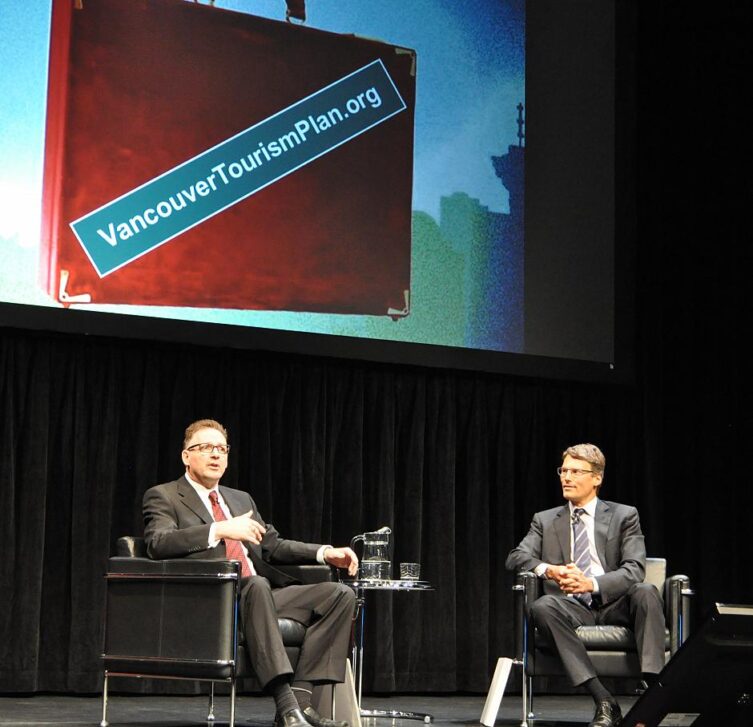

Tourism Vancouver AGM 2013 | BCBusiness Tourism Vancouver chair R. Gordon Johnson (left) and Mayor Gregor Robertson at the Tourism Vancouver 2013 AGM.

Vancouver’s Tourism Master Plan Revealed

First ever Tourism Vancouver Master Plan calls for improved product development, events, visitor experience design, neighbourhoods, tourism infrastructure development and transportation, and more

More than 300 members of the Vancouver’s $2.7 billion tourism industry gathered at the Vancouver Playhouse yesterday to hear an overview of city’s first ever Tourism Master Plan at Tourism Vancouver ‘s 110th annual general meeting.

The concept of the plan, led by Resonance Consultancy and a combined effort by Tourism Vancouver, the City of Vancouver and the Vancouver Economic Commission, began over a year ago. The action for it stemmed from Rethink Vancouver, a Tourism Vancouver-led industry collaboration that started in 2010 aimed at identifying steps to help Vancouver achieve its goal of becoming a “World City.”

“Rethink Vancouver and the Tourism Master Plan are monumental steps for Vancouver,” said Tourism Vancouver president and CEO Rick Antonson. “We are particularly heartened by how closely the interests of local residents align with the tourism industry.”

The plan has involved more than 180 interviews with tourism industry professionals, an online survey of more than 2,000 residents and industry people, two open house forums and a review of more than 400 documents and reports.

Recommendations in the plan hit eight key areas of focus: product development, events, visitor experience design, neighbourhoods, tourism infrastructure development, transportation, advocacy and public affairs and partnerships and alliances. (A full list of recommendations can be found on the Tourism Master Plan website .)

“Building on the incredible success of the 2010 Olympic and Paralympic Winter Games, [tourism] is an industry with vast potential for growth and one that merits the full ongoing support of government partners,” Mayor Robertson said at the meeting.

Recommendations from the plan further include establishing a product development strategy to support existing attractions and create new tourism concepts; creating a dedicated events organization to lead, organize and manage citywide efforts in delivering year-round events; and creating a neighbourhood marketing council with Business Improvements Areas to promote the diversity of neighbourhoods in Vancouver.

The overall goal of the plan is to guide the development of Vancouver’s tourism sector in a more coordinated fashion, ensuring that the industry grows in an economically, socially and environmentally sustainable manner. The final plan will be released to the public in July.

The AGM also introduced Tourism Vancouver’s 2013/2014 Board of Directors. Incoming chair Bob Lindsay, owner/operator of Lift Bar, Grill, View will lead a 15-member board made up of prominent members of the tourism industry.

Recommended for You

Land Values: Can Intelligent City’s use of robotics knock down Vancouver’s housing crisis?

Social Cues: How Vancouver-based Poshmark Canada delivers good engagement and great memes

Small Town Success: How TravelBar is shaking up the bartending world

Pacific Trader: Amid the cannabis bust, Rubicon Organics is looking like a survivor

Education Guide 2024: How micro-credential programs in B.C. are helping advance careers across the province

Entrepreneurs call Fort St. John Home for the affordability, the economy and, most importantly, the community

Bc business.

Vancouver City Council finalizes tourism plan

Committee aims to attract more visitors to vancouver.

Just in time for the summer swarm of tourists, the city of Vancouver has finalized a 25-page tourism plan designed to attract visitors to the city.

The master destination plan , created by Visit Vancouver WA, the city and a steering committee, intends to guide businesses and organizations to make Vancouver as tourist friendly as possible as the city continues to grow.

“The overall idea with the plan is that Vancouver has changed a lot in the last five, 10 years,” said Erica Lindemann, director of marketing at Visit Vancouver WA. “The whole idea is to get the community on board and grasp what tourism can do for the economy and how we can all stand together to increase or improve the experience in Vancouver for both visitors and residents.”

The steering committee that created the plan used strategic recommendations to narrow the scope of the 10-year guide. The plan focuses on engaging local businesses, enhancing mobility and public access, strengthening Vancouver’s outdoor recreation opportunities, and solidifying Vancouver’s tourism identity.

Lindemann said tourists have started spending more time in Vancouver, the second largest city in the Portland metro area.

“We’re kind of becoming a destination. … We are Washington’s fourth largest city and still growing, and so I think we’re finally getting the recognition that we deserve,” she said.

The numbers support this. In 2021, more than 4.1 million people visited Clark County, generating a daily economic impact of $1.42 million, according to the report.

Tourism bolsters small businesses, restaurants, stores, and perhaps most significantly, hotels. By the end of this year, Clark County will reach more than 3,600 hotel rooms — a 44 percent increase over the past 10 years, the report states.

The plan includes goals with smaller scopes as well, such as improving playgrounds and increasing wheelchair accessible paths.

Though most of Vancouver’s tourists flock to the waterfront and downtown, Lindemann said the plan will benefit the entire city.

“People come because of the waterfront, but then they disseminate to Fort Vancouver and Fourth Plain International District and all these other awesome areas of Vancouver,” she said.

In addition to the plan, Visit Vancouver WA prepared funding projections and recommendations for Vancouver, which receives nearly all of its tourism funding from the city’s lodging tax and tourism promotion area funds.

The nonprofit suggested the city adopt a tourism improvement district, which the city would invest in specifically to attract more tourists.

“(Tourism improvement districts) create a platform for the industry to establish an ‘industry-led’ revenue stream that bolsters a collaborative environment to raise all boats within a community,” the report states. “Based on our research, the implementation of a (tourism improvement district) would be the ideal short-term goal to increase the available funding for Visit Vancouver Washington.”

Related Stories

Tourism Vancouver’s CEO on Steering The Future of Urban Travel

SkiftX + Skift

March 13th, 2018 at 5:38 PM EDT

Many heavily visited cities have a whole host of issues to collectively address based on the challenges of overtourism and the opportunities provided by new connectivity platforms. Here's a deep-dive masterclass on how Vancouver is tackling the future.

This post is original content created by the SkiftX brand strategy team for our Skift Cities platform. Learn more about what SkiftX can do for partners here .

This sponsored content was created in collaboration with a Skift partner.

Vancouver has never really had a tourism brand.

The city has succeeded as a travel destination largely based on its image and reputation as one of the world’s most beautiful, livable, and progressive urban environments. In 2017, Vancouver welcomed more than 10.3 million overnight visitors — the fourth consecutive year with record tourist arrivals.

However, Vancouver is long overdue for a specific travel brand promise that transcends its physical drama at the intersection of the Rocky Mountains, Pacific Ocean and downtown core. And one that goes beyond the open-mindedness, diversity and inclusivity baked into the city’s social fabric.

Therefore, Tourism Vancouver is developing a new destination marketing and development strategy leveraging the rise of global demand for transformative travel experiences.

“We believe we are a place, if we go to the essence of the brand, that connects people and inspires them to live with passion,” explains Ty Speer, president and CEO of Tourism Vancouver. “Based on our surveys and research in our origin markets, we’re pretty comfortable with the idea that people are coming to Vancouver to reconnect with themselves, reconnect with others, and have a bit of a small, medium or large life-changing moment in time.”

To deliver on that strategy over the long run, Vancouver needs to maintain the quality of its urban user experience for both locals and visitors, which is challenging in the face of record growth year-over-year. To address that, the public and private sectors have been following mandates from the 2013 Vancouver Tourism Master Plan to inform sustainable development.

Among the primary takeaways from the master plan, the city has to continue to preserve and improve the integrity of the built and natural environments, and how people move between the two. More can also be done to help a wider breadth of the community benefit from inbound tourism, especially by dispersing visitors beyond Stanley Park and the urban center. And, the city needs to ramp up its leadership in smart city infrastructure to connect the visitor and local economies more effectively.

The master plan is presently being updated with a new Vancouver 2030 strategy report developed in partnership with Resonance Consultancy and Tourism Economics . Due out this summer, the new policy framework addresses growing threats related to overtourism, spiraling real estate costs, infrastructure capacity, labor shortages and climate warming, etc., through the end of the next decade.

It also investigates potential opportunities in smart technology, community building and advanced placemaking, among others.

“The Vancouver 2030 process analyzed both demographic and economic factors in each of Vancouver’s specific source markets to forecast future visitor volume,” explains Chris Fair, president of Resonance. “We then identified key supply-side factors that could accelerate or constrain that growth, which led to the creation of different distinct scenarios that outline a range of ways these forces might interact with each other to shape Vancouver’s tourism industry over the next decade.”

Vancouver has long been at the forefront of smart and sustainable tourism development. But like many global cities, the convergence of shifting urban economics, evolving travel consumer behavior and heightened competitiveness is rewriting the rules of destination marketing and management.

We sat down with Speer to discuss many of these themes in-depth, and how Tourism Vancouver and the city are collaborating to design the future of urban travel. The following has been edited for length.

Skift: What can you tell us about your new tourism brand strategy and campaign you’re gearing up to launch this year?

Ty Speer: We are in the final length of finishing up a new destination brand for Vancouver, which is really ironic because there hasn’t been one, so it’s not as though we’re re-branding, we’re actually branding. When you look around, you see the city brand or an economic commission brand or a Tourism Vancouver company brand, but the destination brand hasn’t been articulated.

One of the great things a lot of Vancouver residents often hear, which really brings home the message of why people want a taste of life here, is we get so many visitors who within a matter of hours say, “Wow. I could really see myself living here.” Right? That’s such a Vancouver thing to hear, and that says a lot about the brand that’s in that transformative travel piece.

I’m not expecting somebody to come here and have their entire life changed. We are happy to help someone come here and say, “You know what? I had a few days of just living a different way, and living the Vancouver way. And after sampling that, there was a change that I was able to make. One that I can integrate into part of my life when I go back home.” That’s firmly in our brand architecture.

Skift: When you say Vancouver is a platform for transformative travel opportunities, how does Canada’s long legacy of acceptance — celebrating diversity, inclusivity, openness, and progressive shared values — fit into that?

Speer: Well, that acceptance piece, to think about that for a second, is really, really important for us, and it came out very clearly in the brand work we did. During the process, somebody made the point that Vancouver is a city that’s really tolerant of all forms of cultures and races. But then somebody else said, “Actually, wait a minute. Tolerant is the opposite of what we are. We’re not tolerant, we’re absolutely accepting.”

For us, the fact that we are a very, very harmonious city with a huge blend of immigrants and locals to us is a really interesting thing. For people coming here, we’re amazingly approachable when it comes to learning something new about Chinese culture, or First Nations culture, or improving the environment, or how Canadians value community and innovation. Yeah, that part to us is a really, really important piece.

Skift: How has the Vancouver Tourism Master Plan influenced the development of the visitor economy in the last few years?

Speer: We’ve pushed forward a whole range of things that came out of the Tourism Master Plan, which was a helpful exercise on two fronts. It was very good in terms of bringing together our industry and organizations outside of our industry that are important to what we need to do. It was also good in articulating a whole range of things that, if done, would make a positive impact. In many ways, it was a massive optioneering document.

If you look at just a sample of specific things that we’ve acted on, there was a recommendation in the master plan to formalize a structure to pursue sports events, so we started that in 2014 with Sport Hosting Vancouver . We’ve built that up and that’s a pipeline obviously for events that attract visitors. Public Wi-Fi was in there, and we’ve worked very closely with the city as they’ve wanted to push their Wi-Fi agenda forward.

Also, Northeast False Creek is probably the biggest land development project that will happen over the next 20 years. We’ve been, as much as we can, right in the middle of that with the things that we think the visitor industry needs. Special events and programming is another, over and above sports. So there’s been a whole range of things where we said, “Okay, we’re going to focus on these now because we’ve got to get to a level of achievability.”

Skift: For visitors to keep saying, “Wow, I could really see myself living here,” Vancouver needs to make sure it doesn’t become a victim of its own success 15 years from now. How does the new Vancouver Tourism 2030 address that?

Speer: We need to continue to refresh our view of the future, so we’ve worked with Chris Fair and his team at Resonance to come at that from a different point of view. It’s a scenario and planning analysis. We’ve looked at a whole range of factors that you first take in isolation, and then you begin to blend those to get to, as close as anybody can, what the world might look like in 2030. And then we looked at the correlation between what it might look like and what we want it to look like. So, how do we begin to define the right mix of likely outcomes and desirable outcomes?

We also have Tourism Economics as a partner this time, so we’ve got a lot of economic analysis underpinning it, which wasn’t in the tourism master plan. The tourism master plan wasn’t a data-driven exercise; it was really a strategic and stakeholder-driven exercise. This is a much more analytical piece of work, so we’ve been able to assess, “If this factor dominates, what does that mean to our growth pattern? If that factor dominates, what does that mean if this eventuality happens?” Tourism Economics has been great about that, so we’ve got a good mix of strategy and analysis to help us look at scenarios that we think are appealing, and then help us realize them.

Skift: You mentioned that you’re supporting the City of Vancouver’s agenda to roll out public Wi-Fi. How does that benefit the visitor economy?

Speer: We’ve been looking at access to free Wi-Fi for a while. The city did phase one a couple years ago, which was very much underpinned by use of city infrastructure and libraries and community centers, so it didn’t have the reach we need. But they’ve now done phase two with Shaw Communications, which leverages infrastructure and Shaw’s hotspots, and now there’s much better coverage. So we’re now in a position where we can put a message out to our visitors that says, “You don’t have to go to Starbucks every time to get free Wi-Fi. You can log into this.” That really unlocks our ability to say, “Now that there’s a platform in place where we don’t have to have a conversation about roaming charges, what do we need to think about in terms of how we enable a smarter way for visitors to experience Vancouver?” We’re kind of in the middle of that right now.

Skift: So, the goal then is that blanket Wi-Fi means greater conversion? Travelers are more likely to access partner content and more likely to buy?

Speer: Well, it can be a number of things. Clearly, information is one. That’s great. We want to be able to do that. We know, as well, that a lot of visitors make a whole number of decisions in destinations to plan their experience. Like, “What restaurant should I choose?” Or, “I don’t know what I’m going do today, I’ll wait on the weather. Oh, it’s a nice day, okay, now I want to go to Grouse Mountain.”

How do we help enable that? We’re already in the ticket-selling business, so if you go downstairs to the tourism and visitor center you can buy a ticket to a whole range of things, but that’s a regional shelf front. Now, we want to take that regional shelf front and represent our members online with more transactional capability. Then, within as short a space as possible, we’ve provided visitors with a service that ultimately helps our members benefit.

But we’d like for it to also extend beyond that. We’ve got a little bit of work to do on this, but I would hope in time it allows us to go back and say, “How’d we do?” We all live and die in the recommendation economy, so we want the ability to go back and say, after an experience, “How was Grouse Mountain? How was Capilano? How was Stanley Park?”

But then, we also want to roll up to where we can say, “Here’s a proxy on the destination.” Every destination is a sum total of every experience and everybody’s opinion, so how are we doing as a destination? Because in the end, if some parts of the destination do really well, but other parts don’t, then you’ve got a dead weight problem. We want to deliver that visitor experience quality everywhere.

Skift: CitizenLab is a crowdsourcing platform that works with cities in Europe to pull citizen feedback on all types of urban themes. They’re expanding into North America for the first time to collaborate with the City of Vancouver on the Canadian government’s Smart Cities Challenge . Couldn’t a platform like that be used to close the feedback loop from visitors?

Speer: It’s the how. I think it’s easy to understand what you would like to do, and probably easy to understand why you’d like to do it, but how you do it is hard. I’m really interested. We’re not in conversation with CitizenLab ourselves. That may be something worth doing. I think what’s really interesting in that space is on two levels. One, and I’ll have to interrogate their platform, is where we could easily have that conversation with visitors to understand the good, the bad, and areas for improvement across the entire destination experience.

The other, which is very important to us, is the right means to engage with our citizens to make sure that we have our finger on the pulse about how they feel about visitors. Right? I think we’re the type of industry that local people should be proud and supportive of. I don’t want to just be accepted as an industry. I want tourism to be appreciated and valued and embraced by our residents. That’s got to be where we are.

People have got to know us and love us that live here, so it has to be a lot more than, “Yeah, it’s all right. Okay, we’ll put up with it.” No way. We’ve got to be much better than that, so these platforms and other initiatives allow us to understand how residents feel. I think they should eventually, and by eventually I mean in the next 12 to 24 months, be a core business vision for every DMO (destination marketing organization).

Skift: Sustainable tourism development is a huge conversation worldwide, but not only in terms of land and urban environmental integrity, but also equitable economic development. Considering Vancouver’s record tourism numbers year-over-year, how are you addressing long-term growth to ensure that a wider breadth of Vancouverites benefit?

Speer: Everything I said a moment ago about wanting to be an industry that’s appreciated and embraced relates to a lot about the sustainability of our industry. The starting point is if people don’t like you, that’s a risk to your industry. That’s number one. Number two is about making sure that we’re continuing to create opportunities and knowledge that help our industry businesses to be community builders, so they contribute to the communities that they operate in.

We’re arguably as significant in size and scale as any industry in the city, and like in most parts of the world, people don’t know that. The tourism industry is famous for being unloved, or invisible or under appreciated. So it’s very important that we get that message out that we make a contribution to the quality of life here. From a sustainability discussion, just take the restaurant sector as an example. The restaurant sector doesn’t fundamentally look at us and say, “Tourism is the most important market for us.” For them, the bulk of their revenue comes from locals. We totally understand that, but restaurants operate on really, really thin margins, and if 5 or 10 percent of their visitors are tourists, that might make the difference between a restaurant making it or not making it.

Or a festival making it or not making it, or an art exhibit being profitable or not being profitable. Although we operate at the margins from a scale point of view for lots of businesses, it’s also the difference between success and failure because we’re adding that extra contribution. So when we look at our broader purpose of why we’re here and what we do, it really is about adding to the reputation of the city and the quality of life here.

Skift: In other worlds, the conversation around the impact of destination marketing and management extends well beyond jobs, tourist spend, and tax base.

Speer: Absolutely. It’s not just about 65,000 jobs and $5 billion of economic contribution. It’s about this place is what it is, in part, because we make the contribution that we make. If we weren’t here, if you took us all out, lots of things would just start to shrink and fall over. That’s important to us from a sustainability point of view because it’s about sustaining the quality of life.

There are other more discrete things. We’re big believers in promoting simple things for visitors around public transport and walkability. Those are critical to being true to what the city is about. We’re big believers in promoting the opportunity to go rent a bike and pedal around the city. I think one of the biggest challenges with the word “sustainability” is every time you use is, somebody has a different definition. Sustainability for a lot of people is the environment, but if you look at the bigger picture, it’s all about long-term viability.

Skift: At Skift, we always talk about how cities are no longer cities. They’re networks of neighborhoods attracting different traveler segments. How are you striving to enhance the long-term viability of your neighborhoods outside the downtown core?

Speer: I think it’s important to always put into context that we’re a member-driven company, so we have about 1,000 members that we represent. We’re always thinking about how can we do as much as we can to serve up business opportunity for members. So that marries well with international transit people who are looking for — I almost hesitate to use it because it’s so overused — authentic experiences.

We go to great lengths promoting our different neighborhoods to say, “Okay, here’s a real Vancouver story for you to be part of.” It makes a lot of sense, especially for people that are interested in something a little bit different and are kind of on that wave. I don’t want to reduce it to, “This is what millennials do,” because usually when we say that it’s wrong. But it does allow us to speak to people in a different way, and of course it means trends like home-sharing and Airbnb.

It’s important that we’re able to say, “Look, Commercial Drive is a great day out.” It’s really interesting and a very different part of Vancouver. It’s not about mountains and water anymore and it’s not about a downtown experience. It’s about a neighborhood with interesting shops and interesting restaurants, and it’s easy to get to. So it’s all about continually reintroducing new chapters, and in an ideal world, maybe that gives somebody a reason to say, “You know what? I’m going to tack on a day.” In our world, as with any destination, one extra overnight stay times a large number of visitors is a massive contribution to all of our businesses and the destination.

Skift: A lot of tourism leaders are now promoting their local makers more to show the creative spirit of their indie entrepreneurs, and how they define and develop a neighborhood. It’s the whole Brooklynization or ‘Keep Portland Weird’ thing where local shops selling bamboo sunglasses or artisanal donuts create a more unique community identity. Does that resonate with you?

Speer: It sort of does. I think eventually you have to work backwards from how can you connect to the people. I’m not sure it’s maker-forward as much as it’s consumer-backward, right? Where is the consumer and how do I work backwards to extract something that’s of interest to them and then connect it with something here? It’s not necessarily, “Go find someone and push them at people.” I’d rather be pulling, and asking, “What do you like? How do I meet your needs?”

So let’s say you’re interested in sustainably-made bamboo sunglasses. I’ve got a guy for that. Right? I think we’ve got to work backwards from the customer and not just kind of assume that we’ve got a bunch of cool people, and customers are going to care. Although, I think eventually those lines just connect.

We’re going to definitely want to expand on all those passion areas that we can find, related to our new brand vision, that we think are meaningful to consumers, and put a human face on them. There’s no doubt about that. But, for us, it will ultimately be more about, “How do I give you something that’s meaningful to you?” I want to find out what you want, and I want to be able to serve up some information that shifts you from, “Okay, I was thinking about coming to Vancouver” to now, “I’m definitely going to visit and I’m going to have a deeper experience.” Then, we’re back into that world of, if you want to call it “transformative travel,” where we can deliver a customized experience that’s more meaningful to you and makes your time in Vancouver all the better.

Skift: Speaking of deeper experiences, Airbnb Experiences offer some really interesting opportunities, like one we did called: “ Hang With a Vancouver Startup Founder .” British Columbia recently voted to collect provincial sales tax and bed tax from Airbnb . Does that shift how you might promote Airbnb and engage with the brand in any new ways?

Speer: In a word, yes. We’ve said for the past three years, there were two major criteria for us to be able to work with Airbnb. One was regulation and the second was taxation. Because we felt without either of those, we’re just dealing in a non-official economy, and as the official representative of the visitors here and visitor businesses here, we just couldn’t be in that space. The regulation will come into effect on the first of April, and the province is going to collect those two taxes, so PST, provincial sales tax, and the MRDT, which is hotel tax.

I’ve said this to Airbnb, “When you guys become legitimate, we’re ready to go.” The missing piece for us, which we’ll sort out in the next little while, is we have to figure out what the right membership structure is because we’ve never dealt with anything like Airbnb and 5,000 hosts before.

We’re ready to go, but we probably won’t rush into it on the first of April. I think there’s a near-term evolution. We’ve got to monitor how compliance happens. If, out of 5,000 or 6,000 hosts, depending on how you count on a given day, nobody signs up, then I’m going to pause because regulation without compliance isn’t really the framework of legitimacy that we need. But assuming that Airbnb drives good compliance, and they’ve said they’ve got very specific plans to drive that compliance, I’m pleased about that. Assuming that happens, we’ll get a membership structure worked out and we will start that work.

So, as I mentioned, we’re ready to go. I’ve met with Airbnb recently. They want to do stuff, we want to do stuff. We’re one of their top 10 cities in the world. China’s the number one outbound market in the world. It’s not rocket science to connect the dots.

Skift: What’s the vibe from the hotels?

Speer: Our hotel partners, which are core partners of ours, kind of moved past the “Airbnb is the enemy” thing a long time ago. The thinking now is that Airbnb just represents more competition. Nobody wants more competition, but I’m not dealing with hotel partners saying, “Make that go away.” They’ve moved on.

Skift: How might you work with Airbnb to promote home-sharing in general, and Airbnb Experiences specifically?

Speer: Well, it all depends. We sit down with lots of our members and work on all kinds of different collaborative promotions. Sometimes it takes the form of member missions in market to sell things. Sometimes it’s trade shows or cooperative advertising. I’ve seen advertising campaigns that take all kinds of forms. We can do a big digital play of course because Airbnb is about as powerful a platform probably as any travel company ever, arguably.

There are any number of ways that we could probably sit down and say, “Okay, how do we go out and find people that might be potential Vancouver visitors and message them together.” We could be a content provider to Airbnb. We’ve got some great destination content that might fit really well on their site.

Skift: So just to sum up, platforms like CitizenLab and Airbnb have been successful connecting the private and public sectors, and people to people, very effectively. So, ideally, it seems that an organization like Tourism Vancouver should eventually be able to plug into that some way to deliver more customized connectivity, right? That’s basically a big part of the premise behind smart cities and smart tourism.

Speer: Sure, of course, and it’s on our mind. Absolutely on our mind. I want those tools to be available, but I think the other thing we have to be mindful of is, Airbnb will do it anyway. They don’t necessarily need me; they’re in that space. There are other things, including tours by locals, and there are other different platforms out there where people are making businesses out of their local expertise and their local passions. It certainly will be part of how we take the passion idea, I think, to market

If somebody’s into seafood, how do we deliver on that? Somebody’s into yoga, how do we do that? Somebody’s into paddle boarding or scuba, how do we do that? I want to think about how we solve all of that, but I’m also mindful that there’ll only be a subset of our visitor base who really wants to go that deep. Some people will still say, “You know what? I want to go to Vancouver and I want to go on a cruise to Alaska. I want to spend a couple nights in a nice hotel. I want to appreciate fresh air, beautiful scenery, some nice meals, a little bit of culture.” They’re not going to go deep.

We’ve got to be in a position to say, “Okay, Greg is going to go deep. How do we help that? Sally is not going to go deep. We’ve got all of that.” Again, I’m a big believer in working back from the customer point of view, so we’ve got to be able to serve up as much or as little depth as somebody wants. It’s about understanding who our visitors are, and how we can help them.

The above content was produced by the branded content SkiftX team for the Skift Cities platform, defining how cities are connecting their visitor and innovation economies.

Have a confidential tip for Skift? Get in touch

Tags: skift cities , tourism , vancouver

Photo credit: Northeast False Creek, Vancouver. Tourism Vancouver

- Tour Operators

- Destinations

- Hotels & Resorts

- Digital Edition Fall 2023

- Travel Webcast

- Suppliers Kit

- Canadian Travel Press

- Travel Courier

- Offshore Travel Magazine

VANCOUVER GETS MASTER PLAN

June 18, 2013

Only one week left to vote in the Agent’s Choice survey!

Virgin Voyages looking seeks new market with all-inclusive offerings

- Skip to main content

- Skip to main navigation

- Skip to site search

- Skip to side bar

- Skip to footer

BC Gov News

- News Archive

- Live Webcast

- Office of the Premier

- Agriculture and Food

- Attorney General

- Children and Family Development

- Citizens' Services

- Education and Child Care

- Emergency Management and Climate Readiness

- Energy, Mines and Low Carbon Innovation

- Environment and Climate Change Strategy

- Indigenous Relations and Reconciliation

- Intergovernmental Relations Secretariat

- Jobs, Economic Development and Innovation

- Mental Health and Addictions

- Municipal Affairs

- Post-Secondary Education and Future Skills

- Public Safety and Solicitor General

- Social Development and Poverty Reduction

Tourism, Arts, Culture and Sport

- Transportation and Infrastructure

- Water, Land and Resource Stewardship

B.C.’s first detox services for Indigenous youth coming to Island

B.C. acts to protect kids, school staff from disruptive protests

More from the premier.

- Factsheets & Opinion Editorials

- Search News

- Premier's Bio

Province strengthens drought preparedness

B.C. vineyards, orchards receive help to replant for changing climate

More from this ministry.

- Minister's Bio

New legislation aims to remove systemic barriers for Indigenous, racialized people

Expanded eligibility, new supports available for current, former youth in care

New position expedites progress on Indigenous child welfare

Governments of canada and british columbia working together to bring high-speed internet to more than 7,500 households.

Michael McEvoy to serve as interim information and privacy commissioner

Safer, larger victoria high opens.

B.C. takes action with new wildfire training and education centre, first of its kind in North America

Upgrades to wastewater infrastructure coming to Comox Valley

Bc hydro issues call for new clean electricity to power b.c.’s future.

New legislation ensures B.C. benefits from clean, affordable electricity

Park additions boost outdoor recreation, strengthen ecosystem protection, reducing emissions for a cleaner future for british columbians, budget 2024: taking action for people, families in b.c..

Climate action tax credit helps people with everyday costs

Wildfire-damaged wood recovery underway in b.c., launch of spring covid-19 vaccine boosters marks end of respiratory illness season, province takes more actions to strengthen primary care for people, b.c. builders can now use mass timber in taller buildings.

SAFER improved, top-up benefit coming for people on rental assistance

New legislation will eliminate discriminatory barriers for first nations.

Engagement results released on proposed legislative amendments to First Nations land ownership

Throne speech lays out vision of a stronger b.c. that works better for people.

Province honours people providing extraordinary community service

Research support helps fight metabolism diseases.

Minister’s statement on March Labour Force Survey results

Minimum wage increases to $17.40 an hour on june 1.

Minister’s and parliamentary secretary’s statement on Construction and Skilled Trades Month

Minister’s statement on lives lost to poisoned drugs in february, expanding multi-language support, services for newcomers, construction underway on cowichan sportsplex field house, new legislation recognizes work of first nations post-secondary institutes.

TradeUpBC builds, enhances tradespeoples’ skills

New digital platform improves response, safety for people in crisis in port moody.

New legislation paves the way for police reform

Budget 2024 supports improvements to treatment, recovery services.

Changes aim to help people out of poverty

Engagement launched for canadians of south asian heritages museum.

Historic water bomber destined for wildfire aviation exhibit

Province, yvr work together to support good jobs, fight pollution.

Airport improvements support services, growth for communities

Province supports new weir to keep cowichan river flowing.

Province strengthens flood defences, protecting people, communities

B.c. launches plan to revitalize tourism, creating opportunities for people.

Honourable Lana Popham

Email: [email protected]

Translations

News release, media contacts, ministry of tourism, arts, culture and sport.

- Visit Ministry Website

Featured Topics

- Tourism Resources

- Arts and Culture

- Multiculturalism & Anti-Racism

- BC Athletic Commissioner

Featured Services

- DestinationBC

- Indigenous Tourism BC

- BC Arts Council

B.C. has launched a new three-year roadmap for rebuilding and revitalizing tourism, creating jobs and opportunities for people and communities in every part of the province.

“B.C. is a world-class destination, and we know the pandemic has hurt tourism,” said Melanie Mark, Minister of Tourism, Arts, Culture and Sport. “As the world opens up again, we’re working together to rebuild and revitalize this critical industry that adds so much to our planet, our people and our shared prosperity.”

The renewed Strategic Framework for Tourism responds to the call to action from the sector to support its recovery from COVID-19. It outlines a roadmap for a more resilient tourism sector by rebuilding to 2019 levels by 2024.

“Every single person connected to the tourism industry has demonstrated incredible fortitude and leadership during the COVID-19 pandemic,” Mark said. “I have been constantly impressed by the dedication and hard work of tourism operators and staff to pivot, realign their businesses and take care of each other. Now, together, we’re going to build back stronger by making our mark to ensure B.C. is first in line to benefit from pent-up demand for world-class tourism experiences.”

A flourishing tourism industry is a key pillar of the StrongerBC Economic Plan and contributes to an inclusive, sustainable and innovative economy that works for all people. Requested by B.C.’s tourism industry leaders and the Tourism Task Force, the update of this framework focuses on provincial priorities of putting people first; lasting and meaningful reconciliation; equity and anti-racism; a better future through fighting climate change; and a strong, sustainable economy that works for everyone.

To continue to support tourism businesses in B.C. to come back stronger, the Province is investing $1 million toward investments in event-bid preparation and sponsorships to attract large-scale arts, culture, and sport events, and public conferences and exhibitions. Investing now in event programs will kick-start the events industry’s recovery and will position B.C. as a safe, world-class, event-hosting jurisdiction once again. This is in addition to the $8 million government recently announced for the Business Events and Conferences Restart Fund to help restart business travel by attracting and hosting business events, conferences and exhibitions.

The Tourism Task Force emphasized how challenging it has been for industry to find the skilled workers it needs. This is why government is investing a further $2 million for post-secondary education and training to support B.C. students who enrol in tourism and hospitality certificate, diploma or degree programs, tourism-related apprenticeships, and trades training and development programs. This program, now in development, will prioritize students who are Indigenous, immigrant or refugee applicants, as well as those from rural or remote locations, and people with accessibility needs. More details will be provided soon.

As part of the Province’s continuing tourism recovery initiatives, government has committed $6 million this year through 2024 for Destination BC to market B.C. as a destination of choice in the highly competitive international market.

“We are very enthused about the Province's further investment in tourism recovery,” said Walt Judas, CEO, Tourism Industry Association of BC. “These funds come at an opportune time as our industry looks to rebuild our workforce, products and service levels to once again welcome guests from all over the world in the months and years ahead."

This funding builds on the $570 million the B.C. government has invested in recovery supports for the tourism sector, including the Small and Medium Sized Business Recovery Grant and the Circuit Breaker Business Relief Grant that are providing funding to nearly 8,200 tourism and hospitality businesses. This funding has supported programs such as the Festival, Fairs and Events Recovery Fund, Tourism Accommodation and Commercial Recreation Relief Fund, business support through Indigenous Tourism BC, and tourism infrastructure development.

Government investment in pandemic support for the hard-hit tourism sector was made early and continues with the sustained rollout of new recovery investment programs spanning the breadth of tourism recovery – from HR recruitment and retention, including engaging students, to resuming large-scale conferences and events, and furthering destination development.

A well-managed, thriving tourism industry makes life better for people: it is integral to the province’s economy and features prominently in B.C.’s economic plan. These initiatives, plus the resumption of strong international marketing efforts, position B.C. as a world-class destination with the programs in place to support a strong economic recovery that will be felt at all levels of community.

Krista Bax, CEO, go2HR –

“This program for training will no doubt spur interest from students as they see a supported pathway to a career in tourism and hospitality. We can’t wait to welcome these new students to our industry. Opportunities await them in an industry that values diversity and is proud to contribute to community vitality throughout our province.”

Richard Porges, CEO, Destination BC –

“Spending more time and money in B.C. compared to domestic travellers, international visitors are vital to the industry’s strong recovery. As the world reopens for travel, this additional funding will enable Destination BC to be even more effective in the incredibly competitive market for international travellers, bringing more tourism dollars to businesses in every corner of the province.”

Brenda Baptiste, chair, Indigenous Tourism BC –

“We look forward to revitalizing tourism, creating jobs, and building capacity and opportunities for Indigenous communities and businesses. Our industry has collaborated and found innovative solutions, and we look forward to a solid roadmap for recovery with the Strategic Tourism Framework.”

Quick Facts:

- The Tourism Task Force recommended the Strategic Framework be updated to reflect the new operating environment that has resulted from COVID-19 and to provide opportunities to support mid-term recovery and long-term resiliency for the tourism industry.

- Government will monitor the framework's delivery through key performance indicators that will be shared publicly.

- Budget 2022 committed almost $25 million to destination development, international marketing, business events and conferences recovery, marquee events bids, and tourism training.

Learn More:

For more information on B.C.'s tourism framework, visit: http://gov.bc.ca/tourismframework

- Tourism_Revitalization_Chinese(traditional).pdf

- Tourism_Revitalization_French.pdf

Related Articles

Elder-in-residence supports cultural knowledge, reconciliation.

Connect with the Ministry

View the Ministry's latest photos on Flickr.

Watch the Ministry's latest videos on YouTube.

Acknowledgment

The B.C. Public Service acknowledges the territories of First Nations around B.C. and is grateful to carry out our work on these lands. We acknowledge the rights, interests, priorities, and concerns of all Indigenous Peoples - First Nations, Métis, and Inuit - respecting and acknowledging their distinct cultures, histories, rights, laws, and governments.

Connect with Us:

- Newsletters

- Accessibility

We use cookies to enhance your browsing experience. No personal information is being stored. By continuing to browse our site you agree to our privacy policy .

What is the Vancouver Plan?

Approved by City Council on July 22, 2022, the Vancouver Plan is an historic long-range land use strategy to create a more livable, affordable and sustainable city for everyone. It guides the long-term growth of the city in an intentional way, clarifying where growth and change will occur over the next 30 years.

Through a multi-year public engagement process, we heard unequivocally that residents want specific actions to create more housing, support the local economy, and address the climate crisis.

Vancouver Plan Timeline

The process and timeline are influenced by what we hear and learn along the way and our sustained recovery effort from the COVID-19 pandemic.

Phase 1: Listen and Learn + Recovery

Fall 2019 - september 2020*.

*Note, short-term community recovery actions will be integrated into the work through January 2021

Phase 2: Developing Emerging Directions

October 2020 – july 2021, phase 3: policy and land use ideas, august 2021 – november 2021, phase 4: revising and final plan, december 2021 – july 2022, phase 5: implementation strategy, summer 2022+, acknowledging the unceded homeland of the musqueam, squamish and tsleil-waututh nations.

This place is the unceded and ancestral homelands of the hən̓q̓əmin̓əm̓ and Sḵwx̱wú7mesh speaking peoples, the xʷməθkʷəy̓əm (Musqueam), Sḵwx̱wú7mesh (Squamish) and səlilwətaɬ (Tsleil-Waututh) Nations (the Nations), and has been traditionally stewarded by them since time immemorial. These lands continue to be occupied by settlers, and Indigenous Peoples face ongoing dispossession and colonial violence. Despite systematic and institutional efforts to eradicate their communities and cultures, the resilience, strength, and wisdom of the Nations have allowed them to revitalize their languages and cultures, and exercise sovereignty over their lands .

Recognizing the lives, cultures, languages, and peoples of this land, the Vancouver Plan seeks to build on our commitment as a City of Reconciliation. Working together with the Nations on the Vancouver Plan and on further work to come, we hope to strengthen reciprocal relationships with each of the three Nations to ensure we move forward together toward a city truly worthy of this amazing place. Settler Vancouver residents have a responsibility to the Nations and Indigenous Peoples that have stewarded these lands to tangible actions and a commitment to Reconciliation through decolonization.

What’s Next

Now that the Vancouver Plan has been approved, it is the City’s strategic land use framework, guiding more detailed plans and policies to come.

Council-approved motions directing staff to consider how renter protections and developer contributions will be included as part of the implementation of this Plan.

Stay Informed

Sign up to our email mailing list for the latest news, updates, and opportunities to participate in upcoming Vancouver Plan implementation projects.

Tourism Master Plan for Vancouver

- June 22, 2013

Vancouver has its first ever tourism master plan, developed by Resonance Consultancy, and set to align city and industry interests over a 10-year period.

Tourism Vancouver will work with the city and the port on future development on infrastructure, said a spokesperson for Resonance. He said they are also cognizant of the Lion’s Gate bridge which may not be tall enough for future ships, and new cruise facilities outside the bridge may eventually be considered.

Meanwhile, he said Tourism Vancouver would like to see the recent uptick in cruise traffic continue to build and get past 2015 and the yet unknown ECA impact, before taking the next step.

In the big picture, the master plan analyzes gaps, identified opportunities and establishes priorities to ensure the tourism industry grows in an economically, socially and environmentally sustainable manner, according to Resonance.

The firm stated that an overarching ambition of the plan is to enhance the alignment between the city administration and the tourism business, including the formalization of an ongoing group of city, industry and tourism partnership to oversee master plan actions and report back to industry and residents.

The full report will be completed in early July.

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

54 Ships | 122,002 Berths | $36 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 2. Transportation

Morgan Westcott

Learning Objectives

- Understand the role of transportation in the tourism industry

- Recognize milestones in the development of the air industry and explain how profitability is measured in this sector

- Report on the historic importance of rail travel and challenges to rail operations today

- Describe water-based transportation segments including cruise travel and passenger ferries

- Recognize the importance of transportation infrastructure in tourism destinations

- Specify elements of sightseeing transportation, and explain current issues regarding rental vehicles and taxis

- Identify and relate industry trends and issues including fuel costs, environmental impacts, and changing weather

The transportation sector is vital to the success of our industry. Put simply, if we can’t move people from place to place — whether by air, sea, or land — we don’t have an industry. This chapter takes a broad approach, covering each segment of the transportation sector globally, nationally, and at home in British Columbia.

Let’s start our review by taking a look at the airline industry.

According to the International Air Transport Association (IATA), in 2014, airlines transported 3.3 billion people across a network of almost 50,000 routes generating 58 million jobs and $2.4 trillion in business activity (International Air Transport Association, 2014a).

Spotlight On: International Air Transport Association

The International Air Transport Association (IATA) is the trade association for the world’s airlines, representing around 240 airlines or 84% of total air traffic. It supports many areas of aviation activity and helps formulate industry policy on critical aviation issues (IATA, 2014b). For more information, visit the International Air Transport Association website : http://www.iata.org

The first commercial (paid) passenger flight took place in Florida on New Year’s Day 1914 as a single person was transported across Tampa Bay (IATA 2014a). There have been a number of international aviation milestones since that flight, as illustrated in Table 2.1.

Rules and Regulations

Aviation is a highly regulated industry as it crosses many government jurisdictions. This section explores key airline regulations in more detail.

The term open skies refers to policies that allow national airlines to fly to, and above, other countries. These policies lift restrictions where countries have good relationships, freeing up the travel of passengers and goods.

Take a Closer Look: The 1944 Chicago Convention on International Civil Aviation

This document contains the original statements from the convention that created the airline industry as we know it, providing a preamble statement as well as detailed articles pertaining to a range of issues from cabotage to pilotless aircraft. Read the 1944 Chicago Convention on International Civil Aviation [PDF] : www.icao.int/publications/Documents/7300_orig.pdf

Canada’s approach to open skies is the Blue Sky Policy , first implemented in 2006. The National Airlines Council of Canada (NACC) and Canadian Airports Council (CAC) support the Blue Sky Policy.

While opening up a ir transport agreements (ATAs) with other jurisdictions is important, the Canadian government doesn’t provide blanket arrangements, instead negotiating “when it is in Canada’s overall interest to do so” (Government of Canada, 2014a). Some su ggest the government should be more liberal with air access so more competitors can enter the market, potentially attracting more visitors to the country (Gill and Raynor, 2003).

Taxes and Fees

According to a 2012 Senate study on issues related to the Canadian airline industry, Canadian travellers are being grounded by airline fees, fuel surcharges, security taxes, airport improvement fees, and other additional costs. Airports are charged rental fees by the Canadian government ($4.8 billion from 1992 to 2004), which they pass on to the airlines, who in turn transfer the costs to travellers. Some think eliminating rental fees would make Canadian airports more competitive, and view rental and other fees as the reason 5 million Canadians went south of the border for flights in 2013, where passenger fees are 230% lower than in Canada (Hermiston and Steele, 2014).

Profitability

Running an airline is like having a baby: fun to conceive, but hell to deliver. – C. E. Woolman, principal founder of Delta Air Lines ( The Economist , 2011).

As the quote above suggests, airlines are faced with many challenges. In addition to operating in a strict regulatory environment, airlines yield extremely small profit margins. In 2013 the industry accumulated $10.6 billion worldwide in revenues, although global profit margins were just 1.5% (IATA, 2014a). To put that into perspective, while the average airline earned 1.5%, Apple’s profit margins were almost 14 times that at 20.15% (YCharts, 2014).

Passenger Load Factor

Key to airline profitability is passenger load factor , which relates how efficiently planes are being used. Load factor for a single flight can be determined by dividing the number of passengers by the number of seats.

Passenger load factors in the airline industry reached a record high in 2013, at just under 80%, which was attributed to increased volumes and strong capacity management in key sectors (IATA, 2104a). One way of increasing capacity is by using larger aircraft. For instance, the introduction of the Airbus A380 model has allowed up to 40% more capacity per flight, carrying up to 525 passengers in a three-class configuration, and up to 853 in a single-class configuration (Airbus, 2014).

Low-Cost Carriers

Another key factor in profitability is the airline’s business model. In 1971, Southwest Airlines became the first low-cost carrier (LCC), revolutionizing the industry. The LCC model involved charging for all extras such as reserved seating, baggage, and on-board service, and cutting costs by offering less legroom and using non-unionized workforces. Typically, an LCC has to run with 90% full planes to break even (Owram, 2014). The high-volume, lower-service system is what we have become used to today, but at the time it was introduced, it was groundbreaking.

Ancillary Revenues

The LCC model, combined with tight margins, led to today’s climate where passengers are charged for value-added services such as meals, headsets, blankets, seat selection, and bag checking. These are known in the industry as ancillary revenues . Profits from these extras rose from $36 billion in 2012 to $42 billion in 2013, or more than $13 a passenger. An average net profit of only $3.39 per passenger was retained by airlines (IATA, 2014a).

As you can see, airlines must strive to maintain profitability, despite thin margins, in an environment with heavy government regulation. But at the same time, they must be responsible for the safety of their passengers.

Air Safety and Security

IATA encourages airlines to view safety from a number of points, including reducing operational risks such as plane crashes, by running safety audit programs. They also advocate for improved infrastructure such as runway upgrades and training for pilots and other crew. Finally, they strive to understand emerging safety issues, including the outsourcing of operations to third-party companies (IATA, 2014a).

In terms of security, coordination between programs such as the Interpol Stolen and Lost Travel Documents initiative and other databases is critical (IATA, 2014a). As reservations and management systems become increasingly computerized, cyber-security becomes a top concern for airlines, who must protect IT (information technology) because their databases contain information about flights and passengers’ personal information. Unruly passengers are also a cause of concern, with over 8,000 incidents reported worldwide every year (IATA, 2014a).

Now that we have a better sense of the complexities of the industry, let’s take a closer look at air travel in Canada and the regional air industry.

Canada’s Air Industry

In 1937, Trans-Canada Air Lines (later to become Air Canada) was launched with two passenger planes and one mail plane. By the 1950s, Canadian Pacific Airlines (CP Air) entered the marketplace, and an economic boom led to more affordable tickets. Around this time CP Air (which became Canadian Airlines in 1987) launched flights to Australia, Japan, and South America (Canadian Geographic, 2000). In 2001, Canadian Airlines International was acquired by Air Canada (Aviation Safety Network, 2012).

In 1996, the marketplace changed drastically with the entry of an Alberta-based LCC called WestJet. By 2014, WestJet had grown to become Canada’s second major airline with more than 9,700 staff flying to 88 destinations across domestic and international networks (WestJet, 2014).

As it grew, WestJet began to offer services such as premium economy class and a frequent-flyer program, launched a regional carrier, and introduced transatlantic flights with service to Dublin, Ireland, evolving away from the LCC model (Owram, 2014). With those changes, and in the absence of a true low-cost carrier, in 2014, some other companies, such as Canada Jetlines and JetNaked, sought to raise upward of $50 million to bring their airlines to market.

However, outside of Air Canada and WestJet, airlines in Canada have found it very challenging to survive, and some examples of LCC startups like Harmony Airways and Jetsgo have fallen by the wayside.

Challenges to Canada’s Air Industry

When looking at these failed airlines in Canada, three key challenges to success can be identified (Owram, 2014):

- Canada’s large geographical size and sparse population mean relatively low demand for flights.

- Canada’s higher taxes and fees compared with other jurisdictions (such as the United States) make pricing less competitive.

- Canada’s two dominant airlines are able to price new entrants out of the market.

In addition to these factors, the European debt crisis, a slow US economic recovery, more cautious spending by Canadians, and fuel price increases led to a $900 million industry loss in 2011 (Conference Board of Canada, 2012) prior to the industry returning to profitability in 2013.

Take a Closer Look: One Size Doesn’t Fit All

In 2013, a special report to the Canadian Senate explored the concept that one size doesn’t fit all when it comes to competitiveness in the country’s airline industry. The report contains general observations about the industry as well as a number of recommendations to stakeholders, including airport managers. Read the report: “One Size Doesn’t Fit All: the Future Growth and Competitiveness of Canadian Air Travel” [PDF] : www.parl.gc.ca/Content/SEN/Committee/411/trcm/rep/rep08apr13-e.pdf

Today, the Canadian airline industry directly employs roughly 141,000 people and is worth $34.9 billion in gross domestic product. It supports 330 jobs for every 100,000 passengers and contributes over $12 billion to federal and provincial treasuries, including over $7 billion in taxes (Gill and Raynor, 2013).

Let’s now turn our attention to the regional air market, focusing on British Columbia.

Regional Airlines

Transportation in BC has always been difficult: incomplete road systems and rugged terrain historically made travel between communities almost impossible. In 1927, a number of businessmen promised to change all that when they opened British Columbia Airways in Victoria with the purchase of a commercial airliner (Canadian Museum of Flight, 2014).

As commercial flying became more popular, and the province grew, regional airports started to spring up around BC as a means of delivering surveying equipment, forestry supplies, and workers. Many of these airports were legacies of Canada’s strategic position for the military. Fort Nelson’s airport, for instance, was established so the US Air Force could fuel aircraft bound for Russia in World War II (Northern Rockies Regional Airport, 2014).

In 1994, Transport Canada transferred all 150 airports under its control to local authorities under the National Airports Policy (NAP). This policy is considered to have been a turning point in the privatization of the airline industry in Canada. A 2004 study showed that after 10 years, 48% of these airports were not able to cover annual costs of operation, leading to concerns about the viability of small local airports in particular (InterVISTAS, 2005).

In 2012, the BC government released its aviation strategy, entitled Connecting with the World , which acknowledged the economic challenges for airports large and small. These range from Vancouver International Airport (YVR), which supports more than 61,000 jobs and creates more than $11 billion in economic activity each year, through to regional and local airports. The strategy outlined a framework to remove barriers to aviation growth including potentially eliminating the two-cent-per-litre International Aviation Fuel Tax ( British Columbia Ministry of Transportation and Infrastructure , 2012).

Given a highly complex regulatory environment, razor-thin profit margins, and intense competition, the airline industry is constantly changing and evolving at global, national, and regional levels. But one thing is certain: air travel is here to stay.

On the other hand, the rail industry has been faced with significant declines since air travel became accessible to the masses. Let’s learn more about this sector.

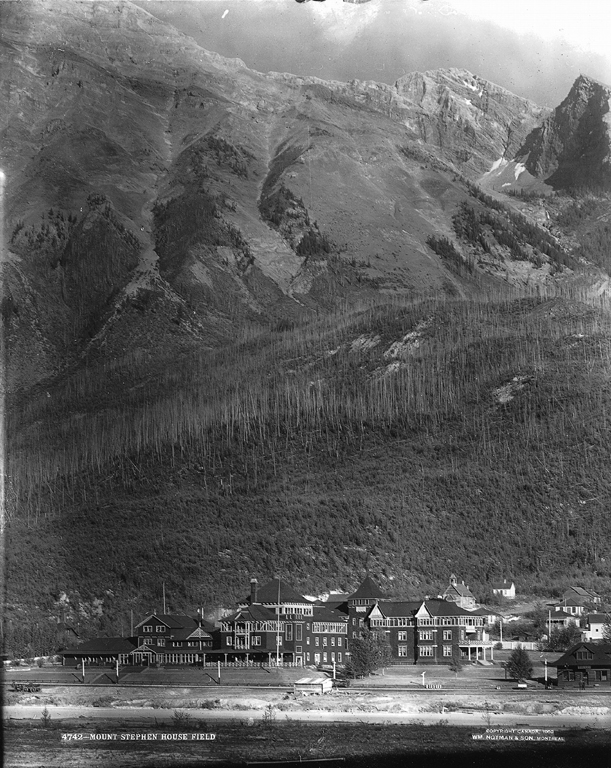

In Chapter 1, we looked at the historic significance of railways as they laid the foundation for the modern tourism industry. That’s because in many places, including Canada and British Columbia, trains were an unprecedented way to move people across vast expanses of land. With the Canadian Pacific company opening up hotels in major cities, BC’s hospitality sector was born and a golden age of rail travel emerged.

However, starting in the 1940s and 1950s, the passenger rail industry began to decline sharply. In 1945, Canadian railways carried 55.4 million passengers, but just 10 years later passenger traffic had dropped to 27.2 million. The creation of VIA Rail in 1977 as a Canadian Crown corporation was an attempt by the government to ensure rail travel did not disappear, but in the years since its founding VIA has struggled, relying heavily on federal subsidies in order to continue operations.

Between 1989 and 1990, VIA lost over 45% of its ridership when it cut unprofitable routes, focusing on areas with better potential for revenue and passenger volumes. From there, annual ridership has stabilized at around 3.5 million to 4.0 million passengers per year, slowly increasing throughout the 1990s and 2000s (Dupuis, 2011).

Despite this slight recovery, there are a number of challenges for passenger rail in Canada, which will likely require continued government support to survive. Three key challenges to a successful passenger rail industry are:

- Passenger rail must negotiate with freight for right-of-use of tracks.

- There is limited potential of routes (with the highest volume existing in the Quebec-Windsor corridor).

- Fixed-cost equipment is aging out, requiring replacement or upgrading.

High-speed rail seems like an attractive option, but would be expensive to construct as existing tracks aren’t suitable for the reasons given above. It’s also unlikely to provide high enough returns to private investors (Dupuis, 2011). This means the Canadian government would have to invest heavily in a rapid rail project for it to proceed. As of 2014, no such investment was planned.

Spotlight On: Rocky Mountaineer Rail Tours

Founded in 1990, Rocky Mountaineer offers three train journeys through BC and Alberta to Banff, Lake Louise, Jasper, and Calgary, and one train excursion from Vancouver to Whistler. In 2013, Rocky Mountaineer introduced Coastal Passage, a new route connecting Seattle to the Canadian Rockies that can be added to any two-day or more rail journey (Rocky Mountaineer, 2014). For more information, please visit the Rocky Mountaineer website : http://www.rockymountaineer.com

While the industry overall has been in a decline, touring companies like Rocky Mountaineer have found a financially successful model by shifting the focus from transportation to the sightseeing experience. The company has weathered financial storms by refusing to discount their luxury product, instead focusing on the unique experiences. The long planning cycle for scenic rail packages has helped the company stand their ground in terms of pricing (Cubbon, 2010).

Rail Safety

In Canada, rail safety is governed by the Railway Safety Act , which ensures safe railway operation and amends other laws that relate to rail safety (Government of Canada, 2014b). The Act is overseen by the Minister of Transport. It covers grade crossings, mining and construction near railways, operating certifications, financial penalties for infractions, and safety management.

The Act was revised in late 2014 in response to the massive rail accident in July 2013 in Lac-Mégantic, Quebec. A runaway oil train exploded, killing 47 people, and subsequently MM&A Railway and three employees, including the train’s engineer, were charged with criminal negligence (CBC News, 2014).

In addition to freight management issues, a key rail safety concern is that of crossings. As recently as April 2014, Transport Canada had to issue orders for improved safety measures at crossings in suburban Ottawa after a signal malfunctioned in the area (CTV News, 2014a). According to Operation Lifesaver Canada (2014), in 2011, there were 169 crossing collisions across Canada, with 25 fatalities and 21 serious injuries. In general, however, Canada’s 73,000 kilometres of railway tracks safely transport both people and goods. And while railways in Canada, and elsewhere, are being forced to innovate, companies like Rocky Mountaineer (see Spotlight On above) give the industry glimmers of hope.

The rail industry shares some common history with the cruise sector. Let’s now turn our focus to the water and learn about the evolution of travel on the high seas.

Travel by water is as old as civilization itself. However, the industry as we know it began when Thomas Newcomen invented the steam engine in 1712. The first crossing of the Atlantic by steam engine took place in 1819 aboard the SS Savannah , landing in Liverpool, England, after 29 days at sea. Forty years later, White Star Lines began building ocean liners including the Olympic -class ships (the Olympic, Britannic , and Titanic ), expanding on previously utilitarian models by adding luxurious amenities (Briggs, 2008).

A boom in passenger ship travel toward the end of the 1800s was aided by a growing influx of immigrants from Europe to America, while more affluent passengers travelled by steamship for pleasure or business. The industry grew over time but, like rail travel, began to decline after the arrival of airlines. Shipping companies were forced to change their business model from pure transportation to “an experience,” and the modern cruise industry was born.

The Cruise Sector

We’ve come a long way since the Olympic class of steamship. Today, the world’s largest cruise ship, MS Oasis of the Seas , has an outdoor park with 12,000 plants, an 82-foot zip wire, and a high-diving performance venue. It’s 20 storeys tall and can hold 5,400 passengers and a crew of up to 2,394 (Magrath, 2014). A crew on a cruise ship will include the captain, the chief officer (in charge of training and maintenance), staff captain, chief engineer, chief medical officer, and chief radio officer (communication, radar, and weather monitoring).

Spotlight On: Cruise Lines International Association

Cruise Lines International Association (CLIA) is the world’s largest cruise industry trade association with representation in North and South America, Europe, Asia, and Australasia. CLIA represents the interests of cruise lines and travel agents in the development of policy. CLIA is also engaged in travel agent training, research, and marketing communications (CLIA, 2014). For more information on CLIA, the cruise industry, and member cruise lines and travel agencies, visit the Cruise Lines International Association website : www.cruising.org

Cruising the World

According to CLIA, 21.7 million passengers were expected to travel worldwide on 63 member lines in 2014. Given increased demand, 24 new ships were expected in 2014-15, adding a total capacity of over 37,000 passengers.

Over 55% of the world’s cruise passengers are from North America, and the leading destinations (based on ship deployments), according to CLIA, are:

- The Caribbean (37%)

- The Mediterranean (19%)

- Northern Europe (11%)

- Australia/New Zealand (6%)

- Alaska (5%)

- South America (3%)

River Cruising

While mass cruises to destinations like the Caribbean remain incredibly popular, river cruises are emerging as another strong segment of the industry. The key differences between river cruises and ocean cruises are (Hill, 2013):

- River cruise ships are smaller (400 feet long by 40 feet wide on average) and can navigate narrow passages.

- River cruises carry fewer passengers (about 10% of the average cruise, or 200 passengers total).

- Beer, wine, and high-end cuisine are generally offered in the standard package.

The price point for river cruises is around the same as ocean trips, with the typical cost ranging from $2,000 to $4,000, depending on the itinerary, accommodations, and other amenities.

From 2008 to 2013, river cruises saw a 10% annual passenger increase. Europe leads the subcategory, while emerging destinations include a cruise route along China’s Yangtze River. As the on-board experience differs greatly from a larger cruise (no play areas, water parks, or on-board stage productions), the target demographic for river cruises is 50- to 70-year-olds. According to Torstein Hagen, founder and chairman of Viking, an international river cruising company, “with river cruises, a destination is the destination,” although many river cruises are themed around cultural or historical events (Hill, 2013).

Cruising in Canada

According to a study completed for the North West & Canada Cruise Association (NWCCA) and its partners, in 2012, approximately 1,100 cruise ship calls were made at Canadian cruise ports generating slightly more than 2 million passenger arrivals throughout the six-month cruise season (BREA, 2013). The study found three key cruise itineraries in Canada:

- Canada/New England

- Quebec (between Montreal and Quebec City and US ports)

- Alaska (either departing from, or using, Vancouver or another BC city as a port of call)

These generated $1.16 billion in direct spending. Cruising also generated almost 10,000 full- and part-time jobs paying $397 million in wages and salaries. The international cruise industry also generated an estimated $269 million in indirect business and income taxes in Canada, and the majority of this spending was in British Columbia (BREA, 2013).

Cruising BC

BC’s rail history and cruise history are intertwined. As early as 1887, Canadian Pacific Railway began offering steamship passage to destinations such as Hawaii, Shanghai, Alaska, and Seattle. Ninety-nine years later, Vancouver’s Canada Place was built, with its cruise ship terminals, allowing the province to attract large ships and capture its share of the growing international cruise industry (Cruise BC, 2014).

Spotlight On: Cruise BC

Cruise BC is a partnership between BC port destinations designed to provide a vehicle for cooperative marketing and development of BC’s cruise sector. Their vision is that the West Coast and British Columbia’s coastal communities are recognized and sought out globally by cruise lines and passengers as a destination of choice. For more information, visit the Cruise BC website : http://www.cruisebc.ca

This potential continues to grow as Nanaimo, Prince Rupert, Victoria, and Vancouver accounted for 57% of the Canadian cruise passenger traffic with 1.18 million passengers in 2012 (BREA, 2013).

Cruising isn’t the only way for visitors to experience the waters of BC. In fact, the vast majority of our water travel is done by ferry. Let’s take a closer look at this vital component of BC’s transportation infrastructure.

Ferry service in British Columbia dates back to the mid-1800s when the Hudson’s Bay Company ran ships between Vancouver Island and the Mainland. Later, CP Rail and Black Ball ferries ran a private service, until 1958 when Premier W.A.C. Bennett announced the BC Ferry Authority would consolidate the ferries under a provincial mandate.

The MV Tsawwassen and the MV Sidney began regular service on June 15, 1960, and BC Ferries was officially launched with two terminals and around 200 employees. Today, there are 35 vessels, 47 destinations, and up to 4,700 employees in the summer peak season (BC Ferries, 2014).

BC isn’t the only destination where ferries make up part of the transportation experience. In 2011, Travel + Leisure Magazine profiled several notable ferry journeys in the article, “World’s Most Beautiful Ferry Rides” including:

- An 800-mile ferry voyage through Chile’s Patagonian fjords

- A three-mile trip from the Egyptian Spice Market to Istanbul, Turkey

- Urban ferry rides including Hong Kong’s Victoria Harbour, Australia’s Sydney Harbour, and New York City’s Staten Island Ferry

The article also featured the 15-hour trip from Port Hardy to Prince Rupert on British Columbia’s coast (Orcutt, 2011).

While cruising is often a pleasant and relaxing experience, there are a number of safety concerns for vessels of all types.

Cruise and Ferry Safety

One of the major concerns on cruise lines is disease outbreak, specifically the norovirus (a stomach flu), which can spread quickly on cruise ships as passengers are so close together. The US Centers for Disease Control (CDC) vessel sanitation program (http://www.cdc.gov/nceh/vsp/default.htm) is designed to help the industry prevent and control the outset, and spreading, of these types of illnesses (Briggs, 2008).

Accidents are also a concern. In 2006, the BC Ferries vessel MV Queen of the North crashed and sank in the Inside Passage, leaving two passengers missing and presumed dead. The ship’s navigating officer was charged with criminal negligence causing their deaths (Keller, 2013). More recently, a “hard landing” at Duke Point terminal on Vancouver Island caused over $4 million in damage. BC Ferries launched a suit against a German engineering firm in late 2013, alleging a piece of equipment failed, making a smooth docking impossible. The Transportation Safety Board found that staff aboard the ship didn’t follow proper docking procedures, however, which contributed to the crash (Canadian Press, 2013).

Spotlight On: The Transportation Safety Board

The Transportation Safety Board (TSB) investigates marine, pipeline, rail, and air incidents. It is an independent agency that reviews an average of 3,200 events every year. It does not determine liability; however, coroners and medical examiners may use TSB findings in their investigations. The head office in Quebec manages 220 staff across the country. For more information, visit the Transportation Safety Board website : http://www.bst-tsb.gc.ca/eng/index.asp