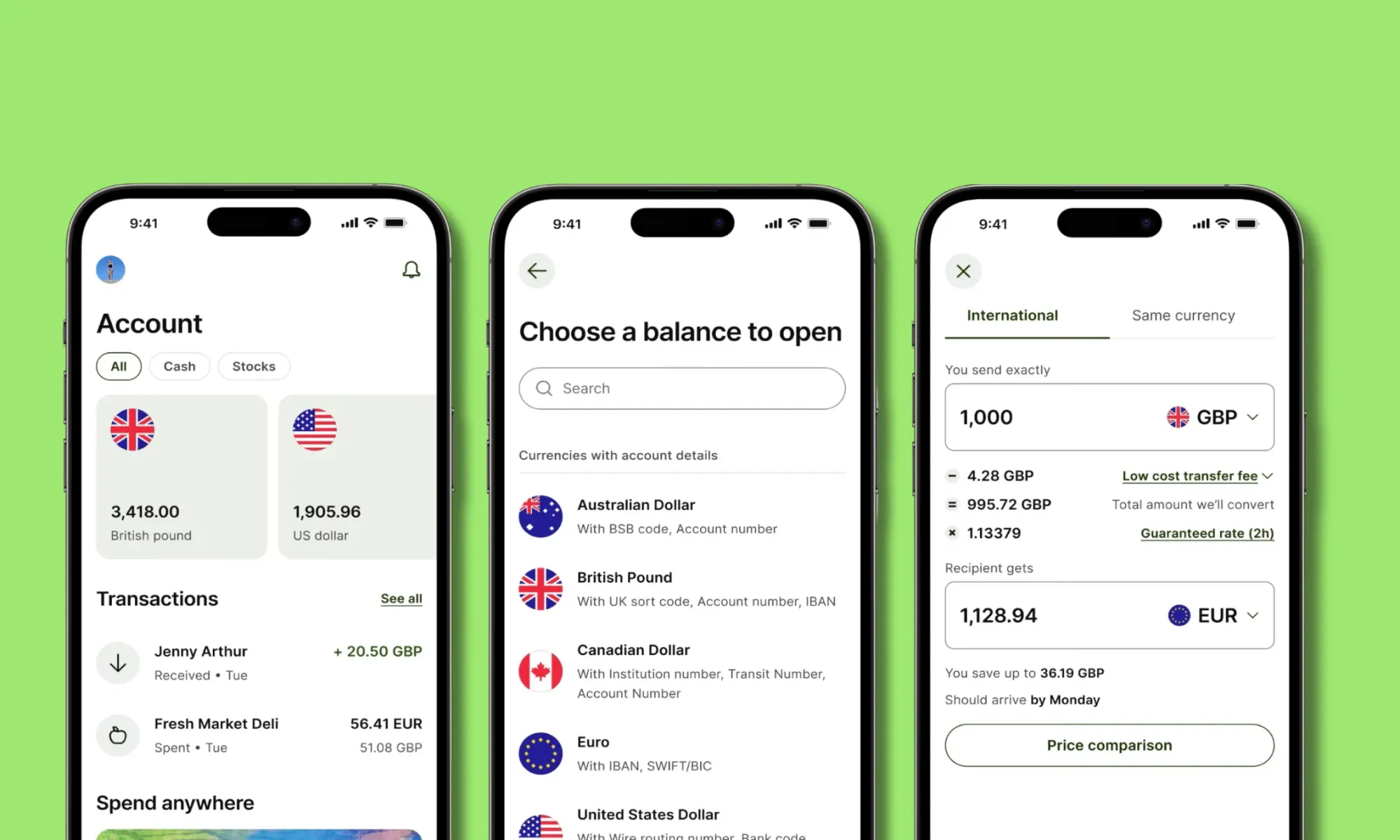

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

The 6 Best Travel Money Cards for Travelling Overseas 2024

If you’re planning on travelling overseas, getting a travel money card can help you cut the costs usually involved in spending foreign currencies.

Travel money cards can include travel debit, prepaid and credit cards, which each work slightly differently, but which all come with features optimised for reducing the costs of spending and withdrawing cash overseas. This guide covers everything there is to know about the different travel card categories, plus we’ll introduce 6 of our top travel card picks so you can see if any suit you.

Wise - our pick for travel debit card when travelling overseas

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee. Top up your account in GBP and switch to the currency of your choice before you travel. All currency conversion uses the mid-market exchange rate, with low fees from 0.41%. Here are some of the pros and cons of the Wise travel money debit card, to help you decide if it’s right for you.

Hold and exchange 40+ currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Travel money cards work much like any other credit or debit card you might have, but are designed to be easy to use when you’re overseas or spending in a foreign currency. You’ll be able to use a travel money card to spend and make ATM withdrawals while you’re travelling abroad, or when you shop online with foreign retailers. Most cards have contactless technology and can also be added to a wallet like Apple Pay for mobile spending, too.

The features you get with a travel money card can vary a lot, but you’ll often find you can hold a balance in multiple currencies, pay low or no foreign transaction fees, or earn cash back and rewards overseas.

What are different types of travel cards?

Travel cards can broadly be split into the following categories. We’ll walk through the features and benefits of each in a moment:

Travel debit cards

Travel prepaid cards

Travel credit cards

Quick summary: Best travel cards for travelling overseas

UK customers can pick from a good selection of different travel card types and providers. This guide includes an overview and in detail reviews of 2 of our favourites from each travel card category to help you choose. Here’s what we’ll be looking at:

Wise travel debit card : Hold 40+ currencies with no ongoing fees, and spend with the mid-market exchange rate with no foreign transaction fee and low conversion costs from 0.43%

Revolut travel debit card : Hold 25+ currencies in one of 4 different plan types, including some with no monthly fee, and some which come with ongoing costs but which unlock more benefits and no fee transactions

Post Office travel money card : Hold 22 currencies, with no fee to spend a currency you hold - 3% fee applies if you don’t have the currency required in your account

Monese travel money card : Hold a balance in GBP, then spend in foreign currencies with no fees, up to your plan’s limit. Different plans on offer, including Simple which has no ongoing fees to pay

Barclays Rewards Visa travel credit card: Spend with the Visa exchange rate, and earn 0.25% cash back, with no foreign transaction fee and no cash advance fee. Interest and penalties can apply

Halifax Clarity Mastercard travel credit card: No foreign transaction fee, no annual fee, and no cash advance fee if you withdraw money at an ATM. Variable interest and penalties can apply

Travel money cards for travelling overseas compared

Here’s a brief comparison of all the cards we’ve picked out - in a moment we’ll also look at each card in more detail.

The good news is that you’ve got lots of different travel cards available in the UK, from specialist providers, banks and card issuers. The right one for you will depend a lot on the way you like to manage your money - but by doing a bit of research you’ll be able to find a good match for your preferences, even travel cards with no foreign transaction fees .

Generally, travel debit cards can be cheap and flexible, but you’ll need to have your travel money saved in advance, so you can top up your account. Credit cards have the advantage that you can spend now and repay later - but are usually more expensive overall between interest and fees. This guide walks through some key points about each of these travel money card types, and proposes a couple of options you might want to check out and compare.

Travel Debit Cards for travelling overseas

Travel debit cards can be ordered online from specialist providers, and are usually linked to a digital multi-currency account. Add money to your account in GBP and then you can either convert to the currency you need in your destination if the card supports it, or just leave your money in pounds so the card’s autoconvert technology can do the conversion for you at the point of payment.

Travel debit cards are generally cheap, secure and reliable, but the exact range of supported currencies, and the way the card fee structure works, can vary a bit depending on the provider you select.

Travel debit card option 1: Wise

There’s no fee to open a personal Wise account , but you’ll pay a one time card order fee of 7 GBP. After that there’s no minimum balance and no monthly charge. Wise accounts can support 40+ currencies for holding and exchange, with low fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account. If the Wise card can’t support the currency you need to spend in your destination, you can just leave your money in pounds and the card will convert for you at the point of payment.

No fee to open a personal Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold 40+ currencies, convert between them with the mid-market rate

Get local account details to receive GBP, NZD, EUR, USD and a selection of other major currencies conveniently

Travel debit card option 2: Revolut

Revolut has a selection of different account tiers for personal customers in the UK, from Standard plans with no monthly fee, to the top end Ultra plan which has a 45 GBP/month fee and comes with loads of perks including a fancy platinum plated card. You can hold around 25 currencies, and convert currencies with the mid-market rate to your plan’s allowance. The higher account tiers also come with extras like various different forms of complimentary insurance, discounts, cash back opportunities and travel benefits. If the currency you need can’t be held as a balance in your Revolut account you can still use your card to pay - just let the card do the conversion for you with the live rate at the time you transact, plus any applicable fair usage fee.

No monthly fee for a Standard Revolut account, or upgrade to one of 4 different account plans which have monthly fees running from 3.99 GBP/month to 45 GBP/month

All accounts have some no fee weekday currency conversion with fair usage fees after that which are 1% for Standard plan holders

Standard plan holders can withdraw 200 GBP overseas per month for free

Hold around 25 currencies

Pros and cons of using debit travel cards when travelling overseas

How much does a travel debit card cost.

Travel debit cards are usually free or cheap to order, and often offer low or no cost currency conversion.

To give an example - Wise has a one time fee to get your card, but then no monthly charges or minimum balance requirements. Currency conversion uses the mid-market exchange rate with low fees from 0.43%. Revolut has 4 different account plans, including one with no ongoing charges, or several different account options with a monthly fee in exchange for extra perks and benefits. Each account has some no-fee currency exchange, but fair usage fees of 0.5% - 1% apply if you exceed your allowance.

How to choose the best travel debit card for travelling overseas?

There’s no single best travel debit card for travelling overseas, the right one for you will depend a lot on the way you prefer to transact and manage your money.

The key things to consider include whether you’re happy to pay a monthly fee for a card or would prefer to have an option with no ongoing fees for occasional use. You’ll also want to look at the transaction costs you’ll need to pay, and what exchange rate is applied when converting currencies.

If you’re struggling to decide whether a travel debit card suits you, the Wise card and the Standard Revolut card both offer no ongoing costs, so are a fairly low risk and low commitment way to test out your options.

Is there a spending limit with a travel debit card when travelling overseas?

You’ll probably find there’s a spending limit for your travel debit card. However, this limit can vary quite significantly, depending on the provider you pick. You can also usually adjust your spending limits for security in the provider’s app which means you can set the limit you’re comfortable with.

For the providers mentioned above, Revolut UK travel debit card holders have some spending caps based on merchant and transaction type. This applies to things like sending money to others, buying travellers cheques or money orders, and betting. Wise caps monthly card spending at 30,000 GBP but you can also move your limit lower if you’d like to, for security reasons.

ATM withdrawals

ATM withdrawals with a travel debit card are also likely to be subject to limits. Revolut applies a 3,000 GBP limit based on any given 24 hour period. Wise ATM withdrawal limits are 4,000 GBP per month. Both providers allow you to make some no fee ATM withdrawals monthly, but the exact amount you can withdraw will depend on your account type.

Prepaid Travel Cards for travelling overseas

[Prepaid travel cards] ( https://exiap.co.uk/guides/best-prepaid-travel-cards ) work in a similar way to travel debit cards, but may have slightly different features and charging structures. The way prepaid travel cards work varies - for example, with the Post Office Travel Money Card, you can collect your card in person at a branch and add any of 22 currencies to it for spending and withdrawals.

The Monese Travel Money Card only lets you hold GBP, EUR and RON, but allows you to spend in foreign currencies with no fees up to a limit specified in your account plan. This range of different functionalities means you can pick the card that works best for your specific needs.

Prepaid travel card option 1: Post Office Travel Money Card

You can order a Post Office Travel Money Card online or pick one up in person at a branch as long as you have a valid ID on you. You’ll be able to top up and hold in 22 currencies, although bear in mind a fee applies if you add money in GBP. There’s no fee to add foreign currencies. The exchange rate used when you top up or convert may include a markup, but once you hold a currency balance in your account you can spend it with no further charges.

22 currencies are supported for holding and exchange

No fee to spend a currency you hold on your card

3% cross border fee if you spend in an unsupported currency

Small ATM withdrawal fee which varies by currency withdrawn, about the equivalent of 1.5 GBP per withdrawal

Manage your account and card from the Post Office travel money app

Prepaid travel card option 2: Monese Travel Money Card

Monese offers several different account plans which come with linked cards you can use while overseas. Depending on the plan you pick you’ll get some free international spending and some free ATM withdrawals. Simple account plans have no monthly fees, but are more limited in terms of no-fee transactions compared to the other account tiers.

Pick the account plan that suits your needs, including a Simple plan with no monthly costs and some plans which do have a fee to pay every month

Accounts offered in GBP, EUR and RON

Simple account plan holders can spend up to 2,000 GBP a month in foreign currencies with no fees - other account plans have unlimited overseas spending with no extra fees

All accounts have some fee free ATM withdrawals every month, with variable limits based on account plan

Virtual cards available

Pros and cons of using prepaid travel cards when travelling overseas

How much does a prepaid card cost.

A prepaid travel card could help you save money compared to using a bank debit or credit card when you travel abroad, but the chances are there will still be a few fees to pay. That could be ongoing monthly fees, currency conversion charges, or fees when you top up, particularly if you top up in cash. Weighing up a few different prepaid travel cards is the only way to decide which is the best value for your particular needs.

How to choose the best travel prepaid card for travelling overseas?

The best prepaid travel card for travelling overseas depends on your spending patterns. The Post Office Travel Money Card has the advantage that you can convert your money to the currency you need in your destination and see your budget instantly. However if you don’t do this, you might end up paying a 3% fee. Monese has different plan types, so has the flexibility to allow you to pick the one you want - but you can’t hold a foreign currency balance aside from RON and EUR.

Prepaid travel card spending limit

The Post Office travel card lets you top up to 5,000 GBP at a time, with the maximum balance at any given time set at 10,000 GBP, or 30,000 GBP annually. Monese accounts may have different limits based on the tier you pick - usually set at a maximum holding balance at any time of 40,000 GBP. You may be limited to spending up to 7,000 GBP a day, depending on your account type.

With the Post Office card, you can make up to the equivalent of 300 GBP maximum daily withdrawals and each withdrawal costs the equivalent of 1.5 GBP. Monese accounts may have a maximum ATM withdrawal of 300 GBP a day, depending on the specific account you pick, so it’s worth reading the fee schedule carefully to understand the details.

Travel Credit Cards for travelling overseas

Travel credit cards are like other credit cards in that you’ll be set a spending limit which you can not exceed on a monthly basis. At the end of the month you’ll have to pay back your bill in full to avoid interest and penalties. When you spend overseas your foreign currency transaction is converted back to GBP to add to your monthly charge - often with a foreign transaction fee added, which can be around 3%. Travel credit cards often waive this foreign transaction fee, which makes them better value for foreign currency spending compared to other credit cards. However, as with any other credit card, you might find you have fees to pay in the form of interest, particularly if you use your card in an ATM, making this a relatively expensive way of managing your money internationally.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa credit card is a good, straightforward option for UK customers looking for a credit card which does not have foreign transaction fees, and which doesn’t have an annual fee. As with any credit card, some costs can apply including interest fees if you don’t clear your bill monthly, but you’ll be able to earn 0.25% cash back on all your card spending at home and abroad.

No annual fee, with 0.25% cash back on card spending

Currency exchange uses the network rate and no foreign transaction fee

No ATM withdrawal fee - but interest can still apply

28.9% representative APR, with penalty fees for late payments

Secure spending with extra protection on some purchases

Travel credit card option 2: Halifax Clarity Mastercard

The Halifax Clarity Mastercard has a variable interest rate which is based on your creditworthiness, but doesn’t use different rates for different transaction types as some cards do. There’s no foreign transaction fee when you spend or withdraw in foreign currencies, but bear in mind that an ATM operator might charge a fee, and interest accrues instantly for cash advance transactions.

No foreign transaction fee when spending or making a cash withdrawal overseas

Interest applies instantly when making cash withdrawals

Same interest rate applies on all purchase categories

Variable APR based on your credit score - you’ll need to check your eligibility online to see the APR you’d be offered

Spending is covered by the Consumer Credit act which means extra protections for purchases from 100 GBP to 30,000 GBP in value

Pros and cons of using credit cards when travelling overseas

How much does a travel credit card cost.

Credit cards are convenient and secure - but they’ll also often be the most expensive way to pay for things. That’s because you may end up paying an annual fee, interest costs, foreign transaction fees, cash advance charges, and penalties if you’re late to repay. The cards we’ve picked out above have the advantage that they have no annual fee, no foreign transaction fee and no cash advance fee - but if you use your card in an ATM you’ll start to accrue interest instantly, which does mean paying more in the end.

How to choose the best travel credit card for travelling overseas?

The best travel credit card for travelling overseas depends on your preferences and situation. Because there’s an eligibility screening process with credit cards, you may find you can’t get approved for some cards if you don’t have an established and strong credit history. It’s generally worth looking for a card with no annual fee, and the lowest available interest rate, just in case you can’t always repay your bill monthly.

Travel credit card spending limit

Your travel credit card spending limit will be set by the card provider, and will depend on your credit score. You’ll be shown details of your spending limit when you’re approved for a travel credit card.

The cards we’ve looked at earlier don’t charge a cash advance fee, but this is a common cost when using a credit card at an ATM, so worth looking out for when you select any credit card. It’s also worth noting that it’s very common for ATM withdrawals to start accruing interest instantly, so you’ll end up needing to repay some charges whenever you use your credit card in an ATM.

How much money do I need when travelling overseas?

Naturally, the costs of your trip can vary wildly depending on where you’re going, how long for, and what you’ll be up to during your holiday. Costs to consider when budgeting include:

Any visa fees, or travel health costs such as vaccinations, if required

Travel or medical insurance

Flights or other travel costs - don’t forget to buy baggage allowance in advance if you need it

Travel to and from the airport, or parking if you drive yourself

Local SIM or roaming data

Accommodation, plus any local tourist taxes

Food and drinks while you’re away

Activities and entry costs to tourist sites

Travel within the country - taxis or bus rides for example

Kennels or any other requirements to look after pets back home

Conclusion: Which travel money card is best for travelling overseas?

Travelling overseas is exciting but does need a bit of planning. In particular, working out how you’ll manage your money while you’re away is essential if you don’t want to get ripped off by poor exchange rates, pay high fees, or end up having a stressful time with money changers on arrival.

Travel cards can help you avoid all these potential pitfalls, manage your travel budget flexibly, and pay less for your trip in the end. Consider a Wise travel debit card for convenient, low cost spending and withdrawals with ways to pay and get paid in foreign currencies. Or as an alternative, check out a Monese travel prepaid card for free currency conversion to your specific plan limit, or a travel credit card like the Barclays Rewards Visa for cash back opportunities and ways to spread your costs over several months if you need to. No matter what type of travel card suits you best, there’s going to be an option for you - use this guide to figure out which is your perfect match, and your travel money could take you further in the end.

FAQ - Best travel cards for travelling overseas

Can you withdraw cash with a credit card when travelling overseas.

Yes. You can use your credit card to make an ATM withdrawal at any ATM where your card network is accepted when travelling overseas. However, bear in mind you’ll pay interest instantly when you use a credit card in an ATM. Choosing to withdraw with a low cost travel debit card from Wise or Revolut may bring down your overall fees.

Can I use a debit card when travelling overseas?

It’s unusual to find you can’t use a card to pay in tourist areas in more developed countries, towns and cities. However, card usage varies widely and in many places, cash is still king. Because of that, having multiple ways to pay is essential and carrying both a prepaid or travel debit card and some foreign currency in cash is a smart plan.

Are prepaid cards safe?

Yes. Prepaid cards are not linked to your normal UK bank account which means that they’re safe to use. Even if you were unlucky and someone stole your card while you're travelling overseas, they would not be able to access your main account - and you could freeze your prepaid card in the app easily if you needed to.

What is the best way to pay when travelling overseas?

Paying for things with a specialist travel debit, prepaid or credit card when travelling overseas is most convenient. However, having a few options for payment is a good plan, just in case your preferred payment method can’t be used for some reason. Consider getting a travel card from a provider like Wise or Revolut, which has some no fee ATM withdrawals so you can also conveniently get cash as a back up, and for when card payments aren’t offered.

- United States

- United Kingdom

In this guide

Restrictions

Your reviews, ask a question.

- Wise Travel Money Card Review

This physical and virtual travel money card lets you hold over 40 currencies, with 2 free ATM withdrawals up to $350 a month and a one-time $10 activation fee.

Wise Travel Money Card supported currencies

- Australian dollars (AUD)

- Canadian dollars (CAD)

- Chinese yuan (CNY)

- Emirates dirham (AED)

- Euros (EUR)

- Great Britain pounds (GBP)

- Hong Kong dollars (HKD)

- Japanese yen (JPY)

- New Zealand dollars (NZD)

- Singapore dollars (SGD)

- Thai baht (THB)

- United States dollars (USD)

Complete list of supported currencies

You'll also typically be able to use the Wise Travel Money Card in most countries and regions around the world, with any business that accepts Mastercard/Visa. But places where your card won't work include Cuba, Iran, Iraq and Myanmar.

Features of the Wise Travel Money Card

- Support for over 40 currencies. The Wise Travel Money Card lets you hold and spend in a wide range of currencies, which can make it easier to keep track of your spending and budget.

- Competitive exchange rates. Wise uses the mid-market rate for exchanges so you get the same rate that's typically listed on Google, Bing and other search engines.

- 2 free ATM withdrawals per month. Wise won't charge an ATM when you withdraw up to AUD$350 over 2 or less transactions in a month. After that, you'll be charged fees worth AUD$1.50 and 1.75% of each withdrawal.

- Instant virtual cards. You can get up to 3 virtual cards linked to your Wise account to keep track of different types of spending. You'll also be able to start using your virtual card as soon as you've set up your account by adding it to Apple Pay or Google Pay.

- Plastic card. You'll also get 1 plastic card sent to you, which you can use for in-person payments anywhere Mastercard/Visa are accepted.

- Wise app. The Wise app lets you top up and convert currency in real time, so you know exactly how much you'll have in any of the supported currencies. You can also freeze your card, organise a new one and manage other account features.

How much does the Wise Travel Money Card cost?

- Application fee. A one-time $10 fee applies when you first get this Wise card.

- ATM fees. After the first $350 of withdrawals in a month, a fee of 1.75% applies. You'll also pay a $1.50 fee for each ATM withdrawal after the first 2 you make in a month.

- Load fees. There is no fee to load funds on by bank transfer from Australia. But a fee will be charged for loading funds by debit card, credit card or SWIFT. The exact fee will be shown on your Wise account when you select "Add Money".

- Currency conversion. If you're spending in a currency that's not loaded onto the card, there will be a fee to convert it. The fee starts from 0.43% of the transaction value and varies by currency.

- No currency order. Unlike many prepaid, multi-currency travel cards, Wise does not have a set drawdown order when you're spending in a currency not loaded on your account. Instead, the funds will be taken from the balance that has the lowest currency conversion fee.

- Funding other accounts. If you use your Wise card to fund an e-wallet, cryptocurrency account, betting account or any other account that may be convertible to cash, a 2% fee applies.

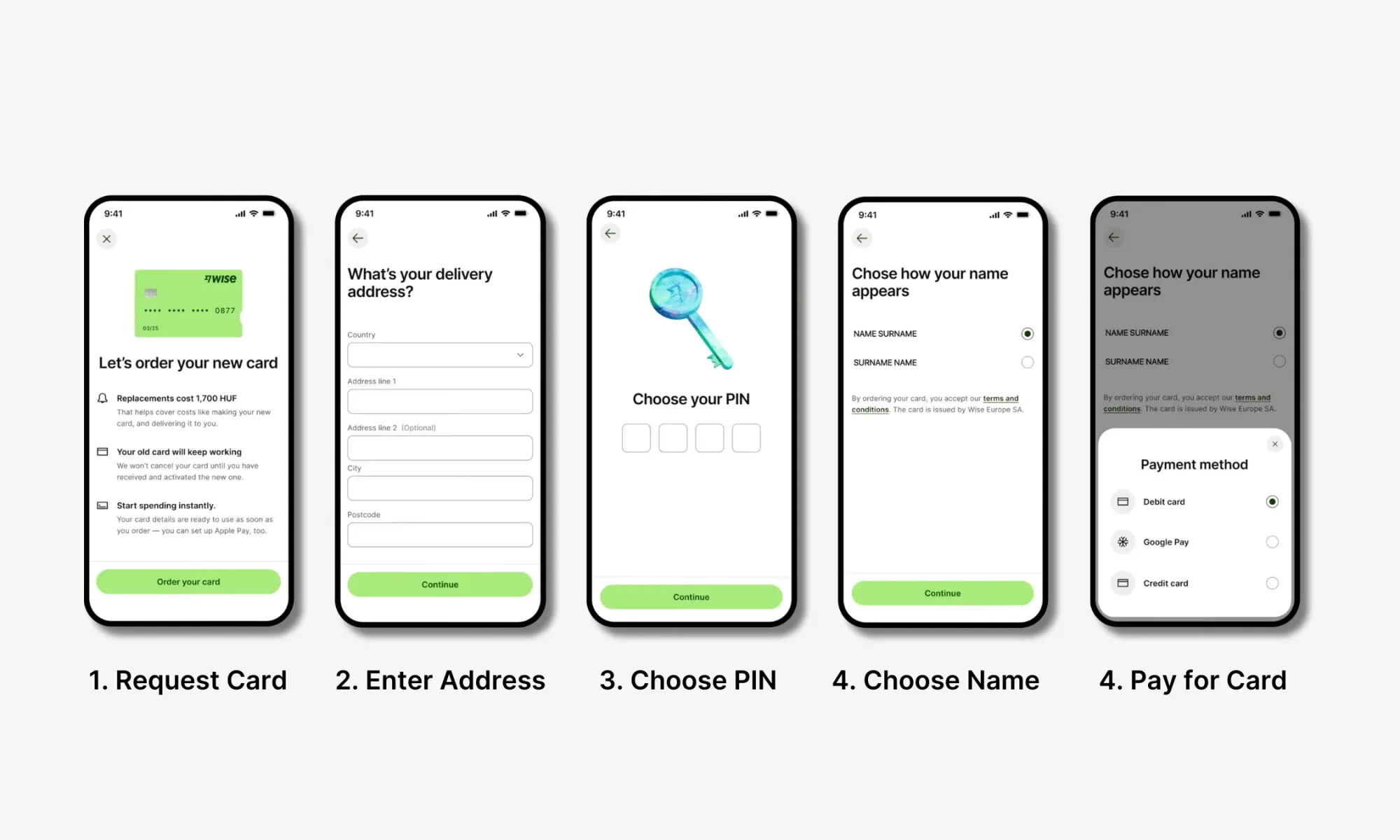

How to apply for the Wise Travel Money Card

If you already have a Wise account, you can order a Wise Travel Money Card in a few minutes by logging into your account.

If you're new to Wise and over 18 years of age, you can get this card by following these steps:

- Sign up and add your first balance to the account.

- Request a card through your account and follow the prompts to verify your identity.

- Set up your virtual card/s and activate the plastic card when it arrives in the mail.

You can use the virtual cards instantly. And after you've activated the plastic card, you can use it to spend the funds loaded on your Wise account around the world and online.

- Wise Travel Money Card information PDF

- Wise Travel Money Card TMD

To ask a question simply log in via your email or create an account .

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

- Debit cards

- Revolut travel account review

- South Korea

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Wise Travel Card Review [2024]

In a Nutshell

A market leader for exchange rates and transparency, the Wise card is one of the best prepaid cards for travel and great for making purchases overseas or online in a foreign currency. Fees apply if you go over the ATM limits. Includes a convenient app and virtual card.

Wise Travel Money Card

- Best Excellent exchange rates

- Worst High ATM fees

- The best exchange rates for a travel card

- No annual fees

- Top up on the go in seconds

- Low conversion fees that are clearly labelled

- Ability to preload up to 53 currencies including USD , CAD , SGD , JPY , EUR and more

- Ability to freeze your card via the app should it get lost or stolen

- Track your spending via the app (great if you've got a travel budget)

- Can use digitally with Apple Pay and Google Pay

- One of the most popular travel cards with over 4 million global users

- Customer support can be slow

- No interest on your balance

- Card delivery may be slow (but you can use the digital card straight away)

- If you withdraw over $350 AUD anytime from an ATM, you will be charged an additional 1.75% of the amount

- After the first two free under $350 AUD ATM withdrawals for the month, a $1.50 fee applies per additional withdrawal

The Wise card (formally TransferWise) removes the money headaches we associate with frequent travelling by making it easy to load and spend a huge range of currencies overseas.

Hands down, it is one of the best cards for overseas travel . No other travel card or debit card offers the same low fees and mid-market exchange rates as Wise. However, charges can add up if you need to withdraw large sums of cash from ATMs.

The average Trustpilot review for Wise is 4.3 stars (from 191,128 users on 14 June 2023).

The most common complaints by users are occasional delays to receive the card, along with poor customer support — although these customers are a minority. 84% of reviewers rate Wise 5 stars.

What is the Wise Travel Card?

The Wise card is a prepaid debit card attached to your Wise multi-currency account . Available as a Mastercard or Visa travel card, it allows you to:

- Makes purchases from 175 different countries

- Transfer money to international bank accounts

- Receive money from overseas in your currency using local bank account details with no fees

- Load up multiple currencies and pay like a local while you’re abroad

Note: Wise is the same company as TransferWise, just with a new name (as of 2021). The Wise multi-currency account used to be called the Borderless account. Nothing else has changed — the debit card remains the same.

How it works

The Wise travel card works just like a normal debit card.

You can use it almost anywhere around the world to withdraw money, make contactless purchases in shops and cafes, pay for accommodation, and shop online.

You can load and hold up to 53 currencies in your Wise account.

If you have the local currency for a payment, the card will use it. If you don’t have the right currency, Wise will convert one of your other currencies for you at the best rate.

Natalie lives in New Zealand and travels to Europe. In her Wise account, she adds euros, British pounds, and New Zealand dollars . She uses her Wise debit card throughout the trip.

In the UK, purchases are automatically deducted from her balance of pounds . In Europe, Wise directly debits purchases from her euros balance.

Towards the end of the trip, Natalie wants to buy a handbag for 500€ but she only has 200€ left in her euros balance, alongside £400, and NZ$1,000.

She can still make the purchase. In this case, Wise deducts the final 200€, then finds the best conversion rate into euros from British pounds or New Zealand dollars. It then converts that currency into euros to complete the purchase.

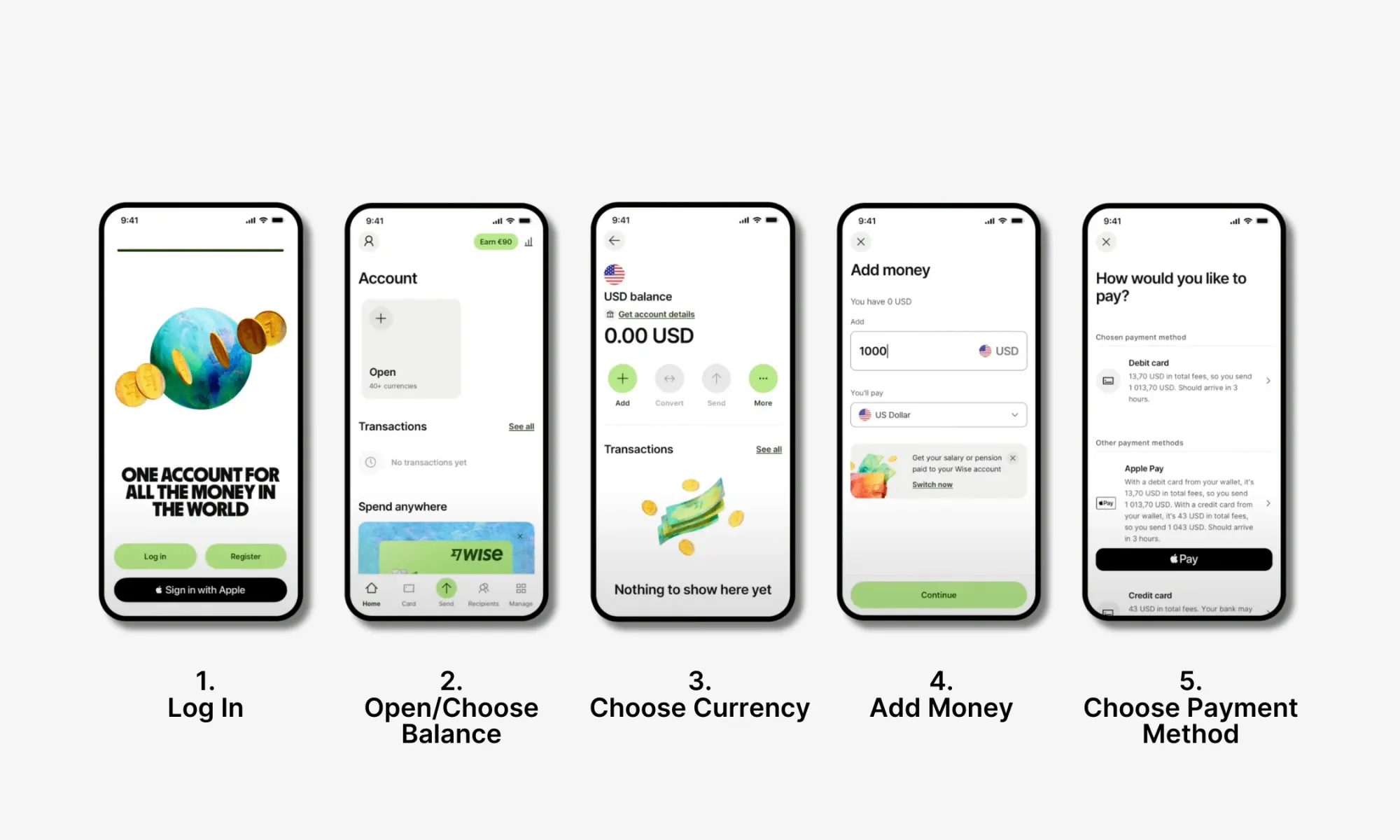

Adding money to your Wise debit card

The Wise app makes it easy to add money to your debit travel card . Just open the app, choose the currency and amount you want to add, and select your payment method (such as a bank transfer or by card).

You can hold and convert money in 53 currencies:

Wise spending limits

For fraud prevention and extra security, spending limits apply to the Wise debit card. These limits depend on where you got your card.

The card has default limits but you can adjust them to your own spending habits in the app or online. a

The table below lists the maximum limits allowed for Australian, New Zealand, and Singapore cardholders (in AUD, NZD, and SGD respectively).

Wise debit card fees

The Wise website declares that their travel card can help you save up to 85% when you spend internationally thanks to a better exchange rate and lower fees compared to banks.

Of course, fees are unavoidable but Wise makes sure to keep them competitively low.

While it’s free to create a multi-currency account with Wise (formerly TransferWise), other charges will be associated with the card, including:

- Card issue and replacement fees

- Currency conversion fees

- ATM withdrawals fees (beyond 2 withdrawals per month)

Currency allowances

Australian customers can hold a large amount of money per currency for free in their Wise balances. The allowance varies depending on the currency but is roughly equivalent to A$23,000 per currency.

If you exceed the maximum allowance per currency for more than 3 days, you’ll be charged an annual fee of 0.4% for Euros and 1.6% for all other currencies. This is charged as a daily fee for every day in the month you hold over the allowance.

For example, if you hold A$24,000 in your account for a month, you will be charged approximately A$1.30 at the end of the month for the excess A$1,000.

Wise card exchange rates

The beauty of the Wise travel card is that it can hold more than 50 currencies so you don’t have to worry about high conversion fees for every purchase.

If you don’t hold the local currency for a purchase, Wise will use whichever currency you have that has the lowest conversion fee.

Here’s where it gets good.

Wise gives you the mid-market exchange rate for any currency conversions — a rate that is typically better than the exchange rates provided by banks or other travel card companies.

If you have the right currency for a payment, you avoid the conversion fee altogether.

Card Provider

Exchange rate.

A$ → GBP (11 am 09 December 2022)

Conversion Fee

Loading A$1000

$4.38 (0.44%)

No fee on weekdays

How it compares

Get your card

You can apply for a Wise card if you live in one of the eligible countries (including Australia and New Zealand). View eligible countries here.

To get your Wise card, it takes just a few simple steps:

Get a Wise multi-currency account for free online or via the Wise (formerly Transferwise) app. You’ll need ID.

Add money to your account

To be eligible for the card, you’ll need to add a minimum of US$20 to the account. This will cover card issuing fees.

Order your card

Apply for your card on the website’s Card tab or the Wise app’s Account tab.

Activate your Wise card

There are different ways to activate your Wise card depending on whether it’s a Visa or Mastercard.

If it’s a Visa card, you can activate it by entering your PIN in the first transaction you make in a physical store or ATM. If it’s a Mastercard, you will need to go online and enter the 6-digit code provided to activate it.

Wise virtual card & app

Wise has fully embraced the digital age with an easy-to-use smartphone app and access to virtual cards — all designed to banish money and currency confusion in an increasingly connected world.

The app (available on Apple and Android) has everything you need to create an account, get your Wise card, and manage it while you’re globe-trotting.

Once you sign up for a Wise multi-currency account and place an order for the physical card, you can have up to 3 Wise virtual cards connected to your account at the same time.

These free digital cards only exist on your phone and are easy to get through the Wise app or website. They’ll have different details to your physical card and are a great backup option.

Wise virtual cards work with Apple Pay, Google Pay, and Samsung Pay and can be used to make payments online, in-store, and overseas.

The best bit? You can start using your virtual cards immediately — no need to wait for your physical card to arrive.

Importantly, the Wise card is not a travel credit card . You must have money in your account to make a purchase. If you don’t have enough funds, the transaction will be declined.

Your Wise card could take anywhere from 3 working days to 3 weeks to arrive, depending on where you live. However, you can set up your digital card on your phone to use immediately.

The Wise card offers 2 withdrawals of up to A$350 each month for free and A$1.50 per withdrawal after that.

If you need to withdraw more than A$350, you will incur a 1.75% fee on the amount withdrawn — plus the A$1.50 withdrawal charge if you’ve already made 2 ATM transactions that month.

The maximum amount you can withdraw in a single transaction is A$1,750. The maximum daily withdrawal is A$2,700 while the monthly maximum is A$7,000 (the default monthly maximum is set at A$5,250 but you can change this in-app).

Contactless is a common form of payment across Australia, Europe, the UK, New Zealand, Japan, Singapore, and Canada.

Wise enables contactless payments with both your physical Wise card and your Wise virtual card (accessible on Google Pay, Apple Pay, Samsung Pay, and more).

There are different payment limits for cardholders in different countries. In Australia, the limit for single contactless payments is A$900. The daily limit is A$1,750 (set at a default of A$900) and the monthly limit is A$7,000.

As an extra security measure, you may be asked to enter your PIN if you’ve made a lot of contactless payments in one day or you’re making a purchase over a certain amount.

You can also pay with a chip and PIN or with the magnetic stripe where possible — different payment limits apply to these payment methods. View payment limits here .

When it comes to your money, safety is paramount. Wise knows this, which is why it has several safety guarantees.

To start, Wise encrypts any information you give them to protect sensitive data and follows strict guidelines for international money transfers.

Safety measures include the ability to freeze and unfreeze your card any time — helpful if you misplace it — and the option to receive instant transaction notifications to track purchases.

The Wise debit card also allows for 3D Secure (3DS) payments, where some transactions require verification through the Wise app, SMS, or a phone call.

As a company, Wise has an Australian Financial Services Licence and is regulated by the Australian Securities and Investment Commission (ASIC). It is also registered overseas with the UK Financial Conduct Authority and the Financial Crimes Enforcement Network (US), among other financial institutions.

It’s worth remembering that the Wise multi-currency account isn’t like a bank account and safeguards your money differently — the company is completely transparent in how it does this .

The Wise card is designed to be used just like a debit card, which means you can use it to withdraw money from any ATM that accepts Visa or Mastercard — with some exceptions.

You can make 2 free monthly withdrawals (up to A$350) each month. After that, there is a withdrawal fee of A$1.50, plus a 1.75% fee on withdrawals over A$350.

Wise cards issued in Singapore or Canada cannot be used for ATM withdrawals in the country of issue. But you can still use them for ATM withdrawals overseas.

For Wise debit cards issued in Japan, you can only withdraw from certain Japanese ATMs (including AEON, Family Mart, Viewcard, and Daily Yamazaki).

If your Wise card is lost or stolen, the first step is to freeze your card temporarily via the Wise website or app.

Freezing the card means it can’t be used for purchases or withdrawals so you can protect your balance. If you find your card, you can unfreeze it online.

If you can’t retrieve your old card, you can order a replacement card through the Wise app or website. There’s a small fee of A$6 for card replacements.

Wise will block and cancel your old card and ship the new one to you. It will take anywhere from 3 working days to 3 weeks for your card to arrive, depending on your location.

While you’re waiting for your replacement card to arrive, you can use a virtual card. Wise allows you to have up to 3 virtual cards at any given time.

Learn more about the best travel money, debit and prepaid cards for travel

Prepaid Travel Card

Best Travel Money Cards

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments