Your screen resolution or Browser size is below the minimum required. 300 x 430 pixels

| VISIT VISA INSURANCE

Policy details.

Dear Customer please note,

- • Insurance Policy will be issued for visitors in KSA seeking for their visit visa extension.

- • Enter correct passport number, Visa and border number details for successful upload of insurance policy in CCHI.

Policyholder Details

(*) Mandatory

Health Conditions

1. Any hospital admission during the last 12 months

2. Have you been diagnosed with any of the following chronic disease limited to: Autism - Benign Tumor - Cancer - Heart Diseases - Chronic Hepatitis C - Gallstones - Kidney failure - Urinary tract stones - thyroid goiter - Cysts – fibroid uterus - Hernias – autoimmune diseases or Multiple sclerosis.

3. Have you been diagnosed with any of the following congenital disorder or hereditary diseases limited to: Cerebral - palsy - sickle cell disorder - Thalassemia -hemophilia - metabolic diseases - Hydrocephalus - spinal - muscle atrophy - gential - malformations - Chromosomal abnormalities - Gauchers disease - G6PD Deficiency - cystic fibosis - hemochromatosis – Wilson disease - polycystic Kidney Disease.

4. Have you been diagnosed with any of the following eye disease limited to Cataract - Glaucoma - Corneal diseases or Retinal diseases

5. Have you been diagnosed with any of the following bone disease limited to Vertebral disc prolapse-Scoliosis - Arthritis or Ligament tears

Pregnant Females only

Summary and Payment

Product summary.

- Product Product Name

- Passport Number Passport Number

- Policy Start Date 12/12/2020

- Policy Expiry Date 12/12/2020

- Insurance Premium SAR

- Promotion Disc. SAR

- Total Insurance Premium SAR

- Value-added Tax (15%) SAR

- Total Amount SAR

Payment Details

Select payment method debit/credit card..

Please enter the OTP code that was sent to your mobile number

You can resend the OTP code in 2:00 mins in case you did not receive it yet. Send Again

- Latest News

- Jawazat and MOI

- Driving in KSA

- Absher Account

Check Iqama insurance status on CCHI

Navigate here 👇

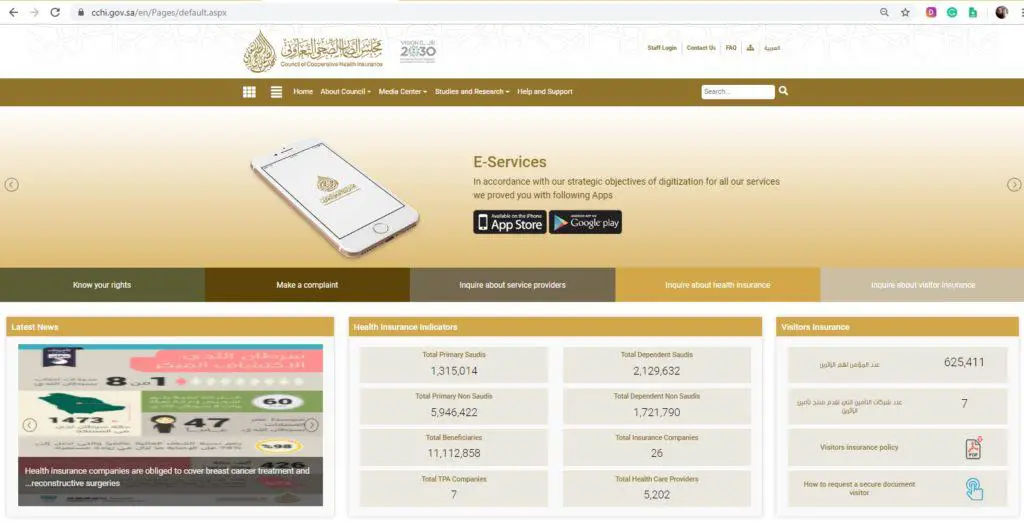

Iqama holders and visit visa holders can check the health insurance status or expiry date of insurance on the CCHI website in KSA. Here is the procedure.

Check Iqama Insurance status on CCHI.

You can check the health insurance status of iqama holders through the CCHI website.

- Open the CCHI website .

- Enter the Iqama Number .

- Write the captcha code.

The system will show you insurance details, including the class, deductible percentage, policy number, beneficiary number, and expiry date.

Check Iqama Insurance expiry date

To check the health insurance expiry date of an iqama holder through Absher,

- Log in to your Absher https://www.absher.sa/

- Click on the “ Family Members ” tab.

- Select the “ Inquiries ” option.

- Click on the “ Query Health Insurance “.

- Select the Family Member from the dependents list.

- The Absher will show you the Health Insurance expiry date.

Check Visit Visa Insurance

You can also check the insurance validity of a family visit visa holder through the CCHI website.

- Enter the Passport Number .

The system will show the name of the health insurance company, the medical insurance type, the issue date, and the validity status of the health insurance of the visit visa holder.

Check Tourist Visa Insurance

You can also check the insurance validity of a tourist visa holder through the CCHI website.

The system will show the name of the health insurance company, the medical insurance type, the issue date, and the validity status of the health insurance for the tourist visa holder.

For the latest updates, you can join our ✅ WhatsApp group or ☑️ Telegram Channel .

Never pay the full price🏷️; join the 📢 Saudi Coupon Codes group and get sales updates and discount codes in one place.

RELATED ARTICLES MORE FROM AUTHOR

How to reset nafath login password, how to get traffic accidents report from absher, how to get traffic violation info report from absher, how to get vehicle info report from absher, how to check/verify absher reports, how to get umrah performance certificate.

The Guide To Health Insurance For The (New) Saudi Visit Visa

Do you need health insurance for a saudi visit visa.

Health Insurance is required for a 1. Single and 2 . Multiple Entry Visit Visas whether it is for Family , Umrah , or Tourist visas.

The Multiple Entry Visit Visa can be extended. (See extension periods below).

What Is The Cost Of The Insurance For The Saudi Visit Visa?

The cost of the Saudi Visit Visa insurance is between SR 30 and SR 100 SR.

The price depends on age, sex, and medical background of the applicant. The cost will depend on the information you enter in the disclaimer form when you apply for the insurance.

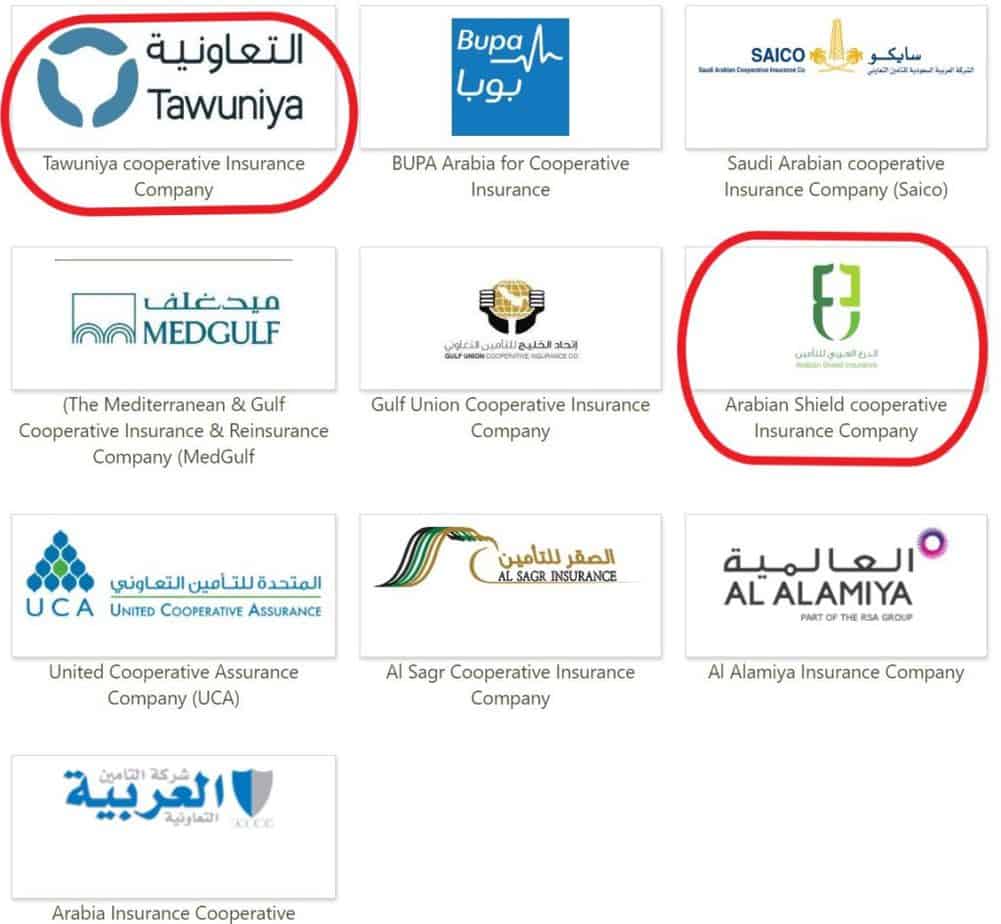

Who Provides Health Insurance For A Saudi Visit Visa?

There are 32 Saudi insurance companies in operation in Saudi Arabia but ONLY 7 are authorized by the Ministry of Health to sell health insurance for the purposes of a Saudi Visit Visa . They are circled in red in the photos.

Click on the following links to compare quotes for the Saudi Visit Visa.

Compare insurance company offers before you buy the Saudi Visit Visa insurance to get the best offer.

What Does A Saudi Visit Visa Health Insurance Cover?

It is travel insurance that only covers treatment for emergency cases. When you are in the kingdom, you would use it in the case of emergencies, traffic accidents, repatriation after death, dental, dialysis, problems of pregnancy problems and injuries through accidents, etc.

However, the costs of normal childbirth must be met by the family visit visa holder.

Costs are covered for expenses up to a maximum of 100,00 SR . Policy limits are set in the contracts for cases of hospitalization, hospital rooms, doctor and nursing services, and life support limited to 600 SR per day.

Included also are scans, X-rays, lab tests, etc.

Medication is NOT included in the policy. The specific conditions are given in each individual the insurance policy.

Treatments Covered :

Treatments not covered: , how much does health insurance cost for a saudi visit visa.

There is a criterion for insurance costs depending on the age, sex and medical background of the visitor applicant. Currently, the prices are between 30 SR and 100 SR.

You apply online or go to a branch that offers travel insurance for the Saudi Visit Visa that will allow you emergency treatment at any one of the Healthcare providers (see list below) above) and those authorized by the Ministry of Health.

How Do You Register with Your Choice of Insurance Company ?

First, compare and choose your medical insurance provider. Then, visit a local branch or apply online.

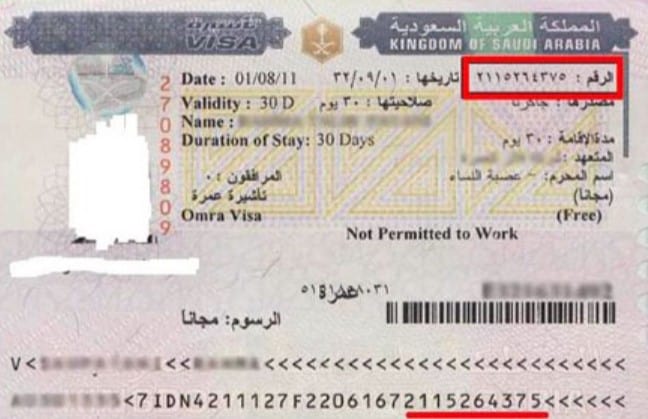

- Enter Your Personal Details

- Enter Visitor Passport Holder Number

- Enter Saudi Visit Visa Holder Number

- Enter the Border Number in Passport

- Pay the Fee

- Print off the Insurance Policy

Your Saudi Visit Visa Insurance is issued to you!

If later you wish to extend the coverage for a Multiple Entry Saudi Visit Visa you can log in again at the same Insurance company website and click through to process the visit visa extension.

How Do You Check Or Download A Saudi Visit Visa Certificate?

Your insurance company should provide you with a web link where you can check and download a policy certificate.

You will need to enter

- Passport Number

- Capture Text/ or Number

How do you check for Medical Insurance Validity for a Saudi Visit Visa?

This Is How You Do It.

- Choose Inquire About Visitor Insurance

- Then click Service Link

- Enter Visitor Passport Number & Captcha Code

Your medical insurance details and expiration dates will be shown on the screen.

How Do You Extend The Saudi Visit Visa?

Check your insurance company website. They can extend your Saudi Visit Visa online or at a branch. You must apply at least 6 days before the expiration date of the Saudi Visit Visa insurance to avoid complications.

To do this, they require the following:

What Are The Possible Extension Periods?

How do you get emergency medical treatment.

Find out which is the closest hospital to you which can provide treatment based on your Saudi Visit Visa insurance. The hospital should belong to the network of government-appointed health care providers in Saudi Arabia.

You need 2 things:

- Visit Visa Insurance Certificate

- Valid Passport

The hospital may have to contact your insurance company to get approval beforehand for certain treatments.

Your insurance policy provider MUST respond and make their approvals for treatments within 1 hr or 60 minutes after being contacted.

How Do You Make A Claim For Reimbursements?

After treatment has ended and to make a claim for reimbursements of medical treatments this is what you should do.

- Complete a Reimbursement Form (From Insurance Company website or branch)

- Obtain Lab Results, Scans or X-ray Reports (If applicable)

- Get Itemized Invoices and Receipt of Hospital Payments

- Obtain Detailed Medical Report from Hospital

- Get Original Doctor’s Medical Prescription

- Make a Copy Of Patient’s Passport

- Enter Visa Entry Number

- Provide The Certificate Of Visit Visa Insurance

Reimbursements will be settled in cash and will only cover emergency treatment according to the standard rate of charges at any hospital which is part of the network of appointed healthcare providers in Saudi Arabia. (See below)

How To Check Up On A Claim After It Is Made

At your insurance company branch or online portal choose Claims then enter the Policy Number .

See the following example of how to check a claim at Tawuniya Insurance Portal.

How Long Will I need To Wait After A Claim Is Made?

If you provide your insurance company with all the required documentation, they can process the claim within two weeks.

What If I Need To Challenge Or Complain About My Insurance Company?

If you enter into a dispute or need to challenge decisions made by your insurance company or your healthcare provider contact the online Council of Cooperative Health Insurance ( CCHI ).

After making a complaint, you have three days to gather all the necessary documents, so it is better to make your complaint at the beginning of the working week on Sunday or Monday to ensure you have enough time to collect the required documents from the hospital or healthcare providers.

Which Hospitals and Clinics Provide Emergency Health Care for Saudi Visit Visa?

The following list contains a detailed list of 4772 hospitals or healthcare centers that provide emergency services for holders of the Saudi Visit Visa insurance.

The list is in Arabic ONLY and you can search for the nearest healthcare provider to you by clicking on the region and city columns. The sheet can be translated in Excel . Click Review, then Translate .

Each entry contains the name of the Hospital, Health Center or Medical Supplies together with their contact details.

Which Is The Best Insurance Company For Saudi Visit Visa Insurance?

Below is a ranking of the best 30 insurance companies operating in Saudi Arabia. This ranking is based on income/turnover ONLY. It does not include customer service or payouts to policyholders.

We would love to hear from you to get feedback about these companies especially of you have made claim with any one of them. How do you rate your insurance provider and what specific issue you have had with them?

To let me know your experience contact Inside Saudi admin at [email protected].

Do You Need Help In Applying For Visas or Insurance?

Also, the process of applying for a visa and insurance is a bit complicated. So at Inside Saudi, we offer consultancy services to assist you in applying for travel visas and insurance.

Our consultants are experts in these matters, have contacts with passport officials and can produce quicker results.

Email us with your query and find out the rates at [email protected].

Salam Allekum! Hi there! Thanks for reading. Contact the Editor Mohammed Francis directly at [email protected] with any questions or queries.

Mohammed Francis

I am a UK national, a college teacher, father of 3, writer and blogger.

Recent Posts

Can Muslim Women Wear A Towel As Head Cover (Hijab)?

One day, a Muslim woman wrote me an email to ask if Islam permits women to wear a towel on their heads as an Islamic head cover (Hijab). She explained that she was going on vacation with her...

5 Reasons Women Should Take A Guardian (Mahram) To The Pilgrimages Hajj or Umrah

Today, Saudi Arabia allows Muslim women to do an Islamic pilgrimage (Hajj / Umrah) without a chaperone (Mahram). However, for centuries, it was not possible. A male relative had to accompany...

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Best Medical Insurance for Visitors to the U.S. (2024)

U.S. visitors can get travel medical insurance for as low as $89 per trip.

with our comparison partner, Squaremouth

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Seven Corners, WorldTrips, IMG and Trawick offer the best health insurance plans for visitors to the U.S.

In this guide, we’ll provide you with details on travel health insurance plans from these providers, including example quotes, information on how to use your visitor health insurance and more.

Do Visitors Need U.S. Health Insurance?

While health insurance is not always mandatory when traveling to the U.S., regulations may vary depending on the circumstances around your visit and your visa needs. In addition, health plans from different countries are generally not accepted in the U.S., which means you could pay thousands of dollars out-of-pocket for treatment in an emergency without a valid plan.

Note that many foreign visitors traveling to the U.S. do not need a visa to enter the country for less than 90 days. However, some visa requirements for long-term visitors require health insurance coverage for the duration of their stay. Regardless of the requirements for your travels, it’s worth considering a travel medical insurance plan based on the high cost of U.S. healthcare. According to GoodRx, an emergency room visit can cost upwards of $2,400 to $2,600 without insurance in the U.S.

Health Insurance Requirements for People Visiting the U.S.

While tourists do not technically need a travel medical insurance plan to obtain a visa, other types of visitors do. For instance, if you’re a student planning to study abroad in a U.S.-based college or university using an F-1 or J-1 visa, you’ll likely need some sort of health insurance or a comparable equivalent. Many universities that accept students on visas require medical coverage that complies with the school’s outlined health insurance requirements.

Note that health insurance requirements for visitors to the U.S. largely depend on the type of visa you need to enter the country. Regardless of whether it’s required, we recommend medical insurance based on the high costs of U.S. healthcare services.

Best Travel Health Insurance for Visitors to the U.S.

Our team has spent extensive time researching the best travel medical insurance plans for visitors to the U.S., considering factors such as availability, coverage, customer support and provider reputation.

- Seven Corners Travel Medical Basic : Our pick for group travelers

- WorldTrips Atlas America : Our pick for high coverage limits

- IMG Patriot Lite : Our pick for budget coverage

- IMG Patriot America Plus : Our pick for continuous coverage

- Trawick Safe Travels USA Comprehensive : Our pick for wellness coverage

Seven Corners

Why We Picked It

Seven Corners’ Travel Medical Basic plan is our pick for group travelers. This plan is specifically designed for groups of up to 10 non-U.S. residents and non-U.S. citizens aged 14 days or older, making it ideal for families traveling together . However, it is also available for solo travelers. You can extend coverage for up to a year, with protection both in the U.S. and worldwide.

Pros and Cons

Medical coverage details.

The Travel Medical Basic plan offers extensive coverage with benefit maximums of up to $1 million and various deductible options, making it easy to customize a plan to suit your needs. Medical coverage offered through this plan includes the following:

- General medical

- Emergency dental

- Emergency services and assistance

- Accidental death and dismemberment (AD&D)

- Optional adventure activity coverage

Learn more : Seven Corners Travel Insurance Review

WorldTrips’ Atlas America plan is our pick for high coverage limits. This plan is designed for U.S. tourists, temporary workers, business visitors and international students studying abroad , providing accessible health coverage to a variety of travelers. It provides overall coverage maximums of up to $2 million, with up to $1 million for emergency medical evacuation coverage.

The Atlas America plan offers up to $2 million in overall coverage and seven different deductible options, providing sound medical coverage along with supplemental travel benefits. Medical coverages include services that fall under the following categories:

- Emergency dental and vision

Learn more: WorldTrips Travel Insurance Review

We chose IMG’s Patriot Lite plan as our pick for budget coverage — the company quoted us less for this plan than its competitors on our list. You can buy this plan as an individual or group, making it ideal for family members traveling to the U.S. together. Like other insurance companies in this review, IMG is partnered with UnitedHealthcare, meaning policyholders have access to a domestic network of over 1.4 million physicians for medical care.

Policyholders can choose coverage with a maximum of up to $1 million with the Patriot Lite plan, with deductibles ranging from $0 to $2,500. Coverages with the Patriot Lite plan include the following:

Learn more : IMG Travel Insurance Review

IMG’s Patriot America Plus plan also made our list for providing short-term insurance for business and leisurely travelers. We named it our pick for continuous coverage, as it provides up to 24 months of renewable, consecutive coverage. Other benefits include access to multilingual customer service representatives and a maximum limit of up to $1 million. Unlike IMG’s Patriot Lite plan, Patriot America Plus covers COVID-19 treatments.

As with IMG’s Patriot Lite plan, coverage with a maximum of up to $1 million is available, with your choice of deductible from $0 to $2,500. Coverages with the Patriot America Plus plan include the following:

Trawick International

We named Trawick’s Safe Travels USA Comprehensive plan our pick for wellness coverage, as it affords policyholders a general wellness visit with a U.S. doctor during their travels for up to $125. As is standard across most plans in our review, Trawick’s Safe Travels plan offers up to $1 million in medical expense coverage. It also offers up to $2 million in emergency medical evacuation coverage and eight deductible options up to $5,000.</p

The Safe Travels USA Comprehensive plan covers up to $1 million in medical benefits after you pay your deductible. Benefits provided with each plan include:

- Optional sports activity coverage (excludes extreme sports)

Read more : Trawick International Travel Insurance Review

Compare Travel Medical Insurance Plans for U.S. Tourists

See the table below for a direct comparison of costs, deductibles and more between travel medical insurance plans for U.S. visitors.

We based plan costs on quotes we obtained for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan includes a medical maximum of $500,000 with a $250 deductible. Note that your actual cost will depend on factors such as your age, number of travelers, chosen deductible and more.

Types of Health Insurance for U.S. Visitors

Travelers have options when it comes to health insurance for U.S. visitors. For one, you could choose an international travel medical insurance plan, which provides coverage for emergency medical expenses or evacuation abroad. A U.S. short-term health insurance plan is also an option. Some health insurance companies, such as UnitedHealthcare, work with providers to allow policyholders to use the company’s preferred provider organization (PPO) network.

If you’re wondering whether your domestic health insurance policy will cover you in the U.S., we encourage you to contact your insurance provider for more details. You may need to purchase valid coverage specifically for your U.S. trip if you’re concerned about or foresee needing medical care abroad.

Fixed Medical Insurance

Fixed medical insurance or fixed indemnity insurance pays a predetermined amount of money for specific medical procedures and services. This type of medical insurance plan is limited — no matter what your total bill amounts to, it will not cover more than the agreed-upon amount. Fixed medical insurance plans are usually cheaper than comprehensive policies, which we cover in the next section.

Comprehensive Medical Insurance

Comprehensive medical insurance covers doctor’s visits, hospital care, prescription drugs and more without setting limits on certain services. Note that these plans typically have coverage maximums, deductibles and copays, so you will have to pay a certain amount before your policy covers any medical expenses.

Comprehensive coverage does not have benefit limits based on the type of medical service like fixed medical does, but it will cost you more overall. However, because health care in the U.S. is expensive, you may find comprehensive plans more beneficial in the long run despite being pricier than a fixed plan.

Short-Term vs. Long-Term Health Insurance

Short-term and long-term health insurance plans provide coverage that lasts for a specific period. You can consider travel medical insurance plans short-term policies for U.S. visitors, as they can cover medical expenses incurred during a period lasting less than a year.

If you plan on staying in the U.S. for longer than a year, you may be eligible to purchase a health insurance plan through a domestic provider, depending on your visa. For example, if you have a J-1 or F-1 visa, you may be eligible for a university-sponsored or private health insurance plan. We encourage you to check with the U.S. Department of State when you receive your visa for more on what long-term health insurance options are available to you.

What Does Travel Insurance in the U.S. Cover?

Travel insurance in the U.S. provides a variety of coverages for unexpected events that can affect your travel plans both before and during your trip. Specifics will vary depending on your choice of policy but will likely include some or all of the following coverages:

airplane Created with Sketch Beta. Trip cancellation: If you must cancel your trip for a covered reason, travel insurance can help you recover non-refundable costs such as hotel reservations, airline tickets and more.

airplane Created with Sketch Beta. Trip interruption: If you need to cut your vacation short for a covered reason, travel insurance plans can compensate you for expenses you didn’t use during your trip.

airplane Created with Sketch Beta. Trip and baggage delays: A travel insurance policy can help cover costs you incur if your trip or baggage gets delayed for a covered reason. Most coverage also includes lost or stolen baggage.

airplane Created with Sketch Beta. Emergency medical: Emergency medical coverage can reimburse the cost of necessary treatments if you experience a medical emergency abroad up to a maximum amount.

airplane Created with Sketch Beta. Emergency evacuation and transport: If you need transportation to a medical facility in the U.S. during a medical emergency, this coverage will provide an expense limit for the services. This benefit can also cover emergency evacuations if a natural disaster or political conflict occurs and affects your travels.

How Much Does Travel Health Insurance for U.S. Visitors Cost?

Our research found that the cost of travel insurance for U.S. visitors can range from $96 to $115 . This range is based on quotes gathered for a 30-year-old Australian citizen traveling to the U.S. for 30 days. Each plan we obtained a quote for included a medical maximum of $500,000 with a $250 deductible.

For cost data specific to your travel needs, we encourage you to gather quotes from the providers in this review. The quotes you receive will depend on factors such as your age, plan limits, chosen deductible, number of travelers and more.

How To Use Visitor Health Insurance

If you’ve purchased a visitor medical insurance plan for your stay in the U.S., it’s important you understand how to use it. Healthcare facilities in the U.S., such as doctor’s offices, urgent care locations and emergency rooms, often require you to bring an insurance card with you. This card includes essential information associated with your policy that helps the facility file a claim with your insurance provider. If you have one through your visitor health insurance plan, it is best to have it on hand when receiving medical treatment.

Your health insurance plan may require pre-approval before you receive treatment in non-emergent cases. Your insurance company may request to verify a procedure or medicine is necessary before agreeing to cover it. Be sure to check your policy to find out what the restrictions are.

Many visitor health insurance plans also cover prescription medications. If you’ve been prescribed medicine through a U.S. doctor during a medical visit, a pharmacy may choose to verify your prescription before filling it. This means the pharmacy will contact your healthcare provider with any questions about the prescription being correct. Verification could delay when you receive your medication, but likely won’t take longer than three to10 business days.

Finding Doctors and Hospitals as a Visitor

Most insurers provide online tools that help you find in-network healthcare providers and facilities covered by your insurance policy. Note that you may pay more if you choose to receive care through a doctor or facility that is not considered in-network. Out-of-network providers do not contract with your health insurance plan to provide agreed-upon rates. Unless you have a plan that lets you pick any provider you’d like, you will need to find a provider or facility working with your insurance.

If you want to verify the benefits offered by your insurance plan, contact your insurance provider directly or consult any documentation provided at the time of purchase. Healthcare providers may also take steps to verify your coverage, as it ensures the facility receives payment and lessens the chance of a denied insurance claim.

The cost of medical treatment depends entirely on the type of insurance plan you have. If you’ve purchased a travel medical insurance plan, your provider will cover emergency medical expenses up to a maximum amount. Once you’ve hit that limit, you will have to pay the rest of your bill. If you have a plan with a deductible or co-pay, you must pay that amount before your insurer will cover your expenses.

Paying Medical Bills Without Insurance

If you opt out of medical coverage when visiting the U.S. and end up needing medical care, you will have to cover the entire bill out of pocket. However, you have several options regarding payment. You can contact the debt collector in charge of your bill and work to negotiate the cost of your bill down . You can also set up a payment plan that works with your income and what you can afford.

While these payment options can be helpful, they do not negate the high U.S. healthcare costs, and can still leave you with a substantial bill after a medical crisis.

According to a study by the Peterson-KFF Health System Tracker , health expenditures per person in the U.S. in 2022 were over $4,000 more than any other high-income nation. For this reason, we recommend some form of medical coverage to help cover potential emergency expenses when visiting the U.S.

Filing a Claim with Visitor Health Insurance

Filing a claim through a visitor insurance plan or travel medical insurance policy will vary based on your provider. Note that providing proper documentation will help the claims process go smoothly, so it is important to keep track of hospital invoices and other billing forms.

If you have a domestic health insurance policy, the healthcare facility that provided your treatment will file your claim. You’ll receive a bill once your insurance provider processes the claim. On the other hand, travel medical insurance may require you to submit documents proving your claims for emergency medical treatment. Once your claim has been approved, your travel insurance company will reimburse your medical bills.

Where Can You Buy Visitors Insurance?

You can buy visitors’ insurance directly from travel insurance companies, international health insurance companies, university-approved providers and domestic providers, depending on the type of visa required during your stay. If you’re on a tourist visa, you can purchase travel medical insurance covering emergency medical services and transport, if needed, to a healthcare facility. Most travel insurance providers also offer travel healthcare plans that can last up to a year if you are planning multiple trips.

If you’re on a J-1 or F-1 visa and enrolling in a schooling program, contact your university to see if you’re eligible for a sponsored or private health insurance plan. If you need clarification on the available coverage or plan to stay in the U.S. for longer than a year, contact the U.S. Department of State for more information.

Do U.S. Visitors Need Health Care Coverage?

Healthcare in the U.S. is expensive. While medical insurance isn’t required for some visitors — such as tourists on a B-2 visa — it’s still worth considering if you’re concerned about an unexpected medical emergency abroad. We encourage you to extensively research your visa type and the coverage available to you before settling on a plan. Understanding the benefits and exclusions of a healthcare coverage plan will ensure there are no surprises if you need medical care during your U.S. trip.

Frequently Asked Questions About Visitor Health Insurance

How much is visitor health insurance in the u.s..

Visitor health insurance costs in the U.S. depend on factors unique to your travel needs. After gathering quotes from the providers in our review, we found that visitor health insurance can range from $89 to $115 . This range is based on a 30-year-old Australian citizen traveling to the U.S. for 30 days, opting for a plan with a medical maximum of $500,000 and a $250 deductible. Your actual costs will vary.

How much does travel insurance cost for trips to the U.S

Our research team found the average cost of travel insurance ranges from $35 to $400, with the average being $221 for a standard policy. Your costs will vary depending on your chosen plan, provider, length of travels, number of travelers and more.

Can foreign visitors get insurance while in the U.S.?

Yes, foreigners can get insurance while in the U.S. Various insurance options are available to travelers depending on their length of stay and visa type. It’s best to research what’s available to you based on your visa requirements before purchasing a plan.

Is it hard to get travel insurance for U.S.-based trips?

No, it’s not hard to get travel insurance for travel to the U.S. Providers such as Seven Corners, WorldTrips, IMG, Trawick and more provide plans for non-U.S. citizens seeking trip and medical coverage while abroad.

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Guides

- Best covid travel insurance companies

- Best cruise insurance plans

- Best travel insurance companies

- Cheapest travel insurance

- Best group travel insurance companies

- Best senior travel insurance

- Best travel insurance for families

- Best student travel insurance plans

- Travel insurance for parents visiting USA

- Best travel medical insurance plans

- How much does travel insurance cost?

If you have questions about this page, please reach out to our editors at [email protected] .

Related Articles

More From Forbes

Is travel insurance refundable here’s everything you need to know.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Sometimes, travel insurance is refundable. Here's when you can get your money back.

Peter Hoagland always checks to see if his travel insurance is refundable. That's because anything can happen between the time you book your vacation and when you leave — and because travel insurance isn't always refundable.

During the pandemic, he discovered that the hard way. He had to cancel a trip and asked for his money back from the insurance company. It refused.

"Since then, I always read the fine print on the policy," he says.

The refundability of travel insurance has always been an open question. Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions.

Like the pandemic, when refund policies were all over the map. Some insurance companies adhered to their published policies. Others offered a credit that could be reused within a year, which was minimally useful because the pandemic was still happening a year later. Others quietly gave their customers a refund.

Hoagland says he fought for his money. Eventually, he contacted a manager at his travel insurance company.

"That produced a quick result," he says. "I got my money back."

It s Possible The Russian Army Is Tricking The Ukrainian Army With A Fake Offensive

Ufc st louis results bonus winners from night of memorable finishes, vasiliy lomachenko vs. george kambosos results: winner, ko, reaction.

But let's face it: Getting a refund for travel insurance can be difficult. There are times when insurance is always refundable because it's required by law. There are times when it's sometimes refundable. And there are times when it's almost never refundable. But even then, there may be a way to recover some — or all — of the value of your policy.

Getting a refund for travel insurance can be a challenge

If you have a travel insurance policy and would like to get a refund, it might be easier said than done, say experts.

"While travel insurance is regulated like auto and home insurance, it’s often less standardized," says Stuart Winchester, CEO of Marble, a digital wallet for your insurance. "So first off, it’s important to check the fine print of your specific policy. Don’t assume it’s like the last one you got."

Even when you have something in writing, a refund can require some serious negotiating skills.

"Getting a refund for travel insurance can be complicated and frustrating," says Peter Hamdy, the managing director of a tour operator in Auckland, New Zealand. He's asked for a refund on policies numerous times and says that despite what travel insurance companies may tell you, there are no hard-and-fast rules when it comes to getting a refund on your policy.

"Some situations can warrant a refund," he says. "It depends on your policy."

What does a typical refundability clause look like? For example, the World Explorer Guardian from Insured Nomads notes that it's refundable only during the 10-day review period from the date of delivery or 15 days from the date of delivery if mailed, provided you have not already departed on your trip and you have not incurred any claimable losses during that time. If you depart on your trip before the expiration of the review period, the review period ends and the policy can't be refunded.

"We go a bit further with our World Explorer Travel Medical plans," notes Andrew Jernigan, CEO of Insured Nomads. "If no claims have been filed then we can refund the unused portion of the policy if you cut your trip short.”

When can you get a refund for travel insurance?

Here are the most common cases where travel insurance can be refunded:

- If you cancel during the "free look" period required by the government. Most states require what's called a "free look" period of anywhere from 10 to 14 days. "During this period, travelers can review the purchase and make sure it fits their needs," explains James Nuttall, general manager of Insubuy . "If it does not, they can cancel it for any reason and get a full refund, no questions asked, so long as you haven’t departed yet.

- If you cancel during the travel insurance company grace period. Many insurance companies also have a grace period for refunds (usually, they are the same as the "free look" although some grace periods can be longer). "If you’re outside your grace period, which typically lasts one to two weeks after signing, you’re contractually obliged to pay your premiums," says David Ciccarelli, CEO of the vacation rental site Lake . "Still, it doesn’t hurt to ask your company for a refund or alternative options if you’re outside your grace window. You might not get a yes, but it could lead to some cost savings or better solutions."

- When someone else cancels your trip. "For instance, if your cruise is canceled due to low river tide, you are not at fault and would typically receive a full refund or credit for a future sailing, thus eliminating the need for the travel insurance policy," explains Rhonda Abedsalam vice president of travel insurance for AXA Assistance US.

- If you die. Typically, the policy would be refunded to your next of kin. Generally, you can also ask for a refund if your travel companion dies before your trip.

Remember, it depends on where you buy your insurance

The refundability of your insurance can depend on where you purchased it. Commercial policies bought from a cruise or tour company are generally canceled and refunded if you cancel the trip far enough in advance of your departure date.

"The travel insurance cancellation provisions are generally tied to the cancellation provisions for the cruise or tour," explains Dan Skilken, president of TripInsurance.com . "After you have paid the last deposits on the cruise and are close enough to departure that they will not provide a refund on the cruise, they generally will also not provide a refund on the travel insurance. But if you cancel early enough to get all or most of your deposit back, you will also get your travel insurance premium refunded."

If you’ve purchased retail travel insurance from a third-party provider or comparison website, you can often get a refund if you can show receipts proving that you received a full refund of all trip deposits and have not had any cancellation penalties or taken any travel credits when you canceled your trip.

That's because retail travel insurance is sold for a specific traveler and for a specific trip. If you have proof of a complete refund and have not received travel credits, then you no longer have what's called an "insurable interest" in the trip. The insurance company must cancel and refund your premium in full, says Skilken.

Insider tip: If the insurance company refuses, just tell them you have proof that you no longer have an insurable interest in the trip. You have to have an insurable interest in a trip to own a travel insurance policy.

Your agent may be able to help you get a refund

You may also be able to lean on the agent who sold you the policy. For example, all policies on Squaremouth come with a money-back guarantee.

"The purpose of this benefit is to give travelers extra time to review their policy documentation to be sure it’s the best policy for their coverage needs," says spokeswoman Jenna Hummer. At Squaremouth, the money-back period typically lasts between 10 and 14 days, which is in line with the mandated "free look" period.

However, I have also seen agents negotiate with travel insurance companies for a more generous refund period in case of extenuating circumstances. There's no guarantee that you'll get it, but it's worth asking — and one reason to work with a third party.

Agents can also help you avoid this problem. Susan Sherren, who runs Couture Trips , a travel agency, notes that American Airlines Vacation Packages offers a predeparture protection insurance plan, which allows cancellation for any reason before the outbound departing flight time. Other restrictions apply, she adds.

"More flexibility will often cost you more," she says. "But having the flexibility is a great way to sleep well at night."

Can't get a refund? Look for other kinds of flexibility from your travel insurance company

Even if your travel insurance company says no to a refund, it doesn't necessarily mean you've lost the value of your policy.

"If a travel supplier changes or cancels your trip, you should be able to change your travel insurance policy to match the new dates of your trip or even cover a new trip, sometimes up to two years into the future," says Daniel Durazo, director of external communications at Allianz Partners USA .

Pro tip: Be sure to change the dates of your travel insurance policy before the departure date of your current itinerary. You can do that online or by calling your agent. Once the policy's effective date has passed, making any changes or initiating a refund or credit becomes much more difficult.

Don't forget to do your due diligence

Bottom line: Travel insurance is refundable under certain circumstances. But knowing when can require research.

"It's important for consumers to carefully read their policy upon receipt to understand the specific terms offered by their insurance provider," says Robert Gallagher, president of the US Travel Insurance Association.

The more you know, the likelier you are to get the refund you want when your plans change.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

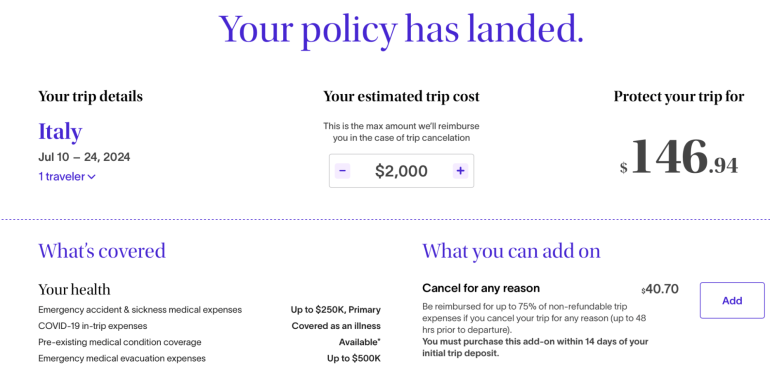

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES

VIDEO

COMMENTS

The Council of Health Insurance. E-Services. / Visitors / Tourists / Omrah and Hajj Insurance Inquiry. Please Fill Your ( Passport Number or Visa Number or Border Number )*. Code*.

Learn how to verify the status and expiry date of your visit visa insurance on the CHI website using your passport number. This is a requirement for obtaining and renewing a visit visa in Saudi Arabia.

Visitors Insurance. By approving the Unified Insurance Policy for the visitors to the Kingdom of Saudi Arabia, CCHI aims to provide the esteemed visitors with secure healthcare services. That is, CCHI aims to secure a basic insurance coverage to those who have applied for an entry visa to the Kingdom for visit, visit extension or for passing ...

How can I apply for Visit Visa and purchase its insurance policy? You can apply for the Visa and purchase its insurance policy through the approved Electronic Visa Services Platform website.For more details and procedures regarding Visa application and eligibility status, please visit the official website of the Saudi Ministry of Foreign Affairs.

This service will allow visitors or tourist to inquiry about their insurance status and identify the insurance company that it was issued by. Visit the CCHI website. Choose the inquiry about insurance services. Press the go to service button. Please enter your passport number that was used to issue the insurance policy.

VISIT VISA INSURANCE. • Insurance Policy will be issued for visitors in KSA seeking for their visit visa extension. • Enter correct passport number, Visa and border number details for successful upload of insurance policy in CCHI. I agree to grant Aljazira Takaful the right to inquire about my data with any relevant authorities.

Check Visit Visa Insurance. You can also check the insurance validity of a family visit visa holder through the CCHI website. Open the CCHI website. Enter the Passport Number. Write the captcha code. The system will show the name of the health insurance company, the medical insurance type, the issue date, and the validity status of the health ...

This travel health insurance will cover you in the event of unforeseen sickness or injury that occurs while you are visiting the U.S., saving you from significant financial trouble abroad. An American visitor insurance policy offers some of the best international coverage and benefits for your trip. For this reason, it is highly recommended to ...

Health Insurance is required for a 1. Single and 2. Multiple Entry Visit Visas whether it is for Family, Umrah, or Tourist visas. The Multiple Entry Visit Visa can be extended. (See extension periods below). Note: Health insurance will also cover the 48-hour Transit Visas. Also, to learn how the A to Z of applying for Family Visit Visa, click ...

Learn how to verify your health insurance policy linked to your tourist visa on the Council of Health Insurance (CHI) website. You only need your passport number and a captcha code to access the information.

This Policy shall only be issued for the visitors who are already in the Kingdom of Saudi Arabia and are seeking for their visa extension. Policy upload to CCHI will be successful if all the details entered are correct. Policy Effective Date should be Visa expiry date mentioned in Absher. When you apply for a visitor visa extension, you will ...

Our Visit USA-HealthCare visitor insurance can offer you the coverage you're looking for when visiting the United States. Nationalized or government sponsored health plans rarely provide adequate coverage for visitors for injuries or illnesses that occur in the United States, which is why it's important to get travel medical insurance. The ...

Atlas America - Best Overall. Patriot America Lite - Best for Cost. Patriot America Plus - Great for Trip Interruption Insurance. Safe Travels USA Comprehensive - Best for Deductible ...

Check the agreement box and click on "Verify" button. On the next page, the visa information will be displayed. Scroll down to the bottom of the page and click on the "Click Here" button that appears below the declaration form. On the following page, answer the health-related question.

Contact. General Secretary. Working hours. From Sunday to Thursday from 8 Am to 4Pm. Customer Service. 920001177. Home. About Council. Speech of Council President.

Visa Information. I hereby declare that all the information I have provided to obtain this policy are "Accurate" and "Correct", including (Visit Visa Expiry date and the completion of matching recorded data on Absher platform). I also give my permission for Tawuniya to access my data and my companions' data available under my passport ...

Best Medical Insurance for Visitors to the U.S. (2024) U.S. visitors can get travel medical insurance for as low as $89 per trip. Seven Corners, WorldTrips, IMG and Trawick offer the best health ...

This Policy shall only be issued for the visitors who are already in the Kingdom of Saudi Arabia and are seeking for their visa extension. Policy upload to CCHI will be successful if all the details entered are correct. Policy Effective Date should be Visa expiry date mentioned in Absher. When you apply for a visitor visa extension, you will ...

Visa Status Check. Welcome! On this website, you can check your U.S. visa application status. Visa Application Type. Please select a location and enter your Application ID or Case Number. Select a location. Application ID or Case Number. (e.g., AA0020AKAX or 2012118 345 0001) NOTE: For applicants who completed their forms prior to January 1 ...

Walaa Insurance is a leading company that offers various insurance products and services in Saudi Arabia. Whether you need car, health, travel, or property insurance, you can find the best plan for you at Walaa. Visit our website to learn more about our offers and locate the nearest branch to you.

Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions ...

Working hours From Sunday to Thursday from 8 Am to 4Pm. Customer Service 920001177. Home. About Council; Speech of Council President; About The General Secretariat

Pre-existing medical condition exclusion waiver. Yes. This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis. The plan is comprehensive and includes ...