- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

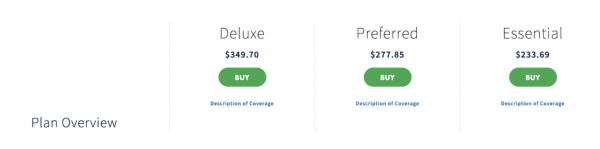

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan New

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.75% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹3 crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

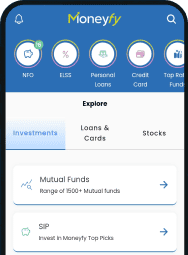

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

- Fixed Deposit

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

- Loan against Property

Loan Against securities

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

Cancer Care Insurance

Offers & Updates

Download the moneyfy app.

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.75%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers.

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

- Two wheeler Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

Compound Interest Calculator

Home Insurance & Travel Insurance

Travel & Home Insurance

Tata aig travel guard, (uin : tattiop23097v032223).

While you are vacationing abroad, any unforeseen contingency should be the last thing on your mind. However, you cannot ignore this aspect, as traveling abroad involves a certain degree of risk, right from falling ill, having a flight delay, to baggage loss or having met with an accident. To remove the stress out of traveling, all you need is Tata AIG Travel Guard.

Disclaimer: Tata Capital Limited (“TCL”) bearing License no. CA0896 valid till 21-Jan-2027, acts as a Composite Corporate Agent for TATA AIA Life Insurance Company Limited, HDFC Life Insurance Company Limited, BAJAJ Allianz Life Insurance Company Limited, Kotak Mahindra Life Insurance Company limited, TATA AIG General Insurance Company Limited, IFFCO Tokio General Insurance Company Limited & Star Health and Allied Insurance Co Ltd. Please note that, TCL does not underwrite the risk or act as an insurer. For more details on the risk factors, terms & conditions please read sales brochure carefully of the Insurance Company before concluding the sale. Participation to buy insurance is purely voluntary.

The Registered office of TCL is Tata Capital Limited, 11th Floor, Tower A, Peninsula Business Park, Ganpatrao Kadam, Marg, Lower Parel, Mumbai-400013

Key Features

Accidental Death and Dismemberment benefit

Accident and Sickness medical expense reimbursement

Baggage delay benefit and checked baggage loss benefit

Home Burglary

Trip Cancellation

Missed Connection/Missed Departure

Bounced Hotel/Airline Booking

Flight Delay

Subscribe to our newsletter

Submitted successfully

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Medical Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Education Loan

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan EMI Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

- Looking for Investments?

- Looking for Loans?

Download our Moneyfy App

Start an SIP in minutes by signing up with the Tata Capital Moneyfy App. We are your one stop shop for all things investment.

Enter your mobile number to receive link to download the app

Download the app for your device.

An SMS has been sent to XXXXXXX051 Click on the link in the message to download the Moneyfy App.

Scan QR to download the App

Download our TATA Capital App

Looking for a seamless loan experience? Get the Tata Capital Loan App and Apply for loans, Download Account Statement/Certificates, Track your requests & much more.

Thank you for subscribing

We will send news and updates to your registered email ID

Stay updated!

We are constantly crafting offers and deals for you. Get them delivered straight to your device through website notifications.

All you have to do is Click on “Allow”

Looking for offers...

Download The Moneyfy App

Be investment ready in minutes by signing up with the Tata Capital Moneyfy App. We are here to make mutual fund investments simpler for you.

Just enter your mobile number and we will share the link with you.

TATA AIG Insurance Online

- TATA AIG Insurance

Travel Insurance

Buy tata aig travel insurance online.

- Including USA and Canada

- Excluding USA and Canada

- Schengen Countries

Indians travelling abroad can buy Tata AIG overseas travel insurance as it is very popular among Indian tourists mainly parents and senior citizens. Tata AIG has designed travel medical insurance for every category of tourist, individual, family, travelers with pre-existing conditions and frequent travelers. The plans also offer global coverage so no matter where the Indians are travelling, Tata AIG will take care of all the specified medical expenses in case of sudden sickness and emergency. Avail free quotes or premium of the coverage for overseas travel medical expenses by filling the above form.

Buy Indian travel insurance online

- Policy should be purchased while traveler/s is in India. If traveler already outside India please e-mail us .

- Indian/International Credit/Debit cards, Net banking and Indian Cheques are accepted.

- Policy will be issued & emailed on completing credit/debit card transaction or receipt of Cheque/DD

- Hard copy of the policy will be couriered if requested.

Other payment options include

- Cash Cards - ItZ cash, Pay Cash

- Mobile Payments - Paymate, IMPS , Scan N Pay

- Wallet - Paytm, Mobikwik, Oxigen wallet, Freecharge, Jio Money etc ...

- UPI - Unified Payment Interface

TATA AIG Travel Insurance Online - FAQ's

For traveler who has already left India, please fill the form for traveler already outside India and send it to us. We will try can get approval from the underwriter company for you to buy international travel insurance.

Travelers up to the age of 99 years can buy Tata AIG international mediclaim travel insurance.

Yes if Tata AIG travel insurance offers cashless settlement, if hospitalized as inpatient for more than 24 hours. AIG IS or ISOS will offer cashless hospitalization by paying 100% of the claim amount.

Tata AIG travel insurance have a 24 hours customer service and assistance. You can contact them by calling them on these customer care numbers .

Travel insurance from TATA AIG

Student insurance, senior insurance, health insurance, schengen insurance, annual insurance, pre-existing insurance, covid insurance, what does tata aig travel insurance cover.

The plan covers for medical expenses due to accident and sickness while traveling outside India.

Reimbursement for loss of checked in baggage.

Coverage for expenses incurred in obtaining a duplicate or new passport.

The policy pays for immediate dental treatment occurring due to sudden acute pain during an overseas insured journey.

Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

In the unfortunate event of the common carrier being hijacked, plan will pay a distress allowance.

Reimbursement of additional expenses due to trip delay (only if the trip is delayed for more than 12 hours).

Travel Guard gives worldwide coverage against Accidental Death and Dismemberment while abroad.

Reimbursement for reasonable expenses incurred for purchase of emergency personal goods due to delay in arrival of checked in baggage while overseas.

Find out more about TATA AIG Travel Guard insurance

Travel insurance FAQ's

Answers to FAQ related to TATA AIG Travel Medical Insurance for visitors from India.

Travel insurance reviews

TATA AIG Travel Insurance Reviews - Customer experiences and testimonials.

Popular travel destinations

TATA AIG travel insurance for popular travel destinations.

Travel insurance customer care

TATA AIG Travel insurance customer care information for Indians travelling overseas.

Travel health insurance from TATA AIG

You can find different sections of insurance types here.

- Get best quotes for TATA AIG travel insurance for above 80 years old

- Pre-existing coverage travel insurance

Parents travel insurance

Individual travel insurance.

Seniors above 80 years

TATA AIG Overseas medical insurance for senior citizens above 80 years.

Explore »

Pre-existing coverage

TATA AIG travel insurance for pre-existing conditions.

International travel insurance for Indian parents overseas.

TATA AIG individual overseas travel insurance online

Resourceful TATA travel insurance links

TATA AIG travel insurance for Indians traveling overseas.

Business travelers making multiple trips overseas annually can buy the annual multi trip travel insurance.

TATA AIG Asia Travel Guard insurance for Indians going to other Asian countries.

Senior travelers up to the age of 90 years can opt for TATA AIG travel insurance coverage.

Applying for Schengen visa? Then this TATA AIG Schengen insurance is a good option to go for!

Compare and buy TATA AIG domestic travel insurance.

Search TATA AIG travel insurance

Travel insurance to Australia

Travel insurance to Canada

Travel insurance to USA

Travel insurance to UK

Travel insurance to New-Zealand

Travel insurance to Dubai

Travel insurance to Thailand

Travel insurance to Singapore

Travel insurance to Malaysia

Travel insurance to Africa

Travel insurance to Bali

Travel insurance to Mauritius

Travel insurance to Srilanka

Travel insurance to Vietnam

Travel insurance to Seychelles

Travel insurance to Egypt

Travel insurance to South Africa

Travel insurance to Kenya

Travel insurance to Tanzania

Travel insurance to China

Travel insurance to Japan

Travel insurance to Maldives

Travel insurance to Hong-Kong

Customers Testimonials

I would highly recommend nriol.com and Tata AIG for travel insurance. The purchase process was simple, the people were helpful and the rates were competitive. But, most importantly, my claim was settled promptly without much bureaucracy.

Thanks a lot for the speedy response and sending me the policy pdf. This is very useful and will be helpful for my parent's travel. I really liked the quick customer service and very happy with the response.

Thank you very much for your amazing service and response. I am really satisfied with the service and support of NRIOL. This is the second time I have benefited from the excellent service of NRIOL. I would surely recommend NRIOL to anyone looking to buy insurance for travelling abroad.

Hi NRIOL team Thanks, I have received the policy. Much appreciate your help and time.

Do you need health insurance?

New addition to your family? GET THEN INSURED Find Affordable HEALTH INSURANCE!!

Do you need travel insurance?

Is your family visiting you? GET THEN INSURED Find Affordable TRAVEL INSURANCE!!

Do you need domestic travel insurance?

Get free quotes and buy Indian Domestic travel insurance plans offered by TATA AIG.

TATA AIG CITATION

Mr. Jaideep Deorukhkar, Head Travel Services at Tata AIG says "NRIOL has been one of our key partners in India for the past 16 years and has been pivotal in providing Tata AIG customers an opportunity to purchase their TATA AIG travel insurance online".

- Call : (080)-41101026

- Contact

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- TATA AIG Travel

TATA AIG Travel Insurance

Get best quotes for TATA AIG

- Including USA and Canada

- Excluding USA and Canada

- Schengen Countries

TATA AIG Overseas Travel Insurance

TATA AIG’s Travel insurance program covers the insured from any unforeseen emergency while traveling abroad or within India, on Business or for Leisure. The plans are ideal for travelers going to any country across the world including the USA , Canada , Europe , South East Asia or Australia . The travelers can also remain covered throughout their travel to any destination in India on any mode of transport.

This Travel insurance policy covers treatment for Covid19 while overseas.

TATA AIG Travel Insurance review

TATA AIG travel insurance coverage for Covid19

The TATA AIG travel insurance provides coverage for Covid19 related medical expenses. COVID19 related expensed are covered up to the sum insured according to the plan chosen. Covid expenses are covered for plans both with and without Sub Limits up to the eligible policy maximum.

- Expenses related to Covid testing are not covered till a positive Covid test report requires further medical expenses.

- Institutional and home quarantine expenses are not covered.

- Expenses incurred by travelers for Covid19 testing as part of government regulation are not covered.

Unique Features of Tata AIG travel insurance for overseas travel

- Available up to 99 years

- Offers coverage for pre-existing conditions

- Offers coverage without sublimits

- TATA AIG travel insurance covers Coronavirus under Hospitalization Medical Expenses.

How to buy a Travel Policy online?

There is a simple online application for travelers to complete and enroll to purchase TATA AIG’s travel insurance.

- Once the online application is filled completely, travelers can use a credit / debit card /other modes or cheque to make the payment of premium for their policy.

- Travelers can purchase this travel insurance online from anywhere in the world.

- Many of our customers are in the USA , Canada , UK , Europe and Australia and buy this insurance online for family members traveling overseas from India.

- It must be noted that policies can be purchased for only those travelers, traveling out from India.

- A confirmation email will be sent to the travel insurance customer immediately after the completion of purchase process and paying the requisite premium.

- Those who are paying via cheque can forward the same to the mailing address of Eindiainsurance office specified on the application.

- Please note that the payment has to be received prior to commencement of travel.

Key features of TATA AIG travel insurance

- Tata AIG has been the undisputed market leader in the travel insurance market in India since inception in 2001 and till date enjoys amongst the highest market share in India in Retail Travel Insurance.

- Today they issue the highest number of International Retail Travel insurance policies and settle the maximum number of International Travel insurance claims as well.

- American International Group, Inc. (AIG) has Business Operations in 130 countries across all General Insurance lines of business including Travel Insurance. This global presence is a big advantage while managing the Travel Insurance business worldwide.

- Tata AIG's Medical Assistance Company is Europe Assistance

- Travel Guard is the worldwide Travel Insurance business was almost $1.05 billion across 80 countries including India. Clearly one of the leaders and the most preferred company for the longest time in the World Market for Travel Insurance.

- Travel Guard is one of the most popular travel insurance plan currently in the Indian market, which is comprehensive in terms of benefits and backed up by efficient and transparent claims servicing.

TATA AIG overseas insurance, TATA AIG international health insurance

Travel Guard

- Asia Travel Guard

- Student Guard

- Domestic Travel Guard

TATA AIG Travel Guard insurance for overseas travel

Travel Guard is a product specifically for International Travelers who are traveling on business or leisure to any destination across the world. This is the largest selling plan for Tata AIG and it is the most comprehensive in terms of Benefit Coverage and Sum Insured options.

Tata AIG currently offers seven variants of their International Travel Insurance product - five variants of Single Trip plans offering different Accident & Sickness (A&S) with Sum insureds like Silver Plan – US$50,000, Silver Plus Plan - US$100,000, Gold Plan - US$250,000 and Platinum Plan - US$500,000 and a recently introduced Senior Plan with a coverage of UDS $50,000. Apart from the Single Trip plans, they offer two variants of Annual Multi Trip Plans with different A&S coverage - Gold Plan - US$250,000 and Platinum Plan - US$500,000.

- Policy is available for all entry ages under different plans from the age of 6 months onwards till 70 years of age for all plans except the Senior Citizen plan, which has an entry age of 71 years.

Tata AIG travel insurance eligibility

- Travel insurance is available for the maximum of 180 days under the Single Trip Plans.

- Traveller should hold either an Indian citizen with an Indian passport, PIO Card (Persons of Indian Origin Card) or OCI Card (Overseas Citizen of India Card)

- Traveller should be traveling out from India and be available in India while purchasing the TATA AIG Policy

Benefits of TATA AIG Travel Guard insurance

- Hospital Room and Board and Hospital miscellaneous: Max $1,500 per day upto 30 days whichever is less.

- Intensive Care Unit: Max $3,000 per day upto 7 days whichever is less.

- Surgical Treatment: Max $10,000

- Anesthetist Services: Upto 25% of Surgical Treatment

- Physician's Visit: Max $75 per Day upto 10 visits

- Diagnostic and Pre-Admission Testing: Max $500

- Ambulance Services: Max $400

Features of Tata AIG Travel Insurance

- Coverage of Medical Expenses Travel Guard takes care of your medical expenses due to Accident and Sickness while traveling so that you can concentrate on enjoying the holiday without any stress.

- Checked Baggage Loss Compensation for the loss of checked in baggage in the custody of the common carrier.

- Baggage delay Compensation for reasonable expenses incurred for purchase of emergency personal effects due to delay in arrival of checked in baggage, whilst overseas.

- Loss of Passport Compensation for expenses incurred directly in obtaining a duplicate or new passport abroad.

- Personal Liability Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

- Hijacking In an unfortunate event of your common carrier in which you are travelling; being hijacked, this product will pay a distress allowance to you.

- In-hospital Indemnity The Policy pays a Daily benefit for each day you are an inpatient in a hospital due to injury or sickness.

- Trip Delay Reimbursement of additional expenses occurred due to trip delay (only if the trip has been delayed for more than 12 hours).

- Automatic-extension of the policy Travel Guard allows you to extend your policy upto a period of 7 days from the policy expiry date in the unfortunate event of Delay by the scheduled airline, which is beyond the control of the insured.

- Personal Accident Travel Guard gives you worldwide coverage against Accidental Death and Dismemberment following an accident during your trip.

- Sickness Dental Relief The policy pays for immediate Dental Treatment occurring due to sudden acute pain during the course of an overseas Insured Journey. Dental benefits will be provided for Medically Necessary filling of the tooth or surgical treatment, services, or supplies.

- Other Benefits Tata AIG’s Plans also cover some other benefits like Trip Cancellation / Curtailment, Repatriation of Remain and Medical Evacuation, Bounced Hotel / Airline Booking and Missed Connection / Departure

TATA AIG Asia Travel Guard Insurance for travel within Asia

Asia Travel Guard is Tata AIG’ s product designed for travellers within the continent of Asia but excludes Japan & Korea. There are two variants of the plan namely Silver and Gold with differential Sum Insureds for Emergency Accident & Sickness (A&S). The Silver plan has an A&S coverage of $50,000 while the Gold Plan has A&S coverage of $200,000.

Eligibility of Asia Travel Guard

- Policy is available for all entry ages under different plans from the age of 6 months onwards till 70 years of age.

- Hospital room and board and hospital miscellaneous: Max $1,500 per day upto 30 days whichever is less.

- Intensive care unit: Max $3,000 per day upto 7 days whichever is less.

- Surgical treatment: Max $10,000

- Anesthetist services: Upto 25% of Surgical Treatment

- Physician's visit: Max $75 per Day upto 10 visits

- Diagnostic and pre-admission testing: Max $500

- Ambulance services: Max $400

Coverage benefits of TATA AIG medical insurance

- Personal accident - 24-hr personal accident cover upto US$ 15,000.

- Medical expenses Cover - Reimbursement of medical expenses due to accident and sickness.

- Emergency medical evacuation and repatriation - In the event of a medical emergency, Tata AIG will arrange for the evacuation and transportation to move an ill or injured traveller to a location where appropriate medical care is available. Policy provides for repatriation of remains in case of unfortunate death of the insured during the trip.

- Checked baggage loss - Compensation for the loss of checked in baggage.

- Loss of passport - Compensation for expenses incurred in obtaining a duplicate or new passport.

- Checked baggage delay - Compensation for reasonable expenses incurred for purchase of emergency personal effects due to delay in arrival checked in baggage, whilst overseas.

- Personal liability - Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

- Afghanistan, Armenia, Azerbaijan, Bahrain, Bangladesh, Bhutan, Brunei, Burma (Myanmar), Cambodia, China, Hongkong, Indonesia, Iran, Iraq, Israel, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Laos, Lebanon, Malaysia, Maldives, Mongolia, Nepal, Oman, Pakistan, Philippines, Qatar, Saudi Arabia, Singapore, Sri Lanka, Syria, Taiwan, Tajikistan, Thailand, Turkey, Turkmenistan, UAE, Uzbekistan, Vietnam, Yemen.

TATA AIG student medical insurance

Studying abroad is a crucial opportunity for students. You can explore new lands, new cultures and new lifestyles during your spare time while abroad for studies. But you also should be aware that along with the opportunity there can be risk of accident or loss of sponsorship. TATA AIG StudentGuard insurance is designed for people who are travelling abroad to pursue their studies.

TATA AIG Domestic Travel Guard Insurance for Travel within India

Domestic Travel Guard completes the product offerings under Travel for Tata AIG. It is a plan suited for insuring a domestic travel journey on business or leisure. Domestic Travel is perhaps the most underpenetrated market in the India insurance space because most persons believe that there is no need for insurance while traveling within India. Tata AIG’s Domestic Guard covers travel outside the home city/location on any mode of transport ie. Air, Road, Rail etc.

Tata AIG’s Domestic Travel Guard has only one plan but there is an option for the insured to purchase multiple units (maximum upto 5 units) of this basic plan. Domestic Travel Guard Insurance also offers many unique benefits such as family transportation cover in case of emergencies, lost ticket reimbursements, missed departure compensations, personal liability coverage and personal accident insurance. So the next time you are traveling, ensure that you leave behind your worries and enjoy every moment of the trip.

- **We will pay the excess of what will be re-inbursed / paid by any other agency / authority.

- #Max units for Core benefits 5. The number of units for Add-on-benefits cannot exceed units for core benefits.

Features of TATA AIG international health insurance

- Missed Departure - In the event of missing the departure of your booked journey, the cost of your actual ticket(air / rail) will be reimbursed subject to certification by the concerned authority.

- Accommodation charges due to trip delay - In the event of the trip delay, the extra accommodation expenses incurred will be reimbursed.

- Lost ticket reimbursement - In case of a ticket loss due to which one cannot continue the journey the actual cost of the ticket will be reimbursed.

- Emergency medical evacuation - In the event of a medical emergency, the arrangements for the evacuation and transportation of the insured for appropriate & quality medical care, shall be covered.

- Repatriation of Remains – Coverage is provided up to the amount stated in the Policy Schedule for covered expenses reasonably incurred to return the insured’s mortal remains body to Your usual residence in India if You die during a Trip. Covered expenses include, but are not limited to, expenses for: (a) embalming;(b) cremation;(c) coffins; and (d) transportation.

- Replacement Of Staff (Business Trip) – the insurer shall pay upto the sum insured in respect of reasonable additional travel and accommodation expenses necessarily incurred under the circumstances in - 1. Sending out a replacement for an Insured Person; and returning the replacement following the completion of the duties necessarily undertaken. Alternately, returning the original person, back to the usual town in India or seding out the original Insured Person to complete a tour of duty following recovery from disability

- Family Transportation - If the insured is hospitalized for a long period of time following a covered hospitalization, the insurer will pay subject to SI for the the cost of round-trip economy airfare to bring one of Your Immediate Family Members chosen by You to and from Your bedside or pay the reimbursement of the hotel room charge due to convalescence after Your Hospital discharge

- 24 x 7 Assistance - Tata AIG’s assistance team will be available round the clock for any assistance or referral services like : Medical evacuation, Medical Assistance, Legal Assistance, Lost Luggage Support, Lost Travel Document Support, Assistance in emergency message transmission, Assistance in hotel accommodation, Arrangement of Bail Bond etc

How are Tata AIG’s overseas travel insurance claims administered/managed?

The Assistance Company, Europe Assistance offers claims support and assistance to the Traveller abroad, across the world. They have 8 alarm centres across the world and Tata AIG’s overseas portfolio is managed from Houston, US and Kuala Lumpur, Malaysia…Some of their services include:

- Pre-departure services- information about foreign locations, passport / visa requirements, immunization requirements etc

- Emergency Travel Agency- provides with 24 hour travel agency service for airline and hotel reservations.

- Medical Assistance- Assistance company will recommend or assist in securing the availability of services of Local Physicians, Admissions in Hospital and arranging other medical services. Assistance service including monitoring the patient and determining the next course of action is also carried out by them.

- Medical Evacuation & Repatriation- In the event of medical emergency, the assistance services will arrange for evacuation and transportation based on the medical evaluation of your condition. Travel Guard also provides for repatriation of remains in case of unfortunate death of the insured while overseas.

- Lost travel documents assistance

- Emergency Message transmission services

- Embassy referral services

- Claims procedures Information services

What are the exclusions under Tata AIG’s travel policies? Some of the key exclusions are listed below:

- Pre-existing Condition or any complication arising from it (unless specifically covered under certain plans that are purchased by the insured)

- Services, supplies, or treatment, including any period of Hospital confinement, which were not recommended or approved, and certified as Medically Necessary by a Physician

- Routine physicals or other examinations where there are no objective indications or impairment in normal health, and laboratory diagnostic or X-ray examinations except in the course of a disability established by the prior call or attendance of a Physician (an example could be a person visiting the hospital to check their blood pressure or their cholesterol levels, just for their information)

- Elective, cosmetic, or plastic surgery, except as a result of an Injury caused by a covered Accident

- Suicide, attempted suicide (whether sane or insane) or intentionally self inflicted Injury or Illness, or sexually transmitted conditions, mental or nervous disorder, anxiety, stress or depression, Acquired Immune Deficiency Syndrome (AIDS), Human Immune deficiency Virus (HIV) infection

- Being under the influence of drugs, alcohol, or other intoxicants or hallucinogens unless properly prescribed by a Physician and taken as prescribed

- Any loss arising out of War, civil war, invasion, insurrection, revolution, act of foreign enemy, hostilities (whether War be declared or not), rebellion, mutiny, use of military power or usurpation of government or military power, Terrorism

- Congenital anomalies or any complications or conditions arising therefrom

- Participation in winter sports, skydiving/parachuting, hang gliding, bungee jumping, scuba diving, mountain climbing (where ropes or guides are customarily used), riding or driving in races or rallies using a motorized vehicle or bicycle, caving or pot-holing, hunting or equestrian activities, skin diving or other underwater activity, rafting or canoeing involving white water rapids, yachting or boating outside coastal waters (2 miles), participation in any Professional Sports, any bodily contact sport or potentially dangerous sport for which You are untrained (please note that on our eIndiaInsurance website, we offer some insurance plans that cover Adventure sports…so if the insured is likely to participate in any of these activities, it’s best to buy a plan that covers Adventure Sports)

- Pregnancy and all related conditions, including services and supplies related to the diagnosis or treatment of infertility or other problems related to inability to conceive a child; birth control, including surgical procedures and devices

Why buy TATA AIG?

There are many advantages of buying TATA AIG’s insurance plans online. Some of the advantages are listed below:

- Tata AIG has been the undisputed market leader in the travel insurance market in India since inception in 2001 and till date enjoys amongst the highest market share in India.

- Tata AIG is a JV with AIG ($55 billion turnover) holding 24% share and balance 76% with Tata Group ($100 billion turnover Industrial conglomerate).

- TATA AIG satisfies all statutory regulations of IRDA in India.

- American International Group, Inc. (AIG) has Business Operations in 130 countries across the following Property, Casualty lines of business apart from Travel. This global presence is a big advantage while managing the Travel business worldwide.

- Europe Assistance have the largest network of hospitals in USA, which is managed through their Houston alarm centre. The Rest of the World Assistance servicing is done through the alarm centre in Kuala Lumpur. At any given time the TATA AIG’s insureds will have access to faster medical assistance services at more number of specialty hospitals

- AIG Travel Inc. is the worldwide Travel Insurance business was almost $1.05 billion across 80 countries including India. Clearly one of the leaders and the most preferred company for the longest time in the World Market for Travel Insurance.

Does Tata AIG Travel Insurance policies cover Covid19?

The outbreak of COVID-19 curbed international travel for a while. Currently, Indian citizens are able to travel on Vande Bharat flights or approved carriers to countries with which we have a travel bubble. Most countries will require you to have an international travel insurance policy that covers the cost of COVID-19 medical care. With TATA AIG, you don’t have to worry since all their international travel insurance plans help you deal with the medical costs associated with COVID-19 if you happen to test positive while you’re abroad.

What does Tata AIG Travel Insurance cover related to Covid19?

Tata AIG policies cover the following Covid related medical and non medical exigencies:

Tata AIG travel insurance Covid19 FAQs

If i am diagnosed with covid-19, who do i need to contact to seek assistance.

- For America’s policies, you can either call us at +1-833-440-1575 (Toll-free within the US and Canada) or write to us at [email protected]

- For other policies, you can either call us at +91 – 022 68227600 (Call back facility available) or write to us at [email protected]

Will I Require Any Special Documents While Filing a Claim for COVID-19?

No, you need not submit any special documents while filing a claim under COVID-19 cover. You just need to submit your report stating that you have tested positive for COVID-19 along with other documents for expenses being claimed.

If I Am Tested Positive for COVID-19, And am Instructed to maintain a Home Isolation, Will My Medical Expenses Be Covered?

No, medical expenses incurred during home isolation are not covered. However, if you are hospitalized, your medical expenses will be covered.

I travelled to a destination with Tata AIG travel insurance covering COVID-19 and get diagnosed with COVID-19 during the trip and am hospitalized for treatment. But, during the days of my hospitalization, the policy expires. In this case, will my post-policy expiry medical charges be claimable?

In such a case, Post your policy Expiry, your medical charges will be claimable till the date of discharge or upto 60 days, whichever is lesser, provided you are hospitalized during the policy period.

Tata AIG travel medical insurance frequently asked questions

What is travel insurance policy.

Travel insurance provides insurance coverage during ones travel overseas. You can also get domestic travel insurance for travel within India, Travel insurance provides coverage more than just for the duration of your travel itself. The scheme covers medical expenses incurred for any in-patient& outpatient treatment throughout your journey.

What is the ‘Policy Period’?

The duration of the Policy from the start date till the expiry date of the policy is called as ‘Policy Period’. You can benefit the coverage as specified only during the duration of ‘Policy Period’.

What is the percentage of the claim payable and whether it will be taxed?

The standard deductible under the Accident & Sickness Reimbursement is $100 irrespective of the value of the claim. The same is not taxable.

Can I get a comprehensive policy without any medical restrictions for my parents who are 60+ years and traveling overseas?

Yes, Tata AIG offers Travel Guard plans without sublimit restrictions, which you can opt for your parents who are 60+ and travelling overseas.

What are the sub-limits prescribed by the policy?

The sublimits are applicable to the Age Category of 56-79. Please refer the benefits under all Plans as in the Travel brochure of Insurance Company.

Are there any restrictions on the hospital where the treatment should be taken?

There is no restriction on the hospital where treatment should be taken. The treatment can be taken in any hospital in the world outside India. However, the only restriction is that the hospital should be a registered hospital under the local jurisdiction. It is however advisable in pre planned hospitalization, the Insured informs the Assistance Company whom may choose the direct them to a Network Hospital in the same locality.

Is the sum insured mentioned under each category applicable to all members traveling on the policy and is there any restriction on number of claims?

The sum insured as mentioned in the policy schedule is for each traveling member. For eg. If there are 3 family members traveling under a single Gold Plan policy, each of the them will be covered for a SI of $250,000 under the Accident & Sickness benefit. Also this limit of $00,000 is per accident which means that the limit gets topped up once a claim is settled. For eg. If Individual A has had an accident and had filed a claim for $10,000, in the event of another sickness claims he/she will be eligible for $200,000 in full and the same will not be reduced by the $10,000 already claimed under the first claim. However the deductible of $100 will be applicable for a single claim/incident. There is no restriction on the number of claims per person in the policy period.

Is a newborn child covered from day one under the Travel Policy?

A newborn child will be covered after 6 months of birth.

What is the Age Limits to buy TATA AIG travel insurance?

Persons between 6 months up to 70 years can buy TATA AIG travel insurance. For those who are above the age of 70 (i.e. 71-79) can buy Senior Citizen plan.

How do you define a trip?

Trip - means any Insured Journey during the Insured Period which starts and finishes in India and involves a destination(s) outside India; which lasts or is expected to last for: « up to 180 » Days or less if covered under Single Trip Insurance; or « up to 30/ 45 » Days or less per Trip, if covered under Annual Multi Trip Insurance.

What are the key benefits of TATA AIG travel health insurance?

What are the plan types in tata aig travel insurance.

Tata AIG essentially offers two types of travel insurance plans…one for single trip and another for multi trip (frequent travellers going abroad more than 3-4 trips in a year). Under the Single trip plans Tata AIG offers Travel Guard for individuals traveling to any part of the world…They also offer plans specific for Asia, and for Domestic travel within India. They also have an insurance plan specifically for students going abroad for their higher studies. Under the Multitrip they offer a comprehensive Annual Multitrip plan covering frequent travellers which has worldwide coverage.

What do you mean by deductible? How much is the deductible in TATA AIG travel insurance plans?

In an insurance policy, the deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments. The policy deductible is applicable for each instance of sickness/ailment. For continuous treatments relating to the same sickness, the deductible will only be applicable once. The insured is required to quote the Claim reference number when contacting the assistance company while undergoing follow up / re-revisit treatments. The deductible will need to be paid in each instance of a new/ different ailment / sickness. The deductible under the Accident & Sickness is normally USD $100 under all Tata AIG plans.

Is TATA AIG travel insurance a cashless travel health insurance?

Yes, Tata AIG offers Cashless Travel/Health Insurance overseas for inpatient hospitalisation, subject to the treatment being covered under the policy. The Assistance TPA/Insurance company will pay up to 100% of the claim to the medical facility above the deductible amount (mentioned on the policy certificate), upto the maximum Sum Insured availed and subject to the policy terms and conditions. This will be done either by placing a Guarantee of Payment (GOP) or making a payment directly to the hospital. This is subject to eligibility of the insured for coverage. Let us look at a couple of examples… Example 1 - if the insured is admitted to the hospital for treatment for a covered illness and the hospital estimates the expenses to be $700, then Tata AIG will pay the hospital $600 and the insured will pay the $100 which is the deductible under the policy. Example 2 – if the insured is admitted to the hospital for treatment for a covered illness and the hospital estimates the expenses to be $70,000, and the total Sum Insured under the policy is $50,000, then Tata AIG will pay the hospital $49,900 and the insured will need to pay the remaining $20,100 which is the deductible under the policy. (Insurer will pay max sum insured of $50,000 minus deductible of $100).

Does TATA AIG travel health insurance cover outpatient medical expenses?

Yes, Tata AIG’s travel insurance plans do cover outpatient medical expenses upto the sum insured opted for by the traveller. However the difference between inpatient and outpatient treatment is that in the case of outpatient (OPD) treatment, the travelling insured needs to settle the hospital bills directly by making a payment to the facility and then get a refund from the insurance company after submitting the invoices to the claims team. This reimbursement process could take upto 7 working days after submitting all the relevant documents.

I am traveling to UK and Schengen countries? Which plan should I buy which will cover both the countries?

Tata AIG’s best selling plan is Travel Guard. Under Travel Guard, they offer an “Excluding Americas” plan which covers travellers who are going to any other country in the world except North and South America. This plan will cover you for your travel to both the Schengen countries and UK. Given the cost of healthcare in these countries it is advisable to go ahead with the Gold or Platinum plan.

What is the maximum coverage that TATA AIG travel health insurance offers for a traveler with pre-existing disease?

A pre existing condition means any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and / or were diagnosed, and / or received medical advice/ treatment, within 48 months prior to commencement of the first Policy issued by the Insurer. This means that if the insured is traveling abroad with a pre existing condition and avails of any treatment abroad, Tata AIG will not be liable for paying the claim. Tata AIG however offers a limited coverage for medical arising due to pre existing conditions, when the situation is Life threatening in nature upto $1,500. A Life threatening condition is an unforeseen medical emergency, which puts the life of the insured at extreme risk. In such event, measures solely designed to relieve acute pain, provided to the Insured by the Physician for Disease/accident arising out of a pre-existing condition would be reimbursed upto a limit specified in the policy terms and conditions. The treatment for these emergency measures would be paid till the insured becomes medically stable or is relieved from acute pain. All further medical cost to improve or maintain medically stable state or to prevent the onset of acute pain would have borne by the Insured.

Can TATA AIG travel insurance be renewed online?

Technically Travel Insurance doesn’t fall under the category of insurance policies which have a renewal date. Two types of plans (Student Insurance and Annual Multi Trip plans) have a renewal date or what can be termed as an extension date. Hence once must apply for a renewal/extension on eindiainsurance and post approval from the insurance company, the extension / renewal policy can be purchased on the same website .

What is the maximum duration TATA AIG travel health insurance be purchased?

Tata AIG’s travel insurance plans for business and leisure travellers can be purchased for a maximum duration of 180 days at a time. As a special case, the traveller can seek an extension beyond this duration, but that is subject to approval from the Tata AIG team. However the Tata AIG Student plans have a maximum duration of 365 days at a time.

How do I claim if I want to use the policy for medical expenses?

There are two types of claims that an insured can file under a Travel Insurance policy. The first is a Cashless/Direct Settlement claim which is typically for Inpatient treatment for Accident & Sickness Medical expense claims. So if the insured is admitted to the hospital, the family should reach out to the Assistance TPA (their contact details are on the insurance certificate) and inform the about the hospitalisation. The Assistance Company will make coordinate with the hospital and insurance company to make a payment directly with the hospital. The other type of claims are Reimbursement claims where the upfront expenses are incurred by the insured and then a reimbursement is sought from the Insurance company. Reimbursement claim are usually for Outpatient Medical Expense claims and for Non Medical claims like Passport Loss, Baggage Delay/Loss, Trip Delay, Missed Connection, Personal Accident etc. Here the insured is required to retain bills, receipts, documents pertaining to the expenses incurred and then submit the same to the insurance company on their return to India. The documents are submitted along with a claim form which narrates the type of loss incurred and other information including bank details, policy details etc. All insurance companies reimburse these claims against the documents submitted in a standard outer timeframe of 7 working days subject to policy terms and conditions.

What is the difference between with medical sub limits and without medical sub limits plan? Can you explain the term "no medical sub limits"?

Tata AIG currently has sublimits under its Travel insurance policies as per the table below…this means that if there is an insured who has opted for an insurance policy with a sum insured of $50,000, in case of a surgery, the insurance company’s exposure/claims payment will be restricted to $10,000 (see table below for Surgical Treatment). Similarly there is a restriction on the room rent, ICU charges etc.

- ince the coverage does not have a restriction like a sublimit, the premium for Non Sublimit plans will be higher than the sublimit plans for a similar coverage.

- It is important to note that Tata AIG plans have a medical sublimit in place only for Sickness Medical expenses and this means that for any Accident related expenses, the maximum Sum insured is available to the insured for treatment.

NEED HELP? Contact our customer service team We are here to help you!

- Call : 080-41101026

Get quotes for Tata AIG travel insurance!

Review and compare the best travel insurance.

India travel insurance blogs and articles

Tips to find good and adequate international travel health insurance Know more

Comparison of overseas Healthcare cost and popular tourist destinations. Know more

How to use Indian visitor insurance in case of sudden sickness and accidents. Know more

Tata AIG travel insurance useful links

How to buy online.

You can buy insurance online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque.

Already outside India

Travelers who have already traveled from India and do not have insurance can buy Tata AIG travel medical insurance after approval.

Tata AIG Travel Insurance Online Renewal

TATA AIG health insurance renewal customers can renew existing policy online before the exipry date at any time.

Tata AIG Travel Insurance Claims & Customer care

In case of a claim or reimbursement of treatment expenses, notify Tata AIG by contacting them.

Tata AIG Travel Insurance Policy Wordings

Kindly refer the Travel Policy Insurance Wordings for complete coverage details along with terms and conditions.

How are Claims settled?

Are travel insurance directly billed or is it reimbursement basis, is there a hospital network.

Resourceful Indian travel insurance links

Travel Insurance Benefits

Premium Calculator

India travel insurance FAQ

Search for tata aig travel insurance.

Compare TATA AIG Travel Insurance with other popular companies

- TATA AIG vs Reliance Travel

- TATA AIG vs Cholamandalam Travel

- TATA AIG vs Bajaj Allianz Travel

- TATA AIG vs Religare Travel