Connection denied by Geolocation Setting.

Reason: Blocked country: Russia

The connection was denied because this country is blocked in the Geolocation settings.

Please contact your administrator for assistance.

Fano Visit Card

La chiave per scoprire le meraviglie delle terre di Fano

Tanti vantaggi, una sola card!

Con la Fano Visit Card puoi avere a disposizione gratuitamente alcuni servizi. Per l’elenco completo visita il sito visitfano.info/fanovisitcard

Clicca qui sotto invece per scegliere la tipologia di card desiderata

Disponibile a breve!

Come funziona

In pochi semplici passi potrai ottenere la tua Fano Visit Card e godere di tutti i suoi vantaggi

Scarica ora l’applicazione

Gestisci le tue Fano Visit Card direttamente dal tuo smartphone!

Con le Cinque Terre Card hai diritto a

- L'accesso al parco

- Visite guidate

...E tanto altro ancora!

Si informa che per l'accesso alla rete sentieristica sono vietate le calzature aperte e/o con suola liscia, ossia non provviste di suola tipo “Vibram”. I trasgressori saranno puniti ai sensi del comma 2 dell’art. 30 della Legge 394/91 e ss.mm.ii.

Si ricorda, nel caso in cui non si riceva l'email con i biglietti, che è sempre possibile recuperare gli stessi facendo login nella propria area riservata e andare nella sezione ORDINI. Da qui è sempre possibile recuperare i propri biglietti

About this app

Data safety.

What's new

App support, more by bbs srl.

Piccolo Explorer

London Days Out | Family Travel

Top Things to do in Fano Italy

Fano is a charming Adriatic seaside town and the third largest by population in the Marche region of central Italy . With history dating back over 2000 years, when it was the largest Roman colony on the Adriatic coast and known as Fanum Fortunae, there is plenty to see and do when exploring this picturesque town. Learn more about Fano in this post and discover the must-see historical attractions, best restaurants and top things to do in Fano, Italy.

Table of Contents

Top Attractions in Fano Italy

Marche – located between Emilia-Romagna to the north and Abruzzo to the south – is renown for its picturesque, hilly countryside and beautiful 180 km-long coastline. Fano is located in the northern part of Marche, between Pesaro (the capital of the province of Pesaro and Urbino) and the beach town of Senigallia.

During Roman times, Fano was an important port and crossroads and you can still see traces of that past within the historical town centre.

At the time, the ancient town was named Fanum Fortunae, after a temple to the goddess of Fortune that once stood there. The Temple of Fortune was built in the 3rd century B.C. by the Romans in honor of their victory against the Carthaginian Asdrubal.

Fano Centro Storico

Fano Centro Città is the historical town centre and the primary location for special events, festivals and street markets. Most of the streets within the town centre are restricted to traffic and open only to pedestrians, cyclists and local tradesmen or residents.

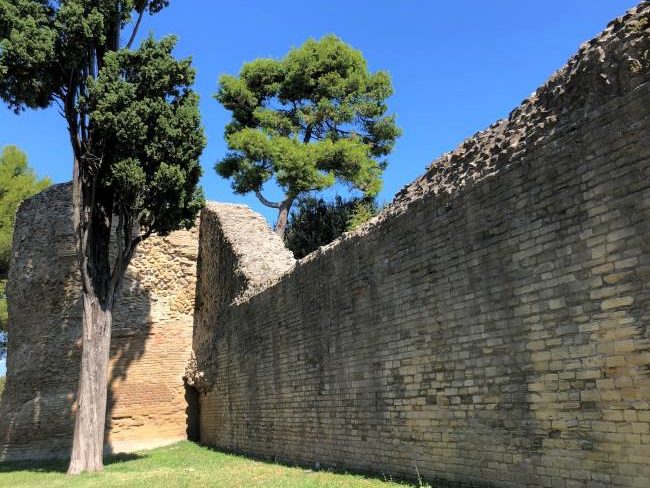

One of the first things you will see approaching the town centre of Fano is that it is partially surrounded by ancient walls. These city walls were built by the Romans and expanded in the Middle Ages by the Malatesta family, and the most prominent feature is the splendid Arco di Augusto that served as a gateway to the town in Roman times.

Arco di Augusto

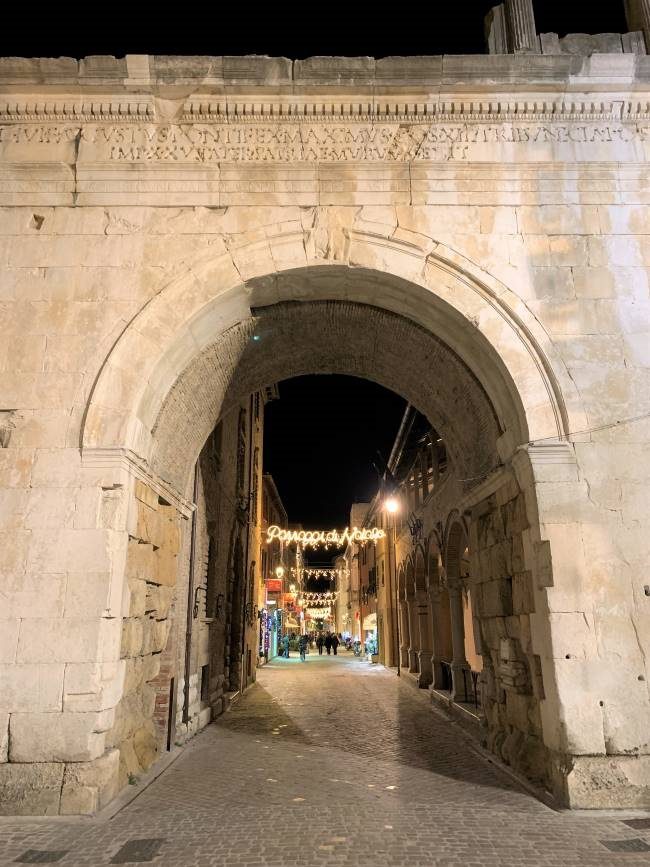

The Arco di Augusto (Arch of Augustus) is a Roman triumphal arch that was built in 9 AD under Roman Emperor Augustus and marked the arrival of the Via Flaminia, an ancient Roman road, on the shores of the Adriatic Sea.

Constructed of travertine, a form of limestone, the Arco di Augusto has three openings, one that was for wagons and horses and two smaller ones for pedestrians. You can still see remnants of the top of the gate that was destroyed in battle in 1463.

Via Flaminia was the most important route to the north, leading from Rome over the Apennine Mountains to Ariminum (now Rimini). Upon entering the town through the Arco di Augusto, Via Flaminia ran on the other side of the city walls that were built to protect Fano (more photos below).

To the left of the Augustus Arch, you can follow the ancient Augustan walls that surround part of Fano Centro Città to the beginning of Corso Matteotti (known as Cardus Maximus in Roman times) which is another route to the historical town centre.

Along the way, you will come across the Porta della Mandria (Gate of the Herd) or Porta Ovest (West Gate). The name “Porta della Mandria” comes from medieval times, when livestock were brought through this gate to graze nearby. The gate was also used for people to travel out of the town towards Pesaro to the north.

Piazza XX Settembre

Corso Matteotti is the mostly pedestrianised main road in the town centre, a bustling hub with independent shops, cafés and clothing stores that brings you straight through the town. Fano’s main square, the Piazza XX Settembre, is located just off Corso Matteotti. Bars and restaurants line the piazza and throughout most of the year, there are tables set up for customers to catch up over coffee or drinks.

The date of 20 September, which marked the end of the Risorgimento, the long process of Italian unification, is commemorated in practically every town in Italy with streets or squares named Via or Piazza XX Settembre respectively

Piazza XX Settembre is overlooked by a prominent Romanesque-Gothic style building that was originally the Palazzo del Podestà, a medieval administrative palace built in 1299. Palazzo del Podestà was converted into a theatre, Teatro della Fortuna , by the scenographer and entrepreneur Giacomo Torelli between 1665 and 1677, then rebuilt with a new opera house with a 900-seat, neo-classical style interior designed by Luigi Poletti that opened in 1863. The theatre suffered damage during World War II and was restored to its original splendour and re-opened again in 1998.

Another prominent feature and iconic Fano attraction in the Piazza XX Settembre is Fontana della Fortuna. The bronze statue on the fountain is of the Goddess Fortuna, and is a copy of the original statue that was modelled and cast in 1593 by Donnino Ambrosi from Urbino. The original statue can be seen in the Museo Civico. The fountain consists of a large basin with coloured marble that was renovated in the 17th century by the Venetian Ludovico Torresini.

Palazzo Malatestiano

At the opposite side of Piazza XX Settembre is the Palazzo Malatestiano. The palace was the family residence of the Malatesta family that was in power from the end of the 12th century to about the mid-1400s.

Today Palazzo Malatestiano houses the Museo Archeologico e Pinacoteca del Palazzo Malatestiano and numerous ancient artefacts in the palace court, Corte Malatestiana.

Museo Civico

The civic museum in Fano is called the Museo Archeologico e Pinacoteca del Palazzo Malatestiano. The archaeological museum and art gallery contains artefacts from around Fano dating back to prehistoric times through to the Roman period, and is divided into four main areas: the Archaeological section, the Ceramics section, the Numismatics Section and the picture gallery, the Pinacoteca.

The Pinacoteca was originally commissioned by Pandolfo III Malatesti and built in the early 15th century. The art gallery consists of paintings from the 15th, 16th and 17th centuries by artists from Fano and from the schools of Bologna, Venice and Rome, as well as works of contemporary art.

Biblioteca Federiciana

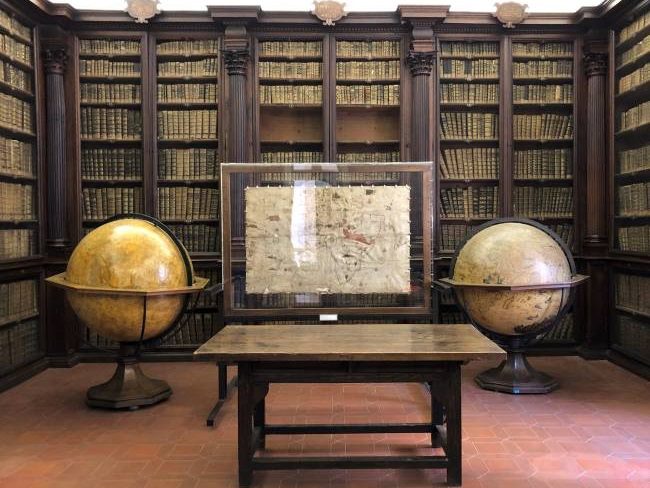

One of the hidden gems in Fano’s town centre is the Biblioteca Federiciana (Federiciana Library), a historical library established in 1681 by Abbott Dominic Federici, who housed a rare collection of books, manuscripts and maps in this library and upon his death, requested in his will that it would be left to the fathers of the Oratory of St. Pietro in Valle and opened to the public.

Today Biblioteca Federiciana Fano has a vast collection that includes ancient and modern works, prints and drawings, musical collections, atlases and geographical texts and thousands of volumes from the 15th, 17th and 18th centuries.

The Sala dei Globi (Room of Globes) within the library features a pair of splendid terrestrial and celestial globes that were created for Abbott Federici by geographer and cosmographer Vincenzo Coronelli in 1688, shown with a great navigation paper designed by Visconte Maggiolo in 1504, one of the few still existing.

Rocca Malatestiana

One of the main monuments and key attractions in Fano is Rocco Malatestiana, an imposing medieval and Renaissance fortress located at the northern corner of Fano’s Roman wall.

The enormous and well-preserved fortress was built in the 15th century and regularly hosts cultural and musical events throughout the year.

Fano Markets

There are Farmer’s Markets, street markets and Fish Markets running regularly in the Fano historical centre. On Wednesdays and Saturdays, the main pedestrianalised roads and squares in the Fano city centre are lined with street vendors selling clothing and shoes, home goods, gadgets and plenty more at bargain prices.

Most mornings you’ll find the Farmer’s Market open in Piazza Andrea Costa, a short walk from Piazza XX Settembre, with several stands offering a selection of fresh fruit and vegetables.

Also in Piazza Andrea Costa, is Fano’s famous covered fish market, Mercato Ittico, which is open Tuesdays to Saturdays, from 0730 to 1330. 12 pescherie (fishmongers) sell a wide range of freshly caught fish and seafood brought into the Porto di Fano.

Porto di Fano

Fano has served as a port since Roman times, and today Porto di Fano is one of the most important Adriatic fishing ports. The port of Fano sits between the town’s Lido and Sassonia beaches and the touristic port, Marina dei Cesari. Locals often come to the port of Fano first thing to buy seafood when the fishermen are just returning with their catch.

Moretta Fanese

A traditional drink that you must try when visiting Fano is the moretta coffee. Moretta is made with three different liquors – anise, rum and cognac – and lemon peel. Each bar has its own special recipe, and one of the best places for a moretta is the Caffè del Porto, located right across from the fishing boats.

The moretta fanese is typical to Fano and is said to have originated as a popular drink for local fishermen to get through the cold and windy days at sea.

You can also purchase moretta liquor blend to try your hand at creating the moretta drink at home. Local shops and bars selling moretta liquor include Caffè del Porto, Bon Bon Art Café in Lido and L’enoteca Il Buongusto in Fano Centro Storico.

Near the Porto di Fano and tucked away from Lido promenade, there is a neighbourhood called El Gugul, with picturesque, narrow roads and quaint, traditional fishermen’s homes marked with maritime flags. “El Gugul” comes from the name of a funnel-shaped fishing net (gugullo) that was used to block the shallow waters and trap fish and eels in a series of successive nets.

El Gugul is a lovely area to explore part of Fano’s maritime past, with brightly coloured, restored buildings decorated with objects that highlight the area’s seafaring traditions. Many of the names shown on the walls outside of these homes are the names of old fishing boats.

Fano Trabucchi

One of the characteristic sights to see on Fano’s coast are the well-preserved trabucchi, or fishing huts, that line the end of the main pier.

The trabucco is an ancient fishing machine, on large wooden structures on stilts, that is typical of the Adriatic coast.

At the end of the pier, you will see a bright green lighthouse as well as the statue “La Tempesta” by Getulio Roberti dedicated to the fallen at sea.

Fano Beaches

The region of Le Marche boasts one of the highest number of Blue Flag beaches of any region in Italy, three of which are in Fano. The prestigious Blue Flag is an important “eco-label” awarded by the Foundation for Environmental Education to environmentally well-kept beaches across Europe that meet strict criteria including water quality, environmental management, safety and other services.

The three Blue Flag beaches in Fano are the North Beach, Sassonia Beach and Torrette Beach, located south of the city centre.

One of the most popular beaches in Fano is Lido, where the sandy beach near a lively promenade is set up with rows of umbrellas from May to early September.

Lido Beach is protected by two jetties on either side which create a calm beach environment, that coupled with the shallow waters make it ideal for families. There are several bagni along Lido Beach, where customers can hire a space on the beach with an umbrella and chairs by the day, week or for the full summer season.

The bagni provide services that include food and drink bars, toilets and outdoor showers, beach huts for hire and often pedalos and outdoor sports facilities.

Lido Promenade

The Lido promenade is a busy spot with children’s playgrounds and summer fun fair, several bars, cafés and restaurants, shops selling beach gear and a regular programme of festivals and street markets.

One of the best places for gelato in Fano is Bon Bon Art Café, also popular for its pastries, cakes and cocktails.

Sassonia Beach

South of Lido and Fano’s port and marina is Sassonia, named after its pebble beach and one of Fano’s Blue Flag beaches. Sassonia is a popular spot for kayaking, windsurfing and kiteboarding.

There are several sports facilities at Sassonia Beach, including tennis and volleyball courts and outdoor swimming pools.

Fano Restaurants

Osteria al 26.

Via Gasparoli, 59, 61032 Fano | facebook.com/osteriaal26

Located in the heart of the historical centre, Osteria al 26 is one of our top local restaurants in Fano that we regularly to when we visit.

We always eat well, whether we order our favourites from the main menu, such as the tagliata, or try new dishes from their daily specials.

Highly recommend visiting for the lovely ambience, the consistently great food and extensive wine list. Osteria al 26 Fano is also a dog-friendly restaurant.

View the menu at Osteria al 26

Osteria dalla Peppa

Via Vecchia, 8, 61032 Fano | www.osteriadallapeppa.it

Osteria dalla Peppa is a charming restaurant in Fano’s city centre that serves authentic specialties local to the Marche region. Osteria dalla Peppa uses only ingredients grown or bred in the area, with everything handmade and representing the local gastronomy.

One of the local specialties offered at Osteria dalla Peppa is the cresc’tajat, a rustic handmade pasta dish made with polenta, flour and water, and served with beans.

The handmade cappalletti is another top local speciality, served on a select days of the week. Cappalletti are small meat and cheese filled “little hat” shaped pasta which are traditionally served in broth on Christmas Day and New Year’s Day in the Marche region.

View the menu at Osteria dall Peppa

Ristorante Levante

Via Cesare Simonetti, 2a, 61032 Fano | www.levante-food.com

Ristorante Levante is the best waterfront restaurant in Fano, located on the main pier with coastal views towards Pesaro, overlooking the Fano beaches.

Levante Fano is the perfect spot for enjoying a sunset dinner or special occassion in a bright, beautifully decorated setting by the sea.

Ristorante Levante serves mainly seafood dishes, offering local specialties such as spaghettone with clams (vongole) and bottarga, traditional fish stew (brodetto), risotto with scampi, sea bream and ricotta cappalletti.

Ristorante Levante also offers a limited menu of non-seafood items, including spaghetti cacio e pepe, beef tenderloin and filet steak. Levante is one of our favourite Fano restaurants that we go to regularly, even for special New Year’s Eve dinners several times in recent years.

View the menu at Ristorante Levante

Ristorante Pizzeria Florida

Via Cesare Simonetti, 31, 61032 Fano | www.florida-fano.it

Located steps away from Fano’s seaside promenade, Ristorante Pizzeria Florida is great for outdoor dining in the summer months, with a large outdoor garden space and lively atmosphere.

Great for families, Ristorante Pizzeria Florida serves a wide choice of wood oven-baked pizzas, along with a menu of seafood, meat and vegetarian dishes. Florida also offers a takeaway service.

The Lido location is closed during the winter months. You can still enjoy Florida’s menu offering at its sister restaurant in the Fano town centre, Ristorante Orfeo on Corso Giacomo Matteotti.

View the menu at Ristorante Pizzeria Florida

Ristorante Pizzeria La Mandria

Viale Buozzi, 24/26, 61032 Fano | www.ristorante-lamandria.it

Located near the Porto della Mandria in the historical centre of Fano, Ristorante Pizzeria La Mandria serves mainly pizza, grilled steak and pasta dishes.

Some of our favourite dishes at Ristorante Pizzeria La Mandria are gnocchi with meat ragu, steak tagliata with roasted potatoes and the classic filet steak. Ristoriante Pizzeria La Mandria also offers a takeaway service.

View the menu at Ristorante Pizzera La Mandria

Travelling to Fano Italy

The closest airport is the Ancona (Marche) Airport (AOI, formally Ancona Falconara Airport) which is about an half an hour drive from Fano. RyanAir has daily flights between Ancona Airport and London Stansted (STN).

The next closest airport, just under 2 hours drive away from Fano, is Bologna Guglielmo Marconi Airport (BLQ) which British Airways flies to out of London Heathrow a few times a week.

I hope you found this travel guide to Fano, Italy helpful! Fano is my husband’s hometown and we visit regularly to see his side of the family. I’ll keep this post updated with our most up-to-date recommendations for the top things to do in Fano, Italy with kids and the best restaurants in Fano Italy.

This post was updated on 29 June 2023 with updated information and photos for restaurants in Fano.

Pin for Later – Things to Do in Fano Italy

Ruth | Tanama Tales

Super cute town full of color! I like that it is located by the sea. The water looks beautiful. I have never tried pasta with beans. That sounds good. Well, all the food pictured in here looks delicious. #FarawayFiles

Never heard of Fano but it certainly looks cute! 🙂 #FarawayFiles

Tanja (the Red phone box travels)

pretty town #farawayfiles

Corey at fifi + hop

I’ve never been to this region of Italy but it looks so peaceful and pretty – always nice when you have relatives that live in a picturesque part of the world! #farawayfiles

Katy Clarke

How lovely Cindy. Looks like you had a wonderful Pasqua in Fano. I love the ritual around Easter in Italy with so many different foods to try and relatives to visit. It’s simple, yet exhausting at the same time I think. Thanks for joining #FarawayFiles

Clare (Suitcases and Sandcastles)

How lucky you are to be able to visit so often. Fano looks utterly delightful – I love the colour of the buildings, that wonderful harbour and that food… Thanks for sharing on #FarawayFiles

Erin Gustafson (@oregongirlworld)

Oh my goodness that food looks sooo good. I adore strolling back alleyways as well and those colorful little corners are gorgeous! Thanks for sharing with #FarawayFiles, Erin

Nell (Pigeon Pair and Me)

This looks amazing! I’m imagining that fish right now, fresh from the sea…

Comments are closed.

You May Also Like

Guide to Disneyland Paris Attractions

Hike to Lago d’Arpy, Aosta Valley, Italy with Kids

Europe Road Trips with Kids

Privacy Policy

The Best Guide For Your Visit To Fanø, Denmark

The small island of Fanø, just 12 minutes by ferry from Esbjerg on the west coast of Denmark, has so much to offer, especially for nature lovers. It’s worth staying over for at least one night if you have the chance.

Fanø lies within the UNESCO-listed Wadden Sea National Park, Denmark’s largest national park. In addition to spotting seals, you can explore the beaches, the dunes, and local museums, look for amber and visit Sønderho, the winner of the prettiest village in Denmark award.

Disclosure: This website is owned and operated by My Path To Travel. As an Amazon Associate, I earn from qualifying purchases. I earn commissions for links to SHEMedia, Booking.com, and other retailers. See My Path To Travel Disclaimer for more information.

What To See And Do In Fanø, Denmark

- How And Where To See Seals on Fanø

- What To Do on Fanø Beaches

- The Best Places For Birdwatching on Fanø

- What is Fanø Klitplantage

- Cycling And Hiring A Bike on Fanø

- What To See And Do at Sønderho

- What To See And Do at Nordby

- Food and Drink on Fanø

- Where Are The ATMs on Fanø

- What Are The Porcelain Dogs You See in The Windows Around Fanø

- Where is Fanø

- How To Get To And Get Around Fanø

- Where To Stay in Fanø

- Emergency Phone Numbers For Fanø

- Fanø Tourist Information Office

How And Where To See Seals On Fanø Island

You may get lucky if the tide is out and spot seals as you wander along the coast. I saw a colony of harbour seals resting on a sandbank just down the road from the ferry port opposite Fanø Krogaard.

Alternatively, there are two tour options to spot seals on Fanø: a seal safari or a boat trip.

Take A Guided Walk To Spot Seals

The seal safari is a 1.7 km (1 mile) guided walk, beginning at Seal Bank Walk Meeting Point at the end of Sønderho Strandvej to Galgerevet, a large sandbank southwest of Sønderho.

Outside of the summer months, you’ll need layers of warm clothes and wellingtons, which you can hire for 25 kr from Club Fanø.

The tour lasts 2 hours and costs 150 kr per person for adults and 60 kr for children aged 4 to 14.

However, if you book the Seal Tour online , you pay an additional 12 kr per adult ticket and 9 kr for children aged 4 to 14. Email bookings at [email protected] do not incur a booking fee.

Take A Seal Watching Boat Trip

Alternatively, from the middle of April until the end of October, you can take a 2-hour boat trip from Fanø Marina in Nordby to the seal banks north of Fanø. The small boat holds up to 12 people, so reserve your place on Tour Boat Martha well in advance. Contact via email .

There are two daily trips, one at 11 am and the other at 2 pm.

The trip costs 300 kr per person for adults and 150 kr for children up to 12 years old.

You should be aware that there is no gangplank; getting on and off the boat is via a vertical ladder and is difficult for people with mobility issues.

Things To Do On Fanø Beaches

Fanø Beach and Rindby Beach offer the perfect area for swimming and sunbathing. However, if you’re looking for something more adventurous, contact Club Fanø to learn how to skimboard, use one-wheeler skateboards, kite surf or kite landboard. Whatever you choose, you’re sure to have an unforgettable experience!

Try Blokarts At Buggy Beach

To the south of Rindby Beach, you’ll find ‘buggy beach’ where you can try out Blokarts, a three-wheel, sail-driven sand kart, kite surfing, kite buggies and land boards. Contact the Blokart School Club Fanø to book a lesson and hire a Blokart.

Enjoy The International Kite Flying Meeting on Fanø Beach

Every June, Fanø hosts an international kite-flying meeting on Fanø beach. The wide beach and perfect wind conditions make Fanø an excellent place for kite flying. The next International Kite Flying Meeting is on the 20th to the 23rd of June, 2024.

Search For Amber On Fanø Beach

One of Denmark’s best places to look for amber is Fanø Beach, which is a little further south than the buggy beach.

Amber can be washed up on the shoreline during a period of low tide following a particularly severe storm. Storms during autumn and winter tend to bring up more amber, making these seasons ideal for amber hunting.

Beachcombers looking for amber should pay attention to where the birds are congregating. Plenty of birds means food and the tide may have also brought in amber.

The Best Spots For Bird Watching on Fanø Island

- The white-tailed eagle, Denmark’s largest bird of prey, can be seen around Fanø Klitplantage during the winter.

- From March to May and August to October, up to 15 million migratory birds use the Wadden Sea as part of their migration route between the Arctic and Africa. The best place to watch migratory birds on Fanø is Hønen, the beach area just south of Sønderho.

- An artificial coastal lake just north of the beach at Sønderho has a camouflaged observation room overlooking the dunes, ideal for birding.

- You are likely to spot the migratory birds east of Sønderho at high tide, but this is a people-free zone, so take binoculars.

What Is Fanø Klitplantage?

Fanø Klitplantage, also known as Fanø Dune Plantation, is a forested area in the centre of the island covering 1,421 hectares. The landscape is an ideal setting for recreational activities such as hiking and birdwatching, consisting of dunes, small lakes, meadows and marshes.

There are three marked hiking trails through the plantation and the chance to spot fallow or red deer and rabbits.

In addition, there is a children’s playground and a dog forest where dogs can run freely off the leash.

Car Parks At Klitplantage

Klitplantage offers several car parking areas for visitors –

- Pælebjergvej, the highest point on Fanø

- One car park at each end of Tolvteskiftvej

- Albue Fulgekoje on Fulglekøjevejen

- Paradisdalen og Gåsehullerne

Travelling outside Copenhagen may be daunting due to the complexity of the language. To ensure your trip goes as smoothly as possible, I have compiled a comprehensive list of Danish words and phrases – Useful Danish Words For Your Trip To Denmark . I recommend keeping this list with you as it will be helpful during your trip to Fanø.

Cycling And Hiring A Bike On Fanø

Five cycle routes on Fanø range from 42 km (26 miles) to 7 km (4.3 miles) in length. Route maps can be purchased from the tourist information office in Nordby.

Where To Hire A Bicycle On Fanø

What to see and do in the village of sønderho.

It’s easy to see why the picturesque village of Sønderho, located at the southern tip of Fanø, won the prestigious title of the Prettiest Village in Denmark. To learn more about its charm, you can take a walking tour and discover the hidden gems with the help of a Club Fanø guide .

Fanø Art Museum (Fanø Kunstmuseum)

The Fanø Art Museum exhibits temporary collections and a permanent exhibition by painters connected to Fanø.

Fanø Art Museum closes from the end of October until the end of March.

Fanø Art Museum Opening Hours, Ticket Price And Website

How to get to fanø art museum.

The Fanø Art Museum is in Sønderho, 350 metres (383 yards) from Sønderho Church. Address – Nordland 5, 6720, Fanø .

Sønderho Windmill, Fire And Lifeboat Museum Information

Sønderho Windmill, Fire Museum, and Lifeboat Museum are not staffed, so payment is by Mobile Pay or put cash in the box at the entrances.

Sønderho Windmill (Sønderho Mølle)

The Sønderho windmill, constructed in 1895, hasn’t worked since 1923. Over the years, the windmill has fallen into various states of disrepair. A storm caused the last significant damage in 2013, but it has since been restored and is worth a visit.

How To Get To Sønderho Windmill

Sønderho windmill is 650 metres (711 yards) from Sønderho church. Address – Vester Land 44, 6720, Fanø.

Sønderho Fire Museum (Sprøjtehuset)

The Sønderho Fire Museum is one of Denmark’s oldest and best-preserved firehouses. It’s known as Sønderho Brandmuseum and Sønderho Sprøjtehuset.

How To Get To Sønderho Fire Museum

Sønderho Fire Museum is 350 metres (383 yards) from Sønderho Church and just 35 metres (38 yards) from Fanø Art Museum. Address – Nord Land 12, 6720, Fanø .

The Old Rescue Station Museum / Sønderho Lifeboat Museum (Sønderho Gamle Redningsstation)

Since its opening in 1889, the Old Rescue Station Museum, also known as Sønderho Lifeboat Museum, still houses the original lifeboat and lifesaving equipment.

How To Get To Sønderho Lifeboat Museum

Sønderho Lifeboat Museum is 500 metres (546 yards) from Sønderho Church along Sønderho Strandvej.

Address – Sønderho Strandvej 15, 6720 Fanø

Hannes House Museum (Hannes Hus)

Hannes House is a recreation of a Fanø sea captain’s home. Hanne and her daughter inhabited it until 1965 when Fanø Trust took over the house and preserved it with its original furnishings.

Hannes House Visitor Information

How to get to hannes house.

Hannes House is 600 metres (656 yards) from Sønderho Church. Address – Østerland 7, 6729, Fanø .

Sønderho Church

Many Danish churches have consecrated model ships hanging from the roof, but Sønderho Church has fifteen, more than any other church in Denmark.

Sønderho church, constructed in 1782, contains a 13th-century font, a pulpit from 1661 and an altar from 1717.

Sønderho Church Website

Sønderho Church Opening Hours

Sønderho Church is open 9 am – 4 pm, but those hours could change due to weddings, funerals or other church events.

How To Get To Sønderho Church

Sønderho Church is just 110 metres (120 yards) from the bus stop on Landevejen. Address – Sønderho Strandvej 1A, 6720, Fanø .

What To See And Do In Nordby

Norby is Fanø’s capital and entry point for visitors arriving by ferry. Explore the quaint streets or wander the promenade with a chance to glimpse seals basking in the water, visit a museum or enjoy one of the charming cafes or restaurants around the small town.

Visit Fanø Museum

The Fanø Museum, established in 1941 and housed in a historic residence owned by Hans Peter Thomsen’s family from 1885 until 1935, offers a unique perspective showcasing the family and presents exhibitions that delve into the fascinating history of life in Fanø.

Fanø Museum Opening Hours, Ticket Price & Website

How to get to fanø museum.

Fanø Museum is 650 metres (710 yards) from the ferry terminal. Address – Skolevej 2, 6720, Nordby .

Fanø Shipping And Costume Collection (Fanø Skibsfarts And Dragtsamling)

The Fanø Shipping and Costume collection contains three permanent exhibitions.

- The costume exhibition features a collection of children’s and women’s clothes only worn by the people of Fanø.

- The shipping exhibition features a scaled model ship collection and highlights a Fanø sailor’s life on board a ship.

- The scaled model of Fanø shows the towns of Nordby and Sønderho in 1890.

How To Get To The Fanø Shipping And Costume Collection

The Fanø Shipping and Costume Collection is 350 metres (383 yards) from the Nordby ferry terminal. Address – Hovedgaden 28, 6720 Fanø .

If you enjoy museums, there are plenty more to visit in Esbjerg, Ribe and the surrounding areas. Check out this article The Best Things To Do In Esbjerg And Why You Should Visit to find out more.

Nordby Church (Nordby Kirke)

Nordby Church is a Lutheran church constructed in 1786. The pulpit and altar are from 1622, and the church organ is from 1845. Like most churches in Denmark, consecrated models of ships hang from the roof.

Nordby Church is open to visitors between 9 am and 4 pm. However, it may be closed for weddings, funerals, and other events.

Nordby Church Website

Address – Hovedgaden 105a, Nordby, 6720, Fanø .

Food And Drink On Fanø

You won’t go hungry on Fanø; there are plenty of places to eat and drink on the island. However, as the island gets busy during the summer months, it’s best to reserve a table in advance if you want to eat at a particular restaurant.

If you’re self-catering or fancy a picnic, there are Super Brugsen supermarkets in Nordby and Sønderho, close to the beach in Rindby and a Spar supermarket in Nordby.

Where To Find ATMs on The Island Of Fanø

There are ATMs on Fanø, including a Danske Bank ATM at Hovedgaden 74 in Nordby . However, it’s best to withdraw cash from ATMs in Esbjerg rather than wait until you are on the island.

If possible, try to avoid using Euronet ATMs. While all Danish banks charge foreign cards, Euronet charges more than reasonable. In addition, Euronet’s exchange rates are appalling, and finding online information about their costs is virtually impossible.

Don’t Use Euronet ATMs

Euronet’s exchange rate is appalling. They charge a transaction fee and a terminal exchange fee, and of course, they add your own bank charges to the transaction. That’s three fees on top of the worst exchange rate out there!

Why Are There Porcelain Dogs In The Windows On Fanø?

Porcelain dogs can be seen in the windows of homes, especially around Sønderho. This tradition dates back to when Fanø and Esbjerg had Denmark’s largest fishing harbour. The dogs, believed to be Staffordshire King Charles Spaniels, are a sign that the men have gone to sea and are watching for their return. When the dogs face inward, it means the sailors have returned.

Not only will you see the porcelain dogs in all the windows, but they’re also for sale in many souvenir shops around the island.

Where Is Fanø, Denmark?

Fanø is located off the southwest coast of Denmark, approximately 16 km (10 miles) from the city of Esbjerg. You must take the ferry from Esbjerg to reach the island, which takes just 12 minutes.

The island of Fanø is 16 km (10 miles) long and just 5 km (3 miles) at its widest and has a resident population of 3,400. The Danish/German border at Padborg/Harrislee is 115 km (71 miles) south of Fanø.

Esbjerg offers a wide variety of attractions and activities, so I have written a separate article entitled The Best Things To Do In Esbjerg: Why You Should Visit , highlighting what you can see and do in the city.

How To Get To Fanø Island

Initially, you’ll need to get to Esbjerg before sailing across to Fanø. If you’re travelling from Copenhagen, take a look at my article How To Travel From Copenhagen To Esbjerg .

How To Get To Fanø From Esbjerg

To get to Fanø from Esbjerg, you’ll need to take the Fanølinjen ferry from Dokvej 5, 6700 Esbjerg .

The ferry port (færgen in Danish) is 2 km (1.2 miles) from Esbjerg train station and 1½ km (1 mile) from the city centre.

What You Need To Know About The Fanø Ferry

Regular sailings take 12 minutes between the ports of Esbjerg and Fanø. While tickets can be purchased at the port, buying them online is more convenient.

Before embarking on the ferry at Esbjerg, scan your ticket. No ticket checks will be performed on the return trip from Fanø to Esbjerg, as all tickets are for a round trip.

Timetables vary depending on the season, ranging from high to intermediate and low.

Esbjerg To Fanø Ferry Ticket Prices

An adult pedestrian return ticket on the Fanø ferry costs 49 kr . Children and young adults under 18 travel free of charge. There is no charge for taking your bicycle on the ferry.

An adult return ticket from Esbjerg to Fanø is 49 kr . Children under 18 travel for free.

The cost of taking a vehicle across on the ferry varies by vehicle size and the time of year. Check the Fanølinjen website to find the price and reserve your tickets.

How To Get Around Fanø

You can choose to get around the island using the public bus, the Telebus, a taxi, or hire a bicycle.

Using The Public Service Bus on Fanø

The public bus service on Fanø travels regularly around the island, with the public bus stop at Nordby next to the Fanø ferry port.

The bus station at Søndero is next to the public library at Landevejen 35, Sønderho, 6720 Fanø .

Check out the Fanø Kommune website for ticket prices and timetable

While the public bus regularly runs between Nordby and Sønderho, there aren’t many services travelling to the beach, especially during the week; this is where the Beach Bus comes in handy.

The Fanø Beach Bus (Strandbussen)

At busy times of the year, such as Easter, the summer holidays (from the middle of June until the end of August), and the October school break, the Fanø Beach Bus (Strandbussen), an eight-seater minivan, travels a circular route between the ferry in Nordby, Fanø beach, and Rindby beach.

The Fanø Telebus And How To Use It

The Fanø Telebus is an 8-seater minivan that offers community transport to and from Nordby to Sønderho and stops in between. It travels between the hours of 7 pm and 11 pm. The Telebus doesn’t travel a scheduled route but travels according to customer needs.

For more information about the Fanø Telebus, check out the Fanø Kommune website .

How To Order The Fanø Telebus

You can only reserve the Telebus on the day you wish to travel.

To order a Telebus ride, call +45 29 68 82 00 .

The Telebus has a lift and is suitable for people with mobility issues, but you must state whether you will bring a wheelchair, walker or similar when booking your journey.

How To Use Taxis On Fanø

If you need transport outside the scheduled public bus and Fanø Telebus times, call Fanø Taxa on +45 88 44 33 99 .

There are a limited number of taxis on the island, so reserve well in advance and anticipate waiting times during busy periods. If you know, you’ll need a taxi outside the regular operating hours’ reserve your taxi before 10 pm.

The taxi office operates from Esbjerg and is open 24 hours a day, but taxis don’t operate outside the hours shown below.

Fanø Taxi Operating Hours

Where to stay on fanø island, denmark.

Generally speaking, accommodation is centred around –

- Nordby, the capital of Fanø Island

- Sønderho, the winner of the prettiest village in Denmark award

- Rindby, close to the Rindby beach

There’s plenty of accommodation on Fanø during the summer, including hotels, homestays, camping, and private accommodation. But Fanø is understandably popular, so reserve your accommodation well in advance.

Emergency Phone Numbers For Fanø, Denmark

Dial (+45) 114 For The Local Police On Fanø

If your service provider is outside Denmark, remember to add +45 before dialling ( Fanø police +45 114 ).

I’m Here To Help If You Have Any Questions

If you have any questions about your trip to Denmark, please don’t hesitate to contact me. I know how difficult it can be to plan a trip, especially when there is so much to see and do, and I’m happy to help.

What To See And Do In And Around Esbjerg

The Best Way To Travel From Copenhagen To Esbjerg

There are three ways to travel directly from Copenhagen to Esbjerg. With rising fuel costs, it’s a good idea to plan your journey to get the best deal. The easiest way to travel from Copenhagen to Esbjerg is by direct…

The Best Things To Do In Esbjerg And Why You Should Visit

Esbjerg is a city on the west coast of Denmark that can be reached in under 3 hours from Copenhagen. With a population of 72,000, it’s the fifth-largest city in Denmark. Yet, despite its size, it retains a cosy feel….

Are you also a fan of beautiful Fanø?

World-class beach, nature and culture.

15 km. beach, seals, dunes, nature playground, the cozy villages of Nordby and Sønderho, art museum and galleries, maritime history, gourmet experiences.

Fanø offers many exciting experiences throughout the year.

Beautiful Fanø in pictures

There are almost no limits to beautiful motifs on Fanø. Here is a small selection of the things you can see and experience here on Fanø.

Fanø offers experiences all year round

Sønderho

- Credit Cards

- Best No Annual Fee Travel Credit Cards

Best No-Annual-Fee Cards For Travel Of April 2024

Fact Checked

Updated: Apr 24, 2024, 3:32pm

Using a travel rewards credit card has long been celebrated as an easy strategy to travel the world for less. Consumers can apply for rewards credit cards and earn points and miles on everyday spending, then redeem rewards for airfare, hotel stays, rental cars and more.

The annual fees travel cards often charge can be worth it if you use the benefits you receive, but not everyone wants to pay a fee to hold a card. Fortunately, many travel credit cards offer benefits for no annual fee.

Why you can trust Forbes Advisor

Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below.

- 113 countries visited

- 5500 hotel nights spent

- 93,000,000 miles and points redeemed

- 29 loyalty programs covered

Best No-Annual-Fee Travel Credit Cards

- Chase Freedom Flex℠ * : Best No-Annual-Fee Travel Card With Rotating Categories

- Chase Freedom Unlimited® : Best Flat-Rate No-Annual Fee Travel Card

- Wells Fargo Active Cash® Card : Best No-Annual-Fee Flat-Rate Cash-Rewards Card for Travel

- Wells Fargo Autograph℠ Card : Best for Everyday Spending

- Alliant Cashback Visa® Signature Credit Card * : Best No-Annual-Fee Credit Union Card for Travel

- Discover it® Cash Back : Best No-Annual-Fee Card To Earn Cash Back on Travel

- Blue Cash Everyday® Card from American Express : Best No Annual Fee Amex Card for Travel

- Bilt World Elite Mastercard® : Best No-Annual-Fee Card To Earn Rewards on Rent

- U.S. Bank Altitude® Go Visa Signature® Card * : Best No-Annual-Fee Card for Dining

- Hilton Honors American Express Card : Best No-Annual-Fee Card for Hilton

- Amex EveryDay® Credit Card * : Best for Earning Membership Rewards Points

- United Gateway℠ Card : Best No-Annual-Fee Airline Card

- Marriott Bonvoy Bold® Credit Card * : Best No-Annual-Fee Hotel Card

- Best Credit Cards Of 2024

- Credit Cards With Travel Insurance

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best Credit Card For Lounge Access

- Best Airline Credit Cards

Wells Fargo Autograph℠ Card

Up to 3X Reward Rate

Earn unlimited 3X points on the things that really add up – like restaurants, travel, gas stations, transit, popular streaming Read More

Welcome Bonus

20,000 bonus points

Regular APR

20.24%, 25.24%, or 29.99% Variable APR

Credit Score

Good, Excellent (700 - 749)

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months – that’s a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up – like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Best No-Annual-Fee Travel Credit Cards of 2024

Best no-annual-fee travel card with rotating categories, chase freedom flex℠ *.

Up to 5% Reward Rate

Earn 5% cash back in categories that rotate quarterly on up to $1,500 when enrolled, 5% on travel purchased through Read More

$200 bonus + 5% on Gas and Grocery (excluding Target and Walmart)

20.49% - 29.24% Variable

Excellent, Good (700 - 749)

This card has the brawn to handle just about all of your credit card spending needs without an over-inflated price tag. The card has an annual fee of $0, yet comes with a pumped-up earnings structure that covers a wide swath of expenses including travel, drugstores and dining plus rotating quarterly bonus categories in areas many households are likely to find appealing.

- No annual fee

- Rotating quarterly categories earn 5% rewards when activated, up to a combined quarterly $1,500 maximum

- Travel rewards rate rivals some of the best premium travel cards

- Generous rewards rate in several other categories

- Travel bookings must be made through Chase Travel℠ to earn 5% cash back

- Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Plus, earn 5% cash back on combined gas station and grocery store purchases (excluding Target and Walmart) on up to $12,000 spent in the first year

- 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% on travel purchased through Chase Travel℠, 3% on dining and drugstores and 1% on all other purchases

Best Flat-Rate No-Annual Fee Travel Card

Chase freedom unlimited®.

Up to 6.5X Reward Rate

Earn an additional 1.5% cash back on up to $20,000 spent in the first year, after that 5% cash back Read More

Up to $300 cash back

A good overall spending card that allows you to hold a balance on new purchases with a low introductory APR, pay no annual fee, and still earn at least 1.5% cashback on all purchases

- Generous welcome offer for a no annual fee card

- Unlimited 1.5% minimum earn rate for cash-back rewards

- No minimum redemption amount

- Foreign transaction fee

- Ongoing balance transfer fee is high

- Requires a companion card to transfer points to travel partners

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

Best No-Annual-Fee Flat-Rate Cash-Rewards Card for Travel

Wells fargo active cash® card.

Unlimited 2% Rewards Rate

Earn unlimited 2% cash rewards on purchases

$200 Cash Rewards

The Wells Fargo Active Cash offers an unlimited 2% cash rewards rate on purchases and charges no annual fee. This puts it in competition with the best flat-rate cash back cards on the market.

- Unlimited 2% cash rewards on purchases

- $0 annual fee

- Cellphone protection benefit

- There’s a balance transfer fee

- There’s a foreign transaction fee

- No travel transfer partners

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- No categories to track or remember and cash rewards don’t expire as long as your account remains open.

Best for Everyday Spending

Earning 3 points per dollar spent on a wide range of spending—including restaurants, travel, gas stations, transit and popular streaming services—for no annual fee, the Wells Fargo Autograph is a powerhouse.

- No foreign transaction fee

- Introductory APR period

- Plentiful reward points categories

- Protections include cell phone insurance

- Balance transfer fee

- No introductory balance transfer APR

Best No-Annual-Fee Credit Union Card for Travel

Alliant cashback visa® signature credit card *.

Up to 2.5% Reward Rate

Those eligible for Tier 1 Rewards earn 2.5% cashback on the first $10,000 of qualifying eligible purchases per billing cycle Read More

17.24% - 27.24% variable

Excellent (750 - 850)

If you regularly rack up your monthly balance, the 2.5% return on the Alliant card is hard to beat. The downsides are that excellent credit is recommended before you apply for the card and the lack of a welcome bonus.

- 2.5% cash back rate on up to $10,000 in monthly purchases for eligible accounts (then 1.5%)

- No foreign transaction fees

- Generous credit line

- No intro APR offer

- No welcome bonus

- Requires a companion checking account with balance, direct deposit and e-statement requirements

- Earn up to 2.5% cash back with no categories to track on up to $10,000 in purchases each billing cycle with qualifying accounts. All other purchases earn 1.5%

- You can choose to receive cash back from your Alliant credit card via a credit card statement credit (appearing within one billing cycle) or as a deposit into your Alliant checking or savings

- Up to $5,000 of Personal Identity Theft Protection for covered expenses to restore your identity

Best No-Annual-Fee Card To Earn Cash Back on Travel

Discover it® cash back.

Earn 5% cash back on everyday purchases at different places each quarter like grocery stores, restaurants, gas stations, and more, Read More

Cashback Match™

17.24% - 28.24% Variable APR

Excellent/Good

For moderate spenders who are willing to activate the 5% rotating categories and track the quarterly spending cap, this no-annual-fee card can deliver tidy rewards outside of its ongoing 1% earning rate.

- 5% cash back on quarterly rotating spending categories throughout the year (activation required)

- Discover will automatically match all the cash back you’ve earned at the end of your first year

- No minimum cashback redemption

- 5% bonus cashback rate is limited to $1,500 per quarter in spending

- Bonus categories must be activated quarterly

- Low 1% base reward rate on everything else

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

Best No Annual Fee Amex Card for Travel

Blue cash everyday® card from american express.

Up to 3% Reward Rate

Earn 3% cash back at U.S. supermarkets, U.S. gas stations, and online retail purchases in the U.S. on up to Read More

19.24%-29.99% Variable

Excellent/Good (700 - 749)

For no annual fee, the Blue Cash Everyday® Card from American Express offers excellent value in the right hands. Spending a lot at U.S. supermarkets and U.S. gas stations brings plump rewards, while the introductory APR rate on purchases helps keep your interest expenses down. Look elsewhere for foreign transactions.

- Introductory APR offer on purchases and balance transfers

- Above-average earnings at U.S. supermarkets, U.S. gas stations and online retail purchases in the U.S.

- Elevated earnings at U.S. supermarkets, U.S. gas stations, and online retail purchases in the U.S. are capped at $6,000 in annual spending per category

- Rewards earning outside of the bonus categories is just 1% cash back

- Earn a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months.

- No Annual Fee.

- Balance Transfer is back! Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. After that, 19.24% to 29.99% variable APR.

- 3% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%.

- 3% Cash Back on U.S. online retail purchases, on up to $6,000 per year, then 1%.

- 3% Cash Back at U.S. gas stations, on up to $6,000 per year, then 1%.

- Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

- Thinking about getting the Disney Bundle which can include Disney+, Hulu, and ESPN+? Your decision made easy with $7/month back in the form of a statement credit after you spend $9.99 or more each month on an eligible subscription (subject to auto renewal) with your Blue Cash Everyday® Card. Enrollment required.

- Enjoy up to $15 back per month when you purchase a Home Chef meal kit subscription (subject to auto renewal) with your enrolled Blue Cash Everyday® Card.

- Terms Apply.

Best No-Annual-Fee Card To Earn Rewards on Rent

Bilt world elite mastercard®.

Up to 3x Reward Rate

1x on rent payments with no transaction fee (on up to 100,000 points each calendar year). 2x points on travel Read More

Good/Excellent (700 - 749)

Pay rent, earn rewards and use your earnings for travel. Sounds like a great way to maximize your rent money to us.

- Earn rewards on rent

- Primary car rental and cell phone insurance

- Points can be transferred to partners

- Requires five card transactions per statement period to earn rewards

- High regular APR range

- Rewards outside of rent spend are relatively low compared to other cards

- Earn points when you make 5 transactions that post each statement period

- 1x points on rent payments with no transaction fee (on up to 100,000 points each calendar year)

- 2x points on travel (when booked directly with an airline, hotel, car rental or cruise company)

- 3x points on dining

- Plus 1x points on other purchases

- Cell Phone Insurance

- Purchase security (theft and damage protection)

- Mastercard® World Elite Concierge

- Lyft Credits

- No foreign currency conversion fee

- Rewards & benefits terms

Best No-Annual-Fee Card for Dining

U.s. bank altitude® go visa signature® card *.

Up to 4X Reward Rate

Earn 4 points per dollar on dining, takeout, and restaurant delivery and 2 points per dollar at grocery stores, grocery Read More

18.24% - 29.24% (Variable)

Excellent Credit (750 - 850)

With no foreign transaction fee and industry-leading earnings on dining, the Altitude Go could get you up into the air quickly.

- No penalty APR

- Generous rewards for a no annual fee card

- Annual credit toward eligible streaming services

- No bonus reward tier for entertainment spending

- Earn 20,000 bonus points after spending $1,000 in purchases in the first 90 days of account opening. That’s a $200 value redeemable towards merchandise, gift cards, cash back, travel and more

- 4 points per dollar spent on dining, takeout, and restaurant delivery

- 2 points per dollar spent on streaming services and a $15 credit for annual streaming purchases

- 2 points per dollar spent at grocery stores, gas stations, and EV charging stations (excluding discount stores, supercenters and wholesale clubs effective September 9, 2024)

- 1 point per dollar spent on all other eligible purchases

- Points never expire

Best No-Annual-Fee Card for Hilton

Hilton honors american express card.

Up to 7X Reward Rate

Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Read More

Earn 80,000 points

20.99%-29.99% Variable

Good,Excellent (700 - 749)

A good intro into the Hilton world without paying an annual fee, the Hilton Honors Card from American Express brings you a few nice perks. But if you’re a serious Hilton traveler, you’ll want to look at one of the higher end cobranded Hilton cards offered by American Express.

- High point earning rates

- Generous welcome bonus

- Automatic Silver status includes fifth night free on award stays

- No annual fee or foreign transaction fee

- No blackout dates

- Low point redemption value

- Silver status comes with limited benefits

- Poor transfer rate to airline partners

- Earn 80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors™ Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors™ Gold status through the end of the next calendar year.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

Best for Earning Membership Rewards Points

Amex everyday® credit card *.

Up to 2x Reward Rate

Earn 2X points at US supermarkets on up to $6,000 per year (then 1X); Earn 2X points at American Express Read More

Earn 10,000 points

18.24% - 29.24% variable

If you are looking for a solid intro APR offer and frequently spend at US supermarkets, this is the card for you.

- Possible to earn 20% bonus on all points earned

- 2 Membership Rewards points per dollar on up to $6,000 spent annually at U.S. supermarkets (then 1 point per dollar)

- 2.7% foreign transaction fee

- Spending cap on bonus points at grocery stores

- Requires 20 purchases per month to earn 20% bonus

- Earn 10,000 membership rewards points after spending $2,000 in qualifying purchases in the first 6 months of card membership

- Earn 2 points per dollar spent on qualifying purchases at US supermarkets up to $6,000 per year (then 1 point)

- Earn 2 points for every dollar when you use your card to book your trip through American Express Travel

- Earn 1 point for every eligible dollar you spend on everything else

- You can use membership rewards points towards eligible charges you make on your card, such as retail, dining, entertainment and more

- Use your card 20 or more times on purchases in a billing period and earn 20% extra points on those purchases

Best No-Annual-Fee Airline Card

United gateway℠ card.

Up to 2x Rewards Rate

2X miles per $1 spent on United purchases, at gas stations and on local transit and commuting. 1 mile per Read More

- Earn 20,000 bonus miles

21.99% - 28.99% Variable

With its simple and respectable rewards rates, plus Visa Signature benefits, casual fliers who are loyal to United will find value in United’s only card with no annual fee.

- Earn 2 miles on purchases with United, at gas stations and on local transportation

- Enjoy expanded United award travel availability

- Earns only 1 mile per dollar spent on non-bonused purchases

- No free checked bag or enhanced boarding benefits

- Earn 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting

- Earn 2 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent at gas stations, on local transit and commuting

- Earn 1 mile per $1 spent on all other purchases

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

Best No-Annual-Fee Hotel Card

Marriott bonvoy bold® credit card *.

3 points per dollar spent at over 7,000 hotels participating in Marriott Bonvoy program, 2 points per dollar on other Read More

Earn 30,000 bonus points

21.49% - 28.49% variable

One of several Marriott credit cards, the Marriott Bonvoy Bold card is the only one without an annual fee. It’s a smart entry-level card for travelers who want to earn points in the Marriott Bonvoy rewards program and enjoy Silver Elite status.

- The first Bonvoy Rewards card with no annual fee

- 15 Elite Night credits per year + Silver Elite status

- Rewards bonus categories are somewhat limited

- 5% fee for balance transfers

- Earn 30,000 bonus points after you spend $1,000 on your first 3 months of account opening.

- Earn 3X points per dollar spent at over 7,000 hotels participating in Marriott Bonvoy®

- Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy member

- 15 elite night credits annually, enough for Silver Elite status, terms apply

Here’s a Summary of the Best No-Annual-Fee Travel Credit Cards

More about the best no-annual-fee travel credit cards.

Navigating the world of credit cards means finding the combination of pros and cons that offer the best value for your needs. A card rewarding your unique spending habits and goals will outperform one that is seemingly best for the average consumer, so make sure to evaluate each card for your specific uses.

Be aware that cards with no annual fee often charge other types of fees. In addition to interest charges incurred when a balance is carried, cardholders may also face penalty charges, including over-limit fees and late payment fees, as well as fees for foreign transactions, cash advances and balance transfers.

If you’re looking for a cash-back credit card and want the option to redeem points for travel, the Chase Freedom Flex℠ * may be exactly what you need. This card lets you earn a strong base rate of rewards for each dollar you spend, and you can redeem points for cash back, statement credits, gift cards, merchandise or travel through the Chase Ultimate Rewards® portal.

Welcome bonus: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Plus, earn 5% cash back on combined gas station and grocery store purchases (excluding Target and Walmart) on up to $12,000 spent in the first year.

Rewards: Earn 5% cash back on up to $1,500 in categories that rotate quarterly (requires activation), 5% cash back on travel purchased through Chase Travel℠, 3% cash back on dining and drugstores and 1% cash back on all other purchases.

Other benefits and drawbacks: The Chase Freedom Flex℠ * may be marketed as a cash-back credit card, but you can redeem rewards for travel through the Chase Ultimate Rewards portal. Since you can also redeem your rewards for statement credits at a rate of 1 cent per point, you can cover travel purchases charged to your card as well.

This card paired with a premium Chase card like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® or Ink Business Preferred® Credit Card can provide extra leverage as points are worth 1.25 to 1.5 cents each when redeemed through the Chase travel portal depending on which premium card you have. Carrying both the Flex card and a premium Chase card also gives you the opportunity for 1:1 transfers to Chase’s airline and hotel partners like United and Hyatt.

The Chase Freedom Flex℠ * offers a 0% intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24% applies. Balance transfer fee of up to 5% (min. $5) of the amount of each transfer applies. This makes the card a solid option if you want to charge a big purchase and pay down your balance over time without worrying about interest for the duration of the 0% introductory APR period.

The card’s benefits also include purchase protection against damage and theft and extended warranties for eligible items.

Those looking to get into the Chase ecosystem with a no-annual-fee card might want to consider the flat-rate Chase Freedom Unlimited® .

Welcome bonus: Earn an additional 1.5% cash back on up to $20,000 spent in the first year, worth up to $300 cash back.

Rewards: Earn 5% cash back on travel purchased through Chase Travel℠, 3% cash back on eligible dining and drugstores and 1.5% on all other purchases, plus an additional 1.5% cash back on the first $20,000 in purchases the first year.

Other benefits and drawbacks: The Chase Freedom Unlimited® may not be the best choice for those who like to travel abroad because it charges a foreign transaction fee. On the plus side, it offers an introductory APR: 0% introductory APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24% applies. An intro transfer fee of either $5 or 3% of the amount of each transfer, whichever is greater, applies in the first 60 days of account opening. After that, a fee of either $5 or 5% of the amount of each transfer applies.

If you’re looking for a card to boost your travel funds but prefer a cash rewards card, the Wells Fargo Active Cash® Card may be the way to go.

Welcome bonus: Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Rewards: Earn 2% cash rewards on purchases.

Other benefits and drawbacks: The Wells Fargo Active Cash® Card offers up to $600 per claim in cellphone protection (subject to a $25 deductible) when you pay a monthly cellphone bill with the card, terms apply.

It also offers a 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers, then a 20.24%, 25.24%, or 29.99% variable APR applies. Balance transfers made within 120 days qualify for the intro rate and fee of 3% then a fee of up to 5%, with a minimum of $5 applies.

The Wells Fargo Autograph℠ Card is excellent for everyday spending with bonus categories that most people will have no problem using.

Welcome bonus: Earn 20,000 bonus points after spending $1,000 in purchases in the first 3 months.

Rewards: Earn 3 points per dollar at restaurants, travel, gas stations, transit, popular streaming services and phone plans. Plus, earn 1 point per dollar on other purchases.

Other benefits and drawbacks: The Wells Fargo Autograph℠ Card also offers an introductory 0% APR: 0% introductory APR on purchases for 12 months from account opening. A variable APR of 20.24%, 25.24%, or 29.99% applies for purchases after the intro period ends and for balance transfers. The card has a balance transfer fee of up to 5%, minimum $5. Cardholders can also benefit from cellphone protection, roadside dispatch and an auto rental collision damage waiver.

The Alliant Cashback Visa® Signature Credit Card * offers the potential for a high rate of cashback, although this rate is limited to the first $10,000 in purchases each month. However, this will likely be sufficient for most people’s monthly spending.

Welcome bonus: This card does not offer a welcome bonus.

Rewards: Earn up to 2.5% cash back with no categories to track on up to $10,000 in purchases each billing cycle with qualifying accounts. All other purchases earn 1.5%.

Other benefits and drawbacks: You’ll have to join Alliant Credit Union to be eligible to apply for this card and to achieve the highest rate of cashback, you’ll have to have an average daily balance of at least $1,000 in your Alliant High-Rate Checking account for each preceding calendar month. The Alliant Cashback card doesn’t charge foreign transaction fees.

The Discover it® Cash Back isn’t specifically marketed as a travel card, but cashback can be used for anything—including travel, so we’ve included it here. This card offers solid rewards as long as you can remember to activate the quarterly categories. It also offers a non-traditional but impressive welcome bonus for those who spend plentifully on the card.

Welcome bonus: Discover will automatically match all the cash back earned at the end of the first year as a cardmember. There's no minimum spending or maximum rewards.

Rewards: Earn 5% cash back on everyday purchases at different places each quarter up to a quarterly maximum of $1,500 in spending when activated. Plus, earn unlimited 1% cash back on all other purchases – automatically.

Other benefits and drawbacks: The Discover it® Cash Back offers a 0% introductory APR for 15 months on purchases and eligible balance transfers. Then, a standard rate of 17.24% - 28.24% variable applies. A balance transfer fee of up to 5% of the amount transferred applies. It also offers online privacy protection tools and free social security number alerts.

The Blue Cash Everyday® Card from American Express (Terms apply, see rates & fees ) is a solid option for those looking to earn cash back from American Express.

Welcome bonus: Earn $200 statement credit after spending $2,000 on purchases within the first 6 months.

Rewards: Earn 3% cash back at U.S. supermarkets, U.S. gas stations, and online retail purchases in the U.S. (on up to $6,000 in each category per year in purchases, then 1%), and 1% cash back on other purchases. Cash back is received in the form of Reward Dollars that can be easily redeemed for statement credits or at Amazon.com checkout.

Other benefits and drawbacks: The Blue Cash Everyday® Card from American Express offers an introductory APR: 0% intro APR for 15 months on purchases and on balance transfers requested within 60 days of account opening, followed by a variable APR of 19.24%-29.99%. A balance transfer fee of $5 or 3%, whichever is greater, applies. Cardholders can also benefit from access to Amex Offers, up to $84 in credit ($7 monthly) for a Disney Bundle subscription and a $180 Home Chef credit. Additional benefits include purchase protection ¹ and car rental loss and damage insurance ² .

The Bilt World Elite Mastercard® ( rates & fees ) lays the claim as the first card that offers the ability to pay rent and earn points on those purchases. For those who pay rent, it’s a great way to earn a bunch of additional points each year.

Rewards: Earn 1 point per dollar on rent payments without the transaction fee (on up to 100,000 points each calendar year), 3 points per dollar on dining, 2 points per dollar on travel (when booked through the Bilt Travel Portal or directly with an airline, hotel, car rental or cruise company), and 1 point per dollar on other purchases.

Other benefits and drawbacks: Bilt points can be transferred at a 1:1 rate to various transfer partners, including American Airlines and Hyatt. The card also offers cellphone protection, various travel benefits and the ability to earn bonus points (and sometimes other benefits) once per month on Rent Day, though you must use the card five times each statement period to earn points ( rewards & benefits ).

The U.S. Bank Altitude® Go Visa Signature® Card * earns points that you can redeem for merchandise, gift cards, cash back or travel, all at a value of 1 cent per point. It offers reasonable earn rates for a no-annual-fee card.

Welcome bonus: Earn 20,000 bonus points after spending $1,000 in eligible purchases within the first 90 days of account opening.

Rewards: Earn 4 points per dollar on dining, takeout, and restaurant delivery, 2 points per dollar at grocery stores, grocery delivery, gas stations, streaming services and on EV charging stations (excluding discount stores, supercenters and wholesale clubs effective September 9, 2024) and 1 point per dollar on all other eligible purchases.

Other benefits and drawbacks: Cardholders can also benefit from a 0% intro APR on purchases and balance transfers for the first 12 billing cycles, followed by a regular variable APR of 18.24% - 29.24%. A balance transfer fee of 3% applies ($5 minimum). The card also offers a $15 annual streaming bonus for services like Netflix, Apple TV+, Spotify and others.

The Hilton Honors American Express Card (Terms apply, see rates & fees ) offers the ability to earn Hilton Honors points for each dollar you spend and automatically qualify for elite perks.

Welcome bonus: Earn 80,000 Hilton Honors bonus points after spending $2,000 in purchases on the card in the first six months of card membership.

Rewards: Earn 7 Hilton Honors points for each dollar of eligible purchases charged directly with hotels or resorts within the Hilton portfolio, 5 points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations and 3 points per dollar on all other eligible purchases.

Other benefits and drawbacks: The Hilton Honors American Express Card offers robust earning categories that let you earn bonus points in many common areas of spending.

Cardholder benefits include automatic Silver status, but you can move up to Hilton Honors™ Gold status if you spend at least $20,000 on your credit card within a calendar year. If you expect to spend this much on your card each year, it may make sense to get a card that automatically provides a higher level of Hilton status and place the spending on a card that will net you more rewards overall.

Those looking for an Amex Card but with a preference to earn Membership Rewards instead of cash back should consider the Amex EveryDay® Credit Card * .

Welcome bonus: Earn 10,000 points after spending $2,000 in qualifying purchases in the first 6 months of account opening.

Rewards: Earn 2 Membership Rewards points per dollar at US supermarkets on up to $6,000 per year in purchases (then 1X), 2 points per dollar when using the card to book trips through American Express Travel and 1 point for every eligible dollar on everything else. Plus, use the card 20 or more times on purchases in a billing period and earn 20% extra points on those purchases.

Other benefits and drawbacks: When you use your Amex EveryDay® Credit Card * 20 or more times per billing cycle, you’ll earn a 20% bonus on all points earned during that billing cycle. This card also offers access to Amex Offers, car rental loss and damage insurance and purchase protection.

United isn’t the only airline with a no-annual-fee card, but it’s the best no-annual-fee airline offering. The United Gateway℠ Card provides a few valuable benefits when a cardholder flies United.

Welcome bonus: Earn 20,000 bonus miles after spending $1,000 on purchases in the first 3 months of account opening.

Rewards: Earn 2 miles per dollar on United® purchases, at gas stations and on local transit and commuting and 1 mile per dollar on all other purchases.

Other benefits and drawbacks: Holders of the United Gateway℠ Card receive 25% off United in-flight purchases made on the card. It also offers an auto rental collision damage waiver, trip cancellation/interruption insurance, purchase protection, extended warranty coverage and doesn’t charge foreign transaction fees.

Those looking for more United benefits, including a free checked bag when flying with the airline, should consider the United℠ Explorer Card that has a $0 intro annual fee for the first year, then $95.

Read more: United Airlines MileagePlus: The Ultimate Guide

The Marriott Bonvoy Bold® Credit Card * is a decent option for those wanting to earn Marriott points without paying an annual fee. If you’re really looking for a Marriott-specific card, you should also ask yourself: Which Marriott Card is right for me ?

Welcome bonus: Earn 30,000 bonus points after spending $1,000 on purchases in the first three months of account opening.

Rewards: Earn 3 points per dollar at over 7,000 hotels participating in Marriott Bonvoy program, 2 points per dollar on other travel purchases (from airfare to taxis and trains) and 1 point per dollar on all other purchases.

Other benefits and drawbacks: The Marriott Bonovy Bold offers complimentary Marriott Bonvoy Silver status and 15 Elite Night credits each year that may help you qualify for higher levels of elite status. The card also offers various travel and purchase coverage like baggage delay insurance and purchase protection, and it doesn’t charge foreign transaction fees.

Methodology

Forbes Advisor compared dozens of travel credit cards from all major issuers to find the best options with no annual fee. Factors we looked at include:

- Earning rates

- Welcome offers

- Introductory APR

- Consumer protections

- Automatic elite status

- Multiple redemption options

Read more: How Forbes Advisor Rates Credit Cards

What Does No Annual Fee Mean?