0330 880 5099

5p/min plus network extras

- Designed for Winter Sports

- Off piste within resort areas

- Upgrade for Higher Risk sports

- Helicopter Rescue if needed

- Instant Cover note by email

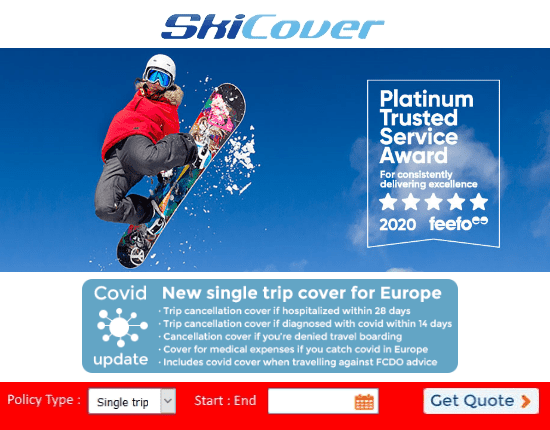

Single trip ski insurance

Single trip Winter Sports insurance policies are specifically designed for a single winter sports holiday. They are suitable for single travellers, couples or families and cover all ages from children through to skiers and boarders who are aged up to 85.

A single trip winter sports travel insurance policy is not designed exclusively for skiing or snowboarding. The policy has been created to include the risk associated with a wide range of winter sports activities including tobogganing and ice skating. It's important when purchasing your policy that you review the activities table associated with each policy to ensure that the activity you wish to partake in is covered

The winter sports travel insurance policies we feature are sourced from a number of underwriters in order to give you variety. Each will differ slightly in terms of levels of ski cover and this in turn will determine the price. The price shown on our site is the full price for the policy and includes the insurance premium tax at the applicable rate

Our approach has always been to offer the traveller the choice when it comes to travel insurance. Following a simple quote stage where we determine your needs, the policy options are laid out on screen in such a way that you can easily see what is covered and more importantly what's not covered under each policy

It is important to purchase your winter sports travel insurance as soon as your holiday is booked as the policy will provide protection should you need to cancel your holiday in advance of going away and make sure the policy has sufficient levels of cancellation cover should the need arise. Often we hear of clients choosing the cheapest insurance option and then being out of pocket when they came to claim as they had paid for a holiday far in excess of the limits of the policy.

Also make sure that you choose a policy which has the right levels of cover for baggage and ski equipment. If you are taking lots of gear and you wanted it covered then you will have to pay slightly more.

(1) Association of British Insurers data https://www.abi.org.uk/products-and-issues/choosing-the-right-insurance/travel-guide/

You are logged in as Click here to access the sales report

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Travel Insurance Can Rescue a Ski Trip

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Trip delay or cancellation coverage

Accidental injury, travel inconvenience, lost or damaged equipment, should i insure my ski trip.

Snow in the forecast can send winter sports enthusiasts flocking to the mountains for some fresh powder. But unpredictable weather doesn't always make for the easiest travel. Inherently, ski trips might be one of the riskiest to book since you can spend big bucks on ski lift tickets, lodging, airfare and equipment rentals, only to lose the money if the weather doesn't cooperate or an injury occurs.

These kinds of travel woes could affect more travelers as skiing and snowboarding grow in popularity. According to the National Ski Areas Association, there were more than 60 million visits to U.S. ski slopes during the 2021-2022 season, the highest since the organization started keeping track in 1978.

To reduce the risk of losing money on an interrupted or canceled ski trip due to adverse weather, travel insurance can be an option to consider. Some of the more common travel insurance benefits, such as trip delay or cancellation coverage, can come in handy for vacations in winter destinations. Plus, some travelers might already have those benefits through a travel credit card .

» Learn more: The best travel credit cards right now

Standalone travel insurance plans, which can offer more specific coverage tailored to ski trips, are also available. With these policies, travelers can get reimbursed for more particular expenses related to winter sports travel.

Here are the types of coverage travelers can expect to find when shopping for travel insurance for a ski trip.

Trip delay and cancellation coverage is a standard part of most travel insurance plans and can benefit those heading toward winter weather. For example, if flights are delayed because of a snowstorm, this type of coverage can help travelers get money back for days they might've missed at the resort. This usually includes reimbursements for nonrefundable travel expenses such as prepaid lift tickets, equipment rentals and other similar expenses.

Trip delay and cancellation insurance could also pay for extra meals and lodging that travelers may have incurred as a result of a delay.

One important caveat is that this coverage usually kicks in for covered reasons only. An airline delaying a flight would be covered, but a traveler looking at the weather report and wanting to bail on the trip for fear of getting stuck wouldn't be.

Skiers and snowboarders who want complete flexibility to cancel as they please should consider Cancel For Any Reason insurance. This coverage is a special add-on that costs more, but travelers typically receive 50% to 75% of their travel costs back if they cancel for any reason.

» Learn more: 10 best ski hotels to book with points

Injury is another big risk for ski trips. Injured skiers and snowboarders would most likely have to cut their trip short. That's when ski travel insurance with trip interruption coverage would help pay for the costs associated with returning home early.

Note that this coverage differs from travel medical insurance and medical evacuation insurance . Injured travelers will typically have to use some combination of their regular health insurance and travel medical insurance from their winter sports insurance policy (regardless if it's provided through a credit card or bought separately).

"Depending on where you're skiing, your home health insurance might cover you for an accident. But it also might not if you're outside of your home health network, and certainly not if you're traveling internationally," says Stan Sandberg, co-founder of TravelInsurance.com.

Advanced skiers and snowboarders will likely need even more coverage. If adventuring into the backcountry, outside of resort bounds or heli-skiing, consider getting additional insurance coverage for adventure sports.

» Learn more: How to save on a ski trip

This is a vague name for coverage, but it's a good add-on to a travel insurance policy for winter sports trips. "Travel inconvenience," sometimes called "Lost Skier Days," will reimburse travelers if the resort closes because of too much or too little snow.

This type of coverage is typically available from Dec. 1 to March 31 for resorts in the Northern Hemisphere and can reimburse up to $125 in lost expenses per day.

Many travelers are familiar with baggage loss or delay coverage , but some might not know that expensive ski or snowboarding gear might not be covered entirely. After all, typical travel insurance policies insure up to a certain dollar amount only. So if the airline loses your expensive skis, you might not be reimbursed for the full value.

Getting ski travel insurance with coverage for items like skis and snowboards can help. With this coverage, if your gear is delayed, the ski insurance provider will reimburse you, up to a limit, for equipment rentals.

If you're worried about losing the nonrefundable costs of your winter sports-focused vacation, ski travel insurance can provide some peace of mind. Look for coverage that reimburses you in case of winter weather delays or accidental injuries. In addition, travel inconvenience or sports equipment coverage are add-ons that can help you recoup the costs associated with lift tickets and equipment rentals.

Skiing and snowboarding are always an adventure, but delays and accidents don't have to be so costly.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Ski Travel Insurance Benefits

White powder, cozy lodges, stunning views: A ski vacation is an unforgettable experience, whether you're traveling solo or with the family. But winter sports are as risky as they are exhilarating, and that's why you need ski travel insurance.

Three Things You Need To Know Before Buying Ski Travel Insurance

Comprehensive ski travel insurance coverage is essential if you're planning a winter adventure anytime soon. Here are the three reasons smart travelers buy trip insurance.

1. Ski travel insurance helps protect your investment.

With lift tickets, ski rentals, airline tickets and peak-season hotel prices, the expenses add up fast for a ski vacation. If you have to make a last-minute trip cancellation , you could lose a lot of money.

A good ski travel insurance policy covers not only trip cancellations, but also travel interruptions and stolen or lost baggage. If something goes awry, having travel insurance may help you recoup your investment and save your vacation.

2. Accidents and medical emergencies happen on a ski trip when you least expect it.

You might glide gracefully down black-diamond trails, but serious accidents can happen to the most experienced skiers. Or a sneaky cold or flu could ruin your long-planned vacation. Ski travel insurance policies may cover emergency medical evacuations and medical care, even on international trips . Look for a ski trip insurance policy that also covers trip interruptions, so if you have to cut your ski trip short, you can get back on the slopes when you're better.

3. When everything depends on the weather, ski travel insurance is a must.

You're wishing for fresh snow, but instead you get slush. Or a record-breaking blizzard closes the airport, leaving you stuck at home. You can't control the weather, but ski travel insurance keeps you from worrying about it. Many travel insurance policies cover ski trip cancellations, interruptions and delays due to weather. Make sure you review your insurance plan carefully before you buy, because not all plans offer the same coverage.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

800-874-2442

"Generali wins out among the best travel insurance companies for its happy combination of below average fees for above average travel coverage."

“I go to France for skiing every year for a month and always feel super safe carrying Generali. I use them for every trip just because that one time, when it happened, they were there for me 100%.”

“We were thrilled when we found out everything was being covered.”

“My husband and I were really surprised by how very smoothly and quickly we received our check.”

Get Travel Insurance for Your Ski Trip

Terms of Use | Privacy Policy | California Privacy Policy | Do Not Sell My Personal Information | © Forbes Advisor, 2021

Trusted by over 6 million travelers every year

Copyright© 1997 - 2023 CSA Travel Protection DBA Generali Global Assistance & Insurance Services, Company Code: 805-93, Approval Code: A8511912

Travel insurance coverages are underwritten by: Generali U.S. Branch, New York, NY; NAIC # 11231, for the operating name used in certain states, and other important information about the Travel Insurance & Assistance Services Plan, please see Important Disclosures .

Compare Plans

Frequently Asked Questions

What types of winter sports can travel insurance cover.

Our travel insurance plans can cover skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

The Premium and Preferred plans include Sporting Equipment and Sporting Equipment Delay coverages that can cover winter sports equipment you might bring on a trip, except motorized equipment, dental wear and eyewear.

If your sporting equipment is damaged, lost or stolen during your trip, Sporting Equipment coverage can reimburse the costs to repair or replace your sporting equipment. The Premium plan covers up to $2,000 and the Preferred plan covers up to $1,500.

Sporting Equipment Delay can reimburse you for the cost of locating your delayed Sporting Equipment and having it returned to you, and the cost of renting equipment in the meantime, up to the coverage limit.

The fine print says: "We will not pay for damage to or loss of boats, motors, motorcycles, motor vehicles, aircraft, and other conveyances or equipment, or parts for such conveyances." See Plan Documents for more details.

How can travel insurance help in case of weather delays on my trip?

Bad weather is always a risk when traveling during the winter. If a winter storm hits, flight cancellations and delays are bound to happen and you may take on some unplanned costs. If this happens, the Trip Interruption coverage included with travel insurance can cover for additional expenses to help get you to your destination and onto the slopes or back home, in addition to reimbursing you for lost trip costs. Travel Delay coverage is also included for certain out-of-pocket costs, such as meals, local transportation or even additional lodging or parking charges.

If a weather event, like a blizzard is foreseeable prior to you purchasing the insurance plan, then travel insurance may not cover it. If the plan is purchased after a storm is named, coverage is not provided for losses resulting from that named storm.

Read more about how travel insurance can help when you travel during the winter

What Can Wreck a Ski Trip and How Travel Insurance Can Help

Problems happen with travel plans more often than you might think. One in six U.S. adults reported having to cancel, interrupt or delay their trip.¹ Travel insurance can help protect your vacation investment from certain unforeseen events that could upset your travel plans and cost you.

Find the Plan That Fits Your Trip Best

There’s no better way to understand how travel insurance and assistance can help protect you and your trip than reading real life examples from fellow travelers.

How can travel insurance help me if I get sick or injured?

If you become critically sick or injured during your trip and no suitable local care is available, all of our plans provide coverage for emergency medical evacuation and coverage to reimburse your medical and dental costs. In addition, Trip Interruption coverage can reimburse you for lost trip costs while you're in hospital, including prepaid lift tickets.

This can be extremely helpful if, for example, you have a ski accident on the slopes — it could even require medical transportation by helicopter, which could cost a lot.

Our plans also include 24-hour emergency assistance services that can provide immediate assistance if a traveler becomes seriously ill or injured on their trip.

Could I be covered if I cancel my trip because of work obligations or job loss?

If you lose your job and cancel your trip as a result, you could be reimbursed for your prepaid, nonrefundable, trip costs. Some requirements must be met.

Our plans don't include Trip Cancellation coverage for work obligations that cause you to cancel your trip, except in the case of unexpected active military duty due to a natural disaster or military leave being revoked. If you want travel insurance that can cover for this reason, consider purchasing our Premium plan and adding Trip Cancellation for Any Reason coverage . This coverage reimburses you up to 60% of the penalty amount when you cancel your trip for any reason ( requirements apply ).

- U.S. Consumer Product Safety Commission

- SITA Baggage Report 2018

*Terms and conditions apply. See plan details for more details .

If you're brave enough to take on a black diamond, or maybe vacationing with kids just starting out on the bunny slope, chances are you could use ski insurance. Travel insurance for your ski trip can cover injuries on the slopes and during your vacation and is designed to help with winter travel mishaps like flight delays, cancellations, illness and more.*

What winter sports are covered?

Our travel insurance plans can cover winter sports on your trip, such as skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

You can also choose a plan designed to cover your sporting equipment if it gets damaged, lost, stolen or delayed. Just be sure that the purpose of your trip is not to participate in any organized amateur sports, professional athletic competitions or sporting events, as those are not covered by our plans.*

sign up and keep track of your travel insurance events

Get Ski Travel Insurance

Wander More. Worry Less.

If you're brave enough to take on a black diamond, or maybe vacationing with kids just starting out on the bunny slope, chances are you could use ski insurance. Travel insurance for your ski trip can cover injuries on the slopes and during your vacation and is designed to help with winter travel mishaps like flight delays, cancellations, illness and more.*

What winter sports are covered?

Our travel insurance plans can cover winter sports on your trip, such as skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more. You can also choose a plan designed to cover your sporting equipment if it gets damaged, lost, stolen or delayed. Just be sure that the purpose of your trip is not to participate in any organized amateur sports, professional athletic competitions or sporting events, as those are not covered by our plans.*

What can wreck a ski trip and how travel insurance can help

- Injury & Illness

- Equipment Issues

Winter Travel Chaos Each year winter storms cause cancellations and delays across the country, wrecking travel plans. If you’re forced to cancel or interrupt your trip, how much of that prepaid trip cost could you get back? Travel insurance can help you recoup losses for 20 different covered events that could cause you to cancel your travel plans. Pre-purchased lift tickets can even be covered.

Travel Delays Your flight is delayed for who knows how long in a winter blizzard. You need to decide whether to get a hotel, what necessities you'll need to buy, where to get dinner... Don't worry—Travel Delay coverage is included with every Generali travel insurance plan, so you can be reimbursed for reasonable out-of-pocket expenses, such as hotel accommodations, meals and transportation if you are delayed during your trip.*

Emergency Medical Accidents happen. Even to the most experienced skiers. Our travel insurance plans can help you with a wide range of medical needs while you’re traveling. Whether it’s a case of utilizing our emergency assistance services to see a local doctor for a prescription refill, filing a Medical and Dental claim after a visit to the emergency room because you slipped on ice during your trip, or the rare need to use the Emergency Assistance and Transportation coverage for medical evacuation by air ambulance, we’re there for you 24/7/365.

Flu Season Last winter was one of the most severe flu seasons in recent memory. If your trip is canceled or interrupted for certain medical reasons, trip insurance can help you get reimbursed for non-refundable, pre-paid trip costs that weren't used and additional transportation costs to return home or rejoin your group on the slopes.

Medical Evacuation Get up to $1 Million in Emergency Assistance and Transportation coverage — crucial for the slopes. More than 220,000 people a year are treated for winter sports injuries in the U.S. 1 Medical evacuation from a ski resort or even from the mountain could require a helicopter, which is not cheap.*

Lost, Damaged or Delayed Sporting Equipment Flying with skis, a snowboard or other equipment? Travel insurance is one of the best ways to help protect your gear. Our Preferred and Premium plans include coverages especially helpful if your equipment is damaged, lost, stolen or delayed on your trip. And, you can get reimbursed for your rentals while your equipment is lost. INFO: Airlines worldwide lose or misplace more than 22 million bags a year. The property that was returned took an average of 1.76 days to get back to their owners.² How long could you go without your gear on a ski trip?

Compare Ski Travel Insurance Plans

Frequently asked questions.

If you lose your job and cancel your trip as a result, you could be reimbursed for your prepaid, nonrefundable, trip costs. Some requirements must be met.

Our plans don't include Trip Cancellation coverage for work obligations that cause you to cancel your trip, except in the case of unexpected active military duty due to a natural disaster or military leave being revoked. If you want travel insurance that can cover for this reason, consider purchasing our Premium plan and adding Trip Cancellation for Any Reason coverage . This coverage reimburses you up to 60% of the penalty amount when you cancel your trip for any reason ( requirements apply ).

If you become critically sick or injured during your trip and no suitable local care is available, all of our plans provide coverage for emergency medical evacuation and coverage to reimburse your medical and dental costs. In addition, Trip Interruption coverage can reimburse you for lost trip costs while you're in hospital, including prepaid lift tickets.

This can be extremely helpful if, for example, you have a ski accident on the slopes — it could even require medical transportation by helicopter, which could cost a lot.

Our plans also include 24-hour emergency assistance services that can provide immediate assistance if a traveler becomes seriously ill or injured on their trip.

Our travel insurance plans can cover skiing, snowboarding, snow tubing/rafting, cross country skiing on marked trails, snow shoeing, sledding, ice skating and more.

The Premium and Preferred plans include Sporting Equipment and Sporting Equipment Delay coverages that can cover winter sports equipment you might bring on a trip, except motorized equipment, dental wear and eyewear.

If your sporting equipment is damaged, lost or stolen during your trip, Sporting Equipment coverage can reimburse the costs to repair or replace your sporting equipment. The Premium plan covers up to $2,000 and the Preferred plan covers up to $1,500.

Sporting Equipment Delay can reimburse you for the cost of locating your delayed Sporting Equipment and having it returned to you, and the cost of renting equipment in the meantime, up to the coverage limit.

The fine print says: "We will not pay for damage to or loss of boats, motors, motorcycles, motor vehicles, aircraft, and other conveyances or equipment, or parts for such conveyances." See the DOC/Policy for more details.

Bad weather is always a risk when traveling during the winter. If a winter storm hits, flight cancellations and delays are bound to happen and you may take on some unplanned costs. If this happens, the Trip Interruption coverage included with travel insurance can cover for additional expenses to help get you to your destination and onto the slopes or back home, in addition to reimbursing you for lost trip costs. Travel Delay coverage is also included for certain out-of-pocket costs, such as meals, local transportation or even additional lodging or parking charges.

If a weather event, like a blizzard is foreseeable prior to you purchasing the insurance plan, then travel insurance may not cover it. If the plan is purchased after a storm is named, coverage is not provided for losses resulting from that named storm.

Read more about how travel insurance can help when you travel during the winter

- U.S. Consumer Product Safety Commission

- SITA Baggage Report 2018

*Terms and conditions apply. See plan details for more details .

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

The Best Ski Travel Insurances for a Cross-Country Ski Holiday

Table of Contents

Safety is one of the most essential factors if one decides to take up any winter sports, and cross-country skiing is no different. From choosing the appropriate clothing for cold weather and snow to making up your mind about a destination, you will definitely minimize risks that could occur during your long awaited ski holiday.

However, even in midst of all precautions, accidents, mishaps do happen and they could completely ruin one’s holiday if not thinking ahead. This is why you might want to consider taking out a special ski insurance whether it be a US or an international destination you choose.

If you think that your general annual travel policy will do, then take a look at the fine print again. Most general travel insurances won’t cover situations that involve winter sports, let alone cross-country or backcountry skiing . Accidents you would normally not want to think of might require rescues costing thousands of dollars that are not covered by a general policy.

Now we have compiled a list of some of the best special ski insurances that are suitable to cross-country skiers as well.

Please, note that the following article is only brief summary of some of the available schemes. It does not include all terms, conditions and exclusions of the plans. You are advised to check the actual website of the insurance company for complete details.

Single Trip Cross-Country Ski Holiday Insurances

World nomads (for us residents).

World Nomads offers one of the most popular insurance when it comes to adventurous activities, including but not limited to our favorite one: cross-country skiing.

World Nomads is a well-trusted travel insurance company dating back to 2002. Their popularity is thanks to their flexible and humane attitude, that may be due to the fact that many of the company founders and team members are travelers themselves. No surprises there when you find that many of their packages cover a wide range of activities that are usually not included as standard in many other insurance plans available on the market. All this with a highly competitive pricing.

Below are some of the popular snow sports which are covered for US residents at the time of writing. Please be aware this information is subject to change and coverage will vary depending on the country of residence of the policyholder. For this reason, always take a careful read at the policy wording for avoiding misunderstandings.

Snowsport activities covered under the Standard Plan (as of Oct 2020)

- Skiing and snowboarding within resorts

- Cross-country skiing on marked trails

- Snowmobiling, ice skating, snow rafting & more.

Snowport activities covered under the Explorer Plan (as of Oct 2020)

- Backcountry skiing or boarding (except areas designated unsafe by the resort).

- Alpine touring

- Skiing out of resort boundaries

- Free-style skiing

- Skiing by helicopter or snow cat.

- Ski instructor or guide (paid or volunteer) & more.

NB: You should always check your activities are covered before you buy a policy, you can do this when you are finalizing a quote or by visiting the Help Centre.

Benefits May Include

- Sports Gear, Baggage and Personal Effects Coverage: Covers the loss, theft or damage of your bags, tech and gear.

- Trip Protection: Protect your hard earned vacation from unexpected cancellation. Trip cancellation is a benefit that reimburses you for any pre-paid non-refundable trip costs if you need to cancel due to a circumstance covered under your plan. The most common reasons for cancellation include sicknesses and injuries, but they could also be related to natural disasters, strikes, terrorist attacks, and other events.

- Emergency Overseas Accident & Sickness Medical Expense: If you’re injured or get sick while you’re traveling, and you’ve bought the policy for the activities you’re doing, you can be covered for: hospitalization; out-patient treatment for medical emergencies; prescribed medicines, x-rays, and laboratory tests; being brought home, if medically necessary;

- Medical Evacuation and Repatriation: Travel insurance can cover repatriation if you encounter a medical emergency abroad and need to be evacuated. You’re just about to reach the peak of a cliff when you take a tumble, and the only thing between you and a hospital is 300 miles and a way to get you there. This is a situation where you’d be grateful for medical evacuation coverage. It’s simple: when you get hurt or sick, you should be able to get to a place where you can get the care you need, pronto.

- Delayed baggage: If your checked-in bags are delayed by 12 hours or more from the scheduled arrival time, your policy can cover essential items you buy so you’re not left wearing the same thing, until your bags are found and returned.

24/7 Emergency Assistance

Whether you need medical or dental assistance or advice, emergency evacuation or travel assistance, you can access support 24 hours a day, 7 days a week, 365 days a year before and during your trip.

- Accidents due to irresponsible behavior (e.g. drunk skiing) or against resort regulations;

- Sporting equipment damaged from use;

- Participation in a race as a professional athlete;

- Any medical expenses in connection with pre-existing medical conditions;

- Travelling against the advice of your physician;

- Any ongoing costs of follow-up treatments due to an accident during your trip

For actual details of exclusions and for what may and may not be covered always read the actual policy wording available at the company website.

COVID-19 Information

World Nomads does not cover any cancellations due to fear of travel. On the other hand, if you or one of your family members were to get sick due to COVID-19, you might still receive benefits according to your plan as normal. Check the World Nomads FAQs for up to date information. Always review the current policy terms before buying.

Travel Guard: Deluxe Travel Plan (for US Residents)

Travel Guard is a long-time travel insurance brand of the AIG Travel, founded in 1982. While the company doesn’t need much introduction, their most broad package definitely deserves our attention. We have found that their Deluxe Travel Insurance Plan may provide an adequate coverage for a cross-country skiing holiday, however be sure to check out their other plans available as well to get what’s really right for you.

Family Coverage

One of the Deluxe Plan’s most favorable aspects is that it may include family coverage, meaning the coverage of one child no more than 17 years old, who travels with and related to the primary adult insured.

Plus, if your trip is prepared well in time, you could make the most of the plan by purchasing it within 15 days of the Initial Trip Payment, and your plan may include a pre-existing medical condition exclusion waiver. A pre-existing medical conditions waiver will allow for you to be covered for medical issues even in case of pre-existing conditions.

Be sure to always check for the actual policy description for details of what may or may not be covered.

- We have probably all been in situations when the snow is completely ruined by rainy weather by the time of your ski holiday booking. The Trip Saver benefit may reimburse up to $2,500 of extra costs to rearrange your holiday sooner than it was originally scheduled. Don’t forget to check the policy wording for the actual coverage and reimbursements.

- Travel Guard may provide $3,000 reimbursement for lost, damaged or stolen luggage, including your precious ski equipment. For what may or may not be covered, take a thorough read at the policy wording.

- Trip Cancellation: If your ski holiday must be cancelled due to injury, or a death of you, a family member, traveling companion or business partner, you may be covered for a maximum of $150,000. For precise terms and exclusions, take a careful read at the policy description.

- Emergency evacuation (and repatriation of remains) may be available for up to $1,000,000 to the nearest adequate medical facility. Be sure, to check the actual policy wording for details of coverage and exclusions.

Deluxe Enhancement Suite May Include

- If you are planning on backcountry skiing off resort limits, then it is a safer choice due to its Adventure Sports Bundle that removes all exclusions from its benefits regarding extreme activities and adventures.

- No snow? Terrible weather? Cancel for any reason provides a maximum reimbursement in case of any cancellation 48 hours prior to the scheduled departure.

- Cross-country skiing with your dog? If you want to have a peace of mind, their Pet Bundle provides daily benefit for its boarding as well as medical expenses coverage in case of illness or injury.

Be sure to check for policy wording for up-to-date coverage.

Assistance Services

Travel Guard provides a variety of assistance services through a number of partners worldwide. Here we have highlighted some of the most useful. For further details, take a thorough read at the Travel Guard website.

- Roadside assistance per car for up to $50: includes towing, flat tire, and locking out of your own vehicle.

- Emergency Travel Assistance: 24/7 available hotline for emergency travel changes, rebooking, etc.

- Travel Medical Assistance for medical evacuations, emergency medical requests,

As of March 11, 2020 Travel Guard considers the COVID-19 as a foreseen event, therefore losses due to for example quarantine or fear of travel (trip cancellation, interruption or delay) will not be covered.

On the other hand, due to the Medical Benefits policy if you would contract COVID-19 before departure, you may be covered for trip cancellation, if you have a confirmed and documented diagnosis. Also, medical benefits for medical expenses, as well as trip interruption may still apply if you contract COVID-19 during your covered holiday.

Always review the current policy terms before buying.

Seven Corners: RoundTrip ® Choice (for US Residents)

Seven Corners offers an excellent insurance for single ski trips, that is RoundTrip Choice, however be sure to check out their other plans available as well to get what’s really right for you.

It may cover up to 10 people, so all your family and friends you are going to spend your ski holiday with could be covered with one policy.

Standard Benefits May Include

- If your trip is cancelled for a number of covered reasons (including weather) Seven Corners may reimburse you for the nonrefundable, prepaid costs of your ski holiday (up to $20,000). Check the actual policy wording for details.

- If you must interrupt your skiing holiday for one of the covered reasons, you can still safely rejoin your family: You may be covered for 150% of your trip cost. For exact details of coverage read the policy description thoroughly.

- If you’d get injured during your trip, you may be covered for $100,000. Don’t forget to check the actual terms and exclusions of coverage at the company website.

- Emergency Medical Evacuation (and repatriation) for up to $500,000 if you are stuck on the mountain, and if you are hospitalized for more than 7 days, Seven Corners may arrange the transport of your children back home, as well as of a person of your choice to your bedside. For details of what may or may not be covered, take a careful read of the policy wording.

- Reimbursement for your delayed ski gear after 12 hours may be for up to $300. Read policy description for coverage details.

- 24-Hour benefit may be included in case of accidental death of dismemberment. Don’t forget to check actual policy wording for details.

Optional Benefits May Include

- Lost Ski Days and Equipment Rental: $500 or $1000 reimbursement may apply if you are unable to ski because more than half of the trails are closed. Additionally, it may also cover for lost, damaged or stolen rented equipment. Be sure to check actual policy wording for details.

- Cancel for any reason: If you purchase your plan within 20 days of your initial trip deposit and at least 2 days before your departure, then you may be eligible for cancelling your trip for any reason. You may be covered for 75% of the nonrefundable prepaid costs. See policy wording for further information.

- On the other hand, you can add work-related cancellation to your plan, which may pay 100% of the costs. It must be purchased 20 days before initial trip deposit. Take a careful read of the policy description available at the company website.

Exclusions Include

- Skiing outside marked trails,

- Heli-skiing,

- Extreme skiing,

- Participating in races or competitions;

- 24/7 Non-Insurance Travel Assistance Services may be available (and required) to contact both in life-threatening and non-urgent situations.

Trip cancellation due to COVID-19 may apply only if you are sick before departure, your condition and medical treatment requires restrictions certified by a physician. However, according to Seven Corners, quarantine is regarded as a strict medical isolation that is imposed by an authority, therefore, self-isolation doesn’t apply.

Fear of travel, as you would expect, may not be covered either, except if you purchase the optional Cancel for Any Reason benefit.

Medical expenses for COVID-19 if you contract it during your trip, may naturally apply, it is simply regarded as any other sickness.

Final Thoughts

Travelling, especially for ski holiday would be considered extremely irresponsible if done without having a travel insurance. However, if you want the best, you should definitely go for one of these more-or-less skiing specific plans that could make or break your holiday in a case of an emergency.

Before choosing, you should never skip on reading the precise wording of each plan, since there could be very personal and specific conditions and exclusions applicable to you.

One more thing, that even having the most expensive and most comprehensive insurance cannot substitute for responsible behavior, having appropriate safety gear and clothing, as well as adhering to common sense and trail regulations. Ski safely!

Related Posts

What to Wear for Cross Country Skiing?

Health Benefits of Cross Country Skiing

Adventure Travel Hub

Travel Resources for Adventurers

Home » Travel Insurance » Reviews » Best Travel Insurance For Ski Trips in 2024

Best Travel Insurance for Ski Trips in 2024

Written by Antonio Cala

- Affiliate Disclosure

Table of Contents

Whether you’re a seasoned skier, snowboarder or an enthusiastic adventurer, having the appropriate insurance is crucial. In this article, we will review the best travel insurance for ski trips available today. We will explain what makes ski travel insurance different, what features to look for and our top picks for 2024.

For an in-depth analysis of insurance choices tailored for adventure travelers, don’t forget to check out the Ultimate Guide to Adventure Travel Insurance .

Quick Recommendations

If you want some quick recommendations, here is our infographic to help you choose the best insurance for your next ski trip.

Ski Travel Insurance Overview

What is ski travel insurance.

Introducing ski insurance, alternatively known as winter sports insurance—a specialized travel coverage designed to safeguard against mishaps during skiing or snowboarding getaways.

Often offered as an add-on to standard travel insurance, this tailored protection extends coverage to ski and snowboard equipment, medical treatments, and expenses associated with skiing-related injuries—areas typically excluded in standard travel insurance policies.

In this guide, we unveil the top-rated policies recommended by our experts, ensuring you make an informed choice for a worry-free winter sports adventure.

What Does It Cover?

The majority of ski trip insurance policies typically provide coverage for the following four categories:

Medical Expenses

Incurring injuries on the slopes can lead to substantial costs. While treatment expenses may be covered based on your location, additional charges for services like air ambulance rescue and medical repatriation may apply.

Most ski insurance policies provide coverage for emergency medical treatment, often up to millions, but it’s crucial to note that rescue coverage might have a capped limit, potentially lower than the medical treatment coverage.

Equipment Coverage

In the unfortunate event of damage, theft, or loss of your skis, poles, or snowboard, ski insurance typically offers coverage ranging from a few hundred dollars to several thousand. You can file a claim for the cost of repairing or replacing your equipment, including expenses for renting replacement gear.

Trip Cancellation or Interruption

In case you need to cancel or cut short your ski trip due to injury, ski insurance enables you to claim reimbursement for the missed portions. Cancellation limits vary, ranging from $500 to $15,000.

Weather-related Issues

Avalanche Delay

Specific to winter sports breaks, ski insurance covers delays caused by avalanches affecting your skiing plans.

Piste Closure

If the ski slope is closed, preventing you from skiing, you can make a claim for compensation. Typically, the closure must exceed a certain duration for eligibility.

What Doesn't Cover?

When contemplating specialized winter travel insurance, it’s essential to grasp the exclusions. These may include:

Venturing off-piste: If you have an accident off the main ski paths, your insurance may not cover medical costs for that situation.

Leaving equipment unattended: Some policies may not provide coverage if belongings are left in public spaces, leading to theft.

Traveling against government advice: If you travel against the recommendations of the Foreign, Commonwealth, and Development Office, your policy is unlikely to cover you.

Extreme winter sports: Activities like heli-skiing, glacier climbing, and base jumping may not be covered by standard policies. Verify if your chosen activities require additional coverage or specialist insurance.

Best Ski Travel Insurance Policies in 2024

Our Pick For

International Trips + Remote Locations + Any Nationality

Global Rescue

Nationalities: all nationalities are covered.

Pre-existing conditions: Yes.

Seniors Over 65: People aged 65-75 are included in the Individual Plan. Extended Plan memberships are available to those age 75-84 and include all services but are contingent upon completion of a medical form and a physician’s medical verification.

Trip Duration: Short term policies (7, 14 or 30-days) and long term policies (1 to 5 years) available.

Groups: Individual, family and student plans available.

Situations covered: It covers civil unrest, natural disasters, government evacuation orders and other security emergencies (when purchasing the Security package).

- Pros & Cons

Reasons To Buy

Remote locations coverage. Coverage available for 65-84. Pre-existing conditions accepted. All nationalities accepted.

Reasons To Avoid

The price is a bit higher than other insurance policies. However, no other company provides the same coverage as Global Rescue. It doesn’t cover trip cancellations or delays. It doesn’t cover equipment.

Worldwide field rescue (up to $500,000) in remote or dangerous environments. Global Rescue’s deployable teams are standing by to rescue their members from the point of illness or injury for any serious medical emergency.

Medical Evacuation. Global Rescue’s fully deployable medical teams have unparalleled capabilities to transport our members back to their home hospital of choice from anywhere in the world. This includes global COVID-19 transport.

Medical & Security Advisory Services. Global Rescue’s operations centers are staffed by experienced nurses, paramedics and military special operations veterans. Global Rescue also has partnerships with the Johns Hopkins Emergency Medicine Division of Special Operations, Elite Medical Group and Partners HealthCare, the Harvard Medical School affiliate.

Security Membership. Global Rescue’s teams of military special operations veterans are available to provide advisory, consultation and evacuation services for events like natural disasters, terror attacks and civil unrest when you are in danger.

Destination Reports & Event Alerts. Destination reports for 215 countries and principalities worldwide include entry requirements, COVID-19 travel status and restrictions, detailed health and security assessments and required immunizations. Keep up to date on health and security events worldwide.

My Global Rescue Mobile App. Access Global Rescue services in one location. Browse destination reports and alerts, activate emergency assistance, real-time virtual health visits and keep track of the people you care about with GPS tracking and messaging.

Security Package. Physical extraction when you are in danger of bodily harm. It includes civil unrest, natural disasters, government evacuation orders and other security emergencies.

Global Rescue is the most comprehensive travel protection available worldwide. It has the least restrictions and biggest coverage than any other medical insurance.

It’s a medical-only protection designed for adventure travelers planning to travel internationally for an independent or organized skiing trip. All nationalities are covered and options for people over 75 are available.

Global Rescue is our preferred option for ski trips out of the US.

Americans + Over 65 + Pre-existing Conditions + Heli-skiing

Nationalities: Only US citizens and residents are eligible.

Pre-existing conditions: Pre-existing conditions can be covered for Trip Cancellations and Interruptions, as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

Seniors Over 65: There is no maximum age limit.

Trip Duration: All plans cover trips up to 180 days.

Groups: Insurance policies for solo travelers, couples and families are available.

The prices are very competitive.

Plans are very customizable with plenty of extras available and the option of removing items you don’t need.

Pre-existing medical conditions accepted.

24/7 chat available with the Faye Mobile App

Only available to American residents.

Emergency Medical Expenses: Up to $250,000. If you experience sudden illness or injury in-trip, including COVID-19. We can cover prescription drugs, hospitalization and physician costs.

Emergency Evacuation: Up to $500,000. Coverage of transportation in the case of illness or injury that is acute, severe or life threatening when adequate medical treatment is not available in the immediate area.

Trip Cancellation: Up to 100%. If you need to cancel your trip for covered reasons, including if you get sick, contract COVID-19, or a travel provider goes bankrupt. We can cover flights, hotel bookings, tickets & activities, and quarantine accommodation.

Trip Interruption: Up to 150%. When you must unexpectedly cut your trip short or extend it for covered reasons, including if you contract COVID-19.

Trip Delay: Up to $4,500. Up to $300/day, for delays of more than 6 hours. When you’re stranded in transit due to reasons outside of your control such as flight delay or theft of passport.

Lost or damaged Belongings: Up to $2,000. Reimbursement for lost, stolen, or damaged luggage, including clothing, personal items and professional equipment like a phone or laptop.

Cancel for Any Reason: Up to 75% of Trip Cost. The ability to nix your trip for reasons other than those covered in your plan’s trip cancellation coverage, including fear of contracting COVID-19, as long as you purchase this coverage within 14 days of your initial trip deposit and cancel at least 48 hours in advance of your scheduled departure date.

Pet Care: Up to $2,500 in veterinary expenses & $250 for kenneling. Coverage of veterinary expenses if you take your furry friend along (including pet sickness or injury), or kenneling costs if you arrive back home later than expected.

Adventure & Extreme Sports: Up to $250K (international trips) or $50K (domestic trips) for accidental & sickness expenses. Medical and transportation coverage if you become injured while participating in an adventure or extreme sport, like skydiving, bungee jumping, motocross or free diving.

Faye insurance provides American residents one of the biggest medical coverages on the market at a very competitive price.

There’s no age limit and, with the Adventure & Extreme Sports Protection, you can even get coverage for heli-skiing.

We recommend Faye for Americans who want a complete travel protection for their skiing or snowboarding trip, including high medical coverage, trip protection cancellation & interruption, and baggage coverage.

Non Americans + Budget

World Nomads

Nationalities: Most nationalities can purchase insurance from World Nomads, including residents of the United States, Canada, the United Kingdom, India, Australia, or New Zealand. However, as of the current writing, most European residents are unable to buy a World Nomads policy.

Pre-existing conditions: Not covered.

Seniors Over 65: Travelers aged 70 and over are not covered.

Trip Duration: All plans cover trips up to 365 days.

The price is competitive.

Prices and coverage vary greatly by the country of residence.

Some European nationalities are not covered.

Pre-existing medical conditions not covered

Max age is 70 years old.

Emergency Accident & Sickness Medical Expense: Up to $100,000. Coverage is for medical expenses for emergency treatment of an accidental injury that occurs during the trip. Emergency treatment must be medically necessary and performed during the trip. Refer to the certificate / policy for complete details.

Emergency dental treatment: Up to $750. Coverage is for emergency dental treatment for accidental injury to sound, natural teeth. The injury and treatment must occur during the trip.

Emergency Evacuation: Up to $500,000. Coverage is for an accidental injury or sickness occurring during the trip that results in your necessary emergency evacuation. An emergency evacuation must be ordered by a physician who certifies that the severity of your accidental injury or sickness warrants your emergency evacuation. Refer to the certificate / policy for complete details.

Trip Cancellation: Up to $10,000. Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date) due to covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike or other covered reasons. Refer to the certificate / policy for complete details.

Trip Interruption: Up to $10,000. Reimburses for prepaid, non-refundable, unused expenses if you must interrupt your trip (after departure) due to a covered sickness, accidental injury, or death of you, a family member or traveling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons. Refer to the certificate / policy for complete details.

Trip Delay: Up to $3,000. Coverage is for unused portion of pre-paid accommodation or additional expenses, on a one-time basis, if you are delayed en route to or from the trip for 6 or more hours due to a defined hazard as explained in the certificate / policy.

Baggage & Personal Effects: Up to $3,000. Reimbursement is for loss, theft or damage during the trip to baggage and personal effects (including sporting equipment) owned by you, provided you have taken all reasonable measures to protect, save and recover the property. Per article limit of $500.

Activities covered based on 4 groups. You pay more for higher group. The Explorer plan includes more activities than the Standard Plan. Extreme activities not covered (cave diving, free soloing, etc)

The World Nomads Explorer Plan is a great option if you’re looking for an affordable travel insurance that covers skiing & snowboarding (on piste, off piste, heli-skiing, heli-boarding).

We recommend World Nomads Explorers plan for skiing trips if you are not American or don’t want the full-protection that Faye provides.

Comparison Table

When selecting insurance for your ski trip, a critical consideration is the remoteness of your ski destination.

For those hitting the slopes in less frequented ski areas, the top choice is Global Rescue . Its superior medical evacuation services distinguish it from other insurance options.

If your ski trip is planned for less remote regions and you’re a US resident, an outstanding insurance choice is Faye . It offers comprehensive medical coverage, includes pre-existing conditions, has no age restrictions, and covers winter sports, even at elevations above 9,000 feet.

For non-US residents embarking on ski adventures that aren’t in particularly isolated locations, the Explorer Plan from World Nomads is a robust alternative. It provides significant medical coverage and is noted for its cost-effectiveness in the insurance market.

Other Travel Insurance Reviews

If you would like to read more about insurance options for other type of adventure trips, you can check out our other reviews below:

- Travel Insurance for Ski Trips

- Travel Insurance for Hiking Trips

- Travel Insurance for Mountaineering & High Altitude Trekking

- Travel Insurance for Mountain Bike Holidays

- Travel Insurance for Adventure Cruises

- Travel Insurance for Diving Liveaboards

- Travel Insurance for Adventure Motorcycle Trips

- Travel Insurance for Everest Base Camp Trek

- Travel Insurance for Mount Kilimanjaro Climb

- Travel Insurance for Seniors Over 65

- Travel Insurance for People with Pre-existing Conditions

Ski Travel Insurance Reviews Online

When doing your research, you might want to read what other publications have to say about the best ski trip insurances out there.

Here are some of the most popular articles I found interesting.

Best Ski Insurance 2024 – Which?

Winter Sports Travel Insurance: Our Pick Of The Best – Forbes.com

About the Author

Antonio was born and raised in Southern Spain, and quit his job in 2013 to travel the world full-time with his wife Amanda for 10 years straight. Their passion for adventure took them to visit 150+ countries.

They cycled 25,000km + from California to Patagonia, sailed over 10,000NM around the Caribbean & Sea of Cortez, rode their motorbikes 30,000 kms+ across West Africa (Spain to South Africa) and visited Antarctica, among many other adventure expeditions. Today, they’re still traveling, currently around the USA with an RV.

Traveling to so many places, remote destinations and by different means taught them a lot about travel insurance, which policies to hold depending on the area and the type of adventure they were doing. Antonio now publishes regular content to help other travelers choose the best travel insurance for adventure trips.

Together, they also run the travel community Summit , the RV site Hitched Up , the boutique accommodation blog Unique Places and the popular newsletter Adventure Fix , where they share their knowledge about the places they’ve visited and the ones still remaining on their list.

Antonio Cala

Co-Founder of Adventure Fix

Privacy Overview

You are our first priority. every time..

We believe everyone should be able to make decisions with confidence. And while our site doesn’t feature every company or travel service available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Personal Loans for Fair Credit

- Home Equity

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Travel Insurance for Skiing and Snowboarding Trips

Planning a snowsports vacation? Find the best skiing insurance to cover your trip and yourself.

Molly Corry is an English literature graduate, travel writer and PR professional specializing in travel advice. Based in Leeds, England, when she is not writing, she enjoys attending dance classes and exploring new travel destinations to get inspired for her next piece of content.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Whether you’re a skiing or snowboarding newbie or a slalom expert, there’s nothing like the thrill of hitting the slopes. But amidst the excitement, it’s important to remember these winter sporting vacations come with certain health risks and dangers.

The last thing you want to experience during your vacation is an injury that puts you in line for travel medical care . Travel insurance for skiing or snowboarding trips is an important way to protect your vacation investment and your health on your trip.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

The Risks of Skiing and Snowboarding

The main risks associated with skiing and snowboarding, especially when traveling internationally, are the following:

- Injury: These sports both involve speed and navigating down steep, snowy slopes. This creates inherent injury risks. Common injuries include fractures, torn ligaments, dislocated shoulders, concussions, etc. Risk may be higher when skiing/riding at unfamiliar resorts with unknown terrain.

- Remote areas: Many resorts are located in very remote mountainous regions, miles from advanced medical care. This can be concerning if injured or in a serious accident when abroad, as access to good hospitals may be limited. Evacuations can also be complex.

- Extreme weather: Mountain weather can change rapidly, leading to low visibility, high winds, frigid temperatures, etc. This is especially dangerous if unprepared gear- or experience-wise.

- Altitude sickness: Most resorts are at high elevations of several thousand feet or more. This can trigger headaches, nausea, fatigue and other altitude illness symptoms in some people, especially when arriving from lower elevations. Staying properly hydrated and allowing time to acclimate is key.

- Costs of medical care: Any injury or illness requiring medical treatment will likely be very expensive if overseas without ample travel insurance. Skiing and medical transport from the slopes can rapidly escalate into thousands or tens of thousands in costs without insurance.

The risks can be managed with proper lessons, smart terrain choices, measured pace of advancement, use of protective gear, staying apprised of conditions, traveling with a companion, and securing travel insurance for the trip dates and locations. But the risk profile is inherently a bit higher than most other types of vacations. Careful preparation is a must to minimize this.

Snow or Winter Storm Interruptions

Choosing specialized travel insurance for skiing and snowboarding vacations will supply you with a backstop if you miss a curve and can’t control your skis or snowboard. These policies are tailored to cover the unique risks associated with these activities.

With insurance in place, you can enjoy your vacation knowing you’re protected against an array of potential mishaps and emergencies. Medical expenses for injuries on the slopes can be expensive, particularly in cases that require emergency evacuation, such as air ambulance rescue from the mountains or medical repatriation. Costs only go up if you have an injury that requires immediate surgery.

Beyond medical coverage, your insurance can also pay for trip interruptions and cancellations. You can claim reimbursement for the remaining costs if an unexpected injury forces you to cancel or cut your trip short.

You also may be eligible for compensation if an avalanche causes delays or piste closures. Your insurance might also protect against the loss, theft or damage of sports equipment — a valuable benefit given the high cost of such equipment and rentals.

Specialized insurance tailored for adventure sports vacations ensures that you’re protected against potential financial setbacks, allowing you to enjoy your adventure without unnecessary worries.

Skiing and Snowboarding Equipment Coverage

Equipment coverage is often considered essential for people who embark on skiing or snowboarding trips. Here are the typical available coverage options.

Equipment Theft Coverage

Equipment theft coverage supplies financial reimbursement if your gear gets stolen during your trip. However, you must review the policy’s fine print to decide the specific circumstances in which you are protected. For instance, confirm whether you are covered for theft at the ski resort, in your accommodation or during transit.

Equipment Damage Coverage

Equipment damage coverage protects you if your equipment sustains damage. Whether it occurs on the slopes or during transportation, this coverage ensures you’re covered for repairs or replacement.

Equipment Loss Coverage

It is always worth checking to see if your policy includes coverage for lost equipment. Losing your gear can be a frustrating and costly experience, so it’s best to have the appropriate protection in place should anything go missing.

Rental Equipment Coverage

Rental equipment coverage is an invaluable feature for people renting their skiing or snowboarding gear on their winter sports holiday. This coverage protects you if your rented equipment gets damaged or stolen or goes missing.

Choosing the Right Ski Travel Insurance Policy

When choosing a travel insurance policy for your snowboarding or ski trip, it’s important to prioritize protection for potential medical emergencies, trip cancellations and interruptions.

The right coverage will allow you to enjoy your time on the slopes without worrying about unforeseen circumstances. Finding the most suitable travel insurance plans involves researching insurance companies, comparing prices and coverages and looking at claims performance. Price comparison websites can be useful when trying to find cheap skiing or snowboarding vacation options.

You’ll first want to check the limit on how much coverage you can buy from various plans. You should also pay attention to age restrictions. Some policies may not cover senior travelers or those above 65, while others don’t have any age limit.

If you have pre-existing medical conditions , obtaining travel insurance coverage is possible but it usually costs more. Check whether your conditions are covered under the policy.

You’ll also want to verify that the cost of lost, damaged and stolen equipment is covered because snowboards and skis are expensive. Lastly, review the exclusions to know exactly what the policy’s limitations are.

By weighing these factors and looking at your trip cost, you can make an informed decision about picking the best travel insurance for your skiing or snowboarding vacation.

Benefits of Winter Sports Travel Insurance

Obtaining health insurance specific to winter sports vacations like ski trips offers multiple benefits. You get coverage for a range of situations, including healthcare expenses, trip interruptions and cancellations, medical evacuation and equipment loss, theft or damage.

You can also expect coverage for piste closures and delays caused by avalanches. And if you can’t use lift tickets you bought because of unforeseen circumstances, you may be eligible for reimbursement for those, too.

Securing the proper insurance coverage will allow you to relax and enjoy your trip, knowing that you are protected against all of the most common issues that could arise.

Tips for a Safe Skiing and Snowboarding Trip

Here are some tips for keeping safe on your snowboard or ski vacation.

Wear Appropriate Safety Gear

One of the most effective ways to stay safe on the slopes is to wear the right safety gear. Wear a well-fitted helmet to protect against potential head injuries , invest in goggles or sunglasses to shield your eyes from the sun, and consider using wrist guards for added protection.

Know and Follow the Mountain Rules

Take time to familiarize yourself with the rules and regulations of the mountain before hitting the slopes. Pay attention to speed limits, warning signs and any specific guidelines the ski resort provides. Adhering to these rules will help maintain a safe environment for all skiers and snowboarders.

Learn Trail Difficulty Levels

Know your skill level and choose slopes that align with your capabilities. Don’t overestimate your abilities and venture onto trails that may be too challenging. Selecting appropriate routes will reduce the risk of accidents and injuries.

Practice Responsible Skiing and Snowboarding

Practice responsible skiing and snowboarding by being mindful of others on the slopes. Stay on marked trails, keep a safe distance from fellow skiers and snowboarders when passing or merging, and avoid attempting maneuvers or slopes beyond your skill level. Respecting mountain etiquette ensures a safer and more enjoyable experience for everyone.

Is Ski Insurance Worth it?

Opting for specialized travel insurance for skiing and snowboarding vacations is the best way to ensure financial protection if unforeseen circumstances alter your trip. These policies are specifically designed to cover the risks associated with adventure vacations: medical emergencies, equipment issues and trip interruptions.

Choosing specialized sports coverage will leave you confident that you’re ready for challenges that may arise during your adventure on the slopes.

When choosing insurance for skiing and snowboarding vacations, carefully review the policy and understand its exclusions. This ensures that you have the coverage you need to enjoy your trip to the fullest.

Frequently Asked Questions About Travel Insurance for Winter Sports

What is travel insurance.

Travel insurance is financial protection for travelers in case some event alters the trip in a major way. It offers a range of benefits that can safeguard against various risks and unexpected events that may arise before or during a trip.

Are skiing accidents covered by insurance?

Should you get into an accident while skiing, your travel insurance will pay some expenses, depending on the policy. Your policy can cover you for injuries and emergency help. However, you must review the specific terms and conditions of your policy to understand the extent to which you’re covered.

Do I need travel insurance for skiing in France?

Whether you’re skiing in France or any other winter sports destination, we highly recommend getting travel insurance. Engaging in adventure sports always involves an element of risk, and having the right coverage in place is the best way to ensure that you’re protected against circumstances that negatively affect your trip.

What is the difference between travel insurance and trip cancellation insurance?