- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How WalmartPlusTravel.com Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

There’s a new option for booking travel that could help you save some money on everyday expenses, and it’s from a spot you might not have expected: Walmart.

The retail giant has launched a travel portal in partnership with Expedia.

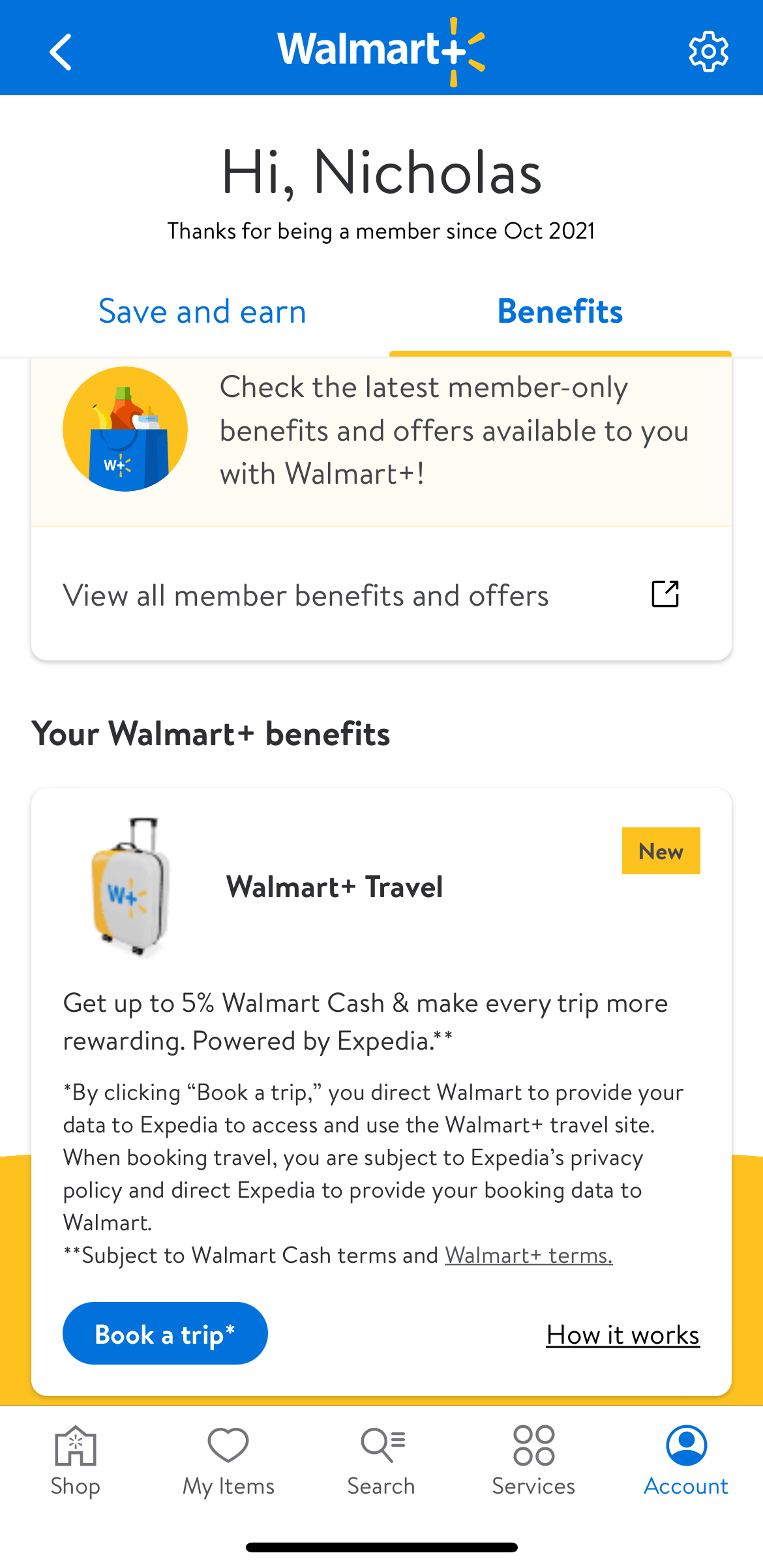

Those who subscribe to Walmart+ can book activities, flights, hotels, rental cars, vacation rentals and travel packages. In return, they’ll earn Walmart Cash that can be used when shopping with the store.

Though it may not be the first choice for avid travelers who want to take advantage of travel loyalty programs, the portal is a way for your travels to help you offset expenses in your daily life; usually, this is done by using strategic everyday credit card spending to help you earn travel rewards.

This new travel portal is also a way travelers carrying The Platinum Card® from American Express can get more value out of their card and its $695 annual fee: Cardmembers can receive a statement credit to cover the Walmart+ membership fee. Terms apply.

» Learn more: The best travel credit cards right now

How do you use the Walmart travel portal?

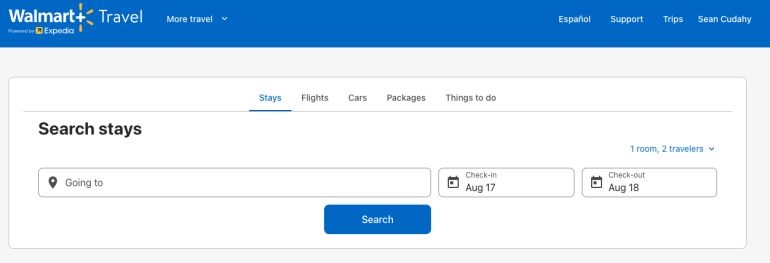

Walmart+ members can access the company’s new travel portal at WalmartPlusTravel.com. It’s also available through the member benefits section of the Walmart+ app.

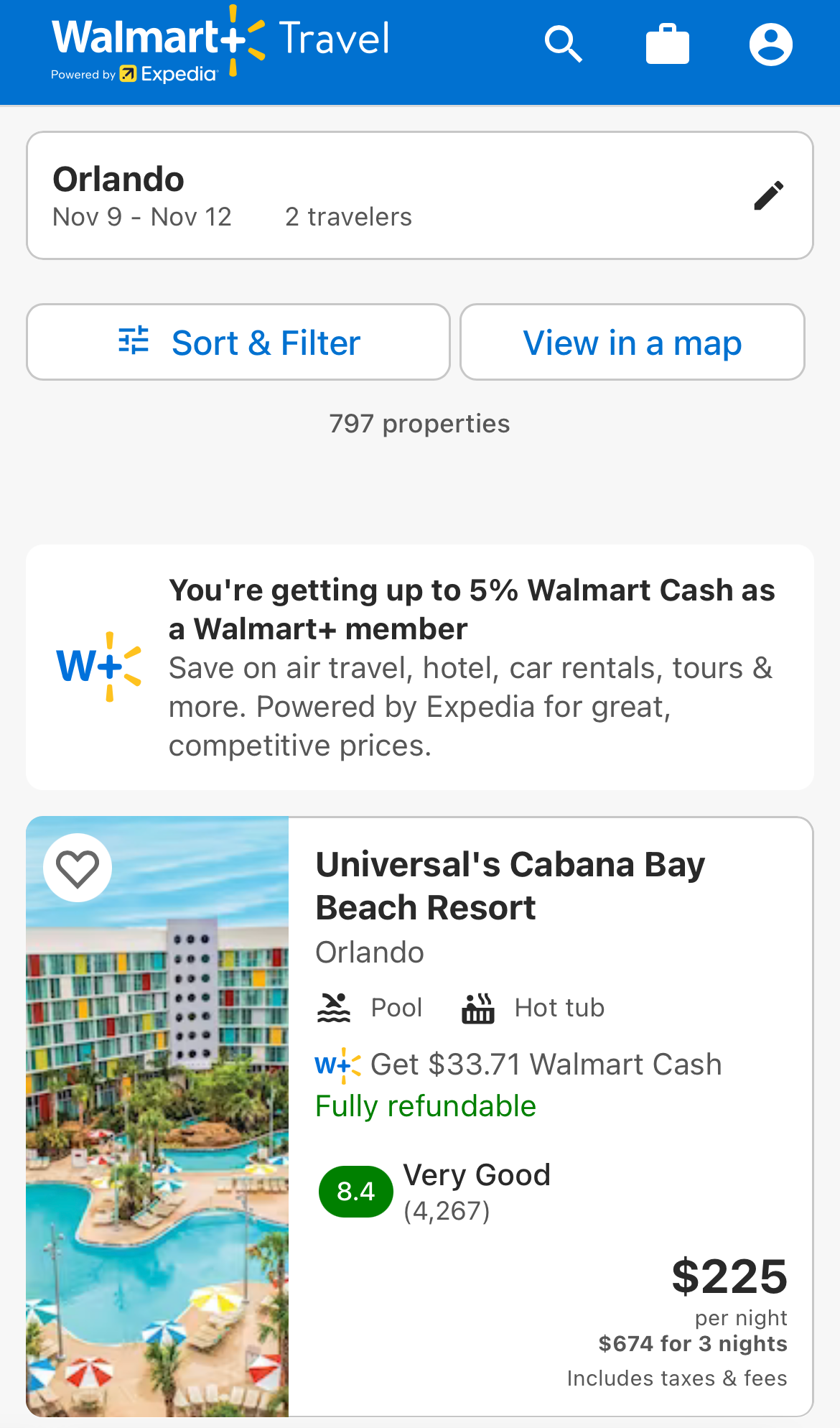

You can use the site to book numerous aspects of your trip. Because the site is powered by Expedia, you’ll be able to access the online travel agency’s vast network of hotels and vacation rentals. The site has access to more than 900,000 properties (including hotels, homes, apartments, etc.), as well as more than 500 airlines globally and more than 100 rental car companies.

You can also book activities using the Walmart travel portal.

» Learn more: The best credit cards to use at Walmart

Earning Walmart Cash for travel

A key benefit for Walmart+ members booking a trip through WalmartPlusTravel.com is the ability to earn Walmart Cash.

Members will earn:

5% Walmart Cash on hotels, vacation rentals, car rentals and activities.

2% Walmart Cash on flights.

If you’re booking a vacation package, you’ll receive a blended Walmart Cash rate: 2% for the flight portion of your trip, 5% for the accommodations element.

Once you confirm a booking, any Walmart Cash you earn will appear in your wallet. It will become available 30 days after you complete travel. You can apply it to future purchases or cash out in the store.

Using WalmartPlusTravel.com

To start using WalmartPlusTravel.com , head to the homepage and sign in using your Walmart+ credentials.

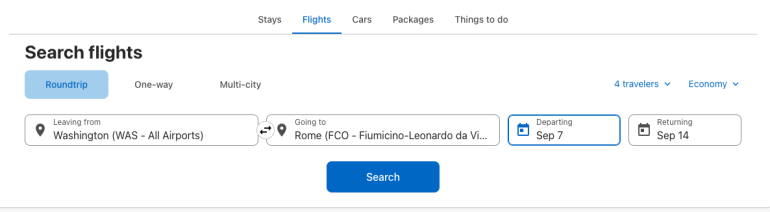

Let’s say you're hoping to take a family of four from Washington, D.C., to Rome in September 2023. Start by plugging in desired flights, like you would on any booking site.

Because it’s an online travel agency, the results turn up options on numerous airlines. You can see itinerary options aboard Delta Air Lines and Air France, among others.

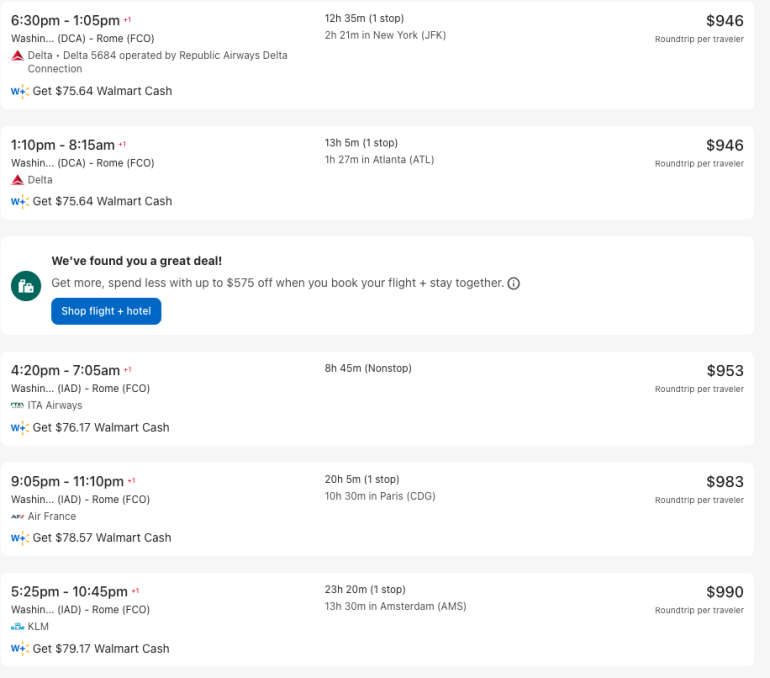

Each itinerary option also shows how much you'd earn in Walmart Cash (again, 2% for flights). The cheapest option, $946, comes to $3,784 for a family of four and would earn $75.64 in Walmart Cash.

The site also points out times in which you might be able to save money by booking a vacation package, instead of choosing your trip elements a la carte.

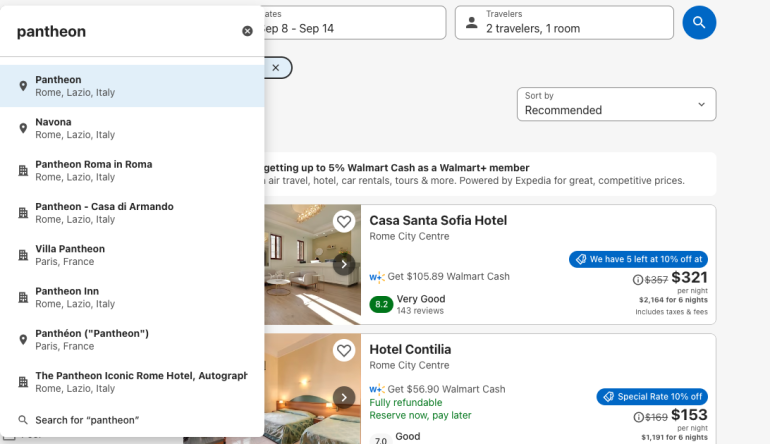

Now that your flights to Rome are set, you need a place to stay when you get there.

Through the Walmart travel portal, you can put in “Rome” or even a landmark in your search terms. For example, let’s say you want to stay as close to the Pantheon as possible. Simply plug that landmark in and search.

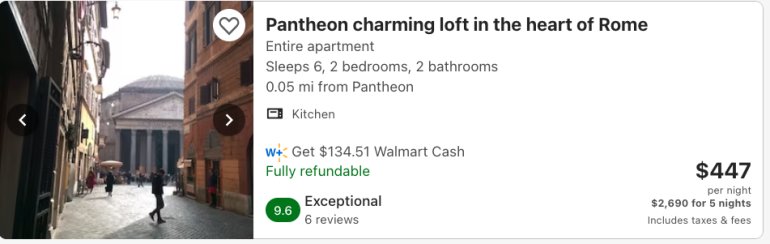

In the search results, there's a rental property option with a loft that sleeps six people and is just steps away from the Pantheon. This property would set you back $447 per night, which means a total of $2,690 for your five-night stay (including taxes and fees). In this case, you would earn 5% Walmart Cash on the property rental — a total of $134.51 for the stay.

That means for just the stay and flights, you’d have $210.15 to spend (or cash out) at Walmart after arriving home.

Is Walmart travel good?

The best part about WalmartTravelPlus.com is the ability to earn money you can apply to your purchases at the store. That means earning cash back is simple and directly applicable to your everyday shopping. Plus, you could maximize your cash back by charging your booking to a travel credit card that earns points or a cash-back credit card that will accelerate your cash-back amount.

As always with online travel agencies , note that flight changes can be difficult, as is earning hotel points or using elite status benefits. However, it could provide a particularly handy return on investment when booking a rental property that’s not part of a major hotel loyalty program.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Great rewards for Walmart customers despite its thin perks portfolio.

- • Small business loans

- • Business grants

Most recently before joining Bankrate, Robert worked as an editor and writer at The Ascent by The Motley Fool, covering a number of personal finance topics, including credit cards, mortgages and loans.

- • Rewards credit cards

- • Travel credit cards

Nouri Zarrugh is a writer and editor for CreditCards.com and Bankrate, focusing on product news, guides and reviews. His areas of expertise include credit card strategy, rewards programs, point valuation and credit scores, and his stories on building credit have been cited by Mic.com, LifeHacker, People.com and more. Through his thorough card reviews and product comparisons, Nouri strives to demystify personal finance topics and credit card terms and conditions to help readers save money and protect their credit score.

Mariah Ackary is a former personal finance editor for Bankrate.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

Capital One Walmart Rewards® Mastercard®

*The information about the Capital One Walmart Rewards® Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

Introductory offer: Earn 5% cash back on purchases in Walmart® stores for the first 12 months when you use your card with Walmart Pay

Rewards rate

Earn 5% cash back on Walmart.com purchases, including pickup and delivery Earn 2% cash back on purchases in Walmart® stores, Murphy USA and Walmart® fuel stations 2% cash back on restaurants and travel purchases 1% cash back on all other purchases everywhere else Mastercard® is accepted

Regular APR

On This Page

- Current offer details

- Walmart Rewards Mastercard pros and cons

- Reasons to get this card

- Reasons to skip this card

- Capital One Walmart Rewards Mastercard® vs. other cash back cards

Best cards to pair with this card

- Is this card worth getting?

- Ratings methodology

Frequently asked questions

Capital one walmart rewards mastercard card overview.

For fans of online shopping and Walmart stores, the no-annual-fee Capital One Walmart Rewards® Mastercard®* could be one of the best credit cards for groceries , everyday products, electronics and home furnishings.

You’ll earn an impressive 5 percent cash back on Walmart.com purchases, including grocery pickup and delivery orders. The card also earns 2 percent cash back for in-store Walmart purchases, restaurants and travel, and 1 percent on all other purchases. Since this is an instant-use credit card , you can start earning rewards with the big-box retailer within minutes of approval.

As long as you take advantage of the card’s high-earning potential and pay your balances in full and on time, the Walmart Rewards Mastercard is a solid pick. But if you prefer to shop elsewhere, a flexible rewards credit card that earns bonus cash back in various categories may provide greater value.

- 5 percent cash back at Walmart.com, including pickup & delivery

- 2 percent cash back in Walmart stores & Walmart-branded gas stations, at restaurants and on travel

- 1 percent cash back on all other purchases

Expert Appraisal: Typical See our expert analysis

Welcome offer

- Earn 5 percent cash back in Walmart stores for the first 12 months when you use your Capital One Walmart Rewards Card with Walmart Pay

Expert Appraisal : Weak See our expert analysis

Rates and fees

- APR: 19.48 percent to 29.99 percent variable

- Annual fee: None

- Balance transfer fee: $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

- Cash advance fee : 3 percent of the amount of the cash advance, but not less than $3

- Late payment fee: Up to $39

Other cardholder perks

- This card does not have any additional perks that cardholders can take advantage of

Capital One Walmart Rewards Mastercard pros and cons

There’s no annual fee to cut into your rewards earnings.

It earns a great rewards rate on Walmart.com purchases, grocery pickup and delivery.

You can use the card immediately in the Walmart app upon approval.

You’ll need to use the Walmart Pay app to earn this card’s welcome offer

The card lacks valuable perks that many other rewards cards offer.

The ongoing rewards rate for in-store Walmart purchases is the same as many flat-rate cards

Why you might want the Capital One Walmart Rewards Mastercard

The Capital One Walmart Rewards Mastercard can be a great option for loyal Walmart customers who regularly shop online to take advantage of its boosted rewards rate. This card also has a solid flat rate for in-store Walmart purchases and big-budget staples like gas (at Walmart fuel stations), restaurants and travel.

Rewards: Great for Walmart.com regulars

If you make most of your purchases online at Walmart and only want one rewards card, you’re the perfect candidate for this card, which earns one of the best available rates for online Walmart purchases. Combining boosted rewards for store loyalty and a solid flat rate for regular purchases sets this card apart from other retail-branded credit cards.

The only downside is that the card’s highest rate only applies to online purchases at Walmart.com. A restriction like this won’t be a problem for savvy online shoppers, but in-store shoppers will only earn 2 percent cash back. You’ll have difficulty finding another credit card with high rates at Walmart because many rewards cards exclude Walmart purchases from categories like grocery stores.

APR: Potentially low ongoing APR without penalty rates

Depending on your creditworthiness, you can qualify for an APR a few percentage points lower than the current average credit card APR . Many cash back cards have favorable APRs , but store-branded cards like the Walmart Rewards Mastercard usually have relatively steep APRs that can inflate your credit card balance with interest.

The Walmart Mastercard also doesn’t charge a penalty APR. While you shouldn’t make late payments a habit, you’ll have peace of mind knowing your APR won’t rise substantially for missing your due date.

Why you might want a different cash back card

Although this card has its strengths for Walmart customers, it has several drawbacks that make it a poor choice for everyday cardholders who want a simple cash back card.

Welcome offer: Requires heavy spending to remain competitive

You can earn 5 percent cash back on purchases in Walmart stores for the first 12 months when using your card with Walmart Pay. If you prefer to shop online at Walmart.com, this welcome offer is nearly valueless since it matches your ongoing cash back rate for online Walmart.com purchases.

Standard welcome offers on comparable cash back cards hover around $200 in value and require you to spend anywhere from $500 to $3,000 to earn. The Walmart Rewards Mastercard has a welcome offer that doesn’t place a ceiling on your cash bonus and doesn’t have a spending requirement. You can spend as much as you want in stores to earn 5 percent back, but you’ll need to spend heavily to match the $200 value of competing offers.

To make this offer competitive, you’ll need to spend $4,000 or more in-store at Walmart during the first year. You’d earn $200 cash back at a rate of 5 percent. Without the extra 3 percent from the welcome offer, you’d only earn about $80 for spending the same amount.

No intro APR: Interest can accrue early on

Many of the best cash back cards come with introductory APR offers for either balance transfers or new purchases, letting cardholders curb interest until the offer term ends. The Walmart Rewards Mastercard doesn’t come with either meaning your balance will accrue interest at the card’s regular APR if you carry a balance.

Lacking an intro APR isn’t necessarily a glaring drawback, but it could be on this card because of how cardholders might take advantage of the welcome offer. It would be much easier to squeeze value out of that welcome offer if you had an intro APR to help you keep your balance low, especially if you plan on racking up large charges to make the most of your in-store cash back rate for the first year.

Perks: Nothing to add value

The Walmart Rewards Mastercard doesn’t have any rewarding perks or benefits . Many issuers include solid perks on their rewards cards, such as statement credits and travel protections. These benefits can provide added value to your card as well as cover emergency situations. This card lacks even the most basic travel and shopping benefits, making this a major drawback compared to other cards.

How the Capital One Walmart Rewards Mastercard compares to other cash back cards

The Capital One Walmart Rewards Card is a great cash back card if Walmart is your go-to place to shop. But if you’re looking for more versatility, here are two other cash back credit cards offering solid rewards.

Recommended Credit Score

Blue Cash Preferred® Card from American Express

Earn a $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months.

6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). 6% Cash Back on select U.S. streaming subscriptions. 3% Cash Back on transit including taxis/rideshare, parking, tolls, trains, buses and more. 3% Cash Back at U.S. gas stations 1% Cash Back on other purchases

Citi Custom Cash® Card

Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back.

Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Earn unlimited 1% cash back on all other purchases.

Capital One Walmart Rewards Mastercard vs. Blue Cash Preferred® Card from American Express

The Blue Cash Preferred® Card from American Express offers 6 percent cash back on up to $6,000 in purchases per year made at U.S. supermarkets, then 1 percent. It excludes superstores like Walmart and warehouse stores but offers the highest cash back rate available for U.S. supermarket purchases. The card also gives you plenty of chances to earn cash back in popular household categories like gas, transit and select streaming services.

Although the Blue Cash Preferred carries an annual fee of $95 ($0 intro annual fee for the first year), its high cash back rate could help to match the deals and discounts find at Walmart. But if Walmart is your preferred store, you’ll find more value in the Capital One Walmart Rewards card, particularly in the first year.

Capital One Walmart Rewards Mastercard vs. Citi Custom Cash® Card

The Citi Custom Cash® Card is an excellent choice if you want a versatile card that earns rewards for no annual fee. You’ll earn 5 percent cash back in your highest eligible spending category (up to the first $500 each billing cycle, then 1 percent), which includes options like gas stations or grocery stores (which doesn’t include Walmart). This card is a great fit for smaller households with no problem staying under the monthly spending cap.

But remember that you should only use the Custom Cash card in one category each billing cycle. Otherwise, you’ll leave a lot of cash back on the table. While Walmart purchases don’t benefit from the Citi Custom Cash it’s a much more flexible option if Walmart purchases aren’t at the top of your budget.

If you value cash back above other rewards, it makes sense to pair the Capital One Walmart Rewards Card with a flat-rate cash back card or another cash back card that offers boosted rewards in different categories.

Chase Freedom Flex℠

The Chase Freedom Flex℠ comes with no annual fee and offers rewards in rotating categories throughout the year. You can earn more cash back in a variety of generously boosted categories than you can with the Walmart Rewards Mastercard. Use the Walmart card for purchases at Walmart.com and the Freedom Flex for purchases that align with Chase’s quarterly rotating rewards program.

Citi Custom Cash® Card

Pairing the Citi Custom Cash with the Walmart Mastercard would be an optimal strategy because you can use the Walmart Mastercard for Walmart.com purchases and the Citi Custom Cash for your next highest spending category. This strategy will net you 5 percent back in two of your spending categories: for the Custom Cash’s top eligible spending category each billing cycle (on up to $500 each billing cycle, then 1 percent) and on Walmart.com purchases with the Walmart Mastercard. The Custom Cash is flexible enough to adapt to changes in your spending habits.

Who is the Capital One Walmart Rewards Mastercard right for?

Walmart customers are most likely to want this card. Although it has some utility for a handful of everyday categories, it isn’t ideal for earning maximum cash back or rewards unless you’re a dedicated Walmart.com shopper.

Online Walmart Customers

Walmart customers, specifically people who shop online at Walmart.com, can benefit the most from the Walmart Rewards Mastercard. While in-store shoppers can benefit from its 2 percent flat-rate cash back, this rate isn’t better than general flat-rate cards. You can also purchase most items online for in-store pickup to get the higher rate if desired.

Bankrate’s Take—Is the Capital One Walmart Rewards Card worth it?

For many, Walmart is more than a retailer—it’s the primary hub for groceries, home goods, auto care and more. With unlimited 5 percent cash back on purchases at Walmart.com, which includes grocery pickup and delivery, there’s a lot to love for those who can shop online at the superstore.

However, if you prefer shopping at different stores or do not live close to a Walmart, getting the card may not be worthwhile. Instead, consider adding a rewards card to your wallet that offers rewards in broader categories that match your spending habits.

*The information about the Chase Freedom Flex℠ and the Capital One Walmart Rewards Mastercard have been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How we rated this card

We rate credit cards using a proprietary card scoring system that ranks each card’s estimated average rewards rate, estimated annual earnings, welcome bonus value, APR, fees, perks and more against those of other cards in its primary category.

Each card feature is assigned a weighting based on how important it is to people looking for a card in a given category. These features are then scored based on how they rank relative to the features on other cards in the category. Based on these calculations, each card receives an overall rating of 1-5 stars (with 5 being the highest possible score and 1 being the lowest).

We analyzed over 150 of the most popular rewards and cash back cards to determine where each stacked up based on their value, cost, benefits and more. Here are some of the key factors that influenced this card’s overall score and how the score influenced our review:

Rewards value

The primary criteria for a rewards or cash back card’s rating is its rewards value. This includes the card’s average rewards rate, estimated annual rewards earnings, sign-up bonus value and reward redemption value.

To estimate a card’s average annual rewards earnings, we first calculate its average rewards rate based on how much it earns in different bonus categories and how closely its categories align with the average person’s spending habits, according to data from the Bureau of Labor Statistics .

Based on this data, we determine a “chargeable” spend (which purchases are likely to be put on a credit card and earn rewards). This includes the following spending by category:

- Groceries: $5,200

- Dining out: $3,000

- Entertainment: $2,500

- Gas: $2,100

- Apparel and services: $1,700

Using this data, we assign a weighting to each of a card’s bonus categories. For example, a card’s grocery rewards rate receives a 23 percent weighting based on how much of the average person’s budget is spent on groceries. We also estimate the redemption value of points or miles from various issuer, airline and hotel rewards programs.

This weighting and rewards valuation allows us to estimate a card’s average annual rewards earnings — how many points or miles you’d earn with a given card if your spending was about average and you used the card for all of your purchases, as well as what those points are worth. We also use point valuations to determine a card’s sign-up bonus value

With these calculations complete, we assign each card a score based on how its average rewards earnings, sign-up bonus value, rewards rate and redemption value stack up against other rewards cards.

We also rate cards based on how much it costs to keep them in your wallet or carry a balance.

To start, each rewards or cash back card is scored based on whether it offers an intro APR and how its ongoing APR compares to the rates available on other rewards or cash back cards.

We also score each card based on how its annual fee influences its overall value.

We consider a card’s annual fee in two ways — how it ranks relative to the fees you’ll find on other cards in the category and how it impacts a card’s overall rewards value. Cards with an annual fee will always be at a slight disadvantage in our scoring system since annual fees inherently cut into your rewards value, but if a card offers terrific value via its ongoing rewards and perks, it can earn a high score even if it carries a high annual fee.

With this in mind, we rate a card based primarily on how its ongoing rewards value and ongoing perk value (such as annual credits or bonuses) stack up against other cards in the category when you subtract its annual fee.

Flexibility

We rate each card’s flexibility based on the restrictions it imposes on earning and redeeming rewards and factor this rating into a card’s overall score.

Flexibility factors include whether a card only allows you to earn a high rewards rate on a small amount of spending or requires you to meet a certain earning threshold before you can redeem rewards. We also examine whether your points are worth less when you redeem for some options versus others and whether a card gives you the flexibility to transfer rewards to airline and hotel partners.

We also score each card’s set of features – its perks and benefits — against five tiers of features to provide a rating.

We break down these tiers as follows:

- Tier 1 has less than standard card features (an ultra-streamlined card that offers basic utility and next to nothing in the way of ancillary benefits.

- Tier 2 includes the benefits you’d expect on standard Visa or Mastercard credit cards, such as free access to your credit score, car rental insurance and $0 liability for fraudulent charges.

- Tier 3 includes “prime card” or better-than-average card features like cellphone insurance, lost luggage insurance, concierge services and purchase protection.

- Tier 4 includes luxury features such as airport lounge access, elite status with an airline or hotel and credits for expedited security screening membership programs.

- Tier 5 includes the sort of exemplary benefits you’ll find on top-tier luxury cards, such as high-value travel credits, cardholder memberships and other unique and valuable perks.

How do I apply for the Walmart credit card?

You can apply for a Walmart credit card through Capital One's website.

What credit score do you need for the Capital One Walmart Rewards credit card?

You’ll need good to excellent credit to qualify for a Capital One Walmart Rewards® Mastercard®. A credit score of 670 or higher is considered good on the FICO Score range.

Is the Walmart Rewards Card only good at Walmart?

You can use the Capital One Walmart Rewards Mastercard wherever Mastercard is accepted.

Is there an app for the Walmart credit card?

You can access your account using either the Walmart mobile app or the Capital One mobile app for iOS and Android. The Capital One app is also compatible with the Walmart® Rewards store card. By using the Walmart app, you can use Walmart Pay to earn maximum rewards for shopping at Walmart in-store during your first year with the card.

Can I use the Capital One Walmart Rewards Card at Sam’s Club?

Yes, the Capital One Walmart Rewards card can be used at Sam's Club. However, you will only earn the base 1 percent cash back rate on purchases, not the boosted cash back rates for Walmart purchases.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One Spark Cash Plus Review

Capital One Spark Miles for Business Review

Ink Business Cash® Credit Card Review

United℠ Business Card Review

Marriott Bonvoy Business® American Express® Card Review

BILL Divvy Corporate Card Review

Capital One Spark Cash Select for Excellent Credit Review

Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card Review

Capital on Tap Business Credit Card Review

Ink Business Premier® Credit Card Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

- Single-Trip Emergency Medical 1 of 5

- Single-Trip All-Inclusive 2 of 5

- Single-Trip Travel Canada Emergency Medical 3 of 5

- Trip Cancellation & Interruption 4 of 5

- COVID19 Pandemic Travel Plan 5 of 5

- Multi-Trip Emergency Medical 1 of 2

- Multi-Trip All-Inclusive 2 of 2

- Emergency Medical Top-Up 1 of 1

- Emergency Medical Plan 1 of 1

- Canadian Studying in Canada Outside the Home Province 1 of 3

- International Student Studying in Canada 2 of 3

- Canadian Studying Outside Canada 3 of 3

Why is Travel Insurance important?

Travel insurance is important to help protect you, your family or visitors to Canada from costs that can occur due to an unforeseen medical emergency during a trip or an unexpected reason to cancel or interrupt a trip. Without it, travellers may be left to pay significant out of pocket expenses.

If you are looking for Single Trip Emergency Medical coverage, we have recently introduced a new plan that provides up to $5 Million for COVID-19 emergencies while travelling outside of Canada. See the COVID-19 Pandemic Travel Plan for more details.

Learn More About Our Plans

Travelling canadians.

The COVID-19 Pandemic Travel Plan is designed for Canadians travelling outside of Canada. It can help protect you against the cost of unexpected emergencies that may occur during your trip.

Manulife Financial Travel Insurance for Travelling Canadians is designed for Canadians travelling out-of-province or outside Canada. It can help protect you against the cost of unexpected emergencies that may occur before or during your trip.

Your government health insurance plan may only cover a fraction of healthcare expenses incurred outside Canada, and may only provide limited coverage. Without travel insurance, a medical emergency or trip interruption due to an emergency could be disruptive and leave you facing large unexpected expenses.

Visitors To Canada

Do you have family or friends coming to stay? Do they have health insurance to help protect them while they’re here? Are you visiting Canada and need health insurance while you are away from home?

When Visitors to Canada purchase Manulife Financial Travel Insurance before leaving home they will have coverage during their uninterrupted flight to Canada.

The Student plan offers those who are studying away from home a smart and economical way to help protect themselves against the cost of emergency medical and basic healthcare expenses and more.

Plans are available for full-time:

- International students studying in Canada or

- Canadian students studying outside their home province or outside of Canada.

Family coverage is also available for immediate family members residing with the student.

- Rewards Card Rewards

- Benefits and Features

- Annual Fee and Other Costs

How the Capital One Walmart Rewards Card Compares

- Why You Should Trust Us

Capital One Walmart Rewards Card Review 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Capital One Walmart Rewards® Mastercard®†, Chase Freedom Flex℠, Citi® Double Cash Card. The details for these products have not been reviewed or provided by the issuer.

Earn 5% cash back at walmart.com, including pickup and delivery. Earn 2% cash back in Walmart stores, Murphy USA and Walmart® fuel stations, restaurants, and travel purchases. Earn 1% cash back on all other purchases.

19.48% or 29.99% Variable

Earn 5% cash back on purchases in Walmart® stores

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You'll earn a strong 5% cash back on Walmart.com purchases, including pickup and delivery (with no limit on what you can earn)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Restaurant and travel purchases earn 2% cash back, as do in-store Walmart purchases in the US and Puerto Rico

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee and no foreign transaction fees

- con icon Two crossed lines that form an 'X'. Many comparable no-annual-fee cash-back cards come with a substantial welcome bonus or other valuable benefits

For a no-annual-fee card, the Capital One Walmart Rewards® Mastercard® comes with surprisingly good benefits, including purchase protection, price protection, and extended warranty. That said, this card really only makes sense if you spend a substantial amount on Walmart.com purchases.

Capital One Walmart Rewards Card Review

Store credit cards are usually not the best option if you want to maximize credit card rewards based on your spending. While it can be tempting to apply for a store credit card to get a discount upfront, in many cases, the benefits of opening a store card are short-lived.

You could also end up getting stung by exorbitant fees and interest if you end up carrying a balance, because one drawback of store cards is that they are notorious for charging extremely high rates. This is one of the reasons why we normally recommend avoiding store credit cards.

The Capital One Walmart Rewards® Mastercard®† doesn't quite fit the store credit card mold. You can use it anywhere Mastercard is accepted, and it earns strong rewards in certain categories — including 5% cash back at Walmart.com (including pickup and delivery) with no cap. Cardholders also earn 2% back in Walmart stores, at Murphy USA and Walmart gas stations, and on restaurants and travel, and 1% back on all other eligible purchases.

For a no-annual-fee card, the Capital One Walmart Rewards® Mastercard®† comes with surprisingly good benefits, including purchase protection, price protection, and extended warranty. And if you're approved for the World Elite Mastercard version of the card, you'll receive even more perks, including cell phone protection.

That said, this card really only makes sense if you spend a substantial amount on Walmart.com purchases. Otherwise, you'll likely do better with a credit card that earns bonus rewards across broader categories, like the Chase Freedom Flex℠ , or a flat-rate cash-back card like the Citi® Double Cash Card or Wells Fargo Active Cash® Card.

Capital One Walmart Rewards Card Rewards

Welcome bonus.

Although it doesn't come with a traditional welcome bonus, new Capital One Walmart Rewards® Mastercard®† cardholders can earn 5% back in Walmart stores when using Walmart Pay (its branded mobile wallet) for the first 12 months of account opening.

How to Earn Rewards

The Capital One Walmart Rewards® Mastercard®† earns rewards in the form of points, although its earning structure is framed as cash back. Cardholders earn:

- 5% cash back on delivery or pickup purchases made through Walmart.com or the Walmart mobile app

- 2% back on purchases made at Walmart stores in the US and Puerto Rico, and at Walmart and Murphy USA gas stations

- 2% back on dining and travel purchases

- 2% back on the purchase of gift cards at Walmart (online, app, Walmart Pay, or in stores)

- 1% back on all other eligible purchases

There's no limit to the amount of cash back you can earn in any of these categories.

How to Use Rewards

With the Capital One Walmart Rewards® Mastercard®†, you'll have several options for redeeming points, and rewards don't expire as long as your account is open. Redemption options include:

- Cash back — as an account credit, during online checkout, to erase a previous purchase, or in the form of a check

- Travel through the Capital One Travel Portal

Your points are worth 1 cent apiece no matter how you use them. For instance, if you want to erase a $100 purchase or redeem for a $100 travel charge, you'd need 10,000 points.

Read more: The best travel credit cards

Capital One Walmart Rewards Card Benefits and Features

Most store credit cards don't offer much in the way of additional features, but the Capital One Walmart Rewards® Mastercard®† actually comes with compelling benefits. Capital One issues two versions of the card — a World Mastercard and a World Elite Mastercard — and the latter comes with more perks.

World and World Elite Mastercard Benefits

Regardless of whether you've got a World or World Elite version of the Capital One Walmart Rewards® Mastercard®†, you'll receive the following benefits:

Purchase assurance

Mastercard purchase protection can cover eligible items bought with your card against damage or theft within 90 days of purchase. There's a coverage maximum of $1,000 per loss and $25,000 per cardholder account per 12-month period. Other restrictions apply so be sure to read the fine print.

Price protection

If you bought an eligible item with your card and find a lower advertised price within 120 days of purchase, you could be eligible for reimbursement of the price difference.

Extended warranty

When you use your card to purchase a new, eligible item with a US manufacturer's warranty of 24 months or less, extended warranty doubles the original manufacturer's warranty up to a maximum of 24 months.

Mastercard ID Theft Protection

Identity theft is an ongoing concern, but when you have the Capital One Walmart Rewards® Mastercard®†, you're eligible for complimentary access to a suite of identity theft online resolution services. These include identity monitoring, dark web scanning, credit bureau monitoring, and lost wallet assistance.

World Elite Mastercard Benefits

When you have the World Elite Mastercard version of the card, you'll get access to additional perks.

Cell phone protection

When you use the card to pay your monthly wireless bill, you're eligible for cell phone protection against covered theft or damage, up to $800 per claim and $1,000 per covered card per 12-month period. There's a $50 deductible per claim and a maximum of two claims per 12-month period.

World Elite Mastercard Concierge

The World Elite Mastercard Concierge can help you arrange things like hard-to-get restaurant reservations or theater tickets, help with trip planning, and remind you of important dates. It doesn't cost anything to use the service, but any third-party costs are your responsibility.

Identity fraud expense reimbursement

If you're a victim of identity fraud, you could be reimbursed for up to $1,000 in eligible losses per claim.

Travel assistance services

When you run into trouble more than 50 miles from home, you can access a travel and emergency assistance hotline that can help arrange things like legal and medical referrals, prescriptions, translation services, and more. Keep in mind any third-party costs are your responsibility.

Car rental insurance

When you decline the rental company's collision insurance and charge the entire rental cost to yourcard, you're covered for theft and collision damage on most cars. In the US, coverage is secondary to your personal insurance — otherwise, it's primary insurance.

Travel accident insurance

If you used your card to pay for your fare, you could be covered for up to $1,000,000 in travel accident insurance.

Trip interruption/cancellation insurance

You can be reimbursed for up to $1,500 if your non-refundable travel is canceled or interrupted for a covered reason.

Baggage delay insurance

If your bags are delayed by four hours or more, you could be reimbursed for essential purchases (like clothing and toiletries) up to $100 per day for up to three days.

Lost or damaged luggage insurance

When you pay for your fare with the card and the carrier damages or loses your bags, you could be covered for up to $1,500 per incident for repairing or replacing your checked and/or carry-on luggage and contents.

Capital One Walmart Rewards Card Fees and Costs

The Capital One Walmart Rewards® Mastercard®† doesn't have an annual fee. It doesn't charge foreign transaction fees, either, so it's a good choice for international purchases.

As with most credit cards, there are fees for cash advances, balance transfers, and late payments.

Capital One Walmart Rewards Mastercard vs. the Walmart Rewards Card

In addition to the Capital One Walmart Rewards® Mastercard®†, there is a Walmart Rewards Card that can only be used at Walmart and Walmart properties. You can use the Capital One Walmart Rewards® Mastercard®† anywhere that Mastercard is accepted, so it's generally a more convenient option.

Capital One Walmart Rewards Mastercard vs. the Amazon Prime Visa

The Prime Visa is another popular store credit card, available to Amazon Prime members with no annual fee. Choosing between the two may come down to where you shop more, but unlike the Capital One Walmart Rewards® Mastercard®† the Prime Visa does offer a more traditional welcome bonus: $100 Amazon gift card instantly upon approval as a Prime member. In addition to earning 5% at Amazon, the Prime Visa earns 5% back on Whole Foods and Chase Travel Portal purchases.

Amazon Prime Visa Review

Capital One Walmart Rewards Card vs. the Blue Cash Everyday Card from American Express

Our final card comparison pits the Capital One Walmart Rewards® Mastercard®† against a popular card for earning cash back on everyday expenses: the Blue Cash Everyday® Card from American Express. This card has a $0 annual fee and earns 3% cash back at U.S. supermarkets on up to $6,000 spent per year, then 1% back; 3% cash back on online retail purchases on up to $6,000 spent per year, then 1% back; and 1% back on all other purchases (cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout).

If you shop at a variety of U.S. supermarkets, not mainly at Walmarts, you may be better off with the Blue Cash Everyday® Card from American Express. Another advantage is that it comes with a welcome bonus of $200 statement credit after you spend $2,000 in purchases on your new card in the first six months of card membership.

Blue Cash Everyday Card Review

Capital One Walmart Rewards Card Frequently Asked Questions

To qualify for the Capital One Walmart Rewards® Mastercard®†, you should have a credit score in the good to excellent range. According to the FICO model, a good credit score is 670 or above, and an excellent credit score is anything above 800.

It could be worth getting a Walmart card if you frequently shop at Walmart, because you'll earn 5% back at Walmart.com and 2% at Walmart stores in the U.S. and Puerto Rico, and at Walmart and Murphy USA gas stations. Especially for online Walmart purchases, this is a great rate of return on your spending.

The disadvantage of a Walmart card is that you can earn more cash back or points on non-Walmart purchases with another card. A Walmart card will be most rewarding for purchases at Walmart only, but for non-Walmart purchases, you should consider other cash-back cards. Some options can earn you as much as 2% back on every purchase.

Why You Should Trust Us: How We Reviewed the Capital One Walmart Rewards Card

Our review of the Capital One Walmart Rewards® Mastercard®† and the numerical score we assigned to the card are based on our credit card rating methodology . We evaluated the card across a handful of categories, including rewards, annual fee, benefits, and options for redeeming rewards.

In every case, we compare a card with other similar cards — so in this case, we compared the Capital One Walmart Rewards® Mastercard®† to other store credit cards and to low- or no-annual-fee cards that offer a high return on grocery spending.

For rates and fees of the Blue Cash Everyday® Card from American Express, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Walmart credit card review: earn up to 5% back at walmart, with a catch, here's a break down of the similarities and differences of the capital one walmart rewards card and the walmart rewards card, so you can choose the best card for your needs..

Walmart shoppers may want to consider opening one of the store's credit cards to maximize savings at the popular retailer.

Walmart partnered with Capital One in September 2019 for two credit cards: the co-branded Capital One Walmart Rewards® Mastercard®* and the private-label Walmart Rewards™ Card .

Both cards offer up to 5% back and come with no annual fee. So you may not know which card to choose, since they're so similar.

To make the decision easier, Select dives into the similarities and differences of both Walmart credit cards so you can choose the best card for your needs.

Walmart Rewards Card review

Where you can use walmart credit cards, walmart credit card rewards.

- Additional benefits

Bottom line

Capital one walmart rewards® mastercard®.

Earn 5% cash back at Walmart.com, including pickup and delivery; 2% cash back on purchases in Walmart® stores, Murphy USA and Walmart® fuel stations, at restaurants and on travel purchases; 1% cash back everywhere else Mastercard® is accepted

Welcome bonus

Earn 5% back on purchases in Walmart® stores for the first 12 months when you use your card with Walmart Pay

Regular APR

18.99% or 29.99% variable

Balance transfer fee

$0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fee

Credit needed.

Good/Excellent

Terms apply.

Walmart Rewards™ Card

5% back at Walmart.com and on the Walmart app; 2% back at Walmart stores, Walmart and Murphy USA fuel stations

5% back on in-store purchases when using Walmart Pay for the first 12 months after approval (after, earn 2%)

26.99% variable

Most credit cards can be used anywhere the card network (Visa, Mastercard, American Express or Discover) is accepted, but some cards have limitations. Credit cards with restricted use are known as private-label cards or store cards and can only be used at the namesake brand's properties.

Since the Walmart Rewards™ Card* is a private-label card, you can only use the card at Walmart properties, which include Walmart.com, the Walmart app, Walmart stores and Murphy USA gas stations.

On the other hand, the Capital One Walmart Rewards® Mastercard®* can be used anywhere Mastercard is accepted.

If you're looking for a credit card that can be used anywhere, the Capital One Walmart Rewards® Mastercard®* provides more flexibility than the Walmart Rewards™ Card.

Each Walmart credit card offers the same base rewards, but the Capital One Walmart Rewards® Mastercard® offers a more in-depth rewards program.

Both cards offer:

- 5% back on purchases at Walmart.com

- 2% back on in-store Walmart® purchases

The Capital One Walmart Rewards® Card* also offers:

- 2% back on restaurant, travel purchases, and Murphy USA and Walmart® fuel stations

- 1% back everywhere else Mastercard is accepted

New applicants for either card can also take advantage of a welcome bonus : Earn 5% cash back on purchases in Walmart® stores for the first 12 months when you use your card with Walmart Pay.

Similar to other Capital One credit cards, rewards can be redeemed at any time and for any amount. Redemption options include travel, gift cards, the ability to cash in points during online checkout at Walmart.com and statement credits.

Walmart credit card added benefits

The Capital One Walmart Rewards card* offers the most benefits, including: extended warranty protection, travel accident insurance, 24-hour travel assistance services, price protection and more. The Walmart Rewards™ Card doesn't come with these perks.

Walmart credit card fees

Both Walmart cards have no annual fee, but the interest rates and other fees differ. The Capital One Walmart Rewards card* has a 18.99% or 29.99% variable APR, while the Walmart Rewards™ Card has a 26.99% variable APR.

Since the Capital One Walmart Rewards card* can be used anywhere Mastercard is accepted, cardholders have the ability to use the card abroad — and without paying a foreign transaction fee . This saves you the 3% fee many other cards charge for purchases made outside the U.S.

You can also use the card to complete a balance transfer , but the terms aren't ideal. There are currently no special financing offers, and the balance transfer fee is $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you.

If you're looking to finance new purchases with no interest or complete a balance transfer , consider alternative cards, such as the Citi Simplicity® Card , which offers 0% intro APR for 21 months on balance transfers from date of first transfer and 0% intro APR for 12 months on purchases from date of account opening (then 19.24% - 29.99% variable APR; see rates and fees ). Balance transfers must be completed within four months of account opening. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

The Walmart credit cards may seem like a good choice at first glance, offering up to 5% back on Walmart purchases, but a closer look shows that the rewards are more geared to online Walmart purchases. If you prefer to shop at Walmart.com, the Walmart app or via Walmart Grocery Pickup and Delivery, then the 5% rewards rate is unmatched.

However, if you prefer to shop in Walmart stores, you can find alternative rewards cards , such as the Capital One Venture Rewards Credit Card (see rates and fees ), that offer the same rewards rate at Walmart stores (2X), plus other perks such as Global Entry or TSA PreCheck statement credit .

And a basic cash-back card , such as the Citi Double Cash® Card , is a simple way to earn the same amount of rewards on all purchases. Double Cash cardholders earn 2% cash back on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. ( see rates and fees. )

If you decide that a Walmart rewards card is your best option, either the Capital One Walmart Rewards® Mastercard®* or the Walmart Rewards™ Card can help you save. The Walmart Rewards™ Card is good if you only plan to use the card on Walmart purchases, but if you want to use the card for more than just Walmart, consider the Capital One® Walmart Rewards™ Card.

Take note that there is one application for both cards, and Capital One will initially consider you for the Capital One Walmart Rewards® Mastercard®* If they are unable to approve you for that card, you will automatically be considered for the Walmart Rewards™ Card.

Learn more:

- Walmart Credit Cards vs Target RedCard: Which is the best for your wallet?

- Amazon vs. Walmart: Which retailer offers the best credit card?

*Information about the Capital One Walmart Rewards® Card and Walmart Rewards™ Card has been collected independently by CNBC and has not been reviewed or provided by the issuer of the cards prior to publication.

- 5 hidden insurance fees to avoid Liz Knueven

- Can I pay my mortgage with a credit card? Kelsey Neubauer

- How can I get homeowners insurance after nonrenewal? Liz Knueven

- Skip to main

- Skip to footer

- Board of Directors

- Walmart History

- New Home Office

- Working at Walmart

- Sam's Club

- Location Facts

- Contact Walmart

- Media Library

- Contact Media Relations

- Opportunity

- Sustainability

- Ethics & Integrity

- Belonging, Diversity, Equity & Inclusion

- Philanthropy

- ESG Reporting

- Health & Wellness

- Stock Information

- Financial Information

- Corporate Governance

- ESG Investors

- Investor Resources

- Supplier Requirements

- Apply to be a Supplier

- Supplier Inclusion

- Sustainability for Suppliers

- America at Work

- Investing In American Jobs

- Sam's Club Suppliers

- Ask Walmart

Walmart and Expedia Group Launch Travel Benefit for Walmart+ Members

This new benefit, powered by expedia, gives walmart+ members the exclusive ability to get walmart cash by booking epic vacations.

July 25, 2023

BENTONVILLE, Ark., July 25, 2023 — There’s still time to pack your bags – Walmart is taking its valued Walmart+ members on a new, more rewarding journey before the summer travel season becomes this fall’s show-and-tell. Beginning today, Walmart+ members can book getaways through WalmartPlusTravel.com and get Walmart Cash. Walmart+ members will receive 5% Walmart Cash on hotels, vacation rentals, car rentals and activities bookings, 2% Walmart Cash on all flights and a blended rate of Walmart Cash on vacation packages 1 .

Travel booking on WalmartPlusTravel.com is powered by Expedia Group’s White Label Template technology, giving Walmart+ members access to more than 900,000 properties, 500+ airlines, 100+ car rental companies and thousands of activities around the world. This new offering will make shopping for travel a win-win for Walmart+ members as they begin getting Walmart Cash, previously Walmart Rewards , on all aspects of their vacation getaways.

"We're bringing together the ultimate savings membership and vacation booking site to deliver a first-ever travel-focused benefit for Walmart+ members," said Venessa Yates, senior vice president and general manager of Walmart+. "Combined with our other benefits — including free delivery, streaming and savings on fuel — we’re creating a membership that saves customers time and money, whether they’re at home or having fun at their favorite vacation destination.”

Here’s how it works:

- Easy to find: Walmart+ members will access travel through their member benefits hub in the app or WalmartPlusTravel.com.

- Easy to book: Members can choose travel options like flights, hotels, vacation rentals, car rentals, packages and activities.

- Easy to earn: After the booking is confirmed, any Walmart Cash received will appear in the member’s Walmart wallet. Walmart Cash will become available 30 days after travel is completed and can be used on future Walmart purchases or cashed out in store.

“We’re delighted to launch this collaboration with Walmart, America’s largest retailer, making planning, shopping and booking travel a new and seamless part of Walmart’s shopping experience. Together, we’re connecting Walmart’s massive customer base with Expedia Group’s extensive array of travel supply partners from all around the world," said Ariane Gorin, president of Expedia for Business. "What's exciting is that with this collaboration, Walmart customers will benefit from Expedia's ongoing innovation through TravelOS, our A.I.-powered travel operating system, as we continue to add new product and feature updates to drive the best traveler experience.”

Walmart+ members will also have access to Expedia Group’s top tier, end-to-end customer service, handling all their travel needs from start to finish. Whether via live agents or by leveraging the company’s self-serve capabilities, like their A.I.-powered Virtual Agent tool, Expedia Group’s services allow members to ask questions about their trip or make changes with ease.

Walmart+ is consistently evolving to deliver what’s most important for members, most recently with the evolution of Walmart Rewards to Walmart Cash, the same great program, under a new name and with the added ability to cash-out in store. Over time, some of the components of Walmart Cash will expand to all customers, while additional ways to get Walmart Cash will remain exclusive to members, like Walmart+ Travel.

For more information about how to become a Walmart+ member, please visit walmart.com/plus .

1 For example, if the package consisted of a hotel + flight, the Walmart Cash received would be 5% Walmart Cash on the hotel element and 2% Walmart Cash on the flight element.

About Walmart Walmart Inc. (NYSE: WMT) is a people-led, tech-powered omnichannel retailer helping people save money and live better - anytime and anywhere - in stores, online, and through their mobile devices. Each week, approximately 240 million customers and members visit more than 10,500 stores and numerous eCommerce websites in 20 countries. With fiscal year 2023 revenue of $611 billion, Walmart employs approximately 2.1 million associates worldwide. Walmart continues to be a leader in sustainability, corporate philanthropy, and employment opportunity. Additional information about Walmart can be found by visiting corporate.walmart.com , on Facebook at facebook.com/walmart , on Twitter at twitter.com/walmart , and on LinkedIn at linkedin.com/company/walmart .

About Expedia Group Expedia Group, Inc. companies power travel for everyone, everywhere through our global platform. Driven by the core belief that travel is a force for good, we help people experience the world in new ways and build lasting connections. We provide industry-leading technology solutions to fuel partner growth and success, while facilitating memorable experiences for travelers. Our organization is made up of three pillars: Expedia Product & Technology, focused on the group’s product and technical strategy and offerings; Expedia Brands, housing all our consumer brands; and Expedia for Business, consisting of business-to-business solutions and relationships throughout the travel ecosystem. The Expedia Group family of brands includes: Expedia®, Hotels.com®, Expedia® Partner Solutions, Vrbo®, trivago®, Orbitz®, Travelocity®, Hotwire®, Wotif®, ebookers®, CheapTickets®, Expedia Group™ Media Solutions, CarRentals.com™, and Expedia Cruises™. For more information, visit www.expediagroup.com . Follow us on Twitter @expediagroup and check out our LinkedIn www.linkedin.com/company/expedia/ . © 2023 Expedia, Inc., an Expedia Group company. All rights reserved. Trademarks and logos are the property of their respective owners. CST: 2029030-50

Make every trip more rewarding with Walmart+

GET UP TO 5% WALMART CASH Walmart+ members get 2% on air travel, plus 5% on hotel, car rentals, tours & more.

Discover your next beach getaway

Save more on quick escapes

Find your fam's perfect home away from home

Redeem your Walmart Cash to prep for your next trip.

Discover hotels at popular road trip destinations in the U.S.

Top destinations for you.

Los Angeles

Explore Your Next Adventure with Walmart+ Travel!

Atlanta hotels

Dallas hotels

Chicago hotels

Houston hotels

Las Vegas hotels

Los Angeles hotels

Phoenix hotels

San Diego hotels

San Francisco hotels

Seattle hotels

Introduction to Walmart+ Travel:

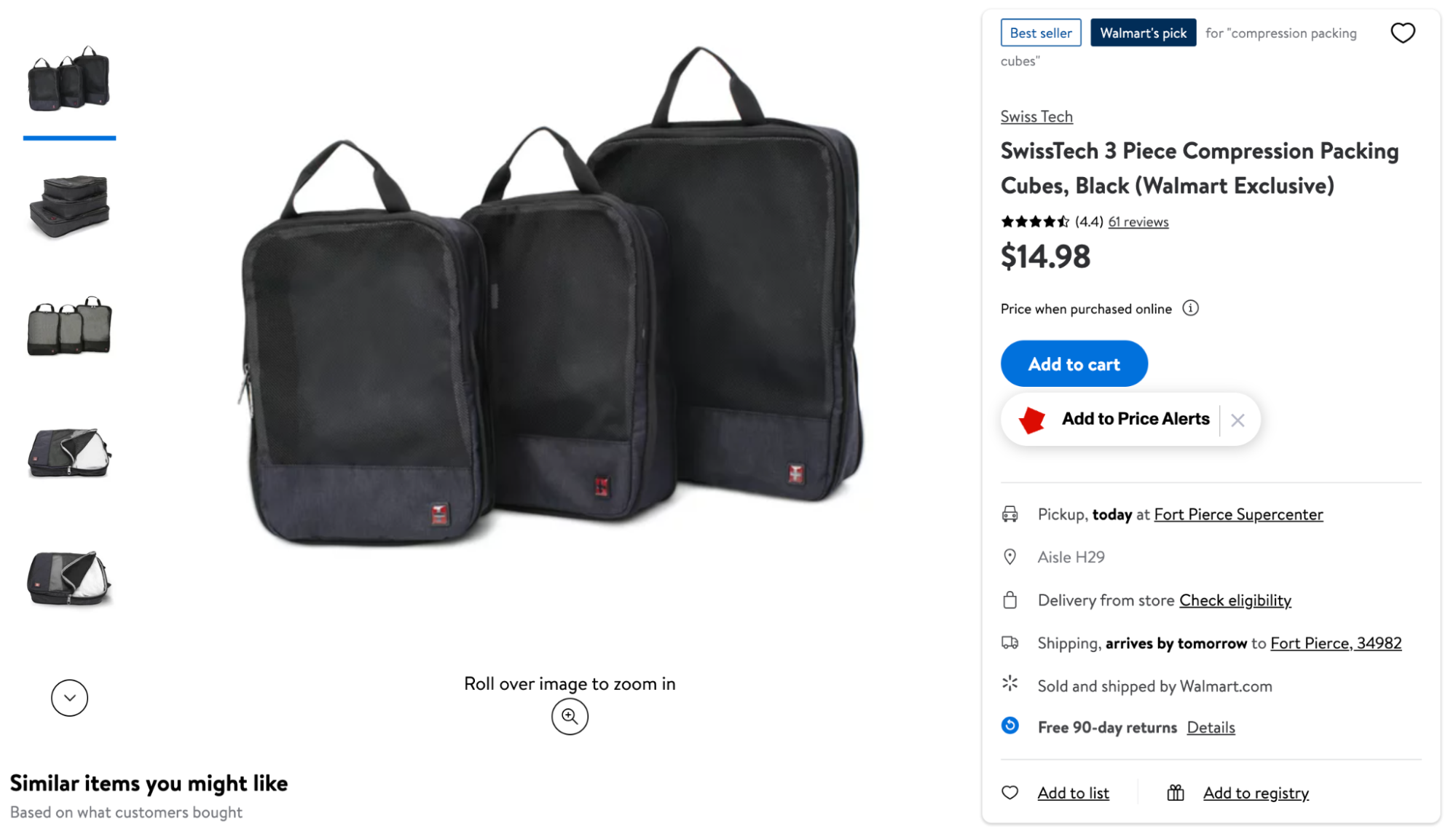

Walmart+ Travel puts everything you need in one account, from car rental to hotels to flights. And you don't need to spend forever searching for a Walmart discount for a hotel, because as a Walmart+ member, you get Walmart Cash on eligible purchases credited automatically to your account. Your Walmart+ benefits include 2% Walmart Cash on all air travel and 5% on other travel expenses like a vacation rental and things to do.

Unleash your wanderlust with Walmart+ Travel

Experience top destinations with Walmart+ Travel and go on a unique vacation your whole family will enjoy. From exciting attractions and theme parks to the nation's top museums and wildlife parks, your next vacation's activities and tickets can be booked in the same place as your flights and hotel with Walmart+ Travel deals.

Walmart+ launches new travel benefit, offering up to 5% Walmart Cash on your trip purchases

For anyone looking for a savings opportunity while traveling, the nation's largest retailer has just launched a new booking platform for its members that can help with just that.

Walmart+ Travel (powered by Expedia) is now live, allowing members to book flights, rental cars, hotels, vacation rentals, activities and more. But the best part? You can get up to 5% Walmart Cash on these purchases.

This new benefit adds to an already lucrative lineup of benefits for Walmart+ members.

Here's everything you need to know about this new offering.

Overview of Walmart+ Travel