Travel, Tourism & Hospitality

Travel and tourism in Indonesia - statistics & facts

Indonesia as a global tourism destination, indonesian tourism: on the road to recovery, key insights.

Detailed statistics

Contribution of the tourism industry to GDP Indonesia 2016-2021

Number of international visitor arrivals Indonesia 2014-2023

Value of international tourism receipts Indonesia 2011-2020

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Number of foreign tourist arrivals to Bali, Indonesia 2008-2023

Average length of stay of inbound visitors to Indonesia 2012-2021

Related topics

Recommended.

- Accommodation in Indonesia

- Aviation industry in Indonesia

- Passenger transport in Indonesia

- Demographics of Indonesia

- Natural disasters in Indonesia

Recommended statistics

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Travel and tourism contribution share to GDP in Indonesia 2019-2021

- Basic Statistic Travel and tourism contribution to GDP in Indonesia 2019-2021

- Premium Statistic Absolute economic contribution of tourism in Indonesia 2014-2029

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

International tourist arrivals worldwide 2019-2022, by subregion

Number of international tourist arrivals worldwide from 2019 to 2022, by subregion (in millions)

Travel and tourism contribution share to GDP in Indonesia 2019-2021

Contribution of travel and tourism sector to GDP in Indonesia from 2019 to 2021

Travel and tourism contribution to GDP in Indonesia 2019-2021

Contribution of travel and tourism sector to GDP in Indonesia from 2019 to 2021 (in trillion Indonesian rupiah)

Absolute economic contribution of tourism in Indonesia 2014-2029

Absolute economic contribution of tourism in Indonesia from 2014 to 2029 (in million U.S. dollars)

Inbound tourism

- Premium Statistic Number of international visitor arrivals Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals from Asia Pacific to Indonesia 2014-2023

- Premium Statistic Number of international visitor arrivals Indonesia 2022, by mode of transport

- Premium Statistic Number of foreign visitor arrivals in Indonesia 2022, by port of entry

- Premium Statistic Monthly international air passengers at Soekarno-Hatta airport Indonesia 2019-2023

- Premium Statistic Average length of stay of inbound visitors to Indonesia 2012-2021

Number of international visitor arrivals in Indonesia from 2014 to 2023 (in millions)

Number of international visitor arrivals from Asia Pacific to Indonesia 2014-2023

Number of international visitor arrivals from Asia Pacific to Indonesia from 2014 to 2023 (in millions)

Number of international visitor arrivals Indonesia 2022, by mode of transport

Number of international visitor arrivals in Indonesia in 2022, by mode of transport (in 1,000s)

Number of foreign visitor arrivals in Indonesia 2022, by port of entry

Number of foreign visitor arrivals in Indonesia 2022, by main port of entries (in 1,000s)

Monthly international air passengers at Soekarno-Hatta airport Indonesia 2019-2023

Number of monthly international air passengers at Soekarno-Hatta Airport (CGK) in Indonesia from January 2019 to December 2023 (in 1,000s)

Average length of stay of inbound visitors to Indonesia from 2012 to 2021 (by number of days)

Domestic tourism

- Premium Statistic Number of domestic trips Indonesia 2013-2022

- Premium Statistic Number of domestic trips made in Indonesia 2021, by mode of transport

- Premium Statistic Breakdown of domestic trips in Indonesia 2021, by purpose

- Premium Statistic Monthly domestic air passengers at Soekarno-Hatta airport Indonesia 2019-2024

- Premium Statistic Number of domestic guests in star hotels Indonesia 2013-2022

- Premium Statistic Average length of stay in hotels by domestic travelers in Indonesia 2012-2021

- Premium Statistic Common concerns about traveling Indonesia 2023

Number of domestic trips Indonesia 2013-2022

Total number of domestic trips in Indonesia from 2013 to 2022 (in millions)

Number of domestic trips made in Indonesia 2021, by mode of transport

Number of domestic trips made in Indonesia in 2021, by mode of transport (in millions)

Breakdown of domestic trips in Indonesia 2021, by purpose

Number of domestic trips made in Indonesia in 2021, by purpose of travel (in millions)

Monthly domestic air passengers at Soekarno-Hatta airport Indonesia 2019-2024

Number of monthly domestic air passengers at Soekarno-Hatta Airport (CGK) in Indonesia from January 2019 to February 2024 (in millions)

Number of domestic guests in star hotels Indonesia 2013-2022

Total number of domestic guests in star hotels in Indonesia from 2013 to 2022 (in millions)

Average length of stay in hotels by domestic travelers in Indonesia 2012-2021

Average length of stay in hotels by domestic travelers in Indonesia from 2012 to 2021 (by number of nights)

Common concerns about traveling Indonesia 2023

Most common concerns about traveling among tourists in Indonesia as of January 2023

Economic impact

- Premium Statistic Average daily expenditure of inbound visitors to Indonesia 2012-2021

- Premium Statistic Inbound tourism expenditure value Indonesia 2013-2022

- Premium Statistic Value of international tourism receipts Indonesia 2011-2020

- Premium Statistic Number of employees in tourism industry Indonesia 2011-2020

Average daily expenditure of inbound visitors to Indonesia 2012-2021

Average daily expenditure of inbound visitors to Indonesia from 2012 to 2021 (in U.S. dollars)

Inbound tourism expenditure value Indonesia 2013-2022

Value of inbound tourism expenditure in Indonesia from 2013 to 2022 (in billion U.S. dollars)

International tourism receipts in Indonesia from 2011 to 2020 (in million U.S. dollars)

Number of employees in tourism industry Indonesia 2011-2020

Number of employees in the tourism industry in Indonesia from 2011 to 2020 (in 1,000s)

Accommodations, hotels, and bookings

- Premium Statistic Number of accommodation establishments for visitors Indonesia 2013-2022

- Premium Statistic Number of hotels and similar establishments Indonesia 2012-2021

- Premium Statistic Total number of hotels by star ratings Indonesia 2023

- Premium Statistic Number of employees in accommodation services for visitors Indonesia 2011-2020

- Premium Statistic Occupancy rate in classified hotels in Indonesia 2013-2022

- Premium Statistic Leading online travel agencies used in Indonesia 2023

- Premium Statistic Preferred accommodation booking methods for year-end holiday Indonesia 2022

Number of accommodation establishments for visitors Indonesia 2013-2022

Number of accommodation establishments for visitors in Indonesia from 2013 to 2022 (in 1,000s)

Number of hotels and similar establishments Indonesia 2012-2021

Number of hotels and similar establishments in Indonesia from 2012 to 2021 (in 1,000s)

Total number of hotels by star ratings Indonesia 2023

Total number of hotels in Indonesia in 2023, by star ratings

Number of employees in accommodation services for visitors Indonesia 2011-2020

Number of employees in hotels and similar establishments in Indonesia from 2011 to 2020 (in 1,000s)

Occupancy rate in classified hotels in Indonesia 2013-2022

Room occupancy rate of classified hotels in Indonesia from 2013 to 2022

Leading online travel agencies used in Indonesia 2023

Most popular online travel agencies among consumers in Indonesia as of June 2023

Preferred accommodation booking methods for year-end holiday Indonesia 2022

Most preferred accommodation booking methods for year-end holiday travel in Indonesia as of November 2022

Impact of COVID-19 on tourism

- Premium Statistic Quarterly change in international tourism receipts COVID-19 in Indonesia 2022

- Premium Statistic Monthly number of international visitor arrivals Indonesia 2020-2023

- Premium Statistic International tourism receipts during the COVID-19 pandemic in Indonesia Q4 2022

- Premium Statistic Monthly change in international tourist arrivals due to COVID-19 Indonesia 2020-2022

Quarterly change in international tourism receipts COVID-19 in Indonesia 2022

Quarterly change in international tourism receipts during the novel coronavirus (COVID-19) pandemic in Indonesia in 2022

Monthly number of international visitor arrivals Indonesia 2020-2023

Number of international visitor arrivals in Indonesia from January 2020 to March 2023 (in 1,000s)

International tourism receipts during the COVID-19 pandemic in Indonesia Q4 2022

International tourism receipts during the novel coronavirus (COVID-19) pandemic in Indonesia as of 4th quarter in 2022 (in thousand U.S. dollars)

Monthly change in international tourist arrivals due to COVID-19 Indonesia 2020-2022

Monthly change in international tourist arrivals during the novel coronavirus (COVID-19) pandemic in Indonesia as of December 2022

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

To read this content please select one of the options below:

Please note you do not have access to teaching notes, tourism development in indonesia.

Delivering Tourism Intelligence

ISBN : 978-1-78769-810-9 , eISBN : 978-1-78769-809-3

Publication date: 8 November 2019

The euphoria of tourism development in Indonesia as one of the leading industries of the country’s economy requires proper planning and an advanced strategy to maintain its sustainability. This chapter discusses strategies used by the Indonesian government for the implementation of sustainable tourism development. The strategy comprises three tourism programs: sustainable destination, sustainable observatory, and sustainable certification. The discussion developed in this chapter stresses that sustainable programs require serious commitment from the government and a carefully developed framework that suits the Indonesian context. Further, the proposed programs have to be introduced in closely monitored stages and are perhaps best developed through a certification program that may encourage positive impacts.

- Sustainability

- Tourism observatory

- Certification

- Sustainable tourism

- Tourism development

Lemy, D.M. , Teguh, F. and Pramezwary, A. (2019), "Tourism Development in Indonesia", Delivering Tourism Intelligence ( Bridging Tourism Theory and Practice, Vol. 11 ), Emerald Publishing Limited, Leeds, pp. 91-108. https://doi.org/10.1108/S2042-144320190000011009

Emerald Publishing Limited

Copyright © 2020 Emerald Publishing Limited

We’re listening — tell us what you think

Something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Tourism Sustainability in Indonesia: Reflection and Reformulation

- First Online: 22 February 2022

Cite this chapter

- Fandy Tjiptono ORCID: orcid.org/0000-0002-2596-9470 5 ,

- Lin Yang ORCID: orcid.org/0000-0001-5784-0922 6 ,

- Andhy Setyawan ORCID: orcid.org/0000-0002-9530-9304 7 ,

- Ida Bagus Gede Adi Permana ORCID: orcid.org/0000-0002-0126-592X 8 &

- I. Putu Esa Widaharthana ORCID: orcid.org/0000-0003-0812-9899 9

Part of the book series: Perspectives on Asian Tourism ((PAT))

435 Accesses

1 Citations

Tourism has long been considered an important sector in Indonesia. Not only it has a significant contribution to the economy, the sector also has substantial impacts on the social, cultural, and environmental aspects of the nation. Just like in other emerging countries, sustainability is not an easy concept to implement, especially in the tourism industry. The trade-offs between short-term benefits (e.g., employment, revenue, contribution to GDP, economic growth, etc.) and long-term interests (e.g., environmental sustainability, protection of cultural heritage, etc.) are one of the most challenging issues faced by all relevant tourism stakeholders. This chapter aims to examine the emergence, development, and challenges of sustainable tourism thought and practices in Indonesia. It provides a brief reflection of what had been achieved up to a pre-COVID 19 period, followed by a description of how the pandemic has adversely disrupted the industry. The chapter also proposes several important potential directions and challenges for the future of tourism sustainability in the ‘new normal’ Indonesia.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Aljazeera. (2020). Bali struggles with ‘Covid-poor’ as Indonesian cases hit record . Retrieved from: https://www.aljazeera.com/news/2020/12/4/covid-poor-emerge-in-bali-as-indonesian-cases-hit-new-records

Aznar, M., & Hoefnagels, H. (2020). Empowering small rural communities through heritage tourism. In P. L. Pearce & H. Oktadiana (Eds.), Delivering tourism intelligence: From analysis to action (pp. 49–60). Emerald Publishing Limited.

Google Scholar

Bloom Consulting. (2020). Bloom consulting country brand ranking 2019–2020 tourism edition . Bloom Consulting.

BPS. (2020a). Inflasi: Perkembangan indeks harga konsumen. Berita Resmi Statistik , 80 (11/XXIII, 2 November).

BPS. (2020b). Pertumbuhan ekonomi: Produk domestik bruto. Berita Resmi Statistik , 85 (11/XXIII, 5 November).

Butler, R. W. (1999). Sustainable tourism: A state-of-the-art review. Tourism Geographies, 1 (1), 7–25.

Article Google Scholar

Child, D. (2020). The positive impacts on the environment since the coronavirus lockdown began. Evening Standard . Retrieved from: https://www.standard.co.uk/news/world/positive-impact-environment-coronavirus-lockdown-a4404751.html

Cottrell, T., & Nault, B. R. (2004). Product variety and firm survival in the microcomputer software industry. Strategic Management Journal, 25 , 1005–1025.

Divianta, D. (2020). Gubernur minta seluruh obyek wisata di Bali ditutup untuk meredam penyebaran COVID-19 . Retrieved from: https://www.liputan6.com/regional/read/4207548/gubernur-minta-seluruh-obyek-wisata-di-bali-ditutup-untuk-meredam-penyebaran-COVID-19

Gurtner, Y. (2016). Returning to paradise: Investigating issues of tourism crisis and disaster recovery on the island of Bali. Journal of Hospitality and Tourism Management, 28 , 11–19.

Indonesia-Investments. (2015). Analysts: Indonesia should attract 33 million foreign tourists by 2019 . Retrieved from: https://www.indonesia-investments.com/news/todays-headlines/analysts-indonesia-should-attract-33-million-foreign-tourists-by-2019/item6284?searchstring=20%20million%20foreign%20tourists

Indonesia-Investments. (2018). Natural disasters in Indonesia . Retrieved from: https://www.indonesia-investments.com/business/risks/natural-disasters/item243#:~:text=Being%20located%20on%20the%20Pacific,%2C%20earthquakes%2C%20floods%20and%20tsunamis .

Jaffrey, S. (2020). Coronavirus blunders in Indonesia turn crisis into catastrophe . Retrieved from: https://carnegieendowment.org/2020/04/29/coronavirus-blunders-in-indonesia-turn-crisis-into-catastrophe-pub-81684

Junaid, I. (2015). Sustainable tourism in Toraja: Perspective of indigenous people. ASEAN Journal on Hospitality and Tourism, 14 (1), 45–55.

Kadirov, D., Tjiptono, F., & Sharipudin, M. N. S. (2020). Halal service research: Challenges of the COVID-19 pandemic. Journal of Halal Service Research, 1 (2), 1–10.

Kotler, P., Bowen, J. T., Makens, J. C., & Baloglu, S. (2017). Marketing for hospitality and tourism (7th ed.). Pearson Education Limited.

Lath, V., Lee, T., Tan, K. T., & Wibowo, P. (2020). With effort, Indonesia can emerge from the Covid-19 crisis stronger . Retrieved from: https://www.mckinsey.com/featured-insights/asia-pacific/with-effort-indonesia-can-emerge-from-the-covid-19-crisis-stronger

Lemy, D. M., Teguh, F., & Pramezwary, A. (2020). Tourism development in Indonesia: Establishment of sustainable strategies. In P. L. Pearce & H. Oktadiana (Eds.), Delivering tourism intelligence: From analysis to action (pp. 91–108). Emerald Publishing Limited.

Liu-Lastres, B., Mariska, D., Tan, X., & Ying, T. (2020). Can post-disaster tourism development improve destination livelihoods? A case study of Aceh, Indonesia. Journal of Destination Marketing & Management, 18 , 100510.

Mair, S. (2020). What will the world be like after coronavirus? Four possible futures. The Stuff . Retrieved from: https://www.stuff.co.nz/national/health/coronavirus/120728480/what-will-the-world-be-like-after-coronavirus-four-possible-futures

McKinsey & Company. (2020). Beyond coronavirus: The path to the next normal . Retrieved from: https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/beyond-coronavirus-the-path-to-the-next-normal

McLaughlin, K. (2020). Satellite images show just how much Venice’s canals have cleared up since the city went under coronavirus lockdown . Retrieved from: https://www.insider.com/satellite-images-venice-canals-clear-coronavirus-lockdown-2020-4

Ministry of Tourism and Creative Economy. (2020). Rencana Strategis 2020–2024 . Ministry of Tourism and Creative Economy of the Republic of Indonesia.

Ministry of Tourism. (2016). Regulations of the Minister of Tourism of the Republic of Indonesia: Number 14 of 2016 on guidelines of sustainable tourism destination . Minister of Tourism of the Republic of Indonesia.

Monks, P. (2020). Here’s how lockdowns have improved air quality around the world . World Economic Forum. Retrieved from: https://www.weforum.org/agenda/2020/04/coronavirus-lockdowns-air-pollution

Novelli, M., Burgess, L. V., Jones, A., & Ritchie, B. W. (2018). No Ebola… still doomed —The Ebola-induced tourism crisis. Annals of Tourism Research, 70 , 76–87.

Nurjaya, I. N. (2018). Sustainable tourism development in Indonesia: Policy and legal political point of view. Advances in Social Science, Education and Humanities Research, 282 , 199–203.

Ruhanen, L., Weiler, B., Moyle, B. D., & McLennan, C. L. J. (2015). Trends and patterns in sustainable tourism research: A 25-year bibliometric analysis. Journal of Sustainable Tourism, 23 (4), 517–535.

Saarinen, J. (2014). Critical sustainability: Setting the limits to growth and responsibility in tourism. Sustainability, 6 (1), 1–17.

Savitz, A. W., & Weber, K. (2006). The triple bottom line: How today’s best-run companies are achieving economic, social and environmental success—And how you can too . Wiley.

Sigala, M. (2020). Tourism and COVID-19: Impacts and implications for advancing and resetting industry and research. Journal of Business Research, 117 , 312–321.

Suarez, F. F., & Utterback, J. M. (1995). Dominant designs and the survival of firms. Strategic Management Journal, 16 (6), 415–430.

Sugiari, L. P. (2020). Dampak COVID-19 bagi pariwisata jauh lebih parah dari bom Bali . Retrieved from: https://bali.bisnis.com/read/20200410/538/1225373/dampak-COVID-19-bagi-pariwisata-jauh-lebih-parah-dari-bom-bali

Susanto, V. Y. (2020). Sepanjang 2019, devisa sektor pariwisata mencapai Rp 280 triliun . Retrieved from: https://nasional.kontan.co.id/news/sepanjang-2019-devisa-sektor-pariwisata-mencapai-rp-280-triliun

Syamsidik, S., Oktari, R. S., Nugroho, A., Fahmi, M., Suppasri, A., Munadi, K., & Amra, R. (2021). Fifteen years of the 2004 Indian Ocean Tsunami in Aceh-Indonesia: Mitigation, preparedness and challenges for a long-term disaster recovery process. International Journal of Disaster Risk Reduction, 54 , 102052.

The Jakarta Post. (2020). Indonesian health system might collapse soon: Covid-19 task force . Retrieved from: https://www.thejakartapost.com/news/2020/09/22/indonesian-health-system-might-collapse-soon-covid-19-task-force.html

Uğur, N. G., & Akbiyik, A. (2020). Impacts of COVID-19 on global tourism industry: A cross-regional comparison. Tourism Management Perspectives, 36 , 100744.

UNEP and UNWTO. (2005). Making tourism more sustainable: A guide for policy makers . United Nations Environment Programme and World Tourism Organization.

UNWTO. (2020). UNWTO world tourism barometer (Vol. 18, Issue 6, October 2020) . UNWTO.

Wibisono, A. (2020). Dampak COVID-19, pertumbuhan perekonomian Bali triwulan I-IV 2020 bakal terkoreksi . Retrieved from: https://balitribune.co.id/content/dampak-COVID-19-pertumbuhan-perekonomian-bali-triwulan-i-iv-2020-bakal-terkoreksi

World Economic Forum. (2019). The travel & tourism competitiveness report 2019: Travel and tourism at a tipping point . World Economic Forum.

Worldometers. (2020). Coronavirus cases . Retrieved from https://www.worldometers.info/coronavirus/?utm_campaign=homeAdvegas1?#countries

WowKeren. (2018). Miris banget, keindahan alam di tempat wisata ini rusak karena ulah manusia. Retrieved from https://www.wowkeren.com/berita/tampil/00233873.html

Yeh, S. S. (2020). Tourism recovery strategy against COVID-19 pandemic. Tourism Recreation Research , 1–7. https://doi.org/10.1080/02508281.2020.1805933

Download references

Author information

Authors and affiliations.

School of Marketing and International Business, Wellington School of Business and Government, Victoria University of Wellington, Wellington, New Zealand

Fandy Tjiptono

Tasmanian School of Business and Economics, University of Tasmania, Sandy Bay, Australia

Faculty of Business and Economics, Universitas Surabaya, Surabaya, Indonesia

Andhy Setyawan

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

Ida Bagus Gede Adi Permana

Hospitality Business Program, Politeknik Pariwisata Bali, Bali, Indonesia

I. Putu Esa Widaharthana

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Fandy Tjiptono .

Editor information

Editors and affiliations.

Nilai University, Seremban, Negeri Sembilan, Malaysia

Ann Selvaranee Balasingam

University of Tasmania, Sandy Bay, TAS, Australia

Rights and permissions

Reprints and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Tjiptono, F., Yang, L., Setyawan, A., Permana, I.B.G.A., Widaharthana, I.P.E. (2022). Tourism Sustainability in Indonesia: Reflection and Reformulation. In: Selvaranee Balasingam, A., Ma, Y. (eds) Asian Tourism Sustainability. Perspectives on Asian Tourism. Springer, Singapore. https://doi.org/10.1007/978-981-16-5264-6_8

Download citation

DOI : https://doi.org/10.1007/978-981-16-5264-6_8

Published : 22 February 2022

Publisher Name : Springer, Singapore

Print ISBN : 978-981-16-5263-9

Online ISBN : 978-981-16-5264-6

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

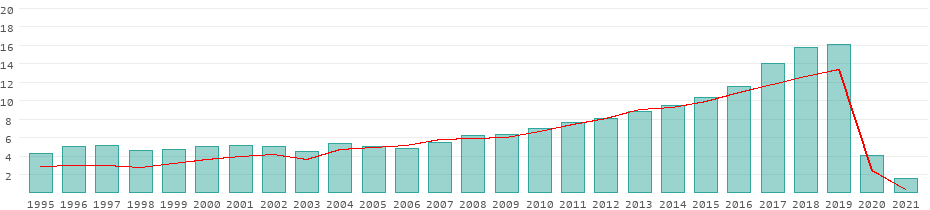

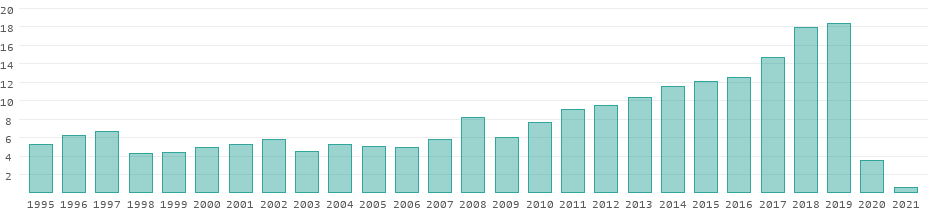

Tourism in Indonesia

Development of the tourism sector in indonesia from 1995 to 2021.

Revenues from tourism

All data for Indonesia in detail

Advancing social justice, promoting decent work ILO is a specialized agency of the United Nations

Migrated Content

12 January 2023

PwC Indonesia Firm Profile

Indonesia's Carbon Pricing

Global Annual Review 2023

Power in Indonesia

Indonesia Electric Vehicle Consumer Survey 2023

Global M&A Industry Trends: 2024 Outlook

PwC Indonesia Mergers and Acquisition Update 2023

PwC's Global NextGen Survey 2024

PwC’s Global Risk Survey 2023

Indonesia Economic Update

Global Entertainment and Media Outlook 2023–2027

Loading Results

No Match Found

Tourism and Regional Development

The government of Indonesia is prioritizing the tourism sector. Given that Indonesia has the largest multilingual population in the world, with 260 million inhabitants and a rich cultural and natural diversity, as well as government support. There is much potential for Indonesian businesses that are in the tourism industry. In 2019, Indonesia received 16.1 million international tourists, and it recorded more than 370 million domestic trips. The tourism sector has been growing at an average annual rate of 5.4% of total GDP. According to the World Tourism and Travel Council, international tourist arrivals were on track to reach 24 million by 2028.

The COVID-19 pandemic and accompanying travel restrictions are impacting the sector, however. Our expertise in Travel and Tourism is dedicated to supporting the Indonesian government and its ministries, provincial governments, state-owned enterprises, international development organizations, and the private sector as they regroup and be prepare to rebound once the pandemic is under control. Our expertise in Travel and Tourism includes the following:

- Destinations, sites, amenities, attractions, and their accessibility;

- Good governance and tourism institutions and organizations;

- Tourism-related infrastructure;

- Products and services relating to travel and tourism;

- The traveller experience;

- Digital transformations;

- Capacity building for tourism; and

- Health, safety, and environment standardization.

Explore more

Tourism - Capability Statements

Julian Smith

Director, Government & Public Services, PwC Indonesia

Tel: +62 21 509 92901

Hendri Hendrawan

Director, PwC Indonesia

© 2018 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Privacy statement

- Legal disclaimer

- Cookies Information

- About site provider

- The T4SDG Platform

- What are the SDGs

- Tourism and SDGs

- Companies CSR and SDGs

- Tourism in National SDG Strategies

- TIPs Toolkit

- SDGs Dashboard

- Tourism for SDGs

- CSR & Sustainable Development Goals

- Tourism in National SDG strategies

- G20 Tourism and SDGs Dashboard

- Vision & Mission

- Core Values

- Directors & Management

- Procurement MUTIP

- Procurement Announcement

- Organization Structure

CEO's Message

- Press Release

The Nusa Dua

The mandalika, the golo mori.

- Investment Opportunity

Micro Small Business Funding Program

Social and environmental responsibility program.

- Good Corporate Governance

- Whistle Blowing System

Creating Destinations

To conduct business in the tourism sector, as well as optimize the utilization of the Company's resources to produce high-quality and highly competitive goods and or services to gain/pursue profits to improve Company’s value by applying the principles of a Limited Liability Company, the Company carries out main business activities and other business activities aiming to create world class tourism destination.

New Normal in Tourism

ITDC has prepared mitigation measures and handling SOPs for tourists as well as supporting facilities for preventing the spread of Covid-19 both in The Nusa Dua or The Mandalika based on the reference for handling Covid-19 issued by the World Health Organization and the Cleanliness, Healthy, Safe and Environtment protocol (CHSE) compiled by the Ministry of Tourism, Economy and Creative as a new normal in tourism destinations.

IndonesianGP at The Mandalika

ITDC, as an official partner of Dorna, introducing MGPA a dynamic business unit set to drive world-class motor racing experiences.

LAPOR! is a National Public Service Management System that is coordinated, managed and supervised by three institutions in the form of a partnership, Kemenpan RB, the Office of the Presidential Staff and the Ombudsman of the Republic of Indonesia.

Anti-Bribery Management System Policy

ITDC has an Anti-Bribery Management System Policy which is regulated in the Decree of the Board of Directors Number 002.2/SK/ITDC.01/I/2024 referring to SNI ISO 37001:2016 and applicable regulations.

We Enhance Business by Investing in Sustainable Tourism Environment to Encourage Local Economy Growth

PT Pengembangan Pariwisata Indonesia or Indonesia Tourism Development Corporation, has rebranded as InJourney Tourism Development Corporation. As part of PT Aviasi Pariwisata Indonesia (Persero) or InJourney, in accordance with Government Regulation of the Republic of Indonesia Number 72 of 2021 and Government Regulation of the Republic of Indonesia Number 104 of 2021. InJourney is present as a holding ecosystem of State-Owned Enterprises in the aviation and tourism sectors in Indonesia, committed to bringing Indonesia's hospitality and cultural diversity to the world, encouraging the revival of the tourism sector, and orchestrating collaboration and integration in the tourism industry.InJourney Tourism Development Corporation is a company that focuses on the development and management of integrated tourism areas in Indonesia, for 50 years has successfully managed The Nusa Dua "Bali's Finest Family-Friendly Resort Haven", a famous tourism area in the south of the island of Bali. The area has become a popular vacation destination thanks to the presence of many luxury hotels within the area. The development of The Nusa Dua began in 1974 as the World Bank's first tourism project for Indonesia, and has now become a benchmark for future destinations.The Nusa Dua area is equipped with international-standard infrastructure, accommodation, and meeting facilities, making the area host to various official international events such as APEC 2013, Bali Democratic Forum, Miss World 2013, and IMF-World Bank Group Annual Meetings 2018 and G20 Presidency in 2022.In addition to The Nusa Dua, InJourney Tourism Development Corporation is also entrusted with the development of The Mandalika area in Central Lombok, West Nusa Tenggara (NTB), which has an area of 1,175 hectares. The Mandalika "The Ultimate Lifestyle Sportstainment Destination" has been a Special Economic Zone (SEZ) since 2017 and has attracted an investment of USD 1.3 billion. Currently, The Mandalika is being created as a world-class tourism destination with various international facilities and attractions, including Pertamina Mandalika International Circuit, which hosts world motorcycle racing events such as WSBK, MotoGP and Asian Road Racing Championship (ARRC).Not only that, InJourney Tourism Development Corporation also received the third assignment from the Government to develop The Golo Mori "Sustainable Marine-Based MICE Tourism Destination" area in West Manggarai Regency, East Nusa Tenggara (NTT). Within this area is a world-class convention center, the Golo Mori Convention Center (GMCC), which offers stunning views overlooking Rinca Island. With international-standard Meetings, Incentives, Conferences and Exhibitions (MICE) facilities, GMCC has become the venue for the 2023 ASEAN Summit. In addition, GMCC is also equipped with a Beach Club and Pier, making The Golo Mori a new tourism icon in the Labuan Bajo area and is being prepared to become a new Tourism Special Economic Zone in Indonesia.Company Profile ITDC: Download here

We are pleased to extend an invitation to you to consider investing in the Mandalika Special Economic Zone, a world-class destination located on the island of Lombok, Indonesia.Managed by the Indonesia Tourism Development Corporation (ITDC), the Mandalika Special Economic Zone is a 1,175-hectare integrated development that features a unique combination of natural and cultural attractions, including pristine beaches, lush forests, and historical landmarks. The zone is envisioned to be a sustainable tourism destination that promotes responsible development, social inclusivity, and environmental conservation.One of the highlights of the Mandalika Special Economic Zone is the 4.3-kilometer circuit that was specially designed to hold MotoGP and World Superbike races. The circuit, which has been certified by the Fédération Internationale de Motocyclisme (FIM), is the first in Indonesia and one of the few in Southeast Asia. It is expected to attract thousands of visitors every year and to boost the local economy significantly.As an investor, you will have the opportunity to participate in one of the most exciting developments in Southeast Asia today. You will be able to contribute to the growth of Indonesia's tourism industry, which is expected to become a major driver of the country's economy in the years to come. You will also benefit from the zone's strategic location, which is easily accessible from major cities in Asia, including Singapore, Hong Kong, and Kuala Lumpur.Moreover, the Mandalika Special Economic Zone offers a range of investment opportunities across various sectors, including hospitality, real estate, entertainment, and infrastructure. Whether you are interested in building a luxury resort, a residential complex, or a theme park, we have the expertise and resources to help you turn your vision into reality.We believe that the Mandalika Special Economic Zone is a unique investment opportunity that offers attractive returns, as well as significant social and environmental benefits. We invite you to explore this opportunity further and to join us in building a sustainable and prosperous future for Indonesia.Please do not hesitate to contact us if you have any questions or if you would like to schedule a visit to the Mandalika Special Economic Zone. We look forward to hearing from you soon.Sincerely,Ari Respati,CEO, Indonesia Tourism Development Corporation (ITDC)

EXPLORE OUR DESTINATIONS

BUSINESS LINES

To conduct business in the tourism sector, as well as optimize the utilization of the Company's resources to produce high-quality and highly competitive goods and or services to gain/pursue profits to improve Company value by applying the principles of a Limited Liability Company, the Company carries out main business activities and other business activities.

Destination Owner

Destination Owner is ITDC’s core business line since its establishment in 1973. Through this business line, ITDC offers land leasing in tourism destinations owned and managed by ITDC, namely The Nusa Dua anda The Mandalika, for business commercial actvities. As the owner of The Nusa Dua and The Mandalika, ITDC’s role includes developing masterplans, building complex infrastructure that is of international standard, and developing an investment system that is attractive for investors to invest in both destinations.As a destination owner, ITDC’s income sources consisting of Minimum Compensation, namely the income of compensation received by the Company on land leases that are billed quarterly during the lease period under the LUDA; Percentage Compensation, which is an additional income received by the Company in an operating period based on a certain percentage of gross sales from each lot rented by the investor; One Time Compensation, namely the source of land rent income paid at the beginning the next few years; and Other Compensations, namely the source of land rental income with a smaller size and its allocation as supporting infrastructure.Land leasing business in tourism destination for business commercial activitiesTarget Customers• Hotel Tenants• CommercialRevenue Model• Leasing Fee

Productive Asset Investor

This business line manages ITDC’s investment in productive assets within the tourism destination managed by ITDC. For example, ITDC has a stake in the Courtyard Marriott and Mercure Hotels located in the Nusa Dua, Bali, and star hotels in The Mandalika, one of which is Pullman Mandalika. Through this business line ITDC can also invest in MICE facilities, commercial areas, and leading attractions, one of which is the Mandalika Street Circuit which will be the venue for MotoGP and World SBK starting in 2021.The Productive Asset Investor business line aims to increase company revenue and ensure that the quality of productive assets in the tourism complex managed by ITDC has world-class standards that are ITDC's commitment. This business line is managed by ITDC’s subsidiary namely PT ITDC Nusantara Properti or INP.In addition to targeting the upper-middle-class tourists, this business line also targets visitors with the aim of business and procurement of national and international eventsTarget Customers• TouristsRevenue Model• Room Rate• Dividend• Profit-Sharing

Utilities Provider

Through the Utilities Provider business line, ITDC develops and provides various supporting facilities in the tourism destinations developed by ITDC, such as water treatment, solid and liquid waste treatment, gas and electricity supply, and other supporting infrastructure. This business line is managed by ITDC’s subsidiary namely ITDC Nusantara Utilities (INU).In The Nusa Dua, this business also includes the arrangement of commercial parking and the procurement of Information and Communication Technology (ICT), while at The Mandalika it includes processing desalination of seawater into clean water and in the future, there is a discourse on the procurement of renewable energy. ITDC consumers in this business line are tenants in the tourism area managed by ITDC, as well as PLN (State-owned enterprise).Target Customers· Utilities, Tenants, and PLNRevenue Model· Sales of clean water

Destination Management

ITDC Destination Management Organization (DMO), a new line of business for ITDC, presents an alluring feature for its partners given what is unquestionable capability and experience building, developing, and managing The Nusa Dua over 46 years.The tourism area needs integrated management from planning to operatorship. ITDC provides this service for landowners, both private and regional governments, who want to develop their land into an integrated tourism area. These services range from helping regional owners make plans or commonly referred to as master planning, conducting feasibility studies, making business models, promoting destinations and attracting investment and funding to the formation of regional operations plans.Target Customers• Destination owner• Government (assignment)Revenue Model• Management fee

Mandalika Urban and Tourism Infrastucture Project

Currently ITDC is in the process of financing program with the Asian Infrastructure Investment Bank ("AIIB") to develop a basic infrastructure facilities in the Mandalika tourism area on the island of Lombok ("Project"). The project covering an area of 1,250 Ha aims to create new job opportunities, improve the economy of the community, increase the country's foreign exchange, protect and preserve local culture, nature and the environment.Although this Project is focused on The Mandalika, it is expected that the impact of its development will also provide benefits in the wider region, support sustainable development, reduce poverty in Central Lombok Regency in particular and West Nusa Tenggara Province in general, and contribute to the Indonesian tourism competitiveness as a whole.

INVESTMENT OPPORTUNITY

Grow your business with Indonesia Tourism Development Cooperation projects in developing new tourism area in Indonesia with high standarts.

E-PROCUREMENT

e-Procurement for the means of procurement of goods / services, inter-unit procurement information, in accordance with the Guidelines for procurement of goods / services applicable at PT. Pengembangan Pariwisata Indonesia (Persero) which is done online application facilities.

OUR MILESTONES

ITDC's vision is to become a world class tourism destination developer that is offering world class tourism infrastructure, facilities, and attractions.

TESTIMONIAL

"I am satisfied after seeing the progress of The Mandalika Circuit construction. I am very enthusiastic about The Mandalika Circuit because it is the first circuit for MotoGP with the concept of street race, yet equipped with facilities like a permanent circuit, such as CoEx building with paddock, hotel, and hospital. I am very optimistic this circuit will be an icon for being the first and wonderful street circuit.”

Carmelo Ezpeleta

CEO DORNA Sports SL

"Today we are very happy to see the progress of The Mandalika Circuit construction. Although the design is still in the process of confirmation, the construction of the circuit is clearly visible, and we are confident of MGPA's hard work in the 18 months going forward, construction can be completed and MotoGP can be held in Indonesia. We look forward to coming back to Indonesia, an important country for motor sports because of the huge fan base. “Besides, bringing MotoGP back to Indonesia is a beautiful gift from the Government to the people of Indonesia, bearing in mind that Indonesia has a very large motor racing fan base. We are sure that MotoGP in Indonesia will be successful, sold out, and bring many tourists to Indonesia, "

Carlos Ezpeleta

Sporting Director DORNA

"For sure, MUI will participate in promoting The Mandalika, Lombok, West Nusa Tenggara to all regions across Indonesia"

K.H. Ma’ruf Amin

Wakil Presiden RI 2019 - 2024

"Indonesia will be very active in submitting bids to host various events and world-class sports activities. There are many destinations that can be maximized for sports tourism. This event serves as the starting point for the development of events and attractions in Mandalika for four-wheeled racing. In the 2023 season, the Porsche Sprint Challenge will take place, promoting The Mandalika to the world"

Dr. H. Sandiaga Salahuddin Uno, B.B.A., M.B.A.

Menteri Kemenparekraf RI

"GMCC is not just a new MICE facility, but also a symbol of our commitment to enhance infrastructure and tourist attractions in Eastern Indonesia. GMCC is also equipped with excellent facilities, including a beach club, observation deck, and wooden pier."

Erick Thohir

Menteri Badan Usaha Milik Negara

In conforming the information needs for people, ITDC provides wide access to search for information on our activities in Indonesia.

JDM Funday Mandalika Time Attack 2024: Sesi Latihan (Free Practice) Para Pembalap Siap Bertanding di Pertamina Mandalika International Circuit

The Mandalika, 29 April 2024 – Japanese Domestic Market (JDM) Funday Mandalika Time Attack 2024 resmi digelar perdana hari ini, (29/4), di Pertamina Mandalika International Circuit, Lombok Tengah, Nusa Tenggara Barat (NTB). Hari pertama dimulai dengan sesi latihan yang menegangkan sebelum berlanjut ke sesi race yang akan berlangsung pada hari kedua (30/4).Sesi latihan 1 (Free Practice 1), sorotan tertuju pada Ahmad Fadillah Alam, driver dari kelas Street B, yang berhasil mencatatkan waktu 1 menit 43,563 detik. Posisi kedua disusul Luckas Dwinanda, pengemudi dari kelas Street B, dengan catatan waktu 1 menit 45,402 detik. Tidak kalah hebatnya, Fitra Eri dari kelas Standard berhasil meraih posisi ketiga dengan waktu memukau 1 menit 51,714 detik.Sementara itu, pada sesi latihan 2 (Free Practice 2), Luckas Dwinanda, driver dari kelas Street B berhasil menjadi yang tercepat dengan catatan waktu 1 menit 44,639 detik. Posisi kedua dan ketiga berhasil diamankan oleh Fitra Eri dari kelas Standard dan Street B dengan 1 menit 51,324 detik dan 1 menit 51,640 detik.Direktur Utama MGPA, Priandhi Satria menyampaikan, “Seluruh rangkaian balapan pada hari pertama JDM Funday Mandalika Time Attack 2024 berjalan dengan gemilang. Lintasan sirkuit di Pertamina Mandalika International Circuit mempertegas kualitasnya, menjadikan setiap sesi balapan, dari latihan hingga race, semakin seru.”Untuk jadwal hari kedua, akan diadakan sesi Kualifikasi, Race Time Attack 1, Race Time Attack 2, Subaru Exhibition, dan Time Attack Final.Sementara itu, Ketua Pelaksana JDM Funday Mandalika Time Attack 2024 Yahya Adi Nugroho mengatakan, “Kami sangat bersemangat menyambut sesi kualifikasi dan balapan yang akan berlangsung pada 30 April 2024. Ini merupakan awal dari perjalanan kami untuk penyelenggaraan kompetisi time attack pertama di Sirkuit Mandalika.”

Adhyaksa International Run 2024 Sukses Terselenggara di The Nusa Dua

The Nusa Dua, 28 April 2024 – Adhyaksa International Run (AIR) 2024, sukses terselenggara di Peninsula Island, The Nusa Dua, kawasan yang dikelola oleh InJourney Tourism Development Corporation (ITDC) pada Sabtu, 27 April 2024. AIR 2024 adalah event lari berskala internasional, yang melibatkan pelari nasional dan internasional, yang diselenggarakan oleh Tunas Muda Adhyaksa, yang bertujuan untuk menyuarakan keadilan dan persamaan pada dunia.AIR 2024 dibagi dalam 2 kategori, yaitu 10 km dan 5 km, dengan jumlah pelari yang mencapai 2.000 orang. Diantaranya berasal dari negara-negara ASEAN, Jepang, Luxemburg, USA, Denmark serta Indonesia. Bertajuk “Find Your Pace”, AIR 2024 dimeriahkan oleh penampilan RAN, Diskopantera, dan beberapa artis papan atas nasional, dengan doorprize yang sangat menarik.Acara dimulai pukul 06.00 WITA dengan sesi warm up, disusul dengan flag off 10K dan 5K yang dilakukan oleh Jaksa Agung RI Dr. ST Burhanuddin, SH., MH. didampingi Ketua Komisi Kejaksaan Prof Dr. Pujiyono Suwadi, SH., MH., Jaksa Agung Muda Intelijen Prof Dr. Reda Manthovani, SH., LLM., Jaksa Agung Pembinaan Dr. Bambang Sugeng Rukmono, SH., MH. Ketua Umum Persatuan Jaksa Indonesia (Persaja) Dr. Amir Yanto SH,.MH., Staf Ahli Jaksa Agung Dr. Narendra Jatna, SH., LLM., Kepala Kejaksaan Tinggi Bali Dr. Ketut Sumedana, SH., MH turut hadir juga para sponsor dan undangan lainnya.General Manager The Nusa Dua I Made Agus Dwiatmika mengatakan, ”Kami sangat berbahagia atas suksesnya penyelenggaraan event lari bergengsi ini. Kami berharap AIR 2024 menjadi agenda wisata olahraga yang menarik di Bali, serta meningkatkan minat masyarakat terhadap olahraga lari sebagai bagian dari pengembangan sport tourism di Indonesia. Dengan suksesnya penyelenggaraan AIR 2024 ini, kami berharap dapat mempromosikan kawasan The Nusa Dua, khususnya Pulau Peninsula, sebagai salah satu spot wisata menarik di Bali, yang sangat cocok dimanfaatkan sebagai venue berolahraga seperti lari, dengan suguhan pemandangan yang sangat indah.”Pulau Peninsula, sebuah pulau dengan luas 5 hektar yang terletak di ujung kawasan The Nusa Dua dan menghadap Samudera Hindia, dapat digunakan untuk berbagai kegiatan side event Meeting, Incentive, Conference, Exhibition (MICE). Pulau ini dilengkapi dengan fasilitas open stage, helipad standard Chinook, stage Kecak yang mampu menampung 600 orang, serta objek wisata alam Water Blow. Sebelumnya, Pulau Peninsula, telah menjadi venue event sport, termasuk BCA Bali Run 2017, Bali International Night Run 2018 dan annual event Run to Give. “Sebagai pengelola kawasan The Nusa Dua, kami membuka ruang kerjasama seluas-luasnya bagi pelaku pariwisata dan penyelenggara event untuk menggelar berbagai event bergengsi di kawasan The Nusa Dua. Kelengkapan fasilitas kawasan dan event venue baik indoor maupun outdoor yang sudah terpercaya dalam penyelenggaraan berbagai event bertaraf nasional maupun internasional,” tutup Made Agus.

Menelusuri Pesona Keindahan Mandalika Serunya Konvoi JDM Funday Mandalika 2024!

The Mandalika, 27 April 2024 – Menyambut gelaran Japan Domestic Market (JDM) Funday Mandalika Time Attack 2024 di Pertamina Mandalika International Circuit, kawasan The Mandalika, Lombok Tengah yang dikelola oleh InJourney Tourism Development Corporation (ITDC) bersama Mandalika Grand Prix Association (MGPA), mengajak para driver JDM Funday Mandalika Time Attack 2024, untuk menyusuri keindahan kawasan The Mandalika dengan mengadakan konvoi pada hari ini, Sabtu (27/4). Acara konvoi ini dimulai dari Pertamina Mandalika International Circuit, menuju Kantor Gubernur Nusa Tenggara Barat (NTB), dan berakhir di Kuta Beach Park (KBP), memberikan pengalaman yang mengagumkan bagi para pengemudi JDM Funday Mandalika Time Attack 2024 yang hadir. Direktur Operasi ITDC Troy Warokka menyatakan, "Langkah ini merupakan upaya untuk memperkuat posisi Pertamina Mandalika International Circuit dan Kawasan The Mandalika sebagai destinasi utama sport & entertainment tourism. Sebagai wadah bagi komunitas otomotif untuk berinteraksi, kami berharap Mandalika akan semakin dikenal sebagai destinasi dengan pesona alam yang menarik bagi para pecinta otomotif, serta menjadi daya tarik utama dalam industri otomotif.”Dalam acara hari ini, JDM Run yang merupakan komunitas mobil sport Japanese Domestic Market terbesar di Indonesia, akan turut meramaikan dengan menghadirkan 85 mobil Jepang performa tinggi dari berbagai daerah di Indonesia. Para peserta akan berlomba dalam kompetisi Time Attack yang menantang, dengan pembagian kategori berdasarkan tingkat pengalaman dan jenis kendaraan yang digunakan. Hal ini diharapkan dapat memberikan kesempatan bagi para pengemudi dengan berbagai tingkat pengalaman untuk merasakan tantangan yang sesuai, sambil menyajikan aksi balap yang memukau bagi para penonton.Sementara itu, Direktur Utama MGPA Priandhi Satria mengatakan, “Ini merupakan inisiatif kami untuk mempromosikan keindahan alam The Mandalika kepada komunitas otomotif, sehingga mereka dapat menikmati pengalaman unik dari konvoi melewati rute yang indah dan menarik. Mengajak para driver JDM Funday Mandalika Time Attack 2024 untuk menjelajahi kawasan The Mandalika, kami berharap dapat memberikan wawasan baru mengenai potensi wisata, serta meningkatkan minat wisatawan untuk mengunjungi The Mandalika kedepannya.”JDM Funday Mandalika Time Attack 2024 yang akan digelar pada tanggal 28 April hingga 1 Mei 2024 di Pertamina Mandalika International Circuit dimulai pukul. Gelaran ini akan menjadi balap roda empat kedua yang digelar di Pertamina Mandalika International Circuit, menandai awal dari serangkaian acara olahraga otomotif yang menarik di kawasan The Mandalika. Melalui gelaran JDM Funday Time Attack 2024, dapat memperkuat positioning Pertamina Mandalika International Circuit sebagai tuan rumah untuk gelaran balap roda-4.“Kami berharap JDM Funday Mandalika Time Attack 2024 akan memulai semangat baru dalam industri otomotif dan pariwisata. ITDC mendukung program aktivasi olahraga otomotif di Pertamina Mandalika International Circuit, dengan tujuan meningkatkan dampak positif bagi perekonomian NTB, khususnya sektor pariwisata. Melalui kegiatan ini, kami berharap dapat memperluas minat masyarakat Indonesia terhadap olahraga otomotif dan memperkuat posisi The Mandalika sebagai destinasi 'sport and entertainment tourism' di Indonesia. Dengan demikian, gelaran ini diharapkan tidak hanya memberikan pengalaman berharga bagi peserta, tetapi juga dampak positif yang berkelanjutan bagi pertumbuhan ekonomi dan kesejahteraan masyarakat lokal di sekitar The Mandalika.” tutup Troy.

Indonesian GP 2024 : Harga Khusus 50% Selama Periode Early Bird

Jakarta, 26 April 2024 – MotoGP 2024 - Pertamina Grand Prix of Indonesia (IndonesianGP), yang digelar oleh InJourney Tourism Development Corporation (ITDC) dan Mandalika Grand Prix Association (MGPA), siap dijual untuk tiket early bird hari ini, 26 April 2024 hingga 5 Mei 2024. Special price selama periode early bird, mulai dari Rp 350.000, dan tersedia sangat terbatas.Beberapa kategori tiket MotoGP 2024 - Pertamina Grand Prix of Indonesia (IndonesianGP) yang tersedia yaitu: Premium Grandstand (Zona A, B, J, K), Regular Grandstand (Zona C, D, E, F, G, H I), dan Festival - GA. Tiket Premium Grandstand Zone A (Sabtu - Minggu) dibanderol dengan harga Rp 1.250.000, Premium Grandstand Zone B (Sabtu - Minggu) Rp 1.150.000, sementara zone Premium Grandstand J, K (Sabtu - Minggu) dibanderol dengan harga Rp 1.000.000.Untuk Regular Grandstand Zone C (Sabtu - Minggu) Rp 750.000, Regular Grandstand Zone D, H, I (Sabtu - Minggu) Rp 500.000, Regular Grandstand Zone E, F, G (Sabtu - Minggu) Rp 400.000. Selain itu, Tiket Festival (Sabtu - Minggu) dibanderol dengan harga Rp 350.000.Direktur Utama ITDC Ari Respati menyatakan, "Periode Early Bird ini memberikan kesempatan bagi para pecinta balap motor untuk mendapatkan tiket dengan harga yang terjangkau, sehingga para penggemar balap dapat turut serta meramaikan kemeriahan MotoGP 2024 - Pertamina Grand Prix of Indonesia (IndonesianGP). Kami berkomitmen untuk menyediakan pengalaman balap yang tak terlupakan bagi semua pengunjung.”ITDC dan MGPA menyediakan website resmi untuk pembelian tiket MotoGP 2024 - Pertamina Grand Prix of Indonesia (IndonesianGP). “Kami berharap dapat memberikan kemudahan bagi masyarakat yang ingin membeli tiket secara praktis dan dapat merasakan langsung pengalaman seru dari Pertamina Grand Prix of Indonesia," imbuh Ari.Pembelian tiket Pertamina Grand Prix of Indonesia periode early bird dapat diakses melalui platform resmi www.themandalikagp.com. Sementara itu, Direktur Utama MGPA Priandhi Satria mengatakan, “Dengan harga terjangkau, kami mengajak masyarakat Indonesia untuk ikut serta dalam kemeriahan ajang balap motor paling bergengsi, MotoGP 2024 - Pertamina Grand Prix of Indonesia (IndonesianGP), dengan hadir langsung ke Pertamina Mandalika International Circuit.”IndonesianGP 2024, akan berlangsung pada 27-29 September 2024 mendatang di Pertamina Mandalika International Circuit, Kab. Lombok Tengah, Nusa Tenggara Barat (NTB). Tidak hanya menawarkan aksi balap motor yang seru, tetapi juga menyajikan berbagai side event menarik. Dimana pengunjung dapat menikmati festival F&B, pertunjukan live music, bazar merchandise, dan masih banyak lagi. Side event ini tentunya memberikan pengalaman bagi para penggemar dan pengunjung.Gelaran IndonesianGP 2024 adalah gelaran keempat di Pertamina Mandalika International Circuit. Kesuksesan ini, tentunya memberikan dampak positif bagi masyarakat NTB dan pengembangan kawasan The Mandalika. Hal ini, menarik minat banyak penyelenggara event otomotif dan olahraga lainnya. Dengan dukungan dan partisipasi masyarakat Indonesia, kami yakin bahwa IndonesianGP 2024 akan kembali mencapai kesuksesan yang lebih tinggi dibandingkan tahun sebelumnya. Konsistensi event ini, menjadikan magnet bagi penggiat event, dan investor, baik dalam skala nasional maupun internasional, yang akan mendukung pengembangan kawasan The Mandalika, sebagai sport & entertainment destination di Indonesia,” tutup Ari.

SIRKUIT MANDALIKA GELAR JDM RUN 2024, TIME ATTACK MOBIL SPORTS JDM TERBESAR DI INDONESIA PADA 28 APRIL – 1 MEI 2024

Jakarta, 21 April 2024 – Pertamina Mandalika International Circuit di Lombok, Nusa Tenggara Barat, yang dikelola oleh InJourney Tourism Development Corporation (ITDC) anak perusahaan Holding BUMN Pariwisata dan Pendukungnya InJourney, akan menjadi tuan rumah Japanese Domestic Market (JDM) Funday untuk pertama kalinya. Setelah kesuksesan JDM Funday di Sentul International Circuit enam tahun yang lalu, JDM Run kembali menggelar kegiatan Time Attack yang dikhususkan untuk para pecinta mobil sport Jepang pada tanggal 28 April - 1 Mei 2024.Kegiatan ini terselenggara berkat kerjasama antara JDM Run, ITDC dan Mandalika Grand Prix Association (MGPA). JDM Run merupakan komunitas mobil sport Japanese Domestic Market terbesar di Indonesia. Sebanyak 85 mobil Jepang performa tinggi dari seluruh Indonesia akan hadir di Pertamina Mandalika International Circuit untuk bersaing dalam kompetisi Time Attack. Kegiatan ini merupakan proyek uji coba pertama di Mandalika International Circuit bagi JDM Run.Setiap peserta akan dikelompokkan berdasarkan tingkat pengalaman dalam berkendara dan jenis kendaraan yang digunakan. Peserta akan dibagi menjadi tiga kategori berdasarkan pengalaman, yaitu Non-Experienced, Experienced, dan Pro. Sedangkan untuk kendaraan, akan dibagi menjadi tiga kelas, yaitu Standard Class, Street Class, dan Race Class. Dengan pembagian ini, setiap peserta akan memiliki kesempatan untuk bersaing dalam kelompok yang sesuai dengan kemampuan mereka, sehingga menciptakan kompetisi yang adil dan menarik. Format Time Attack yang dihadirkan disusun sedemikian rupa sehingga ramah bagi peserta yang belum memiliki pengalaman balap mobil, akan tetapi tetap menantang bagi peserta yang sudah berpengalaman.“Melalui pembagian kelas tersebut, setiap peserta diharapkan dapat merasakan keseruan yang sama walau kemampuan berkendara maupun spesifikasi kendaraan mereka berbeda-beda, karena pada hakikatnya masing-masing peserta akan berjuang untuk menorehkan catatan waktu terbaik mereka sendiri (Personal Best Lap),” kata Ketua Pelaksana JDM Funday Mandalika 2024, Yahya Adi Nugroho.JDM Funday Mandalika 2024 terselenggara berkat dukungan dari berbagai pihak. Kolaborasi antara JDM Run, InJourney Tourism Development Corporation (ITDC) dan Mandalika Grand Prix Association (MGPA) merupakan faktor kunci dalam memastikan kesuksesan persiapan, promosi, dan penyelenggaraan JDM Funday Mandalika 2024. Sinergi ini menunjukkan komitmen bersama untuk menghadirkan acara yang berkualitas dan berkesan bagi semua pihak yang terlibat.Direktur Pemasaran dan Program Pariwisata PT Aviasi Pariwisata Indonesia (Persero) atau InJourney, Maya Watono, berharap acara ini akan memperkuat posisi Mandalika sebagai sport and entertainment tourism. “Sejauh ini, Mandalika biasanya hanya dipakai untuk ajang balap motor roda dua. Event ini sebagai langkah kami dalam mempersiapkan Mandalika International Circuit untuk balapan roda empat setelah sebelumnya Porsche juga pernah berlaga di Mandalika melalui ajang Porsche Sprint Challenge,” ujarnya.Sementara Direktur Operasi ITDC, Troy Warokka mengungkapkan, ITDC mendukung penuh semua program aktivasi olahraga otomotif di sirkuit Pertamina Mandalika karena akan memberikan dampak positif untuk ekonomi NTB utamanya sektor pariwisata. ”Kami mengucapkan terima kasih kepada Kementerian BUMN, InJourney Group, MGPA, Ikatan Motor Indonesia, Pemerintah Daerah serta para stakeholders lainnya atas dukungan serta kepercayaan mereka terhadap terselenggaranya JDM Funday Mandalika 2024 pada tanggal 28 April hingga 1 Mei mendatang,” kata Troy Warokka.“Kami akan terus mengupayakan agar JDM Funday Mandalika 2024 dapat terselenggara dengan sukses dan memberikan manfaat semua pihak yang terlibat. Diharapkan acara di Mandalika International Circuit kali ini dapat menjadi sebuah momentum yang berharga bagi para penggemar mobil sport Jepang serta industri Motor Sport di Indonesia,” ujar Direktur Utama MGPA, Priandi Satria.Penyelenggara berharap, melalui JDM Funday Mandalika 2024, dapat membuka pintu bagi para penggemar mobil sport untuk terjun aktif ke dunia Motorsport dan membentuk pengendara yang bertanggung jawab baik di dalam lingkungan sirkuit maupun di jalan umum. Selain itu, acara ini tidak hanya menjadi ajang kompetisi, tetapi juga menjadi sarana untuk mempromosikan keselamatan berkendara dan semangat sportivitas di antara para penggemar mobil sport.

ITDC Mencatat Angka Menggembirakan, Kunjungan Wisatawan Pecah Selama Libur Lebaran Di Kawasan Pariwisata Yang Dikelola

Jakarta, 19 April 2024 - InJourney Tourism Development Corporation (ITDC) mencatat kunjungan wisatawan yang cukup tinggi di kawasan The Mandalika dan The Nusa Dua selama libur Lebaran tahun ini. ITDC mencatat jumlah kunjungan wisatawan ke kawasan The Mandalika selama libur Lebaran tahun 2024, periode tanggal 8-18 April mencapai 47.786 orang. Puncak kunjungan wisatawan mencapai 13.835 orang terjadi pada Rabu, (17/4), bertepatan dengan lebaran Topat, menjadi momen perayaan bagi masyarakat Suku Sasak untuk mengunjungi pantai di sekitar kawasan. Jumlah kunjungan wisatawan tersebut didominasi oleh wisatawan domestik (wisdom) mencapai 39.628 orang, mayoritas berasal dari Lombok dengan jumlah kunjungan 29.721 orang, diikuti oleh wisatawan asal Sumbawa dengan 3.963 orang, dan disusul oleh wisatawan mancanegara (wisman) mencapai 4.403 orang.Kawasan The Mandalika, memiliki beberapa spot menarik favorit bagi wisatawan yaitu Bazaar Mandalika, Kuta Beach Park (KBP), Bukit Merese, Pantai Tanjung Aan, Seger dan serenting, serta Pertamina Mandalika International Circuit. Selain itu, program Lampaq di Pertamina Mandalika International Circuit juga sukses mencatat jumlah kunjungan wisatawan mencapai 2.245 orang, menunjukkan tingginya animo masyarakat untuk menikmati keindahan sirkuit. Sementara itu, kawasan The Nusa Dua, jumlah kunjungan wisatawan ke Daya Tarik Wisata (DTW) Water Blow, Peninsula Island, The Nusa Dua, mencatat kunjungan mencapai hampir 3.000 orang pada periode libur Lebaran, dengan rata-rata kunjungan mencapai 500 orang per hari. Angka ini meningkat 87% dibandingkan periode libur Lebaran tahun lalu.Direktur Utama ITDC Ari Respati menyatakan, “Selama libur lebaran tahun ini, berdasarkan pemantauan dari posko lebaran seru yang kami dirikan, wisatawan yang berkunjung rata-rata membawa serta anggota keluarga, untuk menikmati keindahan kawasan The Mandalika dan The Nusa Dua. Kegiatan yang paling diminati oleh wisatawan di kawasan The Mandalika adalah mengunjungi KBP dan menikmati keindahan sunset di Bukit Merese. Di kawasan The Nusa Dua, wisatawan menikmati berbagai atraksi seperti Kecak and Barong Dance, Devdan Show, Museum Pasifika, dan fasilitas kawasan yang tersedia menjadi daya tarik utama”. Selain itu, kawasan The Nusa Dua telah mencatat rata-rata tingkat hunian atau okupansi selama libur Lebaran 2024, juga mengalami peningkatan mencapai 81% meningkat 3,35% dari tingkat okupansi libur Lebaran 2023 sebesar 78,37%. ITDC optimis kunjungan wisatawan ke The Nusa Dua, akan mengalami peningkatan pada TW II tahun 2024, dengan adanya berbagai event menarik seperti Konferensi Jaksa ASEAN, Musrenbang yang dirangkaikan dengan Adhyaksa International Run pada bulan April. Konferensi Pariwisata PBB (UNWTO) dan World Water Forum 2024 pada bulan Mei, serta Bali and Beyond Travel Fair (BBTF) 2024 pada bulan Juni.“Dalam menyempurnakan pengalaman liburan, ITDC menjadi destinasi wisata lengkap, dengan memenuhi kebutuhan rekreasi dan pengalaman yang mendalam bagi wisatawan, kami berharap dapat memberikan kontribusi positif bagi perkembangan pariwisata di Indonesia. Kami juga berharap kunjungan wisatawan terus meningkat hingga akhir tahun,” tutup Ari.

CSR ACTIVITIES

With more than 40 years of business experience ITDC is strongly committed to maintain the values of integrity through optimizing the application of the Good Corporate Governance (GCG) principles.

GET IN TOUCH

We'd love to hear from you! Please fill out our we'll contact you as soon as possible.

Head Office (021) 8064 2791 Nusa Dua Office (0361) 771010 Mandalika Office (0370) 650 2339

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Tourism Development in Indonesia

This considers issues pertaining to tourism development in Indonesia and will examine several aspects of tourism growth, regional tourism backgrounds, and tourism development, and the impact of the transitional period of regional autonomy in Indonesia (1999 - present). At a national level, tourism growth is analysed in relation to such aspects as domestic-foreign visitors, tourist destinations, and the significance of tourism to the regional economy in Indonesia. Discussion of regional tourist development follows. Other issues examined include: investment relating to regional economics; tourism stakeholders and destinations, regional investment and tourism impacts, and the military and Indonesian Chinese involvement in the tourism industry. Finally, project developments will be considered from a regional autonomy perspective to distinguish the key stakeholders of tourism project developments, particularly in the three regional tourism centres of Yogyakarta, Bali, and Batam.

Related Papers

Regional Science Inquiry

Setiawan Priatmoko , Edith Pallás

The Indonesian government is currently boosting its tourism by using the success of the island of Bali as a model, the project is called Ten New Balis. This article examines previous studies and statistical data to presents a deep analysis of macro-environmental factors of tourism in Indonesia related to Bali as a development model. The study is based on Scopus articles associated with Indonesia and Bali tourism development articles and statistical data collected from the statistics bureau's Indonesian office, BPS-Statistics. The thematic framework analysis and descriptive analysis describe complementary insight of tourism planning and development issues. Proposed future tourism development planning could be seen clearer by using mixed-method analysis. Extending different research articles databases will give a good result comparison.

Steve Noakes

made siti sundari

OECD Economics Department Working Papers

Patrice Ollivaud

woko suparwoko

This chapter discusses the growth of tourism internationally and in Southeast Asia as well as the constraints on further development. The chapter will also examine the various roles of international, regional and national tourism industry in the region. In the global context, international tourism covers major markets including the world-regions of America, Europe, Africa, the Middle East, and the Asia Pacific. Critical indicators of international tourism growth are tourist arrivals and revenues. The constraints on tourism include terrorism- and other security-related issues, health issues such as SARS1 and Indonesia‟s economic, political and security crisis. These issues will be examined in the context of their impact on local communities, particularly in the three case study areas of Bali, Yogyakarta, and Central Java. The regional tourism development in South East Asia will focus on Indonesia, Malaysia, Thailand and the Philippines and in this comparative context the potential fo...

fafurida fafurida

Tourism sector is important as the leveraging sector of regional economic growth. It is because tourism activities bring multiplier effect to the economic sector movement in it. The Indonesian government encourages the tourism sector development because it is expected to be fast enough to accelerate the increase in economy and social welfare. This research analyzes a relationship between the tourism using the proxy with the number of international tourist visits and the economic development in Indonesia by using two models of econometric data panel (33 provinces in 2011-2017 period of time). The first model hypothesis covering gross domestic regional income (GDRB), human development index (HDI), and international trade (TRD) has the positive effect on tourism variable (WIS), while poverty (POV) has the negative effect. The second model analyzes the relationship between WIS, HDI, and TRD variables and GDRB with a hypothesis having the positive effect. Poverty variable (POV) has the n...

International Journal of Architecture and Urbanism

1.22 Nanda Sofia

Economics World

Handoko Hadiyanto

Proceedings of the Asia Tourism Forum. 2016 - the 12th Biennial Conference of Hospitality and Tourism Industry in Asia

Ike Janita Dewi

Scientific Research Journal

NOVITA WULANDARI

RELATED PAPERS

The Raffles bulletin of zoology

SUKREE HAJISAMAE

Stevanus Adi Pratama

Cell stem cell

Jennifer Nichols

Recherche et pratiques pédagogiques en langues de spécialité

Bernd Müller-Jacquier

Cristina Chirino

Glycobiology

Thomas Gerken

LitNet Akademies

Marcos de Castro Falleiros

Psicología …

María del Carmen Castrillón

Anales de la Facultad de Medicina

José Cotrina

Journal of Meteorology and Related Sciences

Alfred Opere

Magnetic Resonance Imaging Clinics of North America

luis santiago beltran

Journal of Spine

pravin londhe

Faar Laksono

Espiral Estudios sobre Estado y sociedad

Esmeralda Matute

Advances in Water Resources

Majid Raoof

International Journal of Ceramic Engineering & Science

Kischa Reed

Pharmaceutics

Donald Clancy

International Journal of Environmental Research and Public Health

Joseph Schwartz

Annals of the Rheumatic Diseases

Erkan Demirkaya

Canadian Journal of Education

Jessica Rizk

Biological Psychiatry

Michael green Taylor

Aboriginal History Journal

Grace Karskens

Roberta Rossini

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Exploring the Potential of a Multi-Level Approach to Advance the Development of the Medical Tourism Industry in Indonesia

Affiliations.

- 1 Applied Health Science Department, Vocational Education Program, Universitas Indonesia, Depok, Indonesia.

- 2 Institute of Science, Istanbul University, Fatih, Istanbul, Turkey.

- PMID: 38601077

- PMCID: PMC11005321

- DOI: 10.1177/11786329241245231

Nowadays, the global medical tourism market size has grown quite rapidly, with a projected increase of 21.1% between 2021 and 2028. This study aimed to explore barriers and potential strategies for the development of medical tourism in Indonesia. A qualitative case study design was employed, where 8 respondents were selected using an expert sampling method from various groups according to the helix framework, including academics, government, professional organizations, the private sector, and the media. Data was collected through document analysis and in-depth interviews, and was analyzed manually using an inductive thematic content analysis approach. Limitations to the development of Indonesian medical tourism are related to regulations concerning medical tourism, the number of health services, distribution, supporting resources, public trust, and competition. At the institutional level, the challenges comprise services and products, hospital facilities, supporting facilities, and marketing processes. Furthermore, at the micro level, the low competency of both health and non-health workers persist as an obstacle. The potential strategy at the macro level include the development of robust marketing and branding strategies, health infrastructure, and resources. At the institutional level, it was necessary to develop related products and services provided, improve quality, and focus on branding and marketing strategies. Additionally, improving human resource skills was needed at the micro level.

Keywords: Medical tourism; developing countries; hospital marketing; hospital quality; stakeholders involvement.

© The Author(s) 2024.

IMAGES

VIDEO

COMMENTS

Tourism in Indonesia is an important component of the Indonesian economy as well as a significant source of its foreign exchange revenues. Indonesia was ranked at 20th in the world tourist Industry in 2017, also ranked as the ninth-fastest growing tourist sector in the world, the third-fastest growing in Asia and fastest-growing in Southeast Asia. In 2018, Denpasar, Jakarta and Batam are among ...

Prior to 2020, tourism in Indonesia was experiencing steady growth, spurred by increasing numbers of foreign visitors. However, the outbreak of the COVID-19 pandemic in 2020 showed how precarious ...

Tourism has boomed in Indonesia in recent years and is one of the main sources of foreign currency earnings. In 2017, contribution of tourism to GDP amounted to IDR 536.8 trillion, 4.1% of Indonesia's total GDP. ... The Government of Indonesia aims for tourism development to provide a range of economic, social and environmental benefits ...

As mentioned above, the government of Indonesia has set 10 tourism destinations to be a development priority since 2016. The development of these tourism areas is targeted to boost the country's foreign exchange from the tourism sector to US $ 20 billion in the next five years, from the current range of US $ 10 billion.

The tourism sector is a significant part of Indonesia's economy. In 2019, tourism directly accounted for 5.0% of the country's GDP. The impacts of COVID-19 saw tourism GDP fall by 56% in 2020 to just 2.2% of the total economy. Prior to 2020, tourism in Indonesia had been steadily growing, fuelled by an influx of international visitors.

The euphoria of tourism development in Indonesia as one of the leading industries of the country's economy requires proper planning and an advanced strategy to maintain its sustainability. This chapter discusses strategies used by the Indonesian government for the implementation of sustainable tourism development. The strategy comprises three ...

Indonesia encompasses more than 17,000 islands, spread out over thousands of kilometres between the Indian and Pacific oceans. With the world's largest tropical coastline, Indonesia has become a leading tourism destination in South-east Asia; the country's cultural and natural diversity also offer significant untapped potential. Although the country has seen expansion in tourism in recent

The World Bank's loan of US$ 300 million for the Indonesia Tourism Development Project (ITDP) was approved on May 30, 2018, with December 31, 2023 as the closing date. The Project Development Objective (PDO) is to improve the quality of, and access to, tourism-relevant basic infrastructure and services,

sustainable regional development. Tourism has boomed in Indonesia in recent years and is already one of the main sources of foreign-currency earnings. Indonesia has rich and diverse natural assets, whose tourism potential remains underutilised. The government has an ambitious target of attracting 20 million

The current study fills the gap by focusing on the emergence, development, and challenges of sustainable tourism thought and practices in Indonesia, the largest economy in the Southeast Asian region. The findings show that there has been a growing awareness and commitment to adopt sustainable tourism development principles in the country.

This considers issues pertaining to tourism development in Indonesia and will examine several aspects of tourism growth, regional tourism backgrounds, and tourism development, and the impact of ...

This study analyzed 861 articles published until February 2021 in the Scopus database on Indonesia's tourism development sustainability. In conducting the analysis, the VosViewer software was used to find results about the most contributing authors, the number of citations, regions, organization, publica-tions and co-occurrences of keywords ...

Social capital is one of the basic elements in developing sustainable tourism in rural areas (Park et al., 2012 ). The definition of social capital explained by Putnam (R. Putnam, 1993) describes community norms, social networks, and trusts to encourage community economic, social, and cultural development. In general, social capital is defined ...

Tourism in Indonesia Indonesia recorded a total of 1.55 million tourists in 2021, ranking 41st in the world in absolute terms. ... Development of the tourism sector in Indonesia from 1995 to 2021 The following chart shows the number of tourist arrivals registered in Indonesia each year. Anyone who spends at least one night in the country but ...

Sunshine, sea… and skills in tourism: ILO supports women in northeastern Indonesia in sustainable tourism development. 12 January 2023. Facebook Twitter Linkedin Advancing social justice, promoting decent work ILO is a specialized agency of the United Nations. International Labour Organization. 4 route des Morillons ...

The spread significantly affected people's lives, including tourism industry (Syafrida and Hartati, 2020). Tourism is designated as a leading sector in increasing economic growth, and according to ...

Tourism and Regional Development. The government of Indonesia is prioritizing the tourism sector. Given that Indonesia has the largest multilingual population in the world, with 260 million inhabitants and a rich cultural and natural diversity, as well as government support. There is much potential for Indonesian businesses that are in the ...

There are 50 National parks in Indonesia ranging from rain forests, endemic species, mountain, sea, rivers and etc. Of all the national parks, 6 are World Heritage Sites, 6 are part of the World Network of Biosphere Reserves and 3 are wetlands of international importance under the Ramsar convention. A total of 9 parks are largely marine. Mount ...

The SUSTOUR project is part of the overall Sustainable Tourism Development in Indonesia (STDI) Program of SECO, led by both SECO and the MoTCE. The Program focuses to develop a sustainable and inclusive expansion of tourism in Indonesia. SUSTOUR aims to increase employment and income opportunities for the local population through inclusive and ...